Managing Financial Resources and Decision Making for Aston Ltd

VerifiedAdded on 2020/12/18

|18

|4611

|151

Report

AI Summary

This report delves into the critical aspects of financial resource management and decision-making within a business context. It begins by identifying potential funding sources, such as equity share capital, bank loans, retained profits, and factoring, evaluating their advantages and disadvantages, and analyzing associated costs. The report emphasizes the significance of financial planning for achieving business goals and mitigating financial risks. It then examines investment appraisal techniques, specifically the Net Present Value (NPV) method, to assess the viability of capital projects, like the proposed investment by Aston Ltd. The report includes a detailed NPV calculation, along with an analysis of the weighted average cost of capital (WACC). Furthermore, the report explores the purpose and formats of financial statements, assessing the financial performance of Tesco Plc. Finally, the report discusses the informational needs of key stakeholders, including business owners, financial institutions, and shareholders, highlighting how they use financial statements to make informed decisions.

Managing Financial Resources and Decision

Making

Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................3

TASK 1......................................................................................................................................3

A Identifying potential sources of funding available to business unit and explaining the

significance of financial planning..........................................................................................3

B Evaluating both long and short terms sources of finance in the context of listed company

................................................................................................................................................4

C Analyzing cost associated with the different sources of finance........................................6

D Assessing the informational needs of three stakeholders...................................................7

TASK 2......................................................................................................................................8

A Explaining results using NPV method...............................................................................8

B Presenting solution by applying discounted and non-discounted payback method on net

cash flows.............................................................................................................................10

C Assessing whether Aston Ltd should continue with such capital project or not..............12

TASK 3....................................................................................................................................12

A Identifying and discussing the purpose of financial statements.......................................12

B Presenting reasons behind the usage of different formats in the varied business

organization..........................................................................................................................13

C Assessing financial performance of Tesco Plc using main financial statement...............14

CONCUSION..........................................................................................................................16

REFERENCES.........................................................................................................................17

INTRODUCTION......................................................................................................................3

TASK 1......................................................................................................................................3

A Identifying potential sources of funding available to business unit and explaining the

significance of financial planning..........................................................................................3

B Evaluating both long and short terms sources of finance in the context of listed company

................................................................................................................................................4

C Analyzing cost associated with the different sources of finance........................................6

D Assessing the informational needs of three stakeholders...................................................7

TASK 2......................................................................................................................................8

A Explaining results using NPV method...............................................................................8

B Presenting solution by applying discounted and non-discounted payback method on net

cash flows.............................................................................................................................10

C Assessing whether Aston Ltd should continue with such capital project or not..............12

TASK 3....................................................................................................................................12

A Identifying and discussing the purpose of financial statements.......................................12

B Presenting reasons behind the usage of different formats in the varied business

organization..........................................................................................................................13

C Assessing financial performance of Tesco Plc using main financial statement...............14

CONCUSION..........................................................................................................................16

REFERENCES.........................................................................................................................17

INTRODUCTION

In the context of business unit, effective financial resource management is vital for the

attainment of success at the competitive marketplace. Moreover, efficient allocation and

utilization of funds ensures high growth and assists in building competitive position. Finance

manager plays a crucial role in developing strategic framework regarding where funds need

to be employed for maximizing both productivity and profitability. The present report is

based on different case scenarios which in turn provides deeper insight about the funding

sources that can be used by listed firm for meeting financial requirements. Further, report will

shed light on the cost as well as suitability of both long and short term sources of finance.

Besides this, report will entail the significance of investment appraisal techniques in the

decision making pertaining to capital project. Report also depicts the format and purposes

behind the preparation of financial statements. It also presents whether financial performance

of Tesco has improved or deteriorated over the time frame.

TASK 1

A Identifying potential sources of funding available to business unit and explaining the

significance of financial planning

The above depicted case scenario presents that listed Hong Kong companies want to

raise capital for the purpose of business projects. Hence, there are several sources which can

be undertaken by Hong Kong firms for meeting financial or monetary requirement.

According to the views of Caselli and Negri (2018), equity share capital is recognized as the

most effective sources which help in meeting financial need to the large extent. By offerings

shares to the general public at large listed companies can easily generate funds. However, on

the critical note, Chava, Livdan and Purnanandam (2018) argued that bank loan source is

prominent in comparison to equity share capital. Moreover, equity share capital source limits

freedom of business entity in the firms operations and decision making. Hence, by applying

to the financial institutions for loan business unit can fulfil its needs. The reason behind this,

banks are usually ready to offer financial assistance to the growing and profitable firms.

Thus, by approaching to the banks and getting funds business unit can capitalize

opportunities.

In the context of business unit, effective financial resource management is vital for the

attainment of success at the competitive marketplace. Moreover, efficient allocation and

utilization of funds ensures high growth and assists in building competitive position. Finance

manager plays a crucial role in developing strategic framework regarding where funds need

to be employed for maximizing both productivity and profitability. The present report is

based on different case scenarios which in turn provides deeper insight about the funding

sources that can be used by listed firm for meeting financial requirements. Further, report will

shed light on the cost as well as suitability of both long and short term sources of finance.

Besides this, report will entail the significance of investment appraisal techniques in the

decision making pertaining to capital project. Report also depicts the format and purposes

behind the preparation of financial statements. It also presents whether financial performance

of Tesco has improved or deteriorated over the time frame.

TASK 1

A Identifying potential sources of funding available to business unit and explaining the

significance of financial planning

The above depicted case scenario presents that listed Hong Kong companies want to

raise capital for the purpose of business projects. Hence, there are several sources which can

be undertaken by Hong Kong firms for meeting financial or monetary requirement.

According to the views of Caselli and Negri (2018), equity share capital is recognized as the

most effective sources which help in meeting financial need to the large extent. By offerings

shares to the general public at large listed companies can easily generate funds. However, on

the critical note, Chava, Livdan and Purnanandam (2018) argued that bank loan source is

prominent in comparison to equity share capital. Moreover, equity share capital source limits

freedom of business entity in the firms operations and decision making. Hence, by applying

to the financial institutions for loan business unit can fulfil its needs. The reason behind this,

banks are usually ready to offer financial assistance to the growing and profitable firms.

Thus, by approaching to the banks and getting funds business unit can capitalize

opportunities.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Anjarsari (2018) presented in their study that listed companies can grab the

opportunities by using retained profit source of finance. For complying with the contingent

situation business units prefer to retain some amount of profit with itself rather than investing

all. Hence, using such source business organization can meet funding requirements. Alan and

et.al., (2018) claimed in their study that retained profit source negatively impacts firm in

terms of loss of shareholders faith. Thus, author identified bank overdraft as a prominent

funding source which help in meeting short term financial needs. Now, banks provide credit

facility to the firms which have maintained good image in terms of financial transactions.

Neri (2014) assessed factoring as the most suitable source which assists in getting funds at

low cost. Each business unit has some receivable note. Thus, by discounting the same from

financial institutions business entity can easily meet financial requirements.

Financial planning: It implies for the process which in turn provides framework for

the achievement of business goals and objectives. In the context of listed firms, financial

planning helps them in avoiding business shock to the great extent. Plans pertaining to the

monetary aspects help firm in prioritize projects more effectually (Topa and Herrador-

Alcaide, 2016).

Significance of financial planning

Financial planning facilitates optimum collection of funds by avoiding wastage level.

It enables listed to set highly structured or optimal capital structure.

Assists in setting priorities and investing money in the appropriate projects.

Ensures proper linkage between investment as well as financing decisions and thereby

makes contribution in the achievement of goals (Financial planning and its

importance, 2018).

Helps in ensuring stability in the business operations by reducing the level of

uncertainty pertaining to fund’s availability.

B Evaluating both long and short terms sources of finance in the context of listed company

Benefits and drawbacks of different long and short term sources of finance are

enumerated below:

Short term sources of finance

Factoring

opportunities by using retained profit source of finance. For complying with the contingent

situation business units prefer to retain some amount of profit with itself rather than investing

all. Hence, using such source business organization can meet funding requirements. Alan and

et.al., (2018) claimed in their study that retained profit source negatively impacts firm in

terms of loss of shareholders faith. Thus, author identified bank overdraft as a prominent

funding source which help in meeting short term financial needs. Now, banks provide credit

facility to the firms which have maintained good image in terms of financial transactions.

Neri (2014) assessed factoring as the most suitable source which assists in getting funds at

low cost. Each business unit has some receivable note. Thus, by discounting the same from

financial institutions business entity can easily meet financial requirements.

Financial planning: It implies for the process which in turn provides framework for

the achievement of business goals and objectives. In the context of listed firms, financial

planning helps them in avoiding business shock to the great extent. Plans pertaining to the

monetary aspects help firm in prioritize projects more effectually (Topa and Herrador-

Alcaide, 2016).

Significance of financial planning

Financial planning facilitates optimum collection of funds by avoiding wastage level.

It enables listed to set highly structured or optimal capital structure.

Assists in setting priorities and investing money in the appropriate projects.

Ensures proper linkage between investment as well as financing decisions and thereby

makes contribution in the achievement of goals (Financial planning and its

importance, 2018).

Helps in ensuring stability in the business operations by reducing the level of

uncertainty pertaining to fund’s availability.

B Evaluating both long and short terms sources of finance in the context of listed company

Benefits and drawbacks of different long and short term sources of finance are

enumerated below:

Short term sources of finance

Factoring

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

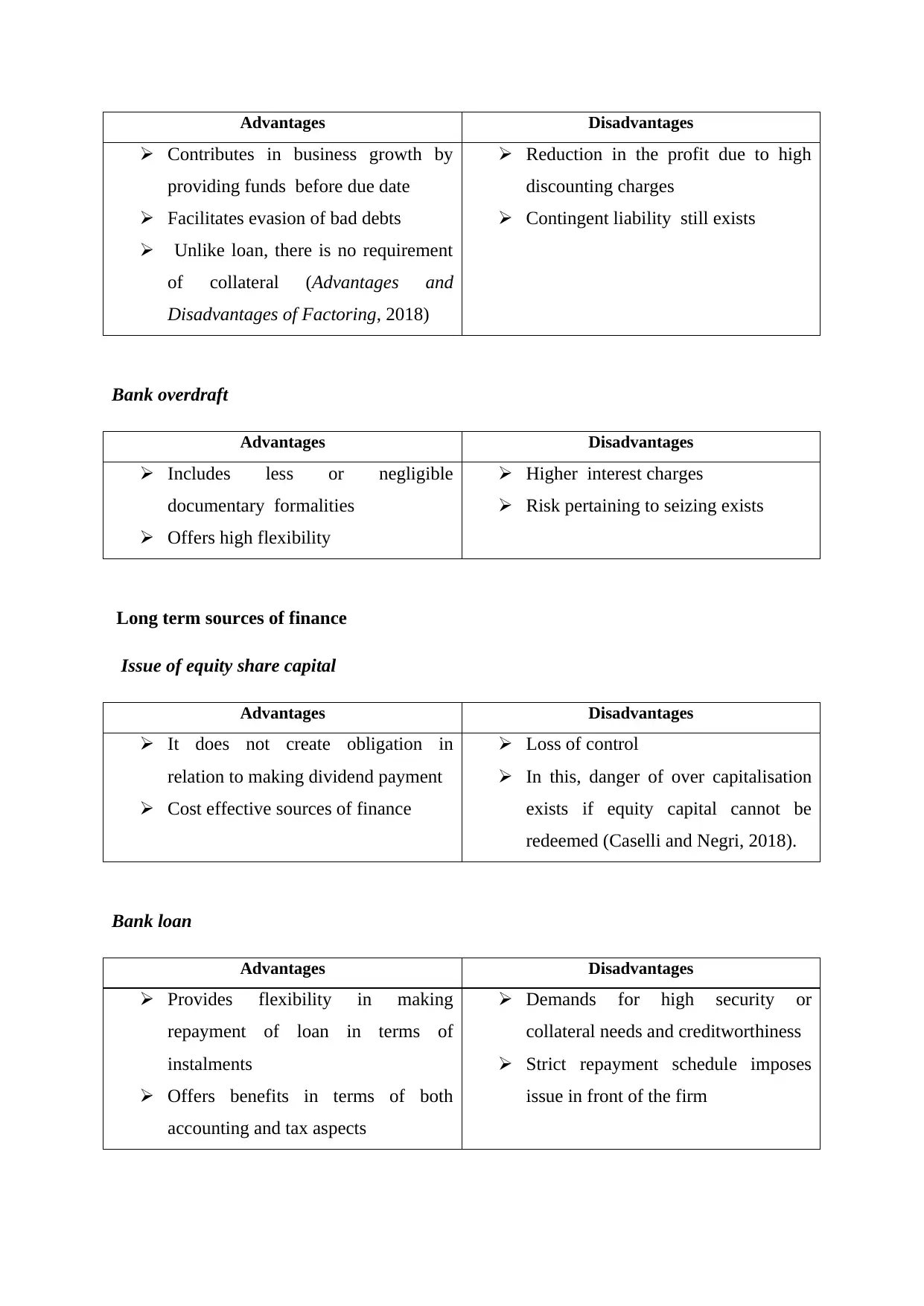

Advantages Disadvantages

Contributes in business growth by

providing funds before due date

Facilitates evasion of bad debts

Unlike loan, there is no requirement

of collateral (Advantages and

Disadvantages of Factoring, 2018)

Reduction in the profit due to high

discounting charges

Contingent liability still exists

Bank overdraft

Advantages Disadvantages

Includes less or negligible

documentary formalities

Offers high flexibility

Higher interest charges

Risk pertaining to seizing exists

Long term sources of finance

Issue of equity share capital

Advantages Disadvantages

It does not create obligation in

relation to making dividend payment

Cost effective sources of finance

Loss of control

In this, danger of over capitalisation

exists if equity capital cannot be

redeemed (Caselli and Negri, 2018).

Bank loan

Advantages Disadvantages

Provides flexibility in making

repayment of loan in terms of

instalments

Offers benefits in terms of both

accounting and tax aspects

Demands for high security or

collateral needs and creditworthiness

Strict repayment schedule imposes

issue in front of the firm

Contributes in business growth by

providing funds before due date

Facilitates evasion of bad debts

Unlike loan, there is no requirement

of collateral (Advantages and

Disadvantages of Factoring, 2018)

Reduction in the profit due to high

discounting charges

Contingent liability still exists

Bank overdraft

Advantages Disadvantages

Includes less or negligible

documentary formalities

Offers high flexibility

Higher interest charges

Risk pertaining to seizing exists

Long term sources of finance

Issue of equity share capital

Advantages Disadvantages

It does not create obligation in

relation to making dividend payment

Cost effective sources of finance

Loss of control

In this, danger of over capitalisation

exists if equity capital cannot be

redeemed (Caselli and Negri, 2018).

Bank loan

Advantages Disadvantages

Provides flexibility in making

repayment of loan in terms of

instalments

Offers benefits in terms of both

accounting and tax aspects

Demands for high security or

collateral needs and creditworthiness

Strict repayment schedule imposes

issue in front of the firm

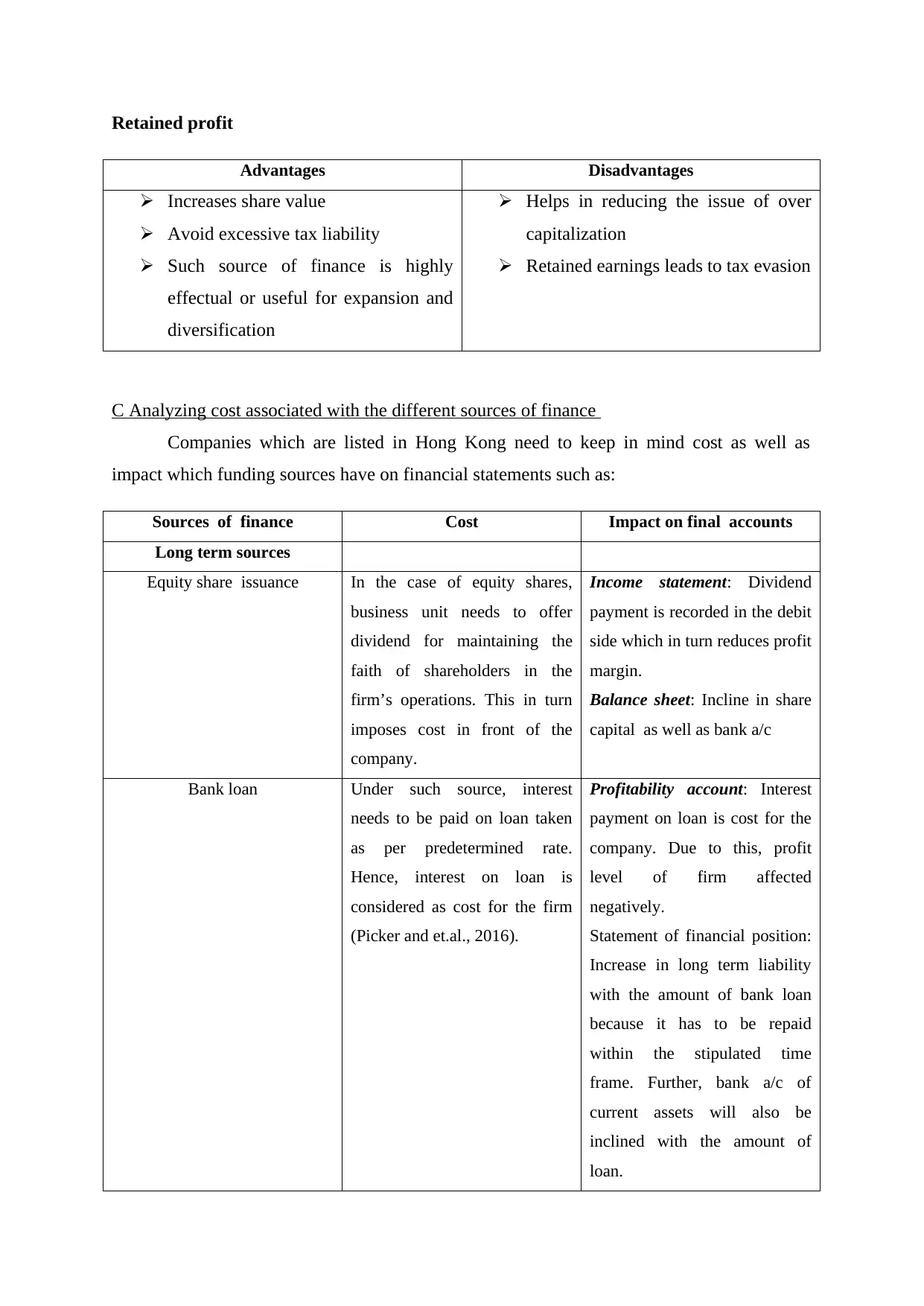

Retained profit

Advantages Disadvantages

Increases share value

Avoid excessive tax liability

Such source of finance is highly

effectual or useful for expansion and

diversification

Helps in reducing the issue of over

capitalization

Retained earnings leads to tax evasion

C Analyzing cost associated with the different sources of finance

Companies which are listed in Hong Kong need to keep in mind cost as well as

impact which funding sources have on financial statements such as:

Sources of finance Cost Impact on final accounts

Long term sources

Equity share issuance In the case of equity shares,

business unit needs to offer

dividend for maintaining the

faith of shareholders in the

firm’s operations. This in turn

imposes cost in front of the

company.

Income statement: Dividend

payment is recorded in the debit

side which in turn reduces profit

margin.

Balance sheet: Incline in share

capital as well as bank a/c

Bank loan Under such source, interest

needs to be paid on loan taken

as per predetermined rate.

Hence, interest on loan is

considered as cost for the firm

(Picker and et.al., 2016).

Profitability account: Interest

payment on loan is cost for the

company. Due to this, profit

level of firm affected

negatively.

Statement of financial position:

Increase in long term liability

with the amount of bank loan

because it has to be repaid

within the stipulated time

frame. Further, bank a/c of

current assets will also be

inclined with the amount of

loan.

Advantages Disadvantages

Increases share value

Avoid excessive tax liability

Such source of finance is highly

effectual or useful for expansion and

diversification

Helps in reducing the issue of over

capitalization

Retained earnings leads to tax evasion

C Analyzing cost associated with the different sources of finance

Companies which are listed in Hong Kong need to keep in mind cost as well as

impact which funding sources have on financial statements such as:

Sources of finance Cost Impact on final accounts

Long term sources

Equity share issuance In the case of equity shares,

business unit needs to offer

dividend for maintaining the

faith of shareholders in the

firm’s operations. This in turn

imposes cost in front of the

company.

Income statement: Dividend

payment is recorded in the debit

side which in turn reduces profit

margin.

Balance sheet: Incline in share

capital as well as bank a/c

Bank loan Under such source, interest

needs to be paid on loan taken

as per predetermined rate.

Hence, interest on loan is

considered as cost for the firm

(Picker and et.al., 2016).

Profitability account: Interest

payment on loan is cost for the

company. Due to this, profit

level of firm affected

negatively.

Statement of financial position:

Increase in long term liability

with the amount of bank loan

because it has to be repaid

within the stipulated time

frame. Further, bank a/c of

current assets will also be

inclined with the amount of

loan.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Retained earnings It imposes opportunity cost in

front of the firm. Moreover,

when company uses retained

earning source then it faces

issue in grabbing future

opportunities. Along with this,

firm also faces difficulty in

offering dividends to the

shareholders which in turn

impacts brand image

negatively.

No changes take place in the

profitability statement as it

imposes opportunity cost rather

than financial.

Balance sheet: Retained

earnings level decreased with

the amount of financial

assistance undertaken.

Short term

Bank overdraft High interest rate is recognized

as cost which bank charges in

against to offering overdraft

facility.

Interest which is charged by

bank recorded in the debit side

of income statement.

Balance sheet: Bank a/c and

current liabilities increases

Factoring At the time of discounting bills

receivable bank charges some

cost. Thus, discounting charges

are considered as cost in this

source (Simba, Mukose and

Bazeyo, 2014).

Income a/c: Bank charges may

result into reduction in

profitability aspect.

Balance sheet: Cash increases

but level of bills receivable

decreases

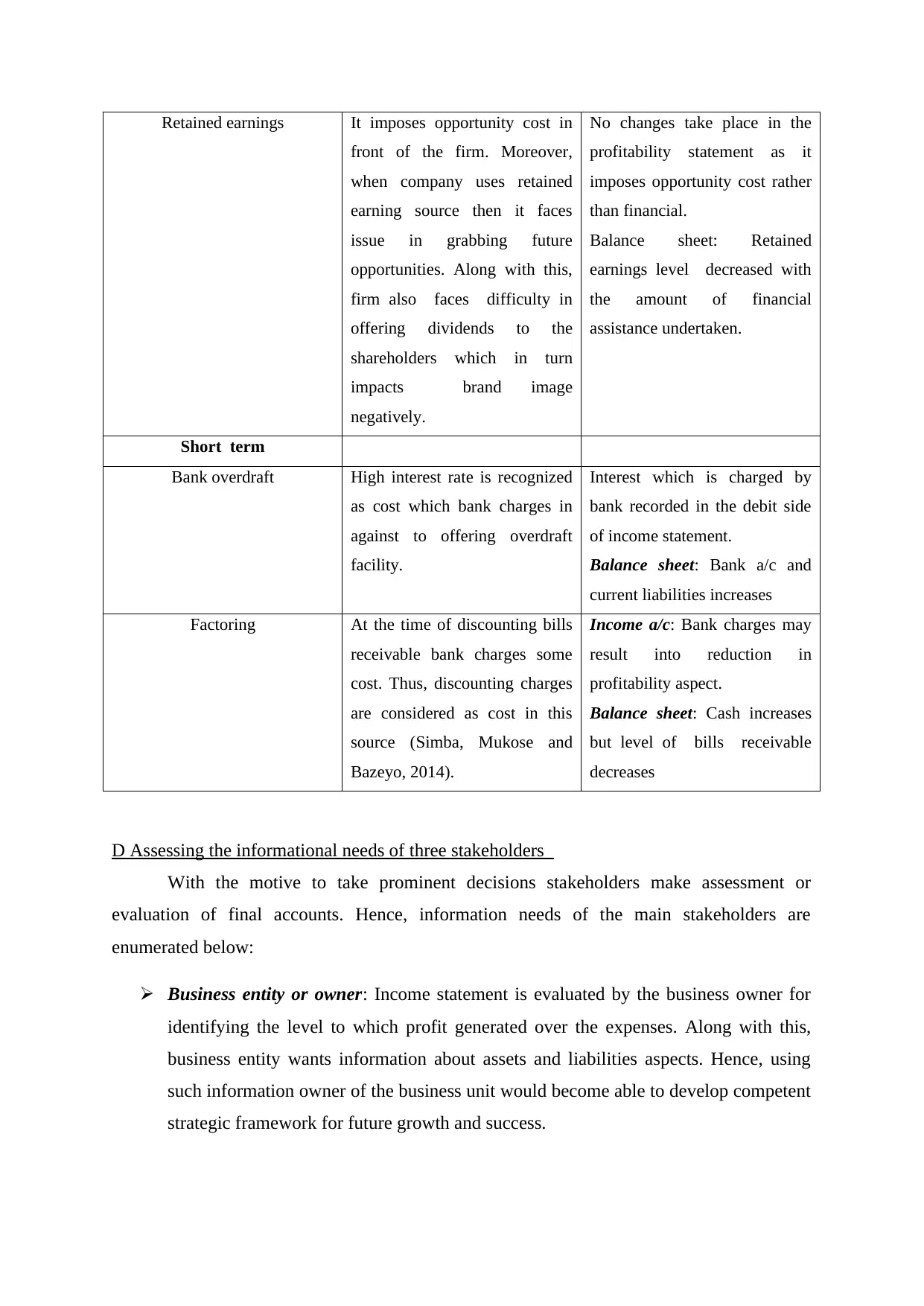

D Assessing the informational needs of three stakeholders

With the motive to take prominent decisions stakeholders make assessment or

evaluation of final accounts. Hence, information needs of the main stakeholders are

enumerated below:

Business entity or owner: Income statement is evaluated by the business owner for

identifying the level to which profit generated over the expenses. Along with this,

business entity wants information about assets and liabilities aspects. Hence, using

such information owner of the business unit would become able to develop competent

strategic framework for future growth and success.

front of the firm. Moreover,

when company uses retained

earning source then it faces

issue in grabbing future

opportunities. Along with this,

firm also faces difficulty in

offering dividends to the

shareholders which in turn

impacts brand image

negatively.

No changes take place in the

profitability statement as it

imposes opportunity cost rather

than financial.

Balance sheet: Retained

earnings level decreased with

the amount of financial

assistance undertaken.

Short term

Bank overdraft High interest rate is recognized

as cost which bank charges in

against to offering overdraft

facility.

Interest which is charged by

bank recorded in the debit side

of income statement.

Balance sheet: Bank a/c and

current liabilities increases

Factoring At the time of discounting bills

receivable bank charges some

cost. Thus, discounting charges

are considered as cost in this

source (Simba, Mukose and

Bazeyo, 2014).

Income a/c: Bank charges may

result into reduction in

profitability aspect.

Balance sheet: Cash increases

but level of bills receivable

decreases

D Assessing the informational needs of three stakeholders

With the motive to take prominent decisions stakeholders make assessment or

evaluation of final accounts. Hence, information needs of the main stakeholders are

enumerated below:

Business entity or owner: Income statement is evaluated by the business owner for

identifying the level to which profit generated over the expenses. Along with this,

business entity wants information about assets and liabilities aspects. Hence, using

such information owner of the business unit would become able to develop competent

strategic framework for future growth and success.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial institution: In order to assess the capacity of company in relation making

payment of loan and interest amount on time banking or financial institutions evaluate

balance sheet. Moreover, balance sheet clearly presents debt and asset position of the

firm (Smith, Nicolla and Zafar, 2014). Thus, financial institutions are highly

interested in the evaluation of balance sheet over others.

Shareholders or investors: Capital appreciation is the main motive of investors

behind making investments. Thus, for the purpose of conducting ratio analysis

shareholders undertake both income statement and balance sheet. This in turn helps

them in evaluating financial performance of the firm and thereby assists in taking

investment decisions.

TASK 2

A Explaining results using NPV method

On the basis of cited case situation, Aston Ltd is planning to invest capital into new

premises. This in turn requires initial capital expenditure of $1000000. Hence, in the context

of such new capital project, investment appraisal technique such as NPV has been applied.

Net present value is the most effectual techniques which help in evaluating the viability of

capital projects from monetary perspectives (Van Deventer, Imai and Mesler, 2013). It

clearly presents the monetary amount or return which business unit will generate over the

initial expenditure.

Computation of net cash flows

Year

s

Cash

Inflow

s (in $)

Cash

Outflow

s (in $)

Net

cash

inflow

s (in $)

$’000 $’000

0 0 1000

1 110 30 80

2 120 35 85

3 130 40 90

4 140 45 95

5 150 50 100

6 160 55 105

7 170 60 110

8 180 65 115

payment of loan and interest amount on time banking or financial institutions evaluate

balance sheet. Moreover, balance sheet clearly presents debt and asset position of the

firm (Smith, Nicolla and Zafar, 2014). Thus, financial institutions are highly

interested in the evaluation of balance sheet over others.

Shareholders or investors: Capital appreciation is the main motive of investors

behind making investments. Thus, for the purpose of conducting ratio analysis

shareholders undertake both income statement and balance sheet. This in turn helps

them in evaluating financial performance of the firm and thereby assists in taking

investment decisions.

TASK 2

A Explaining results using NPV method

On the basis of cited case situation, Aston Ltd is planning to invest capital into new

premises. This in turn requires initial capital expenditure of $1000000. Hence, in the context

of such new capital project, investment appraisal technique such as NPV has been applied.

Net present value is the most effectual techniques which help in evaluating the viability of

capital projects from monetary perspectives (Van Deventer, Imai and Mesler, 2013). It

clearly presents the monetary amount or return which business unit will generate over the

initial expenditure.

Computation of net cash flows

Year

s

Cash

Inflow

s (in $)

Cash

Outflow

s (in $)

Net

cash

inflow

s (in $)

$’000 $’000

0 0 1000

1 110 30 80

2 120 35 85

3 130 40 90

4 140 45 95

5 150 50 100

6 160 55 105

7 170 60 110

8 180 65 115

9 190 70 120

10 200 75 125

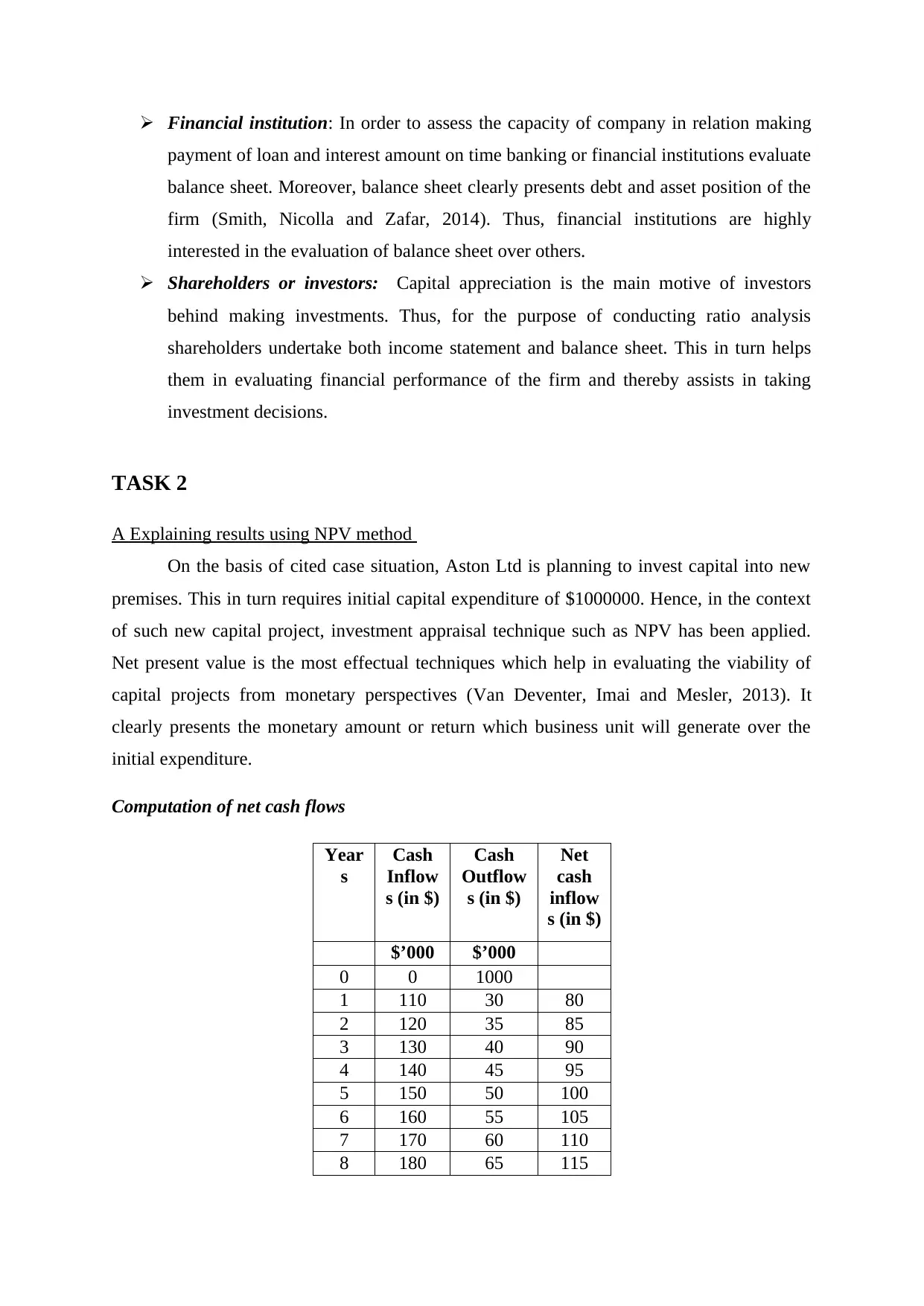

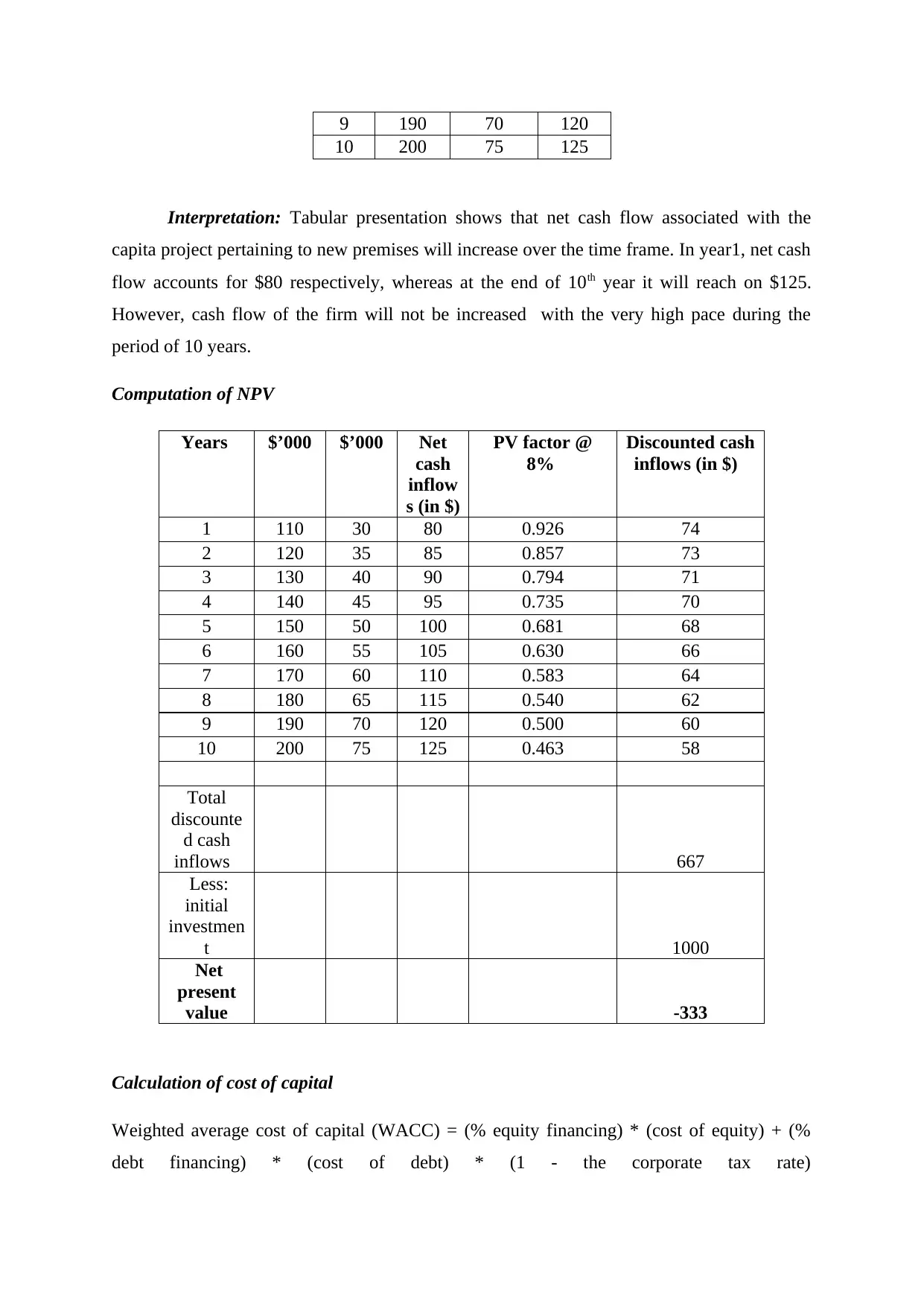

Interpretation: Tabular presentation shows that net cash flow associated with the

capita project pertaining to new premises will increase over the time frame. In year1, net cash

flow accounts for $80 respectively, whereas at the end of 10th year it will reach on $125.

However, cash flow of the firm will not be increased with the very high pace during the

period of 10 years.

Computation of NPV

Years $’000 $’000 Net

cash

inflow

s (in $)

PV factor @

8%

Discounted cash

inflows (in $)

1 110 30 80 0.926 74

2 120 35 85 0.857 73

3 130 40 90 0.794 71

4 140 45 95 0.735 70

5 150 50 100 0.681 68

6 160 55 105 0.630 66

7 170 60 110 0.583 64

8 180 65 115 0.540 62

9 190 70 120 0.500 60

10 200 75 125 0.463 58

Total

discounte

d cash

inflows 667

Less:

initial

investmen

t 1000

Net

present

value -333

Calculation of cost of capital

Weighted average cost of capital (WACC) = (% equity financing) * (cost of equity) + (%

debt financing) * (cost of debt) * (1 - the corporate tax rate)

10 200 75 125

Interpretation: Tabular presentation shows that net cash flow associated with the

capita project pertaining to new premises will increase over the time frame. In year1, net cash

flow accounts for $80 respectively, whereas at the end of 10th year it will reach on $125.

However, cash flow of the firm will not be increased with the very high pace during the

period of 10 years.

Computation of NPV

Years $’000 $’000 Net

cash

inflow

s (in $)

PV factor @

8%

Discounted cash

inflows (in $)

1 110 30 80 0.926 74

2 120 35 85 0.857 73

3 130 40 90 0.794 71

4 140 45 95 0.735 70

5 150 50 100 0.681 68

6 160 55 105 0.630 66

7 170 60 110 0.583 64

8 180 65 115 0.540 62

9 190 70 120 0.500 60

10 200 75 125 0.463 58

Total

discounte

d cash

inflows 667

Less:

initial

investmen

t 1000

Net

present

value -333

Calculation of cost of capital

Weighted average cost of capital (WACC) = (% equity financing) * (cost of equity) + (%

debt financing) * (cost of debt) * (1 - the corporate tax rate)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

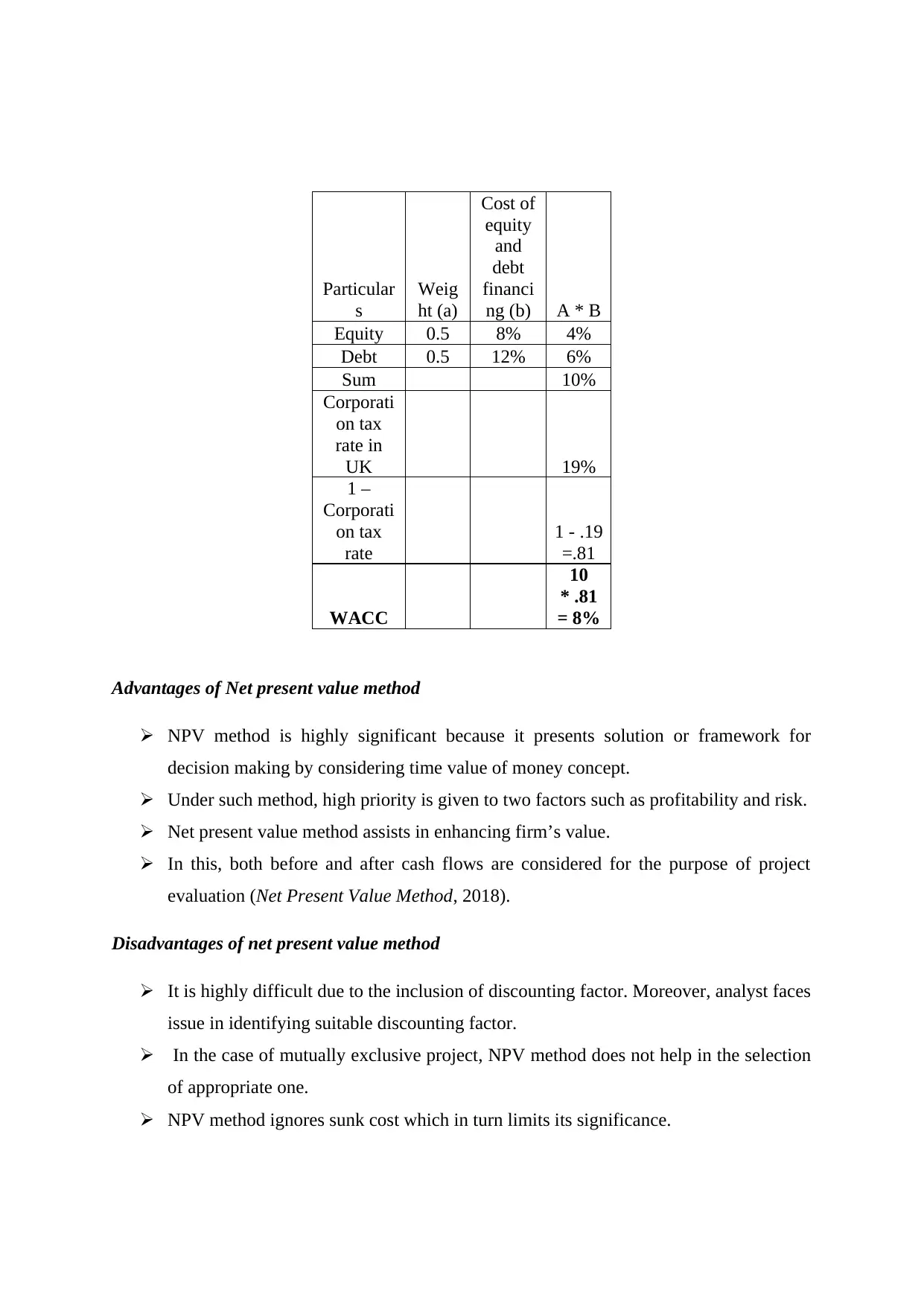

Particular

s

Weig

ht (a)

Cost of

equity

and

debt

financi

ng (b) A * B

Equity 0.5 8% 4%

Debt 0.5 12% 6%

Sum 10%

Corporati

on tax

rate in

UK 19%

1 –

Corporati

on tax

rate

1 - .19

=.81

WACC

10

* .81

= 8%

Advantages of Net present value method

NPV method is highly significant because it presents solution or framework for

decision making by considering time value of money concept.

Under such method, high priority is given to two factors such as profitability and risk.

Net present value method assists in enhancing firm’s value.

In this, both before and after cash flows are considered for the purpose of project

evaluation (Net Present Value Method, 2018).

Disadvantages of net present value method

It is highly difficult due to the inclusion of discounting factor. Moreover, analyst faces

issue in identifying suitable discounting factor.

In the case of mutually exclusive project, NPV method does not help in the selection

of appropriate one.

NPV method ignores sunk cost which in turn limits its significance.

s

Weig

ht (a)

Cost of

equity

and

debt

financi

ng (b) A * B

Equity 0.5 8% 4%

Debt 0.5 12% 6%

Sum 10%

Corporati

on tax

rate in

UK 19%

1 –

Corporati

on tax

rate

1 - .19

=.81

WACC

10

* .81

= 8%

Advantages of Net present value method

NPV method is highly significant because it presents solution or framework for

decision making by considering time value of money concept.

Under such method, high priority is given to two factors such as profitability and risk.

Net present value method assists in enhancing firm’s value.

In this, both before and after cash flows are considered for the purpose of project

evaluation (Net Present Value Method, 2018).

Disadvantages of net present value method

It is highly difficult due to the inclusion of discounting factor. Moreover, analyst faces

issue in identifying suitable discounting factor.

In the case of mutually exclusive project, NPV method does not help in the selection

of appropriate one.

NPV method ignores sunk cost which in turn limits its significance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

B Presenting solution by applying discounted and non-discounted payback method on net

cash flows

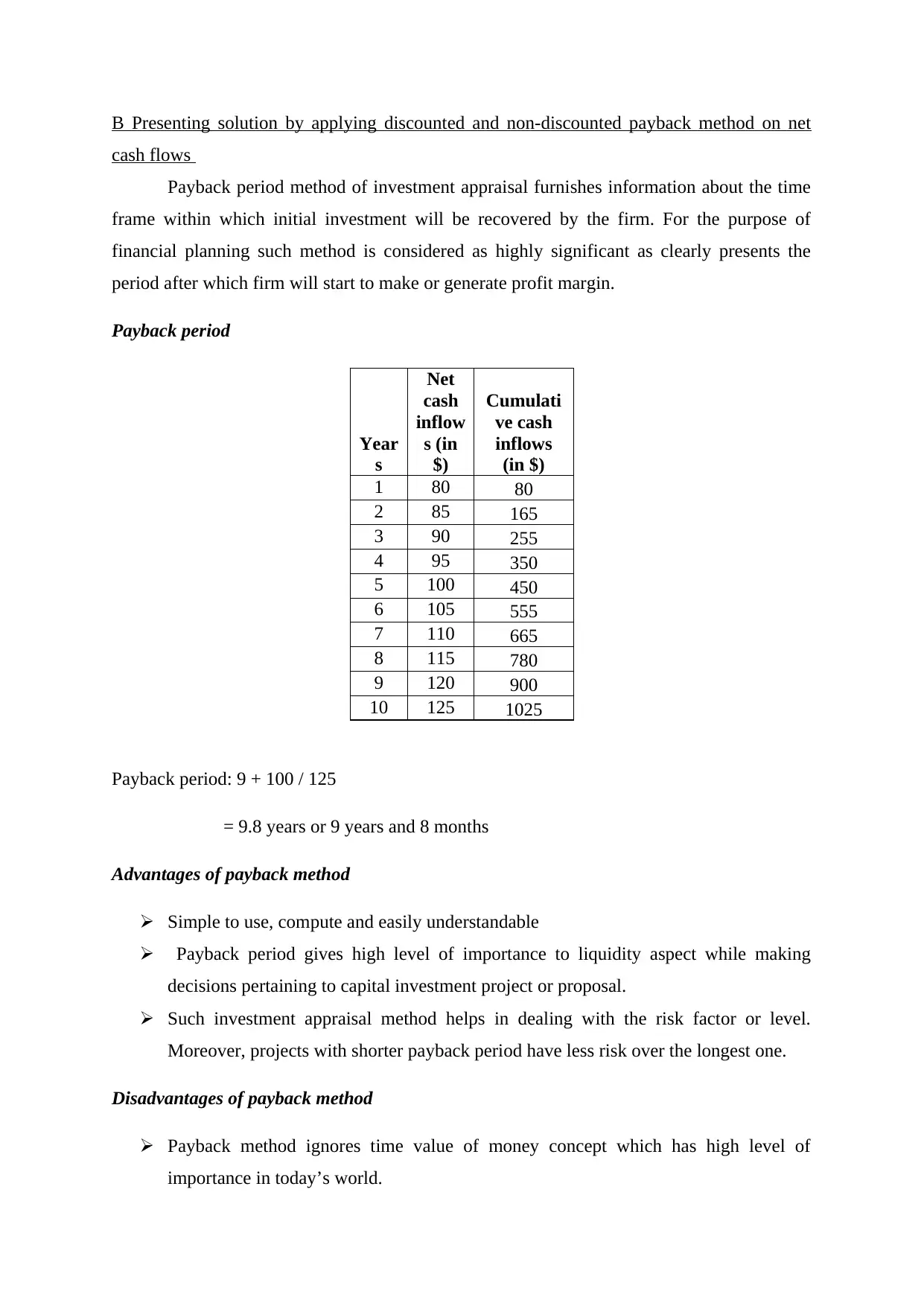

Payback period method of investment appraisal furnishes information about the time

frame within which initial investment will be recovered by the firm. For the purpose of

financial planning such method is considered as highly significant as clearly presents the

period after which firm will start to make or generate profit margin.

Payback period

Year

s

Net

cash

inflow

s (in

$)

Cumulati

ve cash

inflows

(in $)

1 80 80

2 85 165

3 90 255

4 95 350

5 100 450

6 105 555

7 110 665

8 115 780

9 120 900

10 125 1025

Payback period: 9 + 100 / 125

= 9.8 years or 9 years and 8 months

Advantages of payback method

Simple to use, compute and easily understandable

Payback period gives high level of importance to liquidity aspect while making

decisions pertaining to capital investment project or proposal.

Such investment appraisal method helps in dealing with the risk factor or level.

Moreover, projects with shorter payback period have less risk over the longest one.

Disadvantages of payback method

Payback method ignores time value of money concept which has high level of

importance in today’s world.

cash flows

Payback period method of investment appraisal furnishes information about the time

frame within which initial investment will be recovered by the firm. For the purpose of

financial planning such method is considered as highly significant as clearly presents the

period after which firm will start to make or generate profit margin.

Payback period

Year

s

Net

cash

inflow

s (in

$)

Cumulati

ve cash

inflows

(in $)

1 80 80

2 85 165

3 90 255

4 95 350

5 100 450

6 105 555

7 110 665

8 115 780

9 120 900

10 125 1025

Payback period: 9 + 100 / 125

= 9.8 years or 9 years and 8 months

Advantages of payback method

Simple to use, compute and easily understandable

Payback period gives high level of importance to liquidity aspect while making

decisions pertaining to capital investment project or proposal.

Such investment appraisal method helps in dealing with the risk factor or level.

Moreover, projects with shorter payback period have less risk over the longest one.

Disadvantages of payback method

Payback method ignores time value of money concept which has high level of

importance in today’s world.

It emphasizes on liquidity aspects but completely avoids profitability factor.

Moreover, such method does not signify the amount which business entity will get

after payback period (Advantages and Disadvantages Of Pay Back Period, 2018).

At the time of assessment, only before cash flow is considered rather than after one.

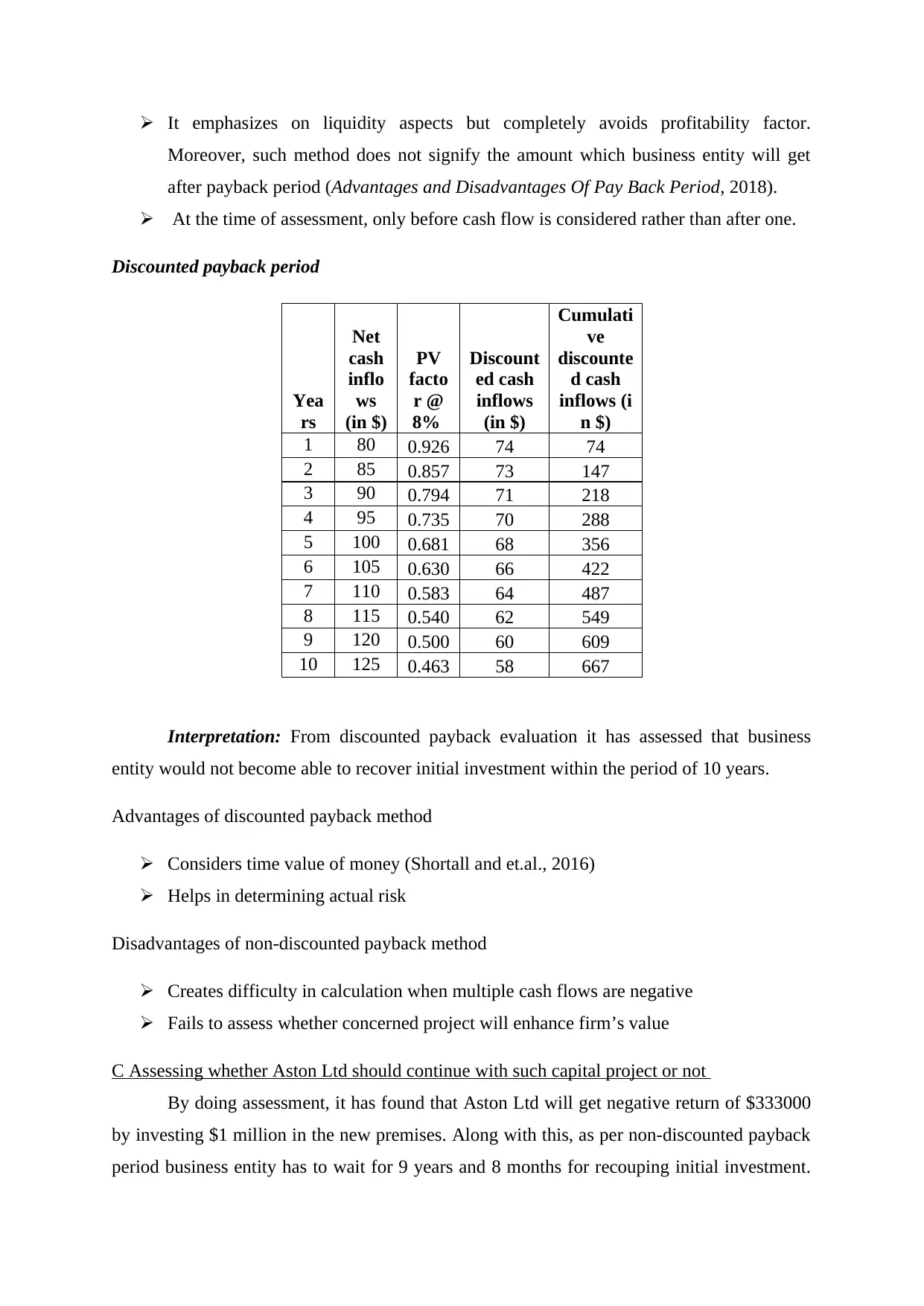

Discounted payback period

Yea

rs

Net

cash

inflo

ws

(in $)

PV

facto

r @

8%

Discount

ed cash

inflows

(in $)

Cumulati

ve

discounte

d cash

inflows (i

n $)

1 80 0.926 74 74

2 85 0.857 73 147

3 90 0.794 71 218

4 95 0.735 70 288

5 100 0.681 68 356

6 105 0.630 66 422

7 110 0.583 64 487

8 115 0.540 62 549

9 120 0.500 60 609

10 125 0.463 58 667

Interpretation: From discounted payback evaluation it has assessed that business

entity would not become able to recover initial investment within the period of 10 years.

Advantages of discounted payback method

Considers time value of money (Shortall and et.al., 2016)

Helps in determining actual risk

Disadvantages of non-discounted payback method

Creates difficulty in calculation when multiple cash flows are negative

Fails to assess whether concerned project will enhance firm’s value

C Assessing whether Aston Ltd should continue with such capital project or not

By doing assessment, it has found that Aston Ltd will get negative return of $333000

by investing $1 million in the new premises. Along with this, as per non-discounted payback

period business entity has to wait for 9 years and 8 months for recouping initial investment.

Moreover, such method does not signify the amount which business entity will get

after payback period (Advantages and Disadvantages Of Pay Back Period, 2018).

At the time of assessment, only before cash flow is considered rather than after one.

Discounted payback period

Yea

rs

Net

cash

inflo

ws

(in $)

PV

facto

r @

8%

Discount

ed cash

inflows

(in $)

Cumulati

ve

discounte

d cash

inflows (i

n $)

1 80 0.926 74 74

2 85 0.857 73 147

3 90 0.794 71 218

4 95 0.735 70 288

5 100 0.681 68 356

6 105 0.630 66 422

7 110 0.583 64 487

8 115 0.540 62 549

9 120 0.500 60 609

10 125 0.463 58 667

Interpretation: From discounted payback evaluation it has assessed that business

entity would not become able to recover initial investment within the period of 10 years.

Advantages of discounted payback method

Considers time value of money (Shortall and et.al., 2016)

Helps in determining actual risk

Disadvantages of non-discounted payback method

Creates difficulty in calculation when multiple cash flows are negative

Fails to assess whether concerned project will enhance firm’s value

C Assessing whether Aston Ltd should continue with such capital project or not

By doing assessment, it has found that Aston Ltd will get negative return of $333000

by investing $1 million in the new premises. Along with this, as per non-discounted payback

period business entity has to wait for 9 years and 8 months for recouping initial investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.