General Motors: Business and Financial Analysis Executive Summary

VerifiedAdded on 2022/10/09

|19

|705

|20

Report

AI Summary

This report provides an executive summary and in-depth analysis of General Motors (GM), an American multinational corporation. It examines GM's business operations, financial performance, and investment strategies, including a focus on the company's expansion in the Chinese electric vehicle market. The report details the company's structure, regional segments, and business-type divisions, along with key financial data such as revenue and profit. It also explores market trends, including the development of new electric vehicle models. The report discusses how GM plans to utilize a $300,000 investment, emphasizing the potential use of debt and equity financing for electric car manufacturing. Furthermore, the report includes a business health assessment using ratio analysis to evaluate profitability, efficiency, liquidity, solvency, and market value. References from reputable sources are also included.

General

Motors

Motors

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

General motors is an American

multinational corporation.

The report consists of the business and

the financial analysis of the GM

Moreover the company is trying to find

the ways to invest $300000

The company is expanding the business

in China, with the electric cars.

General motors is an American

multinational corporation.

The report consists of the business and

the financial analysis of the GM

Moreover the company is trying to find

the ways to invest $300000

The company is expanding the business

in China, with the electric cars.

Description of the Country

The automotive industry in China has been

termed as the largest since year 2008.

China provides a solid base for the

companies engaged in the business of the

automobiles globally.

China’s entry into the World trade

Organization accelerated the development

of the million of the vehicles.

The automotive industry in China has been

termed as the largest since year 2008.

China provides a solid base for the

companies engaged in the business of the

automobiles globally.

China’s entry into the World trade

Organization accelerated the development

of the million of the vehicles.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business description and

Structure

General Motors is commonly known as GE Motors

Its headquarters are in Detroit, Michigan US

The company came into existence in the year

1908, 110 years ago (General Motors, 2018).

The company has around 396 facilities on overall

six continents (General Motors, 2018).

The key persons involves in the business are Mary

T. Barra who is chairman as well as CEO of the

company.

The company operates in the automotive industry

Structure

General Motors is commonly known as GE Motors

Its headquarters are in Detroit, Michigan US

The company came into existence in the year

1908, 110 years ago (General Motors, 2018).

The company has around 396 facilities on overall

six continents (General Motors, 2018).

The key persons involves in the business are Mary

T. Barra who is chairman as well as CEO of the

company.

The company operates in the automotive industry

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Organizational Structure of

General Motors

The general motors has a regional division structure

notably as

Regional Segments

Business-Type Decisions

Corporate Functional Groups

The general motors regional segments involve

GM North America

GM Europe

GM International Operations

GM South America

The business-type divisions are

Automotive

GM Financial

General Motors

The general motors has a regional division structure

notably as

Regional Segments

Business-Type Decisions

Corporate Functional Groups

The general motors regional segments involve

GM North America

GM Europe

GM International Operations

GM South America

The business-type divisions are

Automotive

GM Financial

Market and Company Analysis

Profit

The profit of the company is $7916

Revenue

The revenue of the company is $147049

Products services

The primary products delivered by the

company are automobiles, automobile

parts and the commercial vehicles.

Profit

The profit of the company is $7916

Revenue

The revenue of the company is $147049

Products services

The primary products delivered by the

company are automobiles, automobile

parts and the commercial vehicles.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Market trends and development

According to GM the two new-vitality

models are to be included, the Velite 6

module half breed electric vehicle and the

Velite 6 electric vehicle to its new-vitality

armada, including the Regal Hybrid, Velite

5 and LaCrosse Hybrid, all sold under the

popular Buick identification.

All around, the organization has just said a

"significant" portion of GM's 20 new all-

electric vehicles to be presented by 2023

will be sold in China.

According to GM the two new-vitality

models are to be included, the Velite 6

module half breed electric vehicle and the

Velite 6 electric vehicle to its new-vitality

armada, including the Regal Hybrid, Velite

5 and LaCrosse Hybrid, all sold under the

popular Buick identification.

All around, the organization has just said a

"significant" portion of GM's 20 new all-

electric vehicles to be presented by 2023

will be sold in China.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

How to use the funds

The total value of $300000 is to be utilized for

the purpose of the initial investment.

The funds can be financed through the debt and

the equity. Since the debt ratio of the company

is smooth the company can invest majorly in the

development of the manufacturing of the

electric cars (South China Morning Post, 2018).

The products that are used in the development

of the electric car are the batteries, spare parts,

automobile engine.

The total value of $300000 is to be utilized for

the purpose of the initial investment.

The funds can be financed through the debt and

the equity. Since the debt ratio of the company

is smooth the company can invest majorly in the

development of the manufacturing of the

electric cars (South China Morning Post, 2018).

The products that are used in the development

of the electric car are the batteries, spare parts,

automobile engine.

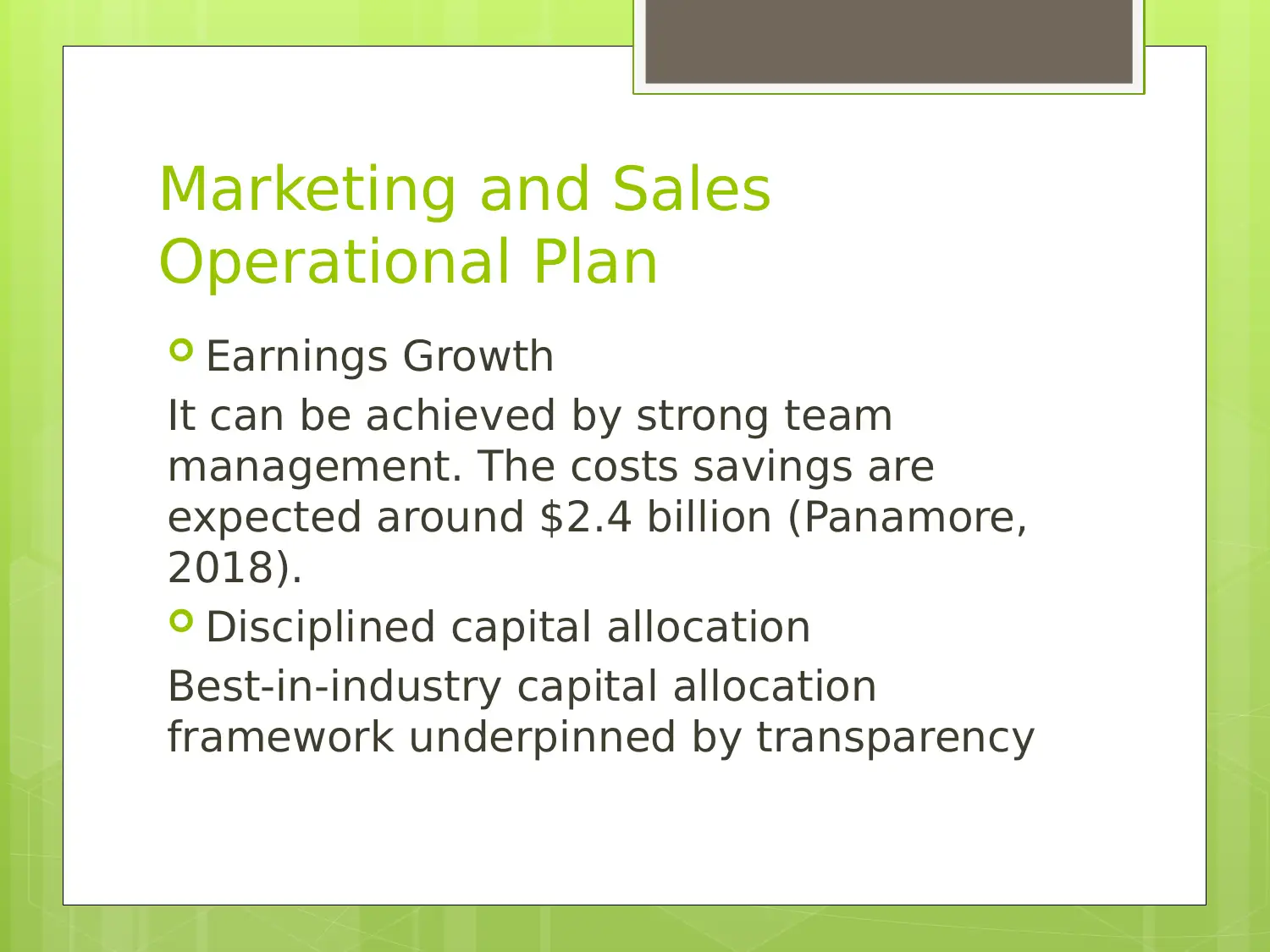

Marketing and Sales

Operational Plan

Earnings Growth

It can be achieved by strong team

management. The costs savings are

expected around $2.4 billion (Panamore,

2018).

Disciplined capital allocation

Best-in-industry capital allocation

framework underpinned by transparency

Operational Plan

Earnings Growth

It can be achieved by strong team

management. The costs savings are

expected around $2.4 billion (Panamore,

2018).

Disciplined capital allocation

Best-in-industry capital allocation

framework underpinned by transparency

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strong Protection and enhancement

With regards to robotized driving

innovation, the organization is

additionally adhering to its arrangement

of taking what it portrays as a

"progressive" course towards enormous

scale business generation of its key

model, the Cruise by 2019 (Kittaneh,

2018).

With regards to robotized driving

innovation, the organization is

additionally adhering to its arrangement

of taking what it portrays as a

"progressive" course towards enormous

scale business generation of its key

model, the Cruise by 2019 (Kittaneh,

2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

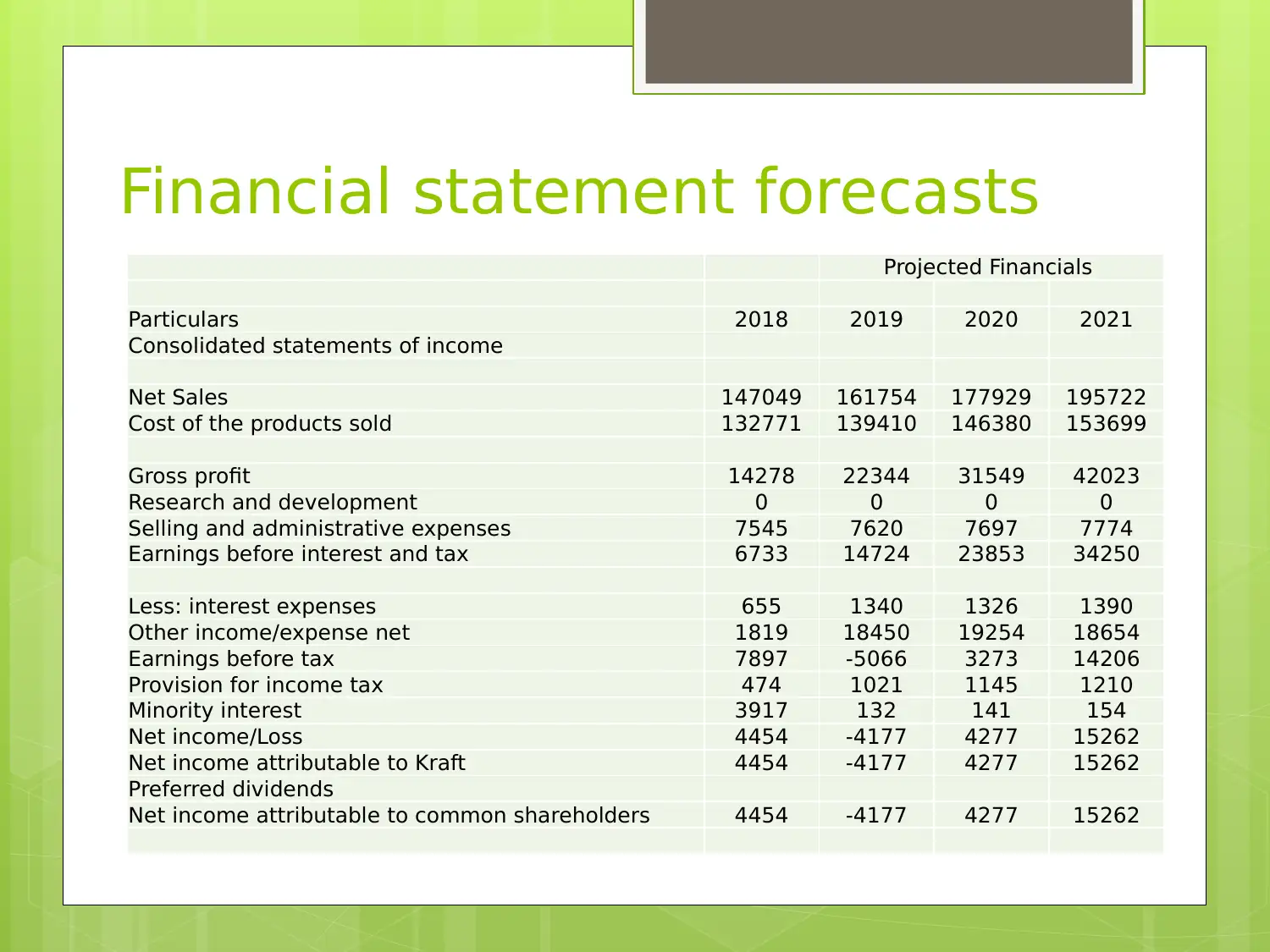

Financial statement forecasts

Projected Financials

Particulars 2018 2019 2020 2021

Consolidated statements of income

Net Sales 147049 161754 177929 195722

Cost of the products sold 132771 139410 146380 153699

Gross profit 14278 22344 31549 42023

Research and development 0 0 0 0

Selling and administrative expenses 7545 7620 7697 7774

Earnings before interest and tax 6733 14724 23853 34250

Less: interest expenses 655 1340 1326 1390

Other income/expense net 1819 18450 19254 18654

Earnings before tax 7897 -5066 3273 14206

Provision for income tax 474 1021 1145 1210

Minority interest 3917 132 141 154

Net income/Loss 4454 -4177 4277 15262

Net income attributable to Kraft 4454 -4177 4277 15262

Preferred dividends

Net income attributable to common shareholders 4454 -4177 4277 15262

Projected Financials

Particulars 2018 2019 2020 2021

Consolidated statements of income

Net Sales 147049 161754 177929 195722

Cost of the products sold 132771 139410 146380 153699

Gross profit 14278 22344 31549 42023

Research and development 0 0 0 0

Selling and administrative expenses 7545 7620 7697 7774

Earnings before interest and tax 6733 14724 23853 34250

Less: interest expenses 655 1340 1326 1390

Other income/expense net 1819 18450 19254 18654

Earnings before tax 7897 -5066 3273 14206

Provision for income tax 474 1021 1145 1210

Minority interest 3917 132 141 154

Net income/Loss 4454 -4177 4277 15262

Net income attributable to Kraft 4454 -4177 4277 15262

Preferred dividends

Net income attributable to common shareholders 4454 -4177 4277 15262

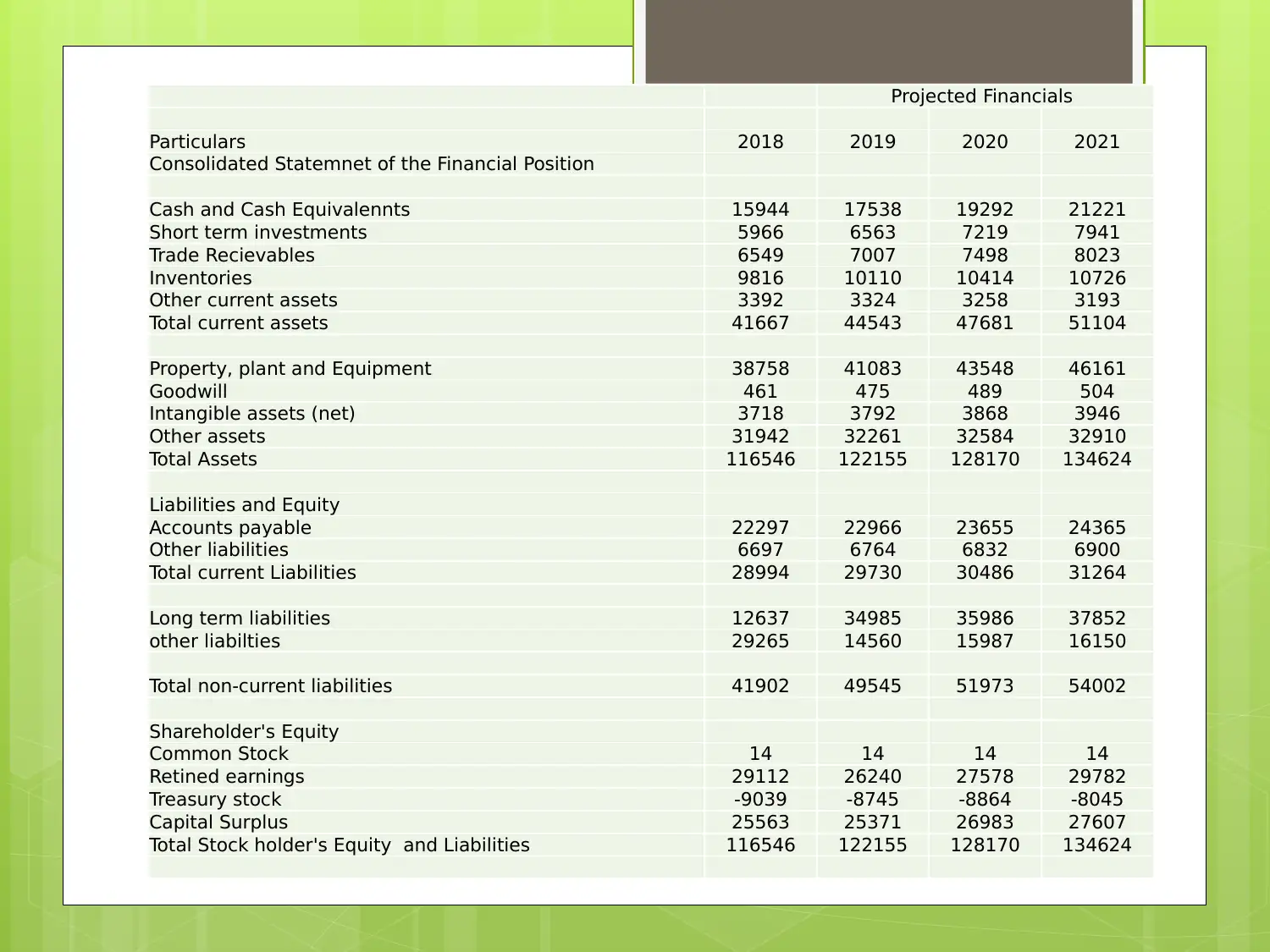

Projected Financials

Particulars 2018 2019 2020 2021

Consolidated Statemnet of the Financial Position

Cash and Cash Equivalennts 15944 17538 19292 21221

Short term investments 5966 6563 7219 7941

Trade Recievables 6549 7007 7498 8023

Inventories 9816 10110 10414 10726

Other current assets 3392 3324 3258 3193

Total current assets 41667 44543 47681 51104

Property, plant and Equipment 38758 41083 43548 46161

Goodwill 461 475 489 504

Intangible assets (net) 3718 3792 3868 3946

Other assets 31942 32261 32584 32910

Total Assets 116546 122155 128170 134624

Liabilities and Equity

Accounts payable 22297 22966 23655 24365

Other liabilities 6697 6764 6832 6900

Total current Liabilities 28994 29730 30486 31264

Long term liabilities 12637 34985 35986 37852

other liabilties 29265 14560 15987 16150

Total non-current liabilities 41902 49545 51973 54002

Shareholder's Equity

Common Stock 14 14 14 14

Retined earnings 29112 26240 27578 29782

Treasury stock -9039 -8745 -8864 -8045

Capital Surplus 25563 25371 26983 27607

Total Stock holder's Equity and Liabilities 116546 122155 128170 134624

Particulars 2018 2019 2020 2021

Consolidated Statemnet of the Financial Position

Cash and Cash Equivalennts 15944 17538 19292 21221

Short term investments 5966 6563 7219 7941

Trade Recievables 6549 7007 7498 8023

Inventories 9816 10110 10414 10726

Other current assets 3392 3324 3258 3193

Total current assets 41667 44543 47681 51104

Property, plant and Equipment 38758 41083 43548 46161

Goodwill 461 475 489 504

Intangible assets (net) 3718 3792 3868 3946

Other assets 31942 32261 32584 32910

Total Assets 116546 122155 128170 134624

Liabilities and Equity

Accounts payable 22297 22966 23655 24365

Other liabilities 6697 6764 6832 6900

Total current Liabilities 28994 29730 30486 31264

Long term liabilities 12637 34985 35986 37852

other liabilties 29265 14560 15987 16150

Total non-current liabilities 41902 49545 51973 54002

Shareholder's Equity

Common Stock 14 14 14 14

Retined earnings 29112 26240 27578 29782

Treasury stock -9039 -8745 -8864 -8045

Capital Surplus 25563 25371 26983 27607

Total Stock holder's Equity and Liabilities 116546 122155 128170 134624

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.