Recording Business Transactions: Financial Analysis Report, Oxford

VerifiedAdded on 2022/12/28

|16

|2518

|85

Report

AI Summary

This report provides a comprehensive analysis of recording business transactions for a new toy business started by Linda at Oxford University. The report meticulously details the recording of transactions in journal entries, ledgers, trial balance, income statement, and balance sheet. It includes a thorough analysis of financial ratios, such as net profit margin, gross profit margin, current ratio, acid test ratio, accounts receivable collection period, and accounts payable payment period, comparing Linda's business performance with the average competitor market. The report highlights the company's financial position, interpretations of the ratios, and concludes with recommendations for improvement, particularly in areas like net profit margin, current ratio, and accounts payable payment period to ensure the business's long-term sustainability and competitiveness in the market. It also addresses the handling of owner's drawings, distinguishing between personal and business-related expenses.

RECORDING BUSINESS

TRANSACTION

TRANSACTION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

PART A...........................................................................................................................................3

A. JOURNAL..............................................................................................................................3

B. LEDGERS...............................................................................................................................5

C. TRIAL BALANCE.................................................................................................................8

D.INCOME STATEMENT.........................................................................................................9

E. BALANCE SHEET.................................................................................................................9

F. BRIEF ON LINDA'S DRAWINGS......................................................................................10

PART B..........................................................................................................................................10

INTERPRETATION..................................................................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

PART A...........................................................................................................................................3

A. JOURNAL..............................................................................................................................3

B. LEDGERS...............................................................................................................................5

C. TRIAL BALANCE.................................................................................................................8

D.INCOME STATEMENT.........................................................................................................9

E. BALANCE SHEET.................................................................................................................9

F. BRIEF ON LINDA'S DRAWINGS......................................................................................10

PART B..........................................................................................................................................10

INTERPRETATION..................................................................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES................................................................................................................................1

INTRODUCTION

The Recording of business transaction records all the transactions in the books of

accounts of any organization in many ways. These transactions are recorded in Journal entries,

Profit and Loss Statement, income statement and balance sheet of the firms (Rechtman, 2017). In

this report Linda started new business of selling toys in Oxford university and record the

transactions' for the first month. It also analysis the ratios of the company and interpretation

which shows the company efficiency and working of business. Whereas, Ratios are also

compared with the competitor market and shows Linda's business position in the market.

MAIN BODY.

PART A

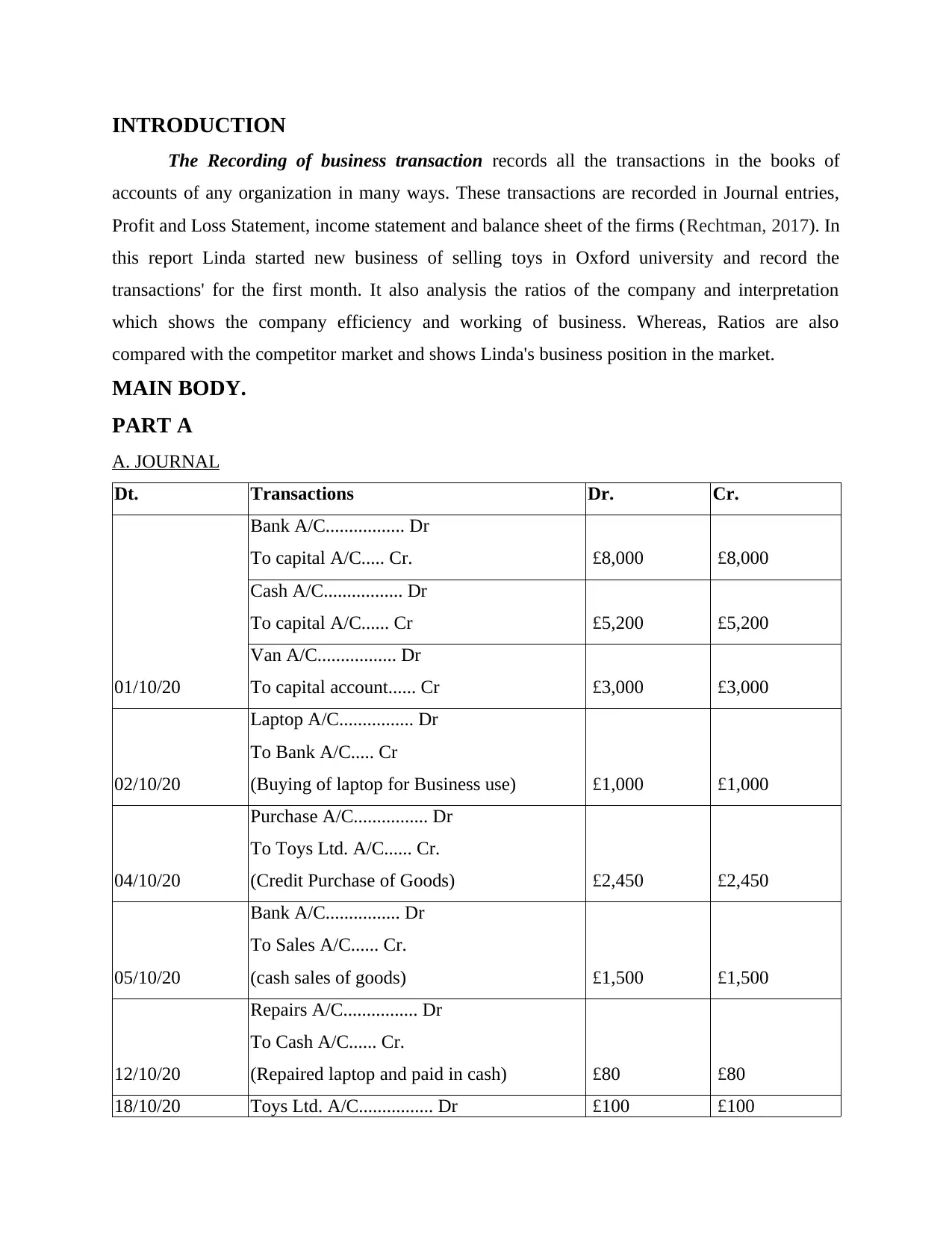

A. JOURNAL

Dt. Transactions Dr. Cr.

01/10/20

Bank A/C................. Dr

To capital A/C..... Cr. £8,000 £8,000

Cash A/C................. Dr

To capital A/C...... Cr £5,200 £5,200

Van A/C................. Dr

To capital account...... Cr £3,000 £3,000

02/10/20

Laptop A/C................ Dr

To Bank A/C..... Cr

(Buying of laptop for Business use) £1,000 £1,000

04/10/20

Purchase A/C................ Dr

To Toys Ltd. A/C...... Cr.

(Credit Purchase of Goods) £2,450 £2,450

05/10/20

Bank A/C................ Dr

To Sales A/C...... Cr.

(cash sales of goods) £1,500 £1,500

12/10/20

Repairs A/C................ Dr

To Cash A/C...... Cr.

(Repaired laptop and paid in cash) £80 £80

18/10/20 Toys Ltd. A/C................ Dr £100 £100

The Recording of business transaction records all the transactions in the books of

accounts of any organization in many ways. These transactions are recorded in Journal entries,

Profit and Loss Statement, income statement and balance sheet of the firms (Rechtman, 2017). In

this report Linda started new business of selling toys in Oxford university and record the

transactions' for the first month. It also analysis the ratios of the company and interpretation

which shows the company efficiency and working of business. Whereas, Ratios are also

compared with the competitor market and shows Linda's business position in the market.

MAIN BODY.

PART A

A. JOURNAL

Dt. Transactions Dr. Cr.

01/10/20

Bank A/C................. Dr

To capital A/C..... Cr. £8,000 £8,000

Cash A/C................. Dr

To capital A/C...... Cr £5,200 £5,200

Van A/C................. Dr

To capital account...... Cr £3,000 £3,000

02/10/20

Laptop A/C................ Dr

To Bank A/C..... Cr

(Buying of laptop for Business use) £1,000 £1,000

04/10/20

Purchase A/C................ Dr

To Toys Ltd. A/C...... Cr.

(Credit Purchase of Goods) £2,450 £2,450

05/10/20

Bank A/C................ Dr

To Sales A/C...... Cr.

(cash sales of goods) £1,500 £1,500

12/10/20

Repairs A/C................ Dr

To Cash A/C...... Cr.

(Repaired laptop and paid in cash) £80 £80

18/10/20 Toys Ltd. A/C................ Dr £100 £100

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

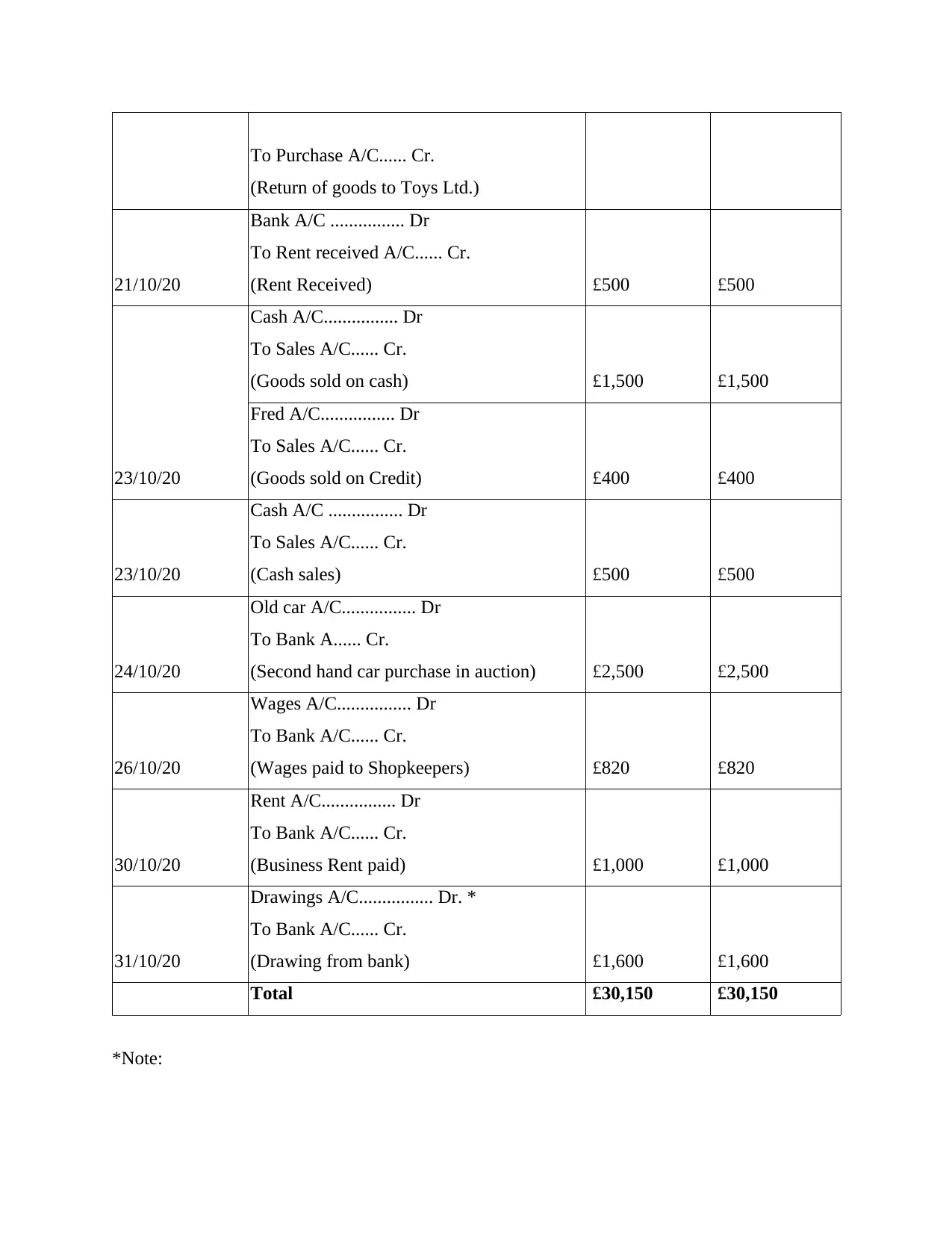

To Purchase A/C...... Cr.

(Return of goods to Toys Ltd.)

21/10/20

Bank A/C ................ Dr

To Rent received A/C...... Cr.

(Rent Received) £500 £500

23/10/20

Cash A/C................ Dr

To Sales A/C...... Cr.

(Goods sold on cash) £1,500 £1,500

Fred A/C................ Dr

To Sales A/C...... Cr.

(Goods sold on Credit) £400 £400

23/10/20

Cash A/C ................ Dr

To Sales A/C...... Cr.

(Cash sales) £500 £500

24/10/20

Old car A/C................ Dr

To Bank A...... Cr.

(Second hand car purchase in auction) £2,500 £2,500

26/10/20

Wages A/C................ Dr

To Bank A/C...... Cr.

(Wages paid to Shopkeepers) £820 £820

30/10/20

Rent A/C................ Dr

To Bank A/C...... Cr.

(Business Rent paid) £1,000 £1,000

31/10/20

Drawings A/C................ Dr. *

To Bank A/C...... Cr.

(Drawing from bank) £1,600 £1,600

Total £30,150 £30,150

*Note:

(Return of goods to Toys Ltd.)

21/10/20

Bank A/C ................ Dr

To Rent received A/C...... Cr.

(Rent Received) £500 £500

23/10/20

Cash A/C................ Dr

To Sales A/C...... Cr.

(Goods sold on cash) £1,500 £1,500

Fred A/C................ Dr

To Sales A/C...... Cr.

(Goods sold on Credit) £400 £400

23/10/20

Cash A/C ................ Dr

To Sales A/C...... Cr.

(Cash sales) £500 £500

24/10/20

Old car A/C................ Dr

To Bank A...... Cr.

(Second hand car purchase in auction) £2,500 £2,500

26/10/20

Wages A/C................ Dr

To Bank A/C...... Cr.

(Wages paid to Shopkeepers) £820 £820

30/10/20

Rent A/C................ Dr

To Bank A/C...... Cr.

(Business Rent paid) £1,000 £1,000

31/10/20

Drawings A/C................ Dr. *

To Bank A/C...... Cr.

(Drawing from bank) £1,600 £1,600

Total £30,150 £30,150

*Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

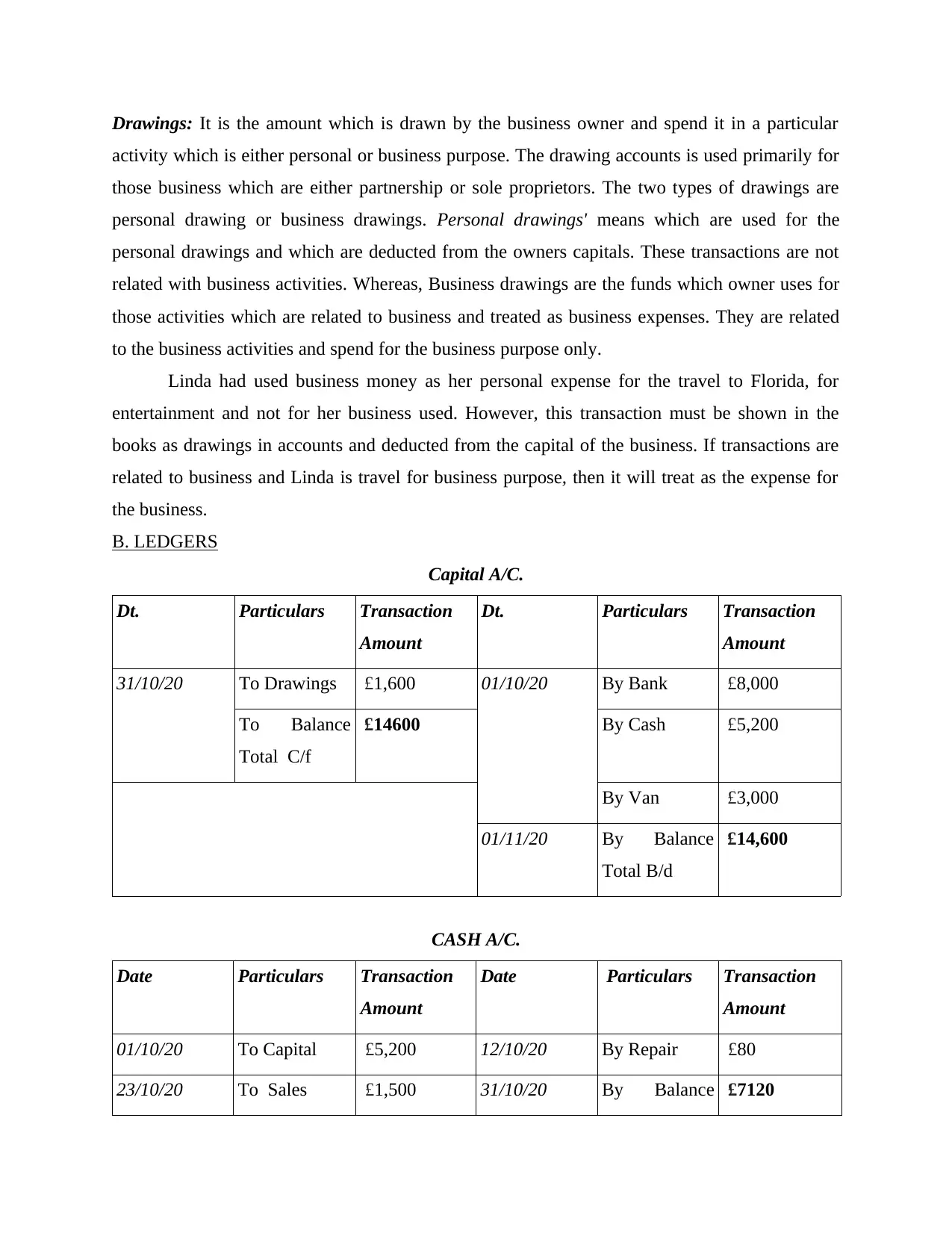

Drawings: It is the amount which is drawn by the business owner and spend it in a particular

activity which is either personal or business purpose. The drawing accounts is used primarily for

those business which are either partnership or sole proprietors. The two types of drawings are

personal drawing or business drawings. Personal drawings' means which are used for the

personal drawings and which are deducted from the owners capitals. These transactions are not

related with business activities. Whereas, Business drawings are the funds which owner uses for

those activities which are related to business and treated as business expenses. They are related

to the business activities and spend for the business purpose only.

Linda had used business money as her personal expense for the travel to Florida, for

entertainment and not for her business used. However, this transaction must be shown in the

books as drawings in accounts and deducted from the capital of the business. If transactions are

related to business and Linda is travel for business purpose, then it will treat as the expense for

the business.

B. LEDGERS

Capital A/C.

Dt. Particulars Transaction

Amount

Dt. Particulars Transaction

Amount

31/10/20 To Drawings £1,600 01/10/20 By Bank £8,000

To Balance

Total C/f

£14600 By Cash £5,200

By Van £3,000

01/11/20 By Balance

Total B/d

£14,600

CASH A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

01/10/20 To Capital £5,200 12/10/20 By Repair £80

23/10/20 To Sales £1,500 31/10/20 By Balance £7120

activity which is either personal or business purpose. The drawing accounts is used primarily for

those business which are either partnership or sole proprietors. The two types of drawings are

personal drawing or business drawings. Personal drawings' means which are used for the

personal drawings and which are deducted from the owners capitals. These transactions are not

related with business activities. Whereas, Business drawings are the funds which owner uses for

those activities which are related to business and treated as business expenses. They are related

to the business activities and spend for the business purpose only.

Linda had used business money as her personal expense for the travel to Florida, for

entertainment and not for her business used. However, this transaction must be shown in the

books as drawings in accounts and deducted from the capital of the business. If transactions are

related to business and Linda is travel for business purpose, then it will treat as the expense for

the business.

B. LEDGERS

Capital A/C.

Dt. Particulars Transaction

Amount

Dt. Particulars Transaction

Amount

31/10/20 To Drawings £1,600 01/10/20 By Bank £8,000

To Balance

Total C/f

£14600 By Cash £5,200

By Van £3,000

01/11/20 By Balance

Total B/d

£14,600

CASH A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

01/10/20 To Capital £5,200 12/10/20 By Repair £80

23/10/20 To Sales £1,500 31/10/20 By Balance £7120

Total C/f

To Sales £500

01/11/20 To Balance

Total B/d

£7,120

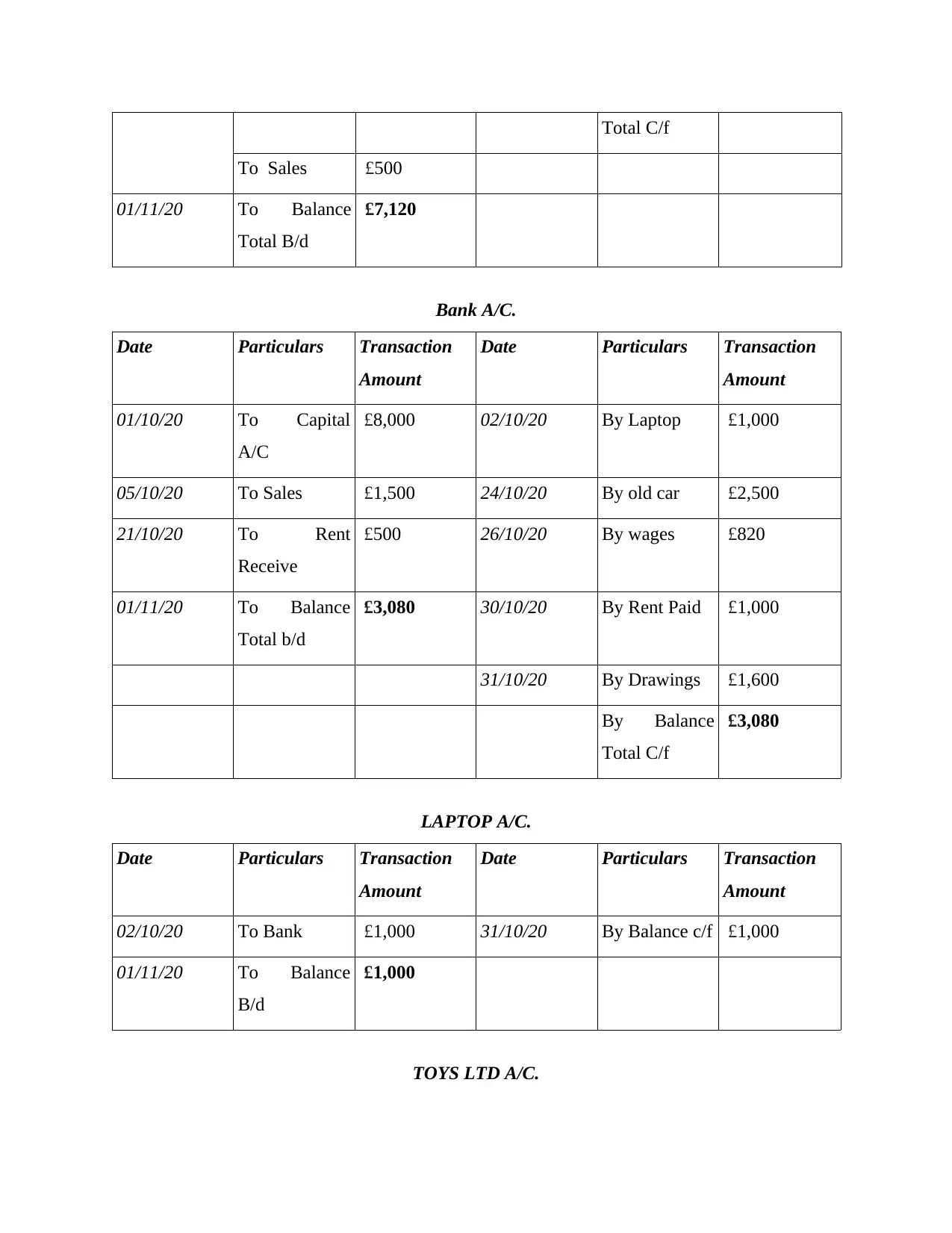

Bank A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

01/10/20 To Capital

A/C

£8,000 02/10/20 By Laptop £1,000

05/10/20 To Sales £1,500 24/10/20 By old car £2,500

21/10/20 To Rent

Receive

£500 26/10/20 By wages £820

01/11/20 To Balance

Total b/d

£3,080 30/10/20 By Rent Paid £1,000

31/10/20 By Drawings £1,600

By Balance

Total C/f

£3,080

LAPTOP A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

02/10/20 To Bank £1,000 31/10/20 By Balance c/f £1,000

01/11/20 To Balance

B/d

£1,000

TOYS LTD A/C.

To Sales £500

01/11/20 To Balance

Total B/d

£7,120

Bank A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

01/10/20 To Capital

A/C

£8,000 02/10/20 By Laptop £1,000

05/10/20 To Sales £1,500 24/10/20 By old car £2,500

21/10/20 To Rent

Receive

£500 26/10/20 By wages £820

01/11/20 To Balance

Total b/d

£3,080 30/10/20 By Rent Paid £1,000

31/10/20 By Drawings £1,600

By Balance

Total C/f

£3,080

LAPTOP A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

02/10/20 To Bank £1,000 31/10/20 By Balance c/f £1,000

01/11/20 To Balance

B/d

£1,000

TOYS LTD A/C.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

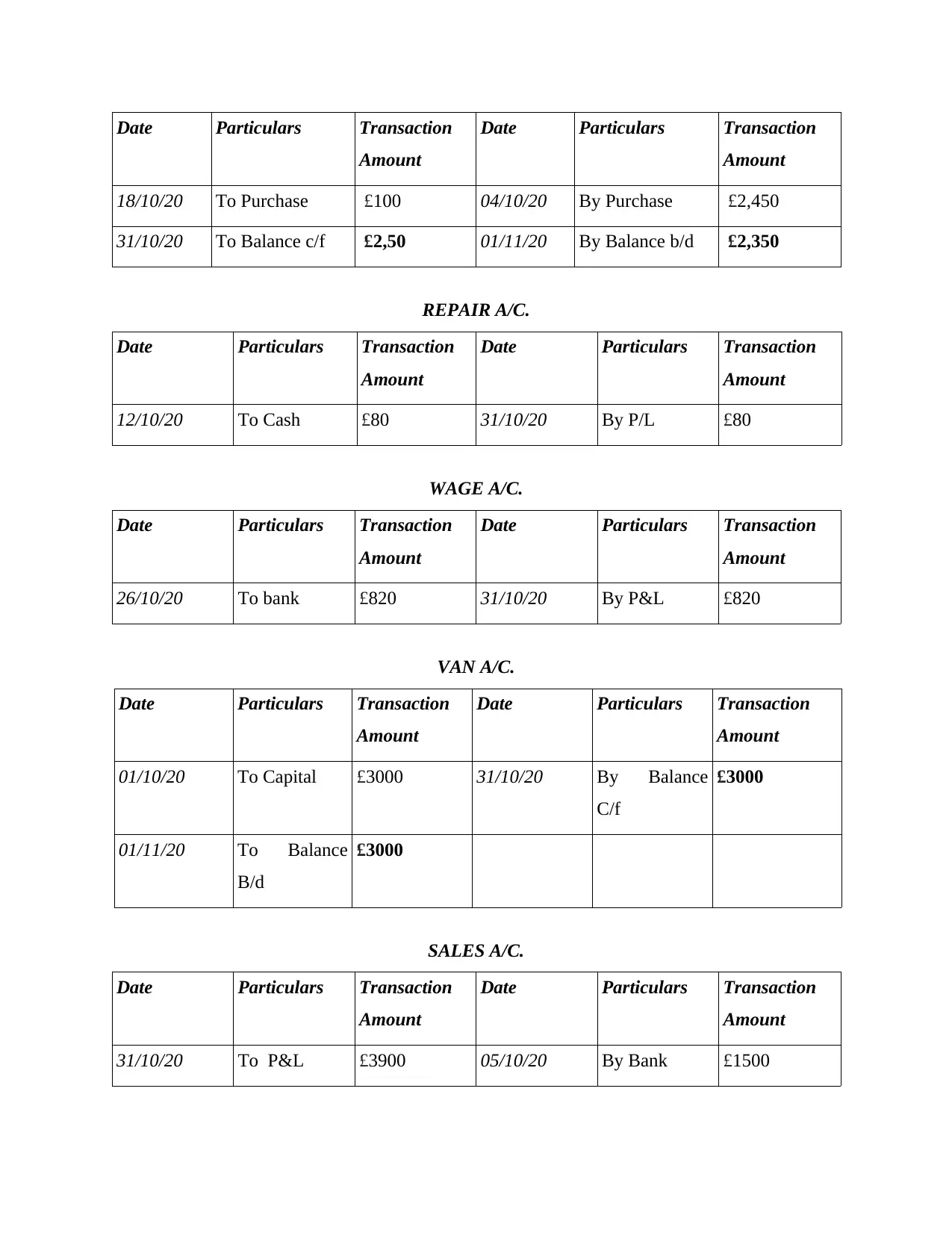

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

18/10/20 To Purchase £100 04/10/20 By Purchase £2,450

31/10/20 To Balance c/f £2,50 01/11/20 By Balance b/d £2,350

REPAIR A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

12/10/20 To Cash £80 31/10/20 By P/L £80

WAGE A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

26/10/20 To bank £820 31/10/20 By P&L £820

VAN A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

01/10/20 To Capital £3000 31/10/20 By Balance

C/f

£3000

01/11/20 To Balance

B/d

£3000

SALES A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

31/10/20 To P&L £3900 05/10/20 By Bank £1500

Amount

Date Particulars Transaction

Amount

18/10/20 To Purchase £100 04/10/20 By Purchase £2,450

31/10/20 To Balance c/f £2,50 01/11/20 By Balance b/d £2,350

REPAIR A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

12/10/20 To Cash £80 31/10/20 By P/L £80

WAGE A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

26/10/20 To bank £820 31/10/20 By P&L £820

VAN A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

01/10/20 To Capital £3000 31/10/20 By Balance

C/f

£3000

01/11/20 To Balance

B/d

£3000

SALES A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

31/10/20 To P&L £3900 05/10/20 By Bank £1500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

23/10/20 By Cash £1500

By Fred £400

By Bank £500

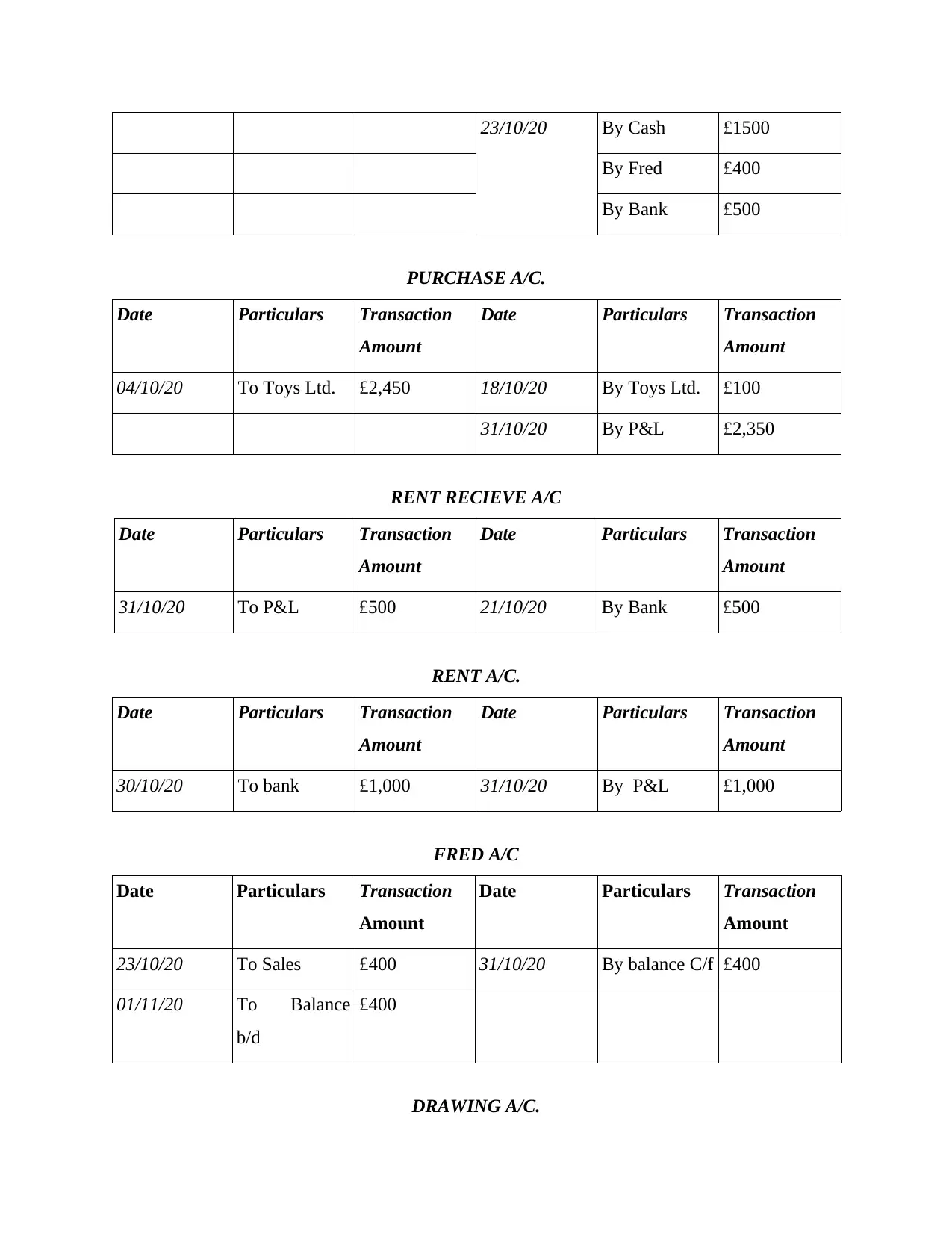

PURCHASE A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

04/10/20 To Toys Ltd. £2,450 18/10/20 By Toys Ltd. £100

31/10/20 By P&L £2,350

RENT RECIEVE A/C

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

31/10/20 To P&L £500 21/10/20 By Bank £500

RENT A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

30/10/20 To bank £1,000 31/10/20 By P&L £1,000

FRED A/C

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

23/10/20 To Sales £400 31/10/20 By balance C/f £400

01/11/20 To Balance

b/d

£400

DRAWING A/C.

By Fred £400

By Bank £500

PURCHASE A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

04/10/20 To Toys Ltd. £2,450 18/10/20 By Toys Ltd. £100

31/10/20 By P&L £2,350

RENT RECIEVE A/C

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

31/10/20 To P&L £500 21/10/20 By Bank £500

RENT A/C.

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

30/10/20 To bank £1,000 31/10/20 By P&L £1,000

FRED A/C

Date Particulars Transaction

Amount

Date Particulars Transaction

Amount

23/10/20 To Sales £400 31/10/20 By balance C/f £400

01/11/20 To Balance

b/d

£400

DRAWING A/C.

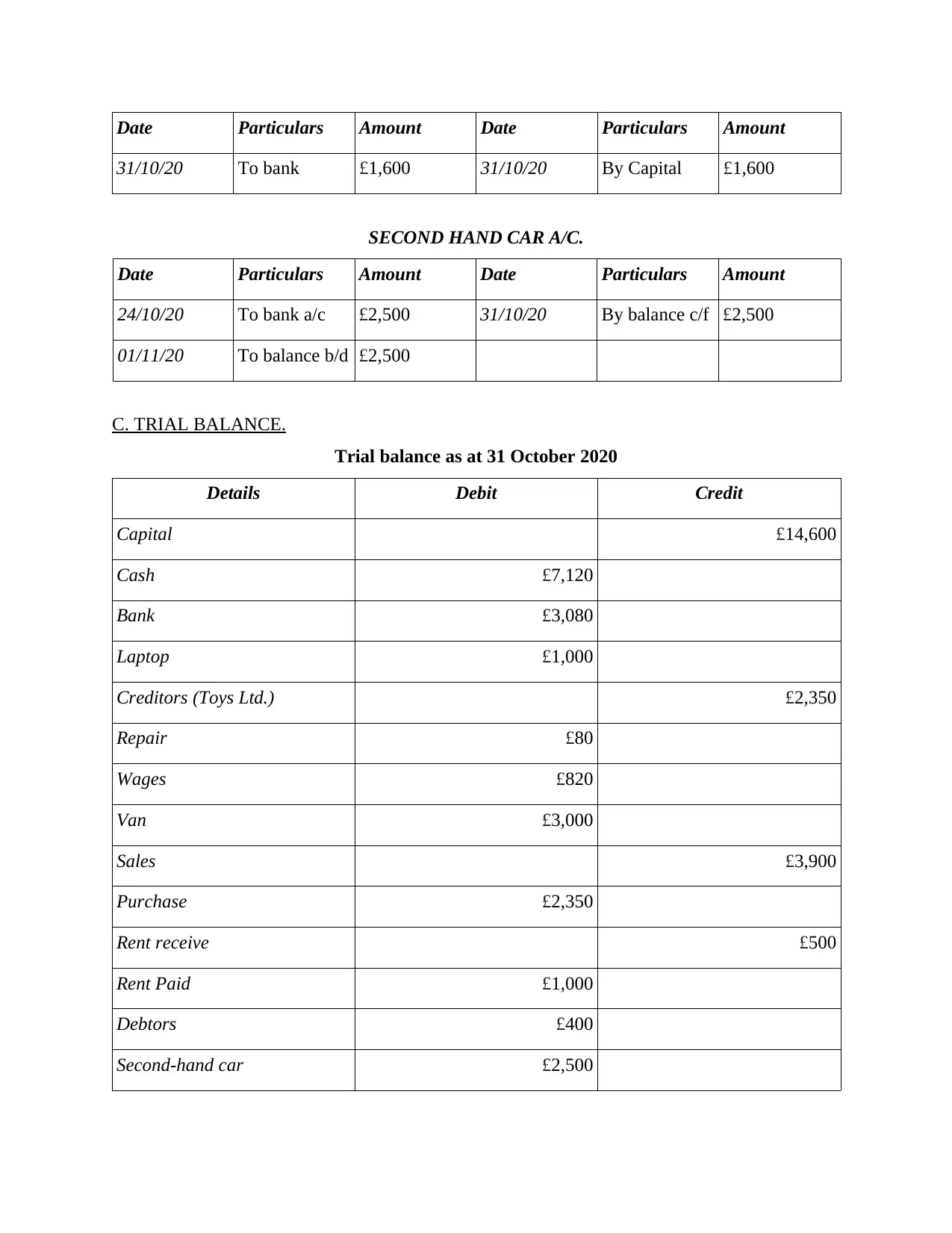

Date Particulars Amount Date Particulars Amount

31/10/20 To bank £1,600 31/10/20 By Capital £1,600

SECOND HAND CAR A/C.

Date Particulars Amount Date Particulars Amount

24/10/20 To bank a/c £2,500 31/10/20 By balance c/f £2,500

01/11/20 To balance b/d £2,500

C. TRIAL BALANCE.

Trial balance as at 31 October 2020

Details Debit Credit

Capital £14,600

Cash £7,120

Bank £3,080

Laptop £1,000

Creditors (Toys Ltd.) £2,350

Repair £80

Wages £820

Van £3,000

Sales £3,900

Purchase £2,350

Rent receive £500

Rent Paid £1,000

Debtors £400

Second-hand car £2,500

31/10/20 To bank £1,600 31/10/20 By Capital £1,600

SECOND HAND CAR A/C.

Date Particulars Amount Date Particulars Amount

24/10/20 To bank a/c £2,500 31/10/20 By balance c/f £2,500

01/11/20 To balance b/d £2,500

C. TRIAL BALANCE.

Trial balance as at 31 October 2020

Details Debit Credit

Capital £14,600

Cash £7,120

Bank £3,080

Laptop £1,000

Creditors (Toys Ltd.) £2,350

Repair £80

Wages £820

Van £3,000

Sales £3,900

Purchase £2,350

Rent receive £500

Rent Paid £1,000

Debtors £400

Second-hand car £2,500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total Amount £21,350 £2,1350

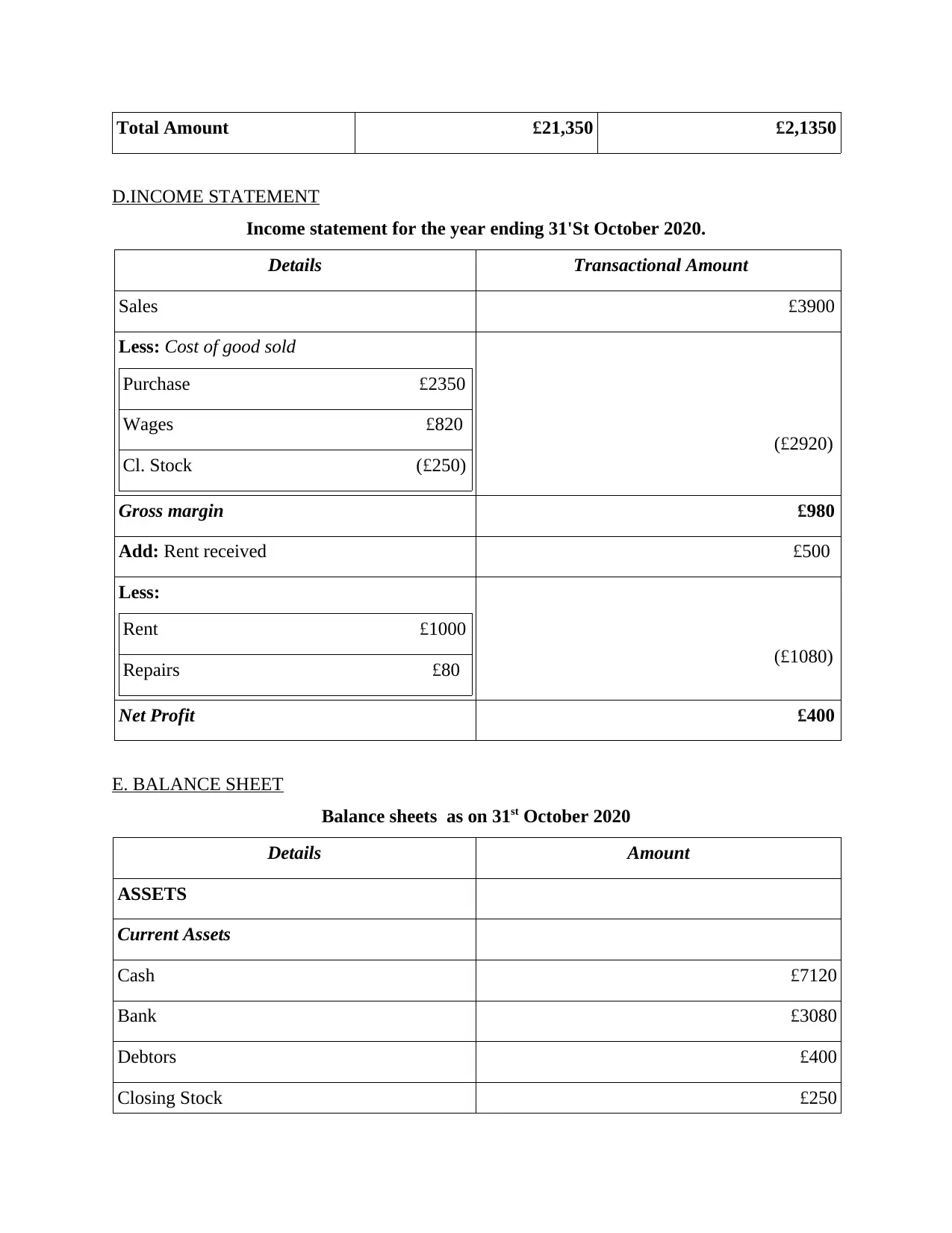

D.INCOME STATEMENT

Income statement for the year ending 31'St October 2020.

Details Transactional Amount

Sales £3900

Less: Cost of good sold

Purchase £2350

Wages £820

Cl. Stock (£250)

(£2920)

Gross margin £980

Add: Rent received £500

Less:

Rent £1000

Repairs £80 (£1080)

Net Profit £400

E. BALANCE SHEET

Balance sheets as on 31st October 2020

Details Amount

ASSETS

Current Assets

Cash £7120

Bank £3080

Debtors £400

Closing Stock £250

D.INCOME STATEMENT

Income statement for the year ending 31'St October 2020.

Details Transactional Amount

Sales £3900

Less: Cost of good sold

Purchase £2350

Wages £820

Cl. Stock (£250)

(£2920)

Gross margin £980

Add: Rent received £500

Less:

Rent £1000

Repairs £80 (£1080)

Net Profit £400

E. BALANCE SHEET

Balance sheets as on 31st October 2020

Details Amount

ASSETS

Current Assets

Cash £7120

Bank £3080

Debtors £400

Closing Stock £250

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

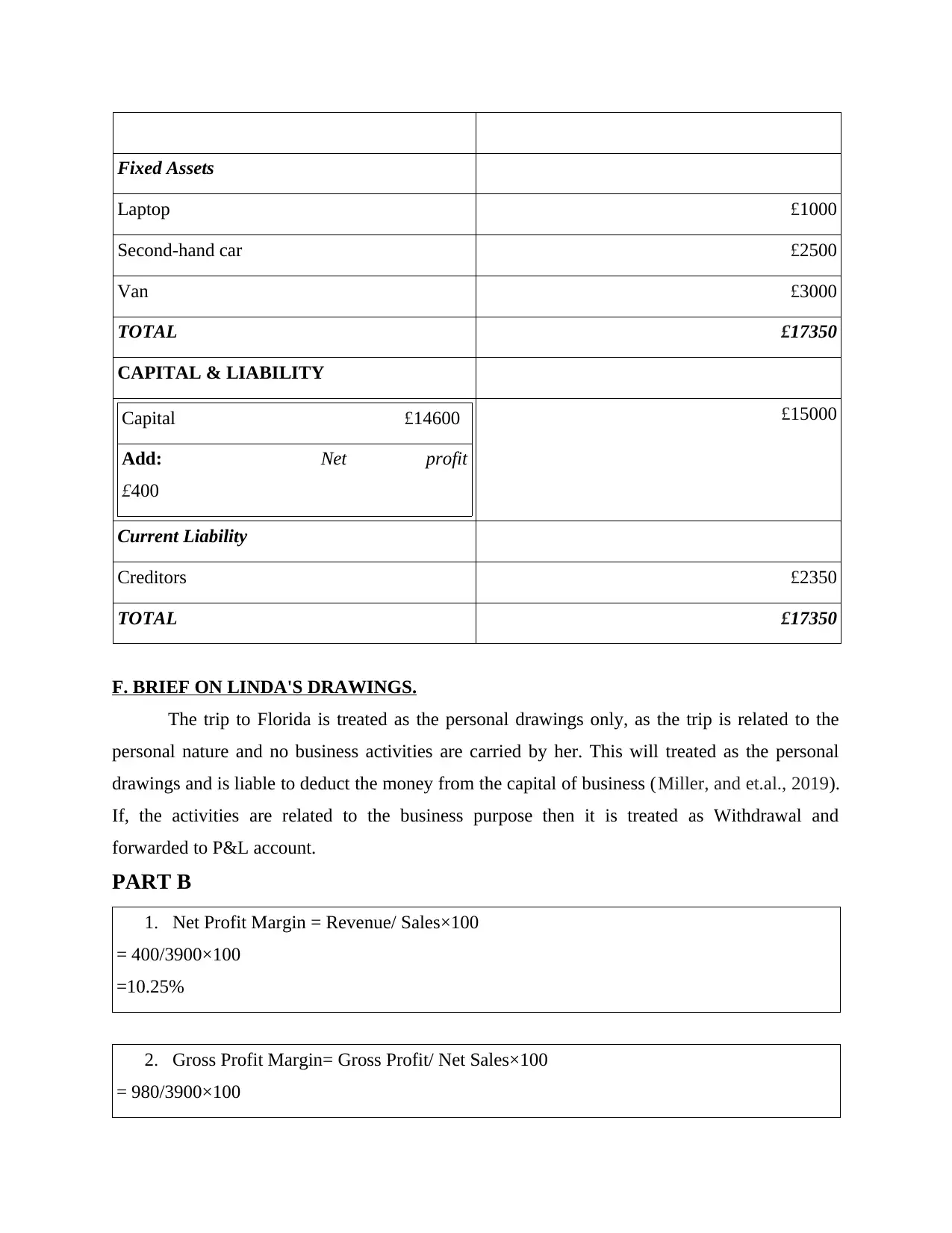

Fixed Assets

Laptop £1000

Second-hand car £2500

Van £3000

TOTAL £17350

CAPITAL & LIABILITY

Capital £14600

Add: Net profit

£400

£15000

Current Liability

Creditors £2350

TOTAL £17350

F. BRIEF ON LINDA'S DRAWINGS.

The trip to Florida is treated as the personal drawings only, as the trip is related to the

personal nature and no business activities are carried by her. This will treated as the personal

drawings and is liable to deduct the money from the capital of business (Miller, and et.al., 2019).

If, the activities are related to the business purpose then it is treated as Withdrawal and

forwarded to P&L account.

PART B

1. Net Profit Margin = Revenue/ Sales×100

= 400/3900×100

=10.25%

2. Gross Profit Margin= Gross Profit/ Net Sales×100

= 980/3900×100

Laptop £1000

Second-hand car £2500

Van £3000

TOTAL £17350

CAPITAL & LIABILITY

Capital £14600

Add: Net profit

£400

£15000

Current Liability

Creditors £2350

TOTAL £17350

F. BRIEF ON LINDA'S DRAWINGS.

The trip to Florida is treated as the personal drawings only, as the trip is related to the

personal nature and no business activities are carried by her. This will treated as the personal

drawings and is liable to deduct the money from the capital of business (Miller, and et.al., 2019).

If, the activities are related to the business purpose then it is treated as Withdrawal and

forwarded to P&L account.

PART B

1. Net Profit Margin = Revenue/ Sales×100

= 400/3900×100

=10.25%

2. Gross Profit Margin= Gross Profit/ Net Sales×100

= 980/3900×100

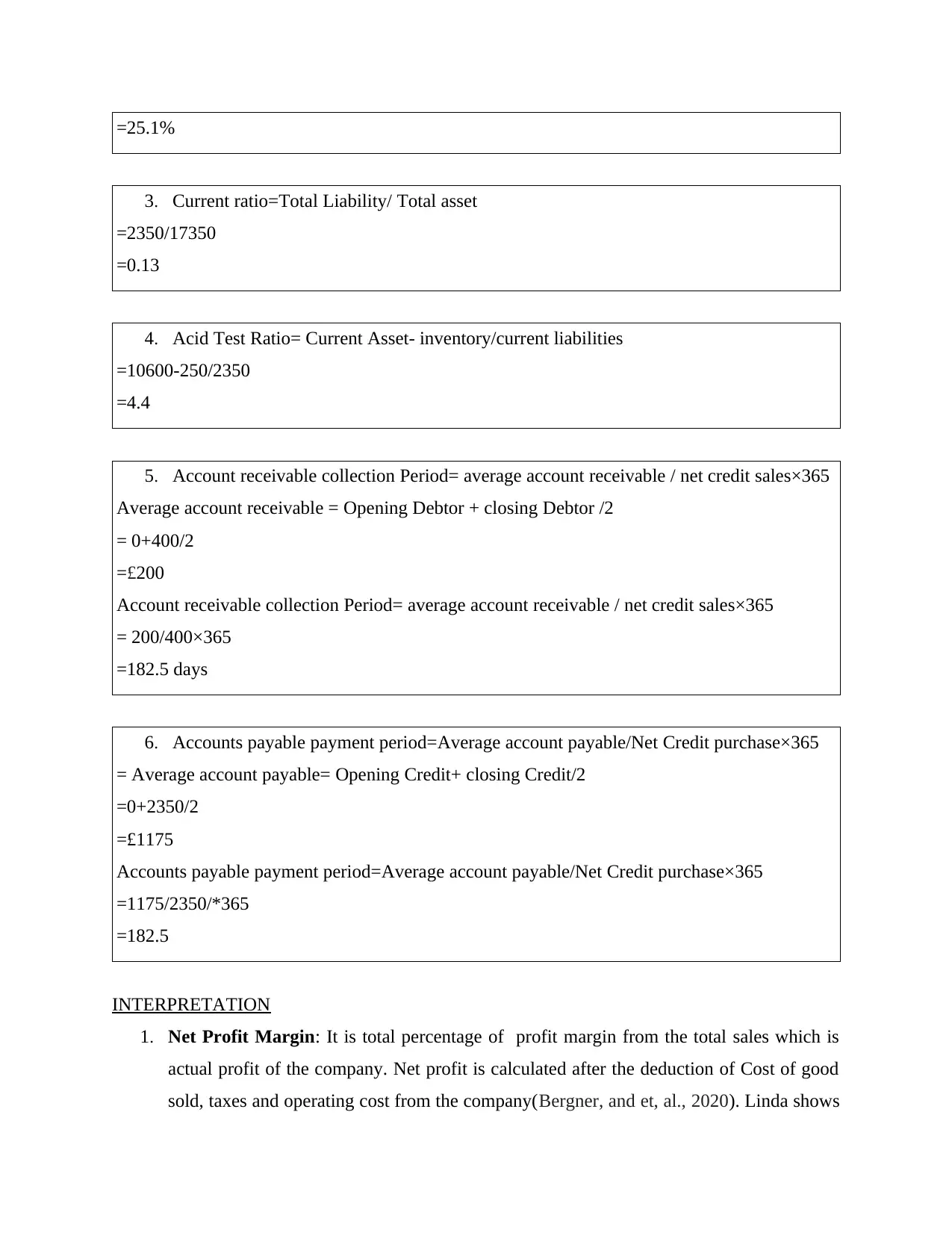

=25.1%

3. Current ratio=Total Liability/ Total asset

=2350/17350

=0.13

4. Acid Test Ratio= Current Asset- inventory/current liabilities

=10600-250/2350

=4.4

5. Account receivable collection Period= average account receivable / net credit sales×365

Average account receivable = Opening Debtor + closing Debtor /2

= 0+400/2

=£200

Account receivable collection Period= average account receivable / net credit sales×365

= 200/400×365

=182.5 days

6. Accounts payable payment period=Average account payable/Net Credit purchase×365

= Average account payable= Opening Credit+ closing Credit/2

=0+2350/2

=£1175

Accounts payable payment period=Average account payable/Net Credit purchase×365

=1175/2350/*365

=182.5

INTERPRETATION

1. Net Profit Margin: It is total percentage of profit margin from the total sales which is

actual profit of the company. Net profit is calculated after the deduction of Cost of good

sold, taxes and operating cost from the company(Bergner, and et, al., 2020). Linda shows

3. Current ratio=Total Liability/ Total asset

=2350/17350

=0.13

4. Acid Test Ratio= Current Asset- inventory/current liabilities

=10600-250/2350

=4.4

5. Account receivable collection Period= average account receivable / net credit sales×365

Average account receivable = Opening Debtor + closing Debtor /2

= 0+400/2

=£200

Account receivable collection Period= average account receivable / net credit sales×365

= 200/400×365

=182.5 days

6. Accounts payable payment period=Average account payable/Net Credit purchase×365

= Average account payable= Opening Credit+ closing Credit/2

=0+2350/2

=£1175

Accounts payable payment period=Average account payable/Net Credit purchase×365

=1175/2350/*365

=182.5

INTERPRETATION

1. Net Profit Margin: It is total percentage of profit margin from the total sales which is

actual profit of the company. Net profit is calculated after the deduction of Cost of good

sold, taxes and operating cost from the company(Bergner, and et, al., 2020). Linda shows

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.