7BSP0353 - Global Economy: M&A and Development in China, India

VerifiedAdded on 2023/04/22

|12

|3548

|270

Essay

AI Summary

This essay examines cross-border mergers and acquisitions (M&A), focusing on factors influencing their success and patterns. It highlights the importance of incentives, due diligence, and political-economic stability for peaceful M&A operations. The essay also compares the economic development models of China and India, noting differences in their approaches to globalization, sectoral focus (manufacturing vs. services), and government intervention. China's development through Special Economic Zones and manufacturing is contrasted with India's service-led growth driven by IT sector liberalization. The analysis incorporates statistical data to illustrate economic growth and sectoral contributions in both countries.

1

GLOBAL ECONOMY

7BSP0353-0901

STUDENT ID - 17073877

Contents

GLOBAL ECONOMY

7BSP0353-0901

STUDENT ID - 17073877

Contents

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Question 3-Factor influencing the peace and the pattern of cross border merger and

acquisition..................................................................................................................................3

Question 4 -Economic development models of China and India...............................................6

Reference..................................................................................................................................10

Question 3-Factor influencing the peace and the pattern of cross border merger and

acquisition..................................................................................................................................3

Question 4 -Economic development models of China and India...............................................6

Reference..................................................................................................................................10

3

Question 3-Factor influencing the peace and the pattern of cross border merger and

acquisition

The overview of Cross border merger and acquisition

The cross border acquisition is a process of merger deals between two companies located in

two different countries. The cross border merger and acquisition is a common process to

enter a foreign market under globalisation. In the year 2000, when most of the economy of

the world opened their economy for the global economy, these kinds of deal increased

prodigiously. Humphery‐Jenner, Sautner, and Suchard (2017) highlighted that, there was a

sudden jump of 200% in the number of cross border merger and acquisition in most of the

world. One of the biggest advantages of the cross border merger and acquisition is that it

allows the companies to share the customer base and the means of production. The Asia

Pacific is the best area in terms of the successful merger and acquisition that is still in

operation. The main reason for the reason to be successful is the fact, that, customer base in

this area is dense and the nature of the economies in this area is somewhat similar to each

other. Nevertheless, other areas of the world such as Latin America also have shown signs of

cross border merger acquisition through different trade blocs and associations. Most of the

merger and acquisition is being attracted by Brazil since the year 2012 due to the inefficient

policies of countries like India and saturation in countries like China. Other economies in the

Latin America region have also been doing great over the years leading to a rise in cross

border merger and acquisition in this region.

The factor affecting the pattern and peace of cross border merger and acquisition

There is a pattern in the cross border merger and acquisition which is heavily affected by

some external factors. First and the foremost factor that influences the merger and acquisition

process is the incentives of two of the companies located in two different countries. Huang,

Officer, and Powell (2016) stated that both the companies and the nations must gain

positively from cross border acquisition for it become fruitful. There have been many

instances where the merger and acquisition deal has fallen apart due to insufficient gains of

some of the partner companies. One of the most important and recent examples of this is the

cross border merger and acquisition between two of the biggest companies in the world.

Nokia which is located in Finland and Microsoft located in the United States of America

Question 3-Factor influencing the peace and the pattern of cross border merger and

acquisition

The overview of Cross border merger and acquisition

The cross border acquisition is a process of merger deals between two companies located in

two different countries. The cross border merger and acquisition is a common process to

enter a foreign market under globalisation. In the year 2000, when most of the economy of

the world opened their economy for the global economy, these kinds of deal increased

prodigiously. Humphery‐Jenner, Sautner, and Suchard (2017) highlighted that, there was a

sudden jump of 200% in the number of cross border merger and acquisition in most of the

world. One of the biggest advantages of the cross border merger and acquisition is that it

allows the companies to share the customer base and the means of production. The Asia

Pacific is the best area in terms of the successful merger and acquisition that is still in

operation. The main reason for the reason to be successful is the fact, that, customer base in

this area is dense and the nature of the economies in this area is somewhat similar to each

other. Nevertheless, other areas of the world such as Latin America also have shown signs of

cross border merger acquisition through different trade blocs and associations. Most of the

merger and acquisition is being attracted by Brazil since the year 2012 due to the inefficient

policies of countries like India and saturation in countries like China. Other economies in the

Latin America region have also been doing great over the years leading to a rise in cross

border merger and acquisition in this region.

The factor affecting the pattern and peace of cross border merger and acquisition

There is a pattern in the cross border merger and acquisition which is heavily affected by

some external factors. First and the foremost factor that influences the merger and acquisition

process is the incentives of two of the companies located in two different countries. Huang,

Officer, and Powell (2016) stated that both the companies and the nations must gain

positively from cross border acquisition for it become fruitful. There have been many

instances where the merger and acquisition deal has fallen apart due to insufficient gains of

some of the partner companies. One of the most important and recent examples of this is the

cross border merger and acquisition between two of the biggest companies in the world.

Nokia which is located in Finland and Microsoft located in the United States of America

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

merged their operation a few years ago. However, the cross border merger failed due to an

insufficient gain of one of the partner and hence the merger fell apart.

Apart from that, another factor that needs to be there before the cross border merger and

acquisition is the due diligence. Alimov and Officer (2017) noted that generally domestic

companies overstate their performances and achievements in order to get a good and lucrative

merger and acquisition deal and then it fails to lead to a loss for the foreign company or the

bigger company. Thus, in the peace of cross border acquisition, the due diligence reports of

each of the company matter a lot. A lot of massive consultancy companies are there in the

market that assists the companies in understanding the operational history of the other firm.

These reports become the factor for the initiation of a cross border merger and acquisition

deal between the two companies. Another important factor for the peaceful operation of the

cross border merger and acquisition deal is the presence of political, economic and social

harmony in the two countries . Political unrests limit the scope of foreign investment in the

business as it reduces the rate of return for the investors. Therefore, the prospective growth of

the merger and acquisition deal gets limited and hence the deal falls apart. In addition to that,

the economic performance in the target country is also important for the cross border merger

and acquisition as it will provide the market base to both of the companies. Lastly, social

structure and some of its measure also help determine the pattern of cross border merger and

acquisition (Francis, Huang and Khurana, 2016). For example, in a target country full of

unskilled labour, production merger and acquisition will be more than service. Thus, the

scope of the different company is there in different countries of the world. For example, India

is a country full with service sector worker who is only slightly skilled. The country has seen

cross border merger and acquisitions among the domestic service company and its global

counterpart.

One of the most used ways to study the risk for undertaking a cross border merger and

acquisition strategy is to understand the risk matrix. According to Buckley et al. (2016), the

study of the risk matrix makes the deal more peaceful and harmonious. The evaluation of the

risk matrix is important to find out any vulnerability of the other company as well. Risk

matrix includes all the risk elements and their weights. The risk matrix finds out the risk

associated with the deal and the companies take a decision based on that matrix. The pattern

of merger and acquisition often depends on the intensity of the risk. In some of the cases, the

foreign counterpart often decides to invest in the domestic company through licensing

without getting fully associated with the operation of the company.

merged their operation a few years ago. However, the cross border merger failed due to an

insufficient gain of one of the partner and hence the merger fell apart.

Apart from that, another factor that needs to be there before the cross border merger and

acquisition is the due diligence. Alimov and Officer (2017) noted that generally domestic

companies overstate their performances and achievements in order to get a good and lucrative

merger and acquisition deal and then it fails to lead to a loss for the foreign company or the

bigger company. Thus, in the peace of cross border acquisition, the due diligence reports of

each of the company matter a lot. A lot of massive consultancy companies are there in the

market that assists the companies in understanding the operational history of the other firm.

These reports become the factor for the initiation of a cross border merger and acquisition

deal between the two companies. Another important factor for the peaceful operation of the

cross border merger and acquisition deal is the presence of political, economic and social

harmony in the two countries . Political unrests limit the scope of foreign investment in the

business as it reduces the rate of return for the investors. Therefore, the prospective growth of

the merger and acquisition deal gets limited and hence the deal falls apart. In addition to that,

the economic performance in the target country is also important for the cross border merger

and acquisition as it will provide the market base to both of the companies. Lastly, social

structure and some of its measure also help determine the pattern of cross border merger and

acquisition (Francis, Huang and Khurana, 2016). For example, in a target country full of

unskilled labour, production merger and acquisition will be more than service. Thus, the

scope of the different company is there in different countries of the world. For example, India

is a country full with service sector worker who is only slightly skilled. The country has seen

cross border merger and acquisitions among the domestic service company and its global

counterpart.

One of the most used ways to study the risk for undertaking a cross border merger and

acquisition strategy is to understand the risk matrix. According to Buckley et al. (2016), the

study of the risk matrix makes the deal more peaceful and harmonious. The evaluation of the

risk matrix is important to find out any vulnerability of the other company as well. Risk

matrix includes all the risk elements and their weights. The risk matrix finds out the risk

associated with the deal and the companies take a decision based on that matrix. The pattern

of merger and acquisition often depends on the intensity of the risk. In some of the cases, the

foreign counterpart often decides to invest in the domestic company through licensing

without getting fully associated with the operation of the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

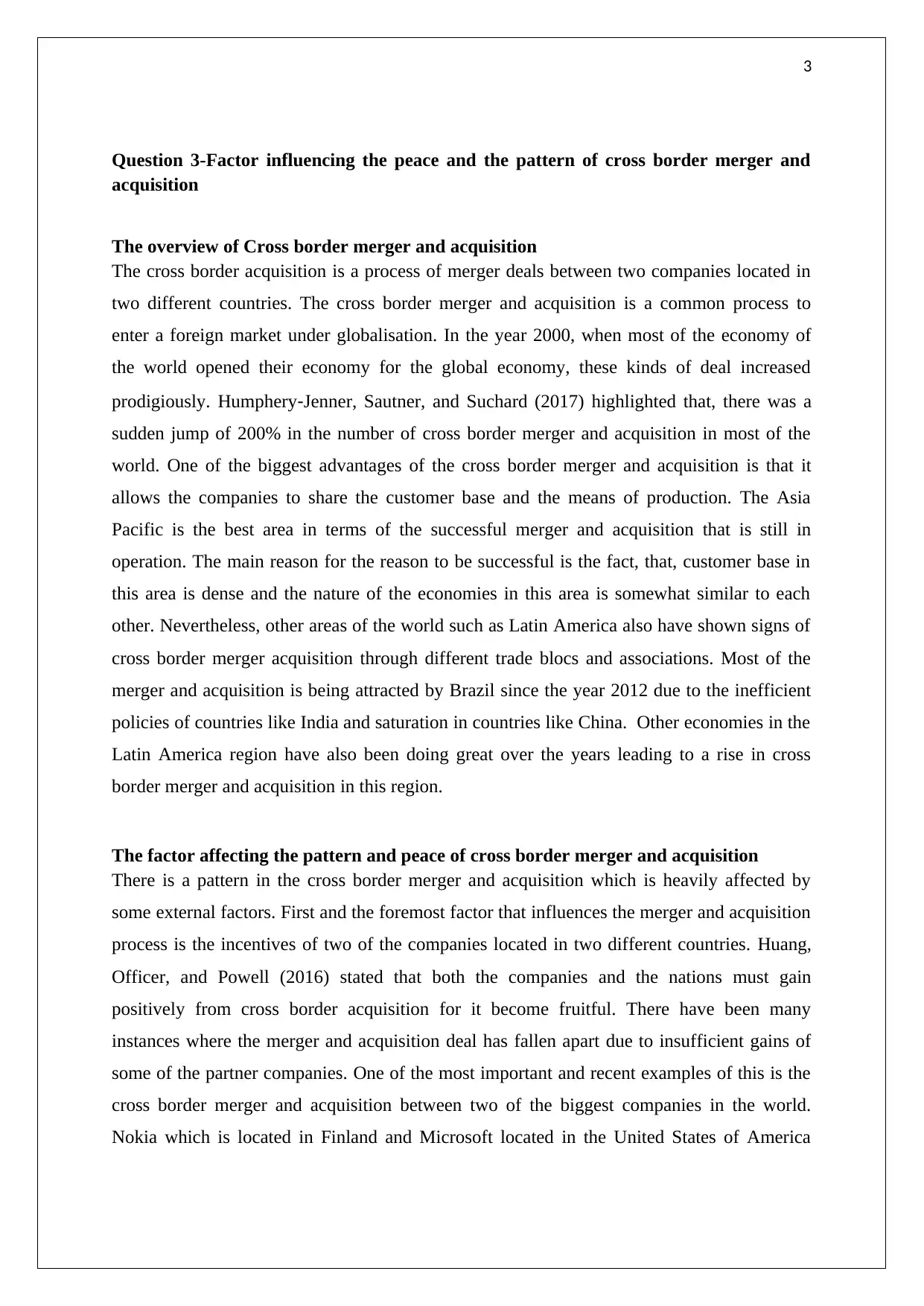

Figure 1: the value of cross border merger and acquisition over the year

(Source: Albuquerque et al. 2018)

The figure 1 shows that the cross border merger and acquisition started to increase after the

year 1990 when most of the economies of the world liberated their economy for the world.

Since the year 1992, there has been around 935% increase in the volume till the year 1997

(Ahammad et al. 2017). In that the time the volume of merger and acquisition peaked two

times, first in the year 2000 and the second in the year 2007. However, the reason for the fall

from the peak is different for the two different occasions. After the year 2000, the number

and hence the volume of cross border merger and acquisition reduced due to fluctuations in

the global business cycle. Apart from that, there was a recession of small magnitude in early

2000 which compelled most of the government of the world to turn inward. Therefore, a huge

number of cross border merger and acquisition had fallen apart.

The reason for the reduction in the volume after the year 2007 is the global financial crisis

that affected most of the economies of the world. The aggregate consumer spending of most

of the economies had hit the lowest point and hence the cross border deals fell apart. (Xie,

Reddy, and Liang (2017) highlighted that the government policies following the financial

crisis had also changed in many of the countries which became unfavourable for the mergers.

However, the volume and the number of cross border merger and acquisition started

increasing since the year 2009 when a bigger economy of the world started rebounding.

Figure 1: the value of cross border merger and acquisition over the year

(Source: Albuquerque et al. 2018)

The figure 1 shows that the cross border merger and acquisition started to increase after the

year 1990 when most of the economies of the world liberated their economy for the world.

Since the year 1992, there has been around 935% increase in the volume till the year 1997

(Ahammad et al. 2017). In that the time the volume of merger and acquisition peaked two

times, first in the year 2000 and the second in the year 2007. However, the reason for the fall

from the peak is different for the two different occasions. After the year 2000, the number

and hence the volume of cross border merger and acquisition reduced due to fluctuations in

the global business cycle. Apart from that, there was a recession of small magnitude in early

2000 which compelled most of the government of the world to turn inward. Therefore, a huge

number of cross border merger and acquisition had fallen apart.

The reason for the reduction in the volume after the year 2007 is the global financial crisis

that affected most of the economies of the world. The aggregate consumer spending of most

of the economies had hit the lowest point and hence the cross border deals fell apart. (Xie,

Reddy, and Liang (2017) highlighted that the government policies following the financial

crisis had also changed in many of the countries which became unfavourable for the mergers.

However, the volume and the number of cross border merger and acquisition started

increasing since the year 2009 when a bigger economy of the world started rebounding.

6

According to the current value, it is estimated that the volume of cross border merger and

acquisition would increase at a huge rate in the coming years (Lee, 2018). The main region

that can boost the cross border merger and acquisition is the Asia Pacific region as it is

growing at an impressive rate and the median income of the consumers are increase which

necessitates that chances of political unrest are low.

Question 4 -Economic development models of China and India

Comparison of Chinese and Indian economy

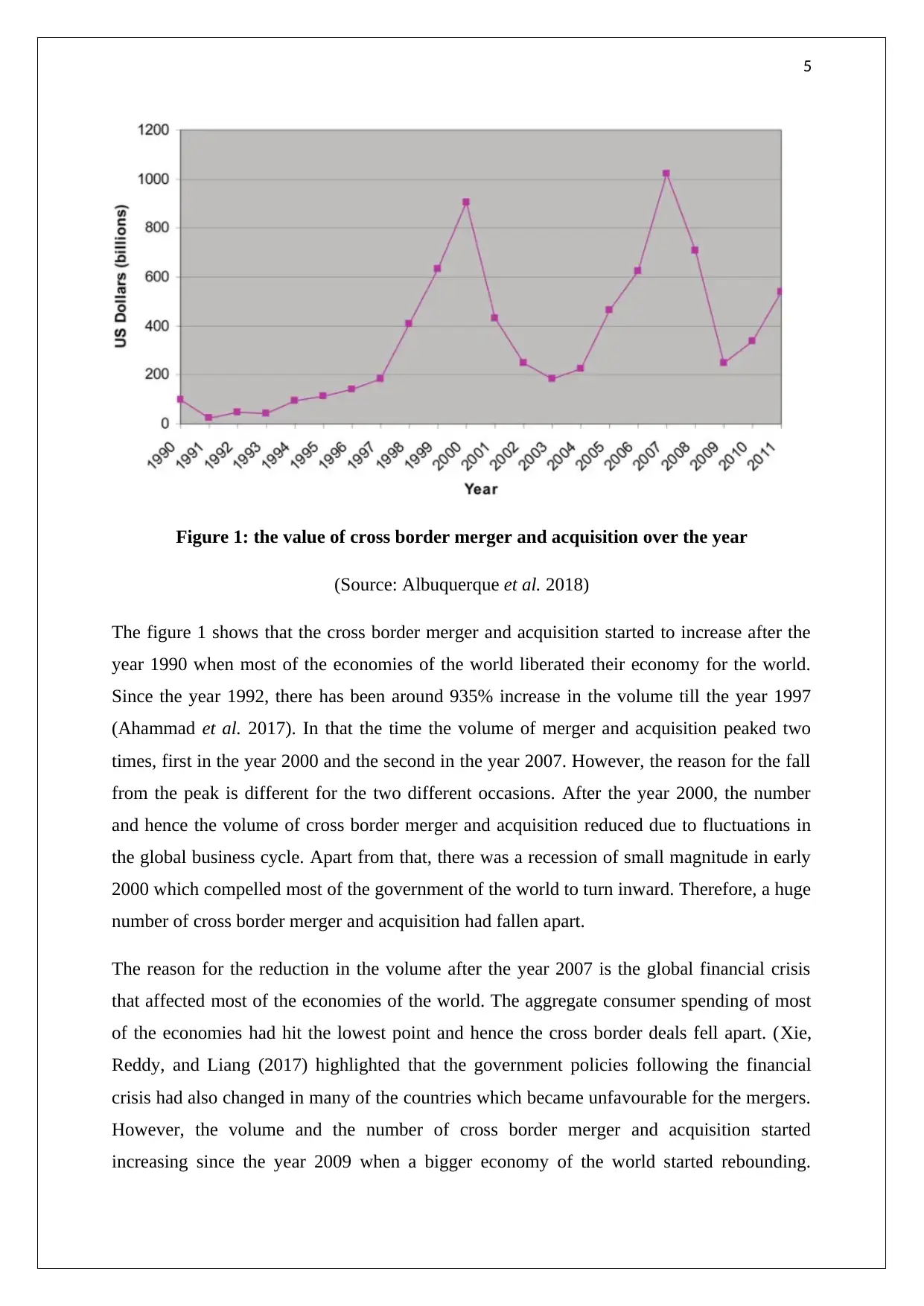

China and India are two of the most growing and developing nations of the world. One f the

common feature of both the country is that they both have a huge consumer base with high

median income. The median income in these two economies is growing at a huge rate. The

GDP per capita income is one of the most reliable measure of the per capita income which

suggests a study of which suggests that both these economies are growing at a sharp rate. The

per capita income of the consumer in China has increased by 71% compared to the data of the

year 2000. For India, the per capita income has grown about 41% since the year 2000. Both

countries attract a huge foreign investment owing to growing aggregate demand in the two

countries. Ahmad et al. (2016) noted that the means of production and skill set of the

employees are decent that makes these two economies attractive target market.

According to the current value, it is estimated that the volume of cross border merger and

acquisition would increase at a huge rate in the coming years (Lee, 2018). The main region

that can boost the cross border merger and acquisition is the Asia Pacific region as it is

growing at an impressive rate and the median income of the consumers are increase which

necessitates that chances of political unrest are low.

Question 4 -Economic development models of China and India

Comparison of Chinese and Indian economy

China and India are two of the most growing and developing nations of the world. One f the

common feature of both the country is that they both have a huge consumer base with high

median income. The median income in these two economies is growing at a huge rate. The

GDP per capita income is one of the most reliable measure of the per capita income which

suggests a study of which suggests that both these economies are growing at a sharp rate. The

per capita income of the consumer in China has increased by 71% compared to the data of the

year 2000. For India, the per capita income has grown about 41% since the year 2000. Both

countries attract a huge foreign investment owing to growing aggregate demand in the two

countries. Ahmad et al. (2016) noted that the means of production and skill set of the

employees are decent that makes these two economies attractive target market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Figure 2: The growth in the per capita income of China and India

(Source: Gay, 2016)

Differences between the economies

Despite the similarities, there are fundamental differences between the two economies and

the policies which have been implemented over the year. While India is the largest mixed

economic country in the world, the economy of China is hugely controlled by the national

government. Although China opened its economy to the world economy way before than

India did, India has coped up due to a higher degree of openness compared to China. In the

year 1978, the Chinese government realised the importance of the integration with the global

economy and adopted a neoliberal policy for the economy (Chow et al. 2017). Therefore,

after being in isolation for a long time, the economy started to engage in foreign trade with

many parts of the world. Compared to that, India adopted the neo-liberal policies later in the

year 1991. However, the main difference between the two economies is that China still had

huge control over the market as it is run by a communist government. On the other hand, the

Indian government significantly reduced the intervention of the government and increased

foreign investment cap in most of the sectors at one go.

Figure 2: The growth in the per capita income of China and India

(Source: Gay, 2016)

Differences between the economies

Despite the similarities, there are fundamental differences between the two economies and

the policies which have been implemented over the year. While India is the largest mixed

economic country in the world, the economy of China is hugely controlled by the national

government. Although China opened its economy to the world economy way before than

India did, India has coped up due to a higher degree of openness compared to China. In the

year 1978, the Chinese government realised the importance of the integration with the global

economy and adopted a neoliberal policy for the economy (Chow et al. 2017). Therefore,

after being in isolation for a long time, the economy started to engage in foreign trade with

many parts of the world. Compared to that, India adopted the neo-liberal policies later in the

year 1991. However, the main difference between the two economies is that China still had

huge control over the market as it is run by a communist government. On the other hand, the

Indian government significantly reduced the intervention of the government and increased

foreign investment cap in most of the sectors at one go.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

The Development channel and processes of development

The development channels for these two economies have also been different due to the nature

of the two economies. While India is an economy dependent mostly on the service sector, the

Chinese economy mainly depends on the manufacturing sector. Although, both the

economies had a huge share of contribution from the agricultural sector of the respective

economies, it had declined sharply after the adoption of the respective neoliberal policies.

The contribution of the manufacturing sector of the economy of China increased from 44.1%

in the year 2004 to 67% in the year 2014. In case of India, the share of service sector in the

GDP of the country increased from a 31% in the year 2001, to a 69% in the year 2015

(Becker et al. 2019). As a developmental programme government of these two economies

undertook different policies. For example, China mainly concentrated on the development of

the Special economic Zone throughout the country that helped in the establishment of a huge

number of manufacturing units in the country. Foreign investment in manufacturing further

reduced the cost of production using which Chine cruised to the first spot as a manufactured

good exporting country surpassing the USA (Breslin, 2016).

India, on the other hand, concentrated on business process exportation which is a service

export to many developed economies of the world. The neo-liberal policies of the Indian

government put a cap of 79% in the IT sector of the economy that allowed a number of

Foreign Service Company to invest and use the labour force of the Indian market. This

mainly helped the English speaking population of the economy and the higher middle classes

the most. The same has been seen in case of China as well, where the domestic investors of

higher income classes have managed to rip benefit from the development policies where

lower income manufacturing workers have hardly realised the gains. Ahmed et al. (2016)

noted that the distribution of the gains in both China and India has been unequal over the

years. Apart from that, the unorganised sector of both the economies has suffered post

introduction of the new developmental policies. The Gini coefficient measure of India shows

that 90% of the wealth of the nation is headed by only 4.6% of the population of the country.

Although China's Gini Coefficient reading is better than that of India, it has a major income

inequality among the working class population of the country.

Another common factor that can be seen in the development model of these economies is that

they both used the trade blocs around the world to flourish the trade with other countries of

the world. China is part of a number of important trade blocs such as ASEAN, ACFTA and

many more that allows the economy to use its customer base for the manufactured goods.

The Development channel and processes of development

The development channels for these two economies have also been different due to the nature

of the two economies. While India is an economy dependent mostly on the service sector, the

Chinese economy mainly depends on the manufacturing sector. Although, both the

economies had a huge share of contribution from the agricultural sector of the respective

economies, it had declined sharply after the adoption of the respective neoliberal policies.

The contribution of the manufacturing sector of the economy of China increased from 44.1%

in the year 2004 to 67% in the year 2014. In case of India, the share of service sector in the

GDP of the country increased from a 31% in the year 2001, to a 69% in the year 2015

(Becker et al. 2019). As a developmental programme government of these two economies

undertook different policies. For example, China mainly concentrated on the development of

the Special economic Zone throughout the country that helped in the establishment of a huge

number of manufacturing units in the country. Foreign investment in manufacturing further

reduced the cost of production using which Chine cruised to the first spot as a manufactured

good exporting country surpassing the USA (Breslin, 2016).

India, on the other hand, concentrated on business process exportation which is a service

export to many developed economies of the world. The neo-liberal policies of the Indian

government put a cap of 79% in the IT sector of the economy that allowed a number of

Foreign Service Company to invest and use the labour force of the Indian market. This

mainly helped the English speaking population of the economy and the higher middle classes

the most. The same has been seen in case of China as well, where the domestic investors of

higher income classes have managed to rip benefit from the development policies where

lower income manufacturing workers have hardly realised the gains. Ahmed et al. (2016)

noted that the distribution of the gains in both China and India has been unequal over the

years. Apart from that, the unorganised sector of both the economies has suffered post

introduction of the new developmental policies. The Gini coefficient measure of India shows

that 90% of the wealth of the nation is headed by only 4.6% of the population of the country.

Although China's Gini Coefficient reading is better than that of India, it has a major income

inequality among the working class population of the country.

Another common factor that can be seen in the development model of these economies is that

they both used the trade blocs around the world to flourish the trade with other countries of

the world. China is part of a number of important trade blocs such as ASEAN, ACFTA and

many more that allows the economy to use its customer base for the manufactured goods.

9

India is also part of a number of trade blocs that gives the economy access to a large number

of markets (Sharma, 2016). The international trade allowed China to increase its potential in

terms of economic growth. As per the estimates of the year 2003, China was supposed to

experience a reduction in the growth of the GDP after the year 2010 due to its rising age

dependency ration. The ratio of youth population to the retired population was rising which

could have impacted the aggregate demand within the economy. However, successful trading

with many other countries of the world allowed China to deal with the excess production and

inventory management. Now, as per the data of the year 2017, the economic growth of china

has been a thumping 6.9% which is more than most of the similar developing nations of the

world .

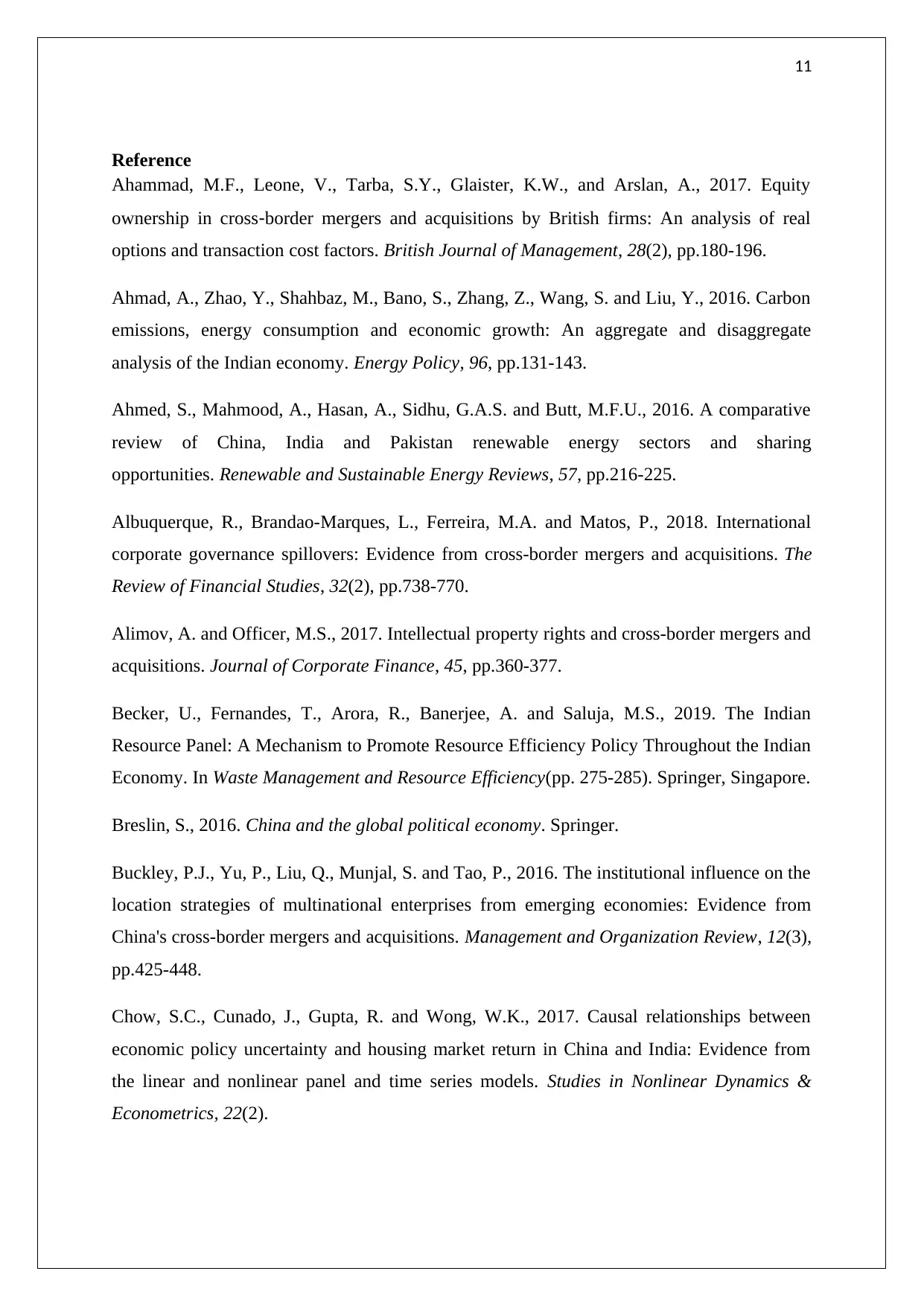

Figure 3: The age demographics of India as per 2016

(Source: Narayanan and Sharma, 2016)

In contrast to that, India has the advantage of a huge percentage of the young population in

the economy. Figure 2 points out that 73% of the population of the country is less than the

age of 55 (Zhang et al. 2017). This, on hand, means the government's spending on benefits

and pensions is hugely outnumbered by the national product that is being estimated.

India is also part of a number of trade blocs that gives the economy access to a large number

of markets (Sharma, 2016). The international trade allowed China to increase its potential in

terms of economic growth. As per the estimates of the year 2003, China was supposed to

experience a reduction in the growth of the GDP after the year 2010 due to its rising age

dependency ration. The ratio of youth population to the retired population was rising which

could have impacted the aggregate demand within the economy. However, successful trading

with many other countries of the world allowed China to deal with the excess production and

inventory management. Now, as per the data of the year 2017, the economic growth of china

has been a thumping 6.9% which is more than most of the similar developing nations of the

world .

Figure 3: The age demographics of India as per 2016

(Source: Narayanan and Sharma, 2016)

In contrast to that, India has the advantage of a huge percentage of the young population in

the economy. Figure 2 points out that 73% of the population of the country is less than the

age of 55 (Zhang et al. 2017). This, on hand, means the government's spending on benefits

and pensions is hugely outnumbered by the national product that is being estimated.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

However, the real concern for India is the contribution of different sectors in the national

economy. While this young pool of a population is expected to benefit the service and

manufacturing sector the economy, the agricultural sector of the economy is expected to

suffer.

Therefore, since the year 1975, the economies of China and India have changed a lot in terms

of structure and the capabilities. It is important to mention that the neo-liberal policies

adopted by these two governments at two different times have benefited the economy at the

aggregate level. However, distributions of the gains have been a major problem over the

years which need to be fixed in order to expand the potential of the economies.

However, the real concern for India is the contribution of different sectors in the national

economy. While this young pool of a population is expected to benefit the service and

manufacturing sector the economy, the agricultural sector of the economy is expected to

suffer.

Therefore, since the year 1975, the economies of China and India have changed a lot in terms

of structure and the capabilities. It is important to mention that the neo-liberal policies

adopted by these two governments at two different times have benefited the economy at the

aggregate level. However, distributions of the gains have been a major problem over the

years which need to be fixed in order to expand the potential of the economies.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

Reference

Ahammad, M.F., Leone, V., Tarba, S.Y., Glaister, K.W., and Arslan, A., 2017. Equity

ownership in cross‐border mergers and acquisitions by British firms: An analysis of real

options and transaction cost factors. British Journal of Management, 28(2), pp.180-196.

Ahmad, A., Zhao, Y., Shahbaz, M., Bano, S., Zhang, Z., Wang, S. and Liu, Y., 2016. Carbon

emissions, energy consumption and economic growth: An aggregate and disaggregate

analysis of the Indian economy. Energy Policy, 96, pp.131-143.

Ahmed, S., Mahmood, A., Hasan, A., Sidhu, G.A.S. and Butt, M.F.U., 2016. A comparative

review of China, India and Pakistan renewable energy sectors and sharing

opportunities. Renewable and Sustainable Energy Reviews, 57, pp.216-225.

Albuquerque, R., Brandao-Marques, L., Ferreira, M.A. and Matos, P., 2018. International

corporate governance spillovers: Evidence from cross-border mergers and acquisitions. The

Review of Financial Studies, 32(2), pp.738-770.

Alimov, A. and Officer, M.S., 2017. Intellectual property rights and cross-border mergers and

acquisitions. Journal of Corporate Finance, 45, pp.360-377.

Becker, U., Fernandes, T., Arora, R., Banerjee, A. and Saluja, M.S., 2019. The Indian

Resource Panel: A Mechanism to Promote Resource Efficiency Policy Throughout the Indian

Economy. In Waste Management and Resource Efficiency(pp. 275-285). Springer, Singapore.

Breslin, S., 2016. China and the global political economy. Springer.

Buckley, P.J., Yu, P., Liu, Q., Munjal, S. and Tao, P., 2016. The institutional influence on the

location strategies of multinational enterprises from emerging economies: Evidence from

China's cross-border mergers and acquisitions. Management and Organization Review, 12(3),

pp.425-448.

Chow, S.C., Cunado, J., Gupta, R. and Wong, W.K., 2017. Causal relationships between

economic policy uncertainty and housing market return in China and India: Evidence from

the linear and nonlinear panel and time series models. Studies in Nonlinear Dynamics &

Econometrics, 22(2).

Reference

Ahammad, M.F., Leone, V., Tarba, S.Y., Glaister, K.W., and Arslan, A., 2017. Equity

ownership in cross‐border mergers and acquisitions by British firms: An analysis of real

options and transaction cost factors. British Journal of Management, 28(2), pp.180-196.

Ahmad, A., Zhao, Y., Shahbaz, M., Bano, S., Zhang, Z., Wang, S. and Liu, Y., 2016. Carbon

emissions, energy consumption and economic growth: An aggregate and disaggregate

analysis of the Indian economy. Energy Policy, 96, pp.131-143.

Ahmed, S., Mahmood, A., Hasan, A., Sidhu, G.A.S. and Butt, M.F.U., 2016. A comparative

review of China, India and Pakistan renewable energy sectors and sharing

opportunities. Renewable and Sustainable Energy Reviews, 57, pp.216-225.

Albuquerque, R., Brandao-Marques, L., Ferreira, M.A. and Matos, P., 2018. International

corporate governance spillovers: Evidence from cross-border mergers and acquisitions. The

Review of Financial Studies, 32(2), pp.738-770.

Alimov, A. and Officer, M.S., 2017. Intellectual property rights and cross-border mergers and

acquisitions. Journal of Corporate Finance, 45, pp.360-377.

Becker, U., Fernandes, T., Arora, R., Banerjee, A. and Saluja, M.S., 2019. The Indian

Resource Panel: A Mechanism to Promote Resource Efficiency Policy Throughout the Indian

Economy. In Waste Management and Resource Efficiency(pp. 275-285). Springer, Singapore.

Breslin, S., 2016. China and the global political economy. Springer.

Buckley, P.J., Yu, P., Liu, Q., Munjal, S. and Tao, P., 2016. The institutional influence on the

location strategies of multinational enterprises from emerging economies: Evidence from

China's cross-border mergers and acquisitions. Management and Organization Review, 12(3),

pp.425-448.

Chow, S.C., Cunado, J., Gupta, R. and Wong, W.K., 2017. Causal relationships between

economic policy uncertainty and housing market return in China and India: Evidence from

the linear and nonlinear panel and time series models. Studies in Nonlinear Dynamics &

Econometrics, 22(2).

12

Francis, J.R., Huang, S.X. and Khurana, I.K., 2016. The role of similar accounting standards

in cross‐border mergers and acquisitions. Contemporary Accounting Research, 33(3),

pp.1298-1330.

Gay, R.D., 2016. Effect of macroeconomic variables on stock market returns for four

emerging economies: Brazil, Russia, India, and China. The International Business &

Economics Research Journal (Online), 15(3), p.119.

Huang, P., Officer, M.S. and Powell, R., 2016. Method of payment and risk mitigation in

cross-border mergers and acquisitions. Journal of Corporate Finance, 40, pp.216-234.

Humphery‐Jenner, M., Sautner, Z. and Suchard, J.A., 2017. Cross‐border mergers and

acquisitions: The role of private equity firms. Strategic Management Journal, 38(8), pp.1688-

1700.

Lee, K.H., 2018. Cross‐border mergers and acquisitions amid political uncertainty: A

bargaining perspective. Strategic Management Journal, 39(11), pp.2992-3005.

Narayanan, B. and Sharma, S.K., 2016. An analysis of tariff reductions in the Trans-Pacific

Partnership (TPP): implications for the Indian economy. Margin: The Journal of Applied

Economic Research, 10(1), pp.1-34.

Sharma, D., 2016. The nexus between financial inclusion and economic growth: Evidence

from the emerging Indian economy. Journal of financial economic policy, 8(1), pp.13-36.

Xie, E., Reddy, K.S. and Liang, J., 2017. Country-specific determinants of cross-border

mergers and acquisitions: A comprehensive review and future research directions. Journal of

World Business, 52(2), pp.127-183.

Zhang, G., Xiao, X., Biradar, C.M., Dong, J., Qin, Y., Menarguez, M.A., Zhou, Y., Zhang,

Y., Jin, C., Wang, J. and Doughty, R.B., 2017. Spatiotemporal patterns of paddy rice

croplands in China and India from 2000 to 2015. Science of the Total Environment, 579,

pp.82-92.

Francis, J.R., Huang, S.X. and Khurana, I.K., 2016. The role of similar accounting standards

in cross‐border mergers and acquisitions. Contemporary Accounting Research, 33(3),

pp.1298-1330.

Gay, R.D., 2016. Effect of macroeconomic variables on stock market returns for four

emerging economies: Brazil, Russia, India, and China. The International Business &

Economics Research Journal (Online), 15(3), p.119.

Huang, P., Officer, M.S. and Powell, R., 2016. Method of payment and risk mitigation in

cross-border mergers and acquisitions. Journal of Corporate Finance, 40, pp.216-234.

Humphery‐Jenner, M., Sautner, Z. and Suchard, J.A., 2017. Cross‐border mergers and

acquisitions: The role of private equity firms. Strategic Management Journal, 38(8), pp.1688-

1700.

Lee, K.H., 2018. Cross‐border mergers and acquisitions amid political uncertainty: A

bargaining perspective. Strategic Management Journal, 39(11), pp.2992-3005.

Narayanan, B. and Sharma, S.K., 2016. An analysis of tariff reductions in the Trans-Pacific

Partnership (TPP): implications for the Indian economy. Margin: The Journal of Applied

Economic Research, 10(1), pp.1-34.

Sharma, D., 2016. The nexus between financial inclusion and economic growth: Evidence

from the emerging Indian economy. Journal of financial economic policy, 8(1), pp.13-36.

Xie, E., Reddy, K.S. and Liang, J., 2017. Country-specific determinants of cross-border

mergers and acquisitions: A comprehensive review and future research directions. Journal of

World Business, 52(2), pp.127-183.

Zhang, G., Xiao, X., Biradar, C.M., Dong, J., Qin, Y., Menarguez, M.A., Zhou, Y., Zhang,

Y., Jin, C., Wang, J. and Doughty, R.B., 2017. Spatiotemporal patterns of paddy rice

croplands in China and India from 2000 to 2015. Science of the Total Environment, 579,

pp.82-92.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.