Management Accounting Report: Financial Strategies for Nisa Retail

VerifiedAdded on 2023/04/04

|17

|4390

|388

Report

AI Summary

This report delves into the realm of management accounting, focusing on its application within a small-scale retail firm, Nisa Retail Stores. The report begins by defining management accounting and exploring different types of management accounting systems, such as inventory management and cost accounting systems. It then moves on to explain various managerial accounting reporting methods, including job cost reports, inventory management reports, and departmental performance reports. Furthermore, the report examines cost calculation techniques, specifically marginal and absorption costing, and discusses the advantages and disadvantages of different planning tools used for budgetary control. Finally, it compares how organizations adapt management accounting systems to address financial problems, providing a comprehensive overview of financial strategies and their impact on business operations. The report is a valuable resource for students studying accounting and management, with access to additional resources and solved assignments on Desklib.

MANAGEMENT ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................................3

P1 Explain management accounting and different types of management accounting system................3

P2 Explaining different methods used for managerial accounting reporting...........................................6

P3 Calculation of costs by applying marginal & absorption costing techniques......................................8

P4 Explain the advantages and disadvantages of different types of planning tools used for budgetary

control...................................................................................................................................................11

P5 Compare how organizations are adapting management accounting systems to respond to financial

problems...............................................................................................................................................13

CONCLUSION.............................................................................................................................................14

REFERENCES..............................................................................................................................................15

INTRODUCTION...........................................................................................................................................3

P1 Explain management accounting and different types of management accounting system................3

P2 Explaining different methods used for managerial accounting reporting...........................................6

P3 Calculation of costs by applying marginal & absorption costing techniques......................................8

P4 Explain the advantages and disadvantages of different types of planning tools used for budgetary

control...................................................................................................................................................11

P5 Compare how organizations are adapting management accounting systems to respond to financial

problems...............................................................................................................................................13

CONCLUSION.............................................................................................................................................14

REFERENCES..............................................................................................................................................15

INTRODUCTION

The process under which financial information of the business assists top management in

businesss planning, policy formulation, executive control over the daily operations and

appeciation of the effectiveness. In the management accounting, higher business authority gather

accounting related information from purchase, sales, marketing, finance and other departments

through reporting and analyze the same to frame better growth plans and informed organizational

decisions. It not only considers important for the larged sized entities, but also gains equal

importance for the small and medium sized corporations who significantly contributes in the

economic growth & success. British retail industry is one of the fastly growing sector in the

corporate world, therefore, the report has taken into consideration a small sized retail firm, Nisa

Retail Stores. It aims at supporting the community all across the UK by rendering them high

quality of food items at competitive prices. The report presents a deeply evaluation of distinguish

reporting and systems of management accounting that assist managers with regards to policy

creation & business decisions. Besides this, cost calculation is an important operational asepct,

henceforth, the report will undertake the practical use of two costing techniques, full as well as

variable costing. Later, traditional as well as contemproary techniques of budgeting formulation

i.e. incremental, zero based and otehrs will be discussed in context to Nisa’s success.

P1 Explain management accounting and different types of management accounting system

Nisa retail store is selected for the current project report which is small scale retail store

who started their business at small level. This entity currently deals in grocery and food products

which are essential requirement of an individual. This is located in the United Kingdom in order

to satisfy the higher expectations of various customers as they want variety of products or

services offered by an enterprise. This retail store is exists in the external market which has

expanded their overall business (Kotas, 2014). The scope of retail industry is gradually

increasing as this has attracted wide tuber of businesses in the current sector which is generating

higher business revenues. An entity exists in the retail sector need to implement various business

policies and practices in order to maintain their existence for long tie in the business to generate

higher revenue and income in the business environment.

The process under which financial information of the business assists top management in

businesss planning, policy formulation, executive control over the daily operations and

appeciation of the effectiveness. In the management accounting, higher business authority gather

accounting related information from purchase, sales, marketing, finance and other departments

through reporting and analyze the same to frame better growth plans and informed organizational

decisions. It not only considers important for the larged sized entities, but also gains equal

importance for the small and medium sized corporations who significantly contributes in the

economic growth & success. British retail industry is one of the fastly growing sector in the

corporate world, therefore, the report has taken into consideration a small sized retail firm, Nisa

Retail Stores. It aims at supporting the community all across the UK by rendering them high

quality of food items at competitive prices. The report presents a deeply evaluation of distinguish

reporting and systems of management accounting that assist managers with regards to policy

creation & business decisions. Besides this, cost calculation is an important operational asepct,

henceforth, the report will undertake the practical use of two costing techniques, full as well as

variable costing. Later, traditional as well as contemproary techniques of budgeting formulation

i.e. incremental, zero based and otehrs will be discussed in context to Nisa’s success.

P1 Explain management accounting and different types of management accounting system

Nisa retail store is selected for the current project report which is small scale retail store

who started their business at small level. This entity currently deals in grocery and food products

which are essential requirement of an individual. This is located in the United Kingdom in order

to satisfy the higher expectations of various customers as they want variety of products or

services offered by an enterprise. This retail store is exists in the external market which has

expanded their overall business (Kotas, 2014). The scope of retail industry is gradually

increasing as this has attracted wide tuber of businesses in the current sector which is generating

higher business revenues. An entity exists in the retail sector need to implement various business

policies and practices in order to maintain their existence for long tie in the business to generate

higher revenue and income in the business environment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Several problems faced by an entity that started their business on a small scale level as

they initially require enough amount of finance to uplift their current working conditions of their

overall business. Quality of all the products should be enough to retain all the consumers with

the business for long time as external market competition will decrease the market share by

offering affordable products to attract wide number of customers. Customer’s satisfaction level

will be increases by an entity to beat all their rivals as primary aim of the business in the current

business environment is to satisfy all the customers located in the external market.

Management accounting principles are emphasized on reducing current costs incurred in

the business which needs to be identified first in reducing with the passage time. Cost sheets are

thee to analyze the current figure of costs to be incurred in the business as management

accountants are appointed for the betterment of an entity as they held responsible for analyzing

of the current business performance of the business in order to gain competitive advantage over

its variety of customers (Lukka, 2014). It is regarded as that important process in which sources

of costs are analyzed in order to reduce all costs along with the proper management systems used

by an entity in order to improve the singular efficiency of all the business activities included in

an entity. Some management accounting systems which hips Nisa retailer is given as below:

Inventory management system- Inventories are important source of an entity that needs to be

procured in the business till it gets all the customers as this will not remain in the business for the

long time (Rossi, 2014). The inventories will not store in the business for long time as it

increases the overall warehousing costs in the organization which in turn decreases the overall

income earned by the business in a particular financial year. The management of inventory gets

possible by adopting appropriate system of managing inventory. The management of inventory

gets possible by evaluating the stock values as this helps in taking important business actions in

the favor of the current business performance. The proper valuation of inventory will help in

increasing the overall profitability of the business within a given time period as this would help

an entity in order to grab higher market share in the external market.

FIFO- It is an acronym that stands for first in first out method which is important method

managing overall inventories takes places in the business which requires proper management of

all the stock procured in the business enterprise. The inventories included in the business have

various forms such as raw materials, manufacturing goods, work in progress inventories. All thee

they initially require enough amount of finance to uplift their current working conditions of their

overall business. Quality of all the products should be enough to retain all the consumers with

the business for long time as external market competition will decrease the market share by

offering affordable products to attract wide number of customers. Customer’s satisfaction level

will be increases by an entity to beat all their rivals as primary aim of the business in the current

business environment is to satisfy all the customers located in the external market.

Management accounting principles are emphasized on reducing current costs incurred in

the business which needs to be identified first in reducing with the passage time. Cost sheets are

thee to analyze the current figure of costs to be incurred in the business as management

accountants are appointed for the betterment of an entity as they held responsible for analyzing

of the current business performance of the business in order to gain competitive advantage over

its variety of customers (Lukka, 2014). It is regarded as that important process in which sources

of costs are analyzed in order to reduce all costs along with the proper management systems used

by an entity in order to improve the singular efficiency of all the business activities included in

an entity. Some management accounting systems which hips Nisa retailer is given as below:

Inventory management system- Inventories are important source of an entity that needs to be

procured in the business till it gets all the customers as this will not remain in the business for the

long time (Rossi, 2014). The inventories will not store in the business for long time as it

increases the overall warehousing costs in the organization which in turn decreases the overall

income earned by the business in a particular financial year. The management of inventory gets

possible by adopting appropriate system of managing inventory. The management of inventory

gets possible by evaluating the stock values as this helps in taking important business actions in

the favor of the current business performance. The proper valuation of inventory will help in

increasing the overall profitability of the business within a given time period as this would help

an entity in order to grab higher market share in the external market.

FIFO- It is an acronym that stands for first in first out method which is important method

managing overall inventories takes places in the business which requires proper management of

all the stock procured in the business enterprise. The inventories included in the business have

various forms such as raw materials, manufacturing goods, work in progress inventories. All thee

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

inventories play an important role in the business as this helps in enhancing overall performance

of an entity (Kotas, 2014). In this approach old inventories are sold first in the organization as

physical inventories can be tracked by an individual in a particular financial year. The cost

valuation shown in the balance sheet at the actual value of inventory whose valuation is done on

the basis of FIFO method will directly show in the balance sheet under the head current assets as

inventories. Thee inventories shown in the balance sheet are regarded as the final and closing

balance of all the inventories.

Date Particulars Number of units Per unit cost Total value

1 April 2017 Beginning

inventory

100 20 2000

5 Purchase 250 50 12500

6 Purchase 300 80 24000

650 29500

10 Sale 500 (100*20)+(250*5

0)+(150*80)

26500

10 Closing inventory (150*80) 12000

LIFO- Last in first out method is another important method used in valuation of all the stocks

held n the business for generating higher business returns in the near future. It is an acronym that

stands for last in first out method which helps in managing overall inventory in the business to

generate optimum return by selling all the existing inventories held in the business for long

period by the business enterprise. Under this particular method the value of sales will be based

on the lastly purchase items included in the business long time period in order to meet the

desired needs and the expectations of the business enterprise.

Date Particulars Number of units Per unit cost Total value

1 April 2017 Purchase 300 60 18000

6 Purchase 450 20 9000

750 27000

11 Sale 450 (450*20) 9000

10 Closing inventory (300*60) 18000

of an entity (Kotas, 2014). In this approach old inventories are sold first in the organization as

physical inventories can be tracked by an individual in a particular financial year. The cost

valuation shown in the balance sheet at the actual value of inventory whose valuation is done on

the basis of FIFO method will directly show in the balance sheet under the head current assets as

inventories. Thee inventories shown in the balance sheet are regarded as the final and closing

balance of all the inventories.

Date Particulars Number of units Per unit cost Total value

1 April 2017 Beginning

inventory

100 20 2000

5 Purchase 250 50 12500

6 Purchase 300 80 24000

650 29500

10 Sale 500 (100*20)+(250*5

0)+(150*80)

26500

10 Closing inventory (150*80) 12000

LIFO- Last in first out method is another important method used in valuation of all the stocks

held n the business for generating higher business returns in the near future. It is an acronym that

stands for last in first out method which helps in managing overall inventory in the business to

generate optimum return by selling all the existing inventories held in the business for long

period by the business enterprise. Under this particular method the value of sales will be based

on the lastly purchase items included in the business long time period in order to meet the

desired needs and the expectations of the business enterprise.

Date Particulars Number of units Per unit cost Total value

1 April 2017 Purchase 300 60 18000

6 Purchase 450 20 9000

750 27000

11 Sale 450 (450*20) 9000

10 Closing inventory (300*60) 18000

Cost accounting systems- Cost is the primary concern of the business as this is essential factor

in improving the overall business of an entity (Kokubu and Kitada, 2015). Costs accounting

systems will consider all kinds of costs incurred in an entity such as fixed as well as variable

costs incurred in the business. All kinds of costs includes in the business to recognizes the

current capability of the firm in order to capture higher market share by reducing its all the

current business costs. Current business costs incurred in the business involves utility bills,

marketing costs, staff salary, kitchen equipment, maintenance, website designing and web

domain costs. All the costs are identified by the management in order to analyses its caliber so

that the focus of an entity ca shifted towards the higher market opportunities.

Cost can be reduced by using various voluntary services in order to organize web

designing contests in which various freelancers take part so that the website will be easily

designed by the business. Accounting of daily routine costs is essential in order to know the

regular as well as potential customers of the business. Hidden aspects of the business are

identified in the cost accounting systems in which major criteria of costs will be selected which

helps in classifying overall costs in the business organizations (Chenhall, 2012). Costs are

majorly classified into two main categories such as fixed as well as variable costs incurred in the

business. Cost of the business will be identified in order to adopt the best suitable system which

will be implemented by an entity in order to enhance the overall efficiency of the business. Cost

is regarded as important obligations imposed on an entity that needs to be reduced with the

passage of time in order to improve the current business conditions of an entity. Ascertainment

of costs can also be compared with the pilot study conducted by an entity in which firstly the

costs is identified and then an entity will make business action in order to enhance their overall

performance.

P2 Explaining different methods used for managerial accounting reporting

To: Nisa’s General Manager

From: MAO (Management Accounting officer)

Date: 13th April 2017

Subject: Various methods of managerial accounting reporting

In the field of management accounting, executives, board of directors and other decision-

in improving the overall business of an entity (Kokubu and Kitada, 2015). Costs accounting

systems will consider all kinds of costs incurred in an entity such as fixed as well as variable

costs incurred in the business. All kinds of costs includes in the business to recognizes the

current capability of the firm in order to capture higher market share by reducing its all the

current business costs. Current business costs incurred in the business involves utility bills,

marketing costs, staff salary, kitchen equipment, maintenance, website designing and web

domain costs. All the costs are identified by the management in order to analyses its caliber so

that the focus of an entity ca shifted towards the higher market opportunities.

Cost can be reduced by using various voluntary services in order to organize web

designing contests in which various freelancers take part so that the website will be easily

designed by the business. Accounting of daily routine costs is essential in order to know the

regular as well as potential customers of the business. Hidden aspects of the business are

identified in the cost accounting systems in which major criteria of costs will be selected which

helps in classifying overall costs in the business organizations (Chenhall, 2012). Costs are

majorly classified into two main categories such as fixed as well as variable costs incurred in the

business. Cost of the business will be identified in order to adopt the best suitable system which

will be implemented by an entity in order to enhance the overall efficiency of the business. Cost

is regarded as important obligations imposed on an entity that needs to be reduced with the

passage of time in order to improve the current business conditions of an entity. Ascertainment

of costs can also be compared with the pilot study conducted by an entity in which firstly the

costs is identified and then an entity will make business action in order to enhance their overall

performance.

P2 Explaining different methods used for managerial accounting reporting

To: Nisa’s General Manager

From: MAO (Management Accounting officer)

Date: 13th April 2017

Subject: Various methods of managerial accounting reporting

In the field of management accounting, executives, board of directors and other decision-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

making authority of the Nisa retailer will make an in-depth evaluation & assessment of their

performance. This process requires information collection which managers gathers from various

reports designed and prepared for distinctive purpose. Several essential & important reports

which managers can utilize are presented here as under:

Job cost report: This report provide essential information to the managerial team and top

authority for the expenditures incurred on a specific kind of job (Faÿ, Introna and Puyou, 2010). It

comprises various set of material information about material purchase, wages paid & overheads

incurred, so that, total cost and profitability on the job work can be founded.

Inventory Management report: Inventory management is a crucial or important area of

operational management, in which, authority aims at maintaing adequate quantum of goods &

services in the stock, so that, risk of sudden inrease in market demand can be meet out

efficiently. This report presents information about physical inventories, hourly cost of labor,

overhead/unit and wastage as well. With this, Nisa’s managers can compare various assembly

lines in the production process and make better decisions to bring substantial improvement in the

actual results.

Debtors/accounts receivable report: Nisa store offer goods & services on cash & credit

basis. For the effective management of cash sources, managers must look towards their trade

receivables, also called debtors. This reports aware the credit collection departments about the

outstanding balances of the customer accounts, time of delay and others, which in turn, manager

can set right decisions to promtply recieve the payments from users by tightening the cash

collection policy (Sullivan, 2012). Moreover, effective decisions can be carried for assessing and

evaluating the consumer creditworthiness before granting them services on credit.

Segmental/Departmental stores: It gives information regarding th performance of each

& every division, segment or departmental stores of Nisa retailer. With the help of such report,

policy makers can determine the segment which lacks behind the targeted results and assists in

strategies creation for bringing out significant level of improvement in the actual results by

driving milennial audience base, better use of resources, appropriate marketing plan, cutting of

cost, boosting saving & others growth strategies.

Performance reports: This reports can be used by the Nisa’s Board of directors (BOD),

in which, detailed information is provided to measure the operational activities results and its

performance. This process requires information collection which managers gathers from various

reports designed and prepared for distinctive purpose. Several essential & important reports

which managers can utilize are presented here as under:

Job cost report: This report provide essential information to the managerial team and top

authority for the expenditures incurred on a specific kind of job (Faÿ, Introna and Puyou, 2010). It

comprises various set of material information about material purchase, wages paid & overheads

incurred, so that, total cost and profitability on the job work can be founded.

Inventory Management report: Inventory management is a crucial or important area of

operational management, in which, authority aims at maintaing adequate quantum of goods &

services in the stock, so that, risk of sudden inrease in market demand can be meet out

efficiently. This report presents information about physical inventories, hourly cost of labor,

overhead/unit and wastage as well. With this, Nisa’s managers can compare various assembly

lines in the production process and make better decisions to bring substantial improvement in the

actual results.

Debtors/accounts receivable report: Nisa store offer goods & services on cash & credit

basis. For the effective management of cash sources, managers must look towards their trade

receivables, also called debtors. This reports aware the credit collection departments about the

outstanding balances of the customer accounts, time of delay and others, which in turn, manager

can set right decisions to promtply recieve the payments from users by tightening the cash

collection policy (Sullivan, 2012). Moreover, effective decisions can be carried for assessing and

evaluating the consumer creditworthiness before granting them services on credit.

Segmental/Departmental stores: It gives information regarding th performance of each

& every division, segment or departmental stores of Nisa retailer. With the help of such report,

policy makers can determine the segment which lacks behind the targeted results and assists in

strategies creation for bringing out significant level of improvement in the actual results by

driving milennial audience base, better use of resources, appropriate marketing plan, cutting of

cost, boosting saving & others growth strategies.

Performance reports: This reports can be used by the Nisa’s Board of directors (BOD),

in which, detailed information is provided to measure the operational activities results and its

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

success over the given time (Fullerton, Kennedy and Widener, 2013). It presents various key

performance indicators (KPIs) i.e. profitability, resource utilization, cost-cutting plans, sales

trend, control over wastage, stock management & others and assist the team in phenomenal

business growth planning.

Operating budget report: Under this reports, set targets income & payments are

communicated to the top managerial authority which facilitates the team to analyze the

divisional’s performance i.e. production efficiency, sales performance, suppliers charges,

marketing operations etc. and provide better control over the costs (Ionescu, 2016). Nisa’s owner

as well as top decision-making authority can also use it as incentive scheme for the workers to

carry out their work with great level of efficiency to meet the decided goals.

Product/service profitability report: As the given name, it gives information about the

return on each and every product offered by the Nisa retail store which is measured by the excess

of revenues over costs made and assist the managers in making a right planning to maximize net

yield by maximizing sales & cutting cost.

P3 Calculation of costs by applying marginal & absorption costing techniques

Finding the right cost of production and goods sold is very important decisions for the

Nisa retail store, and also affect other aspects like profitability determination, pricing fixation

and others. There are two most often utilized techniques which business entities can use that are

marginal & absorption costing, enumerated here below:

Marginal/variable costing: In simple words, marginal cost refers to the cost of

manufacturing a single unit of item or service. With context to Nisa, if production department

produce one more unit, then, business entity will only the variable cost such as material, labor

and others. Thus, this costing method believes that only the variable prodcution cost should be

considered for finding out the production cost and avoid fixed production overheads (Saladrigues

and Tena, 2017).

Absorption/full-costing: In contrast to marginal, this method favors the accumulation of

all the production overheads i.e. fixed & variable while figuring out the cost of production, this is

the reason why it is also called full costing.

performance indicators (KPIs) i.e. profitability, resource utilization, cost-cutting plans, sales

trend, control over wastage, stock management & others and assist the team in phenomenal

business growth planning.

Operating budget report: Under this reports, set targets income & payments are

communicated to the top managerial authority which facilitates the team to analyze the

divisional’s performance i.e. production efficiency, sales performance, suppliers charges,

marketing operations etc. and provide better control over the costs (Ionescu, 2016). Nisa’s owner

as well as top decision-making authority can also use it as incentive scheme for the workers to

carry out their work with great level of efficiency to meet the decided goals.

Product/service profitability report: As the given name, it gives information about the

return on each and every product offered by the Nisa retail store which is measured by the excess

of revenues over costs made and assist the managers in making a right planning to maximize net

yield by maximizing sales & cutting cost.

P3 Calculation of costs by applying marginal & absorption costing techniques

Finding the right cost of production and goods sold is very important decisions for the

Nisa retail store, and also affect other aspects like profitability determination, pricing fixation

and others. There are two most often utilized techniques which business entities can use that are

marginal & absorption costing, enumerated here below:

Marginal/variable costing: In simple words, marginal cost refers to the cost of

manufacturing a single unit of item or service. With context to Nisa, if production department

produce one more unit, then, business entity will only the variable cost such as material, labor

and others. Thus, this costing method believes that only the variable prodcution cost should be

considered for finding out the production cost and avoid fixed production overheads (Saladrigues

and Tena, 2017).

Absorption/full-costing: In contrast to marginal, this method favors the accumulation of

all the production overheads i.e. fixed & variable while figuring out the cost of production, this is

the reason why it is also called full costing.

Difference between marginal & absorption costing

MC considers variable costs for inventory valuation, unlike it, under absorption, both

fixed & variable production expenses are considered.

Under MC, fixed overheads are treated differently because they are considered as

periodic costs through the profit-volume-ratio (Banerjee and Das, 2017). However, on the

other hand, under absorption costing, fixed costs is charged to the production costs.

MC, production cost per unit is not affected with the difference of opening and closing

inventories. However, under absorption costing, it afffects the production cost each unit.

Computation of cost of production/unit

Items Absorption/full costing Marginal/variable

Material purchased 6 6

Direct labor's wages 5 5

Variable production overheads 2 2

Fixed production expense 3 -

Production cost/per unit 16 13

Fixed production overhead absorption rate (OAR)

= Total budgeted fixed production overheads/Number of units

= 1800GBP/600units

= 3GBP/unit

Calculation of cost of goods sold Actual

Material purchase 4200.00

Labor’s wages 3500.00

Variable manufacturing/production overheads 1400.00

Fixed production overheads 2100.00

Costs of production 11200.00

MC considers variable costs for inventory valuation, unlike it, under absorption, both

fixed & variable production expenses are considered.

Under MC, fixed overheads are treated differently because they are considered as

periodic costs through the profit-volume-ratio (Banerjee and Das, 2017). However, on the

other hand, under absorption costing, fixed costs is charged to the production costs.

MC, production cost per unit is not affected with the difference of opening and closing

inventories. However, under absorption costing, it afffects the production cost each unit.

Computation of cost of production/unit

Items Absorption/full costing Marginal/variable

Material purchased 6 6

Direct labor's wages 5 5

Variable production overheads 2 2

Fixed production expense 3 -

Production cost/per unit 16 13

Fixed production overhead absorption rate (OAR)

= Total budgeted fixed production overheads/Number of units

= 1800GBP/600units

= 3GBP/unit

Calculation of cost of goods sold Actual

Material purchase 4200.00

Labor’s wages 3500.00

Variable manufacturing/production overheads 1400.00

Fixed production overheads 2100.00

Costs of production 11200.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Add: Opening/beginning inventory

less: ending/closing inventory 1600.00

Cost of goods sold (COGS) 9600.00

COGS/unit 16.00

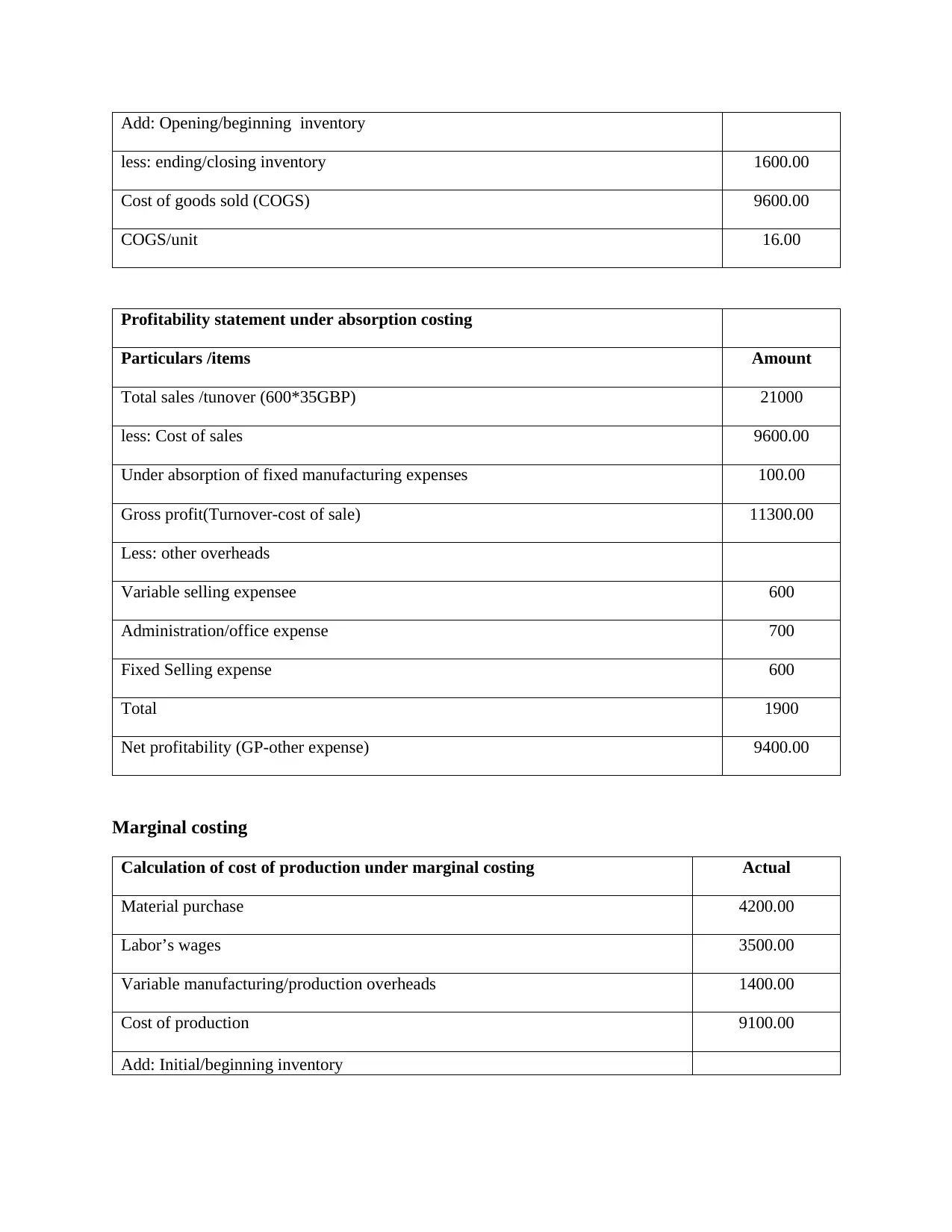

Profitability statement under absorption costing

Particulars /items Amount

Total sales /tunover (600*35GBP) 21000

less: Cost of sales 9600.00

Under absorption of fixed manufacturing expenses 100.00

Gross profit(Turnover-cost of sale) 11300.00

Less: other overheads

Variable selling expensee 600

Administration/office expense 700

Fixed Selling expense 600

Total 1900

Net profitability (GP-other expense) 9400.00

Marginal costing

Calculation of cost of production under marginal costing Actual

Material purchase 4200.00

Labor’s wages 3500.00

Variable manufacturing/production overheads 1400.00

Cost of production 9100.00

Add: Initial/beginning inventory

less: ending/closing inventory 1600.00

Cost of goods sold (COGS) 9600.00

COGS/unit 16.00

Profitability statement under absorption costing

Particulars /items Amount

Total sales /tunover (600*35GBP) 21000

less: Cost of sales 9600.00

Under absorption of fixed manufacturing expenses 100.00

Gross profit(Turnover-cost of sale) 11300.00

Less: other overheads

Variable selling expensee 600

Administration/office expense 700

Fixed Selling expense 600

Total 1900

Net profitability (GP-other expense) 9400.00

Marginal costing

Calculation of cost of production under marginal costing Actual

Material purchase 4200.00

Labor’s wages 3500.00

Variable manufacturing/production overheads 1400.00

Cost of production 9100.00

Add: Initial/beginning inventory

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

less: Ending/closing inventory 1300.00

Cost of goods sold (COGS) 7800.00

COGS/unit 13

Computing the net profitability using marginal/variable costing method

ActualParticulars/Items

Turnover (600*35) 21000

less: Cost of goods sold (COGS) 7800.00

Variable selling overheads 600

Total variable cost (TVC) 8400.00

Total contribution (sales –TVC) 12600.00

Less: Fixed expenses

Administrative overheads 700

Selling expense 600

Total fixed cost (TFC) 1300

Net profitability/return (Contribution – TFC) 11300.00

Interpretation: Findings the outcome of the above results, it is founded that cost of

production under absorption and marginal costing founded to 16 & 13 per unit. Further, profit

under the full costing method is derived to 9400 whilst in marginal, contribution was figured to

12,600 & net profit identified to 11,300.

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control

Cash flow statements- Cash flow statement's is used by an entity in order to determine

the current movement of cash in the overall business (Kokubu and Kitada, 2015). It includes

three important activities such as operating, investing and financing activities in order to

Cost of goods sold (COGS) 7800.00

COGS/unit 13

Computing the net profitability using marginal/variable costing method

ActualParticulars/Items

Turnover (600*35) 21000

less: Cost of goods sold (COGS) 7800.00

Variable selling overheads 600

Total variable cost (TVC) 8400.00

Total contribution (sales –TVC) 12600.00

Less: Fixed expenses

Administrative overheads 700

Selling expense 600

Total fixed cost (TFC) 1300

Net profitability/return (Contribution – TFC) 11300.00

Interpretation: Findings the outcome of the above results, it is founded that cost of

production under absorption and marginal costing founded to 16 & 13 per unit. Further, profit

under the full costing method is derived to 9400 whilst in marginal, contribution was figured to

12,600 & net profit identified to 11,300.

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control

Cash flow statements- Cash flow statement's is used by an entity in order to determine

the current movement of cash in the overall business (Kokubu and Kitada, 2015). It includes

three important activities such as operating, investing and financing activities in order to

determine the final balance of cash by comparing it with the closing balance of cash in the

business enterprise. The benefit of using cash flow statement's to know the current position of

cash in the organization as it is important to have cash in the firm to meet all kinds of short term

obligations in the business enterprise. Limitation of cash flow statement's is that higher deficits

incurred in the business will affect the overall performance of an entity.

Budgetary control- Budgets are important written statement's that includes all the

financial resources incurred in the business in order to grab higher market share by improving

existing business performance of an entity. Budgets are prepared for various components in the

business such as all the expenses, sales budget, purchase budget. It is essential to prepare

different kinds of budgets in enhancing overall business performance of an entity with the

passage of time that helps in creating higher position of the business in the external market

(Kokubu and Kitada, 2015). In the preparation of budget it is important to record all the business

incomes and expenditures in the appropriate proportion to gain higher market share.

Standard costing- Standard costing is used by an entity in order to improve the current

performance of an entity in order to eliminate all the existing deficiency of the business which is

restricting the business performance of an entity in order to grab higher market advantage in the

near future. The major objectives of the standard costing is to compare actual output of the

business as compared to all he standards prepared by an entity in order to regulate the current

tasks and duties allocated to all the employees working in the business for the betterment of an

enterprise. It has various aspects such as material variance, labor variance and overhead variance.

Overhead variance has classified into two types such as fixed as well as variable overhead that

enhances overall business performance of an enterprise.

Financial statement's analysis- Financial statement's prepared by an entity is to reflect

the financial performance of an entity after consider all kinds of financial resources included in

various financial statements included in the business enterprise of Hungry house (Ng, Harrison

and Akroyd, 2013). Financial statement's has standard formats such as income statement's,

balance sheet and cash flow statements which are fund in every businesses wants to determine

their financial performance after analyzing all the financial resources kept in an entity. The

performance of an entity will be classified into two types such as qualitative and quantitative

kinds of information interpreted by variety of business in order to make important decisions

business enterprise. The benefit of using cash flow statement's to know the current position of

cash in the organization as it is important to have cash in the firm to meet all kinds of short term

obligations in the business enterprise. Limitation of cash flow statement's is that higher deficits

incurred in the business will affect the overall performance of an entity.

Budgetary control- Budgets are important written statement's that includes all the

financial resources incurred in the business in order to grab higher market share by improving

existing business performance of an entity. Budgets are prepared for various components in the

business such as all the expenses, sales budget, purchase budget. It is essential to prepare

different kinds of budgets in enhancing overall business performance of an entity with the

passage of time that helps in creating higher position of the business in the external market

(Kokubu and Kitada, 2015). In the preparation of budget it is important to record all the business

incomes and expenditures in the appropriate proportion to gain higher market share.

Standard costing- Standard costing is used by an entity in order to improve the current

performance of an entity in order to eliminate all the existing deficiency of the business which is

restricting the business performance of an entity in order to grab higher market advantage in the

near future. The major objectives of the standard costing is to compare actual output of the

business as compared to all he standards prepared by an entity in order to regulate the current

tasks and duties allocated to all the employees working in the business for the betterment of an

enterprise. It has various aspects such as material variance, labor variance and overhead variance.

Overhead variance has classified into two types such as fixed as well as variable overhead that

enhances overall business performance of an enterprise.

Financial statement's analysis- Financial statement's prepared by an entity is to reflect

the financial performance of an entity after consider all kinds of financial resources included in

various financial statements included in the business enterprise of Hungry house (Ng, Harrison

and Akroyd, 2013). Financial statement's has standard formats such as income statement's,

balance sheet and cash flow statements which are fund in every businesses wants to determine

their financial performance after analyzing all the financial resources kept in an entity. The

performance of an entity will be classified into two types such as qualitative and quantitative

kinds of information interpreted by variety of business in order to make important decisions

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.