Financial Reporting: IFRS, IAS, and Financial Statements

VerifiedAdded on 2020/10/22

|18

|4242

|215

Report

AI Summary

This report provides a comprehensive overview of financial reporting, covering its context, purpose, and the conceptual and regulatory frameworks, including the qualitative characteristics required for reliable financial information. It identifies the main stakeholders of an organization, detailing the benefits of providing financial information to them, and explores the value of financial reporting in meeting organizational objectives and fostering growth. The report examines the main financial statements as per IAS 1, including a case study analysis of Marks and Spencer's financial statements. It differentiates between International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS), highlighting the benefits of IFRS and the varying degrees of compliance across organizations globally. The report concludes with a discussion on the implications of these standards and their impact on financial reporting practices.

INTERNATIONAL

FINANCIAL REPORTING

FINANCIAL REPORTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. Context and purpose of Financial reporting ...........................................................................3

2. The conceptual and regulatory framework of financial reporting and qualitative

characteristics required for making financial information more reliable....................................4

3. The main stakeholders of an organisation and benefit of providing financial information to

them.............................................................................................................................................5

4. Value of financial reporting for meeting organisational objective and growth .....................7

5. The main financial statements as per IAS 1............................................................................7

6. Two years Financial statements of Marks and Spencer........................................................11

7. Difference between International Accounting standard (IAS) and International financial

reporting standard (IFRS).........................................................................................................13

8. Benefits of IFRS....................................................................................................................13

9. The varying degree of compliance with IFRS by organisation across the world................14

CONCLUSION .............................................................................................................................15

REFERENCES..............................................................................................................................16

APPENDIX....................................................................................................................................18

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. Context and purpose of Financial reporting ...........................................................................3

2. The conceptual and regulatory framework of financial reporting and qualitative

characteristics required for making financial information more reliable....................................4

3. The main stakeholders of an organisation and benefit of providing financial information to

them.............................................................................................................................................5

4. Value of financial reporting for meeting organisational objective and growth .....................7

5. The main financial statements as per IAS 1............................................................................7

6. Two years Financial statements of Marks and Spencer........................................................11

7. Difference between International Accounting standard (IAS) and International financial

reporting standard (IFRS).........................................................................................................13

8. Benefits of IFRS....................................................................................................................13

9. The varying degree of compliance with IFRS by organisation across the world................14

CONCLUSION .............................................................................................................................15

REFERENCES..............................................................................................................................16

APPENDIX....................................................................................................................................18

INTRODUCTION

Financial reporting is a process of disclosing the financial information in a report format

to provide information about the performance and position of organisation to its various

Stakeholders of company. As a junior auditor of the large accounting firm the following task will

be included for preparing a business report. This study will include context and purpose of

financial reporting also, it will provide understanding of the conceptual and regulatory

framework of financial reporting and the qualitative characteristics of financial reporting.

Furthermore, it will assist in identifying the various stakeholders of an organisation and the

benefit of financial reporting to them. Moreover, this assignment will give information about the

various financial statement such as profit and loss statement, balance sheet and statement of

equity. This study will include difference between international accounting standard and

international financial reporting standard. This assignment will include benefits of IFRS. Also,

this project will provide information about the varying degree of compliance with IFRS . Marks

and Spencer is selected to determination of the ratios to identify its performance and

profitability.

MAIN BODY

1. Context and purpose of Financial reporting

The purpose of financial reporting is to provide the financial information to the

management and various stakeholders of the organisation to make effective decision making for

organisation. Financial statements are provided to the management in order to formulate various

policies and make effective decision for improving the performance and position of firm (Ali,

Akbar and Ormrod, 2016). The main purpose of financial reporting is to provide information

which is useful for making decision so that management can take the decision based on the

financial statements.

Financial reporting includes profit and loss statements, balance sheet and cash flow

statements which helps the firm in identifying there performance and position. Profit and loss

statement prepared by the firm helps them in determining the profitability of the organisation on

the basis of which it can identify the performance in the industry (Biddle And et.al., 2016).

Balance sheet assist in identifying the position of the organisation on the basis of its assets and

liabilities. Cash flow statements helps the organisation in identifying the cash requirement of the

Financial reporting is a process of disclosing the financial information in a report format

to provide information about the performance and position of organisation to its various

Stakeholders of company. As a junior auditor of the large accounting firm the following task will

be included for preparing a business report. This study will include context and purpose of

financial reporting also, it will provide understanding of the conceptual and regulatory

framework of financial reporting and the qualitative characteristics of financial reporting.

Furthermore, it will assist in identifying the various stakeholders of an organisation and the

benefit of financial reporting to them. Moreover, this assignment will give information about the

various financial statement such as profit and loss statement, balance sheet and statement of

equity. This study will include difference between international accounting standard and

international financial reporting standard. This assignment will include benefits of IFRS. Also,

this project will provide information about the varying degree of compliance with IFRS . Marks

and Spencer is selected to determination of the ratios to identify its performance and

profitability.

MAIN BODY

1. Context and purpose of Financial reporting

The purpose of financial reporting is to provide the financial information to the

management and various stakeholders of the organisation to make effective decision making for

organisation. Financial statements are provided to the management in order to formulate various

policies and make effective decision for improving the performance and position of firm (Ali,

Akbar and Ormrod, 2016). The main purpose of financial reporting is to provide information

which is useful for making decision so that management can take the decision based on the

financial statements.

Financial reporting includes profit and loss statements, balance sheet and cash flow

statements which helps the firm in identifying there performance and position. Profit and loss

statement prepared by the firm helps them in determining the profitability of the organisation on

the basis of which it can identify the performance in the industry (Biddle And et.al., 2016).

Balance sheet assist in identifying the position of the organisation on the basis of its assets and

liabilities. Cash flow statements helps the organisation in identifying the cash requirement of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company to perform their various future operation on the basis of cash inflow and outflow of the

firm.

Financial reporting helps the firm in providing information about the activities performed

by the organisation in a year on the basis of which company formulate various strategies and

prepare the budget to reduce the expenses to increase firm profitability level to improve its

performance in the market to attract more customers towards the organisation. Financial

reporting main purpose is to provide adequate information which helps the firm in improving

their future performance on the basis of the past results (Chen and Li, 2015). The purpose of

financial reporting is to provide information to lenders to give them information about the

liquidity position of the firm to pay its obligation in order to attract lenders to lent them money.

Financial reporting are provided to investors in order to provide information to investors about

the profitability of the firm and ability of the firm to generate more profits to pay them higher

returns.

2. The conceptual and regulatory framework of financial reporting and qualitative characteristics

required for making financial information more reliable

The conceptual framework of financial reporting include various fundamental concepts

that assist in preparing the financial statements and helps the board in development IFRS

standards. It assists in ensuring that the standards are conceptually consistent and that similar

transactions are treated in the similar way in order to provide useful information to various

stakeholders of the organisation (Christiaens and et.al.,2015). Conceptual framework also helps

the firm in developing policies when the IFRS standards does not apply to particular transaction.

The conceptual framework provide qualitative characteristics in order to make the

financial information more reliable. Also, it provides definition s for the assets , liabilities,

equity, income and expenses in order to include them in financial reporting. This framework

assist in determining the measurement bases and guidance to use them in financial reporting. It

provides concepts and guidance for presentation and disclosure of financial information.

Moreover, it provides understanding of concepts relating to capital and capital maintenance.

The regulatory framework of financial reporting govern the applicability of various rules

and regulation for preparing the financial reporting. It helps in providing useful information and

reduce chances of misappropriation of accounting information. Financial reporting are governed

by the standards set out by international accounting standards and international financial

firm.

Financial reporting helps the firm in providing information about the activities performed

by the organisation in a year on the basis of which company formulate various strategies and

prepare the budget to reduce the expenses to increase firm profitability level to improve its

performance in the market to attract more customers towards the organisation. Financial

reporting main purpose is to provide adequate information which helps the firm in improving

their future performance on the basis of the past results (Chen and Li, 2015). The purpose of

financial reporting is to provide information to lenders to give them information about the

liquidity position of the firm to pay its obligation in order to attract lenders to lent them money.

Financial reporting are provided to investors in order to provide information to investors about

the profitability of the firm and ability of the firm to generate more profits to pay them higher

returns.

2. The conceptual and regulatory framework of financial reporting and qualitative characteristics

required for making financial information more reliable

The conceptual framework of financial reporting include various fundamental concepts

that assist in preparing the financial statements and helps the board in development IFRS

standards. It assists in ensuring that the standards are conceptually consistent and that similar

transactions are treated in the similar way in order to provide useful information to various

stakeholders of the organisation (Christiaens and et.al.,2015). Conceptual framework also helps

the firm in developing policies when the IFRS standards does not apply to particular transaction.

The conceptual framework provide qualitative characteristics in order to make the

financial information more reliable. Also, it provides definition s for the assets , liabilities,

equity, income and expenses in order to include them in financial reporting. This framework

assist in determining the measurement bases and guidance to use them in financial reporting. It

provides concepts and guidance for presentation and disclosure of financial information.

Moreover, it provides understanding of concepts relating to capital and capital maintenance.

The regulatory framework of financial reporting govern the applicability of various rules

and regulation for preparing the financial reporting. It helps in providing useful information and

reduce chances of misappropriation of accounting information. Financial reporting are governed

by the standards set out by international accounting standards and international financial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

reporting standards board. IAS is the regulatory body which governs the preparation of financial

reporting and according to the set rules and regulation it is mandatory for the organisation to use

the standards while preparing financial statements. The key principles of IFRS and IAS include

Invested assets and derivatives according to IAS 32 and 39. Insurance and investment contract

(IFRS 4 and 39 ). IFRS 4 provide principles for shadow accounting. Also, IFRS 2 laid down

principles for treasury shares.

The qualitative characteristics required for making the financial information more

reliable:

Reliability : financial information provided in the reporting must be free from material

errors and the information must present the correct information relating to the

transaction. The information contained in the financial reporting must be reliable and

free from bias and must not present the wrong information.

Relevance : the information contained in the financial reporting must be relevant in

order to make the economic decisions (Leuz and Wysocki, 2016). It must be relevant to

the need of users and thus helps them in making decision on the basis of the information

provided to them.

Understandability : the financial information provided in the statement must be easy to

understand. It is required to present the information clearly in order to provide the clear

understanding to the inverters and various stakeholders about the performance and

position of organisation.

Comparability : it is required to present the financial information in a way that it can be

comparable with the financial information of the other accounting period in order to

identify the trend of performance and financial position of the entity.

3. The main stakeholders of an organisation and benefit of providing financial information to

them.

There are various stakeholders of the organisation that are provided with the financial

information for various purposes. The stakeholders of the firm are classified into internal and

external stakeholders.Internal stakeholders : It consists of people that uses the financial

information from within the organisation and includes managers and employees (Nobes, 2014).

reporting and according to the set rules and regulation it is mandatory for the organisation to use

the standards while preparing financial statements. The key principles of IFRS and IAS include

Invested assets and derivatives according to IAS 32 and 39. Insurance and investment contract

(IFRS 4 and 39 ). IFRS 4 provide principles for shadow accounting. Also, IFRS 2 laid down

principles for treasury shares.

The qualitative characteristics required for making the financial information more

reliable:

Reliability : financial information provided in the reporting must be free from material

errors and the information must present the correct information relating to the

transaction. The information contained in the financial reporting must be reliable and

free from bias and must not present the wrong information.

Relevance : the information contained in the financial reporting must be relevant in

order to make the economic decisions (Leuz and Wysocki, 2016). It must be relevant to

the need of users and thus helps them in making decision on the basis of the information

provided to them.

Understandability : the financial information provided in the statement must be easy to

understand. It is required to present the information clearly in order to provide the clear

understanding to the inverters and various stakeholders about the performance and

position of organisation.

Comparability : it is required to present the financial information in a way that it can be

comparable with the financial information of the other accounting period in order to

identify the trend of performance and financial position of the entity.

3. The main stakeholders of an organisation and benefit of providing financial information to

them.

There are various stakeholders of the organisation that are provided with the financial

information for various purposes. The stakeholders of the firm are classified into internal and

external stakeholders.Internal stakeholders : It consists of people that uses the financial

information from within the organisation and includes managers and employees (Nobes, 2014).

Managers : managers are the internal stakeholders of the organisation and provided with

the financial information for various purposes such as for decision making, planning , controlling

etc. managers use the financial information for decision making to improve future performance.

Employees : they are provided with the financial information to provide them

understanding about the performance and position of the organisation for their future prospects

and to compare the performance of the firm with other organisations.

External stakeholder : it consists of people that are provided by the information which

are outside the organisation but uses the information for various reasons.

Investors : The financial information of the company is provided to the investors in order

to provide them understanding of the profitability of the firm in which they have invested their

money (Lang and Stice-Lawrence, 2015). Investors are the users of financial statements as it

helps them in determining the return on the capital invested.

Lenders : lenders are the people that lent money to the organisation for running their

business activities. Lenders uses the financial data for identifying the liquidity position of the

organisation in order to get the repayment of money lent by them to the organisation.

Suppliers : These are the people that supply raw material to the organisation for their

products and services. The financial information is provided to them in order to provide them

understanding about the future growth and performance of organisation.

Customers : they are provided the financial information in order to give understanding to

them about the performance and position of the firm in the market to attract more customers

towards the organisation (Users of Financial statements, 2017). Government : financial

information helps the government in identifying the tax liability of the organisation to determine

if proper tax are paid by them or not and also helps the government in formulating various

policies for the economic development etc.

Competitors : the information is provided to the competitors to inform them about the

strategies followed by organisation and to compare their performance with the firm to grow their

business.

Benefits of providing financial information

Financial information helps the users in determining profitability of the firm which helps

in identifying the performance.

the financial information for various purposes such as for decision making, planning , controlling

etc. managers use the financial information for decision making to improve future performance.

Employees : they are provided with the financial information to provide them

understanding about the performance and position of the organisation for their future prospects

and to compare the performance of the firm with other organisations.

External stakeholder : it consists of people that are provided by the information which

are outside the organisation but uses the information for various reasons.

Investors : The financial information of the company is provided to the investors in order

to provide them understanding of the profitability of the firm in which they have invested their

money (Lang and Stice-Lawrence, 2015). Investors are the users of financial statements as it

helps them in determining the return on the capital invested.

Lenders : lenders are the people that lent money to the organisation for running their

business activities. Lenders uses the financial data for identifying the liquidity position of the

organisation in order to get the repayment of money lent by them to the organisation.

Suppliers : These are the people that supply raw material to the organisation for their

products and services. The financial information is provided to them in order to provide them

understanding about the future growth and performance of organisation.

Customers : they are provided the financial information in order to give understanding to

them about the performance and position of the firm in the market to attract more customers

towards the organisation (Users of Financial statements, 2017). Government : financial

information helps the government in identifying the tax liability of the organisation to determine

if proper tax are paid by them or not and also helps the government in formulating various

policies for the economic development etc.

Competitors : the information is provided to the competitors to inform them about the

strategies followed by organisation and to compare their performance with the firm to grow their

business.

Benefits of providing financial information

Financial information helps the users in determining profitability of the firm which helps

in identifying the performance.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial statements helps the managers in decision making to improve the future

performance of the firm by taking effective decisions.

Financial information provided to the stakeholders helps them in making comparison of

the firm performance with the others to identify the growth of organisation.

It helps the government in identifying the tax liability of the organisation.

4. Value of financial reporting for meeting organisational objective and growth

Financial reporting helps the firm in achieving their overall objective of the firm by

improving the performance of firm on the basis of financial information. It assists in identifying

the future profitability of the firm on the basis of past records which support in improving the

profitability and position of organisation. Financial reporting are valuable for organisation as it

provide information to the organisation about the incomes , expenses, liabilities and assets.

Financial information provided to the organisation helps the firm in getting better result in the

future. Financial reporting helps the management in making decisions which assist in

formulating various policies and strategies for growth and success of the company.

Financial reporting gives information to the firm on the basis of which entity is able to

prepared budget to perform various activities according to the budget set in order to achieve the

performance goals a per budget. Financial reporting assist in setting performance goals for

future to improve the performance (Lang and Stice-Lawrence, 2015). It helps the investors,

creditors and other people associated with business about the financial integrity and

creditworthiness of the company which helps the firm in attracting more investors towards the

firm.

Financial reporting assist in improving the performance level and efficiency of

employees by providing them information about the company's financial statement. It also helps

the firm in identifying the cash requirement of the organisation on the basis of cash flow

statements which helps the firm in increasing the future cash inflows and reducing the cash

outflows by making effective strategies.

5. The main financial statements as per IAS 1

a) Statement of profit and loss

Godwin Plc statement for profit and loss for the year ended 31 December 2017

performance of the firm by taking effective decisions.

Financial information provided to the stakeholders helps them in making comparison of

the firm performance with the others to identify the growth of organisation.

It helps the government in identifying the tax liability of the organisation.

4. Value of financial reporting for meeting organisational objective and growth

Financial reporting helps the firm in achieving their overall objective of the firm by

improving the performance of firm on the basis of financial information. It assists in identifying

the future profitability of the firm on the basis of past records which support in improving the

profitability and position of organisation. Financial reporting are valuable for organisation as it

provide information to the organisation about the incomes , expenses, liabilities and assets.

Financial information provided to the organisation helps the firm in getting better result in the

future. Financial reporting helps the management in making decisions which assist in

formulating various policies and strategies for growth and success of the company.

Financial reporting gives information to the firm on the basis of which entity is able to

prepared budget to perform various activities according to the budget set in order to achieve the

performance goals a per budget. Financial reporting assist in setting performance goals for

future to improve the performance (Lang and Stice-Lawrence, 2015). It helps the investors,

creditors and other people associated with business about the financial integrity and

creditworthiness of the company which helps the firm in attracting more investors towards the

firm.

Financial reporting assist in improving the performance level and efficiency of

employees by providing them information about the company's financial statement. It also helps

the firm in identifying the cash requirement of the organisation on the basis of cash flow

statements which helps the firm in increasing the future cash inflows and reducing the cash

outflows by making effective strategies.

5. The main financial statements as per IAS 1

a) Statement of profit and loss

Godwin Plc statement for profit and loss for the year ended 31 December 2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

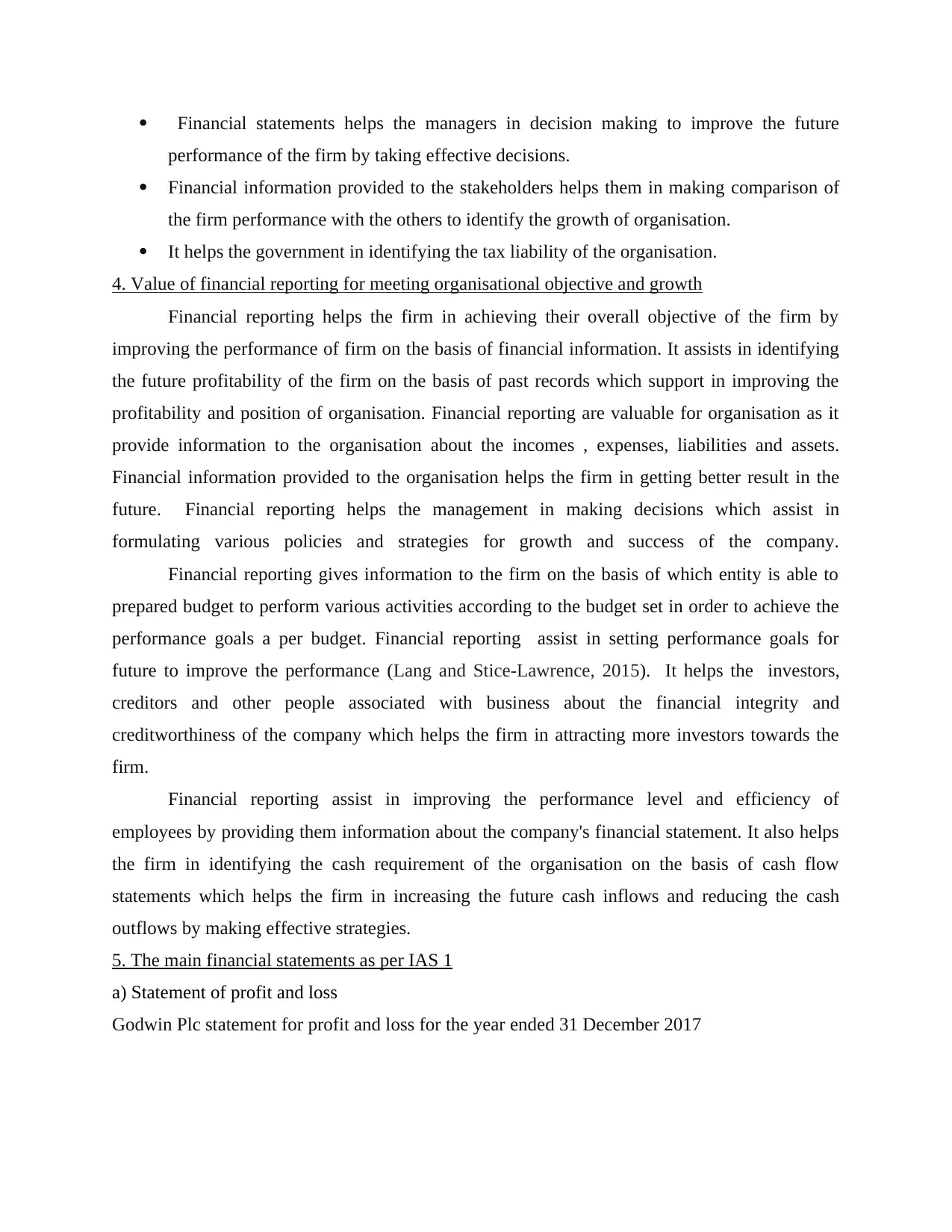

b) Godwin PLC statement of changes inequity for the year ended 2017

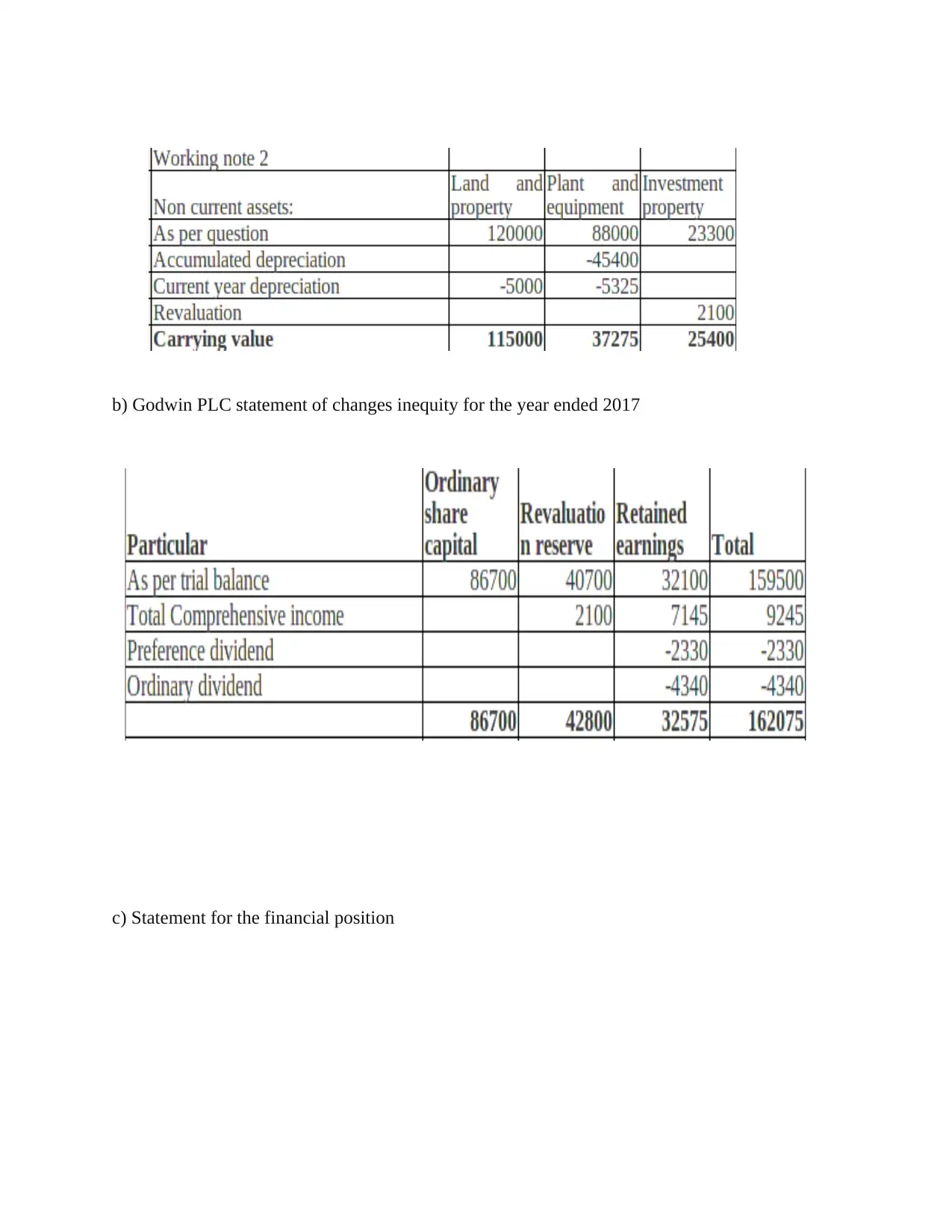

c) Statement for the financial position

c) Statement for the financial position

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

d) Cash flow statement provides information which helps the firm in identifying the future cash

requirement to perform various activities of the organisation. Cash flow statement includes cash

inflow and cash outflow identify about the incomes and expenses for the period. Cash flow

statement includes operating activities, investing activities and financing activities. Operating

requirement to perform various activities of the organisation. Cash flow statement includes cash

inflow and cash outflow identify about the incomes and expenses for the period. Cash flow

statement includes operating activities, investing activities and financing activities. Operating

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

activities includes information about cash inflow and outflow for various operating activities

which are not included in the profit and loss statement . Operating activities includes receipt

from sale of goods and services, payment made to suppliers of goods and services Etc. Financing

activities includes sources of cash from investors or banks it includes payment of dividend,

Payment for stock purchases etc. investment activities includes purchase of sale of fixed assets

loans made to vendors or receive from customers etc.

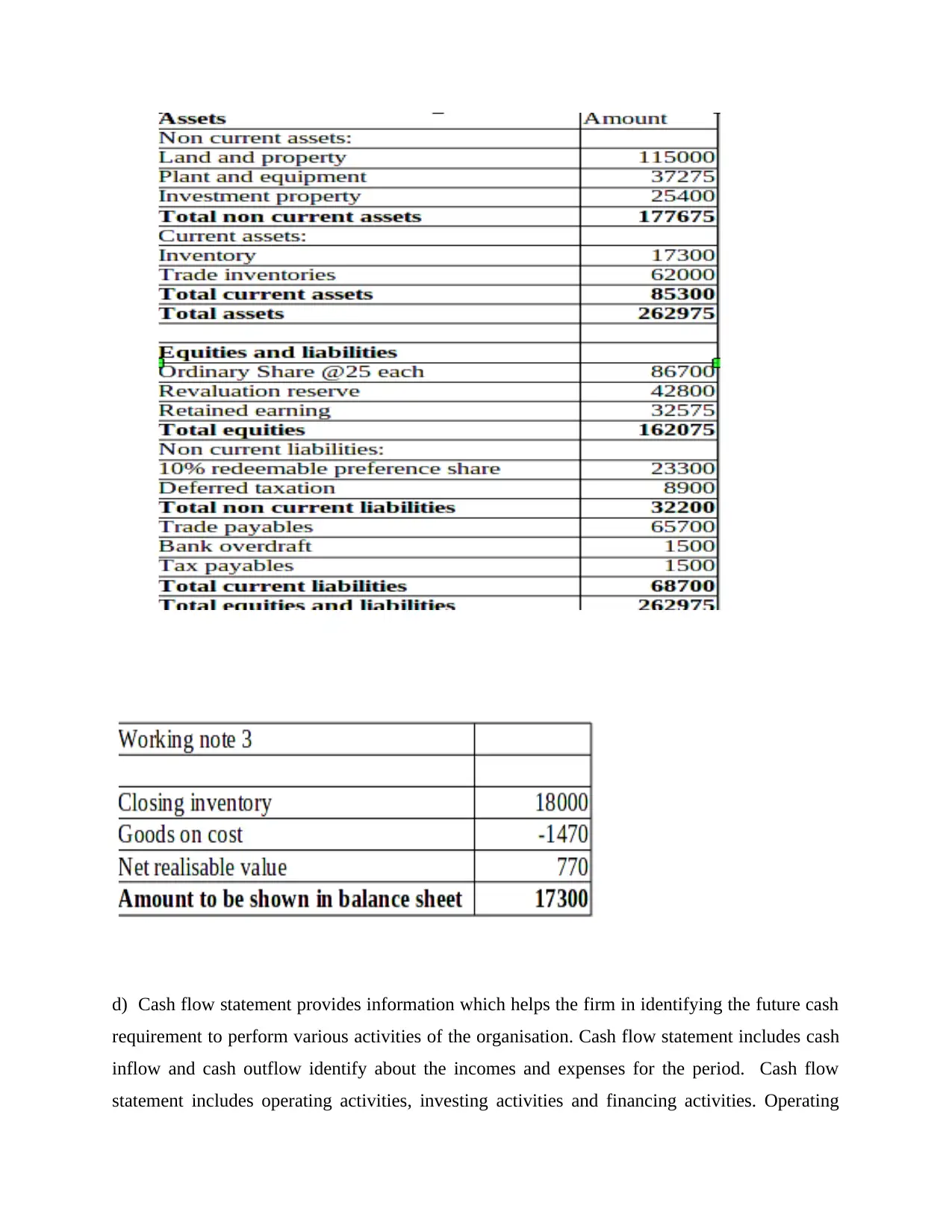

6. Two years Financial statements of Marks and Spencer

Profitability ratios

Particulars Formula 2017 2018

Operating profit 691 671

Net profit 116 29

Sales revenue 10622 10698

OP ratio

Operating profit/sales

revenue 6.51% 6.27%

NP ratio Net profit/ sales 1.09% 0.27%

From the above computation it can be interpreted that sales revenue for the period 2017

was 10622 and for 2018 is 10698. The profitability ratio consist of operating profit ratio and net

profit ratio. Operating profit ratio is computed by dividing the operating profit by sales revenue

which shows that operating profit ratio is 6.51 % in 2017 which reduced to 6.27 % which shows

that the profitability of marks and Spencer is reduced. Also, it shows that net profits for marks

and Spencer are reduced in 2018 to 0.27 $% which was 1.09 % which shows company

performance and profitability is reduced in 2018 as compared to 2017.

Liquidity ratios

Particulars Formula 2017 2018

Current assets 1723 1318

Stock 759 781

Current liabilities 2368 1826

Current ratio

Current assets / current

liabilities 0.73 0.72

Quick ratio

Current assets- stock/

current liabilities 0.41 0.29

which are not included in the profit and loss statement . Operating activities includes receipt

from sale of goods and services, payment made to suppliers of goods and services Etc. Financing

activities includes sources of cash from investors or banks it includes payment of dividend,

Payment for stock purchases etc. investment activities includes purchase of sale of fixed assets

loans made to vendors or receive from customers etc.

6. Two years Financial statements of Marks and Spencer

Profitability ratios

Particulars Formula 2017 2018

Operating profit 691 671

Net profit 116 29

Sales revenue 10622 10698

OP ratio

Operating profit/sales

revenue 6.51% 6.27%

NP ratio Net profit/ sales 1.09% 0.27%

From the above computation it can be interpreted that sales revenue for the period 2017

was 10622 and for 2018 is 10698. The profitability ratio consist of operating profit ratio and net

profit ratio. Operating profit ratio is computed by dividing the operating profit by sales revenue

which shows that operating profit ratio is 6.51 % in 2017 which reduced to 6.27 % which shows

that the profitability of marks and Spencer is reduced. Also, it shows that net profits for marks

and Spencer are reduced in 2018 to 0.27 $% which was 1.09 % which shows company

performance and profitability is reduced in 2018 as compared to 2017.

Liquidity ratios

Particulars Formula 2017 2018

Current assets 1723 1318

Stock 759 781

Current liabilities 2368 1826

Current ratio

Current assets / current

liabilities 0.73 0.72

Quick ratio

Current assets- stock/

current liabilities 0.41 0.29

From the above computation it can be interpreted that current ratio for 2017 is 0.73

which reduced to 0.72 in 2018 which shows that liquidity position of marks and Spencer is not

good as the ideal current ratio is 2: 1 . It shows that company cannot pay its obligations. Also, it

can be interpreted that organisation have current liabilities more than its current assets.

Furthermore, it can be interpreted that quick ratio of marks and Spencer is reduced to 0.29 in

2018 which was 0.41 in 2017. this shows that liquidity position of the company is not good.

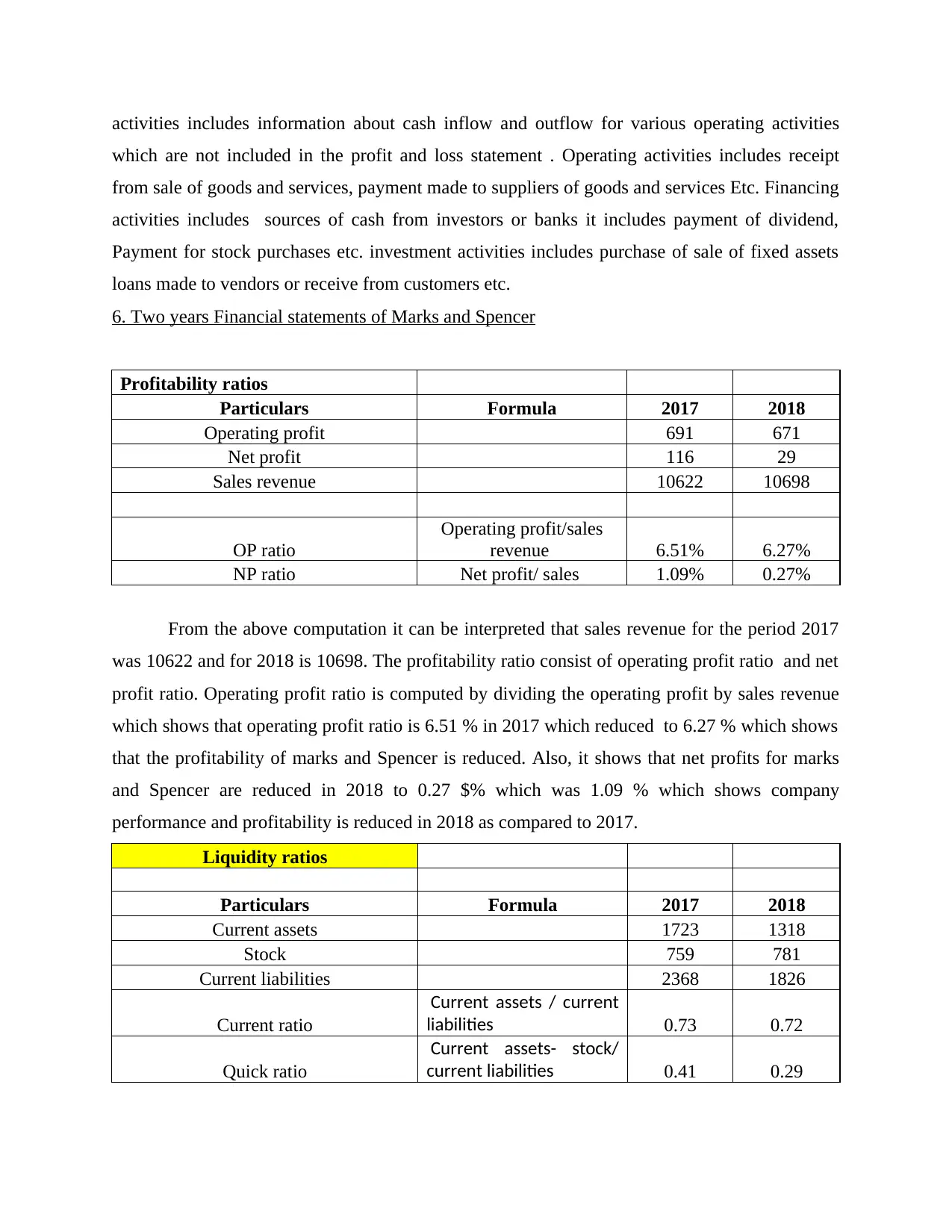

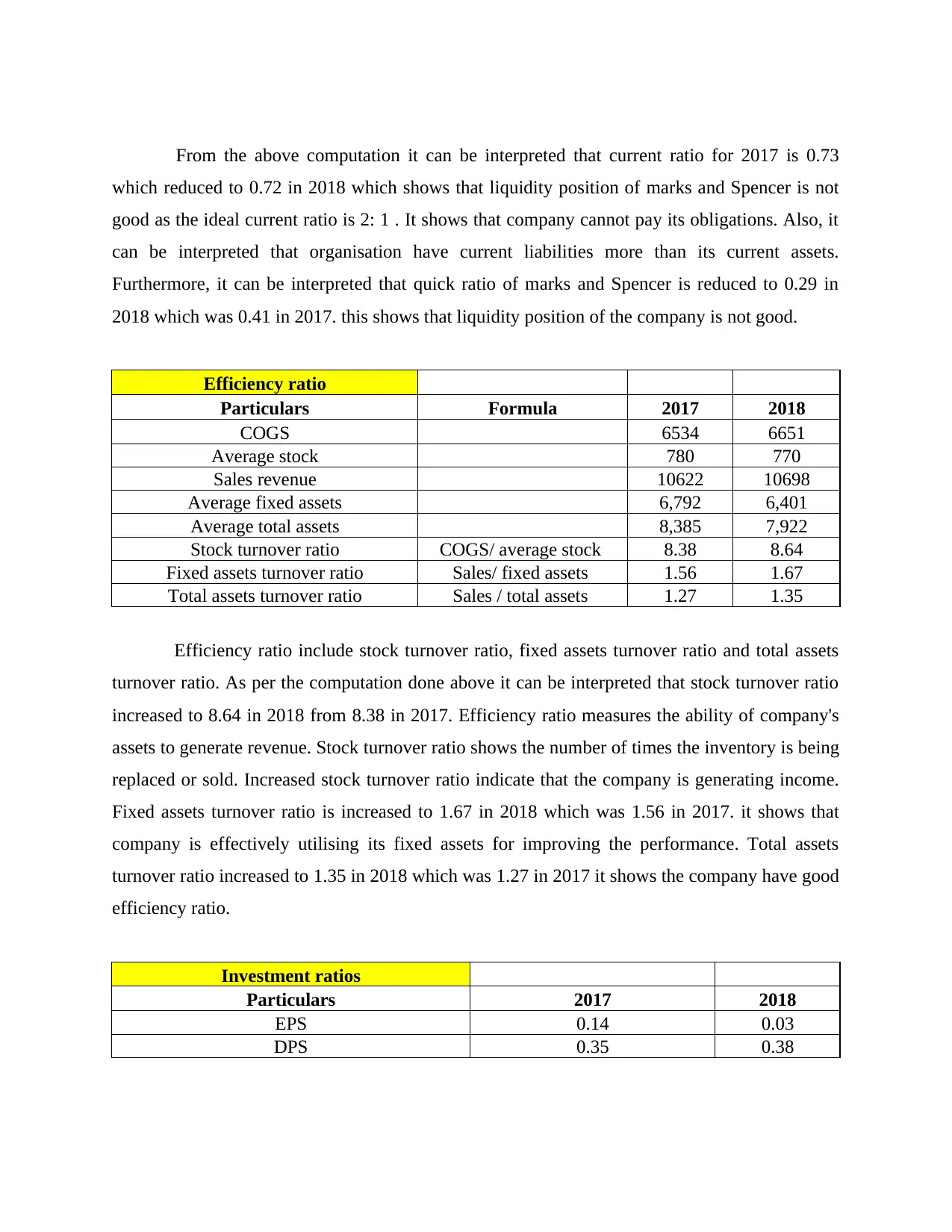

Efficiency ratio

Particulars Formula 2017 2018

COGS 6534 6651

Average stock 780 770

Sales revenue 10622 10698

Average fixed assets 6,792 6,401

Average total assets 8,385 7,922

Stock turnover ratio COGS/ average stock 8.38 8.64

Fixed assets turnover ratio Sales/ fixed assets 1.56 1.67

Total assets turnover ratio Sales / total assets 1.27 1.35

Efficiency ratio include stock turnover ratio, fixed assets turnover ratio and total assets

turnover ratio. As per the computation done above it can be interpreted that stock turnover ratio

increased to 8.64 in 2018 from 8.38 in 2017. Efficiency ratio measures the ability of company's

assets to generate revenue. Stock turnover ratio shows the number of times the inventory is being

replaced or sold. Increased stock turnover ratio indicate that the company is generating income.

Fixed assets turnover ratio is increased to 1.67 in 2018 which was 1.56 in 2017. it shows that

company is effectively utilising its fixed assets for improving the performance. Total assets

turnover ratio increased to 1.35 in 2018 which was 1.27 in 2017 it shows the company have good

efficiency ratio.

Investment ratios

Particulars 2017 2018

EPS 0.14 0.03

DPS 0.35 0.38

which reduced to 0.72 in 2018 which shows that liquidity position of marks and Spencer is not

good as the ideal current ratio is 2: 1 . It shows that company cannot pay its obligations. Also, it

can be interpreted that organisation have current liabilities more than its current assets.

Furthermore, it can be interpreted that quick ratio of marks and Spencer is reduced to 0.29 in

2018 which was 0.41 in 2017. this shows that liquidity position of the company is not good.

Efficiency ratio

Particulars Formula 2017 2018

COGS 6534 6651

Average stock 780 770

Sales revenue 10622 10698

Average fixed assets 6,792 6,401

Average total assets 8,385 7,922

Stock turnover ratio COGS/ average stock 8.38 8.64

Fixed assets turnover ratio Sales/ fixed assets 1.56 1.67

Total assets turnover ratio Sales / total assets 1.27 1.35

Efficiency ratio include stock turnover ratio, fixed assets turnover ratio and total assets

turnover ratio. As per the computation done above it can be interpreted that stock turnover ratio

increased to 8.64 in 2018 from 8.38 in 2017. Efficiency ratio measures the ability of company's

assets to generate revenue. Stock turnover ratio shows the number of times the inventory is being

replaced or sold. Increased stock turnover ratio indicate that the company is generating income.

Fixed assets turnover ratio is increased to 1.67 in 2018 which was 1.56 in 2017. it shows that

company is effectively utilising its fixed assets for improving the performance. Total assets

turnover ratio increased to 1.35 in 2018 which was 1.27 in 2017 it shows the company have good

efficiency ratio.

Investment ratios

Particulars 2017 2018

EPS 0.14 0.03

DPS 0.35 0.38

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.