France & India: M&S Business - Global Economic and Finance Report

VerifiedAdded on 2023/06/14

|14

|3483

|238

Report

AI Summary

This report provides a comprehensive analysis of the global business, economic, and financial factors affecting Marks and Spencer in France and India. It examines the market structure, comparing economic indicators such as GDP growth rate, GDP per capita, inflation, unemployment rate, government balances, and balance of payments for both countries. The report also discusses the monetary and fiscal policies of France and India, along with their foreign trade policies, highlighting the impact of Brexit on M&S's operations in France and the company's growth strategies in the Indian market. The analysis includes the effects of COVID-19 and various economic policies on the company's performance and market share in both regions. Desklib offers a platform to explore similar solved assignments and study resources for students.

Global business

economic and finance

economic and finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

MAIN BODY.............................................................................................................................3

Overview of the company and purpose of the report.............................................................3

Market Structure.....................................................................................................................3

Comparative Analysis of Economic Indicators – France and India.......................................4

Monetary Policy.....................................................................................................................9

Fiscal Policy.........................................................................................................................10

Foreign Trade Policy............................................................................................................11

REFERENCES.........................................................................................................................13

MAIN BODY.............................................................................................................................3

Overview of the company and purpose of the report.............................................................3

Market Structure.....................................................................................................................3

Comparative Analysis of Economic Indicators – France and India.......................................4

Monetary Policy.....................................................................................................................9

Fiscal Policy.........................................................................................................................10

Foreign Trade Policy............................................................................................................11

REFERENCES.........................................................................................................................13

MAIN BODY

Overview of the company and purpose of the report.

The company which has been considered in this report is Marks and Spencer which is

established in the year 1884 in the retail industry. Its headquarters are situated in London.

United Kingdom and England. It serves its products across the world in more than 50

countries. It has more than 100 stores all over the world (Abid and et.al., 2022).

The purpose of the report is to go through the market of the company in both the

counties France and India. It will assist the corporation in knowing about the global economic

activities and the micro economic factors that can affect the operations of the entity in terms

of business economics and finance.

Market Structure

It consists of various type of the enter and exits point in the market. So, for this the company

has a market structure of oligopoly in the regions. As it is a brand which has less store across

the country and has more customers in the market. This s the reason oligopoly is considered

as the market structure of the entity. The another reason is that the firm exits in the market

where the competitors and there but it leads the competition by making its price of the

products justifiable for its purchase and deals with the competitors in the market system.

In India, M & S has become the second largest retailer after UK in 2019 after the

expansion of its subsidiaries in the nation. It will grow faster in the tier 2 and 3 cities as it is

keen to expand its range of goods with more local relevance and culture. The market space of

India is a place where more of the international brands are promoted and has the space to

elevate and expand. It provides the enterprise numerous opportunities for the expansion drive

and to generate more revenue (Acheampong, 2019). The corporation has almost clicked the

amount of approximately 908 crore rupees in the year of 2018 -2019 only from the Indian

market. It has set a high momentum for its competitors to touch the above designated amount.

It has grown by customising its products especially for the Indian market which has let to

generate 25 % of the revenue. Also, it has expanded to the online shopping platform as well

which will give it a certain rise in the business. But the impact of Covid -19 has adversely

effected the company by lessening its revenue and the net profit. The market share of the

company has also decreased due to this.

On the contrary in France, due to Brexit, he corporation has to shut its various stores

which were operating under a franchise. Because the exit of UK from the European Union

has limited the supply of goods and service and the chilled products from UK to Europe.

Overview of the company and purpose of the report.

The company which has been considered in this report is Marks and Spencer which is

established in the year 1884 in the retail industry. Its headquarters are situated in London.

United Kingdom and England. It serves its products across the world in more than 50

countries. It has more than 100 stores all over the world (Abid and et.al., 2022).

The purpose of the report is to go through the market of the company in both the

counties France and India. It will assist the corporation in knowing about the global economic

activities and the micro economic factors that can affect the operations of the entity in terms

of business economics and finance.

Market Structure

It consists of various type of the enter and exits point in the market. So, for this the company

has a market structure of oligopoly in the regions. As it is a brand which has less store across

the country and has more customers in the market. This s the reason oligopoly is considered

as the market structure of the entity. The another reason is that the firm exits in the market

where the competitors and there but it leads the competition by making its price of the

products justifiable for its purchase and deals with the competitors in the market system.

In India, M & S has become the second largest retailer after UK in 2019 after the

expansion of its subsidiaries in the nation. It will grow faster in the tier 2 and 3 cities as it is

keen to expand its range of goods with more local relevance and culture. The market space of

India is a place where more of the international brands are promoted and has the space to

elevate and expand. It provides the enterprise numerous opportunities for the expansion drive

and to generate more revenue (Acheampong, 2019). The corporation has almost clicked the

amount of approximately 908 crore rupees in the year of 2018 -2019 only from the Indian

market. It has set a high momentum for its competitors to touch the above designated amount.

It has grown by customising its products especially for the Indian market which has let to

generate 25 % of the revenue. Also, it has expanded to the online shopping platform as well

which will give it a certain rise in the business. But the impact of Covid -19 has adversely

effected the company by lessening its revenue and the net profit. The market share of the

company has also decreased due to this.

On the contrary in France, due to Brexit, he corporation has to shut its various stores

which were operating under a franchise. Because the exit of UK from the European Union

has limited the supply of goods and service and the chilled products from UK to Europe.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Considering the situation new standard were passes. Which forces the company to empty its

stock as fast as possible. This has deeply impacted the market share of France and is very

important to gain it up (Adji and et.al., 2018). Otherwise, contrasting with the Indian

economy it can be assessed that the economic position of India considering the cony status

will grow and for France the company needs to put some new innovative strategies which

could be dealt in the market structure of France.

Comparative Analysis of Economic Indicators – France and India

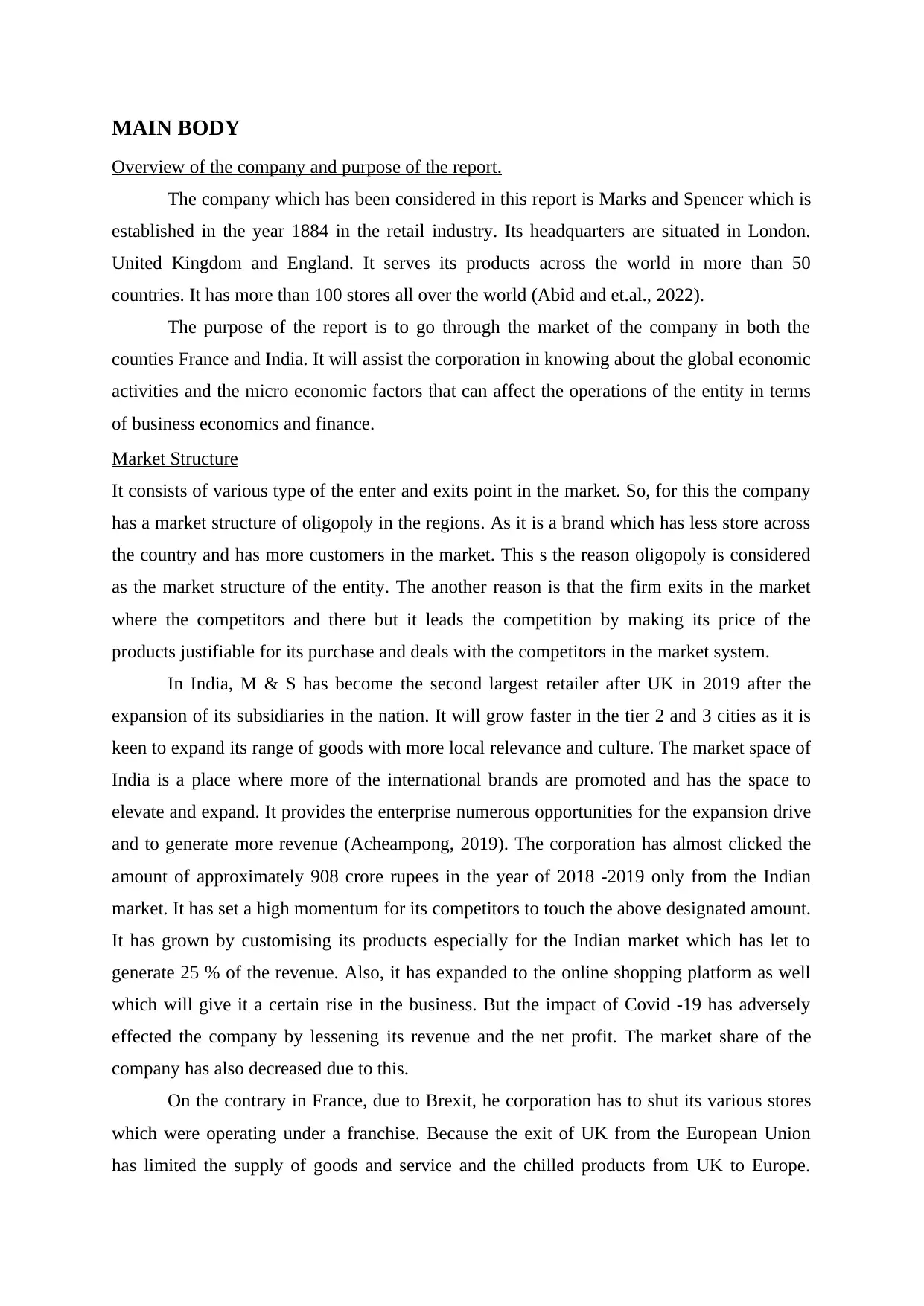

1. GDP Growth Rate

Figure 1Comparison of GDP growth Rate between India and France

From the graph above, it can be asserted that the GDP annual growth rate of France is

fluctuating and it diminished speedily rom 2018 and is negative now. On the similar page

India is running its economy, it showed a growth from 2011 to 2016, but then it is slowly

diminishing and now it has reached that the GDP growth rate is negative due to effect of

Covid – 19. It has influence the number of influencer that are willing to invest in the

organisation (Ahmad, and et.al., 2020). It has major affected the construction and

manufacturing sector and lead aftermath to a steady growth in the India’s GDP till 2016.

Marks and Spencer also effected and had a slowdown before 2011, but it bucked itself

after the adverse slowdown in both the nations. Especially in India, it surfaced its growth

hugely as it adapted the culture of India and made its products accordingly. It helped the

stock as fast as possible. This has deeply impacted the market share of France and is very

important to gain it up (Adji and et.al., 2018). Otherwise, contrasting with the Indian

economy it can be assessed that the economic position of India considering the cony status

will grow and for France the company needs to put some new innovative strategies which

could be dealt in the market structure of France.

Comparative Analysis of Economic Indicators – France and India

1. GDP Growth Rate

Figure 1Comparison of GDP growth Rate between India and France

From the graph above, it can be asserted that the GDP annual growth rate of France is

fluctuating and it diminished speedily rom 2018 and is negative now. On the similar page

India is running its economy, it showed a growth from 2011 to 2016, but then it is slowly

diminishing and now it has reached that the GDP growth rate is negative due to effect of

Covid – 19. It has influence the number of influencer that are willing to invest in the

organisation (Ahmad, and et.al., 2020). It has major affected the construction and

manufacturing sector and lead aftermath to a steady growth in the India’s GDP till 2016.

Marks and Spencer also effected and had a slowdown before 2011, but it bucked itself

after the adverse slowdown in both the nations. Especially in India, it surfaced its growth

hugely as it adapted the culture of India and made its products accordingly. It helped the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

country in hiking up it GDP growth rate but the effect of covid – 19 has slowed sown all the

economies and lead to downturn its economic position.

On the other hand, Marks and Spencer was able to launch its new stores in France but

the Brexit has created a hype in the market as the policies relating to trade and customs

changed. It forced the company to shut its many stores from the country and this effected the

economic situation of France adversely.

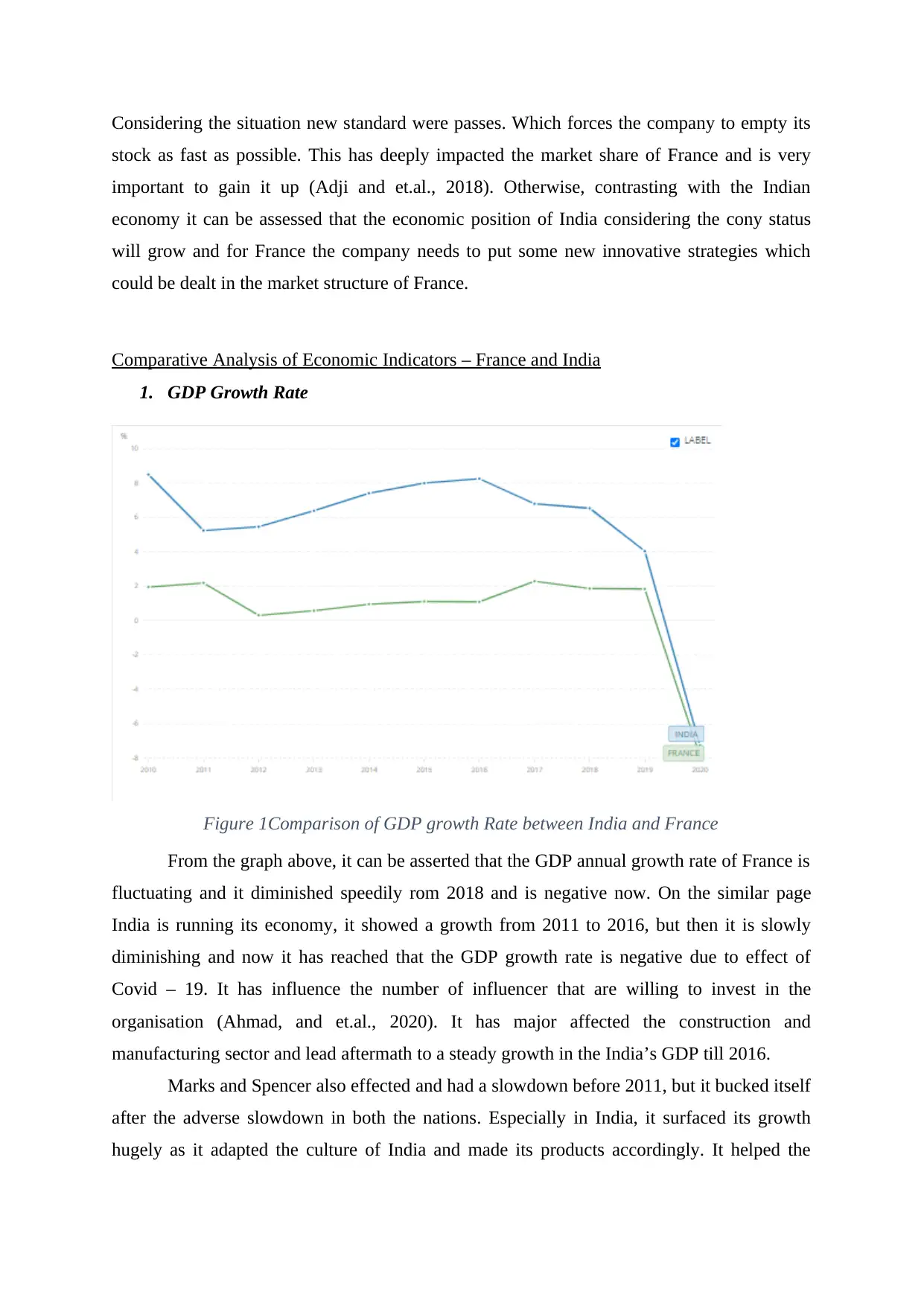

2. GDP per capita at constant prices

As seen in the above chart, there is a major difference in the GDP per capita of India

and France. It can be measured that the economy of India is growing at a faster rate from

2010 to 2019. France has also managed to increase its GDP per capita by almost at a constant

rate. The higher GDP means the spending power of the family has increase in India and the

demand of purchasing the goods will also increase (Ding, Khattak and Ahmad, 2021).

From the context of Marks and Spencer, India has been proved good for enhancing

the company’s monetary status which is good for the company as it is been able to increase

its stores. But in France again the impact of Brexit was so large that it led the economy to fall

and the purchasing power of the customers also diminished. This is the reason that the

country was not able to increase its economic position and led to entity to shut down its

stores.

economies and lead to downturn its economic position.

On the other hand, Marks and Spencer was able to launch its new stores in France but

the Brexit has created a hype in the market as the policies relating to trade and customs

changed. It forced the company to shut its many stores from the country and this effected the

economic situation of France adversely.

2. GDP per capita at constant prices

As seen in the above chart, there is a major difference in the GDP per capita of India

and France. It can be measured that the economy of India is growing at a faster rate from

2010 to 2019. France has also managed to increase its GDP per capita by almost at a constant

rate. The higher GDP means the spending power of the family has increase in India and the

demand of purchasing the goods will also increase (Ding, Khattak and Ahmad, 2021).

From the context of Marks and Spencer, India has been proved good for enhancing

the company’s monetary status which is good for the company as it is been able to increase

its stores. But in France again the impact of Brexit was so large that it led the economy to fall

and the purchasing power of the customers also diminished. This is the reason that the

country was not able to increase its economic position and led to entity to shut down its

stores.

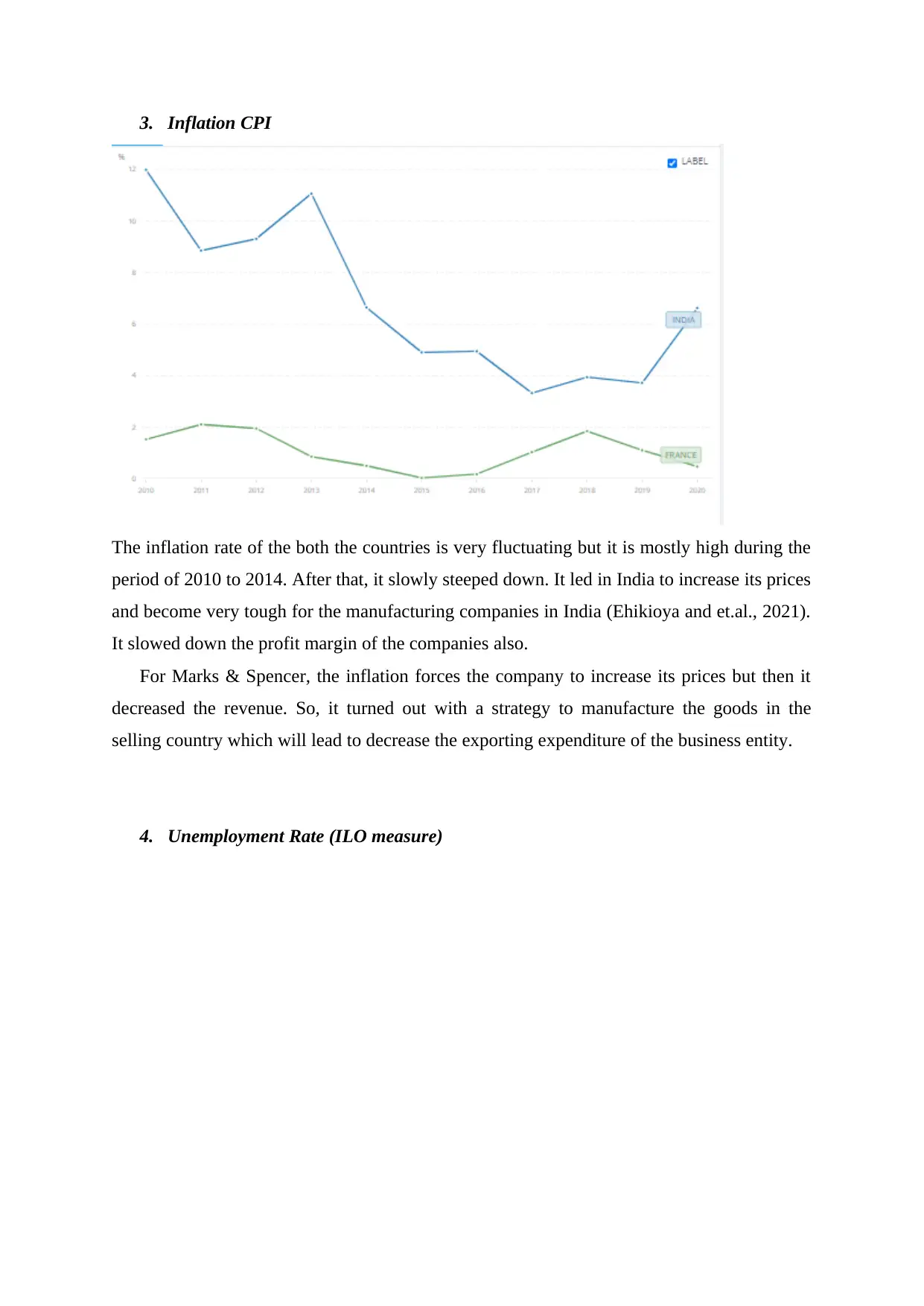

3. Inflation CPI

The inflation rate of the both the countries is very fluctuating but it is mostly high during the

period of 2010 to 2014. After that, it slowly steeped down. It led in India to increase its prices

and become very tough for the manufacturing companies in India (Ehikioya and et.al., 2021).

It slowed down the profit margin of the companies also.

For Marks & Spencer, the inflation forces the company to increase its prices but then it

decreased the revenue. So, it turned out with a strategy to manufacture the goods in the

selling country which will lead to decrease the exporting expenditure of the business entity.

4. Unemployment Rate (ILO measure)

The inflation rate of the both the countries is very fluctuating but it is mostly high during the

period of 2010 to 2014. After that, it slowly steeped down. It led in India to increase its prices

and become very tough for the manufacturing companies in India (Ehikioya and et.al., 2021).

It slowed down the profit margin of the companies also.

For Marks & Spencer, the inflation forces the company to increase its prices but then it

decreased the revenue. So, it turned out with a strategy to manufacture the goods in the

selling country which will lead to decrease the exporting expenditure of the business entity.

4. Unemployment Rate (ILO measure)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

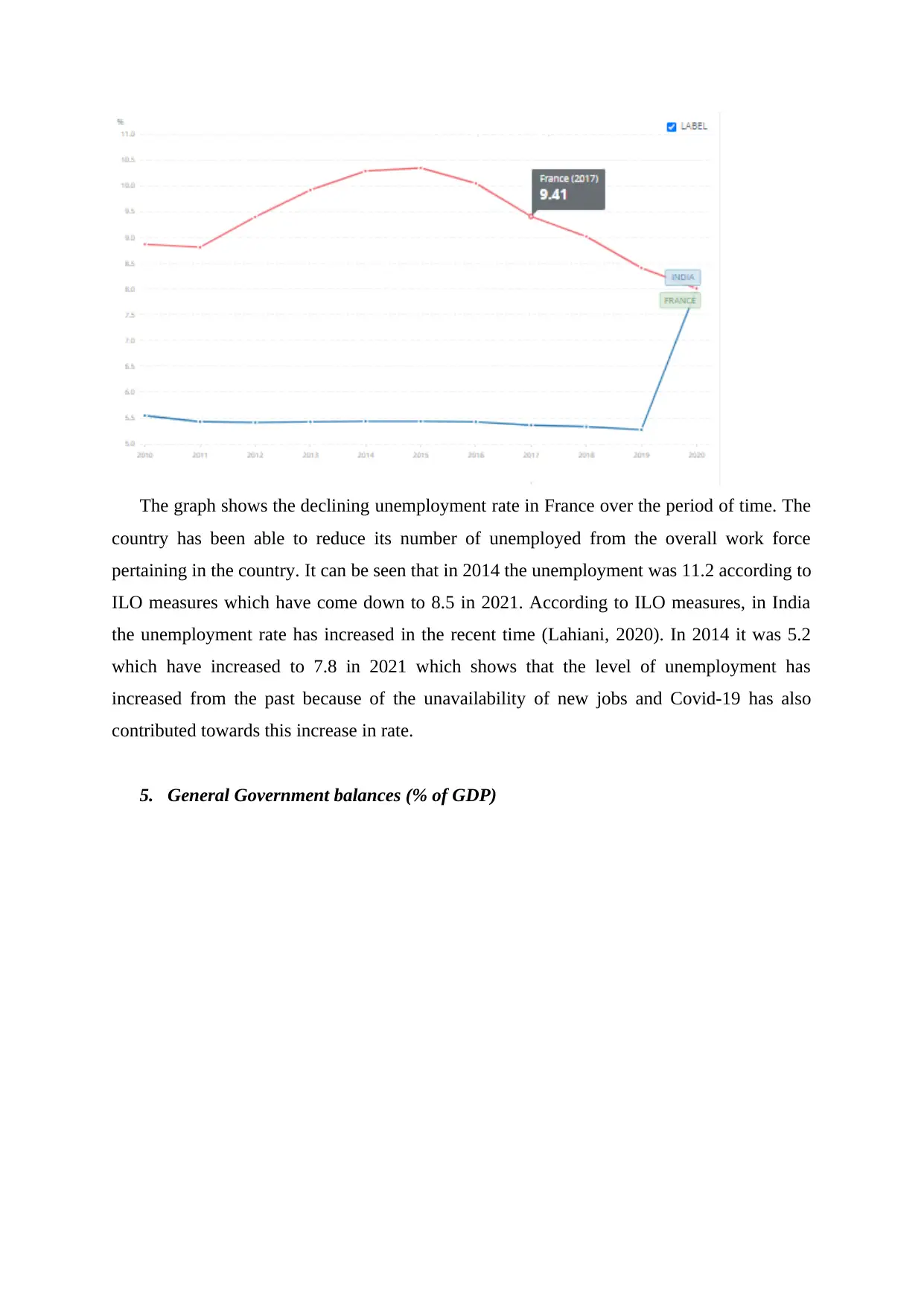

The graph shows the declining unemployment rate in France over the period of time. The

country has been able to reduce its number of unemployed from the overall work force

pertaining in the country. It can be seen that in 2014 the unemployment was 11.2 according to

ILO measures which have come down to 8.5 in 2021. According to ILO measures, in India

the unemployment rate has increased in the recent time (Lahiani, 2020). In 2014 it was 5.2

which have increased to 7.8 in 2021 which shows that the level of unemployment has

increased from the past because of the unavailability of new jobs and Covid-19 has also

contributed towards this increase in rate.

5. General Government balances (% of GDP)

country has been able to reduce its number of unemployed from the overall work force

pertaining in the country. It can be seen that in 2014 the unemployment was 11.2 according to

ILO measures which have come down to 8.5 in 2021. According to ILO measures, in India

the unemployment rate has increased in the recent time (Lahiani, 2020). In 2014 it was 5.2

which have increased to 7.8 in 2021 which shows that the level of unemployment has

increased from the past because of the unavailability of new jobs and Covid-19 has also

contributed towards this increase in rate.

5. General Government balances (% of GDP)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

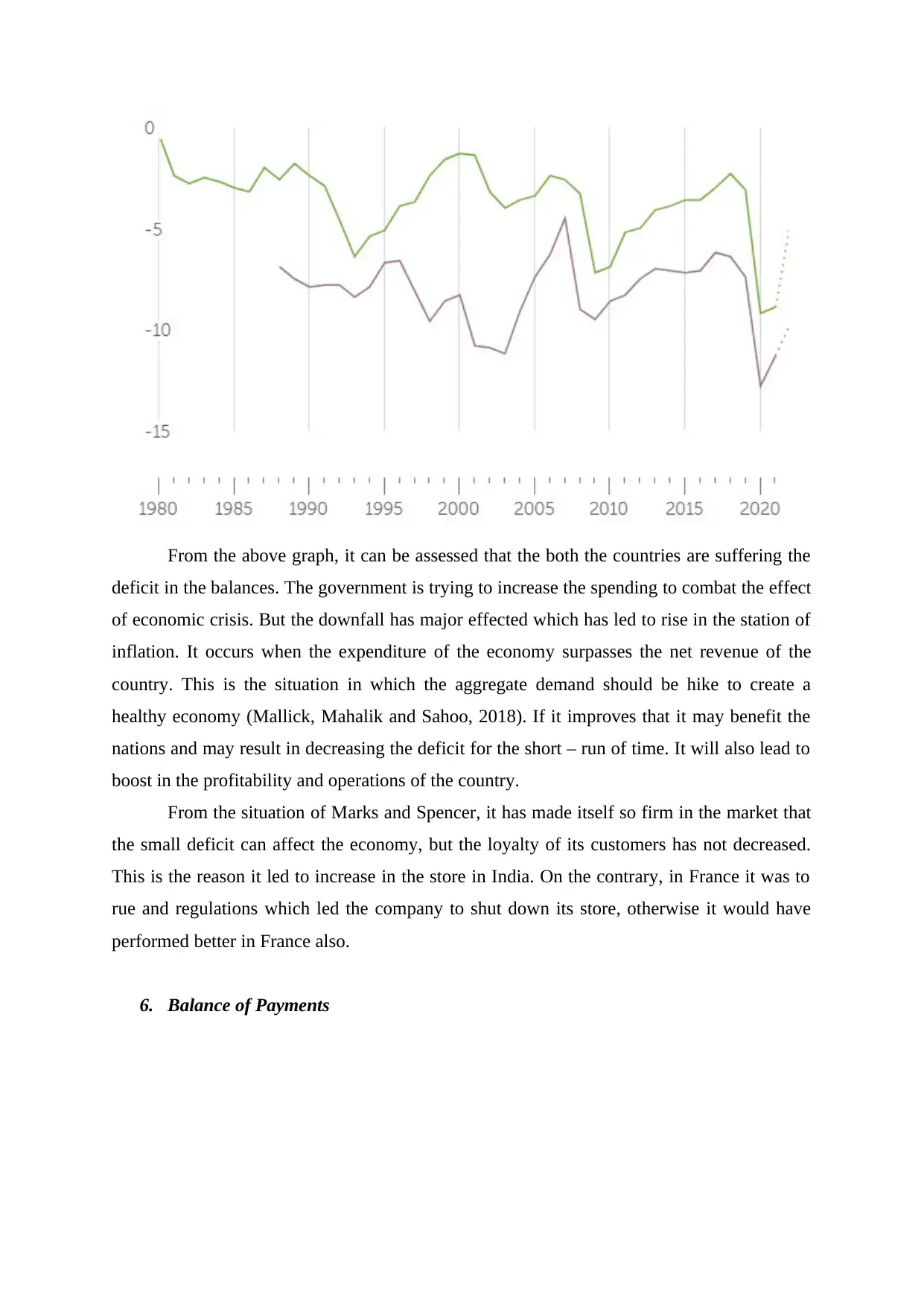

From the above graph, it can be assessed that the both the countries are suffering the

deficit in the balances. The government is trying to increase the spending to combat the effect

of economic crisis. But the downfall has major effected which has led to rise in the station of

inflation. It occurs when the expenditure of the economy surpasses the net revenue of the

country. This is the situation in which the aggregate demand should be hike to create a

healthy economy (Mallick, Mahalik and Sahoo, 2018). If it improves that it may benefit the

nations and may result in decreasing the deficit for the short – run of time. It will also lead to

boost in the profitability and operations of the country.

From the situation of Marks and Spencer, it has made itself so firm in the market that

the small deficit can affect the economy, but the loyalty of its customers has not decreased.

This is the reason it led to increase in the store in India. On the contrary, in France it was to

rue and regulations which led the company to shut down its store, otherwise it would have

performed better in France also.

6. Balance of Payments

deficit in the balances. The government is trying to increase the spending to combat the effect

of economic crisis. But the downfall has major effected which has led to rise in the station of

inflation. It occurs when the expenditure of the economy surpasses the net revenue of the

country. This is the situation in which the aggregate demand should be hike to create a

healthy economy (Mallick, Mahalik and Sahoo, 2018). If it improves that it may benefit the

nations and may result in decreasing the deficit for the short – run of time. It will also lead to

boost in the profitability and operations of the country.

From the situation of Marks and Spencer, it has made itself so firm in the market that

the small deficit can affect the economy, but the loyalty of its customers has not decreased.

This is the reason it led to increase in the store in India. On the contrary, in France it was to

rue and regulations which led the company to shut down its store, otherwise it would have

performed better in France also.

6. Balance of Payments

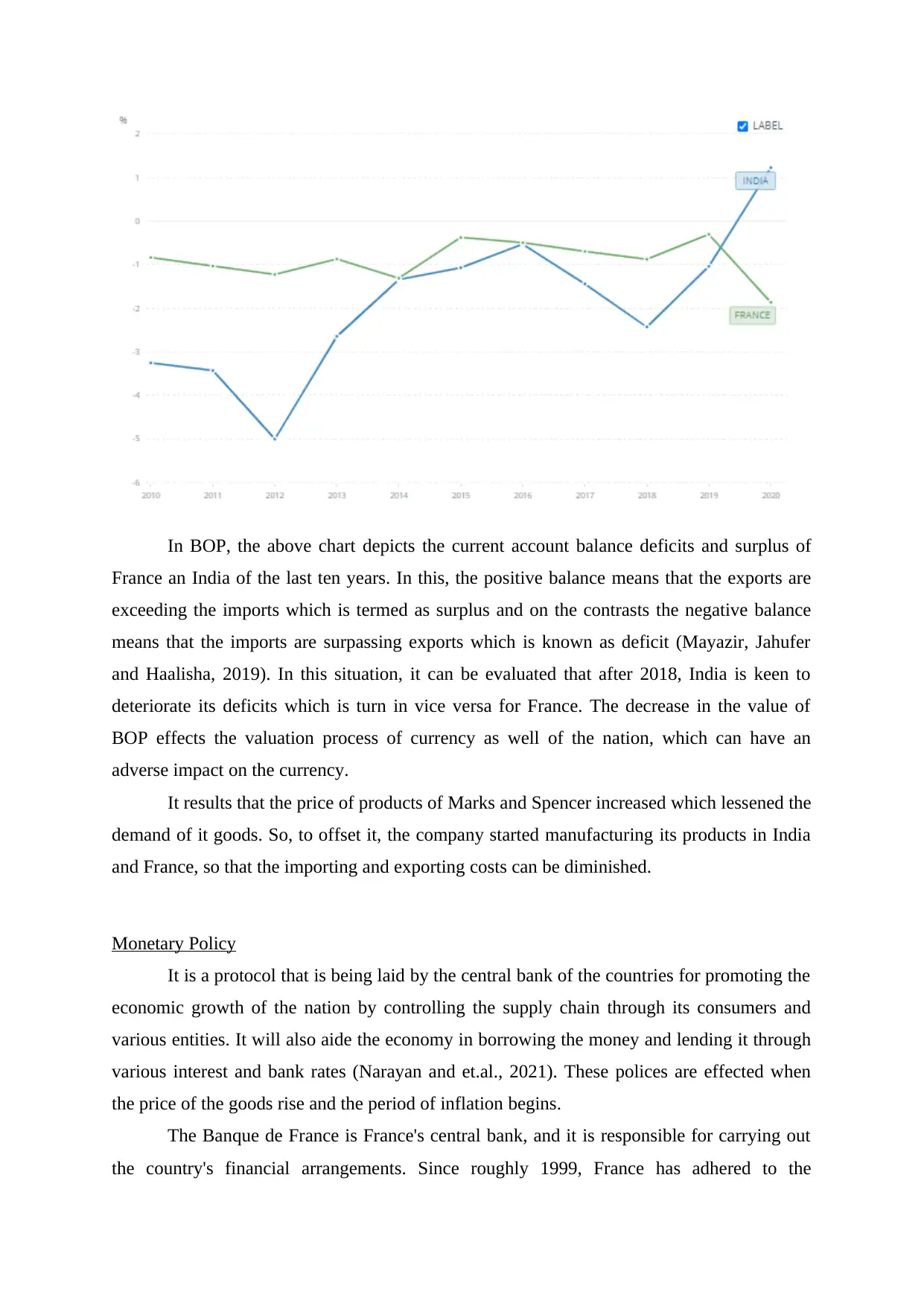

In BOP, the above chart depicts the current account balance deficits and surplus of

France an India of the last ten years. In this, the positive balance means that the exports are

exceeding the imports which is termed as surplus and on the contrasts the negative balance

means that the imports are surpassing exports which is known as deficit (Mayazir, Jahufer

and Haalisha, 2019). In this situation, it can be evaluated that after 2018, India is keen to

deteriorate its deficits which is turn in vice versa for France. The decrease in the value of

BOP effects the valuation process of currency as well of the nation, which can have an

adverse impact on the currency.

It results that the price of products of Marks and Spencer increased which lessened the

demand of it goods. So, to offset it, the company started manufacturing its products in India

and France, so that the importing and exporting costs can be diminished.

Monetary Policy

It is a protocol that is being laid by the central bank of the countries for promoting the

economic growth of the nation by controlling the supply chain through its consumers and

various entities. It will also aide the economy in borrowing the money and lending it through

various interest and bank rates (Narayan and et.al., 2021). These polices are effected when

the price of the goods rise and the period of inflation begins.

The Banque de France is France's central bank, and it is responsible for carrying out

the country's financial arrangements. Since roughly 1999, France has adhered to the

France an India of the last ten years. In this, the positive balance means that the exports are

exceeding the imports which is termed as surplus and on the contrasts the negative balance

means that the imports are surpassing exports which is known as deficit (Mayazir, Jahufer

and Haalisha, 2019). In this situation, it can be evaluated that after 2018, India is keen to

deteriorate its deficits which is turn in vice versa for France. The decrease in the value of

BOP effects the valuation process of currency as well of the nation, which can have an

adverse impact on the currency.

It results that the price of products of Marks and Spencer increased which lessened the

demand of it goods. So, to offset it, the company started manufacturing its products in India

and France, so that the importing and exporting costs can be diminished.

Monetary Policy

It is a protocol that is being laid by the central bank of the countries for promoting the

economic growth of the nation by controlling the supply chain through its consumers and

various entities. It will also aide the economy in borrowing the money and lending it through

various interest and bank rates (Narayan and et.al., 2021). These polices are effected when

the price of the goods rise and the period of inflation begins.

The Banque de France is France's central bank, and it is responsible for carrying out

the country's financial arrangements. Since roughly 1999, France has adhered to the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Eurozone's standard financial framework, as determined by the European Central Bank

(ECB). The ECB's funds arrangement's main goal is to stay ahead with the Eurozone

countries market development. The Bank is now affiliated towards the ECB and follows the

European System of Central Banks financing cost approach. Over the intermediate term, the

ECB is intent on keeping growth below, but close to, 2%. The ECB achieves this goal by

employing a variety of money-related policy instruments, such as setting a key storage rate or

benchmark renegotiating rate (Qiuling and Qifeng, 2020). The basic goal of India's monetary

arrangement is to provide fundamental value security and adequate credit to various helpful

regions in the country

During the mid-2000s, RBI underwent a substantial transformation, shifting from an

immediate lending fee strategy to a backhanded market-based financing cost method. It

embraced the office of constant change (LAF). The LAF began as a fixed-rate repurchase

agreement before being altered to a variable-rate repurchase agreement in 2004.

The impact of monetary policy on the business of Marks and spencer is that, as

monetary policy determines the availability of financial funds in an economy, this has an

impact on the financial funds that the business owns. If the government is focusing on

expansionary policy, it will present more funds and better employment in the business of

marks and spencer and in return, better availability of resources for growth. If the economy is

focusing on contractionary policy, it will reduce the availability of financial resources for the

business and in return decreased growth aspects.

Fiscal Policy

France, like many other European countries, has seen an enlargement of bureaucracy

and a build-up of public debt. Ever since economic meltdown, the government has had to

deal with new monetary realities and has turned to the monetary strategy as a tool for

reviving the economy and reducing the budget deficit. To try to stimulate the French

economy and reduce the country's budget deficit, former President Sarkozy implemented

severe measures, notably budget cuts and price increases (Safi and et.al., 2021). In any case,

incumbent President Hollande was elected with the goal of resolving the budget deficit by

raising taxes on the wealthy while maintaining government spending.

In India, the progression of expense incomes and public usage to investigate the

economy is controlled by a nation's public authority. If the public authority receives more

revenue than it spends, it has an excess; if it spends more than it receives in assessment and

(ECB). The ECB's funds arrangement's main goal is to stay ahead with the Eurozone

countries market development. The Bank is now affiliated towards the ECB and follows the

European System of Central Banks financing cost approach. Over the intermediate term, the

ECB is intent on keeping growth below, but close to, 2%. The ECB achieves this goal by

employing a variety of money-related policy instruments, such as setting a key storage rate or

benchmark renegotiating rate (Qiuling and Qifeng, 2020). The basic goal of India's monetary

arrangement is to provide fundamental value security and adequate credit to various helpful

regions in the country

During the mid-2000s, RBI underwent a substantial transformation, shifting from an

immediate lending fee strategy to a backhanded market-based financing cost method. It

embraced the office of constant change (LAF). The LAF began as a fixed-rate repurchase

agreement before being altered to a variable-rate repurchase agreement in 2004.

The impact of monetary policy on the business of Marks and spencer is that, as

monetary policy determines the availability of financial funds in an economy, this has an

impact on the financial funds that the business owns. If the government is focusing on

expansionary policy, it will present more funds and better employment in the business of

marks and spencer and in return, better availability of resources for growth. If the economy is

focusing on contractionary policy, it will reduce the availability of financial resources for the

business and in return decreased growth aspects.

Fiscal Policy

France, like many other European countries, has seen an enlargement of bureaucracy

and a build-up of public debt. Ever since economic meltdown, the government has had to

deal with new monetary realities and has turned to the monetary strategy as a tool for

reviving the economy and reducing the budget deficit. To try to stimulate the French

economy and reduce the country's budget deficit, former President Sarkozy implemented

severe measures, notably budget cuts and price increases (Safi and et.al., 2021). In any case,

incumbent President Hollande was elected with the goal of resolving the budget deficit by

raising taxes on the wealthy while maintaining government spending.

In India, the progression of expense incomes and public usage to investigate the

economy is controlled by a nation's public authority. If the public authority receives more

revenue than it spends, it has an excess; if it spends more than it receives in assessment and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

non-charge revenue, it has a deficit. To address further needs, the government must get

locally or from outside. The government, on the other hand, may choose to use its unfamiliar

trade savings or print extra money (Shamsuddin, 2018).

The fiscal policy of the business determines the inflation rate in the economy. If the

economy is facing inflation, the business will be impacted as they will have to pay more taxes

to the government which in return decreases the financial funds with the business. If the

economy is facing deflation, the government will focus on providing more goods in the

economy so they will lower the taxation rate and in return, the business will have more

financial resources to be used in the business.

Foreign Trade Policy

After its largest trading partner, Germany, France is Europe's second-largest exporter.

France, in particular, consumes a lot of imported client merchandise, which is less expensive

than "Made in France" items. France is also a net oil exporter; therefore, price fluctuations are

a concern. France is an EU member state that adopts an exchange strategy similar to those of

other EU member states, with a standard EU weighted normal duty rate (Usman, Makhdum,

and Kousar, 2021). In addition, France and other EU member states have many bilateral and

territorial commercial agreements and are members of the WTO. Although France has a

broadly open economy, there are a few barriers to trade. France receives a lot of FDI, and the

rules for speculation are generally straightforward, albeit there are still a number of

regulatory hurdles to overcome.

The Foreign Trade Policy (FTP) of India provides the necessary system of strategy

and method for the advancement of products and trade. It is periodically investigated in order

to adapt to changing domestic and global circumstances. It focuses on expanding India's

share in the global industry in existing business sectors and items, as well as researching new

products and business sectors. India's Foreign Trade Policy also envisions assisting exporters

in utilising GST benefits, carefully inspecting send out exhibitions, improving the ease of

exchanging across borders, expanding recognition of India's agribusiness-based commodities,

and advancing products from MSMEs and work serious areas (Weimin and et.al., 2021).

The foreign trade policy of an economy impacts the M&S working in the economy.

The trade policy of India and France impacts the imports and exports that the business have.

If the economy has strict foreign trade policy, they business will have to pay more for their

imports and exports, in return the availability of funds will deteriorate for the business of

locally or from outside. The government, on the other hand, may choose to use its unfamiliar

trade savings or print extra money (Shamsuddin, 2018).

The fiscal policy of the business determines the inflation rate in the economy. If the

economy is facing inflation, the business will be impacted as they will have to pay more taxes

to the government which in return decreases the financial funds with the business. If the

economy is facing deflation, the government will focus on providing more goods in the

economy so they will lower the taxation rate and in return, the business will have more

financial resources to be used in the business.

Foreign Trade Policy

After its largest trading partner, Germany, France is Europe's second-largest exporter.

France, in particular, consumes a lot of imported client merchandise, which is less expensive

than "Made in France" items. France is also a net oil exporter; therefore, price fluctuations are

a concern. France is an EU member state that adopts an exchange strategy similar to those of

other EU member states, with a standard EU weighted normal duty rate (Usman, Makhdum,

and Kousar, 2021). In addition, France and other EU member states have many bilateral and

territorial commercial agreements and are members of the WTO. Although France has a

broadly open economy, there are a few barriers to trade. France receives a lot of FDI, and the

rules for speculation are generally straightforward, albeit there are still a number of

regulatory hurdles to overcome.

The Foreign Trade Policy (FTP) of India provides the necessary system of strategy

and method for the advancement of products and trade. It is periodically investigated in order

to adapt to changing domestic and global circumstances. It focuses on expanding India's

share in the global industry in existing business sectors and items, as well as researching new

products and business sectors. India's Foreign Trade Policy also envisions assisting exporters

in utilising GST benefits, carefully inspecting send out exhibitions, improving the ease of

exchanging across borders, expanding recognition of India's agribusiness-based commodities,

and advancing products from MSMEs and work serious areas (Weimin and et.al., 2021).

The foreign trade policy of an economy impacts the M&S working in the economy.

The trade policy of India and France impacts the imports and exports that the business have.

If the economy has strict foreign trade policy, they business will have to pay more for their

imports and exports, in return the availability of funds will deteriorate for the business of

marks and spencer. If the economy has flexible rate on imports and exports, the business may

plan on spending more on its imports and exports and in return gain foreign resources

advantage (Zulkifli, 2018).

plan on spending more on its imports and exports and in return gain foreign resources

advantage (Zulkifli, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.