FNSACC501: Financial Analysis & Business Performance Information

VerifiedAdded on 2023/04/25

|17

|4973

|364

Project

AI Summary

This FNSACC501 project solution provides a detailed analysis of business performance information and tax legislation. It addresses key areas such as tax treatment of business expenses, tax allowances for trusts, forecasting returns, and NFP sector compliance with government financial policies. The project includes a spreadsheet for loan repayment calculations, identifies business performance objectives, and discusses general-purpose financial reporting frameworks. It also covers state and territory charges, taxes on land, and Commonwealth tax practices. Furthermore, the solution uses a client information form (CIF) to analyze client objectives and financial requirements, explores financial options for different clients, and provides a forecast versus actual analysis for an operational project, including variance analysis and recommendations. This resource helps students understand the complexities of financial and business performance reporting.

Assessment Details

Qualification Code/Title Diploma of Accounting

Assessment Type Assessment -2 Time allowed

Due Date Location AHIC Term / Year

Student Details

Student Name Student ID

Student Declaration: I declare that the work submitted is my own,

and has not been copied or plagiarised from any person or source.

Signature: ____________________________

Date: _____/______/__________

Assessor Details

Assessor’s Name

RESULTS (Please

Circle) SATISFACTORY NOT SATISFACTORY

Feedback to student:

.........................................................................................................................................................................................

.........................................................................................................................................................................................

.........................................................................................................................................................................................

.........................................................................................................................................................................................

Student Declaration: I declare that I have been

assessed in this unit, and I have been advised of my

result. I am also aware of my appeal rights.

Signature: _______________________________

Date: ______/_______/___________

Assessor Declaration: I declare that I have conducted a fair,

valid, reliable and flexible assessment with this student, and I

have provided appropriate feedback.

Signature: ________________________________________

Date: ______/_______/___________

Instructions to the Candidates

This assessment is to be completed in class supervised by assessor.

Should you not answer the questions correctly, you will be given feedback on the results and your gaps in knowledge. You will

be given another opportunity to demonstrate your knowledge and skills to be deemed competent for this unit of competency.

If you are not sure about any aspect of this assessment, please ask for clarification from your assessor.

Please refer to the College re-submission and re-sit policy for more information.

If you have questions and other concerns that may affect your performance in the examination please inform the assessor

immediately.

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 1 of 17

Unit of Competency

National Code/Title FNSACC501-Provide Financial and Business Performance Information

Qualification Code/Title Diploma of Accounting

Assessment Type Assessment -2 Time allowed

Due Date Location AHIC Term / Year

Student Details

Student Name Student ID

Student Declaration: I declare that the work submitted is my own,

and has not been copied or plagiarised from any person or source.

Signature: ____________________________

Date: _____/______/__________

Assessor Details

Assessor’s Name

RESULTS (Please

Circle) SATISFACTORY NOT SATISFACTORY

Feedback to student:

.........................................................................................................................................................................................

.........................................................................................................................................................................................

.........................................................................................................................................................................................

.........................................................................................................................................................................................

Student Declaration: I declare that I have been

assessed in this unit, and I have been advised of my

result. I am also aware of my appeal rights.

Signature: _______________________________

Date: ______/_______/___________

Assessor Declaration: I declare that I have conducted a fair,

valid, reliable and flexible assessment with this student, and I

have provided appropriate feedback.

Signature: ________________________________________

Date: ______/_______/___________

Instructions to the Candidates

This assessment is to be completed in class supervised by assessor.

Should you not answer the questions correctly, you will be given feedback on the results and your gaps in knowledge. You will

be given another opportunity to demonstrate your knowledge and skills to be deemed competent for this unit of competency.

If you are not sure about any aspect of this assessment, please ask for clarification from your assessor.

Please refer to the College re-submission and re-sit policy for more information.

If you have questions and other concerns that may affect your performance in the examination please inform the assessor

immediately.

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 1 of 17

Unit of Competency

National Code/Title FNSACC501-Provide Financial and Business Performance Information

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Project 1

Part 1

1. How are business expenses treated in regard to tax legislation? Discuss in 30 to 50 words.

As per the provisions which is stated in tax legislations, any business expenses which in ordinary

sense helps the business to generate revenue are deductible in nature. Such expenses are

deducted from the assessable income and after which tax liability of the business is computed.

2. What allowance in tax legislation is there for businesses that are managed on behalf of a

trust? Discuss in 80 to 100 words.

The trusts form of businesses does not attract tax as the same is applicable on individuals unless

the trust is corporate public or trading trusts as defined in the Income Tax Assessment Act 1936.

The net income which is generated by a trust is taxable at the hands of the beneficiary

regardless of whether the income was actually received by him or not. The trust need to be

registered under the tax laws and also needs to file tax returns for the assessable income

generated by it.

3. Describe forecast returns and set up and describe a simple table over several years for

similar amounts. Discuss in 50 to 80 words.

Forecasting of returns are done by business for the purpose of planning for the revenue and

profits which can be generated for the future period. There are numerous methods which can be

used for the purpose of forecasting returns for a business such as moving average method,

Delphi method and similar other methods as well. A table showing forecasted returns for the

years 2020 is shown using moving average method.

Return forecast using 3 years Moving Average Method

Year Returns Forecasts

2015 1000

2016 1200

2017 1500

2018 2000 1233.33

2019 2100 1566.67

2020 1866.67

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 2 of 17

Part 1

1. How are business expenses treated in regard to tax legislation? Discuss in 30 to 50 words.

As per the provisions which is stated in tax legislations, any business expenses which in ordinary

sense helps the business to generate revenue are deductible in nature. Such expenses are

deducted from the assessable income and after which tax liability of the business is computed.

2. What allowance in tax legislation is there for businesses that are managed on behalf of a

trust? Discuss in 80 to 100 words.

The trusts form of businesses does not attract tax as the same is applicable on individuals unless

the trust is corporate public or trading trusts as defined in the Income Tax Assessment Act 1936.

The net income which is generated by a trust is taxable at the hands of the beneficiary

regardless of whether the income was actually received by him or not. The trust need to be

registered under the tax laws and also needs to file tax returns for the assessable income

generated by it.

3. Describe forecast returns and set up and describe a simple table over several years for

similar amounts. Discuss in 50 to 80 words.

Forecasting of returns are done by business for the purpose of planning for the revenue and

profits which can be generated for the future period. There are numerous methods which can be

used for the purpose of forecasting returns for a business such as moving average method,

Delphi method and similar other methods as well. A table showing forecasted returns for the

years 2020 is shown using moving average method.

Return forecast using 3 years Moving Average Method

Year Returns Forecasts

2015 1000

2016 1200

2017 1500

2018 2000 1233.33

2019 2100 1566.67

2020 1866.67

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 2 of 17

4. Describe (150 to 180 words) how NFP sector organisations adhere to government financial

policies where the preparation of statutory returns are required.

The tax obligations for NFP Sector businesses which are operating in Australia may cover goods

and services tax(GST), income tax, land tax and in addition to this NFP sectors are also not

eligible for rebates and deductions. A not For Profit seeking business are not eligible for

exemptions which are allowed to other business and they also need to file tax returns on their

assessable income. However, it must be considered that the rate at which taxes are charged on

such businesses are lower than taxes charged on other businesses. The ATO specifies the NFP

businesses on the basis of the activities which are carried on by such businesses. It is to be noted

that the provisions which are stated by ATO would be considered in case any rebates or

exemptions are applicable to such a business.

5. Your client is XYZ company. After discussions it is identified they require a spreadsheet

summarising the repayment amounts and current balance for a long-term loan of $500,000

to be repaid over eight years at a rate of 10% per annum. They are interested in business

information that will show the amount they need to repay each year.

Show the calculations required for the loan.

Prepare the spreadsheet for the loan. Include a summary section to comment on the table.

Round the initial opening balance of the loan up to the nearest dollar and round up to

present values in whole dollars.

Year

s Particulars

Principal

Payment

Interest

Payment

Repayment

Amount

Balance

Amount

1

Loan

repayment 62500 50000 112500 437500

2

Loan

repayment 62500 43750 106250 375000

3

Loan

repayment 62500 37500 100000 312500

4

Loan

repayment 62500 31250 93750 250000

5

Loan

repayment 62500 25000 87500 187500

6

Loan

repayment 62500 18750 81250 125000

7

Loan

repayment 62500 12500 75000 62500

8

Loan

repayment 62500 6250 68750 0

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 3 of 17

policies where the preparation of statutory returns are required.

The tax obligations for NFP Sector businesses which are operating in Australia may cover goods

and services tax(GST), income tax, land tax and in addition to this NFP sectors are also not

eligible for rebates and deductions. A not For Profit seeking business are not eligible for

exemptions which are allowed to other business and they also need to file tax returns on their

assessable income. However, it must be considered that the rate at which taxes are charged on

such businesses are lower than taxes charged on other businesses. The ATO specifies the NFP

businesses on the basis of the activities which are carried on by such businesses. It is to be noted

that the provisions which are stated by ATO would be considered in case any rebates or

exemptions are applicable to such a business.

5. Your client is XYZ company. After discussions it is identified they require a spreadsheet

summarising the repayment amounts and current balance for a long-term loan of $500,000

to be repaid over eight years at a rate of 10% per annum. They are interested in business

information that will show the amount they need to repay each year.

Show the calculations required for the loan.

Prepare the spreadsheet for the loan. Include a summary section to comment on the table.

Round the initial opening balance of the loan up to the nearest dollar and round up to

present values in whole dollars.

Year

s Particulars

Principal

Payment

Interest

Payment

Repayment

Amount

Balance

Amount

1

Loan

repayment 62500 50000 112500 437500

2

Loan

repayment 62500 43750 106250 375000

3

Loan

repayment 62500 37500 100000 312500

4

Loan

repayment 62500 31250 93750 250000

5

Loan

repayment 62500 25000 87500 187500

6

Loan

repayment 62500 18750 81250 125000

7

Loan

repayment 62500 12500 75000 62500

8

Loan

repayment 62500 6250 68750 0

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 3 of 17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6. List the four categories that client’s business performance objectives can be set up as.

The four categories for measuring clients businesses performance objectives can be set up with

the help of

Reports generated by the business

Meetings conducted with the management

Presentation made by the client

Documenting procedures

7. What does GPFRU’s mean? List three potential users.

GPFRU stands for general purpose financial reporting framework which is used for reporting

financial information and effectively present the information so that the users are able to

understand and interpret the same. The potential users of the framework are corporate houses,

financial institutions, banks, potential investors.

8. What type of clients can expect state and territory charges? Discuss in 50 to 80 words.

The clients which can expect states and territory charges are clients engaging in gambling or

horse racing. In addition to this, some clients who are covered under Charitable Collection Act

2003 would also be considered for this aspect.

9. How can the amount of taxes and charges on land be calculated? Discuss in 50 to 80 words.

The taxes and charges which are associated with land can be computed by firstly estimating the

value of the land and on the basis of the value of land annual fees or charges which is associated

with the land. The rates levied which is levied by the government also must be considered for

computing annual charges.

10. What practices should these businesses and those who pay Commonwealth taxes complete?

Discuss in 80 to 100 words.

Common wealth taxes are taxes which are paid between state and territory and such taxes are

paid for the public services which is provided by the government and also includes transfer

payments which is made by the government. These types of taxes include stamp duty, payroll

taxes and similar other types of taxes.

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 4 of 17

The four categories for measuring clients businesses performance objectives can be set up with

the help of

Reports generated by the business

Meetings conducted with the management

Presentation made by the client

Documenting procedures

7. What does GPFRU’s mean? List three potential users.

GPFRU stands for general purpose financial reporting framework which is used for reporting

financial information and effectively present the information so that the users are able to

understand and interpret the same. The potential users of the framework are corporate houses,

financial institutions, banks, potential investors.

8. What type of clients can expect state and territory charges? Discuss in 50 to 80 words.

The clients which can expect states and territory charges are clients engaging in gambling or

horse racing. In addition to this, some clients who are covered under Charitable Collection Act

2003 would also be considered for this aspect.

9. How can the amount of taxes and charges on land be calculated? Discuss in 50 to 80 words.

The taxes and charges which are associated with land can be computed by firstly estimating the

value of the land and on the basis of the value of land annual fees or charges which is associated

with the land. The rates levied which is levied by the government also must be considered for

computing annual charges.

10. What practices should these businesses and those who pay Commonwealth taxes complete?

Discuss in 80 to 100 words.

Common wealth taxes are taxes which are paid between state and territory and such taxes are

paid for the public services which is provided by the government and also includes transfer

payments which is made by the government. These types of taxes include stamp duty, payroll

taxes and similar other types of taxes.

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 4 of 17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Part 2

1. Use the supplied CIF to answer the questions listed.

a. Where can information about client objectives be found?

The information which is related to clients objectives is included in financial information

sought section of the client information form.

b. Describe (80 to 100 words) how the Type of business section on the supplied CIF is

relevant to the client’s legal and financial requirements, explain how this is important to

taxation.

The type of businesses which is shown in the Customer Information file for the customer is

shown to be associated with building services. The client information file shows that the

client is a sole proprietor and the computation of taxes depends on the services which is

provided by the proprietor and also the revenue which is generated by the proprietor. There

are certain regulations which are applicable to construction business and the same

provisions needs to be considered in tax computations as well.

ABC Financial Management

Client Information Form

Surname Citizen

First name John

Employment title Manager

Other key staff

Type of business Building services Sole proprietor

Financial Provide ongoing financial management especially in the reduction of annual

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 5 of 17

1. Use the supplied CIF to answer the questions listed.

a. Where can information about client objectives be found?

The information which is related to clients objectives is included in financial information

sought section of the client information form.

b. Describe (80 to 100 words) how the Type of business section on the supplied CIF is

relevant to the client’s legal and financial requirements, explain how this is important to

taxation.

The type of businesses which is shown in the Customer Information file for the customer is

shown to be associated with building services. The client information file shows that the

client is a sole proprietor and the computation of taxes depends on the services which is

provided by the proprietor and also the revenue which is generated by the proprietor. There

are certain regulations which are applicable to construction business and the same

provisions needs to be considered in tax computations as well.

ABC Financial Management

Client Information Form

Surname Citizen

First name John

Employment title Manager

Other key staff

Type of business Building services Sole proprietor

Financial Provide ongoing financial management especially in the reduction of annual

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 5 of 17

information sought income tax and checking goods and services tax (GST) and other legislative

reports.

Size Four full-time or equivalent staff.

Business assets $550,000 Tools, vehicles, building inventories

Revenue $ 1 Million

Expenses $ 680,000

Cash flow –$50,000

Number of years

operating

Current

information

Internal reports by part-time administrative staff. Includes fortnightly payroll

and payment of accounts and banking.

2. You have had discussions with the client who has explained that you were recommended

through a colleague in the NFP sector who you have been providing acquittal services to.

Describe the different types of financial options that are available for different clients related

to the provision of business performance information. Discuss in 150 to 180 words.

3. Prepare an example of a forecast versus actual for XYZ company for an operational project.

Include columns to show forecast returns versus actual on a multi period report. Include a

summary section.

In the books of XYZ ltd

Peri

od

Forecasted

Return

Actual

Return

Varian

ce Summary Statement

Year

1 50000 45000 -5000 The actual return is lower than budgeted return

Year

2 55000 60000 5000

The actual return is shown to be higher than

budgeted return

Year

3 60500 59000 -1500 The actual return is lower than budgeted return

Year

4 66550 70000 3450

The actual return is shown to be higher than

budgeted return

Year 73205 75000 1795 The actual return is shown to be higher than

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 6 of 17

reports.

Size Four full-time or equivalent staff.

Business assets $550,000 Tools, vehicles, building inventories

Revenue $ 1 Million

Expenses $ 680,000

Cash flow –$50,000

Number of years

operating

Current

information

Internal reports by part-time administrative staff. Includes fortnightly payroll

and payment of accounts and banking.

2. You have had discussions with the client who has explained that you were recommended

through a colleague in the NFP sector who you have been providing acquittal services to.

Describe the different types of financial options that are available for different clients related

to the provision of business performance information. Discuss in 150 to 180 words.

3. Prepare an example of a forecast versus actual for XYZ company for an operational project.

Include columns to show forecast returns versus actual on a multi period report. Include a

summary section.

In the books of XYZ ltd

Peri

od

Forecasted

Return

Actual

Return

Varian

ce Summary Statement

Year

1 50000 45000 -5000 The actual return is lower than budgeted return

Year

2 55000 60000 5000

The actual return is shown to be higher than

budgeted return

Year

3 60500 59000 -1500 The actual return is lower than budgeted return

Year

4 66550 70000 3450

The actual return is shown to be higher than

budgeted return

Year 73205 75000 1795 The actual return is shown to be higher than

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 6 of 17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

5 budgeted return

4. At what stage of financial management would you discover that the actual rates of returns are

significantly lower than those returns forecasted? Discuss in 30 to 50 words.

The actual returns of the business can be seen to be significantly lower than forecasted return when

comparison is made between the actual results and forecasted results of the business. Therefore, it

can be said that the evaluation of the financial performance of the business and comparison with

estimated results are done at the last stage.

5. What would be the agreed criteria and what other steps would need to be taken? Discuss in 30

to 50 words.

The management of the company needs to investigate on the causes of the variances between the

actual estimates and the budgeted estimate which was set by the management of the company for

the financial year.

6. You work for ABC financial management. Your client is XYZ company. The CEO contacts you

directly on the 1st July, thanking you for the satisfaction of current objectives in line with the

financial plan. Current objectives are reporting annual financial reports including preparing the

BAS.

The client asks that this now ceases as the finance officer will take over the duties. The client

asks that you prepare a manual to assist the finance officer in their new duties. The client also

asks that you now assist with preparing for and recording monthly governance board meetings.

a. Prepare a quarterly financial management questionnaire for the current quarter to

show the current and proposed new objectives as if they had been discovered as a

result of the quarterly questionnaire process.

b. Prepare a file note to properly record the main points of your phone call with the

CEO.

7. Your client contact is the finance officer of XYZ company. They phone you briefly on 1.10.20xx

and say that the financial position detail report contains too much detail. They also state that

there is no explanation for the changes in financial position even though they know that

several new desks were purchased in the previous quarter because they recorded them on the

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 7 of 17

4. At what stage of financial management would you discover that the actual rates of returns are

significantly lower than those returns forecasted? Discuss in 30 to 50 words.

The actual returns of the business can be seen to be significantly lower than forecasted return when

comparison is made between the actual results and forecasted results of the business. Therefore, it

can be said that the evaluation of the financial performance of the business and comparison with

estimated results are done at the last stage.

5. What would be the agreed criteria and what other steps would need to be taken? Discuss in 30

to 50 words.

The management of the company needs to investigate on the causes of the variances between the

actual estimates and the budgeted estimate which was set by the management of the company for

the financial year.

6. You work for ABC financial management. Your client is XYZ company. The CEO contacts you

directly on the 1st July, thanking you for the satisfaction of current objectives in line with the

financial plan. Current objectives are reporting annual financial reports including preparing the

BAS.

The client asks that this now ceases as the finance officer will take over the duties. The client

asks that you prepare a manual to assist the finance officer in their new duties. The client also

asks that you now assist with preparing for and recording monthly governance board meetings.

a. Prepare a quarterly financial management questionnaire for the current quarter to

show the current and proposed new objectives as if they had been discovered as a

result of the quarterly questionnaire process.

b. Prepare a file note to properly record the main points of your phone call with the

CEO.

7. Your client contact is the finance officer of XYZ company. They phone you briefly on 1.10.20xx

and say that the financial position detail report contains too much detail. They also state that

there is no explanation for the changes in financial position even though they know that

several new desks were purchased in the previous quarter because they recorded them on the

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 7 of 17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

asset register. Prepare a file note to show how the feedback will be incorporated into services

to the client.

8. Your client is XYZ company. They phone you on 15.11.20xx and question what has caused them

to pay higher than normal GST. Your investigation shows that the income amount included the

previous year’s income. Record a file note to implement improved customer services.

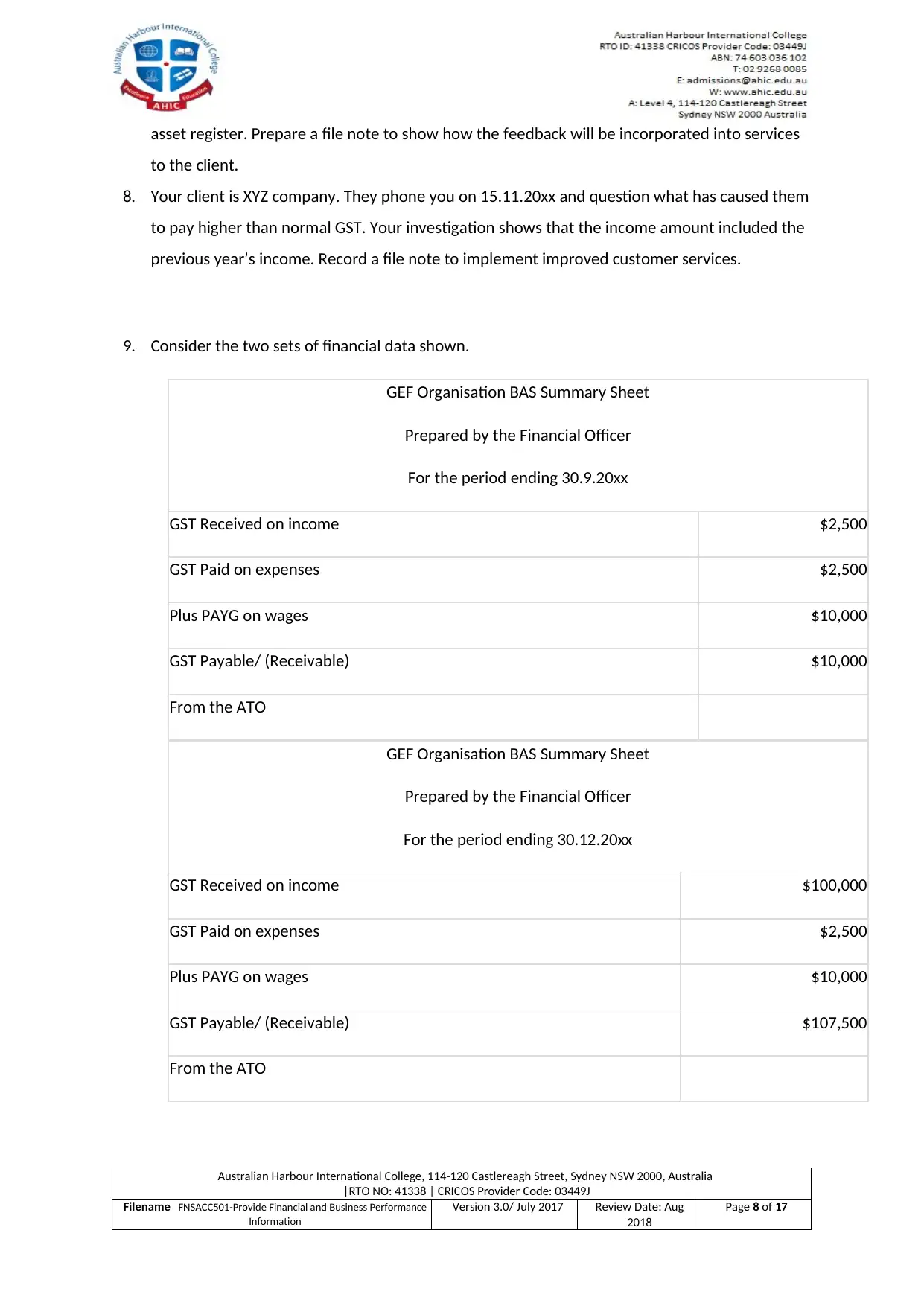

9. Consider the two sets of financial data shown.

GEF Organisation BAS Summary Sheet

Prepared by the Financial Officer

For the period ending 30.9.20xx

GST Received on income $2,500

GST Paid on expenses $2,500

Plus PAYG on wages $10,000

GST Payable/ (Receivable) $10,000

From the ATO

GEF Organisation BAS Summary Sheet

Prepared by the Financial Officer

For the period ending 30.12.20xx

GST Received on income $100,000

GST Paid on expenses $2,500

Plus PAYG on wages $10,000

GST Payable/ (Receivable) $107,500

From the ATO

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 8 of 17

to the client.

8. Your client is XYZ company. They phone you on 15.11.20xx and question what has caused them

to pay higher than normal GST. Your investigation shows that the income amount included the

previous year’s income. Record a file note to implement improved customer services.

9. Consider the two sets of financial data shown.

GEF Organisation BAS Summary Sheet

Prepared by the Financial Officer

For the period ending 30.9.20xx

GST Received on income $2,500

GST Paid on expenses $2,500

Plus PAYG on wages $10,000

GST Payable/ (Receivable) $10,000

From the ATO

GEF Organisation BAS Summary Sheet

Prepared by the Financial Officer

For the period ending 30.12.20xx

GST Received on income $100,000

GST Paid on expenses $2,500

Plus PAYG on wages $10,000

GST Payable/ (Receivable) $107,500

From the ATO

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 8 of 17

a. What would be of interest to the financial manager responsible for preparing the BAS

based on the reports? Discuss in 30 to 50 words.

The GST Payable of a higher amount would be beneficial for the business as this would

provide more deductions to the business and allow the management of the company to

claim more deductions and thereby creating a favorable impact on the final price which is

offered to the consumers.

b. For what reason would this be of interest? Discuss in 30 to 50 words.

This would be creating a favorable impact on the price which is charged by the business on

the final price which is established by the management of the company.

c. What steps should the financial manager take in this scenario? Discuss in 50 to 80

words.

The step which the finance manager needs to take is to ensure that the financial information

which is shown in the BAS Statement is appropriate and appropriate submit the same to

ATO for consideration.

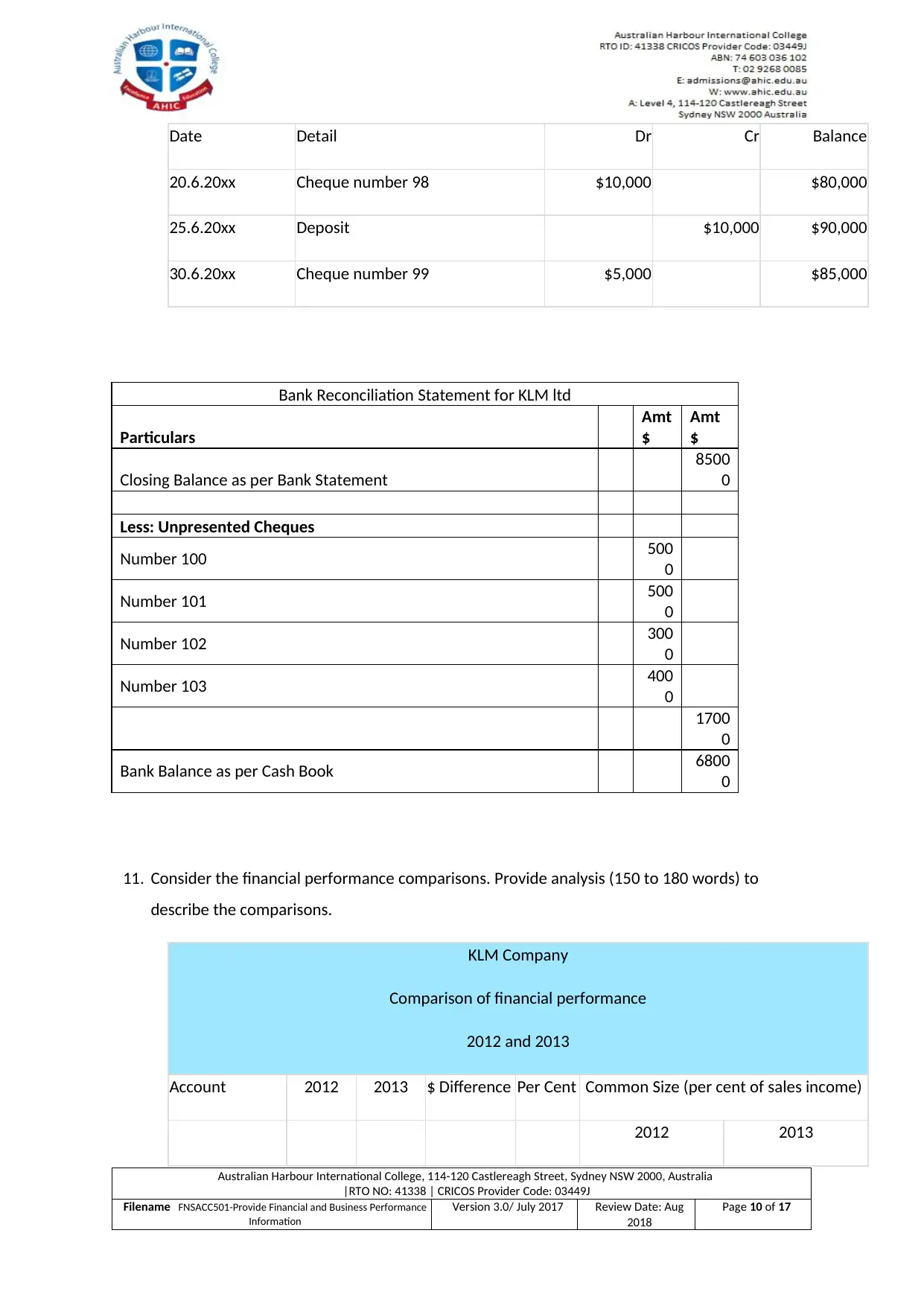

10.Use the following information to prepare a bank reconciliation for KLM company.

Closing account balance 30.6.20xx, $68,000

Unpresented cheques:

Number 100 $5,000

Number 101 $5,000

Number 102 $3,000

Number 103 $4,000

KLM Bank Statement extract

June 20xx

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 9 of 17

based on the reports? Discuss in 30 to 50 words.

The GST Payable of a higher amount would be beneficial for the business as this would

provide more deductions to the business and allow the management of the company to

claim more deductions and thereby creating a favorable impact on the final price which is

offered to the consumers.

b. For what reason would this be of interest? Discuss in 30 to 50 words.

This would be creating a favorable impact on the price which is charged by the business on

the final price which is established by the management of the company.

c. What steps should the financial manager take in this scenario? Discuss in 50 to 80

words.

The step which the finance manager needs to take is to ensure that the financial information

which is shown in the BAS Statement is appropriate and appropriate submit the same to

ATO for consideration.

10.Use the following information to prepare a bank reconciliation for KLM company.

Closing account balance 30.6.20xx, $68,000

Unpresented cheques:

Number 100 $5,000

Number 101 $5,000

Number 102 $3,000

Number 103 $4,000

KLM Bank Statement extract

June 20xx

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 9 of 17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Date Detail Dr Cr Balance

20.6.20xx Cheque number 98 $10,000 $80,000

25.6.20xx Deposit $10,000 $90,000

30.6.20xx Cheque number 99 $5,000 $85,000

Bank Reconciliation Statement for KLM ltd

Particulars

Amt

$

Amt

$

Closing Balance as per Bank Statement

8500

0

Less: Unpresented Cheques

Number 100 500

0

Number 101 500

0

Number 102 300

0

Number 103 400

0

1700

0

Bank Balance as per Cash Book 6800

0

11. Consider the financial performance comparisons. Provide analysis (150 to 180 words) to

describe the comparisons.

KLM Company

Comparison of financial performance

2012 and 2013

Account 2012 2013 $ Difference Per Cent Common Size (per cent of sales income)

2012 2013

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 10 of 17

20.6.20xx Cheque number 98 $10,000 $80,000

25.6.20xx Deposit $10,000 $90,000

30.6.20xx Cheque number 99 $5,000 $85,000

Bank Reconciliation Statement for KLM ltd

Particulars

Amt

$

Amt

$

Closing Balance as per Bank Statement

8500

0

Less: Unpresented Cheques

Number 100 500

0

Number 101 500

0

Number 102 300

0

Number 103 400

0

1700

0

Bank Balance as per Cash Book 6800

0

11. Consider the financial performance comparisons. Provide analysis (150 to 180 words) to

describe the comparisons.

KLM Company

Comparison of financial performance

2012 and 2013

Account 2012 2013 $ Difference Per Cent Common Size (per cent of sales income)

2012 2013

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 10 of 17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sales Income $230,000 $320,000 $90,000 39 100 100

Cost of sales $115,000 $165,000 $50,000 43 50 51.6

Wage Costs $30,000 $45,000 $15,000 50 13 14

Transport Costs $25,000 $35,000 $10,000 40 10.9 10.9

Marketing Costs $15,000 $20,000 $5,000 33 6.5 6.3

Total costs $185,000 $265,000 $80,000 43 80.4 82.8

Profit $45,000 $55,000 $10,000 22 19.6 17.2

The above analysis which is presented in the table above shows the financial performance of the

business for the year 2013. The overall sales of the business is shown to have enhanced which is a

positive sign for the business. In addition to this, the management has also considered the figure of

sales for common size analysis. The cost of sales has also increased as the overall sales of the

business has increased. The cost of sales forms 51.6% of the total sales figure which I a favorable

sign. The total cost of the business is shown to be around 80.4% of the total sales in 2012 while the

same is shown to be 82.8% which shows that there has been a marginal increase in sales for the

business. The profit has increased but in marginal terms the same has declined and this shows that

the management of the business needs to reduce the overall costs of the business so that overall

profits of the business can be further enhanced.

12. Consider the supplied cost–benefit analysis.

a. Complete the cash flows in the table.

b. Considering the effect on cash flow, is the analysis worthwhile? Discuss in 30 to 50

words.

QRS Co. Motor vehicle expense account

Cost–benefit analysis using

Budget versus Actual Variance Reporting

October 20xx

Month Existing Estimate Change to Effect on:

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 11 of 17

Cost of sales $115,000 $165,000 $50,000 43 50 51.6

Wage Costs $30,000 $45,000 $15,000 50 13 14

Transport Costs $25,000 $35,000 $10,000 40 10.9 10.9

Marketing Costs $15,000 $20,000 $5,000 33 6.5 6.3

Total costs $185,000 $265,000 $80,000 43 80.4 82.8

Profit $45,000 $55,000 $10,000 22 19.6 17.2

The above analysis which is presented in the table above shows the financial performance of the

business for the year 2013. The overall sales of the business is shown to have enhanced which is a

positive sign for the business. In addition to this, the management has also considered the figure of

sales for common size analysis. The cost of sales has also increased as the overall sales of the

business has increased. The cost of sales forms 51.6% of the total sales figure which I a favorable

sign. The total cost of the business is shown to be around 80.4% of the total sales in 2012 while the

same is shown to be 82.8% which shows that there has been a marginal increase in sales for the

business. The profit has increased but in marginal terms the same has declined and this shows that

the management of the business needs to reduce the overall costs of the business so that overall

profits of the business can be further enhanced.

12. Consider the supplied cost–benefit analysis.

a. Complete the cash flows in the table.

b. Considering the effect on cash flow, is the analysis worthwhile? Discuss in 30 to 50

words.

QRS Co. Motor vehicle expense account

Cost–benefit analysis using

Budget versus Actual Variance Reporting

October 20xx

Month Existing Estimate Change to Effect on:

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 11 of 17

Income Expenses Cash Flow

July $700 -$700

Aug $750 -$750

Sept $800 -$800

Oct $900 -$900

Nov $950 $830

Dec $800 $680

Jan $800 $680

Feb $800 $680

Mar $800 $680

Apr $800 $680

May $800 $680

June $800 $680

Total $9,700 $5,590

13. Which ratio is used to measure financial stability? Discuss in 80 to 100 words.

The ratio which is considered to be important for measuring the financial stability of the business is

known as liquidity ratios. The most important estimate for the liquidity ratio is current ratio as the

same is closely associated with the ability of the business to meet with current obligations of the

business. The current ratio also depicts the liquidity position of the business and the ability of the

business to manage and invest in projects.

14. Use the financial statement to calculate the debt ratio including a discussion (80 to 100 words).

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 12 of 17

July $700 -$700

Aug $750 -$750

Sept $800 -$800

Oct $900 -$900

Nov $950 $830

Dec $800 $680

Jan $800 $680

Feb $800 $680

Mar $800 $680

Apr $800 $680

May $800 $680

June $800 $680

Total $9,700 $5,590

13. Which ratio is used to measure financial stability? Discuss in 80 to 100 words.

The ratio which is considered to be important for measuring the financial stability of the business is

known as liquidity ratios. The most important estimate for the liquidity ratio is current ratio as the

same is closely associated with the ability of the business to meet with current obligations of the

business. The current ratio also depicts the liquidity position of the business and the ability of the

business to manage and invest in projects.

14. Use the financial statement to calculate the debt ratio including a discussion (80 to 100 words).

Australian Harbour International College, 114-120 Castlereagh Street, Sydney NSW 2000, Australia

|RTO NO: 41338 | CRICOS Provider Code: 03449J

Filename FNSACC501-Provide Financial and Business Performance

Information

Version 3.0/ July 2017 Review Date: Aug

2018

Page 12 of 17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.