Financial Analysis of Stock Returns and Portfolio Creation

VerifiedAdded on 2023/04/19

|8

|577

|229

Homework Assignment

AI Summary

This finance assignment analyzes the returns of three stocks (WBC.AX, CBA.AX, and AORD) using various financial metrics. The solution calculates holding period returns, average and annual holding period returns, and standard deviation. It includes a scatter plot to visualize the data and determines the CAPM return and SML line. The assignment culminates in portfolio creation and a recommendation for investment based on the analysis, suggesting that investment in all three options is viable due to the correlation between risk and return. The document utilizes data from Yahoo Finance and provides a comprehensive overview of the financial analysis process.

Running head: ACCOUNTING & FINANCIAL

Accounting & Financial

Name of the Student:

Name of the University:

Authors Note:

Accounting & Financial

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING & FINANCIAL 2

Table of Contents

Question 4:.................................................................................................................................3

Answer to 1): Holding period return of the three stocks............................................................3

Answer to 2): Average Holding period return...........................................................................4

Answer to 3): Annual Holding period return.............................................................................5

Answer to 4): Standard deviation...............................................................................................5

Answer to 5): Scatter Plot..........................................................................................................5

Answer to 6): CAPM Return......................................................................................................6

Answer to 7): SML Line............................................................................................................6

Answer to 8): Portfolio Creation................................................................................................6

Answer to 9): Recommendation.................................................................................................7

Bibliography:..............................................................................................................................8

Table of Contents

Question 4:.................................................................................................................................3

Answer to 1): Holding period return of the three stocks............................................................3

Answer to 2): Average Holding period return...........................................................................4

Answer to 3): Annual Holding period return.............................................................................5

Answer to 4): Standard deviation...............................................................................................5

Answer to 5): Scatter Plot..........................................................................................................5

Answer to 6): CAPM Return......................................................................................................6

Answer to 7): SML Line............................................................................................................6

Answer to 8): Portfolio Creation................................................................................................6

Answer to 9): Recommendation.................................................................................................7

Bibliography:..............................................................................................................................8

ACCOUNTING & FINANCIAL 3

Question 4:

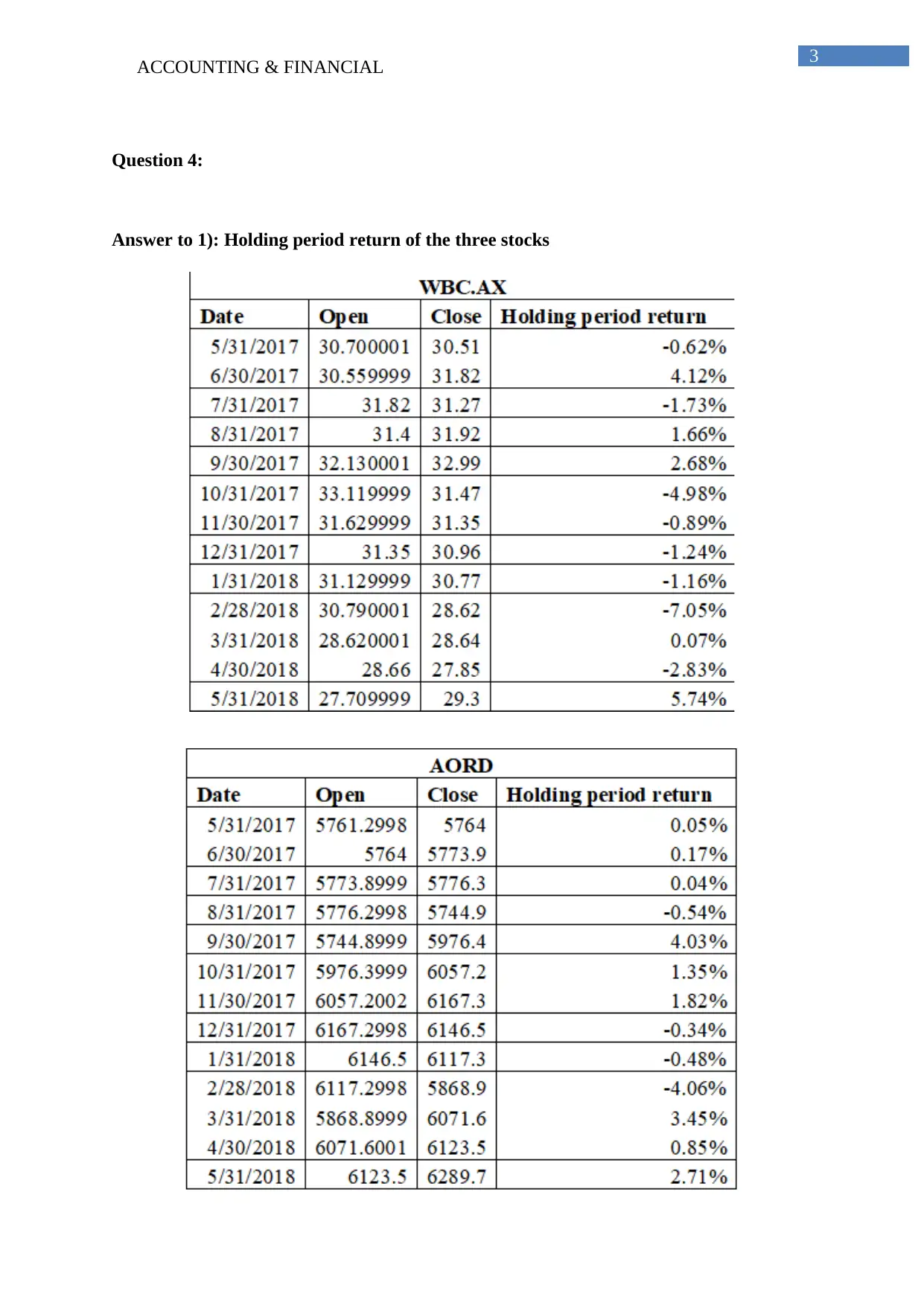

Answer to 1): Holding period return of the three stocks

Question 4:

Answer to 1): Holding period return of the three stocks

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING & FINANCIAL 4

6/1/2017

7/1/2017

8/1/2017

9/1/2017

10/1/2017

11/1/2017

12/1/2017

1/1/2018

2/1/2018

3/1/2018

4/1/2018

5/1/2018

-12.00%

-10.00%

-8.00%

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00%

6.00%

8.00%

Return of Three A sset

WBC.AX CBA.AX AORD

Answer to 2): Average Holding period return

Particulars

WBC.A

X CBA.AX AORD

Average Holding period return -0.479% -0.698% 0.697

%

6/1/2017

7/1/2017

8/1/2017

9/1/2017

10/1/2017

11/1/2017

12/1/2017

1/1/2018

2/1/2018

3/1/2018

4/1/2018

5/1/2018

-12.00%

-10.00%

-8.00%

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00%

6.00%

8.00%

Return of Three A sset

WBC.AX CBA.AX AORD

Answer to 2): Average Holding period return

Particulars

WBC.A

X CBA.AX AORD

Average Holding period return -0.479% -0.698% 0.697

%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING & FINANCIAL 5

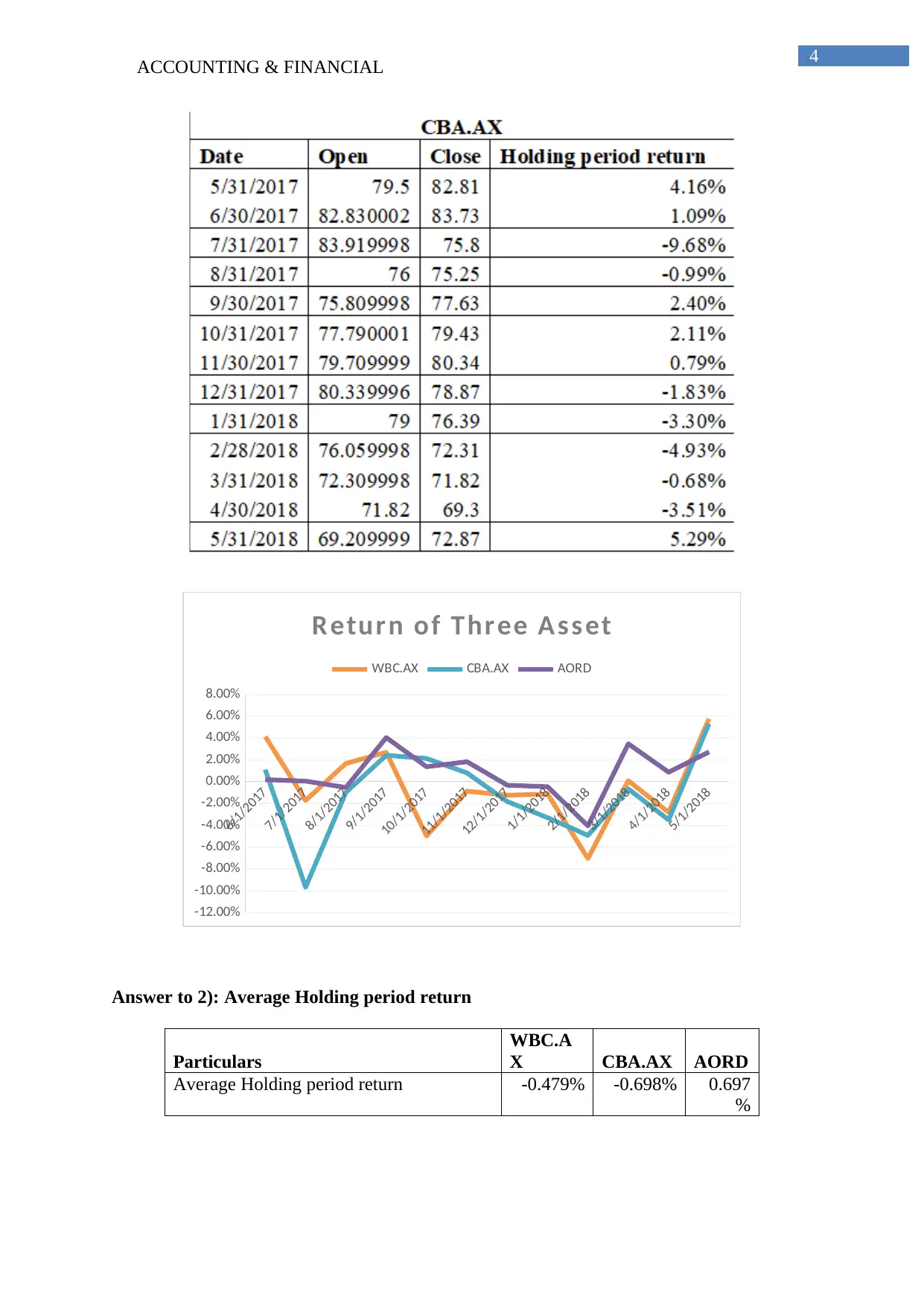

Answer to 3): Annual Holding period return

Particulars WBC.AX CBA.AX AORD

Annual Holding period

return

-0.479% * 12 -0.698% * 12 0.697% * 12

Annual Holding period

return

-5.746% -8.377% 8.368%

Answer to 4): Standard deviation

Particulars WBC.AX CBA.AX AORD

Standard deviation 3.493% 4.051% 2.086%

Answer to 5): Scatter Plot

1.500% 2.000% 2.500% 3.000% 3.500% 4.000% 4.500%

-10.000%

-8.000%

-6.000%

-4.000%

-2.000%

0.000%

2.000%

4.000%

6.000%

8.000%

10.000%

8.368%

-8.377%

-5.746%

Scatter plot

WBC.AX CBA.AX AORD

Answer to 3): Annual Holding period return

Particulars WBC.AX CBA.AX AORD

Annual Holding period

return

-0.479% * 12 -0.698% * 12 0.697% * 12

Annual Holding period

return

-5.746% -8.377% 8.368%

Answer to 4): Standard deviation

Particulars WBC.AX CBA.AX AORD

Standard deviation 3.493% 4.051% 2.086%

Answer to 5): Scatter Plot

1.500% 2.000% 2.500% 3.000% 3.500% 4.000% 4.500%

-10.000%

-8.000%

-6.000%

-4.000%

-2.000%

0.000%

2.000%

4.000%

6.000%

8.000%

10.000%

8.368%

-8.377%

-5.746%

Scatter plot

WBC.AX CBA.AX AORD

ACCOUNTING & FINANCIAL 6

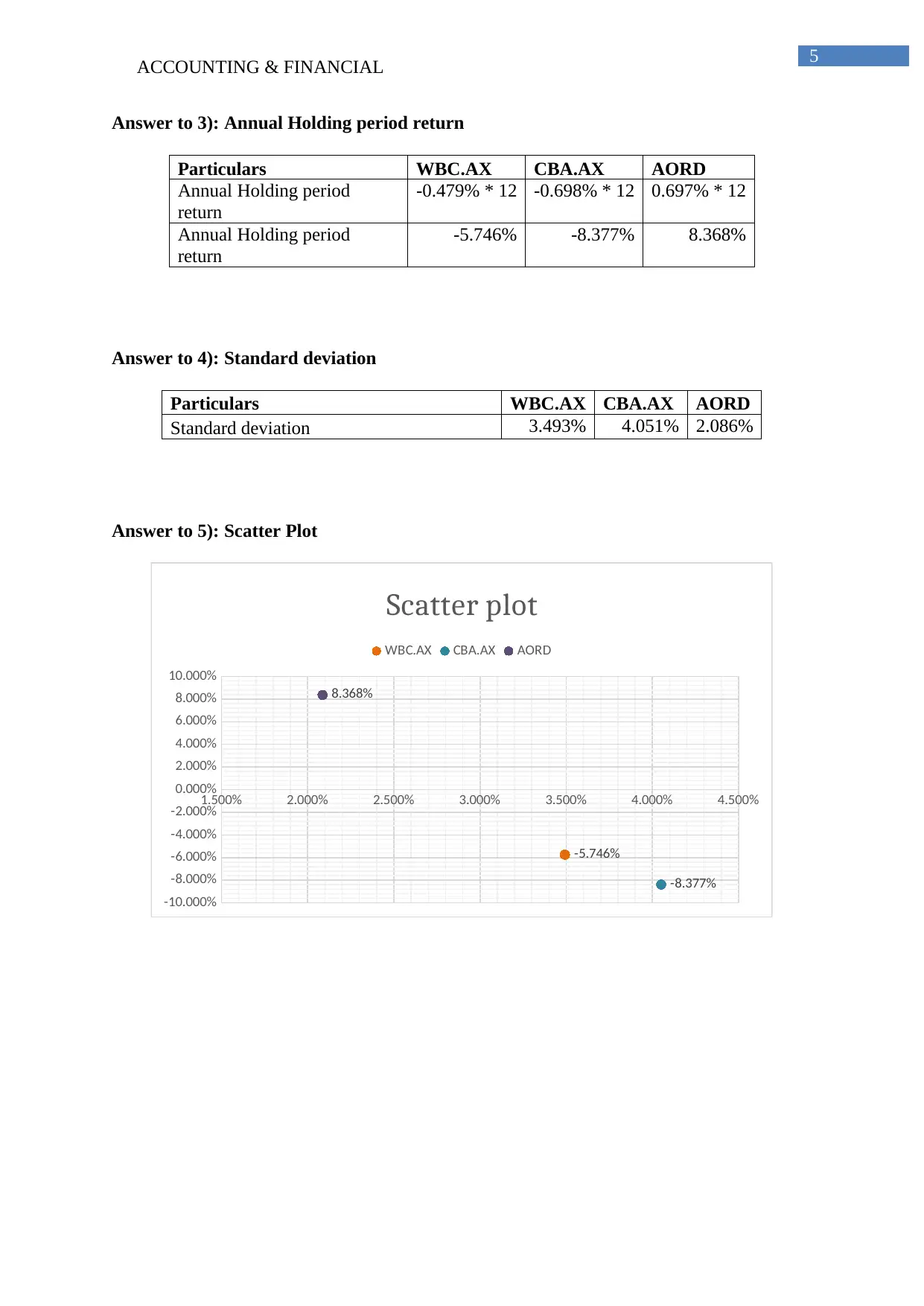

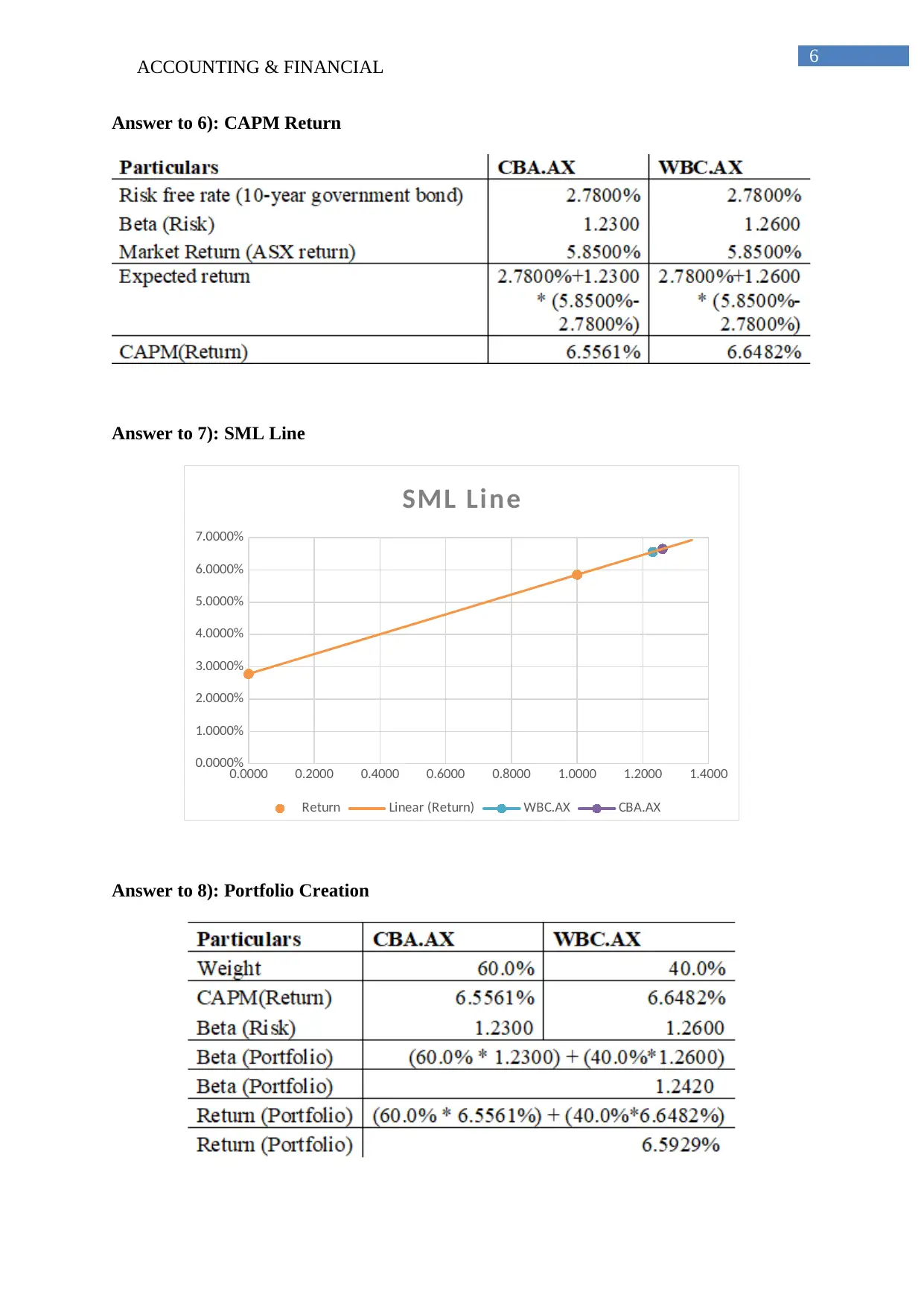

Answer to 6): CAPM Return

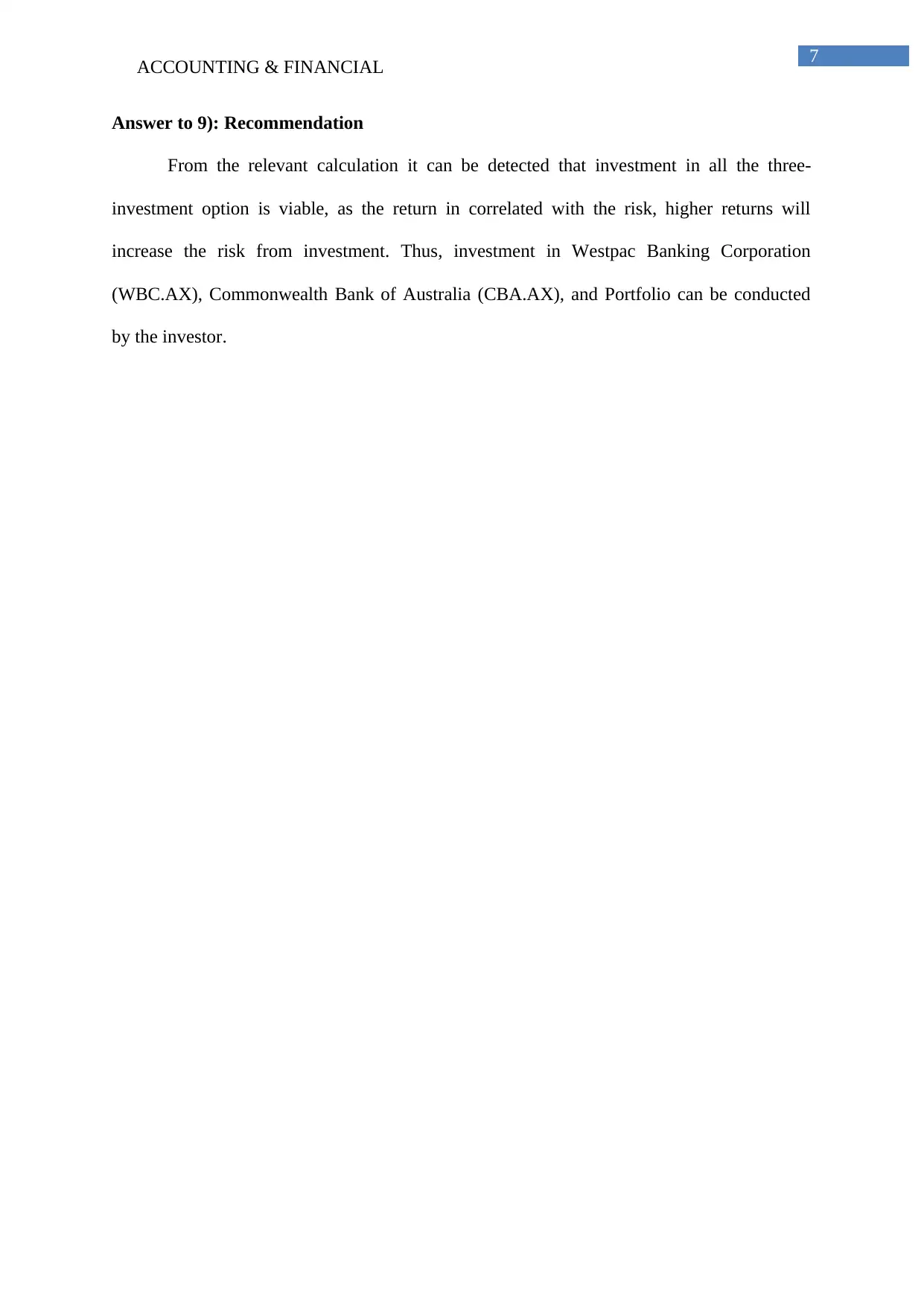

Answer to 7): SML Line

0.0000 0.2000 0.4000 0.6000 0.8000 1.0000 1.2000 1.4000

0.0000%

1.0000%

2.0000%

3.0000%

4.0000%

5.0000%

6.0000%

7.0000%

SML Line

Return Linear (Return) WBC.AX CBA.AX

Answer to 8): Portfolio Creation

Answer to 6): CAPM Return

Answer to 7): SML Line

0.0000 0.2000 0.4000 0.6000 0.8000 1.0000 1.2000 1.4000

0.0000%

1.0000%

2.0000%

3.0000%

4.0000%

5.0000%

6.0000%

7.0000%

SML Line

Return Linear (Return) WBC.AX CBA.AX

Answer to 8): Portfolio Creation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING & FINANCIAL 7

Answer to 9): Recommendation

From the relevant calculation it can be detected that investment in all the three-

investment option is viable, as the return in correlated with the risk, higher returns will

increase the risk from investment. Thus, investment in Westpac Banking Corporation

(WBC.AX), Commonwealth Bank of Australia (CBA.AX), and Portfolio can be conducted

by the investor.

Answer to 9): Recommendation

From the relevant calculation it can be detected that investment in all the three-

investment option is viable, as the return in correlated with the risk, higher returns will

increase the risk from investment. Thus, investment in Westpac Banking Corporation

(WBC.AX), Commonwealth Bank of Australia (CBA.AX), and Portfolio can be conducted

by the investor.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING & FINANCIAL 8

Bibliography:

Au.finance.yahoo.com. (2018). Au.finance.yahoo.com. Retrieved 18 December 2018, from

https://au.finance.yahoo.com/quote/CBA.AX/history?

period1=1464719400&period2=1498761000&interval=1mo&filter=history&frequenc

y=1mo

Au.finance.yahoo.com. (2018). Au.finance.yahoo.com. Retrieved 18 December 2018, from

https://au.finance.yahoo.com/quote/WBC.AX/history?

period1=1464719400&period2=1498761000&interval=1mo&filter=history&frequenc

y=1mo

Bibliography:

Au.finance.yahoo.com. (2018). Au.finance.yahoo.com. Retrieved 18 December 2018, from

https://au.finance.yahoo.com/quote/CBA.AX/history?

period1=1464719400&period2=1498761000&interval=1mo&filter=history&frequenc

y=1mo

Au.finance.yahoo.com. (2018). Au.finance.yahoo.com. Retrieved 18 December 2018, from

https://au.finance.yahoo.com/quote/WBC.AX/history?

period1=1464719400&period2=1498761000&interval=1mo&filter=history&frequenc

y=1mo

1 out of 8

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.