FNSACC504 Financial Accounting: In-depth Assessment Report with AASB

VerifiedAdded on 2024/05/31

|16

|3920

|310

Report

AI Summary

This document presents a comprehensive solution to an FNSACC504 Financial Accounting assessment. It includes a consolidation worksheet, comprehensive income statement, statement of changes in equity, statement of financial position, cash flow statement, and notes on important information as per AASB standards. The assessment also covers the differences in income tax calculation based on the PAYG system and the Income Tax Assessment Act, taxable transactions and governing legislation, and the impact of AASB on business reporting requirements. The document provides detailed financial statements and explanations related to accounting principles and taxation laws.

FNSACC504 - Assessment

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Assessment 1...................................................................................................................................3

Assessment 2...................................................................................................................................5

1: Comprehensive income statement...........................................................................................5

2: Prepare Statement of Change in Equity..................................................................................5

3: Statement of Financial Position................................................................................................6

4: Cash flow statement:.................................................................................................................8

5: Provide notes for the important information as per AASB standards.................................9

Assessment 3.................................................................................................................................10

Part 1.............................................................................................................................................10

Part 2.............................................................................................................................................14

References.....................................................................................................................................16

2

Assessment 1...................................................................................................................................3

Assessment 2...................................................................................................................................5

1: Comprehensive income statement...........................................................................................5

2: Prepare Statement of Change in Equity..................................................................................5

3: Statement of Financial Position................................................................................................6

4: Cash flow statement:.................................................................................................................8

5: Provide notes for the important information as per AASB standards.................................9

Assessment 3.................................................................................................................................10

Part 1.............................................................................................................................................10

Part 2.............................................................................................................................................14

References.....................................................................................................................................16

2

Assessment 1

Consolidation worksheet

30 June 2016

TMH

Ltd

RDL Elimination

Consolidation Statement

Consolidation

statement

Dr. Cr

$ $ $ $ $

Sales 330,000 240,000 20,000 - 5,50,000

Inventory 1-7-2015 30,000 20,000 - 1,000 49,000

Purchase 180,000 110,000 20,000 - 2,70,000

210,000 130,000 - - 8,70,000

Inventory 30-6-2016 40,000 20,000 - 7,00 59,300

Cost of goods sold 170,000 110,000 - - 8,10,700

Gross profit 160,000 130,000 9700 - 2,80,300

Operating expenses 113,000 94,000 - - 2,07,000

47,000 36,000 - - 73,300

Add: Profit on sale of

plant

- 4,000 4000 - -

Management fee received

from RDL

7,000 - 4,000 - -

Dividend received from

RDL

4,000 - 4,000 - -

Profit before tax 58,000 40,000 - - 73,300

Less: Income tax

expenses

10,000 18,000 - - 12,637

Profit 48,000 22,000 - - 60,663

Retained earnings 1-7-

2015

20,000 16,000 - - 36,000

Available for

appropriation

68,000 38,000 - - 96,663

Appropriation:

Interim dividend paid 8,000 4,000 4,000 - 8,000

Declared final dividend 10,000 6,000 6,000 - 10,000

General reserve 10,000 4,000 -14,000 - -

Total appropriation 28,000 14,000 - - 32,000

Retained earnings 30-6-

1016

40,000 24,000 - - 64,000

Share capital 200,000 60,000 60,000 - 2,00,000

General reserve 72,000 15,000 45000 - 42,000

Non-current liabilities 2,000 16,000 - - 18,000

Current liabilities 56,000 27,000 - - 83,000

370,000 142,000 - - 4,07,000

Share in RDL Ltd 110,000 - 1,10,000 - -

Other non-current assets 150,000 90,000 - - 2,40,000

Inventory 46,000 20,000 - - 66,000

3

Consolidation worksheet

30 June 2016

TMH

Ltd

RDL Elimination

Consolidation Statement

Consolidation

statement

Dr. Cr

$ $ $ $ $

Sales 330,000 240,000 20,000 - 5,50,000

Inventory 1-7-2015 30,000 20,000 - 1,000 49,000

Purchase 180,000 110,000 20,000 - 2,70,000

210,000 130,000 - - 8,70,000

Inventory 30-6-2016 40,000 20,000 - 7,00 59,300

Cost of goods sold 170,000 110,000 - - 8,10,700

Gross profit 160,000 130,000 9700 - 2,80,300

Operating expenses 113,000 94,000 - - 2,07,000

47,000 36,000 - - 73,300

Add: Profit on sale of

plant

- 4,000 4000 - -

Management fee received

from RDL

7,000 - 4,000 - -

Dividend received from

RDL

4,000 - 4,000 - -

Profit before tax 58,000 40,000 - - 73,300

Less: Income tax

expenses

10,000 18,000 - - 12,637

Profit 48,000 22,000 - - 60,663

Retained earnings 1-7-

2015

20,000 16,000 - - 36,000

Available for

appropriation

68,000 38,000 - - 96,663

Appropriation:

Interim dividend paid 8,000 4,000 4,000 - 8,000

Declared final dividend 10,000 6,000 6,000 - 10,000

General reserve 10,000 4,000 -14,000 - -

Total appropriation 28,000 14,000 - - 32,000

Retained earnings 30-6-

1016

40,000 24,000 - - 64,000

Share capital 200,000 60,000 60,000 - 2,00,000

General reserve 72,000 15,000 45000 - 42,000

Non-current liabilities 2,000 16,000 - - 18,000

Current liabilities 56,000 27,000 - - 83,000

370,000 142,000 - - 4,07,000

Share in RDL Ltd 110,000 - 1,10,000 - -

Other non-current assets 150,000 90,000 - - 2,40,000

Inventory 46,000 20,000 - - 66,000

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

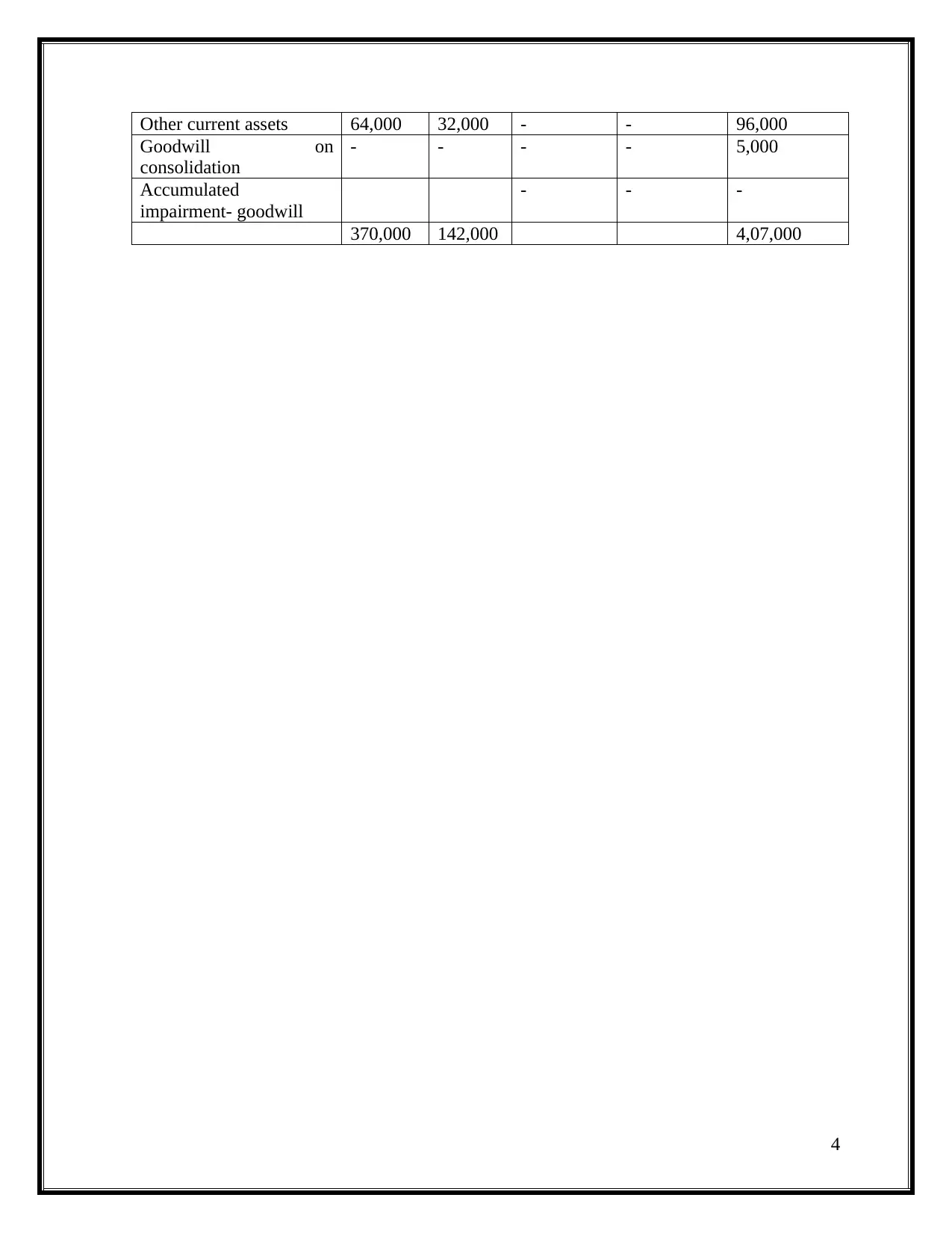

Other current assets 64,000 32,000 - - 96,000

Goodwill on

consolidation

- - - - 5,000

Accumulated

impairment- goodwill

- - -

370,000 142,000 4,07,000

4

Goodwill on

consolidation

- - - - 5,000

Accumulated

impairment- goodwill

- - -

370,000 142,000 4,07,000

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment 2

1: Comprehensive income statement

Comprehensive income: items which are not included in profit and loss statement due to their

nature but have a significant impact on the financial position of the business, called

comprehensive income items and the statement which is used to report such items known as

comprehensive income statement (Gazzola and Amelio, 2014).

Income and comprehensive income statement

Profit statement 2015 2016

sales 675000 7,62,250

Cost of goods sold 3,50,000 386790

GP 3,25,000 3,75,460

Salaries and wages 1,57,860 1,97,800

Superannuation 15,000 7,900

Motor vehicle expenses 30,000 14,700

General expenses 20,140 18,300

Depreciation- Building 4,000 5,400

Depreciation- Motor vehicle 11,000 12,900

Depreciation- Plant 5,000 6,800

Advertising expenses 2,000 500

Bad debts 5,000 2,310

net profit 75,000 1,08,850

Income tax expenses 25,000 35,920

Net profit 50,000 72,930

comprehensive Adjustment

Profit on revaluation - 50000

Total income attributed to shareholders fund 50000 1,22,930

2: Prepare Statement of Change in Equity

This statement is made to express the change in capital of shareholders. In other words,

various transactions take place in the course of business which affects the balance of

shareholder’s equity. It includes the information about the retained earnings, increases or

decreases in capital reserves etc.

5

1: Comprehensive income statement

Comprehensive income: items which are not included in profit and loss statement due to their

nature but have a significant impact on the financial position of the business, called

comprehensive income items and the statement which is used to report such items known as

comprehensive income statement (Gazzola and Amelio, 2014).

Income and comprehensive income statement

Profit statement 2015 2016

sales 675000 7,62,250

Cost of goods sold 3,50,000 386790

GP 3,25,000 3,75,460

Salaries and wages 1,57,860 1,97,800

Superannuation 15,000 7,900

Motor vehicle expenses 30,000 14,700

General expenses 20,140 18,300

Depreciation- Building 4,000 5,400

Depreciation- Motor vehicle 11,000 12,900

Depreciation- Plant 5,000 6,800

Advertising expenses 2,000 500

Bad debts 5,000 2,310

net profit 75,000 1,08,850

Income tax expenses 25,000 35,920

Net profit 50,000 72,930

comprehensive Adjustment

Profit on revaluation - 50000

Total income attributed to shareholders fund 50000 1,22,930

2: Prepare Statement of Change in Equity

This statement is made to express the change in capital of shareholders. In other words,

various transactions take place in the course of business which affects the balance of

shareholder’s equity. It includes the information about the retained earnings, increases or

decreases in capital reserves etc.

5

Statement of Change in Equity

Particulars Equity general reserve Retained earnings

Opening balance 400000 - 21940

the issue during the year 100000 - -

Transfer to general reserve - 2194 19746

Dividend (interim) - -254 -19746

Closing balance 500000 1940 0

3: Statement of Financial Position

Statement of financial position can be defined as a statement which denotes the position of an

asset, capital and liabilities of an organization at a particular date (Kulikova, et, al., 2015). It

is also known as balance sheet and made at end of the year to report the financial situation of

an organization.

Particulars 2015 2016

Assets

Current asset

Cash at bank 17560 135880

Account receivable 86,810 91590

Commission income accrued 400 600

Inventory 77,520 73190

Total current asset 1,82,290 3,01,260

Non-current asset

Land and building less Acc. 2,36,000 190600

Motor vehicle less Acc. 27100 39200

Plant less Acc 34500 20200

Suspense accounts - 50000

Call on deposit - 200000

Total Non-current asset 2,97,600 5,00,000

Total Asset 4,79,890 8,01,260

Liabilities

Current Liabilities

Account payable 55,860 59,440

Accrued salaries and wages 790 1,030

Taxation payable 21,300 35,920

Dividend payable 30,000 10,000

Total Current Liabilities 1,07,950 1,06,390

6

Particulars Equity general reserve Retained earnings

Opening balance 400000 - 21940

the issue during the year 100000 - -

Transfer to general reserve - 2194 19746

Dividend (interim) - -254 -19746

Closing balance 500000 1940 0

3: Statement of Financial Position

Statement of financial position can be defined as a statement which denotes the position of an

asset, capital and liabilities of an organization at a particular date (Kulikova, et, al., 2015). It

is also known as balance sheet and made at end of the year to report the financial situation of

an organization.

Particulars 2015 2016

Assets

Current asset

Cash at bank 17560 135880

Account receivable 86,810 91590

Commission income accrued 400 600

Inventory 77,520 73190

Total current asset 1,82,290 3,01,260

Non-current asset

Land and building less Acc. 2,36,000 190600

Motor vehicle less Acc. 27100 39200

Plant less Acc 34500 20200

Suspense accounts - 50000

Call on deposit - 200000

Total Non-current asset 2,97,600 5,00,000

Total Asset 4,79,890 8,01,260

Liabilities

Current Liabilities

Account payable 55,860 59,440

Accrued salaries and wages 790 1,030

Taxation payable 21,300 35,920

Dividend payable 30,000 10,000

Total Current Liabilities 1,07,950 1,06,390

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Non-Current Liabilities

Debenture - 100000

Total Liabilities 1,07,950 2,06,390

Share capital 300000 500000

Retained earning 21940 19746

General reserve - 2194

Profit for the year 50000 72930

Total share capital 371940 594870

Total liabilities and share capital 4,79,890 8,01,260

4: Cash flow statement:

Cash flow statements can be defined as those statements which are used to show the flow of

cash (Miletić, 2014). It includes all cash related transaction without considering their nature

and size.

Particulars 2016

Cash receipt from sales 86000

Cash receipt from customers -

cash paid to suppliers -

Motor vehicle expenses -14700

General expenses -18300

Advertising expenses -500

Miscellaneous income 2000

Cash purchase -34500

Net from Operating Activities 20000

Investment activities (Net) -

Financing Activities

Capital Issue 100000

Dividend of 2015 -30000

Interim dividend -20000

Net from Financing Activities 50000

Net Decrease or increase in cash 70000

Opening balance of cash 65880

Closing balance 135880

7

Debenture - 100000

Total Liabilities 1,07,950 2,06,390

Share capital 300000 500000

Retained earning 21940 19746

General reserve - 2194

Profit for the year 50000 72930

Total share capital 371940 594870

Total liabilities and share capital 4,79,890 8,01,260

4: Cash flow statement:

Cash flow statements can be defined as those statements which are used to show the flow of

cash (Miletić, 2014). It includes all cash related transaction without considering their nature

and size.

Particulars 2016

Cash receipt from sales 86000

Cash receipt from customers -

cash paid to suppliers -

Motor vehicle expenses -14700

General expenses -18300

Advertising expenses -500

Miscellaneous income 2000

Cash purchase -34500

Net from Operating Activities 20000

Investment activities (Net) -

Financing Activities

Capital Issue 100000

Dividend of 2015 -30000

Interim dividend -20000

Net from Financing Activities 50000

Net Decrease or increase in cash 70000

Opening balance of cash 65880

Closing balance 135880

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5: Provide notes for the important information as per AASB standards.

AS per AASB 1039: According to the AASB 1039, Australian companies should prepare

and publish their concise financial statements. The concise financial statements mean that

company should report complete financial information in financial statements.

As per AASB 139: AASB recognition and measurement, the financial statements are made

after the sufficient risk measurement. The company also measured the risk related to the

value of the fixed asset and significant adjustment is made for the risk factors. The

revaluation hedges are included in the comprehensive income statement to give the effect on

capital.

As per AASB 107: AASB 107’cash flow’ denotes that a statement of cash changes should

be made along with financial statements to report the receipt and allocation of cash funds.

AASB 107 marks that cash flow statements are assumed as the part of financial statements

and Atlanta Company is made cash flow statements as per need.

As per AASB 116: As per AASB 116, Property, “Plant and Equipment” a business should

value its fixed asset appropriately and the amount of depreciation, revaluation, carrying

amounts and cost should be segregated properly. Financial statements of Atlanta Company

are also made after considering all instructions of AASB 116.

8

AS per AASB 1039: According to the AASB 1039, Australian companies should prepare

and publish their concise financial statements. The concise financial statements mean that

company should report complete financial information in financial statements.

As per AASB 139: AASB recognition and measurement, the financial statements are made

after the sufficient risk measurement. The company also measured the risk related to the

value of the fixed asset and significant adjustment is made for the risk factors. The

revaluation hedges are included in the comprehensive income statement to give the effect on

capital.

As per AASB 107: AASB 107’cash flow’ denotes that a statement of cash changes should

be made along with financial statements to report the receipt and allocation of cash funds.

AASB 107 marks that cash flow statements are assumed as the part of financial statements

and Atlanta Company is made cash flow statements as per need.

As per AASB 116: As per AASB 116, Property, “Plant and Equipment” a business should

value its fixed asset appropriately and the amount of depreciation, revaluation, carrying

amounts and cost should be segregated properly. Financial statements of Atlanta Company

are also made after considering all instructions of AASB 116.

8

Assessment 3

Part 1

Discuss the differences in the calculation of income tax based on the PAYG system and the

Income Tax Assessment Act.

In Australia, there are various laws which can be followed in relation to taxation and there are

several systems which are available for the calculation of the tax amount. The tax can be

calculated either by the income tax assessment act or with the help of PAYG system. There are

various aspects which are required to be noted in them and for that, it will be required that proper

understanding in relation to them is obtained. There are several differences between them which

will also be identified by the information which is provided below:

PAYG system:

This is the system of the tax in which the company will be making the advance payment in

relation to the tax so that the expected tax liability which will be arising is covered by the

business. In this, the investment income which is related to the present year will also be

considered. This will be paid on the basis of the assumption in which the expected tax will be

calculated (D'Elia, 2016). Then at the end of the ear actual accounts will be prepared and the tax

in accordance with them will be calculated. The amount which has been paid will be compared

to the company with the actual amount and the deviation which is there will be ascertained. By

this, the amount which is to be collected as a refund or the additional liability is any will be

determined. If the paid amount is more than a refund will be there and in case of the actual being

high, the company will have to issue a further invoice in this respect of the amount that is

payable. The amount of the PAYG tax will be calculated by the company and in that they will be

considering the information which will be available with the help of the information that is

present in the income tax returns which have been recently filed (Chen, 2015). The tax is

calculated by the ATO on the investment and business income in which growth in GDP will be

included and this will determine the amount of the installment. This will be paid in a quarterly

manner.

9

Part 1

Discuss the differences in the calculation of income tax based on the PAYG system and the

Income Tax Assessment Act.

In Australia, there are various laws which can be followed in relation to taxation and there are

several systems which are available for the calculation of the tax amount. The tax can be

calculated either by the income tax assessment act or with the help of PAYG system. There are

various aspects which are required to be noted in them and for that, it will be required that proper

understanding in relation to them is obtained. There are several differences between them which

will also be identified by the information which is provided below:

PAYG system:

This is the system of the tax in which the company will be making the advance payment in

relation to the tax so that the expected tax liability which will be arising is covered by the

business. In this, the investment income which is related to the present year will also be

considered. This will be paid on the basis of the assumption in which the expected tax will be

calculated (D'Elia, 2016). Then at the end of the ear actual accounts will be prepared and the tax

in accordance with them will be calculated. The amount which has been paid will be compared

to the company with the actual amount and the deviation which is there will be ascertained. By

this, the amount which is to be collected as a refund or the additional liability is any will be

determined. If the paid amount is more than a refund will be there and in case of the actual being

high, the company will have to issue a further invoice in this respect of the amount that is

payable. The amount of the PAYG tax will be calculated by the company and in that they will be

considering the information which will be available with the help of the information that is

present in the income tax returns which have been recently filed (Chen, 2015). The tax is

calculated by the ATO on the investment and business income in which growth in GDP will be

included and this will determine the amount of the installment. This will be paid in a quarterly

manner.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Income tax assessment act:

It is the Act which is made by the parliament of Australia and in this, the laws which are required

to be followed by all the assesses are specified (Baum, et. al., 2017). There are various

provisions and sections which are specified in them in which the manner in which the company

will be required to calculate the assessable income and tax on the same will be ascertained. There

are various rules which are to be followed in respect of deductible and non-deductible expenses.

In this, all types of incomes and expenses are given the consideration (Faccio & Xu, 2015).

There is the proper system which will be followed and then the rate which is provided is used to

calculate the amount of the tax.

In this, no advance payment is made as in case of the PAYG and all of the calculation is made on

the actual information and no estimation is made.

Discuss what constitute taxable transactions, and what legislation governs this.

In the business, there are various transactions which are carried and it is required that the ones on

which tax is to be paid are identified and they are known as the taxable transactions. The

company will be liable to pay the tax on this. Out of all the taxable transactions, there are some

of the events which are exempt and they are to be excluded from the tax. The tax is paid on the

various transactions and they include international transactions which are made, the assessable

income which is earned in business will also be taxable and that will be taken after allowing the

deduction (Hemmelgarn, et. al., 2016). The capital gains which are made will also be considered

as the taxable transactions. All of the incomes which are made in the business will be included in

this as they will be the earning and will be counted as the taxable transaction. They all are

specified in the laws and act which is formulated and is to be followed.

There are various legislations which will be governing this and they include local government

legislation in which the state government will be making the act. Another is Commonwealth

legislation which will be dealing with all of the tax-related matters and in this various types of

taxes such as customs duties and excise will be covered. The last is the state and territory

legislation in which the stamp tax, payroll tax, and land tax are levied.

10

It is the Act which is made by the parliament of Australia and in this, the laws which are required

to be followed by all the assesses are specified (Baum, et. al., 2017). There are various

provisions and sections which are specified in them in which the manner in which the company

will be required to calculate the assessable income and tax on the same will be ascertained. There

are various rules which are to be followed in respect of deductible and non-deductible expenses.

In this, all types of incomes and expenses are given the consideration (Faccio & Xu, 2015).

There is the proper system which will be followed and then the rate which is provided is used to

calculate the amount of the tax.

In this, no advance payment is made as in case of the PAYG and all of the calculation is made on

the actual information and no estimation is made.

Discuss what constitute taxable transactions, and what legislation governs this.

In the business, there are various transactions which are carried and it is required that the ones on

which tax is to be paid are identified and they are known as the taxable transactions. The

company will be liable to pay the tax on this. Out of all the taxable transactions, there are some

of the events which are exempt and they are to be excluded from the tax. The tax is paid on the

various transactions and they include international transactions which are made, the assessable

income which is earned in business will also be taxable and that will be taken after allowing the

deduction (Hemmelgarn, et. al., 2016). The capital gains which are made will also be considered

as the taxable transactions. All of the incomes which are made in the business will be included in

this as they will be the earning and will be counted as the taxable transaction. They all are

specified in the laws and act which is formulated and is to be followed.

There are various legislations which will be governing this and they include local government

legislation in which the state government will be making the act. Another is Commonwealth

legislation which will be dealing with all of the tax-related matters and in this various types of

taxes such as customs duties and excise will be covered. The last is the state and territory

legislation in which the stamp tax, payroll tax, and land tax are levied.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Provide information regarding the impact the AASB has on reporting requirements to

businesses

The AASB is being adopted in Australia in place of the IFRS and there are various impacts

which will be faced by the business due to this in respect of the financial reporting. There are

various new policies and standards which are formulated under this and they will be required to

be applied (Kent, 2017). By them, the reporting will be made in their accordance and various

modifications will have to be adopted. There are several disclosure requirements that are to be

compiled by with the introduction of them. The new policies are providing the information to the

users and by that, they can take the decisions on various aspects inappropriate manner. The

change which will be faced in the financial position due to the new standards will have to be

disclosed. The reporting is now made in the more effective manner and true position of the

business is depicted by them (Adrian & Liang, 2016). The reporting will be made in lieu of the

acts and they will be reported to the responsible authorities.

Discuss the legal implications that affect business-research into a different state and federal

legislation.

There are various changes that may affect the business of the organization (Larrat, et. al., 2012).

The New Year implies the new taxation policies and this is important as it helps in gaining the

developments in the infrastructure of the organization. The change in the policy is different from

gaining the competitive advantage due to various compliance issues (Kitching, et. al., 2015). The

legal implications which may impact the business are:

1. Tax Policy Changes: The change in the tax policy may impact the business in the

adverse way that the federal tax policy reforms is passed in the Congress but have the

implications on business which are of all sizes (Kitching, et. al., 2015). The US tax code,

as well as the many states, may change the change the policies so that the better federal

policy can be confirmed and the regulations can be enhanced (Larrat, et. al., 2012). The

business should keep the proper track on the development of the new technologies so that

the new opportunities and the strategies can be pursued and the profitability within the

organization can be attained (Larrat, et. al., 2012).

11

businesses

The AASB is being adopted in Australia in place of the IFRS and there are various impacts

which will be faced by the business due to this in respect of the financial reporting. There are

various new policies and standards which are formulated under this and they will be required to

be applied (Kent, 2017). By them, the reporting will be made in their accordance and various

modifications will have to be adopted. There are several disclosure requirements that are to be

compiled by with the introduction of them. The new policies are providing the information to the

users and by that, they can take the decisions on various aspects inappropriate manner. The

change which will be faced in the financial position due to the new standards will have to be

disclosed. The reporting is now made in the more effective manner and true position of the

business is depicted by them (Adrian & Liang, 2016). The reporting will be made in lieu of the

acts and they will be reported to the responsible authorities.

Discuss the legal implications that affect business-research into a different state and federal

legislation.

There are various changes that may affect the business of the organization (Larrat, et. al., 2012).

The New Year implies the new taxation policies and this is important as it helps in gaining the

developments in the infrastructure of the organization. The change in the policy is different from

gaining the competitive advantage due to various compliance issues (Kitching, et. al., 2015). The

legal implications which may impact the business are:

1. Tax Policy Changes: The change in the tax policy may impact the business in the

adverse way that the federal tax policy reforms is passed in the Congress but have the

implications on business which are of all sizes (Kitching, et. al., 2015). The US tax code,

as well as the many states, may change the change the policies so that the better federal

policy can be confirmed and the regulations can be enhanced (Larrat, et. al., 2012). The

business should keep the proper track on the development of the new technologies so that

the new opportunities and the strategies can be pursued and the profitability within the

organization can be attained (Larrat, et. al., 2012).

11

2. General data protection regulations (GDPR) in the European Union: The general

data protection regulations are established so as to follow up with the regulations which

are similar so that the American network can be constructed and the data can be secured

(Larrat, et. al., 2012). These developments are very much important for the entrepreneurs

so that the data security can be maintained within the European as well as the other

countries. The businessman should ensure that the policies are on the radar and thee

regulations are to be maintained in future (Kitching, et. al., 2015).

3. The Affordable Care Act: The change in this act will also impact the business

operations in the United States. This is the reform which is for the health care reform.

The tax changes which were made in the year 2018 include the provision within itself

that there was the reduction in Affordable Care Act (Larrat, et. al., 2012). The standards

which are set of the reporting are hard to change but the individuals who are self-insured

and the employees should always be ready to adopt all the changes (Kitching, et. al.,

2015).

So, the size of the organization does not matters but the businessman or the entrepreneur

should be ready to comply with all the changes that may affect the business in the future.

These should be included in their reports so that the managers of the business or the

organizations can take the decisions related to the particular implication accordingly (Larrat,

et. al., 2012).

12

data protection regulations are established so as to follow up with the regulations which

are similar so that the American network can be constructed and the data can be secured

(Larrat, et. al., 2012). These developments are very much important for the entrepreneurs

so that the data security can be maintained within the European as well as the other

countries. The businessman should ensure that the policies are on the radar and thee

regulations are to be maintained in future (Kitching, et. al., 2015).

3. The Affordable Care Act: The change in this act will also impact the business

operations in the United States. This is the reform which is for the health care reform.

The tax changes which were made in the year 2018 include the provision within itself

that there was the reduction in Affordable Care Act (Larrat, et. al., 2012). The standards

which are set of the reporting are hard to change but the individuals who are self-insured

and the employees should always be ready to adopt all the changes (Kitching, et. al.,

2015).

So, the size of the organization does not matters but the businessman or the entrepreneur

should be ready to comply with all the changes that may affect the business in the future.

These should be included in their reports so that the managers of the business or the

organizations can take the decisions related to the particular implication accordingly (Larrat,

et. al., 2012).

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.