1202AFE Financial Planning 1 Trimester 1, 2018: Statement of Advice

VerifiedAdded on 2023/06/12

|5

|1285

|186

Report

AI Summary

This document presents a financial planning file note for Pete Molloy, a 28-year-old electrician, created on April 9, 2018. The statement of advice (SOA) covers wealth creation, lifestyle goals, personal insurances (life, TPD, income protection, trauma, and private health), superannuation, and taxation planning. Pete's current situation, including his income, assets, and objectives like purchasing a house, securing his daughter's future, and planning for retirement, are outlined. The analysis includes recommendations for wealth creation outside superannuation (house deposit), lifestyle (holiday planning), and superannuation strategies, along with insurance advice. The file note also assesses Pete's risk profile as a growth investor and provides detailed future value calculations in the appendix. Desklib provides access to this and other solved assignments.

1202AFE Financial Planning 1

Trimester 1, 2018

File Note – Statement of Advice

Client's name: Pete Molloy

Date of contact: 9 April2018

Re: Initial Appointment

FSG and adviser profile

Pete was handed Financial Services Guide (FSG) version 4 010217 and my Adviser Profile

at the interview on 9 April 2018. The FSG was explained to him.

Scope of advice

Full statement of advice (SOA). Specifically, the SOA will provide advice on the achievement

of wealth creation and lifestyle goals, personal insurances (that is life, total & permanent

disability (TPD), income protection (IP), trauma and private health insurance),

superannuation (including salary sacrifice, personal tax deductible contributions and/or after

tax contributions) and taxation planning where relevant.

The SOA excludes any budgeting and cash flow analysis, as well as any advice on debt

repayment, social security and estate planning. Client to be advised on the risks of not

receiving advice in these areas.

Current situation

Pete is a 28 years old person who is single as he got separated from his wife and

currently lives with his daughter Isabelle who is 8 years old. He works as an

electrician in a large electric company and earns $65,000 yearly along with 9.5%

Super. Pete works for around 40 hours in a week and is a full time employee. Pete

has the intention of purchasing a house for them in order to live healthy and happily

and accordingly even wants to maintain sufficient income with the help of which he

would be able to take care of the future of her child. Pete therefore wants to

undertake investments with the help of which he would be able to provide adequate

education to his child in order to establish her in the society. Pete has two Super

funds in which he has sufficient balance and has a savings bank account in which he

maintains a balance of $32,000 and out of this $10,000 is kept for emergency

purposes. Pete even wants to undertake investments in order to earn income with

the help of which he would be able to maintain the current living style even after

retirement. Pete does not have significant amount of assets and only has a car and

home contents. Pete even wants to purchase insurance for him and his daughter in

order to remunerate financially in case of any kind of accidents and unprecedented

events.

Potential issues / special consideration

The potential issue that needs to be taken into consideration is that Pete’s only

source of income is the salary he receives from the company and a small amount of

interest from his savings. It is even seen that Pete does not have insurance and

therefore it can cause harm to him in the future due to unprecedented events. Pete’s

child is growing and therefore it becomes essential for him to increase his level of

Trimester 1, 2018

File Note – Statement of Advice

Client's name: Pete Molloy

Date of contact: 9 April2018

Re: Initial Appointment

FSG and adviser profile

Pete was handed Financial Services Guide (FSG) version 4 010217 and my Adviser Profile

at the interview on 9 April 2018. The FSG was explained to him.

Scope of advice

Full statement of advice (SOA). Specifically, the SOA will provide advice on the achievement

of wealth creation and lifestyle goals, personal insurances (that is life, total & permanent

disability (TPD), income protection (IP), trauma and private health insurance),

superannuation (including salary sacrifice, personal tax deductible contributions and/or after

tax contributions) and taxation planning where relevant.

The SOA excludes any budgeting and cash flow analysis, as well as any advice on debt

repayment, social security and estate planning. Client to be advised on the risks of not

receiving advice in these areas.

Current situation

Pete is a 28 years old person who is single as he got separated from his wife and

currently lives with his daughter Isabelle who is 8 years old. He works as an

electrician in a large electric company and earns $65,000 yearly along with 9.5%

Super. Pete works for around 40 hours in a week and is a full time employee. Pete

has the intention of purchasing a house for them in order to live healthy and happily

and accordingly even wants to maintain sufficient income with the help of which he

would be able to take care of the future of her child. Pete therefore wants to

undertake investments with the help of which he would be able to provide adequate

education to his child in order to establish her in the society. Pete has two Super

funds in which he has sufficient balance and has a savings bank account in which he

maintains a balance of $32,000 and out of this $10,000 is kept for emergency

purposes. Pete even wants to undertake investments in order to earn income with

the help of which he would be able to maintain the current living style even after

retirement. Pete does not have significant amount of assets and only has a car and

home contents. Pete even wants to purchase insurance for him and his daughter in

order to remunerate financially in case of any kind of accidents and unprecedented

events.

Potential issues / special consideration

The potential issue that needs to be taken into consideration is that Pete’s only

source of income is the salary he receives from the company and a small amount of

interest from his savings. It is even seen that Pete does not have insurance and

therefore it can cause harm to him in the future due to unprecedented events. Pete’s

child is growing and therefore it becomes essential for him to increase his level of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1202AFE Financial Planning 1

Trimester 1, 2018

income with the help of which the future of his child as well as for Pete can be

secured.

Objectives

Make sure that his child is protected financially in the event of his death

Purchase his own house

Establish adequate future income for his child for her education for the time when

she attains the age of 21 years

Getting the superannuation fund sorted in order to provide adequate income even

after his retirement.

Taking a family holiday in UK

Purchasing adequate insurance and making investments in such a manner so that

the risks would be lower and level of returns would be high.

Risk profile

The evaluation of the risk profile for Pete suggests the fact that the client is a risk

taker and therefore he is a growth investors. As he is quite young, he ready to face

risks and earn more and therefore 80% of the investments would be in growth

investments and the rest of 20% would be in the defensive assets.

Wealth creation recommendations – outside superannuation

1. Goal[house deposit]

Recommended strategy:

In order to purchase the house, Pete needs to make adequate money in order to pay

for the house deposits and therefore Pete has to plan his superannuation in a proper

way and invest more in the superannuation. This is a very tax effective tool for the

investor as it is seen that balance from the superannuation can be used for the

purpose of purchasing properties and therefore the initial deposit of the house can

be made with the help of the balance available in the superannuation.

Advantages of strategy

Tax effective,

High returns would be available

Has the potential for long term income

Would act as a retirement strategy as well.

Disadvantages of strategy

The return is not as high as the investment in equities

Alternatives considered

Increase the savings in the term deposit which can be used as an alternative in order

to pay for the house deposit or else the income that is attained from the portfolio

investments can be used for the purpose making the house deposits as the house

would be purchased within a span of 5-6 years time from now.

Trimester 1, 2018

income with the help of which the future of his child as well as for Pete can be

secured.

Objectives

Make sure that his child is protected financially in the event of his death

Purchase his own house

Establish adequate future income for his child for her education for the time when

she attains the age of 21 years

Getting the superannuation fund sorted in order to provide adequate income even

after his retirement.

Taking a family holiday in UK

Purchasing adequate insurance and making investments in such a manner so that

the risks would be lower and level of returns would be high.

Risk profile

The evaluation of the risk profile for Pete suggests the fact that the client is a risk

taker and therefore he is a growth investors. As he is quite young, he ready to face

risks and earn more and therefore 80% of the investments would be in growth

investments and the rest of 20% would be in the defensive assets.

Wealth creation recommendations – outside superannuation

1. Goal[house deposit]

Recommended strategy:

In order to purchase the house, Pete needs to make adequate money in order to pay

for the house deposits and therefore Pete has to plan his superannuation in a proper

way and invest more in the superannuation. This is a very tax effective tool for the

investor as it is seen that balance from the superannuation can be used for the

purpose of purchasing properties and therefore the initial deposit of the house can

be made with the help of the balance available in the superannuation.

Advantages of strategy

Tax effective,

High returns would be available

Has the potential for long term income

Would act as a retirement strategy as well.

Disadvantages of strategy

The return is not as high as the investment in equities

Alternatives considered

Increase the savings in the term deposit which can be used as an alternative in order

to pay for the house deposit or else the income that is attained from the portfolio

investments can be used for the purpose making the house deposits as the house

would be purchased within a span of 5-6 years time from now.

1202AFE Financial Planning 1

Trimester 1, 2018

Lifestyle recommendations

1. Goal[holiday]

Recommended strategy:

The strategy that is recommended is undertaking investments in the asset and share

portfolio and the investment should be an aggressive one with the help of which

higher level of returns can be attained at a shorter time period and this can be used

for the purpose of paying off for the holiday that has been decided.

Advantages of strategy

Apart from paying for the holiday, additional income would be received from the

investment that can be used for the future use.

Disadvantages of strategy

The extent of risk associated to such investments is significantly high and income

invested can be lost as well.

Alternatives considered

Either invests in the share portfolio by investing more in the defensive assets and

less in the growing assets or else invest more in superannuation and banking

products.

Wealth creation recommendations – superannuation

1. Goal[sort out superannuation]

Recommended strategy:

Superannuation Strategies inclusive of the option of setting up a SMSF

Advantages of strategy

Several choice available for investment

Effective tax strategies

Transparency

Expenses are low

Flexibility

Consolidation of the super assets

Disadvantages of strategy

The cost increases when the balance gets lowered

Increase in the level of accountability

Trimester 1, 2018

Lifestyle recommendations

1. Goal[holiday]

Recommended strategy:

The strategy that is recommended is undertaking investments in the asset and share

portfolio and the investment should be an aggressive one with the help of which

higher level of returns can be attained at a shorter time period and this can be used

for the purpose of paying off for the holiday that has been decided.

Advantages of strategy

Apart from paying for the holiday, additional income would be received from the

investment that can be used for the future use.

Disadvantages of strategy

The extent of risk associated to such investments is significantly high and income

invested can be lost as well.

Alternatives considered

Either invests in the share portfolio by investing more in the defensive assets and

less in the growing assets or else invest more in superannuation and banking

products.

Wealth creation recommendations – superannuation

1. Goal[sort out superannuation]

Recommended strategy:

Superannuation Strategies inclusive of the option of setting up a SMSF

Advantages of strategy

Several choice available for investment

Effective tax strategies

Transparency

Expenses are low

Flexibility

Consolidation of the super assets

Disadvantages of strategy

The cost increases when the balance gets lowered

Increase in the level of accountability

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1202AFE Financial Planning 1

Trimester 1, 2018

Alternatives considered

Investing in real estate and even in share and asset portfolio in order to maintain the

amount that is desired

Increasing the level of deposit in the term deposits

Wealth protection (insurance) - recommendations

1. Life insurance

Australian Income Protection Specialists

2. Total and permanent disability (TPD) insurance

Permanent Insurance Company

3. Income protection (IP) insurance

TAL Income Protection

4. Trauma insurance

Real Life Insurance

5. Private healthinsurance

Australian Health Insurance

Other

NA

Trimester 1, 2018

Alternatives considered

Investing in real estate and even in share and asset portfolio in order to maintain the

amount that is desired

Increasing the level of deposit in the term deposits

Wealth protection (insurance) - recommendations

1. Life insurance

Australian Income Protection Specialists

2. Total and permanent disability (TPD) insurance

Permanent Insurance Company

3. Income protection (IP) insurance

TAL Income Protection

4. Trauma insurance

Real Life Insurance

5. Private healthinsurance

Australian Health Insurance

Other

NA

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1202AFE Financial Planning 1

Trimester 1, 2018

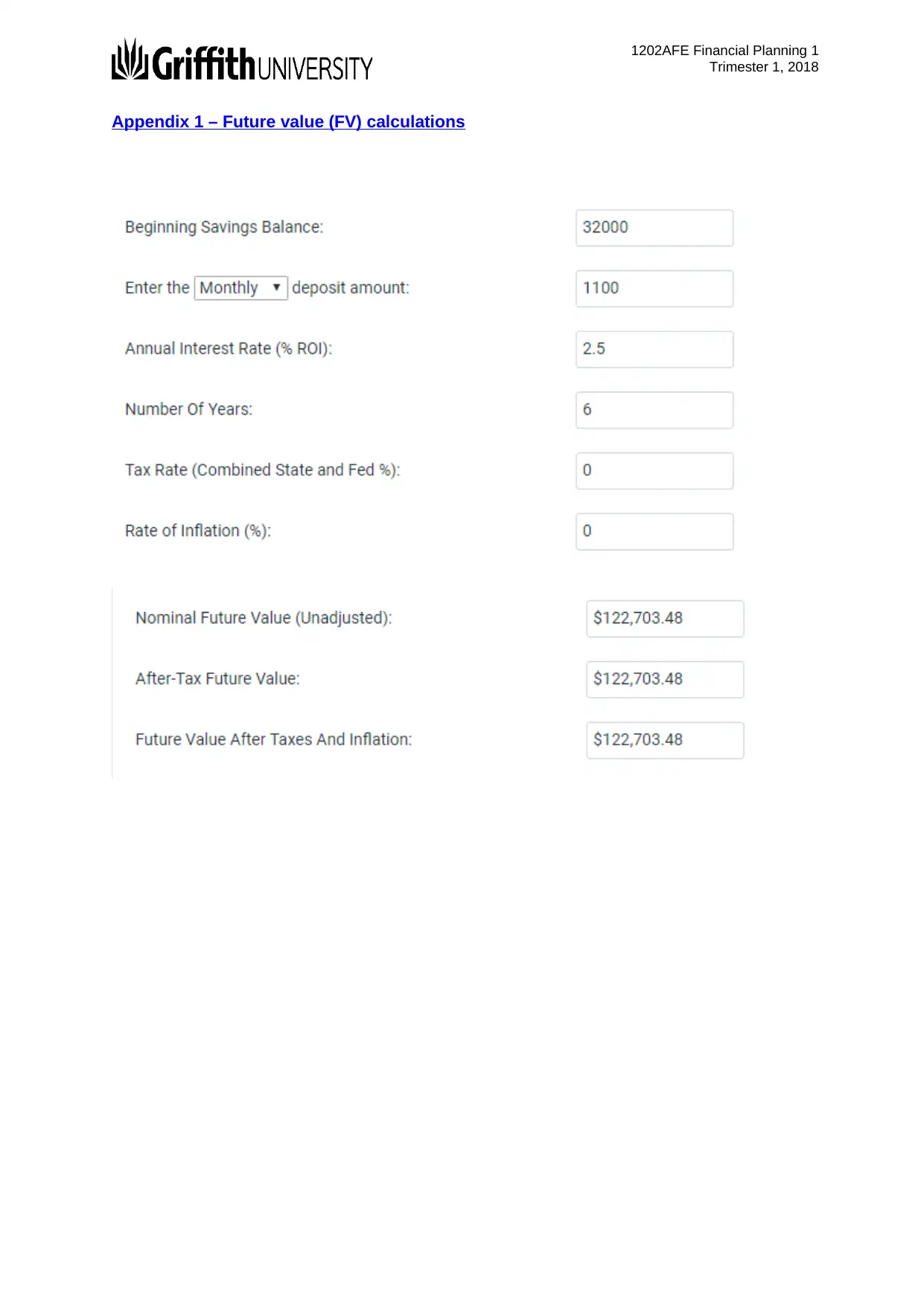

Appendix 1 – Future value (FV) calculations

Trimester 1, 2018

Appendix 1 – Future value (FV) calculations

1 out of 5

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.