FNSACC501 Diploma of Accounting: Provide Financial Information

VerifiedAdded on 2023/03/30

|22

|3005

|55

Homework Assignment

AI Summary

This assignment solution for FNSACC501 Diploma of Accounting focuses on providing financial and business performance information. It includes short answer and worked answer questions based on the textbook "Provide Financial & Business Performance Information." The assignment covers topics such as sources of debt finance, operational risk mitigation, economic order quantity (EOQ) calculation, and financial ratio analysis using a consolidated balance sheet. Specific calculations include current ratio, liquid ratio, average collection period, inventory holding days, and return on equity. The solution provides detailed workings and comments on liquidity and efficiency based on the calculated ratios. The assignment also addresses after-tax cost of funds.

FNS50215 Diploma of Accounting

Module3.1Assignment

Instructions:

This assignment contains multiple Assessment Activities.

Please complete the Declaration of Authenticity at the bottom of this page

Save this assignment (e.g. on your desktop)

To complete the assignment, read the instructions for each question carefully.

You may be required to refer to your learning materials or other sources to complete

this assessment.

You are required to type all your responses in the spaces provided

Once you have completed all parts of the assignment and saved it, login to the

Monarch Institute LMS to submit your assignment for grading

To submit your assignment click on the file ”SubmitDiploma of AccountingModule 3.1

Assignment” in the Module 3.1section of your course and upload your assignment file.

Please be sure to click “Continue” after clicking “submit”.This ensures your assessor receives

notification of your submission – very important!

Declaration of Understanding and Authenticity *

I have read and understood the assessment instructions provided to me in the Learning Management System.

I certify that the attached material is my original work. No other person’s work has been used without due

acknowledgement. I understand that the work submitted may be reproduced and/or communicated for the purpose

of detecting plagiarism.

Student Name*: Date:

* I understand that by typing my name or inserting a digital signature into this box that I agree and am bound by the

above student declaration.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 1 of 22

Module3.1Assignment

Instructions:

This assignment contains multiple Assessment Activities.

Please complete the Declaration of Authenticity at the bottom of this page

Save this assignment (e.g. on your desktop)

To complete the assignment, read the instructions for each question carefully.

You may be required to refer to your learning materials or other sources to complete

this assessment.

You are required to type all your responses in the spaces provided

Once you have completed all parts of the assignment and saved it, login to the

Monarch Institute LMS to submit your assignment for grading

To submit your assignment click on the file ”SubmitDiploma of AccountingModule 3.1

Assignment” in the Module 3.1section of your course and upload your assignment file.

Please be sure to click “Continue” after clicking “submit”.This ensures your assessor receives

notification of your submission – very important!

Declaration of Understanding and Authenticity *

I have read and understood the assessment instructions provided to me in the Learning Management System.

I certify that the attached material is my original work. No other person’s work has been used without due

acknowledgement. I understand that the work submitted may be reproduced and/or communicated for the purpose

of detecting plagiarism.

Student Name*: Date:

* I understand that by typing my name or inserting a digital signature into this box that I agree and am bound by the

above student declaration.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 1 of 22

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Units Covered: FNSACC501

Important assessment information

Aims of this assessment

This assessment focuses on providing financial and business performance information.

Marking and feedback

This assignment contains multiple Assessment Activities each containing specific instructions.

You are required to attempt all questions.

This particular assessment forms part of your overall assessment for the following unit(s) of

competency:

FNSACC501Provide financial and business performance information

Grading for this assessment will be deemed “competent” or “not-yet-competent” in line with

specified educational standards under the Australian Qualifications Framework.

What does “competent” mean?

These answers contain relevant and accurate information in response to the question/s with

limited serious errors in fact or application. If incorrect information is contained in an answer, it

must be fundamentally outweighed by the accurate information provided. This will be assessed

against a marking guide provided to assessors for their determination.

What does “not-yet-competent” mean?

This occurs when an assessment does not meet the marking guide standards provided to

assessors. These answers either do not address the question specifically, or are wrong from a

legislative perspective, or are incorrectly applied. Answers that omit to provide a response to any

significant issue (where multiple issues must be addressed in a question) may also be deemed

not-yet-competent. Answers that have faulty reasoning, a poor standard of expression or include

plagiarism may also be deemed not-yet-competent. Please note, additional information regarding

Monarch’s plagiarism policy is contained in the Student Information Guide which can be found

here: http://www.monarch.edu.au/student-info/

Diploma of Accounting - Module 3.1 Assignment 1702 Page 2 of 22

Important assessment information

Aims of this assessment

This assessment focuses on providing financial and business performance information.

Marking and feedback

This assignment contains multiple Assessment Activities each containing specific instructions.

You are required to attempt all questions.

This particular assessment forms part of your overall assessment for the following unit(s) of

competency:

FNSACC501Provide financial and business performance information

Grading for this assessment will be deemed “competent” or “not-yet-competent” in line with

specified educational standards under the Australian Qualifications Framework.

What does “competent” mean?

These answers contain relevant and accurate information in response to the question/s with

limited serious errors in fact or application. If incorrect information is contained in an answer, it

must be fundamentally outweighed by the accurate information provided. This will be assessed

against a marking guide provided to assessors for their determination.

What does “not-yet-competent” mean?

This occurs when an assessment does not meet the marking guide standards provided to

assessors. These answers either do not address the question specifically, or are wrong from a

legislative perspective, or are incorrectly applied. Answers that omit to provide a response to any

significant issue (where multiple issues must be addressed in a question) may also be deemed

not-yet-competent. Answers that have faulty reasoning, a poor standard of expression or include

plagiarism may also be deemed not-yet-competent. Please note, additional information regarding

Monarch’s plagiarism policy is contained in the Student Information Guide which can be found

here: http://www.monarch.edu.au/student-info/

Diploma of Accounting - Module 3.1 Assignment 1702 Page 2 of 22

Units Covered: FNSACC501

What happens if you are deemed not-yet-competent?

In the event you do not achieve competency by your assessor on this assessment, you will be

given one more opportunity to re-submit the assessment after consultation with your Trainer/

Assessor. You will know your assessment is deemed ‘not-yet-competent’ if your grade book in the

Monarch LMS says “NYC” after you have received an email from your assessor advising your

assessment has been graded.

Important: It is your responsibility to ensure your assessment resubmission addresses all areas

deemed unsatisfactory by your assessor. Please note, if you are still unsuccessful in meeting

competency after resubmitting your assessment, you will be required to repeat those units.

In the event that you have concerns about the assessment decision then you can refer to our

Complaints & Appeals process also contained within the Student Information Guide.

Expectations from your assessor when answering different types of assessment questions:

Knowledge based questions:

A knowledge based question requires you to clearly identify and cover the key subject matter

areas raised in the question in full as part of the response.

Performance based questions:

A performance based question requires you to clearly demonstrate your ability to complete

certain tasks, that is, to perform these tasks.

Good luck

Finally, good luck with your learning and assessments and remember your trainers are here to

assist you

Diploma of Accounting - Module 3.1 Assignment 1702 Page 3 of 22

What happens if you are deemed not-yet-competent?

In the event you do not achieve competency by your assessor on this assessment, you will be

given one more opportunity to re-submit the assessment after consultation with your Trainer/

Assessor. You will know your assessment is deemed ‘not-yet-competent’ if your grade book in the

Monarch LMS says “NYC” after you have received an email from your assessor advising your

assessment has been graded.

Important: It is your responsibility to ensure your assessment resubmission addresses all areas

deemed unsatisfactory by your assessor. Please note, if you are still unsuccessful in meeting

competency after resubmitting your assessment, you will be required to repeat those units.

In the event that you have concerns about the assessment decision then you can refer to our

Complaints & Appeals process also contained within the Student Information Guide.

Expectations from your assessor when answering different types of assessment questions:

Knowledge based questions:

A knowledge based question requires you to clearly identify and cover the key subject matter

areas raised in the question in full as part of the response.

Performance based questions:

A performance based question requires you to clearly demonstrate your ability to complete

certain tasks, that is, to perform these tasks.

Good luck

Finally, good luck with your learning and assessments and remember your trainers are here to

assist you

Diploma of Accounting - Module 3.1 Assignment 1702 Page 3 of 22

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Units Covered: FNSACC501

Assessment Activities

Short Answer and Worked Answer Questions

FNSACC501–Provide financial and business performance information

The following questions are based on the material in the textbook“Provide Financial & Business Performance

Information” by Richard Hughes & Godfrey Senaratne, 6th Edition (January, 2016).

Activity instructions to candidates

This is an open book assessment activity.

You may use a financial calculator or computer application to help calculate values

You are required to read this assessment and answer all questions that follow.

Please type your answers in the spaces provided.

Please ensure you have read “Important assessment information” at the front of this assessment

Estimated time for completion of this assessment activity: 2-3 hours

Diploma of Accounting - Module 3.1 Assignment 1702 Page 4 of 22

Assessment Activities

Short Answer and Worked Answer Questions

FNSACC501–Provide financial and business performance information

The following questions are based on the material in the textbook“Provide Financial & Business Performance

Information” by Richard Hughes & Godfrey Senaratne, 6th Edition (January, 2016).

Activity instructions to candidates

This is an open book assessment activity.

You may use a financial calculator or computer application to help calculate values

You are required to read this assessment and answer all questions that follow.

Please type your answers in the spaces provided.

Please ensure you have read “Important assessment information” at the front of this assessment

Estimated time for completion of this assessment activity: 2-3 hours

Diploma of Accounting - Module 3.1 Assignment 1702 Page 4 of 22

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Units Covered: FNSACC501

The following questions are based on the material in Chapter 2:

Q1.

List six (6) sources of debt finance available to organisations and corporations in Australia:

1. Trade credit is the credit that is extended to an organisation by the suppliers by allowing

the former to purchase now and pay at a later point of time.

2. Bank overdraft is a facility that a bank provides to an organisation to draw funds from its

account in excess of the balance

3. Commercial bills are exchange bills that an organisation issues for obtaining money for

short-term requirements

4. Promissory notes are legal financial instruments that one party issues for promising to

repay the debt owed to another party

5. Debentures and unsecured notes are kinds of investments that incur interest and they are

issued to obtain funds from the investors

6. Factoring is a kind of financial transaction where an organisation sells its trade receivables

Diploma of Accounting - Module 3.1 Assignment 1702 Page 5 of 22

The following questions are based on the material in Chapter 2:

Q1.

List six (6) sources of debt finance available to organisations and corporations in Australia:

1. Trade credit is the credit that is extended to an organisation by the suppliers by allowing

the former to purchase now and pay at a later point of time.

2. Bank overdraft is a facility that a bank provides to an organisation to draw funds from its

account in excess of the balance

3. Commercial bills are exchange bills that an organisation issues for obtaining money for

short-term requirements

4. Promissory notes are legal financial instruments that one party issues for promising to

repay the debt owed to another party

5. Debentures and unsecured notes are kinds of investments that incur interest and they are

issued to obtain funds from the investors

6. Factoring is a kind of financial transaction where an organisation sells its trade receivables

Diploma of Accounting - Module 3.1 Assignment 1702 Page 5 of 22

Units Covered: FNSACC501

The following questions are based on the material in Chapter 3:

Q2.Operational risks can be split into internal and external risks.

How can managers mitigate internal risks?

How can managers mitigate external risks?

Diploma of Accounting - Module 3.1 Assignment 1702 Page 6 of 22

It is possible to mitigate internal operational risks by assuring the presence of adequate

controls for reducing the probability of losses from internal risks. This is deemed to be

internal control.

It is possible for the managers to manage external operational risks by buying insurance

for compensating the organisation in case of occurrence of external risk event.

The following questions are based on the material in Chapter 3:

Q2.Operational risks can be split into internal and external risks.

How can managers mitigate internal risks?

How can managers mitigate external risks?

Diploma of Accounting - Module 3.1 Assignment 1702 Page 6 of 22

It is possible to mitigate internal operational risks by assuring the presence of adequate

controls for reducing the probability of losses from internal risks. This is deemed to be

internal control.

It is possible for the managers to manage external operational risks by buying insurance

for compensating the organisation in case of occurrence of external risk event.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Units Covered: FNSACC501

The following questions are based on the material in Chapter 5:

Q3.

The Pinewood Company is trying to determine the optimal order quantity of sofas. Annualsales of

sofas are 900 units at a retail price of $300. The cost of carrying sofas is $1 per monthper sofa. It costs

$37.50 to prepare and receive an order.

Determine the economic orderquantity.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 7 of 22

Economic order quantity (EOQ) = Sqrt (2 x Annual sales x Ordering costs per order/Dollar cost of

carrying a single unit per year)

EOQ = Sqrt (2 x 900 x 37.50/12) = 75 sofas

The following questions are based on the material in Chapter 5:

Q3.

The Pinewood Company is trying to determine the optimal order quantity of sofas. Annualsales of

sofas are 900 units at a retail price of $300. The cost of carrying sofas is $1 per monthper sofa. It costs

$37.50 to prepare and receive an order.

Determine the economic orderquantity.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 7 of 22

Economic order quantity (EOQ) = Sqrt (2 x Annual sales x Ordering costs per order/Dollar cost of

carrying a single unit per year)

EOQ = Sqrt (2 x 900 x 37.50/12) = 75 sofas

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Units Covered: FNSACC501

Q4.

A company sells 60,000 litres of a commodity per year. Cost of the commodity is $10 per

litre.Inventory carrying costs are 15% of the commodity cost. The cost of ordering is $72 per

order.Order lead timeaverages five days and average daily demand is 200 litres per business day.

Management wantsa safety stock of ten days.

Required:

(a) Calculate the E.O.Q. for the commodity.

(b) Determine how many orders should be placed each year.

(c) Find the re-order point.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 8 of 22

Re-order point = Safety stock + Lead time consumption

= (200 x 5) + (200 x 10) = 3,000 litres

Annual consumption = 60,000; Cost per litre = $10; Inventory carrying costs = 15%; Ordering cost

per order = $72; Carrying cost = $10 x 15% = $1.50

Economic order quantity = Sqrt (2 x 60,000 x $72/$1.50) = 2,400

Orders to be placed each year = Annual consumption/Economic order quantity

= 60,000/2,400 = 25

Q4.

A company sells 60,000 litres of a commodity per year. Cost of the commodity is $10 per

litre.Inventory carrying costs are 15% of the commodity cost. The cost of ordering is $72 per

order.Order lead timeaverages five days and average daily demand is 200 litres per business day.

Management wantsa safety stock of ten days.

Required:

(a) Calculate the E.O.Q. for the commodity.

(b) Determine how many orders should be placed each year.

(c) Find the re-order point.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 8 of 22

Re-order point = Safety stock + Lead time consumption

= (200 x 5) + (200 x 10) = 3,000 litres

Annual consumption = 60,000; Cost per litre = $10; Inventory carrying costs = 15%; Ordering cost

per order = $72; Carrying cost = $10 x 15% = $1.50

Economic order quantity = Sqrt (2 x 60,000 x $72/$1.50) = 2,400

Orders to be placed each year = Annual consumption/Economic order quantity

= 60,000/2,400 = 25

Units Covered: FNSACC501

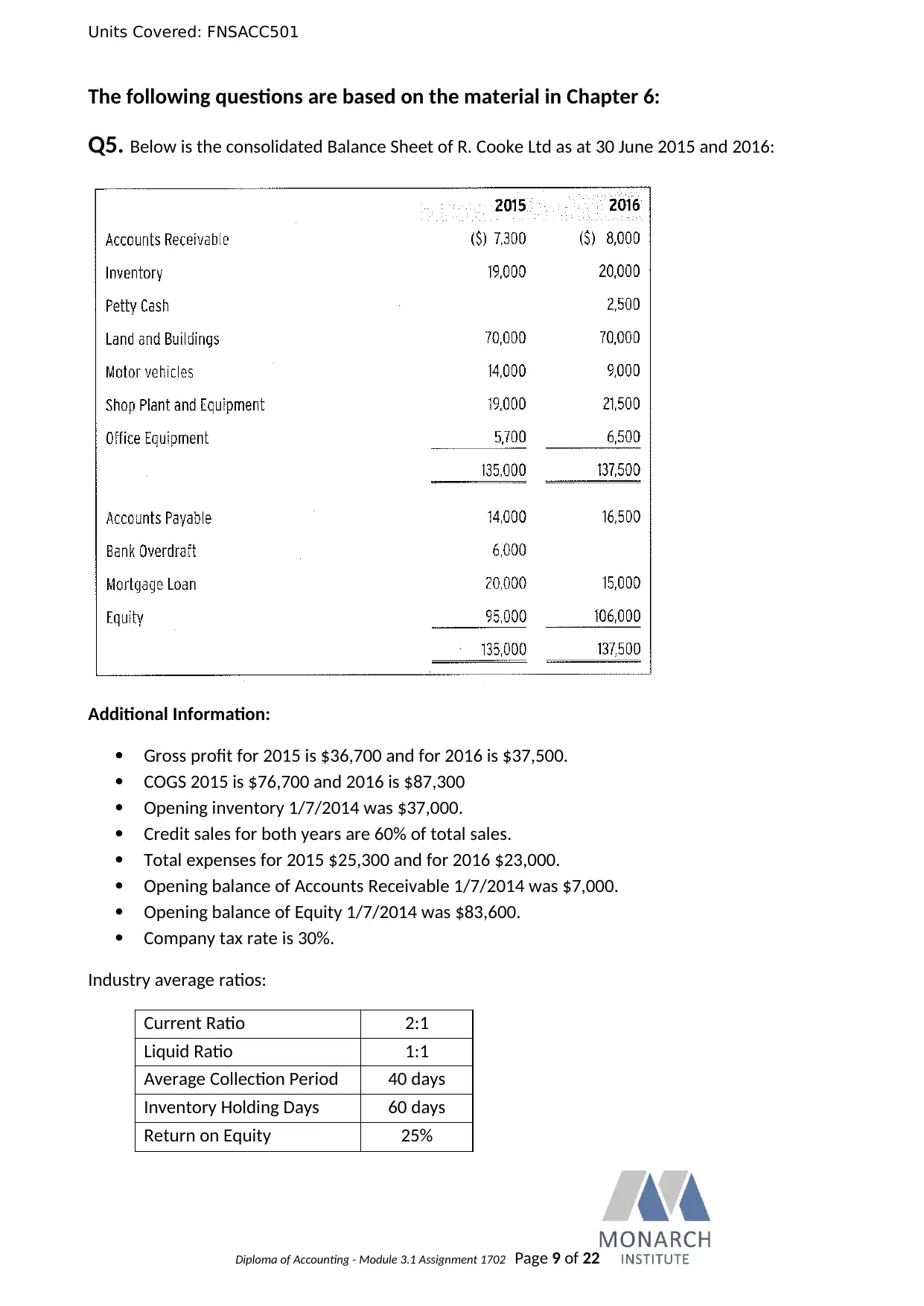

The following questions are based on the material in Chapter 6:

Q5. Below is the consolidated Balance Sheet of R. Cooke Ltd as at 30 June 2015 and 2016:

Additional Information:

Gross profit for 2015 is $36,700 and for 2016 is $37,500.

COGS 2015 is $76,700 and 2016 is $87,300

Opening inventory 1/7/2014 was $37,000.

Credit sales for both years are 60% of total sales.

Total expenses for 2015 $25,300 and for 2016 $23,000.

Opening balance of Accounts Receivable 1/7/2014 was $7,000.

Opening balance of Equity 1/7/2014 was $83,600.

Company tax rate is 30%.

Industry average ratios:

Current Ratio 2:1

Liquid Ratio 1:1

Average Collection Period 40 days

Inventory Holding Days 60 days

Return on Equity 25%

Diploma of Accounting - Module 3.1 Assignment 1702 Page 9 of 22

The following questions are based on the material in Chapter 6:

Q5. Below is the consolidated Balance Sheet of R. Cooke Ltd as at 30 June 2015 and 2016:

Additional Information:

Gross profit for 2015 is $36,700 and for 2016 is $37,500.

COGS 2015 is $76,700 and 2016 is $87,300

Opening inventory 1/7/2014 was $37,000.

Credit sales for both years are 60% of total sales.

Total expenses for 2015 $25,300 and for 2016 $23,000.

Opening balance of Accounts Receivable 1/7/2014 was $7,000.

Opening balance of Equity 1/7/2014 was $83,600.

Company tax rate is 30%.

Industry average ratios:

Current Ratio 2:1

Liquid Ratio 1:1

Average Collection Period 40 days

Inventory Holding Days 60 days

Return on Equity 25%

Diploma of Accounting - Module 3.1 Assignment 1702 Page 9 of 22

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Units Covered: FNSACC501

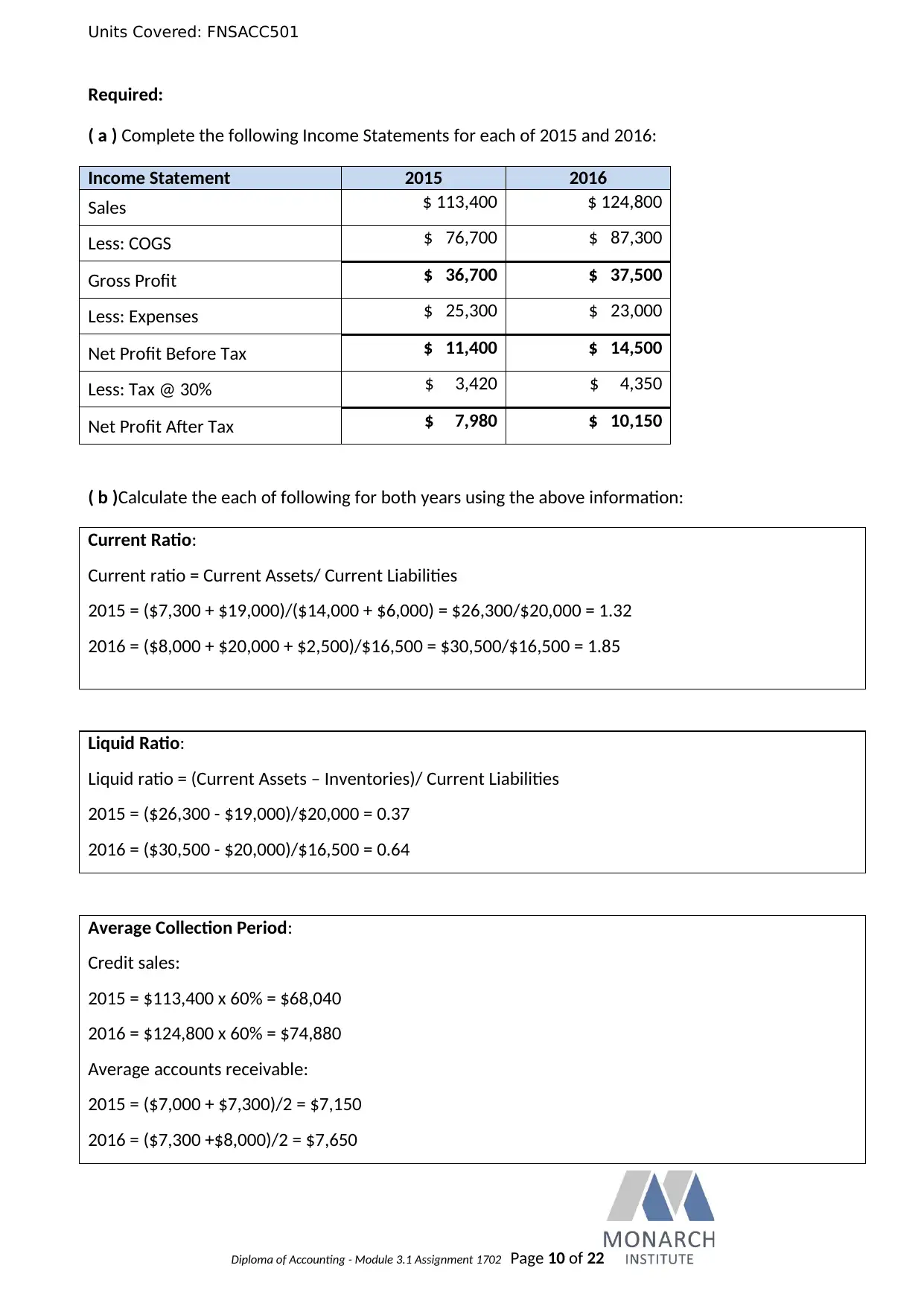

Required:

( a ) Complete the following Income Statements for each of 2015 and 2016:

Income Statement 2015 2016

Sales $ 113,400 $ 124,800

Less: COGS $ 76,700 $ 87,300

Gross Profit $ 36,700 $ 37,500

Less: Expenses $ 25,300 $ 23,000

Net Profit Before Tax $ 11,400 $ 14,500

Less: Tax @ 30% $ 3,420 $ 4,350

Net Profit After Tax $ 7,980 $ 10,150

( b )Calculate the each of following for both years using the above information:

Current Ratio:

Current ratio = Current Assets/ Current Liabilities

2015 = ($7,300 + $19,000)/($14,000 + $6,000) = $26,300/$20,000 = 1.32

2016 = ($8,000 + $20,000 + $2,500)/$16,500 = $30,500/$16,500 = 1.85

Liquid Ratio:

Liquid ratio = (Current Assets – Inventories)/ Current Liabilities

2015 = ($26,300 - $19,000)/$20,000 = 0.37

2016 = ($30,500 - $20,000)/$16,500 = 0.64

Average Collection Period:

Credit sales:

2015 = $113,400 x 60% = $68,040

2016 = $124,800 x 60% = $74,880

Average accounts receivable:

2015 = ($7,000 + $7,300)/2 = $7,150

2016 = ($7,300 +$8,000)/2 = $7,650

Diploma of Accounting - Module 3.1 Assignment 1702 Page 10 of 22

Required:

( a ) Complete the following Income Statements for each of 2015 and 2016:

Income Statement 2015 2016

Sales $ 113,400 $ 124,800

Less: COGS $ 76,700 $ 87,300

Gross Profit $ 36,700 $ 37,500

Less: Expenses $ 25,300 $ 23,000

Net Profit Before Tax $ 11,400 $ 14,500

Less: Tax @ 30% $ 3,420 $ 4,350

Net Profit After Tax $ 7,980 $ 10,150

( b )Calculate the each of following for both years using the above information:

Current Ratio:

Current ratio = Current Assets/ Current Liabilities

2015 = ($7,300 + $19,000)/($14,000 + $6,000) = $26,300/$20,000 = 1.32

2016 = ($8,000 + $20,000 + $2,500)/$16,500 = $30,500/$16,500 = 1.85

Liquid Ratio:

Liquid ratio = (Current Assets – Inventories)/ Current Liabilities

2015 = ($26,300 - $19,000)/$20,000 = 0.37

2016 = ($30,500 - $20,000)/$16,500 = 0.64

Average Collection Period:

Credit sales:

2015 = $113,400 x 60% = $68,040

2016 = $124,800 x 60% = $74,880

Average accounts receivable:

2015 = ($7,000 + $7,300)/2 = $7,150

2016 = ($7,300 +$8,000)/2 = $7,650

Diploma of Accounting - Module 3.1 Assignment 1702 Page 10 of 22

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Units Covered: FNSACC501

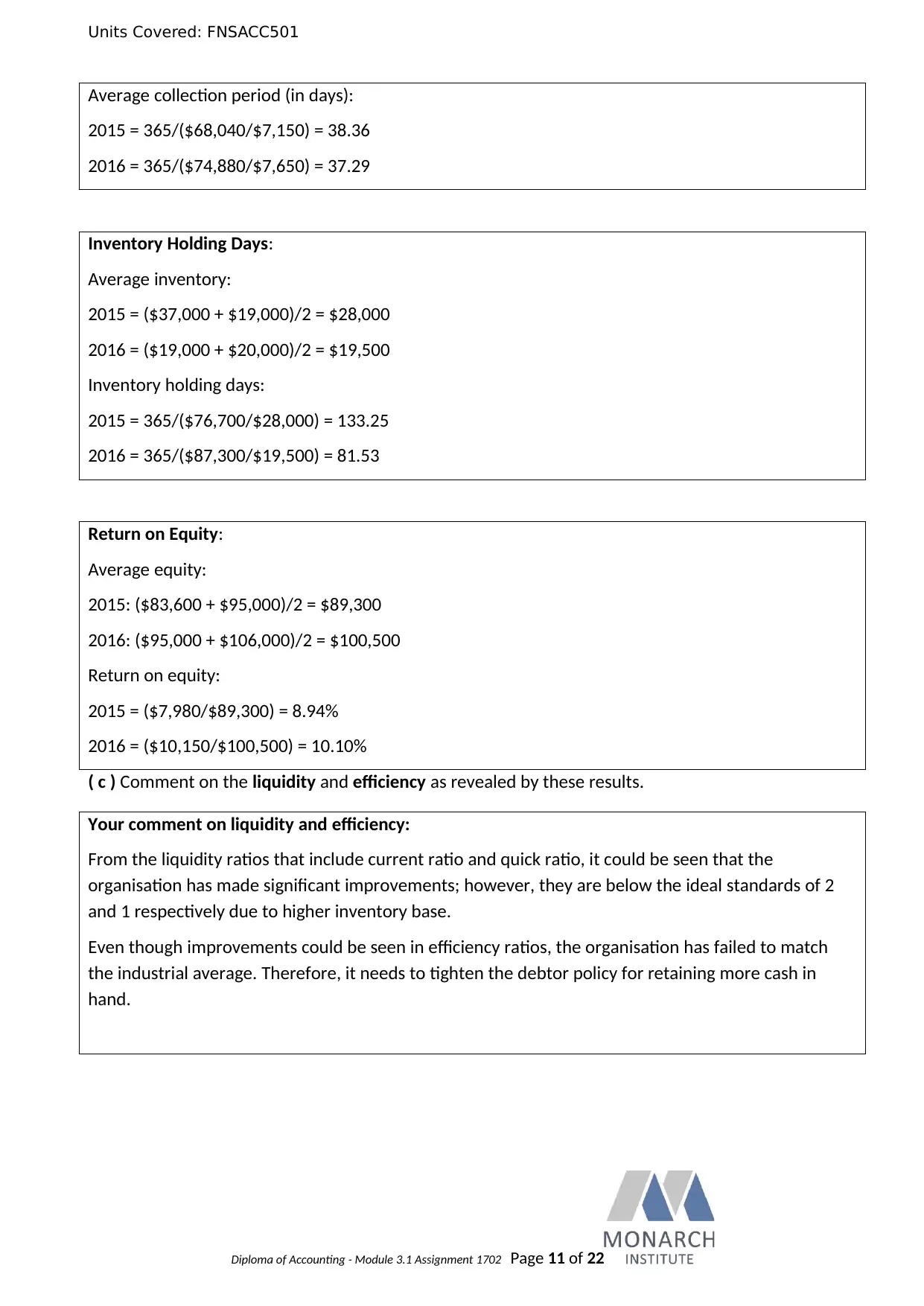

Average collection period (in days):

2015 = 365/($68,040/$7,150) = 38.36

2016 = 365/($74,880/$7,650) = 37.29

Inventory Holding Days:

Average inventory:

2015 = ($37,000 + $19,000)/2 = $28,000

2016 = ($19,000 + $20,000)/2 = $19,500

Inventory holding days:

2015 = 365/($76,700/$28,000) = 133.25

2016 = 365/($87,300/$19,500) = 81.53

Return on Equity:

Average equity:

2015: ($83,600 + $95,000)/2 = $89,300

2016: ($95,000 + $106,000)/2 = $100,500

Return on equity:

2015 = ($7,980/$89,300) = 8.94%

2016 = ($10,150/$100,500) = 10.10%

( c ) Comment on the liquidity and efficiency as revealed by these results.

Your comment on liquidity and efficiency:

From the liquidity ratios that include current ratio and quick ratio, it could be seen that the

organisation has made significant improvements; however, they are below the ideal standards of 2

and 1 respectively due to higher inventory base.

Even though improvements could be seen in efficiency ratios, the organisation has failed to match

the industrial average. Therefore, it needs to tighten the debtor policy for retaining more cash in

hand.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 11 of 22

Average collection period (in days):

2015 = 365/($68,040/$7,150) = 38.36

2016 = 365/($74,880/$7,650) = 37.29

Inventory Holding Days:

Average inventory:

2015 = ($37,000 + $19,000)/2 = $28,000

2016 = ($19,000 + $20,000)/2 = $19,500

Inventory holding days:

2015 = 365/($76,700/$28,000) = 133.25

2016 = 365/($87,300/$19,500) = 81.53

Return on Equity:

Average equity:

2015: ($83,600 + $95,000)/2 = $89,300

2016: ($95,000 + $106,000)/2 = $100,500

Return on equity:

2015 = ($7,980/$89,300) = 8.94%

2016 = ($10,150/$100,500) = 10.10%

( c ) Comment on the liquidity and efficiency as revealed by these results.

Your comment on liquidity and efficiency:

From the liquidity ratios that include current ratio and quick ratio, it could be seen that the

organisation has made significant improvements; however, they are below the ideal standards of 2

and 1 respectively due to higher inventory base.

Even though improvements could be seen in efficiency ratios, the organisation has failed to match

the industrial average. Therefore, it needs to tighten the debtor policy for retaining more cash in

hand.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 11 of 22

Units Covered: FNSACC501

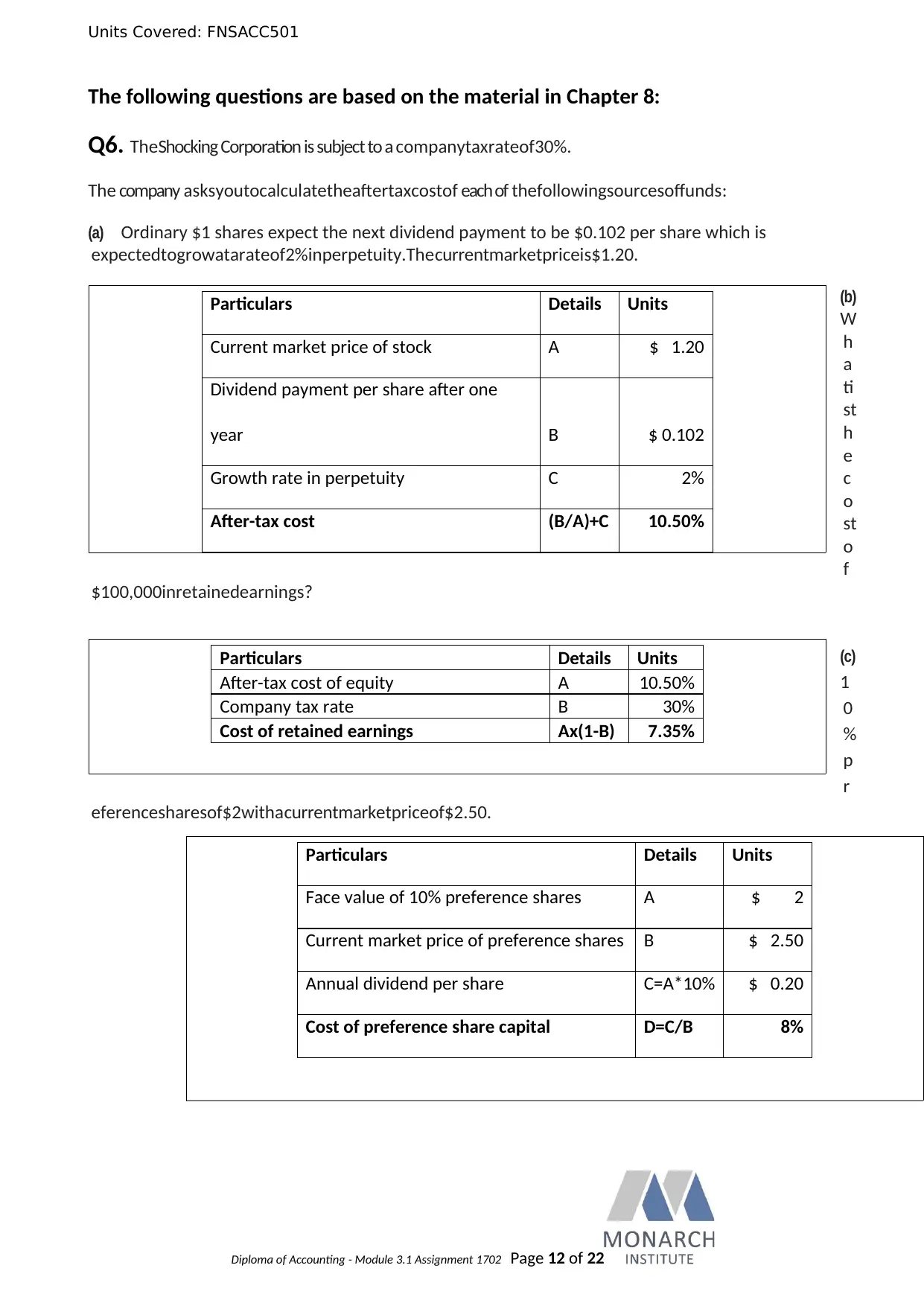

The following questions are based on the material in Chapter 8:

Q6. TheShocking Corporation is subject to a companytaxrateof30%.

The company asksyoutocalculatetheaftertaxcostof each of thefollowingsourcesoffunds:

(a) Ordinary $1 shares expect the next dividend payment to be $0.102 per share which is

expectedtogrowatarateof2%inperpetuity.Thecurrentmarketpriceis$1.20.

(b)

W

h

a

ti

st

h

e

c

o

st

o

f

$100,000inretainedearnings?

(c)

1

0

%

p

r

eferencesharesof$2withacurrentmarketpriceof$2.50.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 12 of 22

Particulars Details Units

Current market price of stock A $ 1.20

Dividend payment per share after one

year B $ 0.102

Growth rate in perpetuity C 2%

After-tax cost (B/A)+C 10.50%

Particulars Details Units

After-tax cost of equity A 10.50%

Company tax rate B 30%

Cost of retained earnings Ax(1-B) 7.35%

Particulars Details Units

Face value of 10% preference shares A $ 2

Current market price of preference shares B $ 2.50

Annual dividend per share C=A*10% $ 0.20

Cost of preference share capital D=C/B 8%

The following questions are based on the material in Chapter 8:

Q6. TheShocking Corporation is subject to a companytaxrateof30%.

The company asksyoutocalculatetheaftertaxcostof each of thefollowingsourcesoffunds:

(a) Ordinary $1 shares expect the next dividend payment to be $0.102 per share which is

expectedtogrowatarateof2%inperpetuity.Thecurrentmarketpriceis$1.20.

(b)

W

h

a

ti

st

h

e

c

o

st

o

f

$100,000inretainedearnings?

(c)

1

0

%

p

r

eferencesharesof$2withacurrentmarketpriceof$2.50.

Diploma of Accounting - Module 3.1 Assignment 1702 Page 12 of 22

Particulars Details Units

Current market price of stock A $ 1.20

Dividend payment per share after one

year B $ 0.102

Growth rate in perpetuity C 2%

After-tax cost (B/A)+C 10.50%

Particulars Details Units

After-tax cost of equity A 10.50%

Company tax rate B 30%

Cost of retained earnings Ax(1-B) 7.35%

Particulars Details Units

Face value of 10% preference shares A $ 2

Current market price of preference shares B $ 2.50

Annual dividend per share C=A*10% $ 0.20

Cost of preference share capital D=C/B 8%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.