Management Accounting Techniques and Financial Reporting for Excite

VerifiedAdded on 2020/11/23

|18

|5101

|371

Report

AI Summary

This report examines the application of management accounting within Excite Entertainment Limited, a leisure and entertainment company. It differentiates between management and financial accounting, detailing various management accounting systems like cost accounting, inventory management, and job costing. The report analyzes different accounting reports, including budget reports, aging reports, job cost reports, and inventory reports, highlighting their importance in financial control and decision-making. It also explores the benefits of management accounting systems, such as cost efficiency, inventory control, and improved accuracy. Furthermore, the report covers marginal and absorption costing, financial reporting techniques, and the use of planning tools for budgetary control. The report culminates in an evaluation of how management accounting systems can be adapted to solve financial problems, providing a comprehensive overview of the subject.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION.............................................................................................................................3

LO 1...................................................................................................................................................3

P1 Management accounting and essential requirements of different types of management

accounting systems.......................................................................................................................3

P2 Different methods used for accounting reports.......................................................................3

M1 Benefits of management accounting systems and their application.......................................3

D1 Evaluation of management accounting systems and reporting within organizational process

.......................................................................................................................................................3

LO 2...................................................................................................................................................3

P3 Calculation of Marginal and Absorption costing.....................................................................3

M2 Management accounting techniques and appropriate financial reporting documents...........3

D2 Preparation of financial reports that apply data for various business activities......................3

LO 3...................................................................................................................................................3

P4 Advantages and disadvantages of different types of planning tools for budgetary control.....3

M3 Use of different planning tools and their application for preparing and forecasting budgets 3

D3 Evaluation of planning tools to solve financial problems.......................................................3

LO 4...................................................................................................................................................3

P5 Adaption of management accounting system to solve financial problems..............................3

M4 Importance of management accounting in solving financial problems..................................3

CONCLUSION.................................................................................................................................3

REFERENCES..................................................................................................................................3

INTRODUCTION.............................................................................................................................3

LO 1...................................................................................................................................................3

P1 Management accounting and essential requirements of different types of management

accounting systems.......................................................................................................................3

P2 Different methods used for accounting reports.......................................................................3

M1 Benefits of management accounting systems and their application.......................................3

D1 Evaluation of management accounting systems and reporting within organizational process

.......................................................................................................................................................3

LO 2...................................................................................................................................................3

P3 Calculation of Marginal and Absorption costing.....................................................................3

M2 Management accounting techniques and appropriate financial reporting documents...........3

D2 Preparation of financial reports that apply data for various business activities......................3

LO 3...................................................................................................................................................3

P4 Advantages and disadvantages of different types of planning tools for budgetary control.....3

M3 Use of different planning tools and their application for preparing and forecasting budgets 3

D3 Evaluation of planning tools to solve financial problems.......................................................3

LO 4...................................................................................................................................................3

P5 Adaption of management accounting system to solve financial problems..............................3

M4 Importance of management accounting in solving financial problems..................................3

CONCLUSION.................................................................................................................................3

REFERENCES..................................................................................................................................3

INTRODUCTION

Management accounting is the application of skills and knowledge that is applied in

preparing accounting information to assist management of the company and help them in making

decisions regarding formulation of policies, planning and to control operations. It helps the

company in finding out early signs of future problem. It helps the companies in finding out

profitability from the particular product and to analyses new product as well as to value stock and

capital budget analysis. To understand each and every concept of Management accounting, the

report will take Excite entertainment limited which deals in leisure and entertainment industry.

The report will first show the basic difference between management accounting and financial

accounting along with different management accounting systems. The report will further focus on

different accounting reports and how management accounting system and reporting system are

integrated in the company. Further, the report will discuss about management accounting

techniques and appropriate financial reporting documents along with calculation of absorption and

marginal costing. To solve financial problems how company will use different budgetary tools

will also be in the report and at last the report will include adaption of management accounting

system to solve financial problems.

LO 1

P1 Management accounting and essential requirements of different types of management

accounting systems

Management accounting is the implied knowledge and skills of manager that helps the

manager in taking decisions related to formulation of policies, planning and controlling the

operations of the company. It helps the company in providing financial as well as non-financial

information on regular intervals to the management.

The management accounting is different from financial accounting as it is used for internal

purpose whereas financial accounting is used for external purpose. Financial accounting is

regulated by law whereas management accounting is not regulated by law and depends on the

skills of manager. Financial accounting provides information to the external users whereas

management accounting provides information to the internal users (D'Onza, 2016.). Financial

accounting only takes monetary value into consideration whereas management accounting takes

both monetary and non-monetary value into consideration.

The different types of management accounting system are:

Management accounting is the application of skills and knowledge that is applied in

preparing accounting information to assist management of the company and help them in making

decisions regarding formulation of policies, planning and to control operations. It helps the

company in finding out early signs of future problem. It helps the companies in finding out

profitability from the particular product and to analyses new product as well as to value stock and

capital budget analysis. To understand each and every concept of Management accounting, the

report will take Excite entertainment limited which deals in leisure and entertainment industry.

The report will first show the basic difference between management accounting and financial

accounting along with different management accounting systems. The report will further focus on

different accounting reports and how management accounting system and reporting system are

integrated in the company. Further, the report will discuss about management accounting

techniques and appropriate financial reporting documents along with calculation of absorption and

marginal costing. To solve financial problems how company will use different budgetary tools

will also be in the report and at last the report will include adaption of management accounting

system to solve financial problems.

LO 1

P1 Management accounting and essential requirements of different types of management

accounting systems

Management accounting is the implied knowledge and skills of manager that helps the

manager in taking decisions related to formulation of policies, planning and controlling the

operations of the company. It helps the company in providing financial as well as non-financial

information on regular intervals to the management.

The management accounting is different from financial accounting as it is used for internal

purpose whereas financial accounting is used for external purpose. Financial accounting is

regulated by law whereas management accounting is not regulated by law and depends on the

skills of manager. Financial accounting provides information to the external users whereas

management accounting provides information to the internal users (D'Onza, 2016.). Financial

accounting only takes monetary value into consideration whereas management accounting takes

both monetary and non-monetary value into consideration.

The different types of management accounting system are:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting system – A cost accounting is a framework used by firms to estimate the

cost of their products for profitability analysis, inventory valuation and cost control. The two main

cost accounting system are job order costing and process costing (Usenko and et.al., 2018). Cost

accounting system includes standard costing which is an integral part of cost accounting system.

This cost is associated with direct cost of the manufacturing company which involves direct labor,

direct material and overheads. The cost accounting system carries all the inventory accounts at

standard cost it is needed in Excite limited to estimate the cost of products that company is selling

and to do their profitability analysis and valuation of inventory.

Inventory management system – This system helps Excite entertainment ltd in tracking

goods through entire supply chain or specific department of the company in which it operates.

This system covers everything from production to retail, warehousing to shipments etc. an

inventory management most likely to perform functions such as bar coding, inventory alerts,

accounting tools, forecasting of inventory etc. It uses two methods to manage the inventory:

LIFO – It refers to last in first out which means the materials that has been received in the

last need to be sold at first.

FIFO - It refers to first in last out which means the materials that has been received in the

first need to be sold at last.

Job costing system – This system helps in assigning and calculating manufacturing cost of

an individual unit of output in Excite entertainment ltd. This system is used when the products

produced by the company are different from each other and has significant cost. It records each

product's direct material and labor that were used along with manufacturing overhead.

Job Order Costing Method – This method of cost accounting system helps in

determining the cost value which has been incurred by the company for producing a

specific product or group of products.

Process Costing Method – The process costing method assist Excite Entertainment Ltd

with facility of collecting, gathering and making assignment of cost amount. This cost

amount is assigned to manufacturing processes.

P2 Different methods used for accounting reports

Different methods of accounting reporting used by Excite entertainment ltd are:

Budget report – it is the most important report in management accounting as it helps the

owners of Excite ltd to understand and control the cost of the company and its operations as a

cost of their products for profitability analysis, inventory valuation and cost control. The two main

cost accounting system are job order costing and process costing (Usenko and et.al., 2018). Cost

accounting system includes standard costing which is an integral part of cost accounting system.

This cost is associated with direct cost of the manufacturing company which involves direct labor,

direct material and overheads. The cost accounting system carries all the inventory accounts at

standard cost it is needed in Excite limited to estimate the cost of products that company is selling

and to do their profitability analysis and valuation of inventory.

Inventory management system – This system helps Excite entertainment ltd in tracking

goods through entire supply chain or specific department of the company in which it operates.

This system covers everything from production to retail, warehousing to shipments etc. an

inventory management most likely to perform functions such as bar coding, inventory alerts,

accounting tools, forecasting of inventory etc. It uses two methods to manage the inventory:

LIFO – It refers to last in first out which means the materials that has been received in the

last need to be sold at first.

FIFO - It refers to first in last out which means the materials that has been received in the

first need to be sold at last.

Job costing system – This system helps in assigning and calculating manufacturing cost of

an individual unit of output in Excite entertainment ltd. This system is used when the products

produced by the company are different from each other and has significant cost. It records each

product's direct material and labor that were used along with manufacturing overhead.

Job Order Costing Method – This method of cost accounting system helps in

determining the cost value which has been incurred by the company for producing a

specific product or group of products.

Process Costing Method – The process costing method assist Excite Entertainment Ltd

with facility of collecting, gathering and making assignment of cost amount. This cost

amount is assigned to manufacturing processes.

P2 Different methods used for accounting reports

Different methods of accounting reporting used by Excite entertainment ltd are:

Budget report – it is the most important report in management accounting as it helps the

owners of Excite ltd to understand and control the cost of the company and its operations as a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

whole and even in particular departments (Usenko and et.al., 2018.). It helps the company in

evaluating expenses of previous years and then estimates the project for particular year and helps

the company in cutting (Ting, 2017).

Company's budget helps it in listing all the expenses and income sources of the company and tries

to achieve its goals and objectives while staying in the budget.

Account receivable aging reports – As Excite ltd relies on extending credit to its

customers therefore it is important for the company to manage account receivable aging reports.

These reports allow manager of the company to identify the defaulters as well as to find the issues

of the Company. In case if the company have too many defaulters then it needs to tighten its

policies to make sure that company has adequate amount of cash flow. This report provides

overview of credit balances according to the time period into separate categories that are 30, 60

and 90 days late. This helps the company in adjust the credit policies to align them with

repayment capabilities of customers.

Job cost report – Job cost report provide a side by side view of the single project by

comparing its estimated revenue to the total cost of that project. This report helps the manager of

excite limited to evaluate the profitability of the company gained by different departments. It also

helps them in finding out most profitable department of the company and manager optimize their

operations by focusing on that particular project. This report helps management in focusing on

department that are profitable and put additional efforts there rather than wasting time and money

on jobs or projects with low margins of profit (Caskey, 2016). These reports analyze expenses

while project is in progress so that manger can correct area of waste before cost gets out of control

. In Excite limited the company use job cost report to find out which department of the company is

profitable. It helps the company in finding out cost and revenue of the project.

Inventory and manufacturing report – Company that produce physical products or

provide services especially those in manufacturing with low fault tolerance find these reports very

valuable. These reports help the company in centralize data on cost of inventory, labor and other

forms of overhead cost involved in the process of production, providing raw materials to optimize

machining. As excite limited is a growing company therefore using inventory and manufacturing

reports makes its processes more efficient. These reports mostly include items such as inventory

waste, hourly labor costs or per unit cost of overhead. After getting the reports, the excite limited

can compare different assembly lines within the business to highlight the areas of improvement

evaluating expenses of previous years and then estimates the project for particular year and helps

the company in cutting (Ting, 2017).

Company's budget helps it in listing all the expenses and income sources of the company and tries

to achieve its goals and objectives while staying in the budget.

Account receivable aging reports – As Excite ltd relies on extending credit to its

customers therefore it is important for the company to manage account receivable aging reports.

These reports allow manager of the company to identify the defaulters as well as to find the issues

of the Company. In case if the company have too many defaulters then it needs to tighten its

policies to make sure that company has adequate amount of cash flow. This report provides

overview of credit balances according to the time period into separate categories that are 30, 60

and 90 days late. This helps the company in adjust the credit policies to align them with

repayment capabilities of customers.

Job cost report – Job cost report provide a side by side view of the single project by

comparing its estimated revenue to the total cost of that project. This report helps the manager of

excite limited to evaluate the profitability of the company gained by different departments. It also

helps them in finding out most profitable department of the company and manager optimize their

operations by focusing on that particular project. This report helps management in focusing on

department that are profitable and put additional efforts there rather than wasting time and money

on jobs or projects with low margins of profit (Caskey, 2016). These reports analyze expenses

while project is in progress so that manger can correct area of waste before cost gets out of control

. In Excite limited the company use job cost report to find out which department of the company is

profitable. It helps the company in finding out cost and revenue of the project.

Inventory and manufacturing report – Company that produce physical products or

provide services especially those in manufacturing with low fault tolerance find these reports very

valuable. These reports help the company in centralize data on cost of inventory, labor and other

forms of overhead cost involved in the process of production, providing raw materials to optimize

machining. As excite limited is a growing company therefore using inventory and manufacturing

reports makes its processes more efficient. These reports mostly include items such as inventory

waste, hourly labor costs or per unit cost of overhead. After getting the reports, the excite limited

can compare different assembly lines within the business to highlight the areas of improvement

for the company or to reduce cost of specific department or to provide bonuses and incentives to

the best performing departments.

The information stating in these reports need to be accurate as this information is used by

management to make decisions related to policies and procedures of the company. The

information need to be reliable as well as based on that manager of the company make decisions

and if the base of the decision will not be reliable then decisions will not be efficient as well. The

information need to be up to date in a fixed proper format which makes it easy for the company to

take decisions and need to be provided in timely manner so that the company does not suffer.

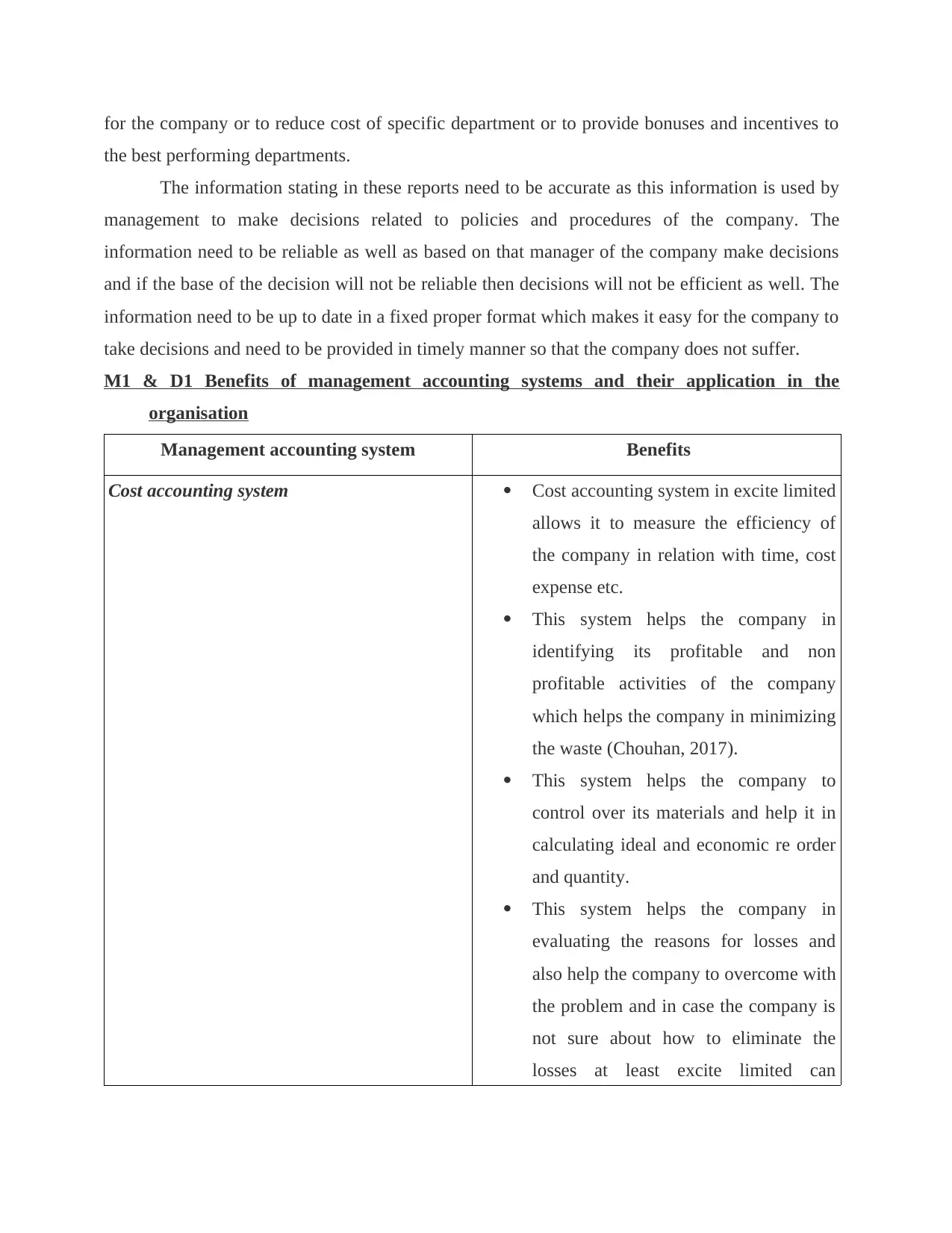

M1 & D1 Benefits of management accounting systems and their application in the

organisation

Management accounting system Benefits

Cost accounting system Cost accounting system in excite limited

allows it to measure the efficiency of

the company in relation with time, cost

expense etc.

This system helps the company in

identifying its profitable and non

profitable activities of the company

which helps the company in minimizing

the waste (Chouhan, 2017).

This system helps the company to

control over its materials and help it in

calculating ideal and economic re order

and quantity.

This system helps the company in

evaluating the reasons for losses and

also help the company to overcome with

the problem and in case the company is

not sure about how to eliminate the

losses at least excite limited can

the best performing departments.

The information stating in these reports need to be accurate as this information is used by

management to make decisions related to policies and procedures of the company. The

information need to be reliable as well as based on that manager of the company make decisions

and if the base of the decision will not be reliable then decisions will not be efficient as well. The

information need to be up to date in a fixed proper format which makes it easy for the company to

take decisions and need to be provided in timely manner so that the company does not suffer.

M1 & D1 Benefits of management accounting systems and their application in the

organisation

Management accounting system Benefits

Cost accounting system Cost accounting system in excite limited

allows it to measure the efficiency of

the company in relation with time, cost

expense etc.

This system helps the company in

identifying its profitable and non

profitable activities of the company

which helps the company in minimizing

the waste (Chouhan, 2017).

This system helps the company to

control over its materials and help it in

calculating ideal and economic re order

and quantity.

This system helps the company in

evaluating the reasons for losses and

also help the company to overcome with

the problem and in case the company is

not sure about how to eliminate the

losses at least excite limited can

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

minimize its losses.

As every company is open to

uncertainties so is Excite limited but the

cost accounting system helps the

company in future planning by

providing detailed data about machines,

labor capacity, level of output etc. to

avoid future uncertainties.

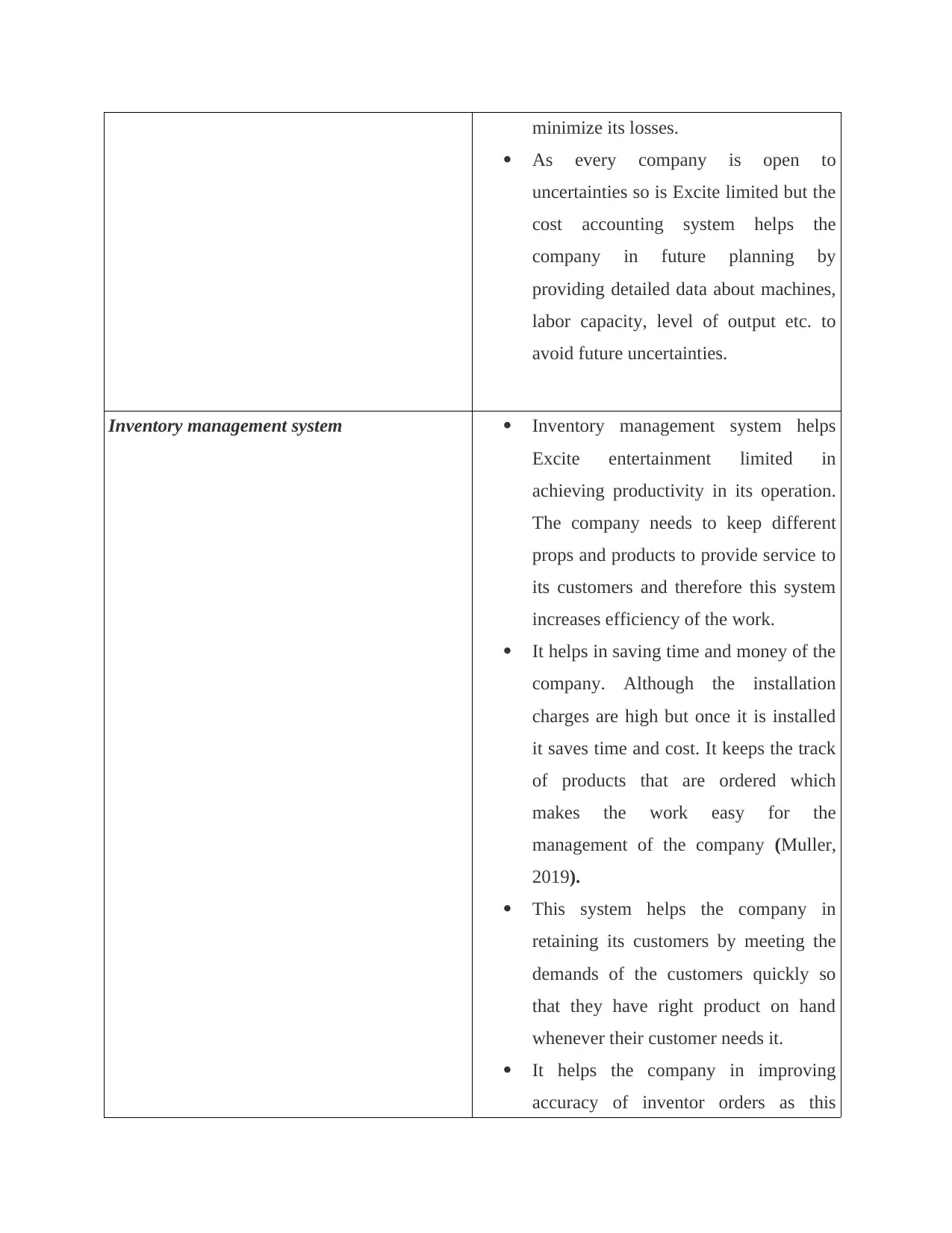

Inventory management system Inventory management system helps

Excite entertainment limited in

achieving productivity in its operation.

The company needs to keep different

props and products to provide service to

its customers and therefore this system

increases efficiency of the work.

It helps in saving time and money of the

company. Although the installation

charges are high but once it is installed

it saves time and cost. It keeps the track

of products that are ordered which

makes the work easy for the

management of the company (Muller,

2019).

This system helps the company in

retaining its customers by meeting the

demands of the customers quickly so

that they have right product on hand

whenever their customer needs it.

It helps the company in improving

accuracy of inventor orders as this

As every company is open to

uncertainties so is Excite limited but the

cost accounting system helps the

company in future planning by

providing detailed data about machines,

labor capacity, level of output etc. to

avoid future uncertainties.

Inventory management system Inventory management system helps

Excite entertainment limited in

achieving productivity in its operation.

The company needs to keep different

props and products to provide service to

its customers and therefore this system

increases efficiency of the work.

It helps in saving time and money of the

company. Although the installation

charges are high but once it is installed

it saves time and cost. It keeps the track

of products that are ordered which

makes the work easy for the

management of the company (Muller,

2019).

This system helps the company in

retaining its customers by meeting the

demands of the customers quickly so

that they have right product on hand

whenever their customer needs it.

It helps the company in improving

accuracy of inventor orders as this

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

system helps the company in knowing

that how much inventory will it need in

hand to meet the need of the customers

(Prahlad and et.al., 2018.). This helps

the company in preventing product

shortage and allow the company to keep

enough inventory without having

burden of warehouse.

Job costing system This system helps the company in

estimating the cost of each job that can

be determined individually to get a clear

and better picture.

It helps in providing basis for estimating

the cost of similar jobs which can be

done by the company in the future.

This helps Excite entertainment limited

in deciding whether it can launch new

product or service or not and it will be

profitable or not by providing the

company with detail information on cost

of material, labor and overheads.

It benefits the company by identifying

spoilage and defective work related to

specific project and responsibility for

the same on different individuals.

It also helps the company in budgetary

control by adopting pre-determined

overhead rates.

that how much inventory will it need in

hand to meet the need of the customers

(Prahlad and et.al., 2018.). This helps

the company in preventing product

shortage and allow the company to keep

enough inventory without having

burden of warehouse.

Job costing system This system helps the company in

estimating the cost of each job that can

be determined individually to get a clear

and better picture.

It helps in providing basis for estimating

the cost of similar jobs which can be

done by the company in the future.

This helps Excite entertainment limited

in deciding whether it can launch new

product or service or not and it will be

profitable or not by providing the

company with detail information on cost

of material, labor and overheads.

It benefits the company by identifying

spoilage and defective work related to

specific project and responsibility for

the same on different individuals.

It also helps the company in budgetary

control by adopting pre-determined

overhead rates.

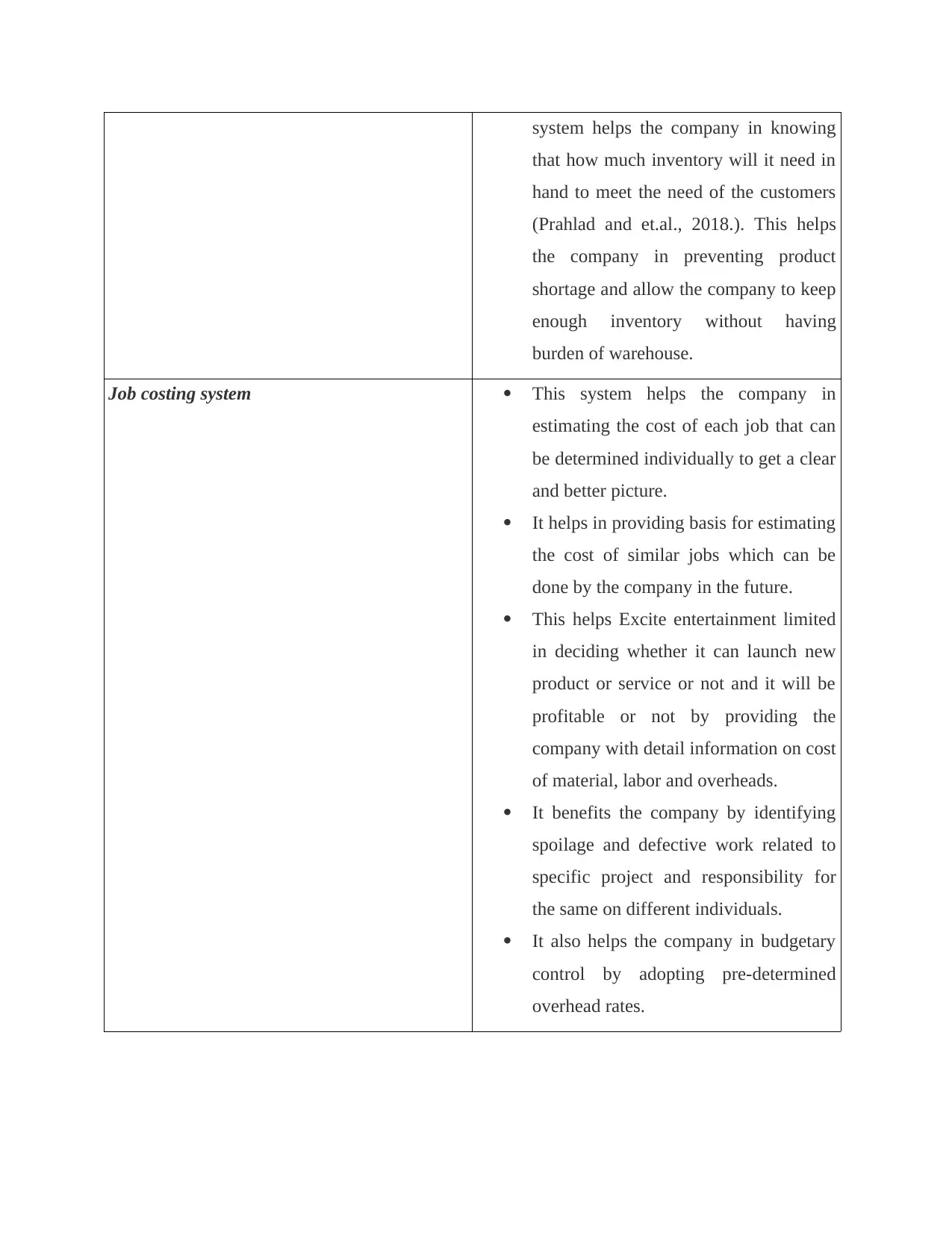

LO 2

P3 Calculation of Marginal and Absorption costing

Absorption costing

Particulars

Amount (in

£)

Per unit cost

(in £)

Net figure (in

£)

Sales 8000 15 120000

Opening stock 500 10 5000

production 10000 10

1000

00

Closing stock 2500 10

2500

0

Cost of goods sold

(Opening stock + purchase – closing

stock) 80000

Gross / Net profit 40000

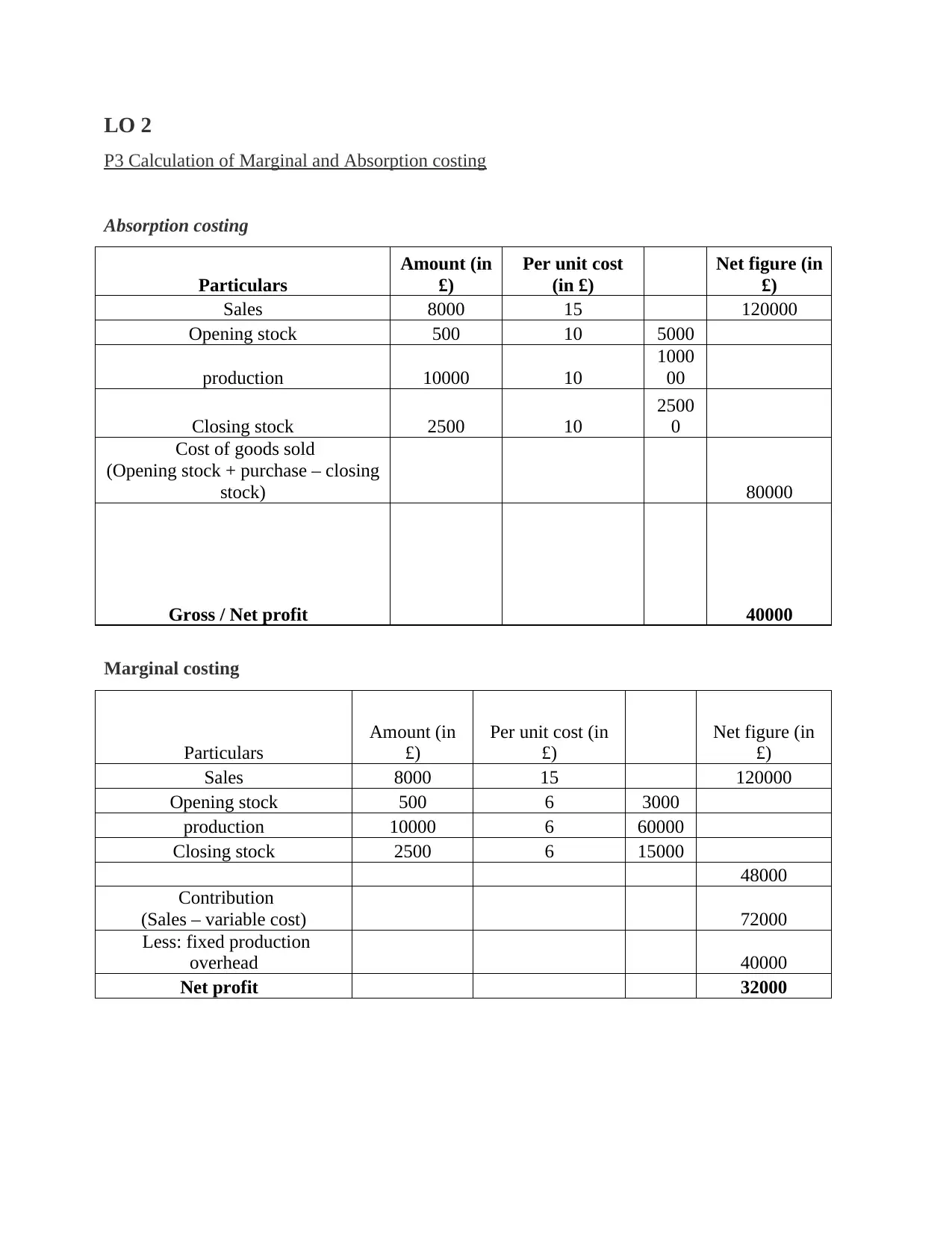

Marginal costing

Particulars

Amount (in

£)

Per unit cost (in

£)

Net figure (in

£)

Sales 8000 15 120000

Opening stock 500 6 3000

production 10000 6 60000

Closing stock 2500 6 15000

48000

Contribution

(Sales – variable cost) 72000

Less: fixed production

overhead 40000

Net profit 32000

P3 Calculation of Marginal and Absorption costing

Absorption costing

Particulars

Amount (in

£)

Per unit cost

(in £)

Net figure (in

£)

Sales 8000 15 120000

Opening stock 500 10 5000

production 10000 10

1000

00

Closing stock 2500 10

2500

0

Cost of goods sold

(Opening stock + purchase – closing

stock) 80000

Gross / Net profit 40000

Marginal costing

Particulars

Amount (in

£)

Per unit cost (in

£)

Net figure (in

£)

Sales 8000 15 120000

Opening stock 500 6 3000

production 10000 6 60000

Closing stock 2500 6 15000

48000

Contribution

(Sales – variable cost) 72000

Less: fixed production

overhead 40000

Net profit 32000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

M2 & D2 Management accounting techniques and appropriate financial reporting documents

There are certain management accounting techniques along with financial reporting

documents that are used by Excite limited company to increase their efficiency of work and

overall performance are:

Cost accounting with cost report – Cost accounting present data of cost based on product,

department etc. and helps in comparing current data with estimated data and difference between

the two tells management about the issues facing by the company (Gallino, 2016). Cost

accounting takes cost reports into consideration which helps the company in making decisions

related to minimizing the use of fund in particular activity.

Budgetary control with budget report – This technique helps Excite limited to estimate

future financial needs of the company and to arrange the funds according to the requirement. It is

used to control financial performances of the busies and directs the business in n desired direction.

Budget report of the company helps in budgetary control by estimating the revenues and

expenditures of particular period and helps the company in taking the decisions accordingly.

Ratio analysis with job costing report – Job costing report helps the company in

estimating revenue and cost of each job individually which creates a clear picture in the mind of

the manager that which job is more profitable and which is not. With the help of ratio analysis

technique, the job costing report can be even more subtle and helpful as ratio analysis helps the

company in forecasting, planning, coordinating etc. by taking different attributes like profitability,

liquidity etc. and to align it with job costing report to help company in making better decisions.

LO 3

P4 Advantages and disadvantages of different types of planning tools for budgetary control

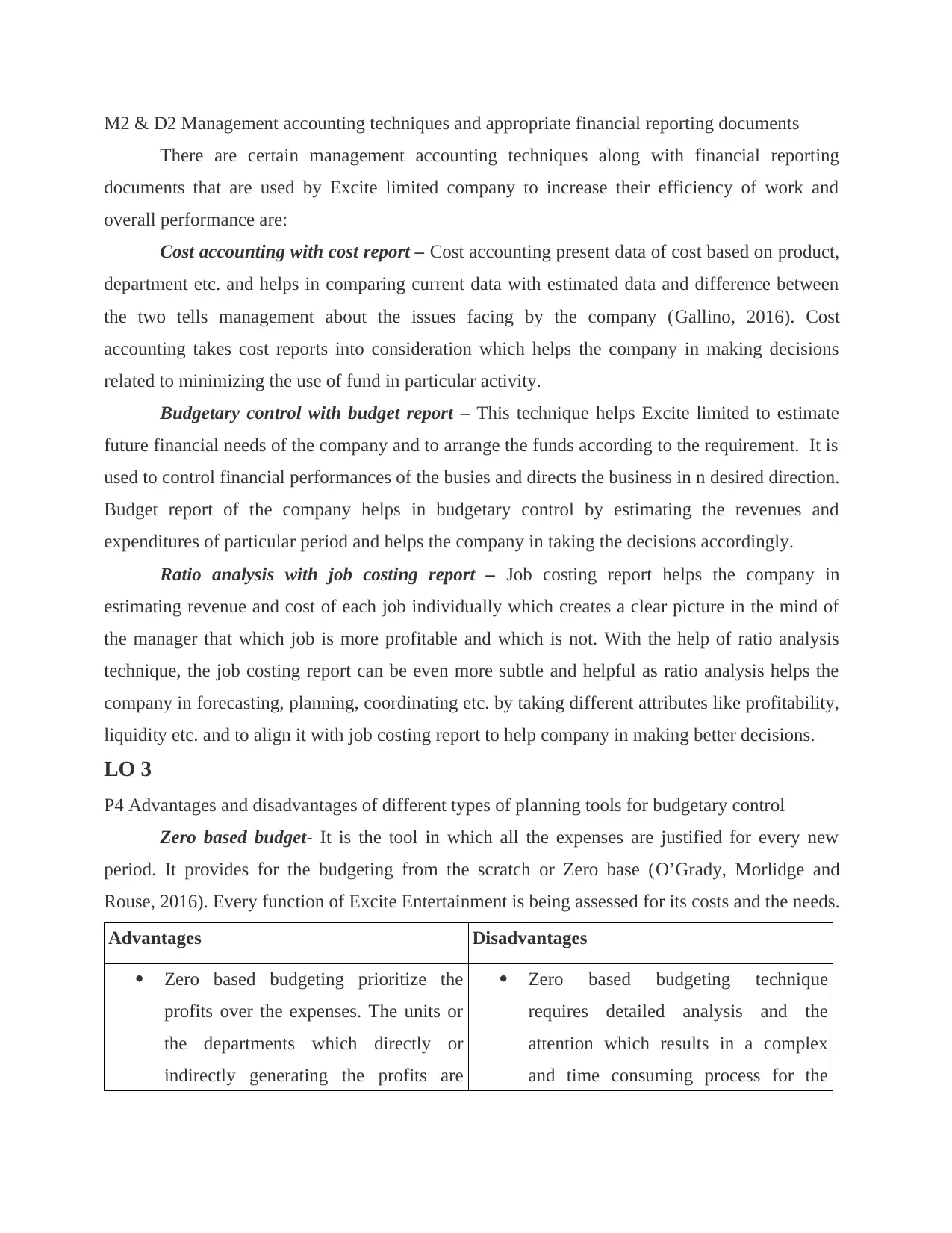

Zero based budget- It is the tool in which all the expenses are justified for every new

period. It provides for the budgeting from the scratch or Zero base (O’Grady, Morlidge and

Rouse, 2016). Every function of Excite Entertainment is being assessed for its costs and the needs.

Advantages Disadvantages

Zero based budgeting prioritize the

profits over the expenses. The units or

the departments which directly or

indirectly generating the profits are

Zero based budgeting technique

requires detailed analysis and the

attention which results in a complex

and time consuming process for the

There are certain management accounting techniques along with financial reporting

documents that are used by Excite limited company to increase their efficiency of work and

overall performance are:

Cost accounting with cost report – Cost accounting present data of cost based on product,

department etc. and helps in comparing current data with estimated data and difference between

the two tells management about the issues facing by the company (Gallino, 2016). Cost

accounting takes cost reports into consideration which helps the company in making decisions

related to minimizing the use of fund in particular activity.

Budgetary control with budget report – This technique helps Excite limited to estimate

future financial needs of the company and to arrange the funds according to the requirement. It is

used to control financial performances of the busies and directs the business in n desired direction.

Budget report of the company helps in budgetary control by estimating the revenues and

expenditures of particular period and helps the company in taking the decisions accordingly.

Ratio analysis with job costing report – Job costing report helps the company in

estimating revenue and cost of each job individually which creates a clear picture in the mind of

the manager that which job is more profitable and which is not. With the help of ratio analysis

technique, the job costing report can be even more subtle and helpful as ratio analysis helps the

company in forecasting, planning, coordinating etc. by taking different attributes like profitability,

liquidity etc. and to align it with job costing report to help company in making better decisions.

LO 3

P4 Advantages and disadvantages of different types of planning tools for budgetary control

Zero based budget- It is the tool in which all the expenses are justified for every new

period. It provides for the budgeting from the scratch or Zero base (O’Grady, Morlidge and

Rouse, 2016). Every function of Excite Entertainment is being assessed for its costs and the needs.

Advantages Disadvantages

Zero based budgeting prioritize the

profits over the expenses. The units or

the departments which directly or

indirectly generating the profits are

Zero based budgeting technique

requires detailed analysis and the

attention which results in a complex

and time consuming process for the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

given the preference (Pellerin and

Perrier, 2018). It helps the company in

gaining large funds so that more

revenues and the profits can

ascertained.

This budgeting helps Excite

entertainment in becoming more and

more strategic as it allows for

expanding only that amount which the

business needs for attaining growing

success. By this the organization can

serve its customers at a large base.

This approach reduces the errors and

enables the business in looking deeply

towards the processes. This leads in

taking utmost care in relation to the

inefficiencies so that effectiveness can

be increased in the business.

managers of the entity.

This budget does not focus on the cost

centers and provides for short term

thinking rather than the long term

prospects. If the cost centers are not

analyzed efficiently, then it could affect

the business adversely.

Activity based budget- This budget refers to the system in which the cost attached to each of the

activities and the budgeted expenditure are combined on the basis of the expected level of the

activity.

Advantages Disadvantages

It allows the business in making

effective cost planning and emphasize

on the types and the volume of the

activity that are occurring within Excite

entertainment.

This tool helps the firm in reducing the

level of the activity that are needed for

The downside of this budgeting is it

increases the requirement of the

workload on the mangers as they need

to track each activity (Maher, Fakhar

and Karimi, 2018). This leads to

lengthy and difficult task.

If the company is producing only a

Perrier, 2018). It helps the company in

gaining large funds so that more

revenues and the profits can

ascertained.

This budgeting helps Excite

entertainment in becoming more and

more strategic as it allows for

expanding only that amount which the

business needs for attaining growing

success. By this the organization can

serve its customers at a large base.

This approach reduces the errors and

enables the business in looking deeply

towards the processes. This leads in

taking utmost care in relation to the

inefficiencies so that effectiveness can

be increased in the business.

managers of the entity.

This budget does not focus on the cost

centers and provides for short term

thinking rather than the long term

prospects. If the cost centers are not

analyzed efficiently, then it could affect

the business adversely.

Activity based budget- This budget refers to the system in which the cost attached to each of the

activities and the budgeted expenditure are combined on the basis of the expected level of the

activity.

Advantages Disadvantages

It allows the business in making

effective cost planning and emphasize

on the types and the volume of the

activity that are occurring within Excite

entertainment.

This tool helps the firm in reducing the

level of the activity that are needed for

The downside of this budgeting is it

increases the requirement of the

workload on the mangers as they need

to track each activity (Maher, Fakhar

and Karimi, 2018). This leads to

lengthy and difficult task.

If the company is producing only a

generating the revenue. This results in

earning increased profits.

It facilitates the information regarding

the cost associated with each activity so

that allocation of the funds can be made

effectively.

single product, then this approach is not

suitable.

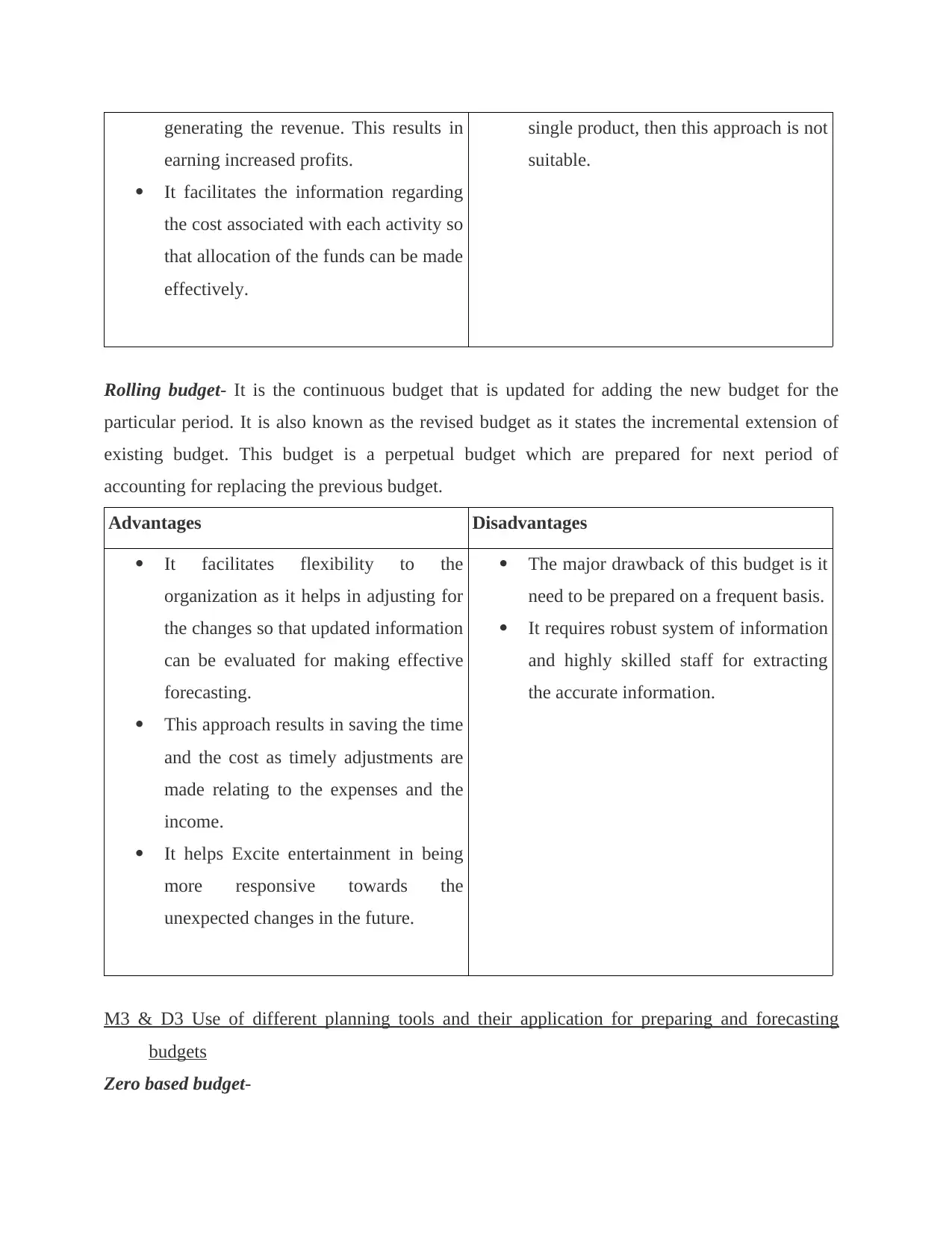

Rolling budget- It is the continuous budget that is updated for adding the new budget for the

particular period. It is also known as the revised budget as it states the incremental extension of

existing budget. This budget is a perpetual budget which are prepared for next period of

accounting for replacing the previous budget.

Advantages Disadvantages

It facilitates flexibility to the

organization as it helps in adjusting for

the changes so that updated information

can be evaluated for making effective

forecasting.

This approach results in saving the time

and the cost as timely adjustments are

made relating to the expenses and the

income.

It helps Excite entertainment in being

more responsive towards the

unexpected changes in the future.

The major drawback of this budget is it

need to be prepared on a frequent basis.

It requires robust system of information

and highly skilled staff for extracting

the accurate information.

M3 & D3 Use of different planning tools and their application for preparing and forecasting

budgets

Zero based budget-

earning increased profits.

It facilitates the information regarding

the cost associated with each activity so

that allocation of the funds can be made

effectively.

single product, then this approach is not

suitable.

Rolling budget- It is the continuous budget that is updated for adding the new budget for the

particular period. It is also known as the revised budget as it states the incremental extension of

existing budget. This budget is a perpetual budget which are prepared for next period of

accounting for replacing the previous budget.

Advantages Disadvantages

It facilitates flexibility to the

organization as it helps in adjusting for

the changes so that updated information

can be evaluated for making effective

forecasting.

This approach results in saving the time

and the cost as timely adjustments are

made relating to the expenses and the

income.

It helps Excite entertainment in being

more responsive towards the

unexpected changes in the future.

The major drawback of this budget is it

need to be prepared on a frequent basis.

It requires robust system of information

and highly skilled staff for extracting

the accurate information.

M3 & D3 Use of different planning tools and their application for preparing and forecasting

budgets

Zero based budget-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.