Financial Analysis of British Sky Broadcasting: 2013-2014 Performance

VerifiedAdded on 2023/01/13

|18

|2711

|45

Report

AI Summary

This report provides a financial analysis of British Sky Broadcasting (BSkyB), examining its performance in 2013 and 2014. The analysis includes the calculation of key financial ratios such as gross profit margin, operating profit margin, and net profit margin, along with an assessment of shareholder satisfaction based on the financial results. The report highlights a decrease in profitability margins from 2013 to 2014, attributing this to increased expenses. It then suggests strategies to improve profitability, such as cost management and boosting productivity. The report concludes that while BSkyB's performance is average, it is sufficient for stakeholders, and recommends specific actions to increase the company's profitability. The report also includes an executive summary regarding the effectiveness of reward and appraisal systems in increasing retention and productivity at McDonald's, identifying problems and causes, and suggesting solutions.

INTRODUCTION TO

BUSINESS (TASK 3)

BUSINESS (TASK 3)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

MAIN BODY...................................................................................................................................3

1. Calculation of ratios................................................................................................................3

2. Extend to which shareholders of above company should be satisfied in accordance of

financial performance of year 2013 and 2014. ...........................................................................5

3. Different types of options which can be beneficial for above company in order to increase

profitability..................................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES.................................................................................................................................9

MAIN BODY...................................................................................................................................3

1. Calculation of ratios................................................................................................................3

2. Extend to which shareholders of above company should be satisfied in accordance of

financial performance of year 2013 and 2014. ...........................................................................5

3. Different types of options which can be beneficial for above company in order to increase

profitability..................................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES.................................................................................................................................9

INTRODUCTION

It is essential for companies to do proper financial analysis in order to take corrective

actions (Vogel, 2016). There are different types of techniques to do so. The project report is

based on British Sky Broadcasting company which supplies telephone and broadband services.

In the report financial performance of this company has been analyzed in terms of different ratios

and profitability. As well as some operations are suggested which may enhance the profitability.

MAIN BODY

1. Calculation of ratios.

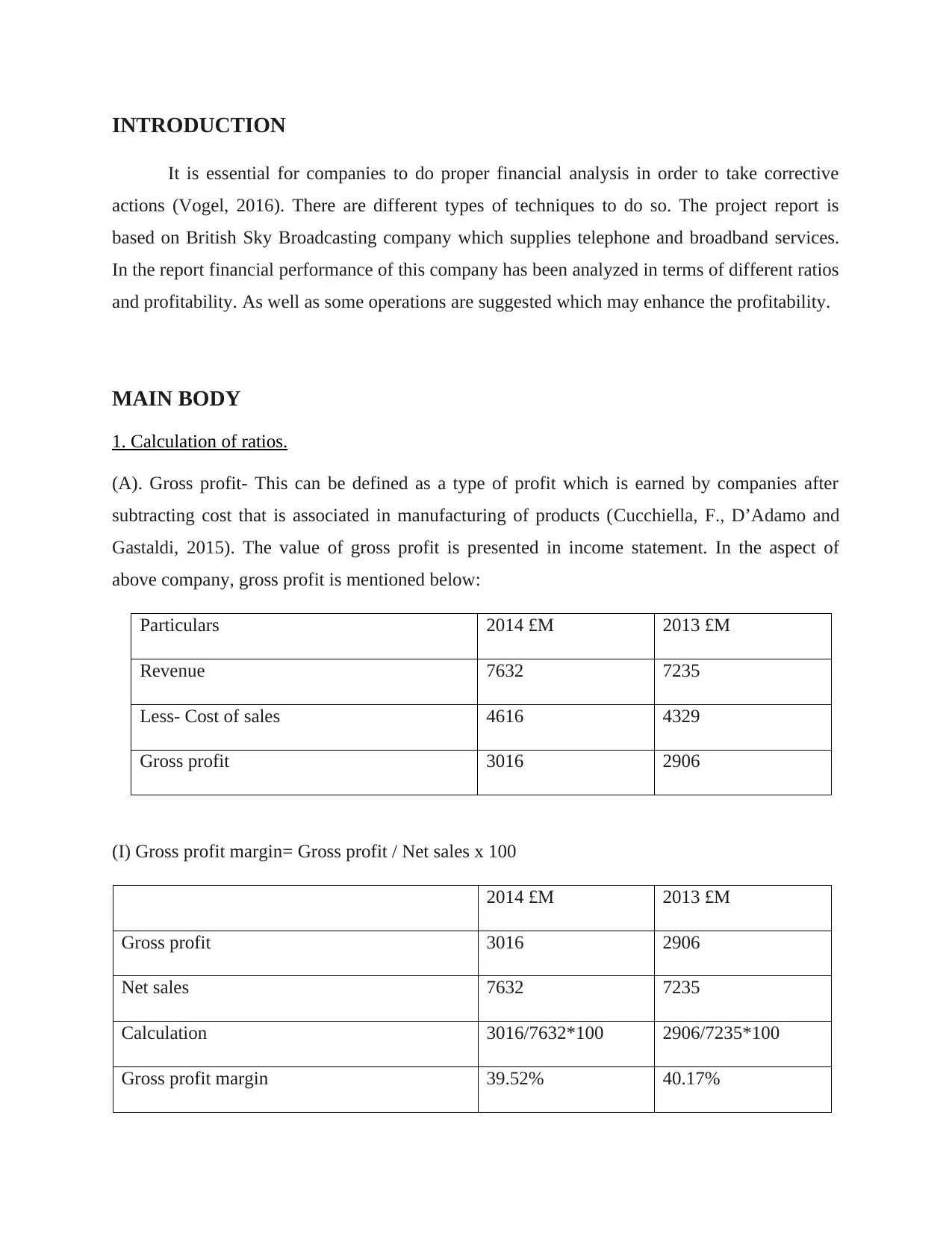

(A). Gross profit- This can be defined as a type of profit which is earned by companies after

subtracting cost that is associated in manufacturing of products (Cucchiella, F., D’Adamo and

Gastaldi, 2015). The value of gross profit is presented in income statement. In the aspect of

above company, gross profit is mentioned below:

Particulars 2014 £M 2013 £M

Revenue 7632 7235

Less- Cost of sales 4616 4329

Gross profit 3016 2906

(I) Gross profit margin= Gross profit / Net sales x 100

2014 £M 2013 £M

Gross profit 3016 2906

Net sales 7632 7235

Calculation 3016/7632*100 2906/7235*100

Gross profit margin 39.52% 40.17%

It is essential for companies to do proper financial analysis in order to take corrective

actions (Vogel, 2016). There are different types of techniques to do so. The project report is

based on British Sky Broadcasting company which supplies telephone and broadband services.

In the report financial performance of this company has been analyzed in terms of different ratios

and profitability. As well as some operations are suggested which may enhance the profitability.

MAIN BODY

1. Calculation of ratios.

(A). Gross profit- This can be defined as a type of profit which is earned by companies after

subtracting cost that is associated in manufacturing of products (Cucchiella, F., D’Adamo and

Gastaldi, 2015). The value of gross profit is presented in income statement. In the aspect of

above company, gross profit is mentioned below:

Particulars 2014 £M 2013 £M

Revenue 7632 7235

Less- Cost of sales 4616 4329

Gross profit 3016 2906

(I) Gross profit margin= Gross profit / Net sales x 100

2014 £M 2013 £M

Gross profit 3016 2906

Net sales 7632 7235

Calculation 3016/7632*100 2906/7235*100

Gross profit margin 39.52% 40.17%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

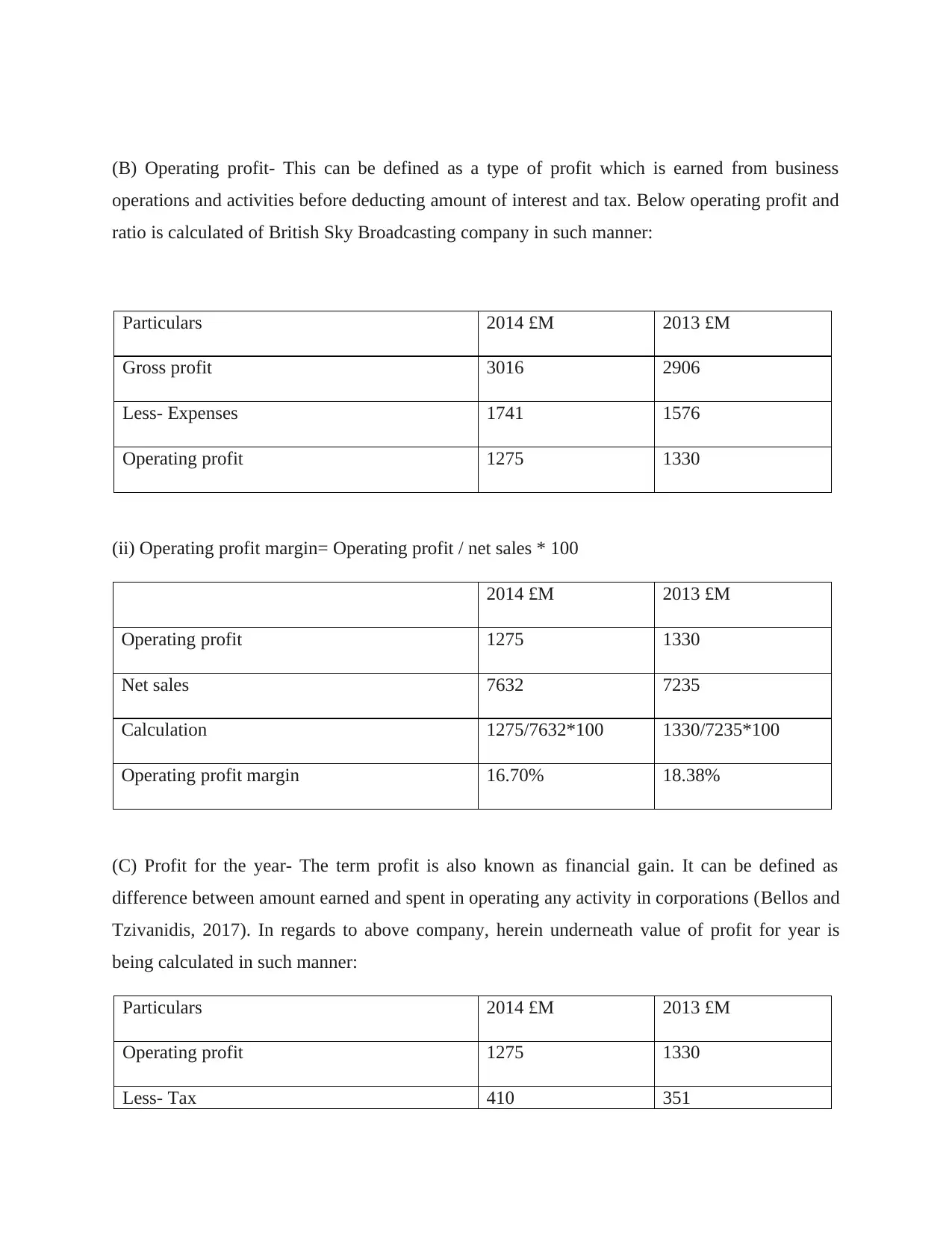

(B) Operating profit- This can be defined as a type of profit which is earned from business

operations and activities before deducting amount of interest and tax. Below operating profit and

ratio is calculated of British Sky Broadcasting company in such manner:

Particulars 2014 £M 2013 £M

Gross profit 3016 2906

Less- Expenses 1741 1576

Operating profit 1275 1330

(ii) Operating profit margin= Operating profit / net sales * 100

2014 £M 2013 £M

Operating profit 1275 1330

Net sales 7632 7235

Calculation 1275/7632*100 1330/7235*100

Operating profit margin 16.70% 18.38%

(C) Profit for the year- The term profit is also known as financial gain. It can be defined as

difference between amount earned and spent in operating any activity in corporations (Bellos and

Tzivanidis, 2017). In regards to above company, herein underneath value of profit for year is

being calculated in such manner:

Particulars 2014 £M 2013 £M

Operating profit 1275 1330

Less- Tax 410 351

operations and activities before deducting amount of interest and tax. Below operating profit and

ratio is calculated of British Sky Broadcasting company in such manner:

Particulars 2014 £M 2013 £M

Gross profit 3016 2906

Less- Expenses 1741 1576

Operating profit 1275 1330

(ii) Operating profit margin= Operating profit / net sales * 100

2014 £M 2013 £M

Operating profit 1275 1330

Net sales 7632 7235

Calculation 1275/7632*100 1330/7235*100

Operating profit margin 16.70% 18.38%

(C) Profit for the year- The term profit is also known as financial gain. It can be defined as

difference between amount earned and spent in operating any activity in corporations (Bellos and

Tzivanidis, 2017). In regards to above company, herein underneath value of profit for year is

being calculated in such manner:

Particulars 2014 £M 2013 £M

Operating profit 1275 1330

Less- Tax 410 351

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Profit 865 979

(iii) Net profit margin = Net profit / Net sales * 100

2014 £M 2013 £M

Profit 865 979

Net sales 7632 7235

Calculation 865/7632*100 979/7235*100

Net profit margin 11.33% 13.53%

2. Extend to which shareholders of above company should be satisfied in accordance of

financial performance of year 2013 and 2014.

Descriptive analysis- In this task of report, descriptive analysis of financial performance of above

mentioned company is done below in such manner:

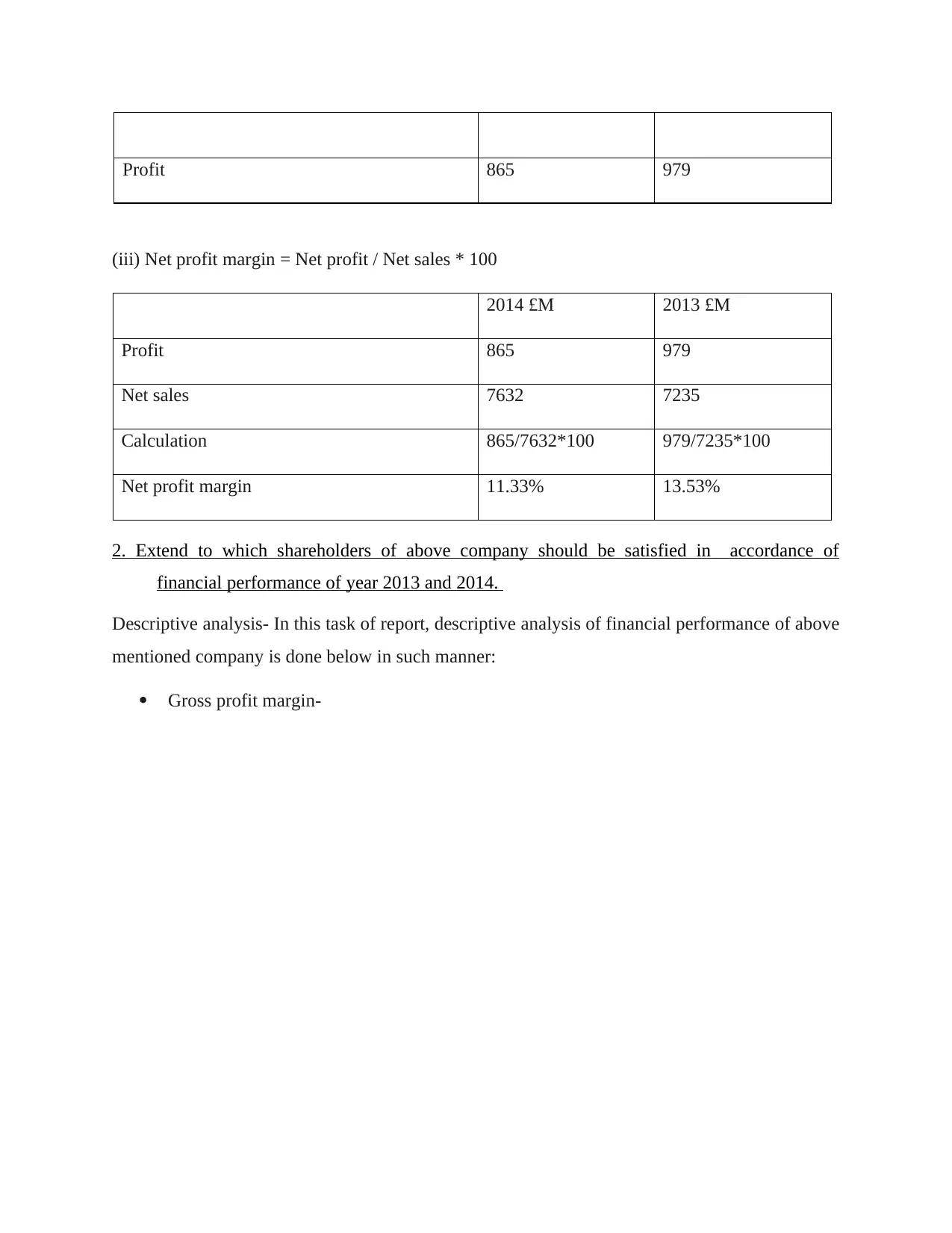

Gross profit margin-

(iii) Net profit margin = Net profit / Net sales * 100

2014 £M 2013 £M

Profit 865 979

Net sales 7632 7235

Calculation 865/7632*100 979/7235*100

Net profit margin 11.33% 13.53%

2. Extend to which shareholders of above company should be satisfied in accordance of

financial performance of year 2013 and 2014.

Descriptive analysis- In this task of report, descriptive analysis of financial performance of above

mentioned company is done below in such manner:

Gross profit margin-

2013 2014

39

39.2

39.4

39.6

39.8

40

40.2

40.4

40.17

39.52

Gross profit margin

Analysis- On the basis of above calculated gross profit margin of company, it can be find out that

in year 2013, their GP ratio was of 40.17% which reduced by short margin and became of

39.52%. This is so because their gross profit increased by just £ 110 million while sales raised by

huge margin.

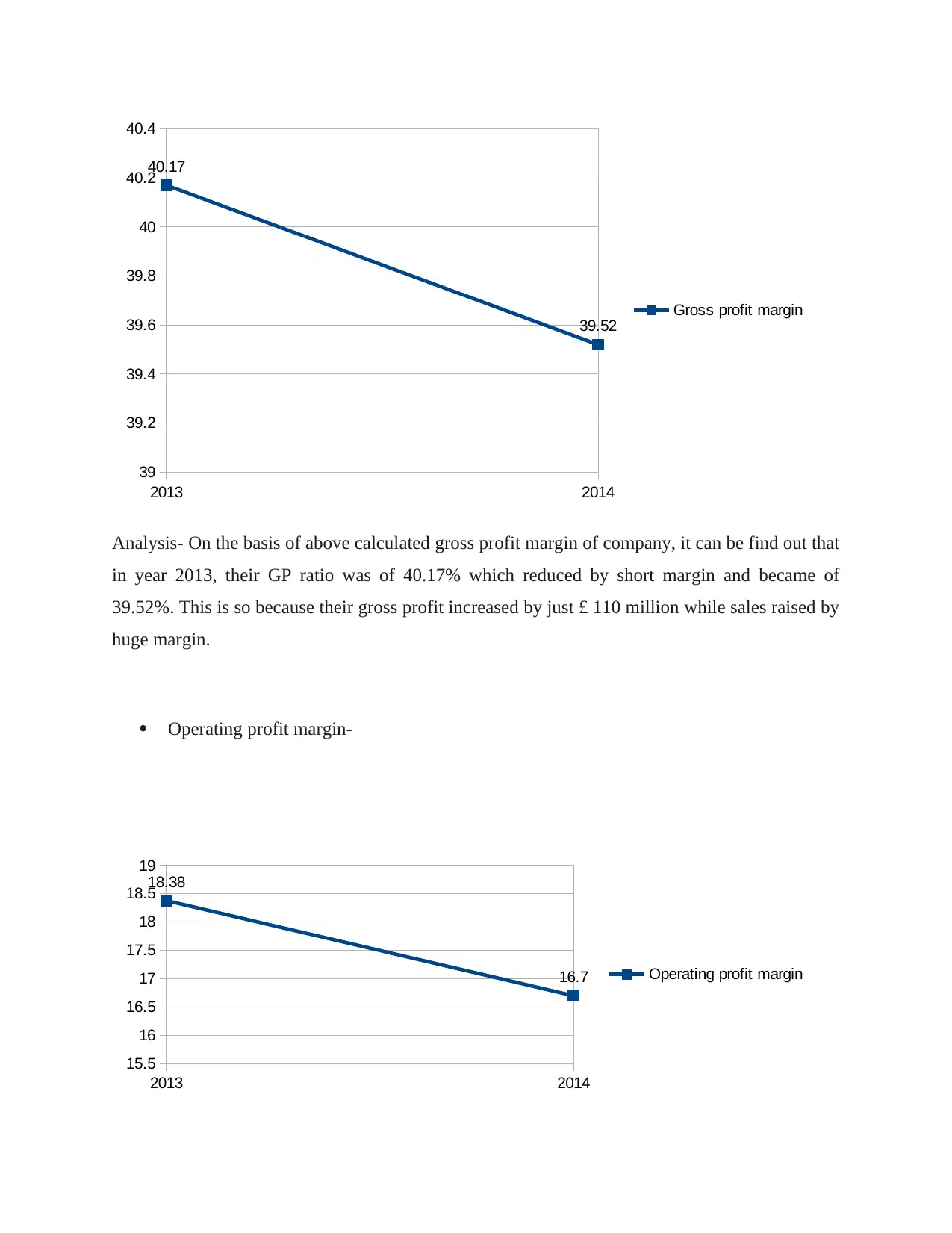

Operating profit margin-

2013 2014

15.5

16

16.5

17

17.5

18

18.5

19

18.38

16.7 Operating profit margin

39

39.2

39.4

39.6

39.8

40

40.2

40.4

40.17

39.52

Gross profit margin

Analysis- On the basis of above calculated gross profit margin of company, it can be find out that

in year 2013, their GP ratio was of 40.17% which reduced by short margin and became of

39.52%. This is so because their gross profit increased by just £ 110 million while sales raised by

huge margin.

Operating profit margin-

2013 2014

15.5

16

16.5

17

17.5

18

18.5

19

18.38

16.7 Operating profit margin

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Analysis- On the basis of above prepared line chart, this can be find out that company's operating

margin is also decreasing similar as above ratio. Such as in year 2013, it was of 18.38% that

decreased and became of 16.7%. This is so bacause of higher expenses in year 2014 as compare

to year 2013.

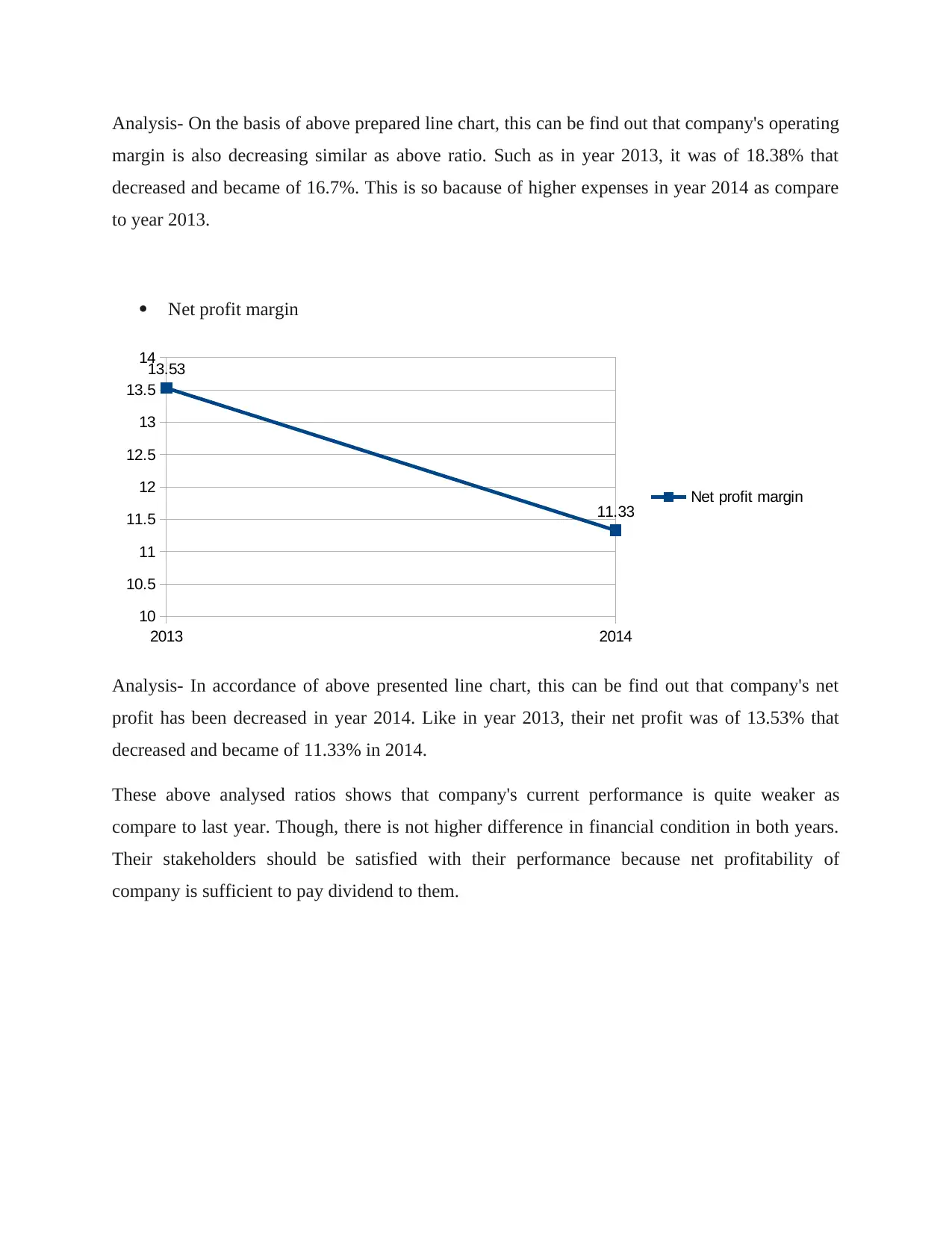

Net profit margin

2013 2014

10

10.5

11

11.5

12

12.5

13

13.5

14

13.53

11.33 Net profit margin

Analysis- In accordance of above presented line chart, this can be find out that company's net

profit has been decreased in year 2014. Like in year 2013, their net profit was of 13.53% that

decreased and became of 11.33% in 2014.

These above analysed ratios shows that company's current performance is quite weaker as

compare to last year. Though, there is not higher difference in financial condition in both years.

Their stakeholders should be satisfied with their performance because net profitability of

company is sufficient to pay dividend to them.

margin is also decreasing similar as above ratio. Such as in year 2013, it was of 18.38% that

decreased and became of 16.7%. This is so bacause of higher expenses in year 2014 as compare

to year 2013.

Net profit margin

2013 2014

10

10.5

11

11.5

12

12.5

13

13.5

14

13.53

11.33 Net profit margin

Analysis- In accordance of above presented line chart, this can be find out that company's net

profit has been decreased in year 2014. Like in year 2013, their net profit was of 13.53% that

decreased and became of 11.33% in 2014.

These above analysed ratios shows that company's current performance is quite weaker as

compare to last year. Though, there is not higher difference in financial condition in both years.

Their stakeholders should be satisfied with their performance because net profitability of

company is sufficient to pay dividend to them.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3. Different types of options which can be beneficial for above company in order to increase

profitability.

On the basis of above analysis of profitability of company, this can be stated that they

need to apply some alternatives to increase level of profit. Herein, underneath some options are

mentioned that can increase profitability such as:

Management of cost- Sky Broadcasting company should try to minimise cost so that

their profits can be increase. The above analysed data shows that their expenditures are

increasing significantly in year 2014. If they will focus on control their cost then it will

be beneficial for them to increase their profitability. Though, this option can be fail if

they do not focus on their sales revenues.

Boost productivity- It is also an important way to increase level of profitability for above

company (Hasibuan and Syahrial, 2019). If they will focus on increasing level of

productivity then this will help them in enhancing capability of satisfying demand of

customers. As a result their net revenue will also increase. This option may not be work

in the case when cost of production goes higher.

So, these are the key options which can be beneficial for above company in order to increase

level of profitability.

CONCLUSION

On the basis of above project report, this can be concluded that financial analysis is

useful for internal and external stakeholders. In the report, different types of ratios such as gross

margin, operating margin etc. are calculated and interpreted of Sky Broadcasting company. In

accordance of mentioned ratios, this has been concluded that company's overall performance is

average but enough for stakeholders. In the end part of report, some recommendations are given

to company which may lead to increased profitability of company.

profitability.

On the basis of above analysis of profitability of company, this can be stated that they

need to apply some alternatives to increase level of profit. Herein, underneath some options are

mentioned that can increase profitability such as:

Management of cost- Sky Broadcasting company should try to minimise cost so that

their profits can be increase. The above analysed data shows that their expenditures are

increasing significantly in year 2014. If they will focus on control their cost then it will

be beneficial for them to increase their profitability. Though, this option can be fail if

they do not focus on their sales revenues.

Boost productivity- It is also an important way to increase level of profitability for above

company (Hasibuan and Syahrial, 2019). If they will focus on increasing level of

productivity then this will help them in enhancing capability of satisfying demand of

customers. As a result their net revenue will also increase. This option may not be work

in the case when cost of production goes higher.

So, these are the key options which can be beneficial for above company in order to increase

level of profitability.

CONCLUSION

On the basis of above project report, this can be concluded that financial analysis is

useful for internal and external stakeholders. In the report, different types of ratios such as gross

margin, operating margin etc. are calculated and interpreted of Sky Broadcasting company. In

accordance of mentioned ratios, this has been concluded that company's overall performance is

average but enough for stakeholders. In the end part of report, some recommendations are given

to company which may lead to increased profitability of company.

REFERENCES

Books and journal:

Vogel, H. L., 2016. Travel industry economics: A guide for financial analysis. Springer.

Cucchiella, F., D’Adamo, I. and Gastaldi, M., 2015. Financial analysis for investment and policy

decisions in the renewable energy sector. Clean Technologies and Environmental

Policy. 17(4). pp.887-904.

Bellos, E. and Tzivanidis, C., 2017. Energetic and financial analysis of solar cooling systems

with single effect absorption chiller in various climates. Applied Thermal Engineering.

126. pp.809-821.

Hasibuan, R .P. S. and Syahrial, H., 2019, August. Analysis Of The Implementation Effects Of

Accrual-Based Governmental Accounting Standards On The Financial Statement

Qualities. In Proceeding ICOPOID 2019 The 2nd International Conference on Politic

of Islamic Development (Vol. 1, No. 1, pp. 18-29).

Books and journal:

Vogel, H. L., 2016. Travel industry economics: A guide for financial analysis. Springer.

Cucchiella, F., D’Adamo, I. and Gastaldi, M., 2015. Financial analysis for investment and policy

decisions in the renewable energy sector. Clean Technologies and Environmental

Policy. 17(4). pp.887-904.

Bellos, E. and Tzivanidis, C., 2017. Energetic and financial analysis of solar cooling systems

with single effect absorption chiller in various climates. Applied Thermal Engineering.

126. pp.809-821.

Hasibuan, R .P. S. and Syahrial, H., 2019, August. Analysis Of The Implementation Effects Of

Accrual-Based Governmental Accounting Standards On The Financial Statement

Qualities. In Proceeding ICOPOID 2019 The 2nd International Conference on Politic

of Islamic Development (Vol. 1, No. 1, pp. 18-29).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

EFFECTIVENESS OF

REWARD AND

APPRAISAL SYSTEM

REWARD AND

APPRAISAL SYSTEM

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

The project report summarise about information regards to reward system of company of

case study. The purpose of report is to demonstrate understanding about role of effective reward

system. In the Mcdonald's company, their reward system has some positives and some negatives.

It is essential for company that they should overcome from shortage of ineffective reward

system.

The project report summarise about information regards to reward system of company of

case study. The purpose of report is to demonstrate understanding about role of effective reward

system. In the Mcdonald's company, their reward system has some positives and some negatives.

It is essential for company that they should overcome from shortage of ineffective reward

system.

INTRODUCTION

This is important for companies to implement an equal reward and appraisal system so

that employees can be motivated. Main objective of this project report is to demonstrate

understanding about role of effective reward system in order to retain employees. This project

report is based on case study of Mcdonald's in which they face challenges in applying reward

system due to lack of monetary resources. In the project report, detailed information about

reward system is mentioned as well as issues of ineffective reward system are also mentioned of

chosen company of case study.

MAIN BODY

1. Definition of reward, appraisal system.

Reward system- This can be defined as a type of incentive program which influence employee

retention and productivity by providing suitable bonus, raised pay and many more. Under this

system, those employees are identified whose performance is excellent (Hankins, 2016).

Appraisal system- It is a type of process in which management department analyse the

performance of employees and gives feeback to them. On the basis of this, employees are

promoted for higher posts.

Employee retention- This can be defined as an capability of a business entity to retain their

employees. It is crucial for companies because if employee retention rate will be lower then this

is being considered better.

Productivity- It can be defined as an effective usage of available resources such as labour,

capital, land etc. in the manufacturing of different products and services (Li and Abumuhfouz,

2015). Higher productivity indicates that company is using their resources in most effective

manner.

2. Reward and appraisal system available in the organisation.

In accordance of policy of Mcdonald's company, this can be find out that company's

reward system is based on the performance of their employees. It indicates that if their

This is important for companies to implement an equal reward and appraisal system so

that employees can be motivated. Main objective of this project report is to demonstrate

understanding about role of effective reward system in order to retain employees. This project

report is based on case study of Mcdonald's in which they face challenges in applying reward

system due to lack of monetary resources. In the project report, detailed information about

reward system is mentioned as well as issues of ineffective reward system are also mentioned of

chosen company of case study.

MAIN BODY

1. Definition of reward, appraisal system.

Reward system- This can be defined as a type of incentive program which influence employee

retention and productivity by providing suitable bonus, raised pay and many more. Under this

system, those employees are identified whose performance is excellent (Hankins, 2016).

Appraisal system- It is a type of process in which management department analyse the

performance of employees and gives feeback to them. On the basis of this, employees are

promoted for higher posts.

Employee retention- This can be defined as an capability of a business entity to retain their

employees. It is crucial for companies because if employee retention rate will be lower then this

is being considered better.

Productivity- It can be defined as an effective usage of available resources such as labour,

capital, land etc. in the manufacturing of different products and services (Li and Abumuhfouz,

2015). Higher productivity indicates that company is using their resources in most effective

manner.

2. Reward and appraisal system available in the organisation.

In accordance of policy of Mcdonald's company, this can be find out that company's

reward system is based on the performance of their employees. It indicates that if their

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.