Financial Reporting: Purpose, Framework, Analysis, and Statements

VerifiedAdded on 2021/02/19

|14

|4013

|203

Report

AI Summary

This report provides a comprehensive overview of financial reporting. It begins by defining financial reporting and outlining its various purposes, such as providing information, supporting decision-making, regulating performance, and controlling financial data. The report then delves into the conceptual and regulatory frameworks, including GAAP and IFRS, highlighting their requirements and purposes. It emphasizes the importance of qualitative characteristics like relevance, reliability, understandability, and comparability. The report identifies and discusses various internal and external stakeholders, including employees, owners, suppliers, customers, and investors, detailing their respective interests in financial information. Furthermore, the report explores how financial reporting fulfills organizational objectives and promotes growth, emphasizing its role in benchmarking and decision-making. It includes sample financial statements (income statement, statement of changes in equity, and balance sheet) and concludes with an analysis of financial statements, including liquidity ratios and the differences between cash flow statements, financial positions, and income statements. The report aims to provide a clear understanding of the financial reporting process and its significance in an accountancy firm.

Financial Reporting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

INTRODUCTION

Financial reporting is the process of presenting the financial information regarding the

different financial data to the different stakeholders for effective and efficient decision-making

process. It includes the various information like income statement, cash flow statement, balance

sheet etc. The report highlight the different purpose of the process like providing financial

information, evaluate the data, decision-making etc. and the requirement of conceptual and

regulatory like IFRS, IAS etc. in the accountancy firm. It also explains the different internal and

external stakeholder such as creditor, customer, employee, owner etc. to evaluate the financial

information via the different accounting report. It also highlights the difference in financial

reporting and their importance to the accountancy firm and the various model of financial

reporting like income statement, balance sheet and cash flow to ascertain the financial position of

the company to make the decision of investment and plan different strategies.

LO 1

1 Financial reporting purpose

Financial reporting : It refers to disclosing company performance to the internal and

external stakeholders and aware them regarding the growth and market share of company in

global market or in compare to the competitors (Crowther, 2018). Financial report are prepared

for the different purpose such as :

Provide information : The main purpose of company to prepare financial statement

reports is providing information like the sales of the company, its profit and revenue of the

particular period to the different stakeholders such as internal and external stakeholders to use

the financial information for the making the decision and evaluate performance of organization

and its employees. The financial information also help for planning, benchmarking, analysing

and decision-making.

Decision making : Financial reporting are prepared to present the financial information

for decision-making. It helps investor to take the decision regarding the investment on the basis

of its profitability and growth in the market. It also helps creditors to know the wealth of the

company and take the decision to provide the credit on the basis of its wealth and performance

(Sutton, Cordery and van Zijl, 2015). It helps to achieve financial and non financial goal of the

company with the efficiency and effectiveness.

2

Financial reporting is the process of presenting the financial information regarding the

different financial data to the different stakeholders for effective and efficient decision-making

process. It includes the various information like income statement, cash flow statement, balance

sheet etc. The report highlight the different purpose of the process like providing financial

information, evaluate the data, decision-making etc. and the requirement of conceptual and

regulatory like IFRS, IAS etc. in the accountancy firm. It also explains the different internal and

external stakeholder such as creditor, customer, employee, owner etc. to evaluate the financial

information via the different accounting report. It also highlights the difference in financial

reporting and their importance to the accountancy firm and the various model of financial

reporting like income statement, balance sheet and cash flow to ascertain the financial position of

the company to make the decision of investment and plan different strategies.

LO 1

1 Financial reporting purpose

Financial reporting : It refers to disclosing company performance to the internal and

external stakeholders and aware them regarding the growth and market share of company in

global market or in compare to the competitors (Crowther, 2018). Financial report are prepared

for the different purpose such as :

Provide information : The main purpose of company to prepare financial statement

reports is providing information like the sales of the company, its profit and revenue of the

particular period to the different stakeholders such as internal and external stakeholders to use

the financial information for the making the decision and evaluate performance of organization

and its employees. The financial information also help for planning, benchmarking, analysing

and decision-making.

Decision making : Financial reporting are prepared to present the financial information

for decision-making. It helps investor to take the decision regarding the investment on the basis

of its profitability and growth in the market. It also helps creditors to know the wealth of the

company and take the decision to provide the credit on the basis of its wealth and performance

(Sutton, Cordery and van Zijl, 2015). It helps to achieve financial and non financial goal of the

company with the efficiency and effectiveness.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Regulate performance : The purpose of financial reporting is to regulate the

performance of the accountancy firm by comparing its value and financial data to the company

data in same field or compare the data to last year financial data (Fekadu, 2018). The

comparisons of the statement help the organization to find that whether the company is

improving its performance to the last year or not and what kind of strategies are prepared to

improve the performance.

Control : Financial reporting are prepared to control the financial data and activities of

the employee and manager to protect data from manipulation. It helps the company to -provide

the accurate and correct data to its stakeholder which represent true information of the company

so the stakeholder can prepare the strategies for the organization to achieve the objective

(Crowther, 2018).

2. Conceptual framework and regulatory framework purpose and requirement

Conceptual framework is used to prescribe the function, nature and objective of financial

statement and financial statement. They are prepared to set the accounting rule for company to

report the accounts of the organization of particular period. The purpose of the accounting

framework is to ensure that the consistency approaches are applied by the company (Chazdon

and et.al., 2016). The various conceptual framework like IASB. GAAP and IFRS are used to

regulate the financial information and set the various rules to present the financial statements.

Requirement and purpose

GAAP (General accepted accounting principle) help the company to develop the

information and statement according to the decided rules and regulation (Eizenberg and

Jabareen, 2017).

It helps the company to follow the accounting standard to meet the requirement of

organization and prepare the statement accurately and accountable.

Conceptual framework such as IASB and IFRS strengthen the credibility and profitability

of the company by attracting large number of investors.

It helps the employee and manager to prepare the data and provide the audit facility to

present the useful information to the stakeholder by minimizing the less useful

transaction.

3

performance of the accountancy firm by comparing its value and financial data to the company

data in same field or compare the data to last year financial data (Fekadu, 2018). The

comparisons of the statement help the organization to find that whether the company is

improving its performance to the last year or not and what kind of strategies are prepared to

improve the performance.

Control : Financial reporting are prepared to control the financial data and activities of

the employee and manager to protect data from manipulation. It helps the company to -provide

the accurate and correct data to its stakeholder which represent true information of the company

so the stakeholder can prepare the strategies for the organization to achieve the objective

(Crowther, 2018).

2. Conceptual framework and regulatory framework purpose and requirement

Conceptual framework is used to prescribe the function, nature and objective of financial

statement and financial statement. They are prepared to set the accounting rule for company to

report the accounts of the organization of particular period. The purpose of the accounting

framework is to ensure that the consistency approaches are applied by the company (Chazdon

and et.al., 2016). The various conceptual framework like IASB. GAAP and IFRS are used to

regulate the financial information and set the various rules to present the financial statements.

Requirement and purpose

GAAP (General accepted accounting principle) help the company to develop the

information and statement according to the decided rules and regulation (Eizenberg and

Jabareen, 2017).

It helps the company to follow the accounting standard to meet the requirement of

organization and prepare the statement accurately and accountable.

Conceptual framework such as IASB and IFRS strengthen the credibility and profitability

of the company by attracting large number of investors.

It helps the employee and manager to prepare the data and provide the audit facility to

present the useful information to the stakeholder by minimizing the less useful

transaction.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

IFRS provides general guidelines to the companies to prepare and present their data in

annual report or to the stakeholders to take the useful decision regarding the organisation

performance and profitability.

Qualitative characteristics of financial reporting

Relevance : The information provided by the company must be relevant to the users such

as it is presented in prescribed format and present all required data so the stakeholder can use the

information and make the decisions on their interest (Erb and Pelger, 2015).

Reliability : The data presented in the financial statement like the expenses, revenue,

profit and other sources of income and loss must be reliable and accurate to present the true

position of the company. All the transaction and events are must be faithfully presented.

Understandability : The presented data in the financial information are understandable

to the users like creditors, shareholders, customers, employees etc. so they can take the decisions

like investor can take the decisions of investment, customer can take the decision of purchase of

goods and services etc.

Comparability : The information presented in the statement and report must be

comparable to the information presented in previous accounting period to identify the trend and

financial position of the company (Robertson and Samy, 2015).

3. Different stakeholders in the organization

Internal stakeholders

Employees : Employees are the person who work for the organization in interest to get

the benefit from the business in the form of salary, incentive etc. They use the monetary

information of the organization to make report on the basis of given information and present it to

the managers or management team (McKiernan, Ackermann and Eden, 2018). It also helps them

to evaluate the performance of the organization in particular period and regulate the trend. The

financial information increases employee involvement in the company.

Owner : owner are the person who have interest in the financial information and

statement to take the useful decision such as preparation of financial plan, investment, strategies

etc. They invest in the business to get the benefit from its performance (Matuleviciene and

Stravinskiene, 2015). They use the financial information to evaluate the profitability of the

company and take the decision on the basis of company performance and profitability.

External stakeholders

4

annual report or to the stakeholders to take the useful decision regarding the organisation

performance and profitability.

Qualitative characteristics of financial reporting

Relevance : The information provided by the company must be relevant to the users such

as it is presented in prescribed format and present all required data so the stakeholder can use the

information and make the decisions on their interest (Erb and Pelger, 2015).

Reliability : The data presented in the financial statement like the expenses, revenue,

profit and other sources of income and loss must be reliable and accurate to present the true

position of the company. All the transaction and events are must be faithfully presented.

Understandability : The presented data in the financial information are understandable

to the users like creditors, shareholders, customers, employees etc. so they can take the decisions

like investor can take the decisions of investment, customer can take the decision of purchase of

goods and services etc.

Comparability : The information presented in the statement and report must be

comparable to the information presented in previous accounting period to identify the trend and

financial position of the company (Robertson and Samy, 2015).

3. Different stakeholders in the organization

Internal stakeholders

Employees : Employees are the person who work for the organization in interest to get

the benefit from the business in the form of salary, incentive etc. They use the monetary

information of the organization to make report on the basis of given information and present it to

the managers or management team (McKiernan, Ackermann and Eden, 2018). It also helps them

to evaluate the performance of the organization in particular period and regulate the trend. The

financial information increases employee involvement in the company.

Owner : owner are the person who have interest in the financial information and

statement to take the useful decision such as preparation of financial plan, investment, strategies

etc. They invest in the business to get the benefit from its performance (Matuleviciene and

Stravinskiene, 2015). They use the financial information to evaluate the profitability of the

company and take the decision on the basis of company performance and profitability.

External stakeholders

4

Suppliers : They were the person who supply the raw material and information to the

organization. They need monetary information regarding the company to evaluate the credit

worthiness of the company to supply the material on credit and not (Robertson and Samy, 2015).

Customer : They are the end user of the goods and services. The use the material for

their own purpose. Customer requires the monetary information of the company to evaluate the

product and services and know the reliability of product to make the purchase decision. They

also require the financial information to compare the products from one company to another with

their services.

Investors : They invest in the company to get the benefit from the company performance

in the market and increase their capital. Investor needs the financial statements data and the

information related to them to evaluate the performance and make the decision to invest in the

company. They also require the financial information get the profit from market share and

profitability (Matuleviciene and Stravinskiene, 2015).

4. Need of financial reporting fulfilling the organisation objective and growth

Financial reporting are used by the organization to meet the organization objective and

growth. The various accounting framework binds the company by providing the general

guidelines to achieve the target and objective in time and with proper resources (Baumgartner

and Rauter, 2017).

It helps the company to get the information regarding its performance in the market and

evaluate the trend to take the major changes such as change the accounting method,

strategies etc. to improve the productivity and profitability of the company to achieve the

business objective.

The evaluation of financial statement help the organization to achieve the target on time

and prepare strategies to attract the investor and customer toward the business.

Financial information also help for benchmarking and decision making. By setting the

benchmark it compares the performance of one year to another year or different business

in the same industry to find out the variance area (Lim and Greenwood, 2017).

Financial reporting helps the company to present the transaction in brief and summarized

form to the external and internal users for the understandability of the data and growth of

the company.

5

organization. They need monetary information regarding the company to evaluate the credit

worthiness of the company to supply the material on credit and not (Robertson and Samy, 2015).

Customer : They are the end user of the goods and services. The use the material for

their own purpose. Customer requires the monetary information of the company to evaluate the

product and services and know the reliability of product to make the purchase decision. They

also require the financial information to compare the products from one company to another with

their services.

Investors : They invest in the company to get the benefit from the company performance

in the market and increase their capital. Investor needs the financial statements data and the

information related to them to evaluate the performance and make the decision to invest in the

company. They also require the financial information get the profit from market share and

profitability (Matuleviciene and Stravinskiene, 2015).

4. Need of financial reporting fulfilling the organisation objective and growth

Financial reporting are used by the organization to meet the organization objective and

growth. The various accounting framework binds the company by providing the general

guidelines to achieve the target and objective in time and with proper resources (Baumgartner

and Rauter, 2017).

It helps the company to get the information regarding its performance in the market and

evaluate the trend to take the major changes such as change the accounting method,

strategies etc. to improve the productivity and profitability of the company to achieve the

business objective.

The evaluation of financial statement help the organization to achieve the target on time

and prepare strategies to attract the investor and customer toward the business.

Financial information also help for benchmarking and decision making. By setting the

benchmark it compares the performance of one year to another year or different business

in the same industry to find out the variance area (Lim and Greenwood, 2017).

Financial reporting helps the company to present the transaction in brief and summarized

form to the external and internal users for the understandability of the data and growth of

the company.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial report is important for the company growth by attracting the investor in the

organization to increase the capital.

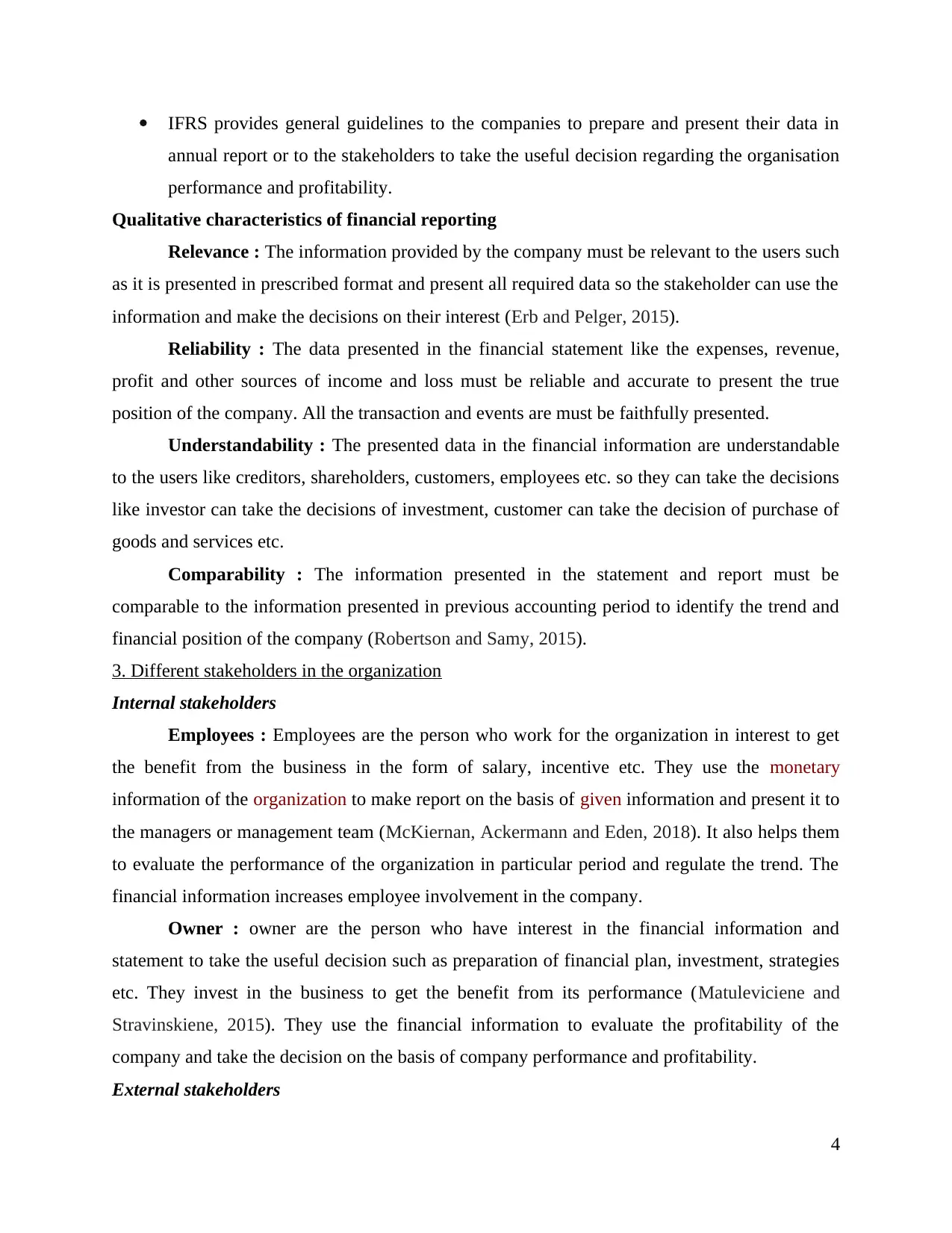

5. Preparation of financial statements

Particulars Amount

Revenue 585100

less Cost of sales 404795

Gross profit 180305

add Operating income 9600

189905

less Operating expenses 93295

Profit before tax 96610

less Tax 9500

Profit after tax 87110

Working note 1

Particular Cost of sales Operating expenses

Trial balance amount 391700 80500

Inventory adjustment 300

Land and property depreciation

(Fixed assets) 4125 4125

Plant and equipment depreciation

(Fixed assets) 8670 8670

404795 93295

Damaged goods cost 2470

Selling cost 2670

Residual value -500

Net residual value 300

6

organization to increase the capital.

5. Preparation of financial statements

Particulars Amount

Revenue 585100

less Cost of sales 404795

Gross profit 180305

add Operating income 9600

189905

less Operating expenses 93295

Profit before tax 96610

less Tax 9500

Profit after tax 87110

Working note 1

Particular Cost of sales Operating expenses

Trial balance amount 391700 80500

Inventory adjustment 300

Land and property depreciation

(Fixed assets) 4125 4125

Plant and equipment depreciation

(Fixed assets) 8670 8670

404795 93295

Damaged goods cost 2470

Selling cost 2670

Residual value -500

Net residual value 300

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

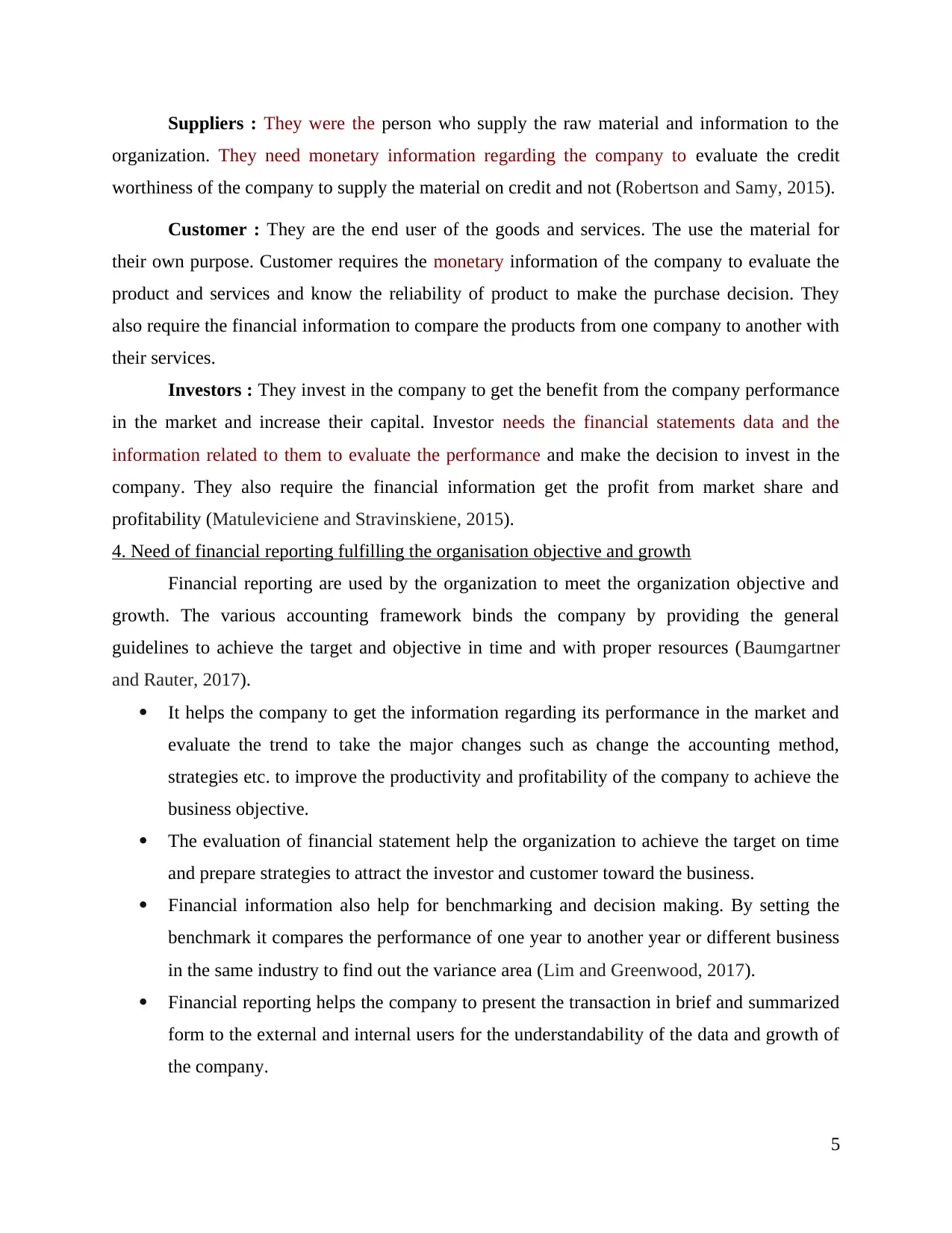

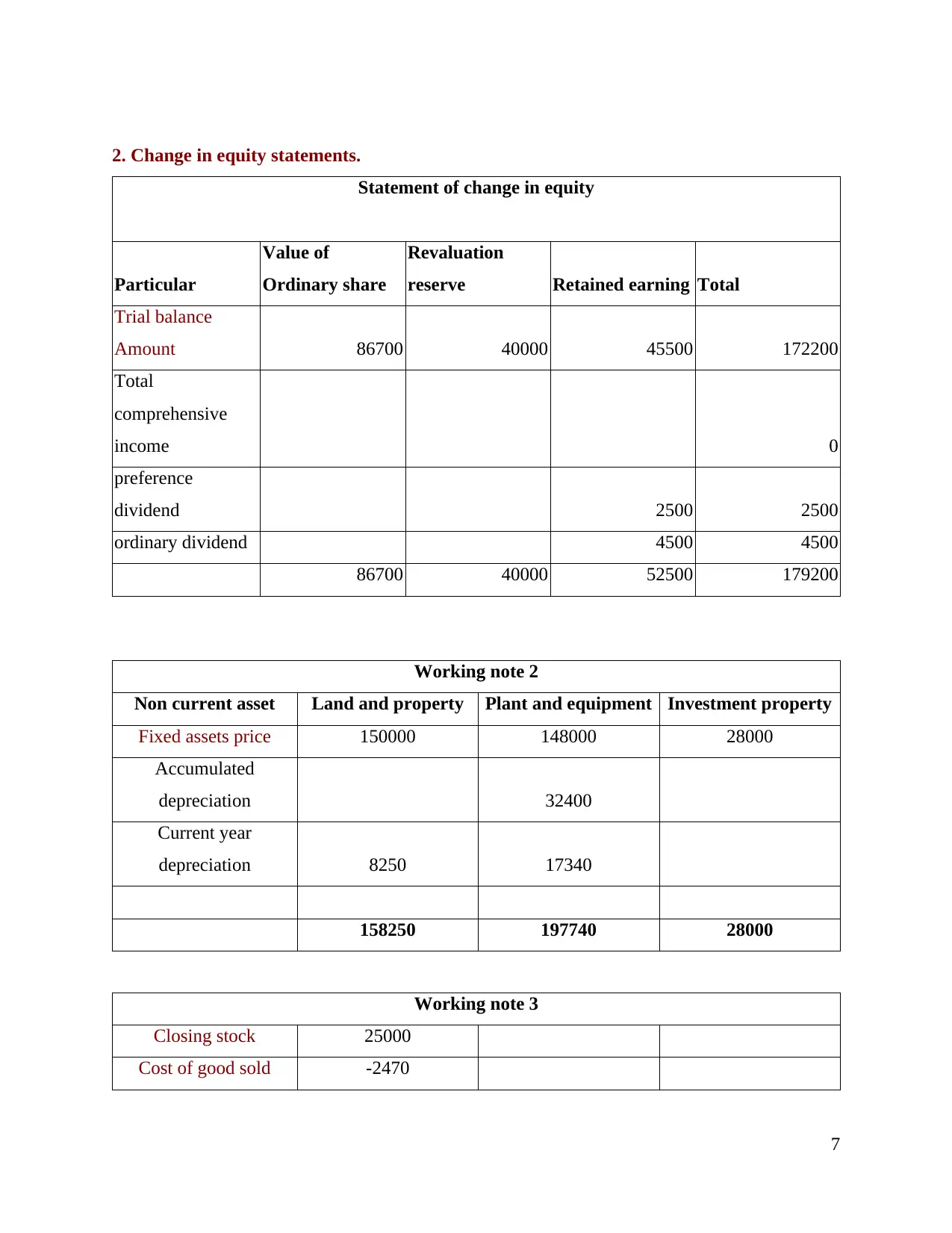

2. Change in equity statements.

Statement of change in equity

Particular

Value of

Ordinary share

Revaluation

reserve Retained earning Total

Trial balance

Amount 86700 40000 45500 172200

Total

comprehensive

income 0

preference

dividend 2500 2500

ordinary dividend 4500 4500

86700 40000 52500 179200

Working note 2

Non current asset Land and property Plant and equipment Investment property

Fixed assets price 150000 148000 28000

Accumulated

depreciation 32400

Current year

depreciation 8250 17340

158250 197740 28000

Working note 3

Closing stock 25000

Cost of good sold -2470

7

Statement of change in equity

Particular

Value of

Ordinary share

Revaluation

reserve Retained earning Total

Trial balance

Amount 86700 40000 45500 172200

Total

comprehensive

income 0

preference

dividend 2500 2500

ordinary dividend 4500 4500

86700 40000 52500 179200

Working note 2

Non current asset Land and property Plant and equipment Investment property

Fixed assets price 150000 148000 28000

Accumulated

depreciation 32400

Current year

depreciation 8250 17340

158250 197740 28000

Working note 3

Closing stock 25000

Cost of good sold -2470

7

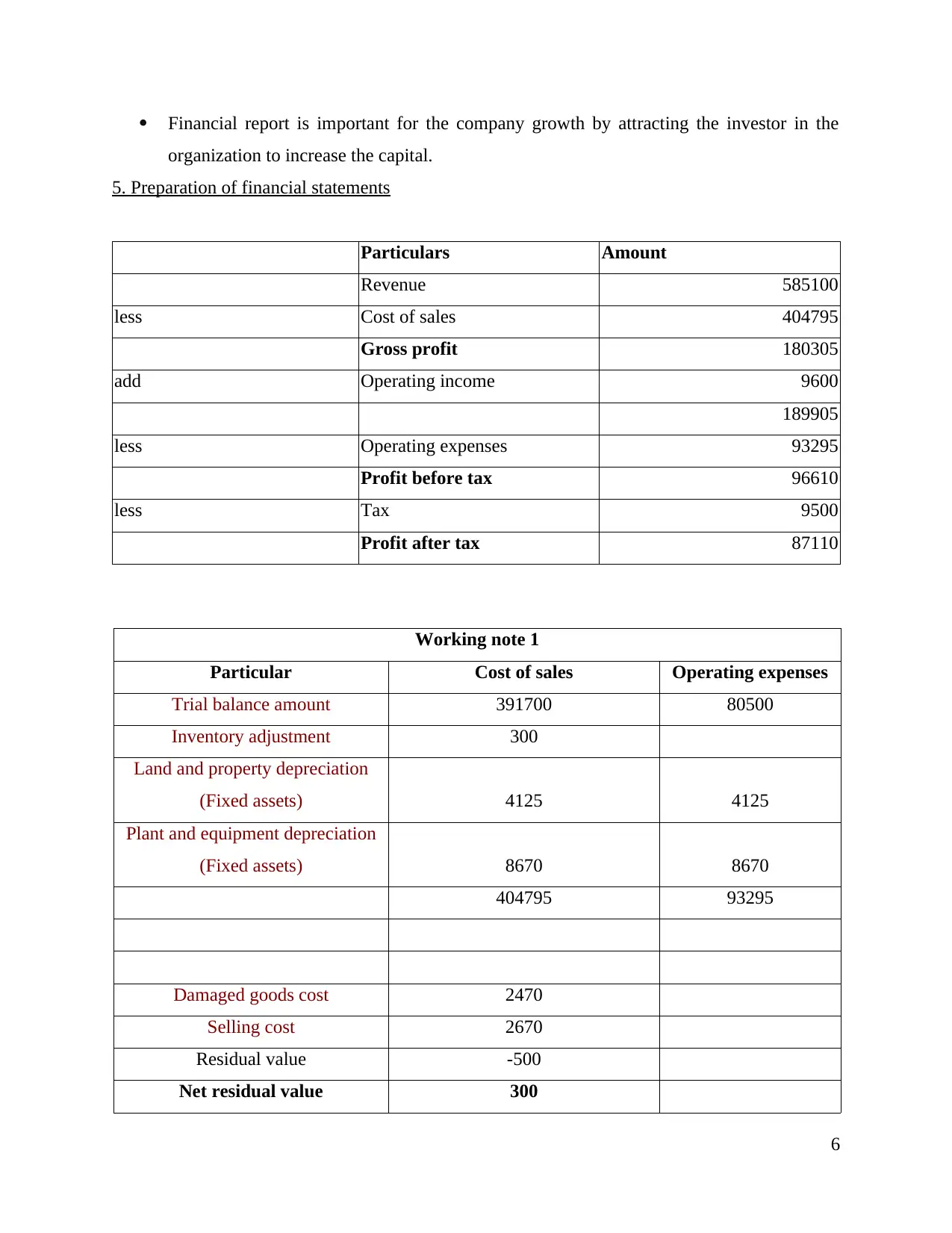

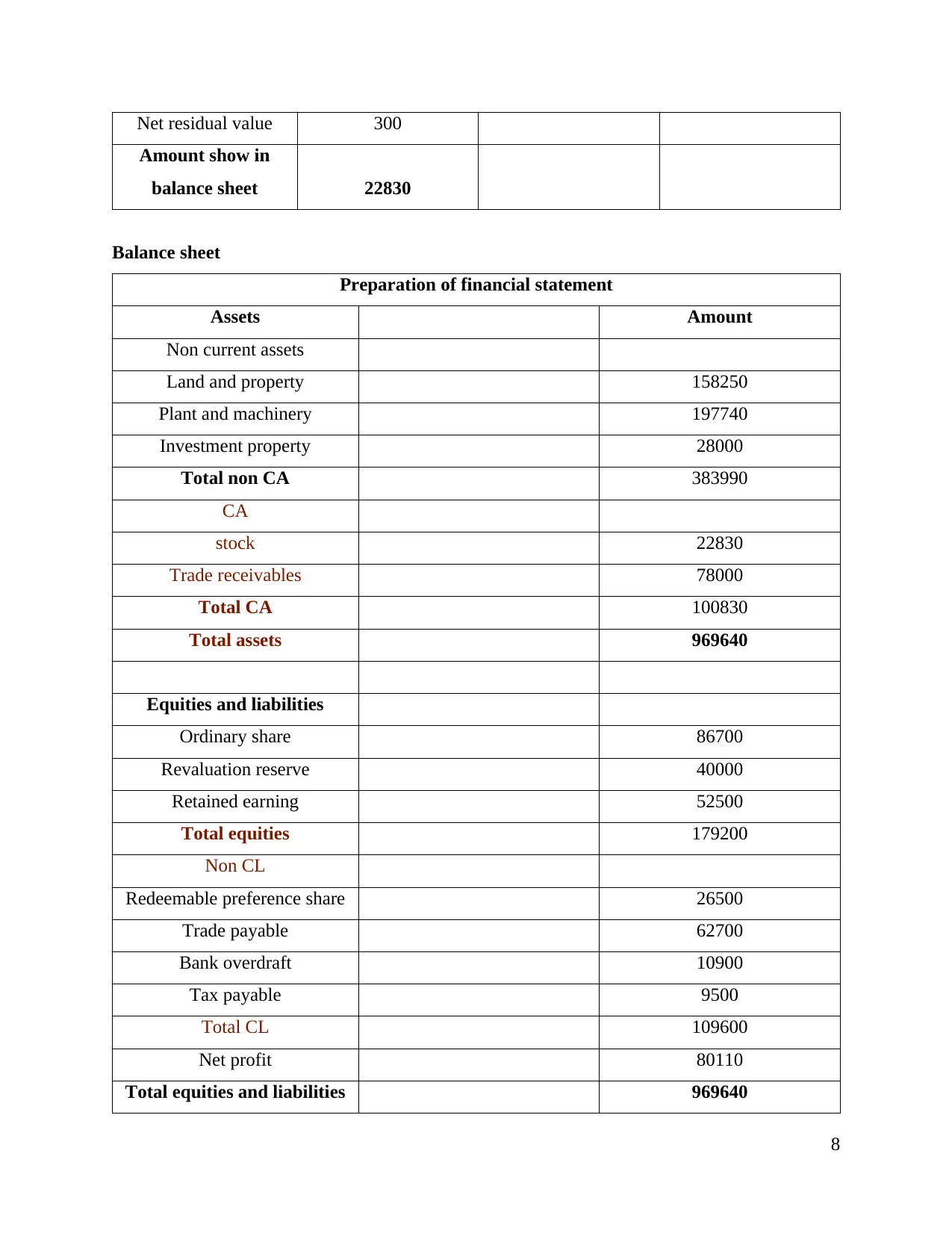

Net residual value 300

Amount show in

balance sheet 22830

Balance sheet

Preparation of financial statement

Assets Amount

Non current assets

Land and property 158250

Plant and machinery 197740

Investment property 28000

Total non CA 383990

CA

stock 22830

Trade receivables 78000

Total CA 100830

Total assets 969640

Equities and liabilities

Ordinary share 86700

Revaluation reserve 40000

Retained earning 52500

Total equities 179200

Non CL

Redeemable preference share 26500

Trade payable 62700

Bank overdraft 10900

Tax payable 9500

Total CL 109600

Net profit 80110

Total equities and liabilities 969640

8

Amount show in

balance sheet 22830

Balance sheet

Preparation of financial statement

Assets Amount

Non current assets

Land and property 158250

Plant and machinery 197740

Investment property 28000

Total non CA 383990

CA

stock 22830

Trade receivables 78000

Total CA 100830

Total assets 969640

Equities and liabilities

Ordinary share 86700

Revaluation reserve 40000

Retained earning 52500

Total equities 179200

Non CL

Redeemable preference share 26500

Trade payable 62700

Bank overdraft 10900

Tax payable 9500

Total CL 109600

Net profit 80110

Total equities and liabilities 969640

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Difference in cash flow with financial position and income statement.

Cash flow statement present the information regarding the total inflow and outflow of

cash in particular period to estimate the usage of net cash. It helps to pay day to day expenses of

the company. Whereas financial statements present the information by assets and liability

through the analysis of ratios.

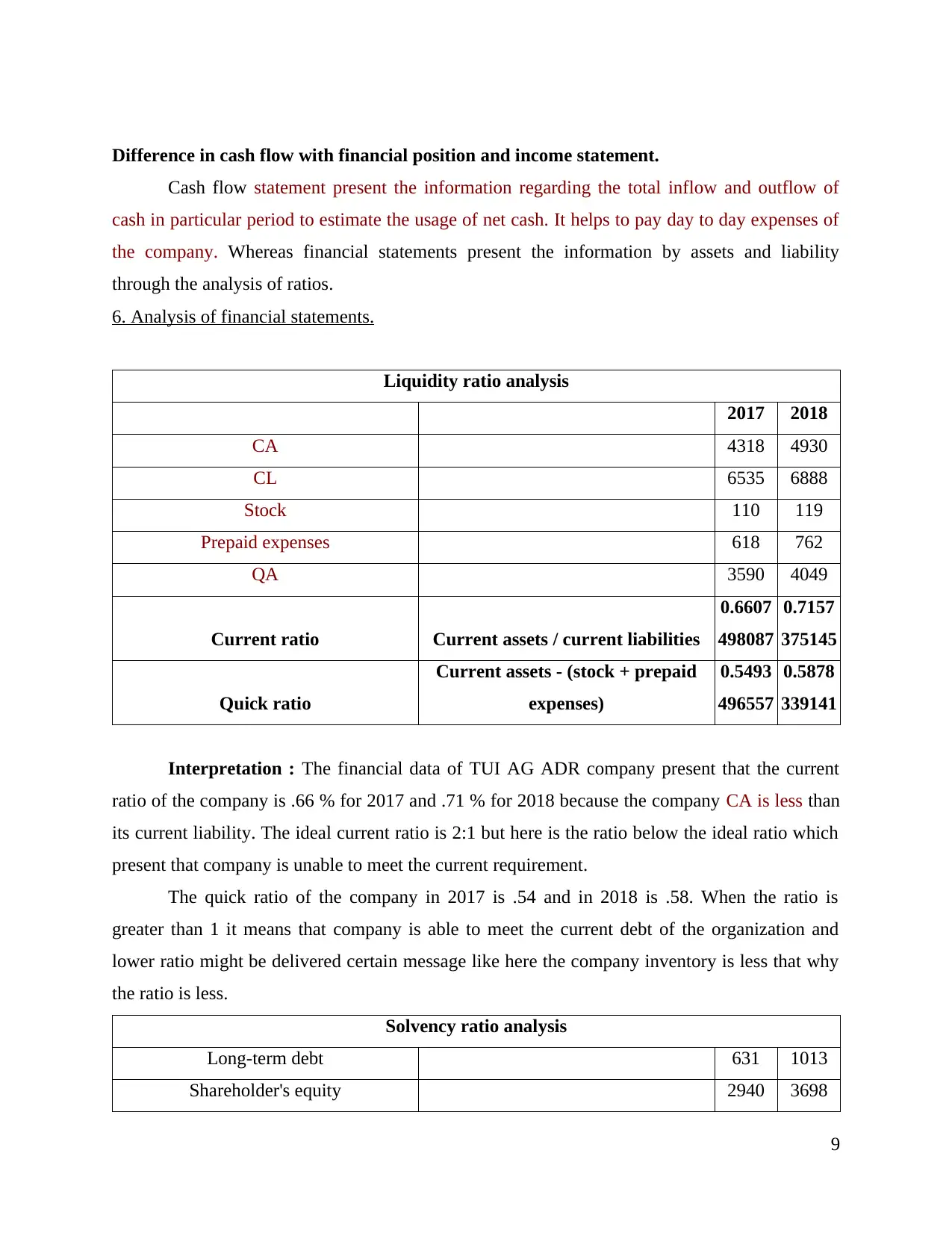

6. Analysis of financial statements.

Liquidity ratio analysis

2017 2018

CA 4318 4930

CL 6535 6888

Stock 110 119

Prepaid expenses 618 762

QA 3590 4049

Current ratio Current assets / current liabilities

0.6607

498087

0.7157

375145

Quick ratio

Current assets - (stock + prepaid

expenses)

0.5493

496557

0.5878

339141

Interpretation : The financial data of TUI AG ADR company present that the current

ratio of the company is .66 % for 2017 and .71 % for 2018 because the company CA is less than

its current liability. The ideal current ratio is 2:1 but here is the ratio below the ideal ratio which

present that company is unable to meet the current requirement.

The quick ratio of the company in 2017 is .54 and in 2018 is .58. When the ratio is

greater than 1 it means that company is able to meet the current debt of the organization and

lower ratio might be delivered certain message like here the company inventory is less that why

the ratio is less.

Solvency ratio analysis

Long-term debt 631 1013

Shareholder's equity 2940 3698

9

Cash flow statement present the information regarding the total inflow and outflow of

cash in particular period to estimate the usage of net cash. It helps to pay day to day expenses of

the company. Whereas financial statements present the information by assets and liability

through the analysis of ratios.

6. Analysis of financial statements.

Liquidity ratio analysis

2017 2018

CA 4318 4930

CL 6535 6888

Stock 110 119

Prepaid expenses 618 762

QA 3590 4049

Current ratio Current assets / current liabilities

0.6607

498087

0.7157

375145

Quick ratio

Current assets - (stock + prepaid

expenses)

0.5493

496557

0.5878

339141

Interpretation : The financial data of TUI AG ADR company present that the current

ratio of the company is .66 % for 2017 and .71 % for 2018 because the company CA is less than

its current liability. The ideal current ratio is 2:1 but here is the ratio below the ideal ratio which

present that company is unable to meet the current requirement.

The quick ratio of the company in 2017 is .54 and in 2018 is .58. When the ratio is

greater than 1 it means that company is able to meet the current debt of the organization and

lower ratio might be delivered certain message like here the company inventory is less that why

the ratio is less.

Solvency ratio analysis

Long-term debt 631 1013

Shareholder's equity 2940 3698

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

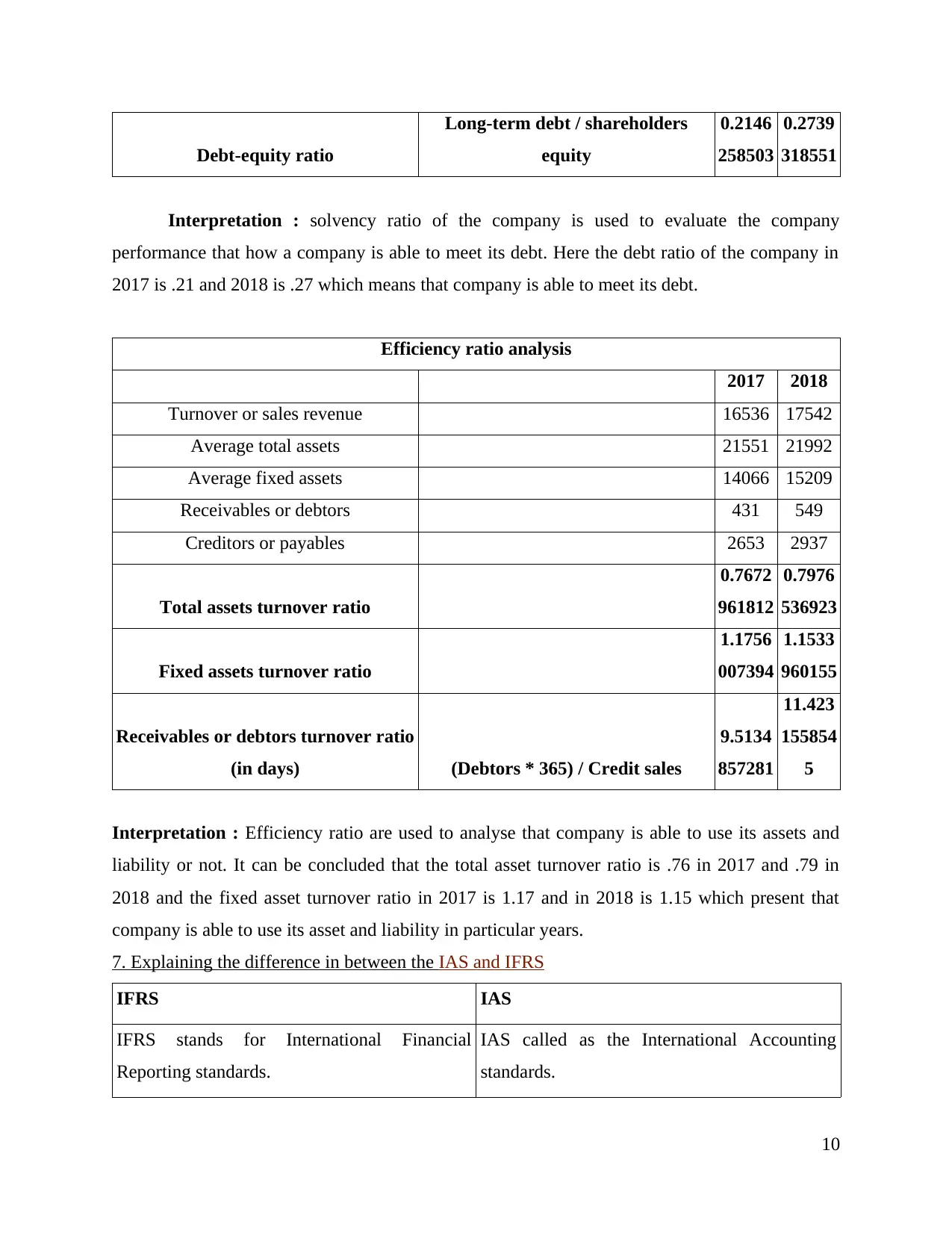

Debt-equity ratio

Long-term debt / shareholders

equity

0.2146

258503

0.2739

318551

Interpretation : solvency ratio of the company is used to evaluate the company

performance that how a company is able to meet its debt. Here the debt ratio of the company in

2017 is .21 and 2018 is .27 which means that company is able to meet its debt.

Efficiency ratio analysis

2017 2018

Turnover or sales revenue 16536 17542

Average total assets 21551 21992

Average fixed assets 14066 15209

Receivables or debtors 431 549

Creditors or payables 2653 2937

Total assets turnover ratio

0.7672

961812

0.7976

536923

Fixed assets turnover ratio

1.1756

007394

1.1533

960155

Receivables or debtors turnover ratio

(in days) (Debtors * 365) / Credit sales

9.5134

857281

11.423

155854

5

Interpretation : Efficiency ratio are used to analyse that company is able to use its assets and

liability or not. It can be concluded that the total asset turnover ratio is .76 in 2017 and .79 in

2018 and the fixed asset turnover ratio in 2017 is 1.17 and in 2018 is 1.15 which present that

company is able to use its asset and liability in particular years.

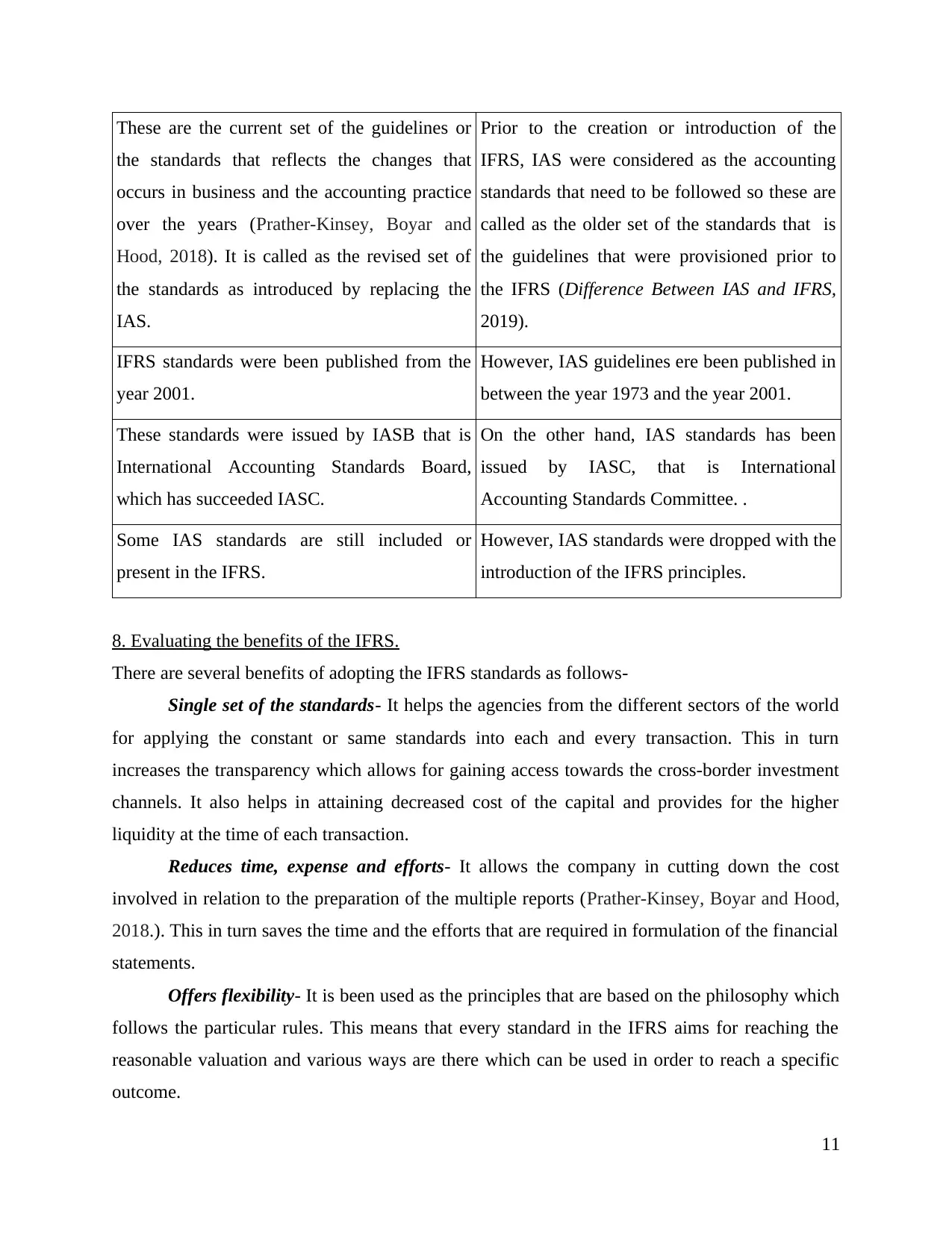

7. Explaining the difference in between the IAS and IFRS

IFRS IAS

IFRS stands for International Financial

Reporting standards.

IAS called as the International Accounting

standards.

10

Long-term debt / shareholders

equity

0.2146

258503

0.2739

318551

Interpretation : solvency ratio of the company is used to evaluate the company

performance that how a company is able to meet its debt. Here the debt ratio of the company in

2017 is .21 and 2018 is .27 which means that company is able to meet its debt.

Efficiency ratio analysis

2017 2018

Turnover or sales revenue 16536 17542

Average total assets 21551 21992

Average fixed assets 14066 15209

Receivables or debtors 431 549

Creditors or payables 2653 2937

Total assets turnover ratio

0.7672

961812

0.7976

536923

Fixed assets turnover ratio

1.1756

007394

1.1533

960155

Receivables or debtors turnover ratio

(in days) (Debtors * 365) / Credit sales

9.5134

857281

11.423

155854

5

Interpretation : Efficiency ratio are used to analyse that company is able to use its assets and

liability or not. It can be concluded that the total asset turnover ratio is .76 in 2017 and .79 in

2018 and the fixed asset turnover ratio in 2017 is 1.17 and in 2018 is 1.15 which present that

company is able to use its asset and liability in particular years.

7. Explaining the difference in between the IAS and IFRS

IFRS IAS

IFRS stands for International Financial

Reporting standards.

IAS called as the International Accounting

standards.

10

These are the current set of the guidelines or

the standards that reflects the changes that

occurs in business and the accounting practice

over the years (Prather-Kinsey, Boyar and

Hood, 2018). It is called as the revised set of

the standards as introduced by replacing the

IAS.

Prior to the creation or introduction of the

IFRS, IAS were considered as the accounting

standards that need to be followed so these are

called as the older set of the standards that is

the guidelines that were provisioned prior to

the IFRS (Difference Between IAS and IFRS,

2019).

IFRS standards were been published from the

year 2001.

However, IAS guidelines ere been published in

between the year 1973 and the year 2001.

These standards were issued by IASB that is

International Accounting Standards Board,

which has succeeded IASC.

On the other hand, IAS standards has been

issued by IASC, that is International

Accounting Standards Committee. .

Some IAS standards are still included or

present in the IFRS.

However, IAS standards were dropped with the

introduction of the IFRS principles.

8. Evaluating the benefits of the IFRS.

There are several benefits of adopting the IFRS standards as follows-

Single set of the standards- It helps the agencies from the different sectors of the world

for applying the constant or same standards into each and every transaction. This in turn

increases the transparency which allows for gaining access towards the cross-border investment

channels. It also helps in attaining decreased cost of the capital and provides for the higher

liquidity at the time of each transaction.

Reduces time, expense and efforts- It allows the company in cutting down the cost

involved in relation to the preparation of the multiple reports (Prather-Kinsey, Boyar and Hood,

2018.). This in turn saves the time and the efforts that are required in formulation of the financial

statements.

Offers flexibility- It is been used as the principles that are based on the philosophy which

follows the particular rules. This means that every standard in the IFRS aims for reaching the

reasonable valuation and various ways are there which can be used in order to reach a specific

outcome.

11

the standards that reflects the changes that

occurs in business and the accounting practice

over the years (Prather-Kinsey, Boyar and

Hood, 2018). It is called as the revised set of

the standards as introduced by replacing the

IAS.

Prior to the creation or introduction of the

IFRS, IAS were considered as the accounting

standards that need to be followed so these are

called as the older set of the standards that is

the guidelines that were provisioned prior to

the IFRS (Difference Between IAS and IFRS,

2019).

IFRS standards were been published from the

year 2001.

However, IAS guidelines ere been published in

between the year 1973 and the year 2001.

These standards were issued by IASB that is

International Accounting Standards Board,

which has succeeded IASC.

On the other hand, IAS standards has been

issued by IASC, that is International

Accounting Standards Committee. .

Some IAS standards are still included or

present in the IFRS.

However, IAS standards were dropped with the

introduction of the IFRS principles.

8. Evaluating the benefits of the IFRS.

There are several benefits of adopting the IFRS standards as follows-

Single set of the standards- It helps the agencies from the different sectors of the world

for applying the constant or same standards into each and every transaction. This in turn

increases the transparency which allows for gaining access towards the cross-border investment

channels. It also helps in attaining decreased cost of the capital and provides for the higher

liquidity at the time of each transaction.

Reduces time, expense and efforts- It allows the company in cutting down the cost

involved in relation to the preparation of the multiple reports (Prather-Kinsey, Boyar and Hood,

2018.). This in turn saves the time and the efforts that are required in formulation of the financial

statements.

Offers flexibility- It is been used as the principles that are based on the philosophy which

follows the particular rules. This means that every standard in the IFRS aims for reaching the

reasonable valuation and various ways are there which can be used in order to reach a specific

outcome.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.