Financial Performance Analysis: Sainsbury Plc vs. Marks & Spencer

VerifiedAdded on 2022/12/15

|17

|4085

|1

Report

AI Summary

This report presents a comprehensive financial performance analysis of Sainsbury Plc, a leading UK supermarket chain. The analysis begins with an examination of key financial ratios, comparing Sainsbury's performance with its competitor, Marks & Spencer, for the years 2018 and 2019. The report delves into liquidity, profitability, efficiency, and investment ratios, providing a detailed comparative evaluation of both companies' financial health. Furthermore, the report evaluates the Kaplan and Norton Balanced Scorecard as a strategic management system for Sainsbury Plc, analyzing its application across financial, customer, internal business process, and learning & growth perspectives. Finally, the report provides a critical analysis of the benefits and challenges associated with adopting Integrated Reporting (IR) for Sainsbury Plc, offering insights into the strategic advantages and potential hurdles of this reporting framework. The report concludes with a summary of findings and recommendations based on the financial performance analysis and strategic considerations.

Financial Performance Management

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1........................................................................................................................................3

Ratio Analysis:.................................................................................................................................8

Question 2........................................................................................................................................9

Evaluation of Kaplan and Norton’s Balanced Scorecard as a Strategic Management System9

Question 3......................................................................................................................................12

Brief description regarding benefits & challenges adopting integrated reporting...............12

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

2

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1........................................................................................................................................3

Ratio Analysis:.................................................................................................................................8

Question 2........................................................................................................................................9

Evaluation of Kaplan and Norton’s Balanced Scorecard as a Strategic Management System9

Question 3......................................................................................................................................12

Brief description regarding benefits & challenges adopting integrated reporting...............12

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

2

INTRODUCTION

Financial performance management is mechanism of a business managing and

monitoring financial results around the board. Financial performance management's core goal is

to equate real outcomes to budgets as well as projections and make changes as required. The

primary aim of the Financial Performance Management, also recognized as the Corporate

Performance Management, is to assist organizations in maximizing sales and operating profits

while also increasing shareholder wealth by connecting strategy to strategies and implementation

through main processes such as goal-setting, modelling, preparing, estimating, close

management including financial reporting (Albuhisi and Abdallah, 2018).

In a nutshell, the adhesive that connects all of an organization's diverse financial as well as

strategic details to strengthen strategy as well as decision-making and illuminate the path

forward. Financial output is subjective indicator of a company's ability to produce sales from its

main mode of operation. The concept is often used as a broad indicator of a company’s overall

fiscal health over time. Financial output is used by analysts and stakeholders to compare related

companies in same industry or even to compare markets or sectors as a whole.

In this report, Sainsbury Plc has been chosen. Sainsbury Plc is UK based corporation

which is leading operator of supermarket of UK. Whereas in the study, second company chosen

is Mark and Spenser, which is one of top competitor of Sainsbury plc and leading supermarket

chain in UK. The study consists of three tasks, the first one covers application of ratio analysis

approach to analyse overall financial performance of these two corporations as well as a

comprehensive comparative evaluation. The second task covers evaluation of Kaplan and

Norton’s Balanced Scorecard as a Strategic Management System of Sainsbury plc. While the

third task of study covers critical analysis of key benefits and challenges of adopting Integrated

Reporting (IR) of Sainsbury plc.

MAIN BODY

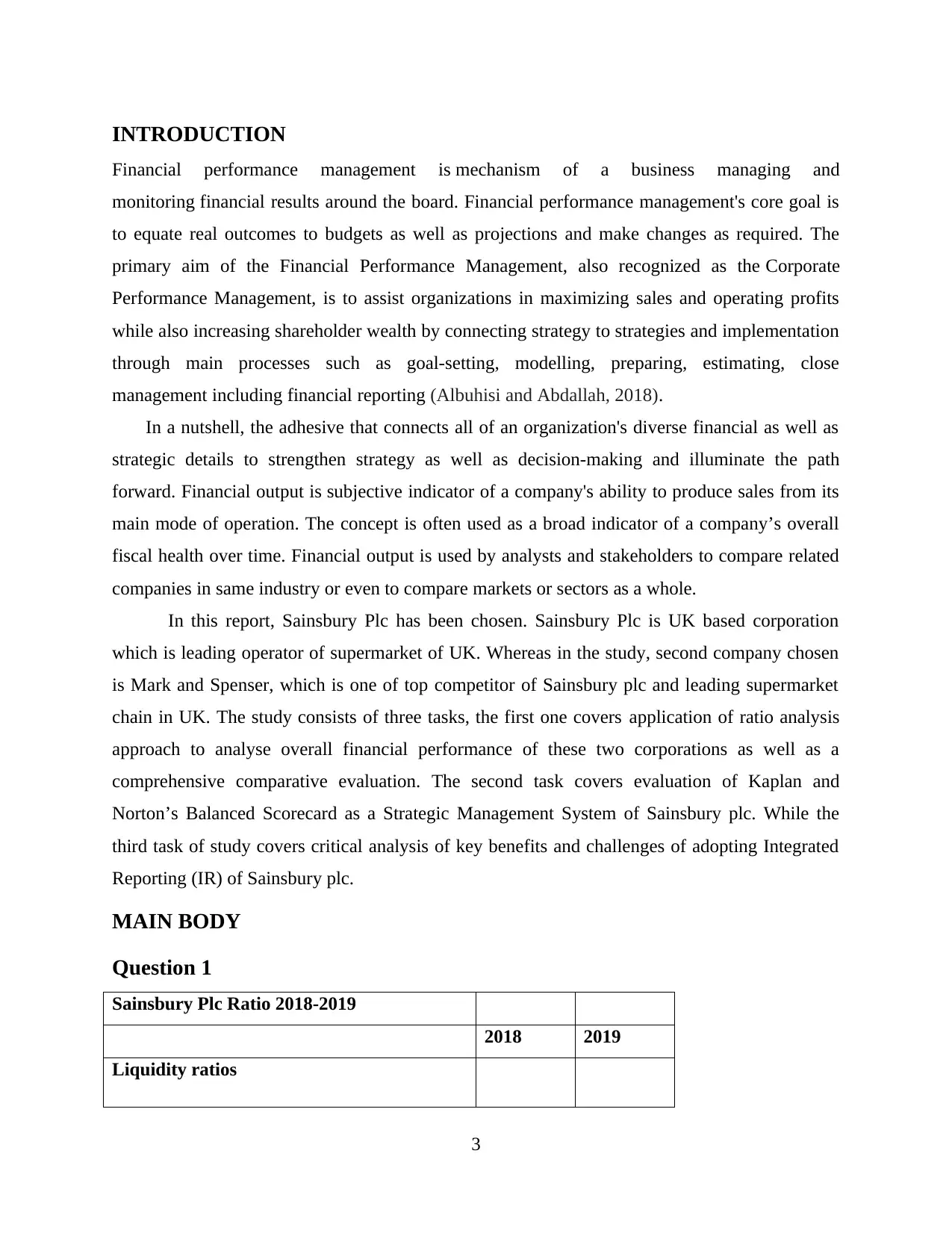

Question 1

Sainsbury Plc Ratio 2018-2019

2018 2019

Liquidity ratios

3

Financial performance management is mechanism of a business managing and

monitoring financial results around the board. Financial performance management's core goal is

to equate real outcomes to budgets as well as projections and make changes as required. The

primary aim of the Financial Performance Management, also recognized as the Corporate

Performance Management, is to assist organizations in maximizing sales and operating profits

while also increasing shareholder wealth by connecting strategy to strategies and implementation

through main processes such as goal-setting, modelling, preparing, estimating, close

management including financial reporting (Albuhisi and Abdallah, 2018).

In a nutshell, the adhesive that connects all of an organization's diverse financial as well as

strategic details to strengthen strategy as well as decision-making and illuminate the path

forward. Financial output is subjective indicator of a company's ability to produce sales from its

main mode of operation. The concept is often used as a broad indicator of a company’s overall

fiscal health over time. Financial output is used by analysts and stakeholders to compare related

companies in same industry or even to compare markets or sectors as a whole.

In this report, Sainsbury Plc has been chosen. Sainsbury Plc is UK based corporation

which is leading operator of supermarket of UK. Whereas in the study, second company chosen

is Mark and Spenser, which is one of top competitor of Sainsbury plc and leading supermarket

chain in UK. The study consists of three tasks, the first one covers application of ratio analysis

approach to analyse overall financial performance of these two corporations as well as a

comprehensive comparative evaluation. The second task covers evaluation of Kaplan and

Norton’s Balanced Scorecard as a Strategic Management System of Sainsbury plc. While the

third task of study covers critical analysis of key benefits and challenges of adopting Integrated

Reporting (IR) of Sainsbury plc.

MAIN BODY

Question 1

Sainsbury Plc Ratio 2018-2019

2018 2019

Liquidity ratios

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

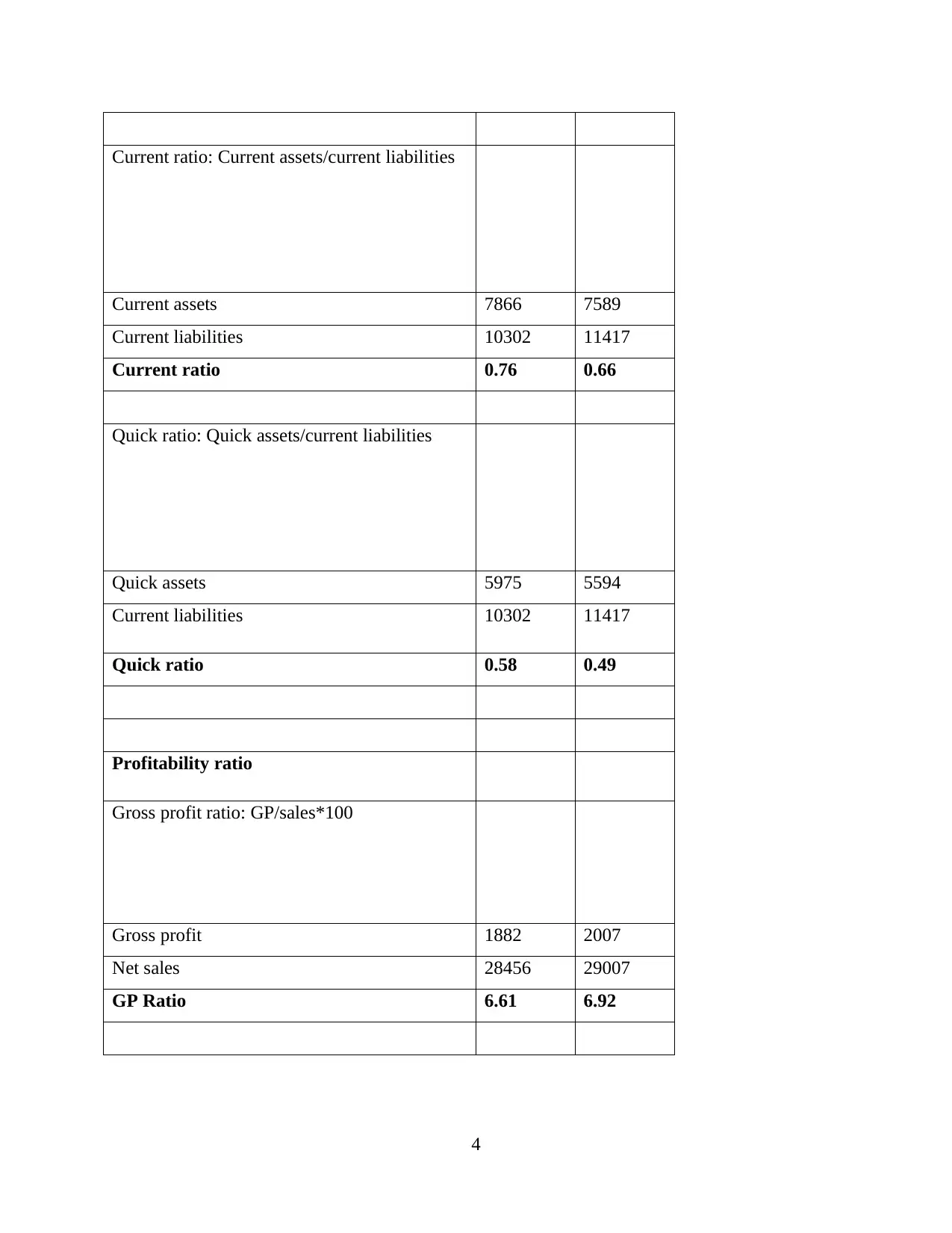

Current ratio: Current assets/current liabilities

Current assets 7866 7589

Current liabilities 10302 11417

Current ratio 0.76 0.66

Quick ratio: Quick assets/current liabilities

Quick assets 5975 5594

Current liabilities 10302 11417

Quick ratio 0.58 0.49

Profitability ratio

Gross profit ratio: GP/sales*100

Gross profit 1882 2007

Net sales 28456 29007

GP Ratio 6.61 6.92

4

Current assets 7866 7589

Current liabilities 10302 11417

Current ratio 0.76 0.66

Quick ratio: Quick assets/current liabilities

Quick assets 5975 5594

Current liabilities 10302 11417

Quick ratio 0.58 0.49

Profitability ratio

Gross profit ratio: GP/sales*100

Gross profit 1882 2007

Net sales 28456 29007

GP Ratio 6.61 6.92

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

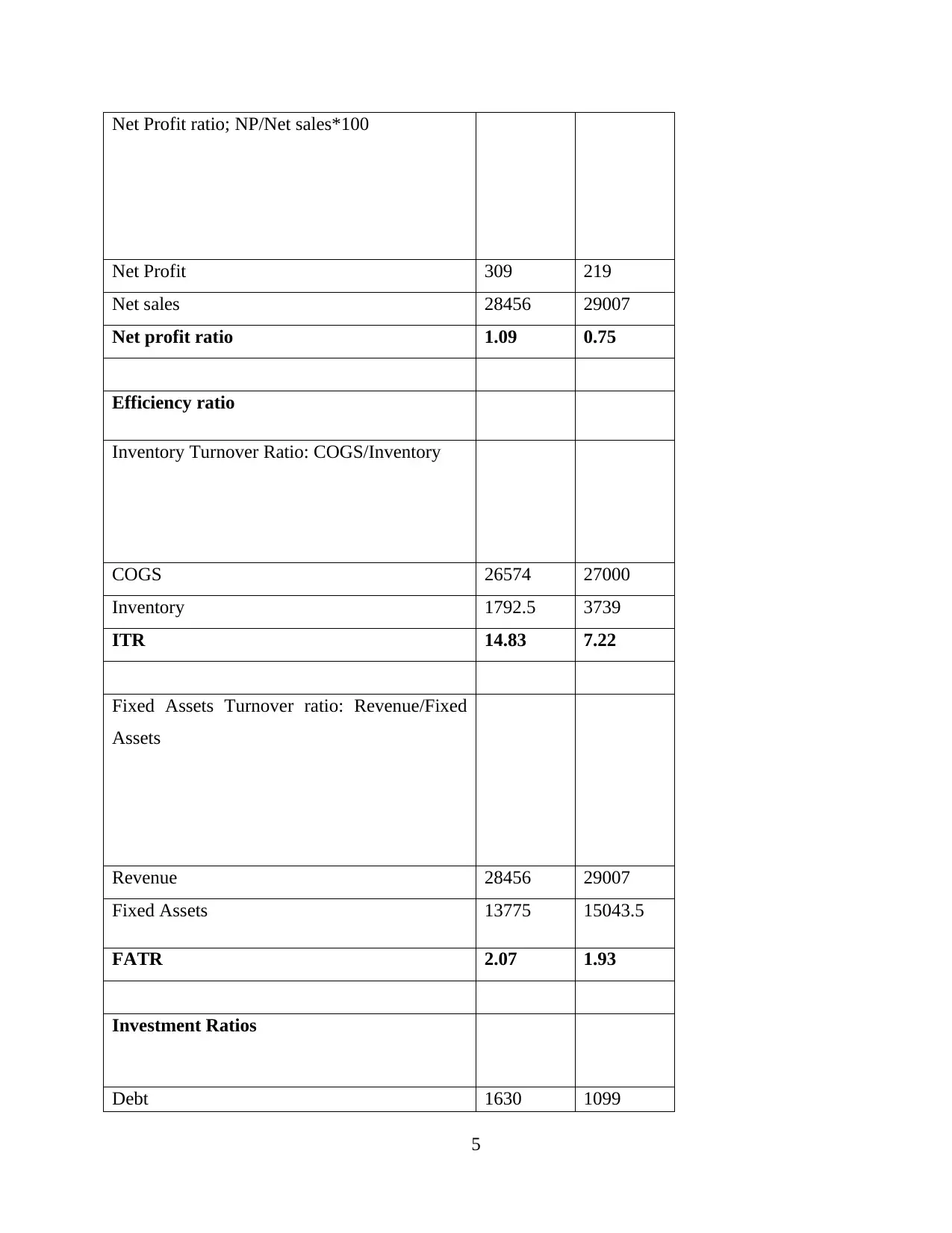

Net Profit ratio; NP/Net sales*100

Net Profit 309 219

Net sales 28456 29007

Net profit ratio 1.09 0.75

Efficiency ratio

Inventory Turnover Ratio: COGS/Inventory

COGS 26574 27000

Inventory 1792.5 3739

ITR 14.83 7.22

Fixed Assets Turnover ratio: Revenue/Fixed

Assets

Revenue 28456 29007

Fixed Assets 13775 15043.5

FATR 2.07 1.93

Investment Ratios

Debt 1630 1099

5

Net Profit 309 219

Net sales 28456 29007

Net profit ratio 1.09 0.75

Efficiency ratio

Inventory Turnover Ratio: COGS/Inventory

COGS 26574 27000

Inventory 1792.5 3739

ITR 14.83 7.22

Fixed Assets Turnover ratio: Revenue/Fixed

Assets

Revenue 28456 29007

Fixed Assets 13775 15043.5

FATR 2.07 1.93

Investment Ratios

Debt 1630 1099

5

equity 7411 8456

Debt/equity 0.22 0.13

1630 1099

Return On equity

Net Profit 309 219

equity 7411 8456

ROE 4.17 2.59

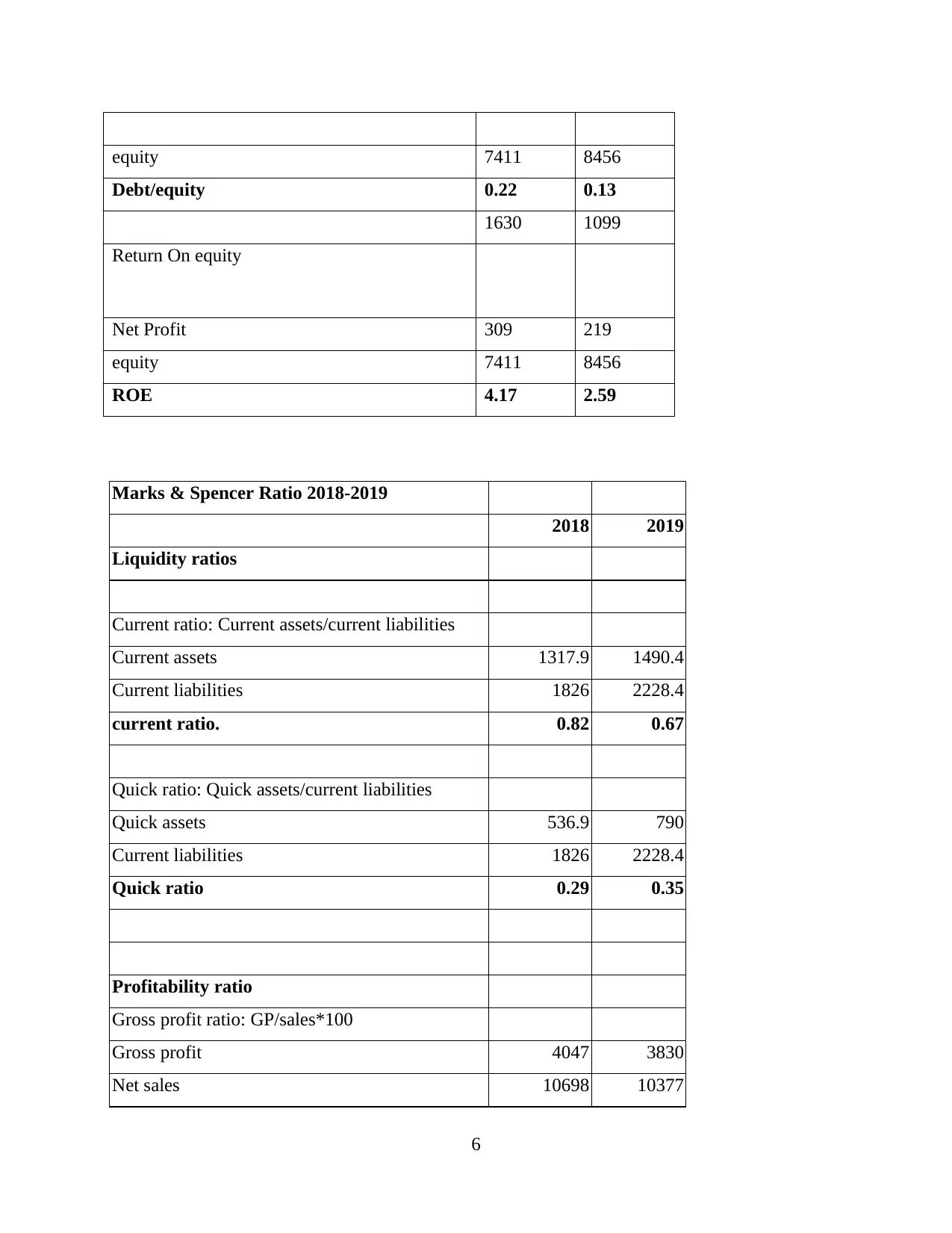

Marks & Spencer Ratio 2018-2019

2018 2019

Liquidity ratios

Current ratio: Current assets/current liabilities

Current assets 1317.9 1490.4

Current liabilities 1826 2228.4

current ratio. 0.82 0.67

Quick ratio: Quick assets/current liabilities

Quick assets 536.9 790

Current liabilities 1826 2228.4

Quick ratio 0.29 0.35

Profitability ratio

Gross profit ratio: GP/sales*100

Gross profit 4047 3830

Net sales 10698 10377

6

Debt/equity 0.22 0.13

1630 1099

Return On equity

Net Profit 309 219

equity 7411 8456

ROE 4.17 2.59

Marks & Spencer Ratio 2018-2019

2018 2019

Liquidity ratios

Current ratio: Current assets/current liabilities

Current assets 1317.9 1490.4

Current liabilities 1826 2228.4

current ratio. 0.82 0.67

Quick ratio: Quick assets/current liabilities

Quick assets 536.9 790

Current liabilities 1826 2228.4

Quick ratio 0.29 0.35

Profitability ratio

Gross profit ratio: GP/sales*100

Gross profit 4047 3830

Net sales 10698 10377

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

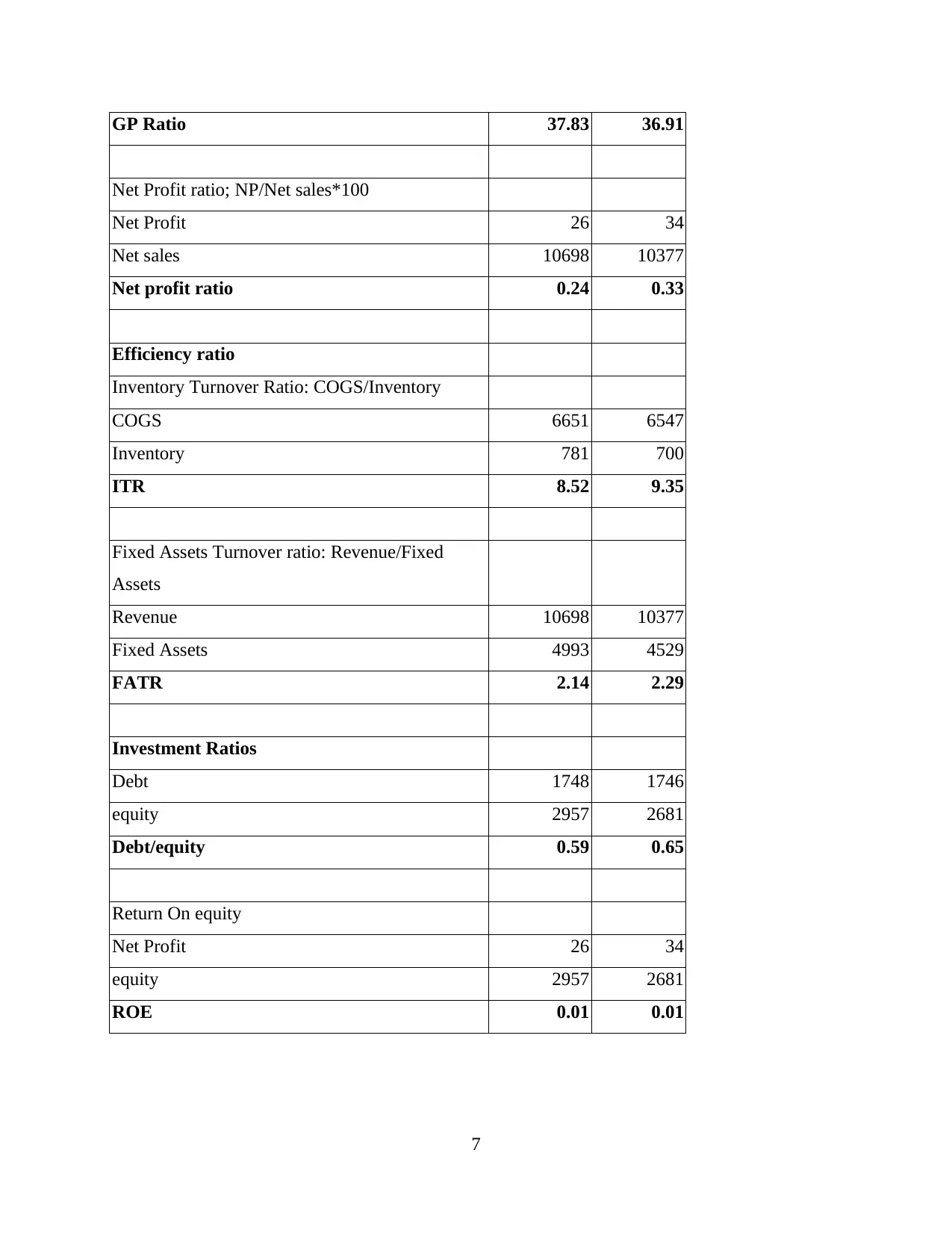

GP Ratio 37.83 36.91

Net Profit ratio; NP/Net sales*100

Net Profit 26 34

Net sales 10698 10377

Net profit ratio 0.24 0.33

Efficiency ratio

Inventory Turnover Ratio: COGS/Inventory

COGS 6651 6547

Inventory 781 700

ITR 8.52 9.35

Fixed Assets Turnover ratio: Revenue/Fixed

Assets

Revenue 10698 10377

Fixed Assets 4993 4529

FATR 2.14 2.29

Investment Ratios

Debt 1748 1746

equity 2957 2681

Debt/equity 0.59 0.65

Return On equity

Net Profit 26 34

equity 2957 2681

ROE 0.01 0.01

7

Net Profit ratio; NP/Net sales*100

Net Profit 26 34

Net sales 10698 10377

Net profit ratio 0.24 0.33

Efficiency ratio

Inventory Turnover Ratio: COGS/Inventory

COGS 6651 6547

Inventory 781 700

ITR 8.52 9.35

Fixed Assets Turnover ratio: Revenue/Fixed

Assets

Revenue 10698 10377

Fixed Assets 4993 4529

FATR 2.14 2.29

Investment Ratios

Debt 1748 1746

equity 2957 2681

Debt/equity 0.59 0.65

Return On equity

Net Profit 26 34

equity 2957 2681

ROE 0.01 0.01

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

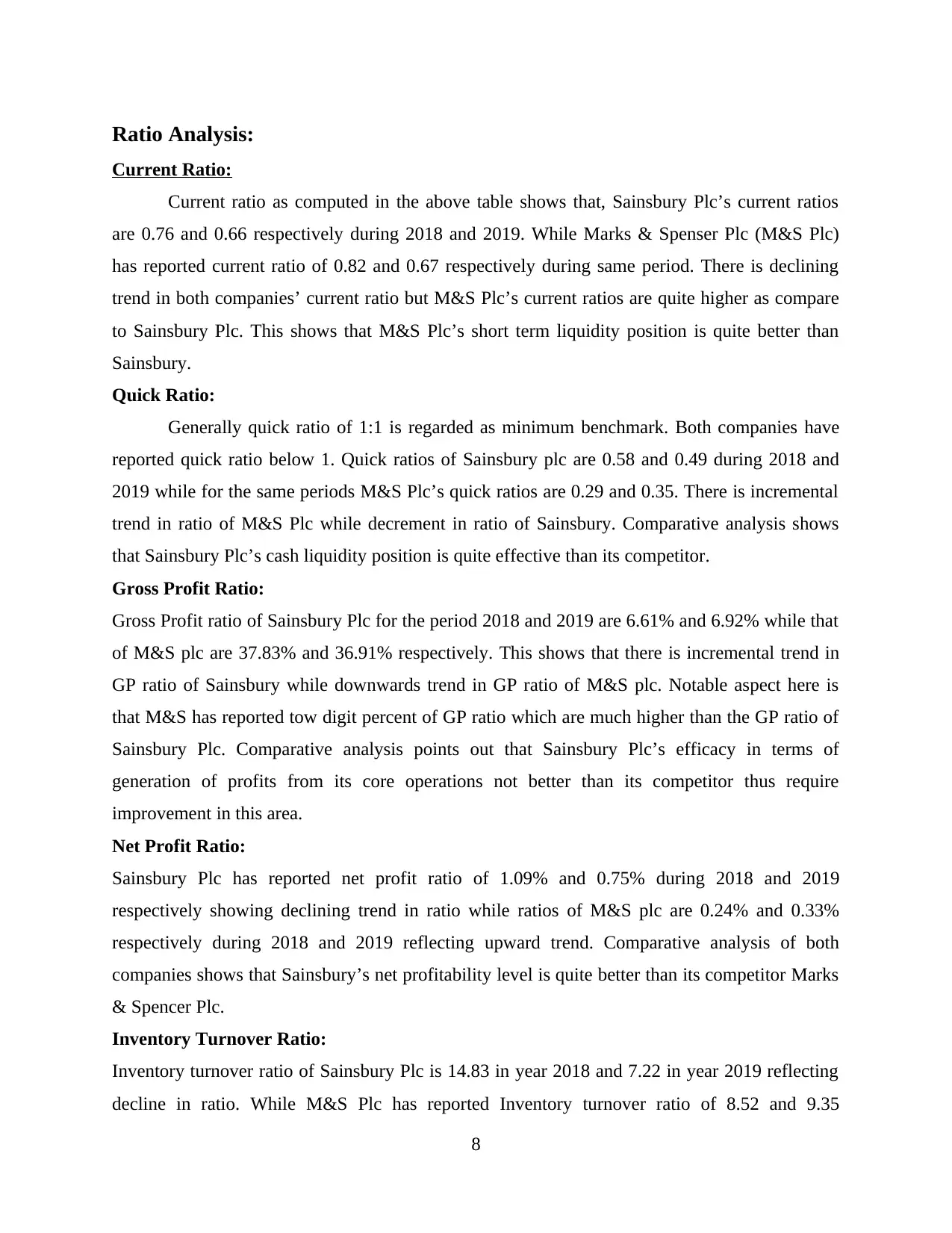

Ratio Analysis:

Current Ratio:

Current ratio as computed in the above table shows that, Sainsbury Plc’s current ratios

are 0.76 and 0.66 respectively during 2018 and 2019. While Marks & Spenser Plc (M&S Plc)

has reported current ratio of 0.82 and 0.67 respectively during same period. There is declining

trend in both companies’ current ratio but M&S Plc’s current ratios are quite higher as compare

to Sainsbury Plc. This shows that M&S Plc’s short term liquidity position is quite better than

Sainsbury.

Quick Ratio:

Generally quick ratio of 1:1 is regarded as minimum benchmark. Both companies have

reported quick ratio below 1. Quick ratios of Sainsbury plc are 0.58 and 0.49 during 2018 and

2019 while for the same periods M&S Plc’s quick ratios are 0.29 and 0.35. There is incremental

trend in ratio of M&S Plc while decrement in ratio of Sainsbury. Comparative analysis shows

that Sainsbury Plc’s cash liquidity position is quite effective than its competitor.

Gross Profit Ratio:

Gross Profit ratio of Sainsbury Plc for the period 2018 and 2019 are 6.61% and 6.92% while that

of M&S plc are 37.83% and 36.91% respectively. This shows that there is incremental trend in

GP ratio of Sainsbury while downwards trend in GP ratio of M&S plc. Notable aspect here is

that M&S has reported tow digit percent of GP ratio which are much higher than the GP ratio of

Sainsbury Plc. Comparative analysis points out that Sainsbury Plc’s efficacy in terms of

generation of profits from its core operations not better than its competitor thus require

improvement in this area.

Net Profit Ratio:

Sainsbury Plc has reported net profit ratio of 1.09% and 0.75% during 2018 and 2019

respectively showing declining trend in ratio while ratios of M&S plc are 0.24% and 0.33%

respectively during 2018 and 2019 reflecting upward trend. Comparative analysis of both

companies shows that Sainsbury’s net profitability level is quite better than its competitor Marks

& Spencer Plc.

Inventory Turnover Ratio:

Inventory turnover ratio of Sainsbury Plc is 14.83 in year 2018 and 7.22 in year 2019 reflecting

decline in ratio. While M&S Plc has reported Inventory turnover ratio of 8.52 and 9.35

8

Current Ratio:

Current ratio as computed in the above table shows that, Sainsbury Plc’s current ratios

are 0.76 and 0.66 respectively during 2018 and 2019. While Marks & Spenser Plc (M&S Plc)

has reported current ratio of 0.82 and 0.67 respectively during same period. There is declining

trend in both companies’ current ratio but M&S Plc’s current ratios are quite higher as compare

to Sainsbury Plc. This shows that M&S Plc’s short term liquidity position is quite better than

Sainsbury.

Quick Ratio:

Generally quick ratio of 1:1 is regarded as minimum benchmark. Both companies have

reported quick ratio below 1. Quick ratios of Sainsbury plc are 0.58 and 0.49 during 2018 and

2019 while for the same periods M&S Plc’s quick ratios are 0.29 and 0.35. There is incremental

trend in ratio of M&S Plc while decrement in ratio of Sainsbury. Comparative analysis shows

that Sainsbury Plc’s cash liquidity position is quite effective than its competitor.

Gross Profit Ratio:

Gross Profit ratio of Sainsbury Plc for the period 2018 and 2019 are 6.61% and 6.92% while that

of M&S plc are 37.83% and 36.91% respectively. This shows that there is incremental trend in

GP ratio of Sainsbury while downwards trend in GP ratio of M&S plc. Notable aspect here is

that M&S has reported tow digit percent of GP ratio which are much higher than the GP ratio of

Sainsbury Plc. Comparative analysis points out that Sainsbury Plc’s efficacy in terms of

generation of profits from its core operations not better than its competitor thus require

improvement in this area.

Net Profit Ratio:

Sainsbury Plc has reported net profit ratio of 1.09% and 0.75% during 2018 and 2019

respectively showing declining trend in ratio while ratios of M&S plc are 0.24% and 0.33%

respectively during 2018 and 2019 reflecting upward trend. Comparative analysis of both

companies shows that Sainsbury’s net profitability level is quite better than its competitor Marks

& Spencer Plc.

Inventory Turnover Ratio:

Inventory turnover ratio of Sainsbury Plc is 14.83 in year 2018 and 7.22 in year 2019 reflecting

decline in ratio. While M&S Plc has reported Inventory turnover ratio of 8.52 and 9.35

8

respectively during 2018 and 2019 indicating increase in ratio. But overall comparative analysis

depicts that Sainsbury plc with greater ratio is more efficient to convert their inventories into

sales as compare to its competitor.

Fixed Asset Turnover Ratio:

Sainsbury’s Fixed-asset turnover ratio for the year 2018 and year 2019 are 2.07 and 1.93

respectively showing decline in ratio. While M&S plc’s has reported Fixed-asset turnover ratio

of 2.14 and 2.29 during 2018 and 2019 reflecting an increase in the ratio. Total comparative

analysis exhibits that M&S plc with greater ratio in comparison of Sainsbury is quite efficient in

utilising its fixed assets to generate sales.

Debt Equity Ratio:

Sainsbury’s debt to equity ratio for the year 2018 is 0.22 and for year 2019 is 0.13 implying a

decline in ratio. M&S plc’s debt to equity ratios during the said period are 0.59 and 0.65

respectively exhibiting increasing trend in this ratio. The comparative analysis of both companies

indicates that Sainsbury with lesser debts has quite better solvency position as compare to its

competitor.

Return on Equity:

ROE of Sainsbury plc are 4.17 and 2.59 respectively during 2018 and 2019 which reflect

decrement in ratio. While ratios of M&S plc are 0.1 during both with minor change. Comparison

shows that ROE of Sainsbury is quite better than M&S plc, although there is major decline in

ratio of Sainsbury Plc which shows that company’s efficiency to provide return to their

shareholders has been declined over the period.

Question 2

Evaluation of Kaplan and Norton’s Balanced Scorecard as a Strategic Management System

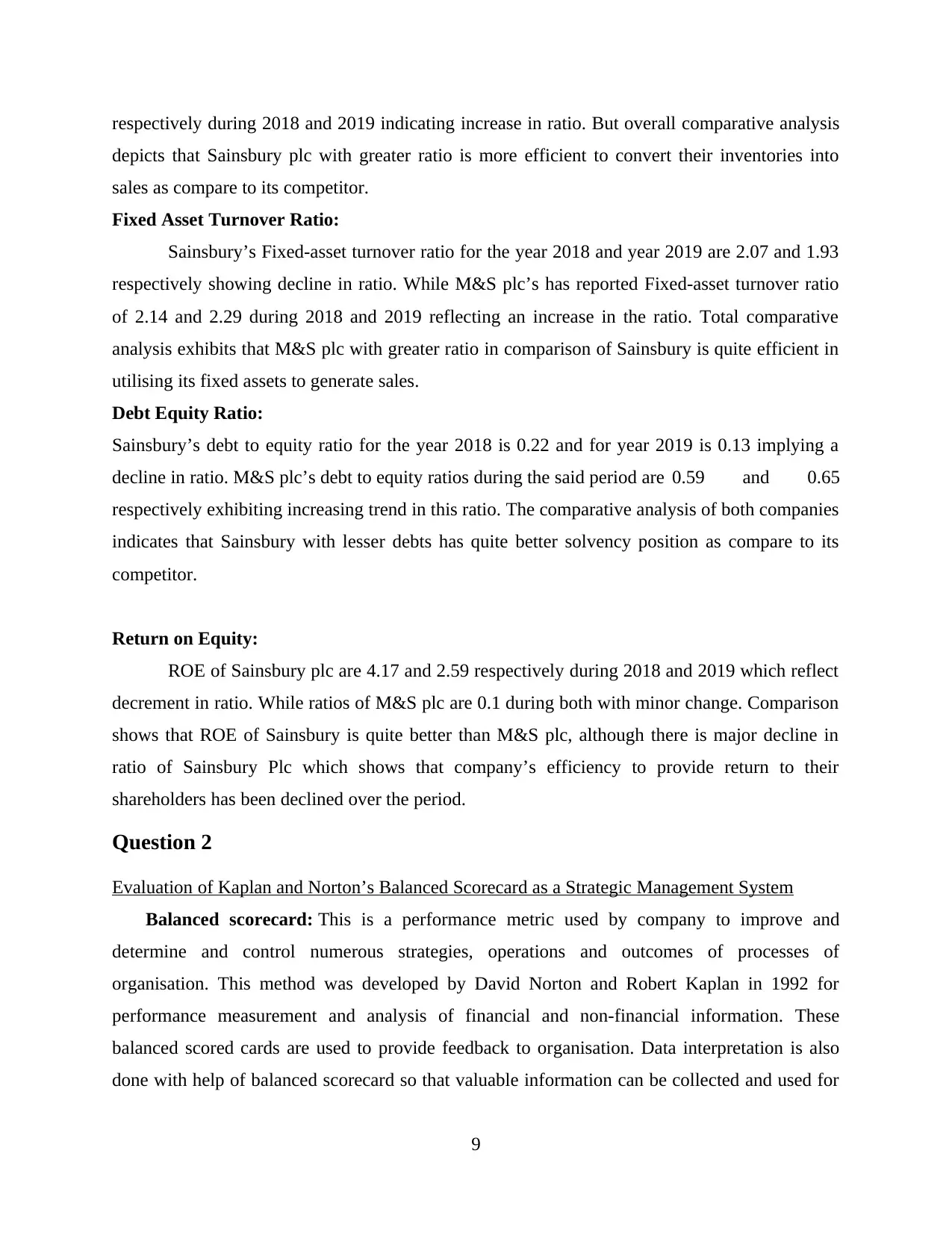

Balanced scorecard: This is a performance metric used by company to improve and

determine and control numerous strategies, operations and outcomes of processes of

organisation. This method was developed by David Norton and Robert Kaplan in 1992 for

performance measurement and analysis of financial and non-financial information. These

balanced scored cards are used to provide feedback to organisation. Data interpretation is also

done with help of balanced scorecard so that valuable information can be collected and used for

9

depicts that Sainsbury plc with greater ratio is more efficient to convert their inventories into

sales as compare to its competitor.

Fixed Asset Turnover Ratio:

Sainsbury’s Fixed-asset turnover ratio for the year 2018 and year 2019 are 2.07 and 1.93

respectively showing decline in ratio. While M&S plc’s has reported Fixed-asset turnover ratio

of 2.14 and 2.29 during 2018 and 2019 reflecting an increase in the ratio. Total comparative

analysis exhibits that M&S plc with greater ratio in comparison of Sainsbury is quite efficient in

utilising its fixed assets to generate sales.

Debt Equity Ratio:

Sainsbury’s debt to equity ratio for the year 2018 is 0.22 and for year 2019 is 0.13 implying a

decline in ratio. M&S plc’s debt to equity ratios during the said period are 0.59 and 0.65

respectively exhibiting increasing trend in this ratio. The comparative analysis of both companies

indicates that Sainsbury with lesser debts has quite better solvency position as compare to its

competitor.

Return on Equity:

ROE of Sainsbury plc are 4.17 and 2.59 respectively during 2018 and 2019 which reflect

decrement in ratio. While ratios of M&S plc are 0.1 during both with minor change. Comparison

shows that ROE of Sainsbury is quite better than M&S plc, although there is major decline in

ratio of Sainsbury Plc which shows that company’s efficiency to provide return to their

shareholders has been declined over the period.

Question 2

Evaluation of Kaplan and Norton’s Balanced Scorecard as a Strategic Management System

Balanced scorecard: This is a performance metric used by company to improve and

determine and control numerous strategies, operations and outcomes of processes of

organisation. This method was developed by David Norton and Robert Kaplan in 1992 for

performance measurement and analysis of financial and non-financial information. These

balanced scored cards are used to provide feedback to organisation. Data interpretation is also

done with help of balanced scorecard so that valuable information can be collected and used for

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

improvement in business operations. Future scorecards can be helpful in identifying obstacles

which are hindering growth of business. An effective scorecard should provide information

regarding learning and growth, business processes, customer prospective and financial data. This

scorecard provides performance measures such as how customers see us, can we continue to

improve and create value etc.

Balanced Scorecard of Sainsbury 1

Kaplan and Norton’s Balanced Scorecard model

This model was introduced in 1996, main dedications and efforts were being made

towards regulating effective performances being produced in the business firm. In order to assess

and understand results, managers must concentrate on four variables that are considered

important. These include consumer perceptions of the company, learning and development

opportunities, financial management tools, and strategic ways to prevent the quality of products

and services (Vieira, Neves and Dias, 2019). According to Kaplan, in order to keep an

organization's worthiness for a long time, they must manipulate and analyse non-financial

resources that are not reflected by financial instruments.

Managers may communicate their vision with the help of this method. They use it to keep

inventory and productivity levels in check within the business. This method aids in improving

organizational coordination and aligning processes, which is useful and advantageous for

10

which are hindering growth of business. An effective scorecard should provide information

regarding learning and growth, business processes, customer prospective and financial data. This

scorecard provides performance measures such as how customers see us, can we continue to

improve and create value etc.

Balanced Scorecard of Sainsbury 1

Kaplan and Norton’s Balanced Scorecard model

This model was introduced in 1996, main dedications and efforts were being made

towards regulating effective performances being produced in the business firm. In order to assess

and understand results, managers must concentrate on four variables that are considered

important. These include consumer perceptions of the company, learning and development

opportunities, financial management tools, and strategic ways to prevent the quality of products

and services (Vieira, Neves and Dias, 2019). According to Kaplan, in order to keep an

organization's worthiness for a long time, they must manipulate and analyse non-financial

resources that are not reflected by financial instruments.

Managers may communicate their vision with the help of this method. They use it to keep

inventory and productivity levels in check within the business. This method aids in improving

organizational coordination and aligning processes, which is useful and advantageous for

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

achieving strategic management objectives. Sainsbury uses four elements of this framework to

assess the efficiency of their divisions, which are listed below:

Strategy and vision: It is regarded as the tool that expresses the organization's ultimate

purpose. The main reason for the formation of an organization. The statement of vision serves as

a roadmap for the top management as it develops strategies. This model is founded on the

premise that vision is related to all perspectives.

Financial perspective: Organizations have specific goals based on their needs and the

achievement of their long-term business objectives. Financial perspective refers to how a

company appears to its shareholders. They do this by tracking their organization's growth,

operations, and harvest life cycles (Esteban-Sanchez, de la Cuesta-Gonzalez and Paredes-

Gazquez, 2017). To assess the financial viewpoint, managers must calculate the profit margin

and gross margin ratio, which they will use to assess the company's effectiveness.

Customers perspective: In this process, businesses evaluate their performance from the

perspective of their clients. They use service rating metrics as well as calculating the amount of

risk management requires to identify the market's viewpoint on the business in order to identify

customer needs.

Respective model assesses share of the market, customer retention rate, productivity satisfaction,

and customer retention level to determine the relevance of customers. According to Kaplan and

Norton, organizations must concentrate on developing a successful customer loyalty policy in

order to gain a sustainable market advantage (De Villiers, Hsiao and Maroun eds., 2020).

Sainsbury's general manager develops strategy with the aim of concentrating on each target

market segment, building solid relationships with consumers, and spreading positive interest in

each target audience by potential consumers.

Innovation and learning: According to Kaplan and Norton, it is important to determine the

response to the question of what are the items and goods that a company has that assist in

providing customer loyalty as well as ways to meet customer requirements. They must create

policies and develop ideas for innovation, as well as introduce or apply innovations throughout

their organisation, in order to achieve this goal.

Sainsbury's top management develops strategies based on the measurement of

interconnected processes across various divisions, as well as cross-organizational culture, from

that they can assess and satisfy customer demand. And to increase shareholder capital.

11

assess the efficiency of their divisions, which are listed below:

Strategy and vision: It is regarded as the tool that expresses the organization's ultimate

purpose. The main reason for the formation of an organization. The statement of vision serves as

a roadmap for the top management as it develops strategies. This model is founded on the

premise that vision is related to all perspectives.

Financial perspective: Organizations have specific goals based on their needs and the

achievement of their long-term business objectives. Financial perspective refers to how a

company appears to its shareholders. They do this by tracking their organization's growth,

operations, and harvest life cycles (Esteban-Sanchez, de la Cuesta-Gonzalez and Paredes-

Gazquez, 2017). To assess the financial viewpoint, managers must calculate the profit margin

and gross margin ratio, which they will use to assess the company's effectiveness.

Customers perspective: In this process, businesses evaluate their performance from the

perspective of their clients. They use service rating metrics as well as calculating the amount of

risk management requires to identify the market's viewpoint on the business in order to identify

customer needs.

Respective model assesses share of the market, customer retention rate, productivity satisfaction,

and customer retention level to determine the relevance of customers. According to Kaplan and

Norton, organizations must concentrate on developing a successful customer loyalty policy in

order to gain a sustainable market advantage (De Villiers, Hsiao and Maroun eds., 2020).

Sainsbury's general manager develops strategy with the aim of concentrating on each target

market segment, building solid relationships with consumers, and spreading positive interest in

each target audience by potential consumers.

Innovation and learning: According to Kaplan and Norton, it is important to determine the

response to the question of what are the items and goods that a company has that assist in

providing customer loyalty as well as ways to meet customer requirements. They must create

policies and develop ideas for innovation, as well as introduce or apply innovations throughout

their organisation, in order to achieve this goal.

Sainsbury's top management develops strategies based on the measurement of

interconnected processes across various divisions, as well as cross-organizational culture, from

that they can assess and satisfy customer demand. And to increase shareholder capital.

11

Internal business strategy: It relates with identifying opportunities and threats in the future so

that a company can retain its market place for a long time while still providing services to

consumers and creating future value. In order to improve an organisation’s ability, it focuses on

cost reduction and the development of new ideas. Sainsbury's general manager uses this tool to

develop their business plans, and it uses the balance scorecard principle to inspire their

employees by providing incentives and recognition that help them advance in their careers.

Sainsbury's management department is focused on the goal that if their employees are inspired,

the company's goals can be easily accomplished, as human capital is considered an important

element in the organization (Shabbir and Wisdom, 2020). The Balanced model developed by

Kaplan and Norton helps employees increase their output by focusing on potential investment

and development. Prospective organisations typically concentrate on skills encouragement and

efficiency enhancement to reach their learning and development goals. Sainsbury will monitor

their level of retaining employees by monitoring employee satisfaction, and it can also benefit

the integration of staffing priorities with company vision, as motivated employees work hard to

achieve business goals.

Sainsbury's management department evaluates their marginal ratio, operating and cost of return

in order to effectively assess consumers' attitudes and identify tactics that help in the

development of an effective method that can easily recognize or quantify the value of the

company (Akisik and Gal, 2017).

With the preparation and development of these systems, Sainsbury's managers and leaders

can easily assess output and determine the reason for the deviation from the regular target. On

this foundation, strategies are developed with an aim attain achievement of the company's

objectives and the development of a good market place.

Question 3

Brief description regarding benefits & challenges adopting integrated reporting

Integrated reporting: It is a tool that is formulated to describe how a business entity should

generate value over a particular period of time, based on their goals, governance, and success, in

order to achieve their long, short, or intermediate target (Choi and et. al., 2018). It can be

described as a tool that is used to demonstrate a correlation with an organisation's internal goals

and external factors.

12

that a company can retain its market place for a long time while still providing services to

consumers and creating future value. In order to improve an organisation’s ability, it focuses on

cost reduction and the development of new ideas. Sainsbury's general manager uses this tool to

develop their business plans, and it uses the balance scorecard principle to inspire their

employees by providing incentives and recognition that help them advance in their careers.

Sainsbury's management department is focused on the goal that if their employees are inspired,

the company's goals can be easily accomplished, as human capital is considered an important

element in the organization (Shabbir and Wisdom, 2020). The Balanced model developed by

Kaplan and Norton helps employees increase their output by focusing on potential investment

and development. Prospective organisations typically concentrate on skills encouragement and

efficiency enhancement to reach their learning and development goals. Sainsbury will monitor

their level of retaining employees by monitoring employee satisfaction, and it can also benefit

the integration of staffing priorities with company vision, as motivated employees work hard to

achieve business goals.

Sainsbury's management department evaluates their marginal ratio, operating and cost of return

in order to effectively assess consumers' attitudes and identify tactics that help in the

development of an effective method that can easily recognize or quantify the value of the

company (Akisik and Gal, 2017).

With the preparation and development of these systems, Sainsbury's managers and leaders

can easily assess output and determine the reason for the deviation from the regular target. On

this foundation, strategies are developed with an aim attain achievement of the company's

objectives and the development of a good market place.

Question 3

Brief description regarding benefits & challenges adopting integrated reporting

Integrated reporting: It is a tool that is formulated to describe how a business entity should

generate value over a particular period of time, based on their goals, governance, and success, in

order to achieve their long, short, or intermediate target (Choi and et. al., 2018). It can be

described as a tool that is used to demonstrate a correlation with an organisation's internal goals

and external factors.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.