Financial Management Report: Valuation, Appraisal, and Policy

VerifiedAdded on 2023/01/09

|18

|3738

|71

Report

AI Summary

This report provides a detailed analysis of key financial management concepts. It begins with an introduction to financial management and its importance, followed by an in-depth examination of mergers and takeovers, including valuation methods like price-earnings ratio, dividend valuation model, and discounted cash flow, along with their advantages and disadvantages. The report then explores investment appraisal techniques, such as payback period, net present value, and internal rate of return, with calculations and recommendations. The assignment also addresses dividend policy, discussing factors for determining dividend size and practical considerations for a listed company. The report uses Lovewell Limited as a case study to determine investment decisions.

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................................3

MAIN BODY.................................................................................................................................................3

Question 1- Merger and Takeovers.............................................................................................................3

1. Calculate the value for Trojan Plc by using various valuation method................................................3

2. Discussed the problems associated with valuation models with the help of evaluating advantages or

disadvantages...........................................................................................................................................6

Question 3 – Investment Appraisal Techniques..........................................................................................8

1. Calculate following investment appraisal technique and give brief recommendations........................8

2. Critically evaluate the Benefits or Drawbacks of different investment appraisal techniques.............13

CONCLUSION.............................................................................................................................................15

REFERENCES..............................................................................................................................................16

INTRODUCTION...........................................................................................................................................3

MAIN BODY.................................................................................................................................................3

Question 1- Merger and Takeovers.............................................................................................................3

1. Calculate the value for Trojan Plc by using various valuation method................................................3

2. Discussed the problems associated with valuation models with the help of evaluating advantages or

disadvantages...........................................................................................................................................6

Question 3 – Investment Appraisal Techniques..........................................................................................8

1. Calculate following investment appraisal technique and give brief recommendations........................8

2. Critically evaluate the Benefits or Drawbacks of different investment appraisal techniques.............13

CONCLUSION.............................................................................................................................................15

REFERENCES..............................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial management relies on the debt and equity financing ratios. It is useful in terms of

commercial banking, distribution of wealth and business development, shorting and controlling

uncertainty in the currency currencies and resource processes. Financial management of an

institution plays a very important role in an entity's financial development (Aifuwa and Embele,

2019). An enterprise would also perceive financial control as a vital factor of the organization’s

operational management. Investment managers are the professionals who can really carry out

research and decide whatever kind of money to collect to fund the acquisitions of the

organization, and to also maximize the profitability of the organization to all stakeholders based

on the report. Two questions that need to be addressed in this document are about merger and

takeover, and the other is investment assessment mechanisms to reassess the most beneficial

investment strategy.

MAIN BODY

Question 1- Merger and Takeovers

1. Calculate the value for Trojan Plc by using various valuation method

Price earnings ratio: The price-earnings ratio (PE ratio) is the relationship between the

exchange value of a company and its earnings per share (EPS). It represents what the customers

are willing to pay for the earnings of an enterprise. Price earnings are important when going to

value the inventory of a business, as shareholders choose to understand whether competitive a

business is and just how successful it will be in the potential. Besides that, unless the future stock

and rate of earnings stay constant, therefore the P / E can be viewed as the period of months the

business would need to repay the amount charged for both the stock (Asghar Butt and et.al,

2018).

Formula:

Price earnings ratio= Net income/total share outstanding

= 40.4/147

Financial management relies on the debt and equity financing ratios. It is useful in terms of

commercial banking, distribution of wealth and business development, shorting and controlling

uncertainty in the currency currencies and resource processes. Financial management of an

institution plays a very important role in an entity's financial development (Aifuwa and Embele,

2019). An enterprise would also perceive financial control as a vital factor of the organization’s

operational management. Investment managers are the professionals who can really carry out

research and decide whatever kind of money to collect to fund the acquisitions of the

organization, and to also maximize the profitability of the organization to all stakeholders based

on the report. Two questions that need to be addressed in this document are about merger and

takeover, and the other is investment assessment mechanisms to reassess the most beneficial

investment strategy.

MAIN BODY

Question 1- Merger and Takeovers

1. Calculate the value for Trojan Plc by using various valuation method

Price earnings ratio: The price-earnings ratio (PE ratio) is the relationship between the

exchange value of a company and its earnings per share (EPS). It represents what the customers

are willing to pay for the earnings of an enterprise. Price earnings are important when going to

value the inventory of a business, as shareholders choose to understand whether competitive a

business is and just how successful it will be in the potential. Besides that, unless the future stock

and rate of earnings stay constant, therefore the P / E can be viewed as the period of months the

business would need to repay the amount charged for both the stock (Asghar Butt and et.al,

2018).

Formula:

Price earnings ratio= Net income/total share outstanding

= 40.4/147

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

= 27 P per share.

Net income= 40.4 Million

Total share outstanding= 147

Dividend valuation model: The Dividend valuation Model (DVM) is used to estimate the value

of stocks in a business. The concept is predicated on the assumption that when discounted back

into the current, the current price of the investment is equivalent to the value of all possible

dividend payouts. If the current value measured underneath the DVM is larger than the initial

selling price, then the inventory is underpriced and applies for a decision to purchase. The

Discount Dividend existing customer that the performance of the investment is the current value

of the all the stockholders' dividend income it would ever charge. The methodology uses the

wealth real options concept (Bempah, 2017).

Dividend Discount Model Fair Value: £ 4.774

Calculation:

Expected Growth Rate = (1 – Dividend Payout Ratio) × Return on Equity

= (1 – 0.48) × 0.27

= 0.14

Expected Dividends Next Year = Dividends per Share × (1 + Expected Growth Rate)

= 0.13 × (1 + 0.14)

= 0.148

Cost of Equity = Risk-Free Rate + Beta × Market Risk Premium

= 0.05 + 1.1 × 0.11

= 0.171

Fair Value = Expected Dividends Next Year / (Cost of Equity – Expected Growth Rate)

Net income= 40.4 Million

Total share outstanding= 147

Dividend valuation model: The Dividend valuation Model (DVM) is used to estimate the value

of stocks in a business. The concept is predicated on the assumption that when discounted back

into the current, the current price of the investment is equivalent to the value of all possible

dividend payouts. If the current value measured underneath the DVM is larger than the initial

selling price, then the inventory is underpriced and applies for a decision to purchase. The

Discount Dividend existing customer that the performance of the investment is the current value

of the all the stockholders' dividend income it would ever charge. The methodology uses the

wealth real options concept (Bempah, 2017).

Dividend Discount Model Fair Value: £ 4.774

Calculation:

Expected Growth Rate = (1 – Dividend Payout Ratio) × Return on Equity

= (1 – 0.48) × 0.27

= 0.14

Expected Dividends Next Year = Dividends per Share × (1 + Expected Growth Rate)

= 0.13 × (1 + 0.14)

= 0.148

Cost of Equity = Risk-Free Rate + Beta × Market Risk Premium

= 0.05 + 1.1 × 0.11

= 0.171

Fair Value = Expected Dividends Next Year / (Cost of Equity – Expected Growth Rate)

= 0.148 / (0.171 – 0.14)

= 4.774

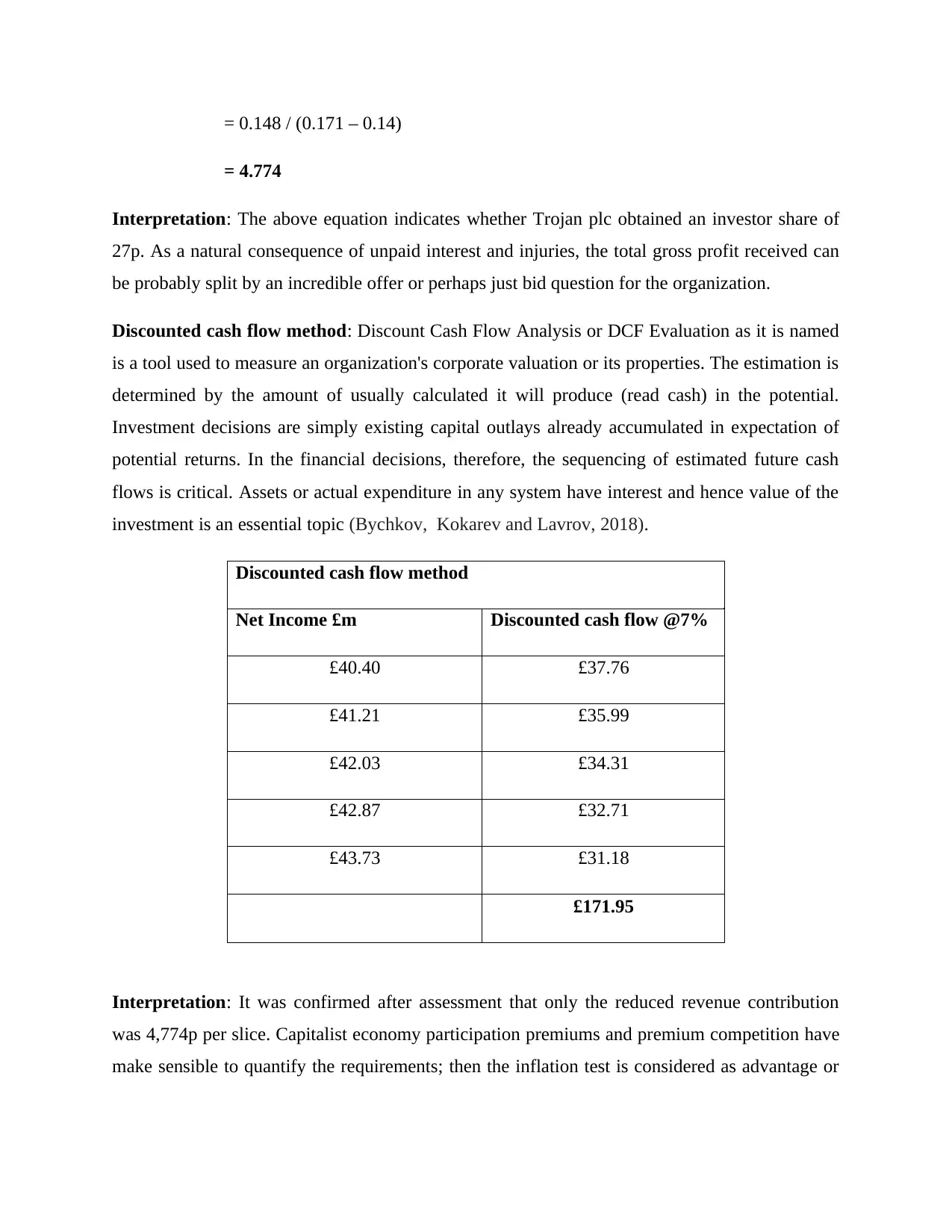

Interpretation: The above equation indicates whether Trojan plc obtained an investor share of

27p. As a natural consequence of unpaid interest and injuries, the total gross profit received can

be probably split by an incredible offer or perhaps just bid question for the organization.

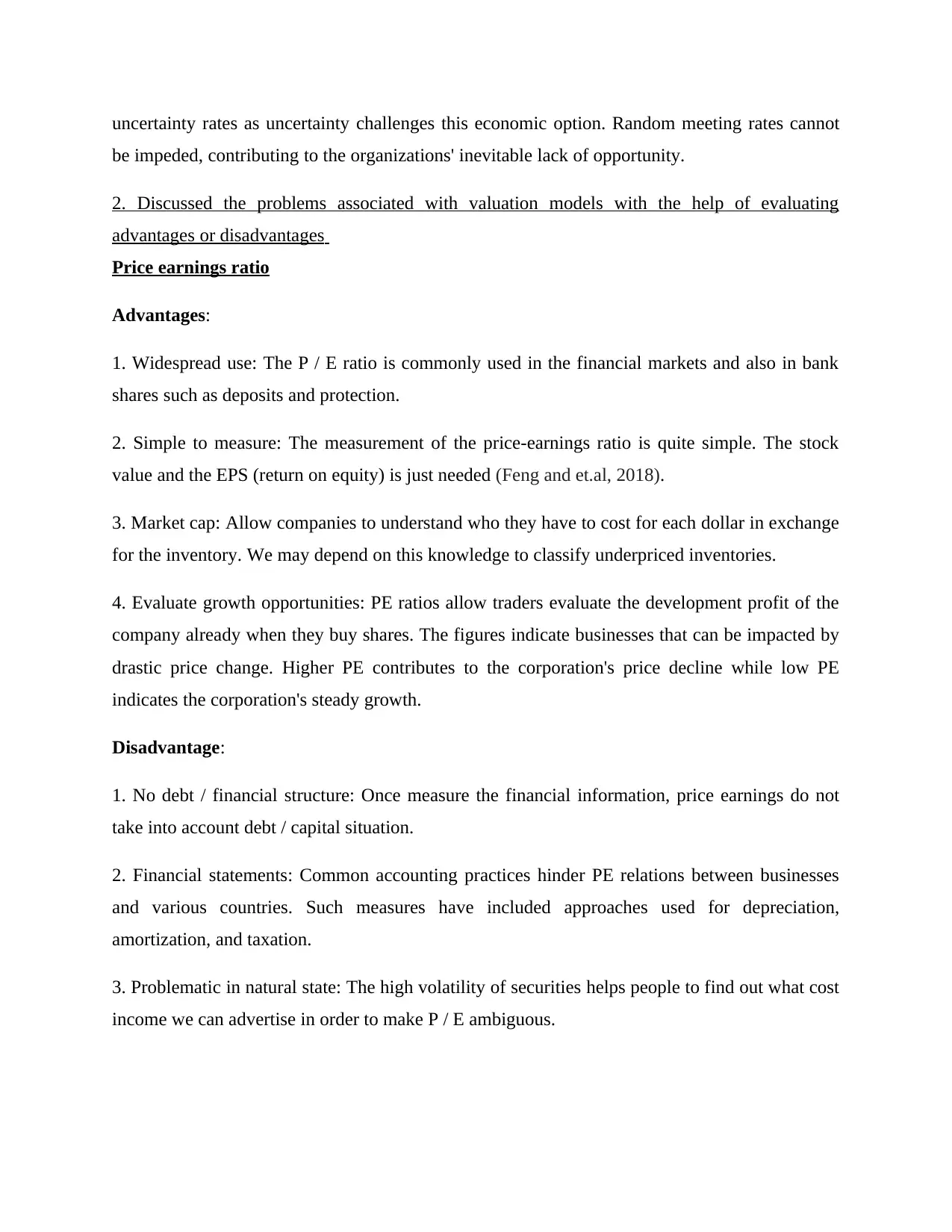

Discounted cash flow method: Discount Cash Flow Analysis or DCF Evaluation as it is named

is a tool used to measure an organization's corporate valuation or its properties. The estimation is

determined by the amount of usually calculated it will produce (read cash) in the potential.

Investment decisions are simply existing capital outlays already accumulated in expectation of

potential returns. In the financial decisions, therefore, the sequencing of estimated future cash

flows is critical. Assets or actual expenditure in any system have interest and hence value of the

investment is an essential topic (Bychkov, Kokarev and Lavrov, 2018).

Discounted cash flow method

Net Income £m Discounted cash flow @7%

£40.40 £37.76

£41.21 £35.99

£42.03 £34.31

£42.87 £32.71

£43.73 £31.18

£171.95

Interpretation: It was confirmed after assessment that only the reduced revenue contribution

was 4,774p per slice. Capitalist economy participation premiums and premium competition have

make sensible to quantify the requirements; then the inflation test is considered as advantage or

= 4.774

Interpretation: The above equation indicates whether Trojan plc obtained an investor share of

27p. As a natural consequence of unpaid interest and injuries, the total gross profit received can

be probably split by an incredible offer or perhaps just bid question for the organization.

Discounted cash flow method: Discount Cash Flow Analysis or DCF Evaluation as it is named

is a tool used to measure an organization's corporate valuation or its properties. The estimation is

determined by the amount of usually calculated it will produce (read cash) in the potential.

Investment decisions are simply existing capital outlays already accumulated in expectation of

potential returns. In the financial decisions, therefore, the sequencing of estimated future cash

flows is critical. Assets or actual expenditure in any system have interest and hence value of the

investment is an essential topic (Bychkov, Kokarev and Lavrov, 2018).

Discounted cash flow method

Net Income £m Discounted cash flow @7%

£40.40 £37.76

£41.21 £35.99

£42.03 £34.31

£42.87 £32.71

£43.73 £31.18

£171.95

Interpretation: It was confirmed after assessment that only the reduced revenue contribution

was 4,774p per slice. Capitalist economy participation premiums and premium competition have

make sensible to quantify the requirements; then the inflation test is considered as advantage or

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

uncertainty rates as uncertainty challenges this economic option. Random meeting rates cannot

be impeded, contributing to the organizations' inevitable lack of opportunity.

2. Discussed the problems associated with valuation models with the help of evaluating

advantages or disadvantages

Price earnings ratio

Advantages:

1. Widespread use: The P / E ratio is commonly used in the financial markets and also in bank

shares such as deposits and protection.

2. Simple to measure: The measurement of the price-earnings ratio is quite simple. The stock

value and the EPS (return on equity) is just needed (Feng and et.al, 2018).

3. Market cap: Allow companies to understand who they have to cost for each dollar in exchange

for the inventory. We may depend on this knowledge to classify underpriced inventories.

4. Evaluate growth opportunities: PE ratios allow traders evaluate the development profit of the

company already when they buy shares. The figures indicate businesses that can be impacted by

drastic price change. Higher PE contributes to the corporation's price decline while low PE

indicates the corporation's steady growth.

Disadvantage:

1. No debt / financial structure: Once measure the financial information, price earnings do not

take into account debt / capital situation.

2. Financial statements: Common accounting practices hinder PE relations between businesses

and various countries. Such measures have included approaches used for depreciation,

amortization, and taxation.

3. Problematic in natural state: The high volatility of securities helps people to find out what cost

income we can advertise in order to make P / E ambiguous.

be impeded, contributing to the organizations' inevitable lack of opportunity.

2. Discussed the problems associated with valuation models with the help of evaluating

advantages or disadvantages

Price earnings ratio

Advantages:

1. Widespread use: The P / E ratio is commonly used in the financial markets and also in bank

shares such as deposits and protection.

2. Simple to measure: The measurement of the price-earnings ratio is quite simple. The stock

value and the EPS (return on equity) is just needed (Feng and et.al, 2018).

3. Market cap: Allow companies to understand who they have to cost for each dollar in exchange

for the inventory. We may depend on this knowledge to classify underpriced inventories.

4. Evaluate growth opportunities: PE ratios allow traders evaluate the development profit of the

company already when they buy shares. The figures indicate businesses that can be impacted by

drastic price change. Higher PE contributes to the corporation's price decline while low PE

indicates the corporation's steady growth.

Disadvantage:

1. No debt / financial structure: Once measure the financial information, price earnings do not

take into account debt / capital situation.

2. Financial statements: Common accounting practices hinder PE relations between businesses

and various countries. Such measures have included approaches used for depreciation,

amortization, and taxation.

3. Problematic in natural state: The high volatility of securities helps people to find out what cost

income we can advertise in order to make P / E ambiguous.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4. Additional cost risk: The speeding ups or established company-backs will boost the profits of

the business and this will contribute to greater expense of threat for that to be done (Giambona

and et.al, 2018).

Dividend valuation model

Advantages: Businesses usually offer programs to make money, or manufacture products. The

company typically makes use of certain gains to pay profits to shareholders. The dividend

valuation model has never ever been configured to work for smaller companies or entrepreneurs.

This is formulated to be an indicator of a mature business' fitness. Annual investment returns are

a indication that a firm is reaching the third phase of wealth creation, that encourages shareholder

productivity. Which makes things simpler to decide whatever the interest rate should be

comparison with other service and the quantity.

Disadvantage: The dividend valuation model's future direction is premised upon the components

it receives. Unless the data is wrong therefore the model's prices will also be misleading.

Businesses are finding that such a system performed quite well if the predictions that they too are

made to create turned out to have been overwhelmingly right. Because once deciding to invest,

it's often stronger to be too securing that than irresponsible, and with this alternative, that it's

almost too progressive for several equities to provide it as an important technique (Le and et.al,

2018).

Discounted cash flow method

Advantages:

1. The DCF service basically lends weight to currency divisions which are similar than unusual

ones. Yet other approaches impractically view abstract amounts of capital with the same

importance as present-day amounts.

2. Through encouraging correlation at the very same period, the DCF option enables natural

meaningful comparisons amongst different types of projects lives and specific time frames

within each stream.

the business and this will contribute to greater expense of threat for that to be done (Giambona

and et.al, 2018).

Dividend valuation model

Advantages: Businesses usually offer programs to make money, or manufacture products. The

company typically makes use of certain gains to pay profits to shareholders. The dividend

valuation model has never ever been configured to work for smaller companies or entrepreneurs.

This is formulated to be an indicator of a mature business' fitness. Annual investment returns are

a indication that a firm is reaching the third phase of wealth creation, that encourages shareholder

productivity. Which makes things simpler to decide whatever the interest rate should be

comparison with other service and the quantity.

Disadvantage: The dividend valuation model's future direction is premised upon the components

it receives. Unless the data is wrong therefore the model's prices will also be misleading.

Businesses are finding that such a system performed quite well if the predictions that they too are

made to create turned out to have been overwhelmingly right. Because once deciding to invest,

it's often stronger to be too securing that than irresponsible, and with this alternative, that it's

almost too progressive for several equities to provide it as an important technique (Le and et.al,

2018).

Discounted cash flow method

Advantages:

1. The DCF service basically lends weight to currency divisions which are similar than unusual

ones. Yet other approaches impractically view abstract amounts of capital with the same

importance as present-day amounts.

2. Through encouraging correlation at the very same period, the DCF option enables natural

meaningful comparisons amongst different types of projects lives and specific time frames

within each stream.

3. When contrasting the equity investment levels with the operating expenses ratios, actions can

be made quickly and comfortably (Mbama and Ezepue, 2018).

4. DCF approaches were proposed hard to grasp and to run. However, the DCF strategies are

easy to comprehend relative to the major problems associated with certain traditional

mathematical and statistical techniques that have positively significantly in recent years.

Moreover it's becoming very simple to manage with the advancement of mechanization financial

reporting and technological advancement.

Disadvantage:

1. The second point is against hypothesizing a flat amount of expenditure during the entire

project. This conclusion derives largely from the use of the theory of compound growth as the

foundation for some of these approaches.

2. The main explanation is they refuse to consider potential risks into consideration. Latest

events in risk management even so that could be integrated into DCF methodologies had also

made this critique slightly unimportant.

3. It would seem that the methodologies of IRR and NPV necessarily lead to essential differences

whilst making decisions. New experimental improvements have remedied much of those

approaches' vulnerabilities (Nguyen, 2019).

4. DCF approaches are preferable to other strategies as they recognize a task 's profits throughout

its overall economic existence, and the financial leverage flows as well.

Question 3 – Investment Appraisal Techniques

1. Calculate following investment appraisal technique and give brief recommendations

In this task study, various forms of measurements needed to be performed to determine

the profitability of any expenditure. Use investment assessment methods, selected Lovewell

Limited Company determine whether, they should and shouldn't investing in better equipment.

Measurement below mentioned is as follows:

Payback period: Payback period is the length of time a company spends to maintain minimum

expense of expenditure. The most significance would be provided to the work completed in the

be made quickly and comfortably (Mbama and Ezepue, 2018).

4. DCF approaches were proposed hard to grasp and to run. However, the DCF strategies are

easy to comprehend relative to the major problems associated with certain traditional

mathematical and statistical techniques that have positively significantly in recent years.

Moreover it's becoming very simple to manage with the advancement of mechanization financial

reporting and technological advancement.

Disadvantage:

1. The second point is against hypothesizing a flat amount of expenditure during the entire

project. This conclusion derives largely from the use of the theory of compound growth as the

foundation for some of these approaches.

2. The main explanation is they refuse to consider potential risks into consideration. Latest

events in risk management even so that could be integrated into DCF methodologies had also

made this critique slightly unimportant.

3. It would seem that the methodologies of IRR and NPV necessarily lead to essential differences

whilst making decisions. New experimental improvements have remedied much of those

approaches' vulnerabilities (Nguyen, 2019).

4. DCF approaches are preferable to other strategies as they recognize a task 's profits throughout

its overall economic existence, and the financial leverage flows as well.

Question 3 – Investment Appraisal Techniques

1. Calculate following investment appraisal technique and give brief recommendations

In this task study, various forms of measurements needed to be performed to determine

the profitability of any expenditure. Use investment assessment methods, selected Lovewell

Limited Company determine whether, they should and shouldn't investing in better equipment.

Measurement below mentioned is as follows:

Payback period: Payback period is the length of time a company spends to maintain minimum

expense of expenditure. The most significance would be provided to the work completed in the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

fewest months. Reaching the Break-Even-Point is the time - consuming process. It is generally

used in the financial planning of developed financial resources. It's really the measure of turning

the expenditure through cash for a vast lot of hours (Nizam and et.al, 2019).

Calculations:

Payback period = £ 275000 / £ 72500

= 3.79 years

It is ascertained which, even though payback period is 3.79 years, the corporation can restore its

new equipment costs inside of 4 years. Low healing process is advantageous for limited

Lovewell and the equipment seems to have an existence of six years. Businesses should focus in

buying new equipment to increase their manufacturing that further contributes to increased

profitability.

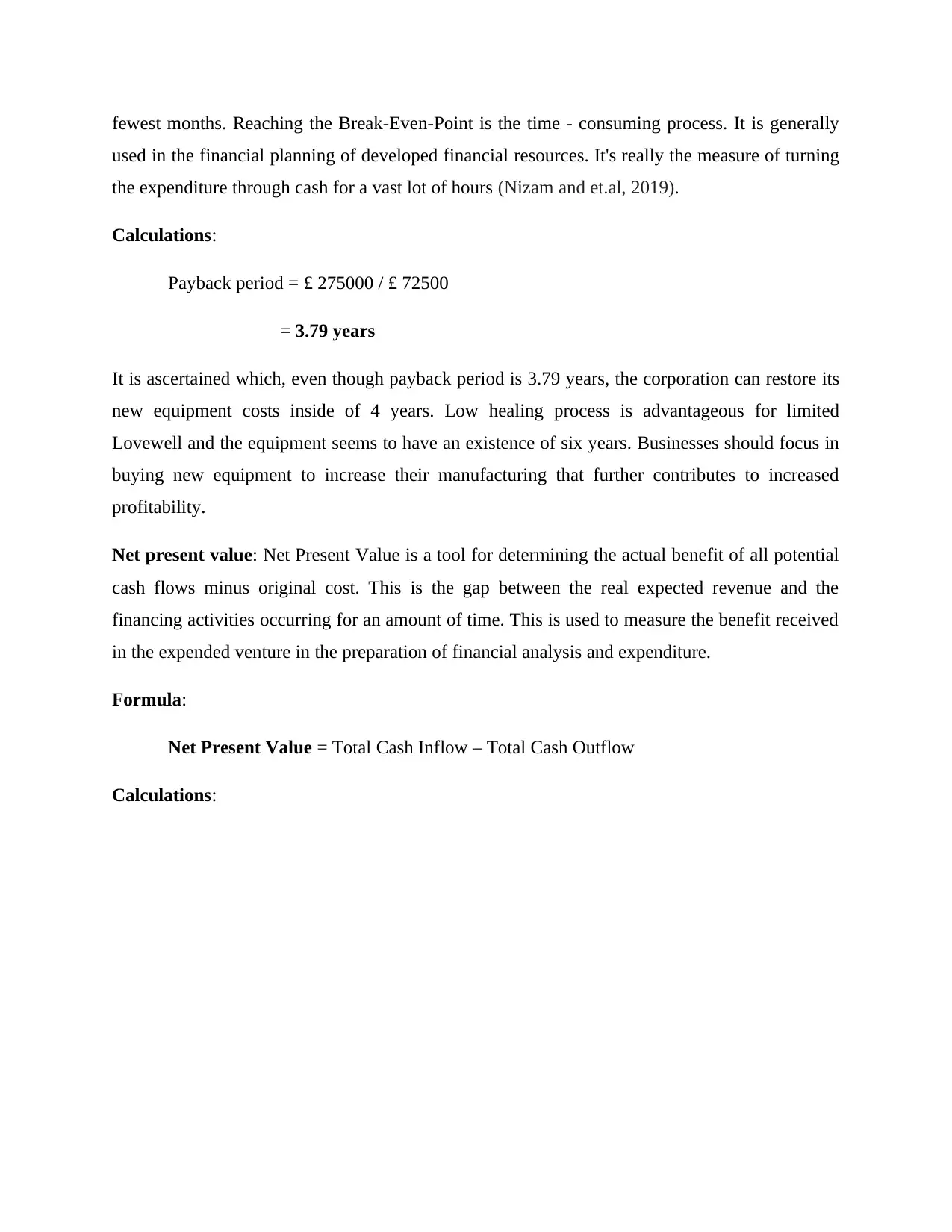

Net present value: Net Present Value is a tool for determining the actual benefit of all potential

cash flows minus original cost. This is the gap between the real expected revenue and the

financing activities occurring for an amount of time. This is used to measure the benefit received

in the expended venture in the preparation of financial analysis and expenditure.

Formula:

Net Present Value = Total Cash Inflow – Total Cash Outflow

Calculations:

used in the financial planning of developed financial resources. It's really the measure of turning

the expenditure through cash for a vast lot of hours (Nizam and et.al, 2019).

Calculations:

Payback period = £ 275000 / £ 72500

= 3.79 years

It is ascertained which, even though payback period is 3.79 years, the corporation can restore its

new equipment costs inside of 4 years. Low healing process is advantageous for limited

Lovewell and the equipment seems to have an existence of six years. Businesses should focus in

buying new equipment to increase their manufacturing that further contributes to increased

profitability.

Net present value: Net Present Value is a tool for determining the actual benefit of all potential

cash flows minus original cost. This is the gap between the real expected revenue and the

financing activities occurring for an amount of time. This is used to measure the benefit received

in the expended venture in the preparation of financial analysis and expenditure.

Formula:

Net Present Value = Total Cash Inflow – Total Cash Outflow

Calculations:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

NPV = Total Cash Inflow – Total Cash Outflow

= 318,838- 275,000

= 43,838

The above equation indicates that NPV of modern equipment is £43,838 which means that

Lovewell Limited investments would be both profitable in the future. It will also lead to

increased efficiency or productivity which could enhance individual manufacturing or selling

price. Positive NPV assigned to unfavorable would be refused, and it will not be beneficial in the

long run.

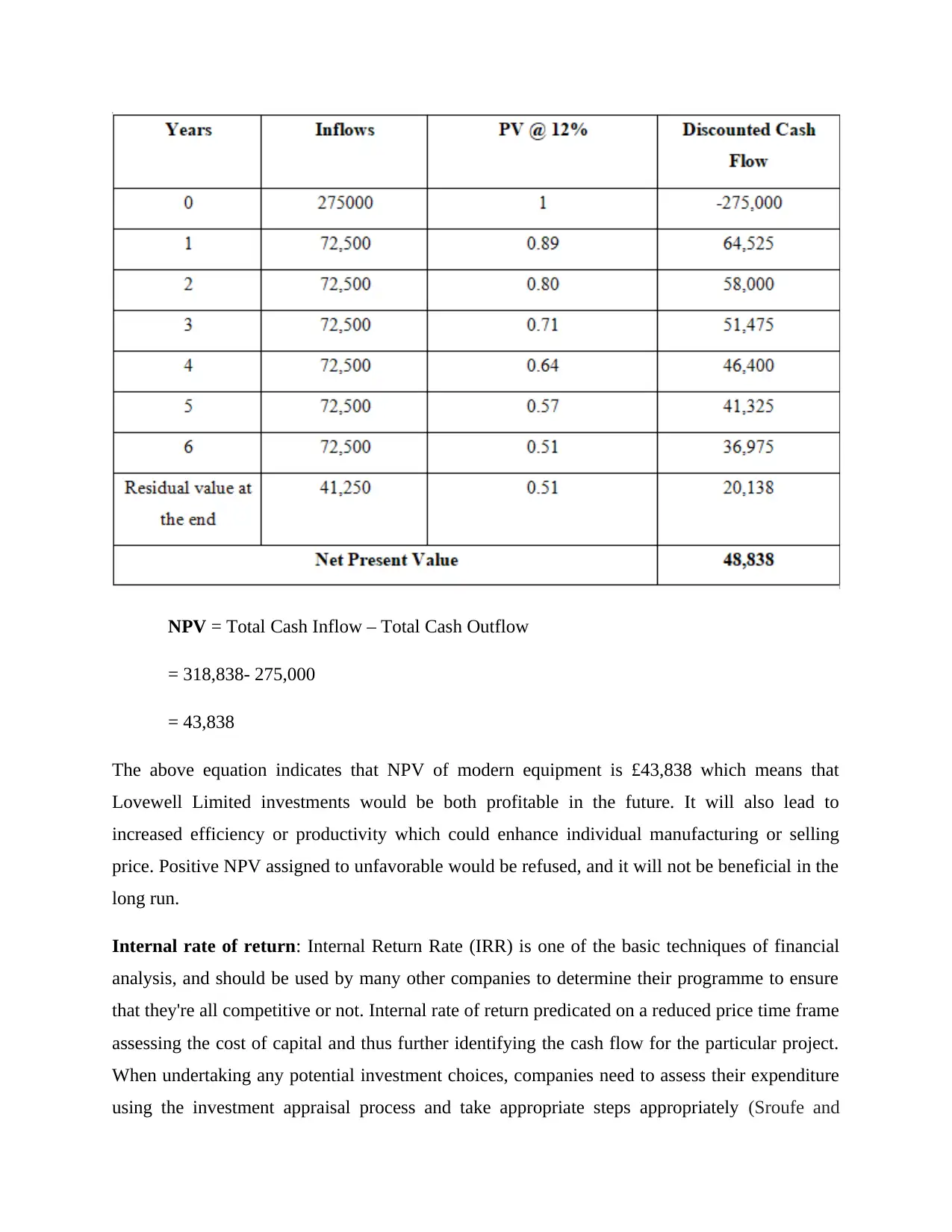

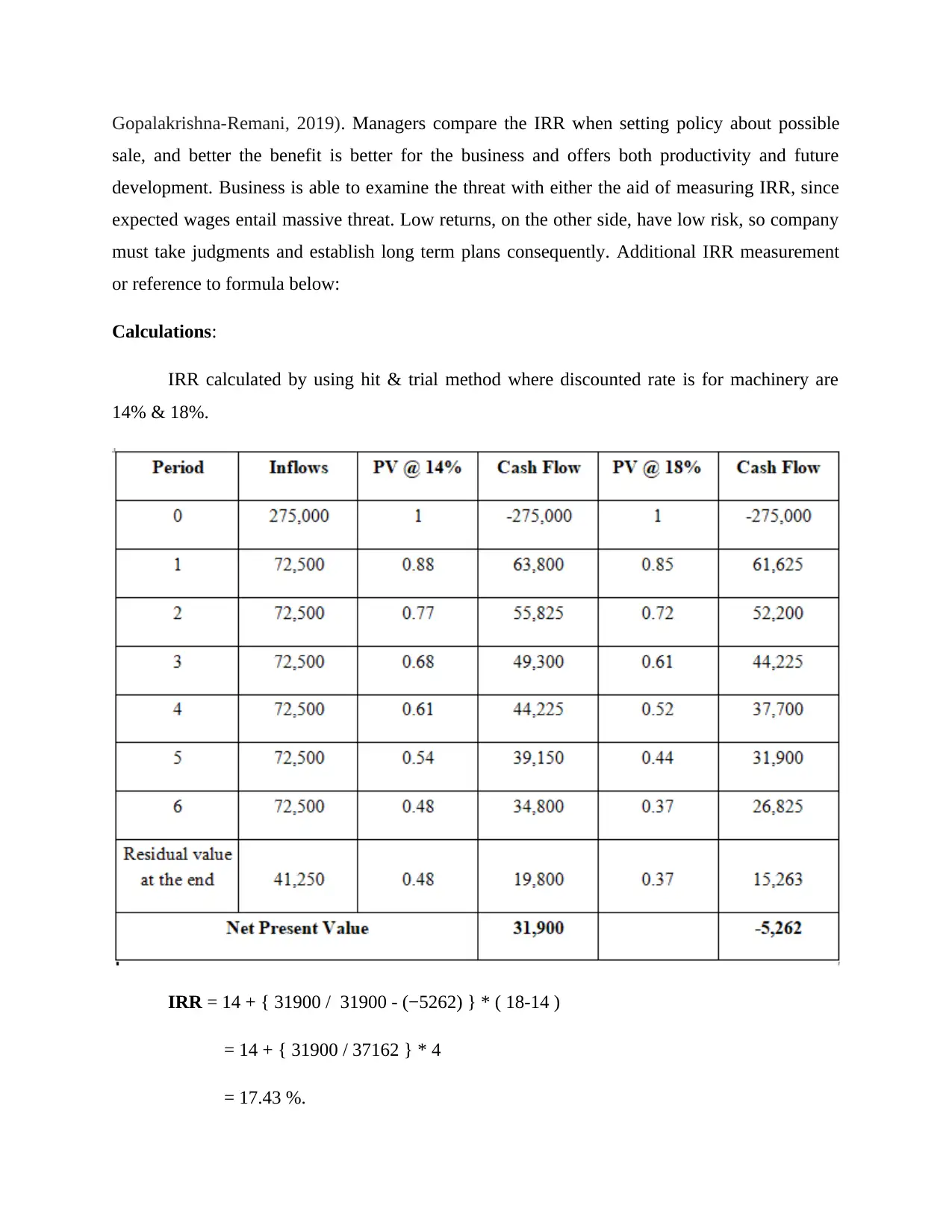

Internal rate of return: Internal Return Rate (IRR) is one of the basic techniques of financial

analysis, and should be used by many other companies to determine their programme to ensure

that they're all competitive or not. Internal rate of return predicated on a reduced price time frame

assessing the cost of capital and thus further identifying the cash flow for the particular project.

When undertaking any potential investment choices, companies need to assess their expenditure

using the investment appraisal process and take appropriate steps appropriately (Sroufe and

= 318,838- 275,000

= 43,838

The above equation indicates that NPV of modern equipment is £43,838 which means that

Lovewell Limited investments would be both profitable in the future. It will also lead to

increased efficiency or productivity which could enhance individual manufacturing or selling

price. Positive NPV assigned to unfavorable would be refused, and it will not be beneficial in the

long run.

Internal rate of return: Internal Return Rate (IRR) is one of the basic techniques of financial

analysis, and should be used by many other companies to determine their programme to ensure

that they're all competitive or not. Internal rate of return predicated on a reduced price time frame

assessing the cost of capital and thus further identifying the cash flow for the particular project.

When undertaking any potential investment choices, companies need to assess their expenditure

using the investment appraisal process and take appropriate steps appropriately (Sroufe and

Gopalakrishna-Remani, 2019). Managers compare the IRR when setting policy about possible

sale, and better the benefit is better for the business and offers both productivity and future

development. Business is able to examine the threat with either the aid of measuring IRR, since

expected wages entail massive threat. Low returns, on the other side, have low risk, so company

must take judgments and establish long term plans consequently. Additional IRR measurement

or reference to formula below:

Calculations:

IRR calculated by using hit & trial method where discounted rate is for machinery are

14% & 18%.

IRR = 14 + { 31900 / 31900 - (−5262) } * ( 18-14 )

= 14 + { 31900 / 37162 } * 4

= 17.43 %.

sale, and better the benefit is better for the business and offers both productivity and future

development. Business is able to examine the threat with either the aid of measuring IRR, since

expected wages entail massive threat. Low returns, on the other side, have low risk, so company

must take judgments and establish long term plans consequently. Additional IRR measurement

or reference to formula below:

Calculations:

IRR calculated by using hit & trial method where discounted rate is for machinery are

14% & 18%.

IRR = 14 + { 31900 / 31900 - (−5262) } * ( 18-14 )

= 14 + { 31900 / 37162 } * 4

= 17.43 %.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.