Dissertation: Forensic Accounting's Role in Anti-Money Laundering

VerifiedAdded on 2021/04/16

|16

|5080

|24

Thesis and Dissertation

AI Summary

This dissertation delves into the critical role of forensic accounting within the banking industry, particularly concerning anti-money laundering (AML) regulations and fraud detection. It explores the historical context of money laundering, its impact on financial institutions, and the increasing demand for forensic accountants. The paper defines money laundering, examines its historical impact on global financial institutions, and analyzes the skills and competencies required for effective AML analysis and forensic accounting practices. It highlights the significance of forensic accounting in mitigating financial crimes, assessing risks, and ensuring regulatory compliance within the banking sector. The dissertation also emphasizes the need for skilled professionals capable of identifying and preventing fraudulent activities, supported by industry data and expert opinions, making the case for the ongoing growth and importance of forensic accounting in the financial landscape.

Running head: DISSERTATION

Dissertation

Name of the Student

Name of the University

Author Note

Dissertation

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1DISSERTATION

Chapter 1: Introduction

1.1: Introduction

The operation of the banking industry needs to be done with the help of the regulation

related to anti-money laundering where the banks are functional within the countries. This is due

to the challenges that are being faced by them from the customers, FATF, governments and

supervisors for identification of the risks and managing it in a proper manner. This has to be

done so that the penalties for financial reputation were reaching new heights. Therefore, almost

all the banks have improved their infrastructures so that the accounting systems can be controlled

through an internal environment. This led to providing more importance on the accountants who

specializes in forensic accounting also known as ‘forensic accountants’. According to the United

Nations Office for Drug Control and Crime Prevention (2001), the laundered of anti-money acts

as the protector of capitalism in the capitalist countries that have developed on a major scale.

1.1.1: Definition of money laundering

Money laundering refers to the process of creating a circumstance where a huge sum of

money is being taken for criminal proceedings such as terrorist activities or trafficking of drugs,

which are shown as legitimate sources of spending. This type of illicit activity is considered to be

a nuisance where the personnel tries to make the amount look clean.

1.2: History and concept of money laundering

The rise in the money laundering activities can be estimated to be £231 billion per year

within the private as well as the public sector, which needs to be stopped with efficient

investigation in to the traditional methods of the auditing system, which is ineffective for the

detection of the fraudulent activities within the banks (Whitehead, H. 2016). The world was

Chapter 1: Introduction

1.1: Introduction

The operation of the banking industry needs to be done with the help of the regulation

related to anti-money laundering where the banks are functional within the countries. This is due

to the challenges that are being faced by them from the customers, FATF, governments and

supervisors for identification of the risks and managing it in a proper manner. This has to be

done so that the penalties for financial reputation were reaching new heights. Therefore, almost

all the banks have improved their infrastructures so that the accounting systems can be controlled

through an internal environment. This led to providing more importance on the accountants who

specializes in forensic accounting also known as ‘forensic accountants’. According to the United

Nations Office for Drug Control and Crime Prevention (2001), the laundered of anti-money acts

as the protector of capitalism in the capitalist countries that have developed on a major scale.

1.1.1: Definition of money laundering

Money laundering refers to the process of creating a circumstance where a huge sum of

money is being taken for criminal proceedings such as terrorist activities or trafficking of drugs,

which are shown as legitimate sources of spending. This type of illicit activity is considered to be

a nuisance where the personnel tries to make the amount look clean.

1.2: History and concept of money laundering

The rise in the money laundering activities can be estimated to be £231 billion per year

within the private as well as the public sector, which needs to be stopped with efficient

investigation in to the traditional methods of the auditing system, which is ineffective for the

detection of the fraudulent activities within the banks (Whitehead, H. 2016). The world was

2DISSERTATION

taken aback with the various catastrophes that happened within the banks with respect to the

activities of money laundering. An example of this would be the financial debacles of Standard

Chartered Bank and HSBC who are guilty with the control of money laundering activities in a

loose manner and the transactions of £5.57 billion and £191.8 billion have been found to be

suspicious respectively (McLaughlin & Pavelka, 2013). The BSI Bank in the year 2016 was

asked to shut down its operations by the Monetary Authority of Singapore, as it breached most of

the requirements that were present in anti-money laundering activities along with the poor

management of the operations within the banks. It was also seen that the bank had behaved with

the staffs in a bad manner as well (MAS, 2016). The French Prudential Supervision and

Resolution Authority (ACPR) had fined BNP Paribas an amount of £8.75 million due to the

inadequate control measures with respect to the anti-money laundering activities. In the year

2014, BNP Paribas was fined an amount of $9 billion by the authorities of the United States, as it

violated the sanctions that were made against Iran, Sudan and Cuba (Reuters, 2017). The big

losses that are happening in the banks are affecting the financial system of the institutions as

well, which gives rise to a bigger question that what is wrong with the systems for prevention

and detection within the banks? It is necessary for the banking institutions to have a forensic

accountant, analysts for anti-money laundering activities and auditors so that they can help in the

identification of the risks that are present with the laundering activities and the threats of

financing the terrorist groups (Jadavji, 2011; Josiah & Samson, 2012). They are also related in a

different manner as well where these personnel are on a constant lookout for the

misrepresentation of the financial data along with the fraud transactions that may take place

within the banks so that it can be detected and proper measures can be taken up (Ozkul &

Pamukcu, 2012).

taken aback with the various catastrophes that happened within the banks with respect to the

activities of money laundering. An example of this would be the financial debacles of Standard

Chartered Bank and HSBC who are guilty with the control of money laundering activities in a

loose manner and the transactions of £5.57 billion and £191.8 billion have been found to be

suspicious respectively (McLaughlin & Pavelka, 2013). The BSI Bank in the year 2016 was

asked to shut down its operations by the Monetary Authority of Singapore, as it breached most of

the requirements that were present in anti-money laundering activities along with the poor

management of the operations within the banks. It was also seen that the bank had behaved with

the staffs in a bad manner as well (MAS, 2016). The French Prudential Supervision and

Resolution Authority (ACPR) had fined BNP Paribas an amount of £8.75 million due to the

inadequate control measures with respect to the anti-money laundering activities. In the year

2014, BNP Paribas was fined an amount of $9 billion by the authorities of the United States, as it

violated the sanctions that were made against Iran, Sudan and Cuba (Reuters, 2017). The big

losses that are happening in the banks are affecting the financial system of the institutions as

well, which gives rise to a bigger question that what is wrong with the systems for prevention

and detection within the banks? It is necessary for the banking institutions to have a forensic

accountant, analysts for anti-money laundering activities and auditors so that they can help in the

identification of the risks that are present with the laundering activities and the threats of

financing the terrorist groups (Jadavji, 2011; Josiah & Samson, 2012). They are also related in a

different manner as well where these personnel are on a constant lookout for the

misrepresentation of the financial data along with the fraud transactions that may take place

within the banks so that it can be detected and proper measures can be taken up (Ozkul &

Pamukcu, 2012).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3DISSERTATION

The studies that have been conducted earlier showed that some of the people within the

institutions are not competent enough in meeting the demands for assessing the risks within the

financial system with the help of the latest technologies or the controlling system in an internal

manner (Simwayi & Wang, 2011). A survey that was conducted by PwC known as the Global

Economic Crime Survey 2016 showed that 19 percent of the claims showed that hiring trained

and experienced employees within the institution is one of the biggest challenges for detecting

the financial corruption within the organization. Almost all the banking institutions are finding it

difficult to hire personnel that are highly skilled so that they can identify the areas that are

vulnerable within the organization and provide assistance on the fraud that is taking place within

the organization (Zea, 2003). This will help in leading to a better rate of growth, as the

professionals will be able to detect and prevent the fraudulent activities that has helped in giving

rise to forensic accounting (Ozkul & Pamukcu, 2013). According to Hopwood et al. (2013),

forensic accounting is seen as the exploration of the skills that are related to the analysis and

investigation of the issues that are used for handling the issues of economy so that it can help in

satisfying the demands that are required by the law. Curtis (2008) was of the opinion that the

legal boards have found the forensic accountants suitable in providing better and efficient

services for analyzing the documents related to finance in the cases of frauds. Curtis (2008) was

again backed by Hopwood et al. (2013) by stating that the accountants who are trained in a better

way will have a minimum amount of knowledge with respect to the policies of accounting, legal

systems, Information Technology (IT), auditing along with the accounting that will help in

investigating the potential benefits that are linked to the banking institutions (Ebere &

Ibanichuka, 2016).

The studies that have been conducted earlier showed that some of the people within the

institutions are not competent enough in meeting the demands for assessing the risks within the

financial system with the help of the latest technologies or the controlling system in an internal

manner (Simwayi & Wang, 2011). A survey that was conducted by PwC known as the Global

Economic Crime Survey 2016 showed that 19 percent of the claims showed that hiring trained

and experienced employees within the institution is one of the biggest challenges for detecting

the financial corruption within the organization. Almost all the banking institutions are finding it

difficult to hire personnel that are highly skilled so that they can identify the areas that are

vulnerable within the organization and provide assistance on the fraud that is taking place within

the organization (Zea, 2003). This will help in leading to a better rate of growth, as the

professionals will be able to detect and prevent the fraudulent activities that has helped in giving

rise to forensic accounting (Ozkul & Pamukcu, 2013). According to Hopwood et al. (2013),

forensic accounting is seen as the exploration of the skills that are related to the analysis and

investigation of the issues that are used for handling the issues of economy so that it can help in

satisfying the demands that are required by the law. Curtis (2008) was of the opinion that the

legal boards have found the forensic accountants suitable in providing better and efficient

services for analyzing the documents related to finance in the cases of frauds. Curtis (2008) was

again backed by Hopwood et al. (2013) by stating that the accountants who are trained in a better

way will have a minimum amount of knowledge with respect to the policies of accounting, legal

systems, Information Technology (IT), auditing along with the accounting that will help in

investigating the potential benefits that are linked to the banking institutions (Ebere &

Ibanichuka, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4DISSERTATION

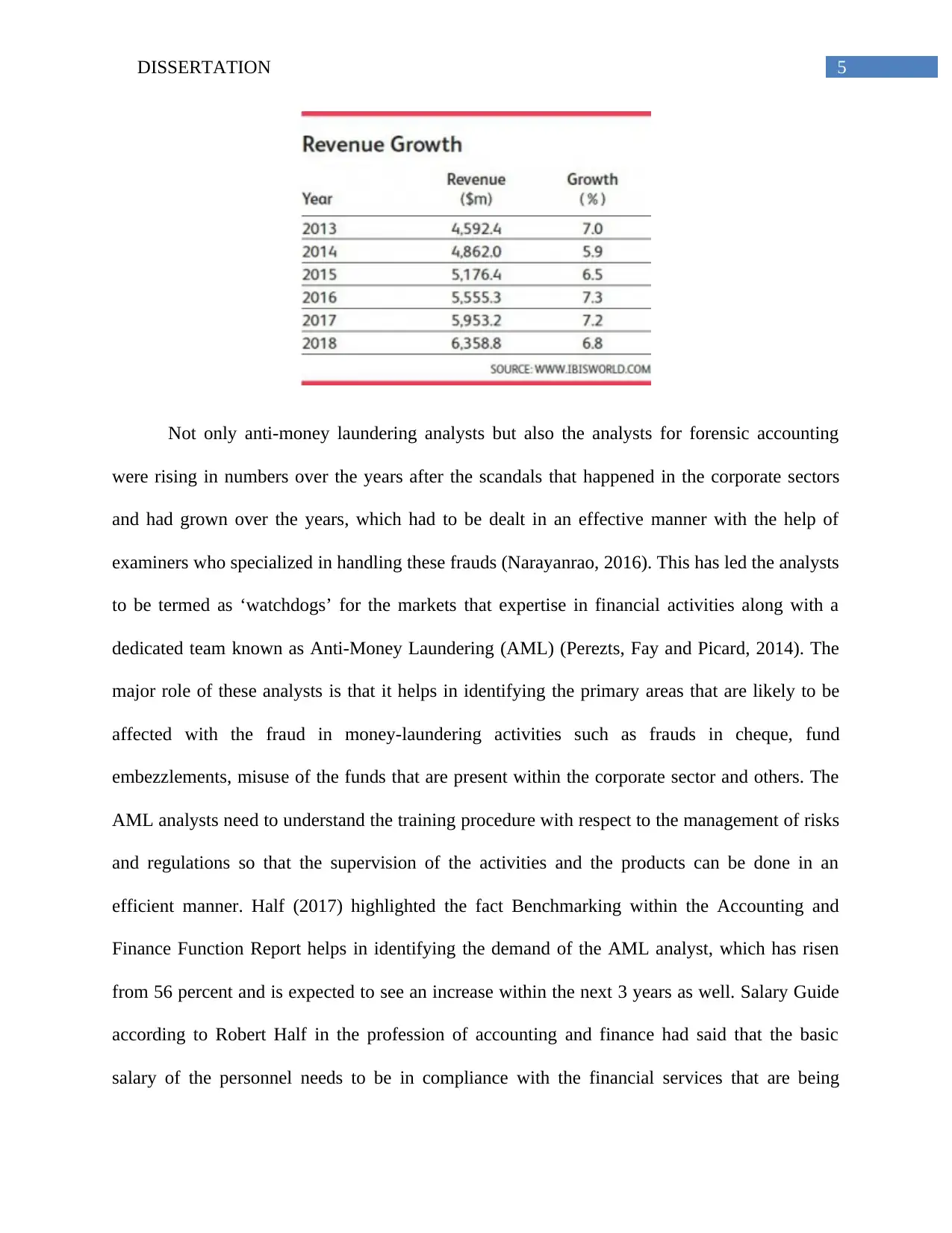

There have been further studies as well on the demands that are increasing on a further

manner with respect to forensic accountant. In a study conducted in 2017 by Kesslr International,

it was seen that there has been an increase in the demand of forensic accounting over the last 40

years along with the advancements in technology that has led to the growth in the fraudulent

activities within the banking institutions. The alterations of the existing laws with respect to the

statutes in anti-money laundering have helped in the creation of demand for investigating in to

the fraud activities through forensic accounting (Henning & Misuraca, 2013). The rise in the

confidence of the business along with the disputes that needs to be feared and the level of

awareness that may increase the risk of the reputation has given a rise in the demand for the

forensic accounting (Stuart, 2018). The graph that has been provided below shows the industry

that is related to forensic accounting with a strong rate of growth of around 8.7 percent on an

approximate and by the end of the five years, the rate of growth has been forecasted to be 6.7

percent by 2018. This is due to the growth on a sustainable manner in the finance as well in the

insurance industry (IBIS world, 2013). The revenue that is accounted from the services of

forensic accounting is about 5 percent in the accounting industry on an overall basis, which

shows that is has an advantage over the services that are being provided by the accounting

industry as well (Henning & Misuraca, 2013). The evidence that is available shows that there is

an increase in the growth of forensic accounting, which is strong as it helped in contributing

towards the growth of revenue at times of financial crisis as well.

There have been further studies as well on the demands that are increasing on a further

manner with respect to forensic accountant. In a study conducted in 2017 by Kesslr International,

it was seen that there has been an increase in the demand of forensic accounting over the last 40

years along with the advancements in technology that has led to the growth in the fraudulent

activities within the banking institutions. The alterations of the existing laws with respect to the

statutes in anti-money laundering have helped in the creation of demand for investigating in to

the fraud activities through forensic accounting (Henning & Misuraca, 2013). The rise in the

confidence of the business along with the disputes that needs to be feared and the level of

awareness that may increase the risk of the reputation has given a rise in the demand for the

forensic accounting (Stuart, 2018). The graph that has been provided below shows the industry

that is related to forensic accounting with a strong rate of growth of around 8.7 percent on an

approximate and by the end of the five years, the rate of growth has been forecasted to be 6.7

percent by 2018. This is due to the growth on a sustainable manner in the finance as well in the

insurance industry (IBIS world, 2013). The revenue that is accounted from the services of

forensic accounting is about 5 percent in the accounting industry on an overall basis, which

shows that is has an advantage over the services that are being provided by the accounting

industry as well (Henning & Misuraca, 2013). The evidence that is available shows that there is

an increase in the growth of forensic accounting, which is strong as it helped in contributing

towards the growth of revenue at times of financial crisis as well.

5DISSERTATION

Not only anti-money laundering analysts but also the analysts for forensic accounting

were rising in numbers over the years after the scandals that happened in the corporate sectors

and had grown over the years, which had to be dealt in an effective manner with the help of

examiners who specialized in handling these frauds (Narayanrao, 2016). This has led the analysts

to be termed as ‘watchdogs’ for the markets that expertise in financial activities along with a

dedicated team known as Anti-Money Laundering (AML) (Perezts, Fay and Picard, 2014). The

major role of these analysts is that it helps in identifying the primary areas that are likely to be

affected with the fraud in money-laundering activities such as frauds in cheque, fund

embezzlements, misuse of the funds that are present within the corporate sector and others. The

AML analysts need to understand the training procedure with respect to the management of risks

and regulations so that the supervision of the activities and the products can be done in an

efficient manner. Half (2017) highlighted the fact Benchmarking within the Accounting and

Finance Function Report helps in identifying the demand of the AML analyst, which has risen

from 56 percent and is expected to see an increase within the next 3 years as well. Salary Guide

according to Robert Half in the profession of accounting and finance had said that the basic

salary of the personnel needs to be in compliance with the financial services that are being

Not only anti-money laundering analysts but also the analysts for forensic accounting

were rising in numbers over the years after the scandals that happened in the corporate sectors

and had grown over the years, which had to be dealt in an effective manner with the help of

examiners who specialized in handling these frauds (Narayanrao, 2016). This has led the analysts

to be termed as ‘watchdogs’ for the markets that expertise in financial activities along with a

dedicated team known as Anti-Money Laundering (AML) (Perezts, Fay and Picard, 2014). The

major role of these analysts is that it helps in identifying the primary areas that are likely to be

affected with the fraud in money-laundering activities such as frauds in cheque, fund

embezzlements, misuse of the funds that are present within the corporate sector and others. The

AML analysts need to understand the training procedure with respect to the management of risks

and regulations so that the supervision of the activities and the products can be done in an

efficient manner. Half (2017) highlighted the fact Benchmarking within the Accounting and

Finance Function Report helps in identifying the demand of the AML analyst, which has risen

from 56 percent and is expected to see an increase within the next 3 years as well. Salary Guide

according to Robert Half in the profession of accounting and finance had said that the basic

salary of the personnel needs to be in compliance with the financial services that are being

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6DISSERTATION

provided by them, which is also inclusive of the officers and the compliance managers along

with the chief officers of the anti-money laundering activities that is forecasted to rise by at least

3.4 percent by the end of 2017. It can thus be inferred that the demand of the analysts who

specializes in AML has been increasing and most of the organizations are ready to remunerate

them with a better package for the services rendered by them. The primary role of the AML

analyst and the forensic accountant is that after the fraud has been committed by using deceptive

means of financial transactions, it needs to be analyzed, examined and presented through a

proper structure of sup-ort, which will help the officials to understand the problems (Narayanrao,

2016).

Nevertheless the question asked by the researchers is with respect to the importance of

the technical abilities and the specialized skills that will help the forensic accountants in

identifying the frauds that has taken place within the organization (Lukito, 2016; Harris &

Brown, 2000 and Ramaswamy, 2005). This is due to the fact that the investigative,

communication, organizational and the analytical skills in assessing the frauds is one of the

important skill sets that needs to be present within the AML analyst (Narayanrao, 2016). With

respect to that, DiGabrielle (2007, 2009) stated that the studies has helped in determining the

relevant skills that needs to be present within the forensic accountant along with the 9

competencies, which needs to be viewed from various perspectives such as practitioners of

forensic accounting, academics of accounting and the people who uses the services present in

forensic accounting.

Another point also needs to be considered that the extent of possibility that is present in

hiring, developing and training the people for the correct roles within the organization along with

the right set of skills. To be more specific, the question is that what are the major sets of skills

provided by them, which is also inclusive of the officers and the compliance managers along

with the chief officers of the anti-money laundering activities that is forecasted to rise by at least

3.4 percent by the end of 2017. It can thus be inferred that the demand of the analysts who

specializes in AML has been increasing and most of the organizations are ready to remunerate

them with a better package for the services rendered by them. The primary role of the AML

analyst and the forensic accountant is that after the fraud has been committed by using deceptive

means of financial transactions, it needs to be analyzed, examined and presented through a

proper structure of sup-ort, which will help the officials to understand the problems (Narayanrao,

2016).

Nevertheless the question asked by the researchers is with respect to the importance of

the technical abilities and the specialized skills that will help the forensic accountants in

identifying the frauds that has taken place within the organization (Lukito, 2016; Harris &

Brown, 2000 and Ramaswamy, 2005). This is due to the fact that the investigative,

communication, organizational and the analytical skills in assessing the frauds is one of the

important skill sets that needs to be present within the AML analyst (Narayanrao, 2016). With

respect to that, DiGabrielle (2007, 2009) stated that the studies has helped in determining the

relevant skills that needs to be present within the forensic accountant along with the 9

competencies, which needs to be viewed from various perspectives such as practitioners of

forensic accounting, academics of accounting and the people who uses the services present in

forensic accounting.

Another point also needs to be considered that the extent of possibility that is present in

hiring, developing and training the people for the correct roles within the organization along with

the right set of skills. To be more specific, the question is that what are the major sets of skills

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7DISSERTATION

that the banks are looking within the employees when they are going for a AML analyst? Does

the foundation of AML in the firm along with the compliance in financial crime will help in

monitoring and detecting the activities of money laundering in an effective manner? Should the

banks employ the people who have knowledge of the skills required in forensic accounting?

ACAMS (2017) had responded that an interview conducted with the practitioners of AML helps

in suggesting that skills related to forensic accounting has to be present among the forensic

accountants so that it will help in assisting the investigations, which will lead to the recovery of

the funds that has been embezzled through the crime. The techniques present in forensic

accounting helps the AML analysts in researching the activities that may be suspicious so that

the information can be useful while filing the SAR. The information that is present within the

SAR helps in assisting the enforcement of law so that proper leads can be developed for

investigating the criminal activities. Moreover, the in-depth investigation of the AML in utilizing

the techniques of forensic accounting can be done by enriching the reporting process of SAR and

in compliance with the requirements of the report within the organization (ACAMS, 2017).

Silverstone et al. (2012) studied that the forensic accounting does not act as a substitute for the

comprehensive investigation methods that are done in an extensive manner that helps in tracking

the transactions in all the banking institutes.

1.3 Problem statement

The scandals that are present in the corporate sector such as the crimes related to white

collar and the activities of money laundering where the analyst of anti-money laundering and

forensic accountants are in the limelight for solving the issues. The act of money laundering has

taken up a major portion of the scandals in corporate sector on a global manner and is estimated

to be around 5 percent of the Gross Domestic Product (GDP) of the world estimating a value of

that the banks are looking within the employees when they are going for a AML analyst? Does

the foundation of AML in the firm along with the compliance in financial crime will help in

monitoring and detecting the activities of money laundering in an effective manner? Should the

banks employ the people who have knowledge of the skills required in forensic accounting?

ACAMS (2017) had responded that an interview conducted with the practitioners of AML helps

in suggesting that skills related to forensic accounting has to be present among the forensic

accountants so that it will help in assisting the investigations, which will lead to the recovery of

the funds that has been embezzled through the crime. The techniques present in forensic

accounting helps the AML analysts in researching the activities that may be suspicious so that

the information can be useful while filing the SAR. The information that is present within the

SAR helps in assisting the enforcement of law so that proper leads can be developed for

investigating the criminal activities. Moreover, the in-depth investigation of the AML in utilizing

the techniques of forensic accounting can be done by enriching the reporting process of SAR and

in compliance with the requirements of the report within the organization (ACAMS, 2017).

Silverstone et al. (2012) studied that the forensic accounting does not act as a substitute for the

comprehensive investigation methods that are done in an extensive manner that helps in tracking

the transactions in all the banking institutes.

1.3 Problem statement

The scandals that are present in the corporate sector such as the crimes related to white

collar and the activities of money laundering where the analyst of anti-money laundering and

forensic accountants are in the limelight for solving the issues. The act of money laundering has

taken up a major portion of the scandals in corporate sector on a global manner and is estimated

to be around 5 percent of the Gross Domestic Product (GDP) of the world estimating a value of

8DISSERTATION

1-2 trillion as loss in money laundering on an annual basis (IMF, Website). According to

Masciandro and Barone (2008), the estimation of the value for money laundering activities is

around USD 1.2 trillion that is equal to 2.7 percent of the total GDP of the world. A report by the

United Nations Office on Drugs and Crime (UNODC) estimated that in the year 2009 that the

money laundering cases was around 3.6 percent of the GDP in the world. It was inferred that

there is a strong indication that most of the countries will be following a standard regulation.

Within Malaysia, the statistics showed that there were around 188 charges against money

laundering activities and the value was around RM 29.9 million in the year 2005 (INCSR Report,

2006) and that there were around 94 cases that were being held in the court amounting to a total

of RM 1.2 billion till the year 2010 (Malaysian Insider, 2010). BNM reported that there are alerts

of fraud that is going on within the banks, which are being investigated under Anti-Terrorism

Financing, Anti-Money Laundering and Proceeds of Unlawful Activities Act (AMLATPUA)

2001.

The evidences may be present in the report from UNODC where the flow of illicit

financial activities on a global manner has to be less than 1 percent from being seized by the

authorities (PwC, 2016). KPMG in 2013 had reported that some of the defrauding companies did

not even report about the fraud that has happened within the institution. A survey that was

conducted showed that around 47 percent of the respondents had agree to the fact that the

companies did not report the frauds due to the negative effect that it would have on the brand

image within the public, around 32 percent agreed that the confidence was not strong in facing

the judiciary and the enforcement system and around 24 percent reported that the criminal cases

were mostly unsettled. Business Insider (2011) had stated that the figures presented by the

organization is for the media only and The Financial Action Task Force (FATF, 2004) stated that

1-2 trillion as loss in money laundering on an annual basis (IMF, Website). According to

Masciandro and Barone (2008), the estimation of the value for money laundering activities is

around USD 1.2 trillion that is equal to 2.7 percent of the total GDP of the world. A report by the

United Nations Office on Drugs and Crime (UNODC) estimated that in the year 2009 that the

money laundering cases was around 3.6 percent of the GDP in the world. It was inferred that

there is a strong indication that most of the countries will be following a standard regulation.

Within Malaysia, the statistics showed that there were around 188 charges against money

laundering activities and the value was around RM 29.9 million in the year 2005 (INCSR Report,

2006) and that there were around 94 cases that were being held in the court amounting to a total

of RM 1.2 billion till the year 2010 (Malaysian Insider, 2010). BNM reported that there are alerts

of fraud that is going on within the banks, which are being investigated under Anti-Terrorism

Financing, Anti-Money Laundering and Proceeds of Unlawful Activities Act (AMLATPUA)

2001.

The evidences may be present in the report from UNODC where the flow of illicit

financial activities on a global manner has to be less than 1 percent from being seized by the

authorities (PwC, 2016). KPMG in 2013 had reported that some of the defrauding companies did

not even report about the fraud that has happened within the institution. A survey that was

conducted showed that around 47 percent of the respondents had agree to the fact that the

companies did not report the frauds due to the negative effect that it would have on the brand

image within the public, around 32 percent agreed that the confidence was not strong in facing

the judiciary and the enforcement system and around 24 percent reported that the criminal cases

were mostly unsettled. Business Insider (2011) had stated that the figures presented by the

organization is for the media only and The Financial Action Task Force (FATF, 2004) stated that

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9DISSERTATION

the estimation of the money laundering will lead to a body of inter-governments so that the fight

against the money laundering activities can be done strongly. The theory of FATF was defended

by Shanmugam et al. (2013) where it was stated that the availability of the data is easy along

with the values that are related to the activities of money laundering. In a same manner, Reuter

and Truman (2005) had stated that the scale estimation for the act of money laundering is

difficult to measure as it does not exist at all. Alkaabi et al. (2010) stated that there is no direct

measure for estimating the way money moves out from the financial system and is converted in

to illegal funds that cannot be traced due to the lack of the financial tools for estimating the

amount of funds that has been embezzled.

In the past few years, it was seen in the United States that almost a dozen of financial

institutes have been imposed with fines of huge amounts relating to millions and billions in

money laundering (PwC, 2016). The Global Economic Crime Survey 2016 (GECS 2016) had

reported findings that almost 18 percent of the financial institutions have faced actions from the

regulator due to fraudulent activities. An example of this would be the collapse of Bank of Credit

and Commerce International (BCCI), as it was involved in crimes with respect to financial

system and money laundering activities. The scandals of Bank of New York in the year 1999, the

scandal of Riggs Bank in 2002 and the fraudulent activities of Standard Chartered and HSBC

Bank in the year 2012 were due to the lack in the controls of anti-money laundering. The

Commonwealth Bank of Australia in 2017 had also faced multiple problems with respect to the

laws of counter terrorism activities and money laundering and in the year 2018, Citibank has

shortcomings in its policies of money laundering, which had exposed the dangers that are present

within the banking system (Whitehead, 2016; Smyth, 2017; Rahman, 2013, Reuters, 2018).

the estimation of the money laundering will lead to a body of inter-governments so that the fight

against the money laundering activities can be done strongly. The theory of FATF was defended

by Shanmugam et al. (2013) where it was stated that the availability of the data is easy along

with the values that are related to the activities of money laundering. In a same manner, Reuter

and Truman (2005) had stated that the scale estimation for the act of money laundering is

difficult to measure as it does not exist at all. Alkaabi et al. (2010) stated that there is no direct

measure for estimating the way money moves out from the financial system and is converted in

to illegal funds that cannot be traced due to the lack of the financial tools for estimating the

amount of funds that has been embezzled.

In the past few years, it was seen in the United States that almost a dozen of financial

institutes have been imposed with fines of huge amounts relating to millions and billions in

money laundering (PwC, 2016). The Global Economic Crime Survey 2016 (GECS 2016) had

reported findings that almost 18 percent of the financial institutions have faced actions from the

regulator due to fraudulent activities. An example of this would be the collapse of Bank of Credit

and Commerce International (BCCI), as it was involved in crimes with respect to financial

system and money laundering activities. The scandals of Bank of New York in the year 1999, the

scandal of Riggs Bank in 2002 and the fraudulent activities of Standard Chartered and HSBC

Bank in the year 2012 were due to the lack in the controls of anti-money laundering. The

Commonwealth Bank of Australia in 2017 had also faced multiple problems with respect to the

laws of counter terrorism activities and money laundering and in the year 2018, Citibank has

shortcomings in its policies of money laundering, which had exposed the dangers that are present

within the banking system (Whitehead, 2016; Smyth, 2017; Rahman, 2013, Reuters, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10DISSERTATION

The scandals within the corporate sector of Malaysia are also responsible for the

calamities that are taking place on a global basis. The 1MDB that is 1 Malaysia Development

Berhad, Megan Media Holdings Berhad and Transmile Group Berhad are some of the famous

cases that are facing charges for the corporate crimes (Omar, Said and Johari, 2016).

One of the biggest scandals with respect to finance was the 1MDB where the department

of justice (DoJ) located in the United States reported that around $3.5 billion was found to be

stolen from 1MDB. Case (2017) reported that the main motive was the promotion of

development of the economy but instead the money was found to be present within the associates

of Prime Minister Najib. The money was divided in to $1 billion that was present in 1MDB and

Petro Saudi, the other part of the amount, which was $1.4 billion, was issued as bonds to an

offshore company in Switzerland and the remaining $1.3 billion was transferred to an account in

Singapore. Laorgna (2015) stated that most of the officials present in 1MDB were corrupt and

the funds of the public were treated as their own bank accounts. The conspirators in the money

laundering case stated that they were under the theory of fraud triangle which is the pressure,

opportunity and rationalization. The case of 1MDB was that the parties had the materials, which

helped them in accessing the accounts of the people. These accounts were opened and the money

was transferred to the offshore company so that they can gain legitimacy.

Transmile Group Berhad (2007) in Malaysia was also a public listed company that had

committed a financial fraud (Securities Commission, 2013). The company was managed by

Robert Kuok who is a billionaire in Malaysia. The company was incorporated in 1996 on 13th

January and was listed under Bursa Malaysia in 1997 on 27th June and was removed from the list

on 24th May, 2011 due to overstating of the profit margin by approximately RM622 million in

2004 and 2006 respectively (Li, 2007; Omar, 2012; Fong, 2007).

The scandals within the corporate sector of Malaysia are also responsible for the

calamities that are taking place on a global basis. The 1MDB that is 1 Malaysia Development

Berhad, Megan Media Holdings Berhad and Transmile Group Berhad are some of the famous

cases that are facing charges for the corporate crimes (Omar, Said and Johari, 2016).

One of the biggest scandals with respect to finance was the 1MDB where the department

of justice (DoJ) located in the United States reported that around $3.5 billion was found to be

stolen from 1MDB. Case (2017) reported that the main motive was the promotion of

development of the economy but instead the money was found to be present within the associates

of Prime Minister Najib. The money was divided in to $1 billion that was present in 1MDB and

Petro Saudi, the other part of the amount, which was $1.4 billion, was issued as bonds to an

offshore company in Switzerland and the remaining $1.3 billion was transferred to an account in

Singapore. Laorgna (2015) stated that most of the officials present in 1MDB were corrupt and

the funds of the public were treated as their own bank accounts. The conspirators in the money

laundering case stated that they were under the theory of fraud triangle which is the pressure,

opportunity and rationalization. The case of 1MDB was that the parties had the materials, which

helped them in accessing the accounts of the people. These accounts were opened and the money

was transferred to the offshore company so that they can gain legitimacy.

Transmile Group Berhad (2007) in Malaysia was also a public listed company that had

committed a financial fraud (Securities Commission, 2013). The company was managed by

Robert Kuok who is a billionaire in Malaysia. The company was incorporated in 1996 on 13th

January and was listed under Bursa Malaysia in 1997 on 27th June and was removed from the list

on 24th May, 2011 due to overstating of the profit margin by approximately RM622 million in

2004 and 2006 respectively (Li, 2007; Omar, 2012; Fong, 2007).

11DISSERTATION

Megan Media Holdings Berhad (2007) was recognized in the early part of 1994 and in

the year 2000 it got listed in the second board of Bursa Malaysia. The company was listed in to

the main board by 2002 and subsequently was removed from the list by 2008 because of its

subsidiaries Memory Tech and MJC Pte Ltd that defaulted on paying RM47 million to its

bondholders. Memory Tech was also found to provide a deposit of 13 lines of products that were

of fictitious nature and had an amount receivable of RM334.30 million. The assets that were

present in Memory Tech was estimated to be around RM456 million. The payments that were

meant to be for the creditors were paid to the third parties of the company, which led to a loss of

RM1.27 billion for the company (News Straits Times, 2007; Omar, 2012).

The major scandals in the corporate houses have the following provisions in money

laundering activities that they are subjected to:

i) The federal government of Malaysia had captured RM32 million worth in cash, cheques

amounted to RM 550,000 and around four land plots were also found with respect to

scandal of Port Klang Free Zone (PKFZ) and was found guilty under the Anti-Money

Laundering and Anti-Terrorism Financing Act as well (The Star, 2011).

ii) The previous chief of the state steel company in malaysia known as Perwaja Steel was

dragged in to court, as they were found to embezzle RM76.4 million that was paid to a

company known as Frilsham Enterprise based in Hong Kong in 1994, which was found

to be not present at a later date (The Star, 2004; BBC News, 2004).

iii) AMMB Holding Bhd (AM Bank Group) was charged with RM53.7 million by the

Negara Malaysia Bank due to the breach in its non-complaints and the real offense has

been kept as a secret. The sources that were present has stated that there has been links in

transactions with SRC International Sdn Bhd and 1MDB (Raj, 2015).

Megan Media Holdings Berhad (2007) was recognized in the early part of 1994 and in

the year 2000 it got listed in the second board of Bursa Malaysia. The company was listed in to

the main board by 2002 and subsequently was removed from the list by 2008 because of its

subsidiaries Memory Tech and MJC Pte Ltd that defaulted on paying RM47 million to its

bondholders. Memory Tech was also found to provide a deposit of 13 lines of products that were

of fictitious nature and had an amount receivable of RM334.30 million. The assets that were

present in Memory Tech was estimated to be around RM456 million. The payments that were

meant to be for the creditors were paid to the third parties of the company, which led to a loss of

RM1.27 billion for the company (News Straits Times, 2007; Omar, 2012).

The major scandals in the corporate houses have the following provisions in money

laundering activities that they are subjected to:

i) The federal government of Malaysia had captured RM32 million worth in cash, cheques

amounted to RM 550,000 and around four land plots were also found with respect to

scandal of Port Klang Free Zone (PKFZ) and was found guilty under the Anti-Money

Laundering and Anti-Terrorism Financing Act as well (The Star, 2011).

ii) The previous chief of the state steel company in malaysia known as Perwaja Steel was

dragged in to court, as they were found to embezzle RM76.4 million that was paid to a

company known as Frilsham Enterprise based in Hong Kong in 1994, which was found

to be not present at a later date (The Star, 2004; BBC News, 2004).

iii) AMMB Holding Bhd (AM Bank Group) was charged with RM53.7 million by the

Negara Malaysia Bank due to the breach in its non-complaints and the real offense has

been kept as a secret. The sources that were present has stated that there has been links in

transactions with SRC International Sdn Bhd and 1MDB (Raj, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.