STAT6003: Financial Statistics Analysis of Market Prices

VerifiedAdded on 2023/03/20

|11

|1785

|97

Report

AI Summary

This report presents a financial statistics analysis, focusing on the relationship between market price and various economic indicators using data from 2002-2017. The analysis employs Ordinary Least Squares (OLS) regression and scatter plots to examine the influence of the Sydney Price Index, annual percentage change, total number of square meters, and age of the house on market price. The report includes the development of regression models, interpretation of coefficients, and assessment of statistical significance. The findings reveal positive correlations between market price and both the Sydney Price Index and the total number of square meters, while a negative correlation is observed with the age of the house. The report also provides a comparison between a multivariate regression model and a linear regression model, offering insights into their predictive capabilities. The report concludes with an estimated market price for a specific land size and includes relevant references.

Running head: FINANCIAL STATISTICS

Financial Statistics

Name of the Student:

Name of the University:

Author Note:

Financial Statistics

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL STATISTICS

Table of Contents

Introduction................................................................................................................................2

Scatter Plots against Market Price..............................................................................................2

Reference....................................................................................................................................5

Table of Contents

Introduction................................................................................................................................2

Scatter Plots against Market Price..............................................................................................2

Reference....................................................................................................................................5

2FINANCIAL STATISTICS

Introduction

The financial analysis uses the statistical techniques to predict the market situations.

Here 5 variables are included in the analysis that are market price measured in $, Sydney

price Index, annual percent change measured in percentage, total number of square meters

and the age of house measured in years. The dependent variables is the market price as it is

influenced by the other mentioned variables. Except market price other four variables are

independent variable (Brooks, 2019). The sample size of data is 15 as the data is considered

from the financial year 2002-03 to 2016-17. The OLS technique is used to estimate the

following model:

market price=β0+( β ¿¿ 1∗Sydney pri ce Index)+ ( β2∗annual percent change ) + ( β3∗total number of square met

Scatter Plots against Market Price

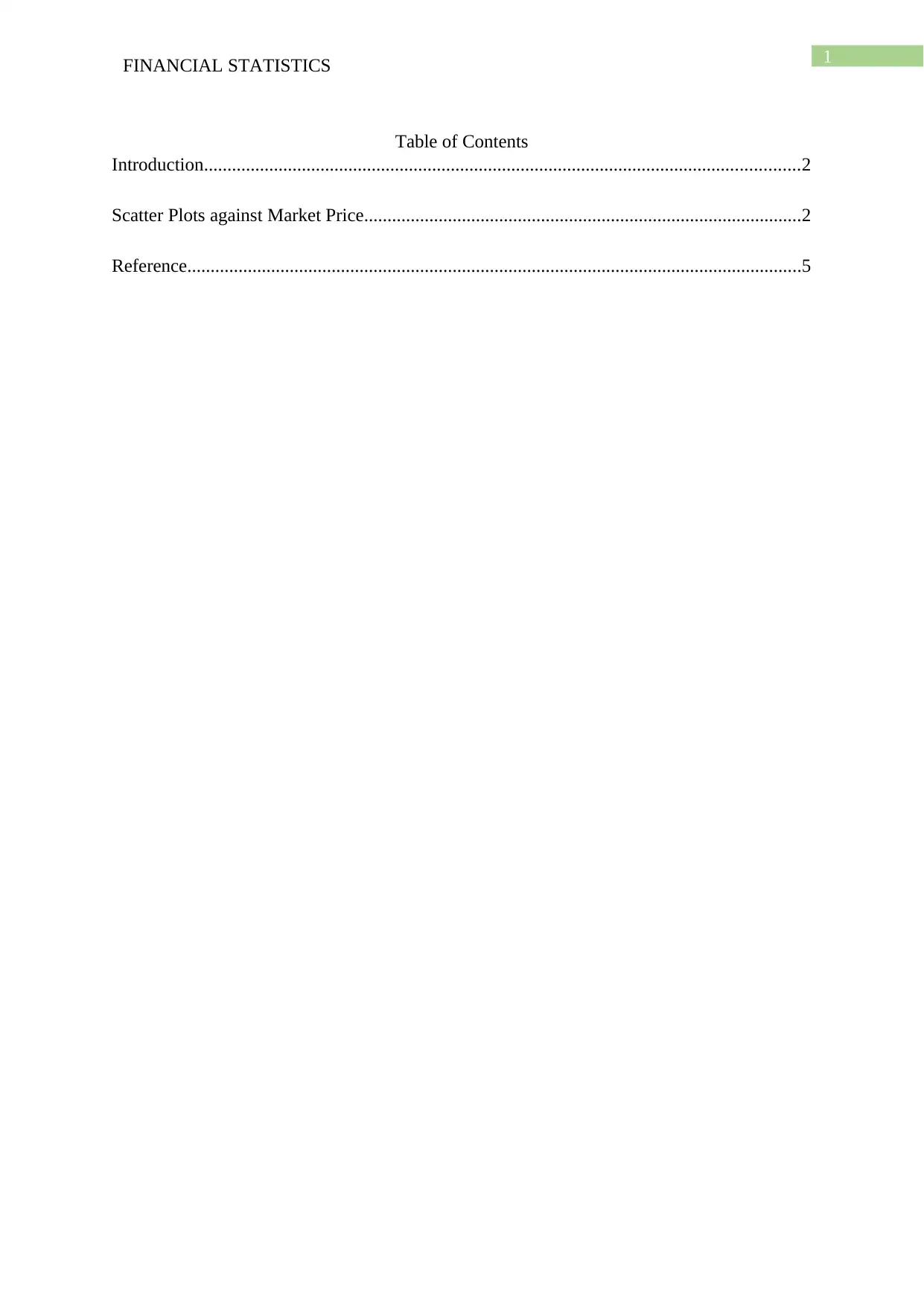

The figure 1, shows that the trend line obtained from the scatter plot is slightly

upward rising. Hence the scatter plot shows that the market price is positively influenced by

the Sydney Price Index.

60 80 100 120 140 160 180 200

0

200

400

600

800

1000

1200

Scatter plot of Market Price against Sydney Price Index

Sydney Price Index

Market price ($000)

Introduction

The financial analysis uses the statistical techniques to predict the market situations.

Here 5 variables are included in the analysis that are market price measured in $, Sydney

price Index, annual percent change measured in percentage, total number of square meters

and the age of house measured in years. The dependent variables is the market price as it is

influenced by the other mentioned variables. Except market price other four variables are

independent variable (Brooks, 2019). The sample size of data is 15 as the data is considered

from the financial year 2002-03 to 2016-17. The OLS technique is used to estimate the

following model:

market price=β0+( β ¿¿ 1∗Sydney pri ce Index)+ ( β2∗annual percent change ) + ( β3∗total number of square met

Scatter Plots against Market Price

The figure 1, shows that the trend line obtained from the scatter plot is slightly

upward rising. Hence the scatter plot shows that the market price is positively influenced by

the Sydney Price Index.

60 80 100 120 140 160 180 200

0

200

400

600

800

1000

1200

Scatter plot of Market Price against Sydney Price Index

Sydney Price Index

Market price ($000)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL STATISTICS

Figure 1: Relationship between Market Price and Sydney Price Index

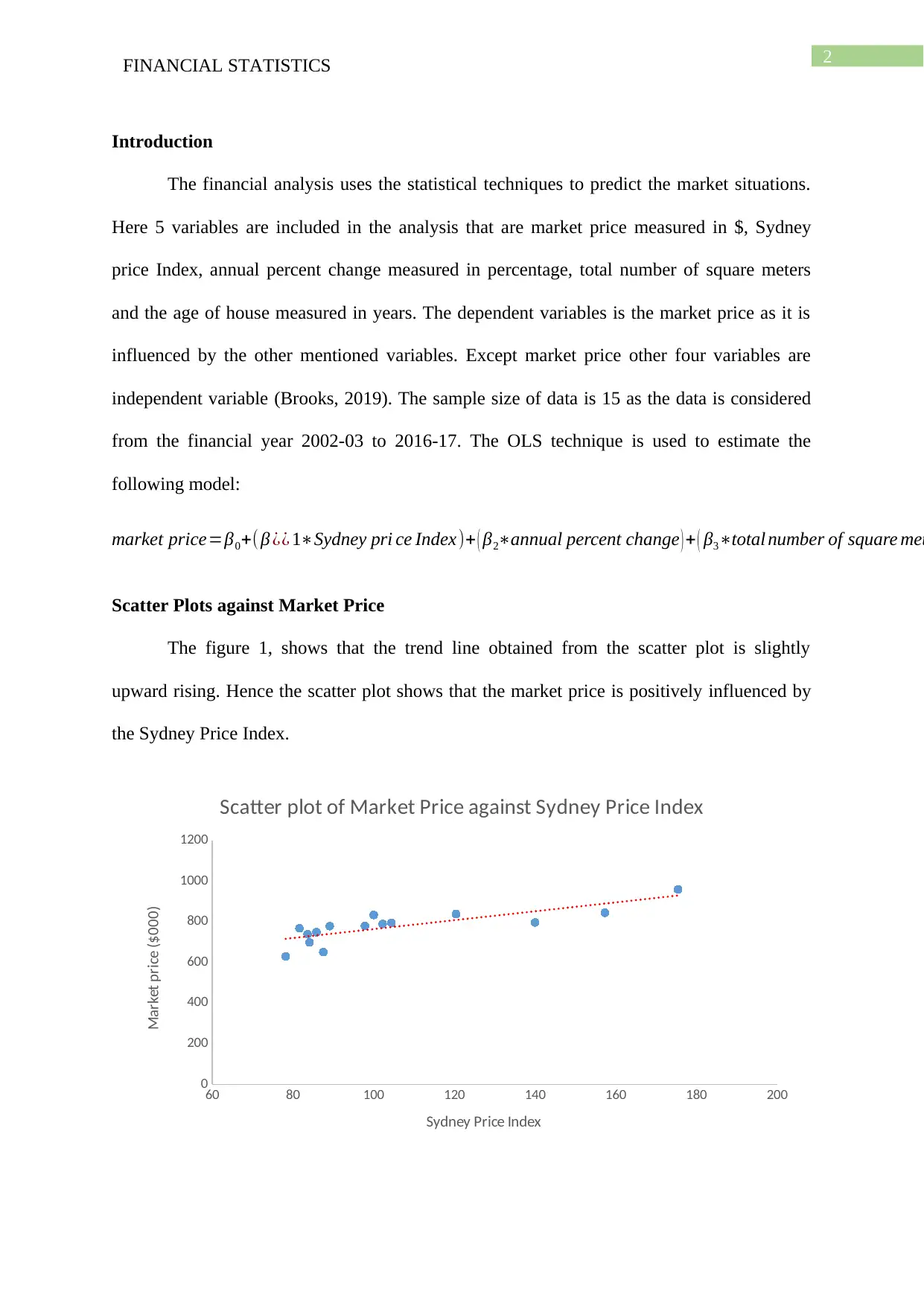

The figure 2, shows that the trend line obtained from the scatter plot is almost parallel

to the x-axis. Hence the scatter plot presents no influence on market price by the annual %

change. The dots are spread too much that also indicates no relationship.

0 2 4 6 8 10 12 14 16 18

0

200

400

600

800

1000

1200

Scatter plot of Market Price against Annual % Change

Annual % Chnage

Market price ($000)

Figure 2: Relationship between Market Price and Annual % Change

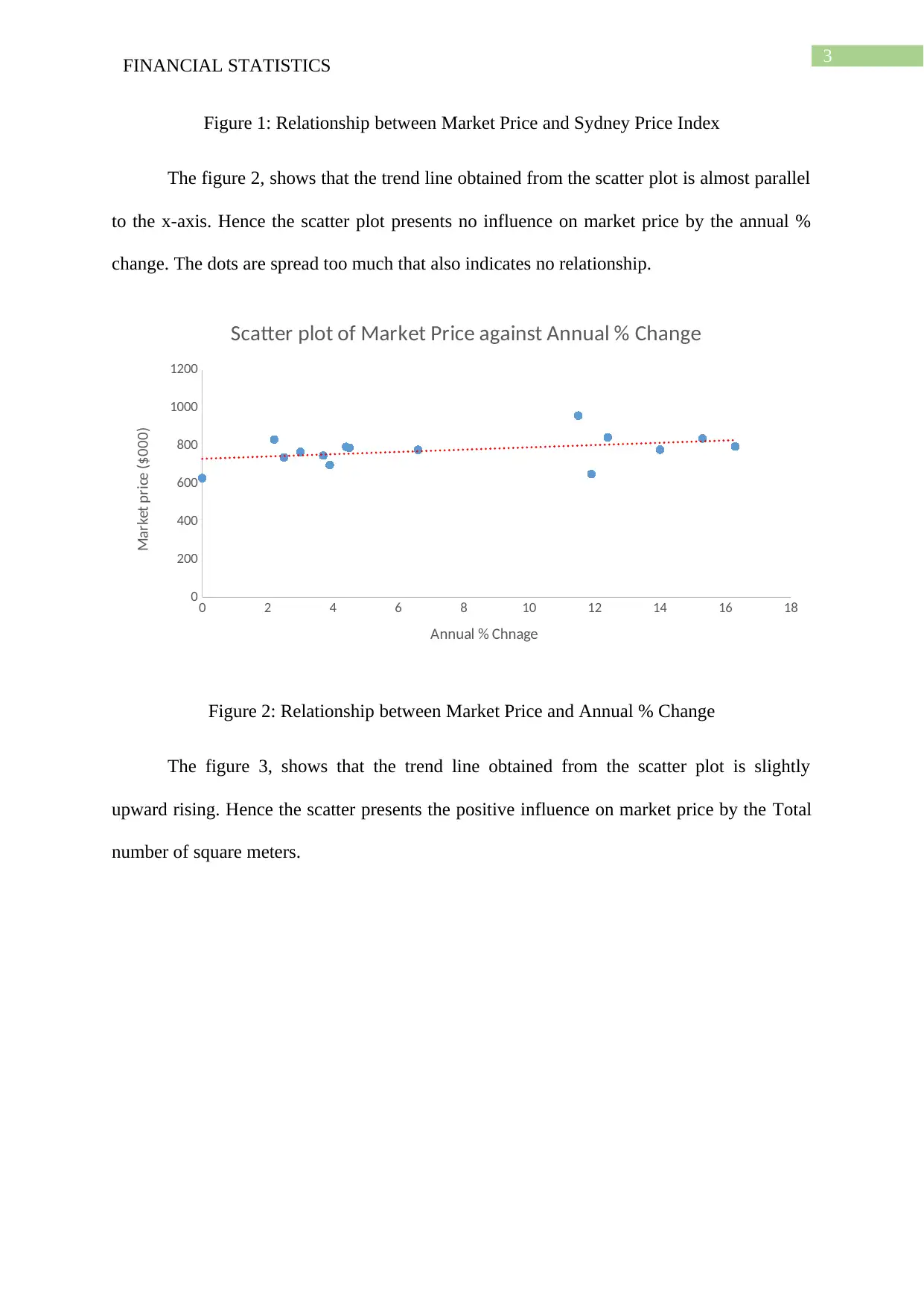

The figure 3, shows that the trend line obtained from the scatter plot is slightly

upward rising. Hence the scatter presents the positive influence on market price by the Total

number of square meters.

Figure 1: Relationship between Market Price and Sydney Price Index

The figure 2, shows that the trend line obtained from the scatter plot is almost parallel

to the x-axis. Hence the scatter plot presents no influence on market price by the annual %

change. The dots are spread too much that also indicates no relationship.

0 2 4 6 8 10 12 14 16 18

0

200

400

600

800

1000

1200

Scatter plot of Market Price against Annual % Change

Annual % Chnage

Market price ($000)

Figure 2: Relationship between Market Price and Annual % Change

The figure 3, shows that the trend line obtained from the scatter plot is slightly

upward rising. Hence the scatter presents the positive influence on market price by the Total

number of square meters.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL STATISTICS

140 160 180 200 220 240 260 280 300 320

0

200

400

600

800

1000

1200

Scatter plot of Market Price against Total Number of Square

Meters

Total number of square meters

Market price ($000)

Figure 3: Relationship between Market Price and Total number of square meters.

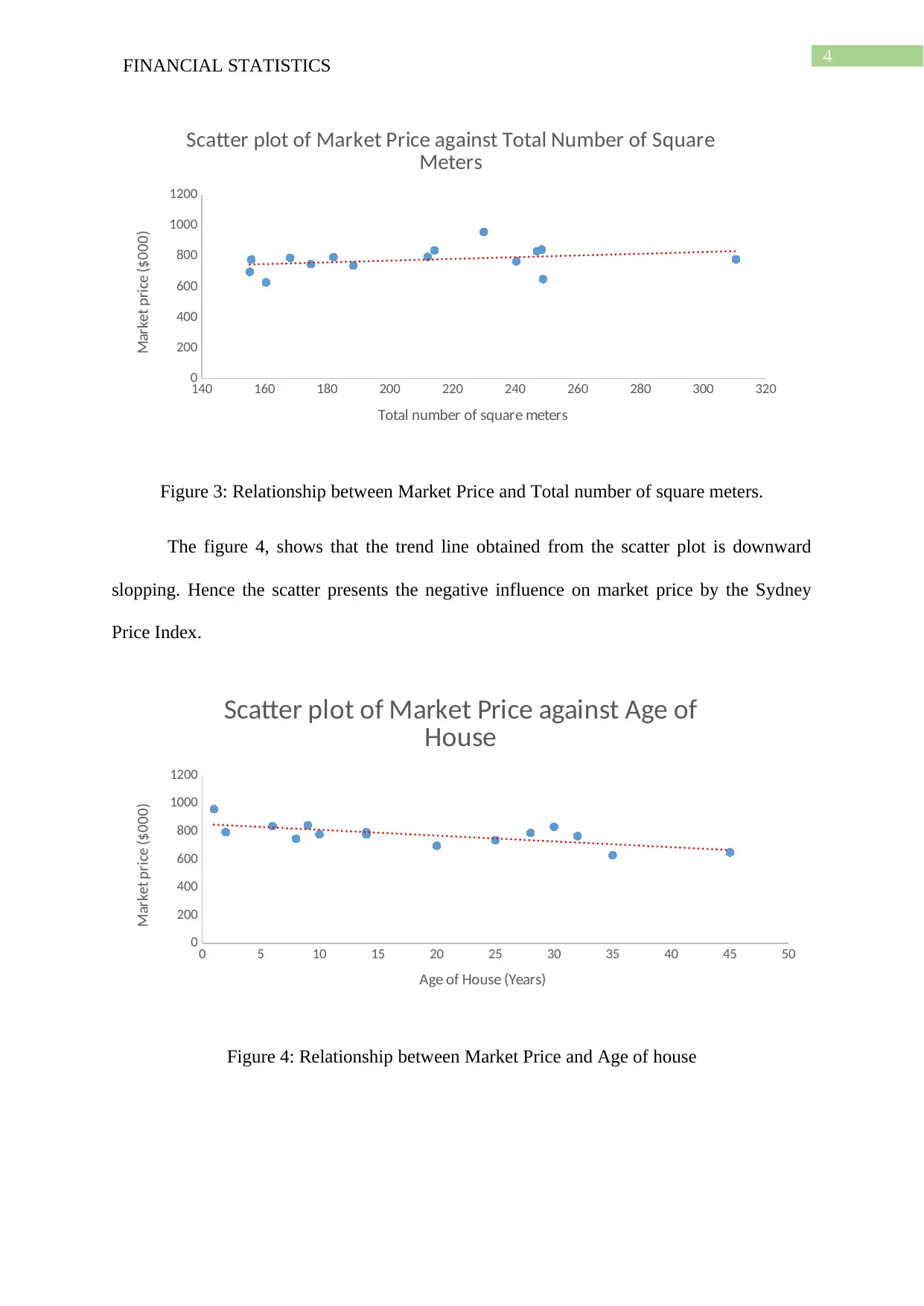

The figure 4, shows that the trend line obtained from the scatter plot is downward

slopping. Hence the scatter presents the negative influence on market price by the Sydney

Price Index.

0 5 10 15 20 25 30 35 40 45 50

0

200

400

600

800

1000

1200

Scatter plot of Market Price against Age of

House

Age of House (Years)

Market price ($000)

Figure 4: Relationship between Market Price and Age of house

140 160 180 200 220 240 260 280 300 320

0

200

400

600

800

1000

1200

Scatter plot of Market Price against Total Number of Square

Meters

Total number of square meters

Market price ($000)

Figure 3: Relationship between Market Price and Total number of square meters.

The figure 4, shows that the trend line obtained from the scatter plot is downward

slopping. Hence the scatter presents the negative influence on market price by the Sydney

Price Index.

0 5 10 15 20 25 30 35 40 45 50

0

200

400

600

800

1000

1200

Scatter plot of Market Price against Age of

House

Age of House (Years)

Market price ($000)

Figure 4: Relationship between Market Price and Age of house

5FINANCIAL STATISTICS

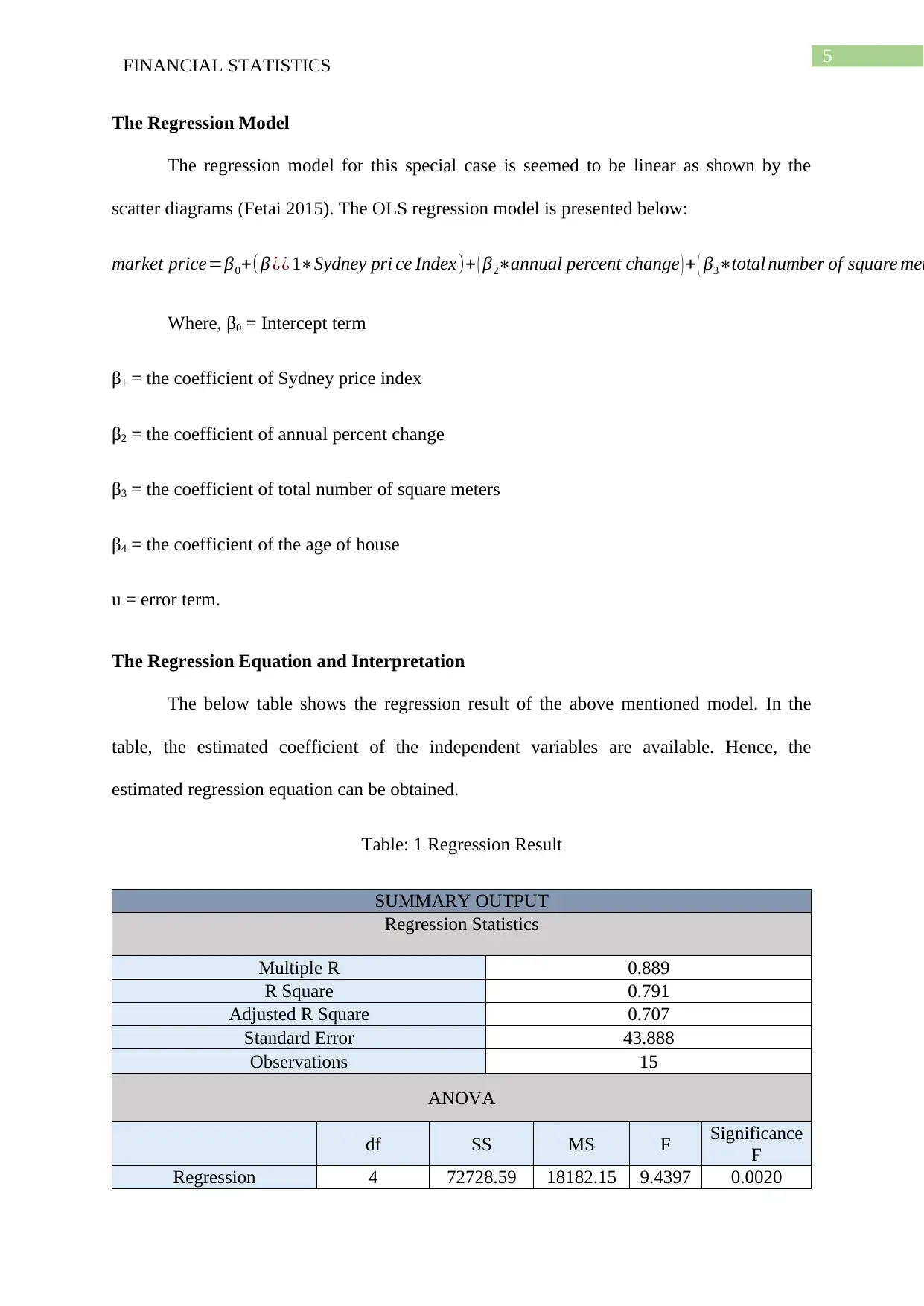

The Regression Model

The regression model for this special case is seemed to be linear as shown by the

scatter diagrams (Fetai 2015). The OLS regression model is presented below:

market price=β0+( β ¿¿ 1∗Sydney pri ce Index)+ ( β2∗annual percent change ) + ( β3∗total number of square met

Where, β0 = Intercept term

β1 = the coefficient of Sydney price index

β2 = the coefficient of annual percent change

β3 = the coefficient of total number of square meters

β4 = the coefficient of the age of house

u = error term.

The Regression Equation and Interpretation

The below table shows the regression result of the above mentioned model. In the

table, the estimated coefficient of the independent variables are available. Hence, the

estimated regression equation can be obtained.

Table: 1 Regression Result

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.889

R Square 0.791

Adjusted R Square 0.707

Standard Error 43.888

Observations 15

ANOVA

df SS MS F Significance

F

Regression 4 72728.59 18182.15 9.4397 0.0020

The Regression Model

The regression model for this special case is seemed to be linear as shown by the

scatter diagrams (Fetai 2015). The OLS regression model is presented below:

market price=β0+( β ¿¿ 1∗Sydney pri ce Index)+ ( β2∗annual percent change ) + ( β3∗total number of square met

Where, β0 = Intercept term

β1 = the coefficient of Sydney price index

β2 = the coefficient of annual percent change

β3 = the coefficient of total number of square meters

β4 = the coefficient of the age of house

u = error term.

The Regression Equation and Interpretation

The below table shows the regression result of the above mentioned model. In the

table, the estimated coefficient of the independent variables are available. Hence, the

estimated regression equation can be obtained.

Table: 1 Regression Result

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.889

R Square 0.791

Adjusted R Square 0.707

Standard Error 43.888

Observations 15

ANOVA

df SS MS F Significance

F

Regression 4 72728.59 18182.15 9.4397 0.0020

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL STATISTICS

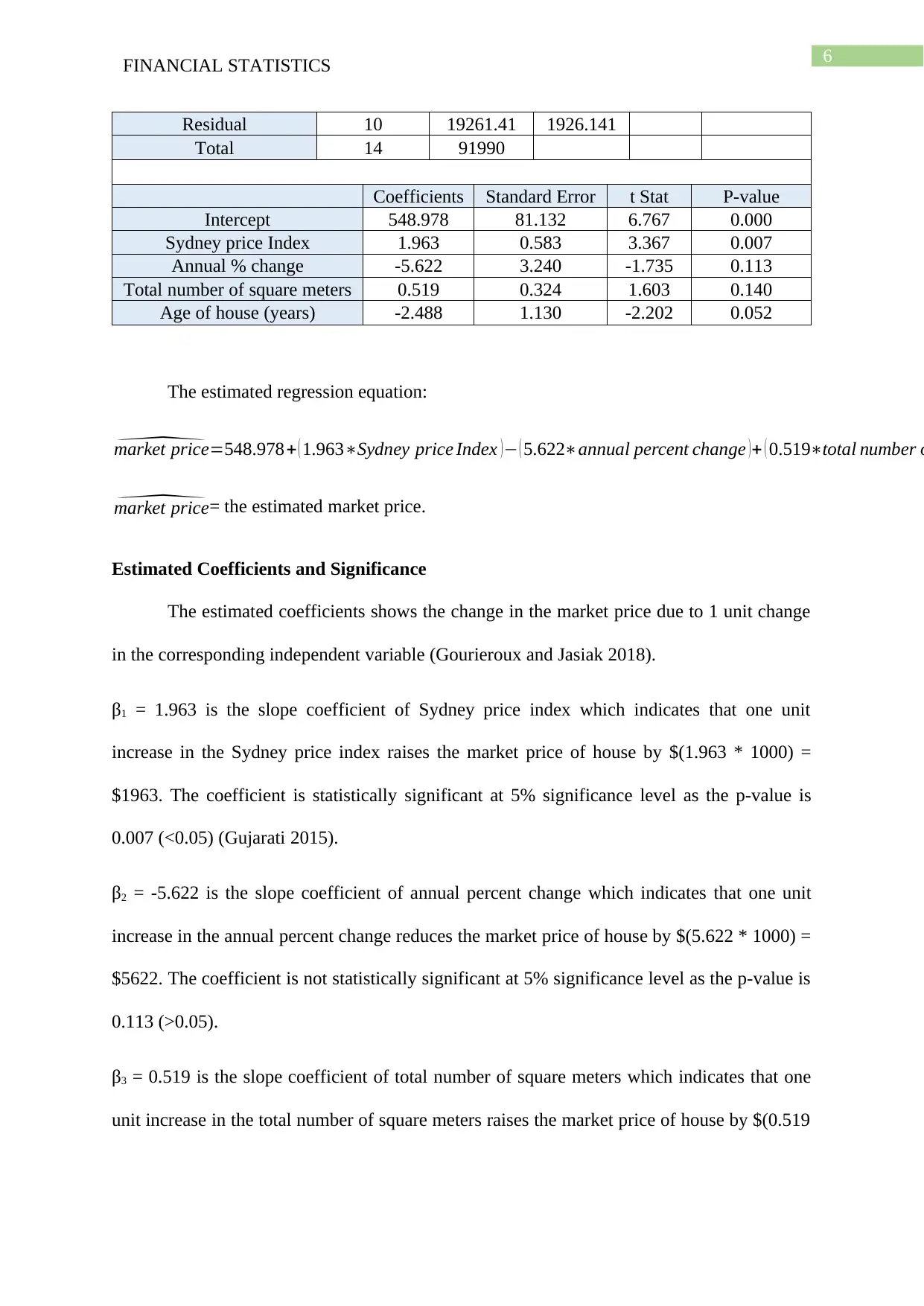

Residual 10 19261.41 1926.141

Total 14 91990

Coefficients Standard Error t Stat P-value

Intercept 548.978 81.132 6.767 0.000

Sydney price Index 1.963 0.583 3.367 0.007

Annual % change -5.622 3.240 -1.735 0.113

Total number of square meters 0.519 0.324 1.603 0.140

Age of house (years) -2.488 1.130 -2.202 0.052

The estimated regression equation:

^market price=548.978+ ( 1.963∗Sydney price Index ) − ( 5.622∗annual percent change ) + ( 0.519∗total number o

^market price= the estimated market price.

Estimated Coefficients and Significance

The estimated coefficients shows the change in the market price due to 1 unit change

in the corresponding independent variable (Gourieroux and Jasiak 2018).

β1 = 1.963 is the slope coefficient of Sydney price index which indicates that one unit

increase in the Sydney price index raises the market price of house by $(1.963 * 1000) =

$1963. The coefficient is statistically significant at 5% significance level as the p-value is

0.007 (<0.05) (Gujarati 2015).

β2 = -5.622 is the slope coefficient of annual percent change which indicates that one unit

increase in the annual percent change reduces the market price of house by $(5.622 * 1000) =

$5622. The coefficient is not statistically significant at 5% significance level as the p-value is

0.113 (>0.05).

β3 = 0.519 is the slope coefficient of total number of square meters which indicates that one

unit increase in the total number of square meters raises the market price of house by $(0.519

Residual 10 19261.41 1926.141

Total 14 91990

Coefficients Standard Error t Stat P-value

Intercept 548.978 81.132 6.767 0.000

Sydney price Index 1.963 0.583 3.367 0.007

Annual % change -5.622 3.240 -1.735 0.113

Total number of square meters 0.519 0.324 1.603 0.140

Age of house (years) -2.488 1.130 -2.202 0.052

The estimated regression equation:

^market price=548.978+ ( 1.963∗Sydney price Index ) − ( 5.622∗annual percent change ) + ( 0.519∗total number o

^market price= the estimated market price.

Estimated Coefficients and Significance

The estimated coefficients shows the change in the market price due to 1 unit change

in the corresponding independent variable (Gourieroux and Jasiak 2018).

β1 = 1.963 is the slope coefficient of Sydney price index which indicates that one unit

increase in the Sydney price index raises the market price of house by $(1.963 * 1000) =

$1963. The coefficient is statistically significant at 5% significance level as the p-value is

0.007 (<0.05) (Gujarati 2015).

β2 = -5.622 is the slope coefficient of annual percent change which indicates that one unit

increase in the annual percent change reduces the market price of house by $(5.622 * 1000) =

$5622. The coefficient is not statistically significant at 5% significance level as the p-value is

0.113 (>0.05).

β3 = 0.519 is the slope coefficient of total number of square meters which indicates that one

unit increase in the total number of square meters raises the market price of house by $(0.519

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL STATISTICS

* 1000) = $519. The coefficient is not statistically significant at 5% significance level as the

p-value is 0.140 (>0.05).

β4 = -2.488 is the slope coefficient of the age of house which indicates that one unit increase

in the age of house reduces the market price of house by $(2.488 * 1000) = $2488. The

coefficient is not statistically significant at 5% significance level as the p-value is 0.052

(>0.05).

Coefficient of Determination

The coefficient of determination is presented by the adjusted R2. It is a measure of

variance in the dependent variable explained by the independent variables. If the adjusted R2

is equal to 1 that means there is no error and indicates a perfect explanation. The value of the

adjusted R2 for the model is 0.707 that means the independent variables are able to predict the

market price by the accuracy of 70.7% (Wooldridge 2015).

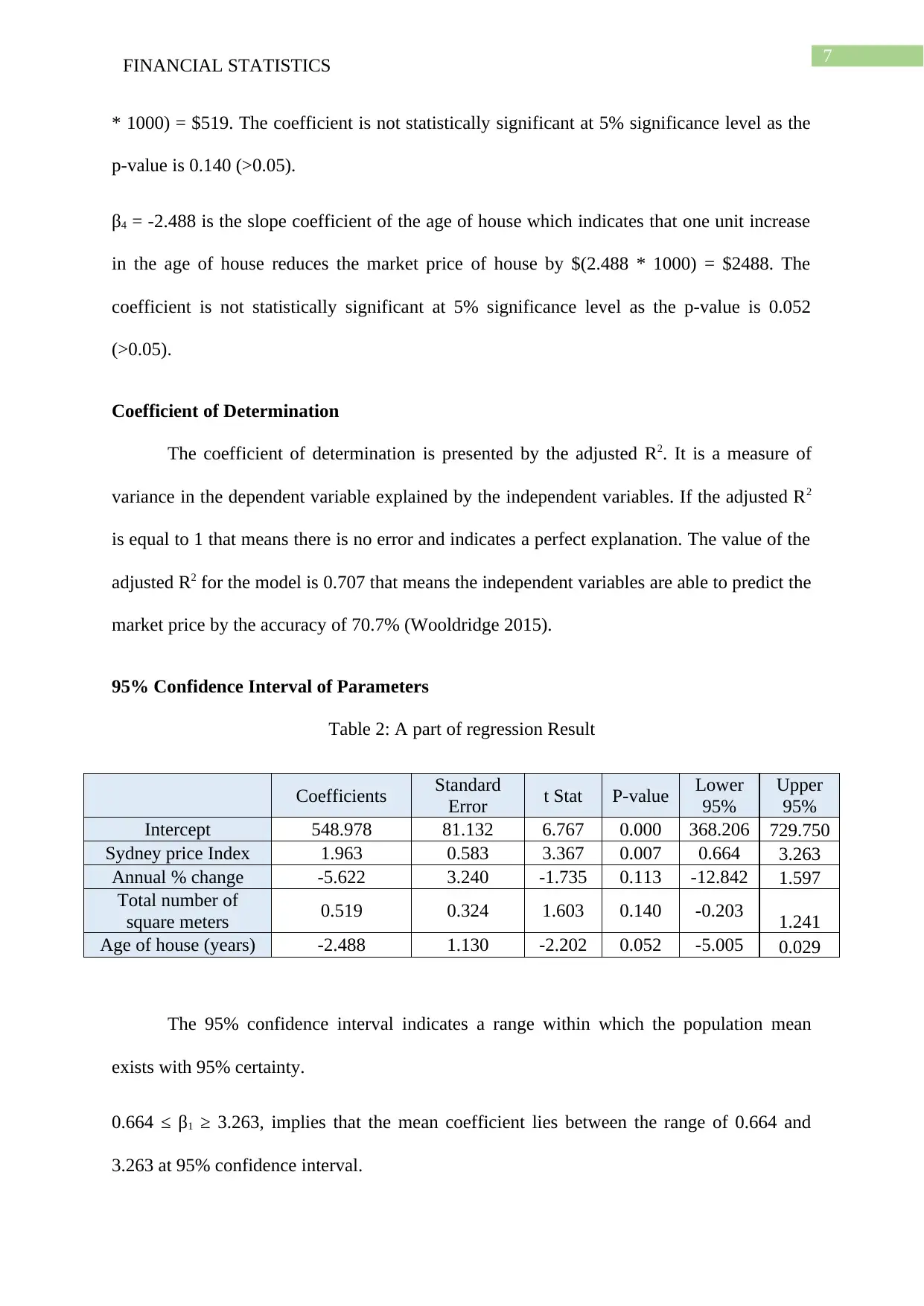

95% Confidence Interval of Parameters

Table 2: A part of regression Result

Coefficients Standard

Error t Stat P-value Lower

95%

Upper

95%

Intercept 548.978 81.132 6.767 0.000 368.206 729.750

Sydney price Index 1.963 0.583 3.367 0.007 0.664 3.263

Annual % change -5.622 3.240 -1.735 0.113 -12.842 1.597

Total number of

square meters 0.519 0.324 1.603 0.140 -0.203 1.241

Age of house (years) -2.488 1.130 -2.202 0.052 -5.005 0.029

The 95% confidence interval indicates a range within which the population mean

exists with 95% certainty.

0.664 ≤ β1 ≥ 3.263, implies that the mean coefficient lies between the range of 0.664 and

3.263 at 95% confidence interval.

* 1000) = $519. The coefficient is not statistically significant at 5% significance level as the

p-value is 0.140 (>0.05).

β4 = -2.488 is the slope coefficient of the age of house which indicates that one unit increase

in the age of house reduces the market price of house by $(2.488 * 1000) = $2488. The

coefficient is not statistically significant at 5% significance level as the p-value is 0.052

(>0.05).

Coefficient of Determination

The coefficient of determination is presented by the adjusted R2. It is a measure of

variance in the dependent variable explained by the independent variables. If the adjusted R2

is equal to 1 that means there is no error and indicates a perfect explanation. The value of the

adjusted R2 for the model is 0.707 that means the independent variables are able to predict the

market price by the accuracy of 70.7% (Wooldridge 2015).

95% Confidence Interval of Parameters

Table 2: A part of regression Result

Coefficients Standard

Error t Stat P-value Lower

95%

Upper

95%

Intercept 548.978 81.132 6.767 0.000 368.206 729.750

Sydney price Index 1.963 0.583 3.367 0.007 0.664 3.263

Annual % change -5.622 3.240 -1.735 0.113 -12.842 1.597

Total number of

square meters 0.519 0.324 1.603 0.140 -0.203 1.241

Age of house (years) -2.488 1.130 -2.202 0.052 -5.005 0.029

The 95% confidence interval indicates a range within which the population mean

exists with 95% certainty.

0.664 ≤ β1 ≥ 3.263, implies that the mean coefficient lies between the range of 0.664 and

3.263 at 95% confidence interval.

8FINANCIAL STATISTICS

-12.842 ≤ β2 ≥ 1.597, implies that the mean coefficient lies between the range of -12.842 and

1.597 at 95% confidence interval.

-0.203 ≤ β3 ≥ 1.241, implies that the mean coefficient lies between the range of -0.203 and

1.241 at 95% confidence interval.

-5.005 ≤ β4 ≥ 0.029, implies that the mean coefficient lies between the range of -5.005 and

0.029 at 95% confidence interval.

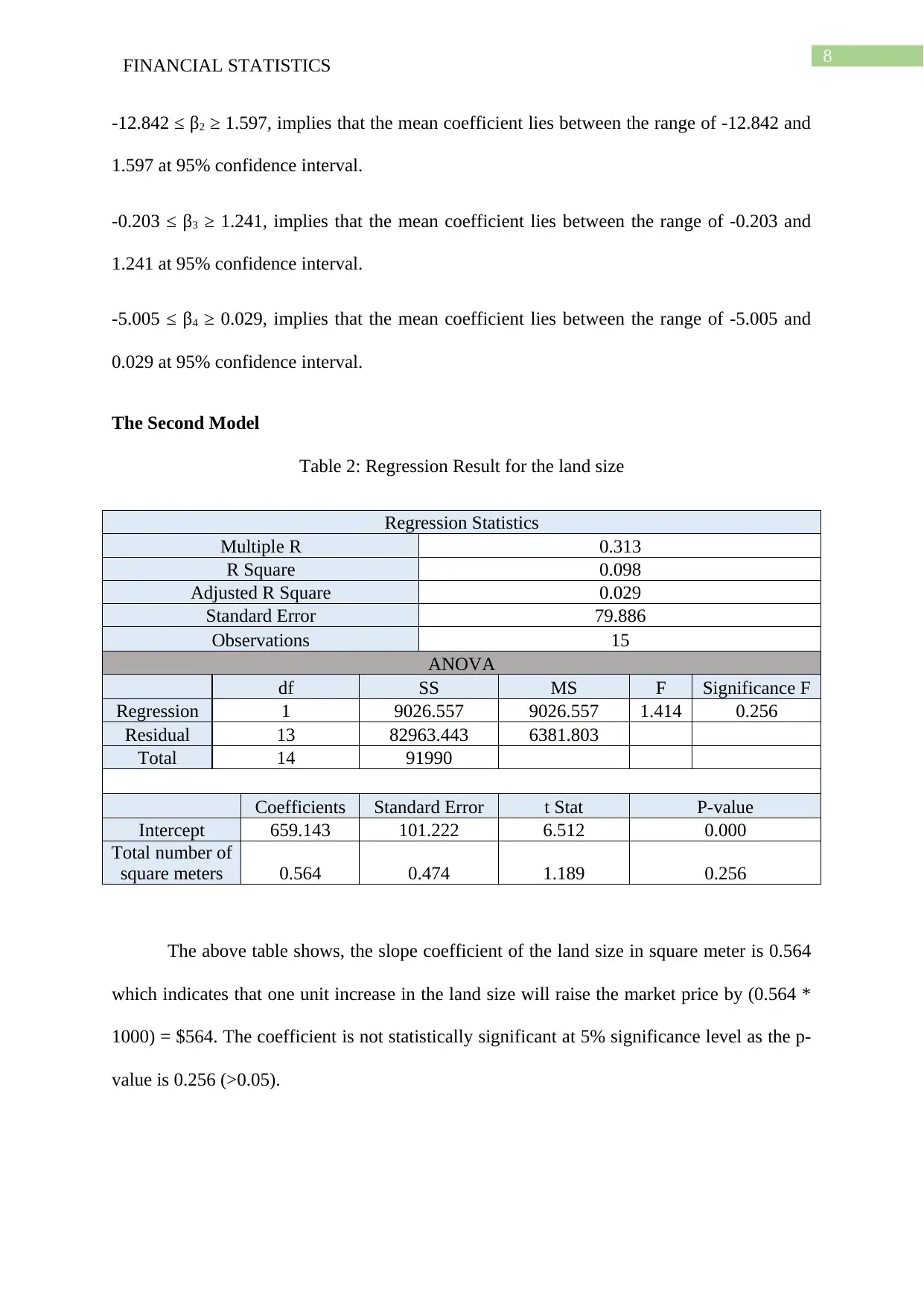

The Second Model

Table 2: Regression Result for the land size

Regression Statistics

Multiple R 0.313

R Square 0.098

Adjusted R Square 0.029

Standard Error 79.886

Observations 15

ANOVA

df SS MS F Significance F

Regression 1 9026.557 9026.557 1.414 0.256

Residual 13 82963.443 6381.803

Total 14 91990

Coefficients Standard Error t Stat P-value

Intercept 659.143 101.222 6.512 0.000

Total number of

square meters 0.564 0.474 1.189 0.256

The above table shows, the slope coefficient of the land size in square meter is 0.564

which indicates that one unit increase in the land size will raise the market price by (0.564 *

1000) = $564. The coefficient is not statistically significant at 5% significance level as the p-

value is 0.256 (>0.05).

-12.842 ≤ β2 ≥ 1.597, implies that the mean coefficient lies between the range of -12.842 and

1.597 at 95% confidence interval.

-0.203 ≤ β3 ≥ 1.241, implies that the mean coefficient lies between the range of -0.203 and

1.241 at 95% confidence interval.

-5.005 ≤ β4 ≥ 0.029, implies that the mean coefficient lies between the range of -5.005 and

0.029 at 95% confidence interval.

The Second Model

Table 2: Regression Result for the land size

Regression Statistics

Multiple R 0.313

R Square 0.098

Adjusted R Square 0.029

Standard Error 79.886

Observations 15

ANOVA

df SS MS F Significance F

Regression 1 9026.557 9026.557 1.414 0.256

Residual 13 82963.443 6381.803

Total 14 91990

Coefficients Standard Error t Stat P-value

Intercept 659.143 101.222 6.512 0.000

Total number of

square meters 0.564 0.474 1.189 0.256

The above table shows, the slope coefficient of the land size in square meter is 0.564

which indicates that one unit increase in the land size will raise the market price by (0.564 *

1000) = $564. The coefficient is not statistically significant at 5% significance level as the p-

value is 0.256 (>0.05).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL STATISTICS

Comparison between Two Models

The adjusted R2 of the multivariate regression model that is for model 1 is 0.707 that

indicates the dependent variable is predictable with 70.7% accuracy. The R2 of the linear

regression model that is for model 2 is 0.098 that means the dependent variable is predictable

with 9.8% accuracy (Abadie and Cattaneo 2018).

Estimated Market Price of House

^market price=659.143+ ( 0.564∗400 )=884.743

The estimated market price for the 400 square meter land size is $(884.743*1000) = $884743.

Comparison between Two Models

The adjusted R2 of the multivariate regression model that is for model 1 is 0.707 that

indicates the dependent variable is predictable with 70.7% accuracy. The R2 of the linear

regression model that is for model 2 is 0.098 that means the dependent variable is predictable

with 9.8% accuracy (Abadie and Cattaneo 2018).

Estimated Market Price of House

^market price=659.143+ ( 0.564∗400 )=884.743

The estimated market price for the 400 square meter land size is $(884.743*1000) = $884743.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL STATISTICS

Reference

Abadie, A. and Cattaneo, M.D., 2018. Econometric methods for program evaluation. Annual

Review of Economics, 10, pp.465-503.

Brooks, C., 2019. Introductory econometrics for finance. Cambridge university press.

Fetai, B., 2015. Financial integration and financial development: does financial integration

metter?. European Research Studies, 18(2), p.97.

Gourieroux, C. and Jasiak, J., 2018. Financial econometrics: Problems, models, and methods.

PrinceFan, J. and Yao, Q., 2017. The elements of financial econometrics. Cambridge

University Press.ton University Press.

Gujarati, D., 2015. Econometrics (by example second edition). China: Palgrave.

Vogel, H.L., 2018. Financial Market Bubbles and Crashes: Features, Causes, and Effects.

Springer.

Wooldridge, J.M., 2015. Introductory econometrics: A modern approach. Nelson Education.

Reference

Abadie, A. and Cattaneo, M.D., 2018. Econometric methods for program evaluation. Annual

Review of Economics, 10, pp.465-503.

Brooks, C., 2019. Introductory econometrics for finance. Cambridge university press.

Fetai, B., 2015. Financial integration and financial development: does financial integration

metter?. European Research Studies, 18(2), p.97.

Gourieroux, C. and Jasiak, J., 2018. Financial econometrics: Problems, models, and methods.

PrinceFan, J. and Yao, Q., 2017. The elements of financial econometrics. Cambridge

University Press.ton University Press.

Gujarati, D., 2015. Econometrics (by example second edition). China: Palgrave.

Vogel, H.L., 2018. Financial Market Bubbles and Crashes: Features, Causes, and Effects.

Springer.

Wooldridge, J.M., 2015. Introductory econometrics: A modern approach. Nelson Education.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.