Managing Financial Resources and Decisions: Detailed Report Analysis

VerifiedAdded on 2020/01/28

|25

|7043

|600

Report

AI Summary

This report, designed for a finance course, analyzes the crucial aspects of managing financial resources and making sound financial decisions. It begins by identifying various sources of finance available to businesses, including equity shares, debentures, and financial institutions like commercial banks. The report assesses the implications and associated costs of each source, evaluating their suitability for different business projects. It delves into the significance of financial planning, emphasizing its role in preventing unnecessary resource allocation and aiding in effective capital structure decisions. Furthermore, the report assesses the information needs of decision-makers and explains the impact of finance on financial statements. It then explores investment appraisal techniques, assessing project viability. The report concludes by discussing key financial statements, comparing their formats for different business types, and interpreting them using financial ratios. This comprehensive analysis provides valuable insights into financial management principles.

MANAGING FINANCIAL

RESOURCES

AND

DECISIONS

RESOURCES

AND

DECISIONS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

.........................................................................................................................................................3

INTRODUCTION...........................................................................................................................4

TASK 1............................................................................................................................................4

1.1 Identifying sources of finance that are available to business.................................................4

1.2 Assessing the implications of different sources.....................................................................5

1.3 Evaluating appropriate sources of finance for a business project..........................................6

2.1 Analyzing the cost of various source of finance....................................................................6

TASK 2............................................................................................................................................7

2.2 Explaining the significance of financial planning.................................................................7

To see that firm does not raise resources unnecessarily:...................................................7

Provide assistance in fixing appropriate capital structure: ...............................................8

3. Helps in Investing Finance in Right Projects:...............................................................8

2.3 Assessing the information needs of different decision makers..............................................8

2.4 Explain the impact of finance on the financial statements...................................................9

TASK 3 .........................................................................................................................................11

3.3 Assessing the viability of a project with the help of investment appraisal techniques. ......14

TASK 4 .........................................................................................................................................18

4.1 Discussing the key financial statements..............................................................................18

4.2 Comparing the appropriate formats of financial statements for varied kinds of business...18

4.3 Interpreting financial statements using appropriate ratios and comparison of same ..........19

REFERENCES..............................................................................................................................22

2

.........................................................................................................................................................3

INTRODUCTION...........................................................................................................................4

TASK 1............................................................................................................................................4

1.1 Identifying sources of finance that are available to business.................................................4

1.2 Assessing the implications of different sources.....................................................................5

1.3 Evaluating appropriate sources of finance for a business project..........................................6

2.1 Analyzing the cost of various source of finance....................................................................6

TASK 2............................................................................................................................................7

2.2 Explaining the significance of financial planning.................................................................7

To see that firm does not raise resources unnecessarily:...................................................7

Provide assistance in fixing appropriate capital structure: ...............................................8

3. Helps in Investing Finance in Right Projects:...............................................................8

2.3 Assessing the information needs of different decision makers..............................................8

2.4 Explain the impact of finance on the financial statements...................................................9

TASK 3 .........................................................................................................................................11

3.3 Assessing the viability of a project with the help of investment appraisal techniques. ......14

TASK 4 .........................................................................................................................................18

4.1 Discussing the key financial statements..............................................................................18

4.2 Comparing the appropriate formats of financial statements for varied kinds of business...18

4.3 Interpreting financial statements using appropriate ratios and comparison of same ..........19

REFERENCES..............................................................................................................................22

2

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Its very important for every kind of organization to make choice of source of finance. As

the choice affects the cash flows of the organization and place impact over the profitability.

Every source comprises different implications as well as cost of the organization (Managing

Financial Resources and Decisions, 2016). Looking at the present competitive and dynamic

business world, it is primary goals of the organizations to have an adequate availability of funds

any time so that it can protect itself from the potential threats. Having required quantity of

finance sources and its proper administration is necessary so that business can achieve their

financial goals in most effectual manner (Adams and et.al., 2010). Present project assignment

will demonstrate different types of sources that an organization can use to fulfill their financial

need. Effective analysis and examination of the sources helps to identify most appropriate

sources so that firms can fulfill their financial requirement at less cost.

TASK 1

1.1 Identifying sources of finance that are available to business

There are various sources of finance from which a business can raise funds: Those are:

Equity Shares/ Share Capital

Share capital is a amount that company raises from the proceeds of shares of stock from

the public investors. Share capital includes equity financing and can be generated through the

sale of common or preferred shares (Beck, Levine and Loayza, 2010). Though share capital

refers to a dollar amount, it is dictated by the number and selling price of a organisation shares.

For example, If a company issues 1,000 shares for £25 per share, it generates £25,000 in share

capital. Share capital falls into one of several categories, depending on where the company is in

the equity-raising process.

Debentures

Debenture us a long term instrument with the help of which copies borrow money from

general public at fixed rate of interest. In originally it can be refer to as the document that either

created acknowledges while some countries are using bonds loan stock etc these days (Bennouna

and et.al., 2010).

Financial Institutes

4

Its very important for every kind of organization to make choice of source of finance. As

the choice affects the cash flows of the organization and place impact over the profitability.

Every source comprises different implications as well as cost of the organization (Managing

Financial Resources and Decisions, 2016). Looking at the present competitive and dynamic

business world, it is primary goals of the organizations to have an adequate availability of funds

any time so that it can protect itself from the potential threats. Having required quantity of

finance sources and its proper administration is necessary so that business can achieve their

financial goals in most effectual manner (Adams and et.al., 2010). Present project assignment

will demonstrate different types of sources that an organization can use to fulfill their financial

need. Effective analysis and examination of the sources helps to identify most appropriate

sources so that firms can fulfill their financial requirement at less cost.

TASK 1

1.1 Identifying sources of finance that are available to business

There are various sources of finance from which a business can raise funds: Those are:

Equity Shares/ Share Capital

Share capital is a amount that company raises from the proceeds of shares of stock from

the public investors. Share capital includes equity financing and can be generated through the

sale of common or preferred shares (Beck, Levine and Loayza, 2010). Though share capital

refers to a dollar amount, it is dictated by the number and selling price of a organisation shares.

For example, If a company issues 1,000 shares for £25 per share, it generates £25,000 in share

capital. Share capital falls into one of several categories, depending on where the company is in

the equity-raising process.

Debentures

Debenture us a long term instrument with the help of which copies borrow money from

general public at fixed rate of interest. In originally it can be refer to as the document that either

created acknowledges while some countries are using bonds loan stock etc these days (Bennouna

and et.al., 2010).

Financial Institutes

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial institute is a establishment that conducts the financial transactions such as

loans, deposits, investments etc (Bhimani, Datar and Foster, 2002). Everything from depositing

money to taking out of loans and exchanging currencies must be done through financial

institutions. Here is an overview of some of the major categories of financial institutions and

their roles in the financial system.

Commercial Banks

A commercial bank is a financial institution that provides different financial service, such

as issuing loans as well as accepting deposits. Commercial bank customers can take advantage of

a range of investment products that commercial banks offer like savings accounts and certificates

of deposit (Blocher, Chen and Lin, 2008). The loans a commercial bank issues can vary from

business loans and auto loans to mortgages.

1.2 Assessing the implications of different sources

Implications of share capital are it helps in increasing the flexibility in issuing additional

stock that is considered as a security that is not require to be paid back. Under this the

organizations are not required to make regular interest or principal payments that gives

management more operational flexibility. It also leads to the dilution of ownership of existing

shareholders (Bougheas, Mizen and Yalcin, 2006).

Debentures does not result into the dilution of interest of equity shareholders as they do

not have any right to vote or either to take a part into the management of organisation. Also the

interest is tax deductible expenditure and so saves income tax. Another implication of debenture

is that cost of debenture is low in comparison to equity as well as preference shares. However,

payment of interest on debenture is obligatory and hence it becomes burden if the company

incurs loss (Broadbent and et.al., 2012).

Implication of financial institute carries both loan capital as well as risk and also provides

facility of underwriting. For the organizations which have been set up at a low scale it is easier

for them to take loan from financial institution than that of taking loans from public. However,

concern requiring finance from public financial institutions has to submit itself to a thorough

investigation that involves a number of formalities and documents (Brunzell and et.al., 2013).

Implications of Commercial Banks are that it is quick and cost effective way of raising

regular working capital. It is best way in which the organisation can make advantage of short

5

loans, deposits, investments etc (Bhimani, Datar and Foster, 2002). Everything from depositing

money to taking out of loans and exchanging currencies must be done through financial

institutions. Here is an overview of some of the major categories of financial institutions and

their roles in the financial system.

Commercial Banks

A commercial bank is a financial institution that provides different financial service, such

as issuing loans as well as accepting deposits. Commercial bank customers can take advantage of

a range of investment products that commercial banks offer like savings accounts and certificates

of deposit (Blocher, Chen and Lin, 2008). The loans a commercial bank issues can vary from

business loans and auto loans to mortgages.

1.2 Assessing the implications of different sources

Implications of share capital are it helps in increasing the flexibility in issuing additional

stock that is considered as a security that is not require to be paid back. Under this the

organizations are not required to make regular interest or principal payments that gives

management more operational flexibility. It also leads to the dilution of ownership of existing

shareholders (Bougheas, Mizen and Yalcin, 2006).

Debentures does not result into the dilution of interest of equity shareholders as they do

not have any right to vote or either to take a part into the management of organisation. Also the

interest is tax deductible expenditure and so saves income tax. Another implication of debenture

is that cost of debenture is low in comparison to equity as well as preference shares. However,

payment of interest on debenture is obligatory and hence it becomes burden if the company

incurs loss (Broadbent and et.al., 2012).

Implication of financial institute carries both loan capital as well as risk and also provides

facility of underwriting. For the organizations which have been set up at a low scale it is easier

for them to take loan from financial institution than that of taking loans from public. However,

concern requiring finance from public financial institutions has to submit itself to a thorough

investigation that involves a number of formalities and documents (Brunzell and et.al., 2013).

Implications of Commercial Banks are that it is quick and cost effective way of raising

regular working capital. It is best way in which the organisation can make advantage of short

5

term interest fluctuations in the markets and also provides exit opportunities to investors to quit

their investments (Georgiou, 2010). However, It is available only to a few selected blue chip and

profitable companies. By issuing commercial paper, the credit available from the banks may get

reduced. Issue of commercial paper is very closely regulated by the RBI guidelines.

1.3 Evaluating appropriate sources of finance for a business project

In order to prepare a business project the company can take loan from two sources that

are commercial banks and financial institutions. As in case if financial institute it is easier for the

companies to recover the theft amount if any. This can be better understand with an example that

is in any case money will be paid back if any hacker has wiped out all financial resource form

the account (Gray and et.al., 2011). Secondly financial institution provides more freedom as if

the company wants to transfer money from other account there is no need to pay extra fees

charges, drop interest rate as well as change policy etc. Hence it will be easier for the company to

move its business somewhere else etc.

Another helpful source for the organization will be of commercial banking can help a

small business by making it easier to manage day-to-day financial tasks. An established

commercial account with a bank will make it easier to borrow money when you grow your

business. Often a business is assigned a representative who works directly with the company to

find the best services and solutions for the issues the business is facing. For example, the

company may save money by outsourcing payroll processing (Adams and et.al., 2010). Banks

also offer invoicing services, with personalized invoices, and can set up transfers to other banks

which will simplify accounting procedures. Some banks offer retirement account management

for your employees as well as other employee benefits. This can save you money, and make it

easier to manage all of the services you offer employees. Some banks allow you to make

deposits online by scanning checks. Your bank may offer you discounts on your merchant

services fees. Commercial banking allows you to set up direct deposits for your employees as

well as for any invoices you need to pay to others, which will save you time.

Since its inception that company wants to expand in market and thus it require large

amount of funds for different business activities. In this respect, company needs to invest in new

building. Therefore, it can obtain bank loan as it provide large amount of funds at flexible

interest rate. The construction loan can be obtained and can be easily repaid in few installments.

6

their investments (Georgiou, 2010). However, It is available only to a few selected blue chip and

profitable companies. By issuing commercial paper, the credit available from the banks may get

reduced. Issue of commercial paper is very closely regulated by the RBI guidelines.

1.3 Evaluating appropriate sources of finance for a business project

In order to prepare a business project the company can take loan from two sources that

are commercial banks and financial institutions. As in case if financial institute it is easier for the

companies to recover the theft amount if any. This can be better understand with an example that

is in any case money will be paid back if any hacker has wiped out all financial resource form

the account (Gray and et.al., 2011). Secondly financial institution provides more freedom as if

the company wants to transfer money from other account there is no need to pay extra fees

charges, drop interest rate as well as change policy etc. Hence it will be easier for the company to

move its business somewhere else etc.

Another helpful source for the organization will be of commercial banking can help a

small business by making it easier to manage day-to-day financial tasks. An established

commercial account with a bank will make it easier to borrow money when you grow your

business. Often a business is assigned a representative who works directly with the company to

find the best services and solutions for the issues the business is facing. For example, the

company may save money by outsourcing payroll processing (Adams and et.al., 2010). Banks

also offer invoicing services, with personalized invoices, and can set up transfers to other banks

which will simplify accounting procedures. Some banks offer retirement account management

for your employees as well as other employee benefits. This can save you money, and make it

easier to manage all of the services you offer employees. Some banks allow you to make

deposits online by scanning checks. Your bank may offer you discounts on your merchant

services fees. Commercial banking allows you to set up direct deposits for your employees as

well as for any invoices you need to pay to others, which will save you time.

Since its inception that company wants to expand in market and thus it require large

amount of funds for different business activities. In this respect, company needs to invest in new

building. Therefore, it can obtain bank loan as it provide large amount of funds at flexible

interest rate. The construction loan can be obtained and can be easily repaid in few installments.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Further, for meeting the working capital requirement it is significant for company to use retained

earning or accumulated depreciation. It is effective source as funds are accessible to the business

without any explicit cost. Similarly, for need of business like new and expensive machinery

company can use leasing. Therefore, in exchange of some payment, company can use the

machine of other party. Thus, firm will be saved for blocking too much funds in purchasing the

asset and thus will be only responsible for its service and maintenance.

2.1 Analyzing the cost of various source of finance

However, financial institute as a source of finances leads towards various cost. In other

words, one of the major cost of financial obligation is of low return on the investment that is the

companies. Also it includes fees and commissions as well as opposing goals. It is important to

consider the cost of fees commission interest rates as well as potential alternatives before mailing

any sort of financial transactions. Customers are required to vary on the basis of opportunities

that can be seem too good to be true or that to make promise high guaranteed returns (Beck,

Levine and Loayza, 2010).

Commercial banking or business accounts are often more expensive than traditional bank

accounts. Banks may charge fees for night deposits, for processing a certain number of checks

and for the payroll services. Depending on the size of your business, some of the services offered

may not be needed, and you may still be charged for the services even if you're not fully using

them (Bennouna and et.al., 2010). Different banks may offer different services and charge

different fees, and it can be difficult to compare the services. Signing up for a commercial

account before your business is ready for one will cost you and may slow the growth of the

business. If you choose the wrong bank, you may have a difficult time opening a new account

and transferring all of the services to another bank. This can cost you both time and money.

Overall, it can be stated that different sources of finance comes up with different cost. The

detailed explanation of which is as follows:

Bank loan: It is easy to obtain funds from commercial bank but they involve significant

cost and expenses. The entity is required to pay interest charges on the amount obtained

through loan.

7

earning or accumulated depreciation. It is effective source as funds are accessible to the business

without any explicit cost. Similarly, for need of business like new and expensive machinery

company can use leasing. Therefore, in exchange of some payment, company can use the

machine of other party. Thus, firm will be saved for blocking too much funds in purchasing the

asset and thus will be only responsible for its service and maintenance.

2.1 Analyzing the cost of various source of finance

However, financial institute as a source of finances leads towards various cost. In other

words, one of the major cost of financial obligation is of low return on the investment that is the

companies. Also it includes fees and commissions as well as opposing goals. It is important to

consider the cost of fees commission interest rates as well as potential alternatives before mailing

any sort of financial transactions. Customers are required to vary on the basis of opportunities

that can be seem too good to be true or that to make promise high guaranteed returns (Beck,

Levine and Loayza, 2010).

Commercial banking or business accounts are often more expensive than traditional bank

accounts. Banks may charge fees for night deposits, for processing a certain number of checks

and for the payroll services. Depending on the size of your business, some of the services offered

may not be needed, and you may still be charged for the services even if you're not fully using

them (Bennouna and et.al., 2010). Different banks may offer different services and charge

different fees, and it can be difficult to compare the services. Signing up for a commercial

account before your business is ready for one will cost you and may slow the growth of the

business. If you choose the wrong bank, you may have a difficult time opening a new account

and transferring all of the services to another bank. This can cost you both time and money.

Overall, it can be stated that different sources of finance comes up with different cost. The

detailed explanation of which is as follows:

Bank loan: It is easy to obtain funds from commercial bank but they involve significant

cost and expenses. The entity is required to pay interest charges on the amount obtained

through loan.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Retained profits: There is no explicit cost involved in the funds obtained from the

retained profits or accumulated depreciation. It involve cost in terms of financial risk as

they are likely to reduce revenue of business.

Debentures: They are long term loans that can be obtained by company in return of fixed

interest rate charges. Therefore,cost involved in debentures is in terms of dividends that

are to be paid every year.

Leasing: It is an agreement whereby one party grants the permission to use a specific

products for duration to the other party. It involve cost in terms of lease rentals which

will be paid by entity at regular intervals.

Grants: It is financial reward that is provided by federal, state or local administration to

an worthy candidate. In order to avail them, one has to pay cost in terms of legal

compliance.

Equity shares: The funds obtained from equity shares is subject to various cost like

interest charges that must be paid after paying off to debenture holders.

Overdrafts: The high rate of interest charges are to paid by company for the amount

overdrawn.

Factoring: It can be defined as short term non banking of accounts receivable. It is help

in obtaining quick cash. However, for this individual has to pay for the commission

charges that are deducted by factor.

TASK 2

2.2 Explaining the significance of financial planning

It is important for every kind or type of organisation conduct a strong financial planing in

order to attain long term success. Some of the significance are as follows:

Ensure availability of funds:

The purpose behind financial planning is to make availability of sufficient fund to meet

day to day expenses and to purchase assets for long term purpose. It check timely accessibility of

finance. Along with availability financial planning also tries to specify the sources of finance

(Importance of a Financial Plan, 2016).

8

retained profits or accumulated depreciation. It involve cost in terms of financial risk as

they are likely to reduce revenue of business.

Debentures: They are long term loans that can be obtained by company in return of fixed

interest rate charges. Therefore,cost involved in debentures is in terms of dividends that

are to be paid every year.

Leasing: It is an agreement whereby one party grants the permission to use a specific

products for duration to the other party. It involve cost in terms of lease rentals which

will be paid by entity at regular intervals.

Grants: It is financial reward that is provided by federal, state or local administration to

an worthy candidate. In order to avail them, one has to pay cost in terms of legal

compliance.

Equity shares: The funds obtained from equity shares is subject to various cost like

interest charges that must be paid after paying off to debenture holders.

Overdrafts: The high rate of interest charges are to paid by company for the amount

overdrawn.

Factoring: It can be defined as short term non banking of accounts receivable. It is help

in obtaining quick cash. However, for this individual has to pay for the commission

charges that are deducted by factor.

TASK 2

2.2 Explaining the significance of financial planning

It is important for every kind or type of organisation conduct a strong financial planing in

order to attain long term success. Some of the significance are as follows:

Ensure availability of funds:

The purpose behind financial planning is to make availability of sufficient fund to meet

day to day expenses and to purchase assets for long term purpose. It check timely accessibility of

finance. Along with availability financial planning also tries to specify the sources of finance

(Importance of a Financial Plan, 2016).

8

To see that firm does not raise resources unnecessarily:

Surplus or extra funding is as bad as deficient or shortfall of monetary fund. If there is

extra money, financial planning must put it in the best possible manner in order to keep the

financial resources idle is a great loss for an organisation (Bhimani, Datar and Foster, 2002).

Financial Planning includes short term and long term planning. Long term planning focuses on

capital expenditure plan whereas short term financial plans are called budgets. Budgets include

detailed plan of action for a period of one year or less (Blocher, Chen and Lin, 2008).

It facilitates optimum collection of funds:

It helps in avoiding situations of surplus capitalization as well as wastage.

Provide assistance in fixing appropriate capital structure:

Funds should be arranged from different sources and are used for long term, medium

term and short term. Financial planning is essential for sound proper sources at appropriate time

as long term funds are generally contributed by shareholders and debenture holders, medium

term by financial institutions and short term by commercial banks (Bougheas, Mizen and Yalcin,

2006).

3. Helps in Investing Finance in Right Projects:

Financial plan suggests how the funds are to be allocated for various purposes by

comparing various investment proposals.

4. Provides assistance in conducting Operational Activities:

The success or failure of production and distribution function of business depends upon

the financial decisions as right decision ensures smooth flow of finance and smooth operation of

production and distribution (Broadbent and et.al., 2012).

5. Base for Financial Control:

Financial preparation acts as base for evaluating the financial activities by making

comparison between the the actual as well as the estimated revenue and actual cost with

estimation cost (Brunzell and et.al., 2013).

6. Proper Utilization of Finance:

9

Surplus or extra funding is as bad as deficient or shortfall of monetary fund. If there is

extra money, financial planning must put it in the best possible manner in order to keep the

financial resources idle is a great loss for an organisation (Bhimani, Datar and Foster, 2002).

Financial Planning includes short term and long term planning. Long term planning focuses on

capital expenditure plan whereas short term financial plans are called budgets. Budgets include

detailed plan of action for a period of one year or less (Blocher, Chen and Lin, 2008).

It facilitates optimum collection of funds:

It helps in avoiding situations of surplus capitalization as well as wastage.

Provide assistance in fixing appropriate capital structure:

Funds should be arranged from different sources and are used for long term, medium

term and short term. Financial planning is essential for sound proper sources at appropriate time

as long term funds are generally contributed by shareholders and debenture holders, medium

term by financial institutions and short term by commercial banks (Bougheas, Mizen and Yalcin,

2006).

3. Helps in Investing Finance in Right Projects:

Financial plan suggests how the funds are to be allocated for various purposes by

comparing various investment proposals.

4. Provides assistance in conducting Operational Activities:

The success or failure of production and distribution function of business depends upon

the financial decisions as right decision ensures smooth flow of finance and smooth operation of

production and distribution (Broadbent and et.al., 2012).

5. Base for Financial Control:

Financial preparation acts as base for evaluating the financial activities by making

comparison between the the actual as well as the estimated revenue and actual cost with

estimation cost (Brunzell and et.al., 2013).

6. Proper Utilization of Finance:

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance is essential source of the business enterprise. This is because the financial

planning is an integral part of organizational planning. Also the business plans depends upon the

status of the financial planning (Georgiou, 2010).

2.3 Assessing the information needs of different decision makers

It is very important for the organisation to collect financial information of organisation

before taking decision. Financial statement or information may include details regarding the

profit or loss account that will help in evaluating the actual performance scale of the company.

Also the balance plays a important role in providing details regarding business assets and

liabilities and also liquidity of business (Gray and et.al., 2011). Also the information regarding

purchases and sales helps the company in making future trading as well as account with suppliers

and clients. Also the company is required to collect information related to the purchase of asset

and liability, wage paid as well as about cost as it will help them in making decision. This will

further help in making appropriate decision about how to reduce cost or how to increase the sales

as well as profitability of the organisation (Adams and et.al., 2010). Following information also

helps organisation that when to make purchase of new capital asserts and the financial sources.

Financial statement is again a source that helps the company in making future budget and

plans. So that mangers will be able to evaluate budget to find any variances or adjustments are to

be made to make ye decision. Profit and loss as well as balance sheet are the financial statement

that helps in collecting past records and data (Beck, Levine and Loayza, 2010).

Following financial statements can be compared with the results attain by related establishment

in previous time periods in order to determine areas of improvement. For instance, if a firm spots

that its cost of sales is higher than those of a rival it may seek to switch to an alternative supplier,

or take other actions such as reducing direct costs (Bennouna and et.al., 2010). Financial

statement provides information in the form of invaluable statistics and evidences on the basis of

which managers takes decisions.

Therefore,different types of information is needed by different parties having interest in

the operations of company. The creditor require information about the financial stability of

company so as to assure that company will be able to pay of its obligations. With this

information the creditor can decide whether they should lend money or goods on credit to

10

planning is an integral part of organizational planning. Also the business plans depends upon the

status of the financial planning (Georgiou, 2010).

2.3 Assessing the information needs of different decision makers

It is very important for the organisation to collect financial information of organisation

before taking decision. Financial statement or information may include details regarding the

profit or loss account that will help in evaluating the actual performance scale of the company.

Also the balance plays a important role in providing details regarding business assets and

liabilities and also liquidity of business (Gray and et.al., 2011). Also the information regarding

purchases and sales helps the company in making future trading as well as account with suppliers

and clients. Also the company is required to collect information related to the purchase of asset

and liability, wage paid as well as about cost as it will help them in making decision. This will

further help in making appropriate decision about how to reduce cost or how to increase the sales

as well as profitability of the organisation (Adams and et.al., 2010). Following information also

helps organisation that when to make purchase of new capital asserts and the financial sources.

Financial statement is again a source that helps the company in making future budget and

plans. So that mangers will be able to evaluate budget to find any variances or adjustments are to

be made to make ye decision. Profit and loss as well as balance sheet are the financial statement

that helps in collecting past records and data (Beck, Levine and Loayza, 2010).

Following financial statements can be compared with the results attain by related establishment

in previous time periods in order to determine areas of improvement. For instance, if a firm spots

that its cost of sales is higher than those of a rival it may seek to switch to an alternative supplier,

or take other actions such as reducing direct costs (Bennouna and et.al., 2010). Financial

statement provides information in the form of invaluable statistics and evidences on the basis of

which managers takes decisions.

Therefore,different types of information is needed by different parties having interest in

the operations of company. The creditor require information about the financial stability of

company so as to assure that company will be able to pay of its obligations. With this

information the creditor can decide whether they should lend money or goods on credit to

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

particular firm or not. Similarly, shareholders require financial information so as to decide

whether they should purchase the shares of particular company or not.

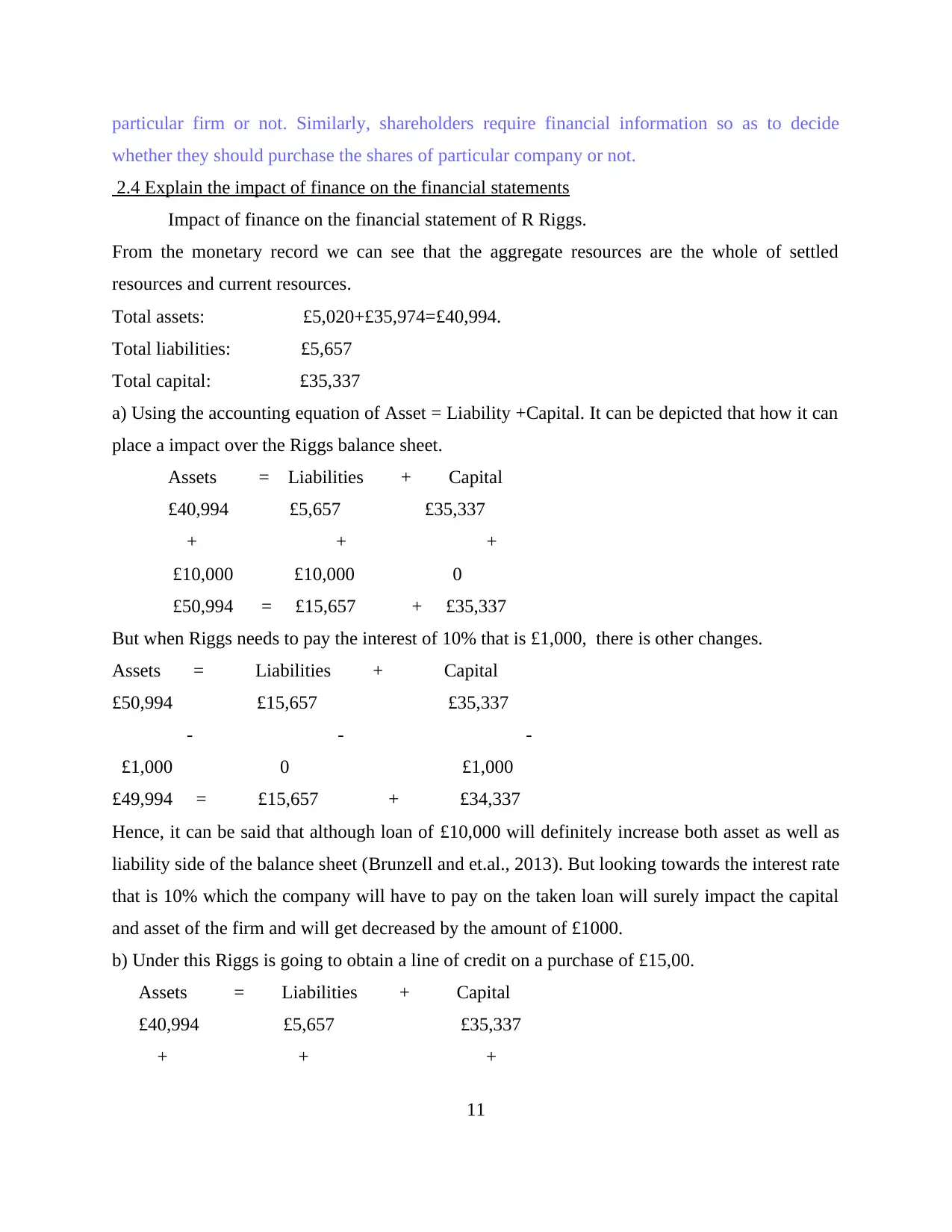

2.4 Explain the impact of finance on the financial statements

Impact of finance on the financial statement of R Riggs.

From the monetary record we can see that the aggregate resources are the whole of settled

resources and current resources.

Total assets: £5,020+£35,974=£40,994.

Total liabilities: £5,657

Total capital: £35,337

a) Using the accounting equation of Asset = Liability +Capital. It can be depicted that how it can

place a impact over the Riggs balance sheet.

Assets = Liabilities + Capital

£40,994 £5,657 £35,337

+ + +

£10,000 £10,000 0

£50,994 = £15,657 + £35,337

But when Riggs needs to pay the interest of 10% that is £1,000, there is other changes.

Assets = Liabilities + Capital

£50,994 £15,657 £35,337

- - -

£1,000 0 £1,000

£49,994 = £15,657 + £34,337

Hence, it can be said that although loan of £10,000 will definitely increase both asset as well as

liability side of the balance sheet (Brunzell and et.al., 2013). But looking towards the interest rate

that is 10% which the company will have to pay on the taken loan will surely impact the capital

and asset of the firm and will get decreased by the amount of £1000.

b) Under this Riggs is going to obtain a line of credit on a purchase of £15,00.

Assets = Liabilities + Capital

£40,994 £5,657 £35,337

+ + +

11

whether they should purchase the shares of particular company or not.

2.4 Explain the impact of finance on the financial statements

Impact of finance on the financial statement of R Riggs.

From the monetary record we can see that the aggregate resources are the whole of settled

resources and current resources.

Total assets: £5,020+£35,974=£40,994.

Total liabilities: £5,657

Total capital: £35,337

a) Using the accounting equation of Asset = Liability +Capital. It can be depicted that how it can

place a impact over the Riggs balance sheet.

Assets = Liabilities + Capital

£40,994 £5,657 £35,337

+ + +

£10,000 £10,000 0

£50,994 = £15,657 + £35,337

But when Riggs needs to pay the interest of 10% that is £1,000, there is other changes.

Assets = Liabilities + Capital

£50,994 £15,657 £35,337

- - -

£1,000 0 £1,000

£49,994 = £15,657 + £34,337

Hence, it can be said that although loan of £10,000 will definitely increase both asset as well as

liability side of the balance sheet (Brunzell and et.al., 2013). But looking towards the interest rate

that is 10% which the company will have to pay on the taken loan will surely impact the capital

and asset of the firm and will get decreased by the amount of £1000.

b) Under this Riggs is going to obtain a line of credit on a purchase of £15,00.

Assets = Liabilities + Capital

£40,994 £5,657 £35,337

+ + +

11

£1,500 £1,500 0

£42,494 = £7,157 + £35,337

it will lead to increase in the both liability and asset side of balance sheet with the amount of

£1,500. Hence there will be no impact on the capital of R Riggs Ltd.

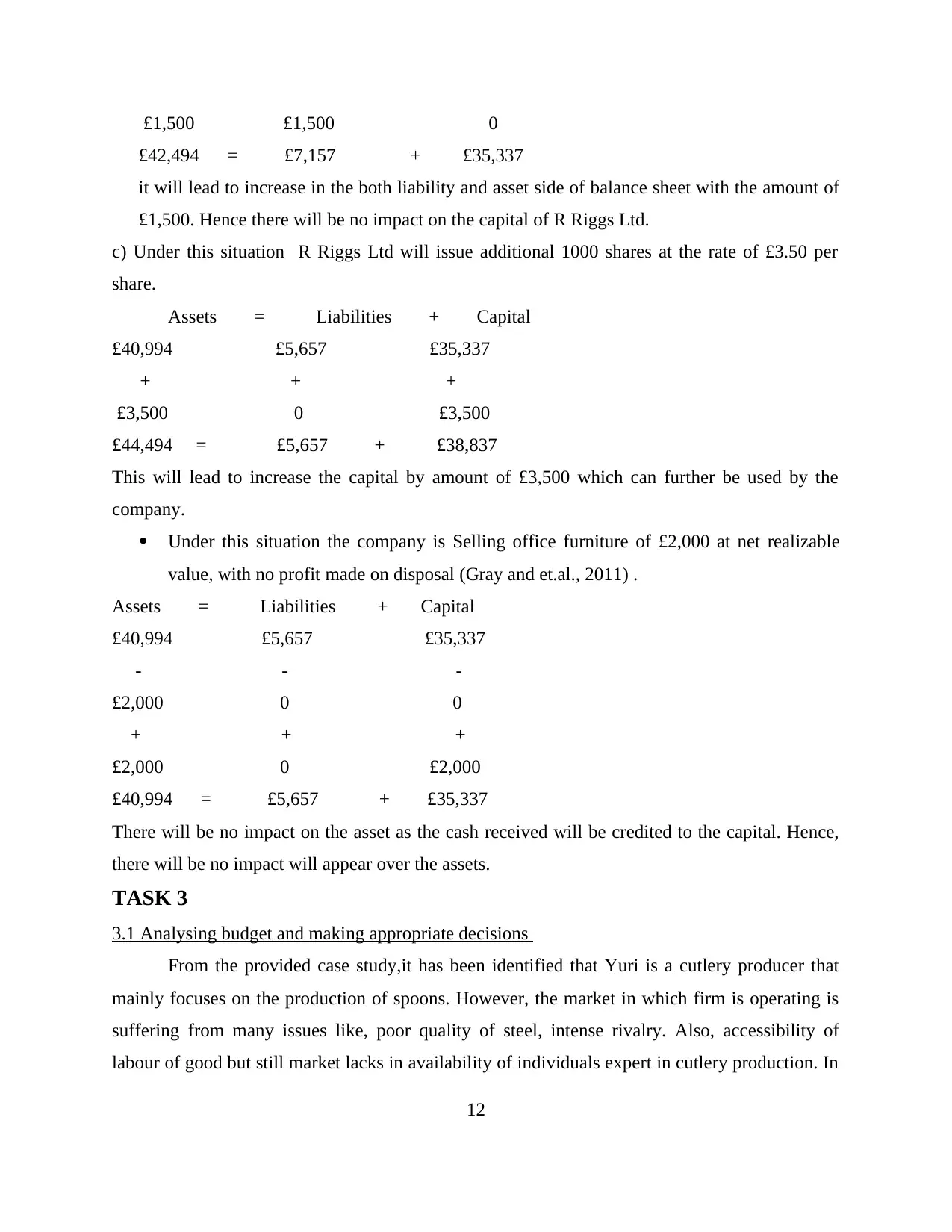

c) Under this situation R Riggs Ltd will issue additional 1000 shares at the rate of £3.50 per

share.

Assets = Liabilities + Capital

£40,994 £5,657 £35,337

+ + +

£3,500 0 £3,500

£44,494 = £5,657 + £38,837

This will lead to increase the capital by amount of £3,500 which can further be used by the

company.

Under this situation the company is Selling office furniture of £2,000 at net realizable

value, with no profit made on disposal (Gray and et.al., 2011) .

Assets = Liabilities + Capital

£40,994 £5,657 £35,337

- - -

£2,000 0 0

+ + +

£2,000 0 £2,000

£40,994 = £5,657 + £35,337

There will be no impact on the asset as the cash received will be credited to the capital. Hence,

there will be no impact will appear over the assets.

TASK 3

3.1 Analysing budget and making appropriate decisions

From the provided case study,it has been identified that Yuri is a cutlery producer that

mainly focuses on the production of spoons. However, the market in which firm is operating is

suffering from many issues like, poor quality of steel, intense rivalry. Also, accessibility of

labour of good but still market lacks in availability of individuals expert in cutlery production. In

12

£42,494 = £7,157 + £35,337

it will lead to increase in the both liability and asset side of balance sheet with the amount of

£1,500. Hence there will be no impact on the capital of R Riggs Ltd.

c) Under this situation R Riggs Ltd will issue additional 1000 shares at the rate of £3.50 per

share.

Assets = Liabilities + Capital

£40,994 £5,657 £35,337

+ + +

£3,500 0 £3,500

£44,494 = £5,657 + £38,837

This will lead to increase the capital by amount of £3,500 which can further be used by the

company.

Under this situation the company is Selling office furniture of £2,000 at net realizable

value, with no profit made on disposal (Gray and et.al., 2011) .

Assets = Liabilities + Capital

£40,994 £5,657 £35,337

- - -

£2,000 0 0

+ + +

£2,000 0 £2,000

£40,994 = £5,657 + £35,337

There will be no impact on the asset as the cash received will be credited to the capital. Hence,

there will be no impact will appear over the assets.

TASK 3

3.1 Analysing budget and making appropriate decisions

From the provided case study,it has been identified that Yuri is a cutlery producer that

mainly focuses on the production of spoons. However, the market in which firm is operating is

suffering from many issues like, poor quality of steel, intense rivalry. Also, accessibility of

labour of good but still market lacks in availability of individuals expert in cutlery production. In

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.