Comprehensive Analysis of PPE Valuation and Financial Reporting

VerifiedAdded on 2023/06/05

|10

|590

|354

Report

AI Summary

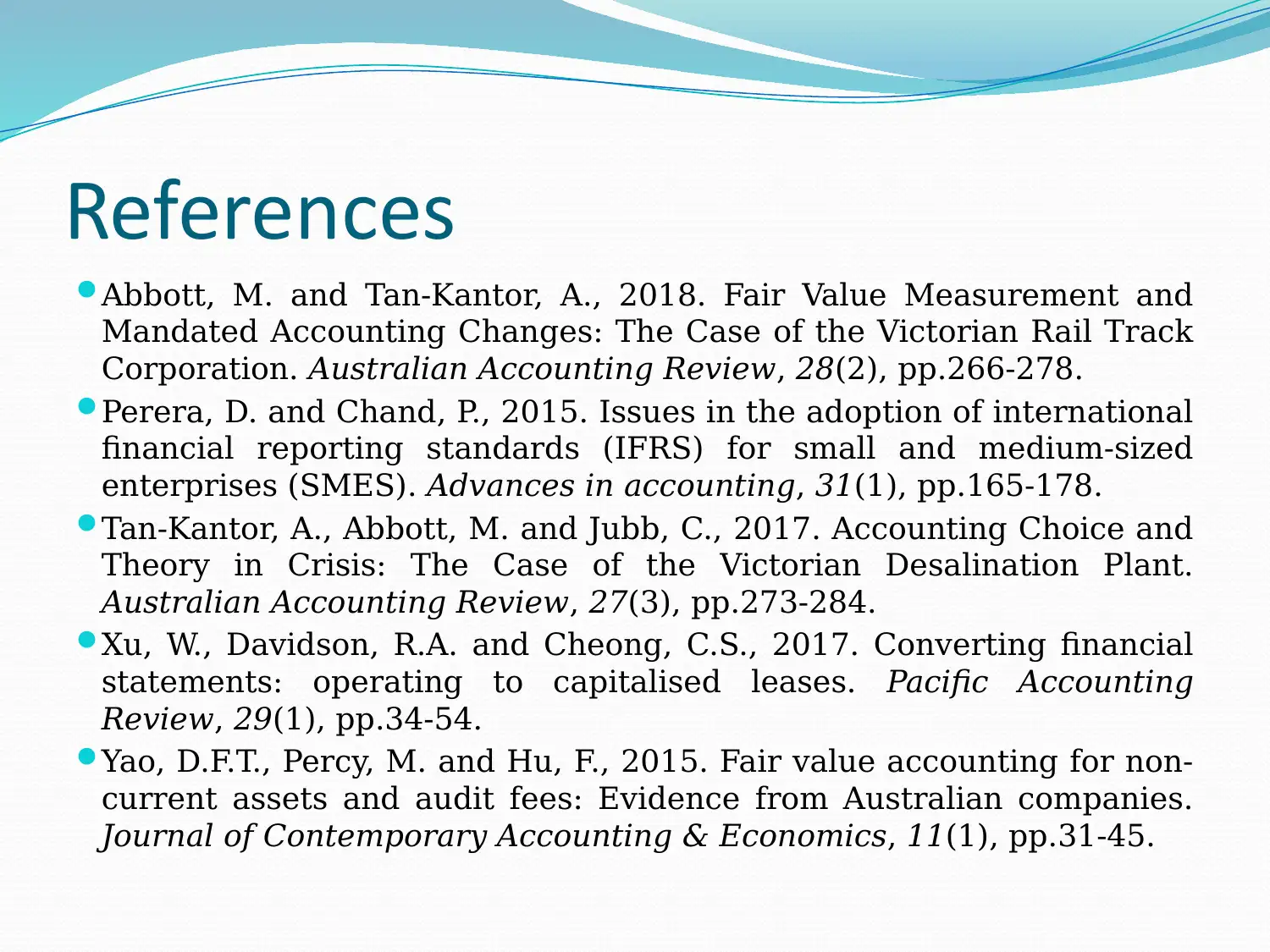

This report focuses on the valuation of Property, Plant, and Equipment (PPE) and its significance in financial reporting. It emphasizes the crucial role of fair valuation for tangible assets in presenting a company's financial position accurately to stakeholders. The report delves into the complexities of PPE valuation, including depreciation, amortization, impairment, and carrying value, highlighting the two primary valuation methods: cost and revaluation. It examines the specific PPE disclosures made by a selected company, Woolworths, which adheres to IFRS guidelines, and provides a detailed explanation of its valuation approach, including the use of the straight-line depreciation method. The report critically analyzes the extent to which the company's latest annual report meets the disclosure requirements of AASB 116 and assesses the alignment of PPE disclosures with the objectives of general-purpose financial reporting, concluding that the company has a robust valuation and reporting system. The report recommends that the company maintain its current practices for future valuation and reporting activities. References include studies on fair value measurement, IFRS adoption, and accounting choices in crisis situations.

1 out of 10

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)