FNSACC501: Financial and Business Performance Report - Kogan Ltd

VerifiedAdded on 2023/06/11

|31

|7008

|336

Report

AI Summary

This document presents a comprehensive analysis of financial and business performance, focusing on Kogan Ltd. It includes an assessment of tax liabilities, wealth accumulation strategies, asset development, and legal and financial requirements. The report also covers insurance needs, tax issues, and implementation strategies for business objectives. Furthermore, it emphasizes the importance of continuous financial review, the accuracy of financial data, and provides vertical and horizontal analysis of Kogan Ltd's income statement. The analysis extends to cash flow statements, profitability, and corporate governance principles. The document also addresses risk management, investment options, different types of taxes, allowable deductions, and financial forecasting techniques. It concludes with a discussion on legal rights, financial information formats, significant acts, important reports, and the role of financial markets and treasury.

Running head: DIPLOMA OF ACCOUNTING

Diploma of Accounting

Name of the Student:

Name of the University:

Author’s Note

Diploma of Accounting

Name of the Student:

Name of the University:

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

DIPLOMA OF ACCOUNTING

Table of Contents

Assessment 1...................................................................................................................................4

Part 1................................................................................................................................................4

Insurance Needs...............................................................................................................................7

Implementation Strategies...............................................................................................................7

Part 2................................................................................................................................................8

Importance of Continuous Review of Financial Position................................................................8

Completeness of the Annual Report of Kogan ltd...........................................................................8

Changes in Financial Position.........................................................................................................8

Assessment 2...................................................................................................................................9

Accuracy of the Financial Data.......................................................................................................9

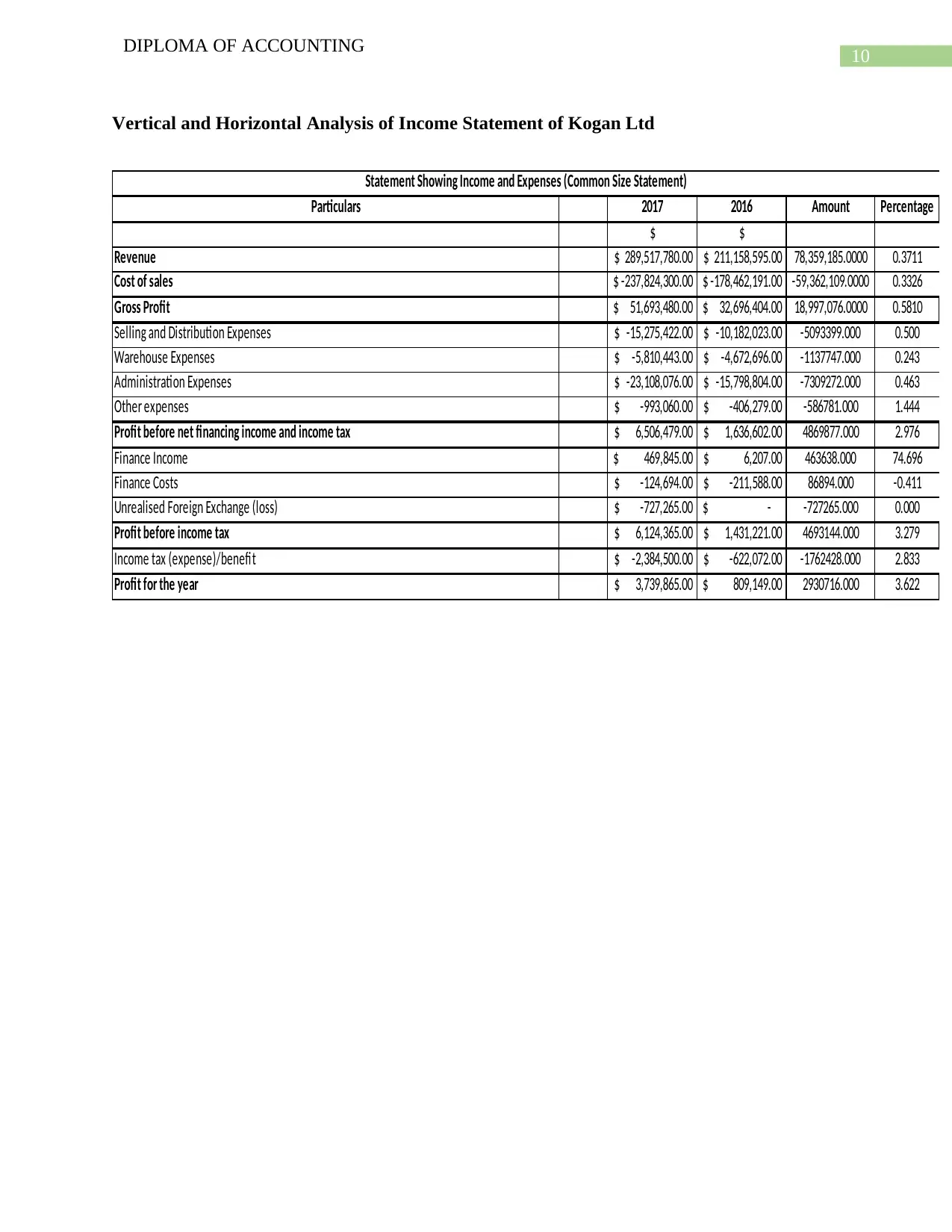

Vertical and Horizontal Analysis of Income Statement of Kogan Ltd..........................................10

Profit and Loss Statement and Debt Equity Ratio.........................................................................11

Problems Faced by Kogan Ltd......................................................................................................12

Analysis of Cash flow Statement...................................................................................................12

Analysis of Performance of the Business......................................................................................12

Increase in Profits..........................................................................................................................13

Funds Requirement........................................................................................................................13

Assignment 3.................................................................................................................................14

Corporate Governance Principles..................................................................................................16

DIPLOMA OF ACCOUNTING

Table of Contents

Assessment 1...................................................................................................................................4

Part 1................................................................................................................................................4

Insurance Needs...............................................................................................................................7

Implementation Strategies...............................................................................................................7

Part 2................................................................................................................................................8

Importance of Continuous Review of Financial Position................................................................8

Completeness of the Annual Report of Kogan ltd...........................................................................8

Changes in Financial Position.........................................................................................................8

Assessment 2...................................................................................................................................9

Accuracy of the Financial Data.......................................................................................................9

Vertical and Horizontal Analysis of Income Statement of Kogan Ltd..........................................10

Profit and Loss Statement and Debt Equity Ratio.........................................................................11

Problems Faced by Kogan Ltd......................................................................................................12

Analysis of Cash flow Statement...................................................................................................12

Analysis of Performance of the Business......................................................................................12

Increase in Profits..........................................................................................................................13

Funds Requirement........................................................................................................................13

Assignment 3.................................................................................................................................14

Corporate Governance Principles..................................................................................................16

2

DIPLOMA OF ACCOUNTING

Risk faced by the Company...........................................................................................................17

Risk Management Strategies.........................................................................................................18

Investment Options........................................................................................................................18

Assessment 4.................................................................................................................................19

Different Types of Taxes...............................................................................................................19

Deductions allowable to a business...............................................................................................20

Rules for Claiming an Expenses as Deduction..............................................................................21

Deduction for Travel Expenses.....................................................................................................21

Simplified Depreciation Rules.......................................................................................................21

Tax Implications of Prepaid expenses...........................................................................................22

Time limit for Amending Tax Assessment....................................................................................23

Capital Gain Tax Concessions.......................................................................................................23

PAYG Installments........................................................................................................................23

GST Concessions...........................................................................................................................24

Areas Causing issues in Taxation..................................................................................................24

Financial Forecasting Techniques.................................................................................................24

Financial Risks...............................................................................................................................24

Managing Risks.............................................................................................................................25

Legal Rights of a Client.................................................................................................................25

Formats Used for Depicting Financial Information.......................................................................26

DIPLOMA OF ACCOUNTING

Risk faced by the Company...........................................................................................................17

Risk Management Strategies.........................................................................................................18

Investment Options........................................................................................................................18

Assessment 4.................................................................................................................................19

Different Types of Taxes...............................................................................................................19

Deductions allowable to a business...............................................................................................20

Rules for Claiming an Expenses as Deduction..............................................................................21

Deduction for Travel Expenses.....................................................................................................21

Simplified Depreciation Rules.......................................................................................................21

Tax Implications of Prepaid expenses...........................................................................................22

Time limit for Amending Tax Assessment....................................................................................23

Capital Gain Tax Concessions.......................................................................................................23

PAYG Installments........................................................................................................................23

GST Concessions...........................................................................................................................24

Areas Causing issues in Taxation..................................................................................................24

Financial Forecasting Techniques.................................................................................................24

Financial Risks...............................................................................................................................24

Managing Risks.............................................................................................................................25

Legal Rights of a Client.................................................................................................................25

Formats Used for Depicting Financial Information.......................................................................26

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

DIPLOMA OF ACCOUNTING

Significant Acts.............................................................................................................................26

Important Reports..........................................................................................................................26

Cash Flow Statement Analysis......................................................................................................27

Budgeting in Business...................................................................................................................27

Financial Markets..........................................................................................................................28

Treasury’s Role..............................................................................................................................28

Reference.......................................................................................................................................29

DIPLOMA OF ACCOUNTING

Significant Acts.............................................................................................................................26

Important Reports..........................................................................................................................26

Cash Flow Statement Analysis......................................................................................................27

Budgeting in Business...................................................................................................................27

Financial Markets..........................................................................................................................28

Treasury’s Role..............................................................................................................................28

Reference.......................................................................................................................................29

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

DIPLOMA OF ACCOUNTING

Assessment 1

Part 1

Tax Liabilities reduction goals

The information which is presented in this assessment is obtained by a process of

interview which is conducted with the board of directors of the business. The board of directors

of the company are responsible for formulation of policies and different strategies of the business

and therefore they are the best persons to get information about the working of the company.

The tax liabilities of the company as shown in the annual report for the year 2017 is

shown to be $ 2,384,500 which is shown in the financial statements. The tax liability of Kogan

Ltd has increased considerably when the tax liability of the business is considered for the

previous year. The tax liability of the company is shown to be $ 622,072 as per the financial

statements of 2016. The tax expenses which is shown in the income statements of the company is

comprised of both current tax expenses and deferred tax expenses of the business. The tax

reduction policies of the business involve effective optimization of taxes as per the policy of the

management1. The management of the company has already employed competent accountants

and tax advisor so as to ensure that all the provisions and legal requirement are followed when

the business is assessing the tax which the business needs to bear at the end of the financial year.

The GST components of the business which are concerned with operating and investing

activities which are either to be paid or received from the ATO is shown in the operating cash

1Kogancorporate.com. (2018). [online] Available at:

https://www.kogancorporate.com/document/73c43b2fa1cd4706851051ddaaced964/

KOG0004%20AR17_PFO_web.pdf [Accessed 29 Jun. 2018].

DIPLOMA OF ACCOUNTING

Assessment 1

Part 1

Tax Liabilities reduction goals

The information which is presented in this assessment is obtained by a process of

interview which is conducted with the board of directors of the business. The board of directors

of the company are responsible for formulation of policies and different strategies of the business

and therefore they are the best persons to get information about the working of the company.

The tax liabilities of the company as shown in the annual report for the year 2017 is

shown to be $ 2,384,500 which is shown in the financial statements. The tax liability of Kogan

Ltd has increased considerably when the tax liability of the business is considered for the

previous year. The tax liability of the company is shown to be $ 622,072 as per the financial

statements of 2016. The tax expenses which is shown in the income statements of the company is

comprised of both current tax expenses and deferred tax expenses of the business. The tax

reduction policies of the business involve effective optimization of taxes as per the policy of the

management1. The management of the company has already employed competent accountants

and tax advisor so as to ensure that all the provisions and legal requirement are followed when

the business is assessing the tax which the business needs to bear at the end of the financial year.

The GST components of the business which are concerned with operating and investing

activities which are either to be paid or received from the ATO is shown in the operating cash

1Kogancorporate.com. (2018). [online] Available at:

https://www.kogancorporate.com/document/73c43b2fa1cd4706851051ddaaced964/

KOG0004%20AR17_PFO_web.pdf [Accessed 29 Jun. 2018].

5

DIPLOMA OF ACCOUNTING

flows of the business. The management of the company will also be availing the various

deductions which are available to the company if certain conditions are met.

Wealth Accumulation

As per the annual report of Kogan ltd, the management of the company focuses on

building up effective customer relationship and also improve the quality of the product which is

provided by the company. In addition to this, the management is committed towards generation

of wealth as per the annual report of the business. The most important role in the accumulation of

wealth for the business is that of the management who are involved in the planning process of

the business2. The wealth accumulation of the business can be clearly identified from the annual

report of the business which shows the asset such as property plants and equipment which are

under construction as shown in the notes to account section of the annual report3. As per the

annual report of the company for the year 2017, the annual report specifies that the effective

performance of the business during the year. Kogan company is engaged in a variety of business

and therefore has an effective portfolio of the services which is provided by the company

(Kogancorporate.com. 2018).

Asset Development

The assets which the company possess in the annual report of the business as per the year

2017. The assets of the business are shown in the profit and loss statements as prepared by the

business. The business has purchased assets during the year as shown in the notes to accounts of

the company. The business also had purchased assets from Dick Smith in the year 2017. The

2 McKernan, Signe-Mary, Caroline Ratcliffe, C. Eugene Steuerle, and Sisi Zhang. Less than equal: Racial

disparities in wealth accumulation. Washington, DC: Urban Institute, 2013.

3 Hills, John. Wealth in the UK: distribution, accumulation, and policy. Oxford University Press, 2013.

DIPLOMA OF ACCOUNTING

flows of the business. The management of the company will also be availing the various

deductions which are available to the company if certain conditions are met.

Wealth Accumulation

As per the annual report of Kogan ltd, the management of the company focuses on

building up effective customer relationship and also improve the quality of the product which is

provided by the company. In addition to this, the management is committed towards generation

of wealth as per the annual report of the business. The most important role in the accumulation of

wealth for the business is that of the management who are involved in the planning process of

the business2. The wealth accumulation of the business can be clearly identified from the annual

report of the business which shows the asset such as property plants and equipment which are

under construction as shown in the notes to account section of the annual report3. As per the

annual report of the company for the year 2017, the annual report specifies that the effective

performance of the business during the year. Kogan company is engaged in a variety of business

and therefore has an effective portfolio of the services which is provided by the company

(Kogancorporate.com. 2018).

Asset Development

The assets which the company possess in the annual report of the business as per the year

2017. The assets of the business are shown in the profit and loss statements as prepared by the

business. The business has purchased assets during the year as shown in the notes to accounts of

the company. The business also had purchased assets from Dick Smith in the year 2017. The

2 McKernan, Signe-Mary, Caroline Ratcliffe, C. Eugene Steuerle, and Sisi Zhang. Less than equal: Racial

disparities in wealth accumulation. Washington, DC: Urban Institute, 2013.

3 Hills, John. Wealth in the UK: distribution, accumulation, and policy. Oxford University Press, 2013.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

DIPLOMA OF ACCOUNTING

business has shown significant amount of profit as shown in the annual report of the company for

the year 2017 which has increased tremendously in comparison to previous year’s estimate

which shows that the management of the business is focused towards generation of wealth for

the shareholders of the company.

Legal and Financial Requirements

The legal requirement of the business focuses on the compliance of all the legal

regulation which is applicable to the company as introduced by the government. In addition to

this, the annual reports of the business show that during the ordinary course of business, the

company has faced law suits which are other than for tax rules compliance. The code of conduct

of the business and management policies of the business are all governed by the legal

requirement of the business.

The financial regulations of the business are as per the standards of accounting which are

established by AASB which are applicable on the business. The other common accounting

policies and conventions which are followed by other businesses belonging to the same industry

is also applicable to the company.

Personal Investment Strategies

As per the cash flow statement which is prepared for Kogan ltd, the business has made

investment in intangibles. In addition to this, the management of the company is expecting

investments in the business. The strategies of the business is to maximize the investments of the

business. The management expects to increase the investments of the company in the coming

year 2018.

DIPLOMA OF ACCOUNTING

business has shown significant amount of profit as shown in the annual report of the company for

the year 2017 which has increased tremendously in comparison to previous year’s estimate

which shows that the management of the business is focused towards generation of wealth for

the shareholders of the company.

Legal and Financial Requirements

The legal requirement of the business focuses on the compliance of all the legal

regulation which is applicable to the company as introduced by the government. In addition to

this, the annual reports of the business show that during the ordinary course of business, the

company has faced law suits which are other than for tax rules compliance. The code of conduct

of the business and management policies of the business are all governed by the legal

requirement of the business.

The financial regulations of the business are as per the standards of accounting which are

established by AASB which are applicable on the business. The other common accounting

policies and conventions which are followed by other businesses belonging to the same industry

is also applicable to the company.

Personal Investment Strategies

As per the cash flow statement which is prepared for Kogan ltd, the business has made

investment in intangibles. In addition to this, the management of the company is expecting

investments in the business. The strategies of the business is to maximize the investments of the

business. The management expects to increase the investments of the company in the coming

year 2018.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

DIPLOMA OF ACCOUNTING

Business Registration

In order to operate in the market, the business needs to register with the authorities. The

registration of the business needs to be handled by the legal team of the business and the

business also needs to comply with all rules and regulations of the corporation act.

Insurance Needs

The business is engaged in a variety of business, therefore the need for insurance for the

overall business is important. The insurance needs of the business are quite evident as the

business has various diversified business and certain retail and other service units might be

subjected to risks for which the business needs insurance cover.

Tax Issues and Requirements

In order to achieve the long-term goals and business objectives of the business, the

management of Kogan ltd need to comply with the legal requirements of tax. Due to the

diversified business of the company, various taxes are applicable on the company which the

business needs to consider in order to proceed with the business and overall operation of the

company.

Implementation Strategies

Strategies will be adopted by the business in order to ensure that all other strategies of the

business are effectively implemented which will be formulated by the top-level management.

The management has already as per the annual report of 2017 established different committee

which will be looking after different roles of the business. In addition to this, the management

DIPLOMA OF ACCOUNTING

Business Registration

In order to operate in the market, the business needs to register with the authorities. The

registration of the business needs to be handled by the legal team of the business and the

business also needs to comply with all rules and regulations of the corporation act.

Insurance Needs

The business is engaged in a variety of business, therefore the need for insurance for the

overall business is important. The insurance needs of the business are quite evident as the

business has various diversified business and certain retail and other service units might be

subjected to risks for which the business needs insurance cover.

Tax Issues and Requirements

In order to achieve the long-term goals and business objectives of the business, the

management of Kogan ltd need to comply with the legal requirements of tax. Due to the

diversified business of the company, various taxes are applicable on the company which the

business needs to consider in order to proceed with the business and overall operation of the

company.

Implementation Strategies

Strategies will be adopted by the business in order to ensure that all other strategies of the

business are effectively implemented which will be formulated by the top-level management.

The management has already as per the annual report of 2017 established different committee

which will be looking after different roles of the business. In addition to this, the management

8

DIPLOMA OF ACCOUNTING

can implement performance report on a monthly basis so as to review the performance of the

business as per the goals and objectives of the business.

Part 2

Importance of Continuous Review of Financial Position

In order to ensure that the financial position of the business is stable and the policies

which are formulated by the business are appropriate, continuous review of the financial position

is needed4. The market and the business environment are dynamic in nature and changes

continuously therefore it is essential that the financial position of the business is review

regularly.

Completeness of the Annual Report of Kogan ltd

The annual report of the company shows the business model of the company which is to

ensure that the best quality of online services is available to the customers. The management of

Kogan ensures that the business uses the best technologies and online technologies for retail

services. The business model of the company focuses on cutting out the benefits of the middle

men and ensure that the clients get the best deals for the products.

Changes in Financial Position

The financial position of the business is shown in the annual report of the company which

is engaged in retail business. The management of the company has brought about changes in the

technological aspect of the business and thereby also improved the operational structure of the

4 Yang, S. Alex, and John R. Birge. "How inventory is (should be) financed: Trade credit in supply chains with

demand uncertainty and costs of financial distress." (2013).

DIPLOMA OF ACCOUNTING

can implement performance report on a monthly basis so as to review the performance of the

business as per the goals and objectives of the business.

Part 2

Importance of Continuous Review of Financial Position

In order to ensure that the financial position of the business is stable and the policies

which are formulated by the business are appropriate, continuous review of the financial position

is needed4. The market and the business environment are dynamic in nature and changes

continuously therefore it is essential that the financial position of the business is review

regularly.

Completeness of the Annual Report of Kogan ltd

The annual report of the company shows the business model of the company which is to

ensure that the best quality of online services is available to the customers. The management of

Kogan ensures that the business uses the best technologies and online technologies for retail

services. The business model of the company focuses on cutting out the benefits of the middle

men and ensure that the clients get the best deals for the products.

Changes in Financial Position

The financial position of the business is shown in the annual report of the company which

is engaged in retail business. The management of the company has brought about changes in the

technological aspect of the business and thereby also improved the operational structure of the

4 Yang, S. Alex, and John R. Birge. "How inventory is (should be) financed: Trade credit in supply chains with

demand uncertainty and costs of financial distress." (2013).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

DIPLOMA OF ACCOUNTING

business. The profits of the business have significantly increased from the results of 2016. The

profit which is earned during the year is shown to be $ 3,739,865. The business should plan

aggressive strategies to further increase the revenues of the business5.

Assessment 2

Accuracy of the Financial Data

The accuracy of the financial information by consulting with the auditors of the business

and also by reviewing the auditor report which is provided in annual report of the business

during the year 2017. The auditors of the company are KPMG and the auditor report shows that

the financial statements are prepared according to corporation act 2001 and is also showing true

and fair view. The accuracy of the financial information can be confirmed by reviewing the

treatments of the various items which are shown in the annual report of the business and ensure

that the same comply with the relevant standards to which the treatments are associated with.

5 Gitman, Lawrence J., Roger Juchau, and Jack Flanagan. Principles of managerial finance. Pearson Higher

Education AU, 2015.

DIPLOMA OF ACCOUNTING

business. The profits of the business have significantly increased from the results of 2016. The

profit which is earned during the year is shown to be $ 3,739,865. The business should plan

aggressive strategies to further increase the revenues of the business5.

Assessment 2

Accuracy of the Financial Data

The accuracy of the financial information by consulting with the auditors of the business

and also by reviewing the auditor report which is provided in annual report of the business

during the year 2017. The auditors of the company are KPMG and the auditor report shows that

the financial statements are prepared according to corporation act 2001 and is also showing true

and fair view. The accuracy of the financial information can be confirmed by reviewing the

treatments of the various items which are shown in the annual report of the business and ensure

that the same comply with the relevant standards to which the treatments are associated with.

5 Gitman, Lawrence J., Roger Juchau, and Jack Flanagan. Principles of managerial finance. Pearson Higher

Education AU, 2015.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

DIPLOMA OF ACCOUNTING

Vertical and Horizontal Analysis of Income Statement of Kogan Ltd

Particulars 2017 2016 Amount Percentage

$ $

Revenue 289,517,780.00$ 211,158,595.00$ 78,359,185.0000 0.3711

Cost of sales -237,824,300.00$ -178,462,191.00$ -59,362,109.0000 0.3326

Gross Profit 51,693,480.00$ 32,696,404.00$ 18,997,076.0000 0.5810

Selling and Distribution Expenses -15,275,422.00$ -10,182,023.00$ -5093399.000 0.500

Warehouse Expenses -5,810,443.00$ -4,672,696.00$ -1137747.000 0.243

Administration Expenses -23,108,076.00$ -15,798,804.00$ -7309272.000 0.463

Other expenses -993,060.00$ -406,279.00$ -586781.000 1.444

Profit before net financing income and income tax 6,506,479.00$ 1,636,602.00$ 4869877.000 2.976

Finance Income 469,845.00$ 6,207.00$ 463638.000 74.696

Finance Costs -124,694.00$ -211,588.00$ 86894.000 -0.411

Unrealised Foreign Exchange (loss) -727,265.00$ -$ -727265.000 0.000

Profit before income tax 6,124,365.00$ 1,431,221.00$ 4693144.000 3.279

Income tax (expense)/benefit -2,384,500.00$ -622,072.00$ -1762428.000 2.833

Profit for the year 3,739,865.00$ 809,149.00$ 2930716.000 3.622

Statement Showing Income and Expenses (Common Size Statement)

DIPLOMA OF ACCOUNTING

Vertical and Horizontal Analysis of Income Statement of Kogan Ltd

Particulars 2017 2016 Amount Percentage

$ $

Revenue 289,517,780.00$ 211,158,595.00$ 78,359,185.0000 0.3711

Cost of sales -237,824,300.00$ -178,462,191.00$ -59,362,109.0000 0.3326

Gross Profit 51,693,480.00$ 32,696,404.00$ 18,997,076.0000 0.5810

Selling and Distribution Expenses -15,275,422.00$ -10,182,023.00$ -5093399.000 0.500

Warehouse Expenses -5,810,443.00$ -4,672,696.00$ -1137747.000 0.243

Administration Expenses -23,108,076.00$ -15,798,804.00$ -7309272.000 0.463

Other expenses -993,060.00$ -406,279.00$ -586781.000 1.444

Profit before net financing income and income tax 6,506,479.00$ 1,636,602.00$ 4869877.000 2.976

Finance Income 469,845.00$ 6,207.00$ 463638.000 74.696

Finance Costs -124,694.00$ -211,588.00$ 86894.000 -0.411

Unrealised Foreign Exchange (loss) -727,265.00$ -$ -727265.000 0.000

Profit before income tax 6,124,365.00$ 1,431,221.00$ 4693144.000 3.279

Income tax (expense)/benefit -2,384,500.00$ -622,072.00$ -1762428.000 2.833

Profit for the year 3,739,865.00$ 809,149.00$ 2930716.000 3.622

Statement Showing Income and Expenses (Common Size Statement)

11

DIPLOMA OF ACCOUNTING

Particulars 2017 Percentage 2016 Percentage

$ $

Revenue 289,517,780.00$ 100.00% 211,158,595.00$ 100.00%

Cost of sales -237,824,300.00$ 82.14% -178,462,191.00$ 84.52%

Gross Profit 51,693,480.00$ 17.86% 32,696,404.00$ 15.48%

Selling and Distribution Expenses -15,275,422.00$ -29.55% -10,182,023.00$ -4.82%

Warehouse Expenses -5,810,443.00$ 2.01% -4,672,696.00$ 2.21%

Administration Expenses -23,108,076.00$ 7.98% -15,798,804.00$ 7.48%

Other expenses -993,060.00$ 0.34% -406,279.00$ 0.19%

Profit before net financing income and income tax 6,506,479.00$ 2.25% 1,636,602.00$ 0.78%

Finance Income 469,845.00$ 0.16% 6,207.00$ 0.00%

Finance Costs -124,694.00$ 0.04% -211,588.00$ 0.10%

Unrealised Foreign Exchange (loss) -727,265.00$ -$

Profit before income tax 6,124,365.00$ 2.12% 1,431,221.00$ 0.68%

Income tax (expense)/benefit -2,384,500.00$ -0.82% -622,072.00$ 0.29%

Profit for the year 3,739,865.00$ 1.29% 809,149.00$ 0.38%

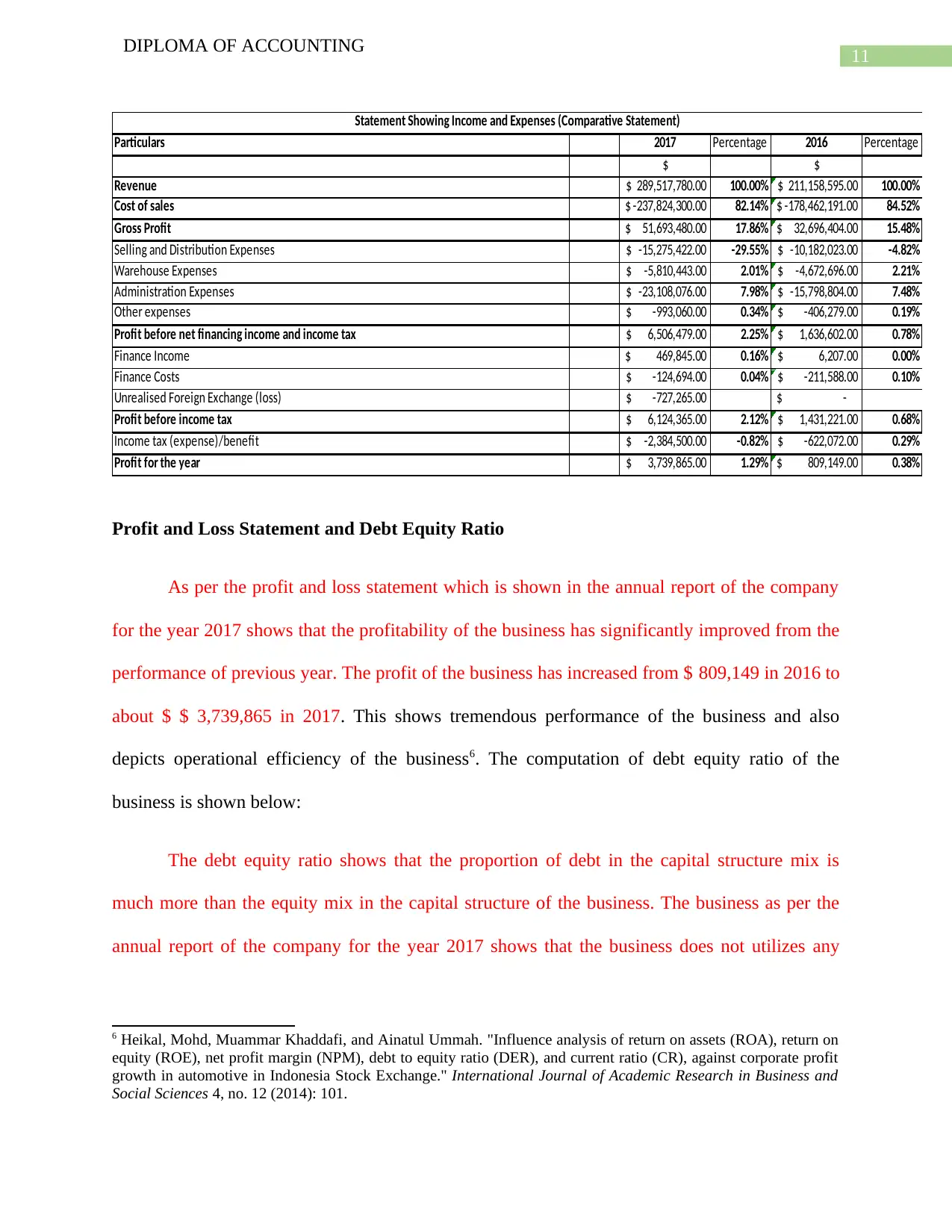

Statement Showing Income and Expenses (Comparative Statement)

Profit and Loss Statement and Debt Equity Ratio

As per the profit and loss statement which is shown in the annual report of the company

for the year 2017 shows that the profitability of the business has significantly improved from the

performance of previous year. The profit of the business has increased from $ 809,149 in 2016 to

about $ $ 3,739,865 in 2017. This shows tremendous performance of the business and also

depicts operational efficiency of the business6. The computation of debt equity ratio of the

business is shown below:

The debt equity ratio shows that the proportion of debt in the capital structure mix is

much more than the equity mix in the capital structure of the business. The business as per the

annual report of the company for the year 2017 shows that the business does not utilizes any

6 Heikal, Mohd, Muammar Khaddafi, and Ainatul Ummah. "Influence analysis of return on assets (ROA), return on

equity (ROE), net profit margin (NPM), debt to equity ratio (DER), and current ratio (CR), against corporate profit

growth in automotive in Indonesia Stock Exchange." International Journal of Academic Research in Business and

Social Sciences 4, no. 12 (2014): 101.

DIPLOMA OF ACCOUNTING

Particulars 2017 Percentage 2016 Percentage

$ $

Revenue 289,517,780.00$ 100.00% 211,158,595.00$ 100.00%

Cost of sales -237,824,300.00$ 82.14% -178,462,191.00$ 84.52%

Gross Profit 51,693,480.00$ 17.86% 32,696,404.00$ 15.48%

Selling and Distribution Expenses -15,275,422.00$ -29.55% -10,182,023.00$ -4.82%

Warehouse Expenses -5,810,443.00$ 2.01% -4,672,696.00$ 2.21%

Administration Expenses -23,108,076.00$ 7.98% -15,798,804.00$ 7.48%

Other expenses -993,060.00$ 0.34% -406,279.00$ 0.19%

Profit before net financing income and income tax 6,506,479.00$ 2.25% 1,636,602.00$ 0.78%

Finance Income 469,845.00$ 0.16% 6,207.00$ 0.00%

Finance Costs -124,694.00$ 0.04% -211,588.00$ 0.10%

Unrealised Foreign Exchange (loss) -727,265.00$ -$

Profit before income tax 6,124,365.00$ 2.12% 1,431,221.00$ 0.68%

Income tax (expense)/benefit -2,384,500.00$ -0.82% -622,072.00$ 0.29%

Profit for the year 3,739,865.00$ 1.29% 809,149.00$ 0.38%

Statement Showing Income and Expenses (Comparative Statement)

Profit and Loss Statement and Debt Equity Ratio

As per the profit and loss statement which is shown in the annual report of the company

for the year 2017 shows that the profitability of the business has significantly improved from the

performance of previous year. The profit of the business has increased from $ 809,149 in 2016 to

about $ $ 3,739,865 in 2017. This shows tremendous performance of the business and also

depicts operational efficiency of the business6. The computation of debt equity ratio of the

business is shown below:

The debt equity ratio shows that the proportion of debt in the capital structure mix is

much more than the equity mix in the capital structure of the business. The business as per the

annual report of the company for the year 2017 shows that the business does not utilizes any

6 Heikal, Mohd, Muammar Khaddafi, and Ainatul Ummah. "Influence analysis of return on assets (ROA), return on

equity (ROE), net profit margin (NPM), debt to equity ratio (DER), and current ratio (CR), against corporate profit

growth in automotive in Indonesia Stock Exchange." International Journal of Academic Research in Business and

Social Sciences 4, no. 12 (2014): 101.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 31

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.