Major Assignment: MAF101 Fundamentals of Finance - Trimester 1, 2019

VerifiedAdded on 2023/03/17

|14

|2639

|90

Homework Assignment

AI Summary

This assignment solution for MAF101, Fundamentals of Finance, covers several key financial concepts. Part 1 includes calculations for net present value, lump sum investments, bond pricing, and share valuation using the dividend growth model. Part 2 focuses on portfolio analysis, exploring the returns and risks associated with different investment strategies. It analyzes portfolio alpha, beta, and gamma, using historical data to assess risk and return profiles. The solution also addresses risk management principles, including diversifiable and non-diversifiable risks, the use of beta and standard deviation, and the implications of risk aversion. Finally, the assignment provides investment recommendations for different customer profiles based on their time horizons and risk tolerance.

Part 1

Question 1

Answer

The policy is not worth it.

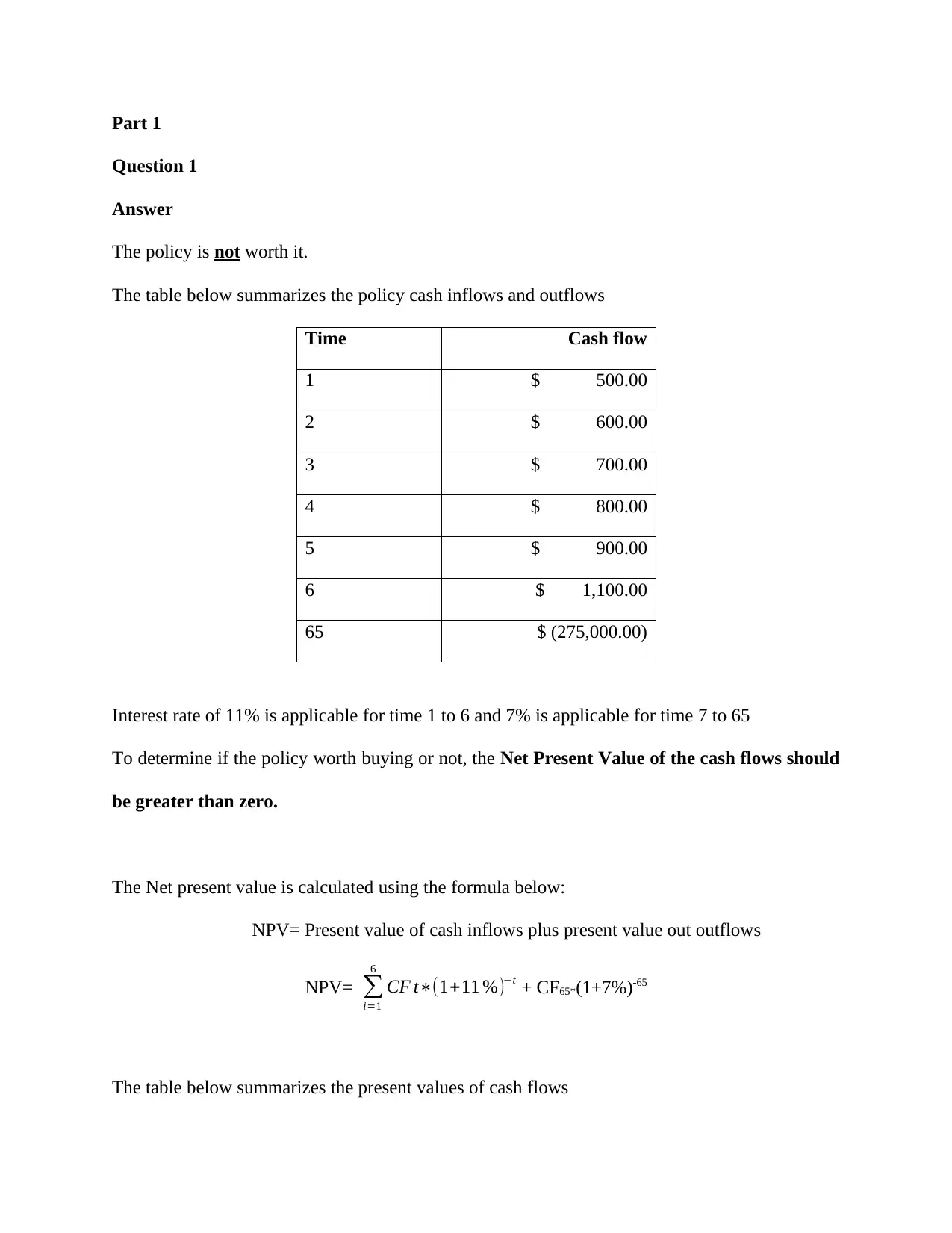

The table below summarizes the policy cash inflows and outflows

Time Cash flow

1 $ 500.00

2 $ 600.00

3 $ 700.00

4 $ 800.00

5 $ 900.00

6 $ 1,100.00

65 $ (275,000.00)

Interest rate of 11% is applicable for time 1 to 6 and 7% is applicable for time 7 to 65

To determine if the policy worth buying or not, the Net Present Value of the cash flows should

be greater than zero.

The Net present value is calculated using the formula below:

NPV= Present value of cash inflows plus present value out outflows

NPV= ∑

i=1

6

CF t∗(1+11 %)−t + CF65*(1+7%)-65

The table below summarizes the present values of cash flows

Question 1

Answer

The policy is not worth it.

The table below summarizes the policy cash inflows and outflows

Time Cash flow

1 $ 500.00

2 $ 600.00

3 $ 700.00

4 $ 800.00

5 $ 900.00

6 $ 1,100.00

65 $ (275,000.00)

Interest rate of 11% is applicable for time 1 to 6 and 7% is applicable for time 7 to 65

To determine if the policy worth buying or not, the Net Present Value of the cash flows should

be greater than zero.

The Net present value is calculated using the formula below:

NPV= Present value of cash inflows plus present value out outflows

NPV= ∑

i=1

6

CF t∗(1+11 %)−t + CF65*(1+7%)-65

The table below summarizes the present values of cash flows

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

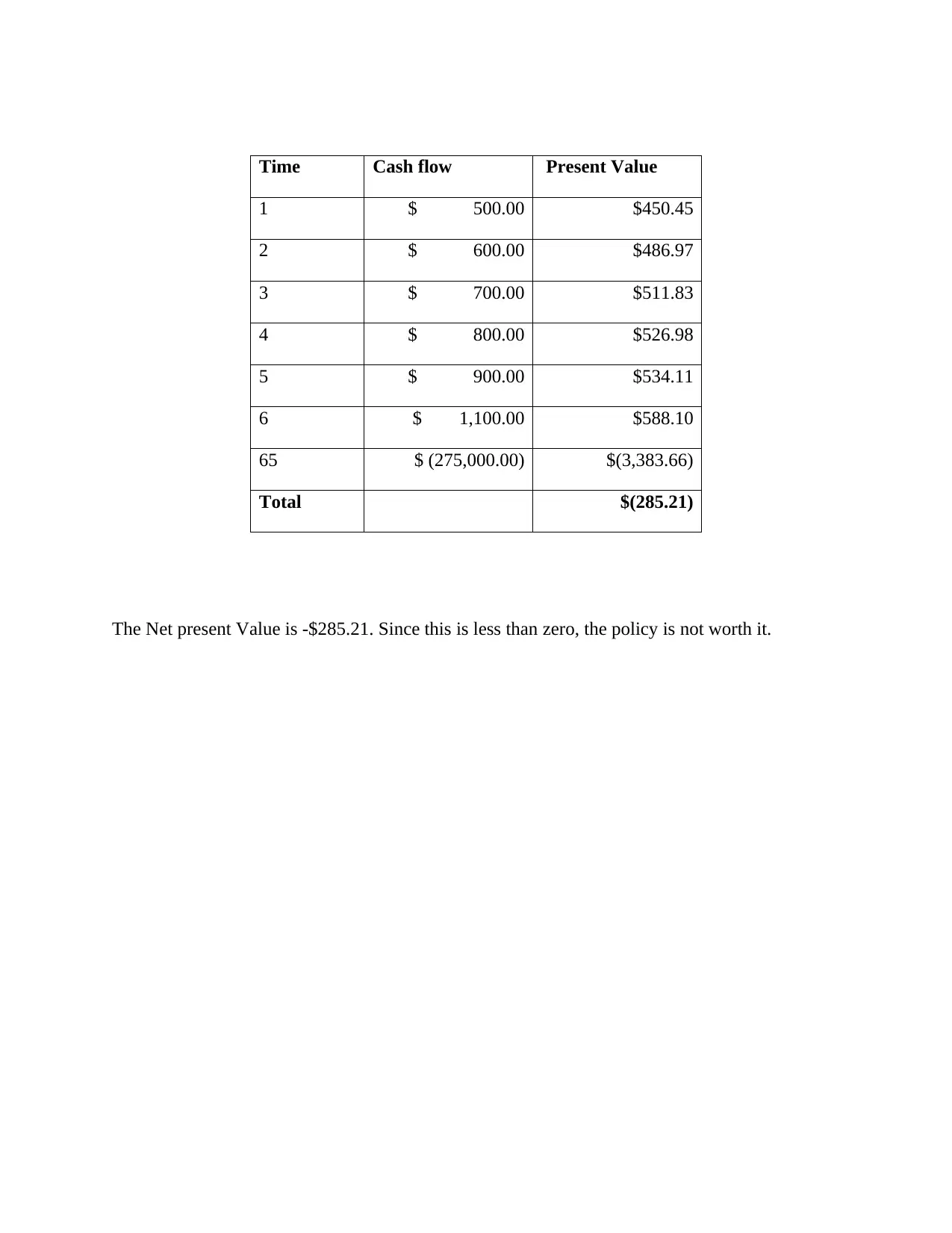

Time Cash flow Present Value

1 $ 500.00 $450.45

2 $ 600.00 $486.97

3 $ 700.00 $511.83

4 $ 800.00 $526.98

5 $ 900.00 $534.11

6 $ 1,100.00 $588.10

65 $ (275,000.00) $(3,383.66)

Total $(285.21)

The Net present Value is -$285.21. Since this is less than zero, the policy is not worth it.

1 $ 500.00 $450.45

2 $ 600.00 $486.97

3 $ 700.00 $511.83

4 $ 800.00 $526.98

5 $ 900.00 $534.11

6 $ 1,100.00 $588.10

65 $ (275,000.00) $(3,383.66)

Total $(285.21)

The Net present Value is -$285.21. Since this is less than zero, the policy is not worth it.

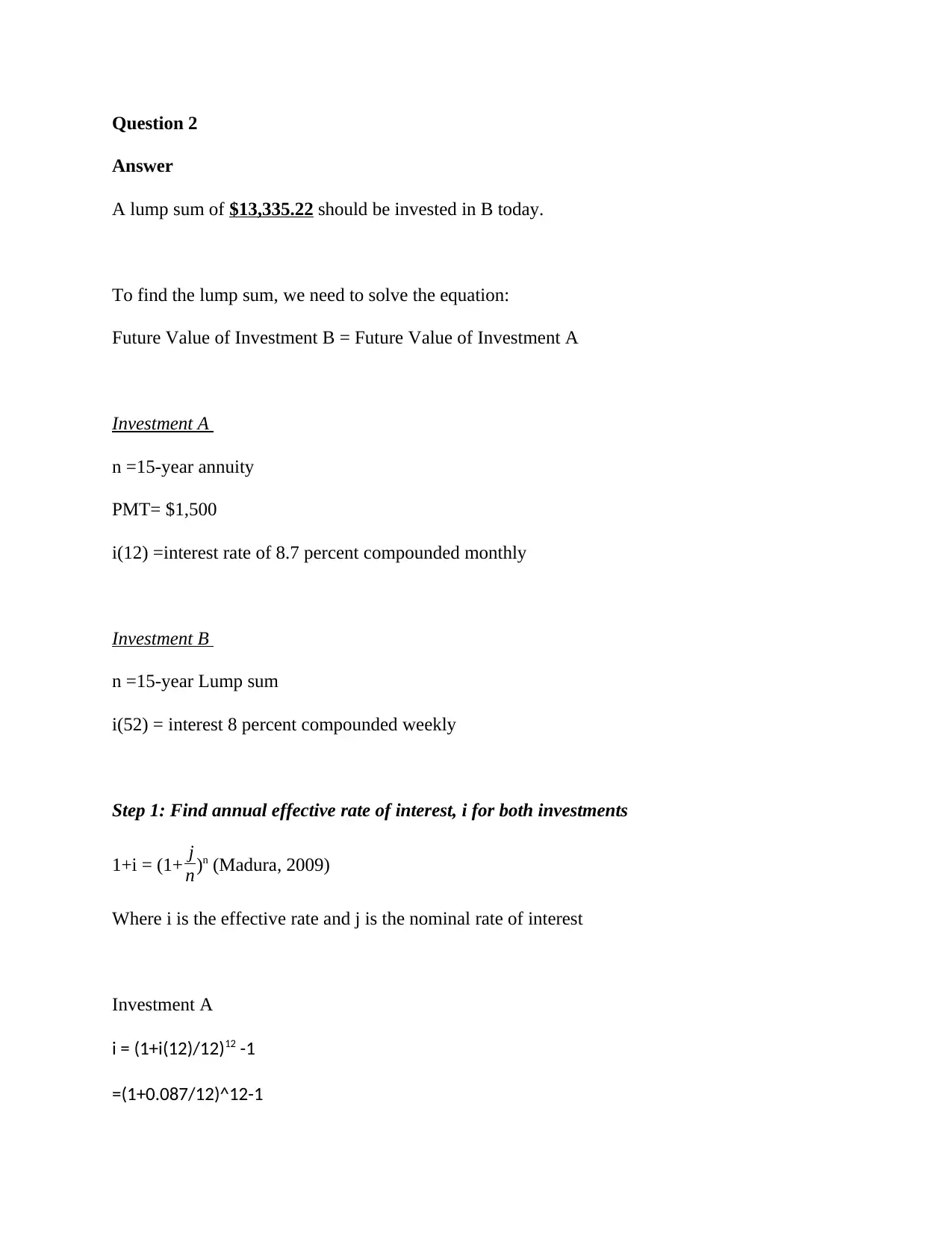

Question 2

Answer

A lump sum of $13,335.22 should be invested in B today.

To find the lump sum, we need to solve the equation:

Future Value of Investment B = Future Value of Investment A

Investment A

n =15-year annuity

PMT= $1,500

i(12) =interest rate of 8.7 percent compounded monthly

Investment B

n =15-year Lump sum

i(52) = interest 8 percent compounded weekly

Step 1: Find annual effective rate of interest, i for both investments

1+i = (1+ j

n)n (Madura, 2009)

Where i is the effective rate and j is the nominal rate of interest

Investment A

i = (1+i(12)/12)12 -1

=(1+0.087/12)^12-1

Answer

A lump sum of $13,335.22 should be invested in B today.

To find the lump sum, we need to solve the equation:

Future Value of Investment B = Future Value of Investment A

Investment A

n =15-year annuity

PMT= $1,500

i(12) =interest rate of 8.7 percent compounded monthly

Investment B

n =15-year Lump sum

i(52) = interest 8 percent compounded weekly

Step 1: Find annual effective rate of interest, i for both investments

1+i = (1+ j

n)n (Madura, 2009)

Where i is the effective rate and j is the nominal rate of interest

Investment A

i = (1+i(12)/12)12 -1

=(1+0.087/12)^12-1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

=9.0554%

Investment B

i = (1+i(52)/52)52 -1

=(1+0.08/52)^52-1

=8.3220%

Step 2: Find Future Value of Investment A

Future Value of Annuity = PMT * [ (1+ i)15−1 ¿¿¿ i ]

= 1500 * [ (1+9.0554 %)15−1

9.0554 % ]

= $44,233.69

Step 3: Solve the equation: Future Value of Investment B = Future Value of Investment A

Future Value of Investment B= Future Value of Investment A

Lump sum*(1+8.3220%)15 =$44,233.69

Lump sum =44233.69/(1+8.3220%)15

Lump sum = $13,335.22

Investment B

i = (1+i(52)/52)52 -1

=(1+0.08/52)^52-1

=8.3220%

Step 2: Find Future Value of Investment A

Future Value of Annuity = PMT * [ (1+ i)15−1 ¿¿¿ i ]

= 1500 * [ (1+9.0554 %)15−1

9.0554 % ]

= $44,233.69

Step 3: Solve the equation: Future Value of Investment B = Future Value of Investment A

Future Value of Investment B= Future Value of Investment A

Lump sum*(1+8.3220%)15 =$44,233.69

Lump sum =44233.69/(1+8.3220%)15

Lump sum = $13,335.22

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

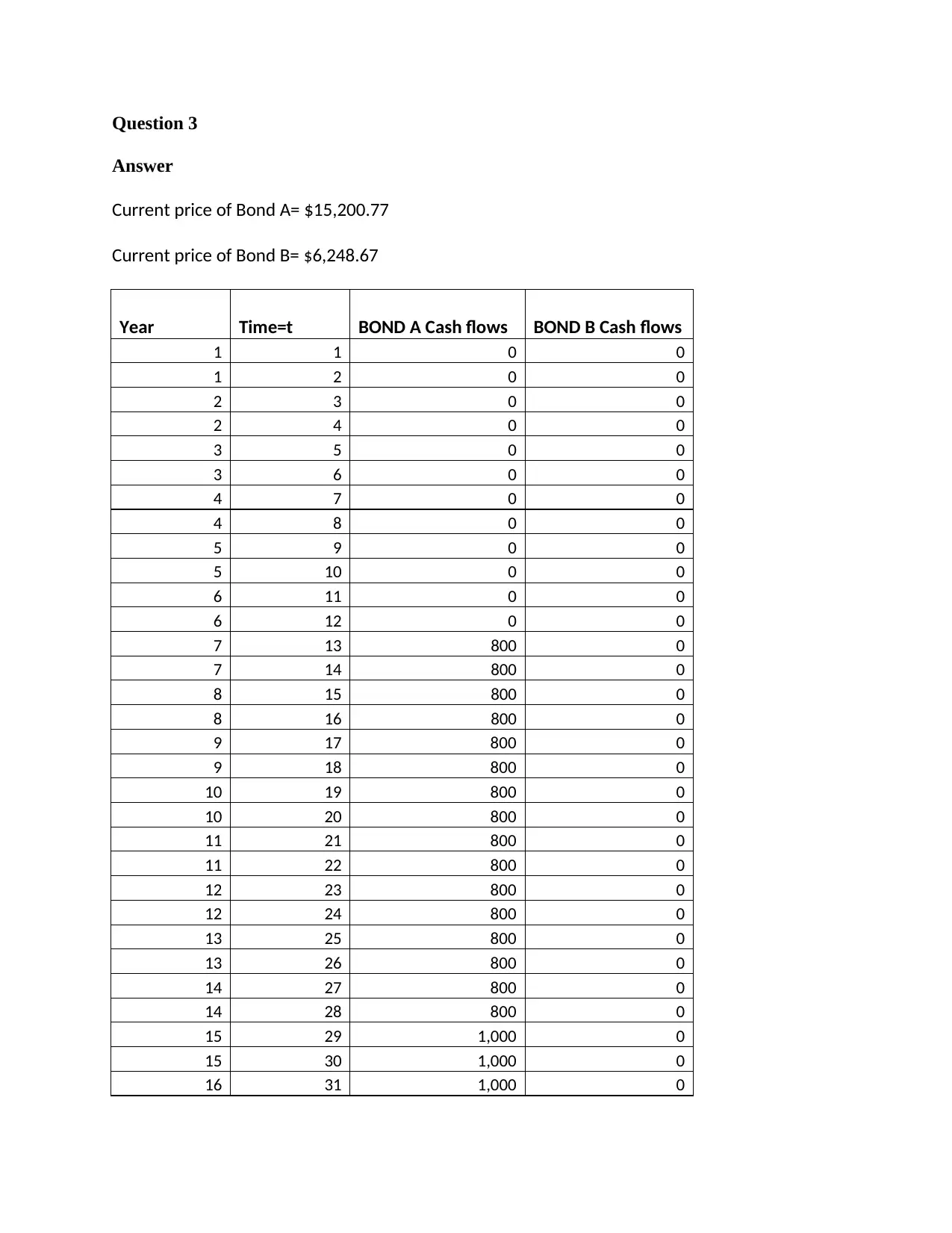

Question 3

Answer

Current price of Bond A= $15,200.77

Current price of Bond B= $6,248.67

Year Time=t BOND A Cash flows BOND B Cash flows

1 1 0 0

1 2 0 0

2 3 0 0

2 4 0 0

3 5 0 0

3 6 0 0

4 7 0 0

4 8 0 0

5 9 0 0

5 10 0 0

6 11 0 0

6 12 0 0

7 13 800 0

7 14 800 0

8 15 800 0

8 16 800 0

9 17 800 0

9 18 800 0

10 19 800 0

10 20 800 0

11 21 800 0

11 22 800 0

12 23 800 0

12 24 800 0

13 25 800 0

13 26 800 0

14 27 800 0

14 28 800 0

15 29 1,000 0

15 30 1,000 0

16 31 1,000 0

Answer

Current price of Bond A= $15,200.77

Current price of Bond B= $6,248.67

Year Time=t BOND A Cash flows BOND B Cash flows

1 1 0 0

1 2 0 0

2 3 0 0

2 4 0 0

3 5 0 0

3 6 0 0

4 7 0 0

4 8 0 0

5 9 0 0

5 10 0 0

6 11 0 0

6 12 0 0

7 13 800 0

7 14 800 0

8 15 800 0

8 16 800 0

9 17 800 0

9 18 800 0

10 19 800 0

10 20 800 0

11 21 800 0

11 22 800 0

12 23 800 0

12 24 800 0

13 25 800 0

13 26 800 0

14 27 800 0

14 28 800 0

15 29 1,000 0

15 30 1,000 0

16 31 1,000 0

16 32 1,000 0

17 33 1,000 0

17 34 1,000 0

18 35 1,000 0

18 36 1,000 0

19 37 1,000 0

19 38 1,000 0

20 39 1,000 0

20 40 31,000 30,000

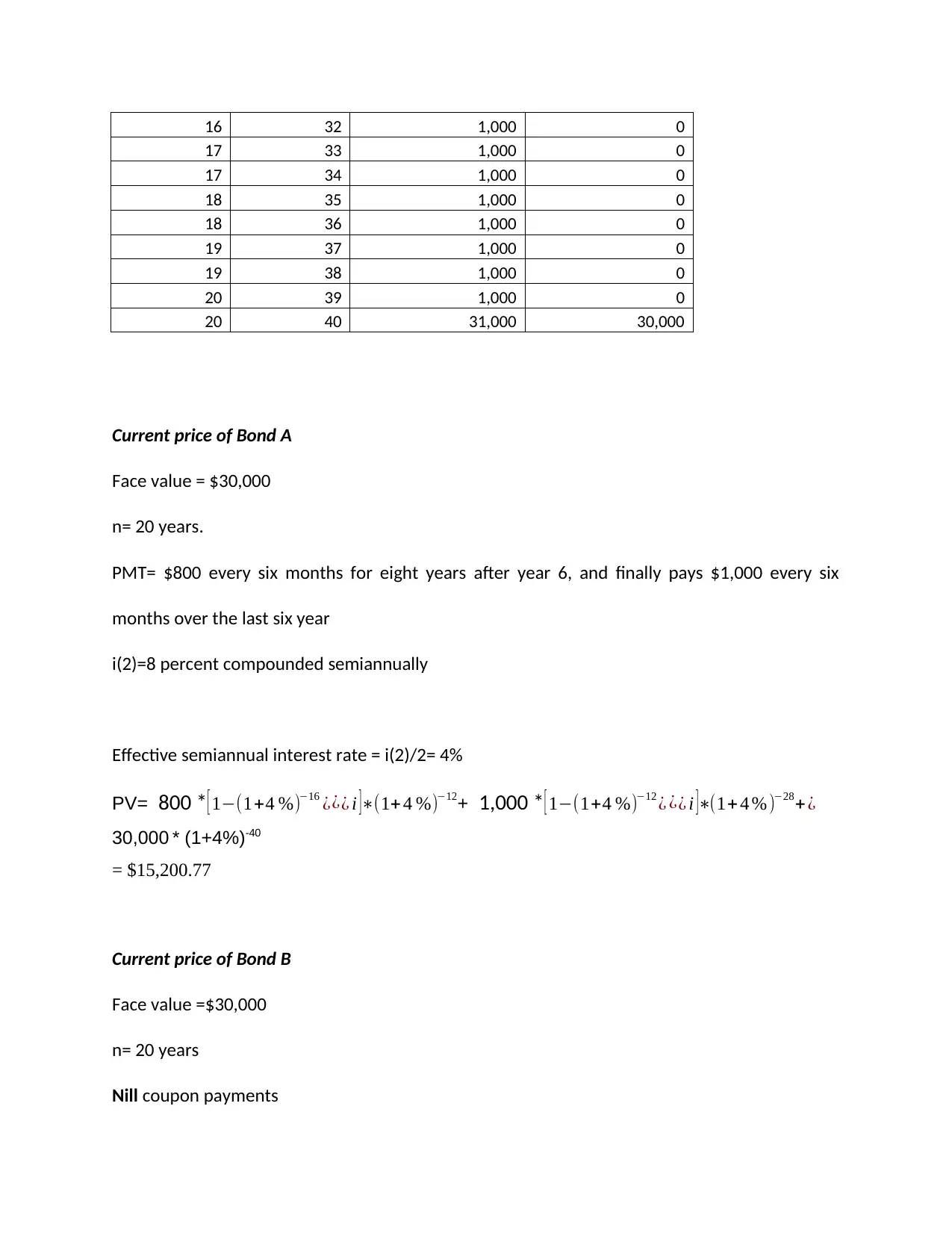

Current price of Bond A

Face value = $30,000

n= 20 years.

PMT= $800 every six months for eight years after year 6, and finally pays $1,000 every six

months over the last six year

i(2)=8 percent compounded semiannually

Effective semiannual interest rate = i(2)/2= 4%

PV= 800 *[ 1−(1+4 %)−16 ¿¿¿ i ]∗(1+ 4 %)−12+ 1,000 * [ 1−(1+4 %)−12 ¿ ¿¿ i ]∗(1+ 4 % )−28+ ¿

30,000 * (1+4%)-40

= $15,200.77

Current price of Bond B

Face value =$30,000

n= 20 years

Nill coupon payments

17 33 1,000 0

17 34 1,000 0

18 35 1,000 0

18 36 1,000 0

19 37 1,000 0

19 38 1,000 0

20 39 1,000 0

20 40 31,000 30,000

Current price of Bond A

Face value = $30,000

n= 20 years.

PMT= $800 every six months for eight years after year 6, and finally pays $1,000 every six

months over the last six year

i(2)=8 percent compounded semiannually

Effective semiannual interest rate = i(2)/2= 4%

PV= 800 *[ 1−(1+4 %)−16 ¿¿¿ i ]∗(1+ 4 %)−12+ 1,000 * [ 1−(1+4 %)−12 ¿ ¿¿ i ]∗(1+ 4 % )−28+ ¿

30,000 * (1+4%)-40

= $15,200.77

Current price of Bond B

Face value =$30,000

n= 20 years

Nill coupon payments

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PV =30,000*(1+4%)-20

= $6,248.67

= $6,248.67

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

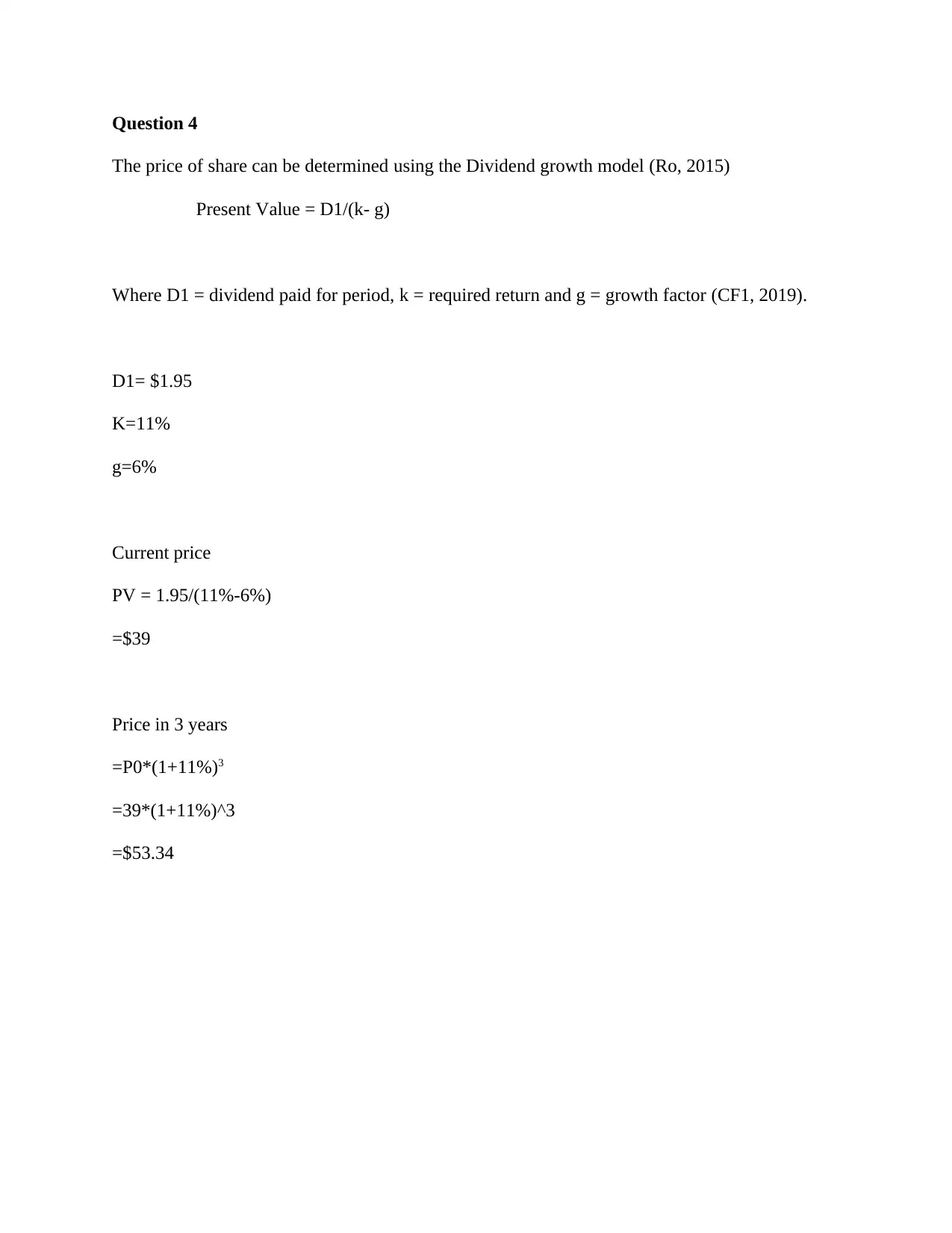

Question 4

The price of share can be determined using the Dividend growth model (Ro, 2015)

Present Value = D1/(k- g)

Where D1 = dividend paid for period, k = required return and g = growth factor (CF1, 2019).

D1= $1.95

K=11%

g=6%

Current price

PV = 1.95/(11%-6%)

=$39

Price in 3 years

=P0*(1+11%)3

=39*(1+11%)^3

=$53.34

The price of share can be determined using the Dividend growth model (Ro, 2015)

Present Value = D1/(k- g)

Where D1 = dividend paid for period, k = required return and g = growth factor (CF1, 2019).

D1= $1.95

K=11%

g=6%

Current price

PV = 1.95/(11%-6%)

=$39

Price in 3 years

=P0*(1+11%)3

=39*(1+11%)^3

=$53.34

Part 2

Question 1

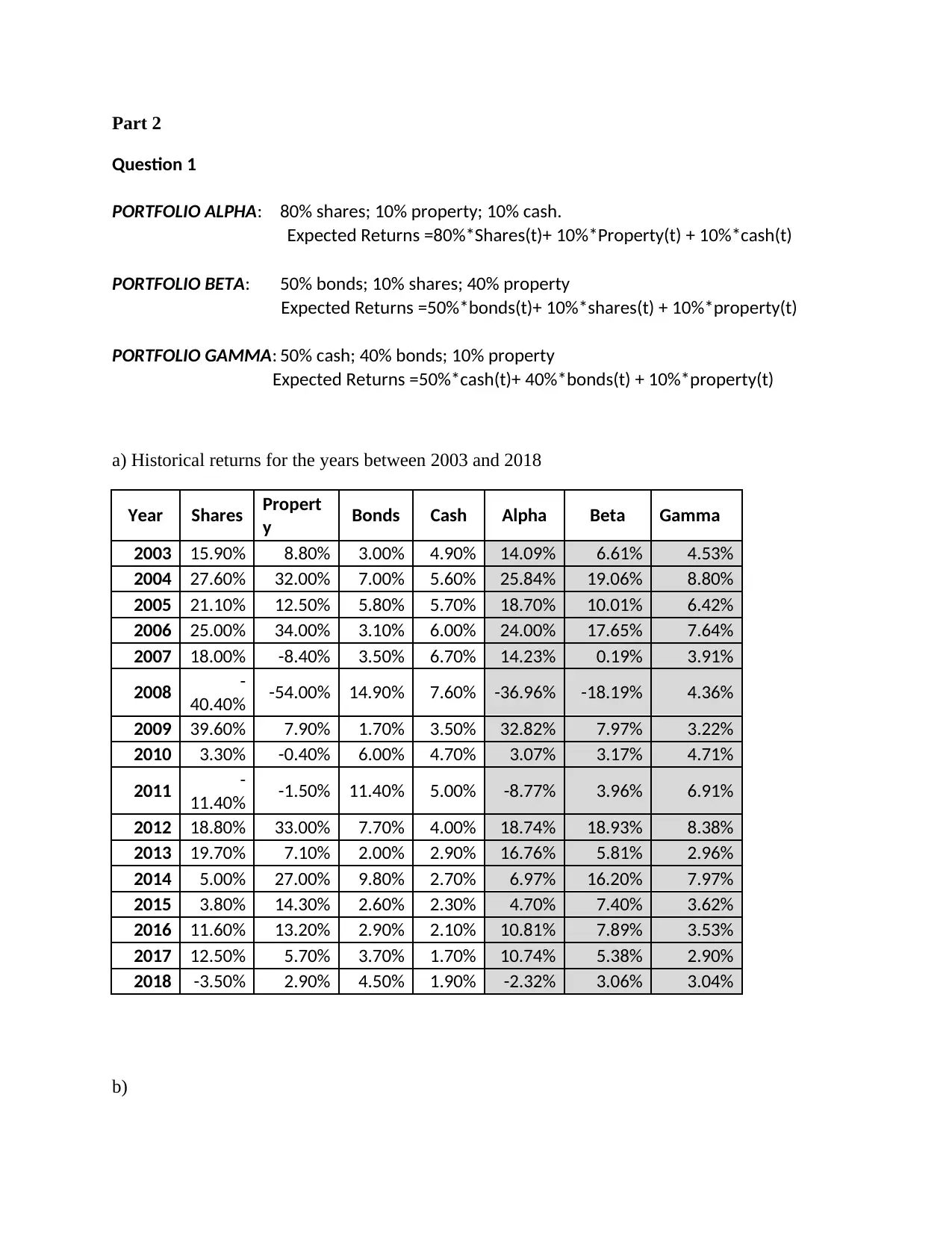

PORTFOLIO ALPHA: 80% shares; 10% property; 10% cash.

Expected Returns =80%*Shares(t)+ 10%*Property(t) + 10%*cash(t)

PORTFOLIO BETA: 50% bonds; 10% shares; 40% property

Expected Returns =50%*bonds(t)+ 10%*shares(t) + 10%*property(t)

PORTFOLIO GAMMA: 50% cash; 40% bonds; 10% property

Expected Returns =50%*cash(t)+ 40%*bonds(t) + 10%*property(t)

a) Historical returns for the years between 2003 and 2018

Year Shares Propert

y Bonds Cash Alpha Beta Gamma

2003 15.90% 8.80% 3.00% 4.90% 14.09% 6.61% 4.53%

2004 27.60% 32.00% 7.00% 5.60% 25.84% 19.06% 8.80%

2005 21.10% 12.50% 5.80% 5.70% 18.70% 10.01% 6.42%

2006 25.00% 34.00% 3.10% 6.00% 24.00% 17.65% 7.64%

2007 18.00% -8.40% 3.50% 6.70% 14.23% 0.19% 3.91%

2008 -

40.40% -54.00% 14.90% 7.60% -36.96% -18.19% 4.36%

2009 39.60% 7.90% 1.70% 3.50% 32.82% 7.97% 3.22%

2010 3.30% -0.40% 6.00% 4.70% 3.07% 3.17% 4.71%

2011 -

11.40% -1.50% 11.40% 5.00% -8.77% 3.96% 6.91%

2012 18.80% 33.00% 7.70% 4.00% 18.74% 18.93% 8.38%

2013 19.70% 7.10% 2.00% 2.90% 16.76% 5.81% 2.96%

2014 5.00% 27.00% 9.80% 2.70% 6.97% 16.20% 7.97%

2015 3.80% 14.30% 2.60% 2.30% 4.70% 7.40% 3.62%

2016 11.60% 13.20% 2.90% 2.10% 10.81% 7.89% 3.53%

2017 12.50% 5.70% 3.70% 1.70% 10.74% 5.38% 2.90%

2018 -3.50% 2.90% 4.50% 1.90% -2.32% 3.06% 3.04%

b)

Question 1

PORTFOLIO ALPHA: 80% shares; 10% property; 10% cash.

Expected Returns =80%*Shares(t)+ 10%*Property(t) + 10%*cash(t)

PORTFOLIO BETA: 50% bonds; 10% shares; 40% property

Expected Returns =50%*bonds(t)+ 10%*shares(t) + 10%*property(t)

PORTFOLIO GAMMA: 50% cash; 40% bonds; 10% property

Expected Returns =50%*cash(t)+ 40%*bonds(t) + 10%*property(t)

a) Historical returns for the years between 2003 and 2018

Year Shares Propert

y Bonds Cash Alpha Beta Gamma

2003 15.90% 8.80% 3.00% 4.90% 14.09% 6.61% 4.53%

2004 27.60% 32.00% 7.00% 5.60% 25.84% 19.06% 8.80%

2005 21.10% 12.50% 5.80% 5.70% 18.70% 10.01% 6.42%

2006 25.00% 34.00% 3.10% 6.00% 24.00% 17.65% 7.64%

2007 18.00% -8.40% 3.50% 6.70% 14.23% 0.19% 3.91%

2008 -

40.40% -54.00% 14.90% 7.60% -36.96% -18.19% 4.36%

2009 39.60% 7.90% 1.70% 3.50% 32.82% 7.97% 3.22%

2010 3.30% -0.40% 6.00% 4.70% 3.07% 3.17% 4.71%

2011 -

11.40% -1.50% 11.40% 5.00% -8.77% 3.96% 6.91%

2012 18.80% 33.00% 7.70% 4.00% 18.74% 18.93% 8.38%

2013 19.70% 7.10% 2.00% 2.90% 16.76% 5.81% 2.96%

2014 5.00% 27.00% 9.80% 2.70% 6.97% 16.20% 7.97%

2015 3.80% 14.30% 2.60% 2.30% 4.70% 7.40% 3.62%

2016 11.60% 13.20% 2.90% 2.10% 10.81% 7.89% 3.53%

2017 12.50% 5.70% 3.70% 1.70% 10.74% 5.38% 2.90%

2018 -3.50% 2.90% 4.50% 1.90% -2.32% 3.06% 3.04%

b)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

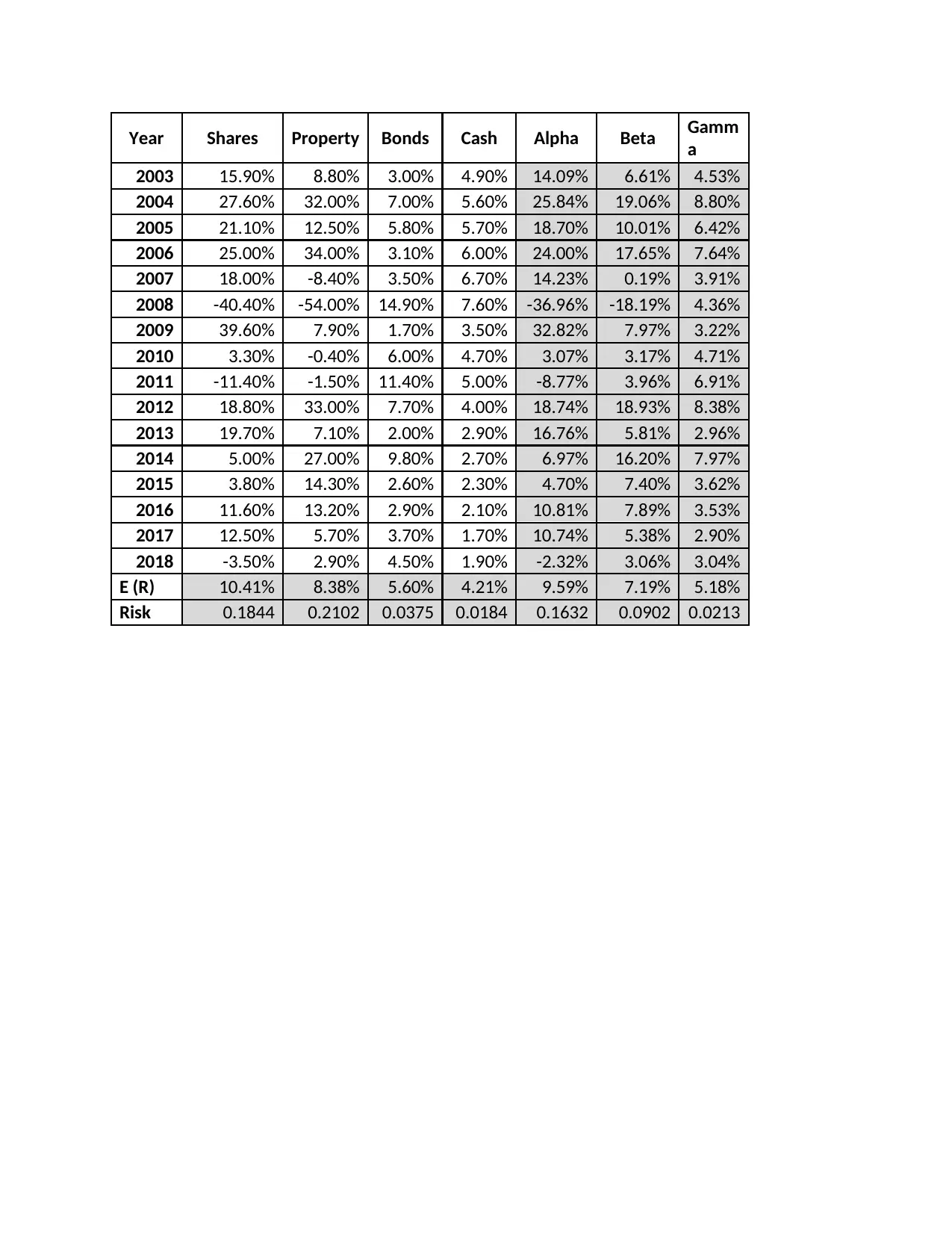

Year Shares Property Bonds Cash Alpha Beta Gamm

a

2003 15.90% 8.80% 3.00% 4.90% 14.09% 6.61% 4.53%

2004 27.60% 32.00% 7.00% 5.60% 25.84% 19.06% 8.80%

2005 21.10% 12.50% 5.80% 5.70% 18.70% 10.01% 6.42%

2006 25.00% 34.00% 3.10% 6.00% 24.00% 17.65% 7.64%

2007 18.00% -8.40% 3.50% 6.70% 14.23% 0.19% 3.91%

2008 -40.40% -54.00% 14.90% 7.60% -36.96% -18.19% 4.36%

2009 39.60% 7.90% 1.70% 3.50% 32.82% 7.97% 3.22%

2010 3.30% -0.40% 6.00% 4.70% 3.07% 3.17% 4.71%

2011 -11.40% -1.50% 11.40% 5.00% -8.77% 3.96% 6.91%

2012 18.80% 33.00% 7.70% 4.00% 18.74% 18.93% 8.38%

2013 19.70% 7.10% 2.00% 2.90% 16.76% 5.81% 2.96%

2014 5.00% 27.00% 9.80% 2.70% 6.97% 16.20% 7.97%

2015 3.80% 14.30% 2.60% 2.30% 4.70% 7.40% 3.62%

2016 11.60% 13.20% 2.90% 2.10% 10.81% 7.89% 3.53%

2017 12.50% 5.70% 3.70% 1.70% 10.74% 5.38% 2.90%

2018 -3.50% 2.90% 4.50% 1.90% -2.32% 3.06% 3.04%

E (R) 10.41% 8.38% 5.60% 4.21% 9.59% 7.19% 5.18%

Risk 0.1844 0.2102 0.0375 0.0184 0.1632 0.0902 0.0213

a

2003 15.90% 8.80% 3.00% 4.90% 14.09% 6.61% 4.53%

2004 27.60% 32.00% 7.00% 5.60% 25.84% 19.06% 8.80%

2005 21.10% 12.50% 5.80% 5.70% 18.70% 10.01% 6.42%

2006 25.00% 34.00% 3.10% 6.00% 24.00% 17.65% 7.64%

2007 18.00% -8.40% 3.50% 6.70% 14.23% 0.19% 3.91%

2008 -40.40% -54.00% 14.90% 7.60% -36.96% -18.19% 4.36%

2009 39.60% 7.90% 1.70% 3.50% 32.82% 7.97% 3.22%

2010 3.30% -0.40% 6.00% 4.70% 3.07% 3.17% 4.71%

2011 -11.40% -1.50% 11.40% 5.00% -8.77% 3.96% 6.91%

2012 18.80% 33.00% 7.70% 4.00% 18.74% 18.93% 8.38%

2013 19.70% 7.10% 2.00% 2.90% 16.76% 5.81% 2.96%

2014 5.00% 27.00% 9.80% 2.70% 6.97% 16.20% 7.97%

2015 3.80% 14.30% 2.60% 2.30% 4.70% 7.40% 3.62%

2016 11.60% 13.20% 2.90% 2.10% 10.81% 7.89% 3.53%

2017 12.50% 5.70% 3.70% 1.70% 10.74% 5.38% 2.90%

2018 -3.50% 2.90% 4.50% 1.90% -2.32% 3.06% 3.04%

E (R) 10.41% 8.38% 5.60% 4.21% 9.59% 7.19% 5.18%

Risk 0.1844 0.2102 0.0375 0.0184 0.1632 0.0902 0.0213

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 2

Diversifiable risk (also known as unsystematic risk) is unique to that asset. It can be eliminated

by investing in a portfolio with different assets whose returns are not correlated. Non-

diversifiable risk (also known as market or systematic risk) affects the entire market (Mitchell &

Mulherin, 1996). As a result, it cannot be diversified away by investing in multiple assets (Ben-

Horim & Levy, 1980).

Control of the risks

Indeed investors can control both the level of unsystematic risk and systematic risk in a portfolio.

For unsystematic, this is through diversification. For systematic, diversification will not work,

though options like hedging may control the risk (The Balance, 2018). However, controlling the

level of risk will be a costly effect on the portfolio’s estimated returns- the higher the risk the

higher the expected return (Inside Business, 2012).

Question 3- Beta and Standard deviation

The beta coefficient is a measure of a stock’s market risk, or the extent to which the returns on a

given stock move with the stock market. It measures the individual stocks volatility in

comparison to the entire market (Rosenberg & Guy, 1995). On the other hand, the standard

deviation measures the stock’s individual risk. Systematic risk cannot be removed no matter how

much an investor diversifies their assets. Therefore, using beta as a measure of risk is more

appropriate for a well-diversified as it takes market risk into consideration (Rosenberg & Guy,

1995).

Diversifiable risk (also known as unsystematic risk) is unique to that asset. It can be eliminated

by investing in a portfolio with different assets whose returns are not correlated. Non-

diversifiable risk (also known as market or systematic risk) affects the entire market (Mitchell &

Mulherin, 1996). As a result, it cannot be diversified away by investing in multiple assets (Ben-

Horim & Levy, 1980).

Control of the risks

Indeed investors can control both the level of unsystematic risk and systematic risk in a portfolio.

For unsystematic, this is through diversification. For systematic, diversification will not work,

though options like hedging may control the risk (The Balance, 2018). However, controlling the

level of risk will be a costly effect on the portfolio’s estimated returns- the higher the risk the

higher the expected return (Inside Business, 2012).

Question 3- Beta and Standard deviation

The beta coefficient is a measure of a stock’s market risk, or the extent to which the returns on a

given stock move with the stock market. It measures the individual stocks volatility in

comparison to the entire market (Rosenberg & Guy, 1995). On the other hand, the standard

deviation measures the stock’s individual risk. Systematic risk cannot be removed no matter how

much an investor diversifies their assets. Therefore, using beta as a measure of risk is more

appropriate for a well-diversified as it takes market risk into consideration (Rosenberg & Guy,

1995).

Question 4 Risk averse and standard deviation

An investor who is risk averse does not like risk. Furthermore, they will only invest in risky

assets if it guarantees a higher rate of return (CFI, 2019). Risks with a high standard deviation

have a high risk. The higher the risk the higher the expected return. However, the actual return an

investor may be different from the expected return. Therefore, his friend is correct in advising

Rajesh to avoid these stocks.

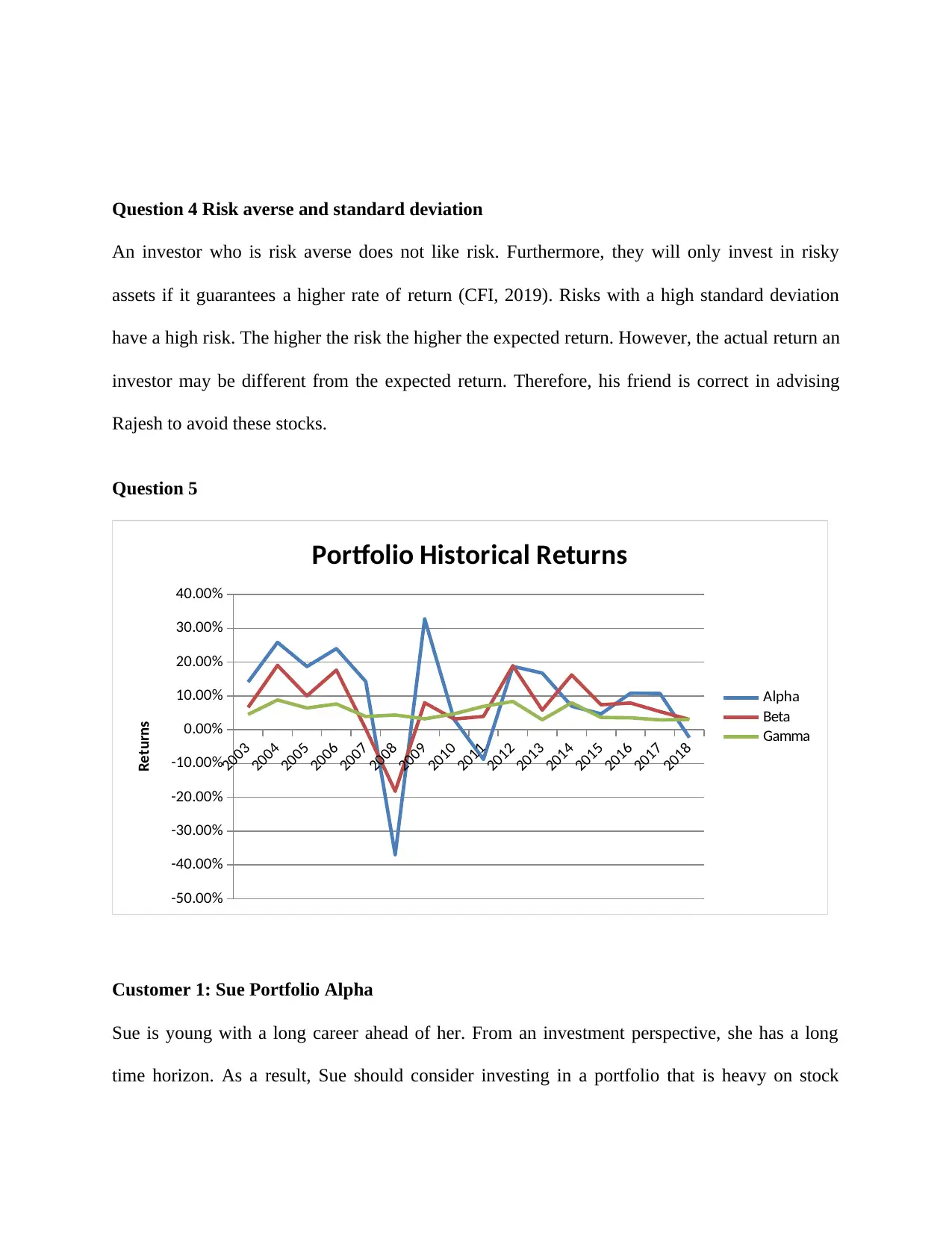

Question 5

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

-50.00%

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

Portfolio Historical Returns

Alpha

Beta

Gamma

Returns

Customer 1: Sue Portfolio Alpha

Sue is young with a long career ahead of her. From an investment perspective, she has a long

time horizon. As a result, Sue should consider investing in a portfolio that is heavy on stock

An investor who is risk averse does not like risk. Furthermore, they will only invest in risky

assets if it guarantees a higher rate of return (CFI, 2019). Risks with a high standard deviation

have a high risk. The higher the risk the higher the expected return. However, the actual return an

investor may be different from the expected return. Therefore, his friend is correct in advising

Rajesh to avoid these stocks.

Question 5

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

-50.00%

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

Portfolio Historical Returns

Alpha

Beta

Gamma

Returns

Customer 1: Sue Portfolio Alpha

Sue is young with a long career ahead of her. From an investment perspective, she has a long

time horizon. As a result, Sue should consider investing in a portfolio that is heavy on stock

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.