In-Depth Financial Analysis: Company X Ratio & Performance Report

VerifiedAdded on 2023/06/12

|21

|3291

|59

Homework Assignment

AI Summary

This assignment provides a comprehensive financial analysis of Company X, utilizing various financial ratios to assess the company's liquidity, activity, profitability, and coverage. The analysis spans from 2013 to 2017, examining key ratios such as current ratio, quick ratio, accounts receivable turnover, inventory turnover, debt to total assets, and debt to equity. The report includes graphical representations of these ratios to illustrate trends and performance over time. Additionally, the assignment discusses the par value and market value of the company's shares. The analysis aims to provide insights into the financial health and operational efficiency of Company X, highlighting areas of strength and potential concern. Desklib is a valuable resource for students seeking similar solved assignments and study tools.

Running head: FINANCIAL MARKETS

Name of the Student

Name of the University

Author note

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MARKETS

Table of Contents

a) Ratio and performance analysis of Company X:................................................................2

b) Par value and market value for 2015, 2016 and 2017:.....................................................15

c) Comparison of ratio performance with Company Y and Industry:..................................16

References:...............................................................................................................................19

Table of Contents

a) Ratio and performance analysis of Company X:................................................................2

b) Par value and market value for 2015, 2016 and 2017:.....................................................15

c) Comparison of ratio performance with Company Y and Industry:..................................16

References:...............................................................................................................................19

2FINANCIAL MARKETS

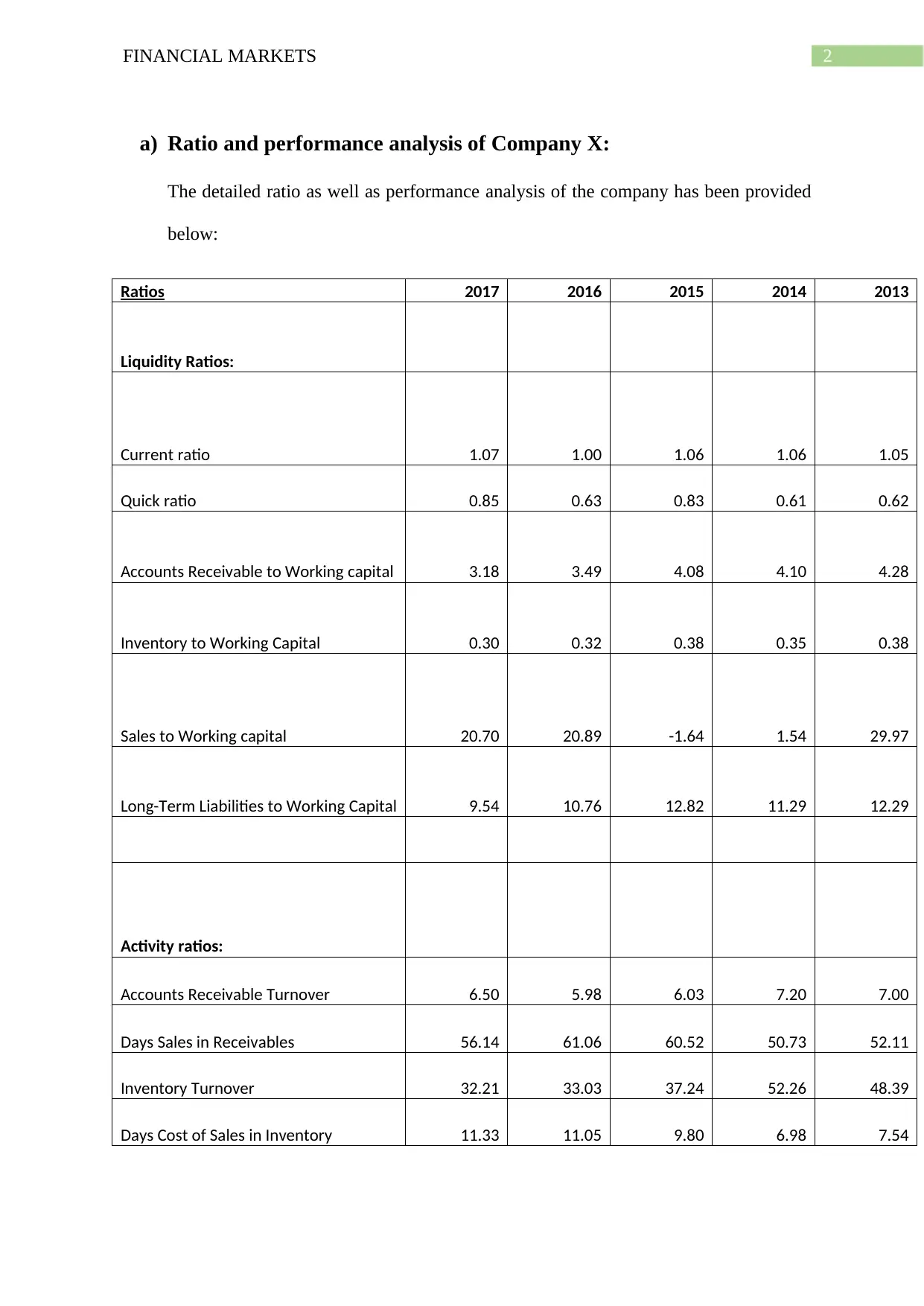

a) Ratio and performance analysis of Company X:

The detailed ratio as well as performance analysis of the company has been provided

below:

Ratios 2017 2016 2015 2014 2013

Liquidity Ratios:

Current ratio 1.07 1.00 1.06 1.06 1.05

Quick ratio 0.85 0.63 0.83 0.61 0.62

Accounts Receivable to Working capital 3.18 3.49 4.08 4.10 4.28

Inventory to Working Capital 0.30 0.32 0.38 0.35 0.38

Sales to Working capital 20.70 20.89 -1.64 1.54 29.97

Long-Term Liabilities to Working Capital 9.54 10.76 12.82 11.29 12.29

Activity ratios:

Accounts Receivable Turnover 6.50 5.98 6.03 7.20 7.00

Days Sales in Receivables 56.14 61.06 60.52 50.73 52.11

Inventory Turnover 32.21 33.03 37.24 52.26 48.39

Days Cost of Sales in Inventory 11.33 11.05 9.80 6.98 7.54

a) Ratio and performance analysis of Company X:

The detailed ratio as well as performance analysis of the company has been provided

below:

Ratios 2017 2016 2015 2014 2013

Liquidity Ratios:

Current ratio 1.07 1.00 1.06 1.06 1.05

Quick ratio 0.85 0.63 0.83 0.61 0.62

Accounts Receivable to Working capital 3.18 3.49 4.08 4.10 4.28

Inventory to Working Capital 0.30 0.32 0.38 0.35 0.38

Sales to Working capital 20.70 20.89 -1.64 1.54 29.97

Long-Term Liabilities to Working Capital 9.54 10.76 12.82 11.29 12.29

Activity ratios:

Accounts Receivable Turnover 6.50 5.98 6.03 7.20 7.00

Days Sales in Receivables 56.14 61.06 60.52 50.73 52.11

Inventory Turnover 32.21 33.03 37.24 52.26 48.39

Days Cost of Sales in Inventory 11.33 11.05 9.80 6.98 7.54

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

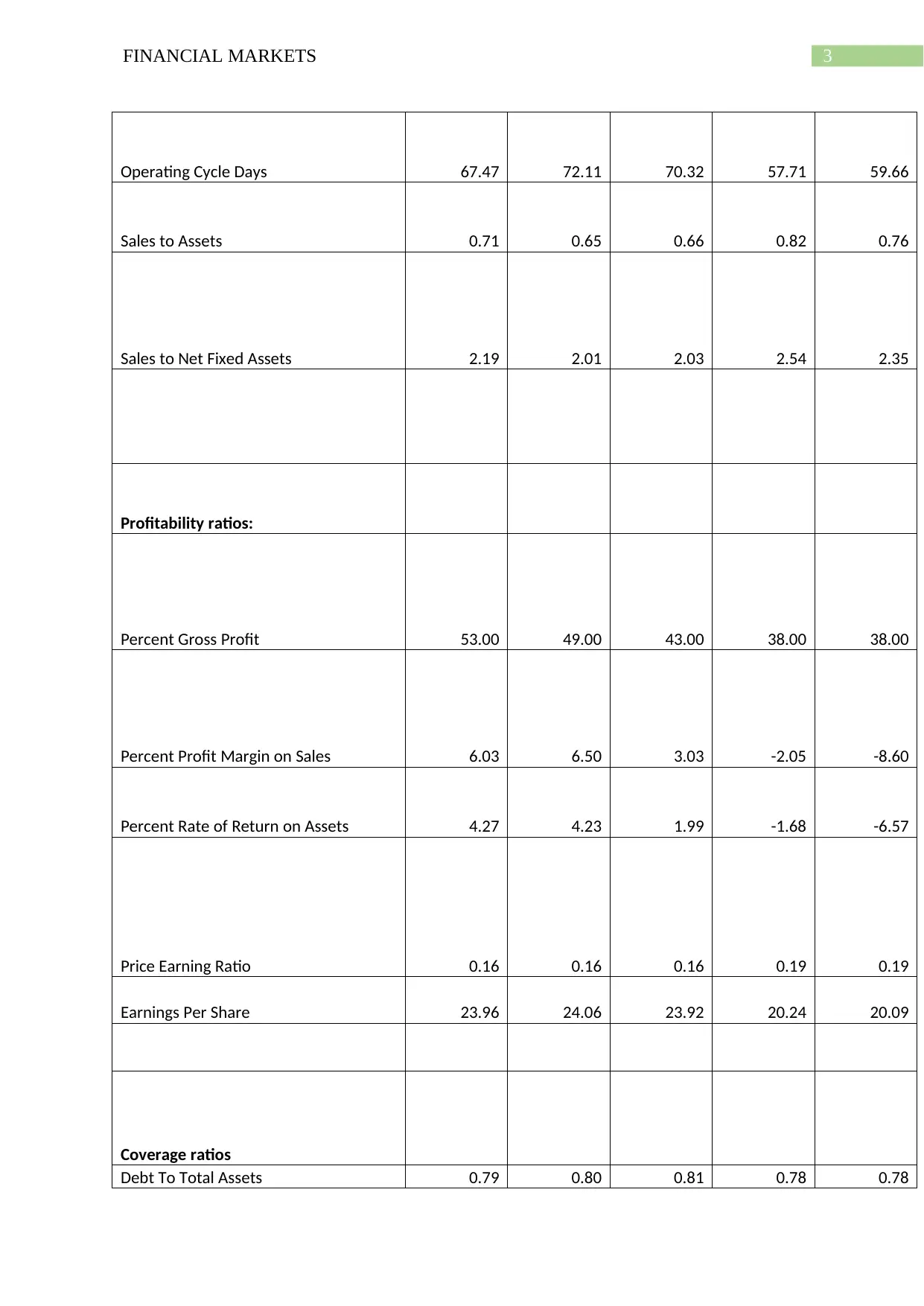

3FINANCIAL MARKETS

Operating Cycle Days 67.47 72.11 70.32 57.71 59.66

Sales to Assets 0.71 0.65 0.66 0.82 0.76

Sales to Net Fixed Assets 2.19 2.01 2.03 2.54 2.35

Profitability ratios:

Percent Gross Profit 53.00 49.00 43.00 38.00 38.00

Percent Profit Margin on Sales 6.03 6.50 3.03 -2.05 -8.60

Percent Rate of Return on Assets 4.27 4.23 1.99 -1.68 -6.57

Price Earning Ratio 0.16 0.16 0.16 0.19 0.19

Earnings Per Share 23.96 24.06 23.92 20.24 20.09

Coverage ratios

Debt To Total Assets 0.79 0.80 0.81 0.78 0.78

Operating Cycle Days 67.47 72.11 70.32 57.71 59.66

Sales to Assets 0.71 0.65 0.66 0.82 0.76

Sales to Net Fixed Assets 2.19 2.01 2.03 2.54 2.35

Profitability ratios:

Percent Gross Profit 53.00 49.00 43.00 38.00 38.00

Percent Profit Margin on Sales 6.03 6.50 3.03 -2.05 -8.60

Percent Rate of Return on Assets 4.27 4.23 1.99 -1.68 -6.57

Price Earning Ratio 0.16 0.16 0.16 0.19 0.19

Earnings Per Share 23.96 24.06 23.92 20.24 20.09

Coverage ratios

Debt To Total Assets 0.79 0.80 0.81 0.78 0.78

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

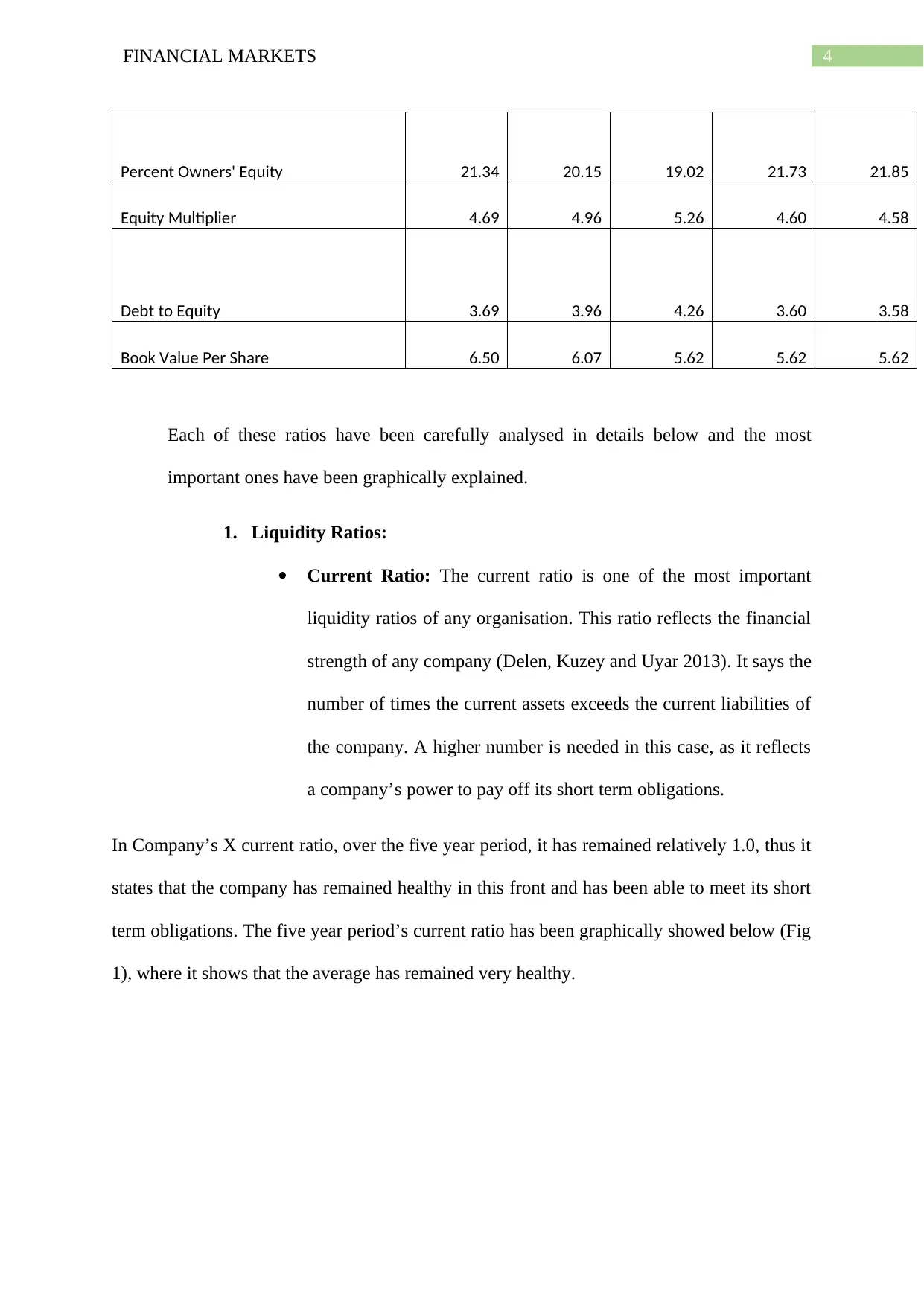

4FINANCIAL MARKETS

Percent Owners' Equity 21.34 20.15 19.02 21.73 21.85

Equity Multiplier 4.69 4.96 5.26 4.60 4.58

Debt to Equity 3.69 3.96 4.26 3.60 3.58

Book Value Per Share 6.50 6.07 5.62 5.62 5.62

Each of these ratios have been carefully analysed in details below and the most

important ones have been graphically explained.

1. Liquidity Ratios:

Current Ratio: The current ratio is one of the most important

liquidity ratios of any organisation. This ratio reflects the financial

strength of any company (Delen, Kuzey and Uyar 2013). It says the

number of times the current assets exceeds the current liabilities of

the company. A higher number is needed in this case, as it reflects

a company’s power to pay off its short term obligations.

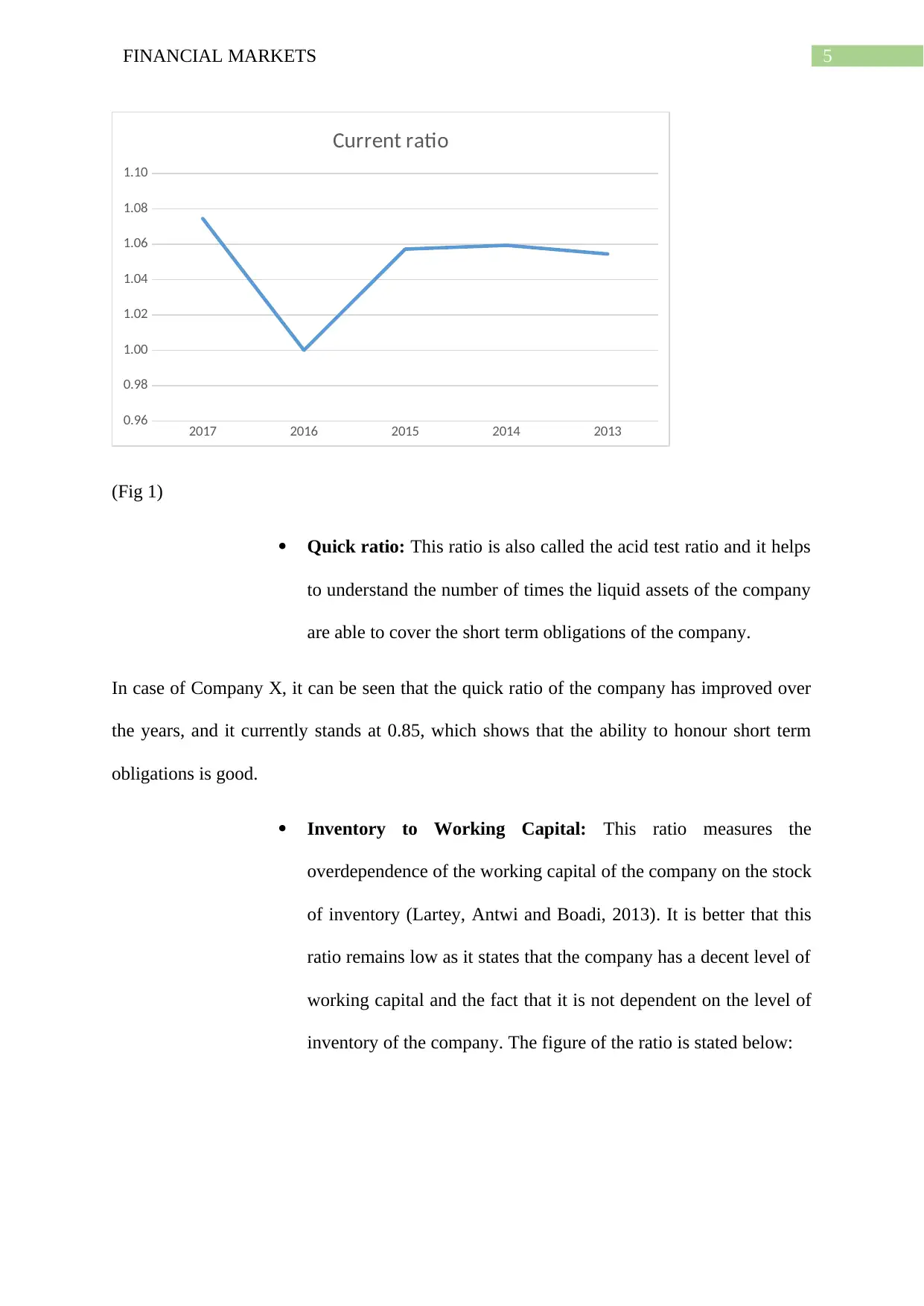

In Company’s X current ratio, over the five year period, it has remained relatively 1.0, thus it

states that the company has remained healthy in this front and has been able to meet its short

term obligations. The five year period’s current ratio has been graphically showed below (Fig

1), where it shows that the average has remained very healthy.

Percent Owners' Equity 21.34 20.15 19.02 21.73 21.85

Equity Multiplier 4.69 4.96 5.26 4.60 4.58

Debt to Equity 3.69 3.96 4.26 3.60 3.58

Book Value Per Share 6.50 6.07 5.62 5.62 5.62

Each of these ratios have been carefully analysed in details below and the most

important ones have been graphically explained.

1. Liquidity Ratios:

Current Ratio: The current ratio is one of the most important

liquidity ratios of any organisation. This ratio reflects the financial

strength of any company (Delen, Kuzey and Uyar 2013). It says the

number of times the current assets exceeds the current liabilities of

the company. A higher number is needed in this case, as it reflects

a company’s power to pay off its short term obligations.

In Company’s X current ratio, over the five year period, it has remained relatively 1.0, thus it

states that the company has remained healthy in this front and has been able to meet its short

term obligations. The five year period’s current ratio has been graphically showed below (Fig

1), where it shows that the average has remained very healthy.

5FINANCIAL MARKETS

2017 2016 2015 2014 2013

0.96

0.98

1.00

1.02

1.04

1.06

1.08

1.10

Current ratio

(Fig 1)

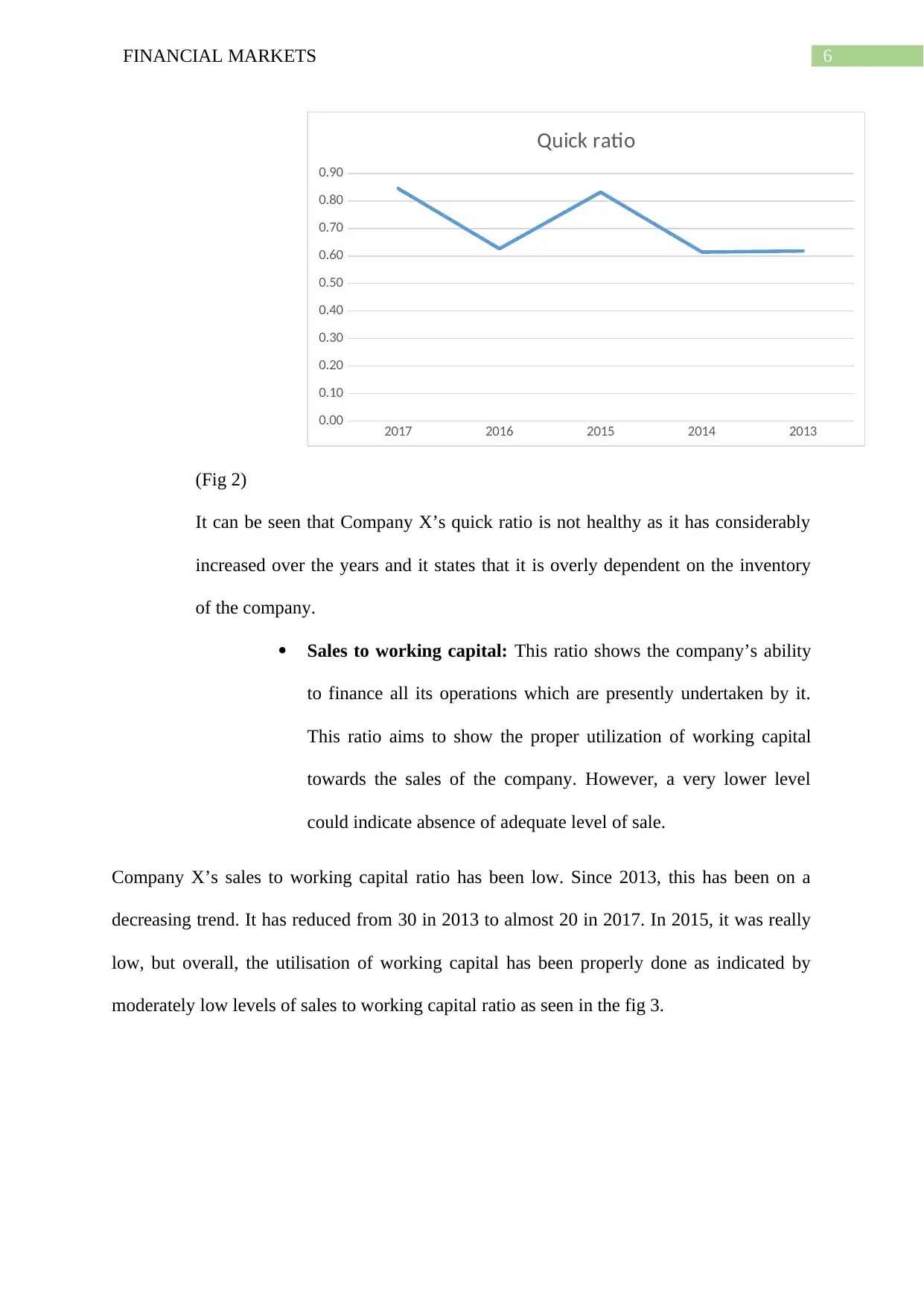

Quick ratio: This ratio is also called the acid test ratio and it helps

to understand the number of times the liquid assets of the company

are able to cover the short term obligations of the company.

In case of Company X, it can be seen that the quick ratio of the company has improved over

the years, and it currently stands at 0.85, which shows that the ability to honour short term

obligations is good.

Inventory to Working Capital: This ratio measures the

overdependence of the working capital of the company on the stock

of inventory (Lartey, Antwi and Boadi, 2013). It is better that this

ratio remains low as it states that the company has a decent level of

working capital and the fact that it is not dependent on the level of

inventory of the company. The figure of the ratio is stated below:

2017 2016 2015 2014 2013

0.96

0.98

1.00

1.02

1.04

1.06

1.08

1.10

Current ratio

(Fig 1)

Quick ratio: This ratio is also called the acid test ratio and it helps

to understand the number of times the liquid assets of the company

are able to cover the short term obligations of the company.

In case of Company X, it can be seen that the quick ratio of the company has improved over

the years, and it currently stands at 0.85, which shows that the ability to honour short term

obligations is good.

Inventory to Working Capital: This ratio measures the

overdependence of the working capital of the company on the stock

of inventory (Lartey, Antwi and Boadi, 2013). It is better that this

ratio remains low as it states that the company has a decent level of

working capital and the fact that it is not dependent on the level of

inventory of the company. The figure of the ratio is stated below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MARKETS

2017 2016 2015 2014 2013

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

Quick ratio

(Fig 2)

It can be seen that Company X’s quick ratio is not healthy as it has considerably

increased over the years and it states that it is overly dependent on the inventory

of the company.

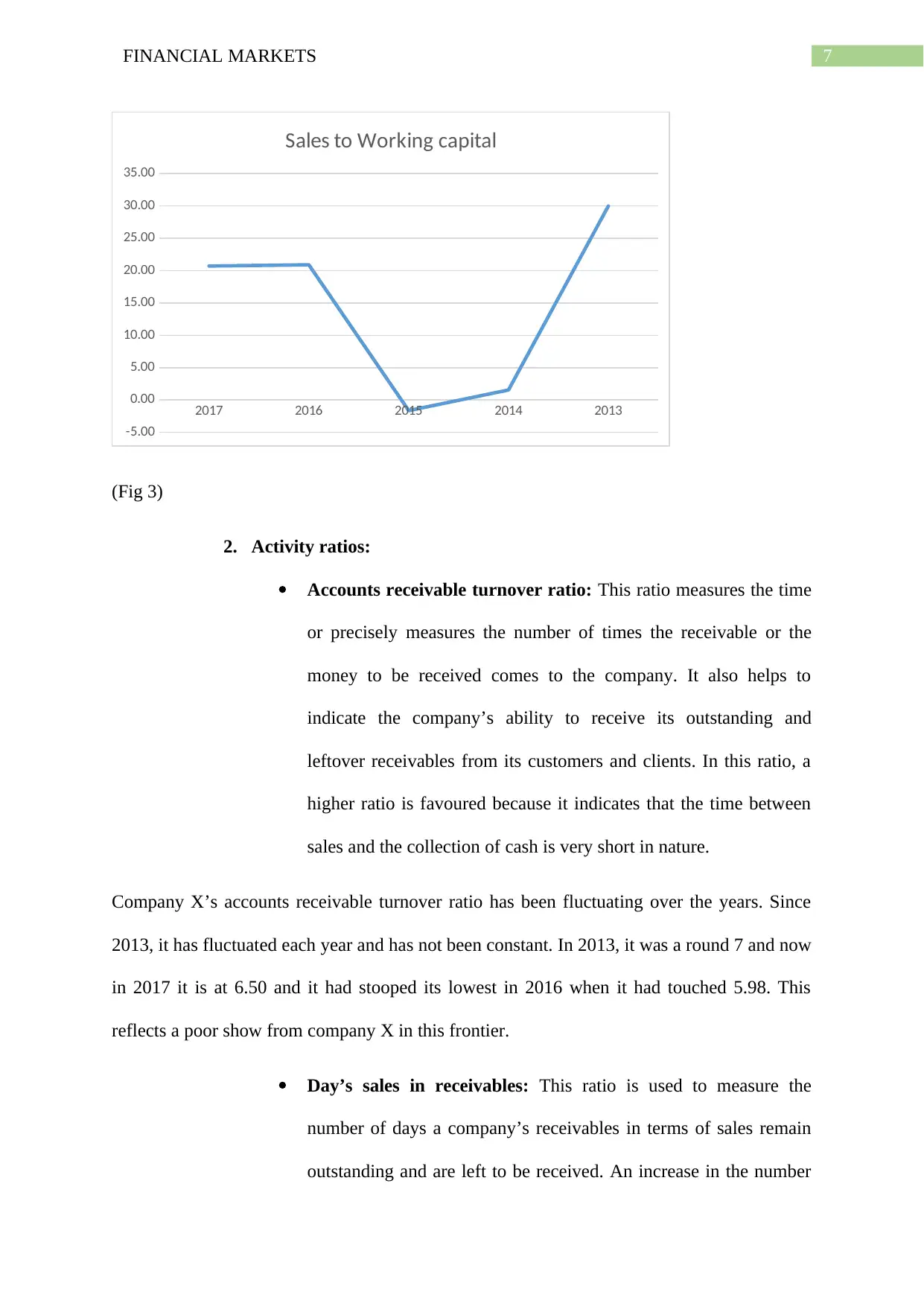

Sales to working capital: This ratio shows the company’s ability

to finance all its operations which are presently undertaken by it.

This ratio aims to show the proper utilization of working capital

towards the sales of the company. However, a very lower level

could indicate absence of adequate level of sale.

Company X’s sales to working capital ratio has been low. Since 2013, this has been on a

decreasing trend. It has reduced from 30 in 2013 to almost 20 in 2017. In 2015, it was really

low, but overall, the utilisation of working capital has been properly done as indicated by

moderately low levels of sales to working capital ratio as seen in the fig 3.

2017 2016 2015 2014 2013

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

Quick ratio

(Fig 2)

It can be seen that Company X’s quick ratio is not healthy as it has considerably

increased over the years and it states that it is overly dependent on the inventory

of the company.

Sales to working capital: This ratio shows the company’s ability

to finance all its operations which are presently undertaken by it.

This ratio aims to show the proper utilization of working capital

towards the sales of the company. However, a very lower level

could indicate absence of adequate level of sale.

Company X’s sales to working capital ratio has been low. Since 2013, this has been on a

decreasing trend. It has reduced from 30 in 2013 to almost 20 in 2017. In 2015, it was really

low, but overall, the utilisation of working capital has been properly done as indicated by

moderately low levels of sales to working capital ratio as seen in the fig 3.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MARKETS

2017 2016 2015 2014 2013

-5.00

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

Sales to Working capital

(Fig 3)

2. Activity ratios:

Accounts receivable turnover ratio: This ratio measures the time

or precisely measures the number of times the receivable or the

money to be received comes to the company. It also helps to

indicate the company’s ability to receive its outstanding and

leftover receivables from its customers and clients. In this ratio, a

higher ratio is favoured because it indicates that the time between

sales and the collection of cash is very short in nature.

Company X’s accounts receivable turnover ratio has been fluctuating over the years. Since

2013, it has fluctuated each year and has not been constant. In 2013, it was a round 7 and now

in 2017 it is at 6.50 and it had stooped its lowest in 2016 when it had touched 5.98. This

reflects a poor show from company X in this frontier.

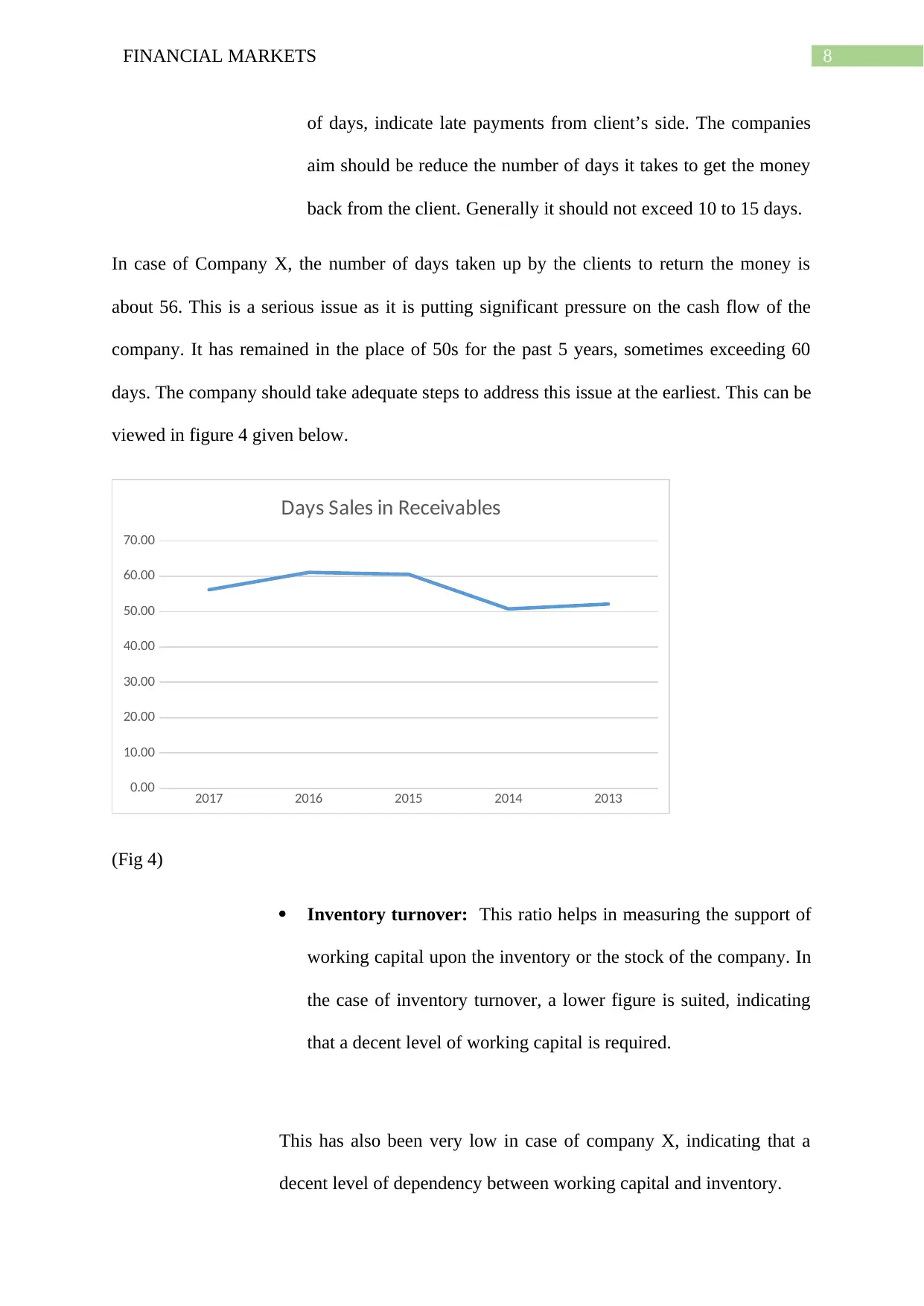

Day’s sales in receivables: This ratio is used to measure the

number of days a company’s receivables in terms of sales remain

outstanding and are left to be received. An increase in the number

2017 2016 2015 2014 2013

-5.00

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

Sales to Working capital

(Fig 3)

2. Activity ratios:

Accounts receivable turnover ratio: This ratio measures the time

or precisely measures the number of times the receivable or the

money to be received comes to the company. It also helps to

indicate the company’s ability to receive its outstanding and

leftover receivables from its customers and clients. In this ratio, a

higher ratio is favoured because it indicates that the time between

sales and the collection of cash is very short in nature.

Company X’s accounts receivable turnover ratio has been fluctuating over the years. Since

2013, it has fluctuated each year and has not been constant. In 2013, it was a round 7 and now

in 2017 it is at 6.50 and it had stooped its lowest in 2016 when it had touched 5.98. This

reflects a poor show from company X in this frontier.

Day’s sales in receivables: This ratio is used to measure the

number of days a company’s receivables in terms of sales remain

outstanding and are left to be received. An increase in the number

8FINANCIAL MARKETS

of days, indicate late payments from client’s side. The companies

aim should be reduce the number of days it takes to get the money

back from the client. Generally it should not exceed 10 to 15 days.

In case of Company X, the number of days taken up by the clients to return the money is

about 56. This is a serious issue as it is putting significant pressure on the cash flow of the

company. It has remained in the place of 50s for the past 5 years, sometimes exceeding 60

days. The company should take adequate steps to address this issue at the earliest. This can be

viewed in figure 4 given below.

2017 2016 2015 2014 2013

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

Days Sales in Receivables

(Fig 4)

Inventory turnover: This ratio helps in measuring the support of

working capital upon the inventory or the stock of the company. In

the case of inventory turnover, a lower figure is suited, indicating

that a decent level of working capital is required.

This has also been very low in case of company X, indicating that a

decent level of dependency between working capital and inventory.

of days, indicate late payments from client’s side. The companies

aim should be reduce the number of days it takes to get the money

back from the client. Generally it should not exceed 10 to 15 days.

In case of Company X, the number of days taken up by the clients to return the money is

about 56. This is a serious issue as it is putting significant pressure on the cash flow of the

company. It has remained in the place of 50s for the past 5 years, sometimes exceeding 60

days. The company should take adequate steps to address this issue at the earliest. This can be

viewed in figure 4 given below.

2017 2016 2015 2014 2013

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

Days Sales in Receivables

(Fig 4)

Inventory turnover: This ratio helps in measuring the support of

working capital upon the inventory or the stock of the company. In

the case of inventory turnover, a lower figure is suited, indicating

that a decent level of working capital is required.

This has also been very low in case of company X, indicating that a

decent level of dependency between working capital and inventory.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL MARKETS

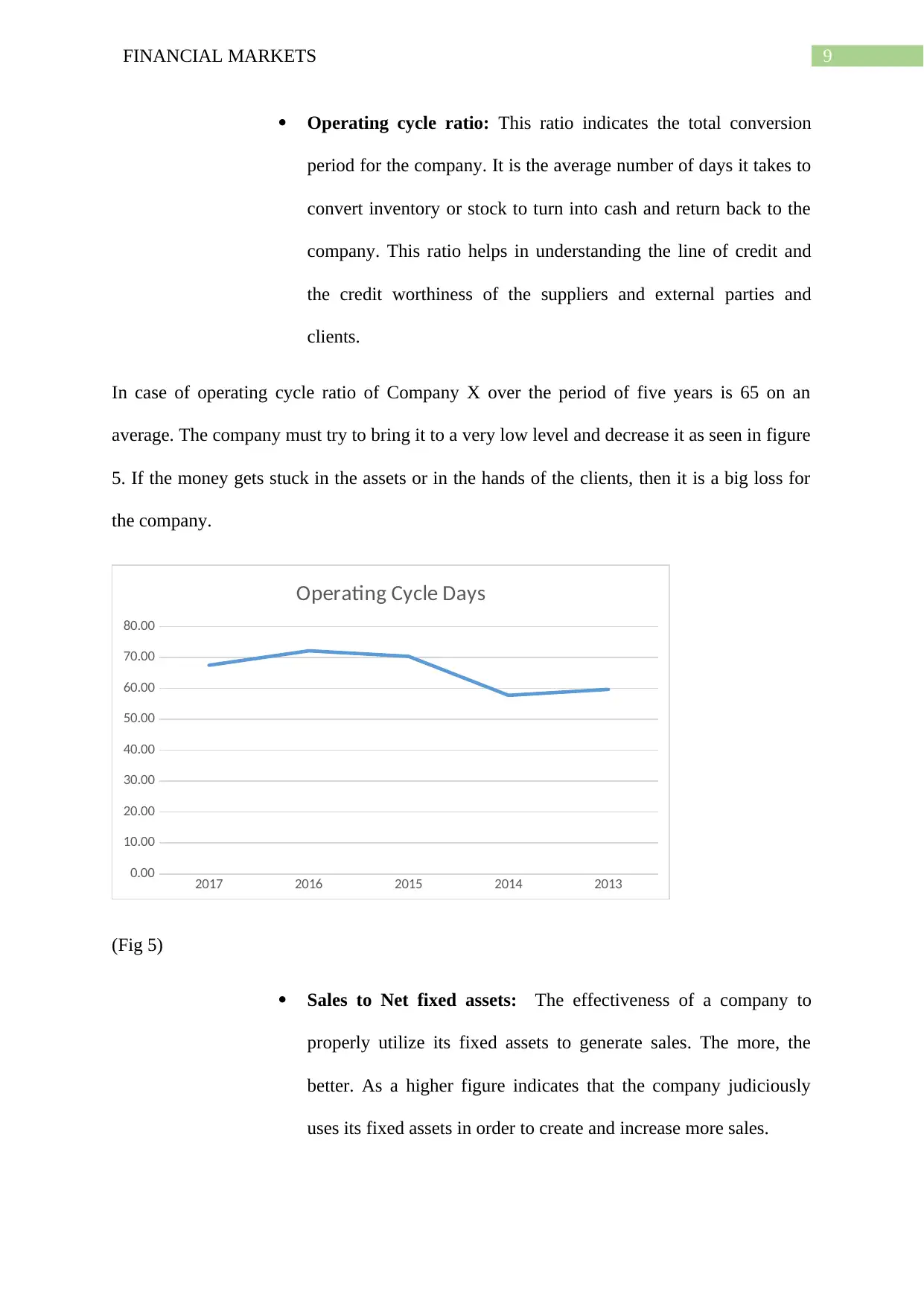

Operating cycle ratio: This ratio indicates the total conversion

period for the company. It is the average number of days it takes to

convert inventory or stock to turn into cash and return back to the

company. This ratio helps in understanding the line of credit and

the credit worthiness of the suppliers and external parties and

clients.

In case of operating cycle ratio of Company X over the period of five years is 65 on an

average. The company must try to bring it to a very low level and decrease it as seen in figure

5. If the money gets stuck in the assets or in the hands of the clients, then it is a big loss for

the company.

2017 2016 2015 2014 2013

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

80.00

Operating Cycle Days

(Fig 5)

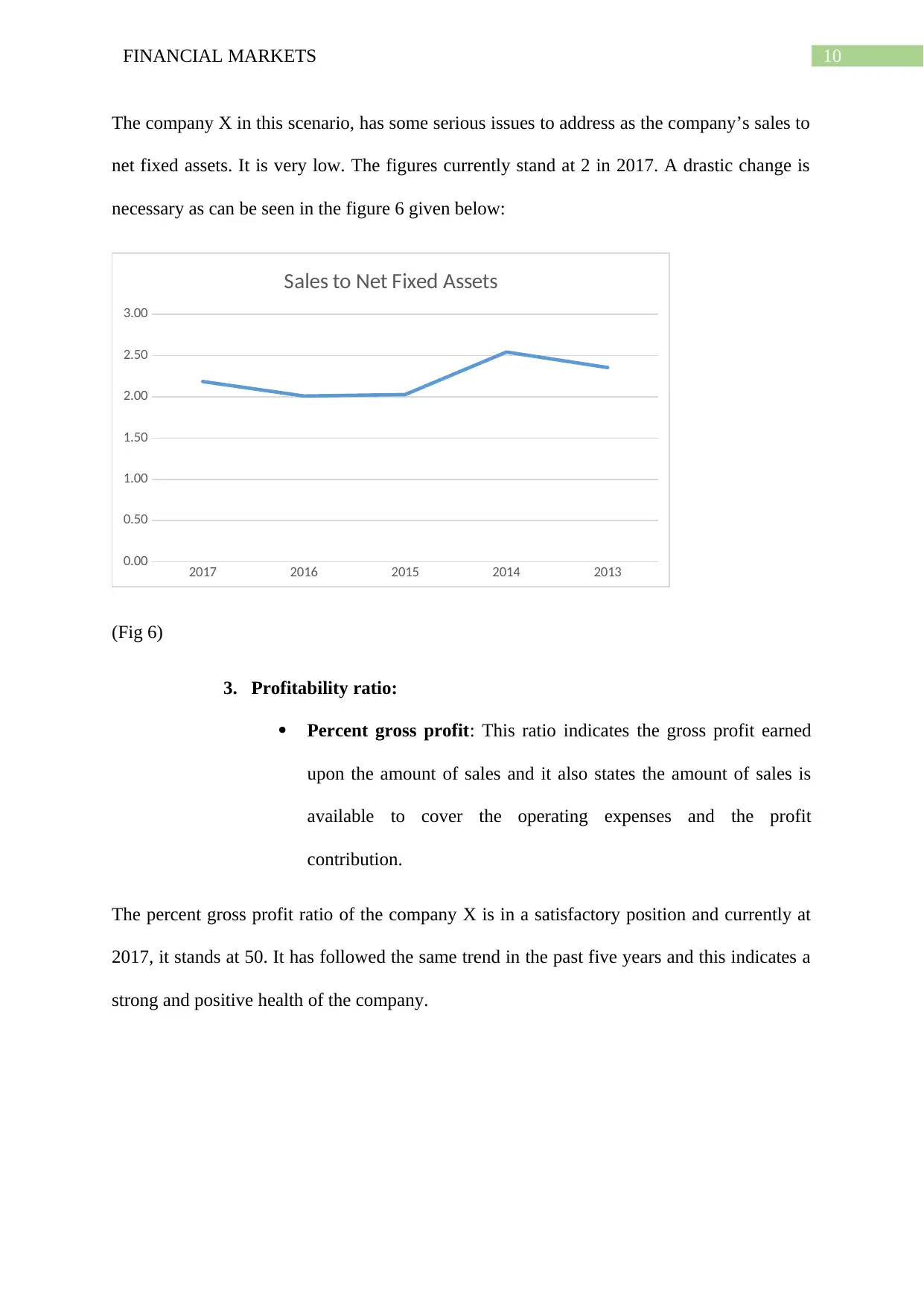

Sales to Net fixed assets: The effectiveness of a company to

properly utilize its fixed assets to generate sales. The more, the

better. As a higher figure indicates that the company judiciously

uses its fixed assets in order to create and increase more sales.

Operating cycle ratio: This ratio indicates the total conversion

period for the company. It is the average number of days it takes to

convert inventory or stock to turn into cash and return back to the

company. This ratio helps in understanding the line of credit and

the credit worthiness of the suppliers and external parties and

clients.

In case of operating cycle ratio of Company X over the period of five years is 65 on an

average. The company must try to bring it to a very low level and decrease it as seen in figure

5. If the money gets stuck in the assets or in the hands of the clients, then it is a big loss for

the company.

2017 2016 2015 2014 2013

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

80.00

Operating Cycle Days

(Fig 5)

Sales to Net fixed assets: The effectiveness of a company to

properly utilize its fixed assets to generate sales. The more, the

better. As a higher figure indicates that the company judiciously

uses its fixed assets in order to create and increase more sales.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL MARKETS

The company X in this scenario, has some serious issues to address as the company’s sales to

net fixed assets. It is very low. The figures currently stand at 2 in 2017. A drastic change is

necessary as can be seen in the figure 6 given below:

2017 2016 2015 2014 2013

0.00

0.50

1.00

1.50

2.00

2.50

3.00

Sales to Net Fixed Assets

(Fig 6)

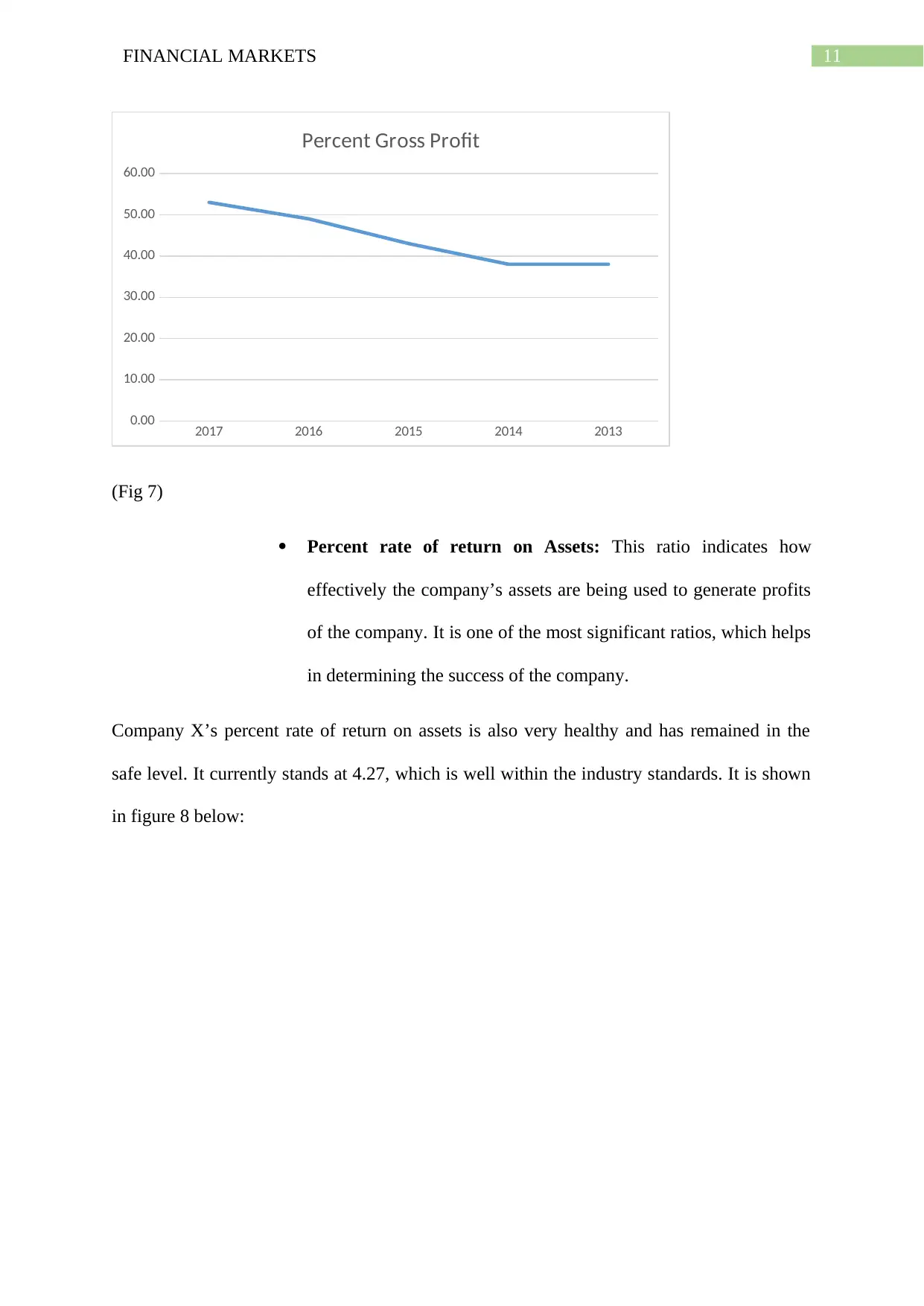

3. Profitability ratio:

Percent gross profit: This ratio indicates the gross profit earned

upon the amount of sales and it also states the amount of sales is

available to cover the operating expenses and the profit

contribution.

The percent gross profit ratio of the company X is in a satisfactory position and currently at

2017, it stands at 50. It has followed the same trend in the past five years and this indicates a

strong and positive health of the company.

The company X in this scenario, has some serious issues to address as the company’s sales to

net fixed assets. It is very low. The figures currently stand at 2 in 2017. A drastic change is

necessary as can be seen in the figure 6 given below:

2017 2016 2015 2014 2013

0.00

0.50

1.00

1.50

2.00

2.50

3.00

Sales to Net Fixed Assets

(Fig 6)

3. Profitability ratio:

Percent gross profit: This ratio indicates the gross profit earned

upon the amount of sales and it also states the amount of sales is

available to cover the operating expenses and the profit

contribution.

The percent gross profit ratio of the company X is in a satisfactory position and currently at

2017, it stands at 50. It has followed the same trend in the past five years and this indicates a

strong and positive health of the company.

11FINANCIAL MARKETS

2017 2016 2015 2014 2013

0.00

10.00

20.00

30.00

40.00

50.00

60.00

Percent Gross Profit

(Fig 7)

Percent rate of return on Assets: This ratio indicates how

effectively the company’s assets are being used to generate profits

of the company. It is one of the most significant ratios, which helps

in determining the success of the company.

Company X’s percent rate of return on assets is also very healthy and has remained in the

safe level. It currently stands at 4.27, which is well within the industry standards. It is shown

in figure 8 below:

2017 2016 2015 2014 2013

0.00

10.00

20.00

30.00

40.00

50.00

60.00

Percent Gross Profit

(Fig 7)

Percent rate of return on Assets: This ratio indicates how

effectively the company’s assets are being used to generate profits

of the company. It is one of the most significant ratios, which helps

in determining the success of the company.

Company X’s percent rate of return on assets is also very healthy and has remained in the

safe level. It currently stands at 4.27, which is well within the industry standards. It is shown

in figure 8 below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.