FNSACC301: Financial Transactions and Reporting Homework Assignment

VerifiedAdded on 2020/10/05

|26

|6313

|127

Homework Assignment

AI Summary

This document contains a completed homework assignment for the FNSACC301 unit, focusing on processing financial transactions and extracting interim reports. The assignment covers essential elements such as checking and verifying supporting documentation, preparing and processing banking and petty cash documents, preparing and processing invoices, preparing and posting journals, posting journals to the ledger, entering data into the system, preparing deposit facilities, and extracting trial balances and interim reports. The student provides detailed answers to knowledge-based questions, including the importance of filing invoices, examples of special transactions with journal entries, the concept of proof of lodgement, security and safety precautions, types of source documents, common financial transaction errors, security procedures for handling cash and cheques, and the main types of business reports. The assignment also includes a practical activity where the student acts as an Accounts Assistant and prepares invoices for a sale. Overall, this assignment demonstrates a strong understanding of financial transaction processing and reporting principles.

PROCESS FINANCIAL

TRANSACTIONS AND EXTRACT

INTERIM REPORTS

FNSACC301: Assessment Tasks

Q1.

Q2.

Q3. ASSESSMENT COVER

SHEET

Q4.

Unit Name Process Financial

Transactions and

Extract Interim

Reports

Company Name of

students workplace

Training Location

Assessors Name

Result code: COM

– Competent NYC – Not Yet

Competent CT – Credit

Transfer RPL – Recognition

Prior Learning

TRANSACTIONS AND EXTRACT

INTERIM REPORTS

FNSACC301: Assessment Tasks

Q1.

Q2.

Q3. ASSESSMENT COVER

SHEET

Q4.

Unit Name Process Financial

Transactions and

Extract Interim

Reports

Company Name of

students workplace

Training Location

Assessors Name

Result code: COM

– Competent NYC – Not Yet

Competent CT – Credit

Transfer RPL – Recognition

Prior Learning

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Result

Assessor’s Feedback

Method: Assessment methods

used:

Q - Questions

A – practical

activities

P - Project

I agree that the purpose and

consequences of the

assessment(s) have been

explained and I have received all

the relevant tools and resources

necessary to undertake

assessment, being fully aware of

Upskilled’s assessment, complaint

and appeal processes, and I

believe that I am ready for

assessment.

I acknowledge and agree that

recorded activities have been

conducted on specified dates and

the assessment process was

carried out fairly, with integrity,

professionally with appropriate

feedback during and after the

assessment.

A Note on Presenting Assessment Tasks.

Provide your answers in the space given, if you need to attach a separate file (e.g. word doc/ppt slides), submit it on

your student portal with appropriate file name.

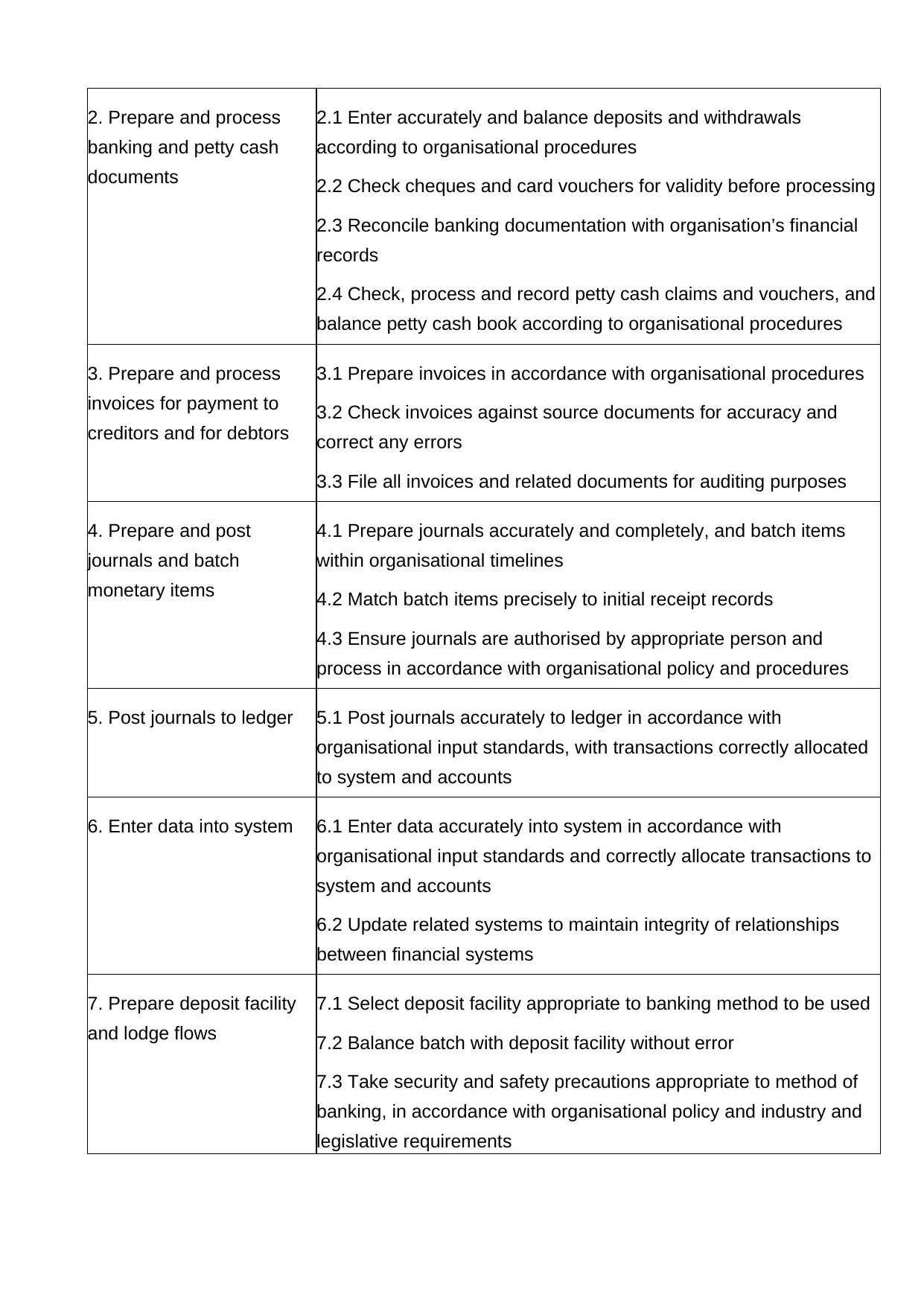

Q5. ELEMENTS AND

PERFORMANCE CRITERIA

FNSACC301 Process financial transactions and extract

interim reports

ELEMENT PERFORMANCE CRITERIA

Elements describe the

essential outcomes.

Performance criteria describe the performance needed to

demonstrate achievement of the element.

1. Check and verify

supporting documentation

1.1 Identify, check and record information from documents

1.2 Examine supporting documentation to establish accuracy and

completeness and to ensure authorisation by appropriate personnel

Assessor’s Feedback

Method: Assessment methods

used:

Q - Questions

A – practical

activities

P - Project

I agree that the purpose and

consequences of the

assessment(s) have been

explained and I have received all

the relevant tools and resources

necessary to undertake

assessment, being fully aware of

Upskilled’s assessment, complaint

and appeal processes, and I

believe that I am ready for

assessment.

I acknowledge and agree that

recorded activities have been

conducted on specified dates and

the assessment process was

carried out fairly, with integrity,

professionally with appropriate

feedback during and after the

assessment.

A Note on Presenting Assessment Tasks.

Provide your answers in the space given, if you need to attach a separate file (e.g. word doc/ppt slides), submit it on

your student portal with appropriate file name.

Q5. ELEMENTS AND

PERFORMANCE CRITERIA

FNSACC301 Process financial transactions and extract

interim reports

ELEMENT PERFORMANCE CRITERIA

Elements describe the

essential outcomes.

Performance criteria describe the performance needed to

demonstrate achievement of the element.

1. Check and verify

supporting documentation

1.1 Identify, check and record information from documents

1.2 Examine supporting documentation to establish accuracy and

completeness and to ensure authorisation by appropriate personnel

2. Prepare and process

banking and petty cash

documents

2.1 Enter accurately and balance deposits and withdrawals

according to organisational procedures

2.2 Check cheques and card vouchers for validity before processing

2.3 Reconcile banking documentation with organisation’s financial

records

2.4 Check, process and record petty cash claims and vouchers, and

balance petty cash book according to organisational procedures

3. Prepare and process

invoices for payment to

creditors and for debtors

3.1 Prepare invoices in accordance with organisational procedures

3.2 Check invoices against source documents for accuracy and

correct any errors

3.3 File all invoices and related documents for auditing purposes

4. Prepare and post

journals and batch

monetary items

4.1 Prepare journals accurately and completely, and batch items

within organisational timelines

4.2 Match batch items precisely to initial receipt records

4.3 Ensure journals are authorised by appropriate person and

process in accordance with organisational policy and procedures

5. Post journals to ledger 5.1 Post journals accurately to ledger in accordance with

organisational input standards, with transactions correctly allocated

to system and accounts

6. Enter data into system 6.1 Enter data accurately into system in accordance with

organisational input standards and correctly allocate transactions to

system and accounts

6.2 Update related systems to maintain integrity of relationships

between financial systems

7. Prepare deposit facility

and lodge flows

7.1 Select deposit facility appropriate to banking method to be used

7.2 Balance batch with deposit facility without error

7.3 Take security and safety precautions appropriate to method of

banking, in accordance with organisational policy and industry and

legislative requirements

banking and petty cash

documents

2.1 Enter accurately and balance deposits and withdrawals

according to organisational procedures

2.2 Check cheques and card vouchers for validity before processing

2.3 Reconcile banking documentation with organisation’s financial

records

2.4 Check, process and record petty cash claims and vouchers, and

balance petty cash book according to organisational procedures

3. Prepare and process

invoices for payment to

creditors and for debtors

3.1 Prepare invoices in accordance with organisational procedures

3.2 Check invoices against source documents for accuracy and

correct any errors

3.3 File all invoices and related documents for auditing purposes

4. Prepare and post

journals and batch

monetary items

4.1 Prepare journals accurately and completely, and batch items

within organisational timelines

4.2 Match batch items precisely to initial receipt records

4.3 Ensure journals are authorised by appropriate person and

process in accordance with organisational policy and procedures

5. Post journals to ledger 5.1 Post journals accurately to ledger in accordance with

organisational input standards, with transactions correctly allocated

to system and accounts

6. Enter data into system 6.1 Enter data accurately into system in accordance with

organisational input standards and correctly allocate transactions to

system and accounts

6.2 Update related systems to maintain integrity of relationships

between financial systems

7. Prepare deposit facility

and lodge flows

7.1 Select deposit facility appropriate to banking method to be used

7.2 Balance batch with deposit facility without error

7.3 Take security and safety precautions appropriate to method of

banking, in accordance with organisational policy and industry and

legislative requirements

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

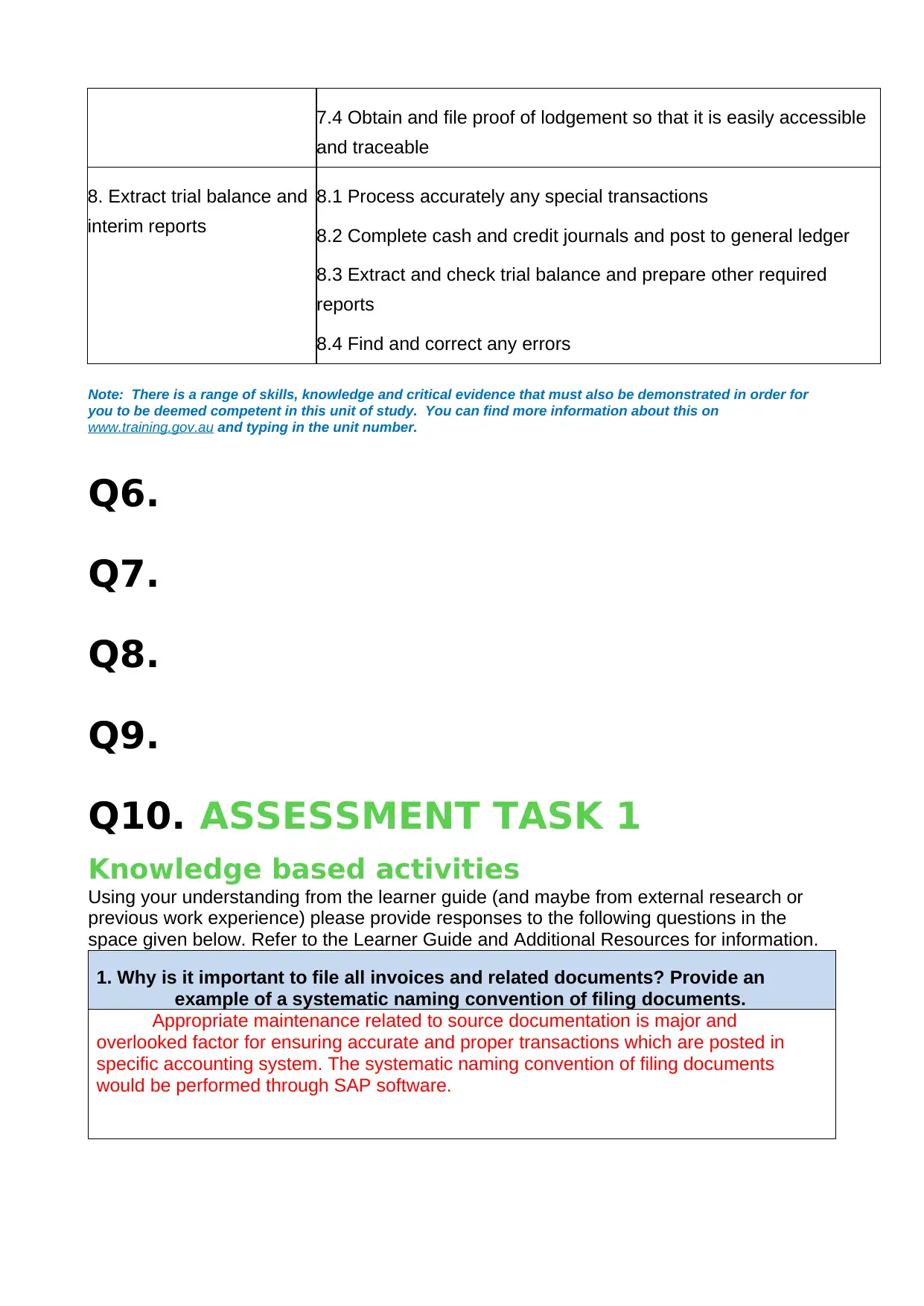

7.4 Obtain and file proof of lodgement so that it is easily accessible

and traceable

8. Extract trial balance and

interim reports

8.1 Process accurately any special transactions

8.2 Complete cash and credit journals and post to general ledger

8.3 Extract and check trial balance and prepare other required

reports

8.4 Find and correct any errors

Note: There is a range of skills, knowledge and critical evidence that must also be demonstrated in order for

you to be deemed competent in this unit of study. You can find more information about this on

www.training.gov.au and typing in the unit number.

Q6.

Q7.

Q8.

Q9.

Q10. ASSESSMENT TASK 1

Knowledge based activities

Using your understanding from the learner guide (and maybe from external research or

previous work experience) please provide responses to the following questions in the

space given below. Refer to the Learner Guide and Additional Resources for information.

1. Why is it important to file all invoices and related documents? Provide an

example of a systematic naming convention of filing documents.

Appropriate maintenance related to source documentation is major and

overlooked factor for ensuring accurate and proper transactions which are posted in

specific accounting system. The systematic naming convention of filing documents

would be performed through SAP software.

and traceable

8. Extract trial balance and

interim reports

8.1 Process accurately any special transactions

8.2 Complete cash and credit journals and post to general ledger

8.3 Extract and check trial balance and prepare other required

reports

8.4 Find and correct any errors

Note: There is a range of skills, knowledge and critical evidence that must also be demonstrated in order for

you to be deemed competent in this unit of study. You can find more information about this on

www.training.gov.au and typing in the unit number.

Q6.

Q7.

Q8.

Q9.

Q10. ASSESSMENT TASK 1

Knowledge based activities

Using your understanding from the learner guide (and maybe from external research or

previous work experience) please provide responses to the following questions in the

space given below. Refer to the Learner Guide and Additional Resources for information.

1. Why is it important to file all invoices and related documents? Provide an

example of a systematic naming convention of filing documents.

Appropriate maintenance related to source documentation is major and

overlooked factor for ensuring accurate and proper transactions which are posted in

specific accounting system. The systematic naming convention of filing documents

would be performed through SAP software.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2. Provide at least 3 examples of special transactions. For each example show the

journal entry

Amount of 4500 was paid as rend advance for 2 months.

Prepaid rent ac dr 4500

Cash ac 4500

Office supply was purchased at cost of 2600 on account

Office supplies ac dr 2600

Account payable ac 2600

Dividends paid of 800

Dividends ac dr 800

Cash ac 800

3. What is proof of lodgement? How can you obtain it? Describe a method of filing

proof of lodgement to ensure it’s easily accessible and traceable.

While depositing money in bank, cash would be checked through bank teller along with

cheques, detail of credit card for ensuring balance. Generally, teller stamps copy of

specific deposit in form of evidence that deposit is made. The stamped deposit slip is

replicated as proof of lodgement while returning from bank. This proof of lodgement

must be reflected in section of accounts where it will file and checked as well.

4. List at least three security and safety precautions that you take while banking

and preparing deposit facilities.

1. Bank statements must be checked for verifying deposit which is correctly entered

or not.

2. All banking details must be completed on documents.

3. The time of banking should be vary.

4. The person must perform bank deposits accountable for cheques and money.

5. What is a source document? What is the purpose of having a source

document? List at least 5 types of common source document that a

business may use.

journal entry

Amount of 4500 was paid as rend advance for 2 months.

Prepaid rent ac dr 4500

Cash ac 4500

Office supply was purchased at cost of 2600 on account

Office supplies ac dr 2600

Account payable ac 2600

Dividends paid of 800

Dividends ac dr 800

Cash ac 800

3. What is proof of lodgement? How can you obtain it? Describe a method of filing

proof of lodgement to ensure it’s easily accessible and traceable.

While depositing money in bank, cash would be checked through bank teller along with

cheques, detail of credit card for ensuring balance. Generally, teller stamps copy of

specific deposit in form of evidence that deposit is made. The stamped deposit slip is

replicated as proof of lodgement while returning from bank. This proof of lodgement

must be reflected in section of accounts where it will file and checked as well.

4. List at least three security and safety precautions that you take while banking

and preparing deposit facilities.

1. Bank statements must be checked for verifying deposit which is correctly entered

or not.

2. All banking details must be completed on documents.

3. The time of banking should be vary.

4. The person must perform bank deposits accountable for cheques and money.

5. What is a source document? What is the purpose of having a source

document? List at least 5 types of common source document that a

business may use.

It is an original record which consist of details for substantiate transactions where

whole key information about transactions are captured like involved parties, transaction's

substance along with date and paid amount. The main objective during audit as

evidence of specific transaction of business which incurred.

Types:

Cash Memo

Receipt

Cheque

Vouchers

Debit Note

6. List at least four typical errors that can be made in processing financial

transactions

Error of Omission

Error of Commission

Error of duplication

Error of Principle

7. Explain the security procedures for handling cheques, eftpos and cash of your

organisation (If you are not currently working, do an online research and

find any organisation to answer the question).

Cash handling security procedure:

Supervisors must observe signals of cash theft.

Store policy is closed to drawer and change must be given.

Unauthorised person are not permitted behind counter for any reason.

Cash drawer should not be left open and cash office should be notified during

requirement of cash pick up.

Cash should be counted through cash office only.

Security procedure and measure must be not discussed rather than manager.

Cheque transaction procedure

The name of company must be correctly used and each correction should be

initialled through customer.

Cheque must be signed in front of supervisor.

whole key information about transactions are captured like involved parties, transaction's

substance along with date and paid amount. The main objective during audit as

evidence of specific transaction of business which incurred.

Types:

Cash Memo

Receipt

Cheque

Vouchers

Debit Note

6. List at least four typical errors that can be made in processing financial

transactions

Error of Omission

Error of Commission

Error of duplication

Error of Principle

7. Explain the security procedures for handling cheques, eftpos and cash of your

organisation (If you are not currently working, do an online research and

find any organisation to answer the question).

Cash handling security procedure:

Supervisors must observe signals of cash theft.

Store policy is closed to drawer and change must be given.

Unauthorised person are not permitted behind counter for any reason.

Cash drawer should not be left open and cash office should be notified during

requirement of cash pick up.

Cash should be counted through cash office only.

Security procedure and measure must be not discussed rather than manager.

Cheque transaction procedure

The name of company must be correctly used and each correction should be

initialled through customer.

Cheque must be signed in front of supervisor.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

All overseas and interstate cheques should be authorised through telephone.

Verification of words and figures must match.

Signature should be verified on cheque match with application of identification.

EFTOPS procedure

Expiration must be checked

Verification of correct amount along with approved circle

Credit card slip must be initiated

Ensure that customer obtain appropriate copy

8. List the three main types of reports that a business prepares. Outline at least

two items of types of account that must be included in each of the

reports.

Statement of Profit and Loss: Revenues, Expenditure

Statement of Cash flows: Operating activities, investing activities

Statement of financial position: Current Asset and Current liability

9. What is double entry bookkeeping? Describe the difference between cash

accounting and accrual accounting.

Double entry system of bookkeeping or accounting signifies about involvement of two or

more accounts. The differences among accrual and cash accounting is with context of

timing when purchases and sales are recorded in particular accounts. Cash accounting

considers expenses and revenue when cash at hand is altered but accrual accounting

considers earned revenue and expenses when they are not bpaid.

10. Do an online research and identify and describe the key features of

finance/accounting industry codes of practice relevant to the profession.

It is set of enforceable rules which are set for commitments of industry for

delivering certain standard of practice. It is intended for raising standards of industry and

legislative requirements are complemented. Reliability and validity is main feature of

accounting.

Verification of words and figures must match.

Signature should be verified on cheque match with application of identification.

EFTOPS procedure

Expiration must be checked

Verification of correct amount along with approved circle

Credit card slip must be initiated

Ensure that customer obtain appropriate copy

8. List the three main types of reports that a business prepares. Outline at least

two items of types of account that must be included in each of the

reports.

Statement of Profit and Loss: Revenues, Expenditure

Statement of Cash flows: Operating activities, investing activities

Statement of financial position: Current Asset and Current liability

9. What is double entry bookkeeping? Describe the difference between cash

accounting and accrual accounting.

Double entry system of bookkeeping or accounting signifies about involvement of two or

more accounts. The differences among accrual and cash accounting is with context of

timing when purchases and sales are recorded in particular accounts. Cash accounting

considers expenses and revenue when cash at hand is altered but accrual accounting

considers earned revenue and expenses when they are not bpaid.

10. Do an online research and identify and describe the key features of

finance/accounting industry codes of practice relevant to the profession.

It is set of enforceable rules which are set for commitments of industry for

delivering certain standard of practice. It is intended for raising standards of industry and

legislative requirements are complemented. Reliability and validity is main feature of

accounting.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11. What is a trial balance? How can you locate an error in a trial balance and

correct it?

Trial balance is replicated as worksheet of bookkeeping where whole balance of

every ledger is combined into credit and debit account column where its aggregate is

always equal. If there is mismatch among total of credit and debit which shows that one

or more transaction posting through journal to ledger is missing or has any other error.

ASSESSMENT TASK 2

Practical activities

You are the Accounts Assistant at OMG Ltd. OMG Ltd sells gym equipment like treadmills,

bikes, cross-trainers etc. You work in their accounts team. Your job role includes

processing financial transactions. Complete the following activities as a part of your daily

job role.

Part 1: Prepare and process invoices

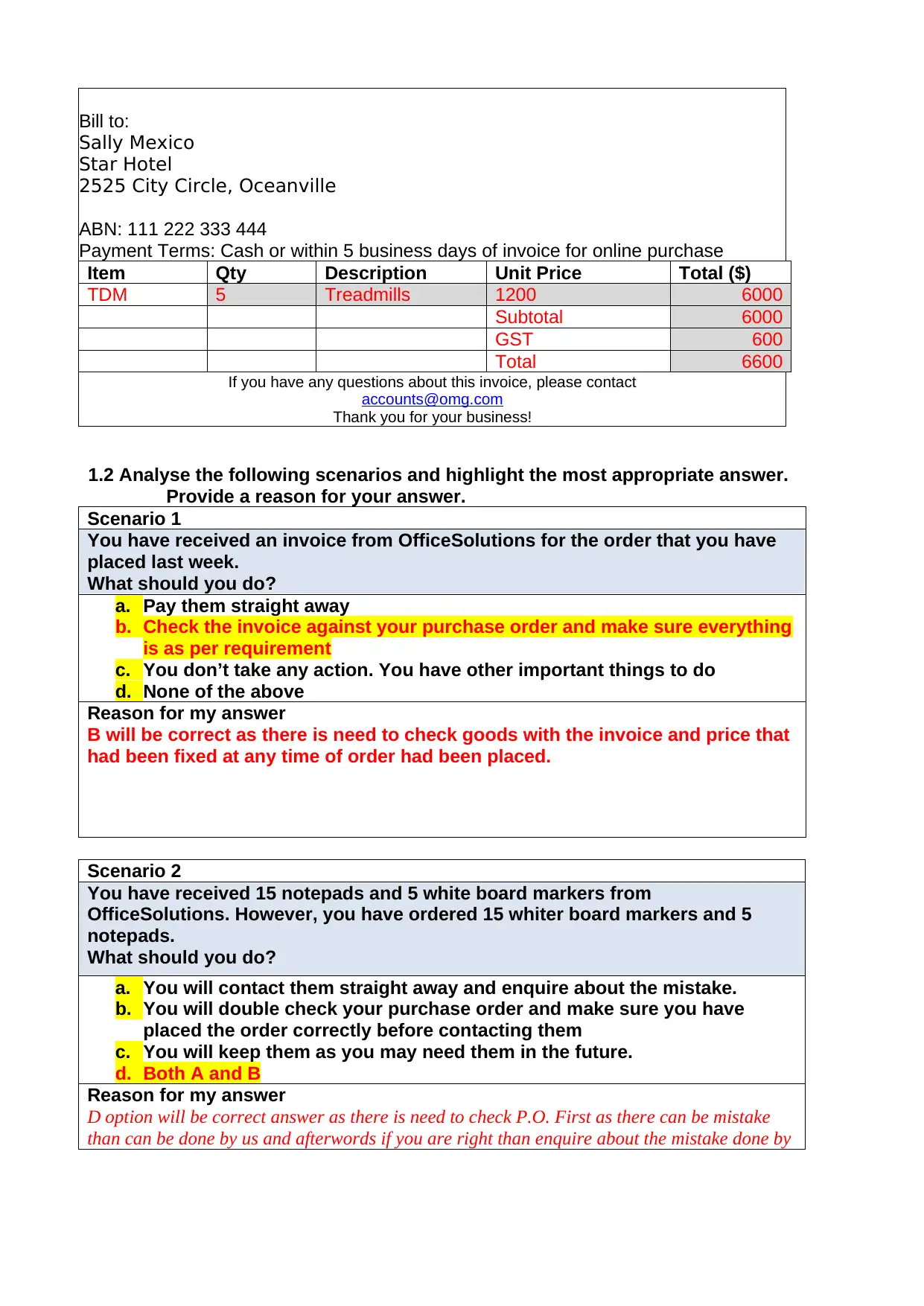

1.1 Sally Mexico comes to your store this morning and enquires about your

treadmills. Sally works for Star Hotel in the city. You sell five treadmills to

Sally. Each of the treadmill costs $1200 plus GST. Sally has paid cash and

now requires a tax invoice.

a. If a customer asks you for a tax invoice, how long do you have to provide one?

At the time of sale Sally must get tax invoice nothing matters even she had paid cash for purchase of

treadmills.

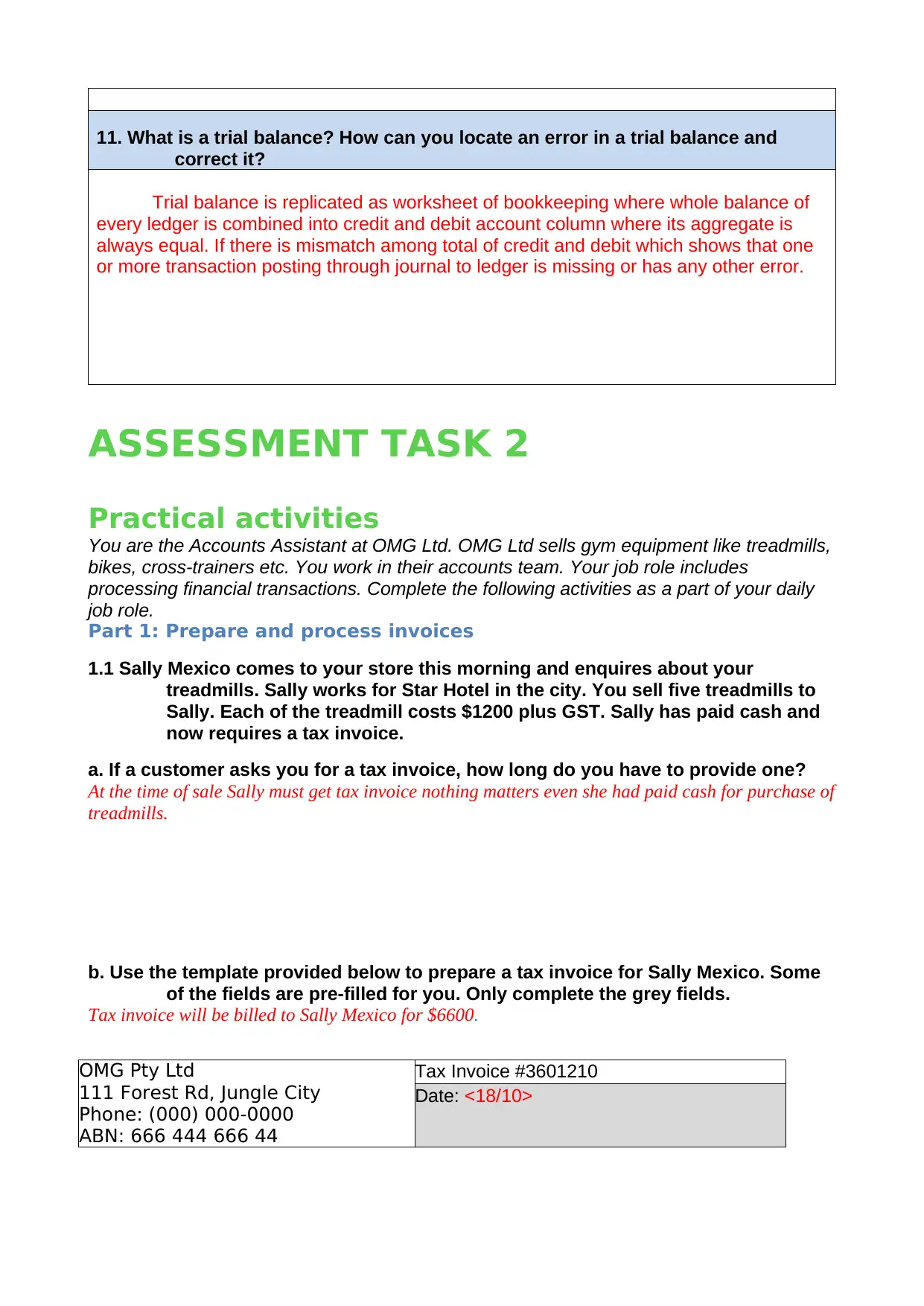

b. Use the template provided below to prepare a tax invoice for Sally Mexico. Some

of the fields are pre-filled for you. Only complete the grey fields.

Tax invoice will be billed to Sally Mexico for $6600.

OMG Pty Ltd

111 Forest Rd, Jungle City

Phone: (000) 000-0000

ABN: 666 444 666 44

Tax Invoice #3601210

Date: <18/10>

correct it?

Trial balance is replicated as worksheet of bookkeeping where whole balance of

every ledger is combined into credit and debit account column where its aggregate is

always equal. If there is mismatch among total of credit and debit which shows that one

or more transaction posting through journal to ledger is missing or has any other error.

ASSESSMENT TASK 2

Practical activities

You are the Accounts Assistant at OMG Ltd. OMG Ltd sells gym equipment like treadmills,

bikes, cross-trainers etc. You work in their accounts team. Your job role includes

processing financial transactions. Complete the following activities as a part of your daily

job role.

Part 1: Prepare and process invoices

1.1 Sally Mexico comes to your store this morning and enquires about your

treadmills. Sally works for Star Hotel in the city. You sell five treadmills to

Sally. Each of the treadmill costs $1200 plus GST. Sally has paid cash and

now requires a tax invoice.

a. If a customer asks you for a tax invoice, how long do you have to provide one?

At the time of sale Sally must get tax invoice nothing matters even she had paid cash for purchase of

treadmills.

b. Use the template provided below to prepare a tax invoice for Sally Mexico. Some

of the fields are pre-filled for you. Only complete the grey fields.

Tax invoice will be billed to Sally Mexico for $6600.

OMG Pty Ltd

111 Forest Rd, Jungle City

Phone: (000) 000-0000

ABN: 666 444 666 44

Tax Invoice #3601210

Date: <18/10>

Bill to:

Sally Mexico

Star Hotel

2525 City Circle, Oceanville

ABN: 111 222 333 444

Payment Terms: Cash or within 5 business days of invoice for online purchase

Item Qty Description Unit Price Total ($)

TDM 5 Treadmills 1200 6000

Subtotal 6000

GST 600

Total 6600

If you have any questions about this invoice, please contact

accounts@omg.com

Thank you for your business!

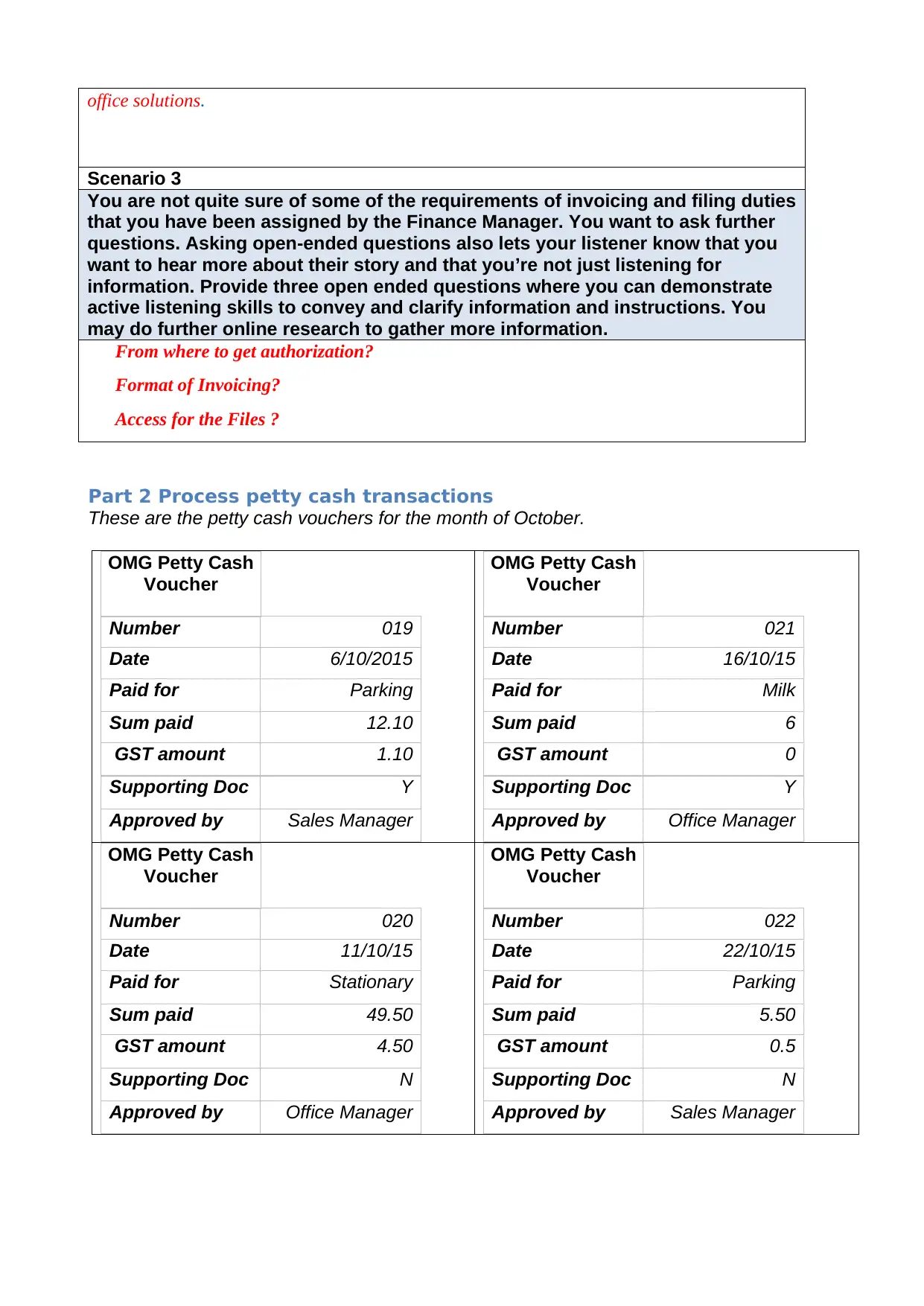

1.2 Analyse the following scenarios and highlight the most appropriate answer.

Provide a reason for your answer.

Scenario 1

You have received an invoice from OfficeSolutions for the order that you have

placed last week.

What should you do?

a. Pay them straight away

b. Check the invoice against your purchase order and make sure everything

is as per requirement

c. You don’t take any action. You have other important things to do

d. None of the above

Reason for my answer

B will be correct as there is need to check goods with the invoice and price that

had been fixed at any time of order had been placed.

Scenario 2

You have received 15 notepads and 5 white board markers from

OfficeSolutions. However, you have ordered 15 whiter board markers and 5

notepads.

What should you do?

a. You will contact them straight away and enquire about the mistake.

b. You will double check your purchase order and make sure you have

placed the order correctly before contacting them

c. You will keep them as you may need them in the future.

d. Both A and B

Reason for my answer

D option will be correct answer as there is need to check P.O. First as there can be mistake

than can be done by us and afterwords if you are right than enquire about the mistake done by

Sally Mexico

Star Hotel

2525 City Circle, Oceanville

ABN: 111 222 333 444

Payment Terms: Cash or within 5 business days of invoice for online purchase

Item Qty Description Unit Price Total ($)

TDM 5 Treadmills 1200 6000

Subtotal 6000

GST 600

Total 6600

If you have any questions about this invoice, please contact

accounts@omg.com

Thank you for your business!

1.2 Analyse the following scenarios and highlight the most appropriate answer.

Provide a reason for your answer.

Scenario 1

You have received an invoice from OfficeSolutions for the order that you have

placed last week.

What should you do?

a. Pay them straight away

b. Check the invoice against your purchase order and make sure everything

is as per requirement

c. You don’t take any action. You have other important things to do

d. None of the above

Reason for my answer

B will be correct as there is need to check goods with the invoice and price that

had been fixed at any time of order had been placed.

Scenario 2

You have received 15 notepads and 5 white board markers from

OfficeSolutions. However, you have ordered 15 whiter board markers and 5

notepads.

What should you do?

a. You will contact them straight away and enquire about the mistake.

b. You will double check your purchase order and make sure you have

placed the order correctly before contacting them

c. You will keep them as you may need them in the future.

d. Both A and B

Reason for my answer

D option will be correct answer as there is need to check P.O. First as there can be mistake

than can be done by us and afterwords if you are right than enquire about the mistake done by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

office solutions.

Scenario 3

You are not quite sure of some of the requirements of invoicing and filing duties

that you have been assigned by the Finance Manager. You want to ask further

questions. Asking open-ended questions also lets your listener know that you

want to hear more about their story and that you’re not just listening for

information. Provide three open ended questions where you can demonstrate

active listening skills to convey and clarify information and instructions. You

may do further online research to gather more information.

From where to get authorization?

Format of Invoicing?

Access for the Files ?

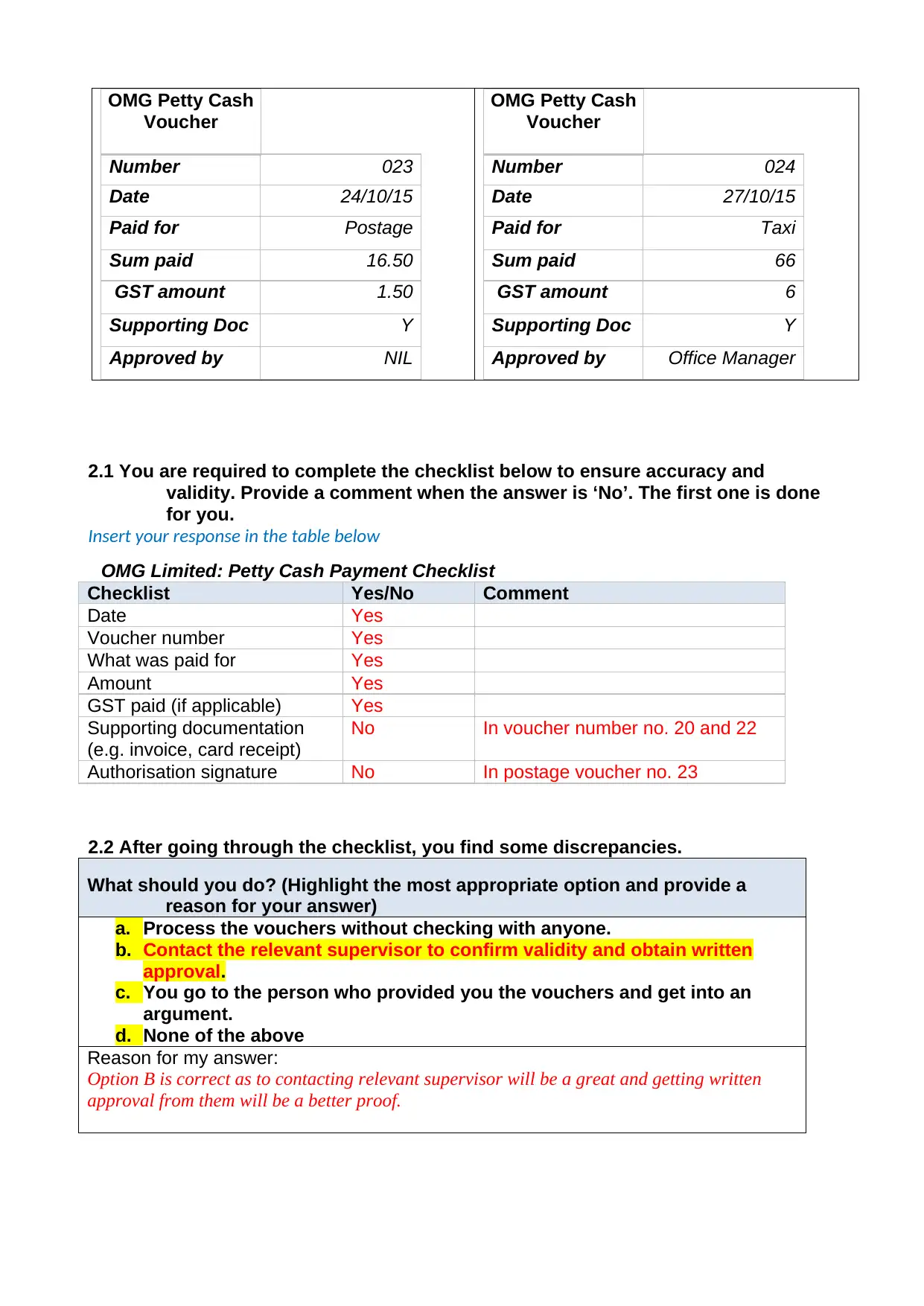

Part 2 Process petty cash transactions

These are the petty cash vouchers for the month of October.

OMG Petty Cash

Voucher

Number 019

Date 6/10/2015

Paid for Parking

Sum paid 12.10

GST amount 1.10

Supporting Doc Y

Approved by Sales Manager

OMG Petty Cash

Voucher

Number 021

Date 16/10/15

Paid for Milk

Sum paid 6

GST amount 0

Supporting Doc Y

Approved by Office Manager

OMG Petty Cash

Voucher

Number 020

Date 11/10/15

Paid for Stationary

Sum paid 49.50

GST amount 4.50

Supporting Doc N

Approved by Office Manager

OMG Petty Cash

Voucher

Number 022

Date 22/10/15

Paid for Parking

Sum paid 5.50

GST amount 0.5

Supporting Doc N

Approved by Sales Manager

Scenario 3

You are not quite sure of some of the requirements of invoicing and filing duties

that you have been assigned by the Finance Manager. You want to ask further

questions. Asking open-ended questions also lets your listener know that you

want to hear more about their story and that you’re not just listening for

information. Provide three open ended questions where you can demonstrate

active listening skills to convey and clarify information and instructions. You

may do further online research to gather more information.

From where to get authorization?

Format of Invoicing?

Access for the Files ?

Part 2 Process petty cash transactions

These are the petty cash vouchers for the month of October.

OMG Petty Cash

Voucher

Number 019

Date 6/10/2015

Paid for Parking

Sum paid 12.10

GST amount 1.10

Supporting Doc Y

Approved by Sales Manager

OMG Petty Cash

Voucher

Number 021

Date 16/10/15

Paid for Milk

Sum paid 6

GST amount 0

Supporting Doc Y

Approved by Office Manager

OMG Petty Cash

Voucher

Number 020

Date 11/10/15

Paid for Stationary

Sum paid 49.50

GST amount 4.50

Supporting Doc N

Approved by Office Manager

OMG Petty Cash

Voucher

Number 022

Date 22/10/15

Paid for Parking

Sum paid 5.50

GST amount 0.5

Supporting Doc N

Approved by Sales Manager

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

OMG Petty Cash

Voucher

Number 023

Date 24/10/15

Paid for Postage

Sum paid 16.50

GST amount 1.50

Supporting Doc Y

Approved by NIL

OMG Petty Cash

Voucher

Number 024

Date 27/10/15

Paid for Taxi

Sum paid 66

GST amount 6

Supporting Doc Y

Approved by Office Manager

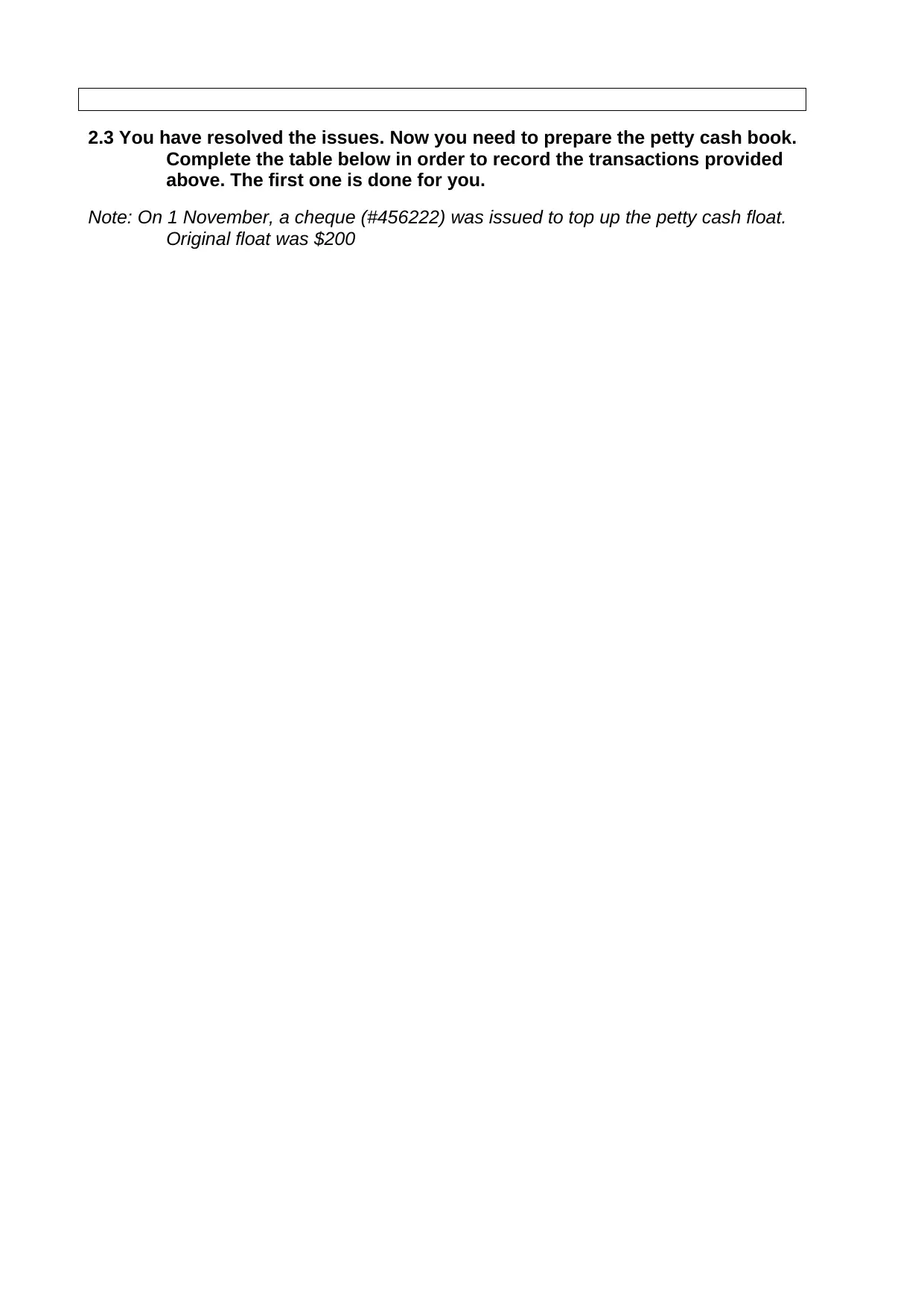

2.1 You are required to complete the checklist below to ensure accuracy and

validity. Provide a comment when the answer is ‘No’. The first one is done

for you.

Insert your response in the table below

OMG Limited: Petty Cash Payment Checklist

Checklist Yes/No Comment

Date Yes

Voucher number Yes

What was paid for Yes

Amount Yes

GST paid (if applicable) Yes

Supporting documentation

(e.g. invoice, card receipt)

No In voucher number no. 20 and 22

Authorisation signature No In postage voucher no. 23

2.2 After going through the checklist, you find some discrepancies.

What should you do? (Highlight the most appropriate option and provide a

reason for your answer)

a. Process the vouchers without checking with anyone.

b. Contact the relevant supervisor to confirm validity and obtain written

approval.

c. You go to the person who provided you the vouchers and get into an

argument.

d. None of the above

Reason for my answer:

Option B is correct as to contacting relevant supervisor will be a great and getting written

approval from them will be a better proof.

Voucher

Number 023

Date 24/10/15

Paid for Postage

Sum paid 16.50

GST amount 1.50

Supporting Doc Y

Approved by NIL

OMG Petty Cash

Voucher

Number 024

Date 27/10/15

Paid for Taxi

Sum paid 66

GST amount 6

Supporting Doc Y

Approved by Office Manager

2.1 You are required to complete the checklist below to ensure accuracy and

validity. Provide a comment when the answer is ‘No’. The first one is done

for you.

Insert your response in the table below

OMG Limited: Petty Cash Payment Checklist

Checklist Yes/No Comment

Date Yes

Voucher number Yes

What was paid for Yes

Amount Yes

GST paid (if applicable) Yes

Supporting documentation

(e.g. invoice, card receipt)

No In voucher number no. 20 and 22

Authorisation signature No In postage voucher no. 23

2.2 After going through the checklist, you find some discrepancies.

What should you do? (Highlight the most appropriate option and provide a

reason for your answer)

a. Process the vouchers without checking with anyone.

b. Contact the relevant supervisor to confirm validity and obtain written

approval.

c. You go to the person who provided you the vouchers and get into an

argument.

d. None of the above

Reason for my answer:

Option B is correct as to contacting relevant supervisor will be a great and getting written

approval from them will be a better proof.

2.3 You have resolved the issues. Now you need to prepare the petty cash book.

Complete the table below in order to record the transactions provided

above. The first one is done for you.

Note: On 1 November, a cheque (#456222) was issued to top up the petty cash float.

Original float was $200

Complete the table below in order to record the transactions provided

above. The first one is done for you.

Note: On 1 November, a cheque (#456222) was issued to top up the petty cash float.

Original float was $200

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 26

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.