Financial Reporting: Context, Purpose, and Stakeholders Analysis

VerifiedAdded on 2021/02/20

|18

|5878

|40

Report

AI Summary

This report provides a comprehensive analysis of financial reporting, focusing on the context, purpose, and stakeholders involved. It explores the importance of financial reporting in business decision-making and examines the qualitative characteristics that make financial information reliable. The report includes a case study of The TaxCom Accountants, analyzing their financial statements and the benefits of financial reporting for meeting objectives and driving growth. It also covers the main financial statements, interpretation of financial performance, and the differences between IAS and IFRS, highlighting the advantages of the international financial reporting system and the degree of compliance. The report emphasizes how financial reporting aids in debt management, trend identification, and overall business development. It provides a detailed overview of internal and external stakeholders, their benefits from financial information, and the value of financial reporting in achieving organizational goals. References are provided at the end.

Financial

Reporting

Reporting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Like theTable of Contents

INTRODUCTION...........................................................................................................................1

QUESTION .....................................................................................................................................1

1. Context and purpose of financial reporting........................................................................1

2. Qualitative features of financial information.....................................................................2

3. Main Stakeholder and benefit to financial information......................................................4

4. Value of financial reporting to meet objective and growth................................................5

5. Main Financial Statements.................................................................................................6

6. Interpretation and communication of financial performance.............................................8

7. Differences between IAS and IFRS.................................................................................11

8. Advantages of International financial reporting system...................................................11

9. Degree of compliance with IFRS.....................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

QUESTION .....................................................................................................................................1

1. Context and purpose of financial reporting........................................................................1

2. Qualitative features of financial information.....................................................................2

3. Main Stakeholder and benefit to financial information......................................................4

4. Value of financial reporting to meet objective and growth................................................5

5. Main Financial Statements.................................................................................................6

6. Interpretation and communication of financial performance.............................................8

7. Differences between IAS and IFRS.................................................................................11

8. Advantages of International financial reporting system...................................................11

9. Degree of compliance with IFRS.....................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

The concept of financial reporting mainly focuses on the accounting process and standard

in establishing and reporting company financial statements (Financial reporting, 2019). It is

related to the financial results of company which are prepared and presented to general public

and interested parties. The primary idea of financial reporting is related to the transparency of

significant financial data presented before stakeholders. Based on this data, in a specified period

of frame, they can examine the general performance and current business condition. In addition,

it present few typical factors of financial reporting such as annual report, crucial listing of

company, financial statements and essential decision related. In this report The TaxCom

Accountants have been selected in order to better understand the concept of financial reporting.

In this report, context and purpose of financial reporting, qualitative characteristics which

makes the financial information more reliable, main stakeholder of company and their benefit

from financial information, value of financial-reporting are discussed in this report. In addition,

income statements, statements of change in equity and statements of financial position have been

prepared. Apart from the difference between IAS and IFRS and its benefits with degree of

compliances are discussed.

QUESTION

1. Context and purpose of financial reporting.

In business world, it has been observed that financial reporting have a major role to be

played in developing and establishing world economy. The main objective is to make sure that

user have the effective and meaningful information so that important decision are made in order

to increase efficiency of business. Managers obtain an annual statement summarizing their

business's efficiency and situation to evaluate how often their business has been accomplished

over the accounting era (Belal, 2016). With the support of financial statements such as income

statement, balance sheet and equity change declaration, the crucial economic data is available.

They analyse general efficiency on the grounds of these accounts and then make efficient choices

to enhance profitability. There is a systematic manner to prepare these accounts such as financial

statement are produced annually and summarize the actual efficiency of several activities and

members of company. Financial reporting comprises of transparency of financial results to top

manager within an organisation organization over a particular span of moment.

1

The concept of financial reporting mainly focuses on the accounting process and standard

in establishing and reporting company financial statements (Financial reporting, 2019). It is

related to the financial results of company which are prepared and presented to general public

and interested parties. The primary idea of financial reporting is related to the transparency of

significant financial data presented before stakeholders. Based on this data, in a specified period

of frame, they can examine the general performance and current business condition. In addition,

it present few typical factors of financial reporting such as annual report, crucial listing of

company, financial statements and essential decision related. In this report The TaxCom

Accountants have been selected in order to better understand the concept of financial reporting.

In this report, context and purpose of financial reporting, qualitative characteristics which

makes the financial information more reliable, main stakeholder of company and their benefit

from financial information, value of financial-reporting are discussed in this report. In addition,

income statements, statements of change in equity and statements of financial position have been

prepared. Apart from the difference between IAS and IFRS and its benefits with degree of

compliances are discussed.

QUESTION

1. Context and purpose of financial reporting.

In business world, it has been observed that financial reporting have a major role to be

played in developing and establishing world economy. The main objective is to make sure that

user have the effective and meaningful information so that important decision are made in order

to increase efficiency of business. Managers obtain an annual statement summarizing their

business's efficiency and situation to evaluate how often their business has been accomplished

over the accounting era (Belal, 2016). With the support of financial statements such as income

statement, balance sheet and equity change declaration, the crucial economic data is available.

They analyse general efficiency on the grounds of these accounts and then make efficient choices

to enhance profitability. There is a systematic manner to prepare these accounts such as financial

statement are produced annually and summarize the actual efficiency of several activities and

members of company. Financial reporting comprises of transparency of financial results to top

manager within an organisation organization over a particular span of moment.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In addition, it is stated that it help in making valuable decision regarding most profitable

investment which ensure to make more profit in order to attain the desired results. It gets that

financial statements significant for The TaxCom Accountants to fulfil the requirement then

comply with a suitable management system (Burton and Jermakowicz, 2015). It provides the

correct data to create a potential investment judgement that is crucial. There are number of useful

purpose of financial reporting that are defined below:

Financial reporting have the primary aim relates to efficient decision-making and

company goal and general policies.

It will assist to provide accurate and relevant data to certain stakeholders who have been

attached to the business and assist in the method of decision making.

This aid in multiple appearances such as credit-related data to a client, borrower lending

and either investing in a specific company or moving to a different option.

A company's financial reports include significant data that has been linked through an

organisation to total net inflows and outflows. It includes adequate time and uneconomic

operations to assess a company's liquidity.

Financial information assist leadership to acknowledge corporate achievements and faults

as well as general economic health.

If there is a range of subdivisions or partners operating within the parent company then

financial reporting has to be the primary component of a key contract between different segments

that makes it simple for stakeholders and investors to have sufficient understanding of cash

(Weil, Schipper and Francis, 2013).

2. Qualitative features of financial information.

Conceptual and Regulatory framework:

In business era, the main user of general financial reporting are different current and

potential capitalist, creditor and other lender. They acquire the collected information in concern

to make useful decision in context to buy, sell or preserve equity or any debt instruments. It

helps to offer or balance debts or other types of credit that might influence the actions of

executives affecting the need for financial assets within organization during an accounting year

(Che Azmi and Hanifa, 2015). The concept or idea of financial reporting is linked to annual

reports which describe the various economic kinds of accounts that contribute to potential

enhancement in judgement making processes. In context of making useful prediction which

2

investment which ensure to make more profit in order to attain the desired results. It gets that

financial statements significant for The TaxCom Accountants to fulfil the requirement then

comply with a suitable management system (Burton and Jermakowicz, 2015). It provides the

correct data to create a potential investment judgement that is crucial. There are number of useful

purpose of financial reporting that are defined below:

Financial reporting have the primary aim relates to efficient decision-making and

company goal and general policies.

It will assist to provide accurate and relevant data to certain stakeholders who have been

attached to the business and assist in the method of decision making.

This aid in multiple appearances such as credit-related data to a client, borrower lending

and either investing in a specific company or moving to a different option.

A company's financial reports include significant data that has been linked through an

organisation to total net inflows and outflows. It includes adequate time and uneconomic

operations to assess a company's liquidity.

Financial information assist leadership to acknowledge corporate achievements and faults

as well as general economic health.

If there is a range of subdivisions or partners operating within the parent company then

financial reporting has to be the primary component of a key contract between different segments

that makes it simple for stakeholders and investors to have sufficient understanding of cash

(Weil, Schipper and Francis, 2013).

2. Qualitative features of financial information.

Conceptual and Regulatory framework:

In business era, the main user of general financial reporting are different current and

potential capitalist, creditor and other lender. They acquire the collected information in concern

to make useful decision in context to buy, sell or preserve equity or any debt instruments. It

helps to offer or balance debts or other types of credit that might influence the actions of

executives affecting the need for financial assets within organization during an accounting year

(Che Azmi and Hanifa, 2015). The concept or idea of financial reporting is linked to annual

reports which describe the various economic kinds of accounts that contribute to potential

enhancement in judgement making processes. In context of making useful prediction which

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

support to improve the effectiveness of economic norms and values, a company legislative

framework is useful. It will provide effective assistance for controlling financial operations. In

The TaxCom Accountants follow the standard and frameworks of IFRS which are discussed

underneath:

Specific accounts provide useful thoughts that can help to ascertain the actual quantity

that is required and vital to successfully sustain company activities.

It is beneficial to create and manage economic data in accordance with accounting

standards requirements.

They support the development of a strong company image by enhancing development

and grasping chances available in the market.

Qualitative characteristics:

It is defined that financial-reporting consider various kind of features that are qualitative

in nature which provide valuable support to internal manager so that they can make meaningful

decision (Mio, 2016). With the help of these characteristics the collected information is consider

to be more reliable and faithful that help in making advance decision. Some of these are

elaborated below:

Understandability: It is one of the most crucial features which state that information

must be promptly understandable to user of the financial reports. This states that

presented information must be clear, contain addition information with supporting

footnote that give essential knowledge about company .

Relevance: The data must be applicable to users requirements, which is the situation

when the data affects users financial choices. So it is the duty of accountant to prepare

report with specific relevant information otherwise any kind of mistake and omission can

impact the decision of investors.

Reliability: It is important that financial information must be free from any kind of error,

not be misleading so that information must be faithfully describe the transactions and

other events which makes these report reliable for user within an accounting framework.

Comparability: It is observed that financial information should be prepared in

significant manner so that user can easily compare the previous report with current one

and analyse the trends in the performance and financial status of company.

3

framework is useful. It will provide effective assistance for controlling financial operations. In

The TaxCom Accountants follow the standard and frameworks of IFRS which are discussed

underneath:

Specific accounts provide useful thoughts that can help to ascertain the actual quantity

that is required and vital to successfully sustain company activities.

It is beneficial to create and manage economic data in accordance with accounting

standards requirements.

They support the development of a strong company image by enhancing development

and grasping chances available in the market.

Qualitative characteristics:

It is defined that financial-reporting consider various kind of features that are qualitative

in nature which provide valuable support to internal manager so that they can make meaningful

decision (Mio, 2016). With the help of these characteristics the collected information is consider

to be more reliable and faithful that help in making advance decision. Some of these are

elaborated below:

Understandability: It is one of the most crucial features which state that information

must be promptly understandable to user of the financial reports. This states that

presented information must be clear, contain addition information with supporting

footnote that give essential knowledge about company .

Relevance: The data must be applicable to users requirements, which is the situation

when the data affects users financial choices. So it is the duty of accountant to prepare

report with specific relevant information otherwise any kind of mistake and omission can

impact the decision of investors.

Reliability: It is important that financial information must be free from any kind of error,

not be misleading so that information must be faithfully describe the transactions and

other events which makes these report reliable for user within an accounting framework.

Comparability: It is observed that financial information should be prepared in

significant manner so that user can easily compare the previous report with current one

and analyse the trends in the performance and financial status of company.

3

3. Main Stakeholder and benefit to financial information.

An individual or a group of people or any company those are influenced by the results of

a certain project of a specific company is termed as stakeholder. These parties have a high

interest in the success and results of a project and stakeholder might be operate from inside or

outside of business firm. In business term, a stakeholder is a party that hold certain engagement

within company and there action might have impact on the overall performance during a year.

The main stakeholder to a regular business entity are investors, customer, employee and

suppliers. They are categorised into internal and external stakeholder those can be affected due to

results of company (Jaya and Verawaty, 2015). Internal stakeholder are individual who have

concern within company and it comes with the direct relationship like employees, owner and

investors. On the other side external stakeholder are the group of people those do not have a

direct connection with company but at the same time can be influenced by the annual results. For

example supplier, creditor and general public are some main external stakeholder. These are

discussed underneath:

Internal stakeholders

Directors: These internal stakeholder are mainly concerned about functioning and

controlling of different function and operation of company. Board of director are usually

involved in decision making process so that effective strategies can be made in order to

increase profitability and performance of company. In The TaxCom Accountants these

stakeholder are regard as first line of defence as they use to make decision about

employee engagement, prepare principle and policies and crucial agreements.

Employees: They are referred as main stakeholder for a company and have a direct

relation with the business activities of company. In respective firm there are number of

employees those have been appointed by management on different crucial activities.

They put their entire efforts and ability to meet the desired results in order to increase

overall profitability of business (Trucco, 2015).

External stakeholders

Investors: These kinds of shareholders, including debt managers and shareholders, invest

their cash in the corporation. Good return rates are expected on their investment cash. It

depends primarily on a company's market value. In context of The TaxCom Accountants

4

An individual or a group of people or any company those are influenced by the results of

a certain project of a specific company is termed as stakeholder. These parties have a high

interest in the success and results of a project and stakeholder might be operate from inside or

outside of business firm. In business term, a stakeholder is a party that hold certain engagement

within company and there action might have impact on the overall performance during a year.

The main stakeholder to a regular business entity are investors, customer, employee and

suppliers. They are categorised into internal and external stakeholder those can be affected due to

results of company (Jaya and Verawaty, 2015). Internal stakeholder are individual who have

concern within company and it comes with the direct relationship like employees, owner and

investors. On the other side external stakeholder are the group of people those do not have a

direct connection with company but at the same time can be influenced by the annual results. For

example supplier, creditor and general public are some main external stakeholder. These are

discussed underneath:

Internal stakeholders

Directors: These internal stakeholder are mainly concerned about functioning and

controlling of different function and operation of company. Board of director are usually

involved in decision making process so that effective strategies can be made in order to

increase profitability and performance of company. In The TaxCom Accountants these

stakeholder are regard as first line of defence as they use to make decision about

employee engagement, prepare principle and policies and crucial agreements.

Employees: They are referred as main stakeholder for a company and have a direct

relation with the business activities of company. In respective firm there are number of

employees those have been appointed by management on different crucial activities.

They put their entire efforts and ability to meet the desired results in order to increase

overall profitability of business (Trucco, 2015).

External stakeholders

Investors: These kinds of shareholders, including debt managers and shareholders, invest

their cash in the corporation. Good return rates are expected on their investment cash. It

depends primarily on a company's market value. In context of The TaxCom Accountants

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the investors are proportionate to debt equity ratio so that they make meaningful

investment decision.

Government: They have a major impact of the functioning of company because their

action might create problem or gives necessary advantages to company during an

accounting year. There are crucial regulation of government in different area of business

such as competition, taxation, consumer protection etc. that can have a greater influence

on business of The TaxCom Accountants.

Customer: These are consider as the main external stakeholder of company because they

are the one those are exposed to risk. Their decision have a major impact on the

profitability of company such as in case if respective firm is unable to provide effective

financial services than they might move to other option in search of more desirable

accountability services.

4. Value of financial reporting to meet objective and growth

The financial statement is useful to each organization that can assist to achieve an

organization's goals. In almost every company the management use different crucial financial

accounts to examine the entire performance and real conditions in current accounting year. This

further support to create effective plan and policies according to the need of company so that

financial report can be easily interprets the overall financial status during an accounting year. In

context of The TaxCom Accountant there are number of financial statements that are develop in

order to maintain financial information which enables to meet the desired aims and objective.

Financial reporting has been used to create significant company choices by owners, executives,

staff, shareholders, organizations, government, and many others. This help to make following

investment decision within company that aid to generate more and more funds inside business

firm so that financial goals and objective can be accomplished (Trotman and Carson, 2018).

Financial Reporting and development of organisation

Using financial reports, company develops various kind of crucial business activities and

operation because it impacts on the company's economic situation. These help to make efficient

decisions for additional funds. Like an organization wishes to distribute its business in different

part of world with the main motive to increase the overall profitability. There are number of

benefit to of financial reporting that assist respective firm to expand their business at reach

predetermined objective (Jin, Shan and Taylor, 2015). Some of these are discussed below:

5

investment decision.

Government: They have a major impact of the functioning of company because their

action might create problem or gives necessary advantages to company during an

accounting year. There are crucial regulation of government in different area of business

such as competition, taxation, consumer protection etc. that can have a greater influence

on business of The TaxCom Accountants.

Customer: These are consider as the main external stakeholder of company because they

are the one those are exposed to risk. Their decision have a major impact on the

profitability of company such as in case if respective firm is unable to provide effective

financial services than they might move to other option in search of more desirable

accountability services.

4. Value of financial reporting to meet objective and growth

The financial statement is useful to each organization that can assist to achieve an

organization's goals. In almost every company the management use different crucial financial

accounts to examine the entire performance and real conditions in current accounting year. This

further support to create effective plan and policies according to the need of company so that

financial report can be easily interprets the overall financial status during an accounting year. In

context of The TaxCom Accountant there are number of financial statements that are develop in

order to maintain financial information which enables to meet the desired aims and objective.

Financial reporting has been used to create significant company choices by owners, executives,

staff, shareholders, organizations, government, and many others. This help to make following

investment decision within company that aid to generate more and more funds inside business

firm so that financial goals and objective can be accomplished (Trotman and Carson, 2018).

Financial Reporting and development of organisation

Using financial reports, company develops various kind of crucial business activities and

operation because it impacts on the company's economic situation. These help to make efficient

decisions for additional funds. Like an organization wishes to distribute its business in different

part of world with the main motive to increase the overall profitability. There are number of

benefit to of financial reporting that assist respective firm to expand their business at reach

predetermined objective (Jin, Shan and Taylor, 2015). Some of these are discussed below:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Improved debt management: Objective of various kinds of financial reporting is nearly

to alternatives that will assist manager to monitor its current liabilities separated by

current assets on yearly balance sheet which further gainful to measure total cash flow

and handle entire debts properly. Therefore with the improved debt management The

TaxCom Accountant are able to operate business in meaningful manner so that yearly

goals are meet.

Trend identification: Financial reporting is valuable for company in tracking and

identifying trends for both past and current that enable the management of respective

company to tackle every weakness and make better improvement which is beneficial for

complete health of company (Mullinova and Simonyants, 2016).

Real time tracking: By giving access to extensive, real-time ideas, manager of The

TaxCom Accountant would be prepared to create precise, educated choices quickly,

removing prospective obstacles at all moments while preserving company financial

liquidity.

Managing liabilities: One of the critical part of business in to manage liabilities such as

business loans, credit card, bills from vendors etc. Financial reports are used for effective

planning so that it can be applied for expansion of business loan. It also benefit to explore

information on the financial statements and evaluate whether current liabilities need to be

reduced before creating an official request (Velte and Stawinoga, 2017).

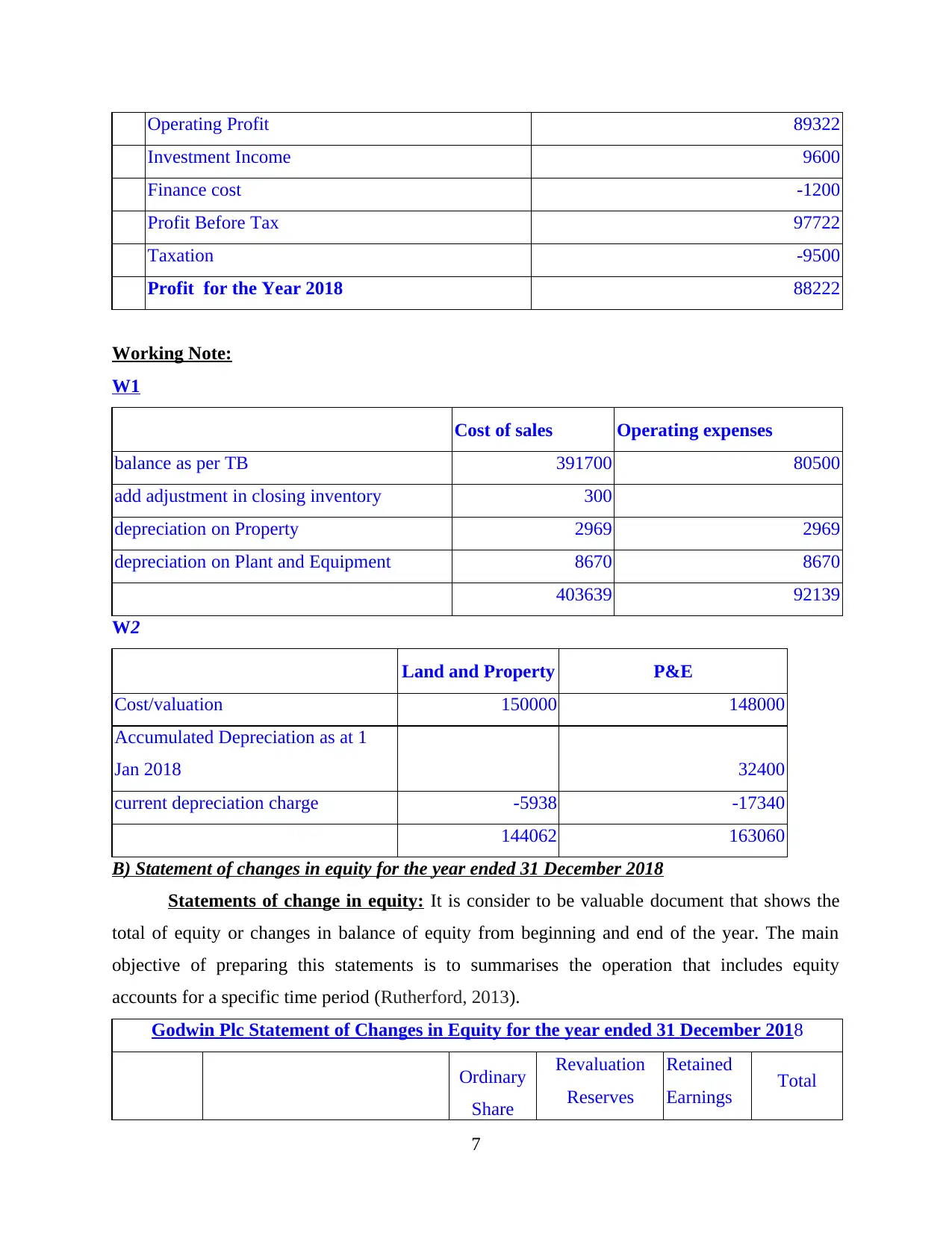

5. Main Financial Statements

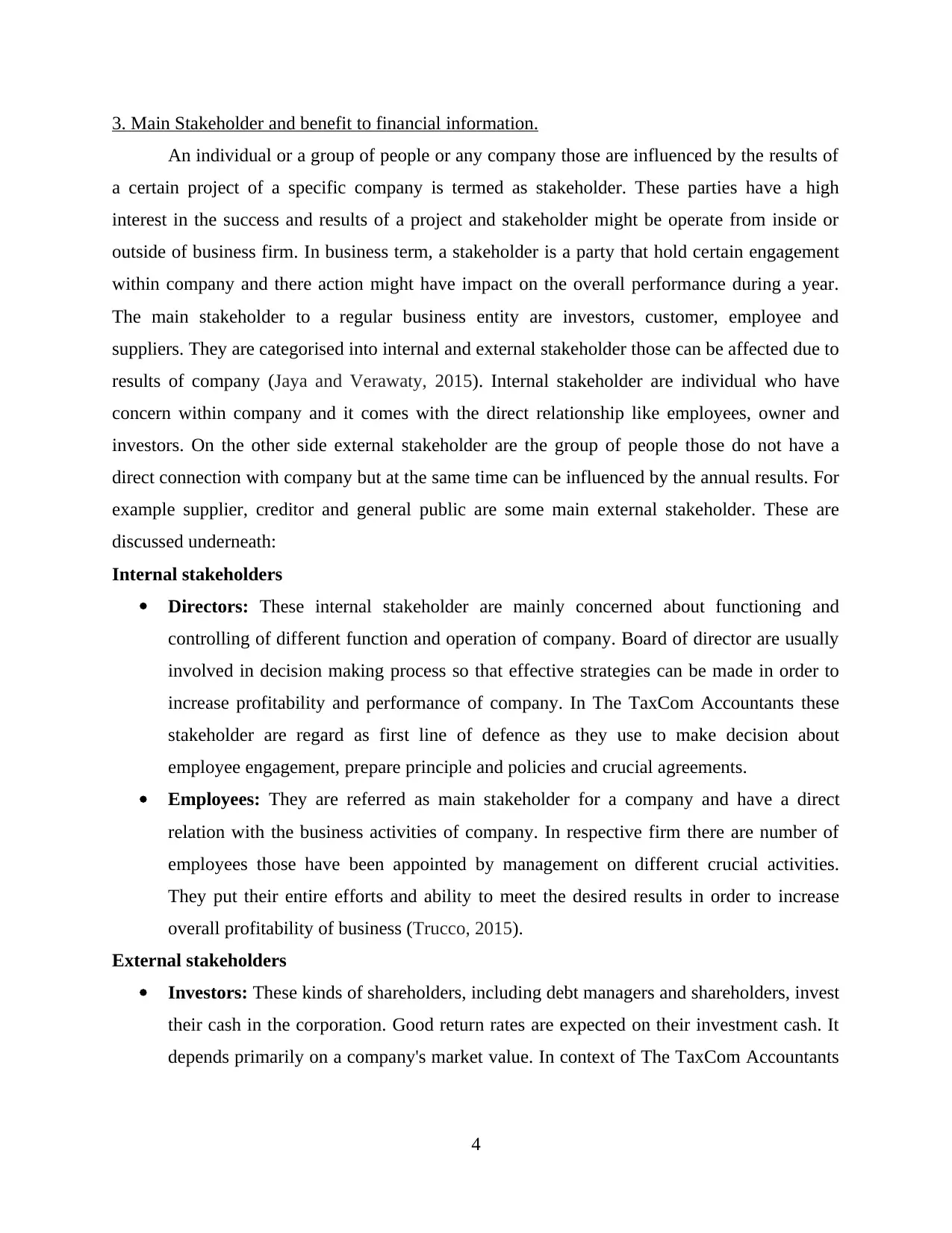

Profit and Loss statement: This is also named as income statements that have the main

purpose to record the total revenue and expenditure of company within a specific period of time.

In accounting term this is consider to be most crucial statements which display the actual

profitability of business in a defined accounting period (Schroeder Clark and Cathey, 2009).

GODWIN Plc Statement of Profit or Loss for the year ended 31 December 2018

£

Revenue 585100

Cost of Sales w1 -403639

Gross Profit 181461

Operating expenses w1 -92139

6

to alternatives that will assist manager to monitor its current liabilities separated by

current assets on yearly balance sheet which further gainful to measure total cash flow

and handle entire debts properly. Therefore with the improved debt management The

TaxCom Accountant are able to operate business in meaningful manner so that yearly

goals are meet.

Trend identification: Financial reporting is valuable for company in tracking and

identifying trends for both past and current that enable the management of respective

company to tackle every weakness and make better improvement which is beneficial for

complete health of company (Mullinova and Simonyants, 2016).

Real time tracking: By giving access to extensive, real-time ideas, manager of The

TaxCom Accountant would be prepared to create precise, educated choices quickly,

removing prospective obstacles at all moments while preserving company financial

liquidity.

Managing liabilities: One of the critical part of business in to manage liabilities such as

business loans, credit card, bills from vendors etc. Financial reports are used for effective

planning so that it can be applied for expansion of business loan. It also benefit to explore

information on the financial statements and evaluate whether current liabilities need to be

reduced before creating an official request (Velte and Stawinoga, 2017).

5. Main Financial Statements

Profit and Loss statement: This is also named as income statements that have the main

purpose to record the total revenue and expenditure of company within a specific period of time.

In accounting term this is consider to be most crucial statements which display the actual

profitability of business in a defined accounting period (Schroeder Clark and Cathey, 2009).

GODWIN Plc Statement of Profit or Loss for the year ended 31 December 2018

£

Revenue 585100

Cost of Sales w1 -403639

Gross Profit 181461

Operating expenses w1 -92139

6

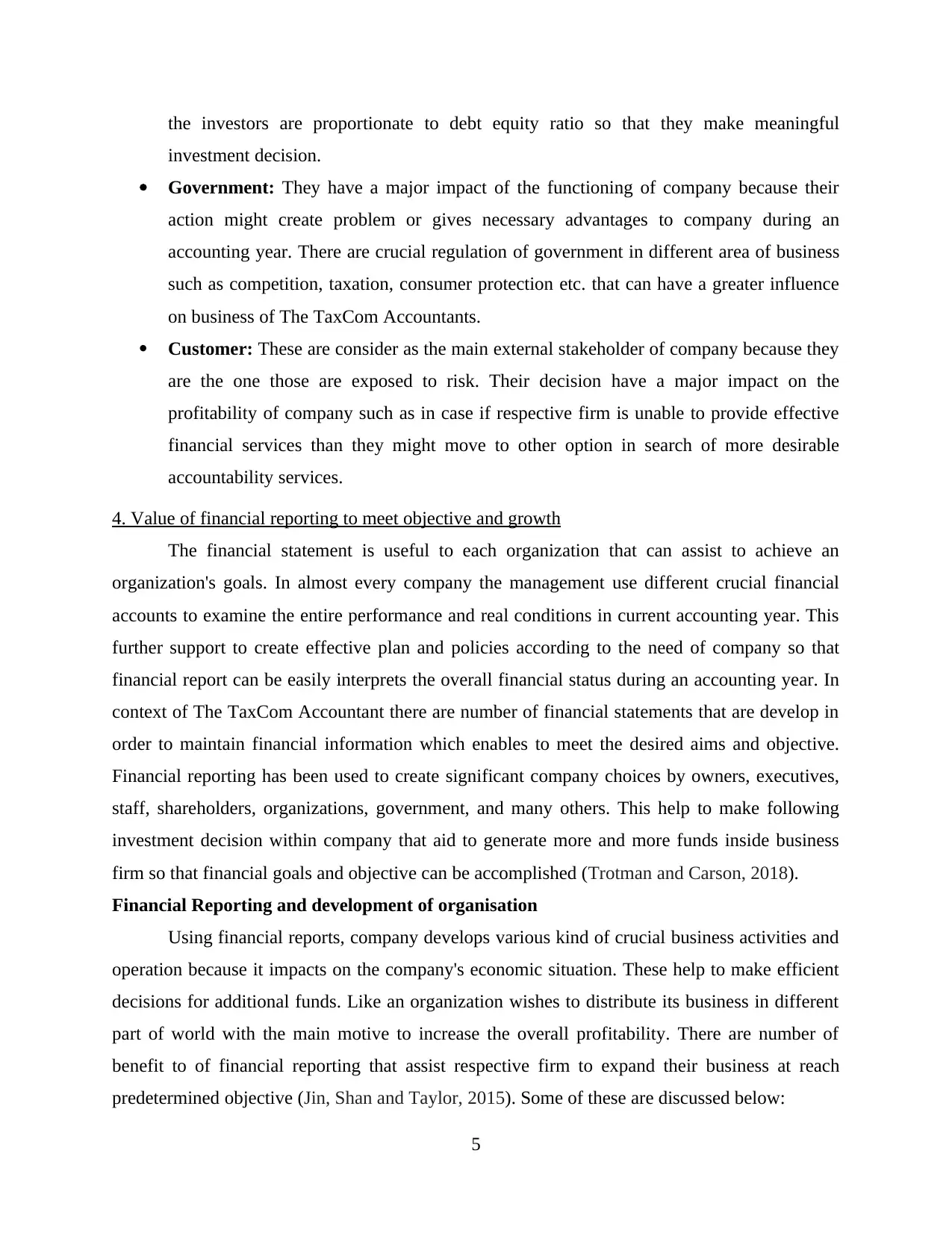

Operating Profit 89322

Investment Income 9600

Finance cost -1200

Profit Before Tax 97722

Taxation -9500

Profit for the Year 2018 88222

Working Note:

W1

Cost of sales Operating expenses

balance as per TB 391700 80500

add adjustment in closing inventory 300

depreciation on Property 2969 2969

depreciation on Plant and Equipment 8670 8670

403639 92139

W2

Land and Property P&E

Cost/valuation 150000 148000

Accumulated Depreciation as at 1

Jan 2018 32400

current depreciation charge -5938 -17340

144062 163060

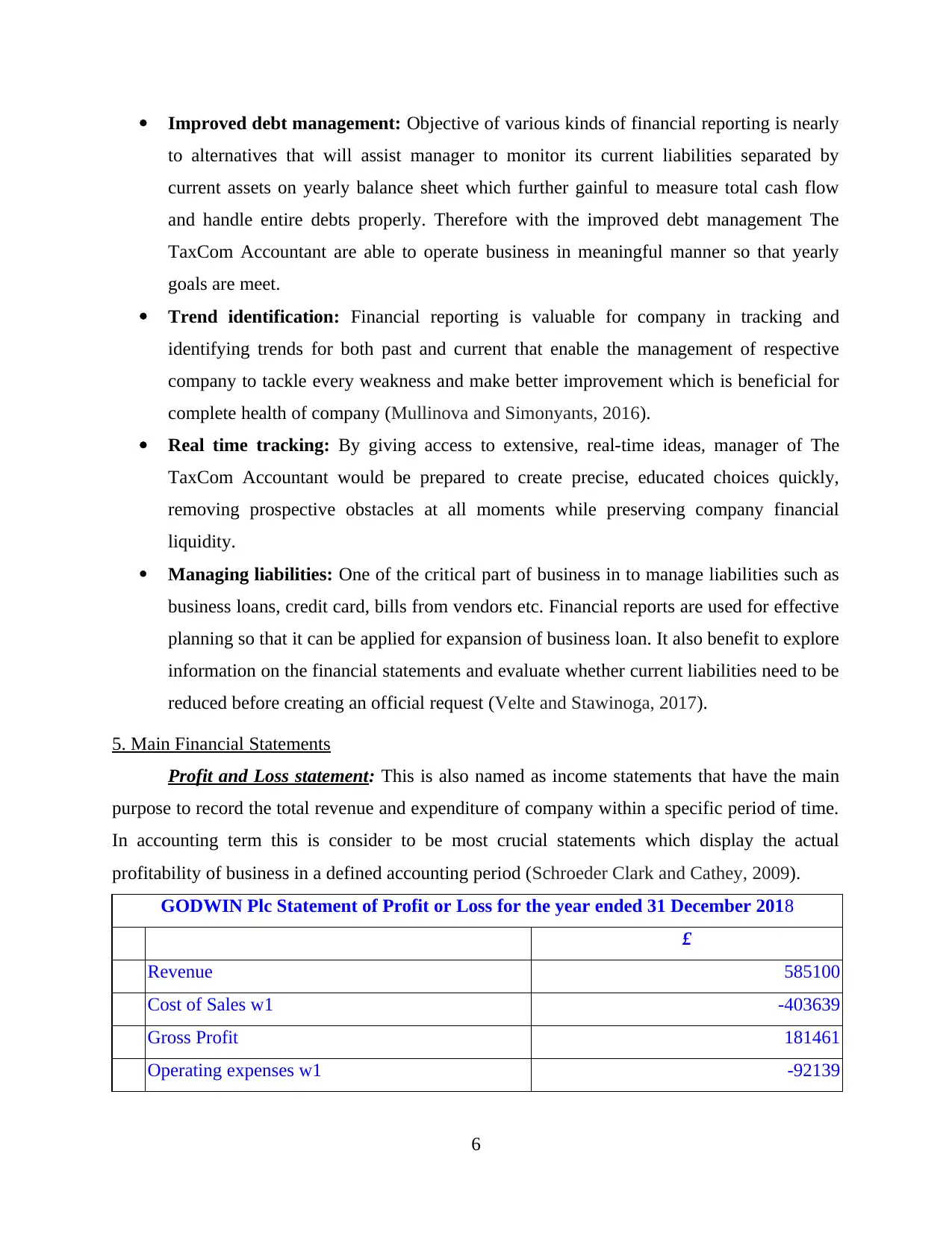

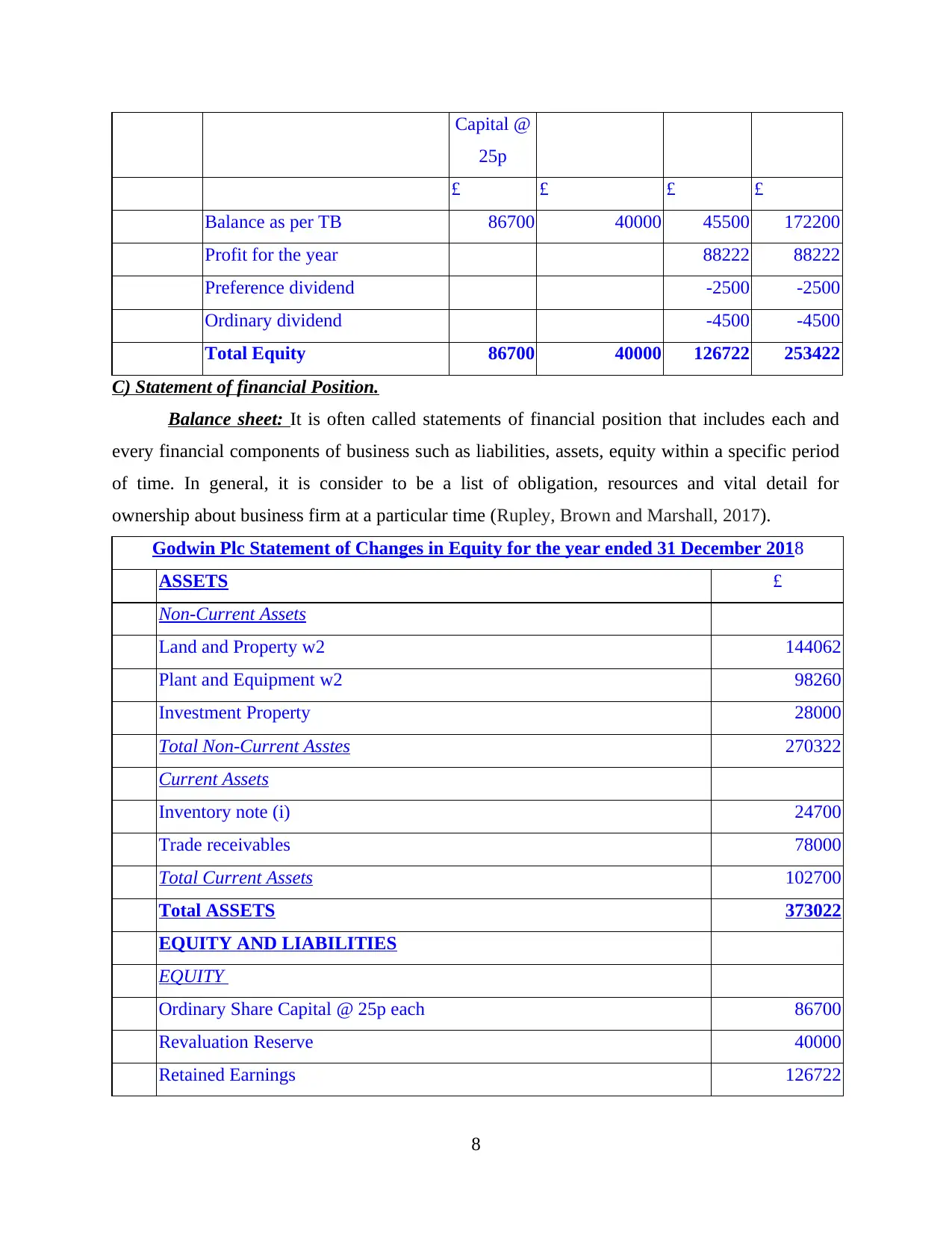

B) Statement of changes in equity for the year ended 31 December 2018

Statements of change in equity: It is consider to be valuable document that shows the

total of equity or changes in balance of equity from beginning and end of the year. The main

objective of preparing this statements is to summarises the operation that includes equity

accounts for a specific time period (Rutherford, 2013).

Godwin Plc Statement of Changes in Equity for the year ended 31 December 2018

Ordinary

Share

Revaluation

Reserves

Retained

Earnings Total

7

Investment Income 9600

Finance cost -1200

Profit Before Tax 97722

Taxation -9500

Profit for the Year 2018 88222

Working Note:

W1

Cost of sales Operating expenses

balance as per TB 391700 80500

add adjustment in closing inventory 300

depreciation on Property 2969 2969

depreciation on Plant and Equipment 8670 8670

403639 92139

W2

Land and Property P&E

Cost/valuation 150000 148000

Accumulated Depreciation as at 1

Jan 2018 32400

current depreciation charge -5938 -17340

144062 163060

B) Statement of changes in equity for the year ended 31 December 2018

Statements of change in equity: It is consider to be valuable document that shows the

total of equity or changes in balance of equity from beginning and end of the year. The main

objective of preparing this statements is to summarises the operation that includes equity

accounts for a specific time period (Rutherford, 2013).

Godwin Plc Statement of Changes in Equity for the year ended 31 December 2018

Ordinary

Share

Revaluation

Reserves

Retained

Earnings Total

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Capital @

25p

£ £ £ £

Balance as per TB 86700 40000 45500 172200

Profit for the year 88222 88222

Preference dividend -2500 -2500

Ordinary dividend -4500 -4500

Total Equity 86700 40000 126722 253422

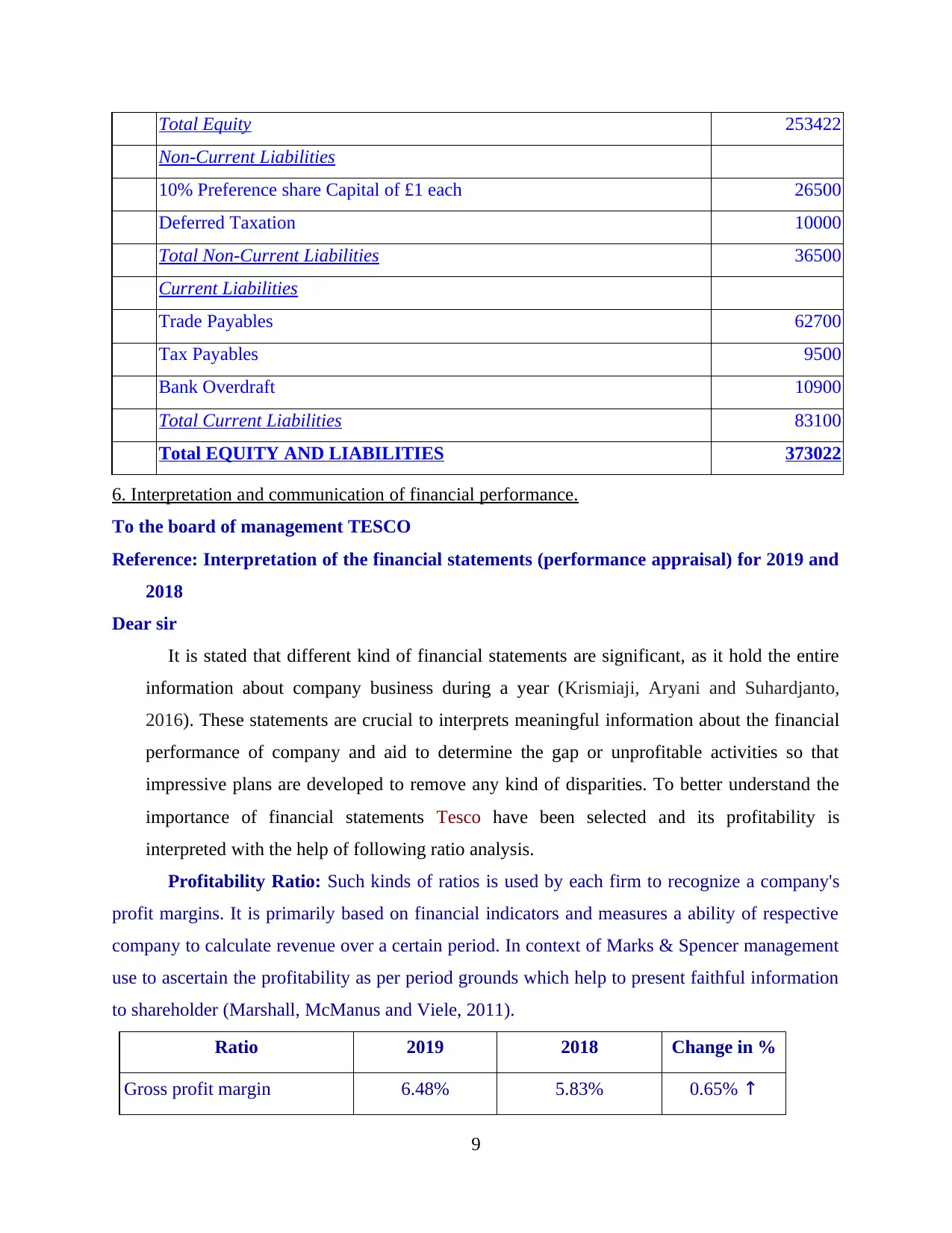

C) Statement of financial Position.

Balance sheet: It is often called statements of financial position that includes each and

every financial components of business such as liabilities, assets, equity within a specific period

of time. In general, it is consider to be a list of obligation, resources and vital detail for

ownership about business firm at a particular time (Rupley, Brown and Marshall, 2017).

Godwin Plc Statement of Changes in Equity for the year ended 31 December 2018

ASSETS £

Non-Current Assets

Land and Property w2 144062

Plant and Equipment w2 98260

Investment Property 28000

Total Non-Current Asstes 270322

Current Assets

Inventory note (i) 24700

Trade receivables 78000

Total Current Assets 102700

Total ASSETS 373022

EQUITY AND LIABILITIES

EQUITY

Ordinary Share Capital @ 25p each 86700

Revaluation Reserve 40000

Retained Earnings 126722

8

25p

£ £ £ £

Balance as per TB 86700 40000 45500 172200

Profit for the year 88222 88222

Preference dividend -2500 -2500

Ordinary dividend -4500 -4500

Total Equity 86700 40000 126722 253422

C) Statement of financial Position.

Balance sheet: It is often called statements of financial position that includes each and

every financial components of business such as liabilities, assets, equity within a specific period

of time. In general, it is consider to be a list of obligation, resources and vital detail for

ownership about business firm at a particular time (Rupley, Brown and Marshall, 2017).

Godwin Plc Statement of Changes in Equity for the year ended 31 December 2018

ASSETS £

Non-Current Assets

Land and Property w2 144062

Plant and Equipment w2 98260

Investment Property 28000

Total Non-Current Asstes 270322

Current Assets

Inventory note (i) 24700

Trade receivables 78000

Total Current Assets 102700

Total ASSETS 373022

EQUITY AND LIABILITIES

EQUITY

Ordinary Share Capital @ 25p each 86700

Revaluation Reserve 40000

Retained Earnings 126722

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total Equity 253422

Non-Current Liabilities

10% Preference share Capital of £1 each 26500

Deferred Taxation 10000

Total Non-Current Liabilities 36500

Current Liabilities

Trade Payables 62700

Tax Payables 9500

Bank Overdraft 10900

Total Current Liabilities 83100

Total EQUITY AND LIABILITIES 373022

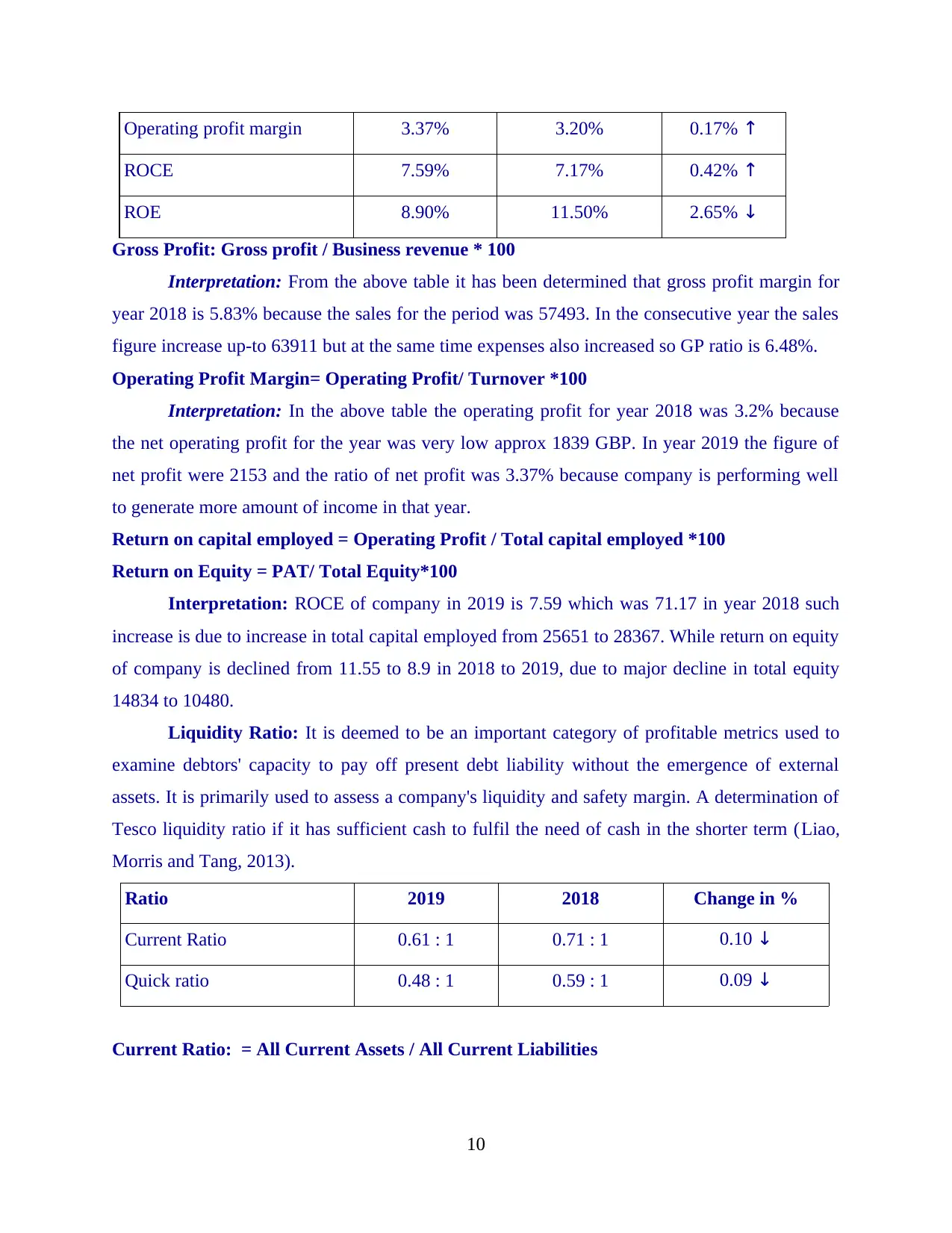

6. Interpretation and communication of financial performance.

To the board of management TESCO

Reference: Interpretation of the financial statements (performance appraisal) for 2019 and

2018

Dear sir

It is stated that different kind of financial statements are significant, as it hold the entire

information about company business during a year (Krismiaji, Aryani and Suhardjanto,

2016). These statements are crucial to interprets meaningful information about the financial

performance of company and aid to determine the gap or unprofitable activities so that

impressive plans are developed to remove any kind of disparities. To better understand the

importance of financial statements Tesco have been selected and its profitability is

interpreted with the help of following ratio analysis.

Profitability Ratio: Such kinds of ratios is used by each firm to recognize a company's

profit margins. It is primarily based on financial indicators and measures a ability of respective

company to calculate revenue over a certain period. In context of Marks & Spencer management

use to ascertain the profitability as per period grounds which help to present faithful information

to shareholder (Marshall, McManus and Viele, 2011).

Ratio 2019 2018 Change in %

Gross profit margin 6.48% 5.83% 0.65% ↑

9

Non-Current Liabilities

10% Preference share Capital of £1 each 26500

Deferred Taxation 10000

Total Non-Current Liabilities 36500

Current Liabilities

Trade Payables 62700

Tax Payables 9500

Bank Overdraft 10900

Total Current Liabilities 83100

Total EQUITY AND LIABILITIES 373022

6. Interpretation and communication of financial performance.

To the board of management TESCO

Reference: Interpretation of the financial statements (performance appraisal) for 2019 and

2018

Dear sir

It is stated that different kind of financial statements are significant, as it hold the entire

information about company business during a year (Krismiaji, Aryani and Suhardjanto,

2016). These statements are crucial to interprets meaningful information about the financial

performance of company and aid to determine the gap or unprofitable activities so that

impressive plans are developed to remove any kind of disparities. To better understand the

importance of financial statements Tesco have been selected and its profitability is

interpreted with the help of following ratio analysis.

Profitability Ratio: Such kinds of ratios is used by each firm to recognize a company's

profit margins. It is primarily based on financial indicators and measures a ability of respective

company to calculate revenue over a certain period. In context of Marks & Spencer management

use to ascertain the profitability as per period grounds which help to present faithful information

to shareholder (Marshall, McManus and Viele, 2011).

Ratio 2019 2018 Change in %

Gross profit margin 6.48% 5.83% 0.65% ↑

9

Operating profit margin 3.37% 3.20% 0.17% ↑

ROCE 7.59% 7.17% 0.42% ↑

ROE 8.90% 11.50% 2.65% ↓

Gross Profit: Gross profit / Business revenue * 100

Interpretation: From the above table it has been determined that gross profit margin for

year 2018 is 5.83% because the sales for the period was 57493. In the consecutive year the sales

figure increase up-to 63911 but at the same time expenses also increased so GP ratio is 6.48%.

Operating Profit Margin= Operating Profit/ Turnover *100

Interpretation: In the above table the operating profit for year 2018 was 3.2% because

the net operating profit for the year was very low approx 1839 GBP. In year 2019 the figure of

net profit were 2153 and the ratio of net profit was 3.37% because company is performing well

to generate more amount of income in that year.

Return on capital employed = Operating Profit / Total capital employed *100

Return on Equity = PAT/ Total Equity*100

Interpretation: ROCE of company in 2019 is 7.59 which was 71.17 in year 2018 such

increase is due to increase in total capital employed from 25651 to 28367. While return on equity

of company is declined from 11.55 to 8.9 in 2018 to 2019, due to major decline in total equity

14834 to 10480.

Liquidity Ratio: It is deemed to be an important category of profitable metrics used to

examine debtors' capacity to pay off present debt liability without the emergence of external

assets. It is primarily used to assess a company's liquidity and safety margin. A determination of

Tesco liquidity ratio if it has sufficient cash to fulfil the need of cash in the shorter term (Liao,

Morris and Tang, 2013).

Ratio 2019 2018 Change in %

Current Ratio 0.61 : 1 0.71 : 1 0.10 ↓

Quick ratio 0.48 : 1 0.59 : 1 0.09 ↓

Current Ratio: = All Current Assets / All Current Liabilities

10

ROCE 7.59% 7.17% 0.42% ↑

ROE 8.90% 11.50% 2.65% ↓

Gross Profit: Gross profit / Business revenue * 100

Interpretation: From the above table it has been determined that gross profit margin for

year 2018 is 5.83% because the sales for the period was 57493. In the consecutive year the sales

figure increase up-to 63911 but at the same time expenses also increased so GP ratio is 6.48%.

Operating Profit Margin= Operating Profit/ Turnover *100

Interpretation: In the above table the operating profit for year 2018 was 3.2% because

the net operating profit for the year was very low approx 1839 GBP. In year 2019 the figure of

net profit were 2153 and the ratio of net profit was 3.37% because company is performing well

to generate more amount of income in that year.

Return on capital employed = Operating Profit / Total capital employed *100

Return on Equity = PAT/ Total Equity*100

Interpretation: ROCE of company in 2019 is 7.59 which was 71.17 in year 2018 such

increase is due to increase in total capital employed from 25651 to 28367. While return on equity

of company is declined from 11.55 to 8.9 in 2018 to 2019, due to major decline in total equity

14834 to 10480.

Liquidity Ratio: It is deemed to be an important category of profitable metrics used to

examine debtors' capacity to pay off present debt liability without the emergence of external

assets. It is primarily used to assess a company's liquidity and safety margin. A determination of

Tesco liquidity ratio if it has sufficient cash to fulfil the need of cash in the shorter term (Liao,

Morris and Tang, 2013).

Ratio 2019 2018 Change in %

Current Ratio 0.61 : 1 0.71 : 1 0.10 ↓

Quick ratio 0.48 : 1 0.59 : 1 0.09 ↓

Current Ratio: = All Current Assets / All Current Liabilities

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.