Managing Financial Resources and Decisions for Clariton Antiques Ltd

VerifiedAdded on 2020/01/07

|21

|5686

|209

Report

AI Summary

This report examines the financial resource management and decision-making processes for Clariton Antiques Ltd (CAL). It begins by identifying and assessing various sources of finance available to CAL, including owner's investment, trade credit, leasing, hire purchase, overdrafts, sale of assets, share capital, debt funds, and retained profits. The report then evaluates the impact of each source, considering legal and financial implications, potential for bankruptcy, and dilution of control. Task 2 delves into the comparison of equity and debt financing costs, emphasizing the importance of financial planning, budgeting, and addressing overtrading. It describes the information needs of different decision-makers, such as partners, venture capitalists, and finance brokers. Furthermore, the impact of finance sources on the final accounts is evaluated. Task 3 focuses on budgeting, cost calculations for antique items, and assessing the commercial viability of investment projects. Finally, Task 4 explains the purpose of financial statements, compares appropriate formats for various businesses, and interprets the findings of the final accounts for Clariton Antiques, incorporating ratio analysis to provide strategic financial insights. The report concludes with recommendations for CAL's financial strategy and expansion plans.

Managing financial resources & decisions

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION................................................................................................................................3

TASK 1.................................................................................................................................................3

1.1 Identifying the sources of finance that are available to CAL....................................................3

1.2 Assessing the impact and influence of variety of sources available to Clariton........................4

1.3 Choosing the appropriate source of finance..............................................................................5

TASK 2.................................................................................................................................................5

2.1 Comparing the cost of equity versus debt financing..................................................................5

2.2 Explaining the importance of financial planning.......................................................................6

2.3 Describing the information needs of different types of decision-makers..................................6

2.4 Evaluating the impact of finance sources on the final accounts................................................7

TASK 3.................................................................................................................................................8

3.1 Making budget & its interpretation for appropriate decisions...................................................8

3.2 Calculating the cost per antique item and making pricing decisions.........................................9

3.3 Assessing the commercial viability of the various investment projects..................................10

TASK 4...............................................................................................................................................12

4.1 Explaining the purpose of financial statements.......................................................................12

4.2 Comparing appropriate formats of financial statements for variety of businesses..................12

4.3 Interpreting the findings of the final accounts for Clariton Antiques......................................14

CONCLUSION..................................................................................................................................16

REFERENCES...................................................................................................................................17

2

INTRODUCTION................................................................................................................................3

TASK 1.................................................................................................................................................3

1.1 Identifying the sources of finance that are available to CAL....................................................3

1.2 Assessing the impact and influence of variety of sources available to Clariton........................4

1.3 Choosing the appropriate source of finance..............................................................................5

TASK 2.................................................................................................................................................5

2.1 Comparing the cost of equity versus debt financing..................................................................5

2.2 Explaining the importance of financial planning.......................................................................6

2.3 Describing the information needs of different types of decision-makers..................................6

2.4 Evaluating the impact of finance sources on the final accounts................................................7

TASK 3.................................................................................................................................................8

3.1 Making budget & its interpretation for appropriate decisions...................................................8

3.2 Calculating the cost per antique item and making pricing decisions.........................................9

3.3 Assessing the commercial viability of the various investment projects..................................10

TASK 4...............................................................................................................................................12

4.1 Explaining the purpose of financial statements.......................................................................12

4.2 Comparing appropriate formats of financial statements for variety of businesses..................12

4.3 Interpreting the findings of the final accounts for Clariton Antiques......................................14

CONCLUSION..................................................................................................................................16

REFERENCES...................................................................................................................................17

2

INTRODUCTION

Money is the first and foremost requirement of every commercial as well as service

organization unit either at a time of new start-up, global expansion or for the continuance of the

routine functionality. Clariton Antiques Ltd (CAL) was started by four partners initially as an

unincorporated business but steadily growth of the firm achieved a good reputation by selling

different antique products. Now, it owes two branches running in London, however, for the

expansion, partners are considering commencing operations at a new branch in Birmingham

requiring a beginning investment worth raise £0.5 million. It has option to “go public” and raise

required money for the prospective expansion project.

Therefore, the report will critically examine both the favourable and negative aspects of

every finance source that are being available to Clariton and chose the most appropriate ones.

Thereafter, in order to manage funds appropriately, it will describe the need and substantial benefits

of financial plan. Along with this, financial accounting concepts and statements will be explained to

guide managers for the preparation of their annual reports whilst the result will be analyzed

incorporating ratio analysis technique of strategic financial analysis.

TASK 1

1.1 Identifying the sources of finance that are available to CAL

Unincorporated organizations: Any of the commercial establishment or business unit that

is owned by an individual or group of several members and regulated by them is called

unincorporated business typically includes sole proprietorship & partnership.

Owner’s investment: It is the best source especially for the sole traders as they can invest

their personal savings available as a residue from the total income. Individual does not need to

repay their own funds to himself or herself back and available at zero cost.

Trade credit: Sole traders & partnership can also deal with the manufacturers for the trade

credit agreement. Under this, they can buy material without making immediately payment at the

point of purchase and eliminates the need of high capitalization (Bir, 2016).

Lease: In order to reduce excessive capital need to acquire new building, office and land,

leasing is considered as the best choice. In such regards, unincorporated businesses can set terms

and conditions with the real owner and receive rights to use assets for a fixed period of lease by

making lease charges at the beginning of every year.

Hire purchase: This alternative is often used by these form of businesses to get equipments

like computer, vehicle & others by paying some amount immediately and residual as per decided

3

Money is the first and foremost requirement of every commercial as well as service

organization unit either at a time of new start-up, global expansion or for the continuance of the

routine functionality. Clariton Antiques Ltd (CAL) was started by four partners initially as an

unincorporated business but steadily growth of the firm achieved a good reputation by selling

different antique products. Now, it owes two branches running in London, however, for the

expansion, partners are considering commencing operations at a new branch in Birmingham

requiring a beginning investment worth raise £0.5 million. It has option to “go public” and raise

required money for the prospective expansion project.

Therefore, the report will critically examine both the favourable and negative aspects of

every finance source that are being available to Clariton and chose the most appropriate ones.

Thereafter, in order to manage funds appropriately, it will describe the need and substantial benefits

of financial plan. Along with this, financial accounting concepts and statements will be explained to

guide managers for the preparation of their annual reports whilst the result will be analyzed

incorporating ratio analysis technique of strategic financial analysis.

TASK 1

1.1 Identifying the sources of finance that are available to CAL

Unincorporated organizations: Any of the commercial establishment or business unit that

is owned by an individual or group of several members and regulated by them is called

unincorporated business typically includes sole proprietorship & partnership.

Owner’s investment: It is the best source especially for the sole traders as they can invest

their personal savings available as a residue from the total income. Individual does not need to

repay their own funds to himself or herself back and available at zero cost.

Trade credit: Sole traders & partnership can also deal with the manufacturers for the trade

credit agreement. Under this, they can buy material without making immediately payment at the

point of purchase and eliminates the need of high capitalization (Bir, 2016).

Lease: In order to reduce excessive capital need to acquire new building, office and land,

leasing is considered as the best choice. In such regards, unincorporated businesses can set terms

and conditions with the real owner and receive rights to use assets for a fixed period of lease by

making lease charges at the beginning of every year.

Hire purchase: This alternative is often used by these form of businesses to get equipments

like computer, vehicle & others by paying some amount immediately and residual as per decided

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

instalments in the agreement (Hire purchase, 2016)

Overdraft: Immediate or urgencies for short-term fund can be effectively resolved through

overdraft by taking permission from the bank to withdraw some extent amount from the money

available in their account.

Sale of assets: Disposable or assets classified as not in use can be disposed-off in market for

the monetary collections by the sole trader or partners:

Incorporated organizations: Corporations/Companies having a separate legal entity from

that of owners are a type of incorporated business like Clariton Antiques Ltd.

Go public/share capital: “Go public” is an option to the CAL to gather money from people

in the form of share capital by the issuance of ordinary & preferences shares.

Debt fund: Raising money through external borrowing is also a choice exists to the Clariton,

in which, it can contact to the financial brokers and borrow required capital for the proposed

expansion plan (Zhao and Lu, 2016).

Retained profits: Putting back the accumulated surplus of historical reporting years is an

option available to the company to meet out their capital requirement without any excessive legal

formalities.

1.2 Assessing the impact and influence of variety of sources available to Clariton

Legal:

There are high and complex legal formalities attached with debts like collateral, reporting

annual accounts & others. However, hire purchase, leasing, overdraft & sales of assets require some

documentation for transfer the right of utilization or ownership. In contrast, as Clariton will opt first

time for the option “go public”, therefore, it will be necessary to list the share in a stock exchange

before issuing it to the public.

Financial:

On debt-funding, trade credit, overdraft, hire purchase & leasing, interest is charged by the

external parties for receiving some extra amount of return. Unlike it, on the disposal of assets,

removal charges and freight outward required to be paid (Kogadeeva and Zamboni, 2016). Despite

it, although dividend is not a legal requirement, but still, to retain equity capital, Clariton will have

to pay reasonable dividend so that they will not disposed-off their share.

Bankruptcy

On debt funding, business is accountable to repay lenders with the borrowed money even if

Clariton fails. In contrast, repayment of equity capital is not compulsory because ordinary investors

are the owners and they will be paid by the remainder fund available after payment to outsiders like

4

Overdraft: Immediate or urgencies for short-term fund can be effectively resolved through

overdraft by taking permission from the bank to withdraw some extent amount from the money

available in their account.

Sale of assets: Disposable or assets classified as not in use can be disposed-off in market for

the monetary collections by the sole trader or partners:

Incorporated organizations: Corporations/Companies having a separate legal entity from

that of owners are a type of incorporated business like Clariton Antiques Ltd.

Go public/share capital: “Go public” is an option to the CAL to gather money from people

in the form of share capital by the issuance of ordinary & preferences shares.

Debt fund: Raising money through external borrowing is also a choice exists to the Clariton,

in which, it can contact to the financial brokers and borrow required capital for the proposed

expansion plan (Zhao and Lu, 2016).

Retained profits: Putting back the accumulated surplus of historical reporting years is an

option available to the company to meet out their capital requirement without any excessive legal

formalities.

1.2 Assessing the impact and influence of variety of sources available to Clariton

Legal:

There are high and complex legal formalities attached with debts like collateral, reporting

annual accounts & others. However, hire purchase, leasing, overdraft & sales of assets require some

documentation for transfer the right of utilization or ownership. In contrast, as Clariton will opt first

time for the option “go public”, therefore, it will be necessary to list the share in a stock exchange

before issuing it to the public.

Financial:

On debt-funding, trade credit, overdraft, hire purchase & leasing, interest is charged by the

external parties for receiving some extra amount of return. Unlike it, on the disposal of assets,

removal charges and freight outward required to be paid (Kogadeeva and Zamboni, 2016). Despite

it, although dividend is not a legal requirement, but still, to retain equity capital, Clariton will have

to pay reasonable dividend so that they will not disposed-off their share.

Bankruptcy

On debt funding, business is accountable to repay lenders with the borrowed money even if

Clariton fails. In contrast, repayment of equity capital is not compulsory because ordinary investors

are the owners and they will be paid by the remainder fund available after payment to outsiders like

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

lenders, suppliers & others.

Dilution:

Issuance of share capital and collecting money through venture capitalists results in

significant dilution of control to the investors, as a result, they can intrusion in the corporate

decisions & control Clariton’s activities. Unlike this, there are no such rights or power available to

lenders, suppliers, lessor & assets vendor, in other words, it does not dilute or diversify control

(Finkler and et.al., 2016). However, retained profit is already the rights of shareholders, therefore, it

bring no change in dilution.

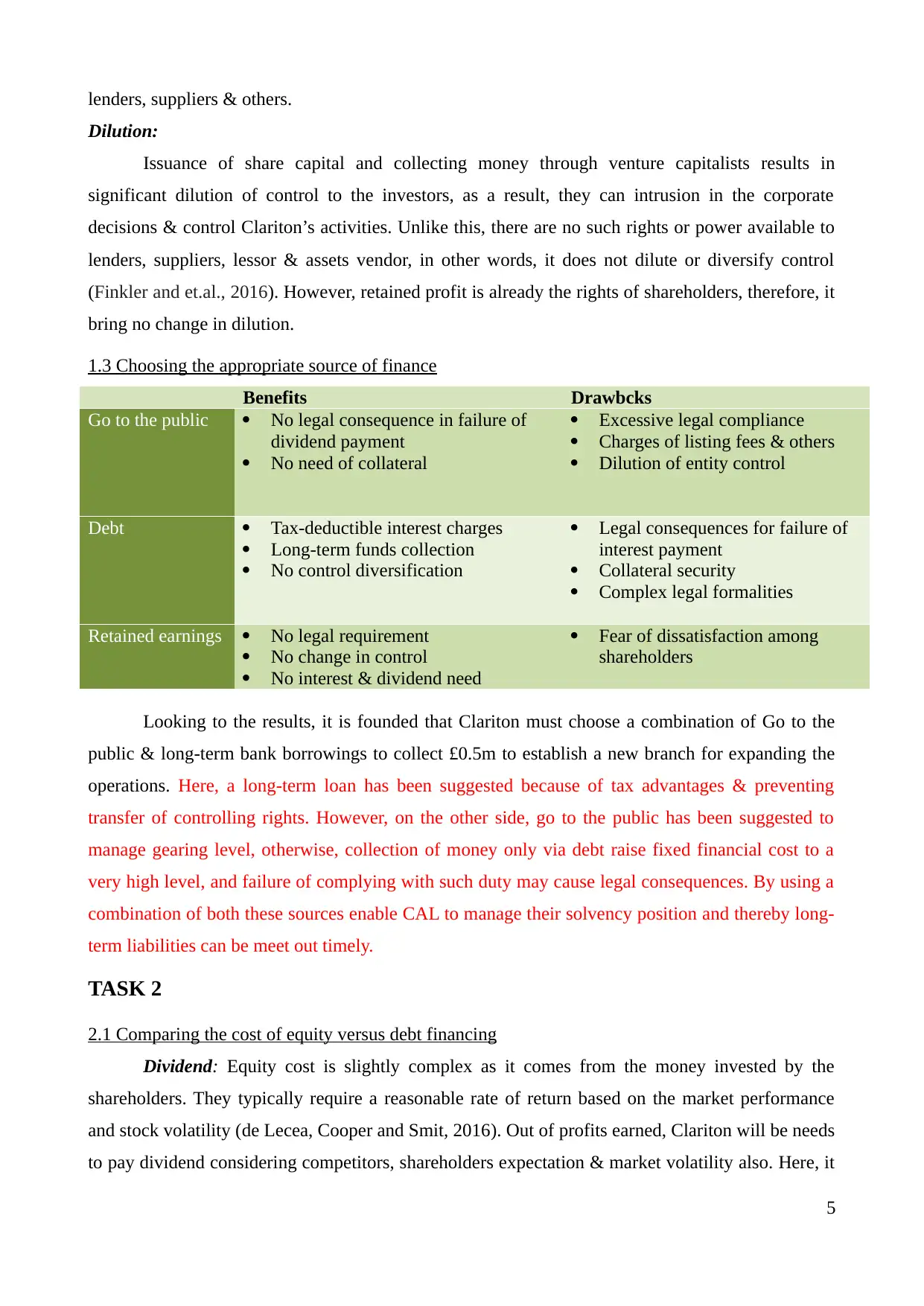

1.3 Choosing the appropriate source of finance

Benefits Drawbcks

Go to the public No legal consequence in failure of

dividend payment

No need of collateral

Excessive legal compliance

Charges of listing fees & others

Dilution of entity control

Debt Tax-deductible interest charges

Long-term funds collection

No control diversification

Legal consequences for failure of

interest payment

Collateral security

Complex legal formalities

Retained earnings No legal requirement

No change in control

No interest & dividend need

Fear of dissatisfaction among

shareholders

Looking to the results, it is founded that Clariton must choose a combination of Go to the

public & long-term bank borrowings to collect £0.5m to establish a new branch for expanding the

operations. Here, a long-term loan has been suggested because of tax advantages & preventing

transfer of controlling rights. However, on the other side, go to the public has been suggested to

manage gearing level, otherwise, collection of money only via debt raise fixed financial cost to a

very high level, and failure of complying with such duty may cause legal consequences. By using a

combination of both these sources enable CAL to manage their solvency position and thereby long-

term liabilities can be meet out timely.

TASK 2

2.1 Comparing the cost of equity versus debt financing

Dividend: Equity cost is slightly complex as it comes from the money invested by the

shareholders. They typically require a reasonable rate of return based on the market performance

and stock volatility (de Lecea, Cooper and Smit, 2016). Out of profits earned, Clariton will be needs

to pay dividend considering competitors, shareholders expectation & market volatility also. Here, it

5

Dilution:

Issuance of share capital and collecting money through venture capitalists results in

significant dilution of control to the investors, as a result, they can intrusion in the corporate

decisions & control Clariton’s activities. Unlike this, there are no such rights or power available to

lenders, suppliers, lessor & assets vendor, in other words, it does not dilute or diversify control

(Finkler and et.al., 2016). However, retained profit is already the rights of shareholders, therefore, it

bring no change in dilution.

1.3 Choosing the appropriate source of finance

Benefits Drawbcks

Go to the public No legal consequence in failure of

dividend payment

No need of collateral

Excessive legal compliance

Charges of listing fees & others

Dilution of entity control

Debt Tax-deductible interest charges

Long-term funds collection

No control diversification

Legal consequences for failure of

interest payment

Collateral security

Complex legal formalities

Retained earnings No legal requirement

No change in control

No interest & dividend need

Fear of dissatisfaction among

shareholders

Looking to the results, it is founded that Clariton must choose a combination of Go to the

public & long-term bank borrowings to collect £0.5m to establish a new branch for expanding the

operations. Here, a long-term loan has been suggested because of tax advantages & preventing

transfer of controlling rights. However, on the other side, go to the public has been suggested to

manage gearing level, otherwise, collection of money only via debt raise fixed financial cost to a

very high level, and failure of complying with such duty may cause legal consequences. By using a

combination of both these sources enable CAL to manage their solvency position and thereby long-

term liabilities can be meet out timely.

TASK 2

2.1 Comparing the cost of equity versus debt financing

Dividend: Equity cost is slightly complex as it comes from the money invested by the

shareholders. They typically require a reasonable rate of return based on the market performance

and stock volatility (de Lecea, Cooper and Smit, 2016). Out of profits earned, Clariton will be needs

to pay dividend considering competitors, shareholders expectation & market volatility also. Here, it

5

is required to be noted that it is not a legal requirement; therefore, if managers decides to not

distribute any dividend because of less return and any other reason, then it will not lead to cause any

legal consequences on the firm.

Interest: Fund that Clariton borrow from the market to meet their capital requirement is

called debt; in return, lenders need the interest for the risk undertaken or the privilege. Thus, the

fixed or volatile burden is the cost of borrowings. In accordance with the debt covenants &

agreements for repayment schedule, it is a legal obligation to make payment of instalments

including interest; otherwise, breach of such duties raises legal consequences to the CAL.

Tax benefits: Although cost of debt is legally compulsory for the firm, still it is

comparatively cheaper source than equity just due to the tax relief. In UK, taxation body, Her

Majesty Revenues & Custom (HMRC) gives taxation reliefs to the corporations to the extent of

money paid as an interest to meet debt obligations and on remainder balance, tax duties are imposed

and levied. On the contrary, dividend distribution decisions are made after subtracting taxation

duties from the remainder of profits available.

2.2 Explaining the importance of financial planning

Financial or monetary planning refers to setting out a plan & policies that how a business

will achieve its set strategic targets & objectives. It starts with setting out a plan and afterwards,

creating policies for the resources, material, equipment and other on the basis of timeframe. CAL’s

financial planner has to create a best plan considering the proper and proficient management of

funds to get good results on this.

Budgeting: Budgetary planning will be of great significance for the Clariton to construct a

plan to tailor future capital requirement, its allocation & distribution, better and proficient

utilization of resources and manage surplus fund through generating larger revenue over expenses

incurred (Martin, 2016).

Failure of business to finance adequately: In the current dynamic era, there are tough

challenges exist in the front of organizations. For instance, volatility in interest, fall in aggregate

market demand, inflation & many others. Meeting out challenges and financial threatening and

achieving desired goals can only assured through an appropriate & suitable financial plan.

Overtrading: Too aggressively and suddenly expansion of the CAL through taking too

much long-term borrowings from the market and financial institutions is called overtrading.

Financial Planner makes plan and keep track over the functionality so as to detect what potential

financial threatening can be arises (Bondarenko, 2016). Moreover, decisions regarding capital

structure (equity versus debt) help to manage balanced structure and combat overtrading possibility.

6

distribute any dividend because of less return and any other reason, then it will not lead to cause any

legal consequences on the firm.

Interest: Fund that Clariton borrow from the market to meet their capital requirement is

called debt; in return, lenders need the interest for the risk undertaken or the privilege. Thus, the

fixed or volatile burden is the cost of borrowings. In accordance with the debt covenants &

agreements for repayment schedule, it is a legal obligation to make payment of instalments

including interest; otherwise, breach of such duties raises legal consequences to the CAL.

Tax benefits: Although cost of debt is legally compulsory for the firm, still it is

comparatively cheaper source than equity just due to the tax relief. In UK, taxation body, Her

Majesty Revenues & Custom (HMRC) gives taxation reliefs to the corporations to the extent of

money paid as an interest to meet debt obligations and on remainder balance, tax duties are imposed

and levied. On the contrary, dividend distribution decisions are made after subtracting taxation

duties from the remainder of profits available.

2.2 Explaining the importance of financial planning

Financial or monetary planning refers to setting out a plan & policies that how a business

will achieve its set strategic targets & objectives. It starts with setting out a plan and afterwards,

creating policies for the resources, material, equipment and other on the basis of timeframe. CAL’s

financial planner has to create a best plan considering the proper and proficient management of

funds to get good results on this.

Budgeting: Budgetary planning will be of great significance for the Clariton to construct a

plan to tailor future capital requirement, its allocation & distribution, better and proficient

utilization of resources and manage surplus fund through generating larger revenue over expenses

incurred (Martin, 2016).

Failure of business to finance adequately: In the current dynamic era, there are tough

challenges exist in the front of organizations. For instance, volatility in interest, fall in aggregate

market demand, inflation & many others. Meeting out challenges and financial threatening and

achieving desired goals can only assured through an appropriate & suitable financial plan.

Overtrading: Too aggressively and suddenly expansion of the CAL through taking too

much long-term borrowings from the market and financial institutions is called overtrading.

Financial Planner makes plan and keep track over the functionality so as to detect what potential

financial threatening can be arises (Bondarenko, 2016). Moreover, decisions regarding capital

structure (equity versus debt) help to manage balanced structure and combat overtrading possibility.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.3 Describing the information needs of different types of decision-makers

Partners: They evaluate current performance, trends and expect the near growth in the

upcoming period. In addition to this, they evaluate and predict aggregate market demand for the

antique products and identify the terms and conditions of the partnership deed regarding interest on

drawing, capital & loan, salary, profit and loss distribution ratio as well (Harris and et.al., 2016).

They put money if they are enough agree and satisfied with the terms and assume that business will

grow in future.

Venture capitalists: They assess reputation, market presence, competitive strength &

profitability margin (Bir, 2016). VCs are risk takers and makes rational decisions after examining

the volatility in stock price and performance of CAL because they need best yield.

Finance broker: Credit rating, ability to pay fixed obligations in accordance with the debt

covenants, solvency & gearing level etc. are analyzed by the brokers. They make best decisions

upon whether loans must be granted or not after a thoroughly analysis of the CAL’s financial health.

They also require information about Clariton’s historical track records, net assets & directors

credibility to make smarter decisions whether loan should be granted or not.

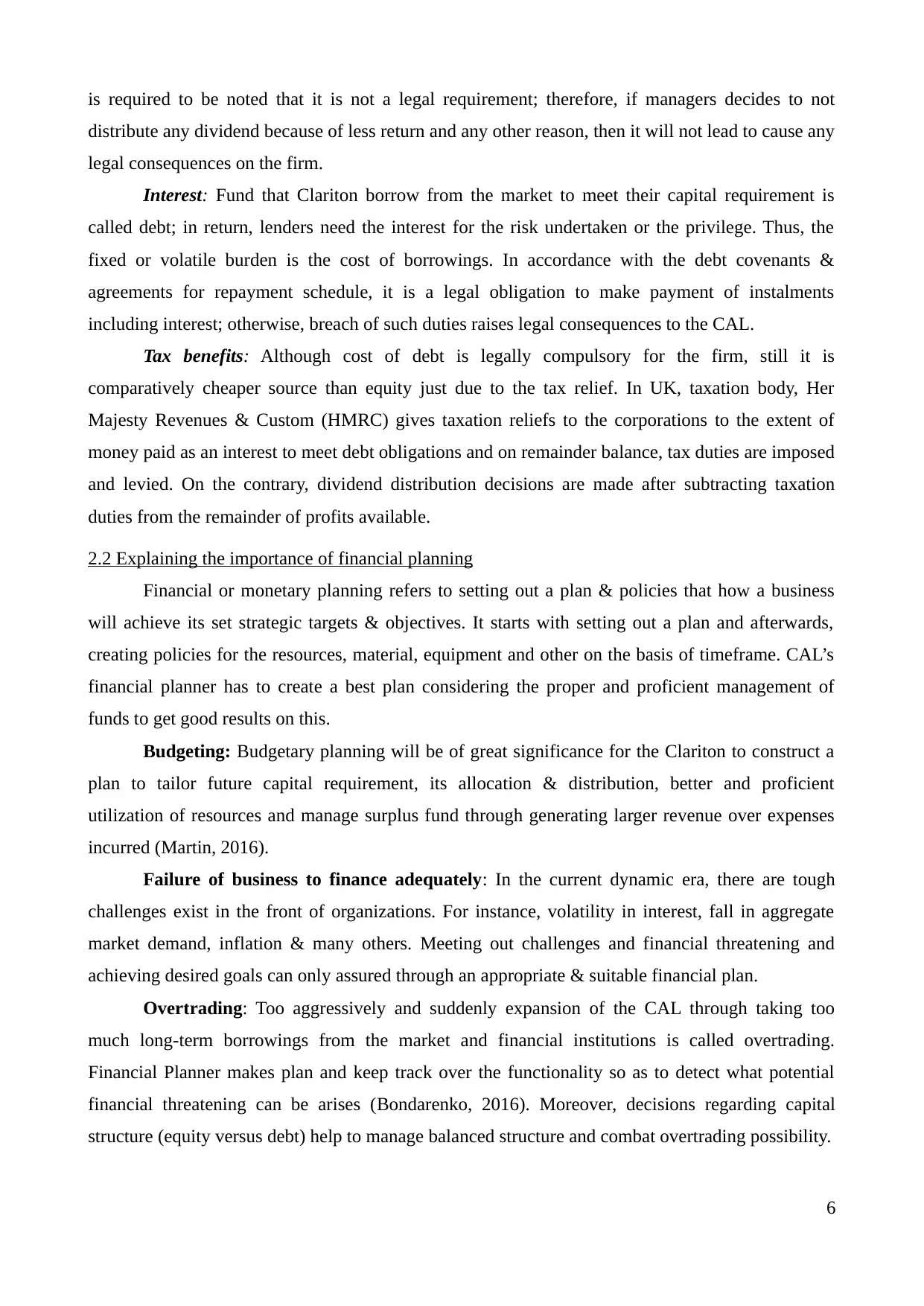

2.4 Evaluating the impact of finance sources on the final accounts

SOCI SOFP SOCF

We

Finance

Limited

Dividend: It will be deducted

from the EAT (earning after taxes)

to determine the residue amount

of retained profits.

Cost of dividend (Kd) =

(DPS/Market price*100 + Growth

rate)

Cash: It will be reduced

by the amount of

dividend and amount of

VCs investment will be

added.

Proprietor’s fund: It

will go up by the

amount of capital

invested by VCs.

Financing activities:

Amount collection

through VCs will

increase cash inflow

whilst dividend

distribution will

maximize outflow.

Finance

Broker

Interest and brokerage:

Financing cost of borrowings will

increase expenditures and decline

net return.

Cost of debt

Interest: 500000*2% = 10000

Brokerage: 500000*1% = 5000

Cash: Brokerage @ 1%

& cost of interest @ 2%

will decrease cash

position. However,

money borrowed will

increase it (Davis,

Cieniewski and

Financing activities:

External borrowings

will improve cash

inflow whilst its

disposal will results

in outflow. In

contrast, interest

7

Partners: They evaluate current performance, trends and expect the near growth in the

upcoming period. In addition to this, they evaluate and predict aggregate market demand for the

antique products and identify the terms and conditions of the partnership deed regarding interest on

drawing, capital & loan, salary, profit and loss distribution ratio as well (Harris and et.al., 2016).

They put money if they are enough agree and satisfied with the terms and assume that business will

grow in future.

Venture capitalists: They assess reputation, market presence, competitive strength &

profitability margin (Bir, 2016). VCs are risk takers and makes rational decisions after examining

the volatility in stock price and performance of CAL because they need best yield.

Finance broker: Credit rating, ability to pay fixed obligations in accordance with the debt

covenants, solvency & gearing level etc. are analyzed by the brokers. They make best decisions

upon whether loans must be granted or not after a thoroughly analysis of the CAL’s financial health.

They also require information about Clariton’s historical track records, net assets & directors

credibility to make smarter decisions whether loan should be granted or not.

2.4 Evaluating the impact of finance sources on the final accounts

SOCI SOFP SOCF

We

Finance

Limited

Dividend: It will be deducted

from the EAT (earning after taxes)

to determine the residue amount

of retained profits.

Cost of dividend (Kd) =

(DPS/Market price*100 + Growth

rate)

Cash: It will be reduced

by the amount of

dividend and amount of

VCs investment will be

added.

Proprietor’s fund: It

will go up by the

amount of capital

invested by VCs.

Financing activities:

Amount collection

through VCs will

increase cash inflow

whilst dividend

distribution will

maximize outflow.

Finance

Broker

Interest and brokerage:

Financing cost of borrowings will

increase expenditures and decline

net return.

Cost of debt

Interest: 500000*2% = 10000

Brokerage: 500000*1% = 5000

Cash: Brokerage @ 1%

& cost of interest @ 2%

will decrease cash

position. However,

money borrowed will

increase it (Davis,

Cieniewski and

Financing activities:

External borrowings

will improve cash

inflow whilst its

disposal will results

in outflow. In

contrast, interest

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost of debt:

(10000+5000)/500000*100

3%

Birenbaum, 2016).

Non-current liabilities:

Loan through external

borrowings raises non-

current liabilities.

payment will be

results in outflow.

TASK 3

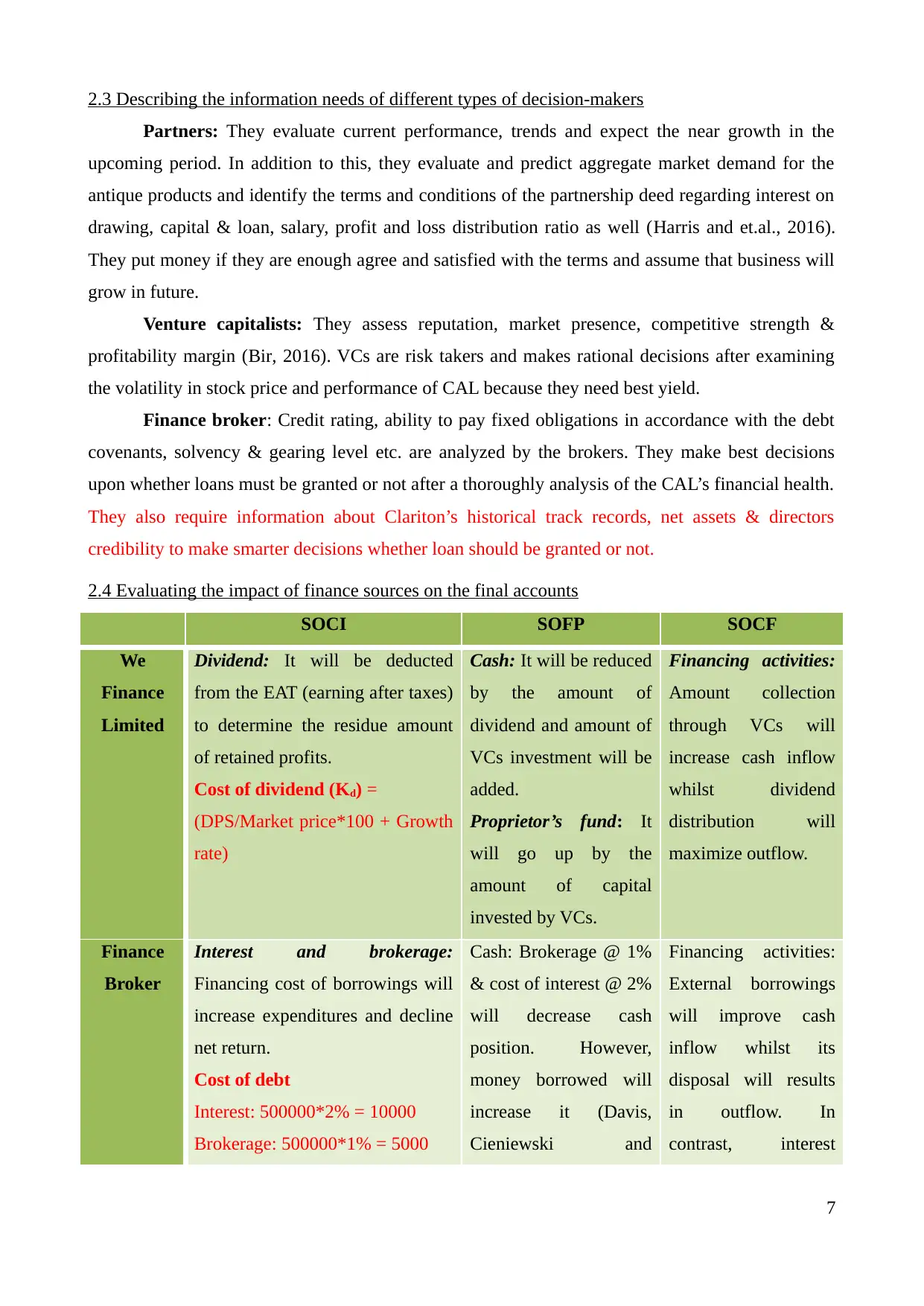

3.1 Making budget & its interpretation for appropriate decisions

In simple meaning, budgeting is defined as a prospective plan for the future planned

activities and regular functionality comprising both the revenue nature and capital nature

transactions. However, cash budget refers to business planning keeping in view a specific element

of balance sheet, cash. It is a well-structured or summarized plan about expected or prospective

receipts and disbursement of cash over the period. For instance, sales of antique items will drive

cash in to the Clariton whereas expenditures, wages, salaries, bills for utility consumption are the

reasons for outflow of cash.

Net cash position = Inflow of cash – Outflow of cash

Importance or benefits of cash budget

Determining the amount of cash collection & its disbursement

It recognises the balance of cash for the decision-making purpose because having huge

money in the business without any use is not considered idle, because, by putting it in an

alternative investment purpose can help CAL to gain reasonable return.

Right and better allocation and distribution of cash resources in marketing, production &

other divisions (Harris and et.al., 2016).

Guide personnel and direct & align their efforts towards the corporate aims & goals helps to

maximize staff productivity.

It helps managers to closely supervise and monitor their staff capabilities whether they are

performing in line with the set budgets or not (Bir, 2016).

Particulars Jan Feb March April May June

Inflow of cash/Sources

(1) 5% sales made on

cash basis

15000 22500 30000 15000 15000 3750

(2) 80% of the previous

month sales received

120000 240000 360000 480000 240000 240000

(3) 15% of the sales of 22500 22500 45000 67500 90000 45000

8

(10000+5000)/500000*100

3%

Birenbaum, 2016).

Non-current liabilities:

Loan through external

borrowings raises non-

current liabilities.

payment will be

results in outflow.

TASK 3

3.1 Making budget & its interpretation for appropriate decisions

In simple meaning, budgeting is defined as a prospective plan for the future planned

activities and regular functionality comprising both the revenue nature and capital nature

transactions. However, cash budget refers to business planning keeping in view a specific element

of balance sheet, cash. It is a well-structured or summarized plan about expected or prospective

receipts and disbursement of cash over the period. For instance, sales of antique items will drive

cash in to the Clariton whereas expenditures, wages, salaries, bills for utility consumption are the

reasons for outflow of cash.

Net cash position = Inflow of cash – Outflow of cash

Importance or benefits of cash budget

Determining the amount of cash collection & its disbursement

It recognises the balance of cash for the decision-making purpose because having huge

money in the business without any use is not considered idle, because, by putting it in an

alternative investment purpose can help CAL to gain reasonable return.

Right and better allocation and distribution of cash resources in marketing, production &

other divisions (Harris and et.al., 2016).

Guide personnel and direct & align their efforts towards the corporate aims & goals helps to

maximize staff productivity.

It helps managers to closely supervise and monitor their staff capabilities whether they are

performing in line with the set budgets or not (Bir, 2016).

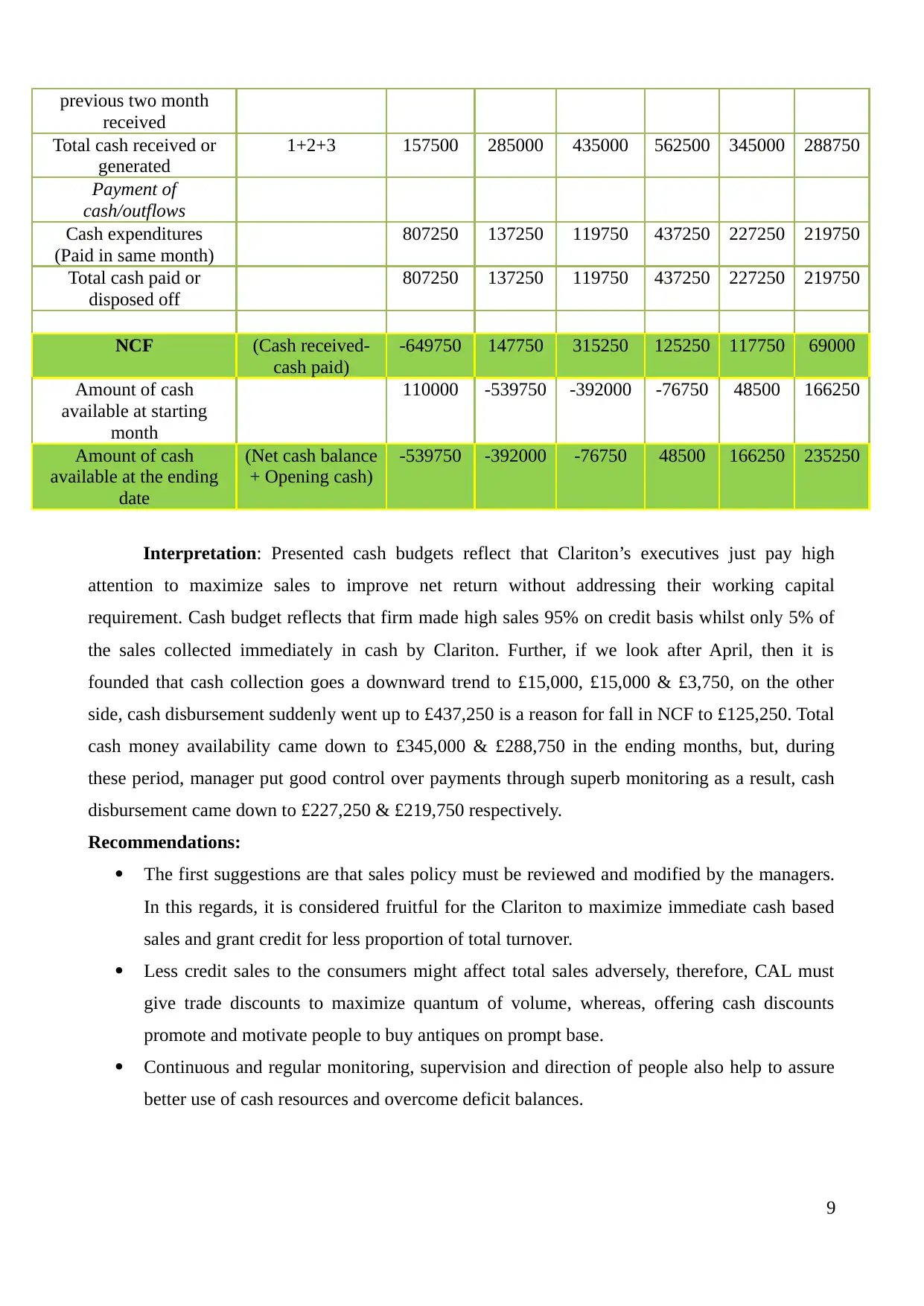

Particulars Jan Feb March April May June

Inflow of cash/Sources

(1) 5% sales made on

cash basis

15000 22500 30000 15000 15000 3750

(2) 80% of the previous

month sales received

120000 240000 360000 480000 240000 240000

(3) 15% of the sales of 22500 22500 45000 67500 90000 45000

8

previous two month

received

Total cash received or

generated

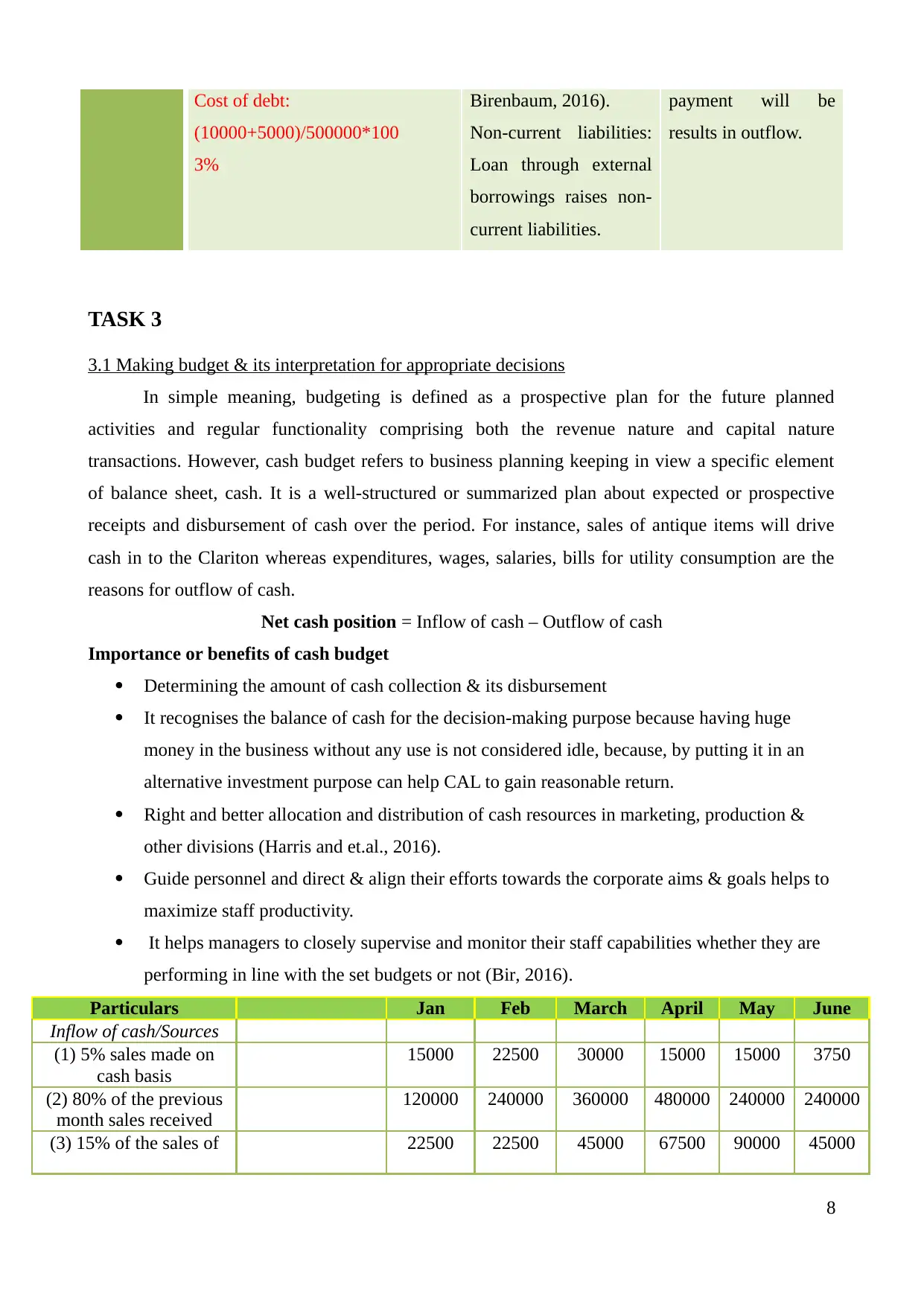

1+2+3 157500 285000 435000 562500 345000 288750

Payment of

cash/outflows

Cash expenditures

(Paid in same month)

807250 137250 119750 437250 227250 219750

Total cash paid or

disposed off

807250 137250 119750 437250 227250 219750

NCF (Cash received-

cash paid)

-649750 147750 315250 125250 117750 69000

Amount of cash

available at starting

month

110000 -539750 -392000 -76750 48500 166250

Amount of cash

available at the ending

date

(Net cash balance

+ Opening cash)

-539750 -392000 -76750 48500 166250 235250

Interpretation: Presented cash budgets reflect that Clariton’s executives just pay high

attention to maximize sales to improve net return without addressing their working capital

requirement. Cash budget reflects that firm made high sales 95% on credit basis whilst only 5% of

the sales collected immediately in cash by Clariton. Further, if we look after April, then it is

founded that cash collection goes a downward trend to £15,000, £15,000 & £3,750, on the other

side, cash disbursement suddenly went up to £437,250 is a reason for fall in NCF to £125,250. Total

cash money availability came down to £345,000 & £288,750 in the ending months, but, during

these period, manager put good control over payments through superb monitoring as a result, cash

disbursement came down to £227,250 & £219,750 respectively.

Recommendations:

The first suggestions are that sales policy must be reviewed and modified by the managers.

In this regards, it is considered fruitful for the Clariton to maximize immediate cash based

sales and grant credit for less proportion of total turnover.

Less credit sales to the consumers might affect total sales adversely, therefore, CAL must

give trade discounts to maximize quantum of volume, whereas, offering cash discounts

promote and motivate people to buy antiques on prompt base.

Continuous and regular monitoring, supervision and direction of people also help to assure

better use of cash resources and overcome deficit balances.

9

received

Total cash received or

generated

1+2+3 157500 285000 435000 562500 345000 288750

Payment of

cash/outflows

Cash expenditures

(Paid in same month)

807250 137250 119750 437250 227250 219750

Total cash paid or

disposed off

807250 137250 119750 437250 227250 219750

NCF (Cash received-

cash paid)

-649750 147750 315250 125250 117750 69000

Amount of cash

available at starting

month

110000 -539750 -392000 -76750 48500 166250

Amount of cash

available at the ending

date

(Net cash balance

+ Opening cash)

-539750 -392000 -76750 48500 166250 235250

Interpretation: Presented cash budgets reflect that Clariton’s executives just pay high

attention to maximize sales to improve net return without addressing their working capital

requirement. Cash budget reflects that firm made high sales 95% on credit basis whilst only 5% of

the sales collected immediately in cash by Clariton. Further, if we look after April, then it is

founded that cash collection goes a downward trend to £15,000, £15,000 & £3,750, on the other

side, cash disbursement suddenly went up to £437,250 is a reason for fall in NCF to £125,250. Total

cash money availability came down to £345,000 & £288,750 in the ending months, but, during

these period, manager put good control over payments through superb monitoring as a result, cash

disbursement came down to £227,250 & £219,750 respectively.

Recommendations:

The first suggestions are that sales policy must be reviewed and modified by the managers.

In this regards, it is considered fruitful for the Clariton to maximize immediate cash based

sales and grant credit for less proportion of total turnover.

Less credit sales to the consumers might affect total sales adversely, therefore, CAL must

give trade discounts to maximize quantum of volume, whereas, offering cash discounts

promote and motivate people to buy antiques on prompt base.

Continuous and regular monitoring, supervision and direction of people also help to assure

better use of cash resources and overcome deficit balances.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

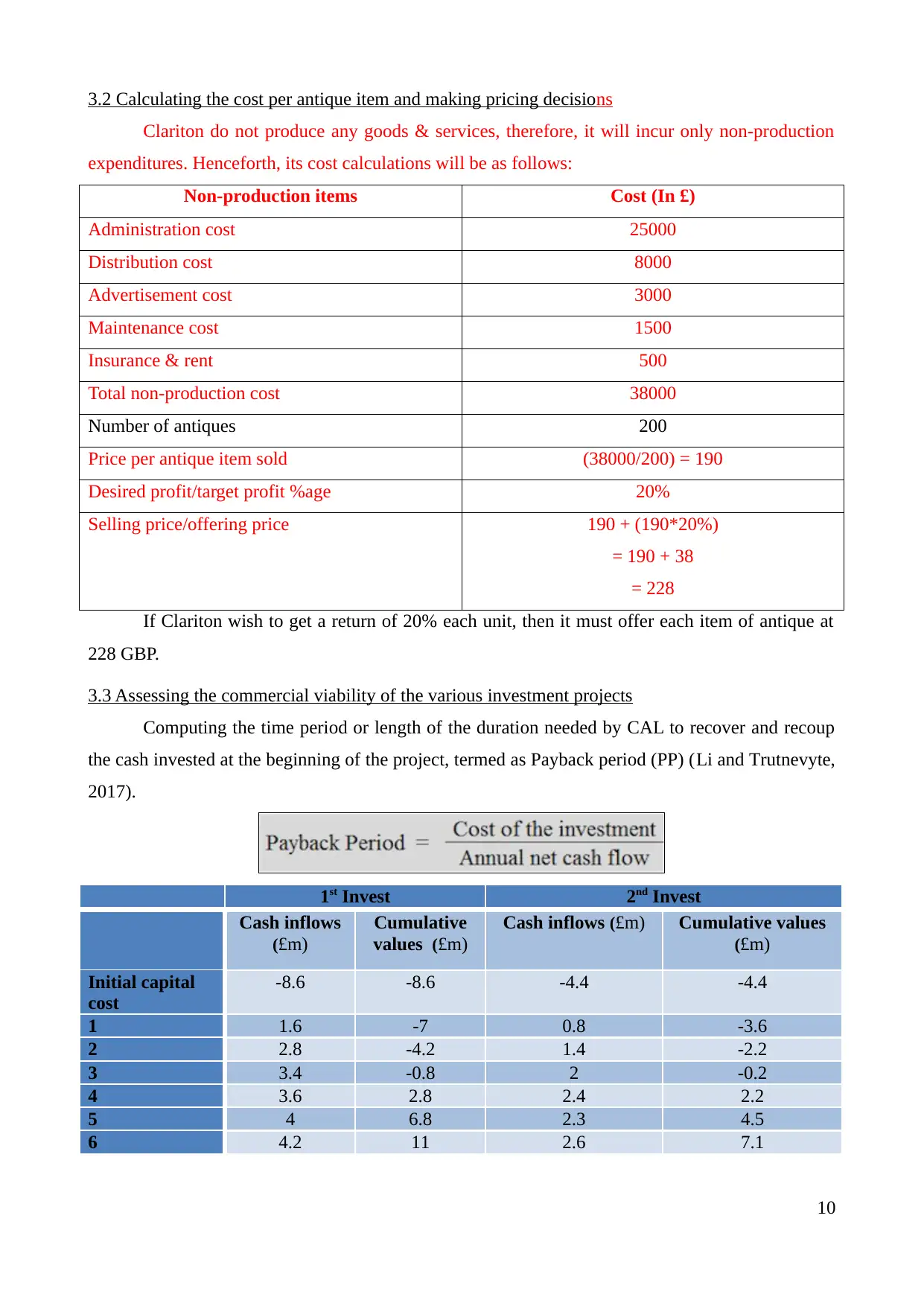

3.2 Calculating the cost per antique item and making pricing decisions

Clariton do not produce any goods & services, therefore, it will incur only non-production

expenditures. Henceforth, its cost calculations will be as follows:

Non-production items Cost (In £)

Administration cost 25000

Distribution cost 8000

Advertisement cost 3000

Maintenance cost 1500

Insurance & rent 500

Total non-production cost 38000

Number of antiques 200

Price per antique item sold (38000/200) = 190

Desired profit/target profit %age 20%

Selling price/offering price 190 + (190*20%)

= 190 + 38

= 228

If Clariton wish to get a return of 20% each unit, then it must offer each item of antique at

228 GBP.

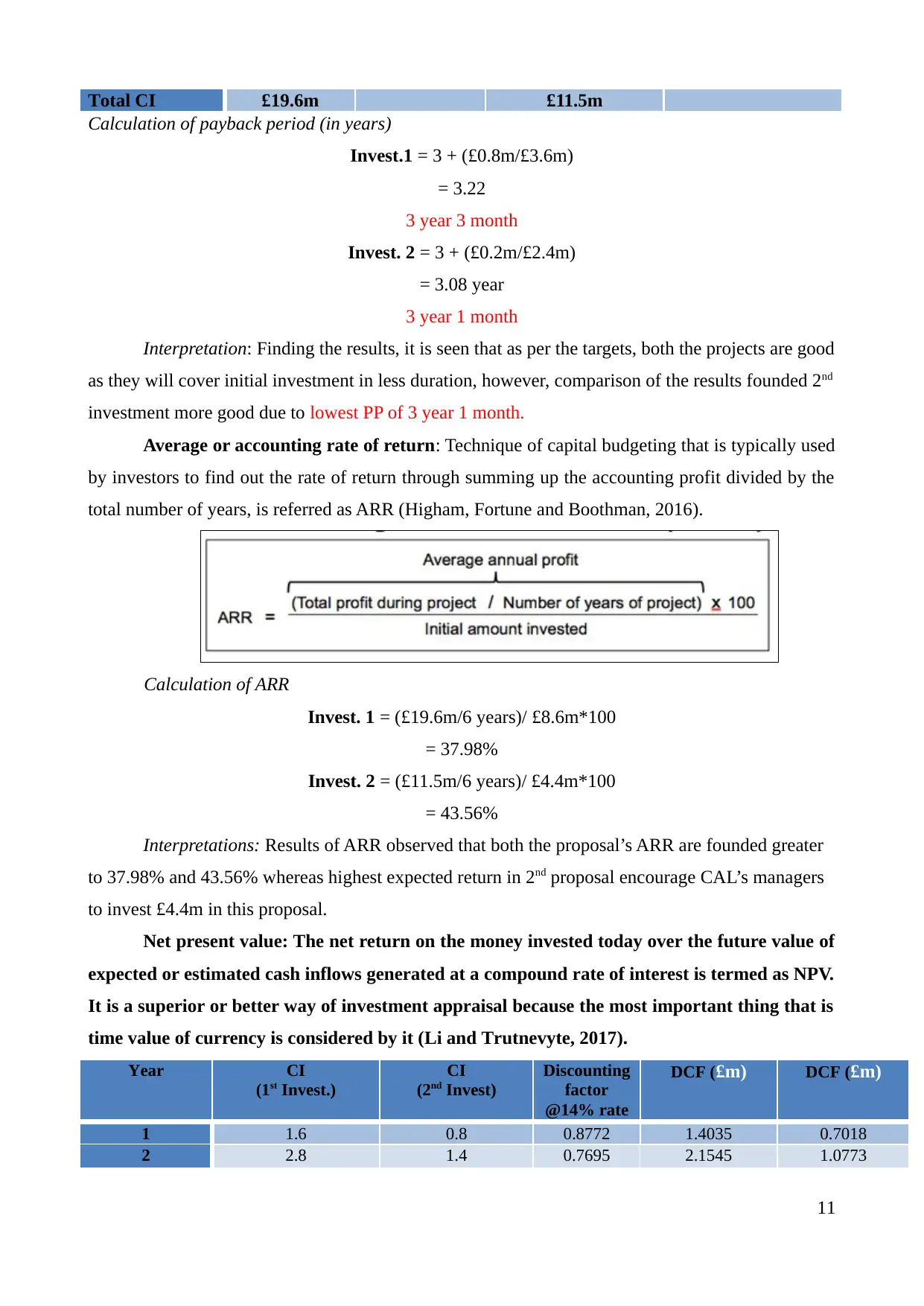

3.3 Assessing the commercial viability of the various investment projects

Computing the time period or length of the duration needed by CAL to recover and recoup

the cash invested at the beginning of the project, termed as Payback period (PP) (Li and Trutnevyte,

2017).

1st Invest 2nd Invest

Cash inflows

(£m)

Cumulative

values (£m)

Cash inflows (£m) Cumulative values

(£m)

Initial capital

cost

-8.6 -8.6 -4.4 -4.4

1 1.6 -7 0.8 -3.6

2 2.8 -4.2 1.4 -2.2

3 3.4 -0.8 2 -0.2

4 3.6 2.8 2.4 2.2

5 4 6.8 2.3 4.5

6 4.2 11 2.6 7.1

10

Clariton do not produce any goods & services, therefore, it will incur only non-production

expenditures. Henceforth, its cost calculations will be as follows:

Non-production items Cost (In £)

Administration cost 25000

Distribution cost 8000

Advertisement cost 3000

Maintenance cost 1500

Insurance & rent 500

Total non-production cost 38000

Number of antiques 200

Price per antique item sold (38000/200) = 190

Desired profit/target profit %age 20%

Selling price/offering price 190 + (190*20%)

= 190 + 38

= 228

If Clariton wish to get a return of 20% each unit, then it must offer each item of antique at

228 GBP.

3.3 Assessing the commercial viability of the various investment projects

Computing the time period or length of the duration needed by CAL to recover and recoup

the cash invested at the beginning of the project, termed as Payback period (PP) (Li and Trutnevyte,

2017).

1st Invest 2nd Invest

Cash inflows

(£m)

Cumulative

values (£m)

Cash inflows (£m) Cumulative values

(£m)

Initial capital

cost

-8.6 -8.6 -4.4 -4.4

1 1.6 -7 0.8 -3.6

2 2.8 -4.2 1.4 -2.2

3 3.4 -0.8 2 -0.2

4 3.6 2.8 2.4 2.2

5 4 6.8 2.3 4.5

6 4.2 11 2.6 7.1

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total CI £19.6m £11.5m

Calculation of payback period (in years)

Invest.1 = 3 + (£0.8m/£3.6m)

= 3.22

3 year 3 month

Invest. 2 = 3 + (£0.2m/£2.4m)

= 3.08 year

3 year 1 month

Interpretation: Finding the results, it is seen that as per the targets, both the projects are good

as they will cover initial investment in less duration, however, comparison of the results founded 2nd

investment more good due to lowest PP of 3 year 1 month.

Average or accounting rate of return: Technique of capital budgeting that is typically used

by investors to find out the rate of return through summing up the accounting profit divided by the

total number of years, is referred as ARR (Higham, Fortune and Boothman, 2016).

Calculation of ARR

Invest. 1 = (£19.6m/6 years)/ £8.6m*100

= 37.98%

Invest. 2 = (£11.5m/6 years)/ £4.4m*100

= 43.56%

Interpretations: Results of ARR observed that both the proposal’s ARR are founded greater

to 37.98% and 43.56% whereas highest expected return in 2nd proposal encourage CAL’s managers

to invest £4.4m in this proposal.

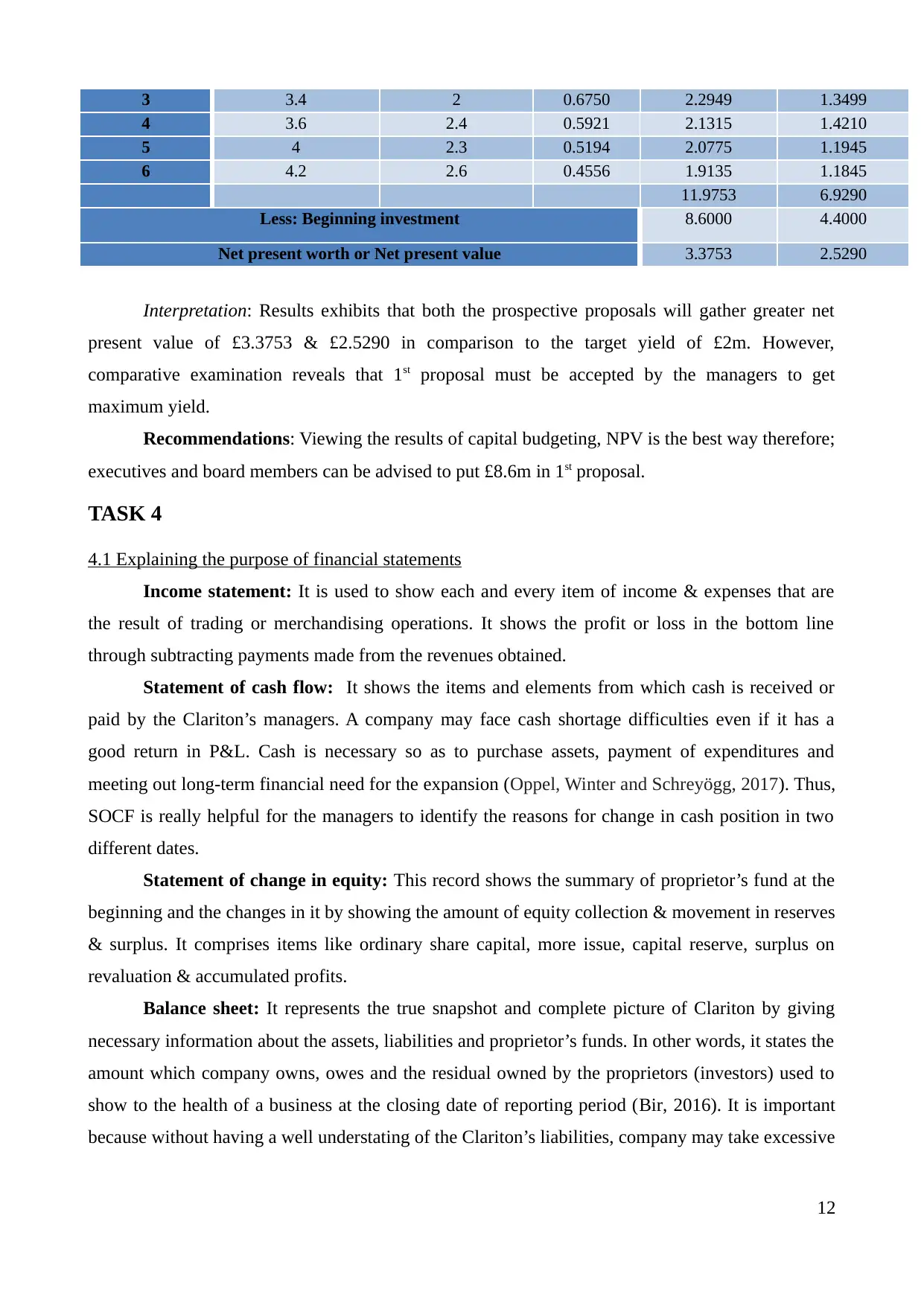

Net present value: The net return on the money invested today over the future value of

expected or estimated cash inflows generated at a compound rate of interest is termed as NPV.

It is a superior or better way of investment appraisal because the most important thing that is

time value of currency is considered by it (Li and Trutnevyte, 2017).

Year CI

(1st Invest.)

CI

(2nd Invest)

Discounting

factor

@14% rate

DCF (£m) DCF (£m)

1 1.6 0.8 0.8772 1.4035 0.7018

2 2.8 1.4 0.7695 2.1545 1.0773

11

Calculation of payback period (in years)

Invest.1 = 3 + (£0.8m/£3.6m)

= 3.22

3 year 3 month

Invest. 2 = 3 + (£0.2m/£2.4m)

= 3.08 year

3 year 1 month

Interpretation: Finding the results, it is seen that as per the targets, both the projects are good

as they will cover initial investment in less duration, however, comparison of the results founded 2nd

investment more good due to lowest PP of 3 year 1 month.

Average or accounting rate of return: Technique of capital budgeting that is typically used

by investors to find out the rate of return through summing up the accounting profit divided by the

total number of years, is referred as ARR (Higham, Fortune and Boothman, 2016).

Calculation of ARR

Invest. 1 = (£19.6m/6 years)/ £8.6m*100

= 37.98%

Invest. 2 = (£11.5m/6 years)/ £4.4m*100

= 43.56%

Interpretations: Results of ARR observed that both the proposal’s ARR are founded greater

to 37.98% and 43.56% whereas highest expected return in 2nd proposal encourage CAL’s managers

to invest £4.4m in this proposal.

Net present value: The net return on the money invested today over the future value of

expected or estimated cash inflows generated at a compound rate of interest is termed as NPV.

It is a superior or better way of investment appraisal because the most important thing that is

time value of currency is considered by it (Li and Trutnevyte, 2017).

Year CI

(1st Invest.)

CI

(2nd Invest)

Discounting

factor

@14% rate

DCF (£m) DCF (£m)

1 1.6 0.8 0.8772 1.4035 0.7018

2 2.8 1.4 0.7695 2.1545 1.0773

11

3 3.4 2 0.6750 2.2949 1.3499

4 3.6 2.4 0.5921 2.1315 1.4210

5 4 2.3 0.5194 2.0775 1.1945

6 4.2 2.6 0.4556 1.9135 1.1845

11.9753 6.9290

Less: Beginning investment 8.6000 4.4000

Net present worth or Net present value 3.3753 2.5290

Interpretation: Results exhibits that both the prospective proposals will gather greater net

present value of £3.3753 & £2.5290 in comparison to the target yield of £2m. However,

comparative examination reveals that 1st proposal must be accepted by the managers to get

maximum yield.

Recommendations: Viewing the results of capital budgeting, NPV is the best way therefore;

executives and board members can be advised to put £8.6m in 1st proposal.

TASK 4

4.1 Explaining the purpose of financial statements

Income statement: It is used to show each and every item of income & expenses that are

the result of trading or merchandising operations. It shows the profit or loss in the bottom line

through subtracting payments made from the revenues obtained.

Statement of cash flow: It shows the items and elements from which cash is received or

paid by the Clariton’s managers. A company may face cash shortage difficulties even if it has a

good return in P&L. Cash is necessary so as to purchase assets, payment of expenditures and

meeting out long-term financial need for the expansion (Oppel, Winter and Schreyögg, 2017). Thus,

SOCF is really helpful for the managers to identify the reasons for change in cash position in two

different dates.

Statement of change in equity: This record shows the summary of proprietor’s fund at the

beginning and the changes in it by showing the amount of equity collection & movement in reserves

& surplus. It comprises items like ordinary share capital, more issue, capital reserve, surplus on

revaluation & accumulated profits.

Balance sheet: It represents the true snapshot and complete picture of Clariton by giving

necessary information about the assets, liabilities and proprietor’s funds. In other words, it states the

amount which company owns, owes and the residual owned by the proprietors (investors) used to

show to the health of a business at the closing date of reporting period (Bir, 2016). It is important

because without having a well understating of the Clariton’s liabilities, company may take excessive

12

4 3.6 2.4 0.5921 2.1315 1.4210

5 4 2.3 0.5194 2.0775 1.1945

6 4.2 2.6 0.4556 1.9135 1.1845

11.9753 6.9290

Less: Beginning investment 8.6000 4.4000

Net present worth or Net present value 3.3753 2.5290

Interpretation: Results exhibits that both the prospective proposals will gather greater net

present value of £3.3753 & £2.5290 in comparison to the target yield of £2m. However,

comparative examination reveals that 1st proposal must be accepted by the managers to get

maximum yield.

Recommendations: Viewing the results of capital budgeting, NPV is the best way therefore;

executives and board members can be advised to put £8.6m in 1st proposal.

TASK 4

4.1 Explaining the purpose of financial statements

Income statement: It is used to show each and every item of income & expenses that are

the result of trading or merchandising operations. It shows the profit or loss in the bottom line

through subtracting payments made from the revenues obtained.

Statement of cash flow: It shows the items and elements from which cash is received or

paid by the Clariton’s managers. A company may face cash shortage difficulties even if it has a

good return in P&L. Cash is necessary so as to purchase assets, payment of expenditures and

meeting out long-term financial need for the expansion (Oppel, Winter and Schreyögg, 2017). Thus,

SOCF is really helpful for the managers to identify the reasons for change in cash position in two

different dates.

Statement of change in equity: This record shows the summary of proprietor’s fund at the

beginning and the changes in it by showing the amount of equity collection & movement in reserves

& surplus. It comprises items like ordinary share capital, more issue, capital reserve, surplus on

revaluation & accumulated profits.

Balance sheet: It represents the true snapshot and complete picture of Clariton by giving

necessary information about the assets, liabilities and proprietor’s funds. In other words, it states the

amount which company owns, owes and the residual owned by the proprietors (investors) used to

show to the health of a business at the closing date of reporting period (Bir, 2016). It is important

because without having a well understating of the Clariton’s liabilities, company may take excessive

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.