CIT ACCT189 FNSACC502: Individual Tax Return 2018 Assessment

VerifiedAdded on 2023/06/03

|18

|4868

|239

Practical Assignment

AI Summary

This document presents a completed individual tax return for Mr. James Brown for the 2018 financial year. The tax return includes detailed information such as TFN, name, address, and contact details. It encompasses income from salary and wages, dividends, and superannuation. The document outlines various deductions, including work-related car expenses and other work-related expenses. The tax return also addresses capital gains, foreign income, and spouse details. Furthermore, the document calculates taxable income, tax offsets, and Medicare levy surcharge details. The document also includes information for ATO validation. The assignment covers various sections of the tax return, providing a comprehensive overview of the income tax calculation process and compliance requirements for an individual.

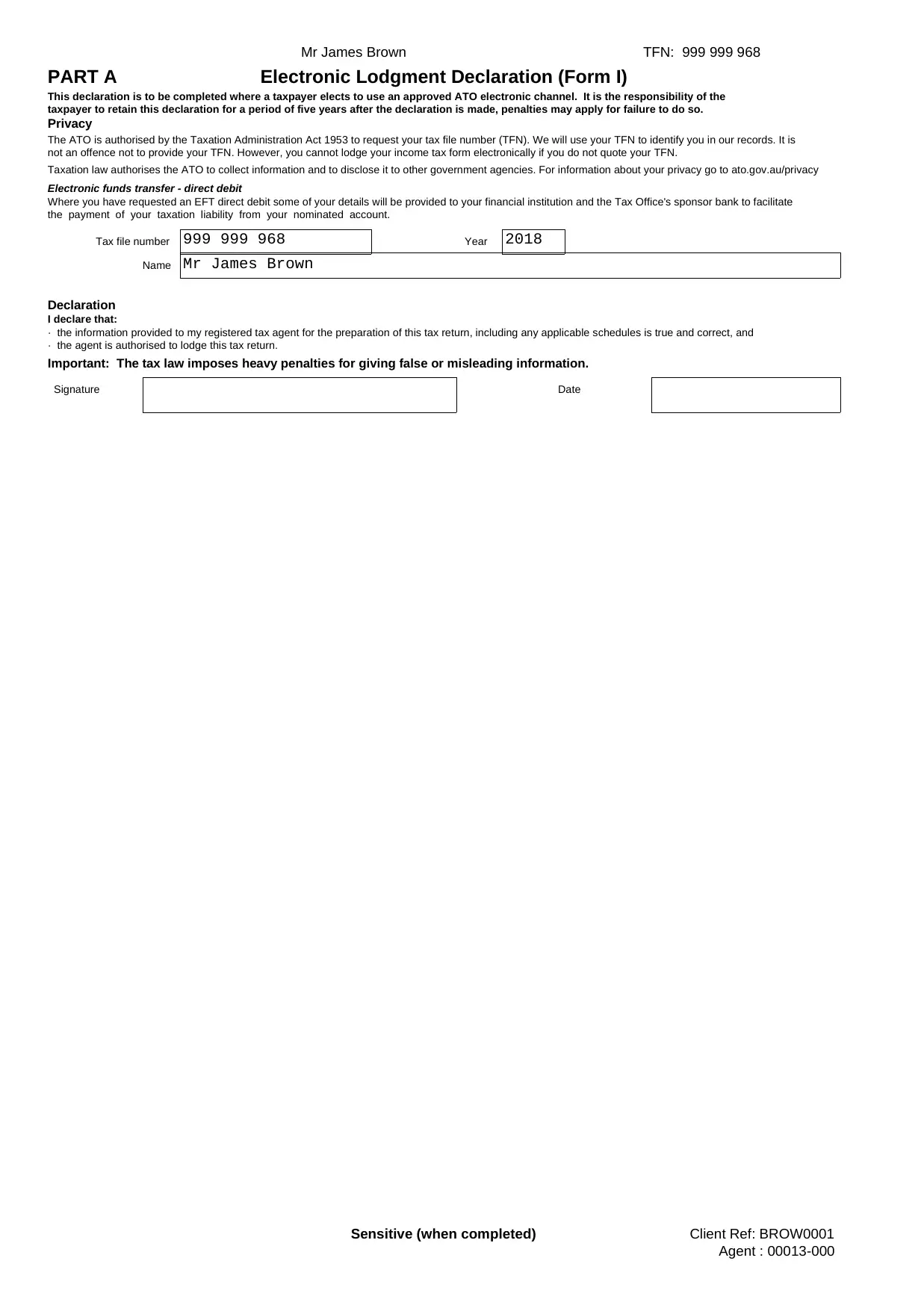

Mr James Brown TFN: 999 999 968

Important: The tax law imposes heavy penalties for giving false or misleading information.

· the agent is authorised to lodge this tax return.

· the information provided to my registered tax agent for the preparation of this tax return, including any applicable schedules is true and correct, and

Declaration

the payment of your taxation liability from your nominated account.

Where you have requested an EFT direct debit some of your details will be provided to your financial institution and the Tax Office's sponsor bank to facilitate

Electronic funds transfer - direct debit

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy go to ato.gov.au/privacy

not an offence not to provide your TFN. However, you cannot lodge your income tax form electronically if you do not quote your TFN.

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you in our records. It is

Privacy

This declaration is to be completed where a taxpayer elects to use an approved ATO electronic channel. It is the responsibility of the

taxpayer to retain this declaration for a period of five years after the declaration is made, penalties may apply for failure to do so.

PART A

Date

I declare that:

YearTax file number

Name

Signature

Electronic Lodgment Declaration (Form I)

999 999 968 2018

Mr James Brown

Sensitive (when completed) Client Ref: BROW0001

Agent : 00013-000

Important: The tax law imposes heavy penalties for giving false or misleading information.

· the agent is authorised to lodge this tax return.

· the information provided to my registered tax agent for the preparation of this tax return, including any applicable schedules is true and correct, and

Declaration

the payment of your taxation liability from your nominated account.

Where you have requested an EFT direct debit some of your details will be provided to your financial institution and the Tax Office's sponsor bank to facilitate

Electronic funds transfer - direct debit

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy go to ato.gov.au/privacy

not an offence not to provide your TFN. However, you cannot lodge your income tax form electronically if you do not quote your TFN.

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you in our records. It is

Privacy

This declaration is to be completed where a taxpayer elects to use an approved ATO electronic channel. It is the responsibility of the

taxpayer to retain this declaration for a period of five years after the declaration is made, penalties may apply for failure to do so.

PART A

Date

I declare that:

YearTax file number

Name

Signature

Electronic Lodgment Declaration (Form I)

999 999 968 2018

Mr James Brown

Sensitive (when completed) Client Ref: BROW0001

Agent : 00013-000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

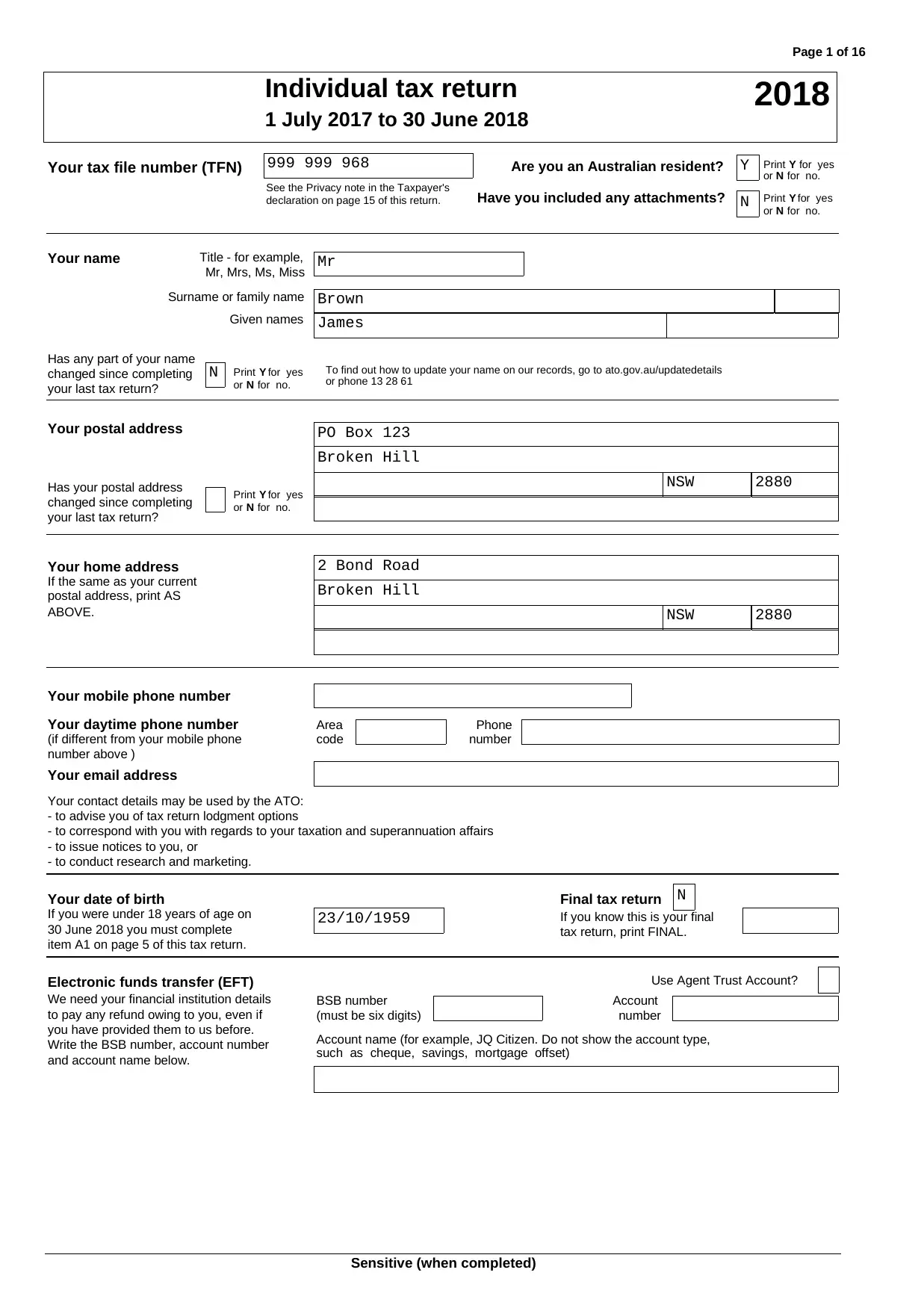

Page 1 of 16

2018

declaration on page 15 of this return.

See the Privacy note in the Taxpayer's

Given names

Surname or family name

Mr, Mrs, Ms, Miss

Title - for example,Your name

Y for yesPrintYour tax file number (TFN)

for no.Nor

for yesYPrintHave you included any attachments?

for no.Nor

Are you an Australian resident?

1 July 2017 to 30 June 2018

Individual tax return

James

Brown

Mr

999 999 968

N

Y

or phone 13 28 61

To find out how to update your name on our records, go to ato.gov.au/updatedetails

for no.Nor

for yesYPrint

your last tax return?

changed since completing

Has any part of your name

N

Print

for no.Nor

for yesY

your last tax return?

changed since completing

Has your postal address

Your postal address

2880NSW

Broken Hill

PO Box 123

ABOVE.

postal address, print AS

If the same as your current

Your home address

2880NSW

Broken Hill

2 Bond Road

- to conduct research and marketing.

- to issue notices to you, or

- to correspond with you with regards to your taxation and superannuation affairs

- to advise you of tax return lodgment options

Your contact details may be used by the ATO:

Your email address

Your mobile phone number

number above )

(if different from your mobile phone numbercode

Your daytime phone number PhoneArea

tax return, print FINAL.

item A1 on page 5 of this tax return.

If you know this is your finalIf you were under 18 years of age on

Final tax returnYour date of birth

30 June 2018 you must complete

N

23/10/1959

and account name below.

Write the BSB number, account number

number

such as cheque, savings, mortgage offset)

you have provided them to us before.

(must be six digits)

Use Agent Trust Account?

Account name (for example, JQ Citizen. Do not show the account type,

AccountBSB number

to pay any refund owing to you, even if

Electronic funds transfer (EFT)

We need your financial institution details

Sensitive (when completed)

2018

declaration on page 15 of this return.

See the Privacy note in the Taxpayer's

Given names

Surname or family name

Mr, Mrs, Ms, Miss

Title - for example,Your name

Y for yesPrintYour tax file number (TFN)

for no.Nor

for yesYPrintHave you included any attachments?

for no.Nor

Are you an Australian resident?

1 July 2017 to 30 June 2018

Individual tax return

James

Brown

Mr

999 999 968

N

Y

or phone 13 28 61

To find out how to update your name on our records, go to ato.gov.au/updatedetails

for no.Nor

for yesYPrint

your last tax return?

changed since completing

Has any part of your name

N

for no.Nor

for yesY

your last tax return?

changed since completing

Has your postal address

Your postal address

2880NSW

Broken Hill

PO Box 123

ABOVE.

postal address, print AS

If the same as your current

Your home address

2880NSW

Broken Hill

2 Bond Road

- to conduct research and marketing.

- to issue notices to you, or

- to correspond with you with regards to your taxation and superannuation affairs

- to advise you of tax return lodgment options

Your contact details may be used by the ATO:

Your email address

Your mobile phone number

number above )

(if different from your mobile phone numbercode

Your daytime phone number PhoneArea

tax return, print FINAL.

item A1 on page 5 of this tax return.

If you know this is your finalIf you were under 18 years of age on

Final tax returnYour date of birth

30 June 2018 you must complete

N

23/10/1959

and account name below.

Write the BSB number, account number

number

such as cheque, savings, mortgage offset)

you have provided them to us before.

(must be six digits)

Use Agent Trust Account?

Account name (for example, JQ Citizen. Do not show the account type,

AccountBSB number

to pay any refund owing to you, even if

Electronic funds transfer (EFT)

We need your financial institution details

Sensitive (when completed)

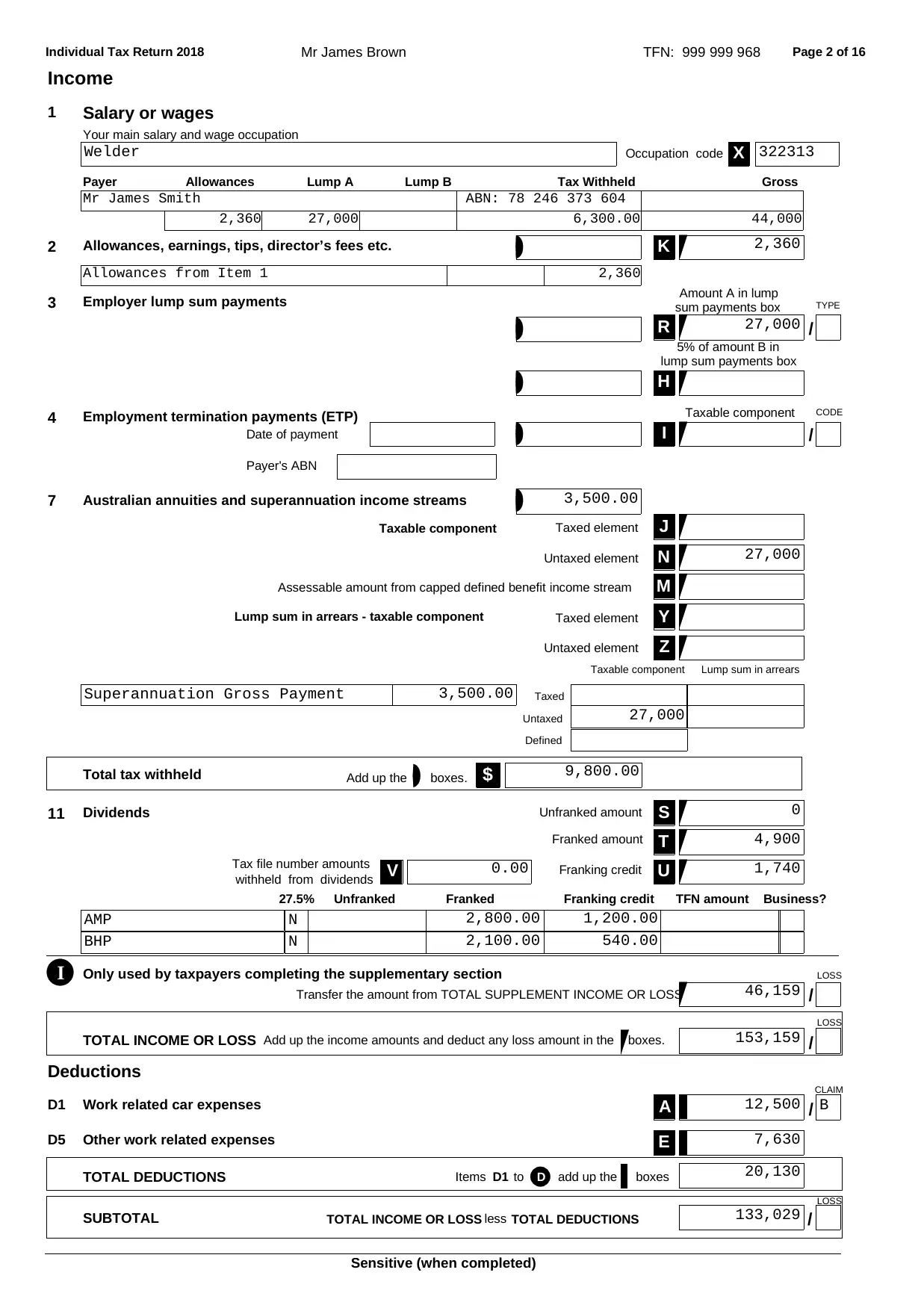

Page 2 of 16Individual Tax Return 2018 Mr James Brown TFN: 999 999 968

Income

Occupation code X

Your main salary and wage occupation

Salary or wages1

322313Welder

Payer Allowances Lump A Lump B Tax Withheld Gross

Mr James Smith ABN: 78 246 373 604

2,360 27,000 6,300.00 44,000

KAllowances, earnings, tips, director’s fees etc.2 2,360

Allowances from Item 1 2,360

Payer's ABN

CODE

/

lump sum payments box

sum payments box TYPE

/

3 Employer lump sum payments

5% of amount B in

Amount A in lump

H

R

4 Employment termination payments (ETP)

Date of payment

Taxable component

I

27,000

7 Australian annuities and superannuation income streams

J

Taxable component Lump sum in arrears

N

Y

Z

Taxed elementTaxable component

Taxed element

Untaxed element

Untaxed element

Lump sum in arrears - taxable component

MAssessable amount from capped defined benefit income stream

3,500.00

27,000

Defined

Untaxed

Taxed

27,000

Superannuation Gross Payment 3,500.00

$boxes.Add up theTotal tax withheld 9,800.00

Dividends11

withheld from dividends V UFranking credit

Franked amount

Unfranked amount S

T

Tax file number amounts

Unfranked Franked Franking credit TFN amount Business?27.5%

0.00 1,740

0

4,900

N 2,800.00 1,200.00AMP

N 2,100.00 540.00BHP

LOSS

/

Only used by taxpayers completing the supplementary sectionI Transfer the amount from TOTAL SUPPLEMENT INCOME OR LOSS 46,159

LOSS

/Add up the income amounts and deduct any loss amount in the boxes.TOTAL INCOME OR LOSS 153,159

Deductions

D1 A

CLAIM

/Work related car expenses B12,500

D5 EOther work related expenses 7,630

boxesadd up thetoD1ItemsTOTAL DEDUCTIONS D 20,130

LOSS

/TOTAL DEDUCTIONSlessTOTAL INCOME OR LOSSSUBTOTAL 133,029

Sensitive (when completed)

Income

Occupation code X

Your main salary and wage occupation

Salary or wages1

322313Welder

Payer Allowances Lump A Lump B Tax Withheld Gross

Mr James Smith ABN: 78 246 373 604

2,360 27,000 6,300.00 44,000

KAllowances, earnings, tips, director’s fees etc.2 2,360

Allowances from Item 1 2,360

Payer's ABN

CODE

/

lump sum payments box

sum payments box TYPE

/

3 Employer lump sum payments

5% of amount B in

Amount A in lump

H

R

4 Employment termination payments (ETP)

Date of payment

Taxable component

I

27,000

7 Australian annuities and superannuation income streams

J

Taxable component Lump sum in arrears

N

Y

Z

Taxed elementTaxable component

Taxed element

Untaxed element

Untaxed element

Lump sum in arrears - taxable component

MAssessable amount from capped defined benefit income stream

3,500.00

27,000

Defined

Untaxed

Taxed

27,000

Superannuation Gross Payment 3,500.00

$boxes.Add up theTotal tax withheld 9,800.00

Dividends11

withheld from dividends V UFranking credit

Franked amount

Unfranked amount S

T

Tax file number amounts

Unfranked Franked Franking credit TFN amount Business?27.5%

0.00 1,740

0

4,900

N 2,800.00 1,200.00AMP

N 2,100.00 540.00BHP

LOSS

/

Only used by taxpayers completing the supplementary sectionI Transfer the amount from TOTAL SUPPLEMENT INCOME OR LOSS 46,159

LOSS

/Add up the income amounts and deduct any loss amount in the boxes.TOTAL INCOME OR LOSS 153,159

Deductions

D1 A

CLAIM

/Work related car expenses B12,500

D5 EOther work related expenses 7,630

boxesadd up thetoD1ItemsTOTAL DEDUCTIONS D 20,130

LOSS

/TOTAL DEDUCTIONSlessTOTAL INCOME OR LOSSSUBTOTAL 133,029

Sensitive (when completed)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

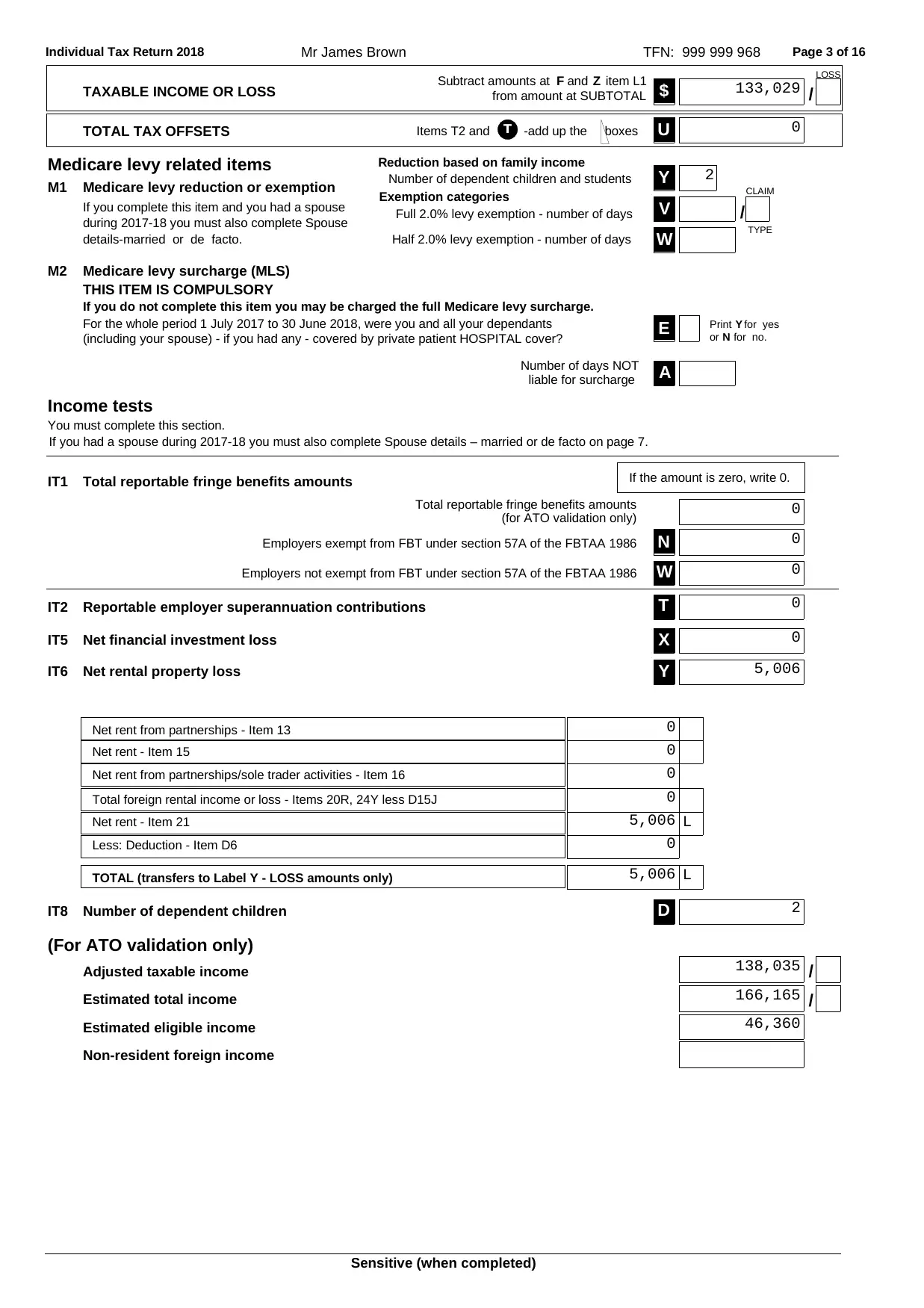

Page 3 of 16Individual Tax Return 2018 Mr James Brown TFN: 999 999 968

from amount at SUBTOTAL

item L1and ZF LOSS

/$

Subtract amounts at

TAXABLE INCOME OR LOSS 133,029

U-add up the boxesItems T2 andTOTAL TAX OFFSETS T 0

during 2017-18 you must also complete Spouse

Medicare levy reduction or exemption

/

WHalf 2.0% levy exemption - number of days

Exemption categories

TYPE

CLAIM

VFull 2.0% levy exemption - number of days

Reduction based on family income

YNumber of dependent children and students

If you complete this item and you had a spouse

M1

Medicare levy related items

details-married or de facto.

2

Medicare levy surcharge (MLS)

(including your spouse) - if you had any - covered by private patient HOSPITAL cover?

liable for surcharge

Number of days NOT A

for no.Nor

for yesYPrint

E

If you do not complete this item you may be charged the full Medicare levy surcharge.

THIS ITEM IS COMPULSORY

M2

For the whole period 1 July 2017 to 30 June 2018, were you and all your dependants

(for ATO validation only)

Total reportable fringe benefits amounts

Employers not exempt from FBT under section 57A of the FBTAA 1986

Employers exempt from FBT under section 57A of the FBTAA 1986

W

If the amount is zero, write 0.

TReportable employer superannuation contributionsIT2

If you had a spouse during 2017-18 you must also complete Spouse details – married or de facto on page 7.

You must complete this section.

Income tests

N

Total reportable fringe benefits amountsIT1

0

0

0

0

XNet financial investment lossIT5 0

YNet rental property lossIT6

Net rent - Item 21

Less: Deduction - Item D6

Net rent from partnerships - Item 13

TOTAL (transfers to Label Y - LOSS amounts only)

Total foreign rental income or loss - Items 20R, 24Y less D15J

Net rent from partnerships/sole trader activities - Item 16

Net rent - Item 15

5,006

L5,006

0

0

0

L5,006

0

0

Number of dependent children DIT8 2

Non-resident foreign income

/

(For ATO validation only)

/

Estimated eligible income

Estimated total income

Adjusted taxable income 138,035

46,360

166,165

Sensitive (when completed)

from amount at SUBTOTAL

item L1and ZF LOSS

/$

Subtract amounts at

TAXABLE INCOME OR LOSS 133,029

U-add up the boxesItems T2 andTOTAL TAX OFFSETS T 0

during 2017-18 you must also complete Spouse

Medicare levy reduction or exemption

/

WHalf 2.0% levy exemption - number of days

Exemption categories

TYPE

CLAIM

VFull 2.0% levy exemption - number of days

Reduction based on family income

YNumber of dependent children and students

If you complete this item and you had a spouse

M1

Medicare levy related items

details-married or de facto.

2

Medicare levy surcharge (MLS)

(including your spouse) - if you had any - covered by private patient HOSPITAL cover?

liable for surcharge

Number of days NOT A

for no.Nor

for yesYPrint

E

If you do not complete this item you may be charged the full Medicare levy surcharge.

THIS ITEM IS COMPULSORY

M2

For the whole period 1 July 2017 to 30 June 2018, were you and all your dependants

(for ATO validation only)

Total reportable fringe benefits amounts

Employers not exempt from FBT under section 57A of the FBTAA 1986

Employers exempt from FBT under section 57A of the FBTAA 1986

W

If the amount is zero, write 0.

TReportable employer superannuation contributionsIT2

If you had a spouse during 2017-18 you must also complete Spouse details – married or de facto on page 7.

You must complete this section.

Income tests

N

Total reportable fringe benefits amountsIT1

0

0

0

0

XNet financial investment lossIT5 0

YNet rental property lossIT6

Net rent - Item 21

Less: Deduction - Item D6

Net rent from partnerships - Item 13

TOTAL (transfers to Label Y - LOSS amounts only)

Total foreign rental income or loss - Items 20R, 24Y less D15J

Net rent from partnerships/sole trader activities - Item 16

Net rent - Item 15

5,006

L5,006

0

0

0

L5,006

0

0

Number of dependent children DIT8 2

Non-resident foreign income

/

(For ATO validation only)

/

Estimated eligible income

Estimated total income

Adjusted taxable income 138,035

46,360

166,165

Sensitive (when completed)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

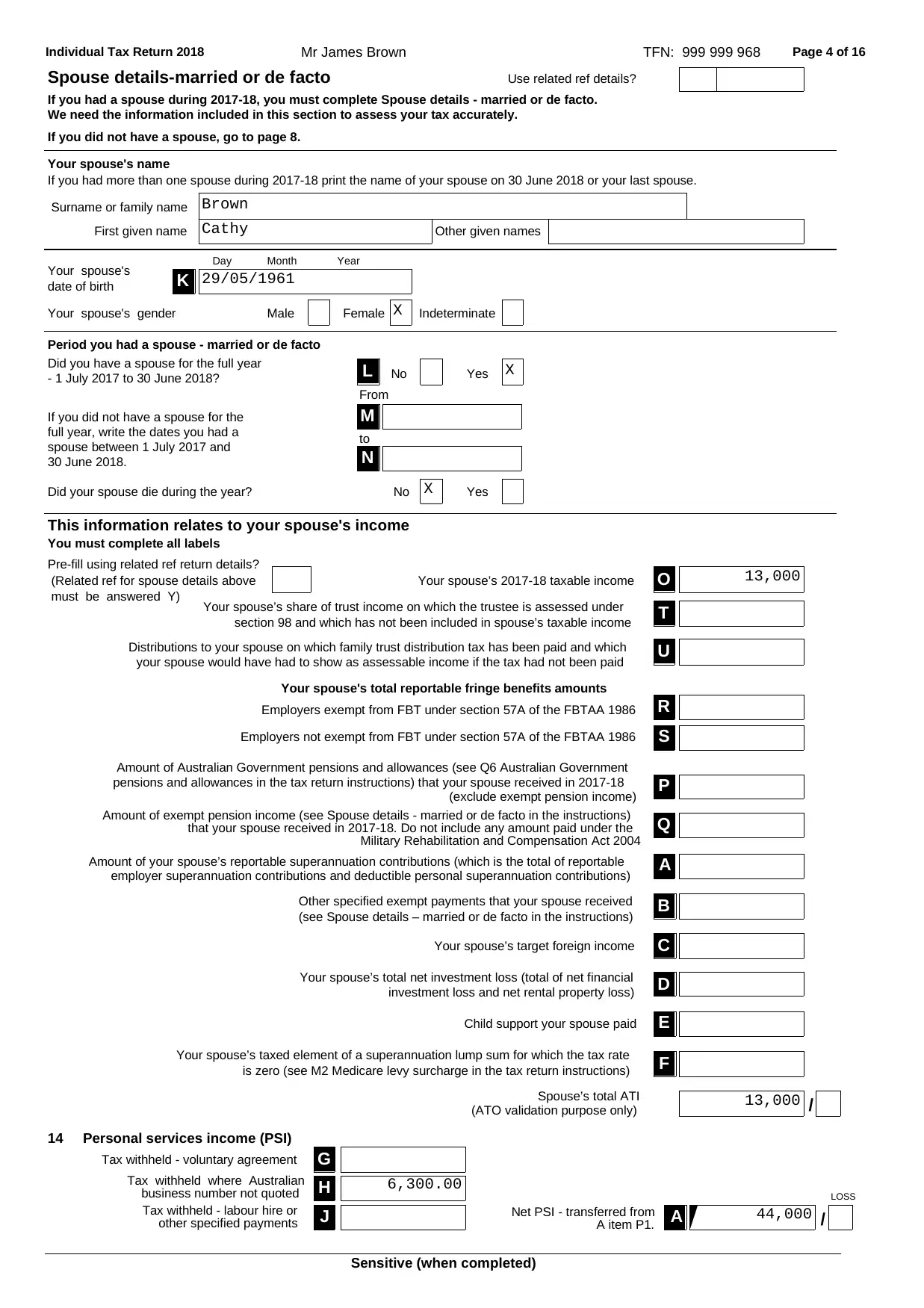

Page 4 of 16Individual Tax Return 2018 Mr James Brown TFN: 999 999 968

Indeterminate

30 June 2018.

No YesDid your spouse die during the year?

YesNo- 1 July 2017 to 30 June 2018?

Did you have a spouse for the full year

If you had more than one spouse during 2017-18 print the name of your spouse on 30 June 2018 or your last spouse.

Your spouse's name

If you did not have a spouse, go to page 8.

Your spouse's gender

Period you had a spouse - married or de facto

K

FemaleMale

date of birth

Your spouse's YearMonthDay

Other given names

Surname or family name

First given name

We need the information included in this section to assess your tax accurately.

If you had a spouse during 2017-18, you must complete Spouse details - married or de facto.

Use related ref details?

From

to

N

spouse between 1 July 2017 and

full year, write the dates you had a

MIf you did not have a spouse for the

L

Spouse details-married or de facto

X

X

X

29/05/1961

Cathy

Brown

Your spouse's total reportable fringe benefits amounts

SEmployers not exempt from FBT under section 57A of the FBTAA 1986

Military Rehabilitation and Compensation Act 2004

You must complete all labels

This information relates to your spouse's income

(exclude exempt pension income)

/(ATO validation purpose only)

Spouse’s total ATI

Your spouse’s taxed element of a superannuation lump sum for which the tax rate

is zero (see M2 Medicare levy surcharge in the tax return instructions) F

Child support your spouse paid E

investment loss and net rental property loss)

Your spouse’s total net investment loss (total of net financial D

CYour spouse’s target foreign income

Other specified exempt payments that your spouse received B

(see Spouse details – married or de facto in the instructions)

employer superannuation contributions and deductible personal superannuation contributions)

Pre-fill using related ref return details?

(Related ref for spouse details above

must be answered Y)

OYour spouse’s 2017-18 taxable income

Amount of your spouse’s reportable superannuation contributions (which is the total of reportable A

that your spouse received in 2017-18. Do not include any amount paid under the Q

Amount of exempt pension income (see Spouse details - married or de facto in the instructions)

pensions and allowances in the tax return instructions) that your spouse received in 2017-18

Amount of Australian Government pensions and allowances (see Q6 Australian Government

P

REmployers exempt from FBT under section 57A of the FBTAA 1986

Distributions to your spouse on which family trust distribution tax has been paid and which U

your spouse would have had to show as assessable income if the tax had not been paid

section 98 and which has not been included in spouse’s taxable income TYour spouse’s share of trust income on which the trustee is assessed under

13,000

13,000

LOSS

A item P1.

Net PSI - transferred from /AJ

G

H

Tax withheld - voluntary agreement

business number not quoted

Tax withheld where Australian

other specified payments

Tax withheld - labour hire or

Personal services income (PSI)14

44,000

6,300.00

Sensitive (when completed)

Indeterminate

30 June 2018.

No YesDid your spouse die during the year?

YesNo- 1 July 2017 to 30 June 2018?

Did you have a spouse for the full year

If you had more than one spouse during 2017-18 print the name of your spouse on 30 June 2018 or your last spouse.

Your spouse's name

If you did not have a spouse, go to page 8.

Your spouse's gender

Period you had a spouse - married or de facto

K

FemaleMale

date of birth

Your spouse's YearMonthDay

Other given names

Surname or family name

First given name

We need the information included in this section to assess your tax accurately.

If you had a spouse during 2017-18, you must complete Spouse details - married or de facto.

Use related ref details?

From

to

N

spouse between 1 July 2017 and

full year, write the dates you had a

MIf you did not have a spouse for the

L

Spouse details-married or de facto

X

X

X

29/05/1961

Cathy

Brown

Your spouse's total reportable fringe benefits amounts

SEmployers not exempt from FBT under section 57A of the FBTAA 1986

Military Rehabilitation and Compensation Act 2004

You must complete all labels

This information relates to your spouse's income

(exclude exempt pension income)

/(ATO validation purpose only)

Spouse’s total ATI

Your spouse’s taxed element of a superannuation lump sum for which the tax rate

is zero (see M2 Medicare levy surcharge in the tax return instructions) F

Child support your spouse paid E

investment loss and net rental property loss)

Your spouse’s total net investment loss (total of net financial D

CYour spouse’s target foreign income

Other specified exempt payments that your spouse received B

(see Spouse details – married or de facto in the instructions)

employer superannuation contributions and deductible personal superannuation contributions)

Pre-fill using related ref return details?

(Related ref for spouse details above

must be answered Y)

OYour spouse’s 2017-18 taxable income

Amount of your spouse’s reportable superannuation contributions (which is the total of reportable A

that your spouse received in 2017-18. Do not include any amount paid under the Q

Amount of exempt pension income (see Spouse details - married or de facto in the instructions)

pensions and allowances in the tax return instructions) that your spouse received in 2017-18

Amount of Australian Government pensions and allowances (see Q6 Australian Government

P

REmployers exempt from FBT under section 57A of the FBTAA 1986

Distributions to your spouse on which family trust distribution tax has been paid and which U

your spouse would have had to show as assessable income if the tax had not been paid

section 98 and which has not been included in spouse’s taxable income TYour spouse’s share of trust income on which the trustee is assessed under

13,000

13,000

LOSS

A item P1.

Net PSI - transferred from /AJ

G

H

Tax withheld - voluntary agreement

business number not quoted

Tax withheld where Australian

other specified payments

Tax withheld - labour hire or

Personal services income (PSI)14

44,000

6,300.00

Sensitive (when completed)

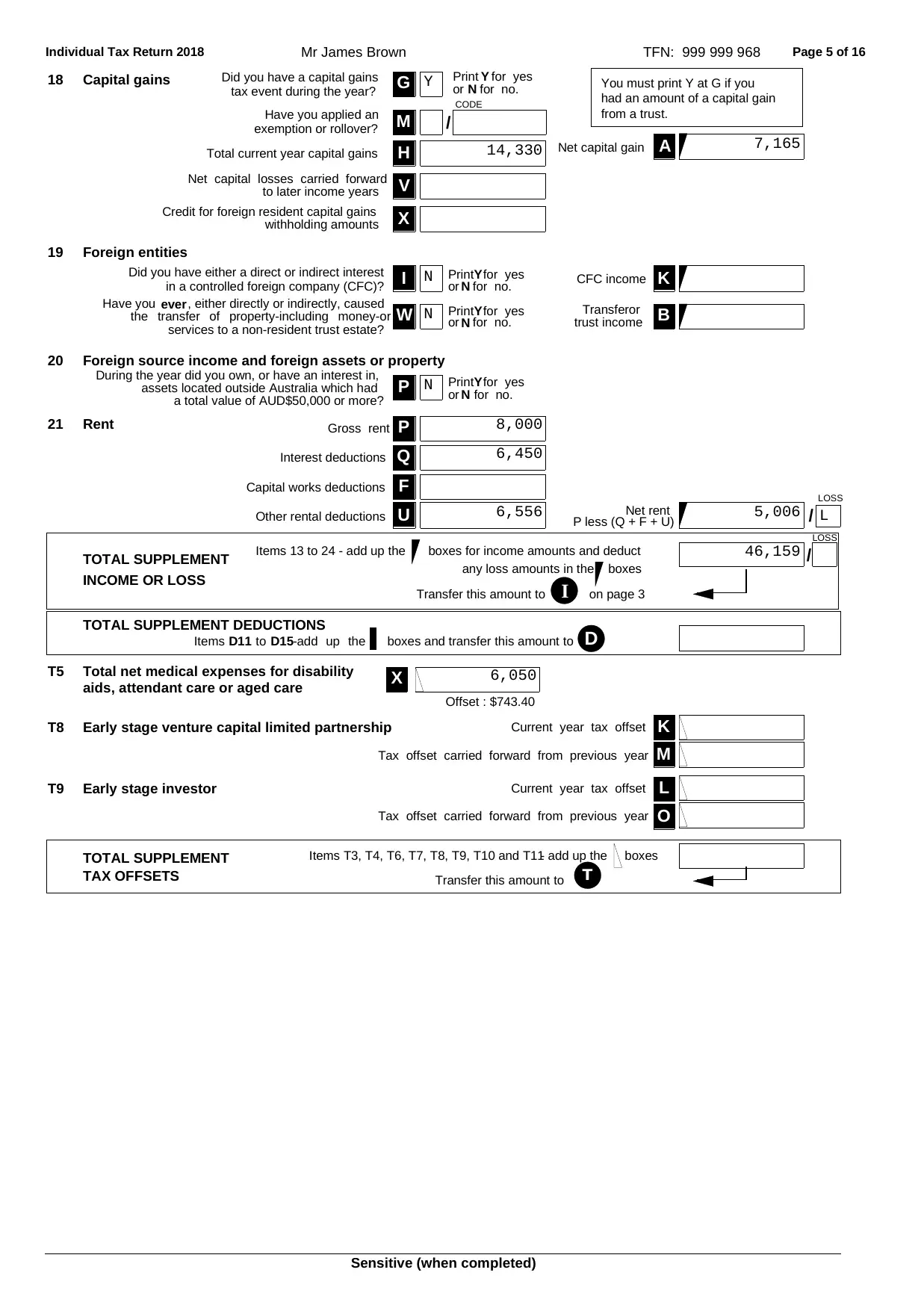

Page 5 of 16Individual Tax Return 2018 Mr James Brown TFN: 999 999 968

Xwithholding amounts

Credit for foreign resident capital gains

/

CODE

exemption or rollover? MHave you applied an from a trust.

tax event during the year?

A

V

H

G

Net capital gain

had an amount of a capital gain

You must print Y at G if you

Total current year capital gains

to later income years

Net capital losses carried forward

Did you have a capital gains for no.Nor for yesYPrintCapital gains18

7,16514,330

Y

K

BW

Iin a controlled foreign company (CFC)?

Did you have either a direct or indirect interest

trust income

Transferor

services to a non-resident trust estate?

the transfer of property-including money-or

, either directly or indirectly, causedeverHave you

for no.Nor for yesYPrint

CFC income

for no.Nor for yesYPrint

Foreign entities19

N

N

P

a total value of AUD$50,000 or more?

assets located outside Australia which had

During the year did you own, or have an interest in,

for no.Nor

for yesYPrint

Foreign source income and foreign assets or property20

N

LOSS

/U

F

Q

P

P less (Q + F + U)

Net rentOther rental deductions

Capital works deductions

Interest deductions

Gross rentRent21 8,000

6,450

5,006 L6,556

boxes for income amounts and deduct

LOSS

Transfer this amount to

/

any loss amounts in the boxes

Items 13 to 24 - add up the

on page 3

INCOME OR LOSS

TOTAL SUPPLEMENT

I

46,159

boxes and transfer this amount to-add up theD15toD11Items

TOTAL SUPPLEMENT DEDUCTIONS

D

aids, attendant care or aged care Offset : $743.40

XTotal net medical expenses for disabilityT5 6,050

Tax offset carried forward from previous year

Current year tax offset

M

KEarly stage venture capital limited partnershipT8

OTax offset carried forward from previous year

Current year tax offset LEarly stage investorT9

Transfer this amount to

- add up the boxesItems T3, T4, T6, T7, T8, T9, T10 and T11

TAX OFFSETS

TOTAL SUPPLEMENT

T

Sensitive (when completed)

Xwithholding amounts

Credit for foreign resident capital gains

/

CODE

exemption or rollover? MHave you applied an from a trust.

tax event during the year?

A

V

H

G

Net capital gain

had an amount of a capital gain

You must print Y at G if you

Total current year capital gains

to later income years

Net capital losses carried forward

Did you have a capital gains for no.Nor for yesYPrintCapital gains18

7,16514,330

Y

K

BW

Iin a controlled foreign company (CFC)?

Did you have either a direct or indirect interest

trust income

Transferor

services to a non-resident trust estate?

the transfer of property-including money-or

, either directly or indirectly, causedeverHave you

for no.Nor for yesYPrint

CFC income

for no.Nor for yesYPrint

Foreign entities19

N

N

P

a total value of AUD$50,000 or more?

assets located outside Australia which had

During the year did you own, or have an interest in,

for no.Nor

for yesYPrint

Foreign source income and foreign assets or property20

N

LOSS

/U

F

Q

P

P less (Q + F + U)

Net rentOther rental deductions

Capital works deductions

Interest deductions

Gross rentRent21 8,000

6,450

5,006 L6,556

boxes for income amounts and deduct

LOSS

Transfer this amount to

/

any loss amounts in the boxes

Items 13 to 24 - add up the

on page 3

INCOME OR LOSS

TOTAL SUPPLEMENT

I

46,159

boxes and transfer this amount to-add up theD15toD11Items

TOTAL SUPPLEMENT DEDUCTIONS

D

aids, attendant care or aged care Offset : $743.40

XTotal net medical expenses for disabilityT5 6,050

Tax offset carried forward from previous year

Current year tax offset

M

KEarly stage venture capital limited partnershipT8

OTax offset carried forward from previous year

Current year tax offset LEarly stage investorT9

Transfer this amount to

- add up the boxesItems T3, T4, T6, T7, T8, T9, T10 and T11

TAX OFFSETS

TOTAL SUPPLEMENT

T

Sensitive (when completed)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

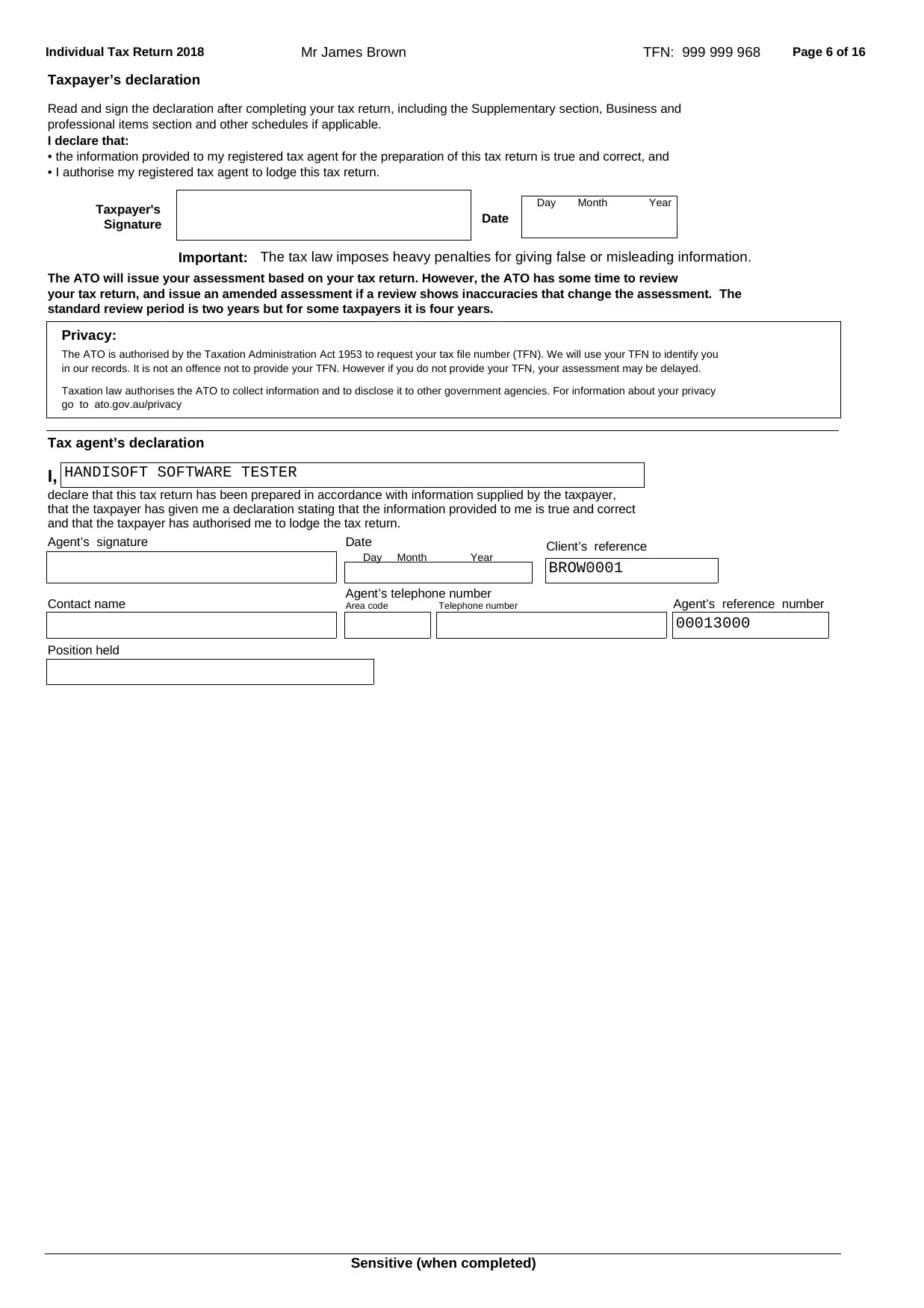

Page 6 of 16Individual Tax Return 2018 Mr James Brown TFN: 999 999 968

Position held

standard review period is two years but for some taxpayers it is four years.

your tax return, and issue an amended assessment if a review shows inaccuracies that change the assessment. The

The ATO will issue your assessment based on your tax return. However, the ATO has some time to review

in our records. It is not an offence not to provide your TFN. However if you do not provide your TFN, your assessment may be delayed.

go to ato.gov.au/privacy

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy

Privacy:

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you

Taxpayer's

• I authorise my registered tax agent to lodge this tax return.

YearMonthDay

DateSignature

The tax law imposes heavy penalties for giving false or misleading information.Important:

I,

• the information provided to my registered tax agent for the preparation of this tax return is true and correct, and

I declare that:

professional items section and other schedules if applicable.

Read and sign the declaration after completing your tax return, including the Supplementary section, Business and

Taxpayer’s declaration

YearDay Month

Telephone numberArea code

Date Client’s referenceAgent’s signature

Agent’s reference number

Agent’s telephone number

Contact name

and that the taxpayer has authorised me to lodge the tax return.

that the taxpayer has given me a declaration stating that the information provided to me is true and correct

declare that this tax return has been prepared in accordance with information supplied by the taxpayer,

Tax agent’s declaration

00013000

HANDISOFT SOFTWARE TESTER

BROW0001

Sensitive (when completed)

Position held

standard review period is two years but for some taxpayers it is four years.

your tax return, and issue an amended assessment if a review shows inaccuracies that change the assessment. The

The ATO will issue your assessment based on your tax return. However, the ATO has some time to review

in our records. It is not an offence not to provide your TFN. However if you do not provide your TFN, your assessment may be delayed.

go to ato.gov.au/privacy

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy

Privacy:

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you

Taxpayer's

• I authorise my registered tax agent to lodge this tax return.

YearMonthDay

DateSignature

The tax law imposes heavy penalties for giving false or misleading information.Important:

I,

• the information provided to my registered tax agent for the preparation of this tax return is true and correct, and

I declare that:

professional items section and other schedules if applicable.

Read and sign the declaration after completing your tax return, including the Supplementary section, Business and

Taxpayer’s declaration

YearDay Month

Telephone numberArea code

Date Client’s referenceAgent’s signature

Agent’s reference number

Agent’s telephone number

Contact name

and that the taxpayer has authorised me to lodge the tax return.

that the taxpayer has given me a declaration stating that the information provided to me is true and correct

declare that this tax return has been prepared in accordance with information supplied by the taxpayer,

Tax agent’s declaration

00013000

HANDISOFT SOFTWARE TESTER

BROW0001

Sensitive (when completed)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 7 of 16Mr James Brown TFN: 999 999 968

999 999 968

Tax file number (TFN)

Mr James Brown (DOB: 23/10/1959)

Full name

Payee's details

Superannuation lump sum schedule

2018Year

Payment details

Prior Year Payment details - for untaxed elements

Name ABN

Amounts received Untaxed Plan

Cap remaining for

this ABN

within Untaxed

Plan Cap

1,418,00027,00027 222 266 667

Taxation law authorises the ATO to collect information and disclose it to other government agencies. For information about your privacy

go to ato.gov.au/privacy

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you

in our records. It is not an offence not to provide your TFN. However if you do not provide your TFN, your assessment may be delayed.

Privacy

I declare that the information on this form is true and correct.

facts before the ATO. The income tax law imposes heavy penalties for false or misleading statements.

Daytime contact number (include area code)

Before making this declaration check to ensure that all the information required has been provided on this form and any attachments to this

DateSignature

form, and that the information provided is true and correct in every detail. If you are in doubt about any aspect of the tax return, place all the

If the schedule is not lodged with the income tax return you are required to sign and date the schedule.

Taxpayer's declaration

Contact person

Important

Sensitive (when completed)

999 999 968

Tax file number (TFN)

Mr James Brown (DOB: 23/10/1959)

Full name

Payee's details

Superannuation lump sum schedule

2018Year

Payment details

Prior Year Payment details - for untaxed elements

Name ABN

Amounts received Untaxed Plan

Cap remaining for

this ABN

within Untaxed

Plan Cap

1,418,00027,00027 222 266 667

Taxation law authorises the ATO to collect information and disclose it to other government agencies. For information about your privacy

go to ato.gov.au/privacy

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to identify you

in our records. It is not an offence not to provide your TFN. However if you do not provide your TFN, your assessment may be delayed.

Privacy

I declare that the information on this form is true and correct.

facts before the ATO. The income tax law imposes heavy penalties for false or misleading statements.

Daytime contact number (include area code)

Before making this declaration check to ensure that all the information required has been provided on this form and any attachments to this

DateSignature

form, and that the information provided is true and correct in every detail. If you are in doubt about any aspect of the tax return, place all the

If the schedule is not lodged with the income tax return you are required to sign and date the schedule.

Taxpayer's declaration

Contact person

Important

Sensitive (when completed)

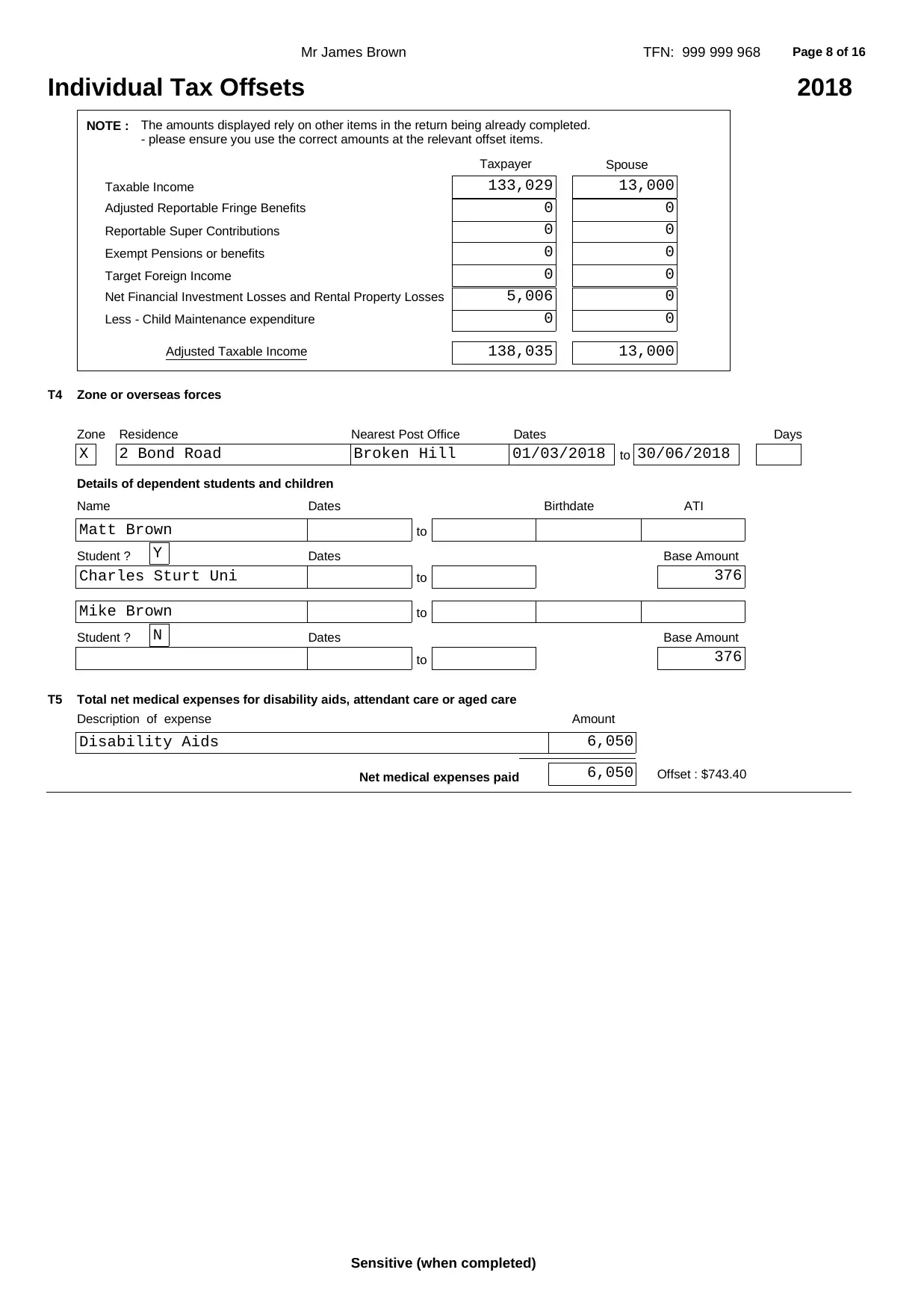

Page 8 of 16Mr James Brown TFN: 999 999 968

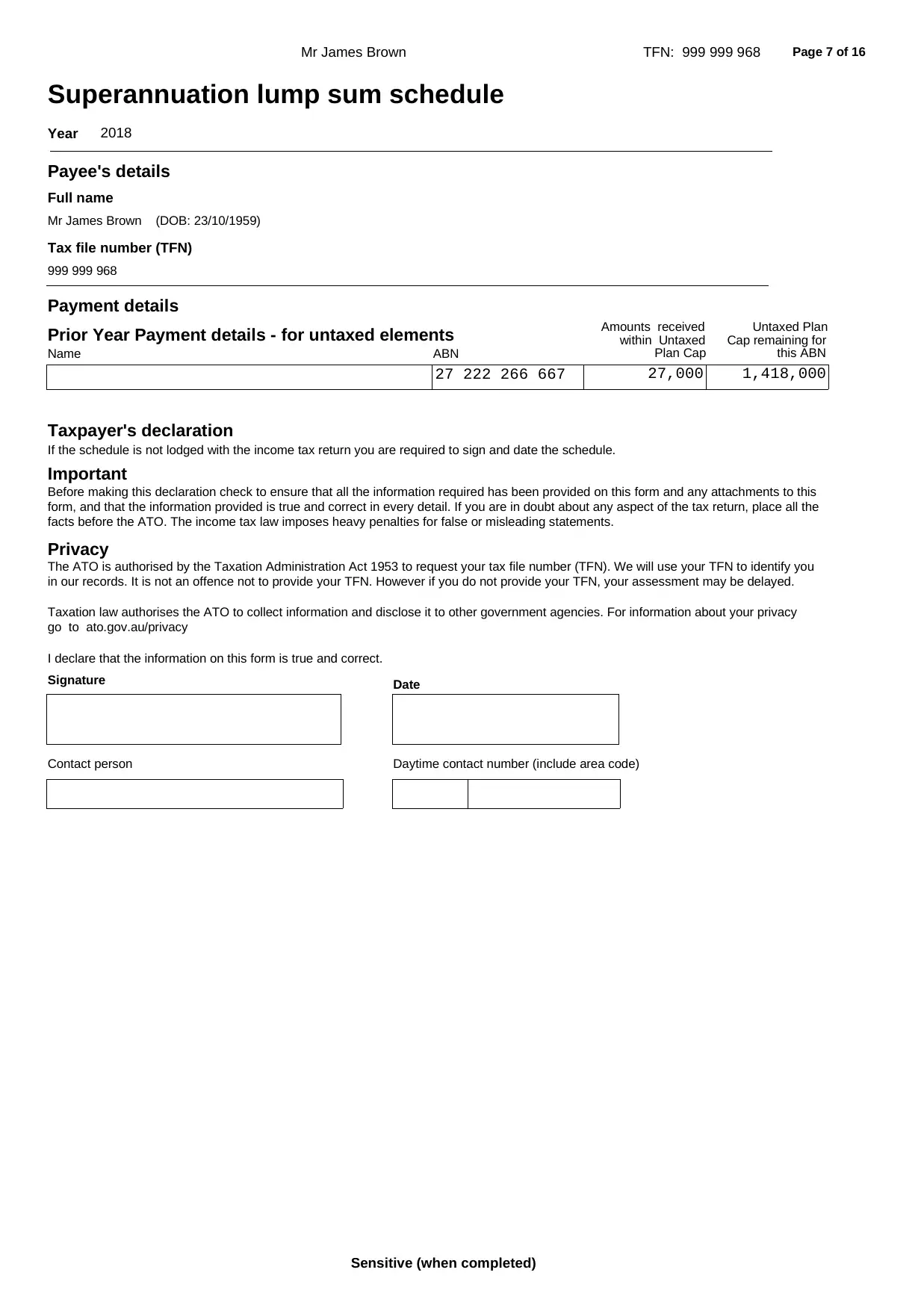

Individual Tax Offsets 2018

SpouseTaxpayer

- please ensure you use the correct amounts at the relevant offset items.

The amounts displayed rely on other items in the return being already completed.NOTE :

Adjusted Taxable Income

Less - Child Maintenance expenditure

Target Foreign Income

Exempt Pensions or benefits

Net Financial Investment Losses and Rental Property Losses

Reportable Super Contributions

Adjusted Reportable Fringe Benefits

Taxable Income

0

13,000

0

0

0

0

0

13,000

0

138,035

0

0

0

5,006

0

133,029

T4

Zone Residence Nearest Post Office Dates Days

Zone or overseas forces

to 30/06/201801/03/2018Broken Hill2 Bond RoadX

Details of dependent students and children

Name Dates Birthdate ATI

Base Amount

to

DatesStudent ?

to

376

Y

Charles Sturt Uni

Matt Brown

Base Amount

to

DatesStudent ?

to

376

N

Mike Brown

T5 Total net medical expenses for disability aids, attendant care or aged care

Description of expense Amount

Disability Aids 6,050

Net medical expenses paid Offset : $743.406,050

Sensitive (when completed)

Individual Tax Offsets 2018

SpouseTaxpayer

- please ensure you use the correct amounts at the relevant offset items.

The amounts displayed rely on other items in the return being already completed.NOTE :

Adjusted Taxable Income

Less - Child Maintenance expenditure

Target Foreign Income

Exempt Pensions or benefits

Net Financial Investment Losses and Rental Property Losses

Reportable Super Contributions

Adjusted Reportable Fringe Benefits

Taxable Income

0

13,000

0

0

0

0

0

13,000

0

138,035

0

0

0

5,006

0

133,029

T4

Zone Residence Nearest Post Office Dates Days

Zone or overseas forces

to 30/06/201801/03/2018Broken Hill2 Bond RoadX

Details of dependent students and children

Name Dates Birthdate ATI

Base Amount

to

DatesStudent ?

to

376

Y

Charles Sturt Uni

Matt Brown

Base Amount

to

DatesStudent ?

to

376

N

Mike Brown

T5 Total net medical expenses for disability aids, attendant care or aged care

Description of expense Amount

Disability Aids 6,050

Net medical expenses paid Offset : $743.406,050

Sensitive (when completed)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

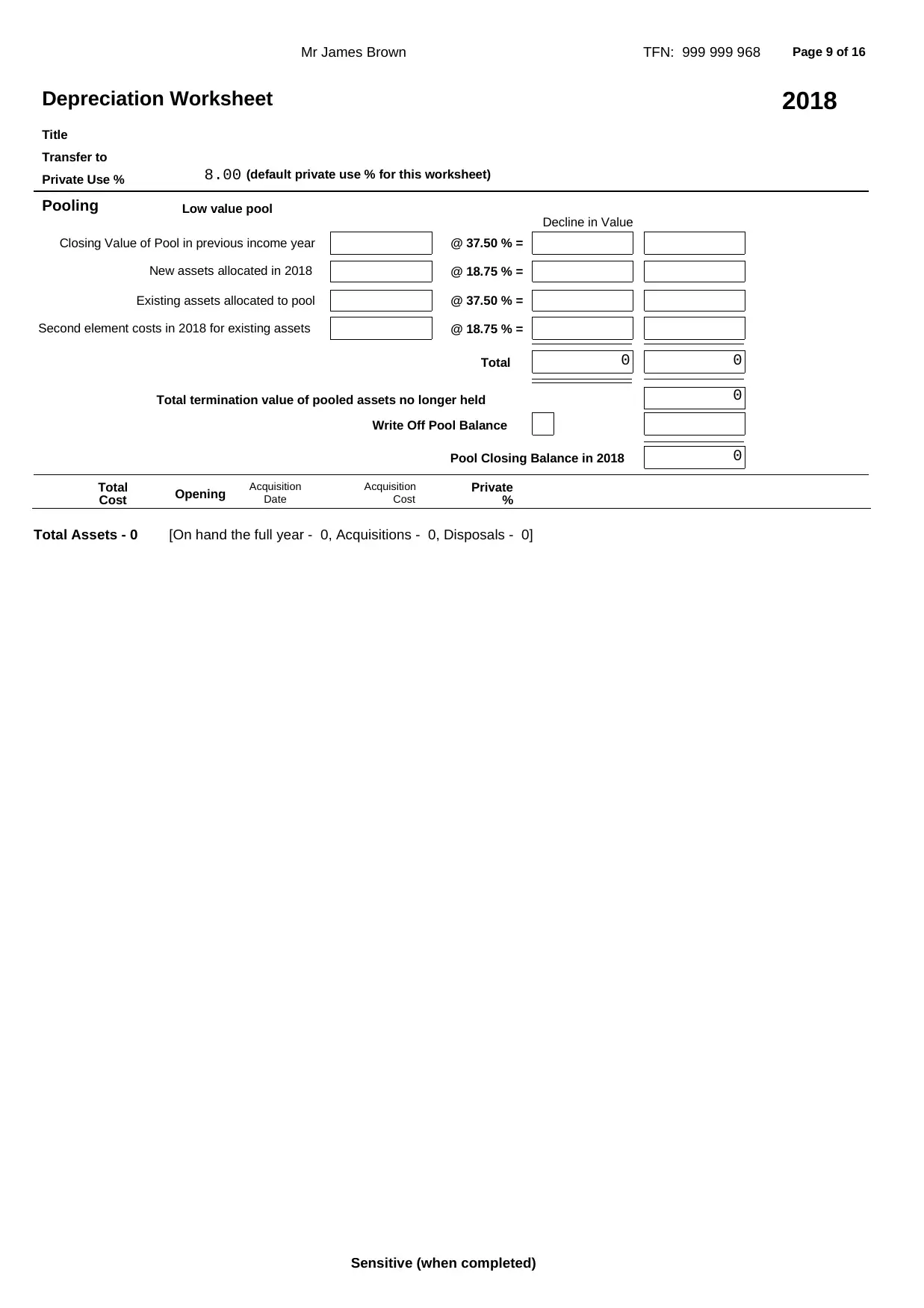

Page 9 of 16Mr James Brown TFN: 999 999 968

(default private use % for this worksheet)Private Use %

2018

Transfer to

Title

Depreciation Worksheet

8.00

Write Off Pool Balance

Decline in Value

Pool Closing Balance in 2018

Total termination value of pooled assets no longer held

Total

@ 18.75 % =Second element costs in 2018 for existing assets

@ 37.50 % =Existing assets allocated to pool

@ 18.75 % =New assets allocated in 2018

@ 37.50 % =

Low value pool

Closing Value of Pool in previous income year

Pooling

0

0

00

Total

Cost Opening Acquisition

Date

Acquisition

Cost

Private

%

Total Assets - 0 [On hand the full year - 0, Acquisitions - 0, Disposals - 0]

Sensitive (when completed)

(default private use % for this worksheet)Private Use %

2018

Transfer to

Title

Depreciation Worksheet

8.00

Write Off Pool Balance

Decline in Value

Pool Closing Balance in 2018

Total termination value of pooled assets no longer held

Total

@ 18.75 % =Second element costs in 2018 for existing assets

@ 37.50 % =Existing assets allocated to pool

@ 18.75 % =New assets allocated in 2018

@ 37.50 % =

Low value pool

Closing Value of Pool in previous income year

Pooling

0

0

00

Total

Cost Opening Acquisition

Date

Acquisition

Cost

Private

%

Total Assets - 0 [On hand the full year - 0, Acquisitions - 0, Disposals - 0]

Sensitive (when completed)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

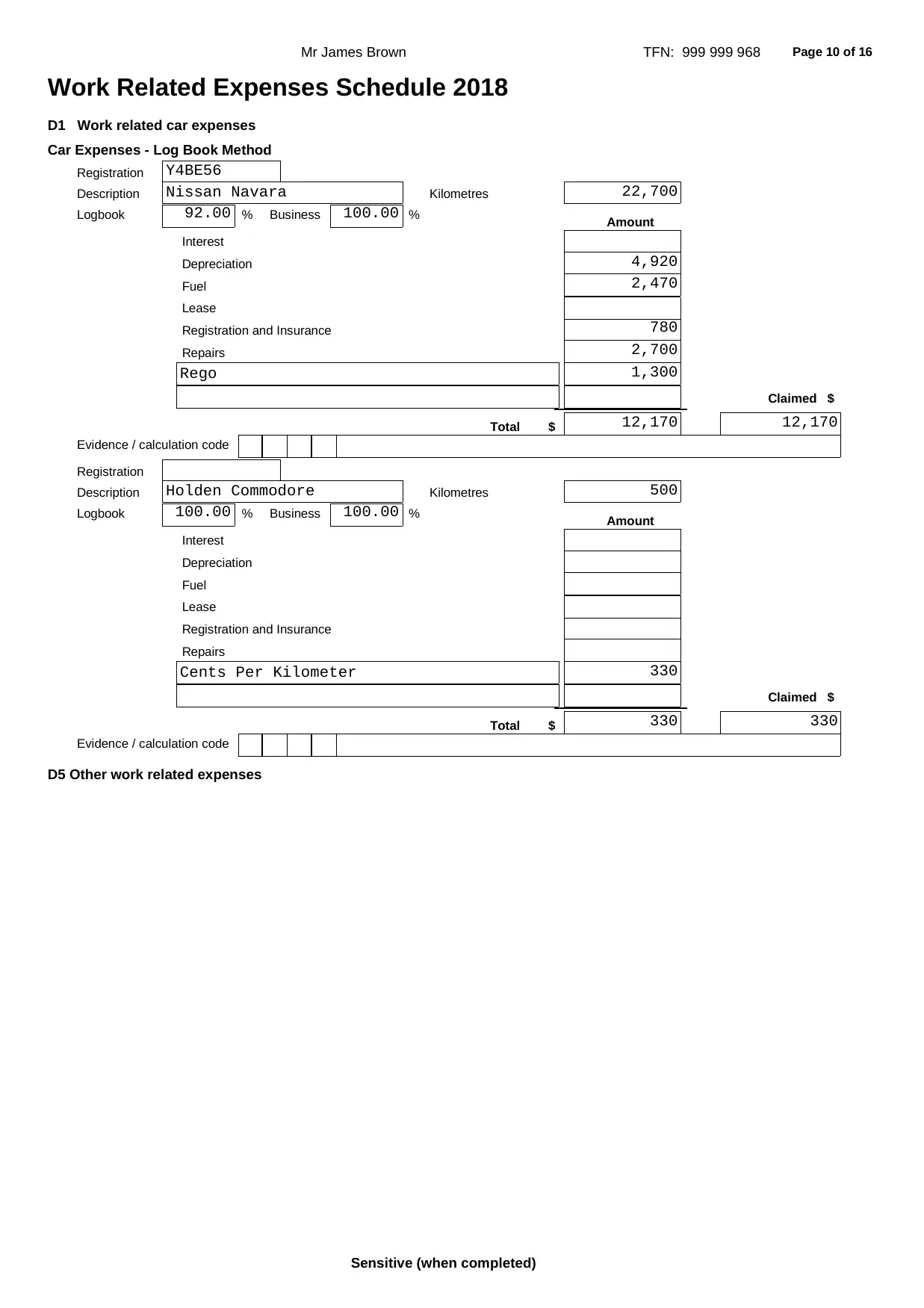

Page 10 of 16Mr James Brown TFN: 999 999 968

Work Related Expenses Schedule 2018

D1 Work related car expenses

Car Expenses - Log Book Method

%

Description

Evidence / calculation code

Claimed $

Total $

Lease

Repairs

Registration and Insurance

Fuel

Depreciation

Interest

Amount

Business%Logbook

Kilometres

Registration

12,17012,170

Rego 1,300

2,700

780

2,470

4,920

100.0092.00

22,700Nissan Navara

Y4BE56

%

Description

Evidence / calculation code

Claimed $

Total $

Lease

Repairs

Registration and Insurance

Fuel

Depreciation

Interest

Amount

Business%Logbook

Kilometres

Registration

330330

Cents Per Kilometer 330

100.00100.00

500Holden Commodore

D5 Other work related expenses

Sensitive (when completed)

Work Related Expenses Schedule 2018

D1 Work related car expenses

Car Expenses - Log Book Method

%

Description

Evidence / calculation code

Claimed $

Total $

Lease

Repairs

Registration and Insurance

Fuel

Depreciation

Interest

Amount

Business%Logbook

Kilometres

Registration

12,17012,170

Rego 1,300

2,700

780

2,470

4,920

100.0092.00

22,700Nissan Navara

Y4BE56

%

Description

Evidence / calculation code

Claimed $

Total $

Lease

Repairs

Registration and Insurance

Fuel

Depreciation

Interest

Amount

Business%Logbook

Kilometres

Registration

330330

Cents Per Kilometer 330

100.00100.00

500Holden Commodore

D5 Other work related expenses

Sensitive (when completed)

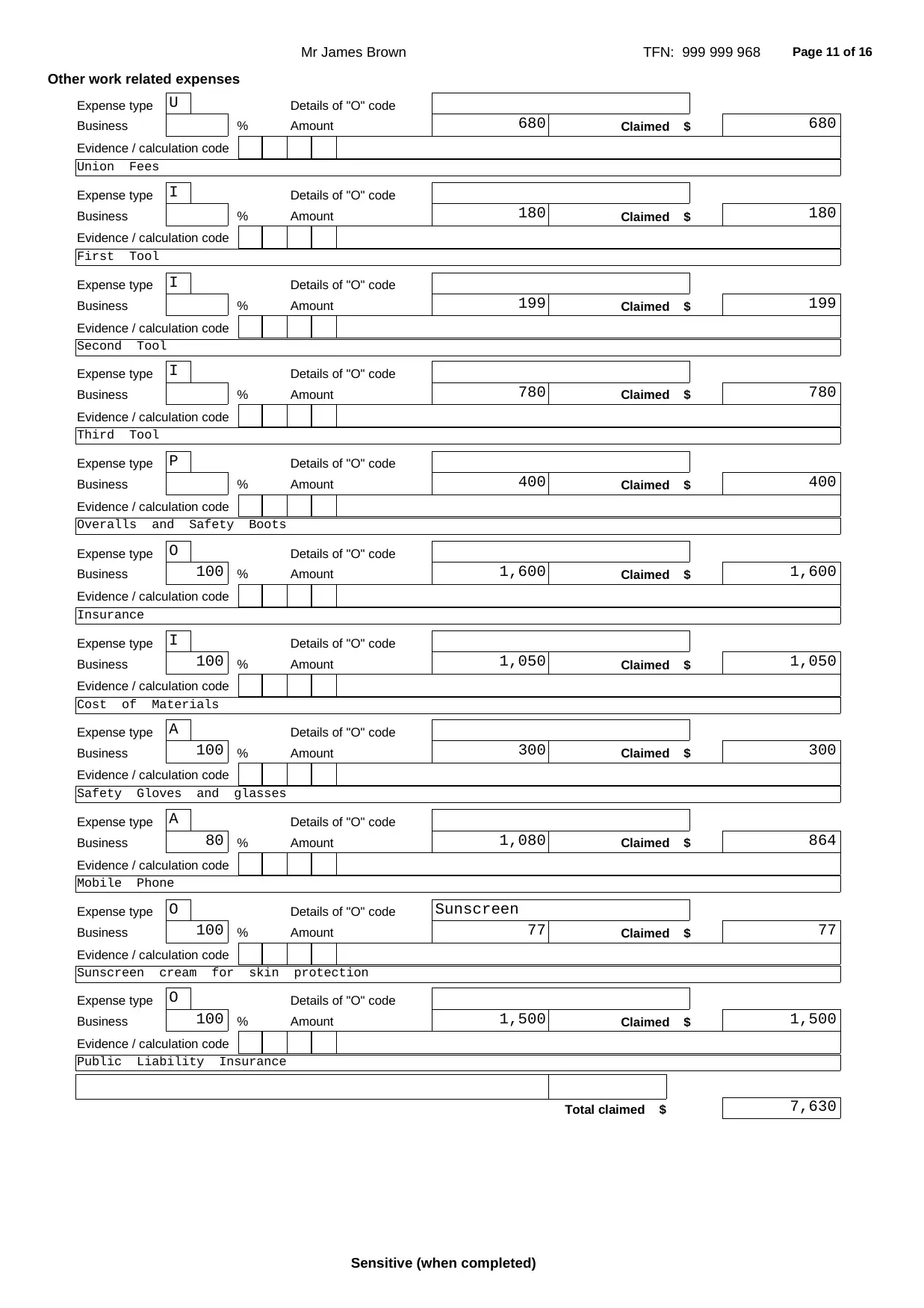

Page 11 of 16Mr James Brown TFN: 999 999 968

Other work related expenses

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

680

Union Fees

680

U

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

180

First Tool

180

I

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

199

Second Tool

199

I

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

780

Third Tool

780

I

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

400

Overalls and Safety Boots

400

P

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

1,600100

Insurance

1,600

O

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

1,050100

Cost of Materials

1,050

I

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

300100

Safety Gloves and glasses

300

A

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

1,08080

Mobile Phone

864

A

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

77100

Sunscreen cream for skin protection

77

SunscreenO

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

1,500100

Public Liability Insurance

1,500

O

Total claimed $ 7,630

Sensitive (when completed)

Other work related expenses

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

680

Union Fees

680

U

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

180

First Tool

180

I

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

199

Second Tool

199

I

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

780

Third Tool

780

I

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

400

Overalls and Safety Boots

400

P

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

1,600100

Insurance

1,600

O

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

1,050100

Cost of Materials

1,050

I

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

300100

Safety Gloves and glasses

300

A

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

1,08080

Mobile Phone

864

A

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

77100

Sunscreen cream for skin protection

77

SunscreenO

AmountBusiness %

Evidence / calculation code

Claimed $

Details of "O" codeExpense type

1,500100

Public Liability Insurance

1,500

O

Total claimed $ 7,630

Sensitive (when completed)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.