Financial Control and Budgeting Report: NHS, UK Case Study Analysis

VerifiedAdded on 2023/01/12

|16

|5371

|30

Report

AI Summary

This report delves into the critical aspects of financial control and budgeting, using the UK National Health Service (NHS) as a comprehensive case study. It begins by outlining the significance of financial management and budgeting in assessing organizational performance and making informed decisions. The report addresses the challenges faced by the NHS, including funding issues and the rising demands of an aging population, and explores recent developments and the regulatory environment. It analyzes alternative funding options like Private Finance Initiatives (PFI), agency partnerships, and resource allocation, evaluating their usefulness and benefits. Furthermore, the report identifies key stakeholders within the social care sector and examines effective communication strategies. A numerical section includes a break-even analysis for ABC care home Ltd, calculating the break-even capacity usage rate. Finally, the report discusses budgetary control methods, agency theory, and outsourcing in the context of financial management within the healthcare sector. The report is designed to provide a detailed overview of financial planning, control, and the challenges and opportunities within the healthcare industry.

Financial Control and

Budgeting

Budgeting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION......................................................................................................................3

MAIN BODY.............................................................................................................................3

TASK 1......................................................................................................................................3

TASK 2......................................................................................................................................7

TASK 3......................................................................................................................................9

CONCLUSION........................................................................................................................14

REFERENCES.........................................................................................................................15

INTRODUCTION......................................................................................................................3

MAIN BODY.............................................................................................................................3

TASK 1......................................................................................................................................3

TASK 2......................................................................................................................................7

TASK 3......................................................................................................................................9

CONCLUSION........................................................................................................................14

REFERENCES.........................................................................................................................15

INTRODUCTION

In the planning of financial reports, financial management and budget play a significant

role. It allows the firm to assess its performance, to see the firm's inflows and outflows.

Budgeting provides the previous years’ report which allows administrators to make decisions,

and to solve the issues they have failed to meet in their objective (Zhang, C.Y. and Sussman,

A.B., 2018). Financial monitoring allows managers to handle costs in order to optimize

income. Financial management provides direct power over the company's earnings and

expenditures. Budget reports enables managers to see the progress and take the decisions

required to keep the business growing.

The report is based on a case study of the UK National Health Service on itslegal,control,

budgetingand financial planning. This case study outlines certain issues which enable

management to recognise the challenges facing the National Health Service on their 70th

anniversary. The project report consists detailed information about regulatory framework of

health and social care as well as various kinds of funding options. The further part of report is

based on numerical portion in which BEP is calculated as per given financial information. In

the end of report, various methods of budgetary control are included.

MAIN BODY

TASK 1

a) Challenges faced by NHS and the recent developments.

NHS is aNationalhealth service in Great Britain that allowpatients to receive free and

affordable costs for medical treatment. The national health services may have a

problem of adequatelyand the improvement of the National Health Service by 2023 to

pay an additional 20 billion per annum. The real concern is that this vast sum of money

is spent adequately in the provision of health services for all citizens. Financial

management allows National Health Service administrators to find the best way to use

the assets. In the last 20 years the number of people who die from the attacks has

dropped by 8,390 each year and people dying from cancer by 634, as per the case study

10,385 fewer people died from heart attacks. The overall productivity growth reported

throughout the last 5 years was 1.4 percent annually who dies of other illnesses.

In the planning of financial reports, financial management and budget play a significant

role. It allows the firm to assess its performance, to see the firm's inflows and outflows.

Budgeting provides the previous years’ report which allows administrators to make decisions,

and to solve the issues they have failed to meet in their objective (Zhang, C.Y. and Sussman,

A.B., 2018). Financial monitoring allows managers to handle costs in order to optimize

income. Financial management provides direct power over the company's earnings and

expenditures. Budget reports enables managers to see the progress and take the decisions

required to keep the business growing.

The report is based on a case study of the UK National Health Service on itslegal,control,

budgetingand financial planning. This case study outlines certain issues which enable

management to recognise the challenges facing the National Health Service on their 70th

anniversary. The project report consists detailed information about regulatory framework of

health and social care as well as various kinds of funding options. The further part of report is

based on numerical portion in which BEP is calculated as per given financial information. In

the end of report, various methods of budgetary control are included.

MAIN BODY

TASK 1

a) Challenges faced by NHS and the recent developments.

NHS is aNationalhealth service in Great Britain that allowpatients to receive free and

affordable costs for medical treatment. The national health services may have a

problem of adequatelyand the improvement of the National Health Service by 2023 to

pay an additional 20 billion per annum. The real concern is that this vast sum of money

is spent adequately in the provision of health services for all citizens. Financial

management allows National Health Service administrators to find the best way to use

the assets. In the last 20 years the number of people who die from the attacks has

dropped by 8,390 each year and people dying from cancer by 634, as per the case study

10,385 fewer people died from heart attacks. The overall productivity growth reported

throughout the last 5 years was 1.4 percent annually who dies of other illnesses.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL ENVIRONMENT- NHS is financed almost fully by central taxes. Over

the last 30 years, the changes have centered on ownership problems and have defined

the right balance between state regulation and rewards. This is how to describe the

issue, with the broad and profoundly unpopular global recession five years ago, the

"bazooka" reforms. This will impact to recent developments because due of

availability of enough financial resources they can enhance their services in more

effective manner.

The health issues of people are generally growing elderly, disabled and able body

need for the NHS is rising rapidly. The NHS must manage its financial resources adequately

in order to fulfil demand. The financial management provides the NHS with a mechanism to

track their spending in their support and services (Munge, Kimani and Ngugi, 2016).

REGULATORY ENVIRONMENT- The healthcare legislation in England includes

two major components: controlling the efficiency and welfare of healthcare facilities

currently being offered by the Care Quality Commission (CQC) and controlling the

health services sector, presently under Oversight control for forming trusts and the

health department.

LEGAL ENVIRONMENT- the Health and Social Care Act 2012 (c 7) is a United

Kingdom Legislature Statute. It means the broadest reorganization of the English

National Aid Service's system to date. The Secretary for Health, who had held the

post since before the beginning of the NHS in 1948, abolished responsibility for the

welfare of the people.

b) The Usefulness of alternative funding options.

Private Financing Initiates, Money, Financial Dimensions of Agency Collaboration are

the alternate funding mechanisms for NHS. Herein, underneath description of these

alternatives is mentioned in such manner that is as follows:

Private Finance Initiatives (PFI): The Labour government first introduced PFI in

1992 and was strengthened extensively in the 1997-2010. More than 700 clinics,

colleges, jails, etc. were constructed under the PFI system at the end of 2011. This

facilitates the maintenance of public systems such as newacademy schools, hospitals,

council housing, security contracts, prisoners and road upgrades, through private

investors (Guo and Yang, 2018). The private sector supports public sector initiatives

in the private finance program by offering financial resources and enabling them

the last 30 years, the changes have centered on ownership problems and have defined

the right balance between state regulation and rewards. This is how to describe the

issue, with the broad and profoundly unpopular global recession five years ago, the

"bazooka" reforms. This will impact to recent developments because due of

availability of enough financial resources they can enhance their services in more

effective manner.

The health issues of people are generally growing elderly, disabled and able body

need for the NHS is rising rapidly. The NHS must manage its financial resources adequately

in order to fulfil demand. The financial management provides the NHS with a mechanism to

track their spending in their support and services (Munge, Kimani and Ngugi, 2016).

REGULATORY ENVIRONMENT- The healthcare legislation in England includes

two major components: controlling the efficiency and welfare of healthcare facilities

currently being offered by the Care Quality Commission (CQC) and controlling the

health services sector, presently under Oversight control for forming trusts and the

health department.

LEGAL ENVIRONMENT- the Health and Social Care Act 2012 (c 7) is a United

Kingdom Legislature Statute. It means the broadest reorganization of the English

National Aid Service's system to date. The Secretary for Health, who had held the

post since before the beginning of the NHS in 1948, abolished responsibility for the

welfare of the people.

b) The Usefulness of alternative funding options.

Private Financing Initiates, Money, Financial Dimensions of Agency Collaboration are

the alternate funding mechanisms for NHS. Herein, underneath description of these

alternatives is mentioned in such manner that is as follows:

Private Finance Initiatives (PFI): The Labour government first introduced PFI in

1992 and was strengthened extensively in the 1997-2010. More than 700 clinics,

colleges, jails, etc. were constructed under the PFI system at the end of 2011. This

facilitates the maintenance of public systems such as newacademy schools, hospitals,

council housing, security contracts, prisoners and road upgrades, through private

investors (Guo and Yang, 2018). The private sector supports public sector initiatives

in the private finance program by offering financial resources and enabling them

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

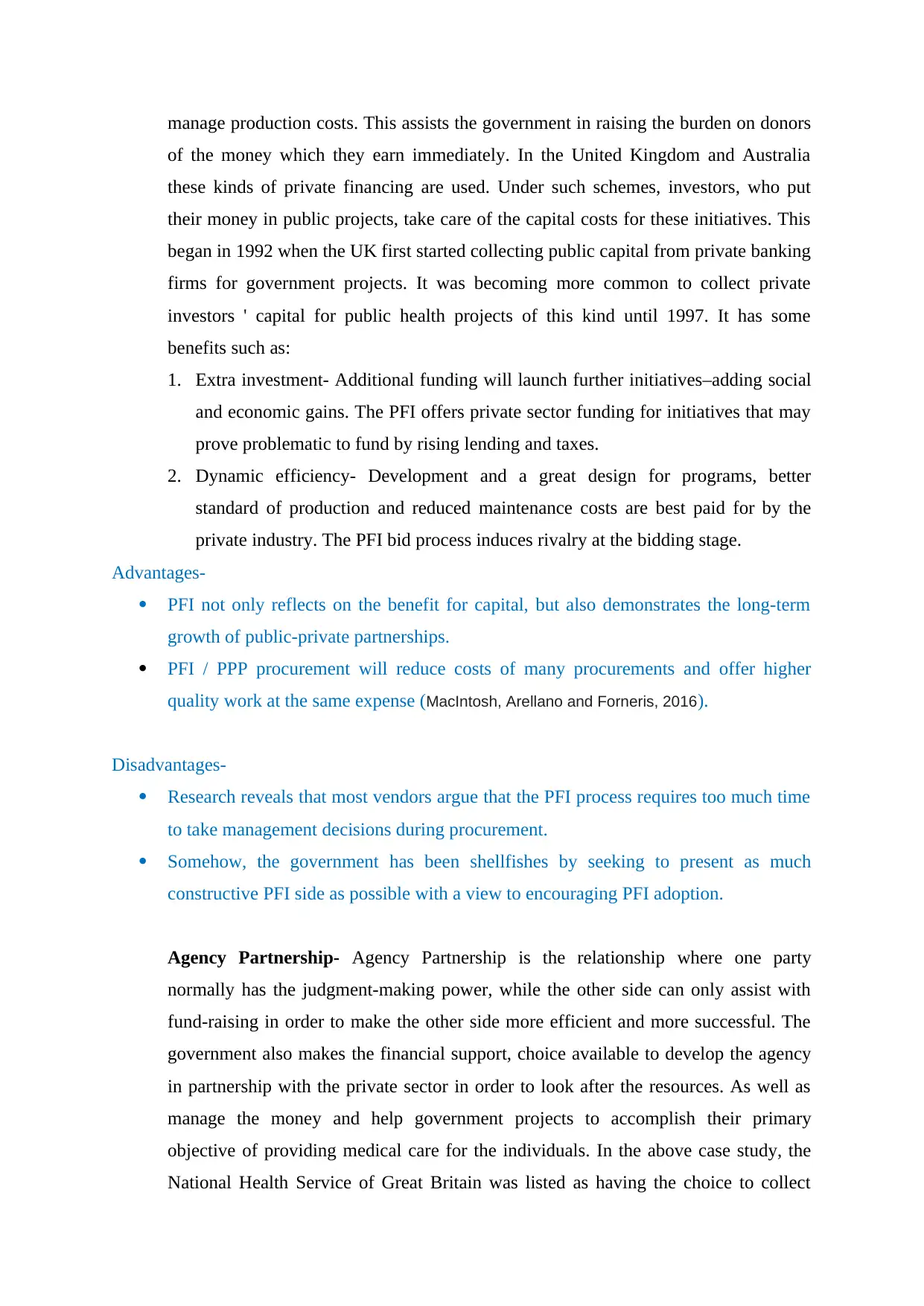

manage production costs. This assists the government in raising the burden on donors

of the money which they earn immediately. In the United Kingdom and Australia

these kinds of private financing are used. Under such schemes, investors, who put

their money in public projects, take care of the capital costs for these initiatives. This

began in 1992 when the UK first started collecting public capital from private banking

firms for government projects. It was becoming more common to collect private

investors ' capital for public health projects of this kind until 1997. It has some

benefits such as:

1. Extra investment- Additional funding will launch further initiatives–adding social

and economic gains. The PFI offers private sector funding for initiatives that may

prove problematic to fund by rising lending and taxes.

2. Dynamic efficiency- Development and a great design for programs, better

standard of production and reduced maintenance costs are best paid for by the

private industry. The PFI bid process induces rivalry at the bidding stage.

Advantages-

PFI not only reflects on the benefit for capital, but also demonstrates the long-term

growth of public-private partnerships.

PFI / PPP procurement will reduce costs of many procurements and offer higher

quality work at the same expense (MacIntosh, Arellano and Forneris, 2016).

Disadvantages-

Research reveals that most vendors argue that the PFI process requires too much time

to take management decisions during procurement.

Somehow, the government has been shellfishes by seeking to present as much

constructive PFI side as possible with a view to encouraging PFI adoption.

Agency Partnership- Agency Partnership is the relationship where one party

normally has the judgment-making power, while the other side can only assist with

fund-raising in order to make the other side more efficient and more successful. The

government also makes the financial support, choice available to develop the agency

in partnership with the private sector in order to look after the resources. As well as

manage the money and help government projects to accomplish their primary

objective of providing medical care for the individuals. In the above case study, the

National Health Service of Great Britain was listed as having the choice to collect

of the money which they earn immediately. In the United Kingdom and Australia

these kinds of private financing are used. Under such schemes, investors, who put

their money in public projects, take care of the capital costs for these initiatives. This

began in 1992 when the UK first started collecting public capital from private banking

firms for government projects. It was becoming more common to collect private

investors ' capital for public health projects of this kind until 1997. It has some

benefits such as:

1. Extra investment- Additional funding will launch further initiatives–adding social

and economic gains. The PFI offers private sector funding for initiatives that may

prove problematic to fund by rising lending and taxes.

2. Dynamic efficiency- Development and a great design for programs, better

standard of production and reduced maintenance costs are best paid for by the

private industry. The PFI bid process induces rivalry at the bidding stage.

Advantages-

PFI not only reflects on the benefit for capital, but also demonstrates the long-term

growth of public-private partnerships.

PFI / PPP procurement will reduce costs of many procurements and offer higher

quality work at the same expense (MacIntosh, Arellano and Forneris, 2016).

Disadvantages-

Research reveals that most vendors argue that the PFI process requires too much time

to take management decisions during procurement.

Somehow, the government has been shellfishes by seeking to present as much

constructive PFI side as possible with a view to encouraging PFI adoption.

Agency Partnership- Agency Partnership is the relationship where one party

normally has the judgment-making power, while the other side can only assist with

fund-raising in order to make the other side more efficient and more successful. The

government also makes the financial support, choice available to develop the agency

in partnership with the private sector in order to look after the resources. As well as

manage the money and help government projects to accomplish their primary

objective of providing medical care for the individuals. In the above case study, the

National Health Service of Great Britain was listed as having the choice to collect

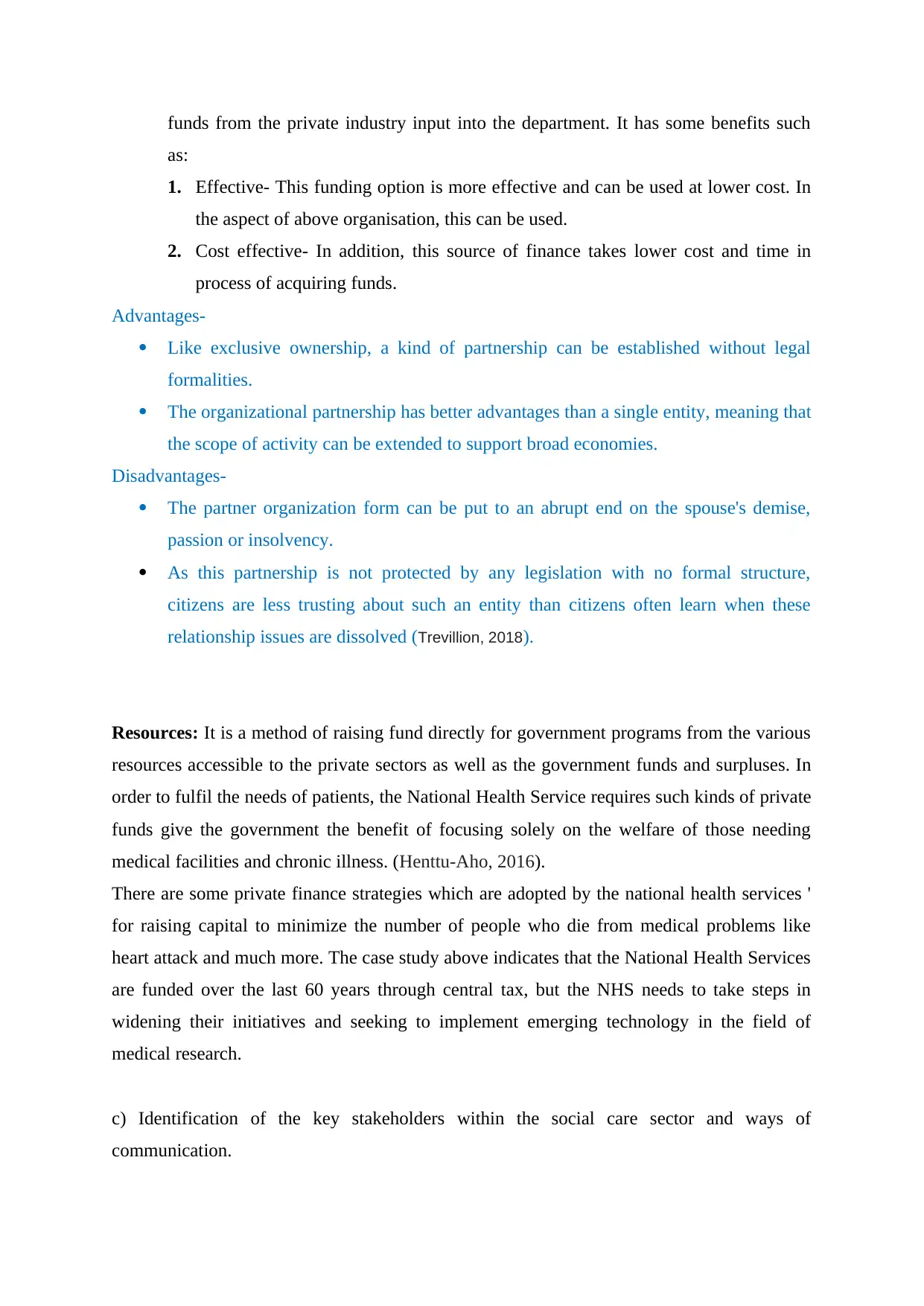

funds from the private industry input into the department. It has some benefits such

as:

1. Effective- This funding option is more effective and can be used at lower cost. In

the aspect of above organisation, this can be used.

2. Cost effective- In addition, this source of finance takes lower cost and time in

process of acquiring funds.

Advantages-

Like exclusive ownership, a kind of partnership can be established without legal

formalities.

The organizational partnership has better advantages than a single entity, meaning that

the scope of activity can be extended to support broad economies.

Disadvantages-

The partner organization form can be put to an abrupt end on the spouse's demise,

passion or insolvency.

As this partnership is not protected by any legislation with no formal structure,

citizens are less trusting about such an entity than citizens often learn when these

relationship issues are dissolved (Trevillion, 2018).

Resources: It is a method of raising fund directly for government programs from the various

resources accessible to the private sectors as well as the government funds and surpluses. In

order to fulfil the needs of patients, the National Health Service requires such kinds of private

funds give the government the benefit of focusing solely on the welfare of those needing

medical facilities and chronic illness. (Henttu-Aho, 2016).

There are some private finance strategies which are adopted by the national health services '

for raising capital to minimize the number of people who die from medical problems like

heart attack and much more. The case study above indicates that the National Health Services

are funded over the last 60 years through central tax, but the NHS needs to take steps in

widening their initiatives and seeking to implement emerging technology in the field of

medical research.

c) Identification of the key stakeholders within the social care sector and ways of

communication.

as:

1. Effective- This funding option is more effective and can be used at lower cost. In

the aspect of above organisation, this can be used.

2. Cost effective- In addition, this source of finance takes lower cost and time in

process of acquiring funds.

Advantages-

Like exclusive ownership, a kind of partnership can be established without legal

formalities.

The organizational partnership has better advantages than a single entity, meaning that

the scope of activity can be extended to support broad economies.

Disadvantages-

The partner organization form can be put to an abrupt end on the spouse's demise,

passion or insolvency.

As this partnership is not protected by any legislation with no formal structure,

citizens are less trusting about such an entity than citizens often learn when these

relationship issues are dissolved (Trevillion, 2018).

Resources: It is a method of raising fund directly for government programs from the various

resources accessible to the private sectors as well as the government funds and surpluses. In

order to fulfil the needs of patients, the National Health Service requires such kinds of private

funds give the government the benefit of focusing solely on the welfare of those needing

medical facilities and chronic illness. (Henttu-Aho, 2016).

There are some private finance strategies which are adopted by the national health services '

for raising capital to minimize the number of people who die from medical problems like

heart attack and much more. The case study above indicates that the National Health Services

are funded over the last 60 years through central tax, but the NHS needs to take steps in

widening their initiatives and seeking to implement emerging technology in the field of

medical research.

c) Identification of the key stakeholders within the social care sector and ways of

communication.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Stakeholders: Stakeholders are persons or groups of people directly involved in the

success and benefit of the company and often decide the appropriate steps. In certain

cases, the government may be shareholders, the creditors who made their investments

in the companies and the interested parties in the business who take advantage of the

company's revenue.

The social care stakeholders may be private industry donors, workers, personnel and

the National Health Services personnel, and people who are in the public's programs for

therapy. It can be conveyed and even reported in the office articles to the main shareholders

in their financial statements and general sessions. The data which main shareholders need is

the quarterly report that shows the progress of the business, in whose creation the national

health services have spent a considerable amount of money. The budget reports provide

shareholders with a map for expenditures, whether the money they spend is used correctly or

not (Henttu-Aho, 2016). These data are often needed in the sense of the previous year for

workers to assess their performance. Such budgets assist the managers in giving the

organization the appropriate role.

The theory of the agency says that the government collects its fund by establishing an agency

with private industries, whereby power over the entity is not given by the private firm to

collect funds. In decision making, corporate management plays a significant role. It helps

managers to coordinate their workers better for the firm's development. This also allows

companies to decide fully how to help the business to expand. Corporate governance allows

the corporation to better control its resources and use its resources wisely and consistently.

The theory of the agency is a concept used to clarify and discuss problems relating to

the connection between managers and their workers. The partnership between owners,

as directors and business managers as agents is the most important. In order to explain

the connections between agents and supervisors, agency theory is used. The agent

serves the principal in a single contract and, irrespective of self-interest, is supposed

to represent the best interest of the principal. The varying desires of directors and

employees may be a source of dispute, because some individuals do not entirely

represent the best desires of the principal.

Outsourcing- Outsourcing is an arrangement in which one business pays another

organization to take liability for a scheduled or ongoing project that is or may be

carried out internally. Outsourcing in the last decade has become incredibly popular

as businesses grow and the demands of firms continue to become so unique, that it is

success and benefit of the company and often decide the appropriate steps. In certain

cases, the government may be shareholders, the creditors who made their investments

in the companies and the interested parties in the business who take advantage of the

company's revenue.

The social care stakeholders may be private industry donors, workers, personnel and

the National Health Services personnel, and people who are in the public's programs for

therapy. It can be conveyed and even reported in the office articles to the main shareholders

in their financial statements and general sessions. The data which main shareholders need is

the quarterly report that shows the progress of the business, in whose creation the national

health services have spent a considerable amount of money. The budget reports provide

shareholders with a map for expenditures, whether the money they spend is used correctly or

not (Henttu-Aho, 2016). These data are often needed in the sense of the previous year for

workers to assess their performance. Such budgets assist the managers in giving the

organization the appropriate role.

The theory of the agency says that the government collects its fund by establishing an agency

with private industries, whereby power over the entity is not given by the private firm to

collect funds. In decision making, corporate management plays a significant role. It helps

managers to coordinate their workers better for the firm's development. This also allows

companies to decide fully how to help the business to expand. Corporate governance allows

the corporation to better control its resources and use its resources wisely and consistently.

The theory of the agency is a concept used to clarify and discuss problems relating to

the connection between managers and their workers. The partnership between owners,

as directors and business managers as agents is the most important. In order to explain

the connections between agents and supervisors, agency theory is used. The agent

serves the principal in a single contract and, irrespective of self-interest, is supposed

to represent the best interest of the principal. The varying desires of directors and

employees may be a source of dispute, because some individuals do not entirely

represent the best desires of the principal.

Outsourcing- Outsourcing is an arrangement in which one business pays another

organization to take liability for a scheduled or ongoing project that is or may be

carried out internally. Outsourcing in the last decade has become incredibly popular

as businesses grow and the demands of firms continue to become so unique, that it is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

not easily available on the domestic market for particular positions (Al-Mutairi, Naser

and Saeid, 2018). Furthermore, with the rise in the start-up climate, outsourcing has

presented investors and developers with a significant discount to find top foreign

development expertise in order to set up their businesses or develop their existing

team.

TASK 2

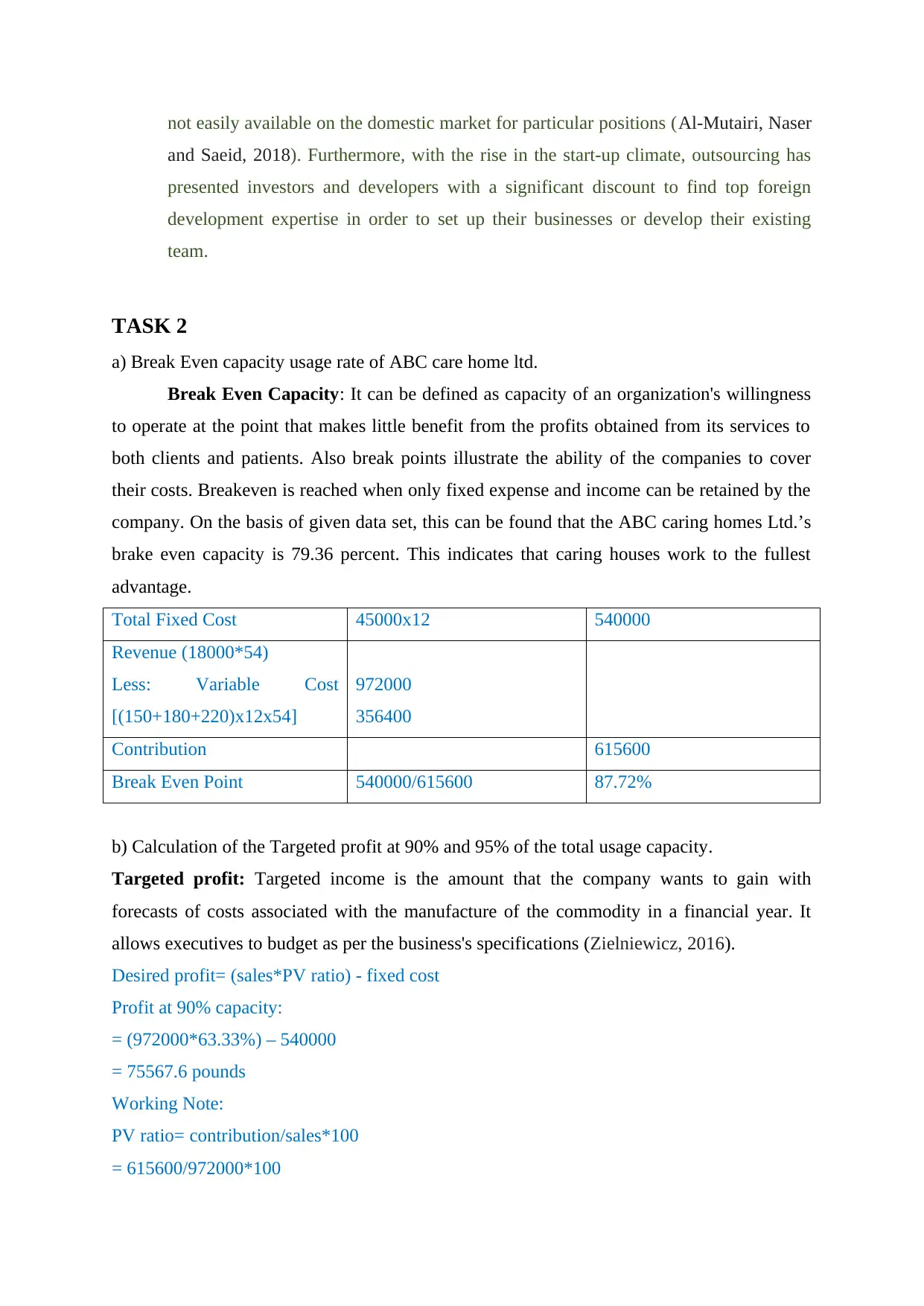

a) Break Even capacity usage rate of ABC care home ltd.

Break Even Capacity: It can be defined as capacity of an organization's willingness

to operate at the point that makes little benefit from the profits obtained from its services to

both clients and patients. Also break points illustrate the ability of the companies to cover

their costs. Breakeven is reached when only fixed expense and income can be retained by the

company. On the basis of given data set, this can be found that the ABC caring homes Ltd.’s

brake even capacity is 79.36 percent. This indicates that caring houses work to the fullest

advantage.

Total Fixed Cost 45000x12 540000

Revenue (18000*54)

Less: Variable Cost

[(150+180+220)x12x54]

972000

356400

Contribution 615600

Break Even Point 540000/615600 87.72%

b) Calculation of the Targeted profit at 90% and 95% of the total usage capacity.

Targeted profit: Targeted income is the amount that the company wants to gain with

forecasts of costs associated with the manufacture of the commodity in a financial year. It

allows executives to budget as per the business's specifications (Zielniewicz, 2016).

Desired profit= (sales*PV ratio) - fixed cost

Profit at 90% capacity:

= (972000*63.33%) – 540000

= 75567.6 pounds

Working Note:

PV ratio= contribution/sales*100

= 615600/972000*100

and Saeid, 2018). Furthermore, with the rise in the start-up climate, outsourcing has

presented investors and developers with a significant discount to find top foreign

development expertise in order to set up their businesses or develop their existing

team.

TASK 2

a) Break Even capacity usage rate of ABC care home ltd.

Break Even Capacity: It can be defined as capacity of an organization's willingness

to operate at the point that makes little benefit from the profits obtained from its services to

both clients and patients. Also break points illustrate the ability of the companies to cover

their costs. Breakeven is reached when only fixed expense and income can be retained by the

company. On the basis of given data set, this can be found that the ABC caring homes Ltd.’s

brake even capacity is 79.36 percent. This indicates that caring houses work to the fullest

advantage.

Total Fixed Cost 45000x12 540000

Revenue (18000*54)

Less: Variable Cost

[(150+180+220)x12x54]

972000

356400

Contribution 615600

Break Even Point 540000/615600 87.72%

b) Calculation of the Targeted profit at 90% and 95% of the total usage capacity.

Targeted profit: Targeted income is the amount that the company wants to gain with

forecasts of costs associated with the manufacture of the commodity in a financial year. It

allows executives to budget as per the business's specifications (Zielniewicz, 2016).

Desired profit= (sales*PV ratio) - fixed cost

Profit at 90% capacity:

= (972000*63.33%) – 540000

= 75567.6 pounds

Working Note:

PV ratio= contribution/sales*100

= 615600/972000*100

= 63.33%

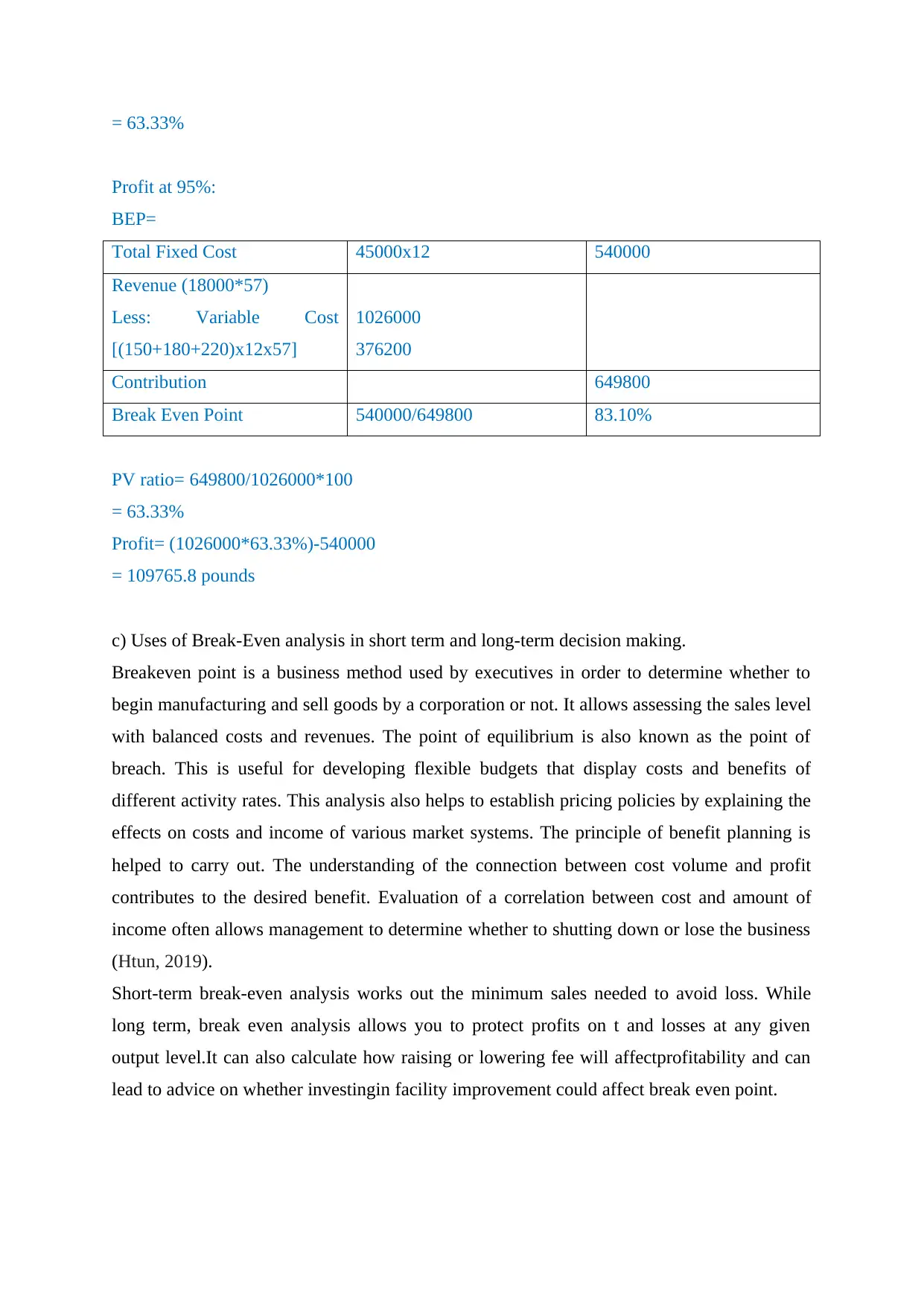

Profit at 95%:

BEP=

Total Fixed Cost 45000x12 540000

Revenue (18000*57)

Less: Variable Cost

[(150+180+220)x12x57]

1026000

376200

Contribution 649800

Break Even Point 540000/649800 83.10%

PV ratio= 649800/1026000*100

= 63.33%

Profit= (1026000*63.33%)-540000

= 109765.8 pounds

c) Uses of Break-Even analysis in short term and long-term decision making.

Breakeven point is a business method used by executives in order to determine whether to

begin manufacturing and sell goods by a corporation or not. It allows assessing the sales level

with balanced costs and revenues. The point of equilibrium is also known as the point of

breach. This is useful for developing flexible budgets that display costs and benefits of

different activity rates. This analysis also helps to establish pricing policies by explaining the

effects on costs and income of various market systems. The principle of benefit planning is

helped to carry out. The understanding of the connection between cost volume and profit

contributes to the desired benefit. Evaluation of a correlation between cost and amount of

income often allows management to determine whether to shutting down or lose the business

(Htun, 2019).

Short-term break-even analysis works out the minimum sales needed to avoid loss. While

long term, break even analysis allows you to protect profits on t and losses at any given

output level.It can also calculate how raising or lowering fee will affectprofitability and can

lead to advice on whether investingin facility improvement could affect break even point.

Profit at 95%:

BEP=

Total Fixed Cost 45000x12 540000

Revenue (18000*57)

Less: Variable Cost

[(150+180+220)x12x57]

1026000

376200

Contribution 649800

Break Even Point 540000/649800 83.10%

PV ratio= 649800/1026000*100

= 63.33%

Profit= (1026000*63.33%)-540000

= 109765.8 pounds

c) Uses of Break-Even analysis in short term and long-term decision making.

Breakeven point is a business method used by executives in order to determine whether to

begin manufacturing and sell goods by a corporation or not. It allows assessing the sales level

with balanced costs and revenues. The point of equilibrium is also known as the point of

breach. This is useful for developing flexible budgets that display costs and benefits of

different activity rates. This analysis also helps to establish pricing policies by explaining the

effects on costs and income of various market systems. The principle of benefit planning is

helped to carry out. The understanding of the connection between cost volume and profit

contributes to the desired benefit. Evaluation of a correlation between cost and amount of

income often allows management to determine whether to shutting down or lose the business

(Htun, 2019).

Short-term break-even analysis works out the minimum sales needed to avoid loss. While

long term, break even analysis allows you to protect profits on t and losses at any given

output level.It can also calculate how raising or lowering fee will affectprofitability and can

lead to advice on whether investingin facility improvement could affect break even point.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 3

(a). Benefits and drawbacks of various budgeting approaches.

The effective process related with planning about future expenses and assuming that

specific amount can be earned by making these expenditures is known as budgeting. The

concept of making budgets can be beneficial for companies in order to identify the most

productive activities andeliminating the ones which can reduce the overall profitability

(Heydari, 2018). In general term, this can be described as an accounting device used to

manage organisation's profits and expenses. Drawing out strategies using various methods

and creating possible predictions dependent on historical evidence is important for corporate

organisations. There are several forms of financial planning strategies that businesses use to

devise an expenditure plan in an acceptable way. In large and small company’s effective

budgets have a greater role as it supports to manage and engage the available monetary as

well as other resources to give higher productivity. Thus, manager is needed to implement the

most suitable strategies while designing budget for the year that are most suitable to the

company’s operation. Some of these techniques are elaborated underneath:

Incremental budgeting: It is mechanism used to build incremental expenditure

plans. This sort of budget is designed by using the details from the previous cycle or by using

the existing situation and results as a basis for making current budget numbers. This is

considering to be main component of financial accounting and is often used to allow minor

adjustments in the organization’s budgets. The addition of any substance in previous year

budget does not requires to follow any sort of mathematical equation because changes are

made as per convenient to reach a specific target. The main benefits and drawbacks are listed

below:

Advantages:

This is really a convenient and efficient method for companies to use, either small or

big. Method of calculation throughout this financial planning is very easy and will

enable administrators report correct amount in the accounting reports.

It's used in most organizations for growing rivalry and creating the importance of

equity amongst operational divisions

Disadvantages:

In this approach the top-level managers ignore creativity and little cost savings.

This promotes massive investment to obtain favourable or beneficial variances.

(a). Benefits and drawbacks of various budgeting approaches.

The effective process related with planning about future expenses and assuming that

specific amount can be earned by making these expenditures is known as budgeting. The

concept of making budgets can be beneficial for companies in order to identify the most

productive activities andeliminating the ones which can reduce the overall profitability

(Heydari, 2018). In general term, this can be described as an accounting device used to

manage organisation's profits and expenses. Drawing out strategies using various methods

and creating possible predictions dependent on historical evidence is important for corporate

organisations. There are several forms of financial planning strategies that businesses use to

devise an expenditure plan in an acceptable way. In large and small company’s effective

budgets have a greater role as it supports to manage and engage the available monetary as

well as other resources to give higher productivity. Thus, manager is needed to implement the

most suitable strategies while designing budget for the year that are most suitable to the

company’s operation. Some of these techniques are elaborated underneath:

Incremental budgeting: It is mechanism used to build incremental expenditure

plans. This sort of budget is designed by using the details from the previous cycle or by using

the existing situation and results as a basis for making current budget numbers. This is

considering to be main component of financial accounting and is often used to allow minor

adjustments in the organization’s budgets. The addition of any substance in previous year

budget does not requires to follow any sort of mathematical equation because changes are

made as per convenient to reach a specific target. The main benefits and drawbacks are listed

below:

Advantages:

This is really a convenient and efficient method for companies to use, either small or

big. Method of calculation throughout this financial planning is very easy and will

enable administrators report correct amount in the accounting reports.

It's used in most organizations for growing rivalry and creating the importance of

equity amongst operational divisions

Disadvantages:

In this approach the top-level managers ignore creativity and little cost savings.

This promotes massive investment to obtain favourable or beneficial variances.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Zero based budgeting: It is primarily used as a forecasting method in financial

accounting, in which expenditure with a zero value is constructed from start. In this system

managers ensure that costs for the relevant duration are justified (Scott, 2017). The

requirement for this kind of budgeting strategy is the foundation for the future and proper

classification about each operation support to reduce the chances contingency. Some of its

major advantages and disadvantages are discussed underneath:

Advantages:

Zero-based budgeting allows administrators to assign expenses according to specific

needs to the company's divisions.

As growing cost in this strategy is explained because it can enable management to

resolve the limitations of incremental expenditure plan.

Disadvantages:

In this process, vast quantities of workers are needed to devise budgets which is not

easy for every organisation to engage more and more worker in budgeting process.

This required some time to shape the budgets because it would be a time-consuming

operation.

Activity based budgeting: According to this budgeting strategy, activity-based cost

is being used to shape financial plan for every specific activity. Under the framework of this

technique expenditure or money were assigned as per their criteria of growing operation

undertaken by the organization. Its main merits and demerits are listed underneath:

Advantages:

It approaches measures every expense driver because it takes into account all the

measures involved in the respective activity of company.

In this financial planning strategy, all unwanted tasks are removed.

Disadvantages:

Within this method the process of evaluating budget is quite complicated and not

easily understandable.

To carry out this method of budgeting, effective and enough expertise is necessary,

and businesses are expected to employ trained staff representatives for this reason.

Rolling budgets: This kind of budget usually include certain addition on previous

budget as per the requirement of company (Downes, Moretti and Nicol, 2017). This mainly

include making suitable changes within the activities which can give higher results for

company and additional alteration into these activities does not make any burden. Some of its

advantages and disadvantages are discussed underneath:

accounting, in which expenditure with a zero value is constructed from start. In this system

managers ensure that costs for the relevant duration are justified (Scott, 2017). The

requirement for this kind of budgeting strategy is the foundation for the future and proper

classification about each operation support to reduce the chances contingency. Some of its

major advantages and disadvantages are discussed underneath:

Advantages:

Zero-based budgeting allows administrators to assign expenses according to specific

needs to the company's divisions.

As growing cost in this strategy is explained because it can enable management to

resolve the limitations of incremental expenditure plan.

Disadvantages:

In this process, vast quantities of workers are needed to devise budgets which is not

easy for every organisation to engage more and more worker in budgeting process.

This required some time to shape the budgets because it would be a time-consuming

operation.

Activity based budgeting: According to this budgeting strategy, activity-based cost

is being used to shape financial plan for every specific activity. Under the framework of this

technique expenditure or money were assigned as per their criteria of growing operation

undertaken by the organization. Its main merits and demerits are listed underneath:

Advantages:

It approaches measures every expense driver because it takes into account all the

measures involved in the respective activity of company.

In this financial planning strategy, all unwanted tasks are removed.

Disadvantages:

Within this method the process of evaluating budget is quite complicated and not

easily understandable.

To carry out this method of budgeting, effective and enough expertise is necessary,

and businesses are expected to employ trained staff representatives for this reason.

Rolling budgets: This kind of budget usually include certain addition on previous

budget as per the requirement of company (Downes, Moretti and Nicol, 2017). This mainly

include making suitable changes within the activities which can give higher results for

company and additional alteration into these activities does not make any burden. Some of its

advantages and disadvantages are discussed underneath:

Advantages:

This is a balanced schedule, where adjustments are made due to results from the

preceding year.

With the aid of this financial planning strategy, evidence of each cost may be

calculated.

Disadvantages:

The method of implementing rolling budget is indeed a time intensive procedure that

takes a significant period to effectively execute all the operations.

The main disadvantages of this techniques are that many time companies make

assumption over negative activities and implement changes by thinking that it will

provide good result in future.

(b). Discourse of specific difficulties faced when budgeting in public sector organisation.

As public service executives carry out budgeting exercises, they need to address

increasing forms of problems and challenges (Naseri and Hosseini, 2017). This is necessary

for all forms of companies to prioritize accordingly so that fiscal capital can be utilized

wisely and consistently. The major difficulties faced by the management of public company

at the time of preparing budgets are:

1. Public sector organisations have as their primary aim the protection of community.

They should not rely on making income, but administrators are expected to ensure

sure they allow good use of the overall public monetary capital.

2. Expenditures plan of public sector firms are presented to the general population

because they want so, so that the administrators face a problem that is linked to the

quality of the sum reported in the report. When it's not correct then that will cause

challenges with the managers and the whole organization.

3. Public sector administrators tend to consider whether the expenditures plan have a

greater level of flexibility in order to make any adjustment as per the government

opinions. However, in the private industry budgets are not needed to be flexible

because once one budget is created then no modifications can be produced.

Thus, it has been determined that manager dealing in public industry are intended to

meet with large number of regulation and laws imposed by governance of a country.

Whereas, the manager in private company are not liable to make every standard of

governance at the time of preparing budget for specific period related to specific activity

(Derfuss, 2016).

This is a balanced schedule, where adjustments are made due to results from the

preceding year.

With the aid of this financial planning strategy, evidence of each cost may be

calculated.

Disadvantages:

The method of implementing rolling budget is indeed a time intensive procedure that

takes a significant period to effectively execute all the operations.

The main disadvantages of this techniques are that many time companies make

assumption over negative activities and implement changes by thinking that it will

provide good result in future.

(b). Discourse of specific difficulties faced when budgeting in public sector organisation.

As public service executives carry out budgeting exercises, they need to address

increasing forms of problems and challenges (Naseri and Hosseini, 2017). This is necessary

for all forms of companies to prioritize accordingly so that fiscal capital can be utilized

wisely and consistently. The major difficulties faced by the management of public company

at the time of preparing budgets are:

1. Public sector organisations have as their primary aim the protection of community.

They should not rely on making income, but administrators are expected to ensure

sure they allow good use of the overall public monetary capital.

2. Expenditures plan of public sector firms are presented to the general population

because they want so, so that the administrators face a problem that is linked to the

quality of the sum reported in the report. When it's not correct then that will cause

challenges with the managers and the whole organization.

3. Public sector administrators tend to consider whether the expenditures plan have a

greater level of flexibility in order to make any adjustment as per the government

opinions. However, in the private industry budgets are not needed to be flexible

because once one budget is created then no modifications can be produced.

Thus, it has been determined that manager dealing in public industry are intended to

meet with large number of regulation and laws imposed by governance of a country.

Whereas, the manager in private company are not liable to make every standard of

governance at the time of preparing budget for specific period related to specific activity

(Derfuss, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.