Financial Reporting: Standards, Stakeholders, and Financial Analysis

VerifiedAdded on 2020/10/22

|17

|3232

|349

Report

AI Summary

This report provides a detailed overview of financial reporting, beginning with its context and purpose, emphasizing the disclosure of financial information for various stakeholders. It examines the conceptual and regulatory framework, including key principles and qualitative characteristics of reliable financial information. The report identifies key stakeholders and assesses the value of financial reporting for organizational growth. It presents the main financial statements according to IAS 1, including the income statement, changes in equity, balance sheet, and cash flow statement, along with an interpretation of financial data through ratio analysis. The report also differentiates between IAS and IFRS, evaluates the benefits of IFRS, and determines the degree of compliance with IFRS, offering a comprehensive analysis of financial reporting standards and practices.

FINANCIAL REPORTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

1. Outlining context and purpose of financial reporting..............................................................1

2. Examining conceptual and regulatory framework with its requirements, purpose and key

principles along with qualitative characteristics for reliable financial information....................2

3. Identifying organization's main stakeholders with reference to financial information............4

4. Examining value of financial reporting for meeting organizational growth and objectives....5

5. Presenting main financial statements according to IAS 1.......................................................6

a) Income statement ....................................................................................................................6

b) Change in equity statement......................................................................................................7

c. Balance sheet............................................................................................................................7

d. Information that is provided by cash flow statement..............................................................9

6.Interpretation of financial data..................................................................................................9

7.Presenting difference between IAS and IFRS........................................................................11

8. Evaluation of Benefits of IFRS..............................................................................................12

9. Determination of degree of compliance with IFRS ..............................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

1. Outlining context and purpose of financial reporting..............................................................1

2. Examining conceptual and regulatory framework with its requirements, purpose and key

principles along with qualitative characteristics for reliable financial information....................2

3. Identifying organization's main stakeholders with reference to financial information............4

4. Examining value of financial reporting for meeting organizational growth and objectives....5

5. Presenting main financial statements according to IAS 1.......................................................6

a) Income statement ....................................................................................................................6

b) Change in equity statement......................................................................................................7

c. Balance sheet............................................................................................................................7

d. Information that is provided by cash flow statement..............................................................9

6.Interpretation of financial data..................................................................................................9

7.Presenting difference between IAS and IFRS........................................................................11

8. Evaluation of Benefits of IFRS..............................................................................................12

9. Determination of degree of compliance with IFRS ..............................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION

Financial reporting has disclosure of financial information for numerous stakeholders

with reference to financial position and performance of any business entity over specified

duration. The financial aspects and accounting of every department are traced and reported to

different stakeholders. The consideration of number of stakeholders are engaged with other

regulatory or statutory requirements, where financial reporting is very essential and critical

activity of business entity. The present report will briefly discuss about objective of financial

reporting, interpreting financial statements along with appropriate evaluation of standards of

financial reporting and theoretical concept and models. This report will reflect international

variances among financial reporting. In the similar aspect, it will be representing financial

statements according to IAS 1 and reflect comparison of purpose of cash flow to other financial

statements and will interpret financial performance of Thomas Cook with reference to ratio

analysis.

1. Outlining context and purpose of financial reporting

Financial reporting is very essential with reference to world economies. Its main

objective is to give useful and relevant information to organization's owners with context of

division among control and ownership of that particular business entity. Its occurrence is in

usually public limited organizations where share capital is pass to public via stock market or

exchange system. The shareholders which are diverse and potentially geographically dispersed

which does not engage in company's management as they appoint directors for performing on

their behalf. The annual statement had been received through owners for summarising company's

position and performance for assessing about investment which has been performed during

reporting period (Amiram and et.al., 2018).

Financial reports are referred as records and documents which are gathered for review

and track amount of money created by business or not. Its main objective is to deliver

information to share owners and lenders for business. The investors and lenders have right for

considering each information about how money is spent and returns to margin. With absence of

reporting system investors would be inclined less towards contribution of capital without

monitoring in effective aspect that hoe business entity is operating through directors and

appointed organization's steward who are directly supposed for operating in shareholder's best

interests.

1

Financial reporting has disclosure of financial information for numerous stakeholders

with reference to financial position and performance of any business entity over specified

duration. The financial aspects and accounting of every department are traced and reported to

different stakeholders. The consideration of number of stakeholders are engaged with other

regulatory or statutory requirements, where financial reporting is very essential and critical

activity of business entity. The present report will briefly discuss about objective of financial

reporting, interpreting financial statements along with appropriate evaluation of standards of

financial reporting and theoretical concept and models. This report will reflect international

variances among financial reporting. In the similar aspect, it will be representing financial

statements according to IAS 1 and reflect comparison of purpose of cash flow to other financial

statements and will interpret financial performance of Thomas Cook with reference to ratio

analysis.

1. Outlining context and purpose of financial reporting

Financial reporting is very essential with reference to world economies. Its main

objective is to give useful and relevant information to organization's owners with context of

division among control and ownership of that particular business entity. Its occurrence is in

usually public limited organizations where share capital is pass to public via stock market or

exchange system. The shareholders which are diverse and potentially geographically dispersed

which does not engage in company's management as they appoint directors for performing on

their behalf. The annual statement had been received through owners for summarising company's

position and performance for assessing about investment which has been performed during

reporting period (Amiram and et.al., 2018).

Financial reports are referred as records and documents which are gathered for review

and track amount of money created by business or not. Its main objective is to deliver

information to share owners and lenders for business. The investors and lenders have right for

considering each information about how money is spent and returns to margin. With absence of

reporting system investors would be inclined less towards contribution of capital without

monitoring in effective aspect that hoe business entity is operating through directors and

appointed organization's steward who are directly supposed for operating in shareholder's best

interests.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

With context of accomplishing requirements of users of financial statements,

organizations directly implement with accounting systems for giving appropriate information. It

is mandatory that system must be regulated for ensuring information provided to particular users

in proper format and is useful for their requirements. It is attained with framework of financial

reporting on basis of conceptual framework.

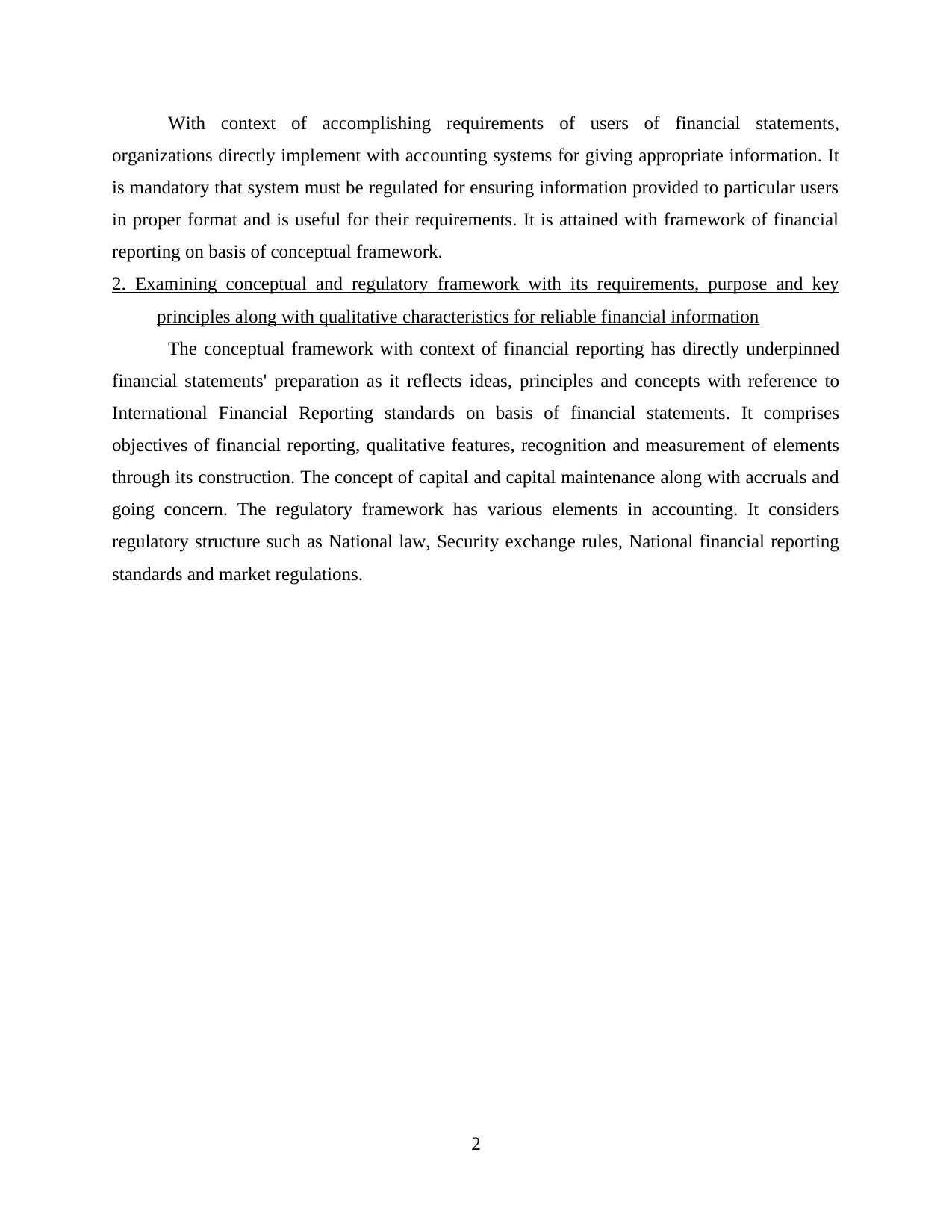

2. Examining conceptual and regulatory framework with its requirements, purpose and key

principles along with qualitative characteristics for reliable financial information

The conceptual framework with context of financial reporting has directly underpinned

financial statements' preparation as it reflects ideas, principles and concepts with reference to

International Financial Reporting standards on basis of financial statements. It comprises

objectives of financial reporting, qualitative features, recognition and measurement of elements

through its construction. The concept of capital and capital maintenance along with accruals and

going concern. The regulatory framework has various elements in accounting. It considers

regulatory structure such as National law, Security exchange rules, National financial reporting

standards and market regulations.

2

organizations directly implement with accounting systems for giving appropriate information. It

is mandatory that system must be regulated for ensuring information provided to particular users

in proper format and is useful for their requirements. It is attained with framework of financial

reporting on basis of conceptual framework.

2. Examining conceptual and regulatory framework with its requirements, purpose and key

principles along with qualitative characteristics for reliable financial information

The conceptual framework with context of financial reporting has directly underpinned

financial statements' preparation as it reflects ideas, principles and concepts with reference to

International Financial Reporting standards on basis of financial statements. It comprises

objectives of financial reporting, qualitative features, recognition and measurement of elements

through its construction. The concept of capital and capital maintenance along with accruals and

going concern. The regulatory framework has various elements in accounting. It considers

regulatory structure such as National law, Security exchange rules, National financial reporting

standards and market regulations.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Illustration 1: Conceptual and Regulatory

framework

(Source: Conceptual Framework for Financial

Reporting, 2018)

A regulatory framework with financial statements' preparation is required for different

reasons as it ensures need of different users of financial statements which are accomplished with

minimum information. Providing en-surety about giving information in economic arena which is

consistent and comparable. It raises confidence in users with process of financial reporting. The

behaviour of organizations are regulated and directors with context of investors. The qualitative

characteristics with application of financial reporting for determining kind of information which

is useful for undertaking decisions about specific reporting entity with reference to information

in financial report.

Financial information is useful when it is relevant and shows faithful for representing. It

is enhanced when it is verifiable, understandable and timely as well. Faithful representation and

relevance are referred as fundamental characteristics which is elaborated below:

Relevance: The financial information must be capable for creating variation in decisions

undertaken by users if they have presence of predictive, confirmatory or both value.

3

framework

(Source: Conceptual Framework for Financial

Reporting, 2018)

A regulatory framework with financial statements' preparation is required for different

reasons as it ensures need of different users of financial statements which are accomplished with

minimum information. Providing en-surety about giving information in economic arena which is

consistent and comparable. It raises confidence in users with process of financial reporting. The

behaviour of organizations are regulated and directors with context of investors. The qualitative

characteristics with application of financial reporting for determining kind of information which

is useful for undertaking decisions about specific reporting entity with reference to information

in financial report.

Financial information is useful when it is relevant and shows faithful for representing. It

is enhanced when it is verifiable, understandable and timely as well. Faithful representation and

relevance are referred as fundamental characteristics which is elaborated below:

Relevance: The financial information must be capable for creating variation in decisions

undertaken by users if they have presence of predictive, confirmatory or both value.

3

Faithful representation: It signifies substance representation of economic phenomenon

rather than showing legal form.

To enhance qualitative characteristics it should be comparability, verifiable, timely and

understandability makes representation in faithful manner which are elaborated below:

Comparability: It enables users for determining and understanding similarities and

variations.

Verifiability:The information should be represented faithfully economic phenomena as

it directly purports for representing.

Timeliness: The availability of information for decision makers with capability for

influencing decisions (Stubbs and Higgins, 2018).

Understandability: The information should be clear and concise with appropriate

classification, presenting and characterising.

3. Identifying organization's main stakeholders with reference to financial information

The stakeholder of organization with context to financial information are stated below:

Owners and investors: The corporation's stockholders has requirement of financial

information to help for decision with context of investment that is to hold, buy or sell

more. The investors have requirement of information for assessing potential for

profitability and success. In the similar aspect, owners of small business has requirement

of financial information for identifying business is profitable or not.

Management: Management considers owners especially in small business. On the

contrary, in big organization it is usually formed with hired professionals which are

entrusted with business operations with proper responsibility. They are considering as

agents of the owners.

Trade creditors or suppliers: The organizations' capability for repaying its obligations

which are due as they are interested for liquidity of company for writing short term

obligations.

Government: The tax authorities are interested for financial information of organization

with objective of taxation and regulatory aspect. Taxes are directly computed on basis of

operations outcome along with other tax base.

Employees: These are considered as very important stakeholders of organization with

stability and profitability of organization. Usually, they are after capability of

4

rather than showing legal form.

To enhance qualitative characteristics it should be comparability, verifiable, timely and

understandability makes representation in faithful manner which are elaborated below:

Comparability: It enables users for determining and understanding similarities and

variations.

Verifiability:The information should be represented faithfully economic phenomena as

it directly purports for representing.

Timeliness: The availability of information for decision makers with capability for

influencing decisions (Stubbs and Higgins, 2018).

Understandability: The information should be clear and concise with appropriate

classification, presenting and characterising.

3. Identifying organization's main stakeholders with reference to financial information

The stakeholder of organization with context to financial information are stated below:

Owners and investors: The corporation's stockholders has requirement of financial

information to help for decision with context of investment that is to hold, buy or sell

more. The investors have requirement of information for assessing potential for

profitability and success. In the similar aspect, owners of small business has requirement

of financial information for identifying business is profitable or not.

Management: Management considers owners especially in small business. On the

contrary, in big organization it is usually formed with hired professionals which are

entrusted with business operations with proper responsibility. They are considering as

agents of the owners.

Trade creditors or suppliers: The organizations' capability for repaying its obligations

which are due as they are interested for liquidity of company for writing short term

obligations.

Government: The tax authorities are interested for financial information of organization

with objective of taxation and regulatory aspect. Taxes are directly computed on basis of

operations outcome along with other tax base.

Employees: These are considered as very important stakeholders of organization with

stability and profitability of organization. Usually, they are after capability of

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organization for paying shares and to give employee benefits. They might be interested in

financial position and performance for assessing expansion of organization with its

possibilities and opportunities for development of career.

Customers: With involvement of contract or long term among company along with its

customers, these stakeholders are highly interested in ability of company for continuing

existence and stability of its operations.

4. Examining value of financial reporting for meeting organizational growth and objectives

The financial reporting could not be over emphasized as it is essential for every

stakeholder for various purpose and reasons. The financial reporting is important for attaining

organizational growth and objectives which are stated below:

The business entity will directly comply with different regulatory requirements as they

have need of financial statements to specific government agencies. If companies are

listed, then there is need of quarterly and annual outcome must be filed to published and

stock exchanges.

It would be directly facilitating statutory audit along with need of auditing organization's

financial statement for expressing opinion.

Financial reports are formed as considered as backbone with reference to financial

planning, benchmarking, decision making and used with objective of numerous

stakeholders (Objectives of financial reporting, 2018).

It helps business entity for increasing capital both overseas and domestic as well.

In the similar aspect, for objective of labour contract, bidding and government supplies

etc. business has requirement of furnishing financial statements and reports.

5

financial position and performance for assessing expansion of organization with its

possibilities and opportunities for development of career.

Customers: With involvement of contract or long term among company along with its

customers, these stakeholders are highly interested in ability of company for continuing

existence and stability of its operations.

4. Examining value of financial reporting for meeting organizational growth and objectives

The financial reporting could not be over emphasized as it is essential for every

stakeholder for various purpose and reasons. The financial reporting is important for attaining

organizational growth and objectives which are stated below:

The business entity will directly comply with different regulatory requirements as they

have need of financial statements to specific government agencies. If companies are

listed, then there is need of quarterly and annual outcome must be filed to published and

stock exchanges.

It would be directly facilitating statutory audit along with need of auditing organization's

financial statement for expressing opinion.

Financial reports are formed as considered as backbone with reference to financial

planning, benchmarking, decision making and used with objective of numerous

stakeholders (Objectives of financial reporting, 2018).

It helps business entity for increasing capital both overseas and domestic as well.

In the similar aspect, for objective of labour contract, bidding and government supplies

etc. business has requirement of furnishing financial statements and reports.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

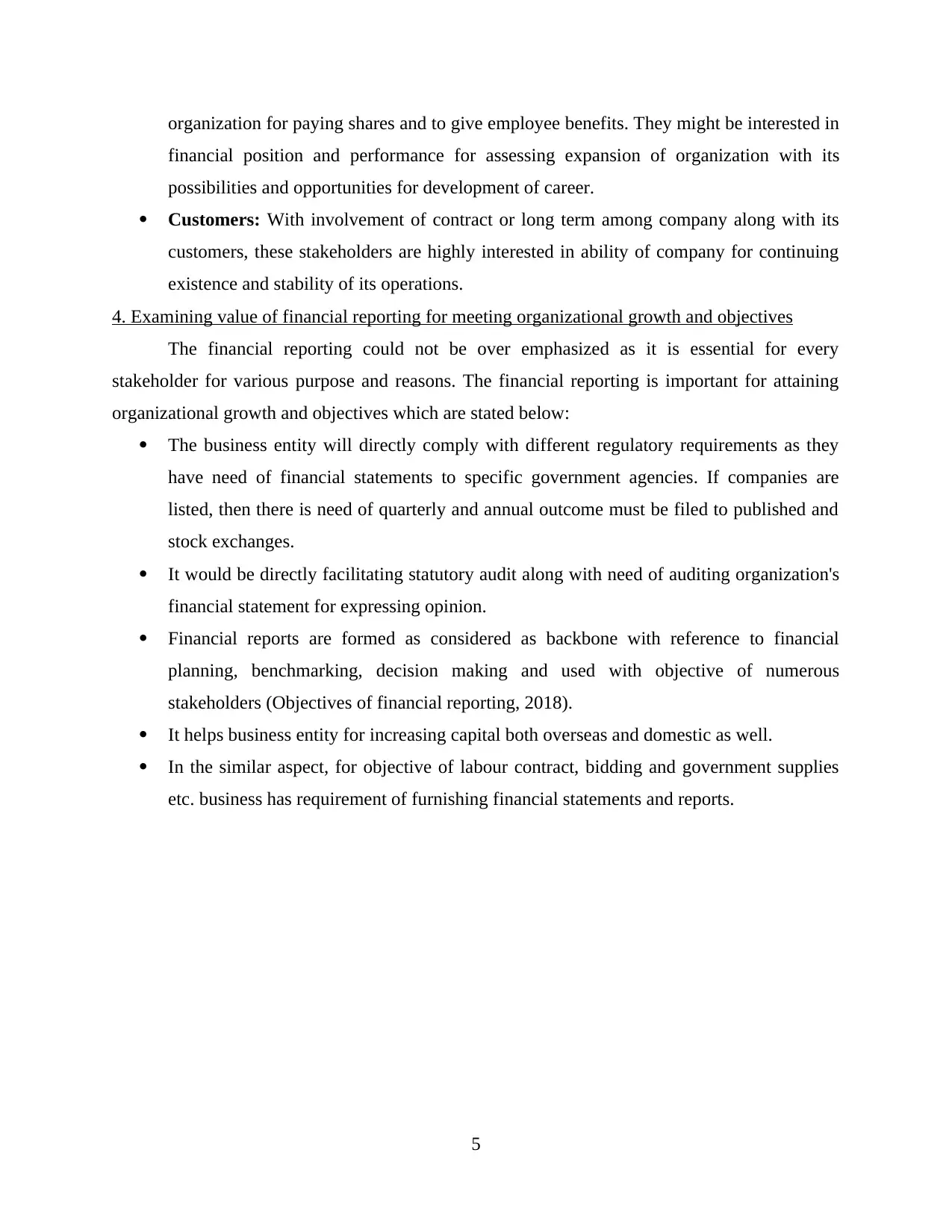

5. Presenting main financial statements according to IAS 1

a) Income statement

6

a) Income statement

6

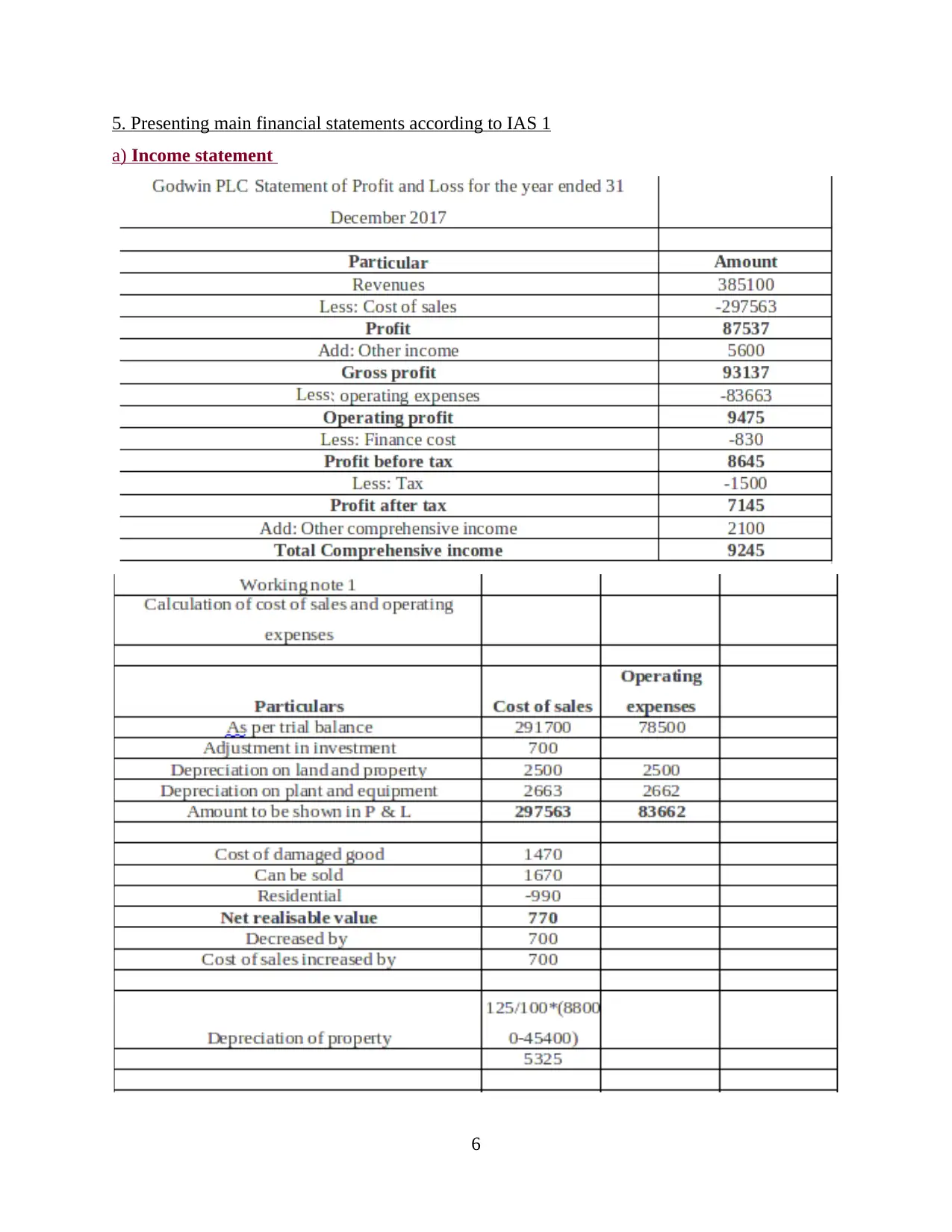

b) Change in equity statement

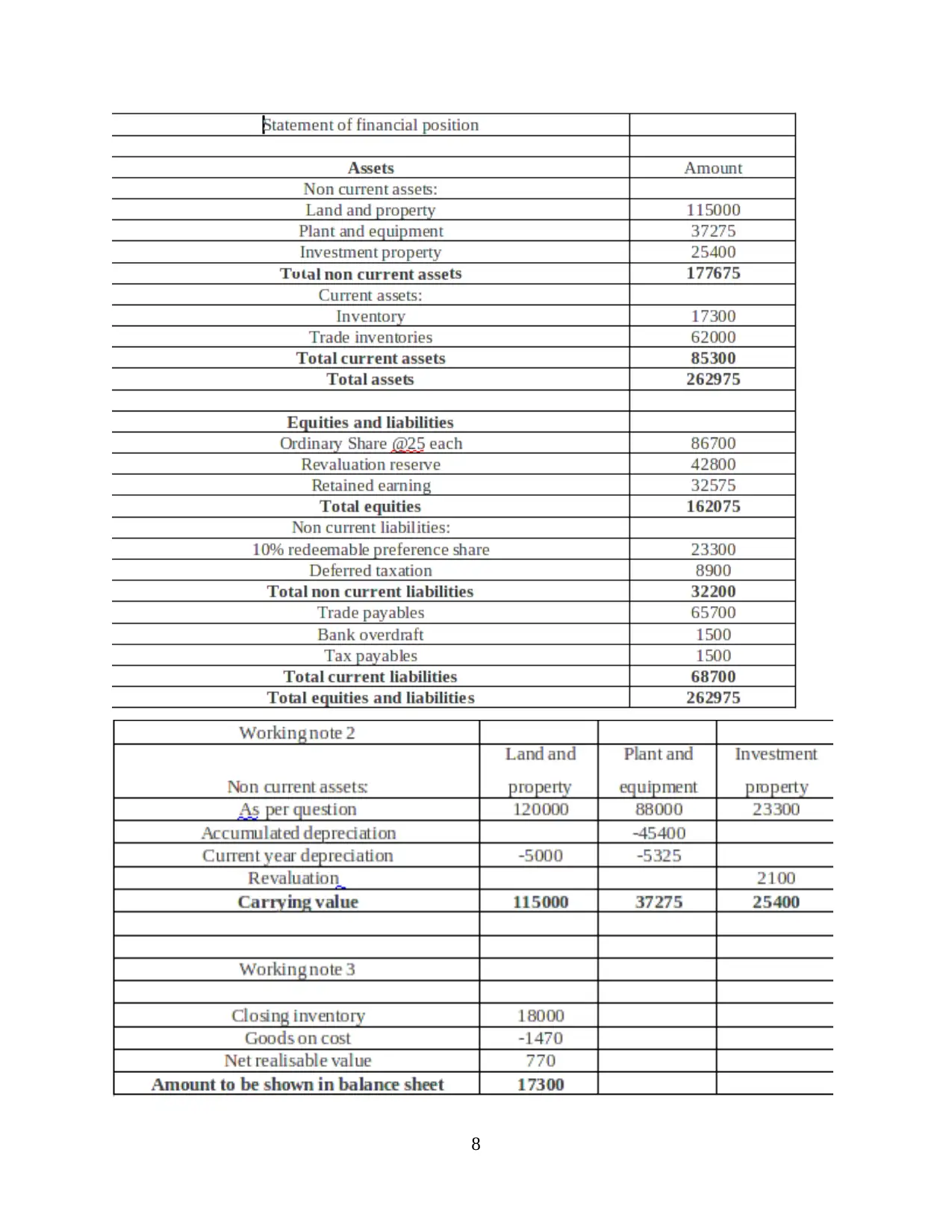

c. Balance sheet

7

c. Balance sheet

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

d. Information that is provided by cash flow statement

The cash flow statement of a business provide information regarding the actual cash in

flow and outflow of the business. This means what are the expenses done with actual cash

payments and the amount which is actually received in cash not in accrual terms. With this

information the cash availability with the business is determined.

6.Interpretation of financial data

9

The cash flow statement of a business provide information regarding the actual cash in

flow and outflow of the business. This means what are the expenses done with actual cash

payments and the amount which is actually received in cash not in accrual terms. With this

information the cash availability with the business is determined.

6.Interpretation of financial data

9

Interpretation:

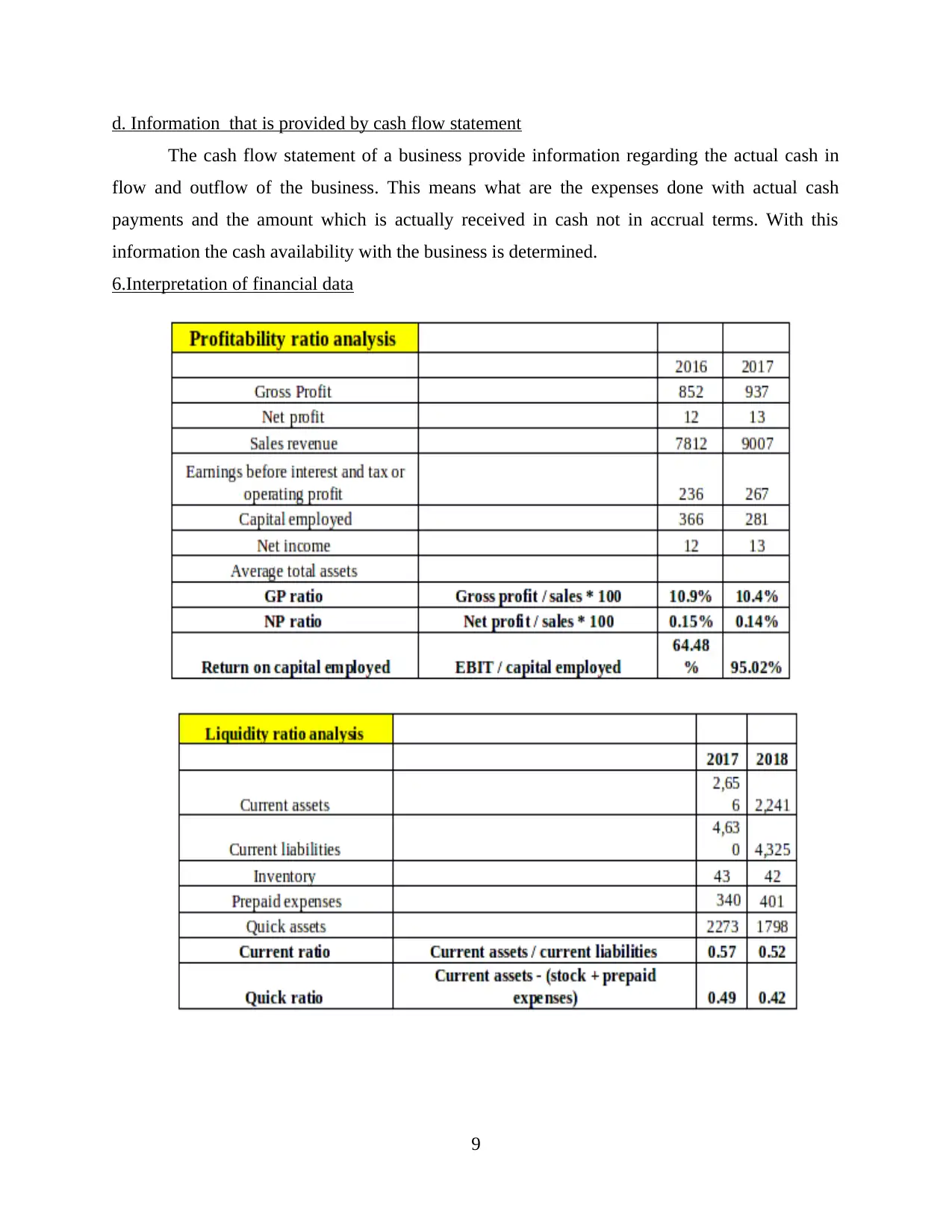

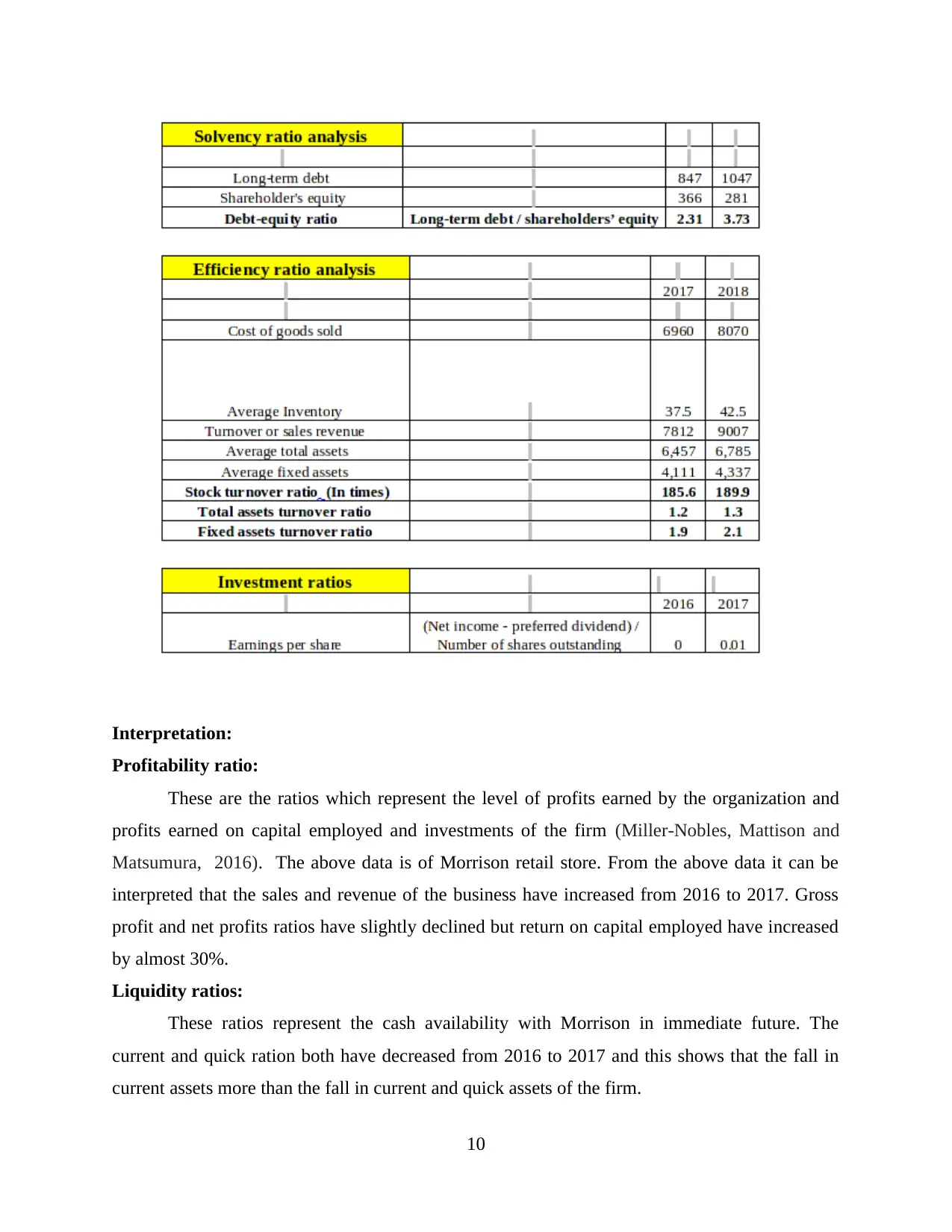

Profitability ratio:

These are the ratios which represent the level of profits earned by the organization and

profits earned on capital employed and investments of the firm (Miller-Nobles, Mattison and

Matsumura, 2016). The above data is of Morrison retail store. From the above data it can be

interpreted that the sales and revenue of the business have increased from 2016 to 2017. Gross

profit and net profits ratios have slightly declined but return on capital employed have increased

by almost 30%.

Liquidity ratios:

These ratios represent the cash availability with Morrison in immediate future. The

current and quick ration both have decreased from 2016 to 2017 and this shows that the fall in

current assets more than the fall in current and quick assets of the firm.

10

Profitability ratio:

These are the ratios which represent the level of profits earned by the organization and

profits earned on capital employed and investments of the firm (Miller-Nobles, Mattison and

Matsumura, 2016). The above data is of Morrison retail store. From the above data it can be

interpreted that the sales and revenue of the business have increased from 2016 to 2017. Gross

profit and net profits ratios have slightly declined but return on capital employed have increased

by almost 30%.

Liquidity ratios:

These ratios represent the cash availability with Morrison in immediate future. The

current and quick ration both have decreased from 2016 to 2017 and this shows that the fall in

current assets more than the fall in current and quick assets of the firm.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.