Financial Resource Management and Decision-Making Analysis Report

VerifiedAdded on 2020/02/05

|17

|5114

|134

Report

AI Summary

This report provides a comprehensive analysis of financial resource management and decision-making, focusing on Care Tech plc. It begins by outlining the principles of costing and budget control systems, identifying the information necessary for managing financial resources, and detailing the relevant regulatory requirements. The report then explores different income sources, analyzes factors influencing financial resource availability, and reviews various budget expenditure types. Furthermore, it delves into methods for managing financial shortfalls, actions to prevent fraud, and budget monitoring arrangements. The report also examines the information needed for financial decisions, the relationship between delivery, cost, and expenditure, and the impact of financial considerations on service users, concluding with recommendations for improving care services. The report covers topics from regulatory bodies like HMRC to internal systems like budgeting and payment methods. It also explores different sources of income such as equity, debt and retained earnings.

MANAGING FINANCIAL

RESOURCES AND DECISION

MAKING

RESOURCES AND DECISION

MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction ...............................................................................................................................3

Task 1.........................................................................................................................................3

1.1 Principles of costing and budget control system.............................................................3

1.2 Information needed to mange financial resources...........................................................4

1.3 Regulatory requirements for managing financial resources Care tech plc......................4

1.4 Systems for managing financial resources at Care tech plc............................................4

TASK 2......................................................................................................................................5

2.1 Different source of income for the firm...........................................................................5

2.2 Analysis of factors that may influence availability of financial resources .....................5

2.3 Review of different types of budget expenditure............................................................7

2.4 Chosen of right decisions on evaluate expenditure ........................................................7

TASK 3......................................................................................................................................8

3.1 Way to manage finance shortfall.....................................................................................8

3.2 Actions that I will take on estimation of occurrence of fraud in an organization...........8

3.3 Budget monitoring arrangements at Care tech plc..........................................................9

Task 4.........................................................................................................................................9

4.1 Identify required information to make financial decisions..............................................9

4.2 Analysis relationship among delivery, cost and expenditure........................................10

4.3 Evaluate financial considerations impact upon service user.........................................10

4.4 Recommendation for improve the care services............................................................10

Conclusion................................................................................................................................10

References..................................................................................................................................1

Introduction ...............................................................................................................................3

Task 1.........................................................................................................................................3

1.1 Principles of costing and budget control system.............................................................3

1.2 Information needed to mange financial resources...........................................................4

1.3 Regulatory requirements for managing financial resources Care tech plc......................4

1.4 Systems for managing financial resources at Care tech plc............................................4

TASK 2......................................................................................................................................5

2.1 Different source of income for the firm...........................................................................5

2.2 Analysis of factors that may influence availability of financial resources .....................5

2.3 Review of different types of budget expenditure............................................................7

2.4 Chosen of right decisions on evaluate expenditure ........................................................7

TASK 3......................................................................................................................................8

3.1 Way to manage finance shortfall.....................................................................................8

3.2 Actions that I will take on estimation of occurrence of fraud in an organization...........8

3.3 Budget monitoring arrangements at Care tech plc..........................................................9

Task 4.........................................................................................................................................9

4.1 Identify required information to make financial decisions..............................................9

4.2 Analysis relationship among delivery, cost and expenditure........................................10

4.3 Evaluate financial considerations impact upon service user.........................................10

4.4 Recommendation for improve the care services............................................................10

Conclusion................................................................................................................................10

References..................................................................................................................................1

INDEX OF TABLES

Table 1: Calculation of budget...................................................................................................7

Table 1: Calculation of budget...................................................................................................7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance is essential for every business unit because it helps to extend business on

higher level. Funds are raised through various sources that are help to expansion of business.

It also supports to plan for new investments and short and long term financial planning. In the

context of research it explains principles of cost and budgetary control in brief. Then identify

relevant information and system to managing financial sources. In the middle content of case

it explains different income sources and analysis influences factor of financial sources.

Moreover, it defines budget monitoring arrangements and information regarding to take

financial decisions is discussed in this research.

TASK 1

1.1 Principles of costing and budget control system

Following are the principles of costing which are followed by each and every type of

business firm: Stakeholder engagement- Many times, it is assumed that costing is related to finance

department only. In healthcare organizations, non finance stakeholders are also

engaged in the activities of hospital and they have a contribution in the entire costing

of healthcare organization. Thus, as per this principle, while computing cost for Care

Tech holding plc that is generated by finance and non finance stakeholder must be

considered. Consistency- For costing purpose, it is inevitable to follow a consistent approach in

the accounting of transactions. This approach is required to be followed by Care Tech

holding plc in order to enable the cost comparisons. Internal consistency is needed to

do time series analysis which is used to measure firm’s performance in the past years.

Hence, costs must be recorded in the books of accounts on regular basis because it

helps managers in determining the cost benchmarks. Data accuracy- For estimating accurate cost of service, it is necessary to collect

accurate input data. These input data are recorded in different systems like accounting

system, patient administration system and theatre system. Cost of all these systems is

added together in the accounting system to compute the final cost of services. As per

this principle, coverage of input data and its quality helps in computing accurate cost

of services. Thus, Care Tech holding plc must simplify its accounting system so that

the entire input data at accurate value can be taken to calculate the cost of services of

business.

Finance is essential for every business unit because it helps to extend business on

higher level. Funds are raised through various sources that are help to expansion of business.

It also supports to plan for new investments and short and long term financial planning. In the

context of research it explains principles of cost and budgetary control in brief. Then identify

relevant information and system to managing financial sources. In the middle content of case

it explains different income sources and analysis influences factor of financial sources.

Moreover, it defines budget monitoring arrangements and information regarding to take

financial decisions is discussed in this research.

TASK 1

1.1 Principles of costing and budget control system

Following are the principles of costing which are followed by each and every type of

business firm: Stakeholder engagement- Many times, it is assumed that costing is related to finance

department only. In healthcare organizations, non finance stakeholders are also

engaged in the activities of hospital and they have a contribution in the entire costing

of healthcare organization. Thus, as per this principle, while computing cost for Care

Tech holding plc that is generated by finance and non finance stakeholder must be

considered. Consistency- For costing purpose, it is inevitable to follow a consistent approach in

the accounting of transactions. This approach is required to be followed by Care Tech

holding plc in order to enable the cost comparisons. Internal consistency is needed to

do time series analysis which is used to measure firm’s performance in the past years.

Hence, costs must be recorded in the books of accounts on regular basis because it

helps managers in determining the cost benchmarks. Data accuracy- For estimating accurate cost of service, it is necessary to collect

accurate input data. These input data are recorded in different systems like accounting

system, patient administration system and theatre system. Cost of all these systems is

added together in the accounting system to compute the final cost of services. As per

this principle, coverage of input data and its quality helps in computing accurate cost

of services. Thus, Care Tech holding plc must simplify its accounting system so that

the entire input data at accurate value can be taken to calculate the cost of services of

business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Principles of budget control system Be conservative not optimistic- As per this principle of budget control system, while

doing forecasting managers must be conservative not optimistic (Pahl-Wostl and

et.al., 2010). Before making any prediction, they must show resistance and after

having valid reasons they must make prediction.

Allow plenty of time- Managers must take plenty of time while determining budget

values. By doing this, they can make sure that appropriate budget will be prepared for

the organization.

1.2 Information needed to mange financial resources

There are many types of information that are needed by the managers in order to

manager financial resources. Some of required information is as follows. Employee’s cost- In order to make best use of financial resources, it is necessary to

make appropriate estimation. HR is the important aspect for the firm and thus by

making estimation of employee cost firm can make best use of available funds

(Conway, 2013). Other expenses- It includes all expenses that do not fall in the category of employee

cost and CAPEX (Bate, Donaldson and Murtagh, 2007). On the basis of estimation of

other expenses, managers adopt cost control methods. By doing this, they mange

funds in a proper way. Finance cost- Care Tech holding plc takes loan at specific interest rate and it is

termed as finance expenses in the firm’s income statement. It is valued at 4,814,000 in

the firm’s income statement. Managers need this information in order to make sure

that its finance cost is in control and organization will be able to make payment of its

finance cost on time.

Tax expenses - In the firm, income statement tax is divided into two parts, that is,

current tax and deferred tax. Managers, by analyzing these statements, identify the

type of tax that firm is paying at higher amount in the current fiscal year.

1.3 Regulatory requirements for managing financial resources Care tech plc

By conducting audit the company can determine that cash is safe and funds are

managed in a proper manner. There are codes of practice that help firm in making best use of

available resources. Code of practice determines the way in which funds must be used by the

managers. Hence, by using same funds can be managed in proper way.

doing forecasting managers must be conservative not optimistic (Pahl-Wostl and

et.al., 2010). Before making any prediction, they must show resistance and after

having valid reasons they must make prediction.

Allow plenty of time- Managers must take plenty of time while determining budget

values. By doing this, they can make sure that appropriate budget will be prepared for

the organization.

1.2 Information needed to mange financial resources

There are many types of information that are needed by the managers in order to

manager financial resources. Some of required information is as follows. Employee’s cost- In order to make best use of financial resources, it is necessary to

make appropriate estimation. HR is the important aspect for the firm and thus by

making estimation of employee cost firm can make best use of available funds

(Conway, 2013). Other expenses- It includes all expenses that do not fall in the category of employee

cost and CAPEX (Bate, Donaldson and Murtagh, 2007). On the basis of estimation of

other expenses, managers adopt cost control methods. By doing this, they mange

funds in a proper way. Finance cost- Care Tech holding plc takes loan at specific interest rate and it is

termed as finance expenses in the firm’s income statement. It is valued at 4,814,000 in

the firm’s income statement. Managers need this information in order to make sure

that its finance cost is in control and organization will be able to make payment of its

finance cost on time.

Tax expenses - In the firm, income statement tax is divided into two parts, that is,

current tax and deferred tax. Managers, by analyzing these statements, identify the

type of tax that firm is paying at higher amount in the current fiscal year.

1.3 Regulatory requirements for managing financial resources Care tech plc

By conducting audit the company can determine that cash is safe and funds are

managed in a proper manner. There are codes of practice that help firm in making best use of

available resources. Code of practice determines the way in which funds must be used by the

managers. Hence, by using same funds can be managed in proper way.

Regulation is a set of rules and regulations that are followed by regulatory authorities

in order to make sure that all procedures determined by the government are accurately

performed by the government. Regulation is important because it ensures that in Health care

sector of UK, all financial and non financial activities are performed in an appropriate way by

the firms like Care tech plc (Bentz, 2007).. This makes sure that patients will be treated in a

proper way by the hospital system and its costing system will be efficient. This would help

the regulators in determining the costs of services provided by the healthcare firm which are

recorded in a legitimate way. Main purpose of regulation is to ascertain that good quality of

services is provided to the patients at hospital. Other main purpose of these regulations is to

check that there is no irregularities in firm’s accounts and government grants are used in an

effectual way by the managers.

Audit commission Roles- Audit commission plays an important role in ensuring that NHS and other

organizations accounts are correct and figures are not manipulated in their financial

statements.

Responsibility – Its responsibility is to appoint its auditors in NHS who will time to

time conduct audit and check organization’s accounts. It is responsibility of auditors

to examine annual return of NHS and to combine the accounting statements in order

to give suggestions for improving the accounting system.

HMRC

It is known as Her Majesty revenue and customs and its roles as well as responsibility

are as follows: Role- It collect tax from people and firms and collected amount is used for UK public

services. Responsibility- It is responsible for administration and collection of direct tax like

income tax and corporate tax. It is responsible for administering anti money

laundering case related to organizations.

Company house Role- It is helpful in registering all newly opened firms in the UK. Responsibility- Its main responsibility is to make sure that all registered firms submit

their financial statements in their offices. It is also responsible to ascertain that all

in order to make sure that all procedures determined by the government are accurately

performed by the government. Regulation is important because it ensures that in Health care

sector of UK, all financial and non financial activities are performed in an appropriate way by

the firms like Care tech plc (Bentz, 2007).. This makes sure that patients will be treated in a

proper way by the hospital system and its costing system will be efficient. This would help

the regulators in determining the costs of services provided by the healthcare firm which are

recorded in a legitimate way. Main purpose of regulation is to ascertain that good quality of

services is provided to the patients at hospital. Other main purpose of these regulations is to

check that there is no irregularities in firm’s accounts and government grants are used in an

effectual way by the managers.

Audit commission Roles- Audit commission plays an important role in ensuring that NHS and other

organizations accounts are correct and figures are not manipulated in their financial

statements.

Responsibility – Its responsibility is to appoint its auditors in NHS who will time to

time conduct audit and check organization’s accounts. It is responsibility of auditors

to examine annual return of NHS and to combine the accounting statements in order

to give suggestions for improving the accounting system.

HMRC

It is known as Her Majesty revenue and customs and its roles as well as responsibility

are as follows: Role- It collect tax from people and firms and collected amount is used for UK public

services. Responsibility- It is responsible for administration and collection of direct tax like

income tax and corporate tax. It is responsible for administering anti money

laundering case related to organizations.

Company house Role- It is helpful in registering all newly opened firms in the UK. Responsibility- Its main responsibility is to make sure that all registered firms submit

their financial statements in their offices. It is also responsible to ascertain that all

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

registered firms provide information about company’s returns which are in public

records.

Financial reporting council Role- It play a crucial role in promoting high quality of corporate governance in UK

as well as it also laid reporting standards for publication of company’s information in

reports. Responsibility- It is responsible to bring changes in codes, standard setting and

relevant policies. It is also responsible to prepare new guidelines related to corporate

reporting of firms.

NHS litigation authority Roles- It proves to be helpful in managing all legal affairs of NHS and is important in

handling disputes between doctors. Responsibility- It is responsible for handling negligence claims that are made against

the NHS of England. It is also responsible for coordinating claims that are related to

equal pay in NHS.

CQC Role- It main role is to ensure that high quality of services is given to the patients in

the hospital. Responsibility- It is the responsibility to monitor and inspect all health care

organizations of the UK.

GMC Role- Plays an important role in maintaining the records of all registered doctors of

the UK. Responsibility- Major responsibility is to protect and to maintain health and safety of

public of UK. It is also responsible for suspending doctors from their post if they are

found culprit in any case.

NMC Role- Having important role in registering nurses and midwives in the UK healthcare

sector.

records.

Financial reporting council Role- It play a crucial role in promoting high quality of corporate governance in UK

as well as it also laid reporting standards for publication of company’s information in

reports. Responsibility- It is responsible to bring changes in codes, standard setting and

relevant policies. It is also responsible to prepare new guidelines related to corporate

reporting of firms.

NHS litigation authority Roles- It proves to be helpful in managing all legal affairs of NHS and is important in

handling disputes between doctors. Responsibility- It is responsible for handling negligence claims that are made against

the NHS of England. It is also responsible for coordinating claims that are related to

equal pay in NHS.

CQC Role- It main role is to ensure that high quality of services is given to the patients in

the hospital. Responsibility- It is the responsibility to monitor and inspect all health care

organizations of the UK.

GMC Role- Plays an important role in maintaining the records of all registered doctors of

the UK. Responsibility- Major responsibility is to protect and to maintain health and safety of

public of UK. It is also responsible for suspending doctors from their post if they are

found culprit in any case.

NMC Role- Having important role in registering nurses and midwives in the UK healthcare

sector.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Responsibility- Responsible to investigate allegations impaired fitness of practice in

the UK as well as to set and review the standards for education and training of nurses

and midlives in the UK.

Conclusion

On the basis of above discussion, it is concluded that there are many authorities in UK

that are playing an important role in ensuring that proper healthcare services are provided to

the people in UK. These bodies ensure that internal system of NHS is working perfectly and

all its services are managed effectually.

1.4 Systems for managing financial resources at Care tech plc

System is a group of things that are working together or are interrelated to each other.

System of UK healthcare sector includes regulatory authorities, hospitals, NHS and all those

who provide healthcare services in the UK (Anheier. and Winder, 2007). All these entities are

related to each other in the healthcare system of the UK. Budgets are prepared on the basis of

projected figures. Healthcare firms make anticipation about their earnings in upcoming years.

On the basis of this estimation, they envisage about the amount of expenses they can make in

the next fiscal year. On the basis of this estimation, firms prepare budget for a year which

breaks down month wise. Budget indicates the way in which various resources will be used

by the firm. In order to make sure that these resources will be used in a proper way,

responsibility of managers and subordinates is determined. This ensures the effective

utilization of available resources (Berwick, Nolan and Whittington, 2008). Firms normally

make payment by electronic fund transfer in order to ensure that transactions will be done

safely. Private firms centralize their payment system in order to delay the cash outflow from

bank account. By doing this, they manage their cash effectively.

TASK 2

2.1 Different source of income for the firm

Following are the sources of finance that are available to business and some of them

are as follows. Equity- Under this firms sale their shares to business entities or launch IPO in primary

market. In order to bring IPO companies needs to fulfil some criteria that are

determined by the recognized stock exchange. If firm pass these parameters then only

it can issue shares (Broadbent and Cullen, 2012). If it is not possible to bring IPO then

the UK as well as to set and review the standards for education and training of nurses

and midlives in the UK.

Conclusion

On the basis of above discussion, it is concluded that there are many authorities in UK

that are playing an important role in ensuring that proper healthcare services are provided to

the people in UK. These bodies ensure that internal system of NHS is working perfectly and

all its services are managed effectually.

1.4 Systems for managing financial resources at Care tech plc

System is a group of things that are working together or are interrelated to each other.

System of UK healthcare sector includes regulatory authorities, hospitals, NHS and all those

who provide healthcare services in the UK (Anheier. and Winder, 2007). All these entities are

related to each other in the healthcare system of the UK. Budgets are prepared on the basis of

projected figures. Healthcare firms make anticipation about their earnings in upcoming years.

On the basis of this estimation, they envisage about the amount of expenses they can make in

the next fiscal year. On the basis of this estimation, firms prepare budget for a year which

breaks down month wise. Budget indicates the way in which various resources will be used

by the firm. In order to make sure that these resources will be used in a proper way,

responsibility of managers and subordinates is determined. This ensures the effective

utilization of available resources (Berwick, Nolan and Whittington, 2008). Firms normally

make payment by electronic fund transfer in order to ensure that transactions will be done

safely. Private firms centralize their payment system in order to delay the cash outflow from

bank account. By doing this, they manage their cash effectively.

TASK 2

2.1 Different source of income for the firm

Following are the sources of finance that are available to business and some of them

are as follows. Equity- Under this firms sale their shares to business entities or launch IPO in primary

market. In order to bring IPO companies needs to fulfil some criteria that are

determined by the recognized stock exchange. If firm pass these parameters then only

it can issue shares (Broadbent and Cullen, 2012). If it is not possible to bring IPO then

firm can sale shares to business firms that are interested in making investment in the

firm. Debt- In this source of finance, companies can take debt from the banks and other

financial institutions. These financial institutions offer loan at fixed and floating

interest rates. If Aqua takes a loan at flexible interest rate then its finance cost may

increase. Thus, it will be better to take loan at fixed interest rate. Retained earnings- It is a portion of company profit that remains with the firm after

deducting all expenses. There is no cost of capital of this source of finance and due to

this reason it is preferred as a source of finance for the business firms (Siano, Kitchen

and Giovanna Confetto, 2010).

Lease finance-Aqua can also finance its needs by taking assets on lease. These assets

may be building or machinery etc. By selecting this source of finance firm can abstain

from making capital expenditures.

There are many factors that may influence the availability of loan to Care Tech plc.

Company’s performance is one of these factors. If performance of Care Tech plc will be good

then more banks will be prepared to give loan to the business firms. Country’s monetary

policy also affects the availability of loan. If it is preparing tight monetary policy then less

amount of loan will be offered to the business firms. Hence, it can be said that there are many

factors that affect the accessibility of loan to the business firm. Care Tech policy is entirely

dependent on business to earn revenue as there are no other sources of income from which it

can earn profit. Currently, firm is providing services related to the adult learning disabilities,

children and people service, mental health services, etc. From these services, it is earning

high amount of revenue from business.

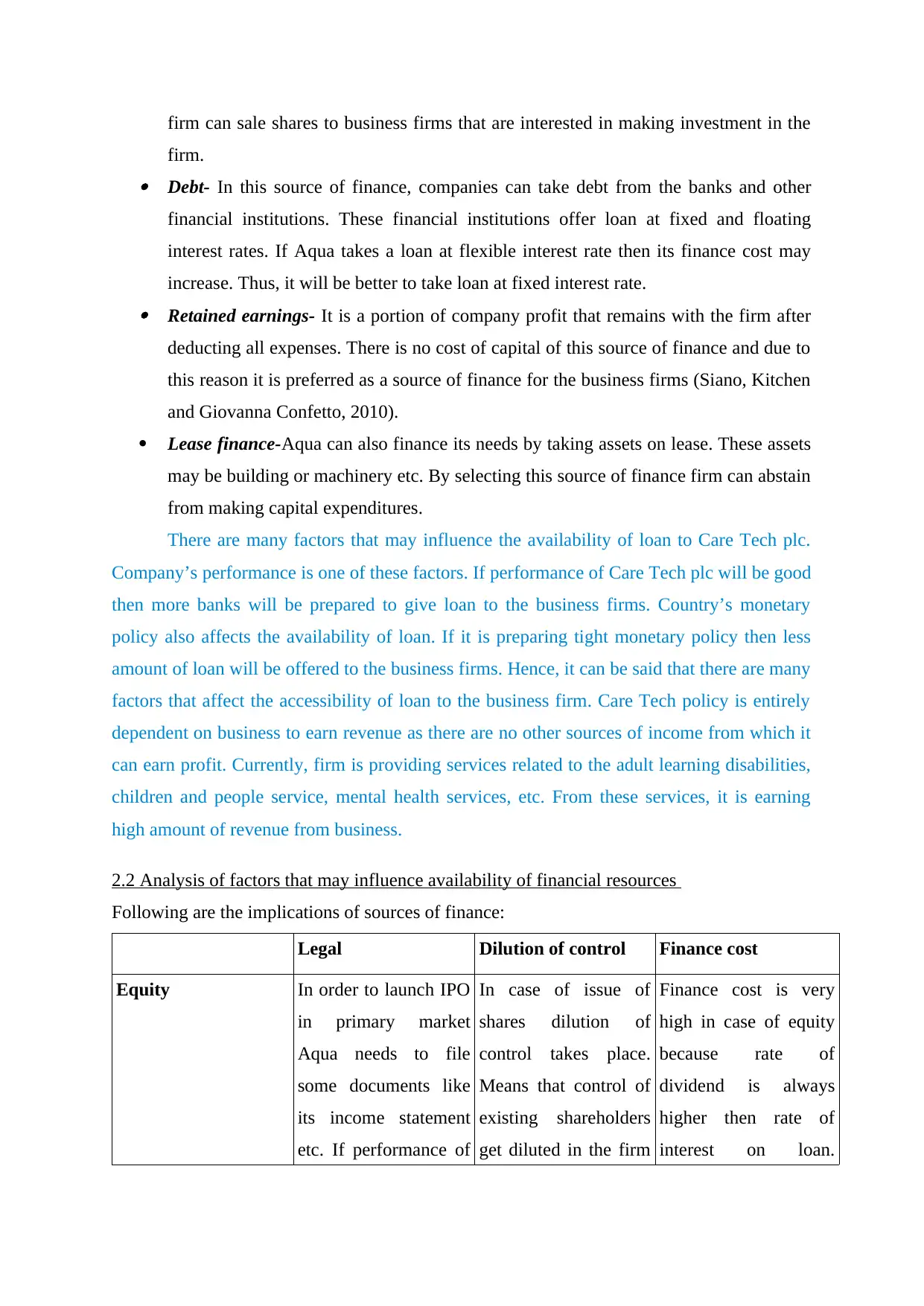

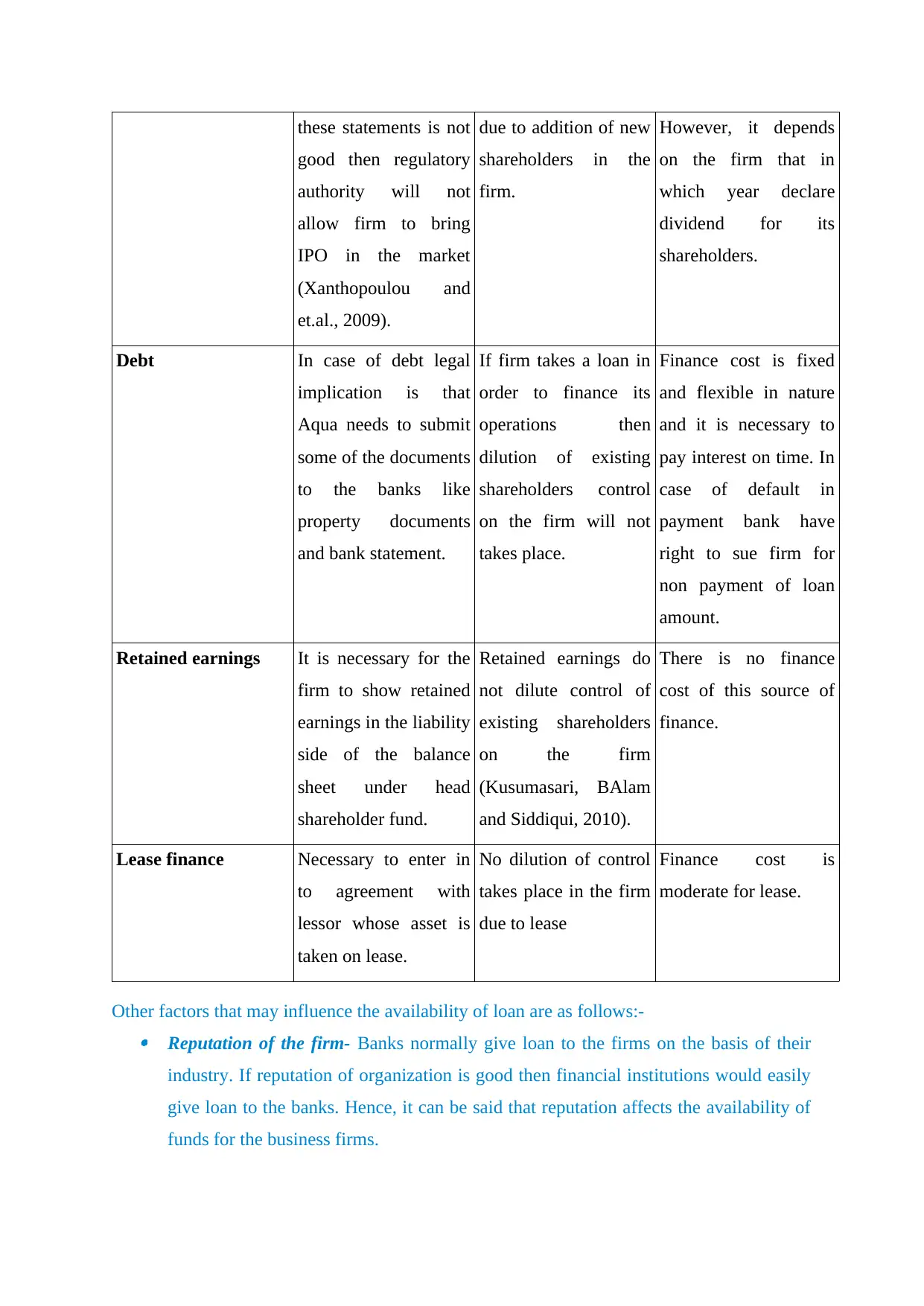

2.2 Analysis of factors that may influence availability of financial resources

Following are the implications of sources of finance:

Legal Dilution of control Finance cost

Equity In order to launch IPO

in primary market

Aqua needs to file

some documents like

its income statement

etc. If performance of

In case of issue of

shares dilution of

control takes place.

Means that control of

existing shareholders

get diluted in the firm

Finance cost is very

high in case of equity

because rate of

dividend is always

higher then rate of

interest on loan.

firm. Debt- In this source of finance, companies can take debt from the banks and other

financial institutions. These financial institutions offer loan at fixed and floating

interest rates. If Aqua takes a loan at flexible interest rate then its finance cost may

increase. Thus, it will be better to take loan at fixed interest rate. Retained earnings- It is a portion of company profit that remains with the firm after

deducting all expenses. There is no cost of capital of this source of finance and due to

this reason it is preferred as a source of finance for the business firms (Siano, Kitchen

and Giovanna Confetto, 2010).

Lease finance-Aqua can also finance its needs by taking assets on lease. These assets

may be building or machinery etc. By selecting this source of finance firm can abstain

from making capital expenditures.

There are many factors that may influence the availability of loan to Care Tech plc.

Company’s performance is one of these factors. If performance of Care Tech plc will be good

then more banks will be prepared to give loan to the business firms. Country’s monetary

policy also affects the availability of loan. If it is preparing tight monetary policy then less

amount of loan will be offered to the business firms. Hence, it can be said that there are many

factors that affect the accessibility of loan to the business firm. Care Tech policy is entirely

dependent on business to earn revenue as there are no other sources of income from which it

can earn profit. Currently, firm is providing services related to the adult learning disabilities,

children and people service, mental health services, etc. From these services, it is earning

high amount of revenue from business.

2.2 Analysis of factors that may influence availability of financial resources

Following are the implications of sources of finance:

Legal Dilution of control Finance cost

Equity In order to launch IPO

in primary market

Aqua needs to file

some documents like

its income statement

etc. If performance of

In case of issue of

shares dilution of

control takes place.

Means that control of

existing shareholders

get diluted in the firm

Finance cost is very

high in case of equity

because rate of

dividend is always

higher then rate of

interest on loan.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

these statements is not

good then regulatory

authority will not

allow firm to bring

IPO in the market

(Xanthopoulou and

et.al., 2009).

due to addition of new

shareholders in the

firm.

However, it depends

on the firm that in

which year declare

dividend for its

shareholders.

Debt In case of debt legal

implication is that

Aqua needs to submit

some of the documents

to the banks like

property documents

and bank statement.

If firm takes a loan in

order to finance its

operations then

dilution of existing

shareholders control

on the firm will not

takes place.

Finance cost is fixed

and flexible in nature

and it is necessary to

pay interest on time. In

case of default in

payment bank have

right to sue firm for

non payment of loan

amount.

Retained earnings It is necessary for the

firm to show retained

earnings in the liability

side of the balance

sheet under head

shareholder fund.

Retained earnings do

not dilute control of

existing shareholders

on the firm

(Kusumasari, BAlam

and Siddiqui, 2010).

There is no finance

cost of this source of

finance.

Lease finance Necessary to enter in

to agreement with

lessor whose asset is

taken on lease.

No dilution of control

takes place in the firm

due to lease

Finance cost is

moderate for lease.

Other factors that may influence the availability of loan are as follows:- Reputation of the firm- Banks normally give loan to the firms on the basis of their

industry. If reputation of organization is good then financial institutions would easily

give loan to the banks. Hence, it can be said that reputation affects the availability of

funds for the business firms.

good then regulatory

authority will not

allow firm to bring

IPO in the market

(Xanthopoulou and

et.al., 2009).

due to addition of new

shareholders in the

firm.

However, it depends

on the firm that in

which year declare

dividend for its

shareholders.

Debt In case of debt legal

implication is that

Aqua needs to submit

some of the documents

to the banks like

property documents

and bank statement.

If firm takes a loan in

order to finance its

operations then

dilution of existing

shareholders control

on the firm will not

takes place.

Finance cost is fixed

and flexible in nature

and it is necessary to

pay interest on time. In

case of default in

payment bank have

right to sue firm for

non payment of loan

amount.

Retained earnings It is necessary for the

firm to show retained

earnings in the liability

side of the balance

sheet under head

shareholder fund.

Retained earnings do

not dilute control of

existing shareholders

on the firm

(Kusumasari, BAlam

and Siddiqui, 2010).

There is no finance

cost of this source of

finance.

Lease finance Necessary to enter in

to agreement with

lessor whose asset is

taken on lease.

No dilution of control

takes place in the firm

due to lease

Finance cost is

moderate for lease.

Other factors that may influence the availability of loan are as follows:- Reputation of the firm- Banks normally give loan to the firms on the basis of their

industry. If reputation of organization is good then financial institutions would easily

give loan to the banks. Hence, it can be said that reputation affects the availability of

funds for the business firms.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sales revenue- Financial institutions evaluate the business firms by analyzing their

sales revenue. If same is increased consistently then it means that organization is

financially very strong. On the basis of this assumption, banks can easily give loan to

the business firms.

Balance sheet assets and liability- Balance sheet indicates the financial position of

the firm at the end of financial year. By using ratio analysis method, managers

evaluate the organization’s performance and decide whether to give loan to business

firm or not. Hence, it can be said that assets and liabilities of balance sheet affects the

availability of funds for the business firms.

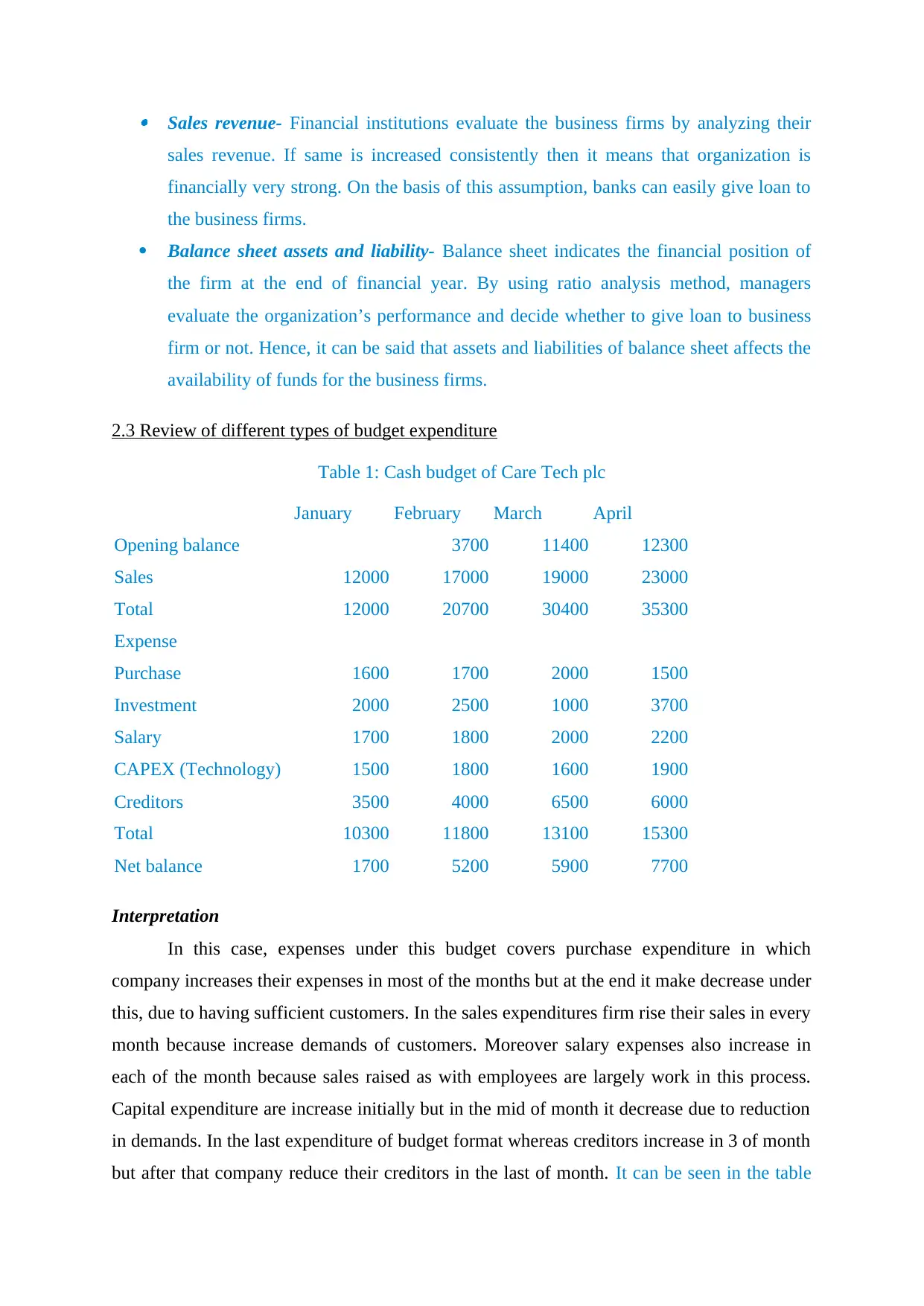

2.3 Review of different types of budget expenditure

Table 1: Cash budget of Care Tech plc

January February March April

Opening balance 3700 11400 12300

Sales 12000 17000 19000 23000

Total 12000 20700 30400 35300

Expense

Purchase 1600 1700 2000 1500

Investment 2000 2500 1000 3700

Salary 1700 1800 2000 2200

CAPEX (Technology) 1500 1800 1600 1900

Creditors 3500 4000 6500 6000

Total 10300 11800 13100 15300

Net balance 1700 5200 5900 7700

Interpretation

In this case, expenses under this budget covers purchase expenditure in which

company increases their expenses in most of the months but at the end it make decrease under

this, due to having sufficient customers. In the sales expenditures firm rise their sales in every

month because increase demands of customers. Moreover salary expenses also increase in

each of the month because sales raised as with employees are largely work in this process.

Capital expenditure are increase initially but in the mid of month it decrease due to reduction

in demands. In the last expenditure of budget format whereas creditors increase in 3 of month

but after that company reduce their creditors in the last of month. It can be seen in the table

sales revenue. If same is increased consistently then it means that organization is

financially very strong. On the basis of this assumption, banks can easily give loan to

the business firms.

Balance sheet assets and liability- Balance sheet indicates the financial position of

the firm at the end of financial year. By using ratio analysis method, managers

evaluate the organization’s performance and decide whether to give loan to business

firm or not. Hence, it can be said that assets and liabilities of balance sheet affects the

availability of funds for the business firms.

2.3 Review of different types of budget expenditure

Table 1: Cash budget of Care Tech plc

January February March April

Opening balance 3700 11400 12300

Sales 12000 17000 19000 23000

Total 12000 20700 30400 35300

Expense

Purchase 1600 1700 2000 1500

Investment 2000 2500 1000 3700

Salary 1700 1800 2000 2200

CAPEX (Technology) 1500 1800 1600 1900

Creditors 3500 4000 6500 6000

Total 10300 11800 13100 15300

Net balance 1700 5200 5900 7700

Interpretation

In this case, expenses under this budget covers purchase expenditure in which

company increases their expenses in most of the months but at the end it make decrease under

this, due to having sufficient customers. In the sales expenditures firm rise their sales in every

month because increase demands of customers. Moreover salary expenses also increase in

each of the month because sales raised as with employees are largely work in this process.

Capital expenditure are increase initially but in the mid of month it decrease due to reduction

in demands. In the last expenditure of budget format whereas creditors increase in 3 of month

but after that company reduce their creditors in the last of month. It can be seen in the table

that firm is making investment in securities and same is increased consistently but only in

month of April, it declined sharply to 1000. Cash flow of the firm has increased consistently

and it can be said that organization is expecting that its performance will be magnificent in

the fiscal year.

2.4 Ways in which decisions about expenditures can be made at Care Tech pl

There are several alternatives on the basis of company that can make helpful to take

right decisions over expenditures in Care tech plc. These define in brief below:

Priorities

Company's main priority is to expand business operation and in order to implement in

same firm and it will increase capital expenditure which will lead to enhancement in

production or sales ratio.

Expenditures

There are two types of expenditures in which one is revenue and other is capital

expenditure. In order to take decision related to the capital expenditure, firms need to

evaluate their long term business plan (Sonnenberg, 2008). On the basis of evaluation, it can

be decided that up to what amount of money, firm needs to incur in the current financial year

in order to implement its long term business plan. In order to take decision related to revenue

expenditure, Care Tech plc can evaluate its budget and can determine the amount up to which

it can make expenses in order to keep same in line to value of expenses that is determined in

the budget. For making investment decision, firm needs to identify extra cash that it may

have in its bank account after meeting working capital needs. On the basis of this estimation,

it can identify the amount of money that it can invest in shares, bonds and mutual fund. In

this way, Care Tech plc can take its decision related to the expenditures in its business.

TASK 3

3.1 Way to manage finance shortfall

Financial planning has a due importance for Aqua because it is going to open its

business and require performing lots of business operations. It needs to take asset on lease

and needs to fund marketing and production as well as distribution operations. By preparing

financial plan in proper manner Aqua can make best allocation of received funds among

different business activities and by doing so it can make best use of available funds (Sullivan,

2009). In order to manage shortfall of finance, firm may use reserved funds of business and

can finance its operations. It will use this option only when it is not getting required amount

month of April, it declined sharply to 1000. Cash flow of the firm has increased consistently

and it can be said that organization is expecting that its performance will be magnificent in

the fiscal year.

2.4 Ways in which decisions about expenditures can be made at Care Tech pl

There are several alternatives on the basis of company that can make helpful to take

right decisions over expenditures in Care tech plc. These define in brief below:

Priorities

Company's main priority is to expand business operation and in order to implement in

same firm and it will increase capital expenditure which will lead to enhancement in

production or sales ratio.

Expenditures

There are two types of expenditures in which one is revenue and other is capital

expenditure. In order to take decision related to the capital expenditure, firms need to

evaluate their long term business plan (Sonnenberg, 2008). On the basis of evaluation, it can

be decided that up to what amount of money, firm needs to incur in the current financial year

in order to implement its long term business plan. In order to take decision related to revenue

expenditure, Care Tech plc can evaluate its budget and can determine the amount up to which

it can make expenses in order to keep same in line to value of expenses that is determined in

the budget. For making investment decision, firm needs to identify extra cash that it may

have in its bank account after meeting working capital needs. On the basis of this estimation,

it can identify the amount of money that it can invest in shares, bonds and mutual fund. In

this way, Care Tech plc can take its decision related to the expenditures in its business.

TASK 3

3.1 Way to manage finance shortfall

Financial planning has a due importance for Aqua because it is going to open its

business and require performing lots of business operations. It needs to take asset on lease

and needs to fund marketing and production as well as distribution operations. By preparing

financial plan in proper manner Aqua can make best allocation of received funds among

different business activities and by doing so it can make best use of available funds (Sullivan,

2009). In order to manage shortfall of finance, firm may use reserved funds of business and

can finance its operations. It will use this option only when it is not getting required amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.