FINA6000: Financial Performance of ANZ and CSL Stocks During Pandemic

VerifiedAdded on 2022/09/25

|14

|776

|11

Presentation

AI Summary

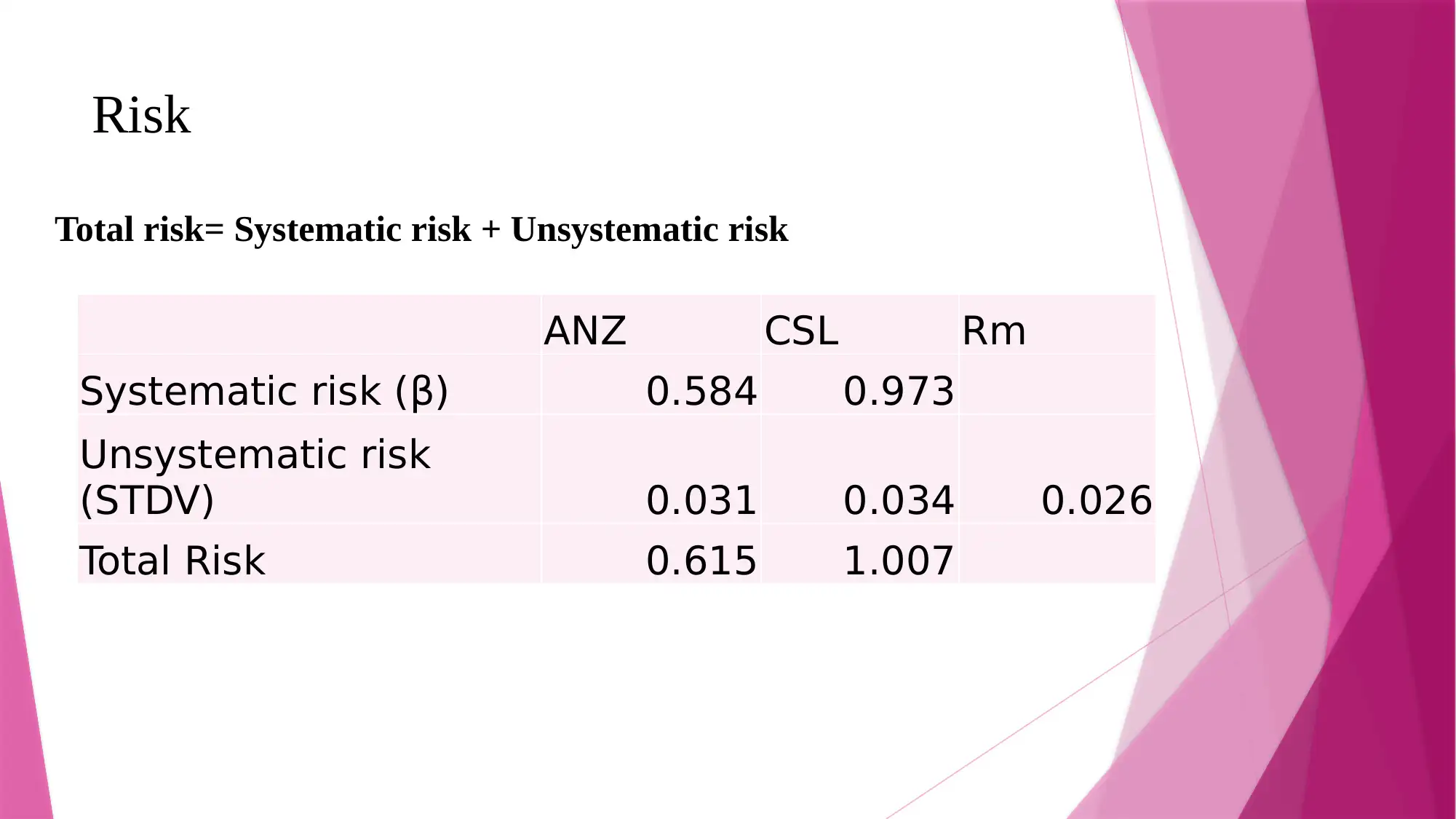

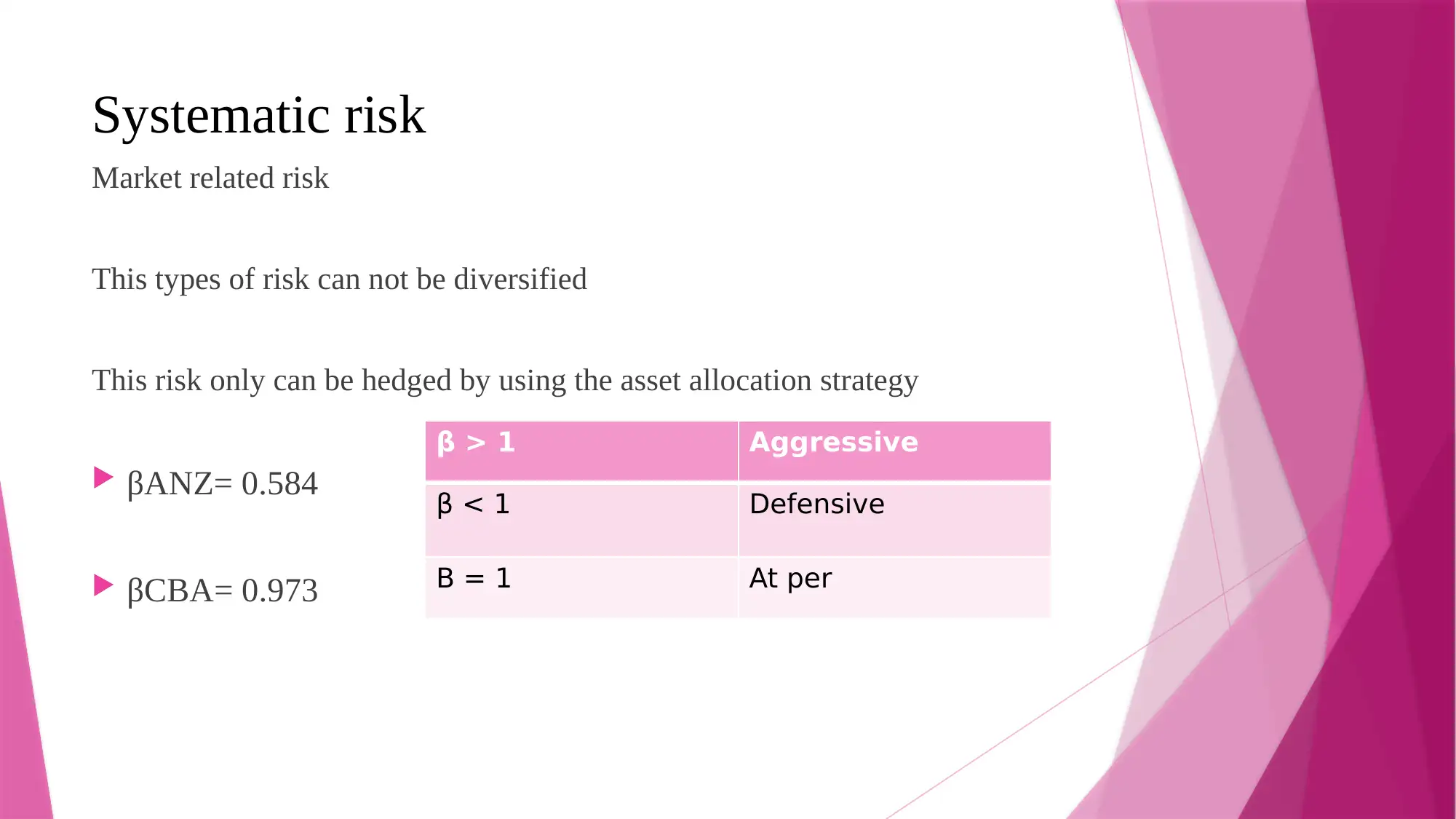

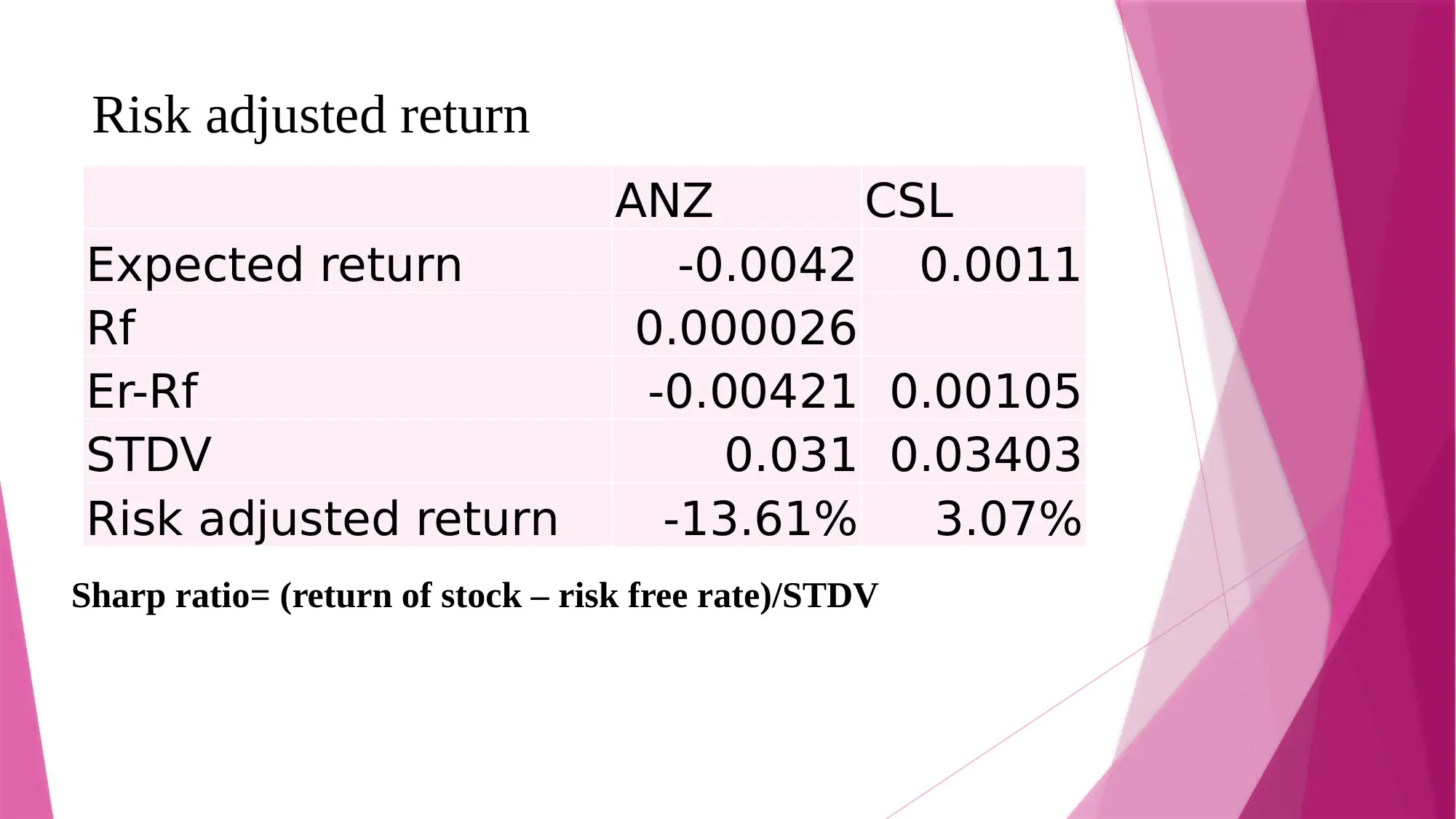

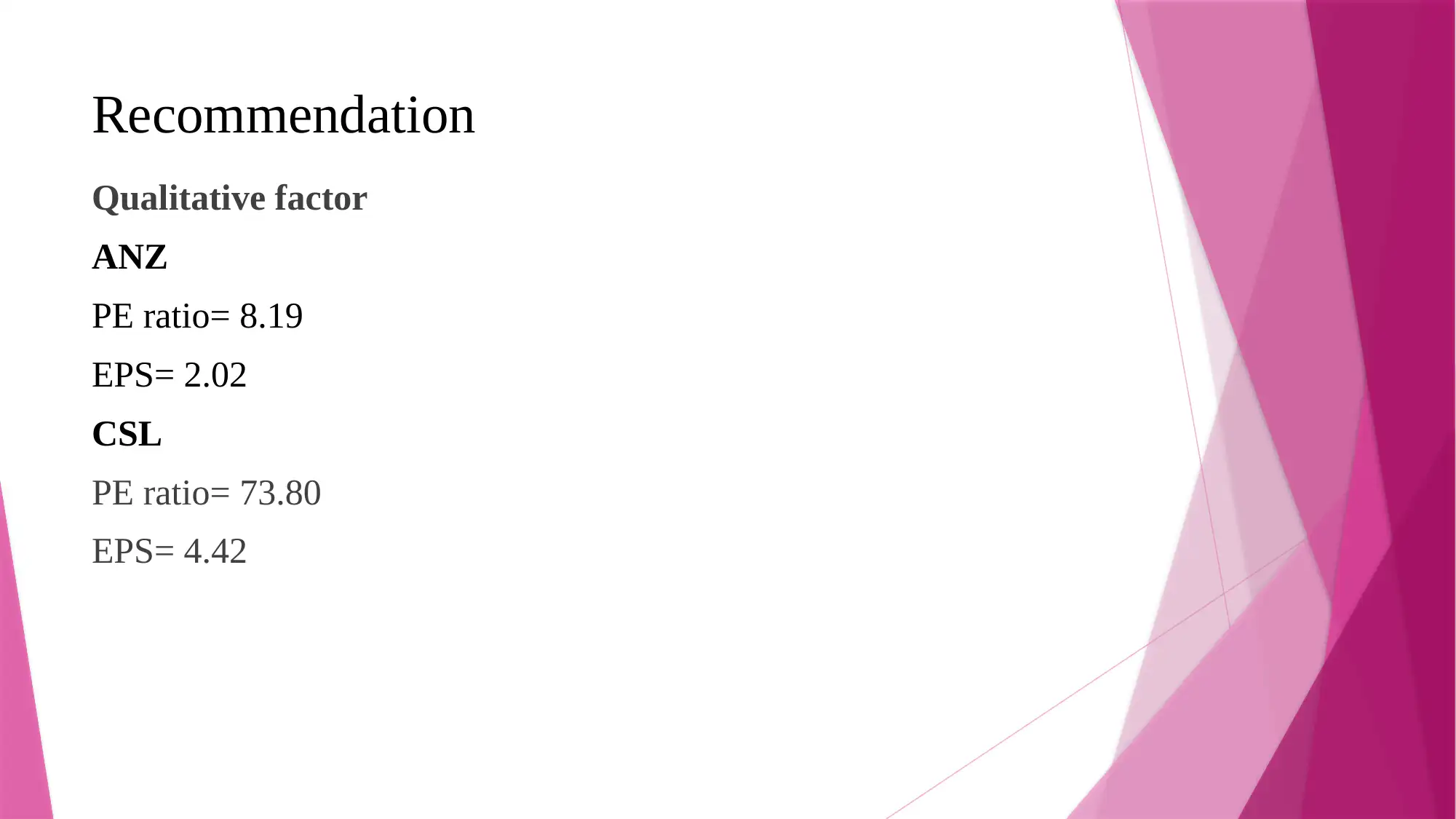

This presentation analyzes the financial performance of ANZ (Australia and New Zealand Banking Group Limited) and CSL Limited stocks during the COVID-19 pandemic. It examines the impact of the pandemic on the global financial market, including the free fall of global equity markets and the negative impact on the global economy, such as the loss of GDP. The analysis includes stock data from Yahoo Finance, geometric mean return, risk assessment (systematic and unsystematic risk), and risk-adjusted return using the Sharpe ratio. The presentation provides a qualitative assessment of each stock, including PE ratios and EPS, and concludes with a discussion of the impact on the selected stocks and recommendations based on the financial data. The author also references several academic papers and financial resources to support the analysis.

1 out of 14

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)