CITI Group Financial Performance: An Analytical Report

VerifiedAdded on 2023/04/10

|8

|896

|283

Report

AI Summary

This report provides a financial analysis of CITI Group, utilizing data from Bloomberg to assess the company's performance. It covers the company's operations, which are divided into Global Consumer Banking Group and Institutional Clients Group, and its presence across North America, Asia, Africa, and Europe. The analysis includes a review of the company's revenue, net income, and cash flows, noting volatility in financial performance due to rising operational costs and digital transformation. The report also highlights Citigroup's strengths, such as effective cost control and stable earnings, and discusses the potential impact of interest rate changes by the Federal Reserve. Tools like comparative income statements, common size income statements, and ratio analysis are employed to evaluate the financial performance over a trend period, with a focus on profitability and financial leverage. The analysis concludes that while the company's financial statements show volatility, the performance in 2018 was comparatively better than in 2017 in terms of profitability and efficiency.

Running head: FINANCIAL ANAYLSIS

Financial Analysis

Name of the Student:

Name of the University:

Author’s Note:

Financial Analysis

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ANALYSIS

Table of Contents

Question 1..................................................................................................................................2

Question 2..................................................................................................................................2

Question 3..................................................................................................................................2

Question 4..................................................................................................................................3

Question 5..................................................................................................................................4

Question 6..................................................................................................................................5

Question 7..................................................................................................................................5

References..................................................................................................................................6

Table of Contents

Question 1..................................................................................................................................2

Question 2..................................................................................................................................2

Question 3..................................................................................................................................2

Question 4..................................................................................................................................3

Question 5..................................................................................................................................4

Question 6..................................................................................................................................5

Question 7..................................................................................................................................5

References..................................................................................................................................6

2FINANCIAL ANALYSIS

Question 1

The company selected for the purpose of the financial analysis is the CITI Group

where the analysis of the company was done by taking the financial data and information

available at the Bloomberg data base.

Question 2

The Citigroup Inc. is a well-diversified company dealing in the financial services

where the company focuses on providing various financial services, products to various

corporates, consumers and government. The operations of the company is spread globally

focusing on North America, Asia, Africa and Europe. The operation of the company is

primarily divided into two segments Global Consumer Banking Group and Institutional

Clients Group. The company was founded in the year 1812 and has a strong employee base

of around 204,000 employees. The company is listed in the New York Stock Exchange with

its ticker symbol with its ticker symbol “C” and the current share price of the company is

around 65.63.

Question 3

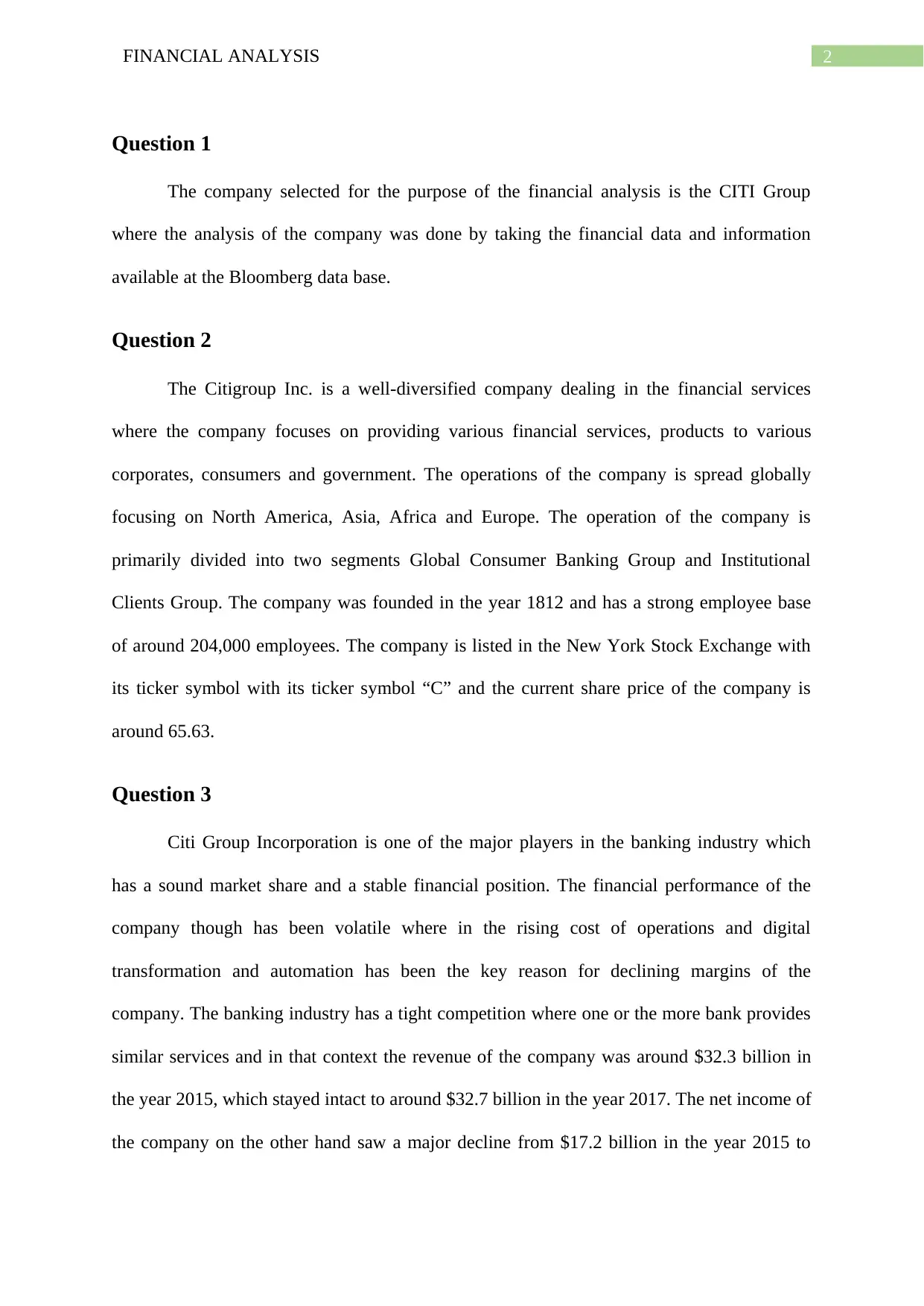

Citi Group Incorporation is one of the major players in the banking industry which

has a sound market share and a stable financial position. The financial performance of the

company though has been volatile where in the rising cost of operations and digital

transformation and automation has been the key reason for declining margins of the

company. The banking industry has a tight competition where one or the more bank provides

similar services and in that context the revenue of the company was around $32.3 billion in

the year 2015, which stayed intact to around $32.7 billion in the year 2017. The net income of

the company on the other hand saw a major decline from $17.2 billion in the year 2015 to

Question 1

The company selected for the purpose of the financial analysis is the CITI Group

where the analysis of the company was done by taking the financial data and information

available at the Bloomberg data base.

Question 2

The Citigroup Inc. is a well-diversified company dealing in the financial services

where the company focuses on providing various financial services, products to various

corporates, consumers and government. The operations of the company is spread globally

focusing on North America, Asia, Africa and Europe. The operation of the company is

primarily divided into two segments Global Consumer Banking Group and Institutional

Clients Group. The company was founded in the year 1812 and has a strong employee base

of around 204,000 employees. The company is listed in the New York Stock Exchange with

its ticker symbol with its ticker symbol “C” and the current share price of the company is

around 65.63.

Question 3

Citi Group Incorporation is one of the major players in the banking industry which

has a sound market share and a stable financial position. The financial performance of the

company though has been volatile where in the rising cost of operations and digital

transformation and automation has been the key reason for declining margins of the

company. The banking industry has a tight competition where one or the more bank provides

similar services and in that context the revenue of the company was around $32.3 billion in

the year 2015, which stayed intact to around $32.7 billion in the year 2017. The net income of

the company on the other hand saw a major decline from $17.2 billion in the year 2015 to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ANALYSIS

about $15.2 billion in the year 2017. The level of activities in the form of cash flows from

operations for the company has been significantly low in the trend period of 2015-2017.

Figure 1: Financial Status of Citigroup Inc.

(Source: Citigroup Inc, 2019)

about $15.2 billion in the year 2017. The level of activities in the form of cash flows from

operations for the company has been significantly low in the trend period of 2015-2017.

Figure 1: Financial Status of Citigroup Inc.

(Source: Citigroup Inc, 2019)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ANALYSIS

Question 4

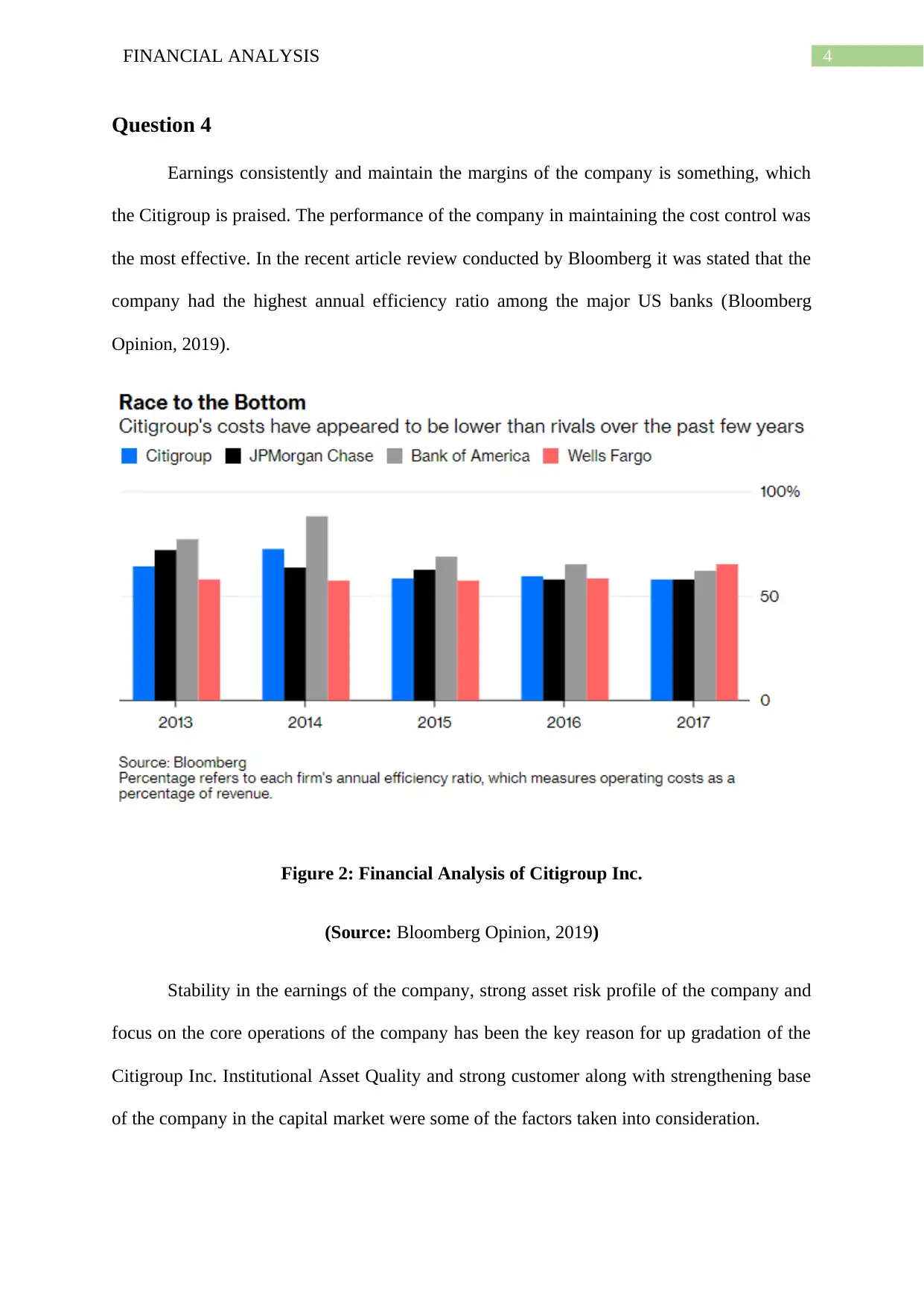

Earnings consistently and maintain the margins of the company is something, which

the Citigroup is praised. The performance of the company in maintaining the cost control was

the most effective. In the recent article review conducted by Bloomberg it was stated that the

company had the highest annual efficiency ratio among the major US banks (Bloomberg

Opinion, 2019).

Figure 2: Financial Analysis of Citigroup Inc.

(Source: Bloomberg Opinion, 2019)

Stability in the earnings of the company, strong asset risk profile of the company and

focus on the core operations of the company has been the key reason for up gradation of the

Citigroup Inc. Institutional Asset Quality and strong customer along with strengthening base

of the company in the capital market were some of the factors taken into consideration.

Question 4

Earnings consistently and maintain the margins of the company is something, which

the Citigroup is praised. The performance of the company in maintaining the cost control was

the most effective. In the recent article review conducted by Bloomberg it was stated that the

company had the highest annual efficiency ratio among the major US banks (Bloomberg

Opinion, 2019).

Figure 2: Financial Analysis of Citigroup Inc.

(Source: Bloomberg Opinion, 2019)

Stability in the earnings of the company, strong asset risk profile of the company and

focus on the core operations of the company has been the key reason for up gradation of the

Citigroup Inc. Institutional Asset Quality and strong customer along with strengthening base

of the company in the capital market were some of the factors taken into consideration.

5FINANCIAL ANALYSIS

In the recent article published for Citi Group stated that if the Fed increase the interest

rate by 0.25 basis point then it would be good for big banks to charge higher rate of interest

and increase their net margins which on an overall would be a positive signal for the

company (Duggan, 2018).

Question 5

The tools used in the financial statement analysis of the company are the comparative

income statement, common size income statement and the ratio analysis which are commonly

used for evaluating the financial performance of the company over a trend period of time.

The vertical common size income statement takes all the value of the statement as a

percentage of base year into account. Since the analysis performed is top down the same is

also called as vertical analysis.

On the other hand side the horizontal common size shows the value across different

years as a percentage of base year values in the given base year of a company. Application of

horizontal analysis is done for comparing the financial statement of the company on a year to

year basis. Comparative income statement shows the value of the financial statement in the

percentage form. Ratio analysis on the other hand is also common used technique for

assessing the financial performance of the company.

Question 6

The financial analysis of the company can be done with the help of the ratio analysis

where the profitability of the company has remained volatile for the company. The company

reported a sharp decline of profitability in the year 2017. The high amount of financial

leverage also effected the debt to equity ratio for the company which in turn increase the

financial risk of the company.

In the recent article published for Citi Group stated that if the Fed increase the interest

rate by 0.25 basis point then it would be good for big banks to charge higher rate of interest

and increase their net margins which on an overall would be a positive signal for the

company (Duggan, 2018).

Question 5

The tools used in the financial statement analysis of the company are the comparative

income statement, common size income statement and the ratio analysis which are commonly

used for evaluating the financial performance of the company over a trend period of time.

The vertical common size income statement takes all the value of the statement as a

percentage of base year into account. Since the analysis performed is top down the same is

also called as vertical analysis.

On the other hand side the horizontal common size shows the value across different

years as a percentage of base year values in the given base year of a company. Application of

horizontal analysis is done for comparing the financial statement of the company on a year to

year basis. Comparative income statement shows the value of the financial statement in the

percentage form. Ratio analysis on the other hand is also common used technique for

assessing the financial performance of the company.

Question 6

The financial analysis of the company can be done with the help of the ratio analysis

where the profitability of the company has remained volatile for the company. The company

reported a sharp decline of profitability in the year 2017. The high amount of financial

leverage also effected the debt to equity ratio for the company which in turn increase the

financial risk of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ANALYSIS

Question 7

The financial statement analysed for the company shows that the company is having a

volatile financial statement with the revenue of the company currently falling in the trend

period 2017. However the performance of the year 2018 was comparatively much better for

the company as compared to 2017 in terms of profitability, financial condition and efficiency

of the company (Annual Report, 2018).

Question 7

The financial statement analysed for the company shows that the company is having a

volatile financial statement with the revenue of the company currently falling in the trend

period 2017. However the performance of the year 2018 was comparatively much better for

the company as compared to 2017 in terms of profitability, financial condition and efficiency

of the company (Annual Report, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ANALYSIS

References

Annual Report. (2018). Retrieved from

https://www.citigroup.com/citi/investor/quarterly/2019/ar18_en.pdf

Bloomberg Opinion. (2019). Retrieved from

https://www.bloomberg.com/opinion/articles/2018-09-19/the-best-thing-going-for-

citigroup-c-it-s-the-worst

Citigroup Inc. (2019). Retrieved from https://www.bloomberg.com/quote/C:US

Duggan, W. (2018). Citigroup Is a Solid Buy After the Fed's Rate Hike. Retrieved from

https://money.usnews.com/investing/stock-market-news/articles/2018-06-14/

citigroup-inc-c-stock

Moody's Investor Services. (2019). Retrieved from https://finance.yahoo.com/news/citigroup-

c-ratings-put-under-142902238.html

References

Annual Report. (2018). Retrieved from

https://www.citigroup.com/citi/investor/quarterly/2019/ar18_en.pdf

Bloomberg Opinion. (2019). Retrieved from

https://www.bloomberg.com/opinion/articles/2018-09-19/the-best-thing-going-for-

citigroup-c-it-s-the-worst

Citigroup Inc. (2019). Retrieved from https://www.bloomberg.com/quote/C:US

Duggan, W. (2018). Citigroup Is a Solid Buy After the Fed's Rate Hike. Retrieved from

https://money.usnews.com/investing/stock-market-news/articles/2018-06-14/

citigroup-inc-c-stock

Moody's Investor Services. (2019). Retrieved from https://finance.yahoo.com/news/citigroup-

c-ratings-put-under-142902238.html

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.