University Finance: Future Options and Derivatives Analysis

VerifiedAdded on 2020/02/19

|6

|562

|82

Homework Assignment

AI Summary

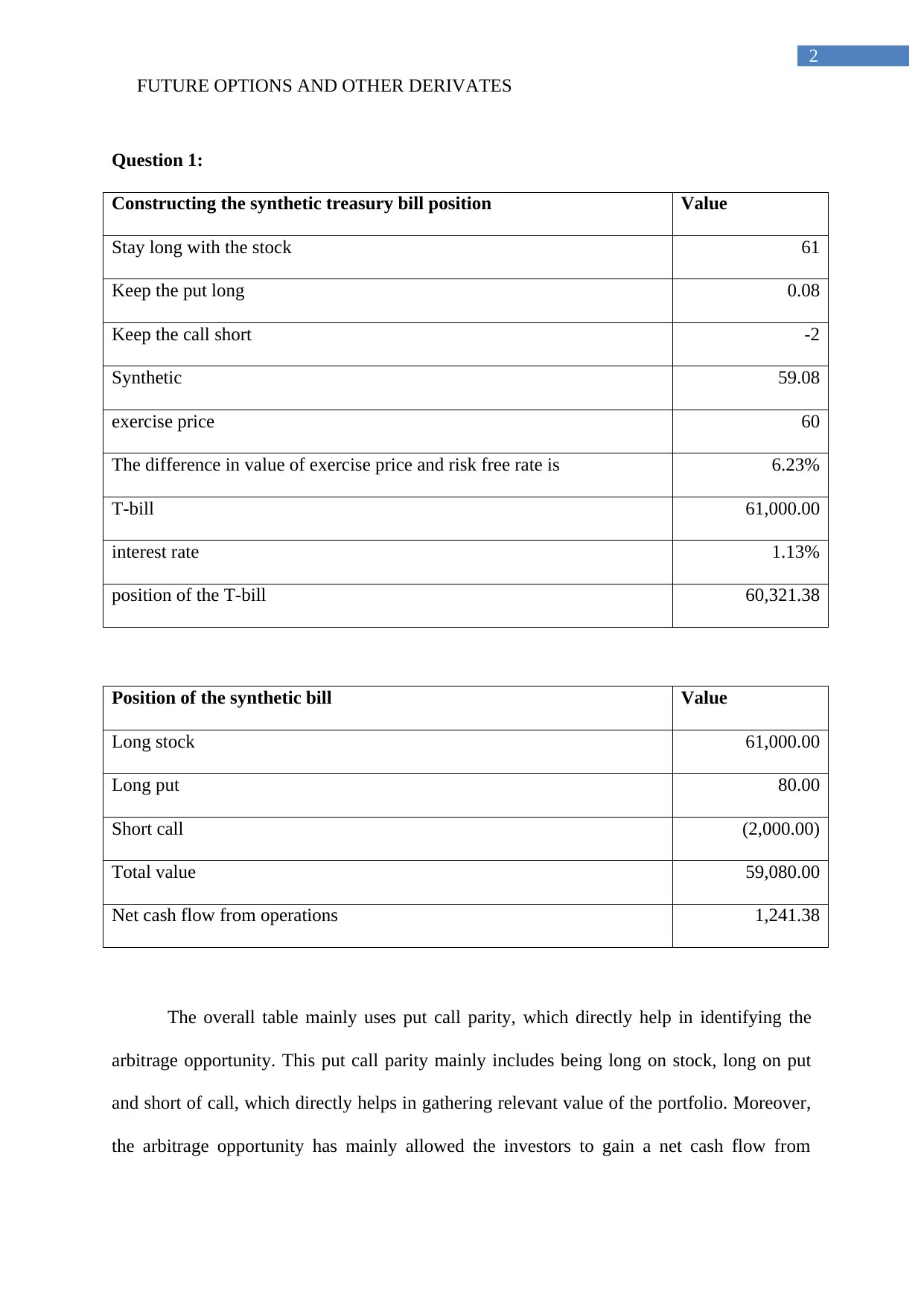

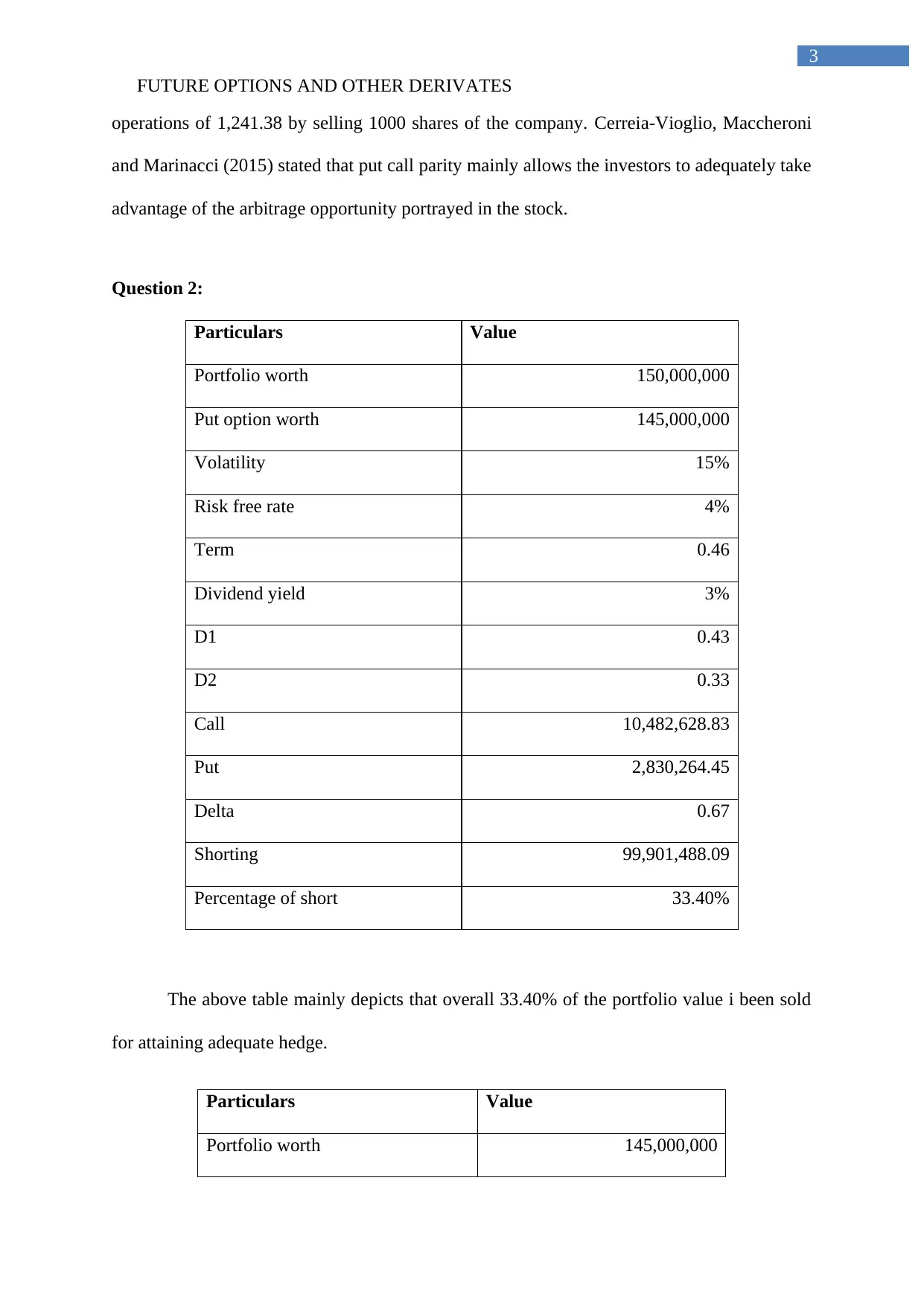

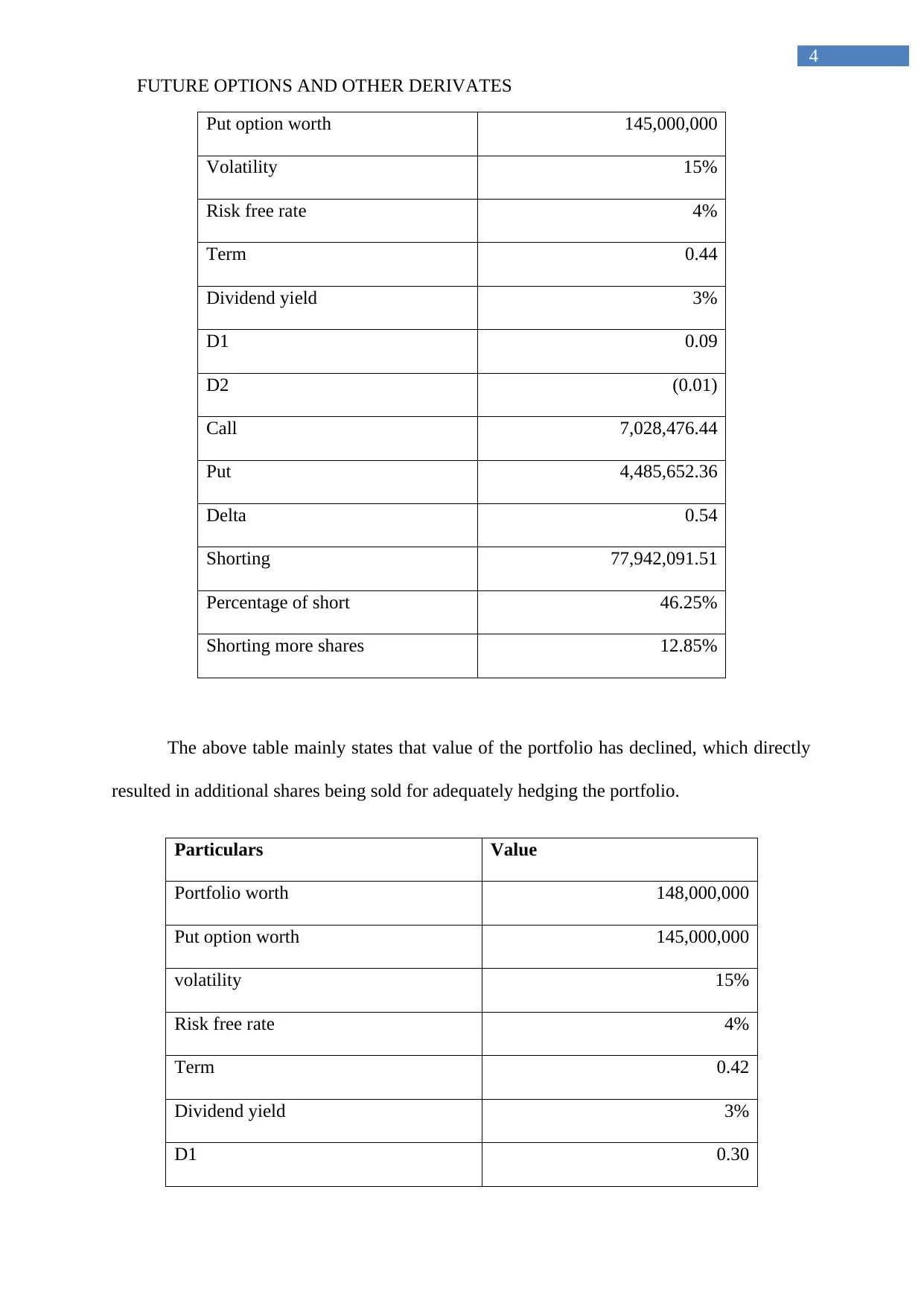

This assignment explores future options and other derivatives, focusing on put-call parity and delta hedging strategies. Question 1 constructs a synthetic treasury bill position to identify arbitrage opportunities, leveraging put-call parity to calculate potential net cash flow. Question 2 analyzes portfolio hedging using put options, examining how changes in portfolio value impact the need for shorting or buying shares to maintain a hedged position. The analysis includes calculations of deltas and percentages of short positions, demonstrating how delta hedging is used to mitigate risk in volatile markets. The assignment references academic sources to support the financial concepts and calculations presented.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)