Accounting and Financial Comparison of Three Australian Companies

VerifiedAdded on 2020/03/28

|16

|3601

|58

Report

AI Summary

This report provides a comparative analysis of the accounting and financial statements of three major Australian companies: Metcash, Wesfarmers, and Woolworths. It begins with an overview of each company, including their founding, core business operations, and revenue generation. The report then delves into the concepts of accruals and deferrals, explaining their significance in accounting. A detailed description of the annual financial reports of each company is presented, focusing on key financial metrics such as revenue, depreciation expense, prepaid rent, interest payable, unearned fees, and salaries. The analysis includes a review of the present financial conditions of each company, highlighting their performance in the context of the Australian market. The report concludes with a summary of the findings and a discussion of the implications of the accounting practices and financial performance of the three companies.

COMPARISON OF ACCOUNTING AND FINANCIAL

STATEMENT OF DIFFERENT COMPANIES

1

STATEMENT OF DIFFERENT COMPANIES

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................3

Overviews of Considered Companies.............................................................................................3

Metcash........................................................................................................................................3

Wesfarmers..................................................................................................................................4

Woolworths..................................................................................................................................4

Concept and Importance of Accruals and Deferrals in Accounting................................................4

Accruals.......................................................................................................................................5

Deferrals.......................................................................................................................................5

Description of Annual Financial Report of Metcash.......................................................................5

Description of Annual Financial Report of Wesfarmers.................................................................7

Description of Annual Financial Report of Woolworths...............................................................10

Review of Present Conditions of Companies................................................................................13

Conclusion.....................................................................................................................................13

References......................................................................................................................................15

2

Introduction......................................................................................................................................3

Overviews of Considered Companies.............................................................................................3

Metcash........................................................................................................................................3

Wesfarmers..................................................................................................................................4

Woolworths..................................................................................................................................4

Concept and Importance of Accruals and Deferrals in Accounting................................................4

Accruals.......................................................................................................................................5

Deferrals.......................................................................................................................................5

Description of Annual Financial Report of Metcash.......................................................................5

Description of Annual Financial Report of Wesfarmers.................................................................7

Description of Annual Financial Report of Woolworths...............................................................10

Review of Present Conditions of Companies................................................................................13

Conclusion.....................................................................................................................................13

References......................................................................................................................................15

2

Introduction

In the current business world, accounting is considered as one of the most significant operations

that are involved in the overall progress of any particular company. Hence, it becomes very

important for the designated department and authorities of any organization to be very extremely

careful and precise while doing the calculations related to accounting so that the associated

profit, losses, accruals, deferrals and certain other financial details. The major function of any

accounting department of any company is to keep a record of the business transactions that have

been done in any specific way from the company’s side. In the following study, three

organizations have been considered for the study of financial accounting services and their

financial performances have been analyzed deeply in terms of many financial aspects and details.

Overviews of Considered Companies

In order to complete the following study related to financial accounting, the companies have

been chosen from online as well as shopping retail business sectors. These companies have

successfully established their roots in the Australian Market of online groceries shopping along

with other popularly used food and beverages. The involvement of these companies in Accruals

and Deferrals has been very active and the business carried out by them has been considered by

many investors and stakeholders for their attractive policies related to accounting. Following are

the details related to the three companies along with work structure.

Metcash

The Metcash was founded in May, 1927 in Australia by its founder Joe David at the Surry Hills

of New South Wales. The company started its operations by opening a small Food Store and

gradually increased to become a Retail Giant in the retailing as well as wholesale market of

Australia. This company deals with liquor distribution, supply of fast food like groceries and also

sells hardware. The C-Distribution is mainly included in the operations that involve Campbells

Wholesale. This company is about selling of groceries along with Independent Brands in the

Liquor Marketers of Australian Continent. The operations of all the subsidies are controlled by

the Company CEO Julie Hutton. The revenue generated by Metcash by the end of Business year

of 2016 was AUD 13.5 billion (Metcash, 2017).

3

In the current business world, accounting is considered as one of the most significant operations

that are involved in the overall progress of any particular company. Hence, it becomes very

important for the designated department and authorities of any organization to be very extremely

careful and precise while doing the calculations related to accounting so that the associated

profit, losses, accruals, deferrals and certain other financial details. The major function of any

accounting department of any company is to keep a record of the business transactions that have

been done in any specific way from the company’s side. In the following study, three

organizations have been considered for the study of financial accounting services and their

financial performances have been analyzed deeply in terms of many financial aspects and details.

Overviews of Considered Companies

In order to complete the following study related to financial accounting, the companies have

been chosen from online as well as shopping retail business sectors. These companies have

successfully established their roots in the Australian Market of online groceries shopping along

with other popularly used food and beverages. The involvement of these companies in Accruals

and Deferrals has been very active and the business carried out by them has been considered by

many investors and stakeholders for their attractive policies related to accounting. Following are

the details related to the three companies along with work structure.

Metcash

The Metcash was founded in May, 1927 in Australia by its founder Joe David at the Surry Hills

of New South Wales. The company started its operations by opening a small Food Store and

gradually increased to become a Retail Giant in the retailing as well as wholesale market of

Australia. This company deals with liquor distribution, supply of fast food like groceries and also

sells hardware. The C-Distribution is mainly included in the operations that involve Campbells

Wholesale. This company is about selling of groceries along with Independent Brands in the

Liquor Marketers of Australian Continent. The operations of all the subsidies are controlled by

the Company CEO Julie Hutton. The revenue generated by Metcash by the end of Business year

of 2016 was AUD 13.5 billion (Metcash, 2017).

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Wesfarmers

Established in 1941, the Wesfarmers is currently located around many parts of Australia and is

headquartered at Western Australia’s Perth. The Wesfarmers Incorporation has been always

counted among the leading business organizations in the Australian continent as it operates in

many sectors of business. This includes Supermarkets, Retail Liquor, Auto Services, Grocery

Stores and several other business domains. The organization is presently headed by Michael

Chaney who is the current chairperson of the company along with Richard Goyder who is the

Chief Executive Officer of the Firm. The Wesfarmers group earns revenue of about AU$ 67

billion every year with over 20,000 workers and management staff working for the company.

The company also provides its services in foreign countries like United Kingdom, New Zealand,

Bangladesh and Ireland (Wesfarmers.com.au, 2017).

Woolworths

The Woolworths Incorporations is another Australian Retail giant that in involved in supply,

processing and distribution of packaged as well as fresh food in the Food markets of Australia.

This organization was established in December 1924 and presently operates in many food

markets at different locations of Australia apart from operating some wholesale distribution

chains. The director of Woolworths is Mr. Brad Banducci and has more than 100,000 employees

that work with the firm. In the year 2016, the overall turnover of Woolworths was AUD 72

billion that was earned from its operations in Australia as well as those located at United

Kingdom, Africa and New Zealand. The firm has earned a profit of AUD 3.5 billion in the year

2016 (Woolworths.com.au, 2017).

Concept and Importance of Accruals and Deferrals in Accounting

Whenever a company intends to initiate a business, it is not possible for the owners all the time

to take the initiative completely in its own capability. Hence, it becomes quite essential that the

company owners take some amount of debts and loans from those companies that are already

well established so that they can carry out the operations in a better manner (Byzalov and Basu,

2016, p.860). In the similar manner, the companies that are performing well and are well

established must contribute some efforts and help towards taking the startup forward to that the

new companies can get a strong hold in the market. This is usually done through lending some

4

Established in 1941, the Wesfarmers is currently located around many parts of Australia and is

headquartered at Western Australia’s Perth. The Wesfarmers Incorporation has been always

counted among the leading business organizations in the Australian continent as it operates in

many sectors of business. This includes Supermarkets, Retail Liquor, Auto Services, Grocery

Stores and several other business domains. The organization is presently headed by Michael

Chaney who is the current chairperson of the company along with Richard Goyder who is the

Chief Executive Officer of the Firm. The Wesfarmers group earns revenue of about AU$ 67

billion every year with over 20,000 workers and management staff working for the company.

The company also provides its services in foreign countries like United Kingdom, New Zealand,

Bangladesh and Ireland (Wesfarmers.com.au, 2017).

Woolworths

The Woolworths Incorporations is another Australian Retail giant that in involved in supply,

processing and distribution of packaged as well as fresh food in the Food markets of Australia.

This organization was established in December 1924 and presently operates in many food

markets at different locations of Australia apart from operating some wholesale distribution

chains. The director of Woolworths is Mr. Brad Banducci and has more than 100,000 employees

that work with the firm. In the year 2016, the overall turnover of Woolworths was AUD 72

billion that was earned from its operations in Australia as well as those located at United

Kingdom, Africa and New Zealand. The firm has earned a profit of AUD 3.5 billion in the year

2016 (Woolworths.com.au, 2017).

Concept and Importance of Accruals and Deferrals in Accounting

Whenever a company intends to initiate a business, it is not possible for the owners all the time

to take the initiative completely in its own capability. Hence, it becomes quite essential that the

company owners take some amount of debts and loans from those companies that are already

well established so that they can carry out the operations in a better manner (Byzalov and Basu,

2016, p.860). In the similar manner, the companies that are performing well and are well

established must contribute some efforts and help towards taking the startup forward to that the

new companies can get a strong hold in the market. This is usually done through lending some

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

amount that can be received later. These lending and borrowing brings up the concept related to

Accruals and Deferrals (Iotti and Bonazzi, 2016, p.714). The detailed explanation of the two

mentioned terms has been mentioned below.

Accruals

The term Accruals means the amount that is supposed to be received from any organization or a

person after the end of a certain period. According to Kanodia and Sapra (2016, p.624), most of

the companies are likely to receive some amount of money after the end of a particular year. This

particular amount is calculated as the Accrual amount in the annual financial report that is

published every year by the firm. It is very much certain as per the company’s strategists as well

as financial experts that their company will receive that amount after the end of that year or in

the near future time. The amount that a company receives is called as the accrued profit.

Similarly, the same amount that is paid by any company or person is called as Accrued Expense.

As stated by Meyering et al. (2017, p.21), any company needs to pay the Accrued Amount only

after the necessary terms and conditions are completed successfully. This also includes the

delivery of all the desired and contracted products and services by the service provider company

to the client group.

Deferrals

The term Deferrals refers to the amount of money that is to be paid by any company or

individual before the delivery of the services. These services normally include the prepaid

services as well as the insurances. In this procedure, the company first receives the payment that

is mostly for insurances related operations and later delivers the products or services that the

client organization is entitled for as mentioned in the contract during the contract deal. The

amount that the host company or the service provider receives is known as the Deferral Profit for

the recipient company. Similarly, the same amount that is paid by the client firm or group is

called Deferral Expense. Moreover, as stated by Omonuk and Dodor (2016, p.102), the time that

is taken to complete the terms and conditions of a contract is known as tenure.

Description of Annual Financial Report of Metcash

Metcash Public Limited has generated revenue of AUD 13.54 billion in the year 2016 that seems

to be a bit higher than that in 2015 that stood at AUD 13.37 billion. The revenue generation has

5

Accruals and Deferrals (Iotti and Bonazzi, 2016, p.714). The detailed explanation of the two

mentioned terms has been mentioned below.

Accruals

The term Accruals means the amount that is supposed to be received from any organization or a

person after the end of a certain period. According to Kanodia and Sapra (2016, p.624), most of

the companies are likely to receive some amount of money after the end of a particular year. This

particular amount is calculated as the Accrual amount in the annual financial report that is

published every year by the firm. It is very much certain as per the company’s strategists as well

as financial experts that their company will receive that amount after the end of that year or in

the near future time. The amount that a company receives is called as the accrued profit.

Similarly, the same amount that is paid by any company or person is called as Accrued Expense.

As stated by Meyering et al. (2017, p.21), any company needs to pay the Accrued Amount only

after the necessary terms and conditions are completed successfully. This also includes the

delivery of all the desired and contracted products and services by the service provider company

to the client group.

Deferrals

The term Deferrals refers to the amount of money that is to be paid by any company or

individual before the delivery of the services. These services normally include the prepaid

services as well as the insurances. In this procedure, the company first receives the payment that

is mostly for insurances related operations and later delivers the products or services that the

client organization is entitled for as mentioned in the contract during the contract deal. The

amount that the host company or the service provider receives is known as the Deferral Profit for

the recipient company. Similarly, the same amount that is paid by the client firm or group is

called Deferral Expense. Moreover, as stated by Omonuk and Dodor (2016, p.102), the time that

is taken to complete the terms and conditions of a contract is known as tenure.

Description of Annual Financial Report of Metcash

Metcash Public Limited has generated revenue of AUD 13.54 billion in the year 2016 that seems

to be a bit higher than that in 2015 that stood at AUD 13.37 billion. The revenue generation has

5

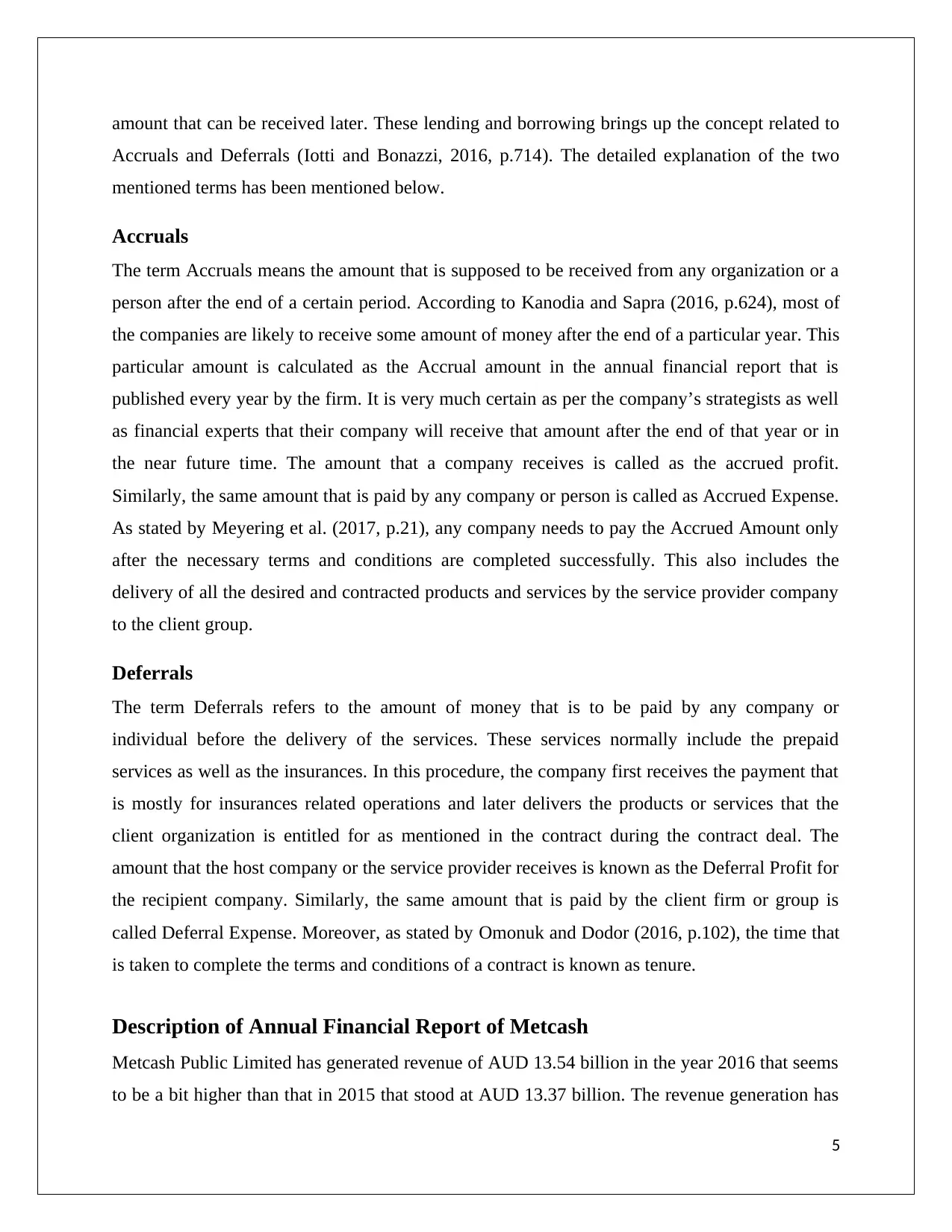

shown 1.3% variance in these two years, which doesn’t qualifies to be a significant growth as per

the stature of the firm. After completion of a performance review of the company, Choudhary et

al. (2016, p.103) have mentioned that a minor increase in revenue is observed in mostly public

companies. The tough level of competition that is given by other private sectors can be the most

significant reason for the observed performance as this led to deviation of customers towards the

privately owned organizations (Jones, 2016, p.24).

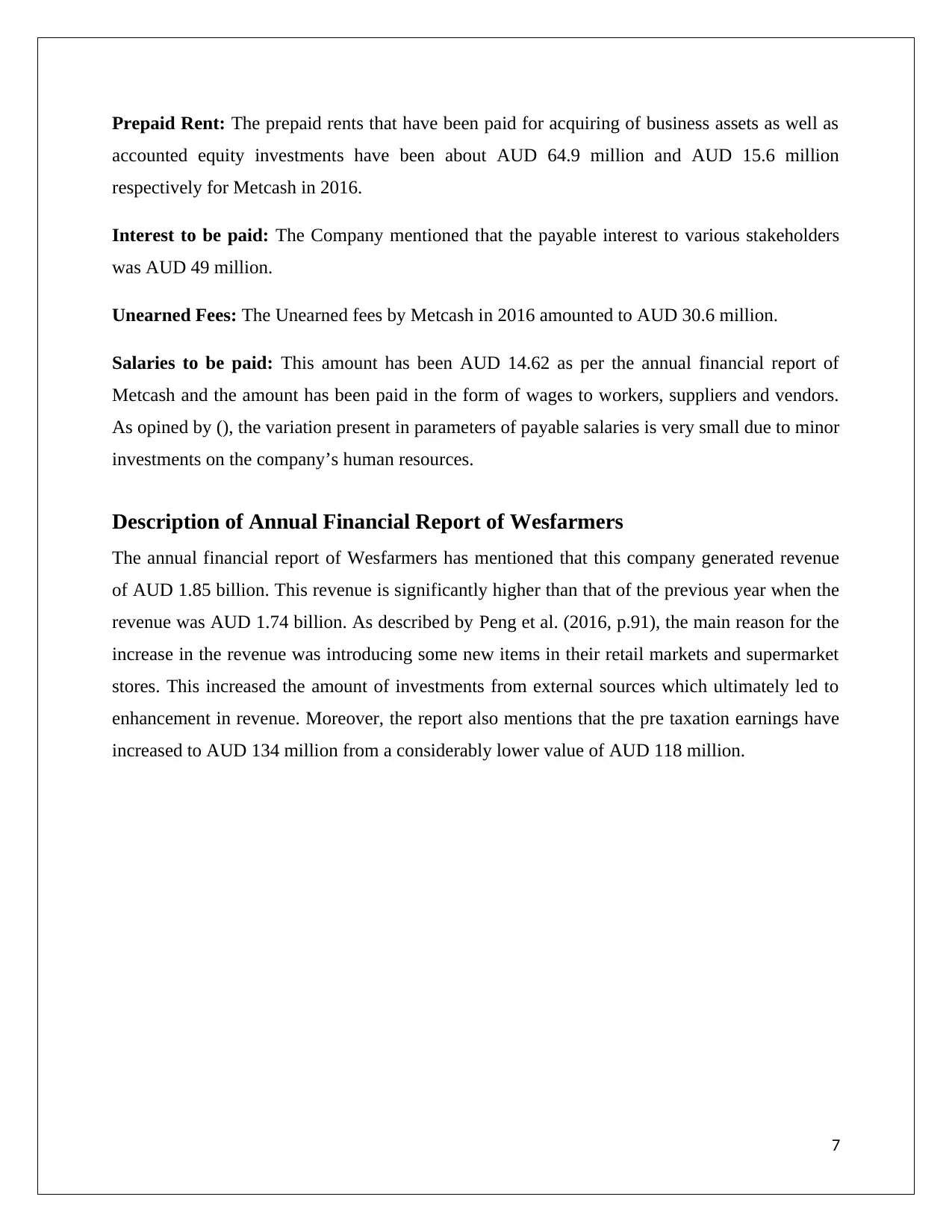

Figure 1: Annual Revenue Generation of Metcash for 2016

(Source: Metcash.com, 2017)

Depreciation Expense: Metcash has spent a sum of AUD 3.3 million in the form of depreciation

expense for properties, equipments, units and plants associated with the business functions.

6

the stature of the firm. After completion of a performance review of the company, Choudhary et

al. (2016, p.103) have mentioned that a minor increase in revenue is observed in mostly public

companies. The tough level of competition that is given by other private sectors can be the most

significant reason for the observed performance as this led to deviation of customers towards the

privately owned organizations (Jones, 2016, p.24).

Figure 1: Annual Revenue Generation of Metcash for 2016

(Source: Metcash.com, 2017)

Depreciation Expense: Metcash has spent a sum of AUD 3.3 million in the form of depreciation

expense for properties, equipments, units and plants associated with the business functions.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Prepaid Rent: The prepaid rents that have been paid for acquiring of business assets as well as

accounted equity investments have been about AUD 64.9 million and AUD 15.6 million

respectively for Metcash in 2016.

Interest to be paid: The Company mentioned that the payable interest to various stakeholders

was AUD 49 million.

Unearned Fees: The Unearned fees by Metcash in 2016 amounted to AUD 30.6 million.

Salaries to be paid: This amount has been AUD 14.62 as per the annual financial report of

Metcash and the amount has been paid in the form of wages to workers, suppliers and vendors.

As opined by (), the variation present in parameters of payable salaries is very small due to minor

investments on the company’s human resources.

Description of Annual Financial Report of Wesfarmers

The annual financial report of Wesfarmers has mentioned that this company generated revenue

of AUD 1.85 billion. This revenue is significantly higher than that of the previous year when the

revenue was AUD 1.74 billion. As described by Peng et al. (2016, p.91), the main reason for the

increase in the revenue was introducing some new items in their retail markets and supermarket

stores. This increased the amount of investments from external sources which ultimately led to

enhancement in revenue. Moreover, the report also mentions that the pre taxation earnings have

increased to AUD 134 million from a considerably lower value of AUD 118 million.

7

accounted equity investments have been about AUD 64.9 million and AUD 15.6 million

respectively for Metcash in 2016.

Interest to be paid: The Company mentioned that the payable interest to various stakeholders

was AUD 49 million.

Unearned Fees: The Unearned fees by Metcash in 2016 amounted to AUD 30.6 million.

Salaries to be paid: This amount has been AUD 14.62 as per the annual financial report of

Metcash and the amount has been paid in the form of wages to workers, suppliers and vendors.

As opined by (), the variation present in parameters of payable salaries is very small due to minor

investments on the company’s human resources.

Description of Annual Financial Report of Wesfarmers

The annual financial report of Wesfarmers has mentioned that this company generated revenue

of AUD 1.85 billion. This revenue is significantly higher than that of the previous year when the

revenue was AUD 1.74 billion. As described by Peng et al. (2016, p.91), the main reason for the

increase in the revenue was introducing some new items in their retail markets and supermarket

stores. This increased the amount of investments from external sources which ultimately led to

enhancement in revenue. Moreover, the report also mentions that the pre taxation earnings have

increased to AUD 134 million from a considerably lower value of AUD 118 million.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

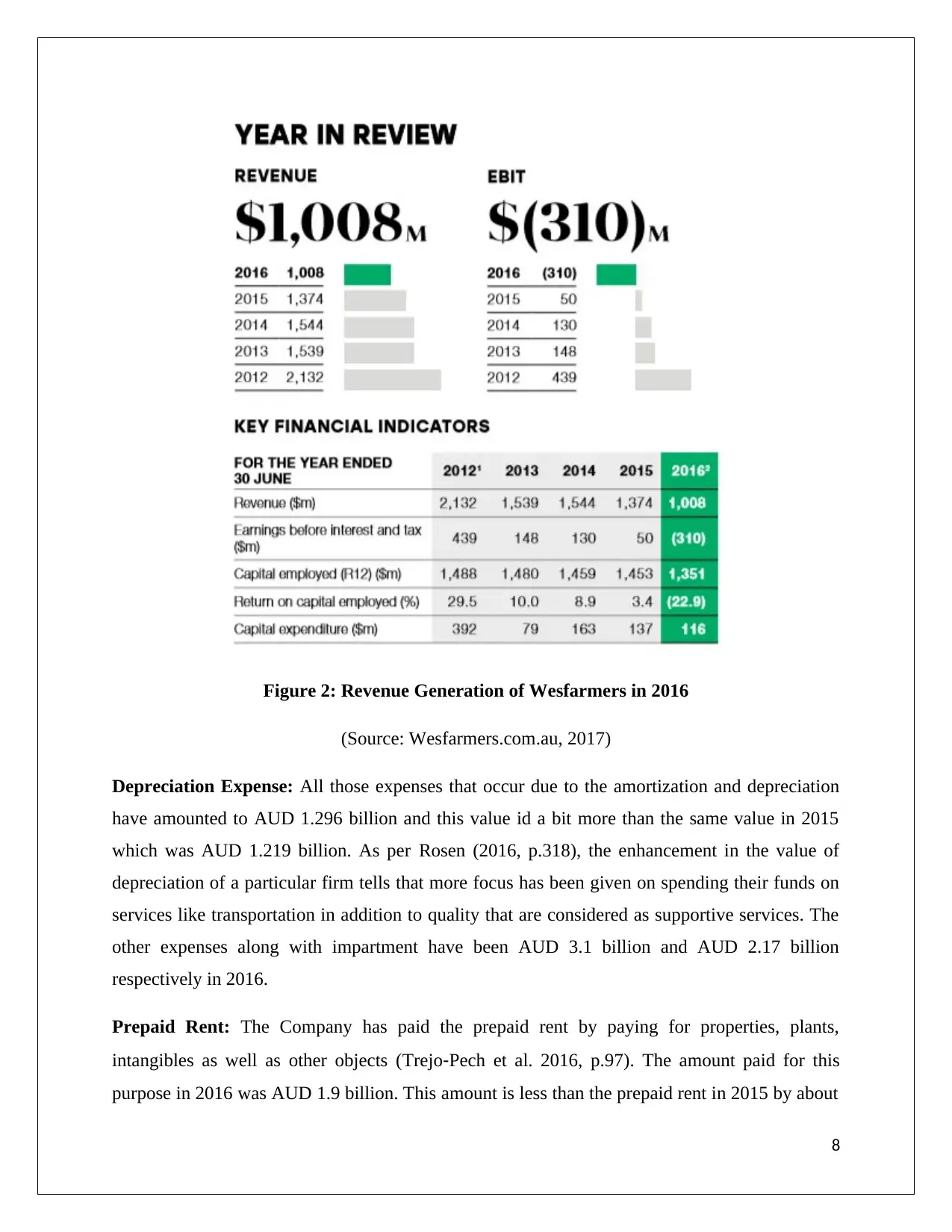

Figure 2: Revenue Generation of Wesfarmers in 2016

(Source: Wesfarmers.com.au, 2017)

Depreciation Expense: All those expenses that occur due to the amortization and depreciation

have amounted to AUD 1.296 billion and this value id a bit more than the same value in 2015

which was AUD 1.219 billion. As per Rosen (2016, p.318), the enhancement in the value of

depreciation of a particular firm tells that more focus has been given on spending their funds on

services like transportation in addition to quality that are considered as supportive services. The

other expenses along with impartment have been AUD 3.1 billion and AUD 2.17 billion

respectively in 2016.

Prepaid Rent: The Company has paid the prepaid rent by paying for properties, plants,

intangibles as well as other objects (Trejo‐Pech et al. 2016, p.97). The amount paid for this

purpose in 2016 was AUD 1.9 billion. This amount is less than the prepaid rent in 2015 by about

8

(Source: Wesfarmers.com.au, 2017)

Depreciation Expense: All those expenses that occur due to the amortization and depreciation

have amounted to AUD 1.296 billion and this value id a bit more than the same value in 2015

which was AUD 1.219 billion. As per Rosen (2016, p.318), the enhancement in the value of

depreciation of a particular firm tells that more focus has been given on spending their funds on

services like transportation in addition to quality that are considered as supportive services. The

other expenses along with impartment have been AUD 3.1 billion and AUD 2.17 billion

respectively in 2016.

Prepaid Rent: The Company has paid the prepaid rent by paying for properties, plants,

intangibles as well as other objects (Trejo‐Pech et al. 2016, p.97). The amount paid for this

purpose in 2016 was AUD 1.9 billion. This amount is less than the prepaid rent in 2015 by about

8

AUD 300 million. This signifies that the company has reduced the prices of its commodities and

less number of investments has been done by other firms (Zimmerman and Bloom, 2016, p.88).

Interest to be paid: The interests that are to be paid in the current liabilities because of trade as

well as other aspects of business are AUD 5.7 billion in the year 2016. This amount is higher

than 2015 figure of AUD 5.5 billion.

Unearned Fees: The Wesfarmers has stated that the amount that the company borrowed was

AUD 1.4 billion and it is almost double than the unearned fees that existed in the year 2015 at

AUD 722 billion.

Salaries to be paid: the salaries that the company has paid to its workers as weekly wages and

as expenses related to employee benefits have been bear about AUD 8.85 billion. This amount is

very much higher than that of 2015 which stands at AUD 8.2 billion. As described by Andries et

al. (2017, p.543), the payable salary increases when the company takes very good care of its

employees and other human resources. Apart from this, the other payables and trade stood at

AUD 6.4 billion.

9

less number of investments has been done by other firms (Zimmerman and Bloom, 2016, p.88).

Interest to be paid: The interests that are to be paid in the current liabilities because of trade as

well as other aspects of business are AUD 5.7 billion in the year 2016. This amount is higher

than 2015 figure of AUD 5.5 billion.

Unearned Fees: The Wesfarmers has stated that the amount that the company borrowed was

AUD 1.4 billion and it is almost double than the unearned fees that existed in the year 2015 at

AUD 722 billion.

Salaries to be paid: the salaries that the company has paid to its workers as weekly wages and

as expenses related to employee benefits have been bear about AUD 8.85 billion. This amount is

very much higher than that of 2015 which stands at AUD 8.2 billion. As described by Andries et

al. (2017, p.543), the payable salary increases when the company takes very good care of its

employees and other human resources. Apart from this, the other payables and trade stood at

AUD 6.4 billion.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

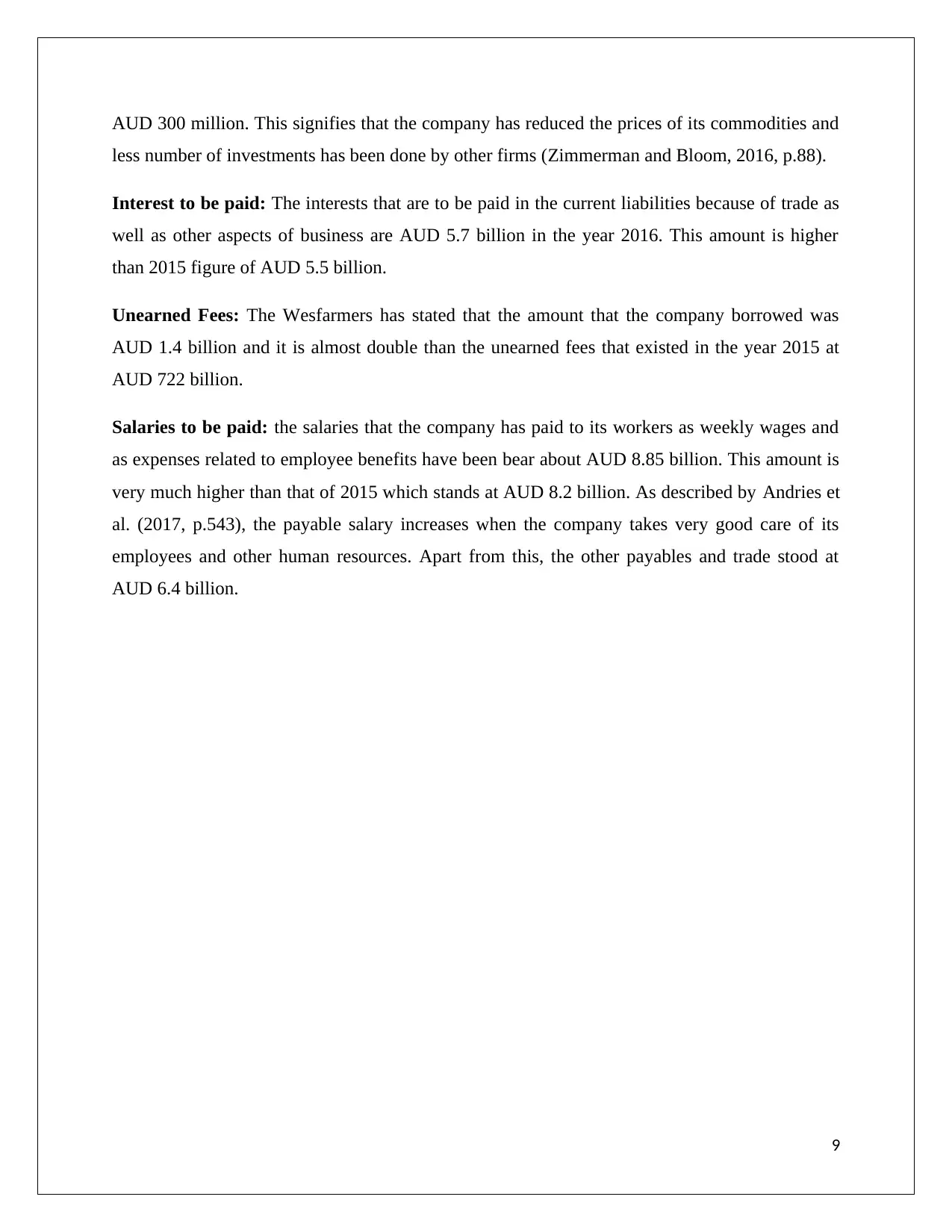

Figure 3: Annual Cash Flow Statement of Wesfarmers for 2016

(Source: Wesfarmers.com.au, 2017)

Description of Annual Financial Report of Woolworths

The complete turnover of Woolworths has been over AUD 72 billion as per what has been

mentioned by the company in their financial report of 2016. This value is higher than the

turnover that occurred in 2015 by an amount of AUD 11 billion. Kim and Zhang (2016, p.419)

have mentioned that the primary reason for this hike in turnover has been the supreme marketing

policies that were adopted by the management level authorities of the organization. The Accruals

and Deferrals amounts were calculated and maintained in a very accurate and precise manner by

10

(Source: Wesfarmers.com.au, 2017)

Description of Annual Financial Report of Woolworths

The complete turnover of Woolworths has been over AUD 72 billion as per what has been

mentioned by the company in their financial report of 2016. This value is higher than the

turnover that occurred in 2015 by an amount of AUD 11 billion. Kim and Zhang (2016, p.419)

have mentioned that the primary reason for this hike in turnover has been the supreme marketing

policies that were adopted by the management level authorities of the organization. The Accruals

and Deferrals amounts were calculated and maintained in a very accurate and precise manner by

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

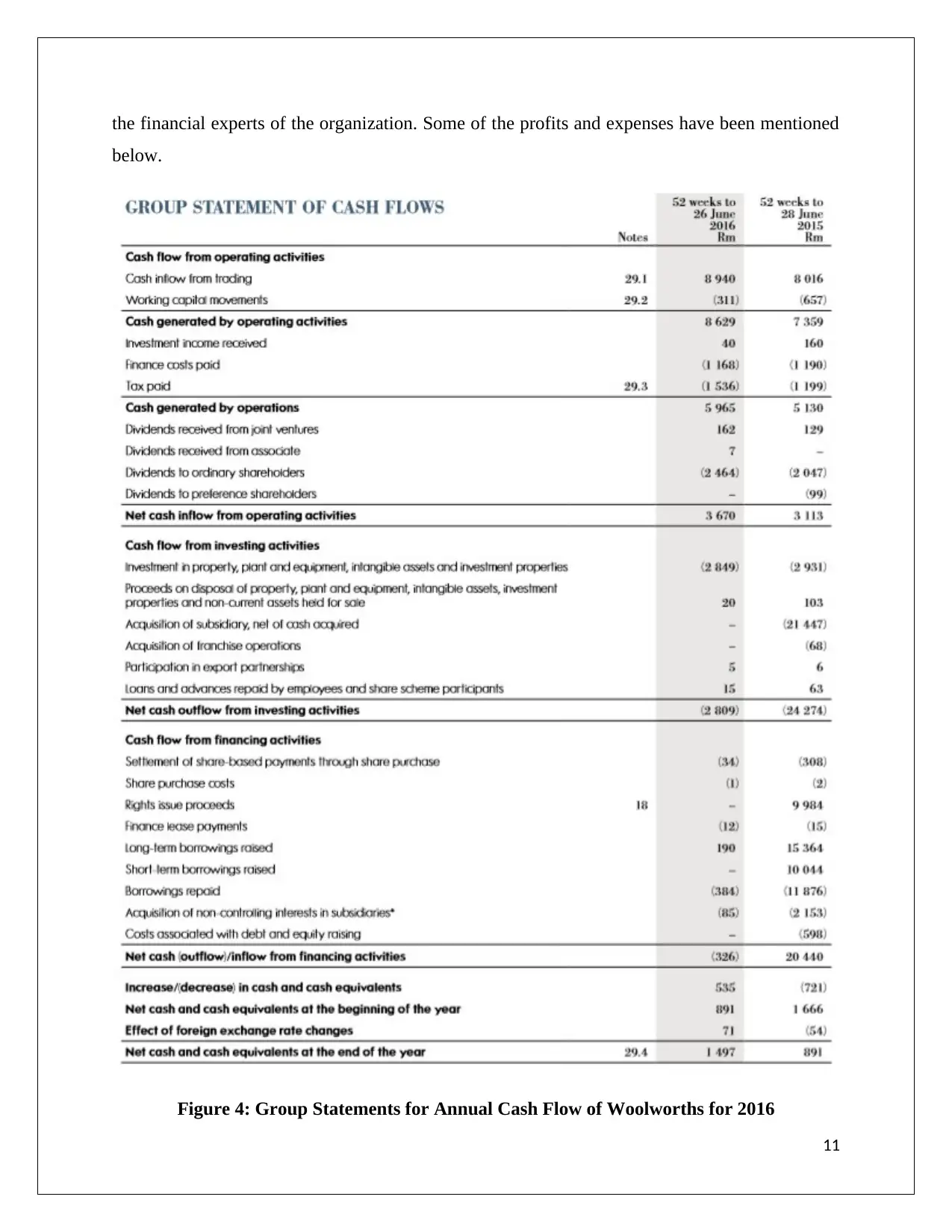

the financial experts of the organization. Some of the profits and expenses have been mentioned

below.

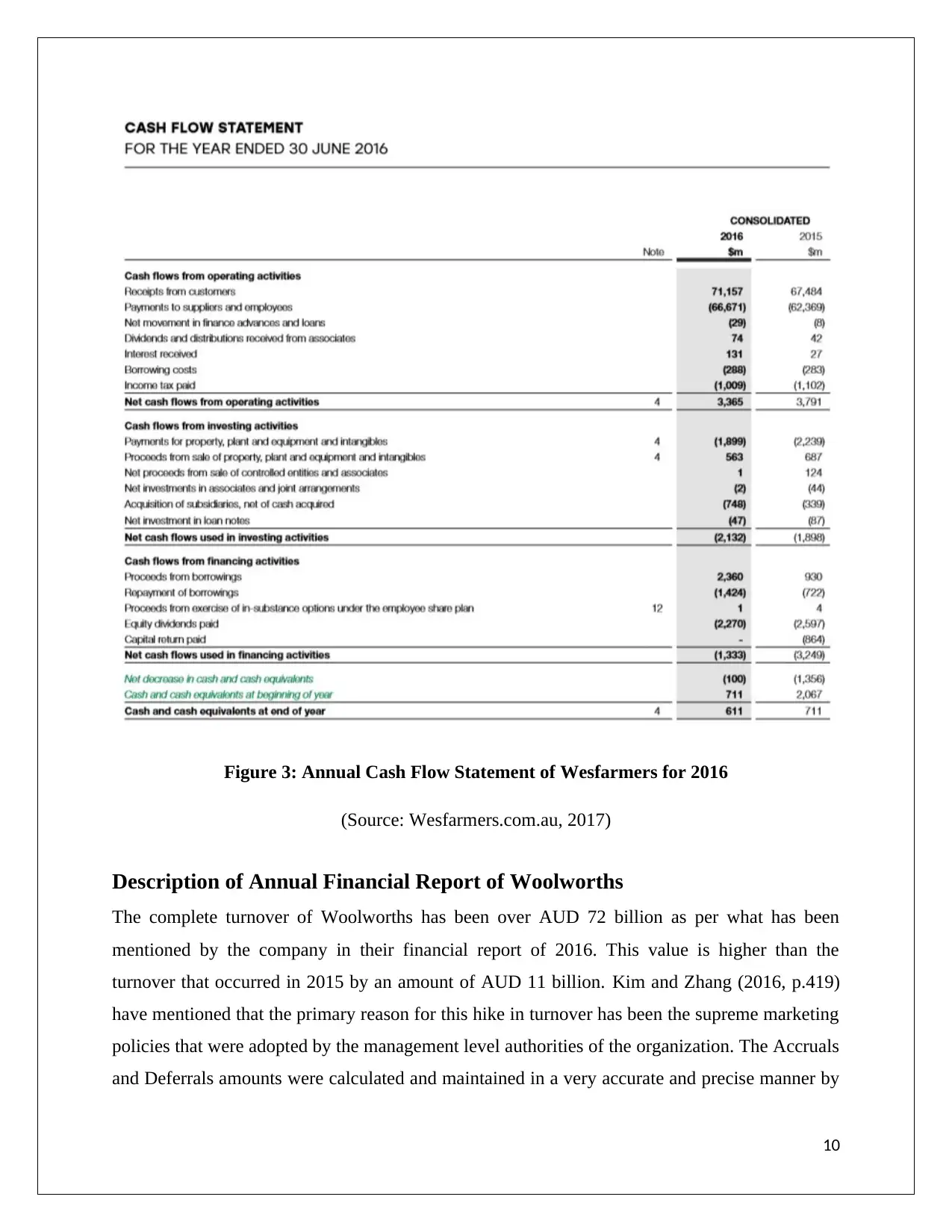

Figure 4: Group Statements for Annual Cash Flow of Woolworths for 2016

11

below.

Figure 4: Group Statements for Annual Cash Flow of Woolworths for 2016

11

(Source: Woolworthsgroup.com.au, 2017)

Depreciation Expense: The Company had to bear an amount of AUD 1.825 billion because of

the amortization and depreciation of company assets. This amount is nearly 300 million higher

than the depreciation amount of AUD 1.526 billion that came out to be in 2015. Moreover, the

financial cost incurred by this organization was about AUD 260 million lower than the

depreciation expense of 2015 at AUD 1.494, which is nearly AUD 1.234 billion. As stated by

Mostafa and Mostafa (2016, p.1759) in their journal related to accounting that obtaining of

accrued profits and asset values in a specific time can be the most evident reason for financial

sots reduction that was incurred by the company. The Woolworth Company has stated in its

annual financial report of 2016 that AUD 9 billion was the ultimate net inflow income that

occurred via trading.

Prepaid Rent: Woolworth’s operating lease accrual stood at AUD 41 million and the lease

adjustment of the firm was AUD 131 million that can be seen as an optimistic measure for the

Woolworths group. Moreover, the payments for finance lease that the Woolworths did in 2016 as

prepaid rent was AUD 12 million. This value is less than that in 2015, which was AUD 15

million. As specified by Omonuk and Dodor (2016, p.110), the prepaid rent reduction signifies

increase in expenses due to accruals for nay firm.

Interest to be paid: The annual financial report of Woolworths has mentioned that the

company’s payable interest was higher in 2016, which stood at AUD 15.7 billion compared to

that in 2015 that stood at AUD 14.9 billion.

Unearned Fees: The Woolworths Company has accounted for AUD 1.4 billion as the unearned

fees for long term equity. The same in respect to short term has been AUD 190 million.

Salaries to be paid: The Woolworths has paid AUD 4.3 billion to its shareholders as well as the

top level management authorities via 9 non controlling assets and interests.

12

Depreciation Expense: The Company had to bear an amount of AUD 1.825 billion because of

the amortization and depreciation of company assets. This amount is nearly 300 million higher

than the depreciation amount of AUD 1.526 billion that came out to be in 2015. Moreover, the

financial cost incurred by this organization was about AUD 260 million lower than the

depreciation expense of 2015 at AUD 1.494, which is nearly AUD 1.234 billion. As stated by

Mostafa and Mostafa (2016, p.1759) in their journal related to accounting that obtaining of

accrued profits and asset values in a specific time can be the most evident reason for financial

sots reduction that was incurred by the company. The Woolworth Company has stated in its

annual financial report of 2016 that AUD 9 billion was the ultimate net inflow income that

occurred via trading.

Prepaid Rent: Woolworth’s operating lease accrual stood at AUD 41 million and the lease

adjustment of the firm was AUD 131 million that can be seen as an optimistic measure for the

Woolworths group. Moreover, the payments for finance lease that the Woolworths did in 2016 as

prepaid rent was AUD 12 million. This value is less than that in 2015, which was AUD 15

million. As specified by Omonuk and Dodor (2016, p.110), the prepaid rent reduction signifies

increase in expenses due to accruals for nay firm.

Interest to be paid: The annual financial report of Woolworths has mentioned that the

company’s payable interest was higher in 2016, which stood at AUD 15.7 billion compared to

that in 2015 that stood at AUD 14.9 billion.

Unearned Fees: The Woolworths Company has accounted for AUD 1.4 billion as the unearned

fees for long term equity. The same in respect to short term has been AUD 190 million.

Salaries to be paid: The Woolworths has paid AUD 4.3 billion to its shareholders as well as the

top level management authorities via 9 non controlling assets and interests.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.