Financial Performance Management of Tesco and Walmart Analysis Report

VerifiedAdded on 2023/06/10

|17

|3943

|219

Report

AI Summary

This report provides a comprehensive analysis of financial performance management, focusing on the application of financial ratios to assess the financial health of companies, including Walmart and Tesco. The report calculates and interprets various financial ratios, such as liquidity, solvency, and profitability ratios, to evaluate the companies' financial positions. It further explores the Balanced Scorecard as a strategic management system, evaluating its application and proposing a Balanced Scorecard for the analyzed companies. Additionally, the report examines the benefits and challenges associated with adopting integrated reporting, emphasizing its role in providing a comprehensive view of organizational performance. The report uses the case studies of Tesco and Walmart to illustrate these concepts and provides insights into their financial strategies and performance.

Financial Performance

Management

Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................4

1. Calculate ratios and measure the financial performance of the business................................4

2. Evaluate Balanced scorecard and Prepare proposed Balanced Scorecard of the company as a

Strategic Management System....................................................................................................8

3. Benefits and Challenges in adopting Integrated Reporting based of the organisation..........12

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................4

1. Calculate ratios and measure the financial performance of the business................................4

2. Evaluate Balanced scorecard and Prepare proposed Balanced Scorecard of the company as a

Strategic Management System....................................................................................................8

3. Benefits and Challenges in adopting Integrated Reporting based of the organisation..........12

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

Financial performance management helps in measuring the performance by using various

financial measure in the working of the organisation. It is also known as corporate performance

management. The foremost objective of the financial performance is to compile the actual

performance with the forecasted performance of the business and to make adjustment

accordingly. Currency performance in a broader sense implies how much of the currency target

is being or has been achieved, and is an important part of the board currency risk. This is the

most common way of estimating the consequences of a company's strategy and mission in

money-related terms. It is used to quantify a company's overall financial health over a given time

frame, and equally can be used to view comparable companies in similar industries or to analyse

businesses or fields of collection. Monetary Executive Check remembers surveys and

translations of financial summaries for a complete picture of a business's productivity and

monetary adequacy. It is the capabilities of the management to assist the performance of the

business which indicates the plans forecast and also handles the reporting and increasing the

financial acquisition and efficiency companywide (Aguiar-Diaz and et.al., 2020). In the

following report it calculates the financial position of the corporate and determining the

outcomes. In the other part it states the scorecard of the both the companies Tesco and Walmart.

In the last part it states about the Integrated reporting of the company by critically evaluating the

benefits and challenges occurred by the organisation.

Financial performance management helps in measuring the performance by using various

financial measure in the working of the organisation. It is also known as corporate performance

management. The foremost objective of the financial performance is to compile the actual

performance with the forecasted performance of the business and to make adjustment

accordingly. Currency performance in a broader sense implies how much of the currency target

is being or has been achieved, and is an important part of the board currency risk. This is the

most common way of estimating the consequences of a company's strategy and mission in

money-related terms. It is used to quantify a company's overall financial health over a given time

frame, and equally can be used to view comparable companies in similar industries or to analyse

businesses or fields of collection. Monetary Executive Check remembers surveys and

translations of financial summaries for a complete picture of a business's productivity and

monetary adequacy. It is the capabilities of the management to assist the performance of the

business which indicates the plans forecast and also handles the reporting and increasing the

financial acquisition and efficiency companywide (Aguiar-Diaz and et.al., 2020). In the

following report it calculates the financial position of the corporate and determining the

outcomes. In the other part it states the scorecard of the both the companies Tesco and Walmart.

In the last part it states about the Integrated reporting of the company by critically evaluating the

benefits and challenges occurred by the organisation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MAIN BODY

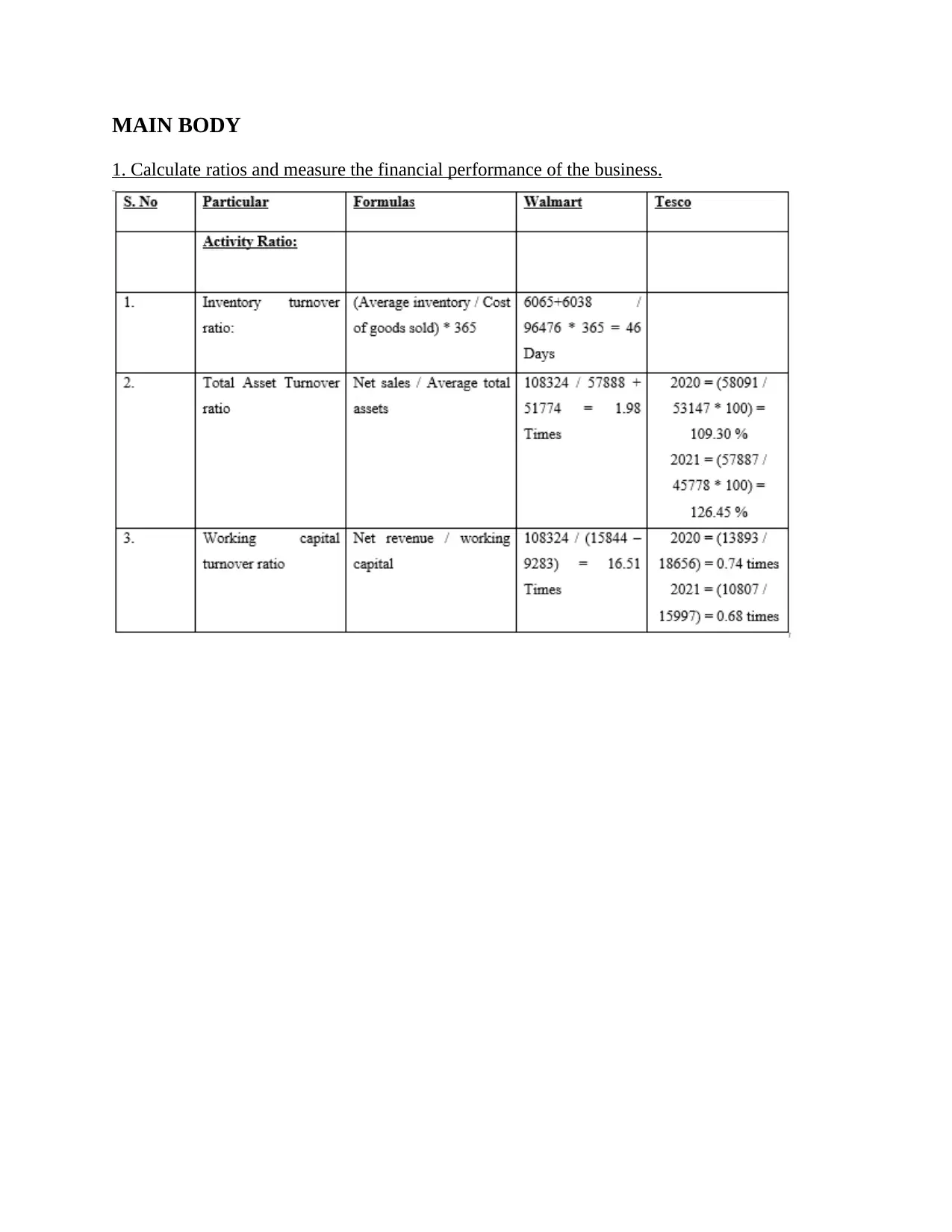

1. Calculate ratios and measure the financial performance of the business.

1. Calculate ratios and measure the financial performance of the business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

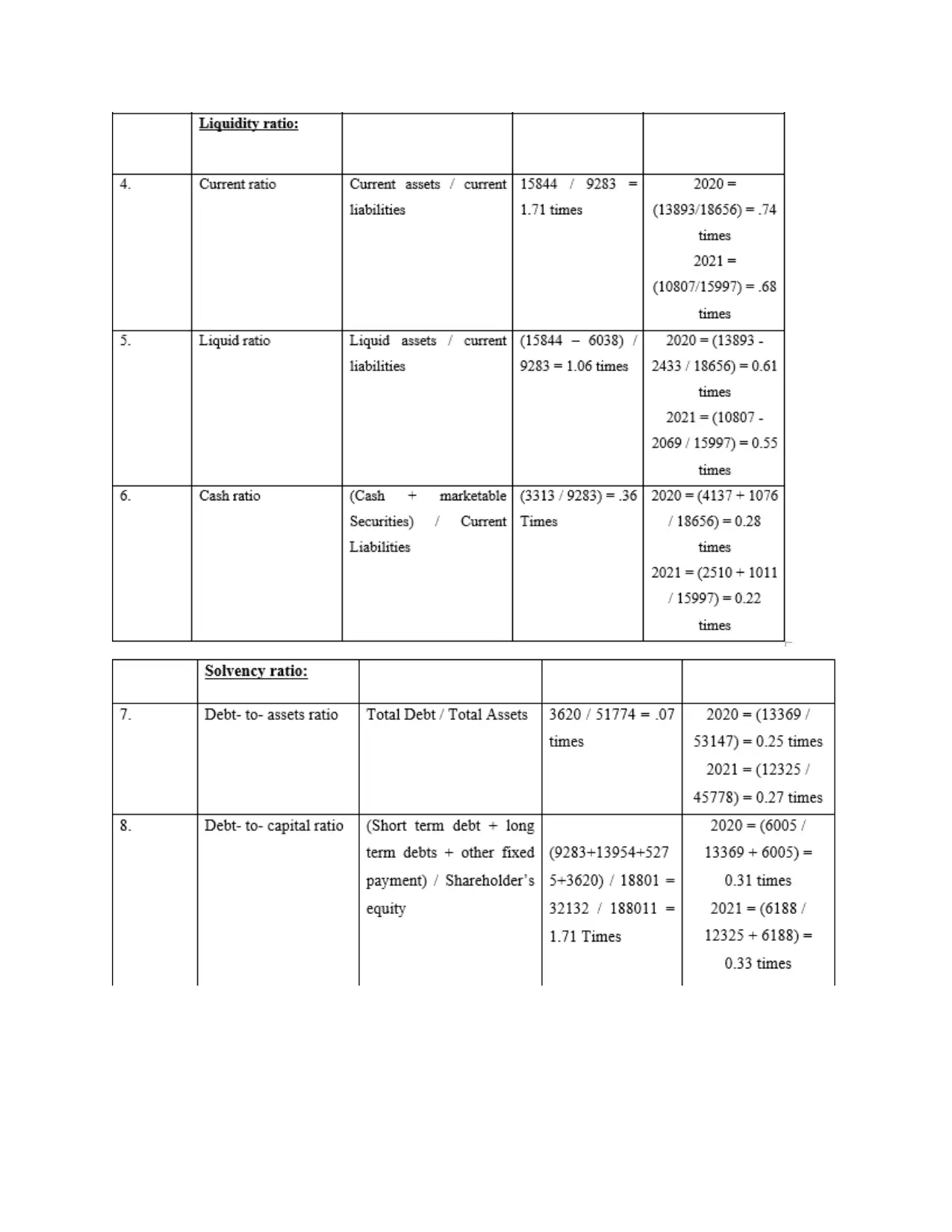

Interpretation:

From the above calculated ratio it can be seen that the average inventory states that the

inventory that the turnover days of the 46 Days for the Walmart and for the Tesco it is 97 days

which is more than the double of the Walmart. Liquidity of the firm denotes the company’s

liquid position which states that the companies paying capacity of paying short term liabilities.

Current ratio of Walmart States the Company’s current ratio is 1.17 which is more than the

current liabilities of company. It suggests that the company has significant resources in paying of

its Current obligations. On the other hand, Tesco has liquidity ratio closer which suggest that the

company is being able to meet its current liabilities but it would be difficult for the company if

its current obligation would have increased.

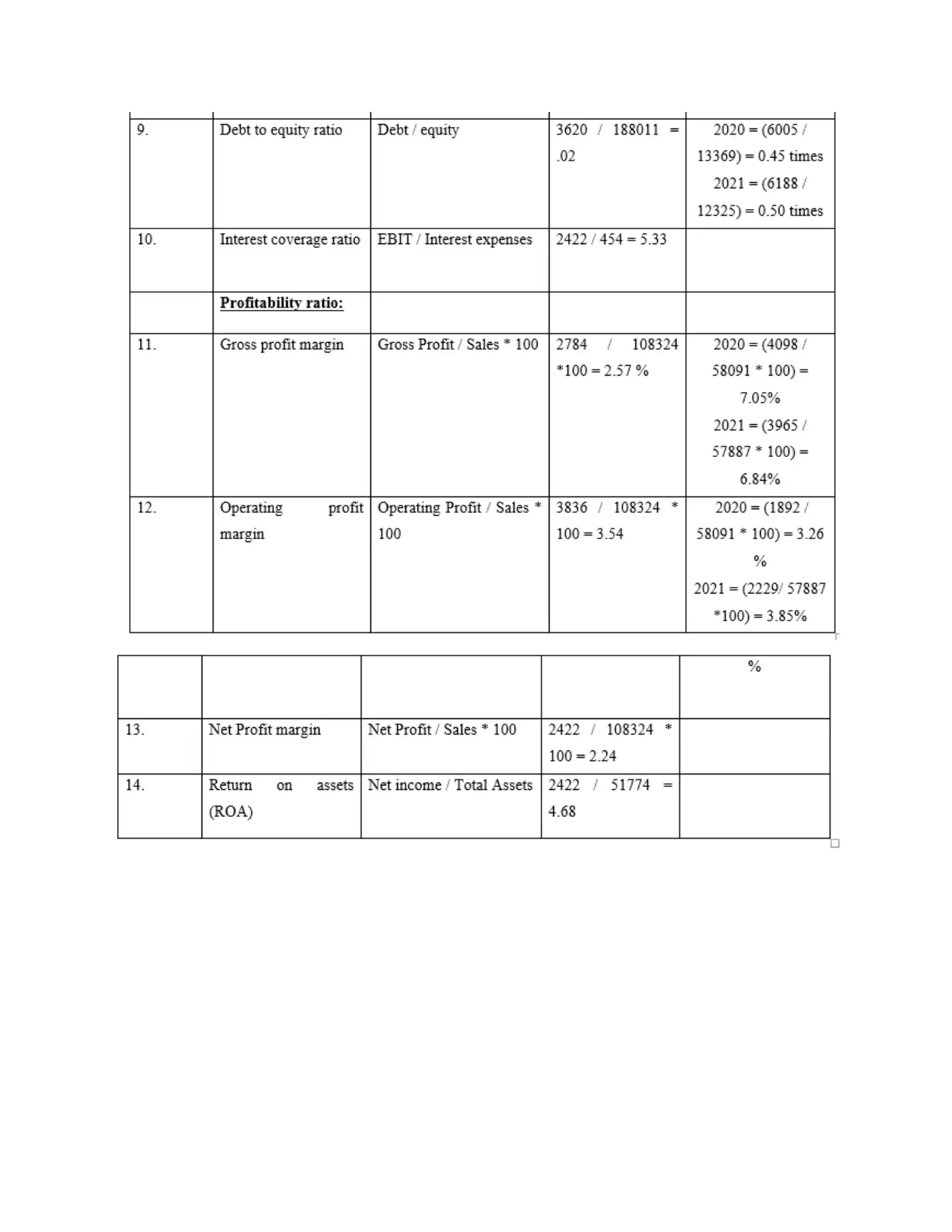

Solvency ratio states the sources of finance used by the firm in order to finance its

business activities. Walmart ’s debt equity ratio is 0.02 which means that the company is using

more of equity as compared to debt. In case of Tesco it is using half of its sources of finance as

debt and more share is of Equity.

From the above calculated ratio it can be seen that the average inventory states that the

inventory that the turnover days of the 46 Days for the Walmart and for the Tesco it is 97 days

which is more than the double of the Walmart. Liquidity of the firm denotes the company’s

liquid position which states that the companies paying capacity of paying short term liabilities.

Current ratio of Walmart States the Company’s current ratio is 1.17 which is more than the

current liabilities of company. It suggests that the company has significant resources in paying of

its Current obligations. On the other hand, Tesco has liquidity ratio closer which suggest that the

company is being able to meet its current liabilities but it would be difficult for the company if

its current obligation would have increased.

Solvency ratio states the sources of finance used by the firm in order to finance its

business activities. Walmart ’s debt equity ratio is 0.02 which means that the company is using

more of equity as compared to debt. In case of Tesco it is using half of its sources of finance as

debt and more share is of Equity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

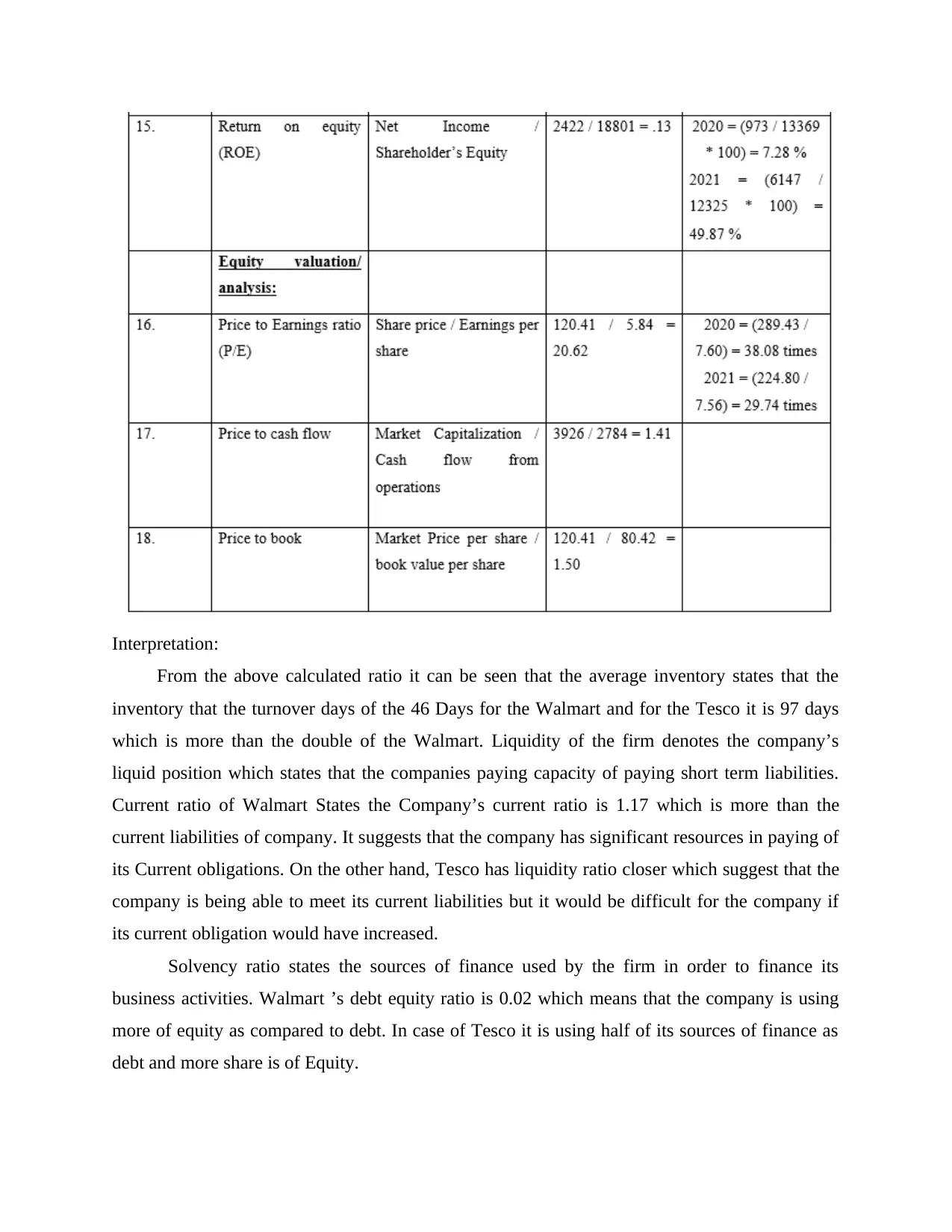

Profitability ratio of the company states the share of profits earned by the company from

its revenue of the company. Tesco earns a profit of 5.33% from the yearly sales of the company.

On the other side Walmart is earning a gross profit margin of 2.57 from the annual sales of the

company. Operating profit ratio states, the amount of earning of the firm which is earned by the

operations of the company. Return on capital employed is the return earned by the company by

using its assets of the company. Price earnings ratio states the amount earned by the company in

terms of shareholders. The shareholders are the owners of the company whom invest their funds

in order to know the actual returns from the amount invested by the shareholders in the company.

The returns earned by the shareholders of Tesco has earned more than the shareholders of

Walmart (Bazzoli, G.J., 2021).

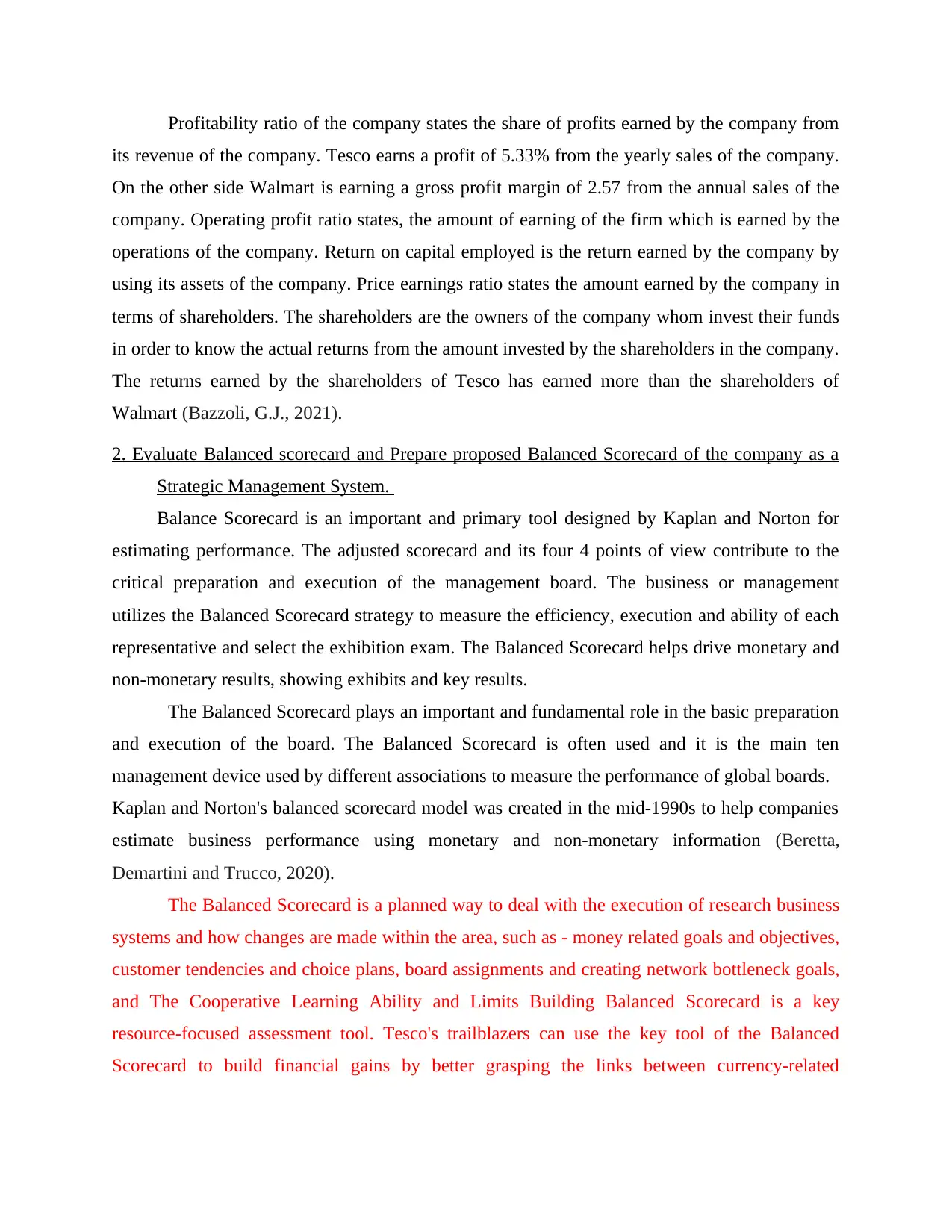

2. Evaluate Balanced scorecard and Prepare proposed Balanced Scorecard of the company as a

Strategic Management System.

Balance Scorecard is an important and primary tool designed by Kaplan and Norton for

estimating performance. The adjusted scorecard and its four 4 points of view contribute to the

critical preparation and execution of the management board. The business or management

utilizes the Balanced Scorecard strategy to measure the efficiency, execution and ability of each

representative and select the exhibition exam. The Balanced Scorecard helps drive monetary and

non-monetary results, showing exhibits and key results.

The Balanced Scorecard plays an important and fundamental role in the basic preparation

and execution of the board. The Balanced Scorecard is often used and it is the main ten

management device used by different associations to measure the performance of global boards.

Kaplan and Norton's balanced scorecard model was created in the mid-1990s to help companies

estimate business performance using monetary and non-monetary information (Beretta,

Demartini and Trucco, 2020).

The Balanced Scorecard is a planned way to deal with the execution of research business

systems and how changes are made within the area, such as - money related goals and objectives,

customer tendencies and choice plans, board assignments and creating network bottleneck goals,

and The Cooperative Learning Ability and Limits Building Balanced Scorecard is a key

resource-focused assessment tool. Tesco's trailblazers can use the key tool of the Balanced

Scorecard to build financial gains by better grasping the links between currency-related

its revenue of the company. Tesco earns a profit of 5.33% from the yearly sales of the company.

On the other side Walmart is earning a gross profit margin of 2.57 from the annual sales of the

company. Operating profit ratio states, the amount of earning of the firm which is earned by the

operations of the company. Return on capital employed is the return earned by the company by

using its assets of the company. Price earnings ratio states the amount earned by the company in

terms of shareholders. The shareholders are the owners of the company whom invest their funds

in order to know the actual returns from the amount invested by the shareholders in the company.

The returns earned by the shareholders of Tesco has earned more than the shareholders of

Walmart (Bazzoli, G.J., 2021).

2. Evaluate Balanced scorecard and Prepare proposed Balanced Scorecard of the company as a

Strategic Management System.

Balance Scorecard is an important and primary tool designed by Kaplan and Norton for

estimating performance. The adjusted scorecard and its four 4 points of view contribute to the

critical preparation and execution of the management board. The business or management

utilizes the Balanced Scorecard strategy to measure the efficiency, execution and ability of each

representative and select the exhibition exam. The Balanced Scorecard helps drive monetary and

non-monetary results, showing exhibits and key results.

The Balanced Scorecard plays an important and fundamental role in the basic preparation

and execution of the board. The Balanced Scorecard is often used and it is the main ten

management device used by different associations to measure the performance of global boards.

Kaplan and Norton's balanced scorecard model was created in the mid-1990s to help companies

estimate business performance using monetary and non-monetary information (Beretta,

Demartini and Trucco, 2020).

The Balanced Scorecard is a planned way to deal with the execution of research business

systems and how changes are made within the area, such as - money related goals and objectives,

customer tendencies and choice plans, board assignments and creating network bottleneck goals,

and The Cooperative Learning Ability and Limits Building Balanced Scorecard is a key

resource-focused assessment tool. Tesco's trailblazers can use the key tool of the Balanced

Scorecard to build financial gains by better grasping the links between currency-related

resources, inward cycles, customer tendencies and board assignments within Tesco's

conventional approach.

According to Robert S. Kaplan and David P. Norton, 85% of leadership teams spend less

than an hour a month talking about systems, and 50% declare that they spend little or no effort in

technical conversations.

The adjusted scorecard helps Tesco interpret, communicate and measure its technology.

Some of the queries responded to by Tesco's Balanced Scorecard analysis in emerging markets

were -

The Balanced Scorecard focuses on "aligning business activities with the vision and

technology of the business, communicating internally and externally, and screening business

execution against key objectives".

No single measure can provide a broad picture of an association's well-being.

So, instead of using individual measures, why not use a comprehensive scorecard that

includes various measures (Boyd and Kannan, 2018).

Kaplan and Norton envisioned a system from four perspectives—currency, customer,

internal, and learning and development.

Associations should choose basic measures for each of these views.

Benefits of Balance Scorecard:

It helps to estimate monetary and non-monetary sources of information and results.

BSC is very efficient in estimation execution.

It helps to make the necessary preparation better

It provides a powerful structure for building communication systems

A decent scorecard helps an organization better align its hierarchy.

It also helps to differentiate between different issue focuses/defects where improvements

are expected to achieve improved results (Buzgurescu and Elena, 2020).

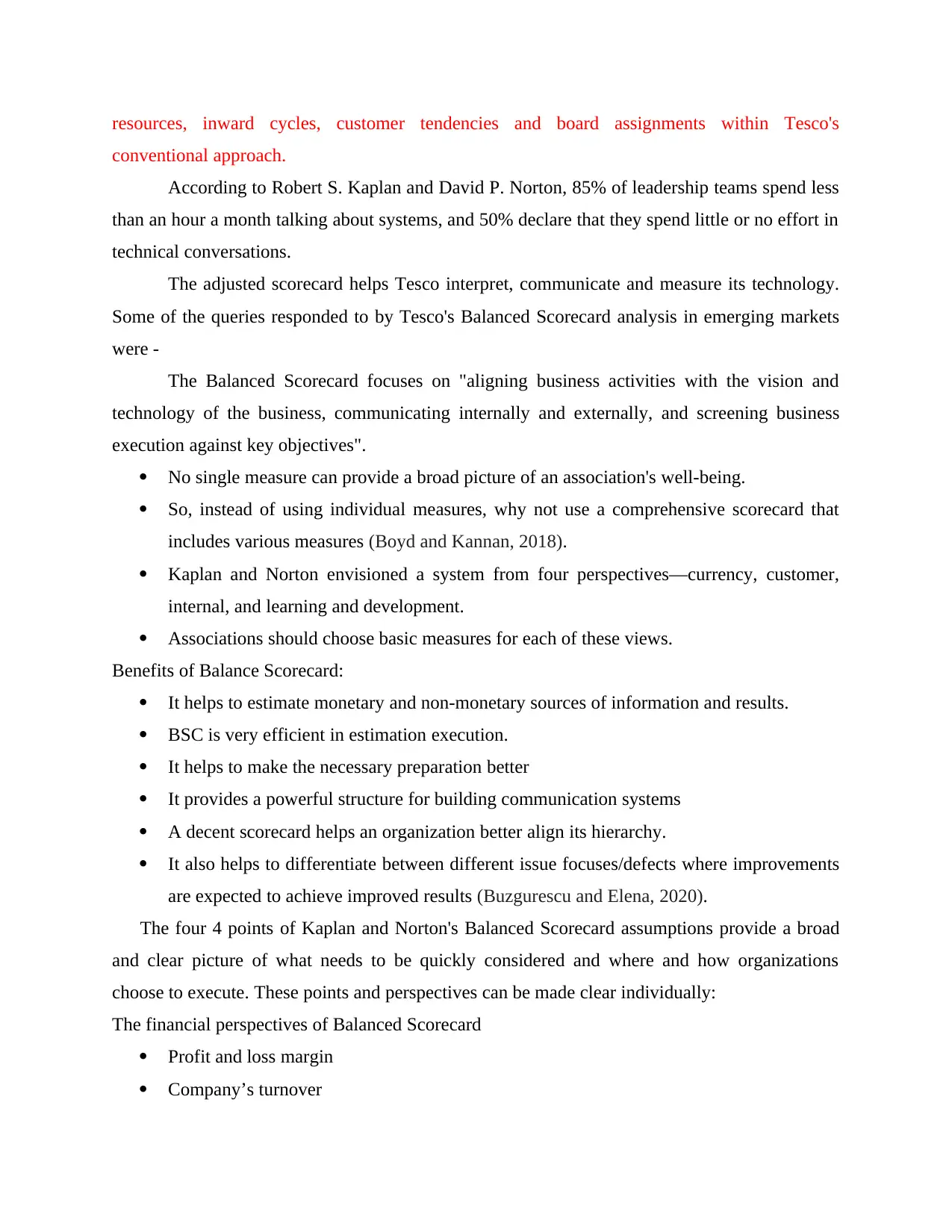

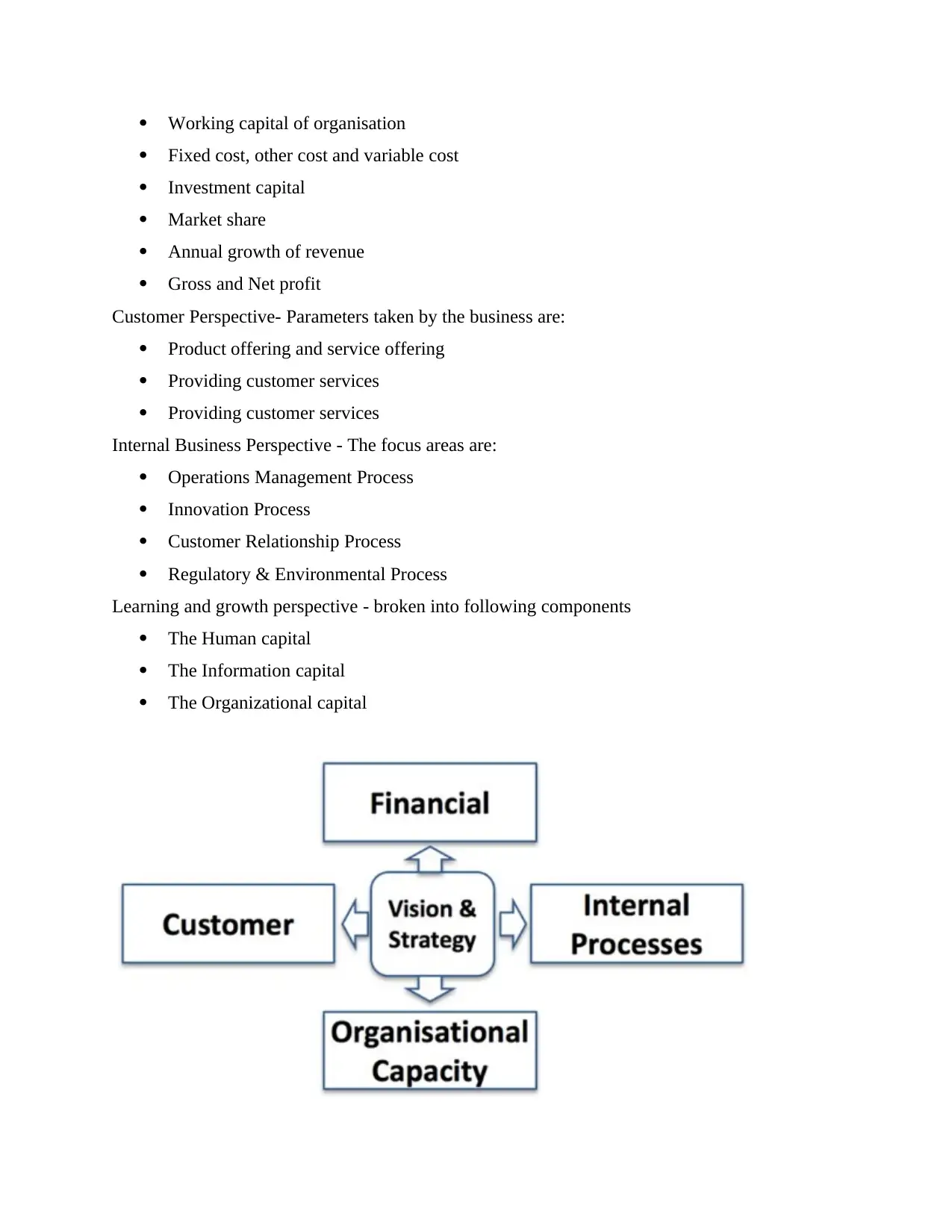

The four 4 points of Kaplan and Norton's Balanced Scorecard assumptions provide a broad

and clear picture of what needs to be quickly considered and where and how organizations

choose to execute. These points and perspectives can be made clear individually:

The financial perspectives of Balanced Scorecard

Profit and loss margin

Company’s turnover

conventional approach.

According to Robert S. Kaplan and David P. Norton, 85% of leadership teams spend less

than an hour a month talking about systems, and 50% declare that they spend little or no effort in

technical conversations.

The adjusted scorecard helps Tesco interpret, communicate and measure its technology.

Some of the queries responded to by Tesco's Balanced Scorecard analysis in emerging markets

were -

The Balanced Scorecard focuses on "aligning business activities with the vision and

technology of the business, communicating internally and externally, and screening business

execution against key objectives".

No single measure can provide a broad picture of an association's well-being.

So, instead of using individual measures, why not use a comprehensive scorecard that

includes various measures (Boyd and Kannan, 2018).

Kaplan and Norton envisioned a system from four perspectives—currency, customer,

internal, and learning and development.

Associations should choose basic measures for each of these views.

Benefits of Balance Scorecard:

It helps to estimate monetary and non-monetary sources of information and results.

BSC is very efficient in estimation execution.

It helps to make the necessary preparation better

It provides a powerful structure for building communication systems

A decent scorecard helps an organization better align its hierarchy.

It also helps to differentiate between different issue focuses/defects where improvements

are expected to achieve improved results (Buzgurescu and Elena, 2020).

The four 4 points of Kaplan and Norton's Balanced Scorecard assumptions provide a broad

and clear picture of what needs to be quickly considered and where and how organizations

choose to execute. These points and perspectives can be made clear individually:

The financial perspectives of Balanced Scorecard

Profit and loss margin

Company’s turnover

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Working capital of organisation

Fixed cost, other cost and variable cost

Investment capital

Market share

Annual growth of revenue

Gross and Net profit

Customer Perspective- Parameters taken by the business are:

Product offering and service offering

Providing customer services

Providing customer services

Internal Business Perspective - The focus areas are:

Operations Management Process

Innovation Process

Customer Relationship Process

Regulatory & Environmental Process

Learning and growth perspective - broken into following components

The Human capital

The Information capital

The Organizational capital

Fixed cost, other cost and variable cost

Investment capital

Market share

Annual growth of revenue

Gross and Net profit

Customer Perspective- Parameters taken by the business are:

Product offering and service offering

Providing customer services

Providing customer services

Internal Business Perspective - The focus areas are:

Operations Management Process

Innovation Process

Customer Relationship Process

Regulatory & Environmental Process

Learning and growth perspective - broken into following components

The Human capital

The Information capital

The Organizational capital

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The greatest advantage of the Tesco Balanced Scorecard approach in growing a business is

that it provides senior executives and trailblazers with a framework they can use to develop

broad innovations rather than simply upgrading a business. A fair scorecard allows controllers to

view the business from four unique perspectives.

In addition, people with lower affiliation are fundamentally assessed by non-money-related

measures, so the Balanced Scorecard approach provides a fair framework to recall their overall

strategy of efforts and teach them how their efforts work on a day-to-day basis Technology and

Tesco results to expand (de Castro Sobrosa Neto and et.al., 2020).

To make it easier to examine a good scorecard and how it works, the case of Walmart is

used as a strong association that has been active for a long time. Wal-Mart Stores Inc. is

probably the best and most visible single retailer on the planet. What makes it all the more

bizarre and clear is that it's buried in extensive discussions, including the record of cases against

it, the media shock at its technology, and the government evaluating parts of its strategy in

discrete conversations.

The Group began under strange conditions in 1945, when two relatives (Sam Walton and

his relatives) opened Ben Franklin's Classified Advertising Company, the party quickly became

famous, and was financially rich. easy to detect. Its record speaks volumes about the

association's solidarity and passion for business.

To date, the organization has more than 4,150 retail offices worldwide and is a major

retailer in Canada, the United Kingdom and Mexico.

It is also in the active pharmaceutical business, photo processing business and tire and

lubricant courier business. The organizers behind the organization, until today the three

systematic goals of the organization's work, these are; "excellent assistance to the buyer, respect

for the individuals working within the organization and their clients, and consistent pursuit of

excellence". Its business management techniques are to sell the best products and brands at the

lowest cost imaginable. It is this technique that, with minimal brand name and project fees, has

opened organizations to constant analysis and claims as it leverages measures to understand

sometimes controversial procedures (Dimitropoulos and Scafarto, 2021).

that it provides senior executives and trailblazers with a framework they can use to develop

broad innovations rather than simply upgrading a business. A fair scorecard allows controllers to

view the business from four unique perspectives.

In addition, people with lower affiliation are fundamentally assessed by non-money-related

measures, so the Balanced Scorecard approach provides a fair framework to recall their overall

strategy of efforts and teach them how their efforts work on a day-to-day basis Technology and

Tesco results to expand (de Castro Sobrosa Neto and et.al., 2020).

To make it easier to examine a good scorecard and how it works, the case of Walmart is

used as a strong association that has been active for a long time. Wal-Mart Stores Inc. is

probably the best and most visible single retailer on the planet. What makes it all the more

bizarre and clear is that it's buried in extensive discussions, including the record of cases against

it, the media shock at its technology, and the government evaluating parts of its strategy in

discrete conversations.

The Group began under strange conditions in 1945, when two relatives (Sam Walton and

his relatives) opened Ben Franklin's Classified Advertising Company, the party quickly became

famous, and was financially rich. easy to detect. Its record speaks volumes about the

association's solidarity and passion for business.

To date, the organization has more than 4,150 retail offices worldwide and is a major

retailer in Canada, the United Kingdom and Mexico.

It is also in the active pharmaceutical business, photo processing business and tire and

lubricant courier business. The organizers behind the organization, until today the three

systematic goals of the organization's work, these are; "excellent assistance to the buyer, respect

for the individuals working within the organization and their clients, and consistent pursuit of

excellence". Its business management techniques are to sell the best products and brands at the

lowest cost imaginable. It is this technique that, with minimal brand name and project fees, has

opened organizations to constant analysis and claims as it leverages measures to understand

sometimes controversial procedures (Dimitropoulos and Scafarto, 2021).

3. Benefits and Challenges in adopting Integrated Reporting based of the organisation.

The combined reveal is a compact correspondence of the management system, execution

and possibilities of an element related to the external climate, which prompted the development

of measures for monetary and non-monetary values during this period.

Corporate apocalypse underpins the convincing operation of a market economy, enabling

financial backers and monetary donors to explore how businesses behave from every angle,

demonstrate their value and exercise robust oversight. For a private organization to be truly

successful, our corporate exposure system should be essentially as solid as the cash business

field itself. More critically, it generally accepts the true ability of those who schedule the reports

to see them.

On the other hand, organizational details are attached to the annual report, showing and

revealing the recorded connections to everyone. Individuals whose organizations provide

accounts are banks, financial supporters, and contributing organizations. While the fundamental

focus of organizational enumeration is monetary information, it equally supports planned

responses (Donatella, 2020).

Intellectual Capital: It includes software system, knowledge, intellectual property, etc.

Human capital: People’s competency, capabilities, skills and experience of the human

capital.

Financial Capital: It is the mix that company utilises the equity and debt or generating

profits from the operations of the company.

Natural Capital: Renewable and non- renewable and incorporates the environmental

resource.

Social and relationship: it is the relationship of the company with its suppliers,

stakeholders and other communities.

Benefits of Integrated Reporting

It helps in understanding the goals and strategy of the organisation to attain the goals of

the organisation.

It promotes the culture which is integrated by the way of thinking.

It helps in linking between the business growth and the non- financial performance of the

business.

The combined reveal is a compact correspondence of the management system, execution

and possibilities of an element related to the external climate, which prompted the development

of measures for monetary and non-monetary values during this period.

Corporate apocalypse underpins the convincing operation of a market economy, enabling

financial backers and monetary donors to explore how businesses behave from every angle,

demonstrate their value and exercise robust oversight. For a private organization to be truly

successful, our corporate exposure system should be essentially as solid as the cash business

field itself. More critically, it generally accepts the true ability of those who schedule the reports

to see them.

On the other hand, organizational details are attached to the annual report, showing and

revealing the recorded connections to everyone. Individuals whose organizations provide

accounts are banks, financial supporters, and contributing organizations. While the fundamental

focus of organizational enumeration is monetary information, it equally supports planned

responses (Donatella, 2020).

Intellectual Capital: It includes software system, knowledge, intellectual property, etc.

Human capital: People’s competency, capabilities, skills and experience of the human

capital.

Financial Capital: It is the mix that company utilises the equity and debt or generating

profits from the operations of the company.

Natural Capital: Renewable and non- renewable and incorporates the environmental

resource.

Social and relationship: it is the relationship of the company with its suppliers,

stakeholders and other communities.

Benefits of Integrated Reporting

It helps in understanding the goals and strategy of the organisation to attain the goals of

the organisation.

It promotes the culture which is integrated by the way of thinking.

It helps in linking between the business growth and the non- financial performance of the

business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.