Funeral Service Business Accounting Report: Financial Analysis

VerifiedAdded on 2023/01/12

|18

|3667

|83

Report

AI Summary

This report provides a detailed financial analysis of a funeral service business. It covers essential aspects such as financial systems, cash management, and cost analysis. The report includes an income statement for the year 2017 and projections for the following two years, detailing revenues from funeral services, burial, and cremation, along with expenses such as salaries, depreciation, and taxes. It also includes a breakdown of startup costs, including location, licenses, equipment, and marketing expenses. Furthermore, the report analyzes fixed and variable expenses, return on investments, and the implications of GST and income tax. The report provides a comprehensive financial overview of the business, including risk assessment and mitigation strategies, and financial assumptions based on market analysis and survey data. The analysis also includes a capital cost analysis, revenue forecasts, and depreciation schedules, providing a complete view of the business's financial performance and future projections.

FUNERAL SERVICE BUSINESS

ACCOUNTING REPORT

ACCOUNTING REPORT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

Funeral Services...............................................................................................................................1

Financial Systems........................................................................................................................1

Cash Management.......................................................................................................................1

Cost analysis................................................................................................................................5

Capital raising and start up cost...................................................................................................9

Financial Viability.......................................................................................................................9

REFERENCES..............................................................................................................................11

APPENDICES...............................................................................................................................12

Start-up capital costs..................................................................................................................12

Projected balance sheet of year 1...............................................................................................12

Payback period...........................................................................................................................13

3 year’s projections on Income statement.................................................................................14

Fixed & Variable Expenses.......................................................................................................15

TABLE OF CONTENTS................................................................................................................2

Funeral Services...............................................................................................................................1

Financial Systems........................................................................................................................1

Cash Management.......................................................................................................................1

Cost analysis................................................................................................................................5

Capital raising and start up cost...................................................................................................9

Financial Viability.......................................................................................................................9

REFERENCES..............................................................................................................................11

APPENDICES...............................................................................................................................12

Start-up capital costs..................................................................................................................12

Projected balance sheet of year 1...............................................................................................12

Payback period...........................................................................................................................13

3 year’s projections on Income statement.................................................................................14

Fixed & Variable Expenses.......................................................................................................15

Funeral Services

Financial Systems

Presumptions have been made regarding the financial conjecture after analysing the

market. figures and expenses have been made after considering all the operations that business is

required to perform in the business.

Accounts section cover all the business transaction related to the funeral service to

undertake for the 3 years. There are number of transactions that are required to be done for

earning the revenues for business. Funeral services are mainly the business related to the

activities and services provided at time of death. It is mainly concerned with the services after

the death of the person.

Cash Management.

Bank Account

Bank account is an essential for starting a business. Bank account will be opened in the

name of Company and initial investments of the capital funds will be deposited in the bank

account of company. All the transaction related to the business will be carried out from the

company bank account for keeping proper record of all the transactions. No minimum monthly

balance requirement.

Unlimited free electronic transactions

40 free non-electronic transactions per month

Direct crediting of regular income

Overdraft facility for approved customers

Cash handling & banking procedures

Business will make minimum use of the cash transaction in the business. most of the

transaction will be carried out using payments through electronic mode. Cash will be handled by

the accounts manager.

Internal Control

Internal control in every business to reduce frauds or errors. Effective internal control

will help the company in reaching its targeted objectives. Internal controls will involve

implementing procedures for inspections of every transaction. All the costs expenses should be

approved by proper authority of the superiors so that errors or frauds are identified.

1

Financial Systems

Presumptions have been made regarding the financial conjecture after analysing the

market. figures and expenses have been made after considering all the operations that business is

required to perform in the business.

Accounts section cover all the business transaction related to the funeral service to

undertake for the 3 years. There are number of transactions that are required to be done for

earning the revenues for business. Funeral services are mainly the business related to the

activities and services provided at time of death. It is mainly concerned with the services after

the death of the person.

Cash Management.

Bank Account

Bank account is an essential for starting a business. Bank account will be opened in the

name of Company and initial investments of the capital funds will be deposited in the bank

account of company. All the transaction related to the business will be carried out from the

company bank account for keeping proper record of all the transactions. No minimum monthly

balance requirement.

Unlimited free electronic transactions

40 free non-electronic transactions per month

Direct crediting of regular income

Overdraft facility for approved customers

Cash handling & banking procedures

Business will make minimum use of the cash transaction in the business. most of the

transaction will be carried out using payments through electronic mode. Cash will be handled by

the accounts manager.

Internal Control

Internal control in every business to reduce frauds or errors. Effective internal control

will help the company in reaching its targeted objectives. Internal controls will involve

implementing procedures for inspections of every transaction. All the costs expenses should be

approved by proper authority of the superiors so that errors or frauds are identified.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

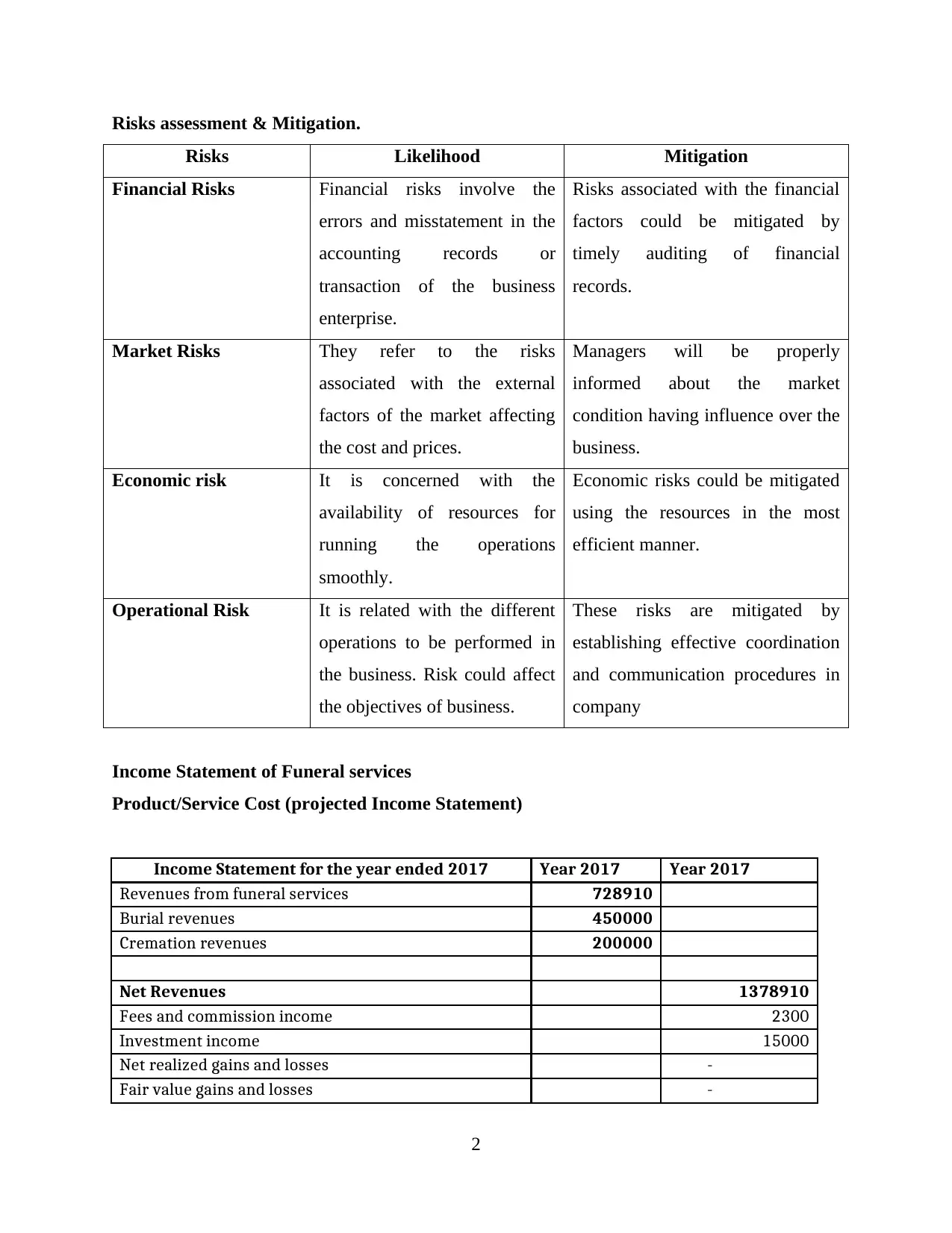

Risks assessment & Mitigation.

Risks Likelihood Mitigation

Financial Risks Financial risks involve the

errors and misstatement in the

accounting records or

transaction of the business

enterprise.

Risks associated with the financial

factors could be mitigated by

timely auditing of financial

records.

Market Risks They refer to the risks

associated with the external

factors of the market affecting

the cost and prices.

Managers will be properly

informed about the market

condition having influence over the

business.

Economic risk It is concerned with the

availability of resources for

running the operations

smoothly.

Economic risks could be mitigated

using the resources in the most

efficient manner.

Operational Risk It is related with the different

operations to be performed in

the business. Risk could affect

the objectives of business.

These risks are mitigated by

establishing effective coordination

and communication procedures in

company

Income Statement of Funeral services

Product/Service Cost (projected Income Statement)

Income Statement for the year ended 2017 Year 2017 Year 2017

Revenues from funeral services 728910

Burial revenues 450000

Cremation revenues 200000

Net Revenues 1378910

Fees and commission income 2300

Investment income 15000

Net realized gains and losses -

Fair value gains and losses -

2

Risks Likelihood Mitigation

Financial Risks Financial risks involve the

errors and misstatement in the

accounting records or

transaction of the business

enterprise.

Risks associated with the financial

factors could be mitigated by

timely auditing of financial

records.

Market Risks They refer to the risks

associated with the external

factors of the market affecting

the cost and prices.

Managers will be properly

informed about the market

condition having influence over the

business.

Economic risk It is concerned with the

availability of resources for

running the operations

smoothly.

Economic risks could be mitigated

using the resources in the most

efficient manner.

Operational Risk It is related with the different

operations to be performed in

the business. Risk could affect

the objectives of business.

These risks are mitigated by

establishing effective coordination

and communication procedures in

company

Income Statement of Funeral services

Product/Service Cost (projected Income Statement)

Income Statement for the year ended 2017 Year 2017 Year 2017

Revenues from funeral services 728910

Burial revenues 450000

Cremation revenues 200000

Net Revenues 1378910

Fees and commission income 2300

Investment income 15000

Net realized gains and losses -

Fair value gains and losses -

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

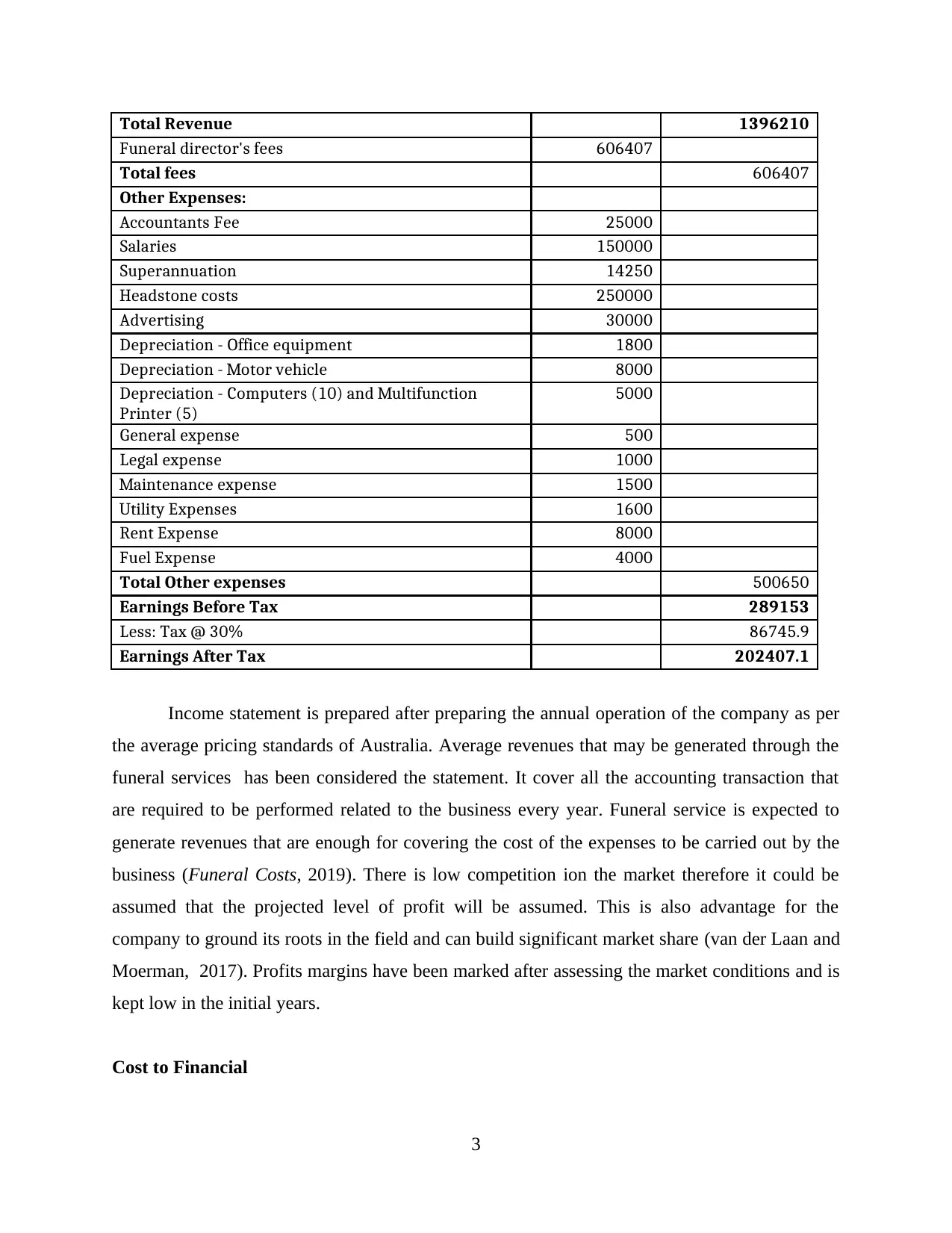

Total Revenue 1396210

Funeral director's fees 606407

Total fees 606407

Other Expenses:

Accountants Fee 25000

Salaries 150000

Superannuation 14250

Headstone costs 250000

Advertising 30000

Depreciation - Office equipment 1800

Depreciation - Motor vehicle 8000

Depreciation - Computers (10) and Multifunction

Printer (5)

5000

General expense 500

Legal expense 1000

Maintenance expense 1500

Utility Expenses 1600

Rent Expense 8000

Fuel Expense 4000

Total Other expenses 500650

Earnings Before Tax 289153

Less: Tax @ 30% 86745.9

Earnings After Tax 202407.1

Income statement is prepared after preparing the annual operation of the company as per

the average pricing standards of Australia. Average revenues that may be generated through the

funeral services has been considered the statement. It cover all the accounting transaction that

are required to be performed related to the business every year. Funeral service is expected to

generate revenues that are enough for covering the cost of the expenses to be carried out by the

business (Funeral Costs, 2019). There is low competition ion the market therefore it could be

assumed that the projected level of profit will be assumed. This is also advantage for the

company to ground its roots in the field and can build significant market share (van der Laan and

Moerman, 2017). Profits margins have been marked after assessing the market conditions and is

kept low in the initial years.

Cost to Financial

3

Funeral director's fees 606407

Total fees 606407

Other Expenses:

Accountants Fee 25000

Salaries 150000

Superannuation 14250

Headstone costs 250000

Advertising 30000

Depreciation - Office equipment 1800

Depreciation - Motor vehicle 8000

Depreciation - Computers (10) and Multifunction

Printer (5)

5000

General expense 500

Legal expense 1000

Maintenance expense 1500

Utility Expenses 1600

Rent Expense 8000

Fuel Expense 4000

Total Other expenses 500650

Earnings Before Tax 289153

Less: Tax @ 30% 86745.9

Earnings After Tax 202407.1

Income statement is prepared after preparing the annual operation of the company as per

the average pricing standards of Australia. Average revenues that may be generated through the

funeral services has been considered the statement. It cover all the accounting transaction that

are required to be performed related to the business every year. Funeral service is expected to

generate revenues that are enough for covering the cost of the expenses to be carried out by the

business (Funeral Costs, 2019). There is low competition ion the market therefore it could be

assumed that the projected level of profit will be assumed. This is also advantage for the

company to ground its roots in the field and can build significant market share (van der Laan and

Moerman, 2017). Profits margins have been marked after assessing the market conditions and is

kept low in the initial years.

Cost to Financial

3

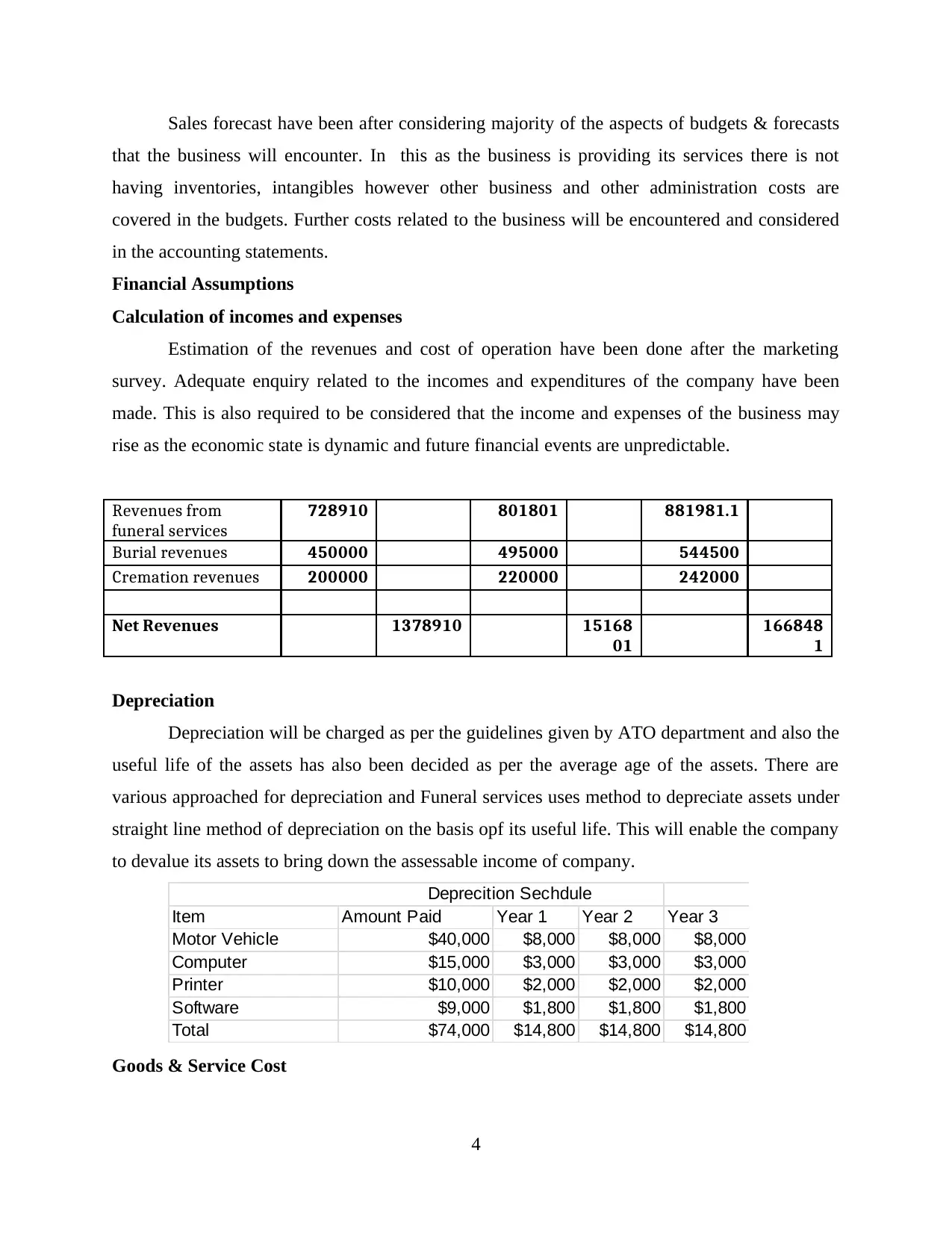

Sales forecast have been after considering majority of the aspects of budgets & forecasts

that the business will encounter. In this as the business is providing its services there is not

having inventories, intangibles however other business and other administration costs are

covered in the budgets. Further costs related to the business will be encountered and considered

in the accounting statements.

Financial Assumptions

Calculation of incomes and expenses

Estimation of the revenues and cost of operation have been done after the marketing

survey. Adequate enquiry related to the incomes and expenditures of the company have been

made. This is also required to be considered that the income and expenses of the business may

rise as the economic state is dynamic and future financial events are unpredictable.

Revenues from

funeral services

728910 801801 881981.1

Burial revenues 450000 495000 544500

Cremation revenues 200000 220000 242000

Net Revenues 1378910 15168

01

166848

1

Depreciation

Depreciation will be charged as per the guidelines given by ATO department and also the

useful life of the assets has also been decided as per the average age of the assets. There are

various approached for depreciation and Funeral services uses method to depreciate assets under

straight line method of depreciation on the basis opf its useful life. This will enable the company

to devalue its assets to bring down the assessable income of company.

Deprecition Sechdule

Item Amount Paid Year 1 Year 2 Year 3

Motor Vehicle $40,000 $8,000 $8,000 $8,000

Computer $15,000 $3,000 $3,000 $3,000

Printer $10,000 $2,000 $2,000 $2,000

Software $9,000 $1,800 $1,800 $1,800

Total $74,000 $14,800 $14,800 $14,800

Goods & Service Cost

4

that the business will encounter. In this as the business is providing its services there is not

having inventories, intangibles however other business and other administration costs are

covered in the budgets. Further costs related to the business will be encountered and considered

in the accounting statements.

Financial Assumptions

Calculation of incomes and expenses

Estimation of the revenues and cost of operation have been done after the marketing

survey. Adequate enquiry related to the incomes and expenditures of the company have been

made. This is also required to be considered that the income and expenses of the business may

rise as the economic state is dynamic and future financial events are unpredictable.

Revenues from

funeral services

728910 801801 881981.1

Burial revenues 450000 495000 544500

Cremation revenues 200000 220000 242000

Net Revenues 1378910 15168

01

166848

1

Depreciation

Depreciation will be charged as per the guidelines given by ATO department and also the

useful life of the assets has also been decided as per the average age of the assets. There are

various approached for depreciation and Funeral services uses method to depreciate assets under

straight line method of depreciation on the basis opf its useful life. This will enable the company

to devalue its assets to bring down the assessable income of company.

Deprecition Sechdule

Item Amount Paid Year 1 Year 2 Year 3

Motor Vehicle $40,000 $8,000 $8,000 $8,000

Computer $15,000 $3,000 $3,000 $3,000

Printer $10,000 $2,000 $2,000 $2,000

Software $9,000 $1,800 $1,800 $1,800

Total $74,000 $14,800 $14,800 $14,800

Goods & Service Cost

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

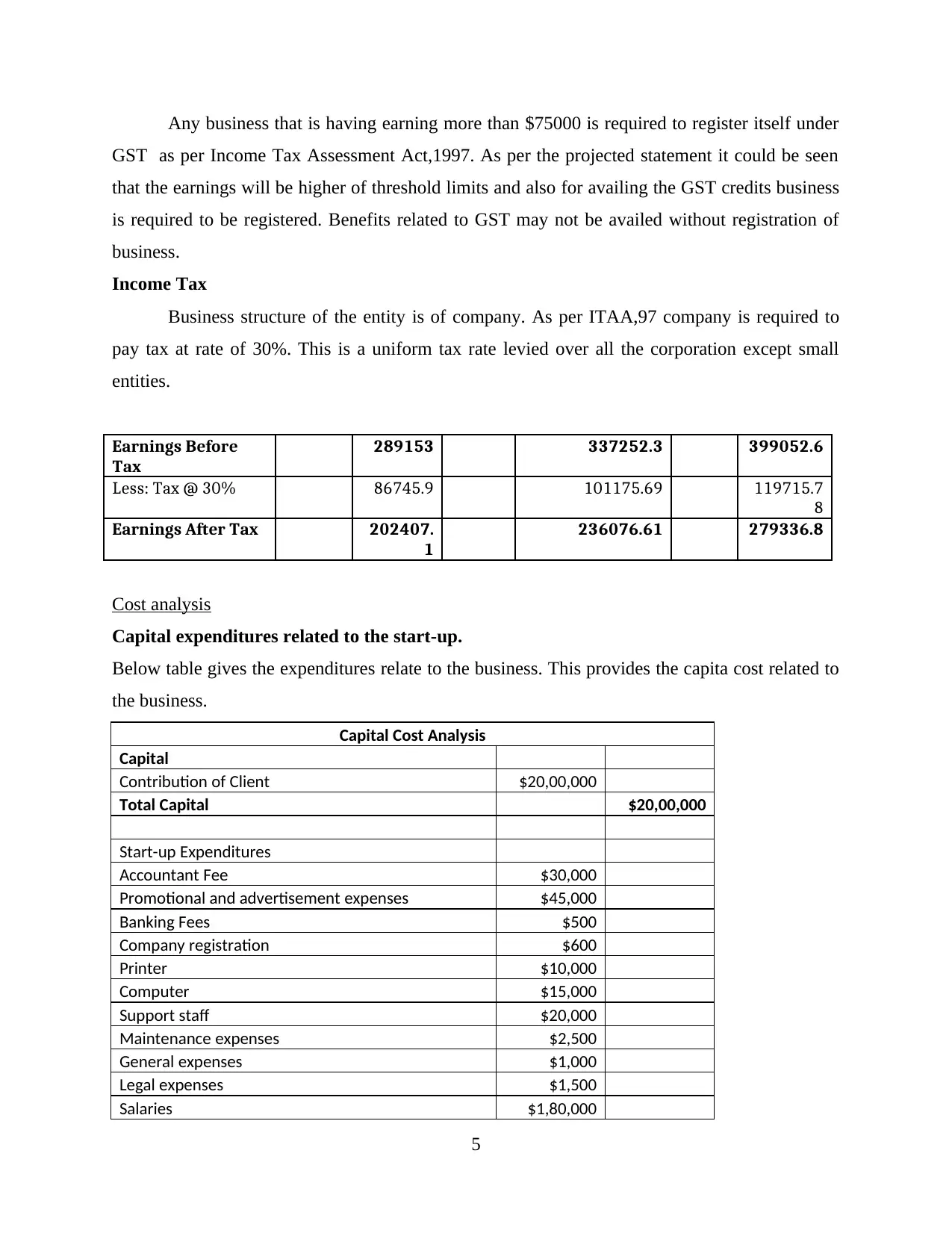

Any business that is having earning more than $75000 is required to register itself under

GST as per Income Tax Assessment Act,1997. As per the projected statement it could be seen

that the earnings will be higher of threshold limits and also for availing the GST credits business

is required to be registered. Benefits related to GST may not be availed without registration of

business.

Income Tax

Business structure of the entity is of company. As per ITAA,97 company is required to

pay tax at rate of 30%. This is a uniform tax rate levied over all the corporation except small

entities.

Earnings Before

Tax

289153 337252.3 399052.6

Less: Tax @ 30% 86745.9 101175.69 119715.7

8

Earnings After Tax 202407.

1

236076.61 279336.8

Cost analysis

Capital expenditures related to the start-up.

Below table gives the expenditures relate to the business. This provides the capita cost related to

the business.

Capital Cost Analysis

Capital

Contribution of Client $20,00,000

Total Capital $20,00,000

Start-up Expenditures

Accountant Fee $30,000

Promotional and advertisement expenses $45,000

Banking Fees $500

Company registration $600

Printer $10,000

Computer $15,000

Support staff $20,000

Maintenance expenses $2,500

General expenses $1,000

Legal expenses $1,500

Salaries $1,80,000

5

GST as per Income Tax Assessment Act,1997. As per the projected statement it could be seen

that the earnings will be higher of threshold limits and also for availing the GST credits business

is required to be registered. Benefits related to GST may not be availed without registration of

business.

Income Tax

Business structure of the entity is of company. As per ITAA,97 company is required to

pay tax at rate of 30%. This is a uniform tax rate levied over all the corporation except small

entities.

Earnings Before

Tax

289153 337252.3 399052.6

Less: Tax @ 30% 86745.9 101175.69 119715.7

8

Earnings After Tax 202407.

1

236076.61 279336.8

Cost analysis

Capital expenditures related to the start-up.

Below table gives the expenditures relate to the business. This provides the capita cost related to

the business.

Capital Cost Analysis

Capital

Contribution of Client $20,00,000

Total Capital $20,00,000

Start-up Expenditures

Accountant Fee $30,000

Promotional and advertisement expenses $45,000

Banking Fees $500

Company registration $600

Printer $10,000

Computer $15,000

Support staff $20,000

Maintenance expenses $2,500

General expenses $1,000

Legal expenses $1,500

Salaries $1,80,000

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

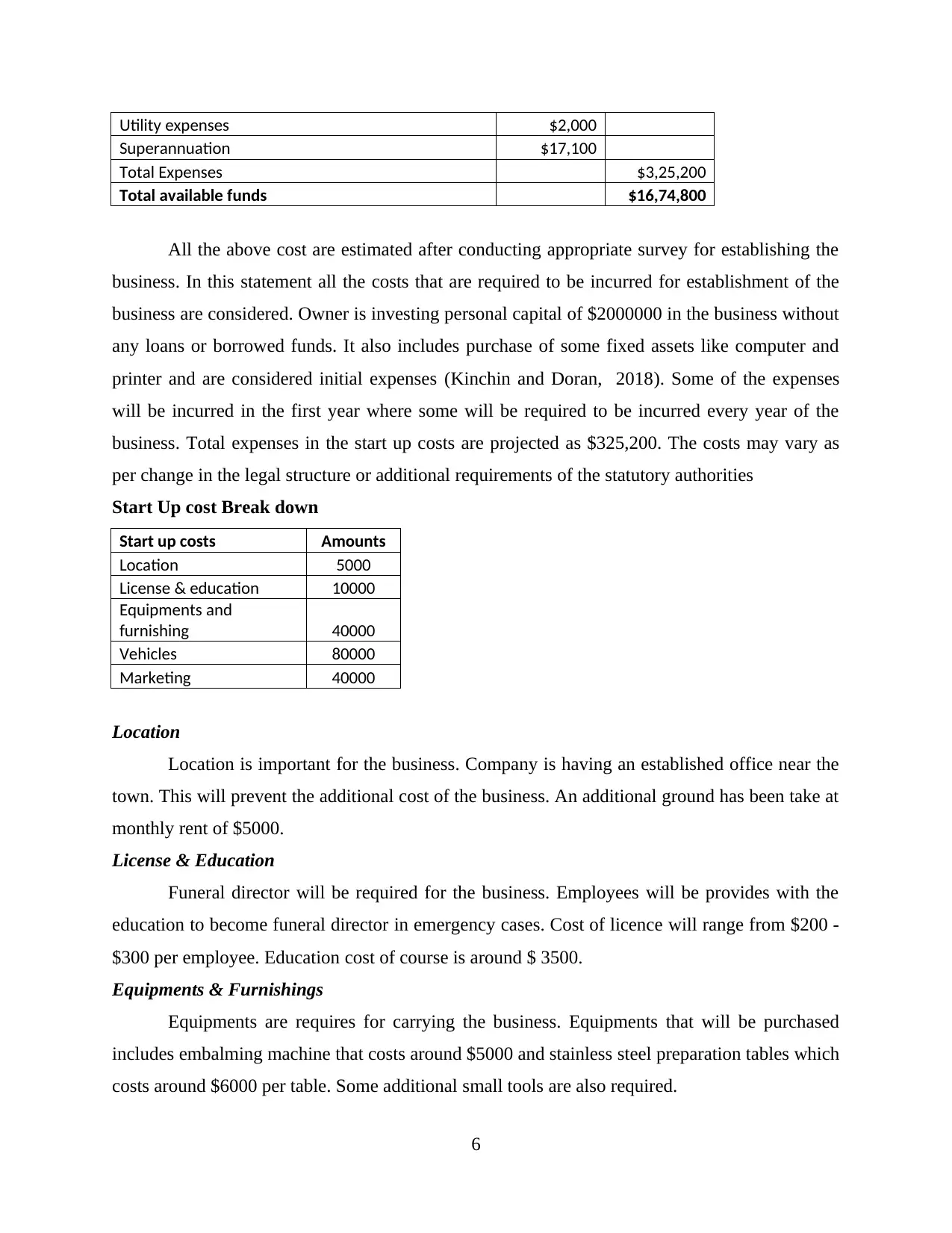

Utility expenses $2,000

Superannuation $17,100

Total Expenses $3,25,200

Total available funds $16,74,800

All the above cost are estimated after conducting appropriate survey for establishing the

business. In this statement all the costs that are required to be incurred for establishment of the

business are considered. Owner is investing personal capital of $2000000 in the business without

any loans or borrowed funds. It also includes purchase of some fixed assets like computer and

printer and are considered initial expenses (Kinchin and Doran, 2018). Some of the expenses

will be incurred in the first year where some will be required to be incurred every year of the

business. Total expenses in the start up costs are projected as $325,200. The costs may vary as

per change in the legal structure or additional requirements of the statutory authorities

Start Up cost Break down

Start up costs Amounts

Location 5000

License & education 10000

Equipments and

furnishing 40000

Vehicles 80000

Marketing 40000

Location

Location is important for the business. Company is having an established office near the

town. This will prevent the additional cost of the business. An additional ground has been take at

monthly rent of $5000.

License & Education

Funeral director will be required for the business. Employees will be provides with the

education to become funeral director in emergency cases. Cost of licence will range from $200 -

$300 per employee. Education cost of course is around $ 3500.

Equipments & Furnishings

Equipments are requires for carrying the business. Equipments that will be purchased

includes embalming machine that costs around $5000 and stainless steel preparation tables which

costs around $6000 per table. Some additional small tools are also required.

6

Superannuation $17,100

Total Expenses $3,25,200

Total available funds $16,74,800

All the above cost are estimated after conducting appropriate survey for establishing the

business. In this statement all the costs that are required to be incurred for establishment of the

business are considered. Owner is investing personal capital of $2000000 in the business without

any loans or borrowed funds. It also includes purchase of some fixed assets like computer and

printer and are considered initial expenses (Kinchin and Doran, 2018). Some of the expenses

will be incurred in the first year where some will be required to be incurred every year of the

business. Total expenses in the start up costs are projected as $325,200. The costs may vary as

per change in the legal structure or additional requirements of the statutory authorities

Start Up cost Break down

Start up costs Amounts

Location 5000

License & education 10000

Equipments and

furnishing 40000

Vehicles 80000

Marketing 40000

Location

Location is important for the business. Company is having an established office near the

town. This will prevent the additional cost of the business. An additional ground has been take at

monthly rent of $5000.

License & Education

Funeral director will be required for the business. Employees will be provides with the

education to become funeral director in emergency cases. Cost of licence will range from $200 -

$300 per employee. Education cost of course is around $ 3500.

Equipments & Furnishings

Equipments are requires for carrying the business. Equipments that will be purchased

includes embalming machine that costs around $5000 and stainless steel preparation tables which

costs around $6000 per table. Some additional small tools are also required.

6

Vehicles

Lead car will be purchased for carrying out the funeral processions. As the vehicles are

used for the business purpose it could also be leased by the business. Leasing will allow to use

up-dated models in the business.

Marketing Cost

Every business is required to market itself for making the society aware about the

establishment of the business. Marketing will be done over all the local advertising platforms for

getting new business.

Requirement of additional finance

As the owner is investing sufficient funds for establishing the company Funeral services

and there is no requirement of the additional funds. It is having funds in excess of the

expenditures amounting to $16,74,800 as given above in the first year. It is having more that

required funds for the business.

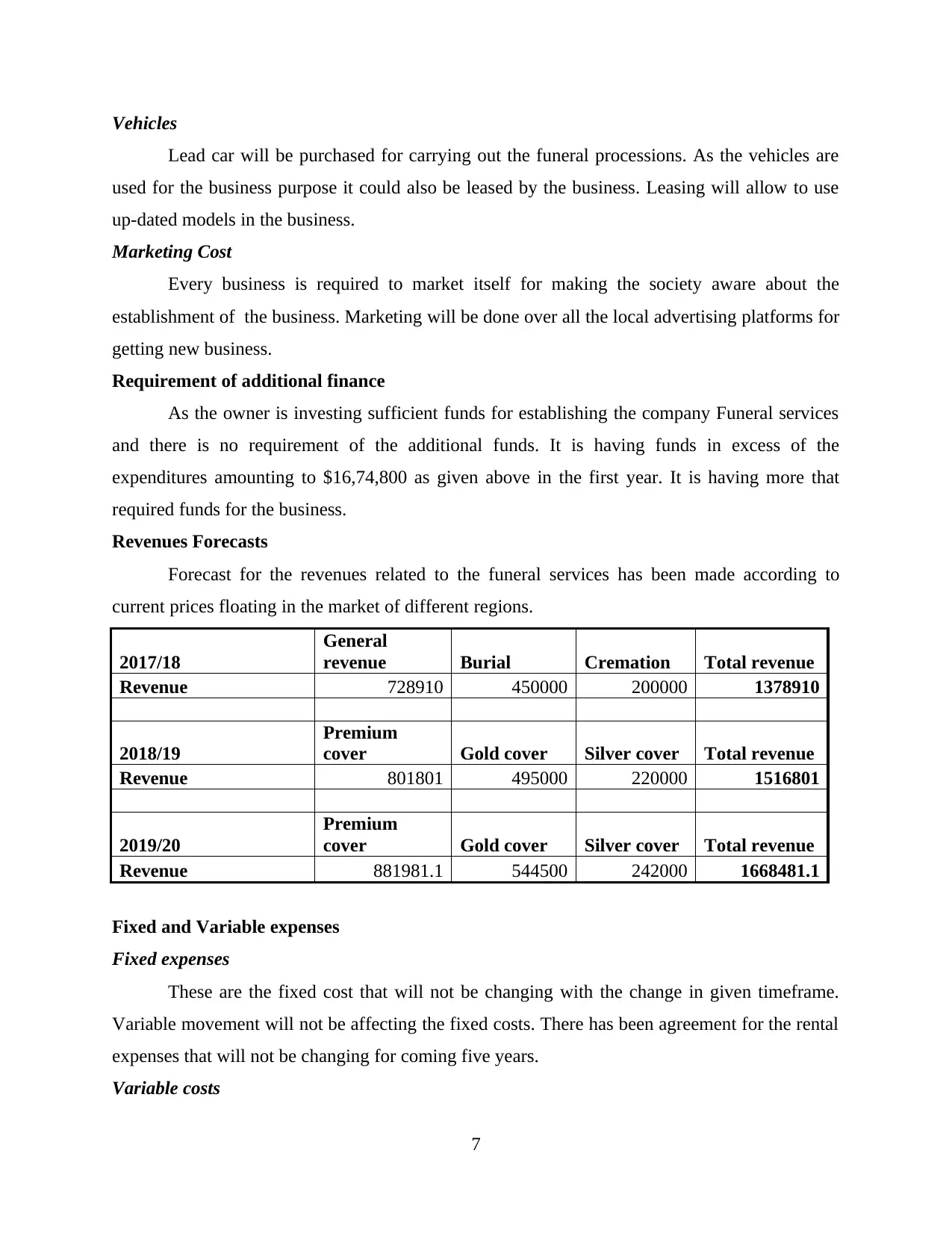

Revenues Forecasts

Forecast for the revenues related to the funeral services has been made according to

current prices floating in the market of different regions.

2017/18

General

revenue Burial Cremation Total revenue

Revenue 728910 450000 200000 1378910

2018/19

Premium

cover Gold cover Silver cover Total revenue

Revenue 801801 495000 220000 1516801

2019/20

Premium

cover Gold cover Silver cover Total revenue

Revenue 881981.1 544500 242000 1668481.1

Fixed and Variable expenses

Fixed expenses

These are the fixed cost that will not be changing with the change in given timeframe.

Variable movement will not be affecting the fixed costs. There has been agreement for the rental

expenses that will not be changing for coming five years.

Variable costs

7

Lead car will be purchased for carrying out the funeral processions. As the vehicles are

used for the business purpose it could also be leased by the business. Leasing will allow to use

up-dated models in the business.

Marketing Cost

Every business is required to market itself for making the society aware about the

establishment of the business. Marketing will be done over all the local advertising platforms for

getting new business.

Requirement of additional finance

As the owner is investing sufficient funds for establishing the company Funeral services

and there is no requirement of the additional funds. It is having funds in excess of the

expenditures amounting to $16,74,800 as given above in the first year. It is having more that

required funds for the business.

Revenues Forecasts

Forecast for the revenues related to the funeral services has been made according to

current prices floating in the market of different regions.

2017/18

General

revenue Burial Cremation Total revenue

Revenue 728910 450000 200000 1378910

2018/19

Premium

cover Gold cover Silver cover Total revenue

Revenue 801801 495000 220000 1516801

2019/20

Premium

cover Gold cover Silver cover Total revenue

Revenue 881981.1 544500 242000 1668481.1

Fixed and Variable expenses

Fixed expenses

These are the fixed cost that will not be changing with the change in given timeframe.

Variable movement will not be affecting the fixed costs. There has been agreement for the rental

expenses that will not be changing for coming five years.

Variable costs

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Costs changing upon the changes in the volumes or action levels. These expenses require

to be considered as variable costs that will be changing in every period (Rainsford and et.al.,

2019). Variable costs are petrol costs as they are influenced by the international pressures.

Expenses of the company against the budgeted revenues are low over the three years.

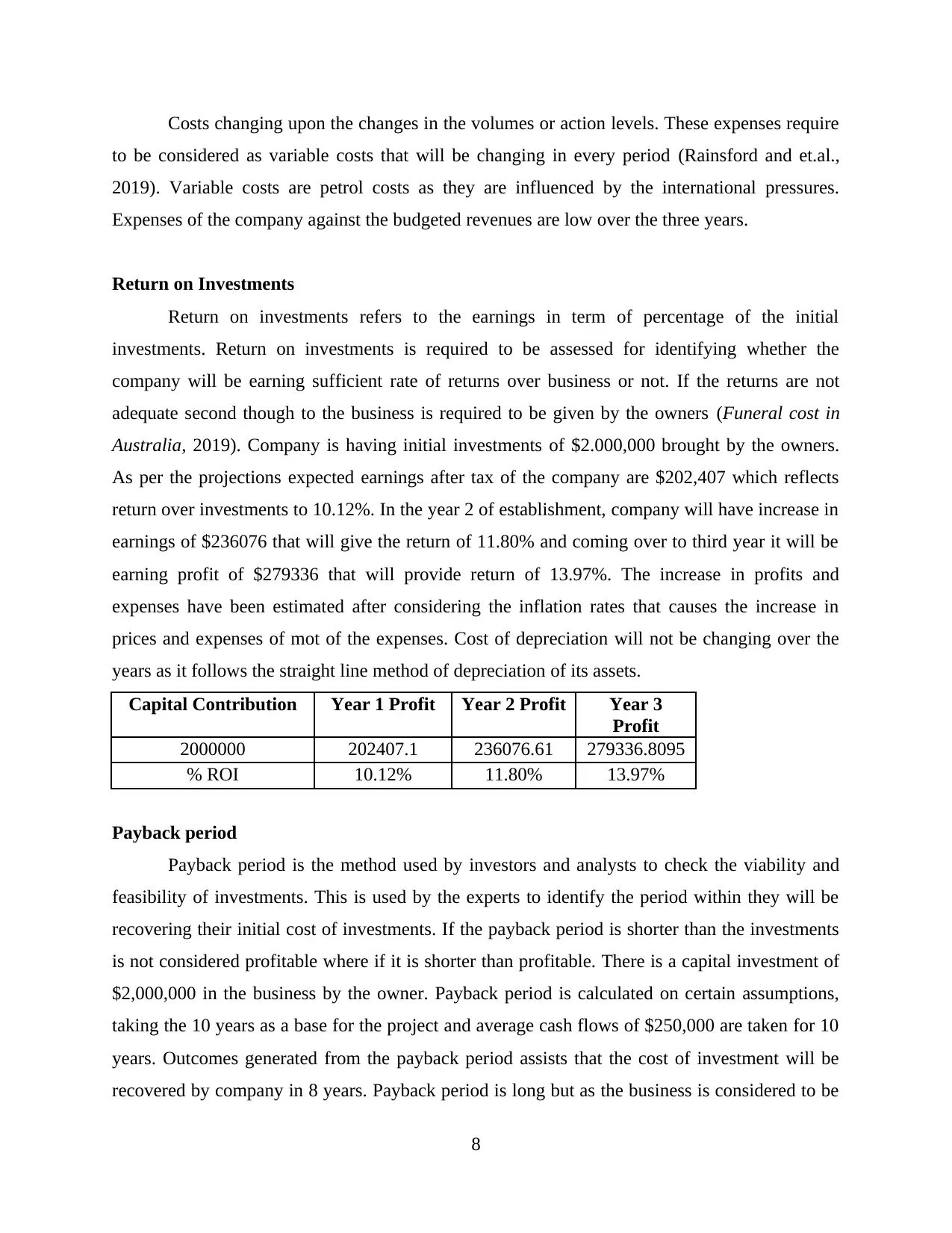

Return on Investments

Return on investments refers to the earnings in term of percentage of the initial

investments. Return on investments is required to be assessed for identifying whether the

company will be earning sufficient rate of returns over business or not. If the returns are not

adequate second though to the business is required to be given by the owners (Funeral cost in

Australia, 2019). Company is having initial investments of $2.000,000 brought by the owners.

As per the projections expected earnings after tax of the company are $202,407 which reflects

return over investments to 10.12%. In the year 2 of establishment, company will have increase in

earnings of $236076 that will give the return of 11.80% and coming over to third year it will be

earning profit of $279336 that will provide return of 13.97%. The increase in profits and

expenses have been estimated after considering the inflation rates that causes the increase in

prices and expenses of mot of the expenses. Cost of depreciation will not be changing over the

years as it follows the straight line method of depreciation of its assets.

Capital Contribution Year 1 Profit Year 2 Profit Year 3

Profit

2000000 202407.1 236076.61 279336.8095

% ROI 10.12% 11.80% 13.97%

Payback period

Payback period is the method used by investors and analysts to check the viability and

feasibility of investments. This is used by the experts to identify the period within they will be

recovering their initial cost of investments. If the payback period is shorter than the investments

is not considered profitable where if it is shorter than profitable. There is a capital investment of

$2,000,000 in the business by the owner. Payback period is calculated on certain assumptions,

taking the 10 years as a base for the project and average cash flows of $250,000 are taken for 10

years. Outcomes generated from the payback period assists that the cost of investment will be

recovered by company in 8 years. Payback period is long but as the business is considered to be

8

to be considered as variable costs that will be changing in every period (Rainsford and et.al.,

2019). Variable costs are petrol costs as they are influenced by the international pressures.

Expenses of the company against the budgeted revenues are low over the three years.

Return on Investments

Return on investments refers to the earnings in term of percentage of the initial

investments. Return on investments is required to be assessed for identifying whether the

company will be earning sufficient rate of returns over business or not. If the returns are not

adequate second though to the business is required to be given by the owners (Funeral cost in

Australia, 2019). Company is having initial investments of $2.000,000 brought by the owners.

As per the projections expected earnings after tax of the company are $202,407 which reflects

return over investments to 10.12%. In the year 2 of establishment, company will have increase in

earnings of $236076 that will give the return of 11.80% and coming over to third year it will be

earning profit of $279336 that will provide return of 13.97%. The increase in profits and

expenses have been estimated after considering the inflation rates that causes the increase in

prices and expenses of mot of the expenses. Cost of depreciation will not be changing over the

years as it follows the straight line method of depreciation of its assets.

Capital Contribution Year 1 Profit Year 2 Profit Year 3

Profit

2000000 202407.1 236076.61 279336.8095

% ROI 10.12% 11.80% 13.97%

Payback period

Payback period is the method used by investors and analysts to check the viability and

feasibility of investments. This is used by the experts to identify the period within they will be

recovering their initial cost of investments. If the payback period is shorter than the investments

is not considered profitable where if it is shorter than profitable. There is a capital investment of

$2,000,000 in the business by the owner. Payback period is calculated on certain assumptions,

taking the 10 years as a base for the project and average cash flows of $250,000 are taken for 10

years. Outcomes generated from the payback period assists that the cost of investment will be

recovered by company in 8 years. Payback period is long but as the business is considered to be

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

going concern therefore the investment will be recovered by the business. However the cash

flows will differ from the projections taken for measuring payback period. Investments

considering the inflations will be recovered much faster.

Loan

Owners are investing sufficient amount of capital in the business. The funds invested in

the business are enough for carrying out the business operations and activities without any

interruptions. As this is a service sector company will not be required to have production or

inventory cost that acquires sufficient part of the financial plans. Company is not required to

make loans for carrying out its business activities and other operation. Raising loans for running

the business will cause additional finance cost for the company decreasing down the returns.

However if the investments are made by personal borrowing than the loan option would be

beneficial as that will reduce the assessable income as the profits will be lowered as finance cost

are allowed to be claimed as business expense under than income tax laws of Australia (van Ryn

and et.al., 2019). Funeral service are not required to raise any external funding through

borrowing or loans.

Capital raising and start up cost

Funds in the business will be incorporated by the owner that are also called private

investments in the capital. This do not attracts any externals costs. Business will not be raising

any external funds. This is not a company listed on stock exchange therefore funds from public

could not be raised by way of equity capital or debt securities. It will not have costs related to the

external borrowings as the loans or other deposits are not raised from bank or financial

institution. Funds employed by the owners in Funeral services are enough for carrying out the

business operations without interruptions (Hay, 2018). This will also keep the cost of capital to

the minimum as compared within other capital structures that would have been adopted by the

business.

Financial Viability

After carrying out internal as well as extensive primary as well as secondary research on

Funeral services, along with financial information that are relevant to the Funeral Services. It

could be concluded from the research that the there will be sufficient profits to the company from

9

flows will differ from the projections taken for measuring payback period. Investments

considering the inflations will be recovered much faster.

Loan

Owners are investing sufficient amount of capital in the business. The funds invested in

the business are enough for carrying out the business operations and activities without any

interruptions. As this is a service sector company will not be required to have production or

inventory cost that acquires sufficient part of the financial plans. Company is not required to

make loans for carrying out its business activities and other operation. Raising loans for running

the business will cause additional finance cost for the company decreasing down the returns.

However if the investments are made by personal borrowing than the loan option would be

beneficial as that will reduce the assessable income as the profits will be lowered as finance cost

are allowed to be claimed as business expense under than income tax laws of Australia (van Ryn

and et.al., 2019). Funeral service are not required to raise any external funding through

borrowing or loans.

Capital raising and start up cost

Funds in the business will be incorporated by the owner that are also called private

investments in the capital. This do not attracts any externals costs. Business will not be raising

any external funds. This is not a company listed on stock exchange therefore funds from public

could not be raised by way of equity capital or debt securities. It will not have costs related to the

external borrowings as the loans or other deposits are not raised from bank or financial

institution. Funds employed by the owners in Funeral services are enough for carrying out the

business operations without interruptions (Hay, 2018). This will also keep the cost of capital to

the minimum as compared within other capital structures that would have been adopted by the

business.

Financial Viability

After carrying out internal as well as extensive primary as well as secondary research on

Funeral services, along with financial information that are relevant to the Funeral Services. It

could be concluded from the research that the there will be sufficient profits to the company from

9

carrying out the business. Business could be expanded in further regions by laying the

promotions of business. It is also highlighted as the initial investment is very high for running the

business. Funds could be invested in other return generating sources to generate return over their

investment instead of blocking all the funds in business. After first year, business runs on the

profits generated on it.

10

promotions of business. It is also highlighted as the initial investment is very high for running the

business. Funds could be invested in other return generating sources to generate return over their

investment instead of blocking all the funds in business. After first year, business runs on the

profits generated on it.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Bank Reconciliation and Petty Cash Analysis Report - [University Name]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fqr%2F12003066b4c34975be8e8016d157389c.jpg&w=256&q=75)