Management Accounting: Fiscal Methods, Pricing, and Budget Analysis

VerifiedAdded on 2023/06/16

|20

|4582

|54

Report

AI Summary

This report delves into the principles of management accounting, emphasizing its role in defining, measuring, analyzing, and assessing budgeting and fiscal accounting documents. It explores various fiscal management frameworks, including standard costing procedures and inventory management systems, highlighting their importance in enhancing revenue, assessing performance, and improving administrative efficiency. The report also discusses multiple fiscal accounting methods such as price optimization, cost accounting, inventory management, and job costing systems. Furthermore, it examines the utilization of financial statements like revenue reports, cash flow statements, and balance sheets for effective decision-making. Different pricing approaches, including marginal costing and absorption costing, are analyzed with practical examples, offering insights into their application for maximizing customer satisfaction and enhancing production. The report concludes by addressing the importance of budgetary procedures and revenue circulation administration solutions for organizational wealth and success.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

Part 1................................................................................................................................................3

P1: There are many different types of fiscal management framework and their documentation

initiatives................................................................................................................................3

P2: Utilisation multiple fiscal accounting methods................................................................5

P3: Different pricing approaches and financial report composition.......................................7

Part 2..............................................................................................................................................11

P4: Use of planned methods in the budgetary procedure in terms advantages and

disadvantages........................................................................................................................11

P5: Issues with income and how to solve it..........................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................3

Part 1................................................................................................................................................3

P1: There are many different types of fiscal management framework and their documentation

initiatives................................................................................................................................3

P2: Utilisation multiple fiscal accounting methods................................................................5

P3: Different pricing approaches and financial report composition.......................................7

Part 2..............................................................................................................................................11

P4: Use of planned methods in the budgetary procedure in terms advantages and

disadvantages........................................................................................................................11

P5: Issues with income and how to solve it..........................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

It becomes much easier to define, measure, analyse, and assess budgeting and fiscal

accounting documents using management accounting, which also helps in giving critical

evidence and making relevant ideas for the advancement of an organisation (Barr-Pulliam,

2019). Accounting for tracking all monetary and non-monetary transactions which happen on a

daily basis, corporate accounting managers are also responsible for identifying economically

feasible methods through which corporations might obtain substantial benefits. A company's

financial position should be presented to potential buyers on a regular basis through accountancy

reports. It is based on Good Clothing Ltd. As a result of this report, all additional aspects are

explained. There are several accounting frameworks discussed in the concept, as well as statistics

which can be used to assist managers build and execute decision-making and budgeting

procedures for wealth and success. A variety of revenue circulation administration solutions are

also mentioned in this report.

TASK 1

P1: There are many different types of fiscal management framework and their documentation

initiatives

As part of a business management, several operations must indeed be recorded and kept in

financial accounts, such as earnings and expenses, financial information or revenue circulation

assertions. As a result of publishing these intentions, the company can effectively prepare for

remedial action if any mistakes or anomalies are found. Organisations are therefore compelled to

develop a range of economic finance accounts, like standard costing procedures and inventory

management systems. For administrators to be able to establish these types of fiscal systems in

an organisation, they should first identify the following problems:

Increased earnings: Discrepancies or variances which might impede people from

functioning to its maximum capacity would've been corrected, resulting in an improvement in

revenue.

Performance assessment: Employee efficiency can be assessed using a variety of

accountancy techniques that compare actual contribution to traditional production. This would

allow management to identify any irregularities and correct them as quickly as possible.

It becomes much easier to define, measure, analyse, and assess budgeting and fiscal

accounting documents using management accounting, which also helps in giving critical

evidence and making relevant ideas for the advancement of an organisation (Barr-Pulliam,

2019). Accounting for tracking all monetary and non-monetary transactions which happen on a

daily basis, corporate accounting managers are also responsible for identifying economically

feasible methods through which corporations might obtain substantial benefits. A company's

financial position should be presented to potential buyers on a regular basis through accountancy

reports. It is based on Good Clothing Ltd. As a result of this report, all additional aspects are

explained. There are several accounting frameworks discussed in the concept, as well as statistics

which can be used to assist managers build and execute decision-making and budgeting

procedures for wealth and success. A variety of revenue circulation administration solutions are

also mentioned in this report.

TASK 1

P1: There are many different types of fiscal management framework and their documentation

initiatives

As part of a business management, several operations must indeed be recorded and kept in

financial accounts, such as earnings and expenses, financial information or revenue circulation

assertions. As a result of publishing these intentions, the company can effectively prepare for

remedial action if any mistakes or anomalies are found. Organisations are therefore compelled to

develop a range of economic finance accounts, like standard costing procedures and inventory

management systems. For administrators to be able to establish these types of fiscal systems in

an organisation, they should first identify the following problems:

Increased earnings: Discrepancies or variances which might impede people from

functioning to its maximum capacity would've been corrected, resulting in an improvement in

revenue.

Performance assessment: Employee efficiency can be assessed using a variety of

accountancy techniques that compare actual contribution to traditional production. This would

allow management to identify any irregularities and correct them as quickly as possible.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Efficient administrative impact: It is possible to oversee and sustain employee efficiency

by employing revenue recognition frameworks. This allows firms to get the best possible

outcomes (Bloom, Sadun and Van Reenen, 2016).

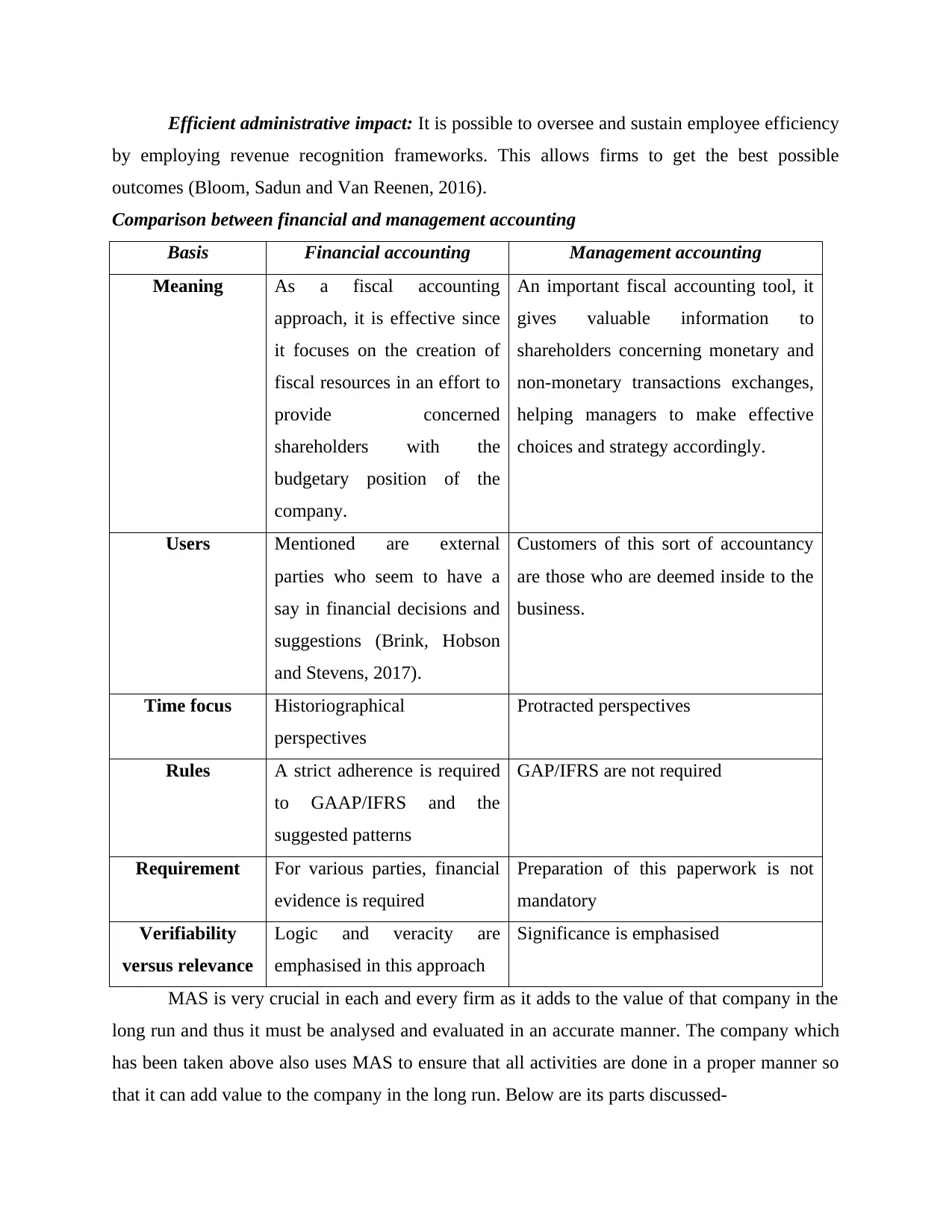

Comparison between financial and management accounting

Basis Financial accounting Management accounting

Meaning As a fiscal accounting

approach, it is effective since

it focuses on the creation of

fiscal resources in an effort to

provide concerned

shareholders with the

budgetary position of the

company.

An important fiscal accounting tool, it

gives valuable information to

shareholders concerning monetary and

non-monetary transactions exchanges,

helping managers to make effective

choices and strategy accordingly.

Users Mentioned are external

parties who seem to have a

say in financial decisions and

suggestions (Brink, Hobson

and Stevens, 2017).

Customers of this sort of accountancy

are those who are deemed inside to the

business.

Time focus Historiographical

perspectives

Protracted perspectives

Rules A strict adherence is required

to GAAP/IFRS and the

suggested patterns

GAP/IFRS are not required

Requirement For various parties, financial

evidence is required

Preparation of this paperwork is not

mandatory

Verifiability

versus relevance

Logic and veracity are

emphasised in this approach

Significance is emphasised

MAS is very crucial in each and every firm as it adds to the value of that company in the

long run and thus it must be analysed and evaluated in an accurate manner. The company which

has been taken above also uses MAS to ensure that all activities are done in a proper manner so

that it can add value to the company in the long run. Below are its parts discussed-

by employing revenue recognition frameworks. This allows firms to get the best possible

outcomes (Bloom, Sadun and Van Reenen, 2016).

Comparison between financial and management accounting

Basis Financial accounting Management accounting

Meaning As a fiscal accounting

approach, it is effective since

it focuses on the creation of

fiscal resources in an effort to

provide concerned

shareholders with the

budgetary position of the

company.

An important fiscal accounting tool, it

gives valuable information to

shareholders concerning monetary and

non-monetary transactions exchanges,

helping managers to make effective

choices and strategy accordingly.

Users Mentioned are external

parties who seem to have a

say in financial decisions and

suggestions (Brink, Hobson

and Stevens, 2017).

Customers of this sort of accountancy

are those who are deemed inside to the

business.

Time focus Historiographical

perspectives

Protracted perspectives

Rules A strict adherence is required

to GAAP/IFRS and the

suggested patterns

GAP/IFRS are not required

Requirement For various parties, financial

evidence is required

Preparation of this paperwork is not

mandatory

Verifiability

versus relevance

Logic and veracity are

emphasised in this approach

Significance is emphasised

MAS is very crucial in each and every firm as it adds to the value of that company in the

long run and thus it must be analysed and evaluated in an accurate manner. The company which

has been taken above also uses MAS to ensure that all activities are done in a proper manner so

that it can add value to the company in the long run. Below are its parts discussed-

Types of accounting system:

Price optimisation: T In attempt to optimise the customer experiences, this seems to be

an effective fiscal accounting method that keeps track of the cost of items. It is for this reason

that Good Clothing Ltd.'s financial manager should hire an analyst who will carry out inquiries

on their service and enable them in determining the actual mindset of customers regarding the

company's suggested rates. When it comes to pricing, details such as administrative costs,

inventories, and historical relevance are taken into consideration. As a result of this, Good

Clothing Ltd's manager is able to develop an appropriate rate that also enhances individual

buying activity and mindset, as well as the company's revenue profits (Chaffer and Webb, 2017).

Cost accounting system: To assess the total price or expenditure incurred in the

production process in order to manufacture durable products, such a finance accounting approach

is beneficial. As a result, Good Clothing Ltd.'s manager must focus on cost-cutting measures,

such as educating its employees about technical breakthroughs that make it feasible to create

high-quality products at the cheapest feasible cost, so enhancing the company's fiscal success.

Inventory management system: It's a way of managing non-capital expenditures and

stocks. Using a system that allows firms to keep track about how much merchandise is available

at any specific time is important. If Good Clothing Ltd. could do this, it might enable businesses

to obtain goods from suppliers in a timely manner so that the production process is not disturbed

and customers' needs are addressed in a timely manner.

Job costing system: For the leadership staff of Good Clothing Ltd., having a revenue

recognition structure is considerably more advantageous in assigning resources to manufacture a

product or a set of products with the maximum efficiency. As a result of this, the worker may be

motivated to think about ways to reduce the cost of work processes and to focus on areas

wherein the cost of creating extra is necessary and therefore might become useful for the firm in

the longer term, That way, they can determine a long-term expenditure strategy that will lead to a

job movement depends on its planning horizon and long-term fiscal viability (Ejiogu and Ejiogu,

2018).

P2: Utilisation multiple fiscal accounting methods

It is essential for a managerial accountant to be well-versed in the financial status of the

company and its present resources in order for long-term business activities to be conducted out

more efficiently. The effect of this is that every business organization, such as Good Clothing

Price optimisation: T In attempt to optimise the customer experiences, this seems to be

an effective fiscal accounting method that keeps track of the cost of items. It is for this reason

that Good Clothing Ltd.'s financial manager should hire an analyst who will carry out inquiries

on their service and enable them in determining the actual mindset of customers regarding the

company's suggested rates. When it comes to pricing, details such as administrative costs,

inventories, and historical relevance are taken into consideration. As a result of this, Good

Clothing Ltd's manager is able to develop an appropriate rate that also enhances individual

buying activity and mindset, as well as the company's revenue profits (Chaffer and Webb, 2017).

Cost accounting system: To assess the total price or expenditure incurred in the

production process in order to manufacture durable products, such a finance accounting approach

is beneficial. As a result, Good Clothing Ltd.'s manager must focus on cost-cutting measures,

such as educating its employees about technical breakthroughs that make it feasible to create

high-quality products at the cheapest feasible cost, so enhancing the company's fiscal success.

Inventory management system: It's a way of managing non-capital expenditures and

stocks. Using a system that allows firms to keep track about how much merchandise is available

at any specific time is important. If Good Clothing Ltd. could do this, it might enable businesses

to obtain goods from suppliers in a timely manner so that the production process is not disturbed

and customers' needs are addressed in a timely manner.

Job costing system: For the leadership staff of Good Clothing Ltd., having a revenue

recognition structure is considerably more advantageous in assigning resources to manufacture a

product or a set of products with the maximum efficiency. As a result of this, the worker may be

motivated to think about ways to reduce the cost of work processes and to focus on areas

wherein the cost of creating extra is necessary and therefore might become useful for the firm in

the longer term, That way, they can determine a long-term expenditure strategy that will lead to a

job movement depends on its planning horizon and long-term fiscal viability (Ejiogu and Ejiogu,

2018).

P2: Utilisation multiple fiscal accounting methods

It is essential for a managerial accountant to be well-versed in the financial status of the

company and its present resources in order for long-term business activities to be conducted out

more efficiently. The effect of this is that every business organization, such as Good Clothing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Ltd. These are only a few of several documents that offer important information to investors,

including revenue report, cash flow assertion, and balance sheet. Using such statistics, one can

determine if a company has the potential to reduce both immediate and protracted

term obligations in the upcoming seasons, based on historical data. So that corporate

performance could be easily observed, all long-term choices taken by administrators should take

into consideration the information provided by such assessments.

As a result of the company's instability, such assessments are far more useful whenever

some modifications are implemented. Without any of the collaboration of many departments,

neither one of those papers can be created. A suitable amount of help from individuals, therefore,

is required in order to handle each unit's needs when it comes to the execution of specialised

industrial activities (Fleischer, 2021). Management must employ diverse monitoring processes in

order to let consumers investigate actual financial transactions. A company's adequate and

precise financial position can be determined with the help of this data. Elements of an accounting

standards of this kind include:

Performance report: For firms, the evaluations serve as a tool to measure the efficiency

of their employees and as an aid to those who are trying to deal with difficulties and

inconsistencies which may arise in the course of dealing with such issues in a far more expedient

manner. Information regarding resource use and potential growth opportunities for third-party

enterprises can be found in these documents. As a consequence, optimal efforts may be pushed

forward to optimise the corporation's efficiency by eradicating all hurdles and regional

differences.

Account receivable ageing report: Documentation on the company's unpaid debtors is

included, and management are instructed to follow specified goals and ideas in order to recoup

the debts, including interests. She is a great asset in helping the business adopt reasonable steps

for eliminating such conditions in the future. Such papers are essential since they provide more

information about the debtors and the debt collection tactics.

Inventory management report: This might be solved by using an inventories system

which might help evaluate an institution's stockpile inventories and help warehousing managers

keep track of merchandise at the top tiers. As an instance of this type of method, consider

economical ordering amount, activity-based pricing, and inventory management percentages.

including revenue report, cash flow assertion, and balance sheet. Using such statistics, one can

determine if a company has the potential to reduce both immediate and protracted

term obligations in the upcoming seasons, based on historical data. So that corporate

performance could be easily observed, all long-term choices taken by administrators should take

into consideration the information provided by such assessments.

As a result of the company's instability, such assessments are far more useful whenever

some modifications are implemented. Without any of the collaboration of many departments,

neither one of those papers can be created. A suitable amount of help from individuals, therefore,

is required in order to handle each unit's needs when it comes to the execution of specialised

industrial activities (Fleischer, 2021). Management must employ diverse monitoring processes in

order to let consumers investigate actual financial transactions. A company's adequate and

precise financial position can be determined with the help of this data. Elements of an accounting

standards of this kind include:

Performance report: For firms, the evaluations serve as a tool to measure the efficiency

of their employees and as an aid to those who are trying to deal with difficulties and

inconsistencies which may arise in the course of dealing with such issues in a far more expedient

manner. Information regarding resource use and potential growth opportunities for third-party

enterprises can be found in these documents. As a consequence, optimal efforts may be pushed

forward to optimise the corporation's efficiency by eradicating all hurdles and regional

differences.

Account receivable ageing report: Documentation on the company's unpaid debtors is

included, and management are instructed to follow specified goals and ideas in order to recoup

the debts, including interests. She is a great asset in helping the business adopt reasonable steps

for eliminating such conditions in the future. Such papers are essential since they provide more

information about the debtors and the debt collection tactics.

Inventory management report: This might be solved by using an inventories system

which might help evaluate an institution's stockpile inventories and help warehousing managers

keep track of merchandise at the top tiers. As an instance of this type of method, consider

economical ordering amount, activity-based pricing, and inventory management percentages.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Due to this, managers were able to identify to choose rather or not to place orders with potential

suppliers based on the information provided in such evaluations (Gamage, 2016).

Job cost report: A management may easily determine the expense to produce each

component using such statistics, which help them keep control of total production expenditures.

A detailed evaluation of costs and associated fiscal viability can help administrators determine

component prices. Attributing operational expenses based on financial efficiency and

performance over time is significantly more efficient.

TASK 2

P3: Different pricing approaches and financial report composition

Cost: It is referring to the amount of revenue invested in the process of conducting out

different managerial activities in terms of achieving profitable outcomes in future seasons. There

are a number of instances of activities such as marketing strategies, production activities, etc.

Production prices, for example, include workers wages, primary commodity charges, and

operational expenses.

This means Good Clothing Ltd.'s administration must use multiple evaluation approaches

to set prices for its products and services that maximise customer satisfaction whilst still

enhancing production (Hrasky and Jones, 2016). Many different methods of pricing appear to be

available for addressing a company's added expenses. Such pricing strategies include the

following elements:

Marginal costing: Basically, it's the cost of providing an additional element of quantity

in addition to satisfy the customer's needs and wants If you include in changing expenses, the

merchandise value is undervalued. Since fixed expenditures are excluded, only variable prices

are taken into consideration in such pricing methods.

Absorption costing: As a result, while evaluating quality products and services, both

fixed and variable expenses should be taken into account. Anything which has a direct impact on

the items is included. Among them are the following: employee's expenses, manufacturing

expenses, and administration expenditures.

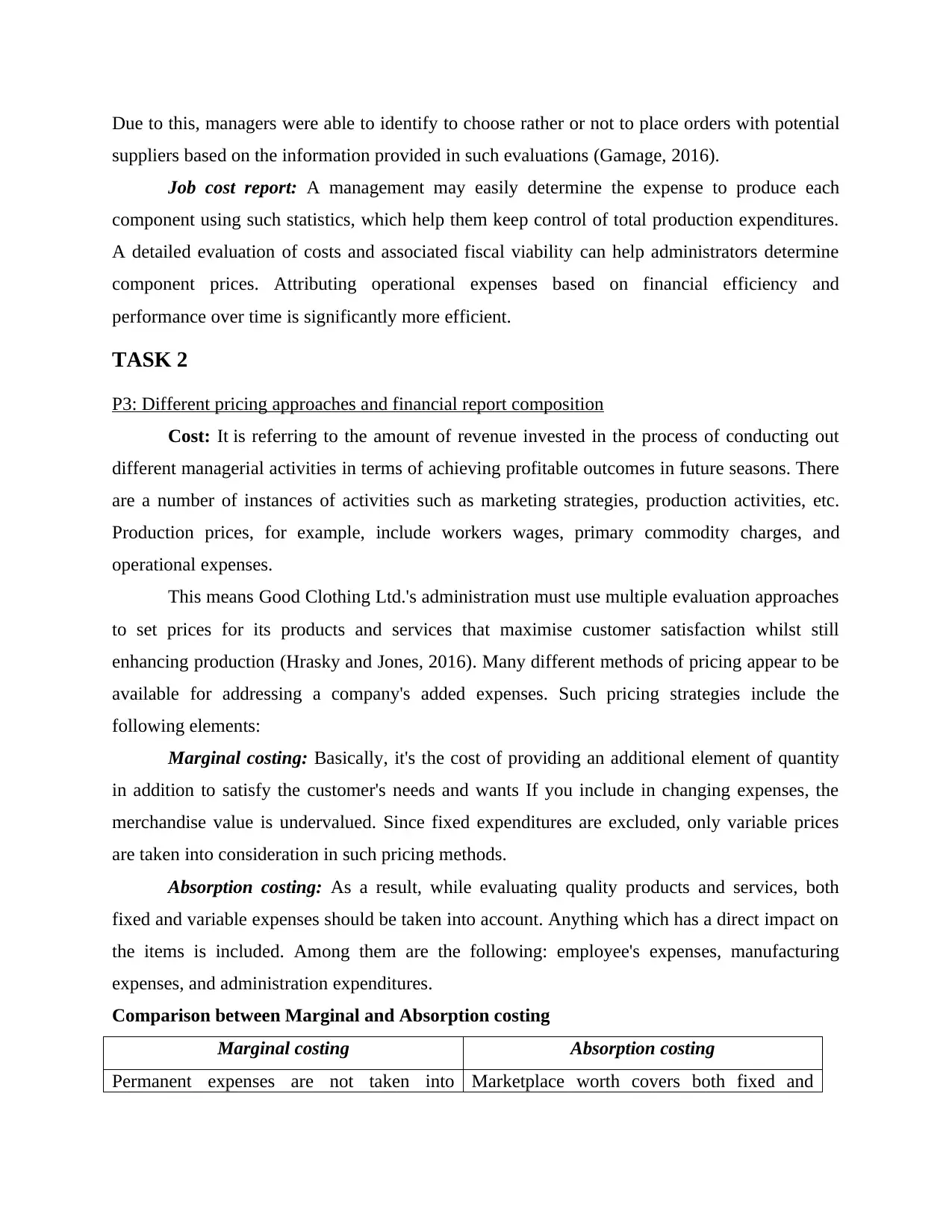

Comparison between Marginal and Absorption costing

Marginal costing Absorption costing

Permanent expenses are not taken into Marketplace worth covers both fixed and

suppliers based on the information provided in such evaluations (Gamage, 2016).

Job cost report: A management may easily determine the expense to produce each

component using such statistics, which help them keep control of total production expenditures.

A detailed evaluation of costs and associated fiscal viability can help administrators determine

component prices. Attributing operational expenses based on financial efficiency and

performance over time is significantly more efficient.

TASK 2

P3: Different pricing approaches and financial report composition

Cost: It is referring to the amount of revenue invested in the process of conducting out

different managerial activities in terms of achieving profitable outcomes in future seasons. There

are a number of instances of activities such as marketing strategies, production activities, etc.

Production prices, for example, include workers wages, primary commodity charges, and

operational expenses.

This means Good Clothing Ltd.'s administration must use multiple evaluation approaches

to set prices for its products and services that maximise customer satisfaction whilst still

enhancing production (Hrasky and Jones, 2016). Many different methods of pricing appear to be

available for addressing a company's added expenses. Such pricing strategies include the

following elements:

Marginal costing: Basically, it's the cost of providing an additional element of quantity

in addition to satisfy the customer's needs and wants If you include in changing expenses, the

merchandise value is undervalued. Since fixed expenditures are excluded, only variable prices

are taken into consideration in such pricing methods.

Absorption costing: As a result, while evaluating quality products and services, both

fixed and variable expenses should be taken into account. Anything which has a direct impact on

the items is included. Among them are the following: employee's expenses, manufacturing

expenses, and administration expenditures.

Comparison between Marginal and Absorption costing

Marginal costing Absorption costing

Permanent expenses are not taken into Marketplace worth covers both fixed and

account considering appraising products and

infrastructure.

variable expenditures.

Whenever using this strategy, profits grow

since each sale generates a profit.

Utilizing this strategy, a revenue margins

seems to be at a basic minimum.

When it comes to making rapid decisions in

an organization, such strategy is invaluable

(Jermias, Gani and Juliana, 2018).

For making long-term decisions, an approach

such as this is beneficial.

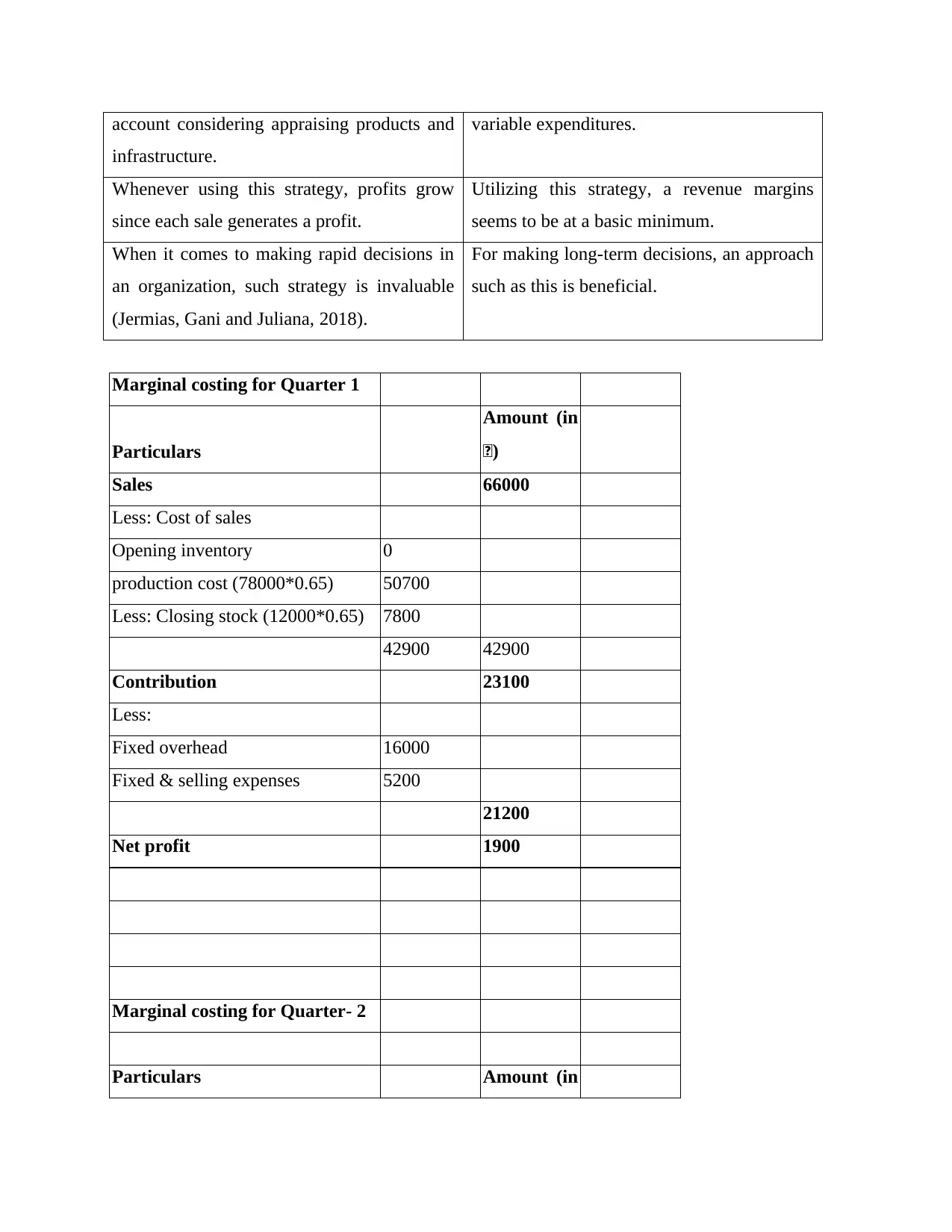

Marginal costing for Quarter 1

Particulars

Amount (in

£)

Sales 66000

Less: Cost of sales

Opening inventory 0

production cost (78000*0.65) 50700

Less: Closing stock (12000*0.65) 7800

42900 42900

Contribution 23100

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit 1900

Marginal costing for Quarter- 2

Particulars Amount (in

infrastructure.

variable expenditures.

Whenever using this strategy, profits grow

since each sale generates a profit.

Utilizing this strategy, a revenue margins

seems to be at a basic minimum.

When it comes to making rapid decisions in

an organization, such strategy is invaluable

(Jermias, Gani and Juliana, 2018).

For making long-term decisions, an approach

such as this is beneficial.

Marginal costing for Quarter 1

Particulars

Amount (in

£)

Sales 66000

Less: Cost of sales

Opening inventory 0

production cost (78000*0.65) 50700

Less: Closing stock (12000*0.65) 7800

42900 42900

Contribution 23100

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit 1900

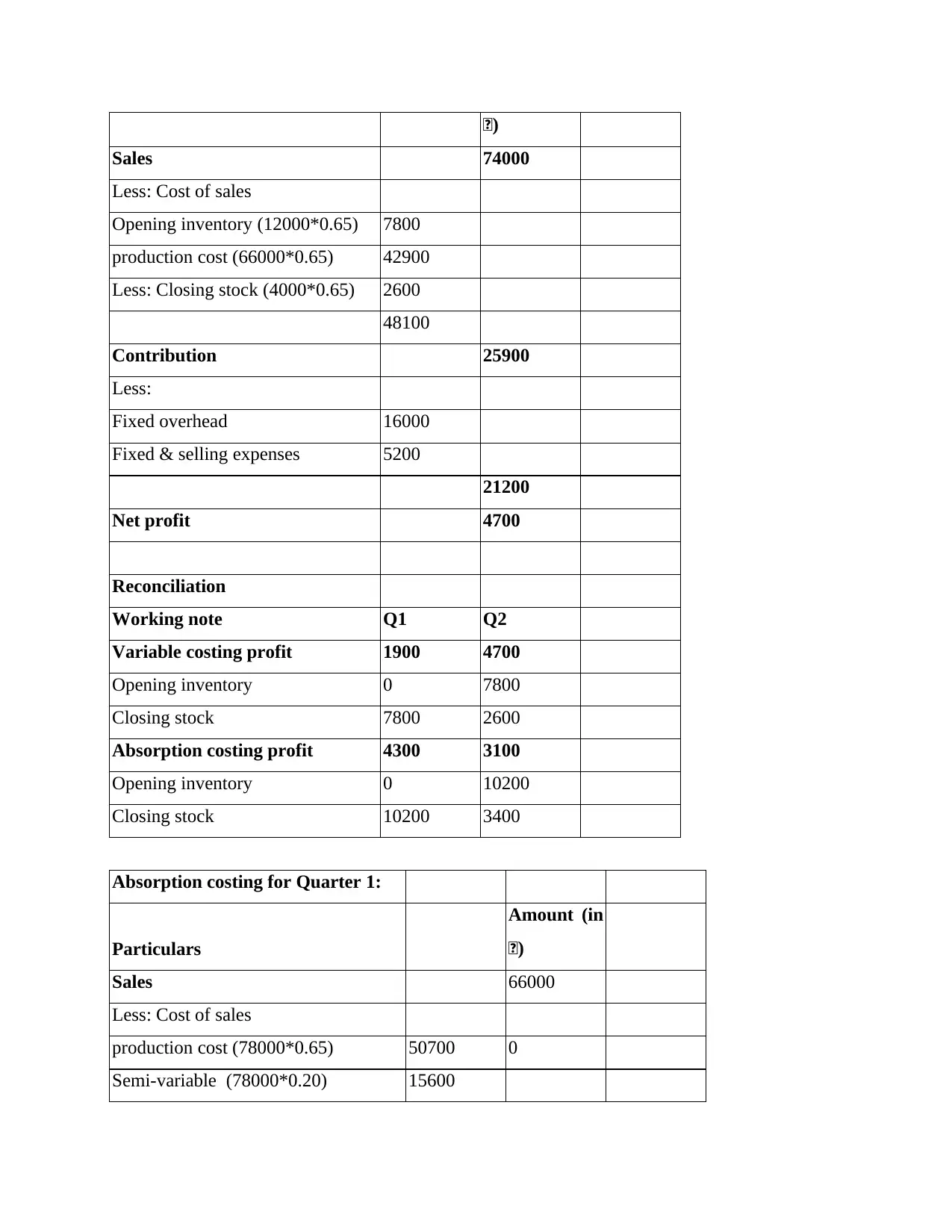

Marginal costing for Quarter- 2

Particulars Amount (in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

£)

Sales 74000

Less: Cost of sales

Opening inventory (12000*0.65) 7800

production cost (66000*0.65) 42900

Less: Closing stock (4000*0.65) 2600

48100

Contribution 25900

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit 4700

Reconciliation

Working note Q1 Q2

Variable costing profit 1900 4700

Opening inventory 0 7800

Closing stock 7800 2600

Absorption costing profit 4300 3100

Opening inventory 0 10200

Closing stock 10200 3400

Absorption costing for Quarter 1:

Particulars

Amount (in

£)

Sales 66000

Less: Cost of sales

production cost (78000*0.65) 50700 0

Semi-variable (78000*0.20) 15600

Sales 74000

Less: Cost of sales

Opening inventory (12000*0.65) 7800

production cost (66000*0.65) 42900

Less: Closing stock (4000*0.65) 2600

48100

Contribution 25900

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit 4700

Reconciliation

Working note Q1 Q2

Variable costing profit 1900 4700

Opening inventory 0 7800

Closing stock 7800 2600

Absorption costing profit 4300 3100

Opening inventory 0 10200

Closing stock 10200 3400

Absorption costing for Quarter 1:

Particulars

Amount (in

£)

Sales 66000

Less: Cost of sales

production cost (78000*0.65) 50700 0

Semi-variable (78000*0.20) 15600

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

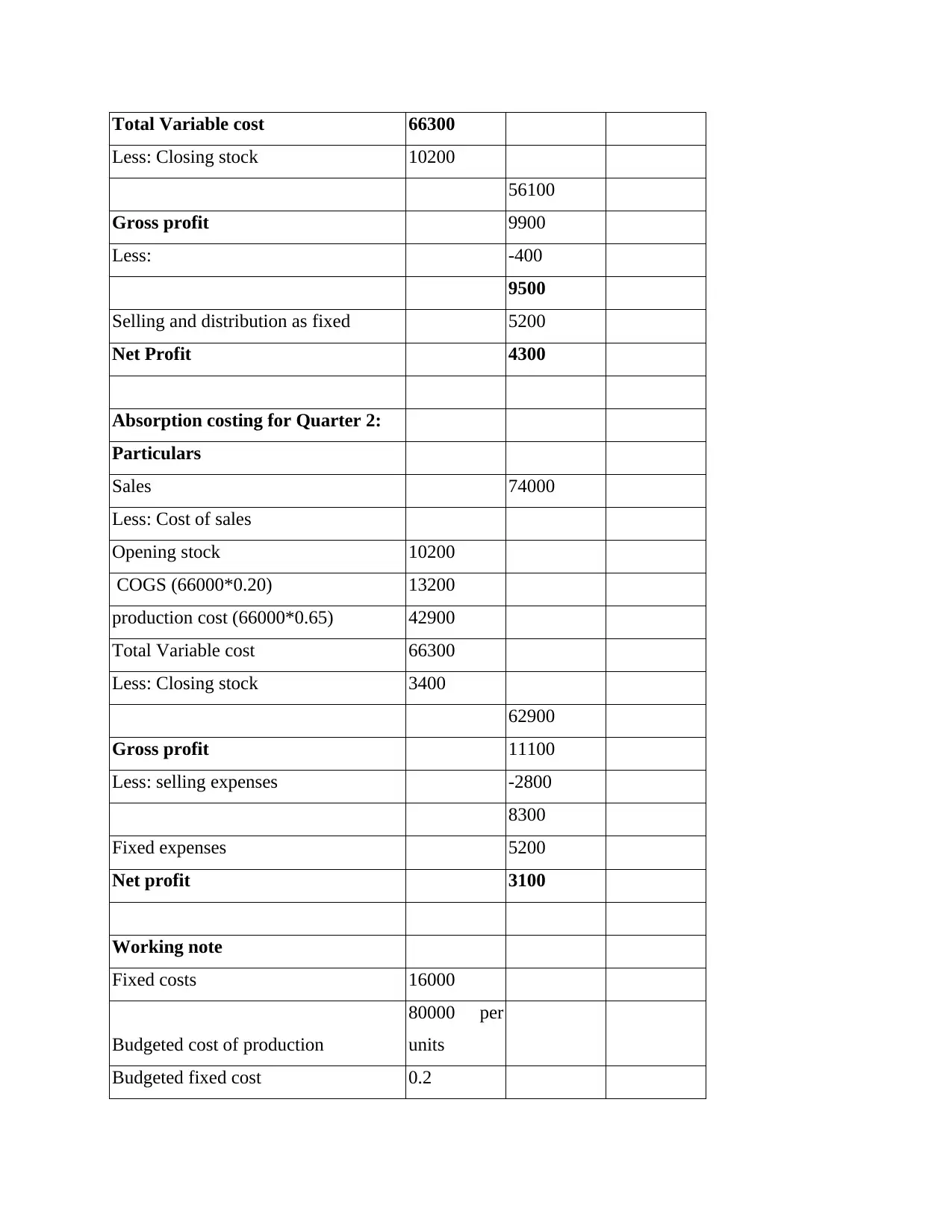

Total Variable cost 66300

Less: Closing stock 10200

56100

Gross profit 9900

Less: -400

9500

Selling and distribution as fixed 5200

Net Profit 4300

Absorption costing for Quarter 2:

Particulars

Sales 74000

Less: Cost of sales

Opening stock 10200

COGS (66000*0.20) 13200

production cost (66000*0.65) 42900

Total Variable cost 66300

Less: Closing stock 3400

62900

Gross profit 11100

Less: selling expenses -2800

8300

Fixed expenses 5200

Net profit 3100

Working note

Fixed costs 16000

Budgeted cost of production

80000 per

units

Budgeted fixed cost 0.2

Less: Closing stock 10200

56100

Gross profit 9900

Less: -400

9500

Selling and distribution as fixed 5200

Net Profit 4300

Absorption costing for Quarter 2:

Particulars

Sales 74000

Less: Cost of sales

Opening stock 10200

COGS (66000*0.20) 13200

production cost (66000*0.65) 42900

Total Variable cost 66300

Less: Closing stock 3400

62900

Gross profit 11100

Less: selling expenses -2800

8300

Fixed expenses 5200

Net profit 3100

Working note

Fixed costs 16000

Budgeted cost of production

80000 per

units

Budgeted fixed cost 0.2

Variable cost per units 0.65

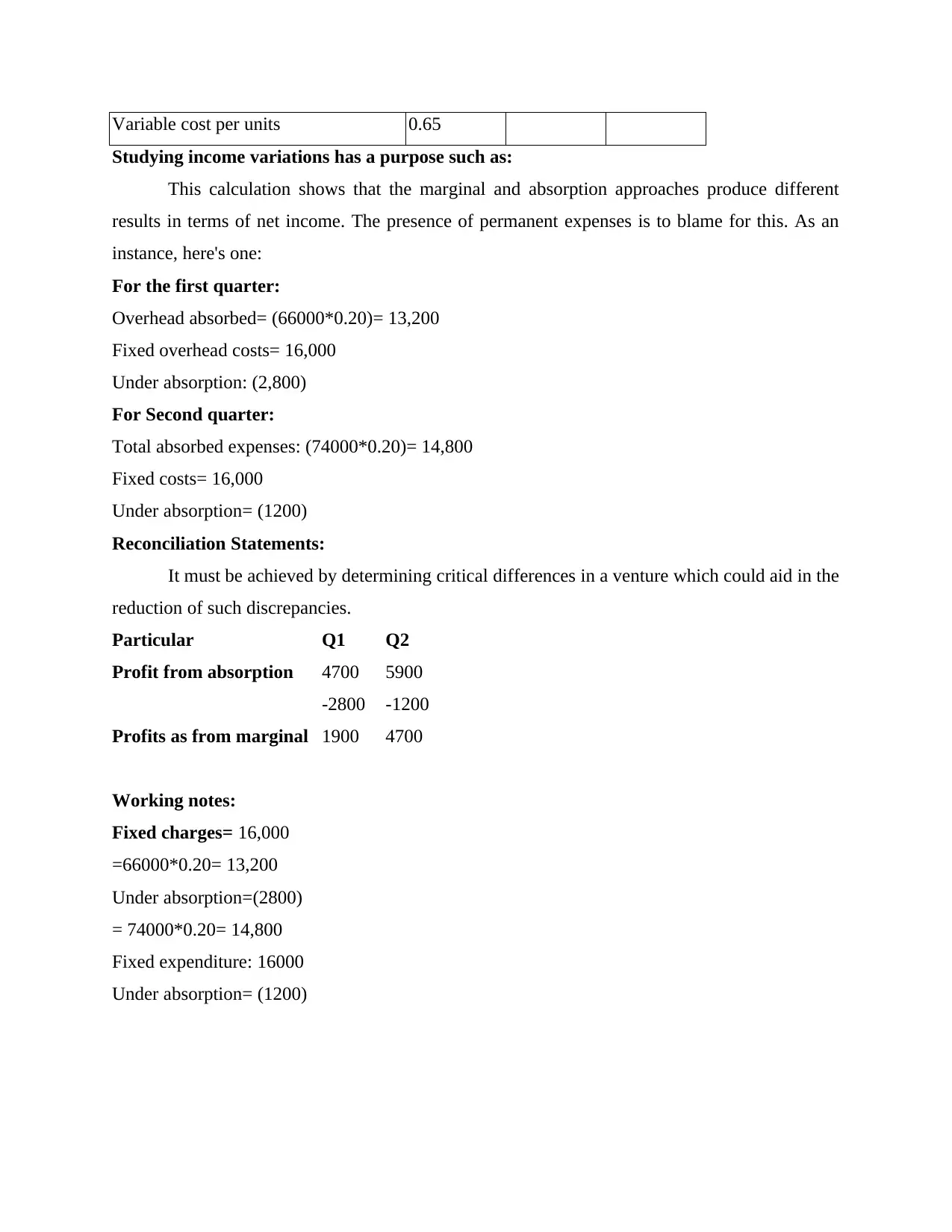

Studying income variations has a purpose such as:

This calculation shows that the marginal and absorption approaches produce different

results in terms of net income. The presence of permanent expenses is to blame for this. As an

instance, here's one:

For the first quarter:

Overhead absorbed= (66000*0.20)= 13,200

Fixed overhead costs= 16,000

Under absorption: (2,800)

For Second quarter:

Total absorbed expenses: (74000*0.20)= 14,800

Fixed costs= 16,000

Under absorption= (1200)

Reconciliation Statements:

It must be achieved by determining critical differences in a venture which could aid in the

reduction of such discrepancies.

Particular Q1 Q2

Profit from absorption 4700 5900

-2800 -1200

Profits as from marginal 1900 4700

Working notes:

Fixed charges= 16,000

=66000*0.20= 13,200

Under absorption=(2800)

= 74000*0.20= 14,800

Fixed expenditure: 16000

Under absorption= (1200)

Studying income variations has a purpose such as:

This calculation shows that the marginal and absorption approaches produce different

results in terms of net income. The presence of permanent expenses is to blame for this. As an

instance, here's one:

For the first quarter:

Overhead absorbed= (66000*0.20)= 13,200

Fixed overhead costs= 16,000

Under absorption: (2,800)

For Second quarter:

Total absorbed expenses: (74000*0.20)= 14,800

Fixed costs= 16,000

Under absorption= (1200)

Reconciliation Statements:

It must be achieved by determining critical differences in a venture which could aid in the

reduction of such discrepancies.

Particular Q1 Q2

Profit from absorption 4700 5900

-2800 -1200

Profits as from marginal 1900 4700

Working notes:

Fixed charges= 16,000

=66000*0.20= 13,200

Under absorption=(2800)

= 74000*0.20= 14,800

Fixed expenditure: 16000

Under absorption= (1200)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.