Factors Influencing Financial Investment in UK Oil and Gas Management

VerifiedAdded on 2020/04/21

|12

|2974

|112

Report

AI Summary

This report provides an analysis of the oil and gas management in the United Kingdom, focusing on the drivers and barriers influencing financial investments in refinery activities. It examines the structure of the UK oil sector, highlighting key players and the challenges they face. The report delves into various factors impacting the industry, including consumer needs, supplier relationships, competition levels, and government policies. It further explores barriers to investment, such as startup costs, political risks, supply and demand fluctuations, environmental concerns, and the adoption of new technologies. The report concludes by summarizing the key findings and their implications for the future of the UK oil and gas sector, offering a comprehensive overview of the industry's dynamics and challenges.

Running head: OIL AND GAS MANAGEMENT

Oil and Gas Management

Name of the Student

Name of the University

Author Note

Oil and Gas Management

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1OIL AND GAS MANAGEMENT

Table of Contents

Introduction......................................................................................................................................2

Drivers of financial investments in refinery activities in UK..........................................................2

Consumer needs...........................................................................................................................3

Suppliers......................................................................................................................................3

Competition levels.......................................................................................................................4

Government policies....................................................................................................................5

Barriers of financial investment in the UK refinery activities.........................................................6

Startup costs.................................................................................................................................6

Political risks...............................................................................................................................6

Supply and demand barriers........................................................................................................7

Environmental barriers................................................................................................................8

Adoption of the technologies.......................................................................................................8

Conclusion.......................................................................................................................................9

Reference List................................................................................................................................10

Table of Contents

Introduction......................................................................................................................................2

Drivers of financial investments in refinery activities in UK..........................................................2

Consumer needs...........................................................................................................................3

Suppliers......................................................................................................................................3

Competition levels.......................................................................................................................4

Government policies....................................................................................................................5

Barriers of financial investment in the UK refinery activities.........................................................6

Startup costs.................................................................................................................................6

Political risks...............................................................................................................................6

Supply and demand barriers........................................................................................................7

Environmental barriers................................................................................................................8

Adoption of the technologies.......................................................................................................8

Conclusion.......................................................................................................................................9

Reference List................................................................................................................................10

2OIL AND GAS MANAGEMENT

Introduction

The oil sector that is present in the United Kingdom comprises of more than 200

companies that are involved in the process of distributing, marketing and refining of the

petroleum products. The refineries that are present are divided in to two sectors such as the retail

and the commercial sector where the oil is transported to government agencies, fuel distributors

and others. It can be seen that the number of refineries that are present in the country is finding it

difficult to invest more money in to their business due to the lack of proper management. The

investments that are done in the refineries help them to filter the petroleum products so that it can

be used for various purposes. The major companies that deal with oil refining activities in the

UK are Lindsey Oil Refinery that is situated in Immingham and Stanlow Refinery that is situated

in Ellesmere Port in the UK (Yusuf et al. 2013).

Drivers of financial investments in refinery activities in UK

There are various factors that affect the size and structure of the oil and gas refining

industry in the United Kingdom such as the consumers, competitors, suppliers and the

government. The demand of the consumers regarding the fuel is dependent on the price of the

oil. The rise in the price of the fuels will see that the consumers will opt for the gas stations that

will be offering comparatively lesser amount. The UK oil market is divided in to two sectors,

which are the retail and the commercial sector. The retail sector consists of the gas stations that

deal with petroleum and it can be seen that there has been a major downfall in the last 25 years

(Bunn et al. 2017).

Introduction

The oil sector that is present in the United Kingdom comprises of more than 200

companies that are involved in the process of distributing, marketing and refining of the

petroleum products. The refineries that are present are divided in to two sectors such as the retail

and the commercial sector where the oil is transported to government agencies, fuel distributors

and others. It can be seen that the number of refineries that are present in the country is finding it

difficult to invest more money in to their business due to the lack of proper management. The

investments that are done in the refineries help them to filter the petroleum products so that it can

be used for various purposes. The major companies that deal with oil refining activities in the

UK are Lindsey Oil Refinery that is situated in Immingham and Stanlow Refinery that is situated

in Ellesmere Port in the UK (Yusuf et al. 2013).

Drivers of financial investments in refinery activities in UK

There are various factors that affect the size and structure of the oil and gas refining

industry in the United Kingdom such as the consumers, competitors, suppliers and the

government. The demand of the consumers regarding the fuel is dependent on the price of the

oil. The rise in the price of the fuels will see that the consumers will opt for the gas stations that

will be offering comparatively lesser amount. The UK oil market is divided in to two sectors,

which are the retail and the commercial sector. The retail sector consists of the gas stations that

deal with petroleum and it can be seen that there has been a major downfall in the last 25 years

(Bunn et al. 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3OIL AND GAS MANAGEMENT

Consumer needs

The needs of the consumers play an important role for the refinery market of petroleum

in the UK market. The consumer behavior depends on the level of the price and the convenience

that they would get with respect to the access of the petroleum. The demand depends on the price

of the fuels so that they can purchase it according to their limits. According to a survey

conducted by UKPIA, it was seen that price and the availability of the gas stations were the

factors that attracted the customers in purchasing it. The consumers also stressed on the point

that the stations that provide benefits such as the loyalty cards and bonuses are the ones that

attracts those (Yusuf et al. 2013).

Suppliers

The suppliers are another factor, as they are the channels through which the supply of

fuel depends directly or indirectly. The agreement is based on the price, as the parties have to

sign a contract based on the price that has been bargained. This will help them in controlling the

prices so that there is an even competition within the market (Bunn et al. 2017). The contract is

inclusive of the cost of distribution and storage, which indirectly leads to the rise in the prices of

the oil. The cost of distribution is dependent on the distances from the gas stations and the place

of the suppliers. Apart from this, other factors such as the nature of the contract, price of the fuel

in the wholesale market, arrangement of logistics and the terms under which the payment has to

be made needs to be taken in to consideration. The contracts are also subjected to limitations

such as the risk of the whole sale prices and the prices that may get increased on the spot as well.

These factors affect the oil industry in the UK market (Chmutina and Goodier 2014).

Consumer needs

The needs of the consumers play an important role for the refinery market of petroleum

in the UK market. The consumer behavior depends on the level of the price and the convenience

that they would get with respect to the access of the petroleum. The demand depends on the price

of the fuels so that they can purchase it according to their limits. According to a survey

conducted by UKPIA, it was seen that price and the availability of the gas stations were the

factors that attracted the customers in purchasing it. The consumers also stressed on the point

that the stations that provide benefits such as the loyalty cards and bonuses are the ones that

attracts those (Yusuf et al. 2013).

Suppliers

The suppliers are another factor, as they are the channels through which the supply of

fuel depends directly or indirectly. The agreement is based on the price, as the parties have to

sign a contract based on the price that has been bargained. This will help them in controlling the

prices so that there is an even competition within the market (Bunn et al. 2017). The contract is

inclusive of the cost of distribution and storage, which indirectly leads to the rise in the prices of

the oil. The cost of distribution is dependent on the distances from the gas stations and the place

of the suppliers. Apart from this, other factors such as the nature of the contract, price of the fuel

in the wholesale market, arrangement of logistics and the terms under which the payment has to

be made needs to be taken in to consideration. The contracts are also subjected to limitations

such as the risk of the whole sale prices and the prices that may get increased on the spot as well.

These factors affect the oil industry in the UK market (Chmutina and Goodier 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4OIL AND GAS MANAGEMENT

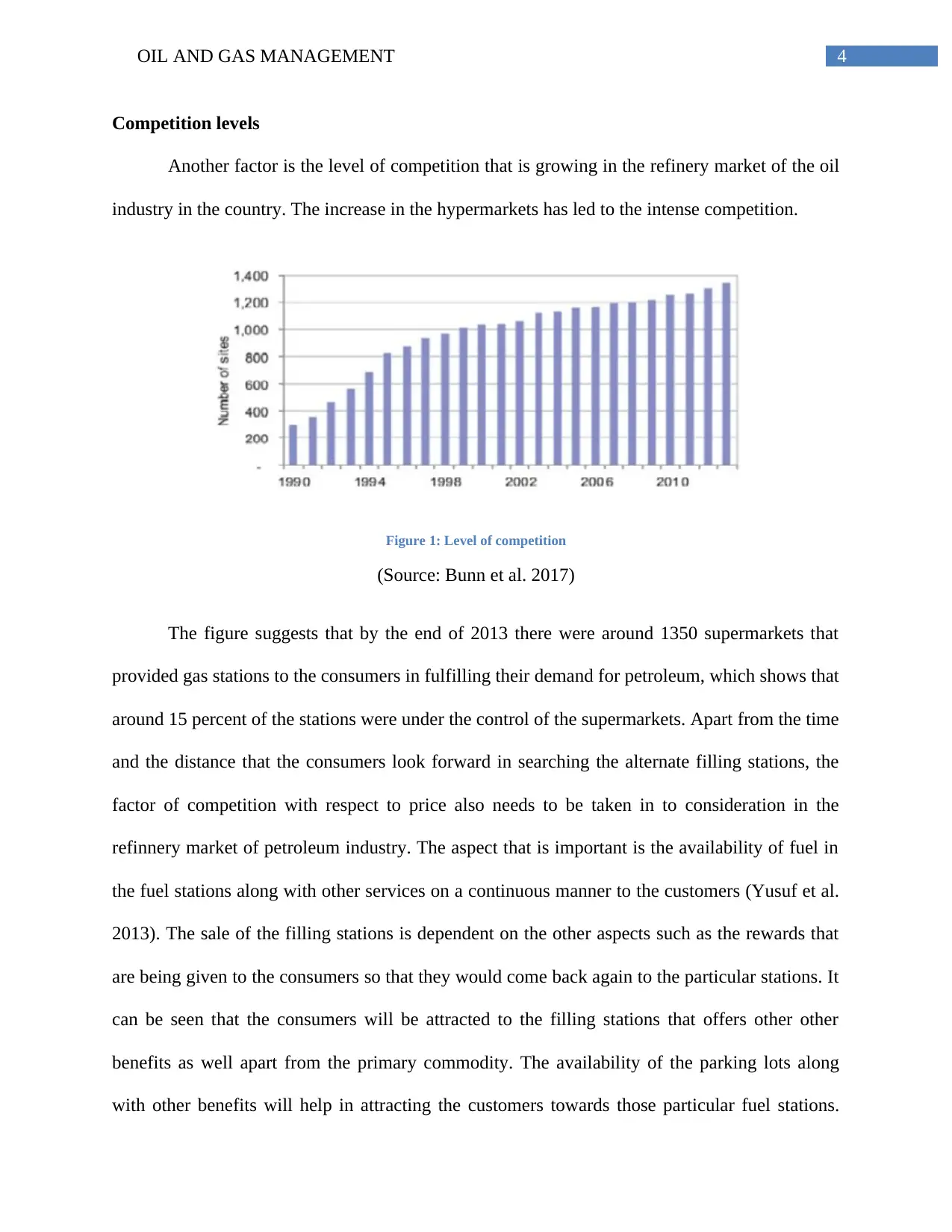

Competition levels

Another factor is the level of competition that is growing in the refinery market of the oil

industry in the country. The increase in the hypermarkets has led to the intense competition.

Figure 1: Level of competition

(Source: Bunn et al. 2017)

The figure suggests that by the end of 2013 there were around 1350 supermarkets that

provided gas stations to the consumers in fulfilling their demand for petroleum, which shows that

around 15 percent of the stations were under the control of the supermarkets. Apart from the time

and the distance that the consumers look forward in searching the alternate filling stations, the

factor of competition with respect to price also needs to be taken in to consideration in the

refinnery market of petroleum industry. The aspect that is important is the availability of fuel in

the fuel stations along with other services on a continuous manner to the customers (Yusuf et al.

2013). The sale of the filling stations is dependent on the other aspects such as the rewards that

are being given to the consumers so that they would come back again to the particular stations. It

can be seen that the consumers will be attracted to the filling stations that offers other other

benefits as well apart from the primary commodity. The availability of the parking lots along

with other benefits will help in attracting the customers towards those particular fuel stations.

Competition levels

Another factor is the level of competition that is growing in the refinery market of the oil

industry in the country. The increase in the hypermarkets has led to the intense competition.

Figure 1: Level of competition

(Source: Bunn et al. 2017)

The figure suggests that by the end of 2013 there were around 1350 supermarkets that

provided gas stations to the consumers in fulfilling their demand for petroleum, which shows that

around 15 percent of the stations were under the control of the supermarkets. Apart from the time

and the distance that the consumers look forward in searching the alternate filling stations, the

factor of competition with respect to price also needs to be taken in to consideration in the

refinnery market of petroleum industry. The aspect that is important is the availability of fuel in

the fuel stations along with other services on a continuous manner to the customers (Yusuf et al.

2013). The sale of the filling stations is dependent on the other aspects such as the rewards that

are being given to the consumers so that they would come back again to the particular stations. It

can be seen that the consumers will be attracted to the filling stations that offers other other

benefits as well apart from the primary commodity. The availability of the parking lots along

with other benefits will help in attracting the customers towards those particular fuel stations.

5OIL AND GAS MANAGEMENT

Therefore, it can be seen that the business models need to put more focus on the sale of non-fuel

products, which will help them in earning better profits (Leete, Xu and Wheeler 2013).

Government policies

Another factor is the government policies and the regulations that are being framed by

them that will create a significant impact on the behavior of the investors, producers and the

consumers. The policies in the country have been divided in to three stages that consists of the

safety measures, fiscal drivers, environmental policies along with the regulatory policies. The

fiscal policy is inclusive of the duties that are present in fuel along with the other taxes and

corporate taxes that result in decreasing the margin of profits for the companies. The rate of

corporate taxes also had a negative impact as it led to the decrease in the profit of the company.

It was seen that the percentage of vat was lowered to 15 in 2009 but was increased in the year

2011 to 20 percent (Mitchel, Marcel and Mitchell 2015). The other driver is the safety standards

and the environmental policies that will help in increasing the share of the renewable sources,

which are being consumed by the transport sector along with the recovery of the vapor system

that will help in reducing the organic compounds that are volatile in nature. These policies ensure

that the environment is protected and it does not affect the business of fuel stations. There has

been a huge decrease in the level of emissions after the onset of new technologies, as it has

helped in completing the process in an easy manner (Mitchell and Mitchell 2014).

The presence of the various regulatory bodies has also affected the refinery market of the

petroleum industry in a direct manner. Apart from these policies, the emergency plan for fuel on

a national basis and the improved system of planning has helped the gas stations in improving to

a great extent. The extra cost of refining and storing the fuel has to be borne b y the government,

which will help in regulating the prices and keep it within the capacity of the customers.

Therefore, it can be seen that the business models need to put more focus on the sale of non-fuel

products, which will help them in earning better profits (Leete, Xu and Wheeler 2013).

Government policies

Another factor is the government policies and the regulations that are being framed by

them that will create a significant impact on the behavior of the investors, producers and the

consumers. The policies in the country have been divided in to three stages that consists of the

safety measures, fiscal drivers, environmental policies along with the regulatory policies. The

fiscal policy is inclusive of the duties that are present in fuel along with the other taxes and

corporate taxes that result in decreasing the margin of profits for the companies. The rate of

corporate taxes also had a negative impact as it led to the decrease in the profit of the company.

It was seen that the percentage of vat was lowered to 15 in 2009 but was increased in the year

2011 to 20 percent (Mitchel, Marcel and Mitchell 2015). The other driver is the safety standards

and the environmental policies that will help in increasing the share of the renewable sources,

which are being consumed by the transport sector along with the recovery of the vapor system

that will help in reducing the organic compounds that are volatile in nature. These policies ensure

that the environment is protected and it does not affect the business of fuel stations. There has

been a huge decrease in the level of emissions after the onset of new technologies, as it has

helped in completing the process in an easy manner (Mitchell and Mitchell 2014).

The presence of the various regulatory bodies has also affected the refinery market of the

petroleum industry in a direct manner. Apart from these policies, the emergency plan for fuel on

a national basis and the improved system of planning has helped the gas stations in improving to

a great extent. The extra cost of refining and storing the fuel has to be borne b y the government,

which will help in regulating the prices and keep it within the capacity of the customers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6OIL AND GAS MANAGEMENT

Barriers of financial investment in the UK refinery activities

Startup costs

The new companies that want to enter the market with the refinement of the oil has to

face trouble, as it is difficult to establish the company in the UK market. The refining companies

that are presently operating in the market will play a crucial role in preventing further investment

in their business due to the rise in the level of competition. The use of methods such as drilling in

a vertical manner will help in pushing up the prices of the refining companies that want to enter

the market. There is a lot of involvement of money, if these new companies after getting

established stop their work due to the pressure that will face from the present refinement

companies. The prediction of the prices with respect to the refinement activities by the new

companies will be difficult, which may result in loss for these companies in the future.

Therefore, price plays an important factor for the new refining companies, as they have to

understand the present condition in the UK market (Cucchiella, D’ADamo and Gastaldi 2015).

Political risks

Politics can affect the oil and gas companies not only by its rules and regulations but in

other ways as well. The political risks may not only depend on the country but may vary from

state to state as well. The companies will tend to establish themselves in the stable political

systems so that it can help them in carrying out its business in an organized manner. The UK

market does not allow any refinery company to come within the country to set up its own

establishment, as it may give rise to the sudden nationalization or shift in the regulatory bodies

within the country (Atil, Lahiani and Nguyen 2014).

Barriers of financial investment in the UK refinery activities

Startup costs

The new companies that want to enter the market with the refinement of the oil has to

face trouble, as it is difficult to establish the company in the UK market. The refining companies

that are presently operating in the market will play a crucial role in preventing further investment

in their business due to the rise in the level of competition. The use of methods such as drilling in

a vertical manner will help in pushing up the prices of the refining companies that want to enter

the market. There is a lot of involvement of money, if these new companies after getting

established stop their work due to the pressure that will face from the present refinement

companies. The prediction of the prices with respect to the refinement activities by the new

companies will be difficult, which may result in loss for these companies in the future.

Therefore, price plays an important factor for the new refining companies, as they have to

understand the present condition in the UK market (Cucchiella, D’ADamo and Gastaldi 2015).

Political risks

Politics can affect the oil and gas companies not only by its rules and regulations but in

other ways as well. The political risks may not only depend on the country but may vary from

state to state as well. The companies will tend to establish themselves in the stable political

systems so that it can help them in carrying out its business in an organized manner. The UK

market does not allow any refinery company to come within the country to set up its own

establishment, as it may give rise to the sudden nationalization or shift in the regulatory bodies

within the country (Atil, Lahiani and Nguyen 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7OIL AND GAS MANAGEMENT

The refinery companies may face risk in the change in the government, which may result

in the end of the company after the capital has been invested by them within the economy. This

will lead to the loss of the companies, as the amount that has been invested cannot be retrieved

anyhow. The rules present in the country try to raise the interest of the local companies in

investing in the oil refineries rather than depending on the foreign companies. The mitigation of

these risks will help in building sustainable and successful relationships with the partners so that

the business can be carried out in an organized manner (Mallabum and Eyre 2014).

Supply and demand barriers

The anchor market that is present in the United States has been longing for new buyers

since the supply market has not been good in the past years. The search for the new buyers has

led to the market penetrating in the UK market, as the research conducted by them saw that the

demand is more in the market. This has led to the increase in the operating cost, as the supply

and demand for the barrels kept on changing. This type of fluctuating industry has led to the play

of the power between the new and the traditional refinery companies of oil. The Middle Eastern

countries are trying to increase their flow of products in the Asian and the UK market that will

help the country in investing more in this sector rather than America. This has lead to the

increase in the consumption of petroleum products in the European countries (Stevens 2016).

The demand of the oil has increased in the UK market, as more number of customers in

the UK market is increasing within the European nations. This has led to the change in the

demand and the supplies within the country. Moreover, the construction of the gas stations in the

country has to be done in a way so that it can provide the customers with other benefits as well.

This will help in attracting the customers towards the particular stations (Carney 2015).

The refinery companies may face risk in the change in the government, which may result

in the end of the company after the capital has been invested by them within the economy. This

will lead to the loss of the companies, as the amount that has been invested cannot be retrieved

anyhow. The rules present in the country try to raise the interest of the local companies in

investing in the oil refineries rather than depending on the foreign companies. The mitigation of

these risks will help in building sustainable and successful relationships with the partners so that

the business can be carried out in an organized manner (Mallabum and Eyre 2014).

Supply and demand barriers

The anchor market that is present in the United States has been longing for new buyers

since the supply market has not been good in the past years. The search for the new buyers has

led to the market penetrating in the UK market, as the research conducted by them saw that the

demand is more in the market. This has led to the increase in the operating cost, as the supply

and demand for the barrels kept on changing. This type of fluctuating industry has led to the play

of the power between the new and the traditional refinery companies of oil. The Middle Eastern

countries are trying to increase their flow of products in the Asian and the UK market that will

help the country in investing more in this sector rather than America. This has lead to the

increase in the consumption of petroleum products in the European countries (Stevens 2016).

The demand of the oil has increased in the UK market, as more number of customers in

the UK market is increasing within the European nations. This has led to the change in the

demand and the supplies within the country. Moreover, the construction of the gas stations in the

country has to be done in a way so that it can provide the customers with other benefits as well.

This will help in attracting the customers towards the particular stations (Carney 2015).

8OIL AND GAS MANAGEMENT

Environmental barriers

The UK government has taken a stern action against the level of pollution that is present

within the country. The construction of these new sites will lead in the increase in the level of

pollution within the surrounding area. The rise in the environmentalist activities is also

preventing the companies in building up of new areas. The excavation of the sites will lead to the

damaging of the areas, which will increase the factor of pollution. The drilling by the refinery

companies and the ecological effects of the new sites will affect the lives of the local residents

(Mallabum and Eyre 2014).

Adoption of the technologies

The future of the oil industry in the UK market is dependent on the improvement that

they make on the technological front. The oil companies on a global level are not in a state to

accept the new technologies that are present in the market, which will help in increasing the sale

of the oil. The use of the 3D seismic mapping has to be adopted so that the exploration of the

resource can be done in an easier way. This will help in decreasing the cost of computing so that

there can be rise in the production by drilling in a horizontal manner. This process will help in

controlling the surface and evaluating the reservoir at the time of drilling process (Bolton and

Foxton 2015). The fracturing technology plays an important role in the oil industry in the UK

that needs to be adopted so that it can help in setting up of the stations in an easy manner. The

adoption of the new technologies in the market is slow, as it leads to various risks in the project

that are of huge nature. The use of the technology in this sector is slow that has led to the

depletion of the oil fields and managing the reservoirs in an economic manner. The government

of UK needs to support the technological drive so that the refinery activities can be done in an

efficient manner (Stevens 2016).

Environmental barriers

The UK government has taken a stern action against the level of pollution that is present

within the country. The construction of these new sites will lead in the increase in the level of

pollution within the surrounding area. The rise in the environmentalist activities is also

preventing the companies in building up of new areas. The excavation of the sites will lead to the

damaging of the areas, which will increase the factor of pollution. The drilling by the refinery

companies and the ecological effects of the new sites will affect the lives of the local residents

(Mallabum and Eyre 2014).

Adoption of the technologies

The future of the oil industry in the UK market is dependent on the improvement that

they make on the technological front. The oil companies on a global level are not in a state to

accept the new technologies that are present in the market, which will help in increasing the sale

of the oil. The use of the 3D seismic mapping has to be adopted so that the exploration of the

resource can be done in an easier way. This will help in decreasing the cost of computing so that

there can be rise in the production by drilling in a horizontal manner. This process will help in

controlling the surface and evaluating the reservoir at the time of drilling process (Bolton and

Foxton 2015). The fracturing technology plays an important role in the oil industry in the UK

that needs to be adopted so that it can help in setting up of the stations in an easy manner. The

adoption of the new technologies in the market is slow, as it leads to various risks in the project

that are of huge nature. The use of the technology in this sector is slow that has led to the

depletion of the oil fields and managing the reservoirs in an economic manner. The government

of UK needs to support the technological drive so that the refinery activities can be done in an

efficient manner (Stevens 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9OIL AND GAS MANAGEMENT

Conclusion

Thus it can be concluded that the refineries have to find certain alternatives so that it can

help them in finding investments for the proper management of the oil. The barriers such as the

government policies and the geographical risks have to be mitigated so that it can help the

companies in attracting the investors to raise money within the company with which they can

continue their refining activities. this would help them in serving the needs of the customers who

are totally dependent on the petroleum products.

Conclusion

Thus it can be concluded that the refineries have to find certain alternatives so that it can

help them in finding investments for the proper management of the oil. The barriers such as the

government policies and the geographical risks have to be mitigated so that it can help the

companies in attracting the investors to raise money within the company with which they can

continue their refining activities. this would help them in serving the needs of the customers who

are totally dependent on the petroleum products.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10OIL AND GAS MANAGEMENT

Reference List

Atil, A., Lahiani, A. and Nguyen, D.K., 2014. Asymmetric and nonlinear pass-through of crude

oil prices to gasoline and natural gas prices. Energy Policy, 65, pp.567-573.

Bolton, R. and Foxon, T.J., 2015. A socio-technical perspective on low carbon investment

challenges–insights for UK energy policy. Environmental Innovation and Societal

Transitions, 14, pp.165-181.

Bunn, D.W., Chevallier, J., Le Pen, Y. and Sevi, B., 2017. Fundamental and financial influences

on the co-movement of oil and gas prices. Energy Journal, 38(2).

Carney, M., 2015. Breaking the tragedy of the horizon—climate change and financial

stability. Speech given at Lloyd’s of London, September, 29.

Chmutina, K. and Goodier, C.I., 2014. Alternative future energy pathways: Assessment of the

potential of innovative decentralised energy systems in the UK. Energy Policy, 66, pp.62-72.

Cucchiella, F., D’Adamo, I. and Gastaldi, M., 2015. Financial analysis for investment and policy

decisions in the renewable energy sector. Clean Technologies and Environmental Policy, 17(4),

pp.887-904.

Leete, S., Xu, J. and Wheeler, D., 2013. Investment barriers and incentives for marine renewable

energy in the UK: An analysis of investor preferences. Energy policy, 60, pp.866-875.

Mallaburn, P.S. and Eyre, N., 2014. Lessons from energy efficiency policy and programmesin

the UK from 1973 to 2013. Energy Efficiency, 7(1), pp.23-41.

Reference List

Atil, A., Lahiani, A. and Nguyen, D.K., 2014. Asymmetric and nonlinear pass-through of crude

oil prices to gasoline and natural gas prices. Energy Policy, 65, pp.567-573.

Bolton, R. and Foxon, T.J., 2015. A socio-technical perspective on low carbon investment

challenges–insights for UK energy policy. Environmental Innovation and Societal

Transitions, 14, pp.165-181.

Bunn, D.W., Chevallier, J., Le Pen, Y. and Sevi, B., 2017. Fundamental and financial influences

on the co-movement of oil and gas prices. Energy Journal, 38(2).

Carney, M., 2015. Breaking the tragedy of the horizon—climate change and financial

stability. Speech given at Lloyd’s of London, September, 29.

Chmutina, K. and Goodier, C.I., 2014. Alternative future energy pathways: Assessment of the

potential of innovative decentralised energy systems in the UK. Energy Policy, 66, pp.62-72.

Cucchiella, F., D’Adamo, I. and Gastaldi, M., 2015. Financial analysis for investment and policy

decisions in the renewable energy sector. Clean Technologies and Environmental Policy, 17(4),

pp.887-904.

Leete, S., Xu, J. and Wheeler, D., 2013. Investment barriers and incentives for marine renewable

energy in the UK: An analysis of investor preferences. Energy policy, 60, pp.866-875.

Mallaburn, P.S. and Eyre, N., 2014. Lessons from energy efficiency policy and programmesin

the UK from 1973 to 2013. Energy Efficiency, 7(1), pp.23-41.

11OIL AND GAS MANAGEMENT

Mitchell, J., Marcel, V. and Mitchell, B., 2015. Oil and gas mismatches: finance, investment and

climate policy. Chatham House Research Paper, London.

Mitchell, J.V. and Mitchell, B., 2014. Structural crisis in the oil and gas industry. Energy

Policy, 64, pp.36-42.

Stevens, P., 2016. International Oil Companies. Chatham House.

Yusuf, Y.Y., Gunasekaran, A., Musa, A., El-Berishy, N.M., Abubakar, T. and Ambursa, H.M.,

2013. The UK oil and gas supply chains: An empirical analysis of adoption of sustainable

measures and performance outcomes. International Journal of Production Economics, 146(2),

pp.501-514.

Mitchell, J., Marcel, V. and Mitchell, B., 2015. Oil and gas mismatches: finance, investment and

climate policy. Chatham House Research Paper, London.

Mitchell, J.V. and Mitchell, B., 2014. Structural crisis in the oil and gas industry. Energy

Policy, 64, pp.36-42.

Stevens, P., 2016. International Oil Companies. Chatham House.

Yusuf, Y.Y., Gunasekaran, A., Musa, A., El-Berishy, N.M., Abubakar, T. and Ambursa, H.M.,

2013. The UK oil and gas supply chains: An empirical analysis of adoption of sustainable

measures and performance outcomes. International Journal of Production Economics, 146(2),

pp.501-514.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.