Ethan Ltd: Preparing Consolidated Financial Statements at June 30

VerifiedAdded on 2023/03/23

|6

|675

|38

Practical Assignment

AI Summary

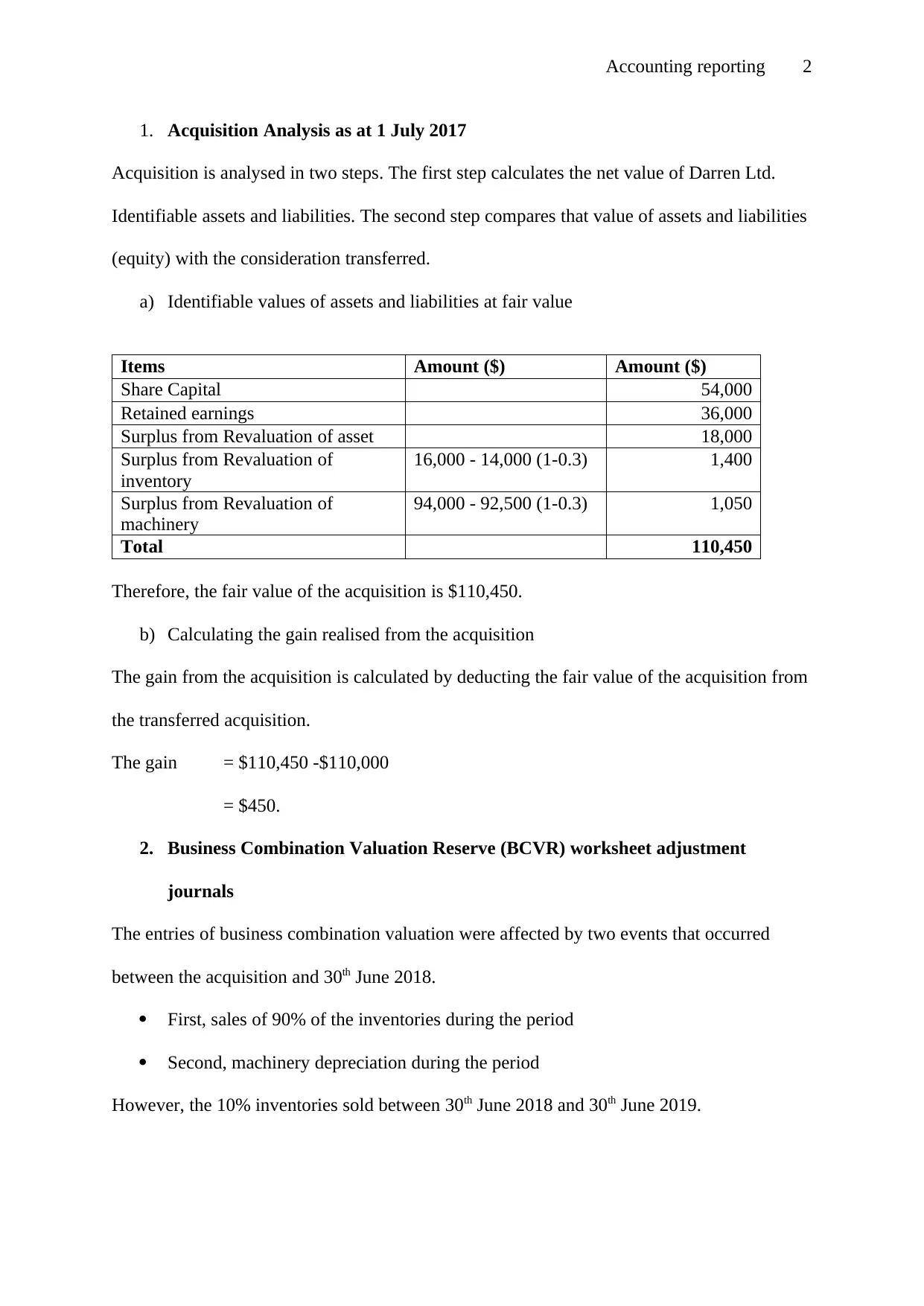

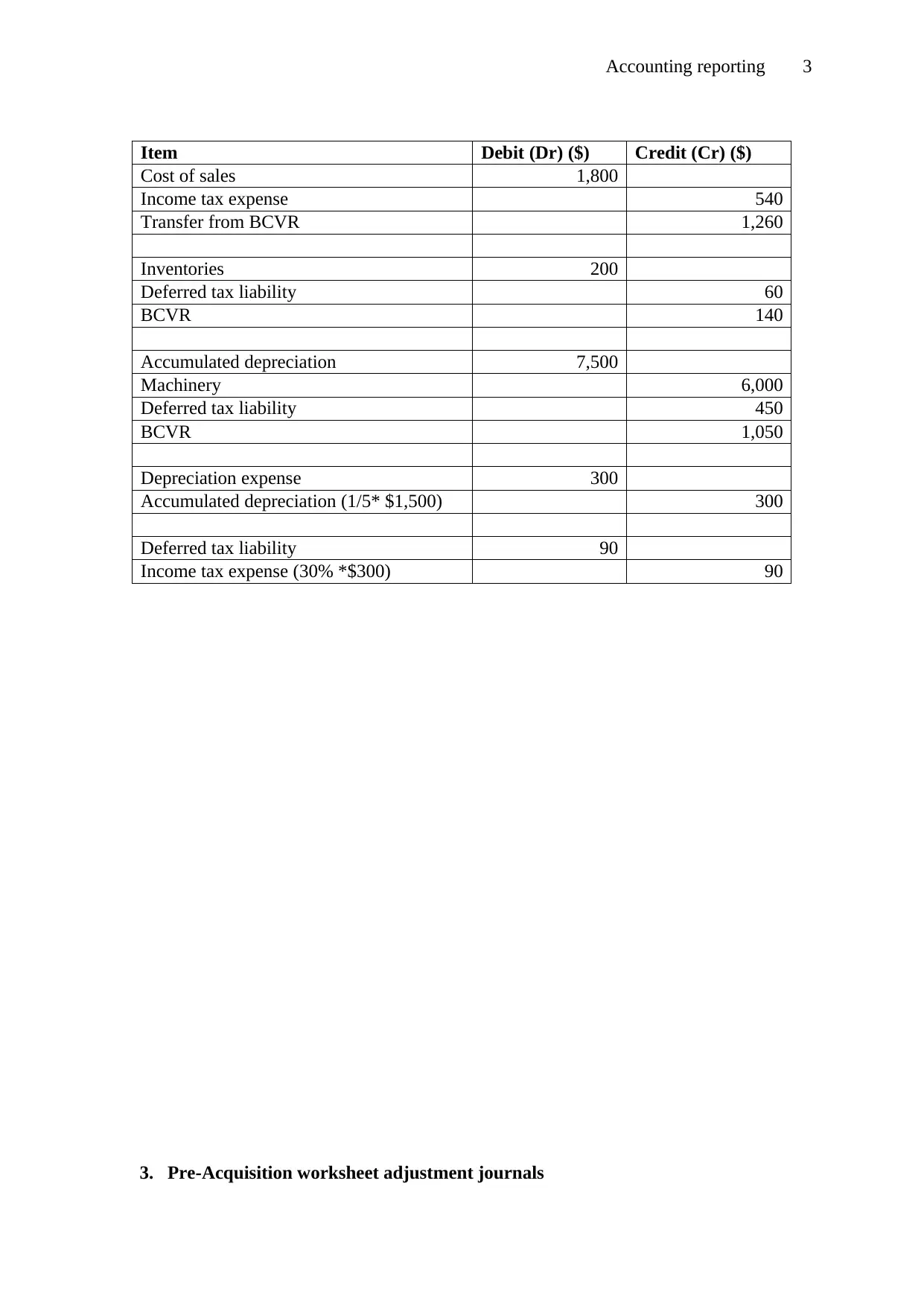

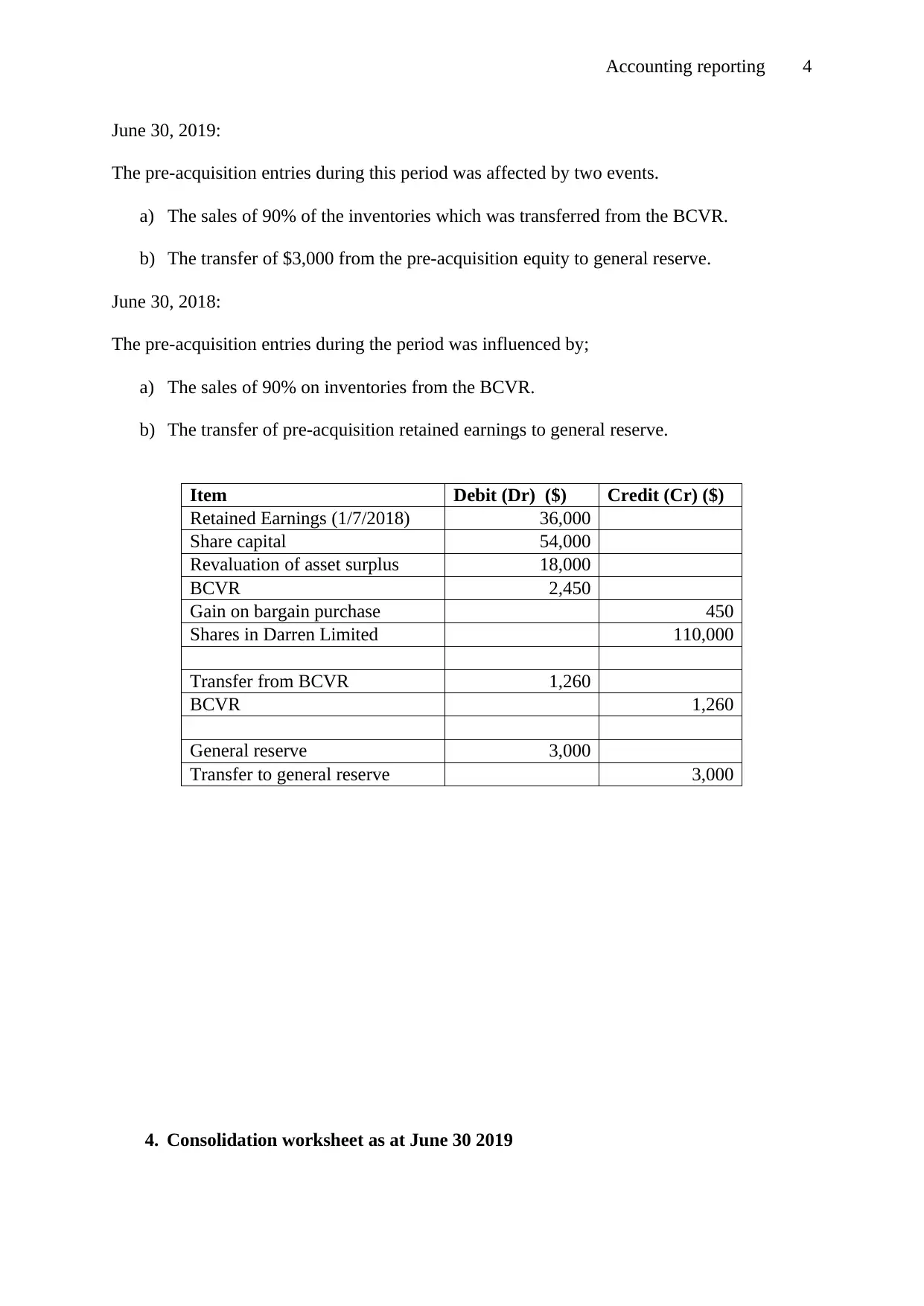

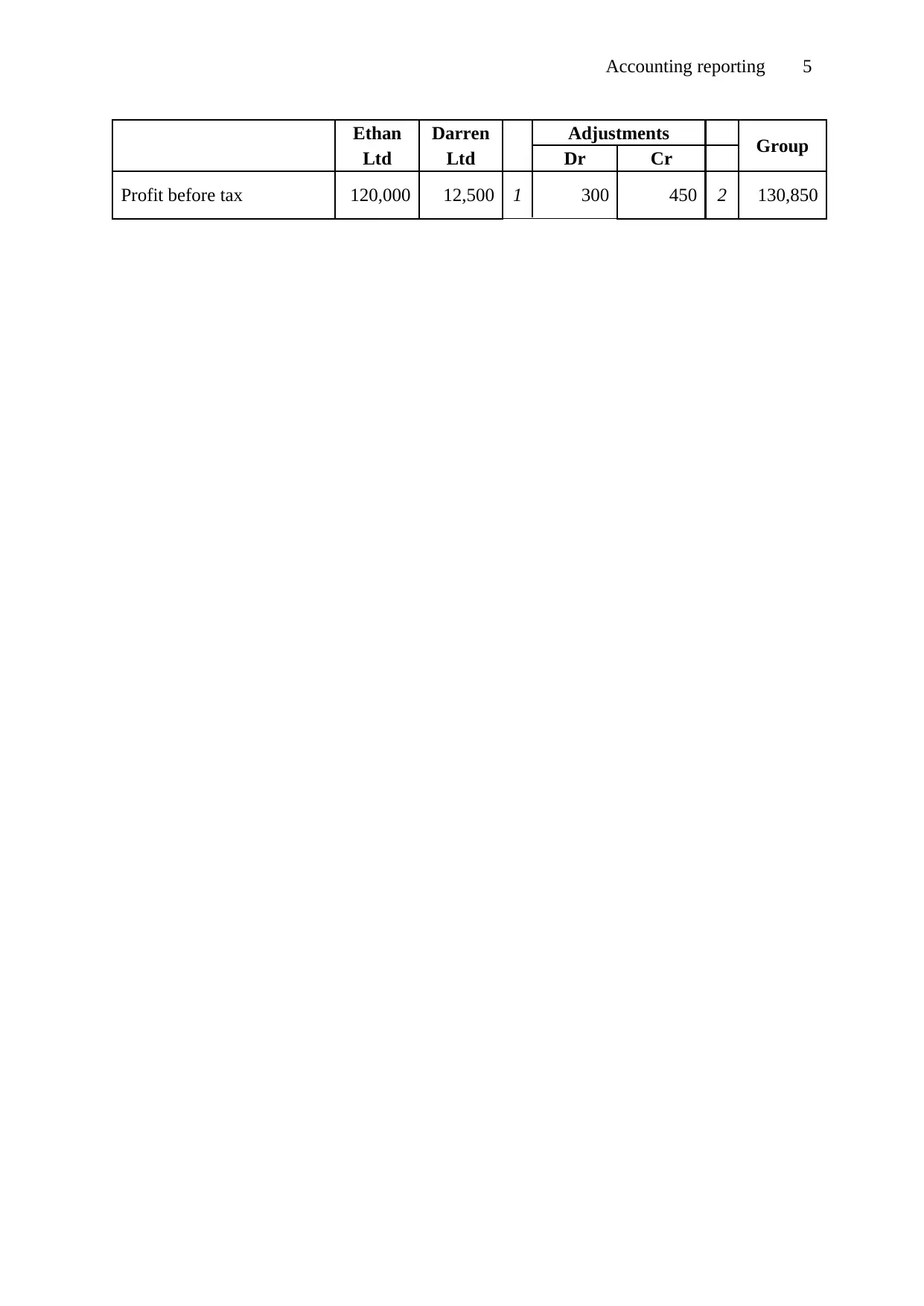

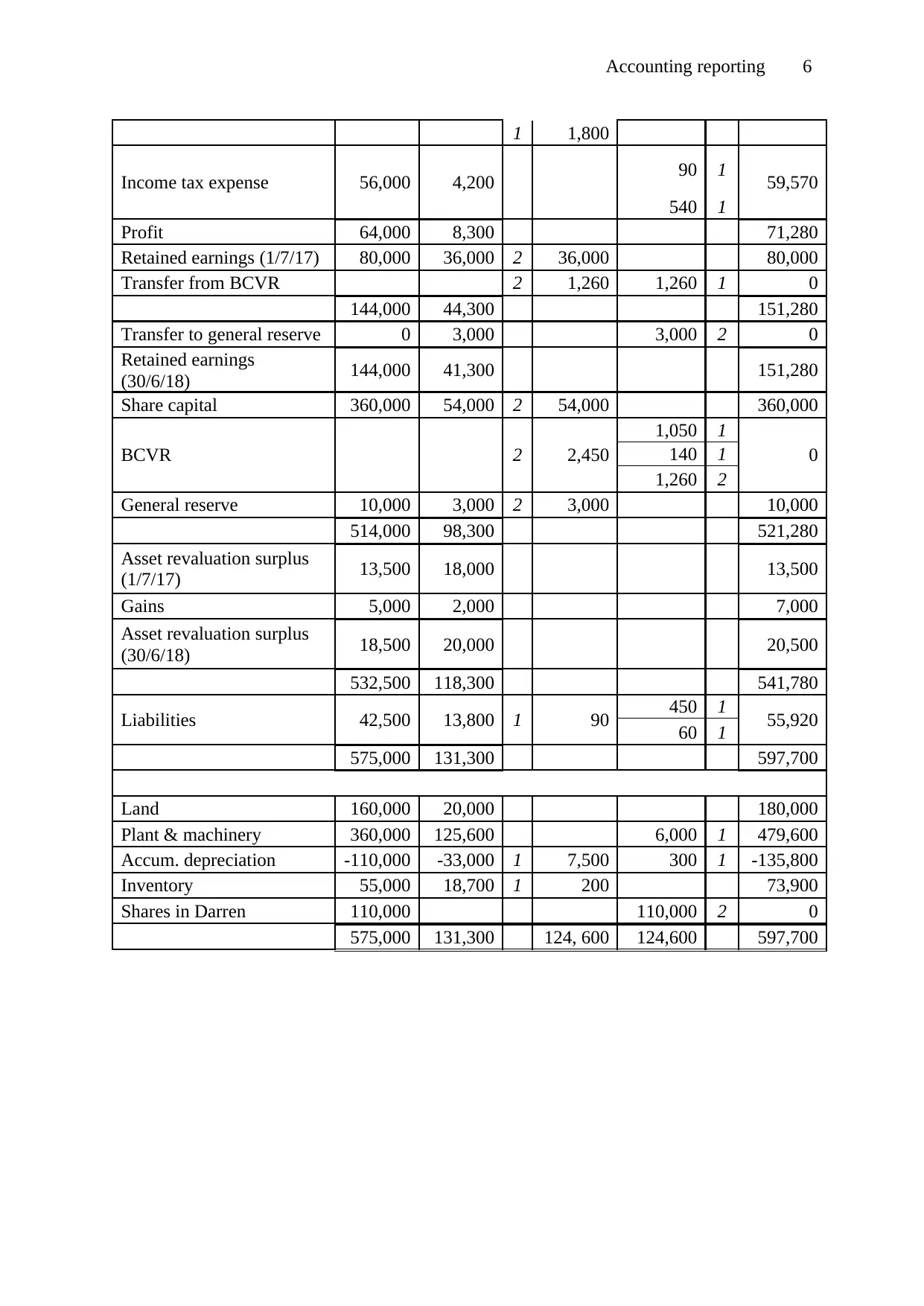

This assignment provides a detailed solution for preparing the consolidated financial statements of Ethan Ltd as of June 30, 2018, following its acquisition of Darren Ltd on July 1, 2017. The solution includes an acquisition analysis calculating the net value of Darren Ltd's identifiable assets and liabilities, as well as the gain realized from the acquisition. It also features business combination valuation reserve (BCVR) worksheet adjustments, pre-acquisition worksheet adjustments, and the consolidation worksheet itself. Key adjustments account for inventory sales, machinery depreciation, and transfers between retained earnings and general reserves. The final consolidated financial statements reflect the combined financial position of Ethan Ltd after the acquisition, providing a comprehensive view of the group's financial performance and position.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)