Corporate Accounting: Analysis of Financial Statements - Simrex

VerifiedAdded on 2023/06/06

|14

|1578

|362

Report

AI Summary

This report provides a comprehensive analysis of Simrex Limited's financial statements, including journal entries, a statement of financial position, a statement of profit and loss, and a statement of changes in equity. It covers key aspects of corporate accounting, such as segment reporting, exceptional items, significant events, income and expenditure recognition, income tax expenses, earnings per share, working capital, accounts receivable, inventories, and accounts payable. The analysis highlights the company's profitability, financial position, and significant events impacting its performance, such as damages and bad debt. The report also includes detailed notes to the financial accounts, providing additional context and explanations.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Authors Note:

Corporate Accounting

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

CORPORATE ACCOUNTING

Contents

Answer 1:.........................................................................................................................................2

Requirement (a):..........................................................................................................................2

Requirement (b):..........................................................................................................................3

Requirement (c):..........................................................................................................................3

References:......................................................................................................................................6

Appendix 1:.....................................................................................................................................7

Appendix 2:...................................................................................................................................12

CORPORATE ACCOUNTING

Contents

Answer 1:.........................................................................................................................................2

Requirement (a):..........................................................................................................................2

Requirement (b):..........................................................................................................................3

Requirement (c):..........................................................................................................................3

References:......................................................................................................................................6

Appendix 1:.....................................................................................................................................7

Appendix 2:...................................................................................................................................12

2

CORPORATE ACCOUNTING

Answer 1:

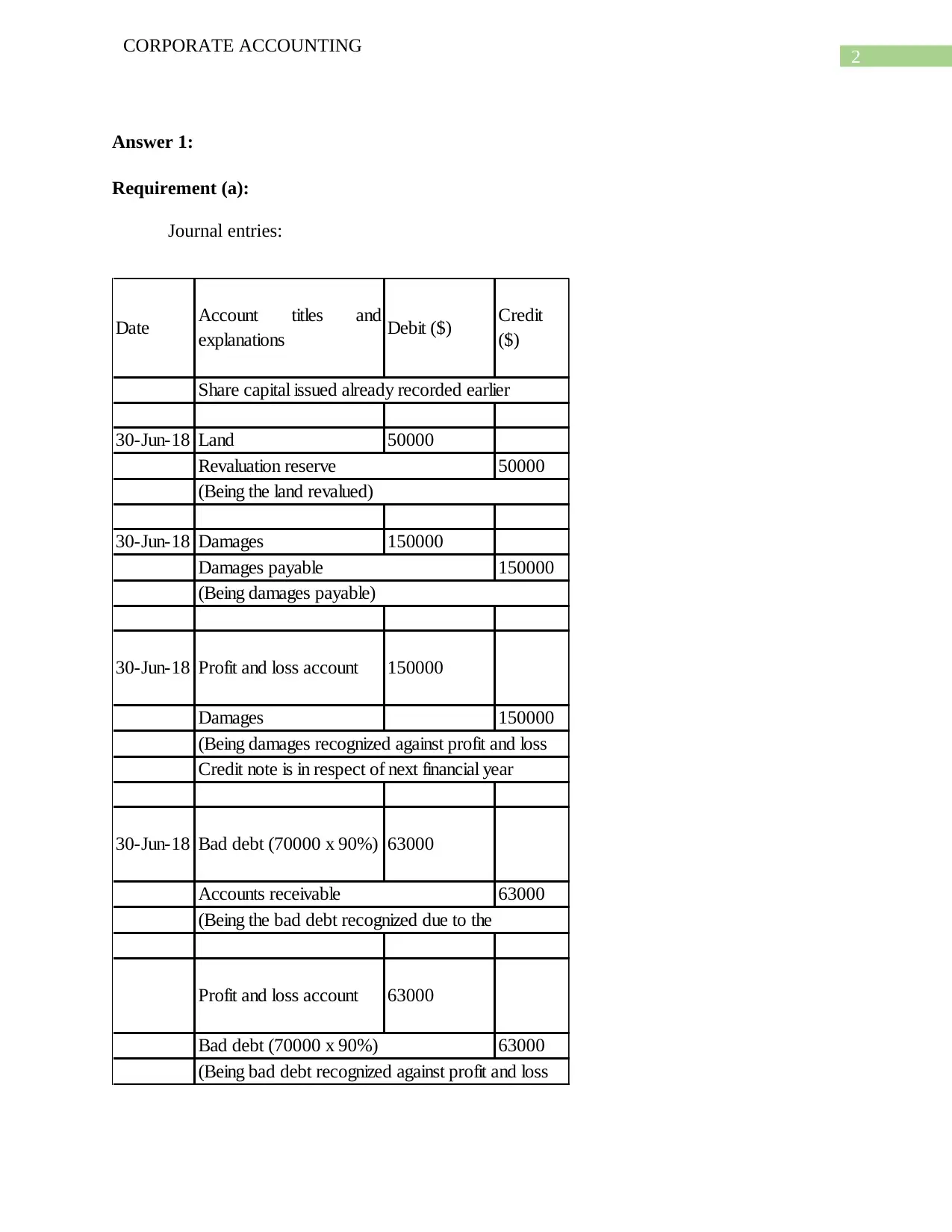

Requirement (a):

Journal entries:

Date Account titles and

explanations Debit ($) Credit

($)

30-Jun-18 Land 50000

50000

30-Jun-18 Damages 150000

150000

30-Jun-18 Profit and loss account 150000

Damages 150000

30-Jun-18 Bad debt (70000 x 90%) 63000

63000

Profit and loss account 63000

63000

Credit note is in respect of next financial year

Accounts receivable

(Being the bad debt recognized due to the

Bad debt (70000 x 90%)

(Being bad debt recognized against profit and loss

Share capital issued already recorded earlier

Revaluation reserve

(Being the land revalued)

Damages payable

(Being damages payable)

(Being damages recognized against profit and loss

CORPORATE ACCOUNTING

Answer 1:

Requirement (a):

Journal entries:

Date Account titles and

explanations Debit ($) Credit

($)

30-Jun-18 Land 50000

50000

30-Jun-18 Damages 150000

150000

30-Jun-18 Profit and loss account 150000

Damages 150000

30-Jun-18 Bad debt (70000 x 90%) 63000

63000

Profit and loss account 63000

63000

Credit note is in respect of next financial year

Accounts receivable

(Being the bad debt recognized due to the

Bad debt (70000 x 90%)

(Being bad debt recognized against profit and loss

Share capital issued already recorded earlier

Revaluation reserve

(Being the land revalued)

Damages payable

(Being damages payable)

(Being damages recognized against profit and loss

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

CORPORATE ACCOUNTING

Requirement (b):

Statement of financial position:

It is a statement reflecting the position of assets and liabilities of an organization as on a

particular date. The statement of financial position of Simrex Limited below has been prepared

taking into consideration the balances provided in Trail Balance and the journal entries made in

the first part of the document (Ball, Li and Shivakumar, 2015).

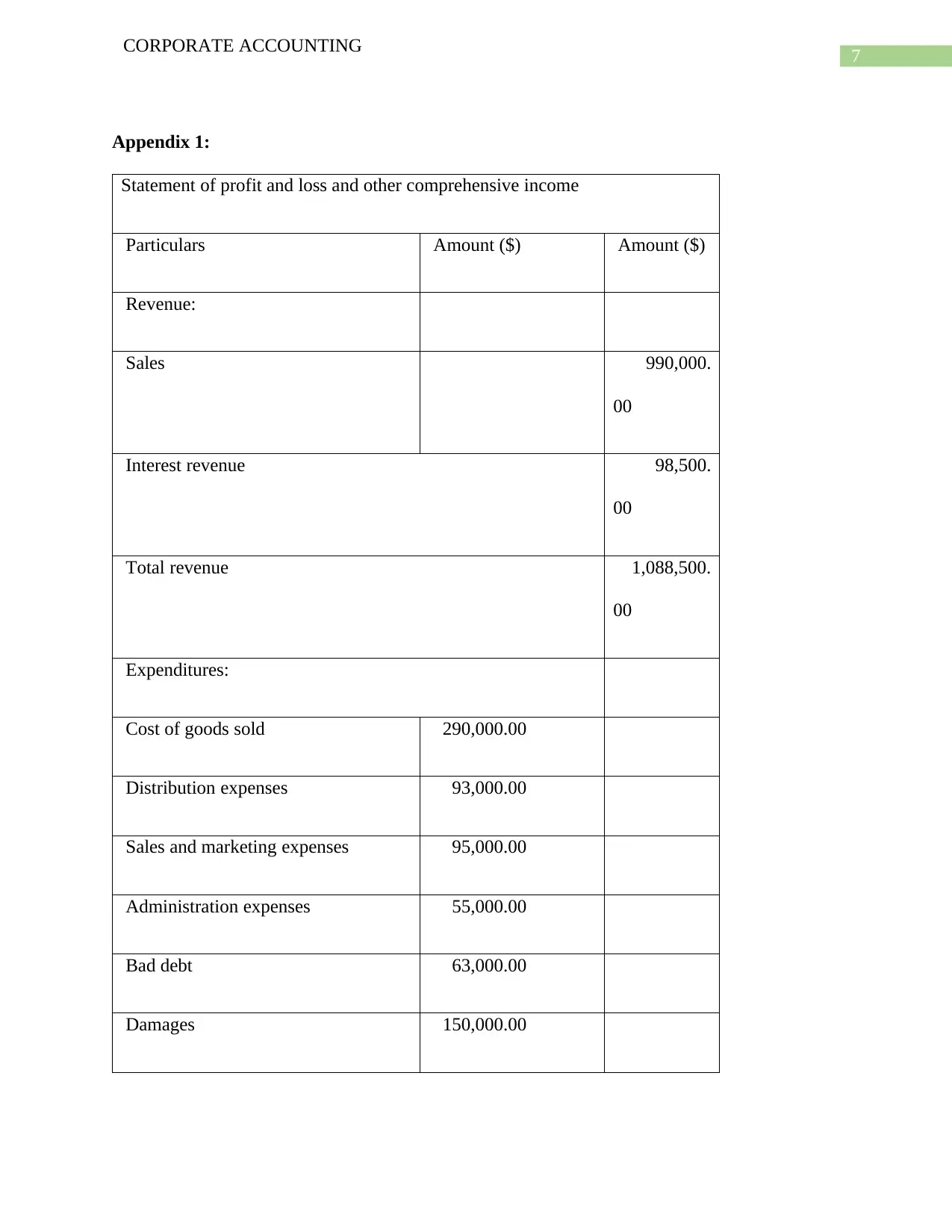

Statement of profit and loss:

Statement of profit and loss of the company shows the amount of profit earned from business

operations or loss incurred in business. In this case despite the loss due to penalty for damages

and bad debt the company has managed to earn a net profit of $117,250 after payment of tax.

Thus, the company has been able to manage its resources quite well to earn significant amount of

profit for the financial year 2017-18 (Zeff, 2016).

Statement of changes in equity:

Statement of changes in equity shows the effects of transactions that affect the shareholders’

equity. The statement of changes in equity of Simrex Limited shows (Appendix 2) that the equity

of shareholders have increased in the current year.

Requirement (c):

Notes to financial accounts:

CORPORATE ACCOUNTING

Requirement (b):

Statement of financial position:

It is a statement reflecting the position of assets and liabilities of an organization as on a

particular date. The statement of financial position of Simrex Limited below has been prepared

taking into consideration the balances provided in Trail Balance and the journal entries made in

the first part of the document (Ball, Li and Shivakumar, 2015).

Statement of profit and loss:

Statement of profit and loss of the company shows the amount of profit earned from business

operations or loss incurred in business. In this case despite the loss due to penalty for damages

and bad debt the company has managed to earn a net profit of $117,250 after payment of tax.

Thus, the company has been able to manage its resources quite well to earn significant amount of

profit for the financial year 2017-18 (Zeff, 2016).

Statement of changes in equity:

Statement of changes in equity shows the effects of transactions that affect the shareholders’

equity. The statement of changes in equity of Simrex Limited shows (Appendix 2) that the equity

of shareholders have increased in the current year.

Requirement (c):

Notes to financial accounts:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

CORPORATE ACCOUNTING

1. Segment reporting: Since the group has no identifiable reporting segments hence, no

segment report has been prepared.

2. Exceptional items: Those items of income and expenditures that are not regular in nature

have been reported as per the requirement of accounting standard. These include damages

of $150,000 to be paid for failure to control pollution (Libby, 2017).

3. Significant events: Significant events that have occurred during, before or after the end of

the year has also been reported to ensure that the users of financial accounts understand

the impact of these events on the financial performance and position of the organization.

Penalty for damage as well as the insolvency of the customers are two significant events

that have reduced the profit of the organization by $213,000 (150000+63000) of revenue

(Gitman, Juchau and Flanagan, 2015).

4. Income: The revenues of the company have been recorded as per the accrual system of

accounting.

5. Expenditures: Expenditures have been reported in the books of accounts even if not paid

following the accrual basis of accounting.

6. Recognition and measurement: Revenue has been recognized as per the accounting

standard on revenue recognition guidelines. Thus, only when the revenue has been earned

and no uncertainty remained regarding the receipt of revenue, it has been recognized in

the books of accounts.

7. Income tax expenses: The organization is on the tax slab rate of 30%. Thus, the amount

of profit earned by the organization has been multiplied by 30% rate to determine the

income tax expense.

CORPORATE ACCOUNTING

1. Segment reporting: Since the group has no identifiable reporting segments hence, no

segment report has been prepared.

2. Exceptional items: Those items of income and expenditures that are not regular in nature

have been reported as per the requirement of accounting standard. These include damages

of $150,000 to be paid for failure to control pollution (Libby, 2017).

3. Significant events: Significant events that have occurred during, before or after the end of

the year has also been reported to ensure that the users of financial accounts understand

the impact of these events on the financial performance and position of the organization.

Penalty for damage as well as the insolvency of the customers are two significant events

that have reduced the profit of the organization by $213,000 (150000+63000) of revenue

(Gitman, Juchau and Flanagan, 2015).

4. Income: The revenues of the company have been recorded as per the accrual system of

accounting.

5. Expenditures: Expenditures have been reported in the books of accounts even if not paid

following the accrual basis of accounting.

6. Recognition and measurement: Revenue has been recognized as per the accounting

standard on revenue recognition guidelines. Thus, only when the revenue has been earned

and no uncertainty remained regarding the receipt of revenue, it has been recognized in

the books of accounts.

7. Income tax expenses: The organization is on the tax slab rate of 30%. Thus, the amount

of profit earned by the organization has been multiplied by 30% rate to determine the

income tax expense.

5

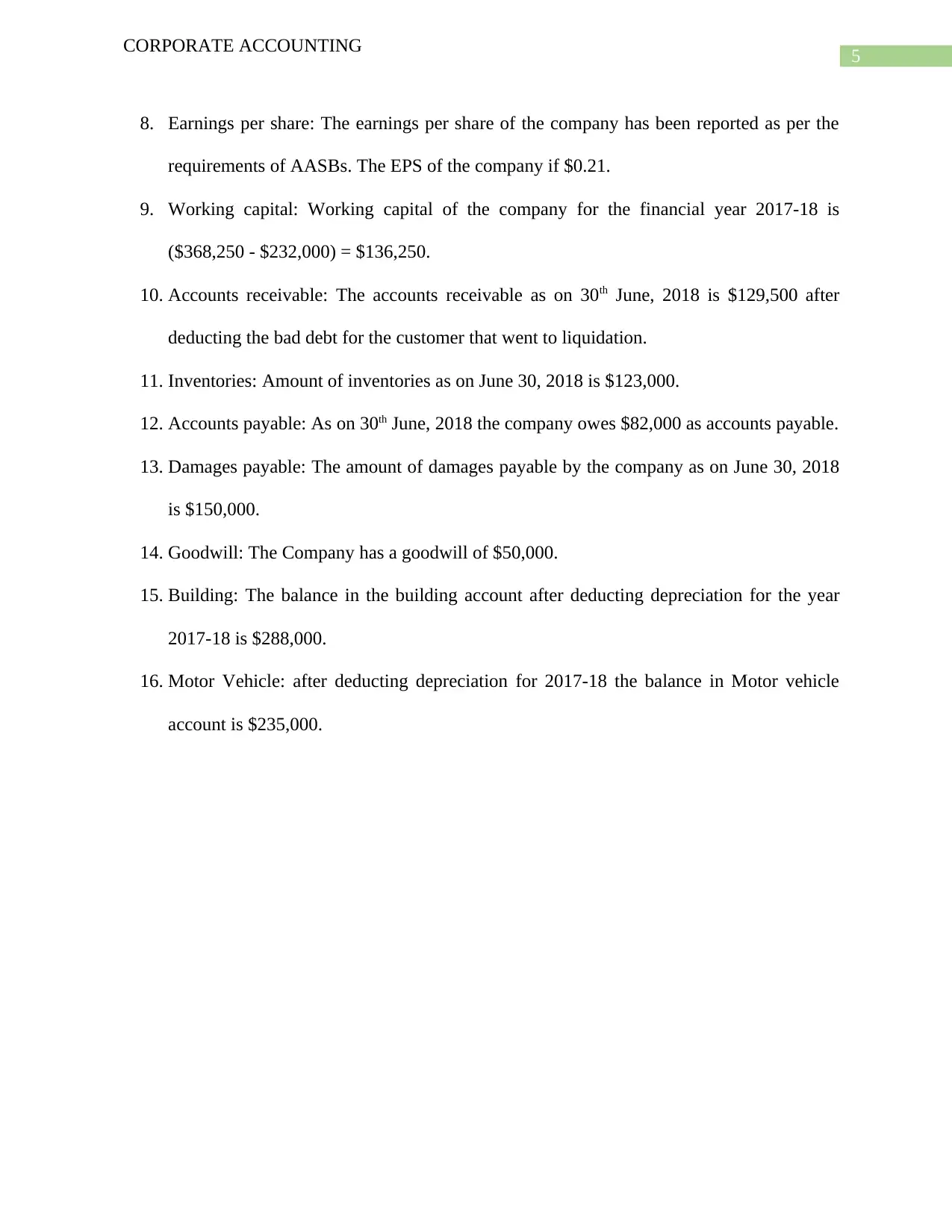

CORPORATE ACCOUNTING

8. Earnings per share: The earnings per share of the company has been reported as per the

requirements of AASBs. The EPS of the company if $0.21.

9. Working capital: Working capital of the company for the financial year 2017-18 is

($368,250 - $232,000) = $136,250.

10. Accounts receivable: The accounts receivable as on 30th June, 2018 is $129,500 after

deducting the bad debt for the customer that went to liquidation.

11. Inventories: Amount of inventories as on June 30, 2018 is $123,000.

12. Accounts payable: As on 30th June, 2018 the company owes $82,000 as accounts payable.

13. Damages payable: The amount of damages payable by the company as on June 30, 2018

is $150,000.

14. Goodwill: The Company has a goodwill of $50,000.

15. Building: The balance in the building account after deducting depreciation for the year

2017-18 is $288,000.

16. Motor Vehicle: after deducting depreciation for 2017-18 the balance in Motor vehicle

account is $235,000.

CORPORATE ACCOUNTING

8. Earnings per share: The earnings per share of the company has been reported as per the

requirements of AASBs. The EPS of the company if $0.21.

9. Working capital: Working capital of the company for the financial year 2017-18 is

($368,250 - $232,000) = $136,250.

10. Accounts receivable: The accounts receivable as on 30th June, 2018 is $129,500 after

deducting the bad debt for the customer that went to liquidation.

11. Inventories: Amount of inventories as on June 30, 2018 is $123,000.

12. Accounts payable: As on 30th June, 2018 the company owes $82,000 as accounts payable.

13. Damages payable: The amount of damages payable by the company as on June 30, 2018

is $150,000.

14. Goodwill: The Company has a goodwill of $50,000.

15. Building: The balance in the building account after deducting depreciation for the year

2017-18 is $288,000.

16. Motor Vehicle: after deducting depreciation for 2017-18 the balance in Motor vehicle

account is $235,000.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

CORPORATE ACCOUNTING

References:

Ball, R., Li, X. and Shivakumar, L., 2015. Contractibility and transparency of financial statement

information prepared under IFRS: Evidence from debt contracts around IFRS adoption. Journal

of Accounting Research, 53(5), pp.915-963. [Online] Available from:

https://onlinelibrary.wiley.com/doi/abs/10.1111/1475-679X.12095 [Accessed 18 September

2018]

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU. [Online] Available from: https://books.google.co.in/books?

hl=en&lr=&id=EQbiBAAAQBAJ&oi=fnd&pg=PP1&dq=Gitman,+L.J.,+Juchau,+R.

+and+Flanagan,+J.,+2015.+Principles+of+managerial+finance.

+Pearson+Higher+Education+AU.&ots=utmVACTXXP&sig=MjtwDafawHDGTeDR3iDCyTP

7Iec#v=onepage&q&f=false [Accessed 18 September 2018]

Libby, R., 2017. Accounting and human information processing. In The Routledge Companion

to Behavioural Accounting Research (pp. 42-54). Routledge. [Online] Available from:

https://www.taylorfrancis.com/books/9781317488002/chapters/10.4324%2F9781315710129-11

[Accessed 18 September 2018]

Zeff, S.A., 2016. Forging accounting principles in five countries: A history and an analysis of

trends. Routledge. [Online] Available from:

https://www.taylorfrancis.com/books/9781317488002/chapters/10.4324%2F9781315710129-11

[Accessed 18 September 2018]

CORPORATE ACCOUNTING

References:

Ball, R., Li, X. and Shivakumar, L., 2015. Contractibility and transparency of financial statement

information prepared under IFRS: Evidence from debt contracts around IFRS adoption. Journal

of Accounting Research, 53(5), pp.915-963. [Online] Available from:

https://onlinelibrary.wiley.com/doi/abs/10.1111/1475-679X.12095 [Accessed 18 September

2018]

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU. [Online] Available from: https://books.google.co.in/books?

hl=en&lr=&id=EQbiBAAAQBAJ&oi=fnd&pg=PP1&dq=Gitman,+L.J.,+Juchau,+R.

+and+Flanagan,+J.,+2015.+Principles+of+managerial+finance.

+Pearson+Higher+Education+AU.&ots=utmVACTXXP&sig=MjtwDafawHDGTeDR3iDCyTP

7Iec#v=onepage&q&f=false [Accessed 18 September 2018]

Libby, R., 2017. Accounting and human information processing. In The Routledge Companion

to Behavioural Accounting Research (pp. 42-54). Routledge. [Online] Available from:

https://www.taylorfrancis.com/books/9781317488002/chapters/10.4324%2F9781315710129-11

[Accessed 18 September 2018]

Zeff, S.A., 2016. Forging accounting principles in five countries: A history and an analysis of

trends. Routledge. [Online] Available from:

https://www.taylorfrancis.com/books/9781317488002/chapters/10.4324%2F9781315710129-11

[Accessed 18 September 2018]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CORPORATE ACCOUNTING

Appendix 1:

Statement of profit and loss and other comprehensive income

Particulars Amount ($) Amount ($)

Revenue:

Sales 990,000.

00

Interest revenue 98,500.

00

Total revenue 1,088,500.

00

Expenditures:

Cost of goods sold 290,000.00

Distribution expenses 93,000.00

Sales and marketing expenses 95,000.00

Administration expenses 55,000.00

Bad debt 63,000.00

Damages 150,000.00

CORPORATE ACCOUNTING

Appendix 1:

Statement of profit and loss and other comprehensive income

Particulars Amount ($) Amount ($)

Revenue:

Sales 990,000.

00

Interest revenue 98,500.

00

Total revenue 1,088,500.

00

Expenditures:

Cost of goods sold 290,000.00

Distribution expenses 93,000.00

Sales and marketing expenses 95,000.00

Administration expenses 55,000.00

Bad debt 63,000.00

Damages 150,000.00

8

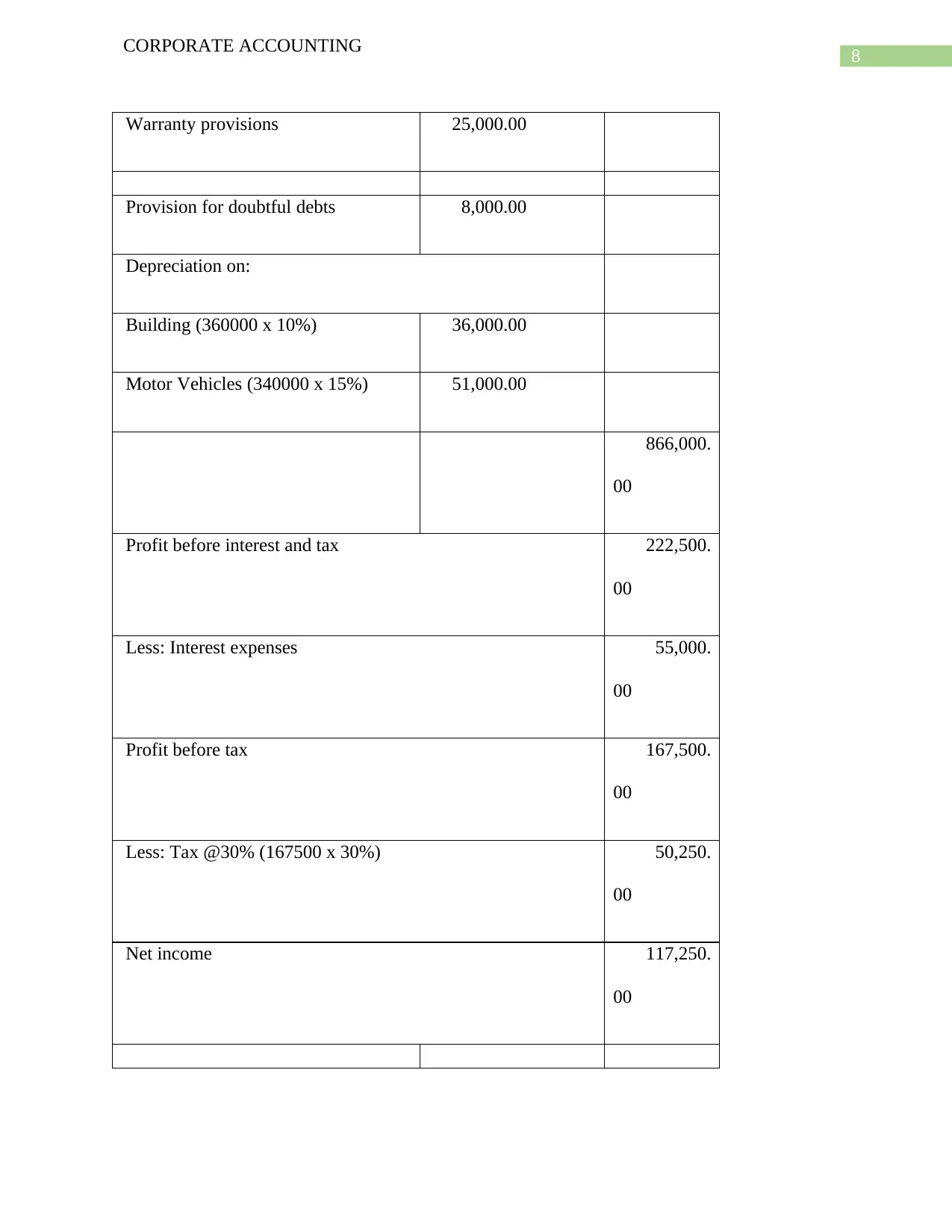

CORPORATE ACCOUNTING

Warranty provisions 25,000.00

Provision for doubtful debts 8,000.00

Depreciation on:

Building (360000 x 10%) 36,000.00

Motor Vehicles (340000 x 15%) 51,000.00

866,000.

00

Profit before interest and tax 222,500.

00

Less: Interest expenses 55,000.

00

Profit before tax 167,500.

00

Less: Tax @30% (167500 x 30%) 50,250.

00

Net income 117,250.

00

CORPORATE ACCOUNTING

Warranty provisions 25,000.00

Provision for doubtful debts 8,000.00

Depreciation on:

Building (360000 x 10%) 36,000.00

Motor Vehicles (340000 x 15%) 51,000.00

866,000.

00

Profit before interest and tax 222,500.

00

Less: Interest expenses 55,000.

00

Profit before tax 167,500.

00

Less: Tax @30% (167500 x 30%) 50,250.

00

Net income 117,250.

00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

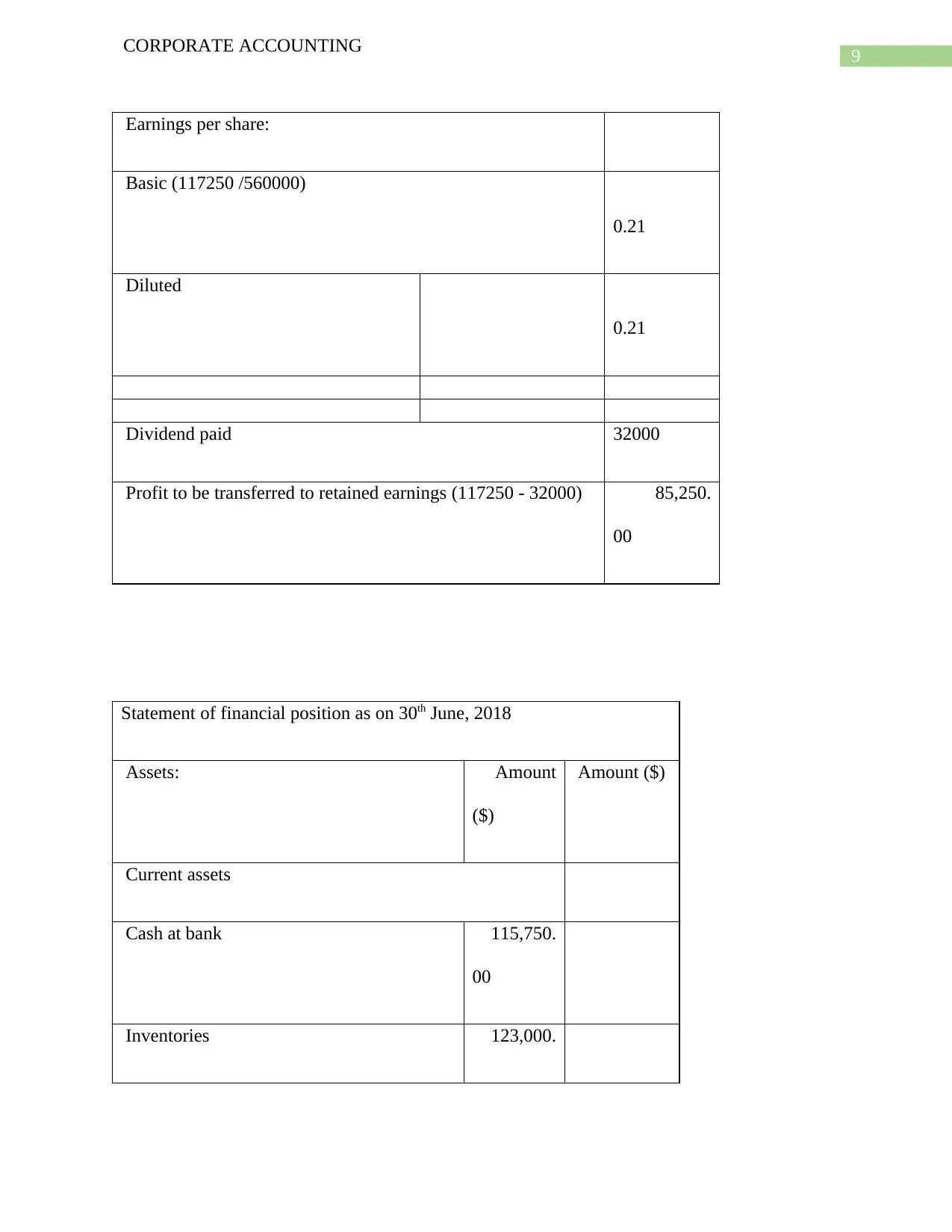

9

CORPORATE ACCOUNTING

Earnings per share:

Basic (117250 /560000)

0.21

Diluted

0.21

Dividend paid 32000

Profit to be transferred to retained earnings (117250 - 32000) 85,250.

00

Statement of financial position as on 30th June, 2018

Assets: Amount

($)

Amount ($)

Current assets

Cash at bank 115,750.

00

Inventories 123,000.

CORPORATE ACCOUNTING

Earnings per share:

Basic (117250 /560000)

0.21

Diluted

0.21

Dividend paid 32000

Profit to be transferred to retained earnings (117250 - 32000) 85,250.

00

Statement of financial position as on 30th June, 2018

Assets: Amount

($)

Amount ($)

Current assets

Cash at bank 115,750.

00

Inventories 123,000.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

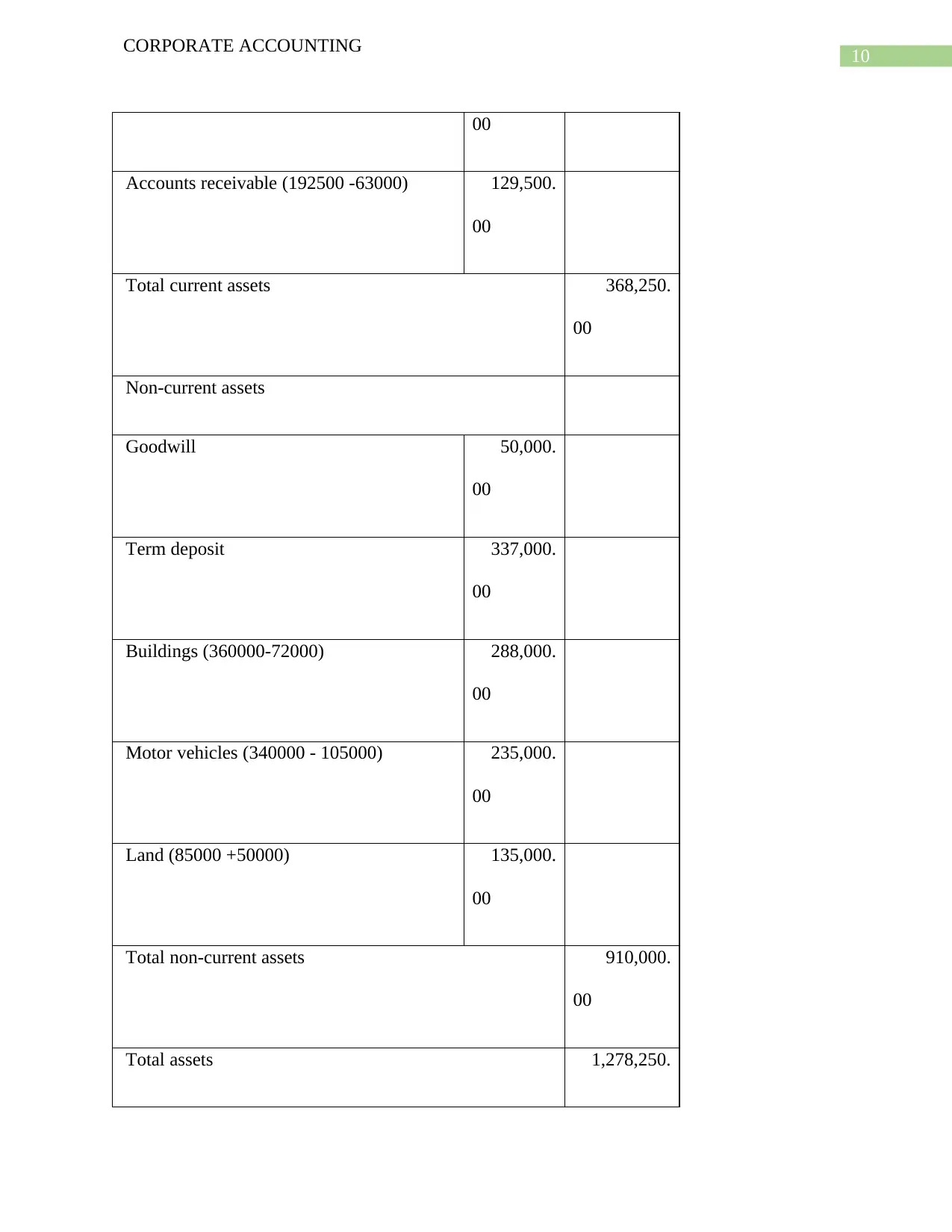

10

CORPORATE ACCOUNTING

00

Accounts receivable (192500 -63000) 129,500.

00

Total current assets 368,250.

00

Non-current assets

Goodwill 50,000.

00

Term deposit 337,000.

00

Buildings (360000-72000) 288,000.

00

Motor vehicles (340000 - 105000) 235,000.

00

Land (85000 +50000) 135,000.

00

Total non-current assets 910,000.

00

Total assets 1,278,250.

CORPORATE ACCOUNTING

00

Accounts receivable (192500 -63000) 129,500.

00

Total current assets 368,250.

00

Non-current assets

Goodwill 50,000.

00

Term deposit 337,000.

00

Buildings (360000-72000) 288,000.

00

Motor vehicles (340000 - 105000) 235,000.

00

Land (85000 +50000) 135,000.

00

Total non-current assets 910,000.

00

Total assets 1,278,250.

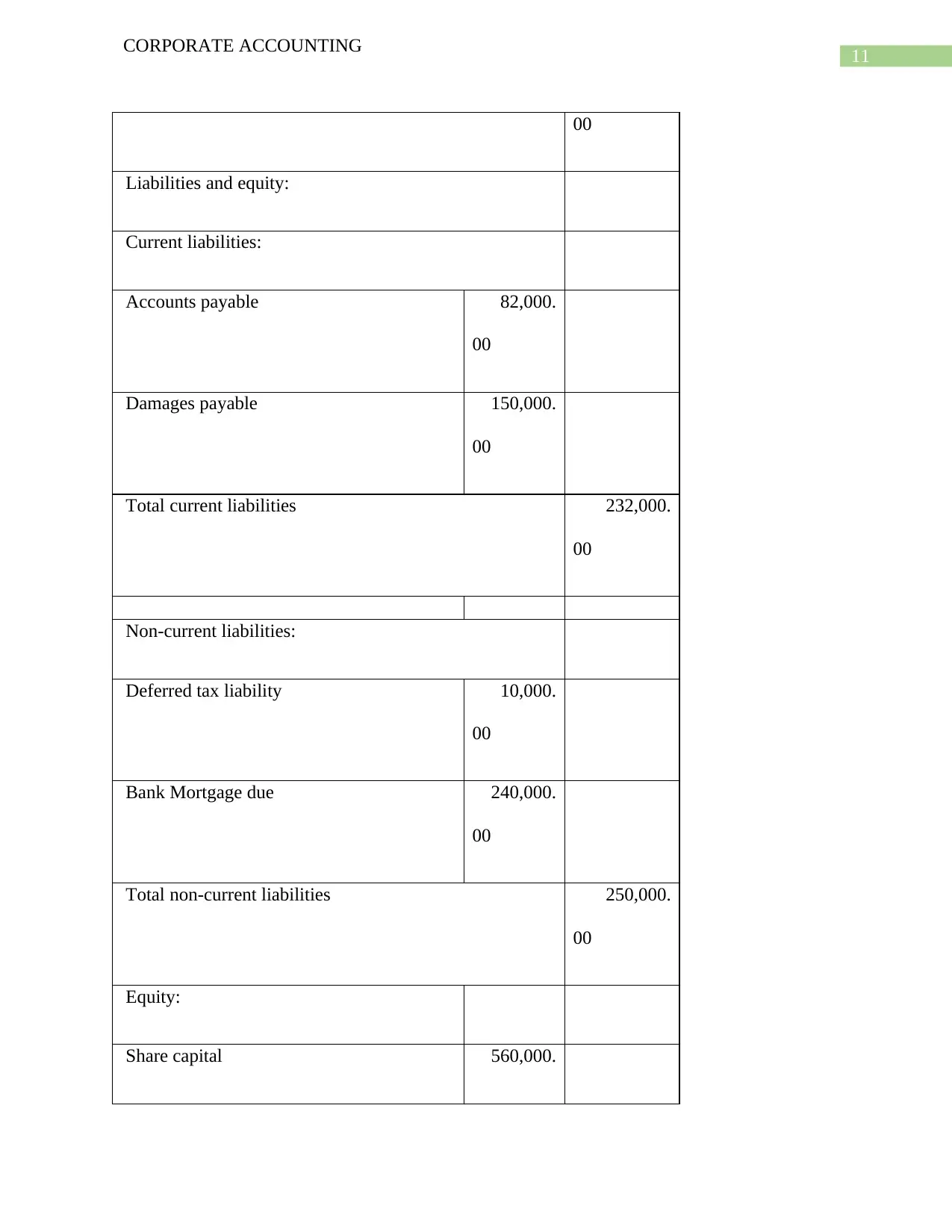

11

CORPORATE ACCOUNTING

00

Liabilities and equity:

Current liabilities:

Accounts payable 82,000.

00

Damages payable 150,000.

00

Total current liabilities 232,000.

00

Non-current liabilities:

Deferred tax liability 10,000.

00

Bank Mortgage due 240,000.

00

Total non-current liabilities 250,000.

00

Equity:

Share capital 560,000.

CORPORATE ACCOUNTING

00

Liabilities and equity:

Current liabilities:

Accounts payable 82,000.

00

Damages payable 150,000.

00

Total current liabilities 232,000.

00

Non-current liabilities:

Deferred tax liability 10,000.

00

Bank Mortgage due 240,000.

00

Total non-current liabilities 250,000.

00

Equity:

Share capital 560,000.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.