University Financial Reporting Report: JB Hi-Fi Hedge Accounting

VerifiedAdded on 2023/01/19

|11

|2194

|81

Report

AI Summary

This financial report analyzes the hedge accounting practices of JB Hi-Fi, an Australian retailer. The report examines the company's use of forward foreign currency contracts and interest rate swaps to manage foreign currency and interest rate risks. It details the qualifying criteria for these hedges, their advantages and disadvantages, and the measurement methods employed. The report references relevant Australian Accounting Standards (AASB) to support its findings, including AASB 7, AASB 9, AASB 101, AASB 132, and AASB 139. It also discusses the impact of these hedging strategies on the company's financial statements, including the presentation of hedge reserves and the treatment of gains and losses. The report concludes that JB Hi-Fi has effectively utilized hedge accounting to mitigate financial risks, adhering to accounting standards and improving market efficiency.

FINANCIAL REPORTING

Student Name

Student Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

[Type here]

[Type here]

2

By student name

Professor

University

Date: 25 April 2019.

[Type here]

By student name

Professor

University

Date: 25 April 2019.

[Type here]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Executive Summary

A report has been prepared on hedge accounting employed by company in the financial statements. The

analysis has been done for the company JB HI FI, which is an Australian based company. The report

explains the concept of hedge and its accounting. It also shows the hedge chosen by company and the

qualifying criteria adopted by the company, the advantages and disadvantages of the hedge accounting.

It also highlights the measurement of hedge instrument and what are the specific hedged items in

company’s financials. Relevant paragraphs from the Australian Accounting Standards have been referred

to corroborate the facts.

[Type here]

Executive Summary

A report has been prepared on hedge accounting employed by company in the financial statements. The

analysis has been done for the company JB HI FI, which is an Australian based company. The report

explains the concept of hedge and its accounting. It also shows the hedge chosen by company and the

qualifying criteria adopted by the company, the advantages and disadvantages of the hedge accounting.

It also highlights the measurement of hedge instrument and what are the specific hedged items in

company’s financials. Relevant paragraphs from the Australian Accounting Standards have been referred

to corroborate the facts.

[Type here]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Contents

Executive Summary.....................................................................................................................................2

Introduction.................................................................................................................................................4

Discussion and Analysis...............................................................................................................................4

Hedge presented in annual report and qualifying criteria.......................................................................4

Advantages and disadvantages of hedge accounting..............................................................................6

Measurement of hedging instrument and the hedged items..................................................................6

Conclusion...................................................................................................................................................7

References...................................................................................................................................................8

[Type here]

Contents

Executive Summary.....................................................................................................................................2

Introduction.................................................................................................................................................4

Discussion and Analysis...............................................................................................................................4

Hedge presented in annual report and qualifying criteria.......................................................................4

Advantages and disadvantages of hedge accounting..............................................................................6

Measurement of hedging instrument and the hedged items..................................................................6

Conclusion...................................................................................................................................................7

References...................................................................................................................................................8

[Type here]

5

Introduction

The company being considered for analysis is JB Hi Fi which is listed on the Australian Stock Exchange

and is an Australian retailer dealing in consumer goods and specially DVDs, CDs, video games,

hardware/software, Blu-rays, electrical home appliances, mobile phones and a range of other services.

The company has grown over the past couple of years via its subsidiary The Good Guys and other

acquisitions. The year of analysis is 2018 (Ehalaiye, et al., 2018).

Hedge is the financial instrument which protects the company from the risky situation of change and

fluctuations in the exchange rates, etc. It is done to minimize or offset the chances that the asset is going

to lose value in the future. It takes the offsetting position w.r.t. the given security. For example is

anybody takes a house in the flood prone area then to avoid the loss of the asset he needs to hedge by

taking the flood insurance as there is no way in which the person can avoid or stop the floods. In the

same way, hedging helps the investors and money managers in hedging their risks and controlling or

reducing them. Some of the examples include forward and future contracts, options and swaps,

insurance covers and other derivative contracts. The same is governed by AASB 7, AASB 9, AASB 101,

AASB 132 and AASB 139 among the accounting standards (Alexander, 2016).

Discussion and Analysis

Hedge presented in annual report and qualifying criteria

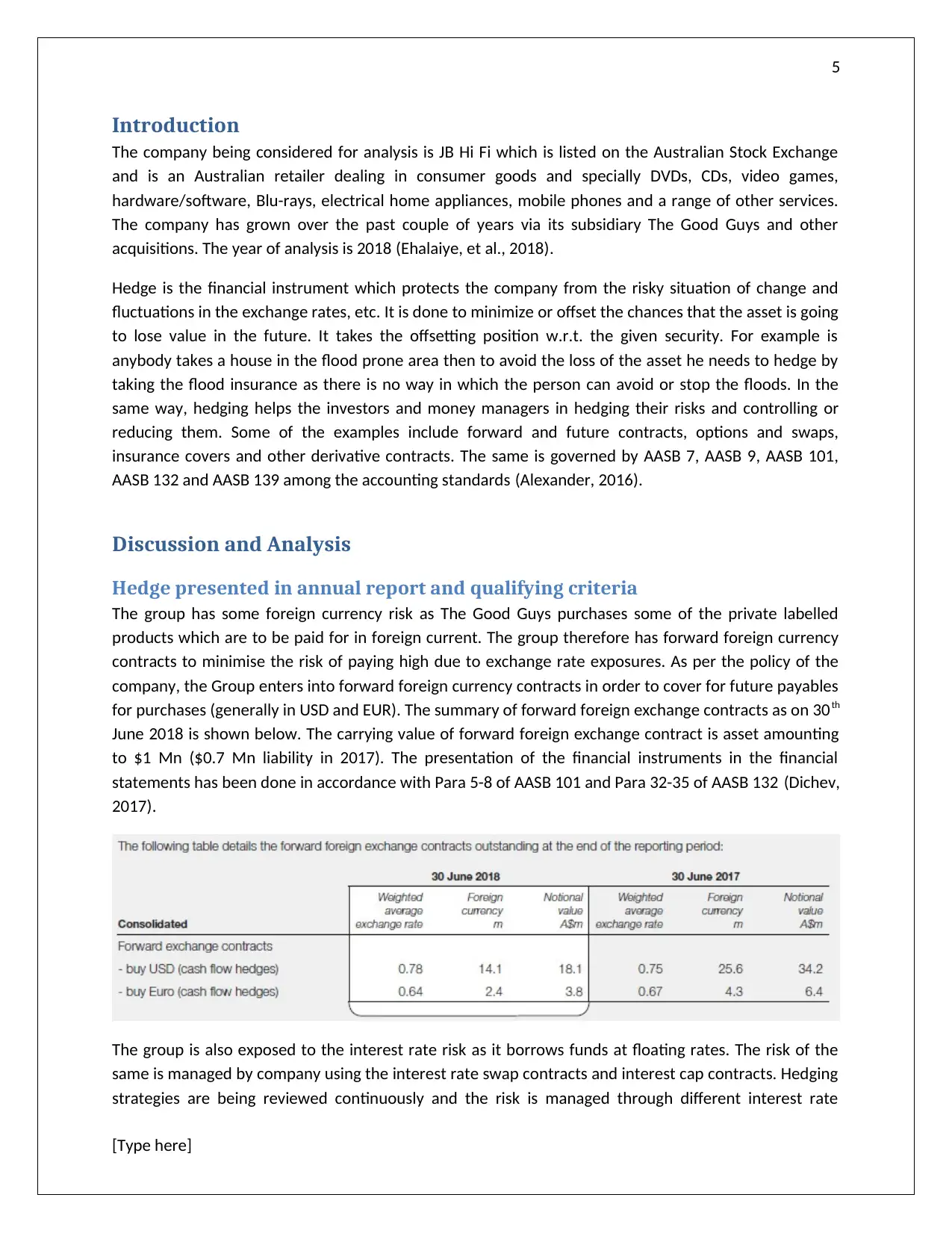

The group has some foreign currency risk as The Good Guys purchases some of the private labelled

products which are to be paid for in foreign current. The group therefore has forward foreign currency

contracts to minimise the risk of paying high due to exchange rate exposures. As per the policy of the

company, the Group enters into forward foreign currency contracts in order to cover for future payables

for purchases (generally in USD and EUR). The summary of forward foreign exchange contracts as on 30 th

June 2018 is shown below. The carrying value of forward foreign exchange contract is asset amounting

to $1 Mn ($0.7 Mn liability in 2017). The presentation of the financial instruments in the financial

statements has been done in accordance with Para 5-8 of AASB 101 and Para 32-35 of AASB 132 (Dichev,

2017).

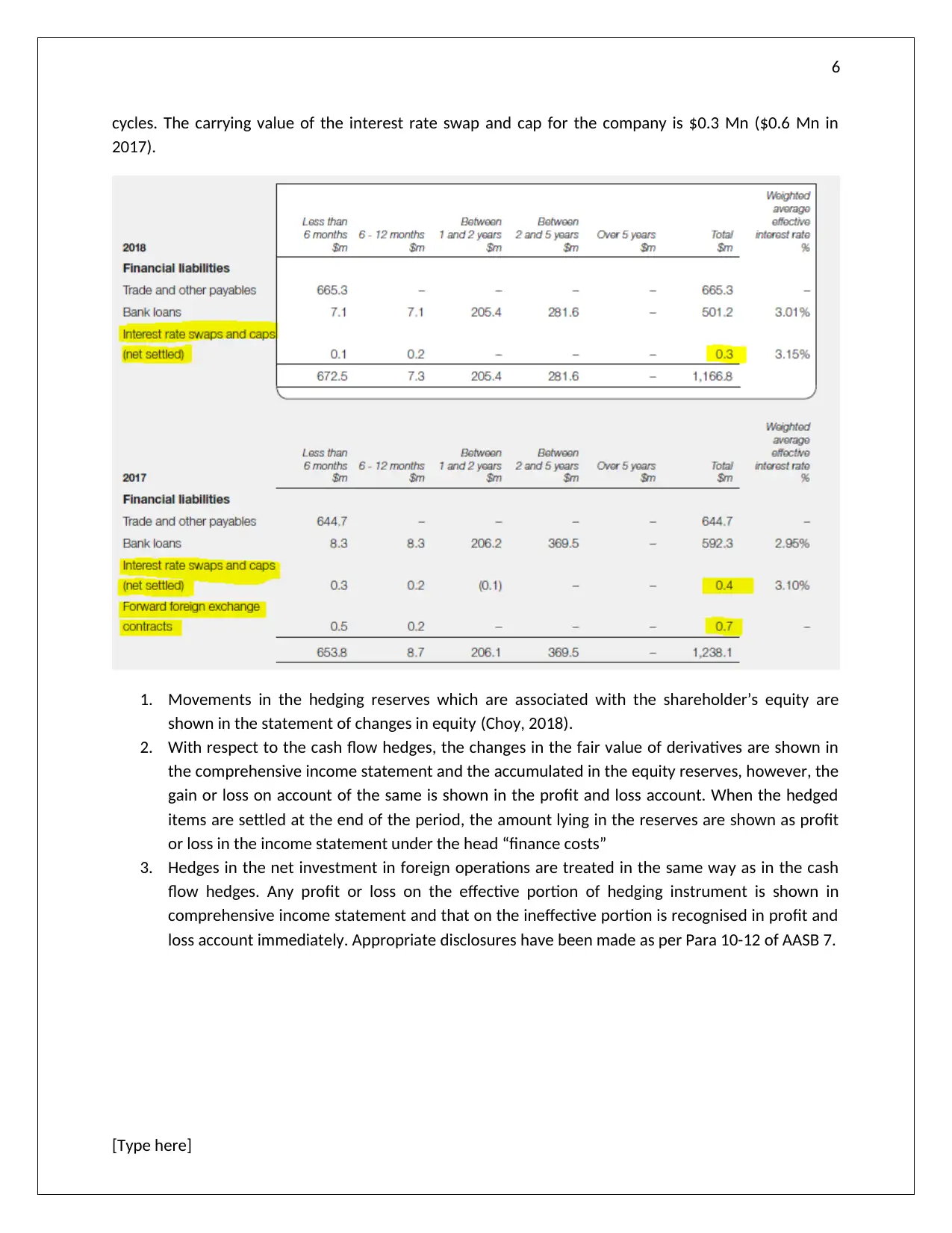

The group is also exposed to the interest rate risk as it borrows funds at floating rates. The risk of the

same is managed by company using the interest rate swap contracts and interest cap contracts. Hedging

strategies are being reviewed continuously and the risk is managed through different interest rate

[Type here]

Introduction

The company being considered for analysis is JB Hi Fi which is listed on the Australian Stock Exchange

and is an Australian retailer dealing in consumer goods and specially DVDs, CDs, video games,

hardware/software, Blu-rays, electrical home appliances, mobile phones and a range of other services.

The company has grown over the past couple of years via its subsidiary The Good Guys and other

acquisitions. The year of analysis is 2018 (Ehalaiye, et al., 2018).

Hedge is the financial instrument which protects the company from the risky situation of change and

fluctuations in the exchange rates, etc. It is done to minimize or offset the chances that the asset is going

to lose value in the future. It takes the offsetting position w.r.t. the given security. For example is

anybody takes a house in the flood prone area then to avoid the loss of the asset he needs to hedge by

taking the flood insurance as there is no way in which the person can avoid or stop the floods. In the

same way, hedging helps the investors and money managers in hedging their risks and controlling or

reducing them. Some of the examples include forward and future contracts, options and swaps,

insurance covers and other derivative contracts. The same is governed by AASB 7, AASB 9, AASB 101,

AASB 132 and AASB 139 among the accounting standards (Alexander, 2016).

Discussion and Analysis

Hedge presented in annual report and qualifying criteria

The group has some foreign currency risk as The Good Guys purchases some of the private labelled

products which are to be paid for in foreign current. The group therefore has forward foreign currency

contracts to minimise the risk of paying high due to exchange rate exposures. As per the policy of the

company, the Group enters into forward foreign currency contracts in order to cover for future payables

for purchases (generally in USD and EUR). The summary of forward foreign exchange contracts as on 30 th

June 2018 is shown below. The carrying value of forward foreign exchange contract is asset amounting

to $1 Mn ($0.7 Mn liability in 2017). The presentation of the financial instruments in the financial

statements has been done in accordance with Para 5-8 of AASB 101 and Para 32-35 of AASB 132 (Dichev,

2017).

The group is also exposed to the interest rate risk as it borrows funds at floating rates. The risk of the

same is managed by company using the interest rate swap contracts and interest cap contracts. Hedging

strategies are being reviewed continuously and the risk is managed through different interest rate

[Type here]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

cycles. The carrying value of the interest rate swap and cap for the company is $0.3 Mn ($0.6 Mn in

2017).

1. Movements in the hedging reserves which are associated with the shareholder’s equity are

shown in the statement of changes in equity (Choy, 2018).

2. With respect to the cash flow hedges, the changes in the fair value of derivatives are shown in

the comprehensive income statement and the accumulated in the equity reserves, however, the

gain or loss on account of the same is shown in the profit and loss account. When the hedged

items are settled at the end of the period, the amount lying in the reserves are shown as profit

or loss in the income statement under the head “finance costs”

3. Hedges in the net investment in foreign operations are treated in the same way as in the cash

flow hedges. Any profit or loss on the effective portion of hedging instrument is shown in

comprehensive income statement and that on the ineffective portion is recognised in profit and

loss account immediately. Appropriate disclosures have been made as per Para 10-12 of AASB 7.

[Type here]

cycles. The carrying value of the interest rate swap and cap for the company is $0.3 Mn ($0.6 Mn in

2017).

1. Movements in the hedging reserves which are associated with the shareholder’s equity are

shown in the statement of changes in equity (Choy, 2018).

2. With respect to the cash flow hedges, the changes in the fair value of derivatives are shown in

the comprehensive income statement and the accumulated in the equity reserves, however, the

gain or loss on account of the same is shown in the profit and loss account. When the hedged

items are settled at the end of the period, the amount lying in the reserves are shown as profit

or loss in the income statement under the head “finance costs”

3. Hedges in the net investment in foreign operations are treated in the same way as in the cash

flow hedges. Any profit or loss on the effective portion of hedging instrument is shown in

comprehensive income statement and that on the ineffective portion is recognised in profit and

loss account immediately. Appropriate disclosures have been made as per Para 10-12 of AASB 7.

[Type here]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

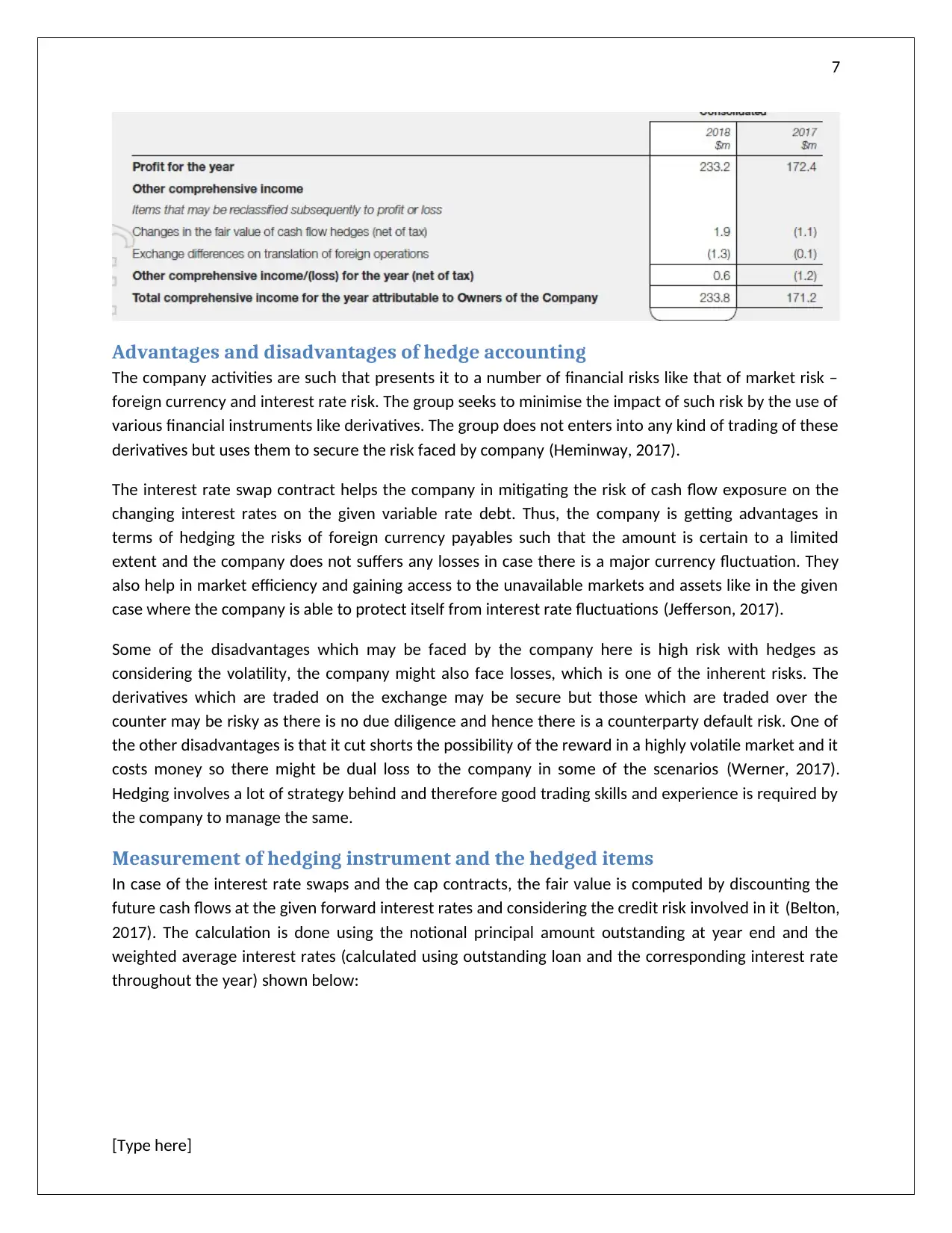

Advantages and disadvantages of hedge accounting

The company activities are such that presents it to a number of financial risks like that of market risk –

foreign currency and interest rate risk. The group seeks to minimise the impact of such risk by the use of

various financial instruments like derivatives. The group does not enters into any kind of trading of these

derivatives but uses them to secure the risk faced by company (Heminway, 2017).

The interest rate swap contract helps the company in mitigating the risk of cash flow exposure on the

changing interest rates on the given variable rate debt. Thus, the company is getting advantages in

terms of hedging the risks of foreign currency payables such that the amount is certain to a limited

extent and the company does not suffers any losses in case there is a major currency fluctuation. They

also help in market efficiency and gaining access to the unavailable markets and assets like in the given

case where the company is able to protect itself from interest rate fluctuations (Jefferson, 2017).

Some of the disadvantages which may be faced by the company here is high risk with hedges as

considering the volatility, the company might also face losses, which is one of the inherent risks. The

derivatives which are traded on the exchange may be secure but those which are traded over the

counter may be risky as there is no due diligence and hence there is a counterparty default risk. One of

the other disadvantages is that it cut shorts the possibility of the reward in a highly volatile market and it

costs money so there might be dual loss to the company in some of the scenarios (Werner, 2017).

Hedging involves a lot of strategy behind and therefore good trading skills and experience is required by

the company to manage the same.

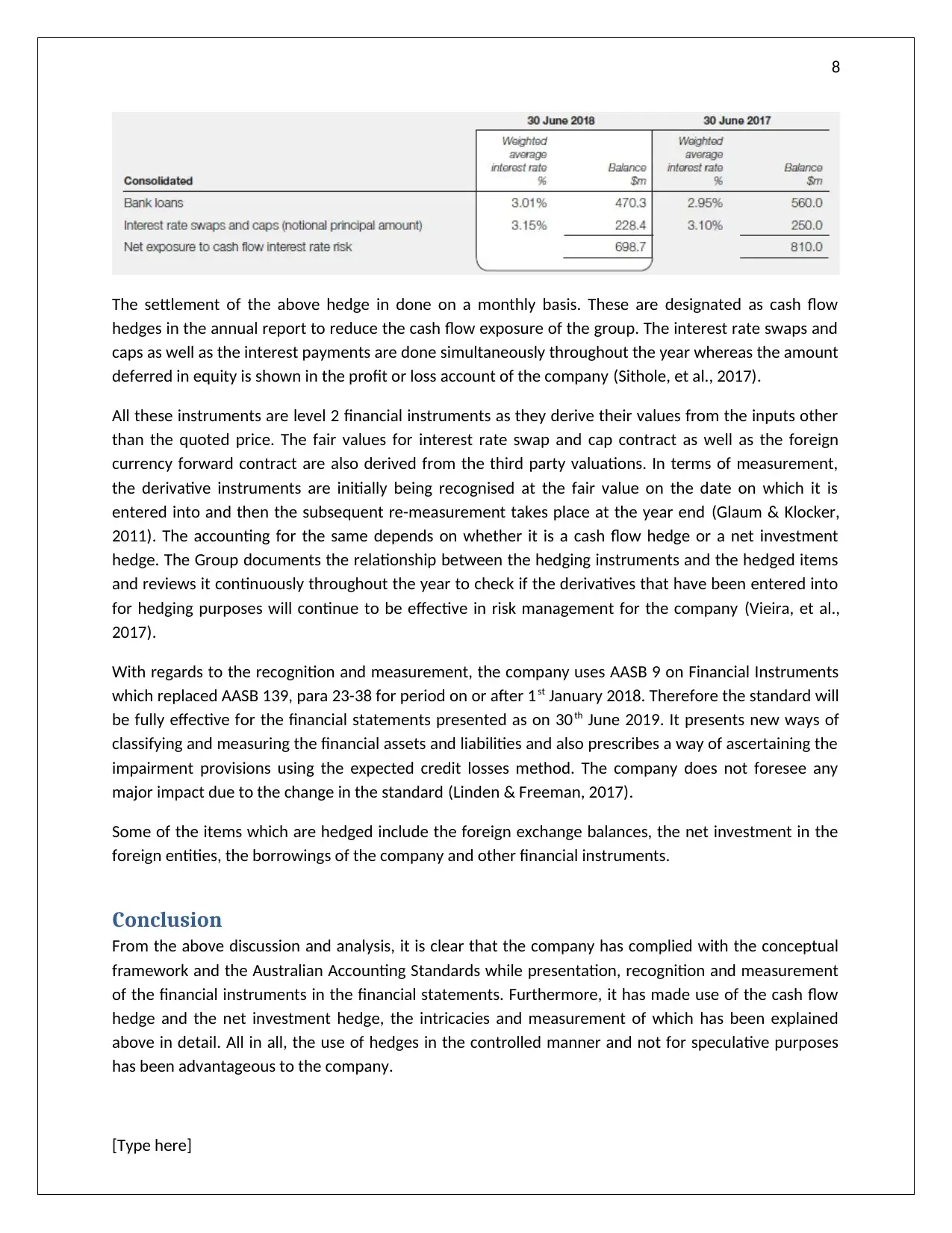

Measurement of hedging instrument and the hedged items

In case of the interest rate swaps and the cap contracts, the fair value is computed by discounting the

future cash flows at the given forward interest rates and considering the credit risk involved in it (Belton,

2017). The calculation is done using the notional principal amount outstanding at year end and the

weighted average interest rates (calculated using outstanding loan and the corresponding interest rate

throughout the year) shown below:

[Type here]

Advantages and disadvantages of hedge accounting

The company activities are such that presents it to a number of financial risks like that of market risk –

foreign currency and interest rate risk. The group seeks to minimise the impact of such risk by the use of

various financial instruments like derivatives. The group does not enters into any kind of trading of these

derivatives but uses them to secure the risk faced by company (Heminway, 2017).

The interest rate swap contract helps the company in mitigating the risk of cash flow exposure on the

changing interest rates on the given variable rate debt. Thus, the company is getting advantages in

terms of hedging the risks of foreign currency payables such that the amount is certain to a limited

extent and the company does not suffers any losses in case there is a major currency fluctuation. They

also help in market efficiency and gaining access to the unavailable markets and assets like in the given

case where the company is able to protect itself from interest rate fluctuations (Jefferson, 2017).

Some of the disadvantages which may be faced by the company here is high risk with hedges as

considering the volatility, the company might also face losses, which is one of the inherent risks. The

derivatives which are traded on the exchange may be secure but those which are traded over the

counter may be risky as there is no due diligence and hence there is a counterparty default risk. One of

the other disadvantages is that it cut shorts the possibility of the reward in a highly volatile market and it

costs money so there might be dual loss to the company in some of the scenarios (Werner, 2017).

Hedging involves a lot of strategy behind and therefore good trading skills and experience is required by

the company to manage the same.

Measurement of hedging instrument and the hedged items

In case of the interest rate swaps and the cap contracts, the fair value is computed by discounting the

future cash flows at the given forward interest rates and considering the credit risk involved in it (Belton,

2017). The calculation is done using the notional principal amount outstanding at year end and the

weighted average interest rates (calculated using outstanding loan and the corresponding interest rate

throughout the year) shown below:

[Type here]

8

The settlement of the above hedge in done on a monthly basis. These are designated as cash flow

hedges in the annual report to reduce the cash flow exposure of the group. The interest rate swaps and

caps as well as the interest payments are done simultaneously throughout the year whereas the amount

deferred in equity is shown in the profit or loss account of the company (Sithole, et al., 2017).

All these instruments are level 2 financial instruments as they derive their values from the inputs other

than the quoted price. The fair values for interest rate swap and cap contract as well as the foreign

currency forward contract are also derived from the third party valuations. In terms of measurement,

the derivative instruments are initially being recognised at the fair value on the date on which it is

entered into and then the subsequent re-measurement takes place at the year end (Glaum & Klocker,

2011). The accounting for the same depends on whether it is a cash flow hedge or a net investment

hedge. The Group documents the relationship between the hedging instruments and the hedged items

and reviews it continuously throughout the year to check if the derivatives that have been entered into

for hedging purposes will continue to be effective in risk management for the company (Vieira, et al.,

2017).

With regards to the recognition and measurement, the company uses AASB 9 on Financial Instruments

which replaced AASB 139, para 23-38 for period on or after 1st January 2018. Therefore the standard will

be fully effective for the financial statements presented as on 30th June 2019. It presents new ways of

classifying and measuring the financial assets and liabilities and also prescribes a way of ascertaining the

impairment provisions using the expected credit losses method. The company does not foresee any

major impact due to the change in the standard (Linden & Freeman, 2017).

Some of the items which are hedged include the foreign exchange balances, the net investment in the

foreign entities, the borrowings of the company and other financial instruments.

Conclusion

From the above discussion and analysis, it is clear that the company has complied with the conceptual

framework and the Australian Accounting Standards while presentation, recognition and measurement

of the financial instruments in the financial statements. Furthermore, it has made use of the cash flow

hedge and the net investment hedge, the intricacies and measurement of which has been explained

above in detail. All in all, the use of hedges in the controlled manner and not for speculative purposes

has been advantageous to the company.

[Type here]

The settlement of the above hedge in done on a monthly basis. These are designated as cash flow

hedges in the annual report to reduce the cash flow exposure of the group. The interest rate swaps and

caps as well as the interest payments are done simultaneously throughout the year whereas the amount

deferred in equity is shown in the profit or loss account of the company (Sithole, et al., 2017).

All these instruments are level 2 financial instruments as they derive their values from the inputs other

than the quoted price. The fair values for interest rate swap and cap contract as well as the foreign

currency forward contract are also derived from the third party valuations. In terms of measurement,

the derivative instruments are initially being recognised at the fair value on the date on which it is

entered into and then the subsequent re-measurement takes place at the year end (Glaum & Klocker,

2011). The accounting for the same depends on whether it is a cash flow hedge or a net investment

hedge. The Group documents the relationship between the hedging instruments and the hedged items

and reviews it continuously throughout the year to check if the derivatives that have been entered into

for hedging purposes will continue to be effective in risk management for the company (Vieira, et al.,

2017).

With regards to the recognition and measurement, the company uses AASB 9 on Financial Instruments

which replaced AASB 139, para 23-38 for period on or after 1st January 2018. Therefore the standard will

be fully effective for the financial statements presented as on 30th June 2019. It presents new ways of

classifying and measuring the financial assets and liabilities and also prescribes a way of ascertaining the

impairment provisions using the expected credit losses method. The company does not foresee any

major impact due to the change in the standard (Linden & Freeman, 2017).

Some of the items which are hedged include the foreign exchange balances, the net investment in the

foreign entities, the borrowings of the company and other financial instruments.

Conclusion

From the above discussion and analysis, it is clear that the company has complied with the conceptual

framework and the Australian Accounting Standards while presentation, recognition and measurement

of the financial instruments in the financial statements. Furthermore, it has made use of the cash flow

hedge and the net investment hedge, the intricacies and measurement of which has been explained

above in detail. All in all, the use of hedges in the controlled manner and not for speculative purposes

has been advantageous to the company.

[Type here]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

References

Alexander, F., 2016. The Changing Face of Accountability. The Journal of Higher Education, 71(4), pp.

411-431.

Belton, P., 2017. Competitive Strategy: Creating and Sustaining Superior Performance. London: Macat

International ltd.

Choy, Y. K., 2018. Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview Analysis.

Ecological Economics, 3(1), p. 145.

Dichev, I., 2017. On the conceptual foundations of financial reporting. Accounting and Business

Research, 47(6), pp. 617-632.

Ehalaiye, D. et al., 2018. Are Financial reports useful? The views of New Zealand Public vs Private Users.

Australian Accounting Review.

Glaum, M. & Klocker, A., 2011. Hedge accounting and its influence on financial hedging: when the tail

wags the dog. Accounting and Business Research, 41(5), pp. 459-489.

Heminway, J., 2017. Shareholder Wealth Maximization as a Function of Statutes, Decisional Law, and

Organic Documents. SSRN, pp. 1-35.

Jefferson, M., 2017. Energy, Complexity and Wealth Maximization, R. Ayres. Springer, Switzerland.

Technological Forecasting and Social Change, pp. 353-354.

Linden, B. & Freeman, R., 2017. Profit and Other Values: Thick Evaluation in Decision Making. Business

Ethics Quarterly, 27(3), pp. 353-379.

[Type here]

References

Alexander, F., 2016. The Changing Face of Accountability. The Journal of Higher Education, 71(4), pp.

411-431.

Belton, P., 2017. Competitive Strategy: Creating and Sustaining Superior Performance. London: Macat

International ltd.

Choy, Y. K., 2018. Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview Analysis.

Ecological Economics, 3(1), p. 145.

Dichev, I., 2017. On the conceptual foundations of financial reporting. Accounting and Business

Research, 47(6), pp. 617-632.

Ehalaiye, D. et al., 2018. Are Financial reports useful? The views of New Zealand Public vs Private Users.

Australian Accounting Review.

Glaum, M. & Klocker, A., 2011. Hedge accounting and its influence on financial hedging: when the tail

wags the dog. Accounting and Business Research, 41(5), pp. 459-489.

Heminway, J., 2017. Shareholder Wealth Maximization as a Function of Statutes, Decisional Law, and

Organic Documents. SSRN, pp. 1-35.

Jefferson, M., 2017. Energy, Complexity and Wealth Maximization, R. Ayres. Springer, Switzerland.

Technological Forecasting and Social Change, pp. 353-354.

Linden, B. & Freeman, R., 2017. Profit and Other Values: Thick Evaluation in Decision Making. Business

Ethics Quarterly, 27(3), pp. 353-379.

[Type here]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

Sithole, S., Chandler, P., Abeysekera, I. & Paas, F., 2017. Benefits of guided self-management of attention

on learning accounting. Journal of Educational Psychology, 109(2), p. 220.

Vieira, R., O’Dwyer, B. & Schneider, R., 2017. Aligning Strategy and Performance Management Systems.

SAGE Journals, 30(1), pp. 23-48.

Werner, M., 2017. Financial process mining - Accounting data structure dependent control flow

inference. International Journal of Accounting Information Systems, 25(1), pp. 57-80.

[Type here]

Sithole, S., Chandler, P., Abeysekera, I. & Paas, F., 2017. Benefits of guided self-management of attention

on learning accounting. Journal of Educational Psychology, 109(2), p. 220.

Vieira, R., O’Dwyer, B. & Schneider, R., 2017. Aligning Strategy and Performance Management Systems.

SAGE Journals, 30(1), pp. 23-48.

Werner, M., 2017. Financial process mining - Accounting data structure dependent control flow

inference. International Journal of Accounting Information Systems, 25(1), pp. 57-80.

[Type here]

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.