Financial Reporting Analysis: Standards, Performance, and Framework

VerifiedAdded on 2021/02/20

|17

|4690

|31

Report

AI Summary

This report provides a comprehensive analysis of financial reporting, beginning with an introduction to the conceptual and regulatory frameworks, including GAAP and IFRS, and their significance for organizations like InterContinental Hotels Group. The report delves into the purpose of financial reporting, emphasizing its role in organizational growth, objectives, and stakeholder engagement. It examines key financial statements such as the balance sheet, income statement, and cash flow statement, providing a practical example through the creation of financial statements for Godwin PLC. The analysis includes the calculation and interpretation of financial ratios to evaluate company performance, along with a comparison of IAS and IFRS. Furthermore, the report highlights the global importance of IFRS and discusses models of financial reporting and auditing, culminating in a conclusion that summarizes the key findings and implications of the financial reporting analysis.

Financial Reporting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

TASK 1............................................................................................................................................1

P1. Financial reporting and regulatory framework along with financial governance..................1

P2. Purpose of financial reporting in order to meet organizational growth, objectives and

development.................................................................................................................................3

TASK 2............................................................................................................................................5

P3. Produce financial statement of the company.........................................................................5

P4. Calculate financial ratios of company in order to evaluate performance and further

investment....................................................................................................................................8

TASK 3............................................................................................................................................9

P5. Difference between International Accounting Standards (IAS) and International Financial

Reporting Standards (IFRS).........................................................................................................9

P6. Models of financial reporting and auditing.........................................................................10

TASK 4..........................................................................................................................................11

P7. Identify the importance of IFRS across the world...............................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

APPENDICES...............................................................................................................................14

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

TASK 1............................................................................................................................................1

P1. Financial reporting and regulatory framework along with financial governance..................1

P2. Purpose of financial reporting in order to meet organizational growth, objectives and

development.................................................................................................................................3

TASK 2............................................................................................................................................5

P3. Produce financial statement of the company.........................................................................5

P4. Calculate financial ratios of company in order to evaluate performance and further

investment....................................................................................................................................8

TASK 3............................................................................................................................................9

P5. Difference between International Accounting Standards (IAS) and International Financial

Reporting Standards (IFRS).........................................................................................................9

P6. Models of financial reporting and auditing.........................................................................10

TASK 4..........................................................................................................................................11

P7. Identify the importance of IFRS across the world...............................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

APPENDICES...............................................................................................................................14

INTRODUCTION

Financial reporting is the method of disclosing financial information for the internal as

well as external parties which is called stakeholders. Reporting help the business to analyse their

performance in the specific duration. Financial reporting can be prepared on quarterly or

annually basis and it includes the various statement such as balance sheet, profit & loss account,

cash flow statement and change in the equity or it is also called statement of retained earning

(Barth, 2018). Oliver Wyman is UK based financial consultancy company and its client company

is InterContinental Hotels Group which is multimational hospitality organization. Its headquater

in Denham, England and it was established 2003 by Keith Barr who is CEO of the company.

This report cover various topics such as purpose of the fianacial reporting, coneceptual or

regulatory gramework and key pricinples. Along with this, it contain interpreation of financial

stataments which help the business to analyse their fianacial position. In addition, satandards of

financial reporting, models & concepts need to analyse. It includes the difference or importantce

of International Financial Reporting Standard (IFRS) in the various countries.

MAIN BODY

TASK 1

P1. Financial reporting and regulatory framework along with financial governance

Conceptual Framework: It is an analystical tool which assist the International

Accounting Standard Board (IASB) for the further development of the International Financial

Reporting Standards (IFRS). It helps the InterContinental Hotels Group to measure their

financial transaction in order to provide accurate information to the stakeholders. Conceptual

framework follow the Generally Accepted Accounting Principle (GAAP). Accountant improve

their management practices which further helps in developing effective or efficient report for the

external parties (Dunne and et.al., 2013). Lack of using these framworks will generate the

various scandels through misappropriation of the accounts and change in the financial transaction

and figures. So conceptual framework helps in various way such as:

Helps in developing future standards which is used by the organization in order to follow

and develop accurate report.

Maintain the relation between accounting standards and regulation.

It helps in increasing communication with stakeholders by using financial reporting.

1

Financial reporting is the method of disclosing financial information for the internal as

well as external parties which is called stakeholders. Reporting help the business to analyse their

performance in the specific duration. Financial reporting can be prepared on quarterly or

annually basis and it includes the various statement such as balance sheet, profit & loss account,

cash flow statement and change in the equity or it is also called statement of retained earning

(Barth, 2018). Oliver Wyman is UK based financial consultancy company and its client company

is InterContinental Hotels Group which is multimational hospitality organization. Its headquater

in Denham, England and it was established 2003 by Keith Barr who is CEO of the company.

This report cover various topics such as purpose of the fianacial reporting, coneceptual or

regulatory gramework and key pricinples. Along with this, it contain interpreation of financial

stataments which help the business to analyse their fianacial position. In addition, satandards of

financial reporting, models & concepts need to analyse. It includes the difference or importantce

of International Financial Reporting Standard (IFRS) in the various countries.

MAIN BODY

TASK 1

P1. Financial reporting and regulatory framework along with financial governance

Conceptual Framework: It is an analystical tool which assist the International

Accounting Standard Board (IASB) for the further development of the International Financial

Reporting Standards (IFRS). It helps the InterContinental Hotels Group to measure their

financial transaction in order to provide accurate information to the stakeholders. Conceptual

framework follow the Generally Accepted Accounting Principle (GAAP). Accountant improve

their management practices which further helps in developing effective or efficient report for the

external parties (Dunne and et.al., 2013). Lack of using these framworks will generate the

various scandels through misappropriation of the accounts and change in the financial transaction

and figures. So conceptual framework helps in various way such as:

Helps in developing future standards which is used by the organization in order to follow

and develop accurate report.

Maintain the relation between accounting standards and regulation.

It helps in increasing communication with stakeholders by using financial reporting.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Regulatory Framework: It is the underground injection which provide the direction to

the organization that how to move further by following all the standards. Every business has to

follow various regulatory framework in order to perform well and achieve their business goals &

objectives under the regulatory framework. International Financial Reporting Standard (IFRS) is

one of the regulatory body of the government and aim is to provide the transparency or

accountability in financial information. With the help of this accounting framework, business

communicate all the relevant information to the stakeholders of InterContinental Hotels Group.

Some of the regulatory framwork used by the organization which is discussed below:

IFRS 1 – For the first time adoption of IFRS.

IFRS 2 – Share based Payments.

IFRS 4 – Insurance Contract.

IFRS 7 – Financial discloser which contain all the financial information and presented in

Balance sheet, income statement or cash flow.

IFRS 10 – Consolidated financial statement.

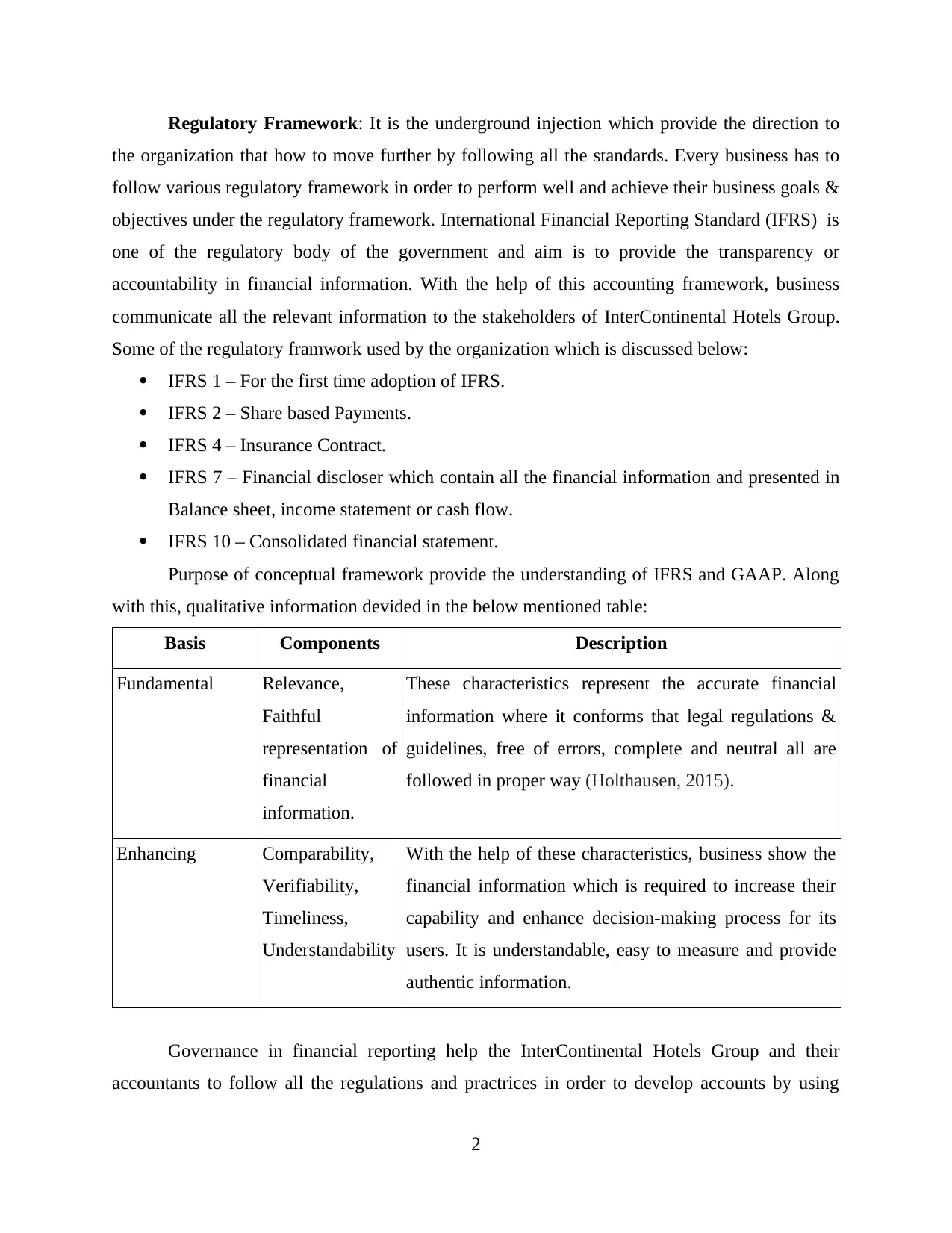

Purpose of conceptual framework provide the understanding of IFRS and GAAP. Along

with this, qualitative information devided in the below mentioned table:

Basis Components Description

Fundamental Relevance,

Faithful

representation of

financial

information.

These characteristics represent the accurate financial

information where it conforms that legal regulations &

guidelines, free of errors, complete and neutral all are

followed in proper way (Holthausen, 2015).

Enhancing Comparability,

Verifiability,

Timeliness,

Understandability

With the help of these characteristics, business show the

financial information which is required to increase their

capability and enhance decision-making process for its

users. It is understandable, easy to measure and provide

authentic information.

Governance in financial reporting help the InterContinental Hotels Group and their

accountants to follow all the regulations and practrices in order to develop accounts by using

2

the organization that how to move further by following all the standards. Every business has to

follow various regulatory framework in order to perform well and achieve their business goals &

objectives under the regulatory framework. International Financial Reporting Standard (IFRS) is

one of the regulatory body of the government and aim is to provide the transparency or

accountability in financial information. With the help of this accounting framework, business

communicate all the relevant information to the stakeholders of InterContinental Hotels Group.

Some of the regulatory framwork used by the organization which is discussed below:

IFRS 1 – For the first time adoption of IFRS.

IFRS 2 – Share based Payments.

IFRS 4 – Insurance Contract.

IFRS 7 – Financial discloser which contain all the financial information and presented in

Balance sheet, income statement or cash flow.

IFRS 10 – Consolidated financial statement.

Purpose of conceptual framework provide the understanding of IFRS and GAAP. Along

with this, qualitative information devided in the below mentioned table:

Basis Components Description

Fundamental Relevance,

Faithful

representation of

financial

information.

These characteristics represent the accurate financial

information where it conforms that legal regulations &

guidelines, free of errors, complete and neutral all are

followed in proper way (Holthausen, 2015).

Enhancing Comparability,

Verifiability,

Timeliness,

Understandability

With the help of these characteristics, business show the

financial information which is required to increase their

capability and enhance decision-making process for its

users. It is understandable, easy to measure and provide

authentic information.

Governance in financial reporting help the InterContinental Hotels Group and their

accountants to follow all the regulations and practrices in order to develop accounts by using

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

effective methods. It will provide the proper process that how to record each financial

information and what is the treatment of different types of transection. With the help of financial

governance, business record, maintain or control the operational activities and then disclose.

InterContinental Hotels Group follow all the relavant regulations in their organisation in order to

produce accurate stataemnet which provide the true position of the business.

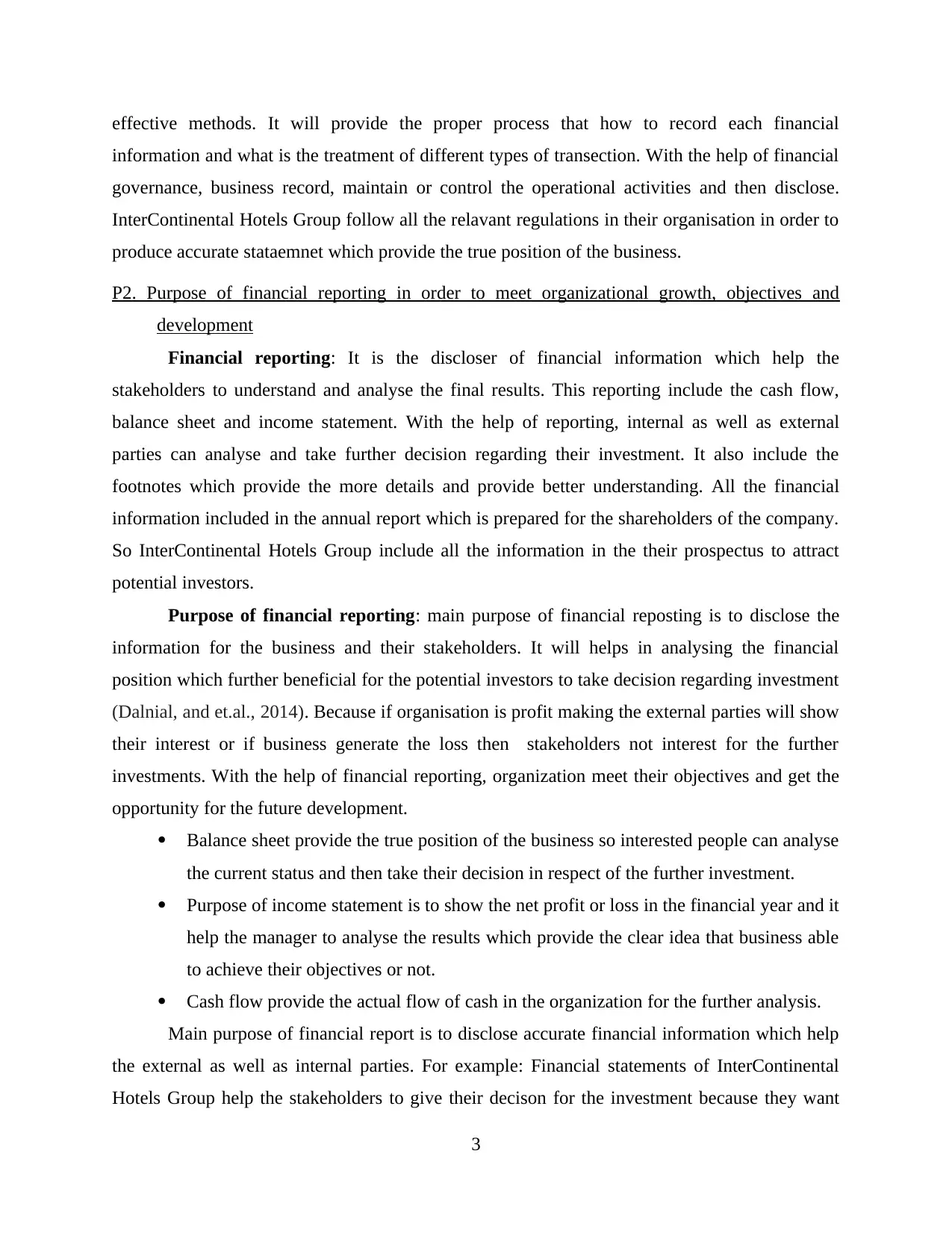

P2. Purpose of financial reporting in order to meet organizational growth, objectives and

development

Financial reporting: It is the discloser of financial information which help the

stakeholders to understand and analyse the final results. This reporting include the cash flow,

balance sheet and income statement. With the help of reporting, internal as well as external

parties can analyse and take further decision regarding their investment. It also include the

footnotes which provide the more details and provide better understanding. All the financial

information included in the annual report which is prepared for the shareholders of the company.

So InterContinental Hotels Group include all the information in the their prospectus to attract

potential investors.

Purpose of financial reporting: main purpose of financial reposting is to disclose the

information for the business and their stakeholders. It will helps in analysing the financial

position which further beneficial for the potential investors to take decision regarding investment

(Dalnial, and et.al., 2014). Because if organisation is profit making the external parties will show

their interest or if business generate the loss then stakeholders not interest for the further

investments. With the help of financial reporting, organization meet their objectives and get the

opportunity for the future development.

Balance sheet provide the true position of the business so interested people can analyse

the current status and then take their decision in respect of the further investment.

Purpose of income statement is to show the net profit or loss in the financial year and it

help the manager to analyse the results which provide the clear idea that business able

to achieve their objectives or not.

Cash flow provide the actual flow of cash in the organization for the further analysis.

Main purpose of financial report is to disclose accurate financial information which help

the external as well as internal parties. For example: Financial statements of InterContinental

Hotels Group help the stakeholders to give their decison for the investment because they want

3

information and what is the treatment of different types of transection. With the help of financial

governance, business record, maintain or control the operational activities and then disclose.

InterContinental Hotels Group follow all the relavant regulations in their organisation in order to

produce accurate stataemnet which provide the true position of the business.

P2. Purpose of financial reporting in order to meet organizational growth, objectives and

development

Financial reporting: It is the discloser of financial information which help the

stakeholders to understand and analyse the final results. This reporting include the cash flow,

balance sheet and income statement. With the help of reporting, internal as well as external

parties can analyse and take further decision regarding their investment. It also include the

footnotes which provide the more details and provide better understanding. All the financial

information included in the annual report which is prepared for the shareholders of the company.

So InterContinental Hotels Group include all the information in the their prospectus to attract

potential investors.

Purpose of financial reporting: main purpose of financial reposting is to disclose the

information for the business and their stakeholders. It will helps in analysing the financial

position which further beneficial for the potential investors to take decision regarding investment

(Dalnial, and et.al., 2014). Because if organisation is profit making the external parties will show

their interest or if business generate the loss then stakeholders not interest for the further

investments. With the help of financial reporting, organization meet their objectives and get the

opportunity for the future development.

Balance sheet provide the true position of the business so interested people can analyse

the current status and then take their decision in respect of the further investment.

Purpose of income statement is to show the net profit or loss in the financial year and it

help the manager to analyse the results which provide the clear idea that business able

to achieve their objectives or not.

Cash flow provide the actual flow of cash in the organization for the further analysis.

Main purpose of financial report is to disclose accurate financial information which help

the external as well as internal parties. For example: Financial statements of InterContinental

Hotels Group help the stakeholders to give their decison for the investment because they want

3

good return. Or if company is loss making then it will affect the investors and their other

shareholders. It is essentialy required because it will provide the sustanable development in the

market as well as helps in acheiving business goals & objectives.

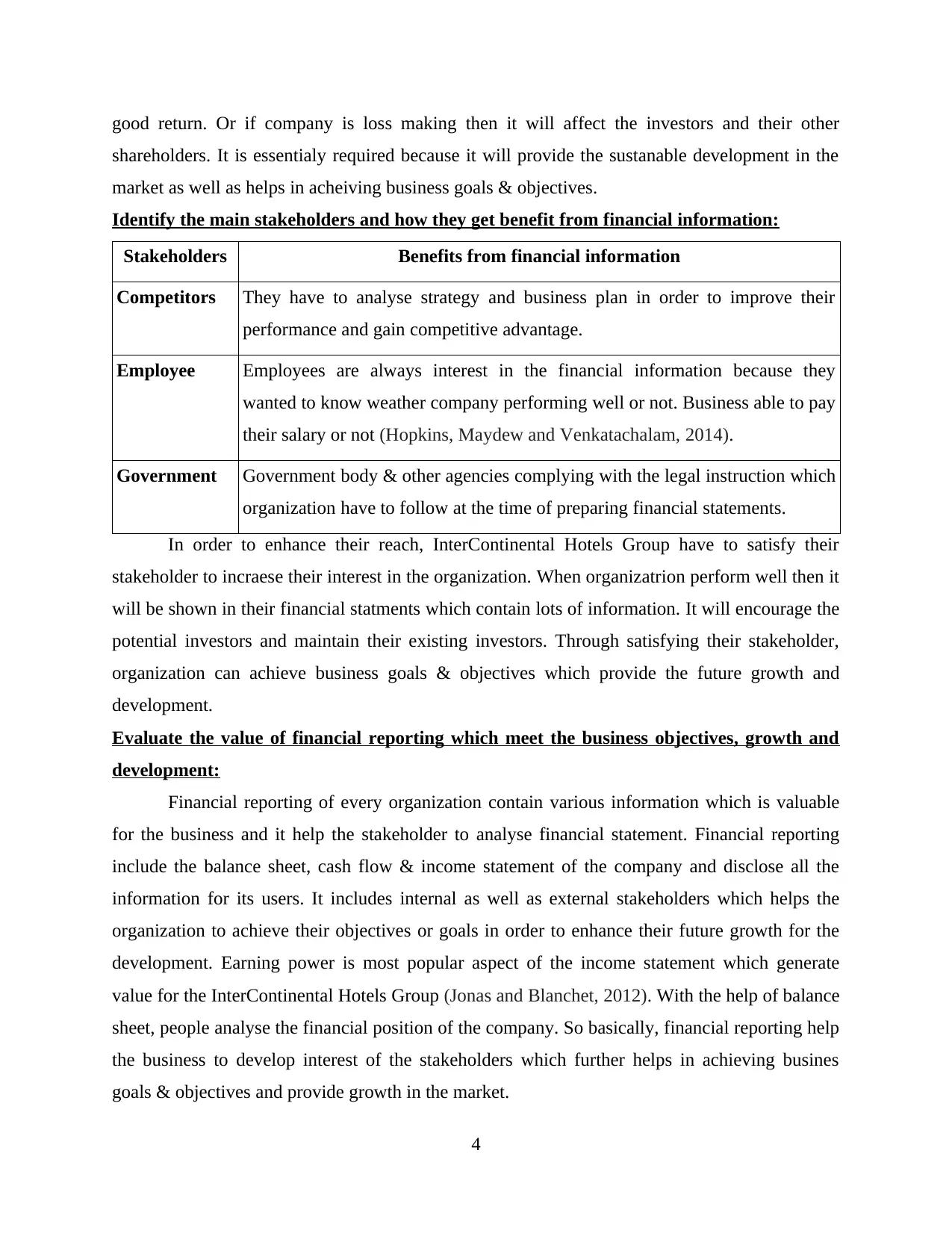

Identify the main stakeholders and how they get benefit from financial information:

Stakeholders Benefits from financial information

Competitors They have to analyse strategy and business plan in order to improve their

performance and gain competitive advantage.

Employee Employees are always interest in the financial information because they

wanted to know weather company performing well or not. Business able to pay

their salary or not (Hopkins, Maydew and Venkatachalam, 2014).

Government Government body & other agencies complying with the legal instruction which

organization have to follow at the time of preparing financial statements.

In order to enhance their reach, InterContinental Hotels Group have to satisfy their

stakeholder to incraese their interest in the organization. When organizatrion perform well then it

will be shown in their financial statments which contain lots of information. It will encourage the

potential investors and maintain their existing investors. Through satisfying their stakeholder,

organization can achieve business goals & objectives which provide the future growth and

development.

Evaluate the value of financial reporting which meet the business objectives, growth and

development:

Financial reporting of every organization contain various information which is valuable

for the business and it help the stakeholder to analyse financial statement. Financial reporting

include the balance sheet, cash flow & income statement of the company and disclose all the

information for its users. It includes internal as well as external stakeholders which helps the

organization to achieve their objectives or goals in order to enhance their future growth for the

development. Earning power is most popular aspect of the income statement which generate

value for the InterContinental Hotels Group (Jonas and Blanchet, 2012). With the help of balance

sheet, people analyse the financial position of the company. So basically, financial reporting help

the business to develop interest of the stakeholders which further helps in achieving busines

goals & objectives and provide growth in the market.

4

shareholders. It is essentialy required because it will provide the sustanable development in the

market as well as helps in acheiving business goals & objectives.

Identify the main stakeholders and how they get benefit from financial information:

Stakeholders Benefits from financial information

Competitors They have to analyse strategy and business plan in order to improve their

performance and gain competitive advantage.

Employee Employees are always interest in the financial information because they

wanted to know weather company performing well or not. Business able to pay

their salary or not (Hopkins, Maydew and Venkatachalam, 2014).

Government Government body & other agencies complying with the legal instruction which

organization have to follow at the time of preparing financial statements.

In order to enhance their reach, InterContinental Hotels Group have to satisfy their

stakeholder to incraese their interest in the organization. When organizatrion perform well then it

will be shown in their financial statments which contain lots of information. It will encourage the

potential investors and maintain their existing investors. Through satisfying their stakeholder,

organization can achieve business goals & objectives which provide the future growth and

development.

Evaluate the value of financial reporting which meet the business objectives, growth and

development:

Financial reporting of every organization contain various information which is valuable

for the business and it help the stakeholder to analyse financial statement. Financial reporting

include the balance sheet, cash flow & income statement of the company and disclose all the

information for its users. It includes internal as well as external stakeholders which helps the

organization to achieve their objectives or goals in order to enhance their future growth for the

development. Earning power is most popular aspect of the income statement which generate

value for the InterContinental Hotels Group (Jonas and Blanchet, 2012). With the help of balance

sheet, people analyse the financial position of the company. So basically, financial reporting help

the business to develop interest of the stakeholders which further helps in achieving busines

goals & objectives and provide growth in the market.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

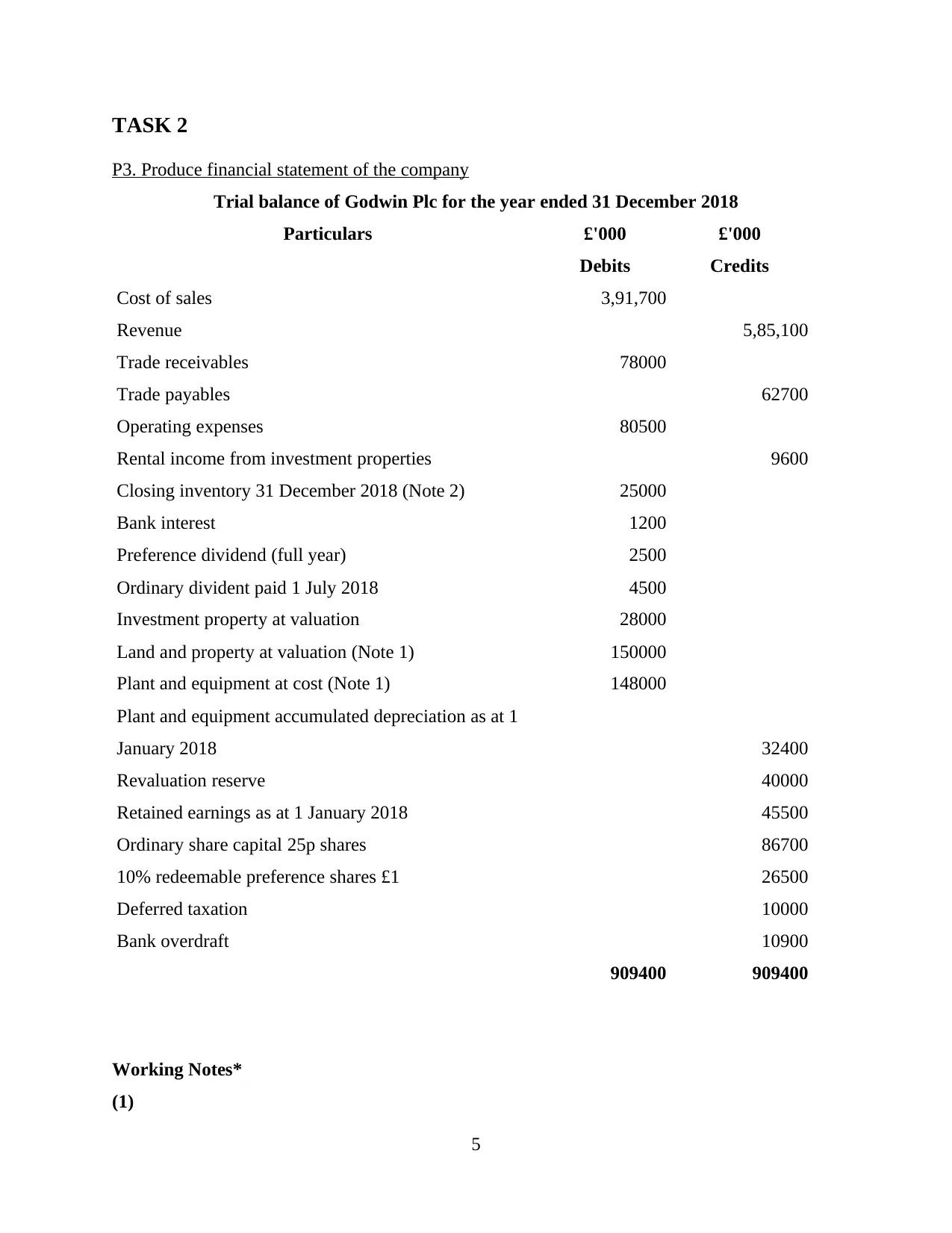

TASK 2

P3. Produce financial statement of the company

Trial balance of Godwin Plc for the year ended 31 December 2018

Particulars £'000 £'000

Debits Credits

Cost of sales 3,91,700

Revenue 5,85,100

Trade receivables 78000

Trade payables 62700

Operating expenses 80500

Rental income from investment properties 9600

Closing inventory 31 December 2018 (Note 2) 25000

Bank interest 1200

Preference dividend (full year) 2500

Ordinary divident paid 1 July 2018 4500

Investment property at valuation 28000

Land and property at valuation (Note 1) 150000

Plant and equipment at cost (Note 1) 148000

Plant and equipment accumulated depreciation as at 1

January 2018 32400

Revaluation reserve 40000

Retained earnings as at 1 January 2018 45500

Ordinary share capital 25p shares 86700

10% redeemable preference shares £1 26500

Deferred taxation 10000

Bank overdraft 10900

909400 909400

Working Notes*

(1)

5

P3. Produce financial statement of the company

Trial balance of Godwin Plc for the year ended 31 December 2018

Particulars £'000 £'000

Debits Credits

Cost of sales 3,91,700

Revenue 5,85,100

Trade receivables 78000

Trade payables 62700

Operating expenses 80500

Rental income from investment properties 9600

Closing inventory 31 December 2018 (Note 2) 25000

Bank interest 1200

Preference dividend (full year) 2500

Ordinary divident paid 1 July 2018 4500

Investment property at valuation 28000

Land and property at valuation (Note 1) 150000

Plant and equipment at cost (Note 1) 148000

Plant and equipment accumulated depreciation as at 1

January 2018 32400

Revaluation reserve 40000

Retained earnings as at 1 January 2018 45500

Ordinary share capital 25p shares 86700

10% redeemable preference shares £1 26500

Deferred taxation 10000

Bank overdraft 10900

909400 909400

Working Notes*

(1)

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

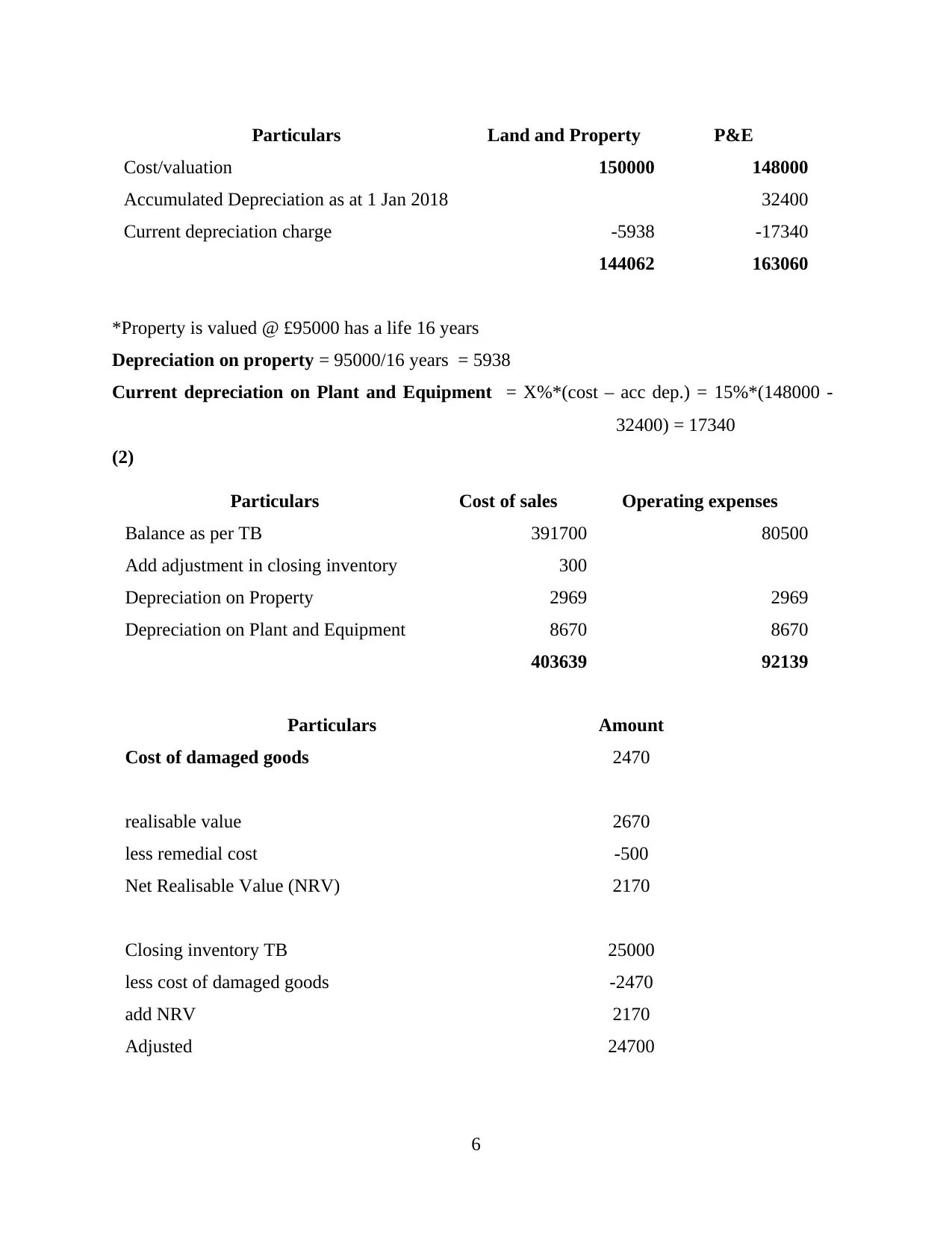

Particulars Land and Property P&E

Cost/valuation 150000 148000

Accumulated Depreciation as at 1 Jan 2018 32400

Current depreciation charge -5938 -17340

144062 163060

*Property is valued @ £95000 has a life 16 years

Depreciation on property = 95000/16 years = 5938

Current depreciation on Plant and Equipment = X%*(cost – acc dep.) = 15%*(148000 -

32400) = 17340

(2)

Particulars Cost of sales Operating expenses

Balance as per TB 391700 80500

Add adjustment in closing inventory 300

Depreciation on Property 2969 2969

Depreciation on Plant and Equipment 8670 8670

403639 92139

Particulars Amount

Cost of damaged goods 2470

realisable value 2670

less remedial cost -500

Net Realisable Value (NRV) 2170

Closing inventory TB 25000

less cost of damaged goods -2470

add NRV 2170

Adjusted 24700

6

Cost/valuation 150000 148000

Accumulated Depreciation as at 1 Jan 2018 32400

Current depreciation charge -5938 -17340

144062 163060

*Property is valued @ £95000 has a life 16 years

Depreciation on property = 95000/16 years = 5938

Current depreciation on Plant and Equipment = X%*(cost – acc dep.) = 15%*(148000 -

32400) = 17340

(2)

Particulars Cost of sales Operating expenses

Balance as per TB 391700 80500

Add adjustment in closing inventory 300

Depreciation on Property 2969 2969

Depreciation on Plant and Equipment 8670 8670

403639 92139

Particulars Amount

Cost of damaged goods 2470

realisable value 2670

less remedial cost -500

Net Realisable Value (NRV) 2170

Closing inventory TB 25000

less cost of damaged goods -2470

add NRV 2170

Adjusted 24700

6

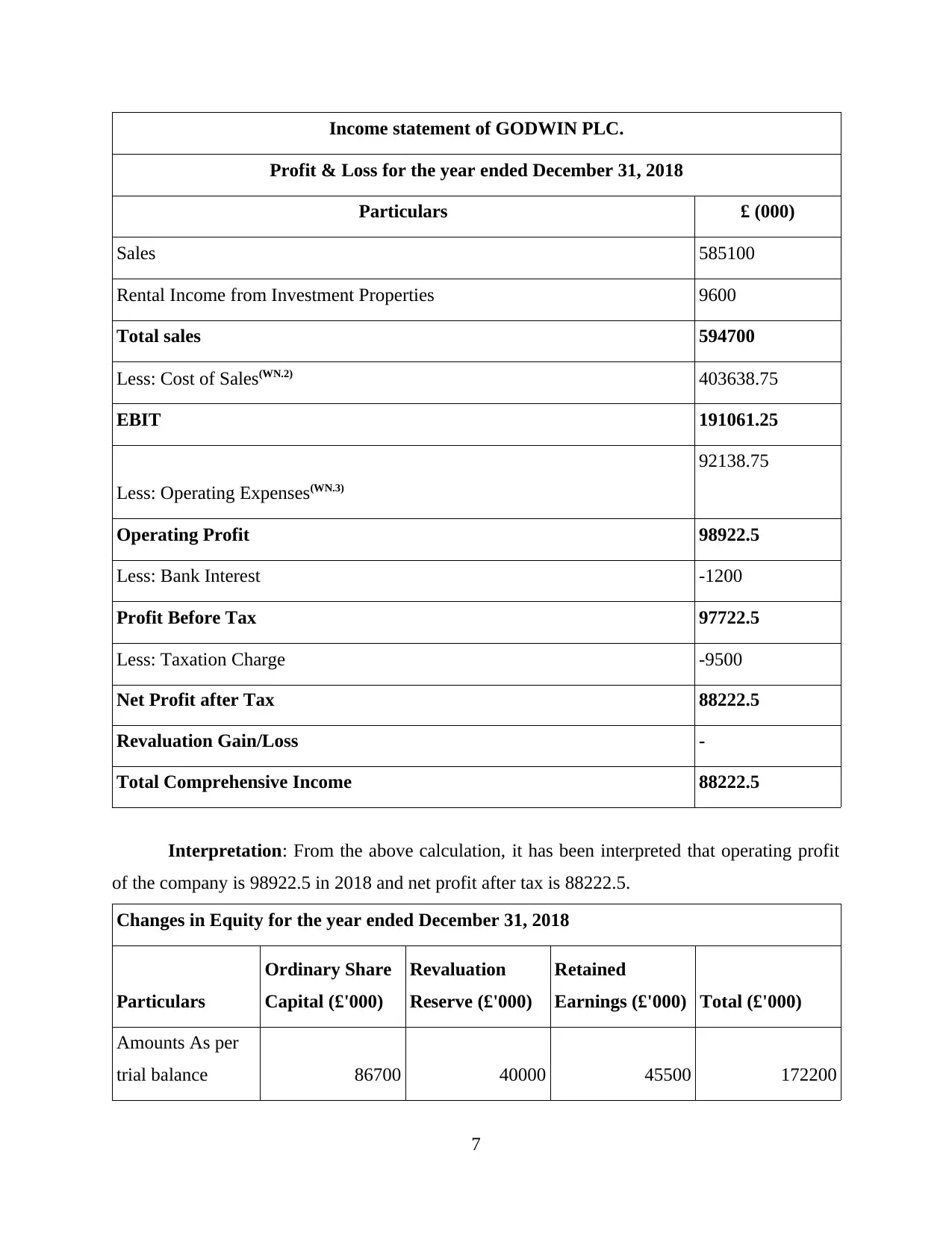

Income statement of GODWIN PLC.

Profit & Loss for the year ended December 31, 2018

Particulars £ (000)

Sales 585100

Rental Income from Investment Properties 9600

Total sales 594700

Less: Cost of Sales(WN.2) 403638.75

EBIT 191061.25

Less: Operating Expenses(WN.3)

92138.75

Operating Profit 98922.5

Less: Bank Interest -1200

Profit Before Tax 97722.5

Less: Taxation Charge -9500

Net Profit after Tax 88222.5

Revaluation Gain/Loss -

Total Comprehensive Income 88222.5

Interpretation: From the above calculation, it has been interpreted that operating profit

of the company is 98922.5 in 2018 and net profit after tax is 88222.5.

Changes in Equity for the year ended December 31, 2018

Particulars

Ordinary Share

Capital (£'000)

Revaluation

Reserve (£'000)

Retained

Earnings (£'000) Total (£'000)

Amounts As per

trial balance 86700 40000 45500 172200

7

Profit & Loss for the year ended December 31, 2018

Particulars £ (000)

Sales 585100

Rental Income from Investment Properties 9600

Total sales 594700

Less: Cost of Sales(WN.2) 403638.75

EBIT 191061.25

Less: Operating Expenses(WN.3)

92138.75

Operating Profit 98922.5

Less: Bank Interest -1200

Profit Before Tax 97722.5

Less: Taxation Charge -9500

Net Profit after Tax 88222.5

Revaluation Gain/Loss -

Total Comprehensive Income 88222.5

Interpretation: From the above calculation, it has been interpreted that operating profit

of the company is 98922.5 in 2018 and net profit after tax is 88222.5.

Changes in Equity for the year ended December 31, 2018

Particulars

Ordinary Share

Capital (£'000)

Revaluation

Reserve (£'000)

Retained

Earnings (£'000) Total (£'000)

Amounts As per

trial balance 86700 40000 45500 172200

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Net Profit after

Tax - - 88222.5 88222.5

Preferential

Dividend - - -2500 -2500

Ordinary

Dividend - - -4500 -4500

Total 86700 40000 126722.5 253422.5

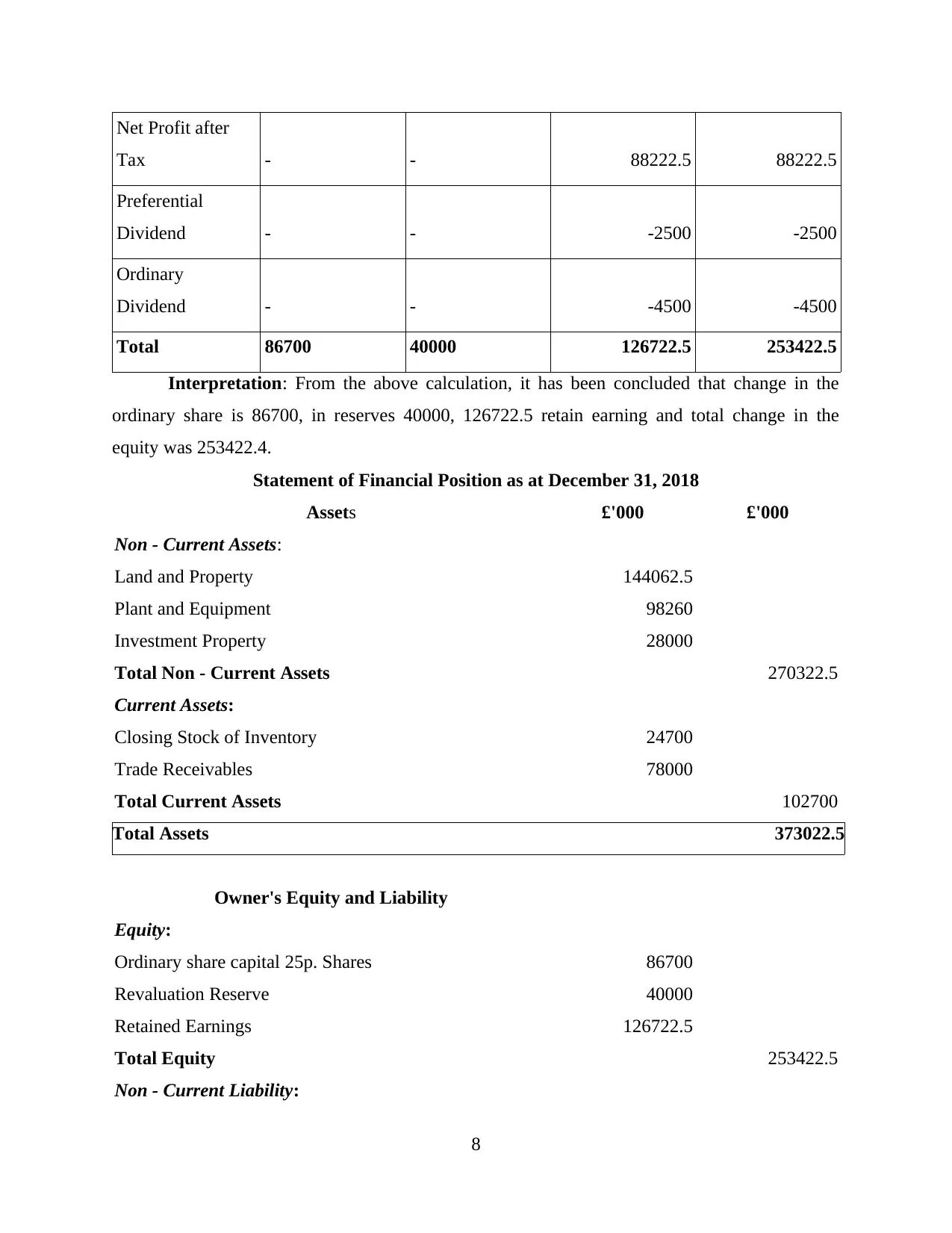

Interpretation: From the above calculation, it has been concluded that change in the

ordinary share is 86700, in reserves 40000, 126722.5 retain earning and total change in the

equity was 253422.4.

Statement of Financial Position as at December 31, 2018

Assets £'000 £'000

Non - Current Assets:

Land and Property 144062.5

Plant and Equipment 98260

Investment Property 28000

Total Non - Current Assets 270322.5

Current Assets:

Closing Stock of Inventory 24700

Trade Receivables 78000

Total Current Assets 102700

Total Assets 373022.5

Owner's Equity and Liability

Equity:

Ordinary share capital 25p. Shares 86700

Revaluation Reserve 40000

Retained Earnings 126722.5

Total Equity 253422.5

Non - Current Liability:

8

Tax - - 88222.5 88222.5

Preferential

Dividend - - -2500 -2500

Ordinary

Dividend - - -4500 -4500

Total 86700 40000 126722.5 253422.5

Interpretation: From the above calculation, it has been concluded that change in the

ordinary share is 86700, in reserves 40000, 126722.5 retain earning and total change in the

equity was 253422.4.

Statement of Financial Position as at December 31, 2018

Assets £'000 £'000

Non - Current Assets:

Land and Property 144062.5

Plant and Equipment 98260

Investment Property 28000

Total Non - Current Assets 270322.5

Current Assets:

Closing Stock of Inventory 24700

Trade Receivables 78000

Total Current Assets 102700

Total Assets 373022.5

Owner's Equity and Liability

Equity:

Ordinary share capital 25p. Shares 86700

Revaluation Reserve 40000

Retained Earnings 126722.5

Total Equity 253422.5

Non - Current Liability:

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10% Redeemable Preferential Share Capital £1 26500

Deferred Taxation 10000

Total Non - Current Liabilities 36500

Current Liability:

Trade Payables 62700

Bank Overdraft 10900

Tax Payables 9500

Total Current Liabilities 83100

Total Equity & Liabilities 373022.5

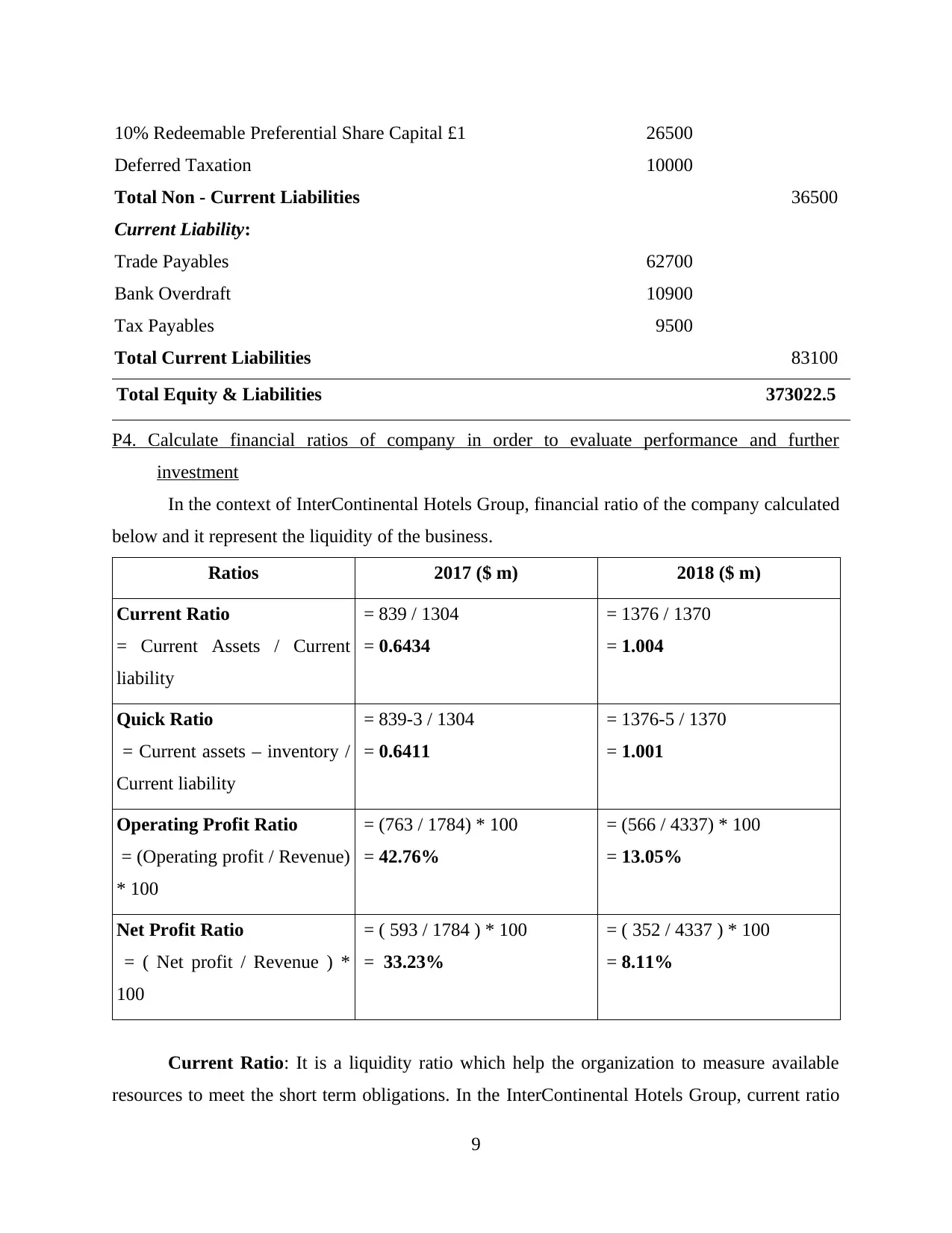

P4. Calculate financial ratios of company in order to evaluate performance and further

investment

In the context of InterContinental Hotels Group, financial ratio of the company calculated

below and it represent the liquidity of the business.

Ratios 2017 ($ m) 2018 ($ m)

Current Ratio

= Current Assets / Current

liability

= 839 / 1304

= 0.6434

= 1376 / 1370

= 1.004

Quick Ratio

= Current assets – inventory /

Current liability

= 839-3 / 1304

= 0.6411

= 1376-5 / 1370

= 1.001

Operating Profit Ratio

= (Operating profit / Revenue)

* 100

= (763 / 1784) * 100

= 42.76%

= (566 / 4337) * 100

= 13.05%

Net Profit Ratio

= ( Net profit / Revenue ) *

100

= ( 593 / 1784 ) * 100

= 33.23%

= ( 352 / 4337 ) * 100

= 8.11%

Current Ratio: It is a liquidity ratio which help the organization to measure available

resources to meet the short term obligations. In the InterContinental Hotels Group, current ratio

9

Deferred Taxation 10000

Total Non - Current Liabilities 36500

Current Liability:

Trade Payables 62700

Bank Overdraft 10900

Tax Payables 9500

Total Current Liabilities 83100

Total Equity & Liabilities 373022.5

P4. Calculate financial ratios of company in order to evaluate performance and further

investment

In the context of InterContinental Hotels Group, financial ratio of the company calculated

below and it represent the liquidity of the business.

Ratios 2017 ($ m) 2018 ($ m)

Current Ratio

= Current Assets / Current

liability

= 839 / 1304

= 0.6434

= 1376 / 1370

= 1.004

Quick Ratio

= Current assets – inventory /

Current liability

= 839-3 / 1304

= 0.6411

= 1376-5 / 1370

= 1.001

Operating Profit Ratio

= (Operating profit / Revenue)

* 100

= (763 / 1784) * 100

= 42.76%

= (566 / 4337) * 100

= 13.05%

Net Profit Ratio

= ( Net profit / Revenue ) *

100

= ( 593 / 1784 ) * 100

= 33.23%

= ( 352 / 4337 ) * 100

= 8.11%

Current Ratio: It is a liquidity ratio which help the organization to measure available

resources to meet the short term obligations. In the InterContinental Hotels Group, current ratio

9

of 2017 was 0.6434 and in the 2018 was 1.004. Ideal ratio is 1:1 which help the business to pay

off their liabilities through available sources. High as well as low from the ideal ration not good

for the company. Manager of the company have to maintain their liquitidy as in the 2018. It help

the manager to evaluate fianncial performance of the company. Currently InterContinental

Hotels Group performanceis goods (InterContinental Hotels Group, 2019)

Quick Ratio: It is also called acid test ratio and it measure the ability of the company

regarding their liquidity which isnear by cash. It exclude the inventory because it will take time

to convert into cash. In the InterContinental Hotels Group, quick ratio of the year 2017 was

64.11 and 1.001 in 2018. This ratio represent the liquidity which help the organization to pay off

their debt immediatly.

Operating Profit Ratio: With the help of this ratio, business measure the revanue from

operating activities. In the InterContinental Hotels Group, operating profit of 2017 was 42.76%

and 13.05 in 2018. It clearly shows that operating profitl decreased in the current year due to

their over expenses. So manager have to reduce their product cost in order to increase the

margin.

Net Profit Ratio: This ratio show the net profit after deduction of tax, it is the final profit

for the owner. It remain the profit after reducing all the cost of production and administration. In

the 2017, net profit was 33.23% and 8.11% in 2018. Profit of the year decreased because

operating profit already decrease from previous year.

TASK 3

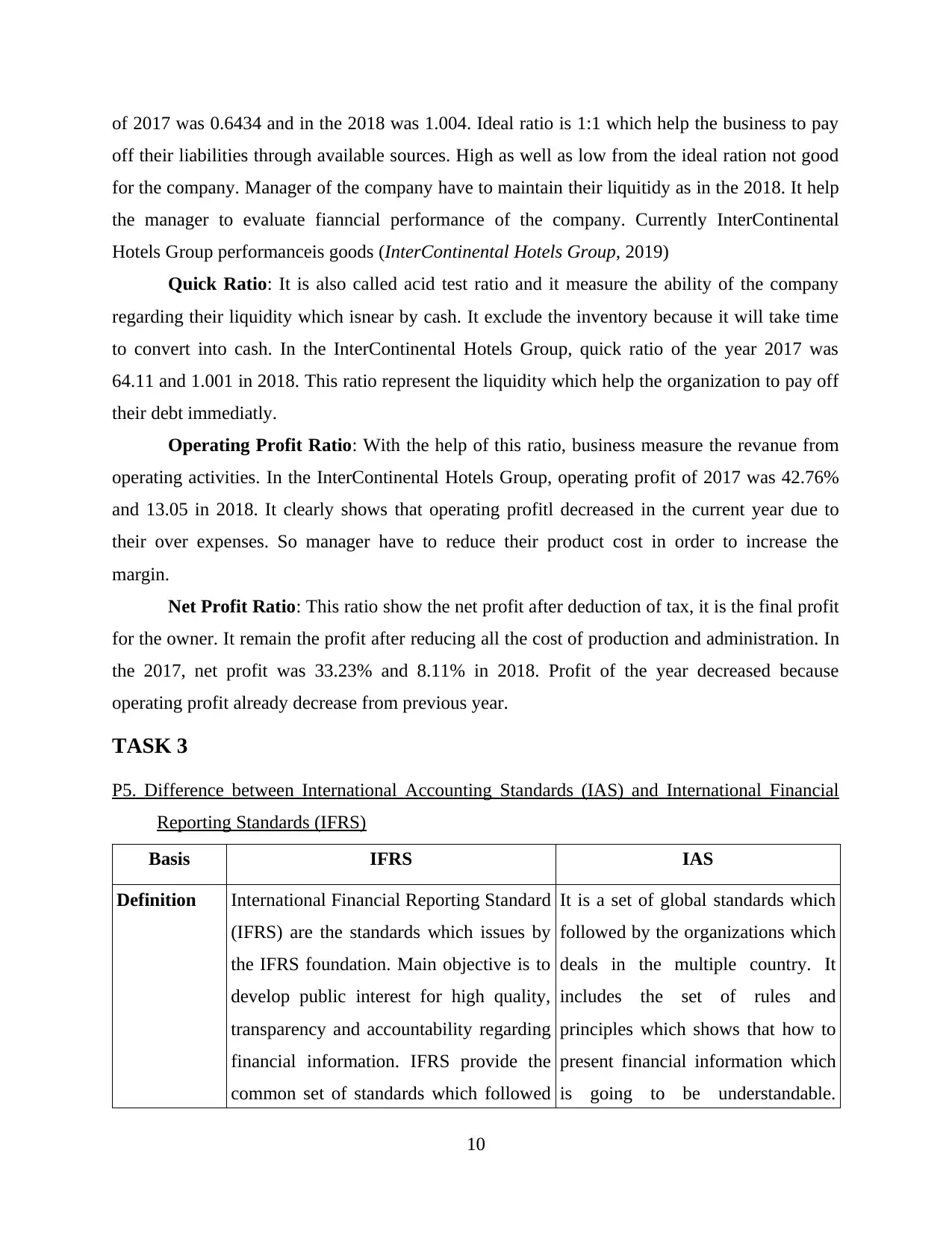

P5. Difference between International Accounting Standards (IAS) and International Financial

Reporting Standards (IFRS)

Basis IFRS IAS

Definition International Financial Reporting Standard

(IFRS) are the standards which issues by

the IFRS foundation. Main objective is to

develop public interest for high quality,

transparency and accountability regarding

financial information. IFRS provide the

common set of standards which followed

It is a set of global standards which

followed by the organizations which

deals in the multiple country. It

includes the set of rules and

principles which shows that how to

present financial information which

is going to be understandable.

10

off their liabilities through available sources. High as well as low from the ideal ration not good

for the company. Manager of the company have to maintain their liquitidy as in the 2018. It help

the manager to evaluate fianncial performance of the company. Currently InterContinental

Hotels Group performanceis goods (InterContinental Hotels Group, 2019)

Quick Ratio: It is also called acid test ratio and it measure the ability of the company

regarding their liquidity which isnear by cash. It exclude the inventory because it will take time

to convert into cash. In the InterContinental Hotels Group, quick ratio of the year 2017 was

64.11 and 1.001 in 2018. This ratio represent the liquidity which help the organization to pay off

their debt immediatly.

Operating Profit Ratio: With the help of this ratio, business measure the revanue from

operating activities. In the InterContinental Hotels Group, operating profit of 2017 was 42.76%

and 13.05 in 2018. It clearly shows that operating profitl decreased in the current year due to

their over expenses. So manager have to reduce their product cost in order to increase the

margin.

Net Profit Ratio: This ratio show the net profit after deduction of tax, it is the final profit

for the owner. It remain the profit after reducing all the cost of production and administration. In

the 2017, net profit was 33.23% and 8.11% in 2018. Profit of the year decreased because

operating profit already decrease from previous year.

TASK 3

P5. Difference between International Accounting Standards (IAS) and International Financial

Reporting Standards (IFRS)

Basis IFRS IAS

Definition International Financial Reporting Standard

(IFRS) are the standards which issues by

the IFRS foundation. Main objective is to

develop public interest for high quality,

transparency and accountability regarding

financial information. IFRS provide the

common set of standards which followed

It is a set of global standards which

followed by the organizations which

deals in the multiple country. It

includes the set of rules and

principles which shows that how to

present financial information which

is going to be understandable.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.