Financial Mathematics: Interest, Annuities, and Present Value Analysis

VerifiedAdded on 2021/04/21

|12

|1252

|127

Homework Assignment

AI Summary

This financial mathematics assignment solution covers a range of topics including simple interest, compound interest, present value, and annuities. The solution demonstrates the calculation of simple interest, both exact and ordinary, and explores the difference between them. It also includes the computation of compound interest with different compounding frequencies (annually, semi-annually, quarterly, and monthly). Furthermore, the assignment delves into present value calculations, rate of return, and the time value of money. The document provides detailed examples and formulas to illustrate each concept, including the present value of annuities at different interest rates. The assignment aims to provide a comprehensive understanding of key financial mathematics principles.

Running head: FINANCIAL MATHEMATICS

Financial mathematics

Name of the student

Name of the university

Student ID

Author note

Financial mathematics

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MATHEMATICS

Table of Contents

I. Simple interest....................................................................................................................2

II. Compound interest..............................................................................................................4

III. Present value......................................................................................................................6

IV. Annuities............................................................................................................................9

V. Present value of annuity.....................................................................................................9

Table of Contents

I. Simple interest....................................................................................................................2

II. Compound interest..............................................................................................................4

III. Present value......................................................................................................................6

IV. Annuities............................................................................................................................9

V. Present value of annuity.....................................................................................................9

2FINANCIAL MATHEMATICS

I. Simple interest

1. Amount and simple interest

Interest = Principal * Rate * Time

Principle = $ 13,750

Rate = 10.25%

Time = 3 years and 5 months = 41/12 years

Therefore, Interest = $ 13,750 * 0.1025 * 41/12

Interest = $ 4815.365

Amount = Principal + Interest

Amount = $ 13,750 + $ 4815.365 = $ 18,565.36

2. Exact simple interest and ordinary simple interest

Exact simple interest

Principal amount = $ 15,180

Interest rate = 9.125%

Number of days = 180

Converting the days into year –

180 days = 180 days * 1/365 days = 180/365 years

Using formula to solve the simple interest,

I. Simple interest

1. Amount and simple interest

Interest = Principal * Rate * Time

Principle = $ 13,750

Rate = 10.25%

Time = 3 years and 5 months = 41/12 years

Therefore, Interest = $ 13,750 * 0.1025 * 41/12

Interest = $ 4815.365

Amount = Principal + Interest

Amount = $ 13,750 + $ 4815.365 = $ 18,565.36

2. Exact simple interest and ordinary simple interest

Exact simple interest

Principal amount = $ 15,180

Interest rate = 9.125%

Number of days = 180

Converting the days into year –

180 days = 180 days * 1/365 days = 180/365 years

Using formula to solve the simple interest,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL MATHEMATICS

Interest = Principal * Rate * Time

Interest = $ 15,000 * 0.09125 * 180/365

Interest = $ 675

Ordinary simple interest

Principal amount = $ 15,180

Interest rate = 9.125%

Number of days = 180

Converting the days into year –

180 days = 180 days * 1/360 days = ½ years

Using formula to solve the simple interest,

Interest = Principal * Rate * Time

Interest = $ 15,000 * 0.09125 * ½

Interest = $ 684.375

Therefore the amount of difference between ordinary simple interest and exact simple interest

is ($ 684.375 - $ 675) = $ 9.84

3. Rate of interest

Principal amount = $ 12,150

Rate of interest = ?

Time = 5 years

Interest = Principal * Rate * Time

Interest = $ 15,000 * 0.09125 * 180/365

Interest = $ 675

Ordinary simple interest

Principal amount = $ 15,180

Interest rate = 9.125%

Number of days = 180

Converting the days into year –

180 days = 180 days * 1/360 days = ½ years

Using formula to solve the simple interest,

Interest = Principal * Rate * Time

Interest = $ 15,000 * 0.09125 * ½

Interest = $ 684.375

Therefore the amount of difference between ordinary simple interest and exact simple interest

is ($ 684.375 - $ 675) = $ 9.84

3. Rate of interest

Principal amount = $ 12,150

Rate of interest = ?

Time = 5 years

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL MATHEMATICS

Interest amount = ( $ 25,800 - $ 12,150) = $ 13,650

Using formula to solve the simple interest,

Interest = Principal * Rate * Time

$ 13,650 = $ 12,150 * Rate * 5

$ 13,650 = $ 60,750 * rate

Rate = 0.2247 or 22.47%.

II. Compound interest

1. Computation of amount

Formula for compound interest –

A = P (1 + r/n)(nt)

Where, A = Future value of investment or loan including the interest

P = Principal amount

R = rate of interest

N = number of times interest compounded

T = no. of years money invested or borrowed for

Here in the given example,

P = $ 11,880

R = 6.25%

T = 15 years

Interest amount = ( $ 25,800 - $ 12,150) = $ 13,650

Using formula to solve the simple interest,

Interest = Principal * Rate * Time

$ 13,650 = $ 12,150 * Rate * 5

$ 13,650 = $ 60,750 * rate

Rate = 0.2247 or 22.47%.

II. Compound interest

1. Computation of amount

Formula for compound interest –

A = P (1 + r/n)(nt)

Where, A = Future value of investment or loan including the interest

P = Principal amount

R = rate of interest

N = number of times interest compounded

T = no. of years money invested or borrowed for

Here in the given example,

P = $ 11,880

R = 6.25%

T = 15 years

5FINANCIAL MATHEMATICS

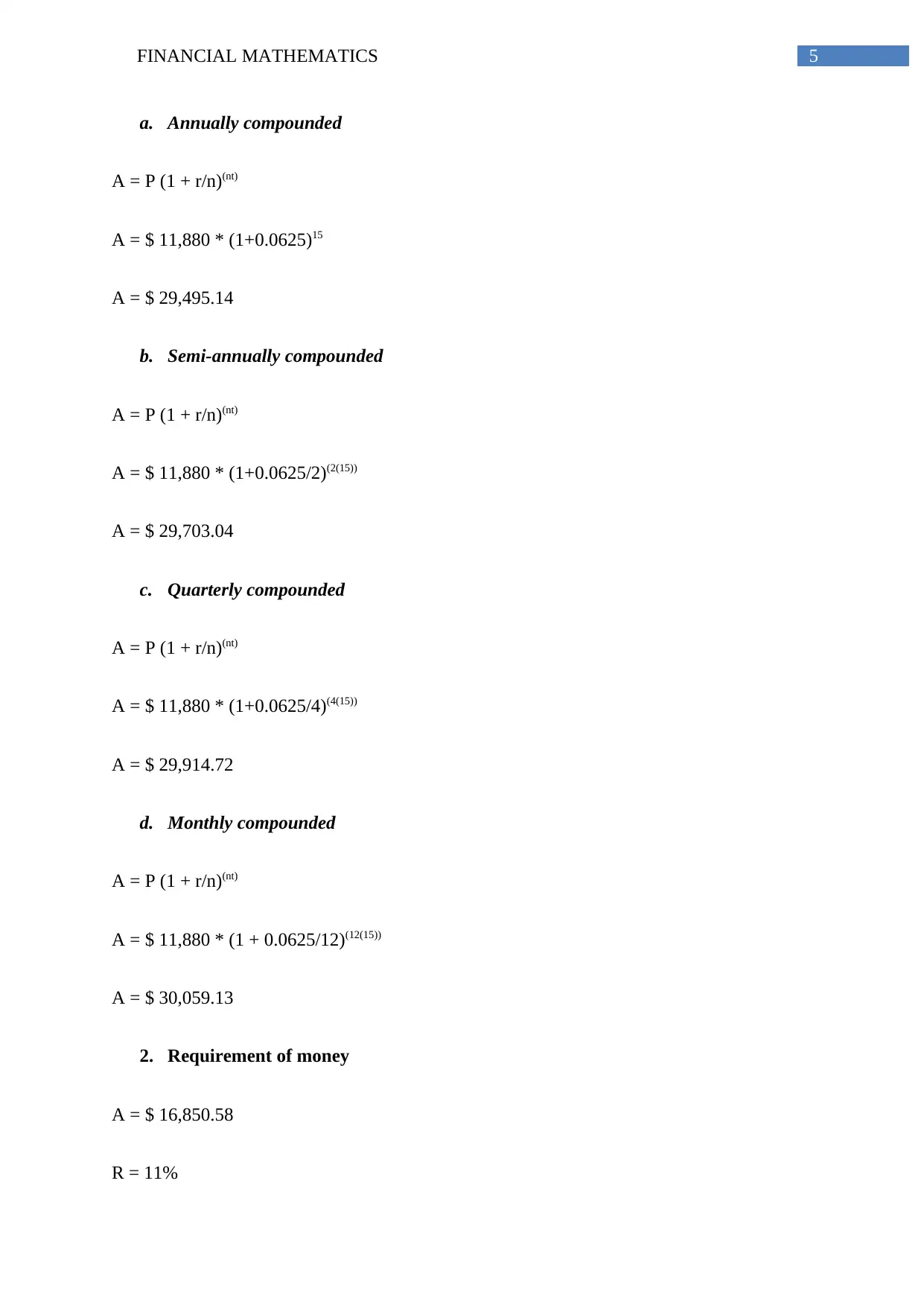

a. Annually compounded

A = P (1 + r/n)(nt)

A = $ 11,880 * (1+0.0625)15

A = $ 29,495.14

b. Semi-annually compounded

A = P (1 + r/n)(nt)

A = $ 11,880 * (1+0.0625/2)(2(15))

A = $ 29,703.04

c. Quarterly compounded

A = P (1 + r/n)(nt)

A = $ 11,880 * (1+0.0625/4)(4(15))

A = $ 29,914.72

d. Monthly compounded

A = P (1 + r/n)(nt)

A = $ 11,880 * (1 + 0.0625/12)(12(15))

A = $ 30,059.13

2. Requirement of money

A = $ 16,850.58

R = 11%

a. Annually compounded

A = P (1 + r/n)(nt)

A = $ 11,880 * (1+0.0625)15

A = $ 29,495.14

b. Semi-annually compounded

A = P (1 + r/n)(nt)

A = $ 11,880 * (1+0.0625/2)(2(15))

A = $ 29,703.04

c. Quarterly compounded

A = P (1 + r/n)(nt)

A = $ 11,880 * (1+0.0625/4)(4(15))

A = $ 29,914.72

d. Monthly compounded

A = P (1 + r/n)(nt)

A = $ 11,880 * (1 + 0.0625/12)(12(15))

A = $ 30,059.13

2. Requirement of money

A = $ 16,850.58

R = 11%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MATHEMATICS

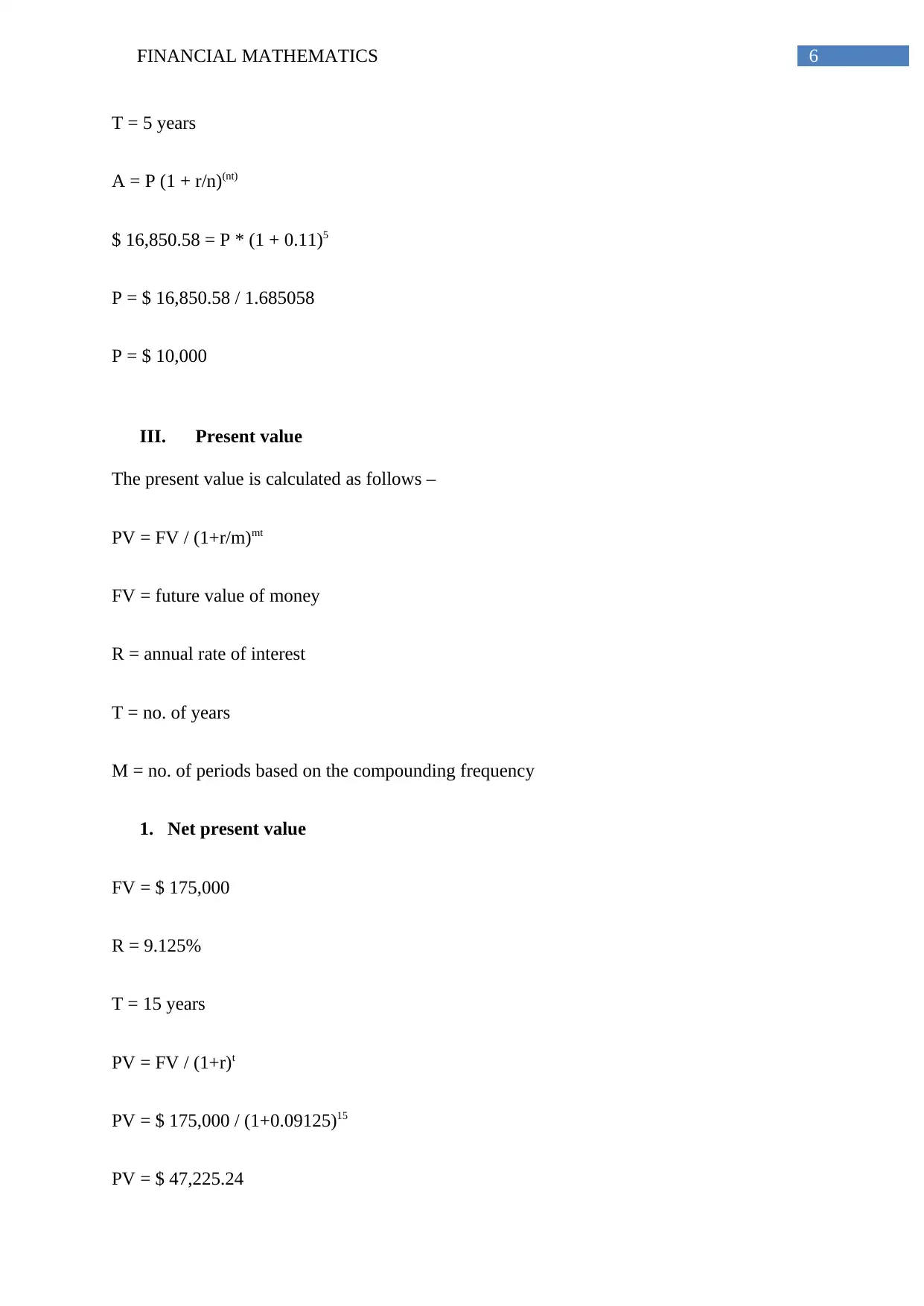

T = 5 years

A = P (1 + r/n)(nt)

$ 16,850.58 = P * (1 + 0.11)5

P = $ 16,850.58 / 1.685058

P = $ 10,000

III. Present value

The present value is calculated as follows –

PV = FV / (1+r/m)mt

FV = future value of money

R = annual rate of interest

T = no. of years

M = no. of periods based on the compounding frequency

1. Net present value

FV = $ 175,000

R = 9.125%

T = 15 years

PV = FV / (1+r)t

PV = $ 175,000 / (1+0.09125)15

PV = $ 47,225.24

T = 5 years

A = P (1 + r/n)(nt)

$ 16,850.58 = P * (1 + 0.11)5

P = $ 16,850.58 / 1.685058

P = $ 10,000

III. Present value

The present value is calculated as follows –

PV = FV / (1+r/m)mt

FV = future value of money

R = annual rate of interest

T = no. of years

M = no. of periods based on the compounding frequency

1. Net present value

FV = $ 175,000

R = 9.125%

T = 15 years

PV = FV / (1+r)t

PV = $ 175,000 / (1+0.09125)15

PV = $ 47,225.24

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MATHEMATICS

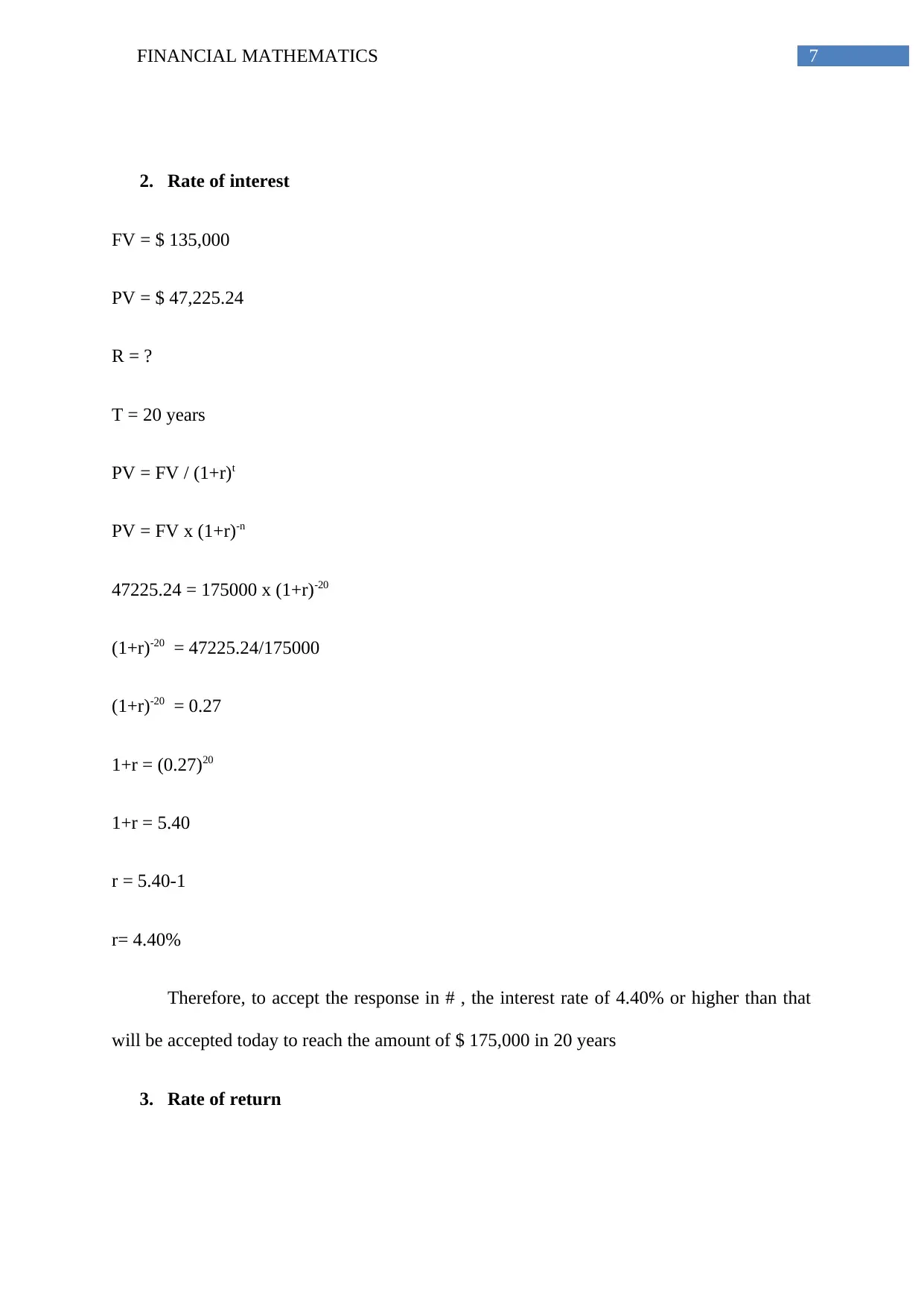

2. Rate of interest

FV = $ 135,000

PV = $ 47,225.24

R = ?

T = 20 years

PV = FV / (1+r)t

PV = FV x (1+r)-n

47225.24 = 175000 x (1+r)-20

(1+r)-20 = 47225.24/175000

(1+r)-20 = 0.27

1+r = (0.27)20

1+r = 5.40

r = 5.40-1

r= 4.40%

Therefore, to accept the response in # , the interest rate of 4.40% or higher than that

will be accepted today to reach the amount of $ 175,000 in 20 years

3. Rate of return

2. Rate of interest

FV = $ 135,000

PV = $ 47,225.24

R = ?

T = 20 years

PV = FV / (1+r)t

PV = FV x (1+r)-n

47225.24 = 175000 x (1+r)-20

(1+r)-20 = 47225.24/175000

(1+r)-20 = 0.27

1+r = (0.27)20

1+r = 5.40

r = 5.40-1

r= 4.40%

Therefore, to accept the response in # , the interest rate of 4.40% or higher than that

will be accepted today to reach the amount of $ 175,000 in 20 years

3. Rate of return

8FINANCIAL MATHEMATICS

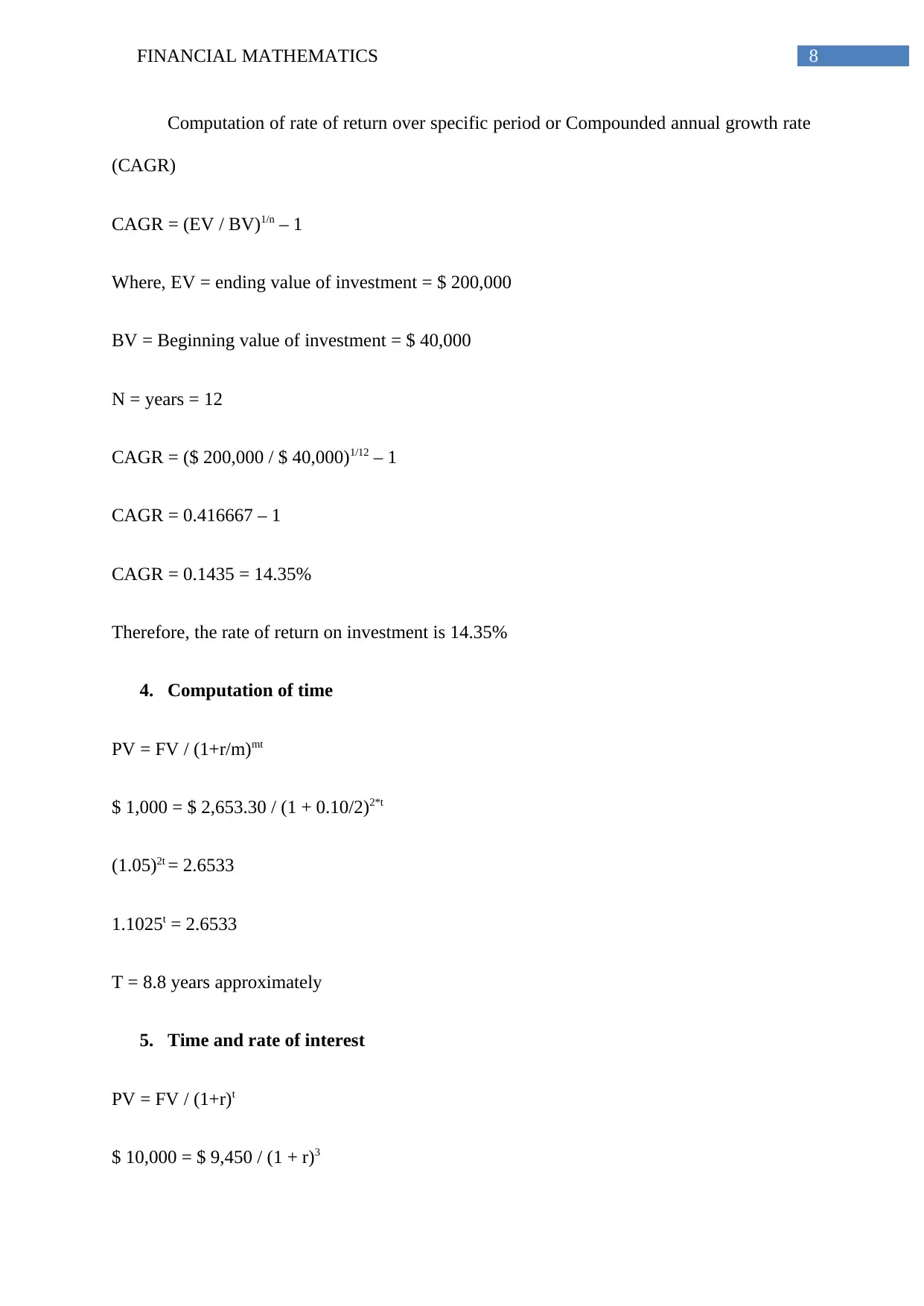

Computation of rate of return over specific period or Compounded annual growth rate

(CAGR)

CAGR = (EV / BV)1/n – 1

Where, EV = ending value of investment = $ 200,000

BV = Beginning value of investment = $ 40,000

N = years = 12

CAGR = ($ 200,000 / $ 40,000)1/12 – 1

CAGR = 0.416667 – 1

CAGR = 0.1435 = 14.35%

Therefore, the rate of return on investment is 14.35%

4. Computation of time

PV = FV / (1+r/m)mt

$ 1,000 = $ 2,653.30 / (1 + 0.10/2)2*t

(1.05)2t = 2.6533

1.1025t = 2.6533

T = 8.8 years approximately

5. Time and rate of interest

PV = FV / (1+r)t

$ 10,000 = $ 9,450 / (1 + r)3

Computation of rate of return over specific period or Compounded annual growth rate

(CAGR)

CAGR = (EV / BV)1/n – 1

Where, EV = ending value of investment = $ 200,000

BV = Beginning value of investment = $ 40,000

N = years = 12

CAGR = ($ 200,000 / $ 40,000)1/12 – 1

CAGR = 0.416667 – 1

CAGR = 0.1435 = 14.35%

Therefore, the rate of return on investment is 14.35%

4. Computation of time

PV = FV / (1+r/m)mt

$ 1,000 = $ 2,653.30 / (1 + 0.10/2)2*t

(1.05)2t = 2.6533

1.1025t = 2.6533

T = 8.8 years approximately

5. Time and rate of interest

PV = FV / (1+r)t

$ 10,000 = $ 9,450 / (1 + r)3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL MATHEMATICS

(1 + r)3 = 0.945

(1 + r) = 0.9813

R = 0.9813 – 1

R = -0187 or discount of 1.87%

IV. Annuities

Present value of annuity, PV = P * [1-(1+r)-n] / r

P = value of each payment = $ 4,500

R = 6.50%

N = no. of period = 25 years

Therefore, PV = $ 4,500 * [1- (1.065)-25] / 0.0650

PV = $ 4,500 * 12.1979

PV = $ 54,890.45

Amount of interest will be = $ 54,890.45 - $ 4,500 = $ 50,390.45

V. Present value of annuity

a. Interest rate = 5% per annum

Present value of annuity, PV = P * [1-(1+r)-n] / r

P = value of each payment = $ 50,000

R = 5%

(1 + r)3 = 0.945

(1 + r) = 0.9813

R = 0.9813 – 1

R = -0187 or discount of 1.87%

IV. Annuities

Present value of annuity, PV = P * [1-(1+r)-n] / r

P = value of each payment = $ 4,500

R = 6.50%

N = no. of period = 25 years

Therefore, PV = $ 4,500 * [1- (1.065)-25] / 0.0650

PV = $ 4,500 * 12.1979

PV = $ 54,890.45

Amount of interest will be = $ 54,890.45 - $ 4,500 = $ 50,390.45

V. Present value of annuity

a. Interest rate = 5% per annum

Present value of annuity, PV = P * [1-(1+r)-n] / r

P = value of each payment = $ 50,000

R = 5%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL MATHEMATICS

N = no. of period = 20 years

Therefore, PV = $ 50000 * [1- (1.05)-20] / 0.05

PV = $ 50,000 * 12.4622

PV = $ 6,23,110.50

b. Interest rate = 10% annual

Present value of annuity, PV = P * [1-(1+r)-n] / r

P = value of each payment = $ 50,000

R = 10%

N = no. of period = 20 years

Therefore, PV = $ 50000 * [1- (1.10)-20] / 0.10

PV = $ 50,000 * 8.5136

PV = $ 4,25,678.20

c. Interest rate = 20% per year

Present value of annuity, PV = P * [1-(1+r)-n] / r

P = value of each payment = $ 50,000

R = 20%

N = no. of period = 20 years

Therefore, PV = $ 50000 * [1- (1.20)-20] / 0.20

PV = $ 50,000 * 4.8696

N = no. of period = 20 years

Therefore, PV = $ 50000 * [1- (1.05)-20] / 0.05

PV = $ 50,000 * 12.4622

PV = $ 6,23,110.50

b. Interest rate = 10% annual

Present value of annuity, PV = P * [1-(1+r)-n] / r

P = value of each payment = $ 50,000

R = 10%

N = no. of period = 20 years

Therefore, PV = $ 50000 * [1- (1.10)-20] / 0.10

PV = $ 50,000 * 8.5136

PV = $ 4,25,678.20

c. Interest rate = 20% per year

Present value of annuity, PV = P * [1-(1+r)-n] / r

P = value of each payment = $ 50,000

R = 20%

N = no. of period = 20 years

Therefore, PV = $ 50000 * [1- (1.20)-20] / 0.20

PV = $ 50,000 * 4.8696

11FINANCIAL MATHEMATICS

PV = $ 2,43,479

PV = $ 2,43,479

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.