Management Accounting Project: Financial Problem Solving

VerifiedAdded on 2023/01/12

|19

|2934

|24

Project

AI Summary

This management accounting project, undertaken for London College, explores various managerial accounting systems, including inventory management, cost accounting, job costing, and optimizing pricing, to enhance strategic decision-making. The project delves into different reporting methods such as inventory management reports, accounts receivable aging reports, and budgetary reports. It then proceeds to calculate income statements using marginal and absorption costing techniques, FIFO, and LIFO methods, providing interpretations and profitability ratio analyses. Furthermore, the project examines planning tools applicable in budgetary control, such as standard costing and ratio analysis, evaluating their pros and cons. Finally, it addresses how organizations should adopt managerial bookkeeping to tackle financial problems like increased cash outflow and expenditure on promotion, recommending solutions like Key Performance Indicators (KPIs) to improve quality and performance. This project provides a comprehensive overview of management accounting principles and their practical application in a business context.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCITON......................................................................................................................3

PROJECT PART 1.....................................................................................................................3

P1. Explain managerial accounting at various types of managerial accounting systems.......3

P2. Describe different methods used for management accounting reporting.........................4

P3. Calculate income statement using appropriate technique of marginal and absorption

costs........................................................................................................................................5

Interpretation :-.........................................................................................................................10

PROJECT PART 2...................................................................................................................11

P4. Determine the pros and cons of various planning tools applicable in budgetary control

..............................................................................................................................................11

P5. Evaluate how organisations must adopt managerial book-keeping to respond its

financial problems................................................................................................................17

CONCLUSION........................................................................................................................18

REFERENCES.........................................................................................................................19

INTRODUCITON......................................................................................................................3

PROJECT PART 1.....................................................................................................................3

P1. Explain managerial accounting at various types of managerial accounting systems.......3

P2. Describe different methods used for management accounting reporting.........................4

P3. Calculate income statement using appropriate technique of marginal and absorption

costs........................................................................................................................................5

Interpretation :-.........................................................................................................................10

PROJECT PART 2...................................................................................................................11

P4. Determine the pros and cons of various planning tools applicable in budgetary control

..............................................................................................................................................11

P5. Evaluate how organisations must adopt managerial book-keeping to respond its

financial problems................................................................................................................17

CONCLUSION........................................................................................................................18

REFERENCES.........................................................................................................................19

INTRODUCITON

Management Accounting refers as to collect, analyse and record information of

accounts which helps managers to take strategic decision for their planning. This creates

opportunity to accumulate financial and non-financial data to perform its action with

effectiveness for achieving success. The project is based upon London College which is

considered as world leader in communicating education through industry-focused courses in

design, media and screen (Akkermans and Van Oorschot, 2018). This project describes

various types of managerial accounting systems that interrelate with management accounting

reports. It develops final statement from appropriate techniques of marginal and absorption

costs. Additionally, it determines the advantages and disadvantages for planning tools used in

budgetary control. This project further adopts managerial accounting to respond in financial

problems.

PROJECT PART 1

P1. Explain managerial accounting at various types of managerial accounting systems

Managerial accounting provides information in planning to develop new idea in

planning. Its main purpose is to determine relevant data and statistics by prediction to control

the activities of enterprise to achieve success. Managers of The London College implement

this managerial book-keeping to analyse data for preparing income statement with budgetary

control.

Management accounting systems:- It is referred as intrinsic data of enterprise

obtained to develop strategic management plan to strategise decentralisation. Managers of

The London College implement this system as it emphasizes them to control costing and

manage functions. The various types of management accounting systems are mentioned as

under:-

Inventory management system:- This accounting method is used to create greater

control over inventories or raw materials. It requires adequate handling of both raw

materials and finished products, thereby promote co-operation between supply and

demand of raw materials. In context to London College, inventory management

system is used by management to keep records of stock and analyse material which

helps to maintain good performance.

Cost accounting system:- This cost method is used for measuring the expense of a

product by proper inventory estimation to assess the productivity of the enterprise.

The cost accounting model is based on either standard or activity-driven costing

system which seeks to monitor manufacturing costs by measuring variable costs on

each component that involves fixed costs. The manager of London College are

focusing on cost of their organisation while providing courses and teaching to

students which help to maintain to the organisational performance (Arroyo, 2012).

Job Costing:- It is the method of analysing the cost at every department which is

further combined on the product label as maximum retail price is paid by consumers.

Management Accounting refers as to collect, analyse and record information of

accounts which helps managers to take strategic decision for their planning. This creates

opportunity to accumulate financial and non-financial data to perform its action with

effectiveness for achieving success. The project is based upon London College which is

considered as world leader in communicating education through industry-focused courses in

design, media and screen (Akkermans and Van Oorschot, 2018). This project describes

various types of managerial accounting systems that interrelate with management accounting

reports. It develops final statement from appropriate techniques of marginal and absorption

costs. Additionally, it determines the advantages and disadvantages for planning tools used in

budgetary control. This project further adopts managerial accounting to respond in financial

problems.

PROJECT PART 1

P1. Explain managerial accounting at various types of managerial accounting systems

Managerial accounting provides information in planning to develop new idea in

planning. Its main purpose is to determine relevant data and statistics by prediction to control

the activities of enterprise to achieve success. Managers of The London College implement

this managerial book-keeping to analyse data for preparing income statement with budgetary

control.

Management accounting systems:- It is referred as intrinsic data of enterprise

obtained to develop strategic management plan to strategise decentralisation. Managers of

The London College implement this system as it emphasizes them to control costing and

manage functions. The various types of management accounting systems are mentioned as

under:-

Inventory management system:- This accounting method is used to create greater

control over inventories or raw materials. It requires adequate handling of both raw

materials and finished products, thereby promote co-operation between supply and

demand of raw materials. In context to London College, inventory management

system is used by management to keep records of stock and analyse material which

helps to maintain good performance.

Cost accounting system:- This cost method is used for measuring the expense of a

product by proper inventory estimation to assess the productivity of the enterprise.

The cost accounting model is based on either standard or activity-driven costing

system which seeks to monitor manufacturing costs by measuring variable costs on

each component that involves fixed costs. The manager of London College are

focusing on cost of their organisation while providing courses and teaching to

students which help to maintain to the organisational performance (Arroyo, 2012).

Job Costing:- It is the method of analysing the cost at every department which is

further combined on the product label as maximum retail price is paid by consumers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managers of London College can use this system as to analyse the actual expense

occurs on particular unit of product development that is to be minimised for enlarging

consumers to purchase more of their product.

Optimising price:- This is main system used by organisations to set the process of

their products and services that helps to maintain the good performance and increase

productivity. In London College, managers are using price setting system that helps to

find out the reasonable prices of their services which they are providing and

maintaining the good performance by taking right action.

From the prescribed discussion, the managers of London College should implement

optimise pricing as it achieves consumer equilibrium point. This enables business to

minimise cost which enlarge buyers to purchase more commodity (Clifton and et. al., 2019).

The benefits of management accounting systems are shown below:-

Relevance:- It is the degree which is relates useful information for analysing data.

Managers of London College are benefited with this as it consists of collected data

which are relevant in planning for strategic decision making process.

Updated Information:- This process is the ability to update information that what is

currently taking place in business through determining the activities performed.

Managers of London College are advantageous with this as they are facilitated with

updated information which creates ease to monitor and control the actions.

Reliability:- It is the statistics which involve consistency of measurements that is

highly reliable to the actions of business. Managers of London College are helpful by

ascertaining reliable data and information to forecast and prepare income statement.

P2. Describe different methods used for management accounting reporting

Managerial accounting reports:- This is important for organisation to prepare

reports on daily basis which can provide regular data and information in order to rake right

action. The management of London College are preparing accounting reports in relation to

management which helps to get right information at right time by performing activities

effectively. The various types of management accounting reports are described with reference

to managers of London College are as follows:-

Inventory Management reports:- These are main report which involves all

information regarding inventory that are available in organisation. In Context to,

London College managers who take care of inventory prepare this report to know the

availability of material and inventory that helps to make further decision and maintain

good performance (Eldenburg and et. al., 2019).

Account Receivable Aging reports:- This describes major dependence upon credit

transaction as it plays essential role in reporting. It usually converts overdraft to cash

flow for operating enterprise smoothly. Managers of London College can use this to

write off bad debts, which are not capable of being recovered.

Budgetary reports:- It develops estimated plan of budget which is achieved by

effective performance of business that is equivalent to expect and actual budget. It

examines deviations and variance that can be solved through corrective measures in

occurs on particular unit of product development that is to be minimised for enlarging

consumers to purchase more of their product.

Optimising price:- This is main system used by organisations to set the process of

their products and services that helps to maintain the good performance and increase

productivity. In London College, managers are using price setting system that helps to

find out the reasonable prices of their services which they are providing and

maintaining the good performance by taking right action.

From the prescribed discussion, the managers of London College should implement

optimise pricing as it achieves consumer equilibrium point. This enables business to

minimise cost which enlarge buyers to purchase more commodity (Clifton and et. al., 2019).

The benefits of management accounting systems are shown below:-

Relevance:- It is the degree which is relates useful information for analysing data.

Managers of London College are benefited with this as it consists of collected data

which are relevant in planning for strategic decision making process.

Updated Information:- This process is the ability to update information that what is

currently taking place in business through determining the activities performed.

Managers of London College are advantageous with this as they are facilitated with

updated information which creates ease to monitor and control the actions.

Reliability:- It is the statistics which involve consistency of measurements that is

highly reliable to the actions of business. Managers of London College are helpful by

ascertaining reliable data and information to forecast and prepare income statement.

P2. Describe different methods used for management accounting reporting

Managerial accounting reports:- This is important for organisation to prepare

reports on daily basis which can provide regular data and information in order to rake right

action. The management of London College are preparing accounting reports in relation to

management which helps to get right information at right time by performing activities

effectively. The various types of management accounting reports are described with reference

to managers of London College are as follows:-

Inventory Management reports:- These are main report which involves all

information regarding inventory that are available in organisation. In Context to,

London College managers who take care of inventory prepare this report to know the

availability of material and inventory that helps to make further decision and maintain

good performance (Eldenburg and et. al., 2019).

Account Receivable Aging reports:- This describes major dependence upon credit

transaction as it plays essential role in reporting. It usually converts overdraft to cash

flow for operating enterprise smoothly. Managers of London College can use this to

write off bad debts, which are not capable of being recovered.

Budgetary reports:- It develops estimated plan of budget which is achieved by

effective performance of business that is equivalent to expect and actual budget. It

examines deviations and variance that can be solved through corrective measures in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

achieving success. Managers of London College use it to determine actual as

compared to expected income and expenditure.

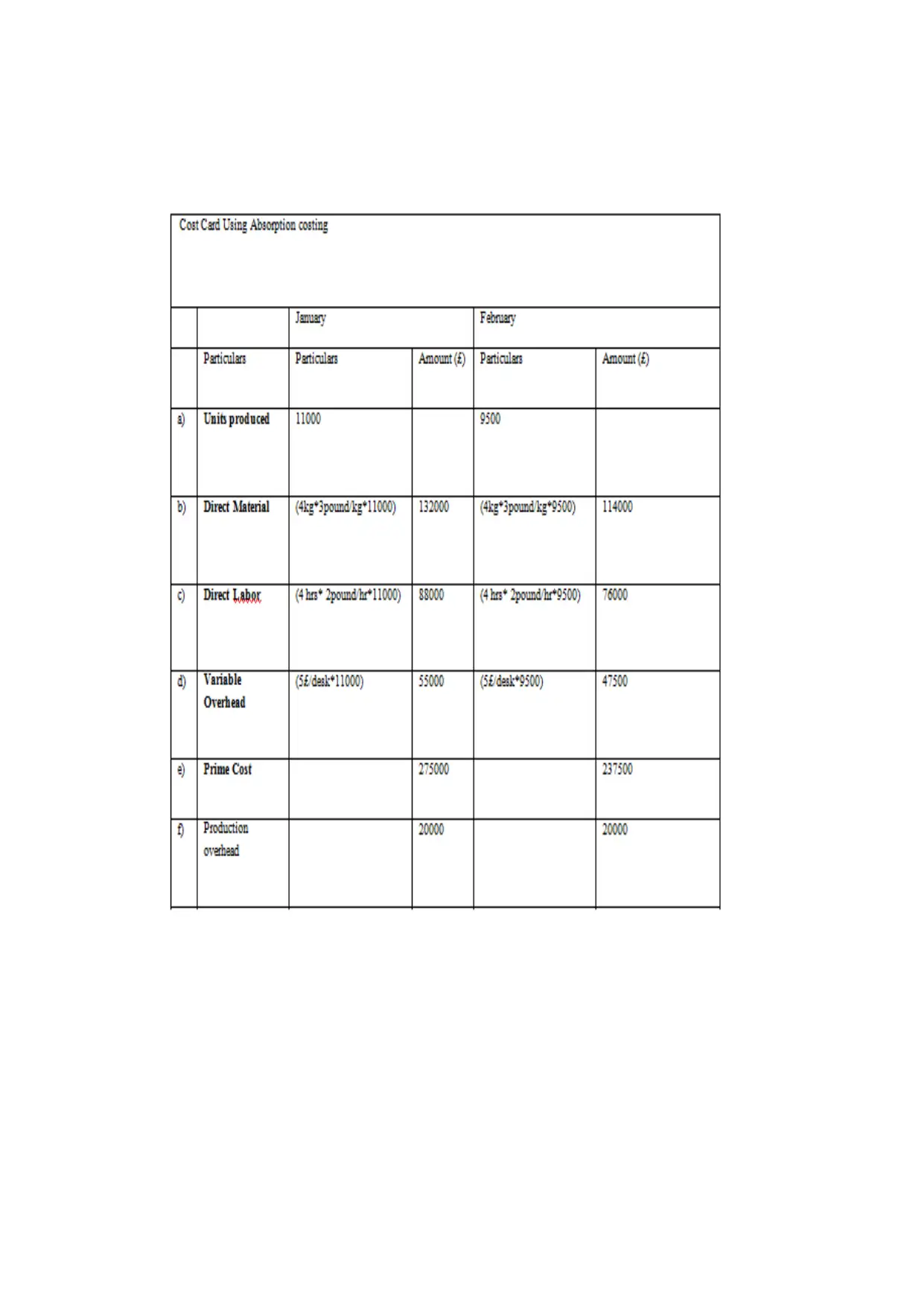

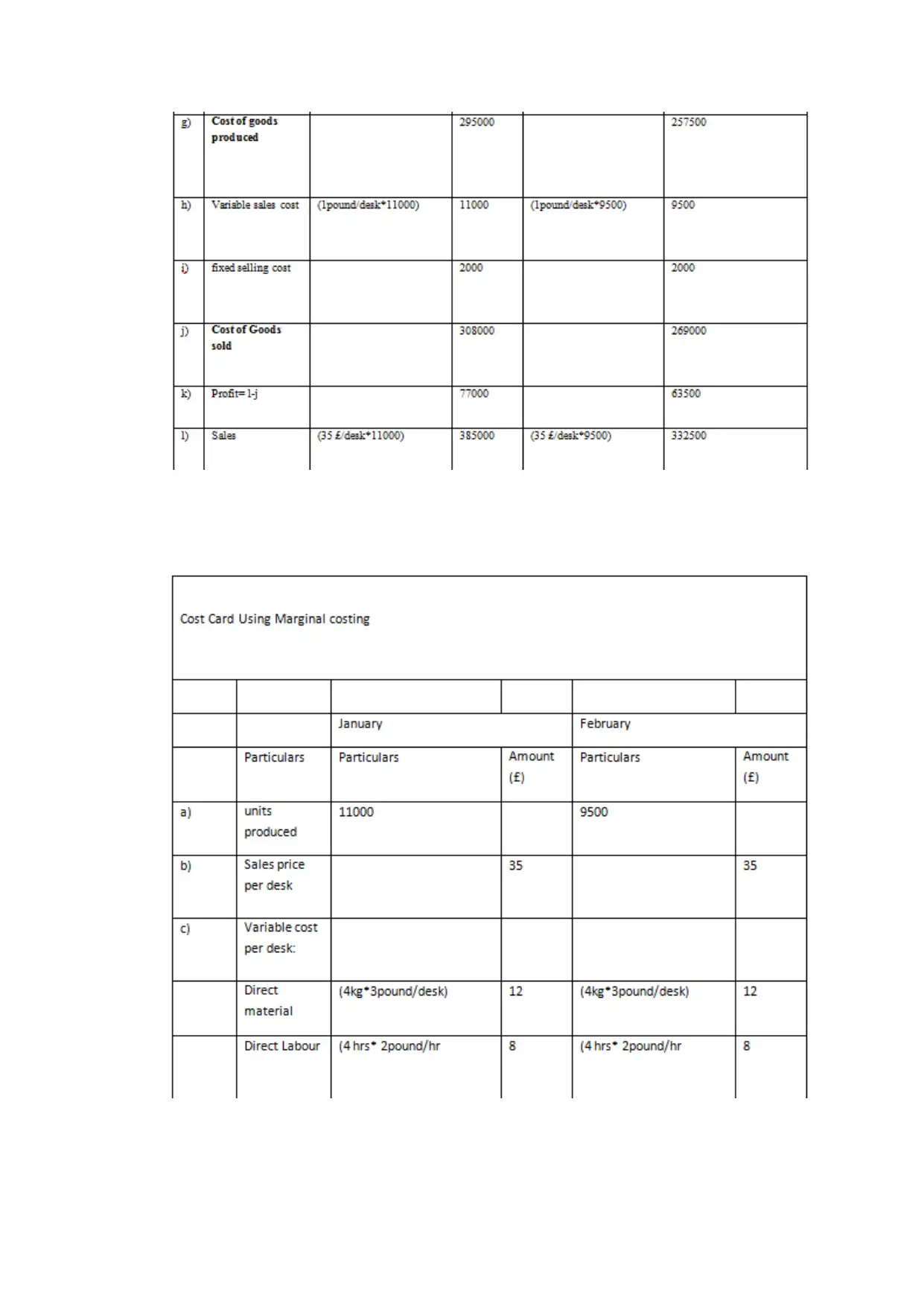

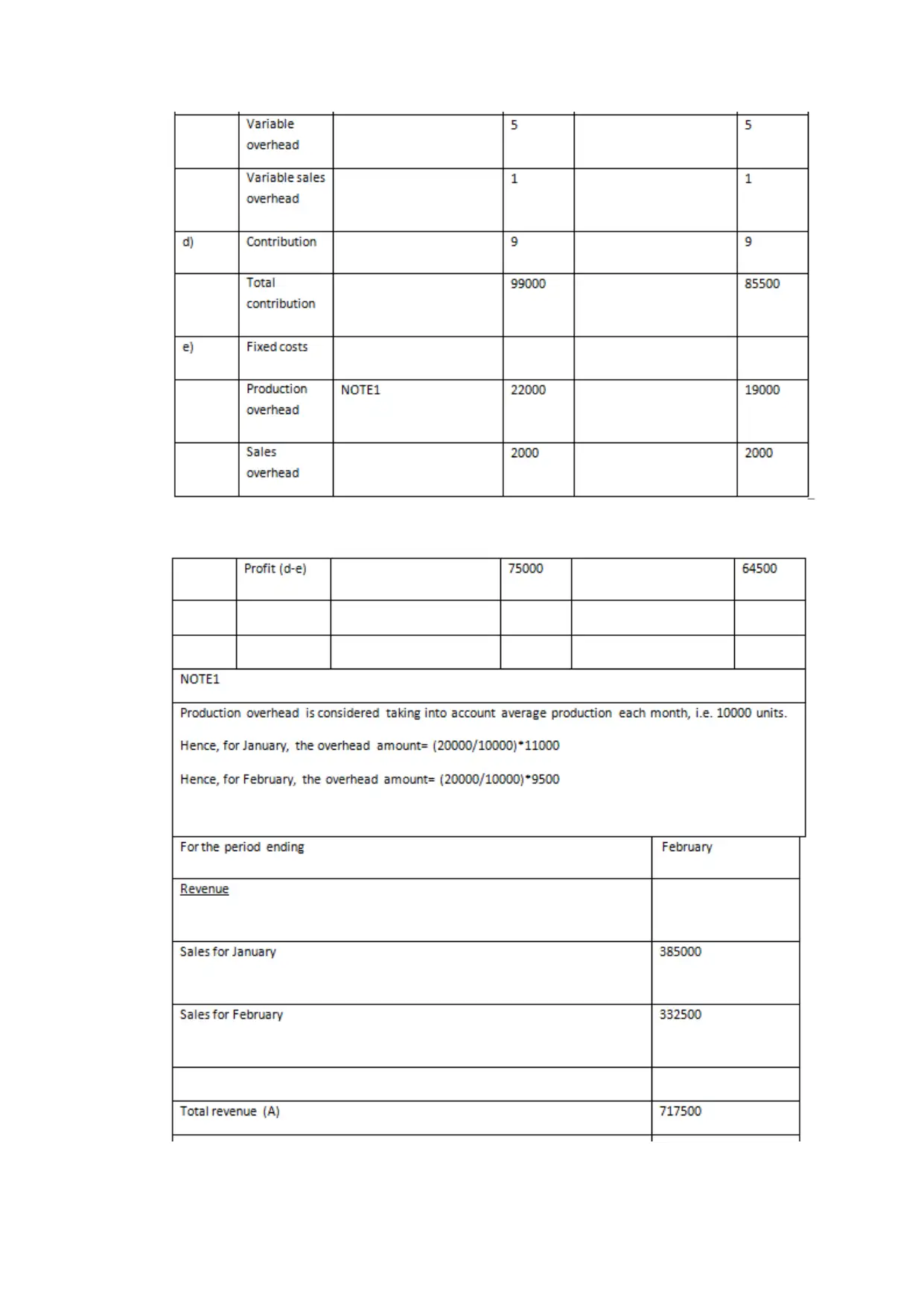

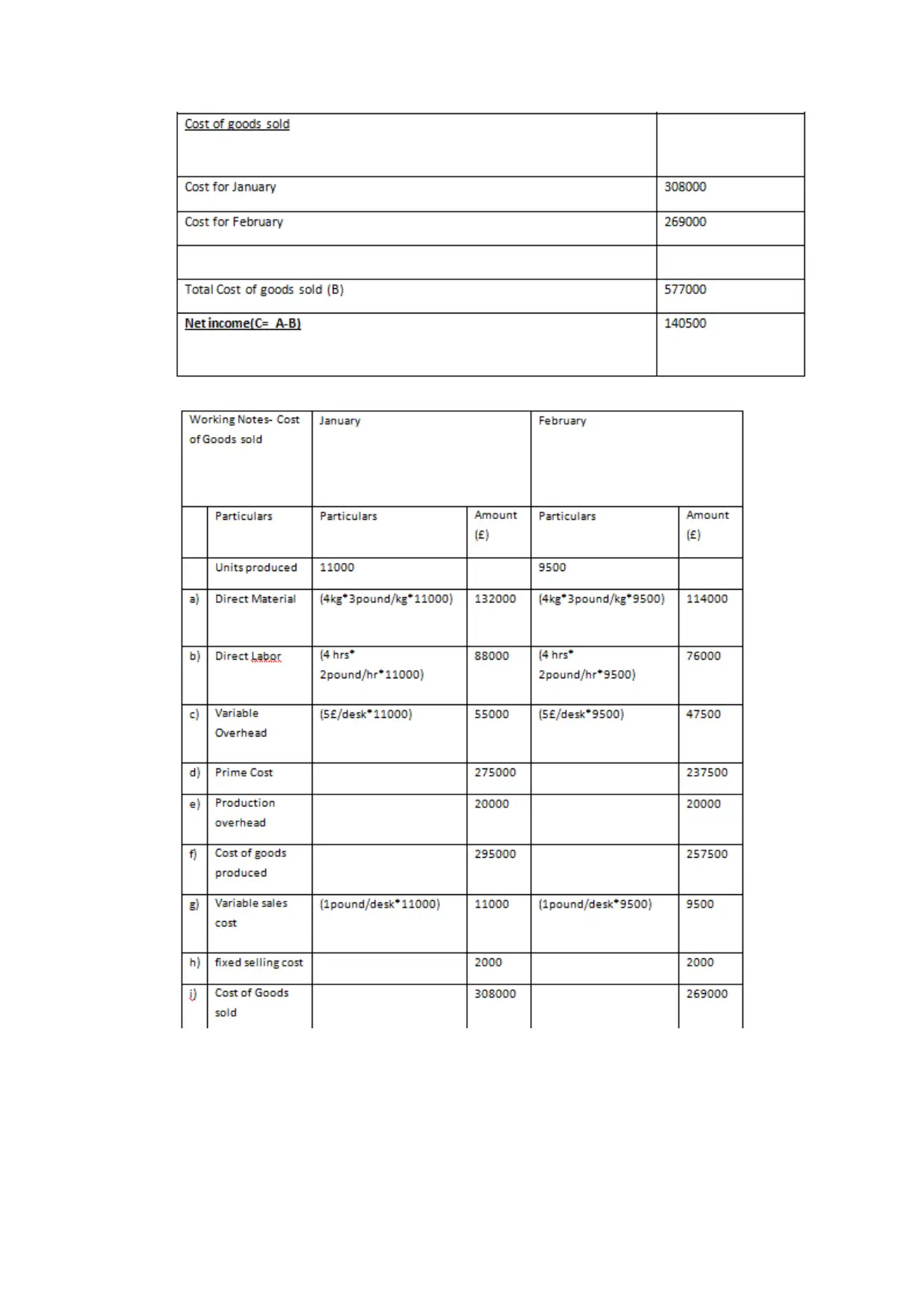

P3. Calculate income statement using appropriate technique of marginal and absorption costs

Cost analysis:- It refers to analyse expense involved in producing finished goods by

determining its cost on every activity performed. Managers of UCK Furniture adopt least-

cost effectiveness to reduce expense with superior quality. The different techniques used to

prepare income statement are described as follows:-

Marginal Costing:- It depends upon variable cost for being flexible in accordance

with units whereas fixed cost remain constant. Managers of UCK Furniture use to analyse the

break-even-point for achieving profit-margin through production.

Advantages:- The Managers of UCK Furniture are benefited with achievement of

cost-volume profit that equalise their investment and capital generation by creating

opportunity to maximise profitability ratios.

Disadvantages:- Managers of UCK Furniture are negatively impacted as they

discriminate cost into fixed and variable that increase time consumption for its data

collection (Fredrick and Patrick, 2019).

Absorption Costing:- This analysis calculate cost from both direct and indirect

material. Managers of UCK Furniture use it to operate income at particular duration.

Advantages:- Managers of UCK Furniture are advantageous by analysing inflexible

cost included in production for preparation of financial accounts.

Disadvantages:- The managers of UCK Furniture challenge the drawbacks of

inappropriate hiding inventory cost, etc.

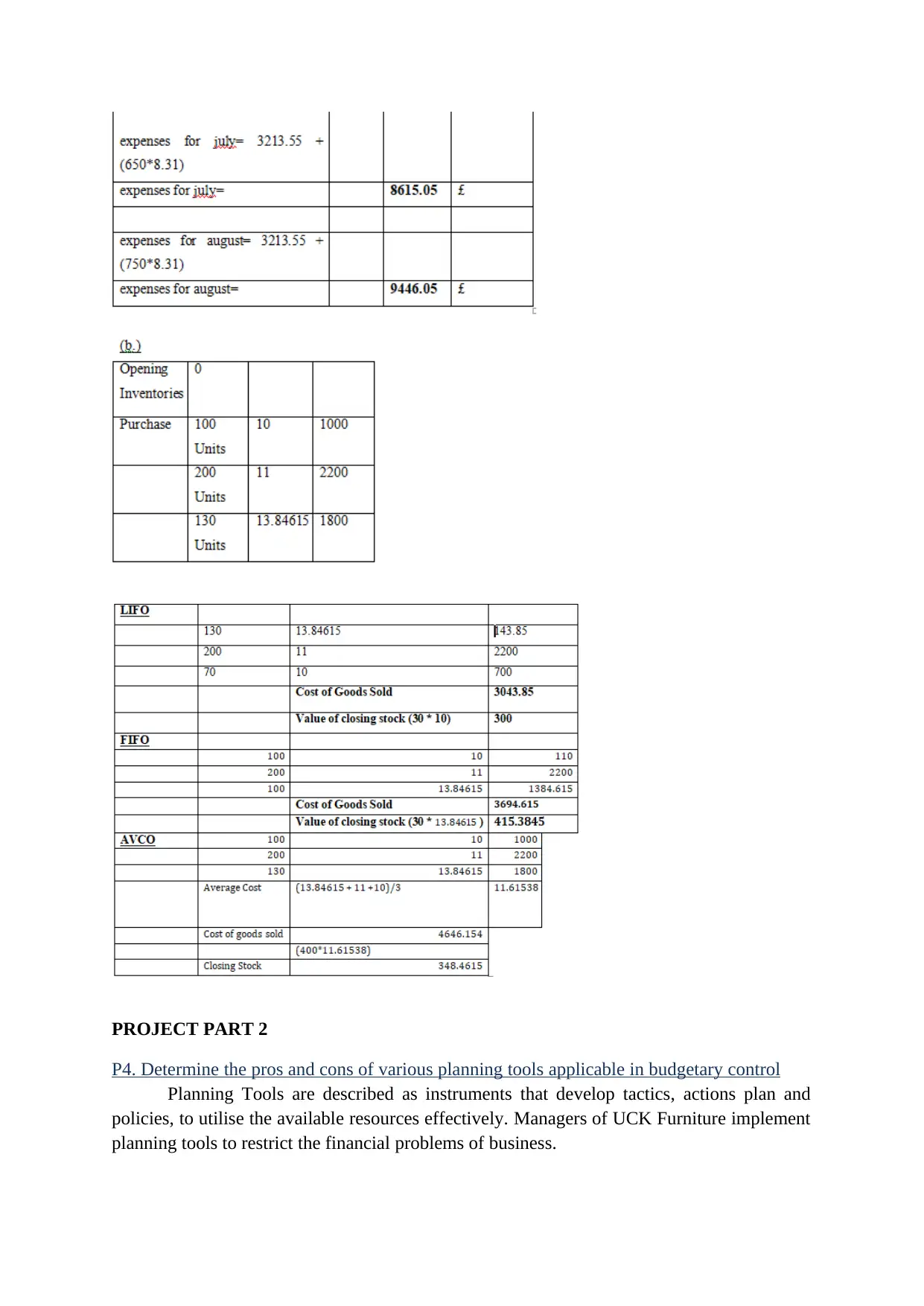

First In First Out (FIFO):- This process of business focus on selling the product

which is produced before and to keep the current in godown. The managers of UCK Furniture

use it to sale the existing product first because it’s a procedure of first in and first out.

Advantages:- The managers of UCK Furniture are advantageous to sell exiting

products before that restrict spoiling of inventory.

Disadvantages:- Managers of UCK Furniture face drawbacks as the consumers taste

and preference change continuously which shows that demand of product declines

and have to be kept in warehouse with excess production.

Last In First Out (LIFO):- This refers as product which are currently produced must

be sold first. The managers of UCK Furniture can use this to enlarge customers in accordance

with their taste and preferences (Monden,, 2019).

Advantages:- The managers of UCK Furniture are helpful by enlarging target market

with change in taste for preferred product that result in maximisation of revenue

Disadvantages:- The managers of UCK Furniture are unfavourably affected with

their existing finished goods that are considered worst and maximise cost of

productivity.

compared to expected income and expenditure.

P3. Calculate income statement using appropriate technique of marginal and absorption costs

Cost analysis:- It refers to analyse expense involved in producing finished goods by

determining its cost on every activity performed. Managers of UCK Furniture adopt least-

cost effectiveness to reduce expense with superior quality. The different techniques used to

prepare income statement are described as follows:-

Marginal Costing:- It depends upon variable cost for being flexible in accordance

with units whereas fixed cost remain constant. Managers of UCK Furniture use to analyse the

break-even-point for achieving profit-margin through production.

Advantages:- The Managers of UCK Furniture are benefited with achievement of

cost-volume profit that equalise their investment and capital generation by creating

opportunity to maximise profitability ratios.

Disadvantages:- Managers of UCK Furniture are negatively impacted as they

discriminate cost into fixed and variable that increase time consumption for its data

collection (Fredrick and Patrick, 2019).

Absorption Costing:- This analysis calculate cost from both direct and indirect

material. Managers of UCK Furniture use it to operate income at particular duration.

Advantages:- Managers of UCK Furniture are advantageous by analysing inflexible

cost included in production for preparation of financial accounts.

Disadvantages:- The managers of UCK Furniture challenge the drawbacks of

inappropriate hiding inventory cost, etc.

First In First Out (FIFO):- This process of business focus on selling the product

which is produced before and to keep the current in godown. The managers of UCK Furniture

use it to sale the existing product first because it’s a procedure of first in and first out.

Advantages:- The managers of UCK Furniture are advantageous to sell exiting

products before that restrict spoiling of inventory.

Disadvantages:- Managers of UCK Furniture face drawbacks as the consumers taste

and preference change continuously which shows that demand of product declines

and have to be kept in warehouse with excess production.

Last In First Out (LIFO):- This refers as product which are currently produced must

be sold first. The managers of UCK Furniture can use this to enlarge customers in accordance

with their taste and preferences (Monden,, 2019).

Advantages:- The managers of UCK Furniture are helpful by enlarging target market

with change in taste for preferred product that result in maximisation of revenue

Disadvantages:- The managers of UCK Furniture are unfavourably affected with

their existing finished goods that are considered worst and maximise cost of

productivity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

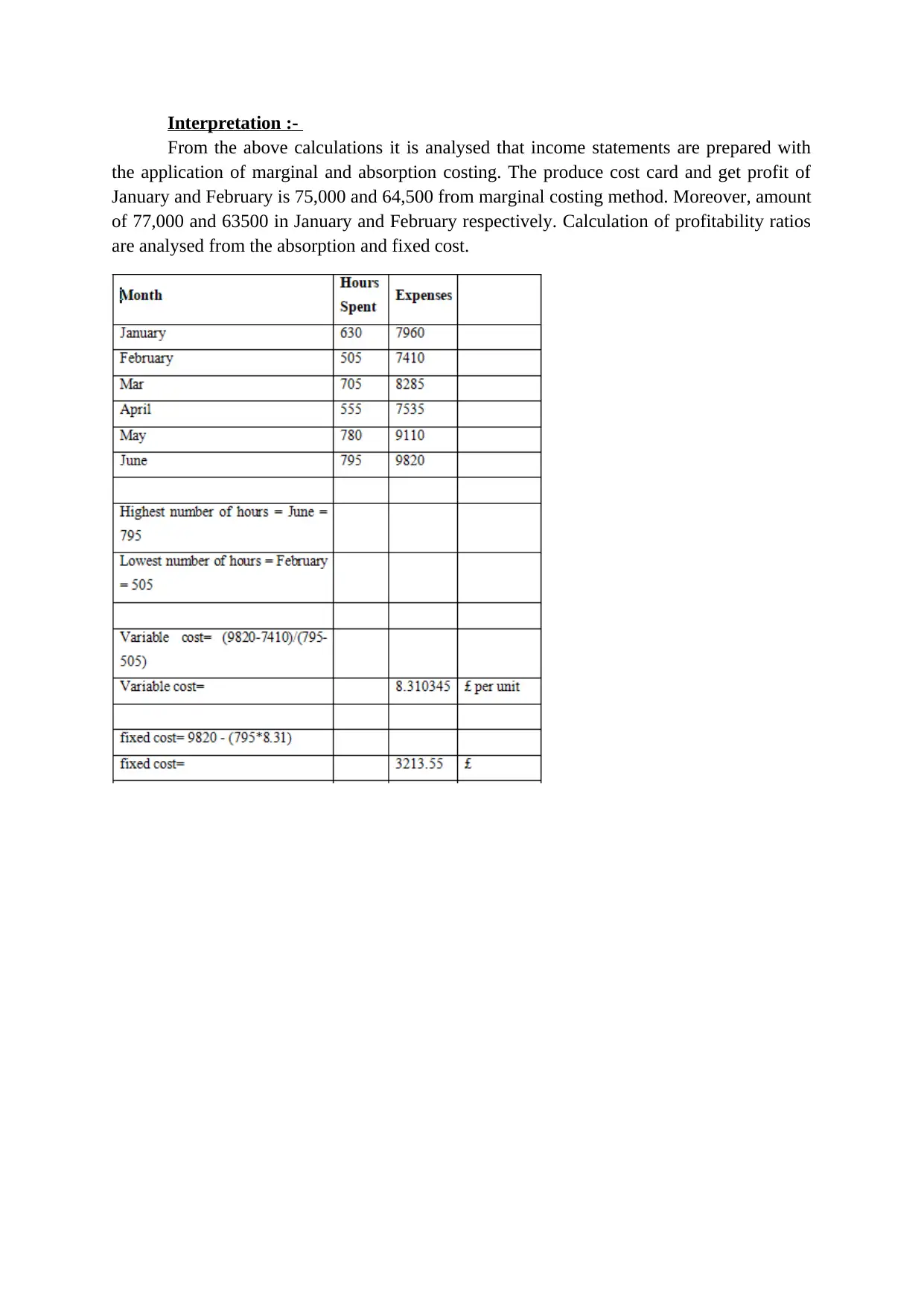

Interpretation :-

From the above calculations it is analysed that income statements are prepared with

the application of marginal and absorption costing. The produce cost card and get profit of

January and February is 75,000 and 64,500 from marginal costing method. Moreover, amount

of 77,000 and 63500 in January and February respectively. Calculation of profitability ratios

are analysed from the absorption and fixed cost.

From the above calculations it is analysed that income statements are prepared with

the application of marginal and absorption costing. The produce cost card and get profit of

January and February is 75,000 and 64,500 from marginal costing method. Moreover, amount

of 77,000 and 63500 in January and February respectively. Calculation of profitability ratios

are analysed from the absorption and fixed cost.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PROJECT PART 2

P4. Determine the pros and cons of various planning tools applicable in budgetary control

Planning Tools are described as instruments that develop tactics, actions plan and

policies, to utilise the available resources effectively. Managers of UCK Furniture implement

planning tools to restrict the financial problems of business.

P4. Determine the pros and cons of various planning tools applicable in budgetary control

Planning Tools are described as instruments that develop tactics, actions plan and

policies, to utilise the available resources effectively. Managers of UCK Furniture implement

planning tools to restrict the financial problems of business.

Budget:- This procedure creates plan to spend money in accordance to minimise cost

that creates opportunity to gain profit-margin. The managers of UCK Furniture implement

budget to analyse their expected expenditure which is to be controlled in actual costing. The

main purpose of preparing budget is to allocate, plan and control the actions of employees

with motivation (Piercy and ed., 2018).

Budgetary control:- This is the procedure through which budgets are estimated for

future with expected income and expense that is compared with actual performance of

production to control activities of business. Managers of UCK Furniture implement this to

examine deviations that delay in growth and stability of business. The planning tools for

budgetary control with reference to UCK Furniture are as follows:-

Standard Costing:- It substitute expected and actual cost to prepare practical records

of book-keeping. Managers of UCK Furniture can use this budget monitor cost control to

increase profitability ratios.

Advantages:- The managers of UCK Furniture are beneficial to control cost with

useful collected data of managerial planning in strategic decision making through

innovative ideas.

Disadvantages:- Managers of UCK Furniture are negatively impacted through low

morale of their workers which create delay in goal achievement.

Ratio Analysis:- It is very essential to evaluate issues such as liquidity, efficiency of

operations and profitability. Managers of UCK Furniture use it to estimate direction of

business by future ratio performance.

Advantages:- Managers of UCK Furniture are beneficial to compare enterprises of

various size with each other and develop financial statements with ease.

Disadvantages:- The managers of UCK Furniture are negatively impacted as these

financial statements are complicated.

that creates opportunity to gain profit-margin. The managers of UCK Furniture implement

budget to analyse their expected expenditure which is to be controlled in actual costing. The

main purpose of preparing budget is to allocate, plan and control the actions of employees

with motivation (Piercy and ed., 2018).

Budgetary control:- This is the procedure through which budgets are estimated for

future with expected income and expense that is compared with actual performance of

production to control activities of business. Managers of UCK Furniture implement this to

examine deviations that delay in growth and stability of business. The planning tools for

budgetary control with reference to UCK Furniture are as follows:-

Standard Costing:- It substitute expected and actual cost to prepare practical records

of book-keeping. Managers of UCK Furniture can use this budget monitor cost control to

increase profitability ratios.

Advantages:- The managers of UCK Furniture are beneficial to control cost with

useful collected data of managerial planning in strategic decision making through

innovative ideas.

Disadvantages:- Managers of UCK Furniture are negatively impacted through low

morale of their workers which create delay in goal achievement.

Ratio Analysis:- It is very essential to evaluate issues such as liquidity, efficiency of

operations and profitability. Managers of UCK Furniture use it to estimate direction of

business by future ratio performance.

Advantages:- Managers of UCK Furniture are beneficial to compare enterprises of

various size with each other and develop financial statements with ease.

Disadvantages:- The managers of UCK Furniture are negatively impacted as these

financial statements are complicated.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.