Financial Resources, Decisions, and Planning for Business Operations

VerifiedAdded on 2020/01/07

|21

|5735

|228

Report

AI Summary

This report delves into the critical aspects of managing financial resources and decisions for a business, specifically using the example of establishing an Osborne Terrace Restaurant. It explores various financial sources, including internal and external options like personal savings, bank loans, share capital, and lease agreements, along with their implications. The report emphasizes the importance of financial planning for decision-makers, covering budgeting, forecasting, and investment appraisal techniques. It also examines financial statements, ratio analysis, and the information needs of internal and external stakeholders. The report provides cost analysis for each financial source, demonstrates the significance of financial planning, and explains the impact of finance on financial statements. Furthermore, it includes budgeting and forecasting for the next six months, unit cost calculations, and investment appraisal techniques for choosing the best project, providing a comprehensive understanding of financial management principles.

Managing financial

resources and

decisions

1

resources and

decisions

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Different financial sources.....................................................................................................3

1.2 Implications of financial sources...........................................................................................4

1.3 Selection of best suitable financial sources...........................................................................5

2.1 Cost analysis for each financial source..................................................................................5

2.2 Significance of financial planning.........................................................................................6

2.3 Information needs for internal and external decision makers................................................7

2.4 Impact of finance on financial statements and importance of financial sources to influence

statements.....................................................................................................................................8

3.1 Budgeting and forecasting for next six months' business operations...................................8

3.2 Unit cost calculation for establishing Osborne restaurant and pricing decisions................10

3.3 Investment appraisal techniques for choosing best project..................................................10

TASK 2..........................................................................................................................................12

4.1 Different financial statements and their objectives..............................................................12

4.2 Comparing financial statement to be prepared for different types of businesses................13

4.3 Ratio analysis.......................................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCE.................................................................................................................................16

2

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Different financial sources.....................................................................................................3

1.2 Implications of financial sources...........................................................................................4

1.3 Selection of best suitable financial sources...........................................................................5

2.1 Cost analysis for each financial source..................................................................................5

2.2 Significance of financial planning.........................................................................................6

2.3 Information needs for internal and external decision makers................................................7

2.4 Impact of finance on financial statements and importance of financial sources to influence

statements.....................................................................................................................................8

3.1 Budgeting and forecasting for next six months' business operations...................................8

3.2 Unit cost calculation for establishing Osborne restaurant and pricing decisions................10

3.3 Investment appraisal techniques for choosing best project..................................................10

TASK 2..........................................................................................................................................12

4.1 Different financial statements and their objectives..............................................................12

4.2 Comparing financial statement to be prepared for different types of businesses................13

4.3 Ratio analysis.......................................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCE.................................................................................................................................16

2

Illustration Index

Illustration 1: Budget for Osborne restaurant................................................................................12

Illustration 2: Unit cost and pricing decisions...............................................................................13

Illustration 3: Pay back period for further investment...................................................................14

Illustration 4: ARR as investment appraisal technique..................................................................14

Illustration 5: NPV for selecting best project................................................................................15

Illustration 6: Ratio analysis of Sainsbury.....................................................................................17

3

Illustration 1: Budget for Osborne restaurant................................................................................12

Illustration 2: Unit cost and pricing decisions...............................................................................13

Illustration 3: Pay back period for further investment...................................................................14

Illustration 4: ARR as investment appraisal technique..................................................................14

Illustration 5: NPV for selecting best project................................................................................15

Illustration 6: Ratio analysis of Sainsbury.....................................................................................17

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Managing financial resources and decision is key component for operating further

business activities. It is effective for analyzing actual financial position on the basis of which

plans are prepared for organization's effectiveness of organization and improving efficiencies at

high level. The present report is to understand different aspects of financial resources and

decisions for establishing Osborne Terrace Restaurant. It is contract finder opportunity for

accomplishing task related to operating small business entity at large scale by 2020. In this

regard, different financial sources including critical evaluation on them can be described.

However, importance of financial planning for decision makers and finance significance to

prepare statement is to be expressed through this assignment. Including this, budgeting and

forecasting plan entity's commencement can be understood for decision making to expand

business firm. Along with this, investment appraisal techniques to select appropriate project is to

be introduced that leads to following on decided plans. Thus, students are able to understand

importance of managing financial resources and decision for commencement of organization and

different tools for business operations through this report.

TASK 1

1.1 Different financial sources

There are different kinds of financial sources to grab opportunity to establish Osborne

restaurant. Therefore, entrepreneur can use various sources to establish Osborne. Some of them

are expressed as under

Internal sources

External sources

Internal sources

Fund can be allocate from following sources internally:

Personal sources: The owner put its own capital into the business. This is the cheapest

source of finance which is readily available. It includes savings, personal cash balance,

borrowing from friends and family (Bakand, Hayes and Dechsakulthorn, 2012). It

includes getting financed from family and friends and involving them in day to day

activities of the business with a percentage of profit sharing that the business earns.

4

Managing financial resources and decision is key component for operating further

business activities. It is effective for analyzing actual financial position on the basis of which

plans are prepared for organization's effectiveness of organization and improving efficiencies at

high level. The present report is to understand different aspects of financial resources and

decisions for establishing Osborne Terrace Restaurant. It is contract finder opportunity for

accomplishing task related to operating small business entity at large scale by 2020. In this

regard, different financial sources including critical evaluation on them can be described.

However, importance of financial planning for decision makers and finance significance to

prepare statement is to be expressed through this assignment. Including this, budgeting and

forecasting plan entity's commencement can be understood for decision making to expand

business firm. Along with this, investment appraisal techniques to select appropriate project is to

be introduced that leads to following on decided plans. Thus, students are able to understand

importance of managing financial resources and decision for commencement of organization and

different tools for business operations through this report.

TASK 1

1.1 Different financial sources

There are different kinds of financial sources to grab opportunity to establish Osborne

restaurant. Therefore, entrepreneur can use various sources to establish Osborne. Some of them

are expressed as under

Internal sources

External sources

Internal sources

Fund can be allocate from following sources internally:

Personal sources: The owner put its own capital into the business. This is the cheapest

source of finance which is readily available. It includes savings, personal cash balance,

borrowing from friends and family (Bakand, Hayes and Dechsakulthorn, 2012). It

includes getting financed from family and friends and involving them in day to day

activities of the business with a percentage of profit sharing that the business earns.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

However, for affirmative results, it requires their agreement on the decision. Some may

not be ready to put their money and get involved in extra business.

External financial sources:

At external level, finance for organization's establishment can be gained through

following sources:

Bank loan: Loans are provided by bank at a specific rate of interest and fir the specific

time frame. Bank requires a guarantor who guarantees that you will return the principal

amount with the specified interest in specified time period. However, much flexibility is

not provided to borrower in terms of interest and time duration (Cheng, Ioannou and

Serafeim, 2014).

Share capital: Share capital consist of all funds raised by companies in exchange of

either common or shared preferred stock. The amount of share capital or equity finance

that company can change over a period of time as per market requirement and company

objectives.

Venture capital: Professional investors manage this kind of fund. A specific kind of

investment is made by them and it is managed by professional investors (Pasquariello,

2014). If the investor like your business idea he will invest in your business with the fact

that they may demand a certain percentage of profit or decision making is some areas of

business depending up on the contract.

Lease: It is a contractual agreement between the two parties where one party gives right

to the other party to use the asset in return to some rental payment. Osborne can take its

fixed assets on lease (Midrigan and Xu, 2014). Since, fixed asset demands heavy

investment, it will reduce the burden from the company

Bank Overdrafts: It is a short term source of finance. It allows the business to make

payments from their current bank accounts even if the necessary balance is not available

in the bank account. There is a certain limit specified by every bank to while availing this

facility. Bank charge interest on the overdrawn amount (Battiston and et.al., 2016).

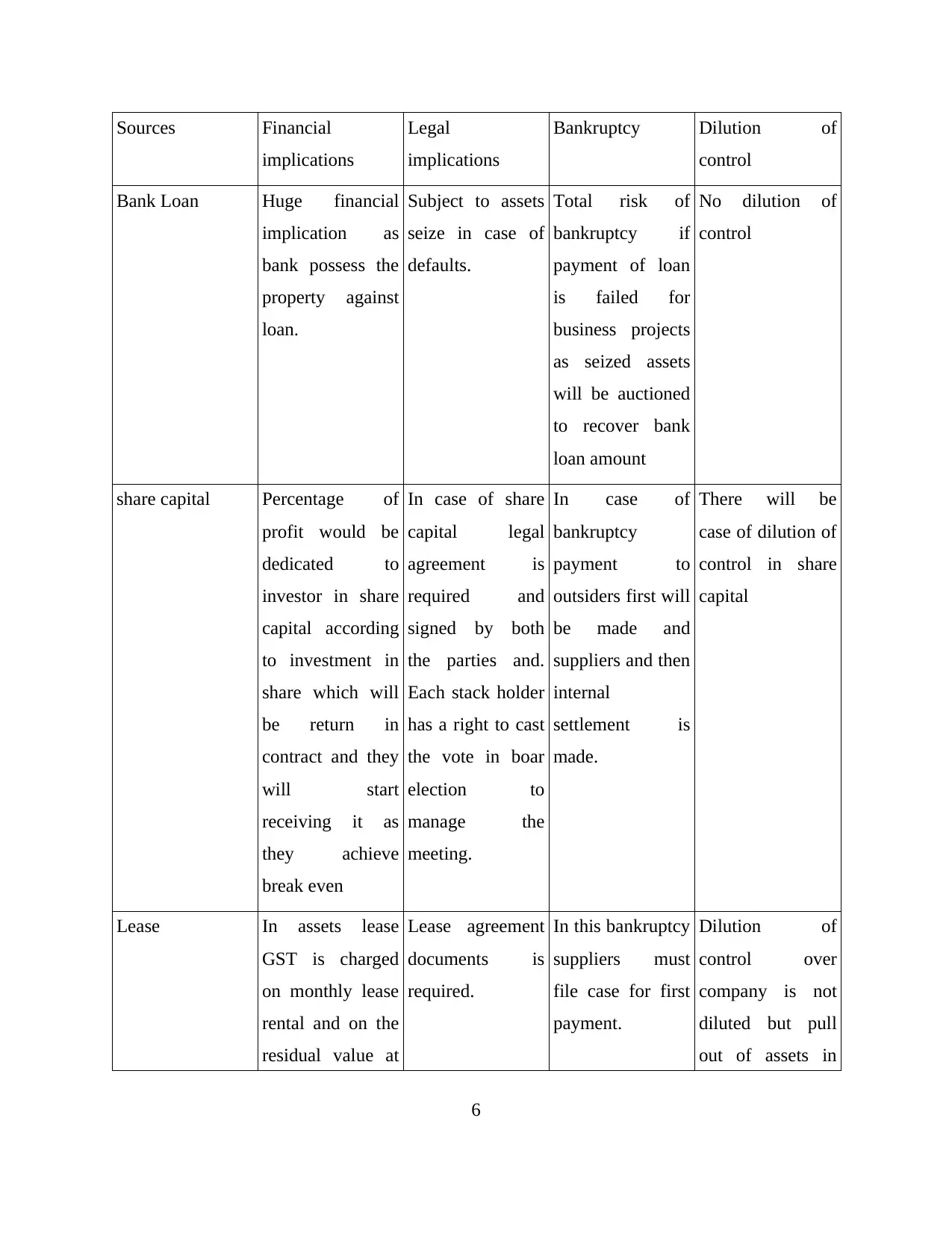

1.2 Implications of financial sources

As per critical evaluation on financial sources, some implications are obtained for getting

sources that can be expressed as follows:-

5

not be ready to put their money and get involved in extra business.

External financial sources:

At external level, finance for organization's establishment can be gained through

following sources:

Bank loan: Loans are provided by bank at a specific rate of interest and fir the specific

time frame. Bank requires a guarantor who guarantees that you will return the principal

amount with the specified interest in specified time period. However, much flexibility is

not provided to borrower in terms of interest and time duration (Cheng, Ioannou and

Serafeim, 2014).

Share capital: Share capital consist of all funds raised by companies in exchange of

either common or shared preferred stock. The amount of share capital or equity finance

that company can change over a period of time as per market requirement and company

objectives.

Venture capital: Professional investors manage this kind of fund. A specific kind of

investment is made by them and it is managed by professional investors (Pasquariello,

2014). If the investor like your business idea he will invest in your business with the fact

that they may demand a certain percentage of profit or decision making is some areas of

business depending up on the contract.

Lease: It is a contractual agreement between the two parties where one party gives right

to the other party to use the asset in return to some rental payment. Osborne can take its

fixed assets on lease (Midrigan and Xu, 2014). Since, fixed asset demands heavy

investment, it will reduce the burden from the company

Bank Overdrafts: It is a short term source of finance. It allows the business to make

payments from their current bank accounts even if the necessary balance is not available

in the bank account. There is a certain limit specified by every bank to while availing this

facility. Bank charge interest on the overdrawn amount (Battiston and et.al., 2016).

1.2 Implications of financial sources

As per critical evaluation on financial sources, some implications are obtained for getting

sources that can be expressed as follows:-

5

Sources Financial

implications

Legal

implications

Bankruptcy Dilution of

control

Bank Loan Huge financial

implication as

bank possess the

property against

loan.

Subject to assets

seize in case of

defaults.

Total risk of

bankruptcy if

payment of loan

is failed for

business projects

as seized assets

will be auctioned

to recover bank

loan amount

No dilution of

control

share capital Percentage of

profit would be

dedicated to

investor in share

capital according

to investment in

share which will

be return in

contract and they

will start

receiving it as

they achieve

break even

In case of share

capital legal

agreement is

required and

signed by both

the parties and.

Each stack holder

has a right to cast

the vote in boar

election to

manage the

meeting.

In case of

bankruptcy

payment to

outsiders first will

be made and

suppliers and then

internal

settlement is

made.

There will be

case of dilution of

control in share

capital

Lease In assets lease

GST is charged

on monthly lease

rental and on the

residual value at

Lease agreement

documents is

required.

In this bankruptcy

suppliers must

file case for first

payment.

Dilution of

control over

company is not

diluted but pull

out of assets in

6

implications

Legal

implications

Bankruptcy Dilution of

control

Bank Loan Huge financial

implication as

bank possess the

property against

loan.

Subject to assets

seize in case of

defaults.

Total risk of

bankruptcy if

payment of loan

is failed for

business projects

as seized assets

will be auctioned

to recover bank

loan amount

No dilution of

control

share capital Percentage of

profit would be

dedicated to

investor in share

capital according

to investment in

share which will

be return in

contract and they

will start

receiving it as

they achieve

break even

In case of share

capital legal

agreement is

required and

signed by both

the parties and.

Each stack holder

has a right to cast

the vote in boar

election to

manage the

meeting.

In case of

bankruptcy

payment to

outsiders first will

be made and

suppliers and then

internal

settlement is

made.

There will be

case of dilution of

control in share

capital

Lease In assets lease

GST is charged

on monthly lease

rental and on the

residual value at

Lease agreement

documents is

required.

In this bankruptcy

suppliers must

file case for first

payment.

Dilution of

control over

company is not

diluted but pull

out of assets in

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the end of the

lease . The

company can

claim the lease

rent as tax

deduction.

case of default

that may hamper

operation.

Bank overdraft Company is

obliged to pay all

charges, penalties

and

miscellaneous

charges in

overdraft if not

paid on time.

Need to fill up a

form in which

promise to pay

repayment with

charges

In case of

bankruptcy first

need to be paid

from the residual

assets of the

company.

No dilution of

control over

company.

1.3 Selection of best suitable financial sources

Bank loan and share capital are best source of financial source. So in selecting the best

source following points need to be considered Repayment terms, Interest and Fee Structure,

Additional requirement. So in repayment term company need to consider payment term should

not be too large and not too small (Segal, Shaliastovich and Yaron, 2015). Company also need

to consider whether interest rates are high or low so that extra cost can be prevented in running

business because excess interest rate can down the company profit. If company need additional

requirement then they should sell their assets.

2.1 Cost analysis for each financial source

Entrepreneur analyses cost to be incurred for getting sources of fund from each source

critically. Therefore, positive and negative both aspects can be identified to select best option. In

this regard, interest incurred on loaning and different factors are to recognized that affects on

further business operation also helpful for forecasting regarding establishment of Osborne

restaurant according to government contract that is interrelated with productivity and

7

lease . The

company can

claim the lease

rent as tax

deduction.

case of default

that may hamper

operation.

Bank overdraft Company is

obliged to pay all

charges, penalties

and

miscellaneous

charges in

overdraft if not

paid on time.

Need to fill up a

form in which

promise to pay

repayment with

charges

In case of

bankruptcy first

need to be paid

from the residual

assets of the

company.

No dilution of

control over

company.

1.3 Selection of best suitable financial sources

Bank loan and share capital are best source of financial source. So in selecting the best

source following points need to be considered Repayment terms, Interest and Fee Structure,

Additional requirement. So in repayment term company need to consider payment term should

not be too large and not too small (Segal, Shaliastovich and Yaron, 2015). Company also need

to consider whether interest rates are high or low so that extra cost can be prevented in running

business because excess interest rate can down the company profit. If company need additional

requirement then they should sell their assets.

2.1 Cost analysis for each financial source

Entrepreneur analyses cost to be incurred for getting sources of fund from each source

critically. Therefore, positive and negative both aspects can be identified to select best option. In

this regard, interest incurred on loaning and different factors are to recognized that affects on

further business operation also helpful for forecasting regarding establishment of Osborne

restaurant according to government contract that is interrelated with productivity and

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

profitability of entity (Bartram, Brown and Waller, 2016). He sets target to arrange 20,000 AUD

for establishment. However, following tools are recognized for financial sources can be

understood briefly as:- Personal saving:- Entrepreneur can use his own savings for establishment of restaurant

as well there will be no interest or additional charge to be refunded for financial source.

Therefore, it will be easier to getting source through using personal saving or taking

financial aid from his family and friends (Segal, Shaliastovich and Yaron, 2015). Thus, it

will be reliable to establish new entity for effective food services. Taking loan from bank:- As set financial target is quite high so bank can help effectively

to allocate this fund. In this regard, high level of finance can be allocated from bank for

which institution charges interest on loan. Hence, it is needed to analyzing interest rates

and forecasting its impact on financial position of restaurant. Thereby, adequate fund can

be allocated from this source to grab opportunity of contract to establish new entity

(Pasquariello, 2014).

Share capital:- For commencement of restaurant, different techniques are used to attract

people to increase share capital. However, calling up shareholders for effective shares can

be a great source for finance to establishment. It is considers as external source by which

adequate fund can be allocated for restaurant establishment (Subrahmanyam and Titman,

2013). In this regard, it is needed to be focused on agreement for providing dividend as

well all terms and conditions regarding equity shares and different sources.

2.2 Significance of financial planning

Financial planning means planning your finances. Finances are planned in order to get

maximum benefit from the available resources. A proper plan of action is prepared. Based in the

current financial condition a future statement is prepared discussing about the incomes and

expenses about the business. An estimation of future cash requirement is prepared to find the

ways of how the cash can be generated in future.

It is important for Osborne to do financial planning. Following are the reasons below:

To ensure that adequate funds are available with firm. It leads to expansion and growth of

a business.

8

for establishment. However, following tools are recognized for financial sources can be

understood briefly as:- Personal saving:- Entrepreneur can use his own savings for establishment of restaurant

as well there will be no interest or additional charge to be refunded for financial source.

Therefore, it will be easier to getting source through using personal saving or taking

financial aid from his family and friends (Segal, Shaliastovich and Yaron, 2015). Thus, it

will be reliable to establish new entity for effective food services. Taking loan from bank:- As set financial target is quite high so bank can help effectively

to allocate this fund. In this regard, high level of finance can be allocated from bank for

which institution charges interest on loan. Hence, it is needed to analyzing interest rates

and forecasting its impact on financial position of restaurant. Thereby, adequate fund can

be allocated from this source to grab opportunity of contract to establish new entity

(Pasquariello, 2014).

Share capital:- For commencement of restaurant, different techniques are used to attract

people to increase share capital. However, calling up shareholders for effective shares can

be a great source for finance to establishment. It is considers as external source by which

adequate fund can be allocated for restaurant establishment (Subrahmanyam and Titman,

2013). In this regard, it is needed to be focused on agreement for providing dividend as

well all terms and conditions regarding equity shares and different sources.

2.2 Significance of financial planning

Financial planning means planning your finances. Finances are planned in order to get

maximum benefit from the available resources. A proper plan of action is prepared. Based in the

current financial condition a future statement is prepared discussing about the incomes and

expenses about the business. An estimation of future cash requirement is prepared to find the

ways of how the cash can be generated in future.

It is important for Osborne to do financial planning. Following are the reasons below:

To ensure that adequate funds are available with firm. It leads to expansion and growth of

a business.

8

To stabilize the inflow and outflow of funds. It ensures optimum utilization of available

funds and restricts over spending.

It’s one of the objective is to frame financial policies for lending and borrowing of funds.

Osborne can keep a check on its borrowing and lending activities.

It will help Osborne to reduce uncertainties and also, ensures its the stability and

profitability.

Financial planning can be undertaken with the help of the following elements in Osborne:

By determining the financial objective, which is based in the company’s overall objective

of Osborne.

By estimating the long term and short term capital requirements of organization.

By determining the kind of securities that will be issued by Osborne.

By determining the lending and borrowing process of entity.

It is significant to do proper financial planning for Osborne. Since, it is the factor that

decides the future of the entity (Murphy, 2016). It is important to have a good grip over the

financial planning of the restaurant.

2.3 Information needs for internal and external decision makers

Accounting entails recording, categorize and summaries of all business transaction. It is a

procedure of identification, measuring and communicating of economical collection involving

four connection form (Vejzagic and Zarafat, 2014).

Phase of preparing financial statement:-

ledger posting

Trail balance

Internal users or primary users of accounting information include:-

Management:- Accounting message is of important assistance to administration for

preparation, controlling decision making cognitive process. Also accounting information

is helpful to managers to do their jobs better (Tatom, 2014). Accounting information

beneficial for every organization because employee have knowledge about the financial

condition of organization.

Employee:-Employee use the account information to find out the financial health,

amount of sales and profit of the organization for there job security and safety.

9

funds and restricts over spending.

It’s one of the objective is to frame financial policies for lending and borrowing of funds.

Osborne can keep a check on its borrowing and lending activities.

It will help Osborne to reduce uncertainties and also, ensures its the stability and

profitability.

Financial planning can be undertaken with the help of the following elements in Osborne:

By determining the financial objective, which is based in the company’s overall objective

of Osborne.

By estimating the long term and short term capital requirements of organization.

By determining the kind of securities that will be issued by Osborne.

By determining the lending and borrowing process of entity.

It is significant to do proper financial planning for Osborne. Since, it is the factor that

decides the future of the entity (Murphy, 2016). It is important to have a good grip over the

financial planning of the restaurant.

2.3 Information needs for internal and external decision makers

Accounting entails recording, categorize and summaries of all business transaction. It is a

procedure of identification, measuring and communicating of economical collection involving

four connection form (Vejzagic and Zarafat, 2014).

Phase of preparing financial statement:-

ledger posting

Trail balance

Internal users or primary users of accounting information include:-

Management:- Accounting message is of important assistance to administration for

preparation, controlling decision making cognitive process. Also accounting information

is helpful to managers to do their jobs better (Tatom, 2014). Accounting information

beneficial for every organization because employee have knowledge about the financial

condition of organization.

Employee:-Employee use the account information to find out the financial health,

amount of sales and profit of the organization for there job security and safety.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Owners:- Owners use the accounting information for forecasting and analysis the

property and profitability of their organization and investment. It also vantage them to

determinant any future coursework of action of the organization.

External users or Secondary users of accounting information include :-

Creditors:- Creditors are involved in accounting information because it modifies them to

determine the credit worthiness of the business and help the organization at critical

situation.

Investors:- They requirement the information, become they are preoccupied with the

risk intrinsic in investing and the returns of the investment.

Customers:- customer's have interest in the accounting message for evaluate the

financial position of a business ,especially in this accounting systems.

Regulatory authorities:- The accounting message is required to secure that it is in

accordance with the rules and regulations and that it provides and covers all organization

aspects.

2.4 Impact of finance on financial statements and importance of financial sources to influence

statements

Business regularly put out financial subject matter such as the income statement, balance

sheet and cash flow statement. when this financial evidence released,they associate have larger

contact on the enterprise and on the investors of the company and the business ensure that

financial statement is important for running in this competitive market scenario.

Impact on company's stock price:-financial statement affect the stock price because the

stock price depends on the organization financial statement because te company's top

management change in financial plan than share market price is up down (Nixon, 2015).

Financing Decisions :-financial statement can also impact on how simple it is for a

business concern to get financing. Financial statement is affection on financing decision

because many organizations are work on different strategic.

Attract new investors for organization:- company adopts low earning strategic

numbers can not destructive effect the number of capitalist willing to invest in this

organization (Andréadès, 2013).

10

property and profitability of their organization and investment. It also vantage them to

determinant any future coursework of action of the organization.

External users or Secondary users of accounting information include :-

Creditors:- Creditors are involved in accounting information because it modifies them to

determine the credit worthiness of the business and help the organization at critical

situation.

Investors:- They requirement the information, become they are preoccupied with the

risk intrinsic in investing and the returns of the investment.

Customers:- customer's have interest in the accounting message for evaluate the

financial position of a business ,especially in this accounting systems.

Regulatory authorities:- The accounting message is required to secure that it is in

accordance with the rules and regulations and that it provides and covers all organization

aspects.

2.4 Impact of finance on financial statements and importance of financial sources to influence

statements

Business regularly put out financial subject matter such as the income statement, balance

sheet and cash flow statement. when this financial evidence released,they associate have larger

contact on the enterprise and on the investors of the company and the business ensure that

financial statement is important for running in this competitive market scenario.

Impact on company's stock price:-financial statement affect the stock price because the

stock price depends on the organization financial statement because te company's top

management change in financial plan than share market price is up down (Nixon, 2015).

Financing Decisions :-financial statement can also impact on how simple it is for a

business concern to get financing. Financial statement is affection on financing decision

because many organizations are work on different strategic.

Attract new investors for organization:- company adopts low earning strategic

numbers can not destructive effect the number of capitalist willing to invest in this

organization (Andréadès, 2013).

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance is considered as provision of money includes investment and getting sources for

business operations. In this regard, decisions are made for investing and getting sources of fund.

It involves gained revenue and spending on expenditures to operate business activities. However,

actual financial information of organization is gained through this process. Including this, it is

helpful to attract new investors to share their fund in company's share capital for business

operations. Therefore, stock price get impacted also identifies organization's potential to refund

on shares. Finance involves different items as sales, collection of money, owners' capital,

expenses, payment of principal and so on that affects economic position of entity. In accordance

to this, gained revenue on selling items impacts income statement and monetary performance of

firm. Along with this, when company issues new shares, it is interrelated with dividend or refund

on shares affects profit and loss account of entity.

Moreover, bills, receipts and data remains interlinked with organization's financial

position to operate business activities. Besides this, leasing approach also impact on economic

position of entity that generates different ideas for further investment and getting sources of fund

in future time. Hence, finance impact on financial position of organization in different ways. It

provides ideas for further operations as well income and expenditures on production and

distribution of goods are gained through financing. It is also suitable for proper financial

management and fund allocation effectively.

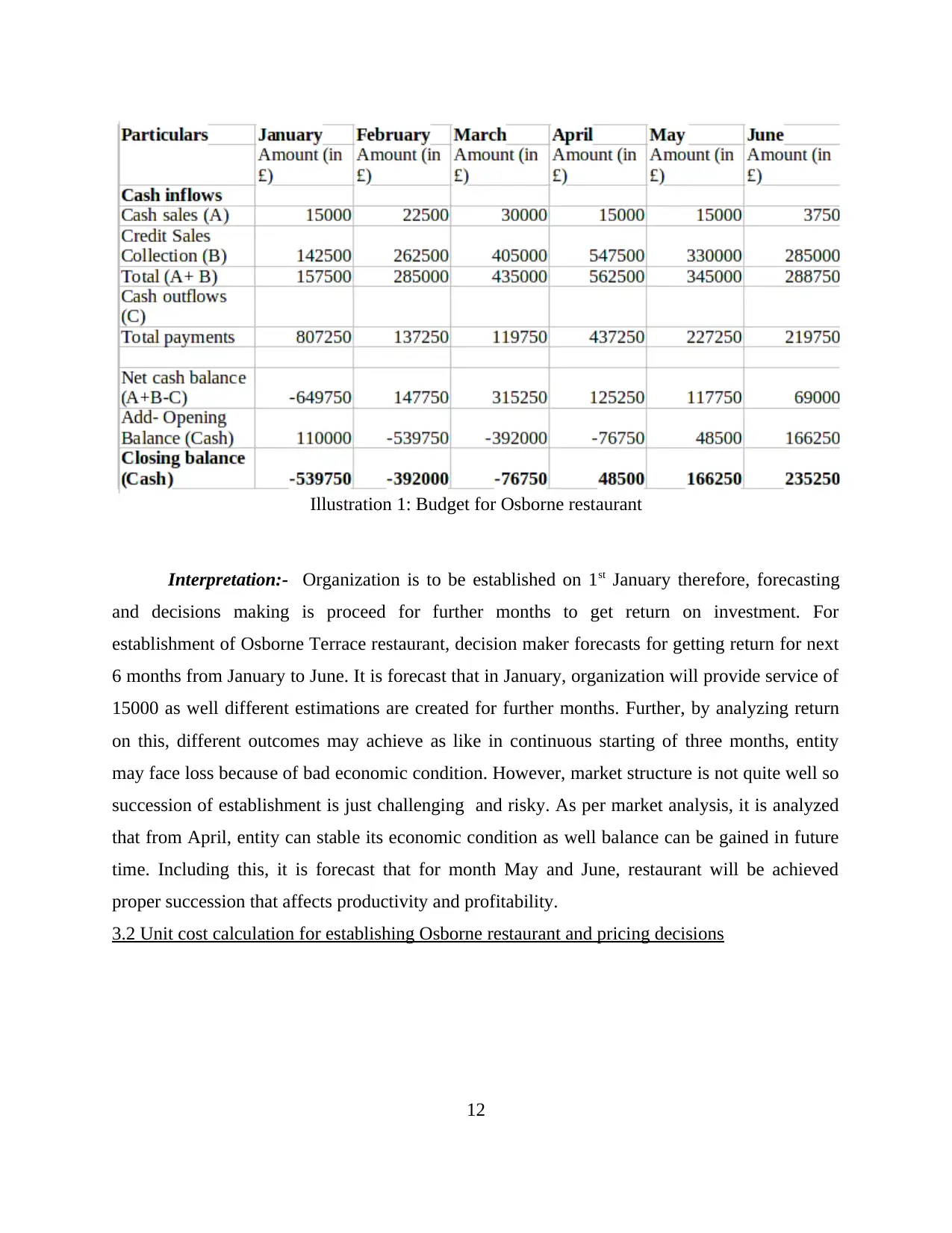

3.1 Budgeting and forecasting for next six months' business operations

Budgeting is an approach for forecasting and decision making related to further business

operations. In this process system, actual performance of organization is analyzed as per which

further business operations are created (Nixon, 2015). Therefore, for commencement of Osborne

Terrace restaurant, decision maker forecasts return on investment for next 6 months. For this

purpose, he prepares budget plan as follows:-

11

business operations. In this regard, decisions are made for investing and getting sources of fund.

It involves gained revenue and spending on expenditures to operate business activities. However,

actual financial information of organization is gained through this process. Including this, it is

helpful to attract new investors to share their fund in company's share capital for business

operations. Therefore, stock price get impacted also identifies organization's potential to refund

on shares. Finance involves different items as sales, collection of money, owners' capital,

expenses, payment of principal and so on that affects economic position of entity. In accordance

to this, gained revenue on selling items impacts income statement and monetary performance of

firm. Along with this, when company issues new shares, it is interrelated with dividend or refund

on shares affects profit and loss account of entity.

Moreover, bills, receipts and data remains interlinked with organization's financial

position to operate business activities. Besides this, leasing approach also impact on economic

position of entity that generates different ideas for further investment and getting sources of fund

in future time. Hence, finance impact on financial position of organization in different ways. It

provides ideas for further operations as well income and expenditures on production and

distribution of goods are gained through financing. It is also suitable for proper financial

management and fund allocation effectively.

3.1 Budgeting and forecasting for next six months' business operations

Budgeting is an approach for forecasting and decision making related to further business

operations. In this process system, actual performance of organization is analyzed as per which

further business operations are created (Nixon, 2015). Therefore, for commencement of Osborne

Terrace restaurant, decision maker forecasts return on investment for next 6 months. For this

purpose, he prepares budget plan as follows:-

11

Interpretation:- Organization is to be established on 1st January therefore, forecasting

and decisions making is proceed for further months to get return on investment. For

establishment of Osborne Terrace restaurant, decision maker forecasts for getting return for next

6 months from January to June. It is forecast that in January, organization will provide service of

15000 as well different estimations are created for further months. Further, by analyzing return

on this, different outcomes may achieve as like in continuous starting of three months, entity

may face loss because of bad economic condition. However, market structure is not quite well so

succession of establishment is just challenging and risky. As per market analysis, it is analyzed

that from April, entity can stable its economic condition as well balance can be gained in future

time. Including this, it is forecast that for month May and June, restaurant will be achieved

proper succession that affects productivity and profitability.

3.2 Unit cost calculation for establishing Osborne restaurant and pricing decisions

12

Illustration 1: Budget for Osborne restaurant

and decisions making is proceed for further months to get return on investment. For

establishment of Osborne Terrace restaurant, decision maker forecasts for getting return for next

6 months from January to June. It is forecast that in January, organization will provide service of

15000 as well different estimations are created for further months. Further, by analyzing return

on this, different outcomes may achieve as like in continuous starting of three months, entity

may face loss because of bad economic condition. However, market structure is not quite well so

succession of establishment is just challenging and risky. As per market analysis, it is analyzed

that from April, entity can stable its economic condition as well balance can be gained in future

time. Including this, it is forecast that for month May and June, restaurant will be achieved

proper succession that affects productivity and profitability.

3.2 Unit cost calculation for establishing Osborne restaurant and pricing decisions

12

Illustration 1: Budget for Osborne restaurant

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.