Financial Statement Analysis of Accounting Solutions LLC - 2019

VerifiedAdded on 2023/01/23

|7

|1232

|89

Report

AI Summary

This report presents a financial statement analysis of Accounting Solutions LLC for the year 2019, examining its performance through profitability ratios, balance sheet ratios, and free cash flow. The analysis reveals a high gross margin and profit margin ratio due to the absence of cost of goods sold and income from unspecified sources. However, the return on capital is slightly lower than the industry average, indicating a need for improvement. The balance sheet analysis indicates adequate working capital and a low debt-to-equity ratio. The free cash flow is negative, suggesting potential challenges in future growth. The report concludes with recommendations for the company to improve its financial stability and growth by optimizing the use of working capital and raising funds through debt.

Running head: FINANCIAL STATEMENT ANALYSIS

Financial Statement Analysis

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Statement Analysis

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL STATEMENT ANALYSIS

Table of Contents

Introduction:....................................................................................................................................2

Financial statement analysis of Accounting Solutions LLC:..........................................................2

Profitability ratios:.......................................................................................................................2

Balance sheet ratios:....................................................................................................................3

Free cash flow:.............................................................................................................................4

Conclusion:......................................................................................................................................5

References:......................................................................................................................................6

Table of Contents

Introduction:....................................................................................................................................2

Financial statement analysis of Accounting Solutions LLC:..........................................................2

Profitability ratios:.......................................................................................................................2

Balance sheet ratios:....................................................................................................................3

Free cash flow:.............................................................................................................................4

Conclusion:......................................................................................................................................5

References:......................................................................................................................................6

2FINANCIAL STATEMENT ANALYSIS

Introduction:

Financial statement analysis denotes the investigation of feasibility, stability and profit

level of a business organization or any undertaken project. The expert analysts perform this

evaluation by using the information from the financial records of the organization (Berk and

DeMarzo 2016). The top management of the organization is provided with these reports, which

they use for undertaking business decisions. Owing to these factors, the analysis of the financial

statements has significant value from the business perspective. The current paper would intend to

analyze the financial statements of Accounting Solutions LLC by considering profitability ratios,

balance sheet ratios and free cash flow for the year 2019.

Financial statement analysis of Accounting Solutions LLC:

In order to conduct the financial statement analysis of Accounting Solutions LLC, the

following tools are taken into consideration:

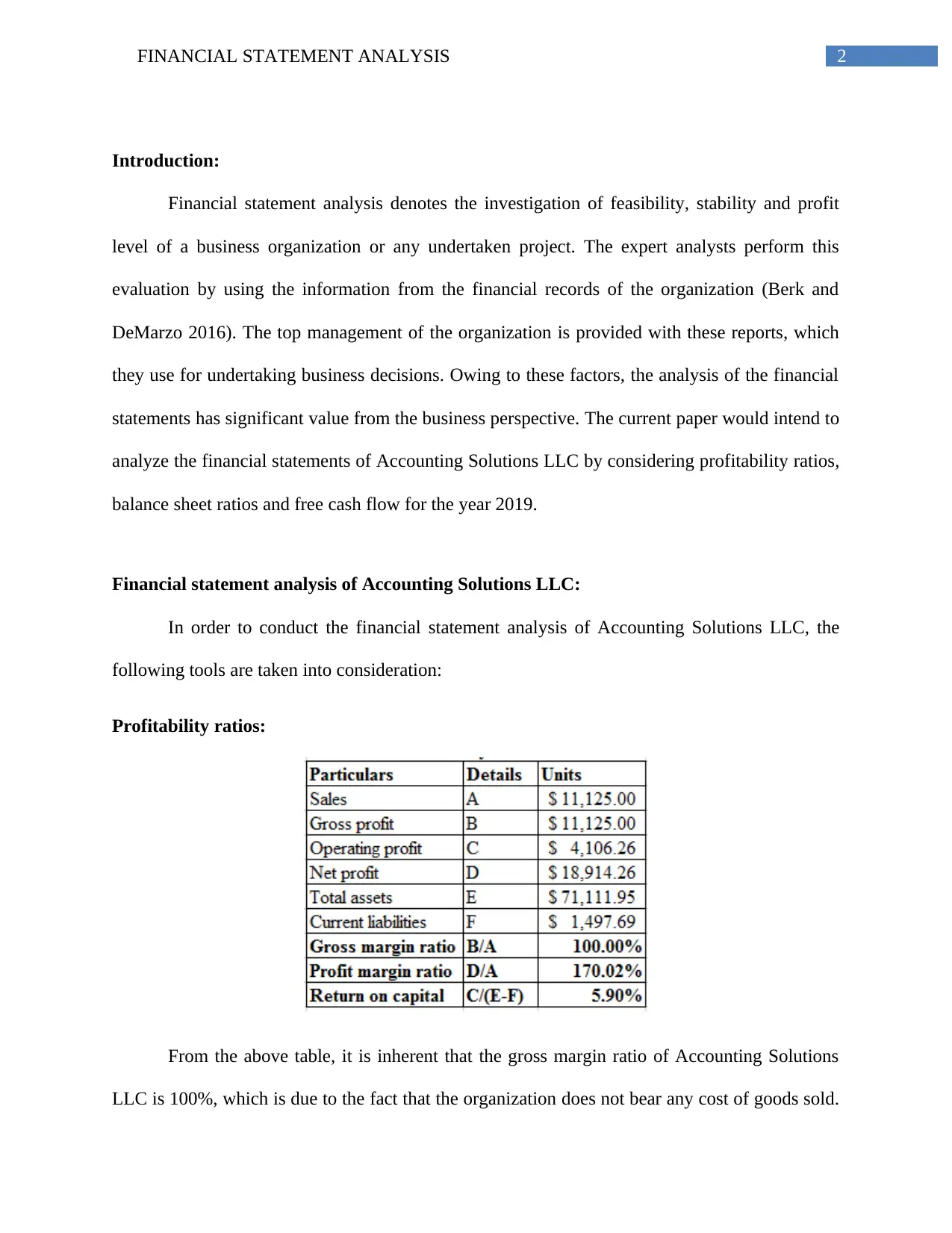

Profitability ratios:

From the above table, it is inherent that the gross margin ratio of Accounting Solutions

LLC is 100%, which is due to the fact that the organization does not bear any cost of goods sold.

Introduction:

Financial statement analysis denotes the investigation of feasibility, stability and profit

level of a business organization or any undertaken project. The expert analysts perform this

evaluation by using the information from the financial records of the organization (Berk and

DeMarzo 2016). The top management of the organization is provided with these reports, which

they use for undertaking business decisions. Owing to these factors, the analysis of the financial

statements has significant value from the business perspective. The current paper would intend to

analyze the financial statements of Accounting Solutions LLC by considering profitability ratios,

balance sheet ratios and free cash flow for the year 2019.

Financial statement analysis of Accounting Solutions LLC:

In order to conduct the financial statement analysis of Accounting Solutions LLC, the

following tools are taken into consideration:

Profitability ratios:

From the above table, it is inherent that the gross margin ratio of Accounting Solutions

LLC is 100%, which is due to the fact that the organization does not bear any cost of goods sold.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL STATEMENT ANALYSIS

This would assist the organization in covering its operating expenses with the help of overall

sales revenue (Brigham et al. 2016). In terms of profit margin ratio, the figure is computed as

170.02%, which is significantly high. In this context, Lang and Stice-Lawrence (2015) stated that

profit margin ratio denotes the percentage of revenue left after deduction of all relevant expenses

like operating costs, finance costs and tax expense from the overall revenue generated by an

organization. The main reason that has been identified behind the increase in profit margin ratio

for Accounting Solutions LLC is the income generated from unspecified sources amounting to

$14,808 in 2019. This denotes that the organization has generated adequate amount of net

income that could be distributed as dividends to its shareholders.

Return on capital is a long-term profitability ratio, since it shows the efficiency of the

performance of an asset while taking into account long-term financing (Loughran and McDonald

2016). Thus, this ratio is deemed to be useful for gauging the longevity of an organization. In

case of Accounting Solutions LLC, this ratio is computed as 5.90%. This denotes that for every

dollar employed, the organization has generated 0.0590 cents. This ratio seems to be slightly on

the lower scale, as the ratio above 10% is deemed to be stable. Hence, Accounting Solutions

LLC needs to undertake necessary measures so that it could generate more returns from capital

in future. However, in terms of overall profitability, the position of the organization is found to

be favorable.

This would assist the organization in covering its operating expenses with the help of overall

sales revenue (Brigham et al. 2016). In terms of profit margin ratio, the figure is computed as

170.02%, which is significantly high. In this context, Lang and Stice-Lawrence (2015) stated that

profit margin ratio denotes the percentage of revenue left after deduction of all relevant expenses

like operating costs, finance costs and tax expense from the overall revenue generated by an

organization. The main reason that has been identified behind the increase in profit margin ratio

for Accounting Solutions LLC is the income generated from unspecified sources amounting to

$14,808 in 2019. This denotes that the organization has generated adequate amount of net

income that could be distributed as dividends to its shareholders.

Return on capital is a long-term profitability ratio, since it shows the efficiency of the

performance of an asset while taking into account long-term financing (Loughran and McDonald

2016). Thus, this ratio is deemed to be useful for gauging the longevity of an organization. In

case of Accounting Solutions LLC, this ratio is computed as 5.90%. This denotes that for every

dollar employed, the organization has generated 0.0590 cents. This ratio seems to be slightly on

the lower scale, as the ratio above 10% is deemed to be stable. Hence, Accounting Solutions

LLC needs to undertake necessary measures so that it could generate more returns from capital

in future. However, in terms of overall profitability, the position of the organization is found to

be favorable.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL STATEMENT ANALYSIS

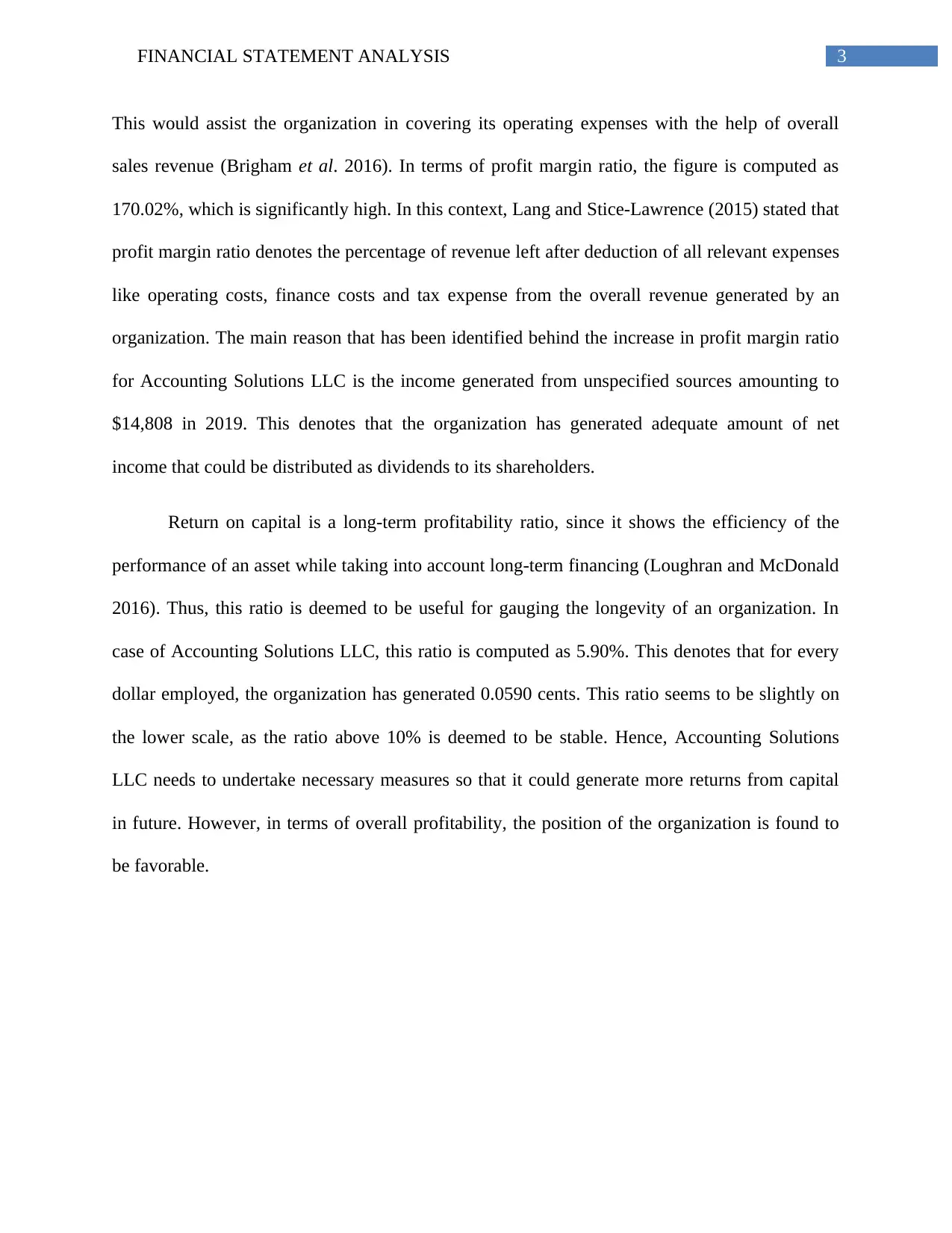

Balance sheet ratios:

The above table clearly indicates the presence of adequate working capital for

Accounting Solutions LLC in 2019, which is $69,614.26. This is a good indication, as it denotes

that the organization has enough ability to settle its short-term obligations effectively. However,

current ratio of the organization is computed as 47.48 in 2019, which is well above the ideal

average of 2 (Robinson et al. 2015). In this case, it is noteworthy to mention that if the current

ratio is significantly high, it denotes the presence of idle working capital, which could not be

utilized for improving business operations or investing in new projects. Thus, Accounting

Solutions LLC has to invest its working capital in order to ensure more profit in future, since it

would not generate income from other sources in future like in the current year.

Finally, debt/equity ratio of the organization implies the solvency or leverage position of

an organization regarding financial or investment risk. For Accounting Solution LLC, this ratio

is computed as 0.02, which denotes that majority of business assets are funded by equity.

Another reason that this ratio is significantly lower is that the organization does not have any

long-term borrowings and thus, it has relied mainly on its shareholders on raising funds. In this

context, it is to be borne in mind that relying excessively on equity minimizes the decision-

making ability of the management, since it would have to obtain the consent of its shareholders

Balance sheet ratios:

The above table clearly indicates the presence of adequate working capital for

Accounting Solutions LLC in 2019, which is $69,614.26. This is a good indication, as it denotes

that the organization has enough ability to settle its short-term obligations effectively. However,

current ratio of the organization is computed as 47.48 in 2019, which is well above the ideal

average of 2 (Robinson et al. 2015). In this case, it is noteworthy to mention that if the current

ratio is significantly high, it denotes the presence of idle working capital, which could not be

utilized for improving business operations or investing in new projects. Thus, Accounting

Solutions LLC has to invest its working capital in order to ensure more profit in future, since it

would not generate income from other sources in future like in the current year.

Finally, debt/equity ratio of the organization implies the solvency or leverage position of

an organization regarding financial or investment risk. For Accounting Solution LLC, this ratio

is computed as 0.02, which denotes that majority of business assets are funded by equity.

Another reason that this ratio is significantly lower is that the organization does not have any

long-term borrowings and thus, it has relied mainly on its shareholders on raising funds. In this

context, it is to be borne in mind that relying excessively on equity minimizes the decision-

making ability of the management, since it would have to obtain the consent of its shareholders

5FINANCIAL STATEMENT ANALYSIS

and there would be increased cost of capital due to increase in cost of equity. Thus, in terms of

balance sheet position, Accounting Solutions LLC is not in a sound position in the market.

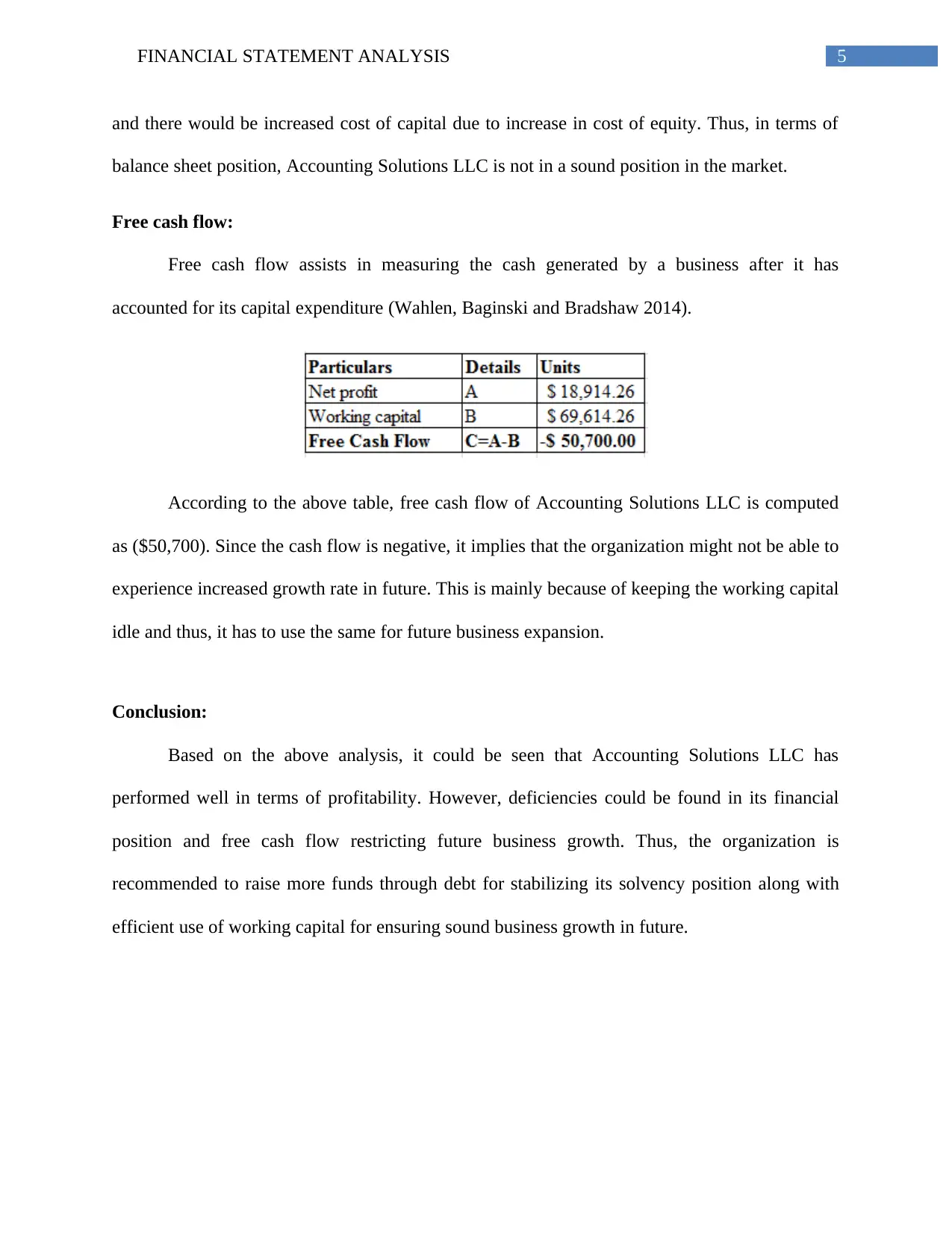

Free cash flow:

Free cash flow assists in measuring the cash generated by a business after it has

accounted for its capital expenditure (Wahlen, Baginski and Bradshaw 2014).

According to the above table, free cash flow of Accounting Solutions LLC is computed

as ($50,700). Since the cash flow is negative, it implies that the organization might not be able to

experience increased growth rate in future. This is mainly because of keeping the working capital

idle and thus, it has to use the same for future business expansion.

Conclusion:

Based on the above analysis, it could be seen that Accounting Solutions LLC has

performed well in terms of profitability. However, deficiencies could be found in its financial

position and free cash flow restricting future business growth. Thus, the organization is

recommended to raise more funds through debt for stabilizing its solvency position along with

efficient use of working capital for ensuring sound business growth in future.

and there would be increased cost of capital due to increase in cost of equity. Thus, in terms of

balance sheet position, Accounting Solutions LLC is not in a sound position in the market.

Free cash flow:

Free cash flow assists in measuring the cash generated by a business after it has

accounted for its capital expenditure (Wahlen, Baginski and Bradshaw 2014).

According to the above table, free cash flow of Accounting Solutions LLC is computed

as ($50,700). Since the cash flow is negative, it implies that the organization might not be able to

experience increased growth rate in future. This is mainly because of keeping the working capital

idle and thus, it has to use the same for future business expansion.

Conclusion:

Based on the above analysis, it could be seen that Accounting Solutions LLC has

performed well in terms of profitability. However, deficiencies could be found in its financial

position and free cash flow restricting future business growth. Thus, the organization is

recommended to raise more funds through debt for stabilizing its solvency position along with

efficient use of working capital for ensuring sound business growth in future.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL STATEMENT ANALYSIS

References:

Berk, J. and DeMarzo, P., 2016. Corporate Finance, GE. Pearson Australia Pty Limited.

Brigham, E.F., Ehrhardt, M.C., Nason, R.R. and Gessaroli, J., 2016. Financial Managment:

Theory And Practice, Canadian Edition. Nelson Education.

Lang, M. and Stice-Lawrence, L., 2015. Textual analysis and international financial reporting:

Large sample evidence. Journal of Accounting and Economics, 60(2-3), pp.110-135.

Loughran, T. and McDonald, B., 2016. Textual analysis in accounting and finance: A

survey. Journal of Accounting Research, 54(4), pp.1187-1230.

Robinson, T.R., Henry, E., Pirie, W.L. and Broihahn, M.A., 2015. International financial

statement analysis. John Wiley & Sons.

Wahlen, J.M., Baginski, S.P. and Bradshaw, M., 2014. Financial reporting, financial statement

analysis and valuation. Nelson Education.

References:

Berk, J. and DeMarzo, P., 2016. Corporate Finance, GE. Pearson Australia Pty Limited.

Brigham, E.F., Ehrhardt, M.C., Nason, R.R. and Gessaroli, J., 2016. Financial Managment:

Theory And Practice, Canadian Edition. Nelson Education.

Lang, M. and Stice-Lawrence, L., 2015. Textual analysis and international financial reporting:

Large sample evidence. Journal of Accounting and Economics, 60(2-3), pp.110-135.

Loughran, T. and McDonald, B., 2016. Textual analysis in accounting and finance: A

survey. Journal of Accounting Research, 54(4), pp.1187-1230.

Robinson, T.R., Henry, E., Pirie, W.L. and Broihahn, M.A., 2015. International financial

statement analysis. John Wiley & Sons.

Wahlen, J.M., Baginski, S.P. and Bradshaw, M., 2014. Financial reporting, financial statement

analysis and valuation. Nelson Education.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.