Business Transaction Recording: Financial Statement Analysis Report

VerifiedAdded on 2022/12/29

|15

|1956

|50

Report

AI Summary

This report provides a detailed analysis of business transaction recording, encompassing double-entry recordings, T-accounts, and the extraction of a trial balance. It includes the preparation of an income statement and a statement of financial position, offering a comprehensive view of the financial performance and position of a business. Furthermore, the report delves into ratio analysis, comparing Linda's business performance with industry benchmarks, including net profit ratio, gross profit ratio, current ratio, quick ratio, and accounts receivable collection period. A brief letter addressing drawings in a small business context is also included. The report provides a complete financial analysis of the business, helping in understanding financial statements and making informed decisions. The report is a valuable resource for students to learn the financial analysis of a business.

Recording Business transaction

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

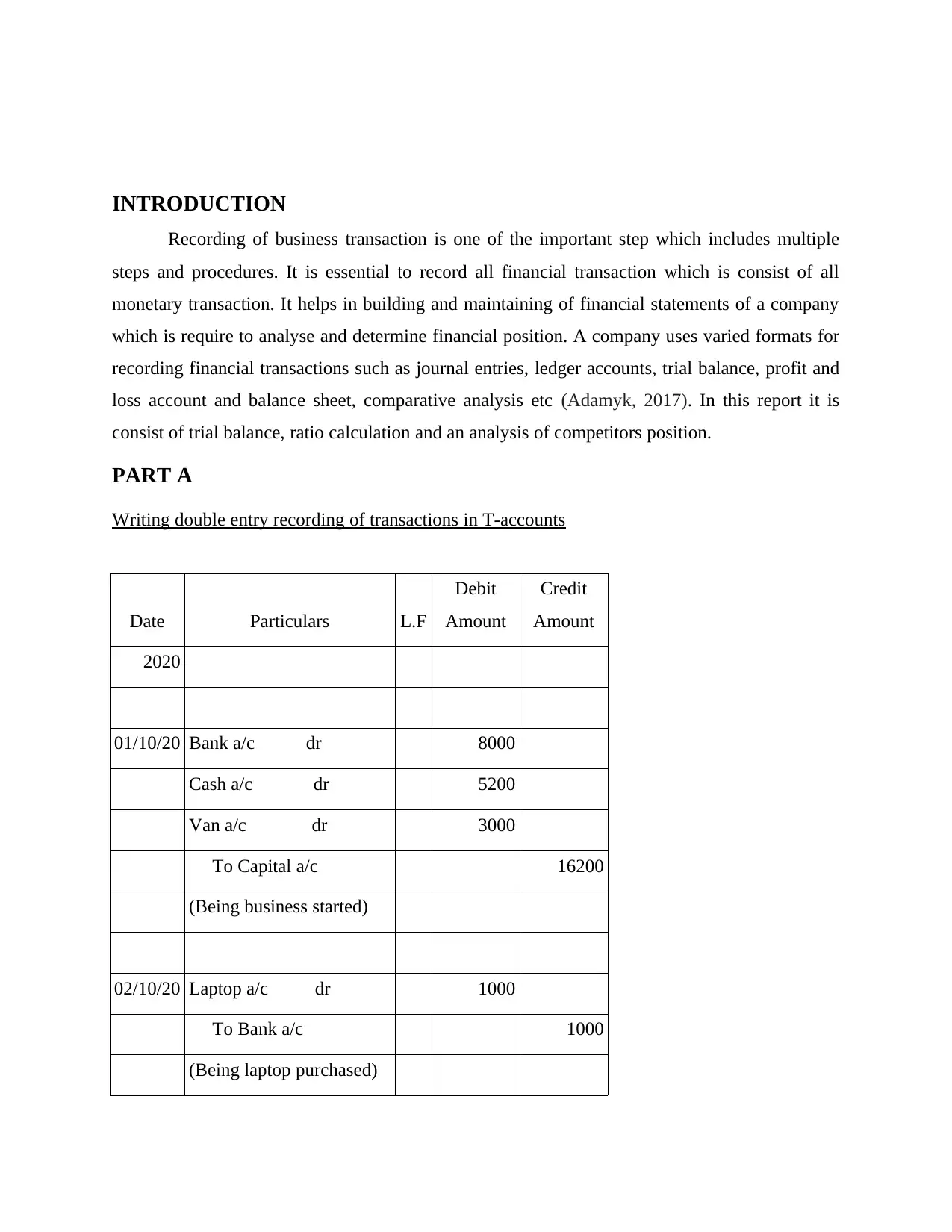

INTRODUCTION

Recording of business transaction is one of the important step which includes multiple

steps and procedures. It is essential to record all financial transaction which is consist of all

monetary transaction. It helps in building and maintaining of financial statements of a company

which is require to analyse and determine financial position. A company uses varied formats for

recording financial transactions such as journal entries, ledger accounts, trial balance, profit and

loss account and balance sheet, comparative analysis etc (Adamyk, 2017). In this report it is

consist of trial balance, ratio calculation and an analysis of competitors position.

PART A

Writing double entry recording of transactions in T-accounts

Date Particulars L.F

Debit

Amount

Credit

Amount

2020

01/10/20 Bank a/c dr 8000

Cash a/c dr 5200

Van a/c dr 3000

To Capital a/c 16200

(Being business started)

02/10/20 Laptop a/c dr 1000

To Bank a/c 1000

(Being laptop purchased)

Recording of business transaction is one of the important step which includes multiple

steps and procedures. It is essential to record all financial transaction which is consist of all

monetary transaction. It helps in building and maintaining of financial statements of a company

which is require to analyse and determine financial position. A company uses varied formats for

recording financial transactions such as journal entries, ledger accounts, trial balance, profit and

loss account and balance sheet, comparative analysis etc (Adamyk, 2017). In this report it is

consist of trial balance, ratio calculation and an analysis of competitors position.

PART A

Writing double entry recording of transactions in T-accounts

Date Particulars L.F

Debit

Amount

Credit

Amount

2020

01/10/20 Bank a/c dr 8000

Cash a/c dr 5200

Van a/c dr 3000

To Capital a/c 16200

(Being business started)

02/10/20 Laptop a/c dr 1000

To Bank a/c 1000

(Being laptop purchased)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

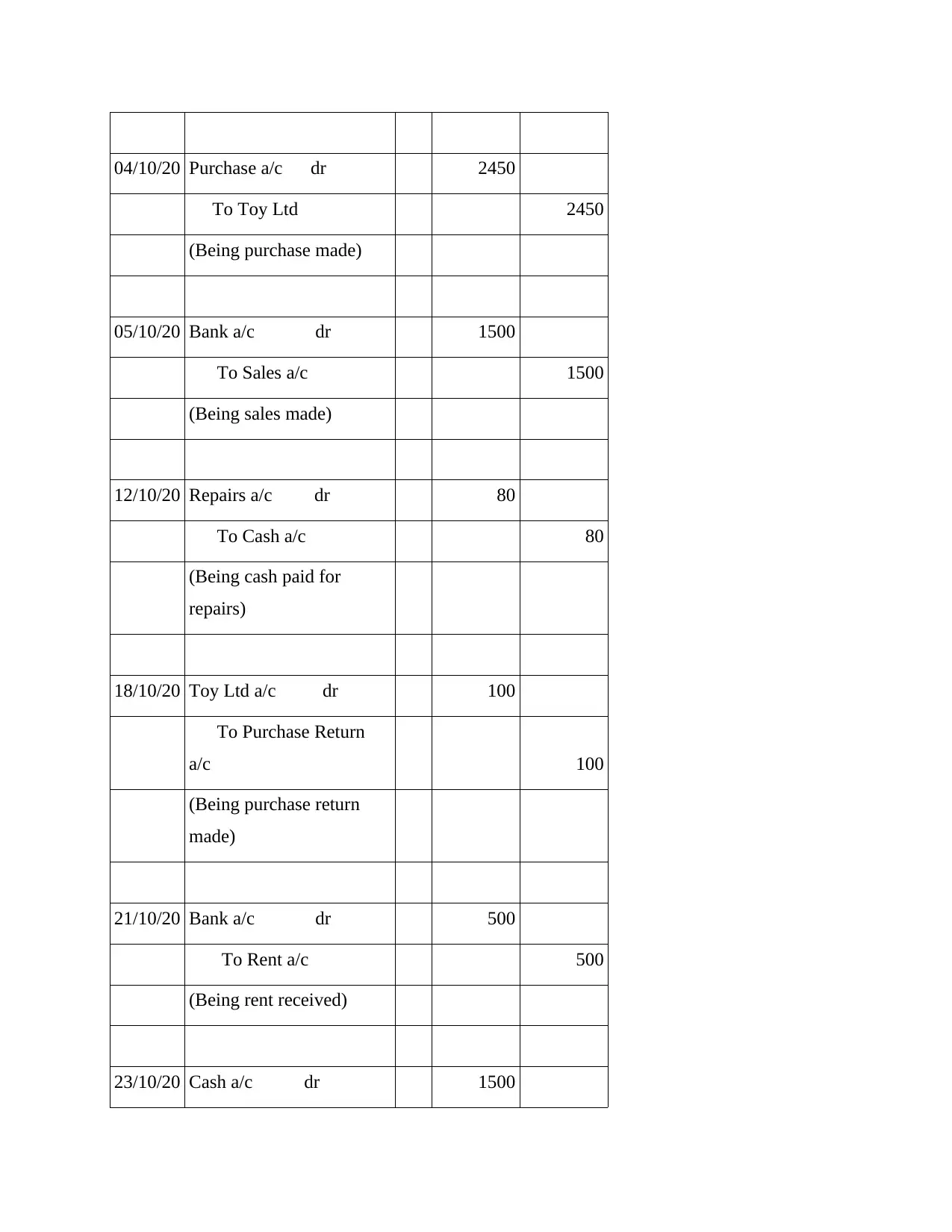

04/10/20 Purchase a/c dr 2450

To Toy Ltd 2450

(Being purchase made)

05/10/20 Bank a/c dr 1500

To Sales a/c 1500

(Being sales made)

12/10/20 Repairs a/c dr 80

To Cash a/c 80

(Being cash paid for

repairs)

18/10/20 Toy Ltd a/c dr 100

To Purchase Return

a/c 100

(Being purchase return

made)

21/10/20 Bank a/c dr 500

To Rent a/c 500

(Being rent received)

23/10/20 Cash a/c dr 1500

To Toy Ltd 2450

(Being purchase made)

05/10/20 Bank a/c dr 1500

To Sales a/c 1500

(Being sales made)

12/10/20 Repairs a/c dr 80

To Cash a/c 80

(Being cash paid for

repairs)

18/10/20 Toy Ltd a/c dr 100

To Purchase Return

a/c 100

(Being purchase return

made)

21/10/20 Bank a/c dr 500

To Rent a/c 500

(Being rent received)

23/10/20 Cash a/c dr 1500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

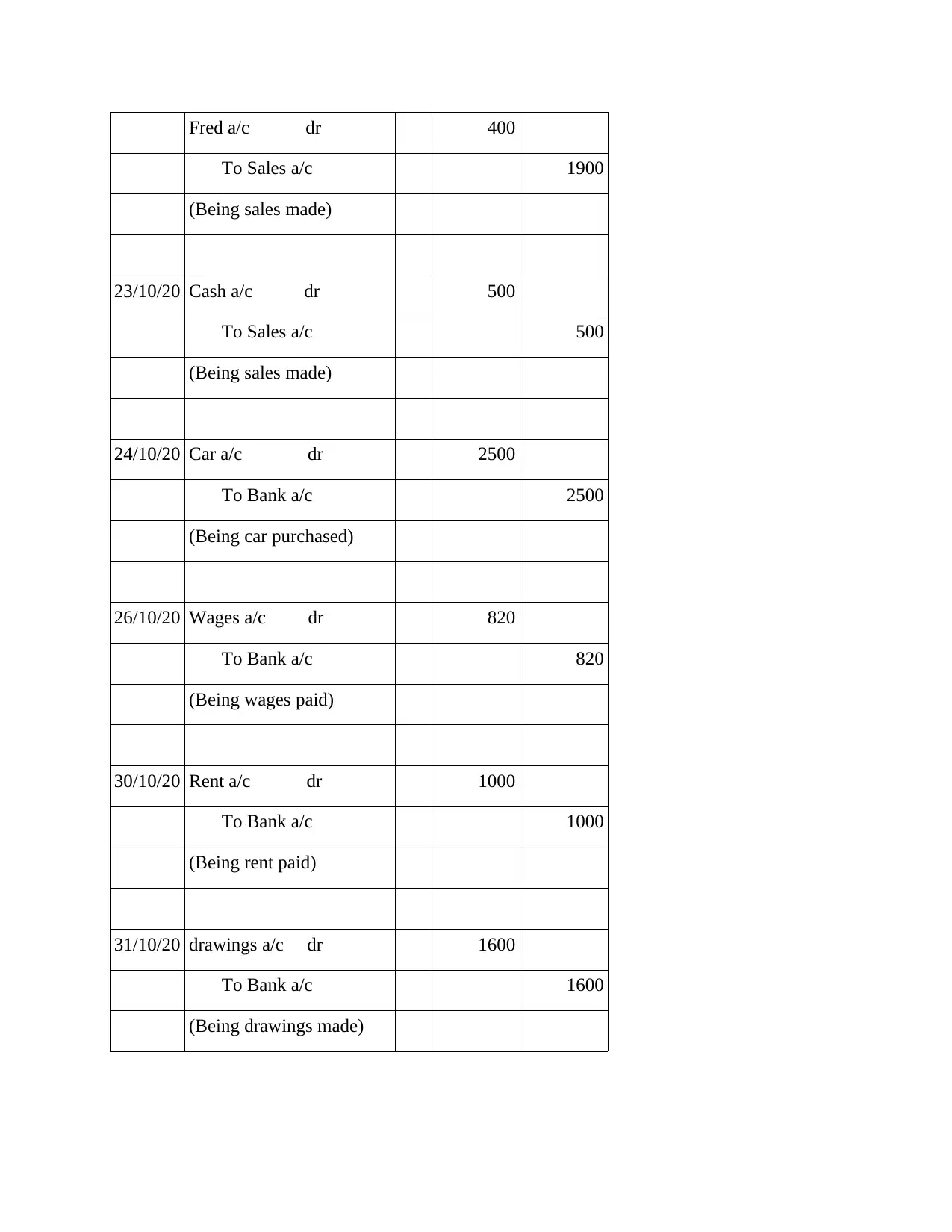

Fred a/c dr 400

To Sales a/c 1900

(Being sales made)

23/10/20 Cash a/c dr 500

To Sales a/c 500

(Being sales made)

24/10/20 Car a/c dr 2500

To Bank a/c 2500

(Being car purchased)

26/10/20 Wages a/c dr 820

To Bank a/c 820

(Being wages paid)

30/10/20 Rent a/c dr 1000

To Bank a/c 1000

(Being rent paid)

31/10/20 drawings a/c dr 1600

To Bank a/c 1600

(Being drawings made)

To Sales a/c 1900

(Being sales made)

23/10/20 Cash a/c dr 500

To Sales a/c 500

(Being sales made)

24/10/20 Car a/c dr 2500

To Bank a/c 2500

(Being car purchased)

26/10/20 Wages a/c dr 820

To Bank a/c 820

(Being wages paid)

30/10/20 Rent a/c dr 1000

To Bank a/c 1000

(Being rent paid)

31/10/20 drawings a/c dr 1600

To Bank a/c 1600

(Being drawings made)

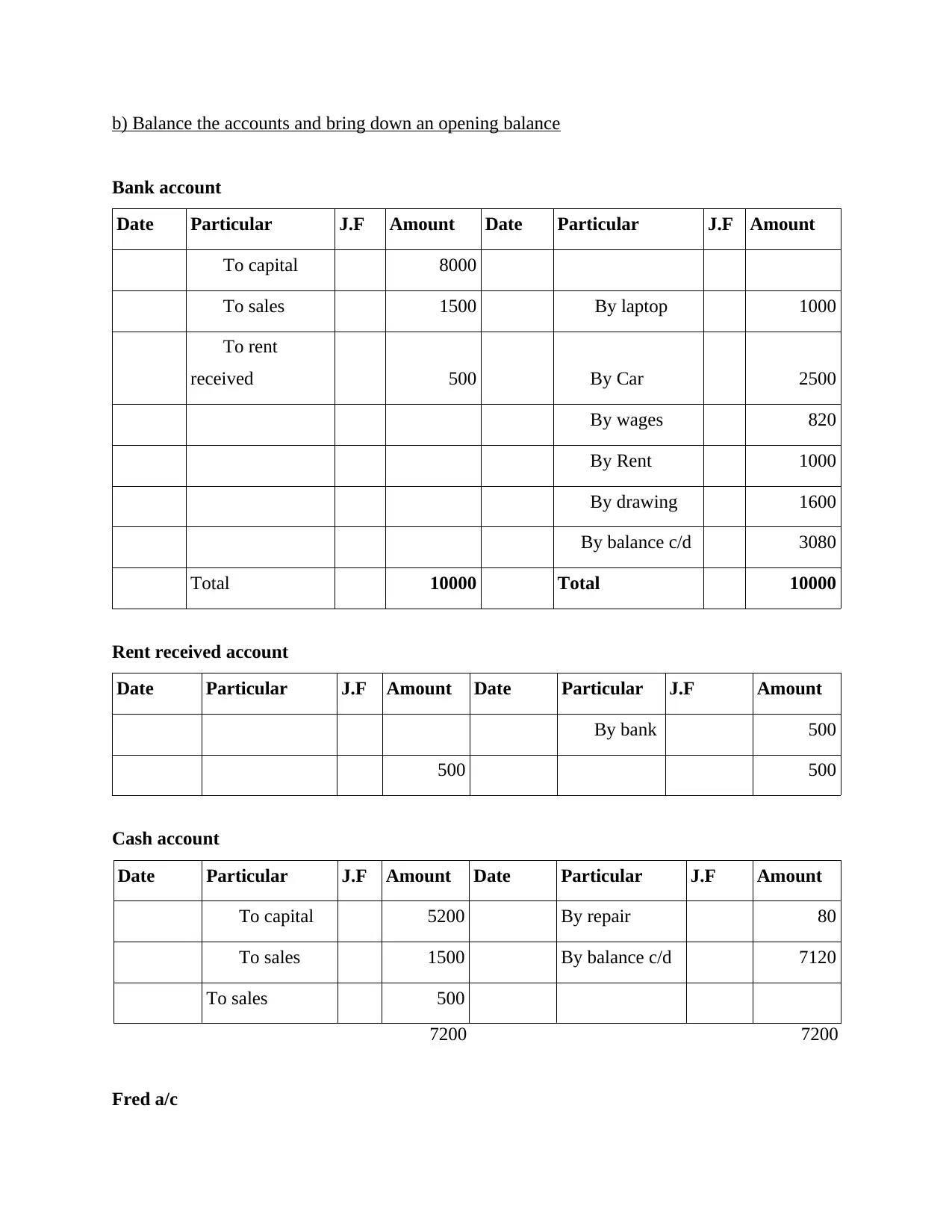

b) Balance the accounts and bring down an opening balance

Bank account

Date Particular J.F Amount Date Particular J.F Amount

…...To capital 8000

…...To sales 1500 …....By laptop 1000

…...To rent

received 500 …...By Car 2500

…...By wages 820

…...By Rent 1000

…...By drawing 1600

….By balance c/d 3080

Total 10000 Total 10000

Rent received account

Date Particular J.F Amount Date Particular J.F Amount

…...By bank 500

500 500

Cash account

Date Particular J.F Amount Date Particular J.F Amount

…...To capital 5200 By repair 80

…...To sales 1500 By balance c/d 7120

To sales 500

7200 7200

Fred a/c

Bank account

Date Particular J.F Amount Date Particular J.F Amount

…...To capital 8000

…...To sales 1500 …....By laptop 1000

…...To rent

received 500 …...By Car 2500

…...By wages 820

…...By Rent 1000

…...By drawing 1600

….By balance c/d 3080

Total 10000 Total 10000

Rent received account

Date Particular J.F Amount Date Particular J.F Amount

…...By bank 500

500 500

Cash account

Date Particular J.F Amount Date Particular J.F Amount

…...To capital 5200 By repair 80

…...To sales 1500 By balance c/d 7120

To sales 500

7200 7200

Fred a/c

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

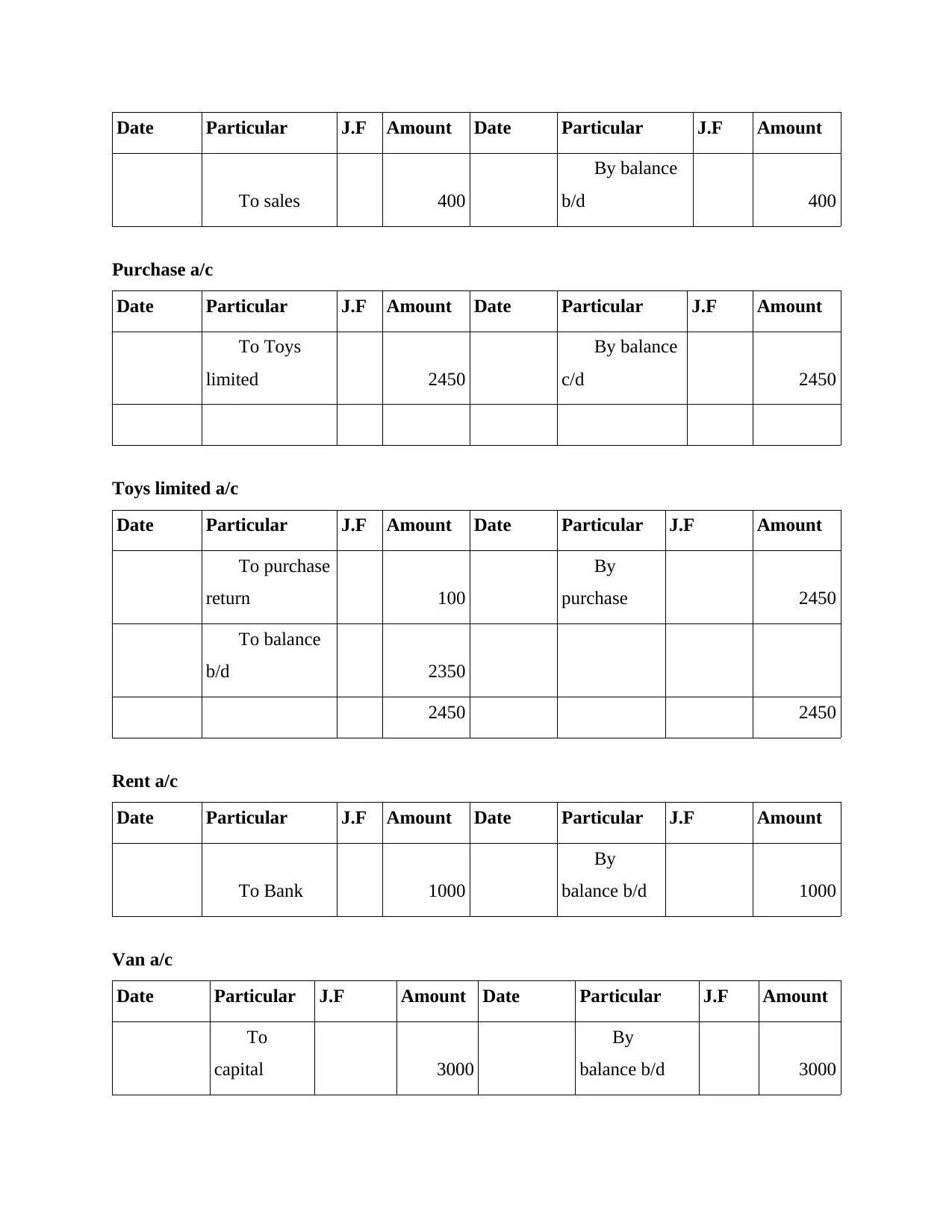

Date Particular J.F Amount Date Particular J.F Amount

…...To sales 400

…...By balance

b/d 400

Purchase a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To Toys

limited 2450

…...By balance

c/d 2450

Toys limited a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To purchase

return 100

…...By

purchase 2450

…...To balance

b/d 2350

2450 2450

Rent a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To Bank 1000

…...By

balance b/d 1000

Van a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To

capital 3000

…...By

balance b/d 3000

…...To sales 400

…...By balance

b/d 400

Purchase a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To Toys

limited 2450

…...By balance

c/d 2450

Toys limited a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To purchase

return 100

…...By

purchase 2450

…...To balance

b/d 2350

2450 2450

Rent a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To Bank 1000

…...By

balance b/d 1000

Van a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To

capital 3000

…...By

balance b/d 3000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

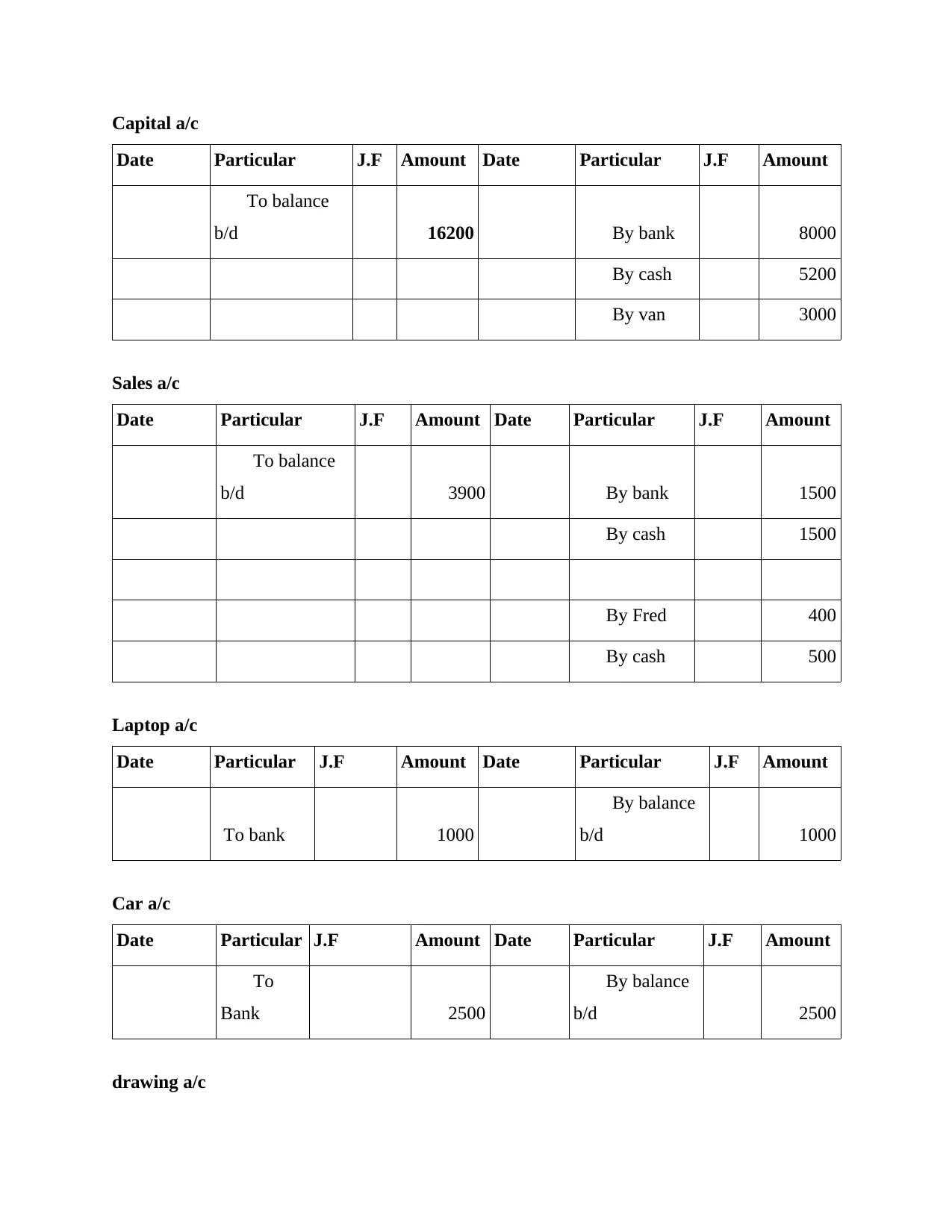

Capital a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To balance

b/d 16200 …...By bank 8000

…...By cash 5200

…...By van 3000

Sales a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To balance

b/d 3900 …...By bank 1500

…...By cash 1500

…...By Fred 400

…...By cash 500

Laptop a/c

Date Particular J.F Amount Date Particular J.F Amount

..To bank 1000

…...By balance

b/d 1000

Car a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To

Bank 2500

…...By balance

b/d 2500

drawing a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To balance

b/d 16200 …...By bank 8000

…...By cash 5200

…...By van 3000

Sales a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To balance

b/d 3900 …...By bank 1500

…...By cash 1500

…...By Fred 400

…...By cash 500

Laptop a/c

Date Particular J.F Amount Date Particular J.F Amount

..To bank 1000

…...By balance

b/d 1000

Car a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To

Bank 2500

…...By balance

b/d 2500

drawing a/c

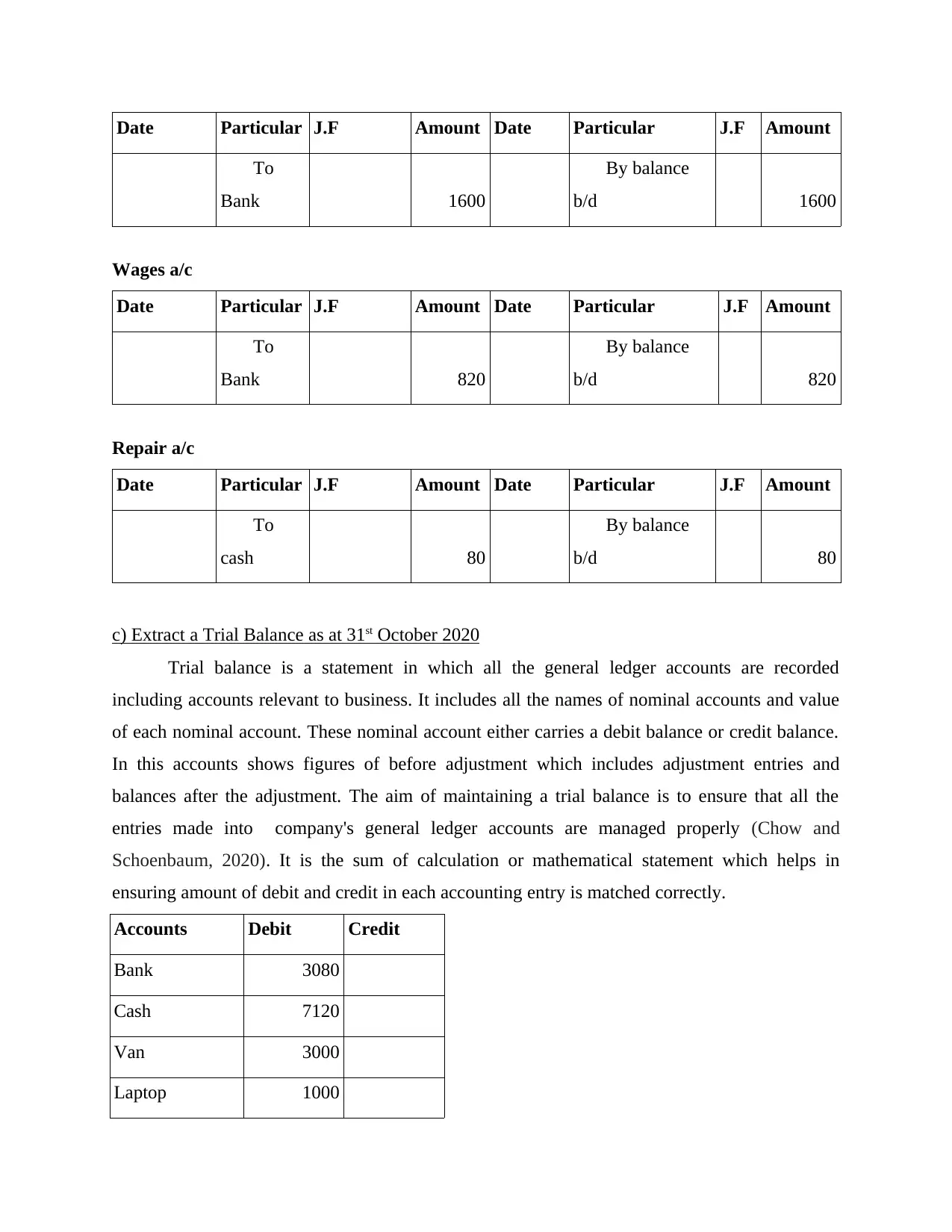

Date Particular J.F Amount Date Particular J.F Amount

…...To

Bank 1600

…...By balance

b/d 1600

Wages a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To

Bank 820

…...By balance

b/d 820

Repair a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To

cash 80

…...By balance

b/d 80

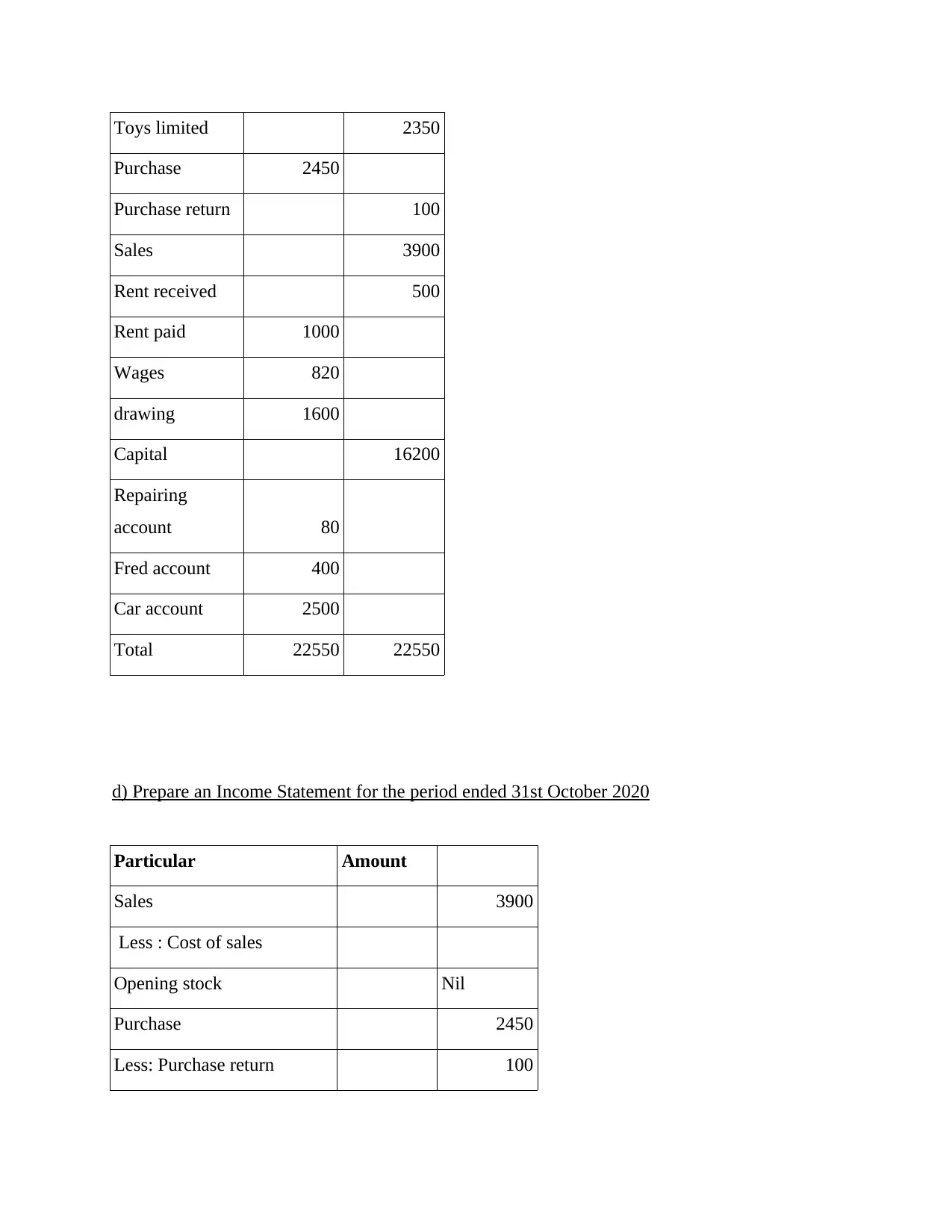

c) Extract a Trial Balance as at 31st October 2020

Trial balance is a statement in which all the general ledger accounts are recorded

including accounts relevant to business. It includes all the names of nominal accounts and value

of each nominal account. These nominal account either carries a debit balance or credit balance.

In this accounts shows figures of before adjustment which includes adjustment entries and

balances after the adjustment. The aim of maintaining a trial balance is to ensure that all the

entries made into company's general ledger accounts are managed properly (Chow and

Schoenbaum, 2020). It is the sum of calculation or mathematical statement which helps in

ensuring amount of debit and credit in each accounting entry is matched correctly.

Accounts Debit Credit

Bank 3080

Cash 7120

Van 3000

Laptop 1000

…...To

Bank 1600

…...By balance

b/d 1600

Wages a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To

Bank 820

…...By balance

b/d 820

Repair a/c

Date Particular J.F Amount Date Particular J.F Amount

…...To

cash 80

…...By balance

b/d 80

c) Extract a Trial Balance as at 31st October 2020

Trial balance is a statement in which all the general ledger accounts are recorded

including accounts relevant to business. It includes all the names of nominal accounts and value

of each nominal account. These nominal account either carries a debit balance or credit balance.

In this accounts shows figures of before adjustment which includes adjustment entries and

balances after the adjustment. The aim of maintaining a trial balance is to ensure that all the

entries made into company's general ledger accounts are managed properly (Chow and

Schoenbaum, 2020). It is the sum of calculation or mathematical statement which helps in

ensuring amount of debit and credit in each accounting entry is matched correctly.

Accounts Debit Credit

Bank 3080

Cash 7120

Van 3000

Laptop 1000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Toys limited 2350

Purchase 2450

Purchase return 100

Sales 3900

Rent received 500

Rent paid 1000

Wages 820

drawing 1600

Capital 16200

Repairing

account 80

Fred account 400

Car account 2500

Total 22550 22550

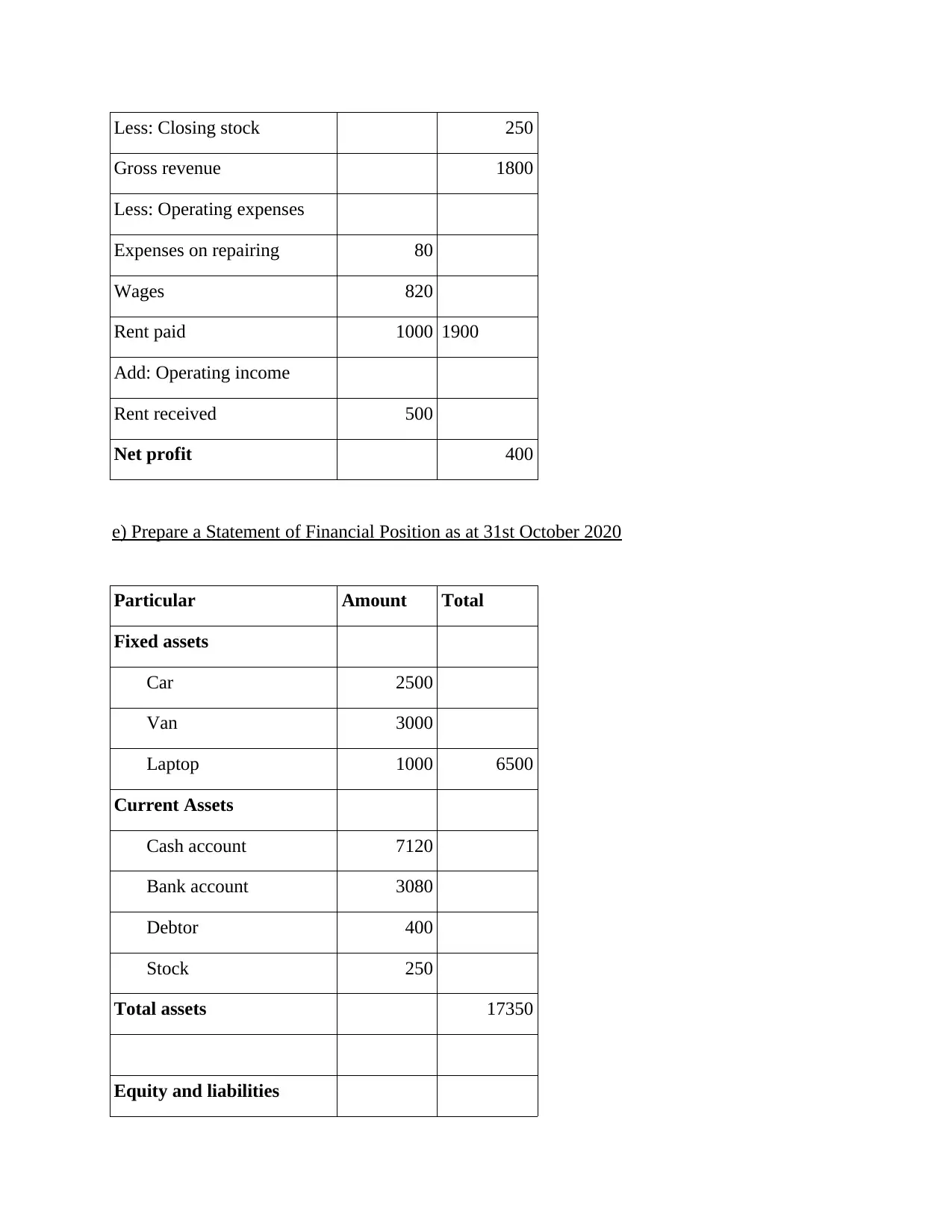

d) Prepare an Income Statement for the period ended 31st October 2020

Particular Amount

Sales 3900

Less : Cost of sales

Opening stock Nil

Purchase 2450

Less: Purchase return 100

Purchase 2450

Purchase return 100

Sales 3900

Rent received 500

Rent paid 1000

Wages 820

drawing 1600

Capital 16200

Repairing

account 80

Fred account 400

Car account 2500

Total 22550 22550

d) Prepare an Income Statement for the period ended 31st October 2020

Particular Amount

Sales 3900

Less : Cost of sales

Opening stock Nil

Purchase 2450

Less: Purchase return 100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less: Closing stock 250

Gross revenue 1800

Less: Operating expenses

Expenses on repairing 80

Wages 820

Rent paid 1000 1900

Add: Operating income

Rent received 500

Net profit 400

e) Prepare a Statement of Financial Position as at 31st October 2020

Particular Amount Total

Fixed assets

…...Car 2500

…...Van 3000

…...Laptop 1000 6500

Current Assets

…...Cash account 7120

…...Bank account 3080

…...Debtor 400

…...Stock 250

Total assets 17350

Equity and liabilities

Gross revenue 1800

Less: Operating expenses

Expenses on repairing 80

Wages 820

Rent paid 1000 1900

Add: Operating income

Rent received 500

Net profit 400

e) Prepare a Statement of Financial Position as at 31st October 2020

Particular Amount Total

Fixed assets

…...Car 2500

…...Van 3000

…...Laptop 1000 6500

Current Assets

…...Cash account 7120

…...Bank account 3080

…...Debtor 400

…...Stock 250

Total assets 17350

Equity and liabilities

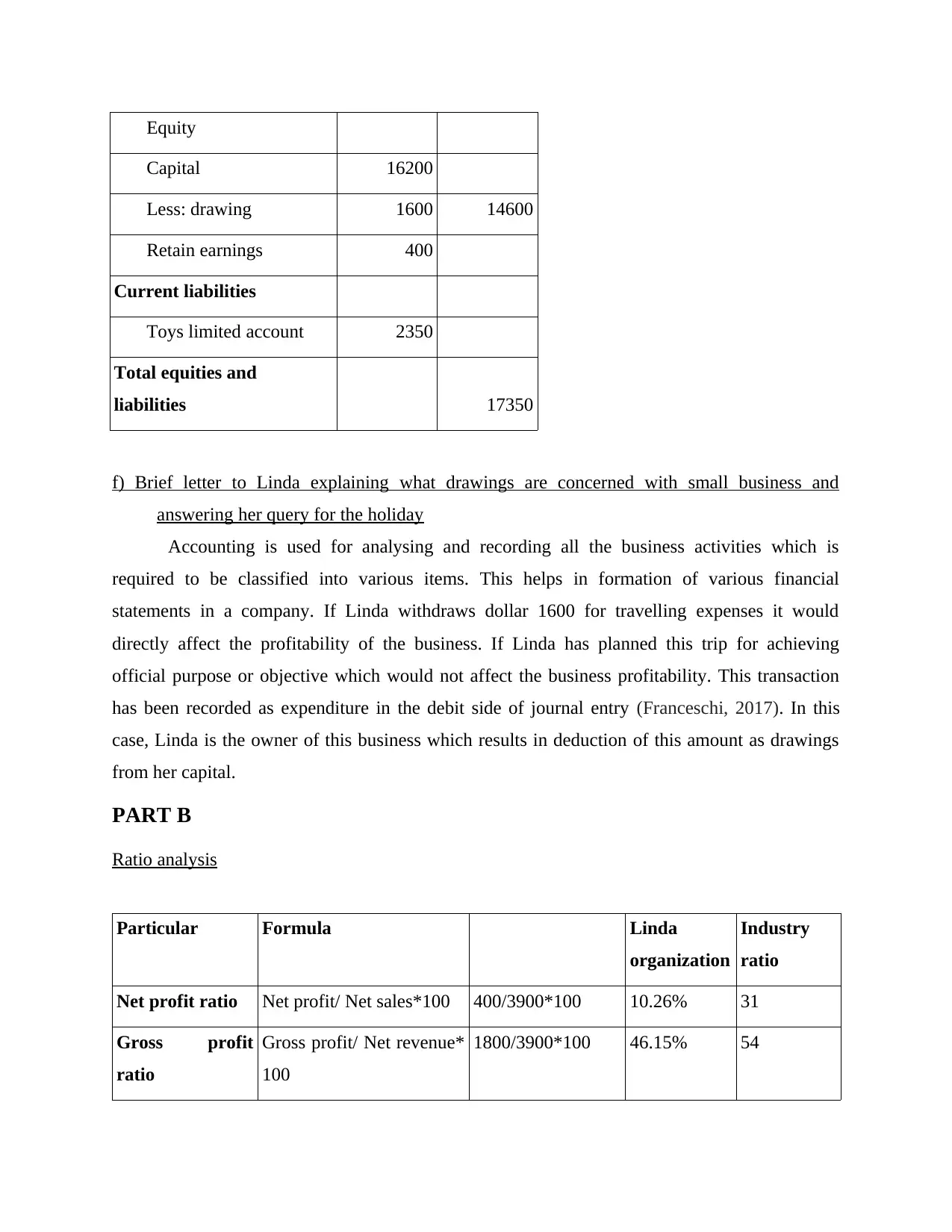

…...Equity

…...Capital 16200

…...Less: drawing 1600 14600

…...Retain earnings 400

Current liabilities

…...Toys limited account 2350

Total equities and

liabilities 17350

f) Brief letter to Linda explaining what drawings are concerned with small business and

answering her query for the holiday

Accounting is used for analysing and recording all the business activities which is

required to be classified into various items. This helps in formation of various financial

statements in a company. If Linda withdraws dollar 1600 for travelling expenses it would

directly affect the profitability of the business. If Linda has planned this trip for achieving

official purpose or objective which would not affect the business profitability. This transaction

has been recorded as expenditure in the debit side of journal entry (Franceschi, 2017). In this

case, Linda is the owner of this business which results in deduction of this amount as drawings

from her capital.

PART B

Ratio analysis

Particular Formula Linda

organization

Industry

ratio

Net profit ratio Net profit/ Net sales*100 400/3900*100 10.26% 31

Gross profit

ratio

Gross profit/ Net revenue*

100

1800/3900*100 46.15% 54

…...Capital 16200

…...Less: drawing 1600 14600

…...Retain earnings 400

Current liabilities

…...Toys limited account 2350

Total equities and

liabilities 17350

f) Brief letter to Linda explaining what drawings are concerned with small business and

answering her query for the holiday

Accounting is used for analysing and recording all the business activities which is

required to be classified into various items. This helps in formation of various financial

statements in a company. If Linda withdraws dollar 1600 for travelling expenses it would

directly affect the profitability of the business. If Linda has planned this trip for achieving

official purpose or objective which would not affect the business profitability. This transaction

has been recorded as expenditure in the debit side of journal entry (Franceschi, 2017). In this

case, Linda is the owner of this business which results in deduction of this amount as drawings

from her capital.

PART B

Ratio analysis

Particular Formula Linda

organization

Industry

ratio

Net profit ratio Net profit/ Net sales*100 400/3900*100 10.26% 31

Gross profit

ratio

Gross profit/ Net revenue*

100

1800/3900*100 46.15% 54

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.