Strategic and Global Finance (AF701) Report: Cafe de Coral Analysis

VerifiedAdded on 2023/06/05

|18

|6093

|365

Report

AI Summary

This report provides a comprehensive analysis of strategic and global finance, covering key concepts such as globalisation and its relationship with investment. It delves into factors affecting businesses, particularly focusing on Cafe de Coral as a case study. The report computes the current value statement of the company and proposes strategies to enhance its organizational value. It further examines strategic decisions made by Cafe de Coral and their financial impacts, explores various financial sources and associated risks, analyzes global risks and mitigation techniques, and discusses different investment strategies within a global context. The report offers insights into financial performance, risk management, and strategic planning in an international business environment.

STRATEGIC

AND

AND

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

GLOBAL FINANCE

Contents

INTRODUCTION...........................................................................................................................2

1. Describing the meaning of globalisation and advantages of investment...........................2

2.Determining the factors affecting the enterprise.................................................................4

3.Computing current value statement of cafe de coral and strategies to gain organisational

value.......................................................................................................................................6

4.Describing strategic decisions taken by cafe de coral and financial impact of strategic

decisions.................................................................................................................................7

5.Elaborating different financial sources available and analysing the risk associated with each

source with its cost involved in handling risk........................................................................8

6. Discuss global risks, mitigation techniques and its different kinds associated the chosen

company...............................................................................................................................10

7. Explain about the different investment strategies and decisions adopted in the global

environment..........................................................................................................................12

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

1

INTRODUCTION...........................................................................................................................2

1. Describing the meaning of globalisation and advantages of investment...........................2

2.Determining the factors affecting the enterprise.................................................................4

3.Computing current value statement of cafe de coral and strategies to gain organisational

value.......................................................................................................................................6

4.Describing strategic decisions taken by cafe de coral and financial impact of strategic

decisions.................................................................................................................................7

5.Elaborating different financial sources available and analysing the risk associated with each

source with its cost involved in handling risk........................................................................8

6. Discuss global risks, mitigation techniques and its different kinds associated the chosen

company...............................................................................................................................10

7. Explain about the different investment strategies and decisions adopted in the global

environment..........................................................................................................................12

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Globalisation refers to the process of interlinking the world by varied cultures,

economies and populations. Investment process is the ploughing funds in different companies to

gain holding in shares of a specific enterprise. This report contains the concept of globalisation

and relationship between process of investment and globalisation in task one. Explaining various

business environment factors on global basis and impact of factors on national and multinational

organisations in task two. Cafe de coral is established in the year 1968 which deals in fast food

chains and restaurants, headquartered in Shatin, Hong Kong. It's current value statement and

process of achieving the value and its strategies which helps to improve value of this company.

Recommendation of strategy Cafe de coral can adopt to improve its organisational value is

discussed in task three of this report. Strategic decisions are those which are related with

complete framework in which an organisation operates (Bandelj, Sowers, and Morgan, 2019).

Task four consists of strategic decision of Cafe de coral and its financial performance on the

basis of those decisions. In task fifth there is an explanation of distinct sources of finance and

risk of each financial source with all the costs of managing risks. Global risk of restaurant and

several mitigation techniques to overcome risk is discussed in task six. Task seven contains

different strategies of investment and decision taken to influence decisions have upon the global

environment.

MAIN BODY

1. Describing the meaning of globalisation and advantages of investment

Globalisation is the dispersion of goods, innovations, ideas, information and jobs across

globe. It is the process of integrating various economies of the world by enhancing free trade on

global basis. This creates an open environment for foreign investments into various sectors of an

economy. It provides several benefits to the home and host country which are as follows.

Transfer of technology or innovations helps to meet the dynamic requirements of

consumers (Chen, and Sivakumar, 2021).

According to the availability movement of labour intensive and capital intensive

technology is transferred from one country to another.

Transportation facilities are improving with the introduction of free flow of goods and

services.

2

Globalisation refers to the process of interlinking the world by varied cultures,

economies and populations. Investment process is the ploughing funds in different companies to

gain holding in shares of a specific enterprise. This report contains the concept of globalisation

and relationship between process of investment and globalisation in task one. Explaining various

business environment factors on global basis and impact of factors on national and multinational

organisations in task two. Cafe de coral is established in the year 1968 which deals in fast food

chains and restaurants, headquartered in Shatin, Hong Kong. It's current value statement and

process of achieving the value and its strategies which helps to improve value of this company.

Recommendation of strategy Cafe de coral can adopt to improve its organisational value is

discussed in task three of this report. Strategic decisions are those which are related with

complete framework in which an organisation operates (Bandelj, Sowers, and Morgan, 2019).

Task four consists of strategic decision of Cafe de coral and its financial performance on the

basis of those decisions. In task fifth there is an explanation of distinct sources of finance and

risk of each financial source with all the costs of managing risks. Global risk of restaurant and

several mitigation techniques to overcome risk is discussed in task six. Task seven contains

different strategies of investment and decision taken to influence decisions have upon the global

environment.

MAIN BODY

1. Describing the meaning of globalisation and advantages of investment

Globalisation is the dispersion of goods, innovations, ideas, information and jobs across

globe. It is the process of integrating various economies of the world by enhancing free trade on

global basis. This creates an open environment for foreign investments into various sectors of an

economy. It provides several benefits to the home and host country which are as follows.

Transfer of technology or innovations helps to meet the dynamic requirements of

consumers (Chen, and Sivakumar, 2021).

According to the availability movement of labour intensive and capital intensive

technology is transferred from one country to another.

Transportation facilities are improving with the introduction of free flow of goods and

services.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Relationship between globalisation and investment process-

An investment is the process of purchasing asset or any other commodity with the motive of

creating income. There can be seen an interrelated relationship between globalisation and

investment which can be described as given below-

Analysing different Markets-There are different market structure on the basis of degree

and nature of products and their elasticities. Globalisation is a tool to know about the

trends in the separate markets which aids in knowing the proportion of investment should

be invested to gain profits of the specific portfolio.

Globalisation boosts international investing- Mutual interest and challenges link one

economic system to another. Globalisation provokes connected economies to invest in

each other for protection of financial health and gain new profits (Cheng, and et.al.,

2022). Companies take advantage of different pricing strategies and arbitrage process for

working class and other necessary supplies.

Potential risk and opportunities- Globalisation helps to identify the threats of existing

and upcoming rivalries in the existing market. Risk imposes a negative impact on the

portfolio of the investor and opportunities implies positive influence on the project. For

the purpose of investing in long term assets it is mandatory to keep watch on every

production as well as service sector.

Advantages of investment-

Investment can be done in various forms such as foreign direct investment and foreign

portfolio investment. There are several pros of investment process which can be elaborated as

given below-

Increased employment- Every economy is struggling with the problem of

unemployment, to solve this issue FDI benefits the recipient nation by improving the

production and services in the nation and income of the people get hike which eventually

rises the purchasing power of economy.

Increase in exports- All the products manufactured in home country is not necessarily

meant for domestic consumption (Cho, and Chen, 2021). Investment process aids in

exchanging products which increases the flow of trade and with the help of special

economic zones and export oriented units’ trade becomes easier and flexible.

3

An investment is the process of purchasing asset or any other commodity with the motive of

creating income. There can be seen an interrelated relationship between globalisation and

investment which can be described as given below-

Analysing different Markets-There are different market structure on the basis of degree

and nature of products and their elasticities. Globalisation is a tool to know about the

trends in the separate markets which aids in knowing the proportion of investment should

be invested to gain profits of the specific portfolio.

Globalisation boosts international investing- Mutual interest and challenges link one

economic system to another. Globalisation provokes connected economies to invest in

each other for protection of financial health and gain new profits (Cheng, and et.al.,

2022). Companies take advantage of different pricing strategies and arbitrage process for

working class and other necessary supplies.

Potential risk and opportunities- Globalisation helps to identify the threats of existing

and upcoming rivalries in the existing market. Risk imposes a negative impact on the

portfolio of the investor and opportunities implies positive influence on the project. For

the purpose of investing in long term assets it is mandatory to keep watch on every

production as well as service sector.

Advantages of investment-

Investment can be done in various forms such as foreign direct investment and foreign

portfolio investment. There are several pros of investment process which can be elaborated as

given below-

Increased employment- Every economy is struggling with the problem of

unemployment, to solve this issue FDI benefits the recipient nation by improving the

production and services in the nation and income of the people get hike which eventually

rises the purchasing power of economy.

Increase in exports- All the products manufactured in home country is not necessarily

meant for domestic consumption (Cho, and Chen, 2021). Investment process aids in

exchanging products which increases the flow of trade and with the help of special

economic zones and export oriented units’ trade becomes easier and flexible.

3

Meeting financial goals- Every organisation is developed with a purpose of achieving

organisational goals. Cafe de coral is designed with a purpose of delivering high quality

good to its customers. By following all the missions, it can create positive impacts on the

mind of the people and result in increased market share.

2.Determining the factors affecting the enterprise

The environment relating to business changes rapidly, therefore careful and systematic

planning is required before implementation of the business process. It is the responsibility of the

internal management of the business concern that before execution of any plan they must be

properly examined the top level management of the enterprise. (Coelho, Kamath, and

Vijayabaskar, 2020). It is important of the organisation to keep their eye open with respect to all

the external factor that could directly or indirectly affects the operation of the organisation.

Further the manager must ensure that there should be the fruitful strategies to deal with such

factors. In this statement we are considering that what the external factors are, how important

they are for the enterprise, and how they are affecting the operating effectiveness and efficiency

of the corporations.

Technological factors: These factors affect the organisation in both ways. They earn

excess profit by following the technology or sometimes they lack in them which creates hurdles

for them in order to compete with the competitor. An enterprise creates GPS systems for

commercial as well as household vehicles that is a technological advantage for such enterprise

and for remaining are disadvantage. The organizations established or situated in their native

countries, will comparatively be less impacted by the effects of technological factors, then the

international organizations. As a matter of fact, the national Organizations are subjected to mild

deviations in the environment as opposed to multinational companies, who must keep track of all

the deviations in the technology applicable in each region it operates in.

Economic factors: These factor affect the operation of the enterprise directly. E.g. of

such factors are Taxation rate, Interest rate, Rate of inflation in the country and so on. It is

important for the business concern to mould their strategies according to the government policy

in order to sustain in such competitive edge. Industries may have to work very hard to fulfil the

needs and requirement of employees and the management such as their salary hikes, timely

promotion, regular payment of bonus. (Dinçer, Yüksel, and Pınarbaşı, 2019). If the business

concern makes products considering the profit margin, then they have to reduce price of the

4

organisational goals. Cafe de coral is designed with a purpose of delivering high quality

good to its customers. By following all the missions, it can create positive impacts on the

mind of the people and result in increased market share.

2.Determining the factors affecting the enterprise

The environment relating to business changes rapidly, therefore careful and systematic

planning is required before implementation of the business process. It is the responsibility of the

internal management of the business concern that before execution of any plan they must be

properly examined the top level management of the enterprise. (Coelho, Kamath, and

Vijayabaskar, 2020). It is important of the organisation to keep their eye open with respect to all

the external factor that could directly or indirectly affects the operation of the organisation.

Further the manager must ensure that there should be the fruitful strategies to deal with such

factors. In this statement we are considering that what the external factors are, how important

they are for the enterprise, and how they are affecting the operating effectiveness and efficiency

of the corporations.

Technological factors: These factors affect the organisation in both ways. They earn

excess profit by following the technology or sometimes they lack in them which creates hurdles

for them in order to compete with the competitor. An enterprise creates GPS systems for

commercial as well as household vehicles that is a technological advantage for such enterprise

and for remaining are disadvantage. The organizations established or situated in their native

countries, will comparatively be less impacted by the effects of technological factors, then the

international organizations. As a matter of fact, the national Organizations are subjected to mild

deviations in the environment as opposed to multinational companies, who must keep track of all

the deviations in the technology applicable in each region it operates in.

Economic factors: These factor affect the operation of the enterprise directly. E.g. of

such factors are Taxation rate, Interest rate, Rate of inflation in the country and so on. It is

important for the business concern to mould their strategies according to the government policy

in order to sustain in such competitive edge. Industries may have to work very hard to fulfil the

needs and requirement of employees and the management such as their salary hikes, timely

promotion, regular payment of bonus. (Dinçer, Yüksel, and Pınarbaşı, 2019). If the business

concern makes products considering the profit margin, then they have to reduce price of the

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

product so that sales volume can be increased accordingly. For instance, the great depression

affected the national as well as multinational entities even though the same was originated in the

United States. This is often considered as an unfavourable situation for the global industries, due

to the fact that individuals concentrated on saving their earnings instead of spending them

towards the market, whether national or international. And as a result, organisations are cost

cutting the price of the product and reducing their overall production to recover their fixed cost.

Political and legal factors: Rules and regulations are framed and implemented by the

political parties. There needs to be proper knowledge of how the new rules and regulations can

affect the business operations of a business. Every country has its own rules and regulations to

follow, which are specifically drafted by the legislation. Where, many a times the personal

disposable income is indirectly proposed by the government and as a result often leads to lower

than usual income earned by the individuals. If the income is not considered sufficient then the

home or global market will fail to sell significant amount of commodities to the consumers, or

establish themselves in the industry.

Social factors: What is the taste of the consumer directly influenced by the place where

they are residing, their personal requirement, and their financial standing. For national

organizations, it is necessary to follow the trends and behaviour adopted by their targeted

audience, towards the market place. Furthermore, the international entities are required to follow

similar methods, however due to the geographical area being vast, the audience preferences may

differ significantly. (Dixon, 2019).

Competitive factors: It is important to regular monitor the competition and the

competitors so that entity may increase their position in market. The national and multinational

companies will be faced with cut throat competition in the market and henceforth are required to

assess their achievement and drawback so that they learn what to include in their operation so

that loss of income cab be avoided.

Global factors: The top level executives have a responsibility to stay on upper side of

local and foreign branches so that organisation can spread their business worldwide. The local

companies are often affected by the multinational organizations who may step foot in any

country to expand their area of business and henceforth may threaten their existence. However,

the national companies may also pose as a barrier for the international firms due to the fact that

the companies know how the local market is like and what factors to administrate.

5

affected the national as well as multinational entities even though the same was originated in the

United States. This is often considered as an unfavourable situation for the global industries, due

to the fact that individuals concentrated on saving their earnings instead of spending them

towards the market, whether national or international. And as a result, organisations are cost

cutting the price of the product and reducing their overall production to recover their fixed cost.

Political and legal factors: Rules and regulations are framed and implemented by the

political parties. There needs to be proper knowledge of how the new rules and regulations can

affect the business operations of a business. Every country has its own rules and regulations to

follow, which are specifically drafted by the legislation. Where, many a times the personal

disposable income is indirectly proposed by the government and as a result often leads to lower

than usual income earned by the individuals. If the income is not considered sufficient then the

home or global market will fail to sell significant amount of commodities to the consumers, or

establish themselves in the industry.

Social factors: What is the taste of the consumer directly influenced by the place where

they are residing, their personal requirement, and their financial standing. For national

organizations, it is necessary to follow the trends and behaviour adopted by their targeted

audience, towards the market place. Furthermore, the international entities are required to follow

similar methods, however due to the geographical area being vast, the audience preferences may

differ significantly. (Dixon, 2019).

Competitive factors: It is important to regular monitor the competition and the

competitors so that entity may increase their position in market. The national and multinational

companies will be faced with cut throat competition in the market and henceforth are required to

assess their achievement and drawback so that they learn what to include in their operation so

that loss of income cab be avoided.

Global factors: The top level executives have a responsibility to stay on upper side of

local and foreign branches so that organisation can spread their business worldwide. The local

companies are often affected by the multinational organizations who may step foot in any

country to expand their area of business and henceforth may threaten their existence. However,

the national companies may also pose as a barrier for the international firms due to the fact that

the companies know how the local market is like and what factors to administrate.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

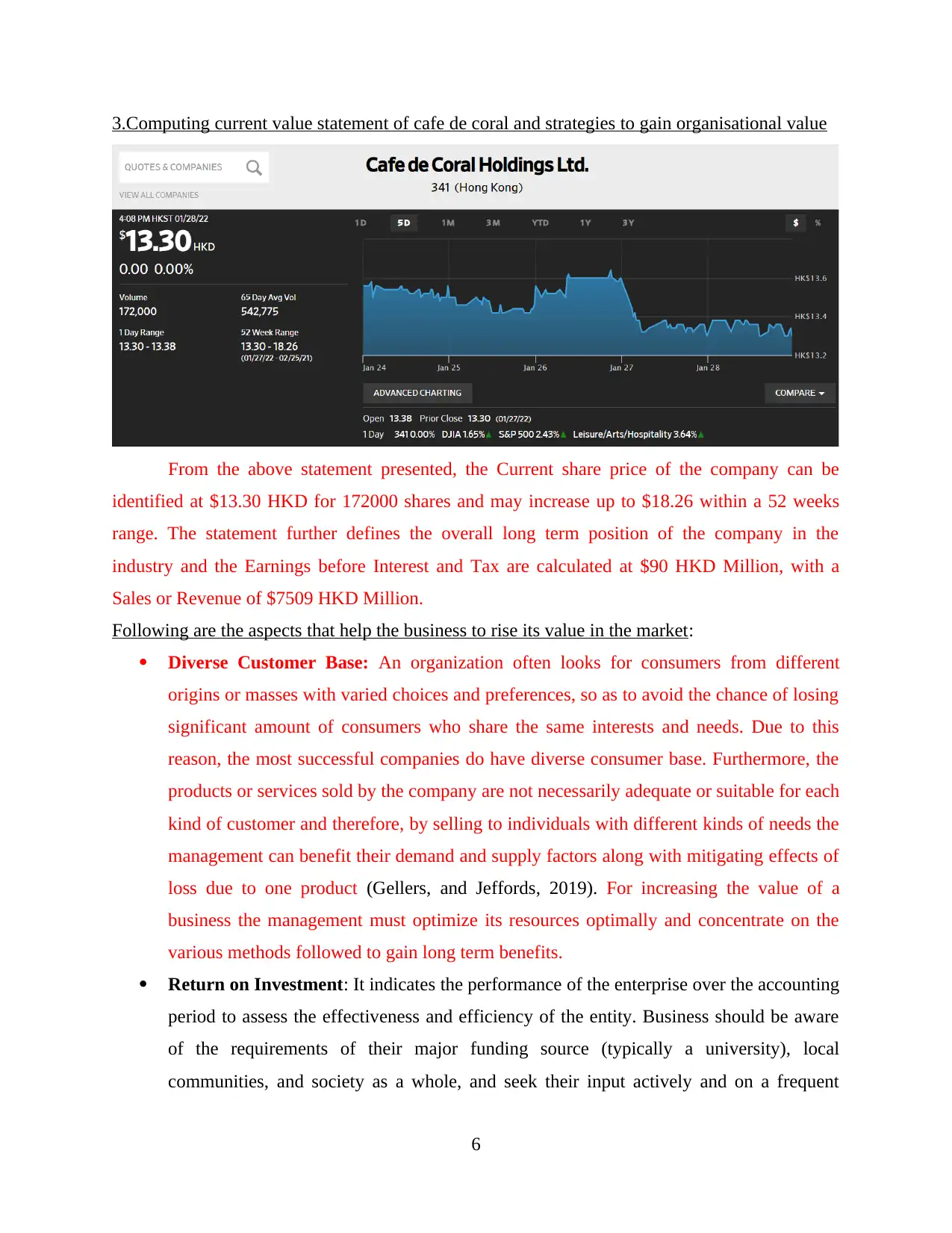

3.Computing current value statement of cafe de coral and strategies to gain organisational value

From the above statement presented, the Current share price of the company can be

identified at $13.30 HKD for 172000 shares and may increase up to $18.26 within a 52 weeks

range. The statement further defines the overall long term position of the company in the

industry and the Earnings before Interest and Tax are calculated at $90 HKD Million, with a

Sales or Revenue of $7509 HKD Million.

Following are the aspects that help the business to rise its value in the market:

Diverse Customer Base: An organization often looks for consumers from different

origins or masses with varied choices and preferences, so as to avoid the chance of losing

significant amount of consumers who share the same interests and needs. Due to this

reason, the most successful companies do have diverse consumer base. Furthermore, the

products or services sold by the company are not necessarily adequate or suitable for each

kind of customer and therefore, by selling to individuals with different kinds of needs the

management can benefit their demand and supply factors along with mitigating effects of

loss due to one product (Gellers, and Jeffords, 2019). For increasing the value of a

business the management must optimize its resources optimally and concentrate on the

various methods followed to gain long term benefits.

Return on Investment: It indicates the performance of the enterprise over the accounting

period to assess the effectiveness and efficiency of the entity. Business should be aware

of the requirements of their major funding source (typically a university), local

communities, and society as a whole, and seek their input actively and on a frequent

6

From the above statement presented, the Current share price of the company can be

identified at $13.30 HKD for 172000 shares and may increase up to $18.26 within a 52 weeks

range. The statement further defines the overall long term position of the company in the

industry and the Earnings before Interest and Tax are calculated at $90 HKD Million, with a

Sales or Revenue of $7509 HKD Million.

Following are the aspects that help the business to rise its value in the market:

Diverse Customer Base: An organization often looks for consumers from different

origins or masses with varied choices and preferences, so as to avoid the chance of losing

significant amount of consumers who share the same interests and needs. Due to this

reason, the most successful companies do have diverse consumer base. Furthermore, the

products or services sold by the company are not necessarily adequate or suitable for each

kind of customer and therefore, by selling to individuals with different kinds of needs the

management can benefit their demand and supply factors along with mitigating effects of

loss due to one product (Gellers, and Jeffords, 2019). For increasing the value of a

business the management must optimize its resources optimally and concentrate on the

various methods followed to gain long term benefits.

Return on Investment: It indicates the performance of the enterprise over the accounting

period to assess the effectiveness and efficiency of the entity. Business should be aware

of the requirements of their major funding source (typically a university), local

communities, and society as a whole, and seek their input actively and on a frequent

6

basis. Business can build stronger and more successful research, teaching, and public-

outreach programmes and fundraising initiatives by knowing and addressing community

and societal needs (Kitamura, 2021). Business can monitor and describe the benefits on

investment to current and prospective donors using appropriate programme indicators.

Importance of a Diversified Funding Portfolio: The establishment of varied portfolios

of financing sources that are more robust in difficult economic times will be one of the

most important aspects in guaranteeing the stability and sustainability of Business. An

institution's sensitivity to variations in any one source of financing is reduced by

diversifying its funding sources. Many Businesses, especially those linked with colleges,

are overly reliant on a single funding source (Kong, and et.al.,2021). As previously

stated, it is critical for parent institutions to offer a steady core of base support for their

Business, but they should also anticipate this support to be leveraged. Most Business

have several options for diversifying and supplementing their financing sources.

4.Describing strategic decisions taken by cafe de coral and financial impact of strategic decisions

Strategic choices affect the environment of the business completely, along with resources

and the person connected with them.

Salient Features of Strategic Decisions:

For a corporation, strategic decisions have significant implication on the entity’s

resources. These decisions can be related to acquisition of new assets of the entity, modifying the

existing asset or relocating the same with existing assets. (Glushakova, and Vaysberg, 2020).

The objective of strategic decisions is to maintained the balance between organisational

resources and their workforce capability to perform an activity.

Strategic decisions are like the fuel for the organisation operation so that they go in the

right direction (Kouvelis, Dong, and Turcic, 2019).

Since the business in working in the changing environment therefore regular updation is

required in the strategic decisions from time to time.

Strategic judgements are difficult because they depend upon person to persons.

Strategic choices are designed by the management team however sometimes it is not

clear as they are connected to future which is uncertain.

The decision taken by the operation team will not match with the strategic team decisions

as they both have different perspective and targets.

7

outreach programmes and fundraising initiatives by knowing and addressing community

and societal needs (Kitamura, 2021). Business can monitor and describe the benefits on

investment to current and prospective donors using appropriate programme indicators.

Importance of a Diversified Funding Portfolio: The establishment of varied portfolios

of financing sources that are more robust in difficult economic times will be one of the

most important aspects in guaranteeing the stability and sustainability of Business. An

institution's sensitivity to variations in any one source of financing is reduced by

diversifying its funding sources. Many Businesses, especially those linked with colleges,

are overly reliant on a single funding source (Kong, and et.al.,2021). As previously

stated, it is critical for parent institutions to offer a steady core of base support for their

Business, but they should also anticipate this support to be leveraged. Most Business

have several options for diversifying and supplementing their financing sources.

4.Describing strategic decisions taken by cafe de coral and financial impact of strategic decisions

Strategic choices affect the environment of the business completely, along with resources

and the person connected with them.

Salient Features of Strategic Decisions:

For a corporation, strategic decisions have significant implication on the entity’s

resources. These decisions can be related to acquisition of new assets of the entity, modifying the

existing asset or relocating the same with existing assets. (Glushakova, and Vaysberg, 2020).

The objective of strategic decisions is to maintained the balance between organisational

resources and their workforce capability to perform an activity.

Strategic decisions are like the fuel for the organisation operation so that they go in the

right direction (Kouvelis, Dong, and Turcic, 2019).

Since the business in working in the changing environment therefore regular updation is

required in the strategic decisions from time to time.

Strategic judgements are difficult because they depend upon person to persons.

Strategic choices are designed by the management team however sometimes it is not

clear as they are connected to future which is uncertain.

The decision taken by the operation team will not match with the strategic team decisions

as they both have different perspective and targets.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Administrative choices are those which need to be address regularly so that they can

provide assistance to strategic or operational decisions of the entity (Lambert, Herbert, and

Rothwell, 2020).

Reduction in cost is the strategic choice of an entity so that operation decisions can be

fulfilled that is profit earning. Operational decisions are reducing the number of workforce and

how they reduced by following certain process is an administrative decision.

Identification, filtrations and implementation of various business process is one of the

advantages of strategic management. Example can be exploring products, markets or industry,

and business venture etc. can only be implemented if organisation engage in strategic planning.

Strategic management enables entities to take look at the operations they are performing

so that cost-benefit analysis can be addressed in order to profits.

Financial Benefits of Strategic Decisions to an entity:

Many readings have established that business concern use strategic management which

makes profitable and successful than those entities who does not consider them in their business

model. Proper planning and implementation of same give an entity to control their business

activity considering the future which is unseen and not predictable in the rapid changing

environment of the twenty-first century. Every year there are thousands of start-ups or enterprise

fails to run their venture in United States, with the majority of them fails due to lack of decision

making at the corporate level (Lara, 2018).

5.Elaborating different financial sources available and analysing the risk associated with each

source with its cost involved in handling risk

There are different sources of finance which can be described as given below:

Debt –

It is the most common source of finance which is cheaper and requires regular payment

to its suppliers (Lioliou, and Willcocks, 2019.). It offers tax shield to an organisation because

interest paid on particular debt is a charge against profit and can be shown as an expense in profit

and loss

Risk associated with debt-

1. Credit risk or default risk- While investing in a particular debt it is crucial to

investigate about the credit rating of an organisation because it reveals about the true and

8

provide assistance to strategic or operational decisions of the entity (Lambert, Herbert, and

Rothwell, 2020).

Reduction in cost is the strategic choice of an entity so that operation decisions can be

fulfilled that is profit earning. Operational decisions are reducing the number of workforce and

how they reduced by following certain process is an administrative decision.

Identification, filtrations and implementation of various business process is one of the

advantages of strategic management. Example can be exploring products, markets or industry,

and business venture etc. can only be implemented if organisation engage in strategic planning.

Strategic management enables entities to take look at the operations they are performing

so that cost-benefit analysis can be addressed in order to profits.

Financial Benefits of Strategic Decisions to an entity:

Many readings have established that business concern use strategic management which

makes profitable and successful than those entities who does not consider them in their business

model. Proper planning and implementation of same give an entity to control their business

activity considering the future which is unseen and not predictable in the rapid changing

environment of the twenty-first century. Every year there are thousands of start-ups or enterprise

fails to run their venture in United States, with the majority of them fails due to lack of decision

making at the corporate level (Lara, 2018).

5.Elaborating different financial sources available and analysing the risk associated with each

source with its cost involved in handling risk

There are different sources of finance which can be described as given below:

Debt –

It is the most common source of finance which is cheaper and requires regular payment

to its suppliers (Lioliou, and Willcocks, 2019.). It offers tax shield to an organisation because

interest paid on particular debt is a charge against profit and can be shown as an expense in profit

and loss

Risk associated with debt-

1. Credit risk or default risk- While investing in a particular debt it is crucial to

investigate about the credit rating of an organisation because it reveals about the true and

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

fair view of an organisation. An organisation with low credit rating increases the chances

of default.

2. Interest rate risk – Acquisition of debt includes interest payment also which is required

to be paid monthly or quarterly depending upon the policies of the organisation.

Fluctuations in the rate of interest contributes to the failure of payment of debt.

3. Market risk – According to different situation such as pandemic, financial crises prices

of interest rate may vary up to a large extent. At the time of covid, cafe de coral faced a

huge loss due to global lock-down because expenses of interest are not able to recover

due to low turnover of sales.

Equity Financing-

It is a form of finance in which an enterprise sell ownership of its company share in

return of capital. It can be done in two ways either private placement of stock to its employees or

public stock offering (Ma, Wang, and Chan, 2020). It offers dividend as appreciation in the value

of shares. There are different types of shares either redeemable or irredeemable. It does not

create any additional burden on the organisation.

Risks associated with equity-

1. Sharing of profits- An enterprise allotting its share of company is also required to shares

percentage of gains with its investors. Dividing gains with shareholders reduces the

profitability of the organisation.

2. Dilution of ownership- While selling share of company to its investors reduces the

ownership of actual owners. Shareholders have right to vote in the affairs of the company

which distributes the decision making power and may sometimes result in the

mismanagement in the organisation.

3. Missing growth opportunities – Funds are blocked with its investors as a result chances

of earning higher returns is least (Macklem, 2020). An enterprise cannot reinvest its share

so it will result in missing opportunities available in the existing market. Cafe de coral

has many subsidiaries such as super congee & Noodles and the Spaghetti house most of

its funds are invested in shares to its stakeholders which results in missing many chances

of profitability.

Lease financing-

9

of default.

2. Interest rate risk – Acquisition of debt includes interest payment also which is required

to be paid monthly or quarterly depending upon the policies of the organisation.

Fluctuations in the rate of interest contributes to the failure of payment of debt.

3. Market risk – According to different situation such as pandemic, financial crises prices

of interest rate may vary up to a large extent. At the time of covid, cafe de coral faced a

huge loss due to global lock-down because expenses of interest are not able to recover

due to low turnover of sales.

Equity Financing-

It is a form of finance in which an enterprise sell ownership of its company share in

return of capital. It can be done in two ways either private placement of stock to its employees or

public stock offering (Ma, Wang, and Chan, 2020). It offers dividend as appreciation in the value

of shares. There are different types of shares either redeemable or irredeemable. It does not

create any additional burden on the organisation.

Risks associated with equity-

1. Sharing of profits- An enterprise allotting its share of company is also required to shares

percentage of gains with its investors. Dividing gains with shareholders reduces the

profitability of the organisation.

2. Dilution of ownership- While selling share of company to its investors reduces the

ownership of actual owners. Shareholders have right to vote in the affairs of the company

which distributes the decision making power and may sometimes result in the

mismanagement in the organisation.

3. Missing growth opportunities – Funds are blocked with its investors as a result chances

of earning higher returns is least (Macklem, 2020). An enterprise cannot reinvest its share

so it will result in missing opportunities available in the existing market. Cafe de coral

has many subsidiaries such as super congee & Noodles and the Spaghetti house most of

its funds are invested in shares to its stakeholders which results in missing many chances

of profitability.

Lease financing-

9

It involves two party’s lessor and lessee. Lessor transfer its assets to the lessee in lieu of

lease payments. It benefits both the parties as lessor receives recurring payments which helps to

operate its operations smoothly and lessee benefited by giving payment of asset at uniform basis

(Mittelman, and Falk, 2018). It reduces the burden of huge cost of asset and break into unified

EMI's. There are mainly two types of lease on the basis of ownership-

A. Operating lease- In operating lease, it does not transfer ownership to the lessee. Depreciation

and other expenses are charged in the books of lessee.

B. Financial lease – It consists of transfer of risk and reward to the lessee. Depreciation and

other overheads are also shown in the books of accounts of lessee.

Risk associated with lease financing-

1. Maintenance cost - Expenses incurred in maintaining leased fixed assets carry huge cost

and reduces the benefits derived from the same.

2. Limited tax related benefits - In a newly start up business where depreciation and other

expenses are low at the same time tax shield provided from these expenses are also less.

3. Complexity in documentation- While entering into lease agreements, there are various

processing and formalities in framing agreement. It creates trouble for Cafe de coral to

follow such registration process and not adherence to these process may increase legal

cost of the respective company.

Identification of the costs involved in management of the global risk:

The global financial risks are identified as the various loop holes or barriers present in the

management of the investments made towards in an organization. The financial risks are often

the cause of concern for the companies who aim towards growth prospects and is required to

manage its position in the industry. Following are types of costs for managing the risks:

Costs of Entry – To mitigate the risk the companies would have to establish a risk

management procedure and furthermore implement the same by way of procedures, rules,

regulations, techniques and training, which must be provided to the employees.

Ongoing Maintenance costs – As by the name, these costs are associated with the

overviewing the system, so as to track any gaps or problems within the management’s

techniques. Henceforth those charged with governance are required to assess and address

the risks coherently.

6. Discuss global risks, mitigation techniques and its different kinds associated the chosen

company.

The global risks are described as the unification of all the unfavourable occurrences which are

caused by dynamic environmental factors and furthermore creates significant negative influence

over the economy of several countries and industries as a whole for a substantial time period or

10

lease payments. It benefits both the parties as lessor receives recurring payments which helps to

operate its operations smoothly and lessee benefited by giving payment of asset at uniform basis

(Mittelman, and Falk, 2018). It reduces the burden of huge cost of asset and break into unified

EMI's. There are mainly two types of lease on the basis of ownership-

A. Operating lease- In operating lease, it does not transfer ownership to the lessee. Depreciation

and other expenses are charged in the books of lessee.

B. Financial lease – It consists of transfer of risk and reward to the lessee. Depreciation and

other overheads are also shown in the books of accounts of lessee.

Risk associated with lease financing-

1. Maintenance cost - Expenses incurred in maintaining leased fixed assets carry huge cost

and reduces the benefits derived from the same.

2. Limited tax related benefits - In a newly start up business where depreciation and other

expenses are low at the same time tax shield provided from these expenses are also less.

3. Complexity in documentation- While entering into lease agreements, there are various

processing and formalities in framing agreement. It creates trouble for Cafe de coral to

follow such registration process and not adherence to these process may increase legal

cost of the respective company.

Identification of the costs involved in management of the global risk:

The global financial risks are identified as the various loop holes or barriers present in the

management of the investments made towards in an organization. The financial risks are often

the cause of concern for the companies who aim towards growth prospects and is required to

manage its position in the industry. Following are types of costs for managing the risks:

Costs of Entry – To mitigate the risk the companies would have to establish a risk

management procedure and furthermore implement the same by way of procedures, rules,

regulations, techniques and training, which must be provided to the employees.

Ongoing Maintenance costs – As by the name, these costs are associated with the

overviewing the system, so as to track any gaps or problems within the management’s

techniques. Henceforth those charged with governance are required to assess and address

the risks coherently.

6. Discuss global risks, mitigation techniques and its different kinds associated the chosen

company.

The global risks are described as the unification of all the unfavourable occurrences which are

caused by dynamic environmental factors and furthermore creates significant negative influence

over the economy of several countries and industries as a whole for a substantial time period or

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.