Impact of Globalisation on Corporate Taxation Policy: British Airways

VerifiedAdded on 2020/10/05

|28

|8001

|465

Project

AI Summary

This research project examines the impact of globalisation on the corporate taxation policy, using British Airways as a case study. The study explores the relationship between globalisation and corporate taxation, and how this affects the financial performance of British Airways. The objectives include understanding the impact of globalisation on the taxation policy adopted by British Airways, evaluating the correlation between globalisation and corporate taxation in the context of pricing strategies, and recommending measures for British Airways to gain competitive advantages. The methodology includes a literature review, research methodology, data analysis, and interpretation. The research questions address the measures to analyze the relationship between globalisation and corporate taxation, the impacts of globalisation on taxation policy, and the evaluation of globalisation's impact on pricing strategies. The literature review covers globalisation, taxation policy, and their interplay, with references to how globalisation affects the financial performance and corporate tax of companies. The research also considers the rationale behind the project and its significance in understanding the effects of globalisation on corporate tax policies, as well as the implications for British Airways' business strategies.

RESEARCH PROJECT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

CHAPTER 1: INTRODUCTION....................................................................................................3

Research Background.............................................................................................................3

Aims and Objectives...............................................................................................................3

Research Questions................................................................................................................4

Rationale.................................................................................................................................4

CHAPTER 2: LITERATURE REVIEW.........................................................................................4

The impact of globalisation on corporate tax. policy of British airways.........................5

The relationship between globalization and corporate taxation affect the financial

performance of British airways...........................................................................................6

The effects of relation between globalization and taxation policy on pricing.................8

CHAPTER 3: RESEARCH METHODOLOGY...........................................................................10

Introduction:.........................................................................................................................10

Research Methodology.........................................................................................................10

Research Philosophy............................................................................................................11

Research Approach...............................................................................................................12

Research choice....................................................................................................................13

Data Collection.....................................................................................................................13

Sampling...............................................................................................................................14

Data Analysis........................................................................................................................14

Research ethics.....................................................................................................................15

CHAPTER 4: DATA ANALYSIS AND INTERPRETATION....................................................15

CHAPTER 5: CONCLUSION......................................................................................................25

RECOMMENDATIONS...............................................................................................................26

REFERENCES..............................................................................................................................27

CHAPTER 1: INTRODUCTION....................................................................................................3

Research Background.............................................................................................................3

Aims and Objectives...............................................................................................................3

Research Questions................................................................................................................4

Rationale.................................................................................................................................4

CHAPTER 2: LITERATURE REVIEW.........................................................................................4

The impact of globalisation on corporate tax. policy of British airways.........................5

The relationship between globalization and corporate taxation affect the financial

performance of British airways...........................................................................................6

The effects of relation between globalization and taxation policy on pricing.................8

CHAPTER 3: RESEARCH METHODOLOGY...........................................................................10

Introduction:.........................................................................................................................10

Research Methodology.........................................................................................................10

Research Philosophy............................................................................................................11

Research Approach...............................................................................................................12

Research choice....................................................................................................................13

Data Collection.....................................................................................................................13

Sampling...............................................................................................................................14

Data Analysis........................................................................................................................14

Research ethics.....................................................................................................................15

CHAPTER 4: DATA ANALYSIS AND INTERPRETATION....................................................15

CHAPTER 5: CONCLUSION......................................................................................................25

RECOMMENDATIONS...............................................................................................................26

REFERENCES..............................................................................................................................27

Topic: To analyse impact of globalisation on the Corporate Taxation policy- A case study on

British Airways

CHAPTER 1: INTRODUCTION

Research Background

Globalisation has assisted most of the business organisation in conducting their business

operations at the global scale. It is a process which is related with the interaction as well as

integration of all the business and human resources, thus making use of it in improving overall

business operational efficiency and performance level. Globalization has resulted in boosting the

level of corporate tax which has directly affected the revenue margin of most of the companies

thereby increasing their business operational efficiency level. With the ease in the availability

and mobility factor of labour as well as capital resources, it has resulted in increased in the

international tax competition and its rate. With the help of this research, one can understand that

how most of the individual and business firms are having freedom of gaining low tax rate

advantages in the foreign market. It will evaluate that because of globalisation and globalised

business economy, it has become almost impossible for most of the countries to charge tax at

high rates as it will result in to out flow of both the people and capital as well.

It is very much important for every business organisation to formulate effective as well as

sound business plans and strategies in line with the aims and objectives of the business. It will

assist many business firms in improving their business performance along with operational

efficiency. By bringing in such improvement, it also affects the level of company’s profitability

and productivity to a great extent. Also, it has provided base for companies for gaining benefits

by sharing if strong as well as effective business ideas, plans, processes, skills and technologies

across the national boundaries of countries. With the help of globalisation, it has enhanced

capital growth rate along with improvement in the per capita income of many countries. Increase

in the level of globalisation because of competitive pressure has assisted in making improvement

in the context of governance and better labour protection.

Aims and Objectives

Aim

To evaluate overall impact which globalisation has created on the corporate taxation

policy in the context of British Airways

British Airways

CHAPTER 1: INTRODUCTION

Research Background

Globalisation has assisted most of the business organisation in conducting their business

operations at the global scale. It is a process which is related with the interaction as well as

integration of all the business and human resources, thus making use of it in improving overall

business operational efficiency and performance level. Globalization has resulted in boosting the

level of corporate tax which has directly affected the revenue margin of most of the companies

thereby increasing their business operational efficiency level. With the ease in the availability

and mobility factor of labour as well as capital resources, it has resulted in increased in the

international tax competition and its rate. With the help of this research, one can understand that

how most of the individual and business firms are having freedom of gaining low tax rate

advantages in the foreign market. It will evaluate that because of globalisation and globalised

business economy, it has become almost impossible for most of the countries to charge tax at

high rates as it will result in to out flow of both the people and capital as well.

It is very much important for every business organisation to formulate effective as well as

sound business plans and strategies in line with the aims and objectives of the business. It will

assist many business firms in improving their business performance along with operational

efficiency. By bringing in such improvement, it also affects the level of company’s profitability

and productivity to a great extent. Also, it has provided base for companies for gaining benefits

by sharing if strong as well as effective business ideas, plans, processes, skills and technologies

across the national boundaries of countries. With the help of globalisation, it has enhanced

capital growth rate along with improvement in the per capita income of many countries. Increase

in the level of globalisation because of competitive pressure has assisted in making improvement

in the context of governance and better labour protection.

Aims and Objectives

Aim

To evaluate overall impact which globalisation has created on the corporate taxation

policy in the context of British Airways

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Objectives

To understand relationship in between globalization and corporate taxation policy

affecting the financial performance of British airways.

To analyse impact of globalisation on the taxation policy adopted by the British Airways.

To evaluate impact of correlation of globalization with the corporate taxation policy in

the context pricing strategies.

To recommend measures to be adopted by the British Airways for gaining competitive

advantages from the changing corporate taxation policies.

Research Questions

Ques. 1. What measures to be undertaken to analyse relationship between globalization and

corporate taxation policy affecting financial performance of British airways?

Ques. 2. What are the impacts of globalisation on the taxation policy adopted by the British

Airways?

Ques. 3. How to evaluate impact of globalization & corporate taxation policy correlation in

the context pricing strategies adopted?

Ques. 4. Any recommendations to the British Airways for making improvements in its

corporate taxation policy for gaining competitive edge.

Rationale

With the help of this research project, the researcher has been able to evaluate impact of

globalisation on the corporate taxation policy. Globalisation has become one of the most

important aspects for many business organisations in increasing their customer base across the

global level. Because of globalised business economy, it has resulted in making most of the

business firms in becoming independent and improving base of their performance. By

undertaking this research study, it will help many other scholars as well as researcher in

completing their own research project in effectually manner. Also, this research project defines

about core impact which has been made by globalisation on the corporate taxation policies of

many companies and measures as undertaken by them for coping up with such aspects.

CHAPTER 2: LITERATURE REVIEW

Globalisation: It is a process of spread of information, technology and goods across the

world. In business contexts, globalisation is a procedure under which a business develops an

international influence by its operation and start operating in the global market under

To understand relationship in between globalization and corporate taxation policy

affecting the financial performance of British airways.

To analyse impact of globalisation on the taxation policy adopted by the British Airways.

To evaluate impact of correlation of globalization with the corporate taxation policy in

the context pricing strategies.

To recommend measures to be adopted by the British Airways for gaining competitive

advantages from the changing corporate taxation policies.

Research Questions

Ques. 1. What measures to be undertaken to analyse relationship between globalization and

corporate taxation policy affecting financial performance of British airways?

Ques. 2. What are the impacts of globalisation on the taxation policy adopted by the British

Airways?

Ques. 3. How to evaluate impact of globalization & corporate taxation policy correlation in

the context pricing strategies adopted?

Ques. 4. Any recommendations to the British Airways for making improvements in its

corporate taxation policy for gaining competitive edge.

Rationale

With the help of this research project, the researcher has been able to evaluate impact of

globalisation on the corporate taxation policy. Globalisation has become one of the most

important aspects for many business organisations in increasing their customer base across the

global level. Because of globalised business economy, it has resulted in making most of the

business firms in becoming independent and improving base of their performance. By

undertaking this research study, it will help many other scholars as well as researcher in

completing their own research project in effectually manner. Also, this research project defines

about core impact which has been made by globalisation on the corporate taxation policies of

many companies and measures as undertaken by them for coping up with such aspects.

CHAPTER 2: LITERATURE REVIEW

Globalisation: It is a process of spread of information, technology and goods across the

world. In business contexts, globalisation is a procedure under which a business develops an

international influence by its operation and start operating in the global market under

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

international trade and commerce. This bring both positive and negative outcomes on the

businesses (Globalisation and its implication on tax policy, 2019).

When businesses globalise their operations, it affects international trade, relations &

economy. Along with which, aspects such as technology, social & cultural dimensions and

corporate world also gets influenced.

Taxation policy: the tax policy is the choice by a government as to what taxes to levy, in

what amounts, and on whom. It has both microeconomic and macroeconomic aspects. For

organisations which globalise their operations has to follow taxation policies of various nations

in which they operate which affects their activities.

The impact of globalisation on corporate tax. policy of British airways.

As per the view point of Crane and et.el., (2019), Globalisation has been defined as a

process of interacting and integrating the economy, business processes and operations of

company of one country with the economy of another company operating in the world. Due to

globalisation, it has benefited several business firm by providing assistance in form of

conducting of business operations at the global level. It has provided ease in making interaction

of people, companies and government across the world enabling them to perform and increase

their market interaction across the boundary. By making use of Globalization concept, British

Airways has been able to increase its trade and commercial activities thereby leading to

acquisition of large market share and profitability ratio. It has provided number of choices for

consumers related to the sourcing of products and services in virtual manner across the world.

On the other hand, Brejning, (2016), argued that with the introduction of Globalization

concept, it has made it difficult for many countries to levy tax at high rate for its services and

products. By charging high percentage of tax amount, it will result in flow of resources including

human, capital and technological one. Every business organization has to make proper and

timely compliance of applicable taxation policies, rules and regulations for remaining

competitive in the global market and economy. Due to globalization, Taxation policy followed

by the British airways has got affected. Earlier before introduction of Globalization, charging of

tax at high rate is feasible for both the company and economy as there is no other option

available for its consumers to sources resources in form of products and services at low rate from

any place in the world. British airways have to make compliance of different business as well as

businesses (Globalisation and its implication on tax policy, 2019).

When businesses globalise their operations, it affects international trade, relations &

economy. Along with which, aspects such as technology, social & cultural dimensions and

corporate world also gets influenced.

Taxation policy: the tax policy is the choice by a government as to what taxes to levy, in

what amounts, and on whom. It has both microeconomic and macroeconomic aspects. For

organisations which globalise their operations has to follow taxation policies of various nations

in which they operate which affects their activities.

The impact of globalisation on corporate tax. policy of British airways.

As per the view point of Crane and et.el., (2019), Globalisation has been defined as a

process of interacting and integrating the economy, business processes and operations of

company of one country with the economy of another company operating in the world. Due to

globalisation, it has benefited several business firm by providing assistance in form of

conducting of business operations at the global level. It has provided ease in making interaction

of people, companies and government across the world enabling them to perform and increase

their market interaction across the boundary. By making use of Globalization concept, British

Airways has been able to increase its trade and commercial activities thereby leading to

acquisition of large market share and profitability ratio. It has provided number of choices for

consumers related to the sourcing of products and services in virtual manner across the world.

On the other hand, Brejning, (2016), argued that with the introduction of Globalization

concept, it has made it difficult for many countries to levy tax at high rate for its services and

products. By charging high percentage of tax amount, it will result in flow of resources including

human, capital and technological one. Every business organization has to make proper and

timely compliance of applicable taxation policies, rules and regulations for remaining

competitive in the global market and economy. Due to globalization, Taxation policy followed

by the British airways has got affected. Earlier before introduction of Globalization, charging of

tax at high rate is feasible for both the company and economy as there is no other option

available for its consumers to sources resources in form of products and services at low rate from

any place in the world. British airways have to make compliance of different business as well as

corporate related taxation policy as per the business operations conducted across the world, non-

compliance of which can make them penalized and charging of high cost.

According to the Evertsson, (2016) globalization increases the trade between two

countries. It provides global platform to perform the activities and explore the business. It helps

the companies to increase their profit by selling their goods and services to the global customer

which ultimately increase their income by charging higher corporate tax on their services.

Globalization increases the business of company because it provides global market to expand the

business. At the same time, it also provides the variety of customer with different interest and

income level. As per the facts and figure due to globalization the business of organization is

increased by 30% which indirectly increases the profit of the company. According to the author

there are little evidence that globalization force to the downward movement of corporate tax and

revenue. Globalization boosts the corporate tax and revenue of the company by increasing the

business.

But Whait and et.al., (2018) argued that globalization decrease the income of the

company because due to the globalization government force the companies to reduce their tax

rate on corporate profit which ultimately affect the profitability of the company. As per the

government they force the companies to minimize the tax rate by two ways. Firstly, they force

the company to reduce the statutory tax rate on the corporate profit and secondly the government

force the companies to reduce the incentives on corporate investment. The both activities of

government ultimately reduces the profit of the company. As per the views of author the impact

of globalization on corporate tax policy is negative for the company because it reduces the

productivity and profitability of organization. They explain that globalization reduces the

corporate tax by 30% in UK market, 35% to 40% in Japan and 16.5% in Canada by 2011.

The relationship between globalization and corporate taxation affect the financial

performance of British airways

As per the thoughts of Morrell, (2018), concept of Globalization and corporate tax are

interrelated as both creates significant impact on the working and operations of business

organization taking place at the global level. Also, the financial performance and position of

company gets influenced by the adopting concepts and ideas related to globalization. With

increase in functioning of globalization and competitions in the taxation policy, it has provided

compliance of which can make them penalized and charging of high cost.

According to the Evertsson, (2016) globalization increases the trade between two

countries. It provides global platform to perform the activities and explore the business. It helps

the companies to increase their profit by selling their goods and services to the global customer

which ultimately increase their income by charging higher corporate tax on their services.

Globalization increases the business of company because it provides global market to expand the

business. At the same time, it also provides the variety of customer with different interest and

income level. As per the facts and figure due to globalization the business of organization is

increased by 30% which indirectly increases the profit of the company. According to the author

there are little evidence that globalization force to the downward movement of corporate tax and

revenue. Globalization boosts the corporate tax and revenue of the company by increasing the

business.

But Whait and et.al., (2018) argued that globalization decrease the income of the

company because due to the globalization government force the companies to reduce their tax

rate on corporate profit which ultimately affect the profitability of the company. As per the

government they force the companies to minimize the tax rate by two ways. Firstly, they force

the company to reduce the statutory tax rate on the corporate profit and secondly the government

force the companies to reduce the incentives on corporate investment. The both activities of

government ultimately reduces the profit of the company. As per the views of author the impact

of globalization on corporate tax policy is negative for the company because it reduces the

productivity and profitability of organization. They explain that globalization reduces the

corporate tax by 30% in UK market, 35% to 40% in Japan and 16.5% in Canada by 2011.

The relationship between globalization and corporate taxation affect the financial

performance of British airways

As per the thoughts of Morrell, (2018), concept of Globalization and corporate tax are

interrelated as both creates significant impact on the working and operations of business

organization taking place at the global level. Also, the financial performance and position of

company gets influenced by the adopting concepts and ideas related to globalization. With

increase in functioning of globalization and competitions in the taxation policy, it has provided

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ease and assistance to large number of individual consumers and businessmen related to freedom

and selection of business as well as human resources, capital and technology which are charging

taxes at very low or minimal rate across the world market. This has resulted in increase in the

productivity level thereby minimizing cost of capital and maximizing the value of firm. Also, it

supports British airways in increasing its profitability level and improving customer satisfaction

level by rendering better improved and quality services to its customer at large level. It thus

brings improvement in the financial performance of the company providing them large customer

base.

However, on the critical note, it has been argued by Waltenberger and Ruff - Stahl,

(2018), that by implementing the concept of Globalization in the business operations, though it

has assisted in facility of conducting business operations at the global level, but it has created

some adverse impact on the financial performance of British airways as well. Companies which

are having monopoly businesses before introduction of globalization, are capable of charging

high tax rate for their products and services which in turn has to be purchased by other business

firms as there are no options available for them to source out resources at reasonable and

affordable prices. This provides huge benefits to all the monopoly business firms thereby

increasing their production, profitability and performance level. But with globalized business

economy, it is very easy to source out all the required resources from abroad having low tax

margin which affects the financial performance of the monopoly company.

As per the views of Crane and et.al., (2019) the globalization and corporate tax are

interrelated. The performance of one factor affect the performance of other factor. Globalization

increases the productivity of the company which improve the financial performance in the

market by attracting more and more customer towards the company. Due to globalization global

customer attracts towards the different services of companies and contributes in the financial

performance. Interrelation of globalization and corporate tax make a positive impact on the

financial services.

The interrelation of corporate tax and globalization influence the companies to innovate

their services to retain in the market and gain the competitive advantages. It differentiates their

product and services from the other companies and provide a different way to improve the

financial performance. It also encourages them to offer variety of services to attract customer and

investor to invest or participate in the financial performance of the organization. Global

and selection of business as well as human resources, capital and technology which are charging

taxes at very low or minimal rate across the world market. This has resulted in increase in the

productivity level thereby minimizing cost of capital and maximizing the value of firm. Also, it

supports British airways in increasing its profitability level and improving customer satisfaction

level by rendering better improved and quality services to its customer at large level. It thus

brings improvement in the financial performance of the company providing them large customer

base.

However, on the critical note, it has been argued by Waltenberger and Ruff - Stahl,

(2018), that by implementing the concept of Globalization in the business operations, though it

has assisted in facility of conducting business operations at the global level, but it has created

some adverse impact on the financial performance of British airways as well. Companies which

are having monopoly businesses before introduction of globalization, are capable of charging

high tax rate for their products and services which in turn has to be purchased by other business

firms as there are no options available for them to source out resources at reasonable and

affordable prices. This provides huge benefits to all the monopoly business firms thereby

increasing their production, profitability and performance level. But with globalized business

economy, it is very easy to source out all the required resources from abroad having low tax

margin which affects the financial performance of the monopoly company.

As per the views of Crane and et.al., (2019) the globalization and corporate tax are

interrelated. The performance of one factor affect the performance of other factor. Globalization

increases the productivity of the company which improve the financial performance in the

market by attracting more and more customer towards the company. Due to globalization global

customer attracts towards the different services of companies and contributes in the financial

performance. Interrelation of globalization and corporate tax make a positive impact on the

financial services.

The interrelation of corporate tax and globalization influence the companies to innovate

their services to retain in the market and gain the competitive advantages. It differentiates their

product and services from the other companies and provide a different way to improve the

financial performance. It also encourages them to offer variety of services to attract customer and

investor to invest or participate in the financial performance of the organization. Global

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

communication makes possible the international trade and financial transaction by understand

the global requirement. Globalization mobilizes the investment of different investors. The

innovative services attract the investors to invest in the company which perform better in the

market which ultimately affect their financial performance.

But the same time author Jones and Temouri, (2016) criticize that due to globalization the

government force the companies to reduce the corporate tax on their services which ultimately

decreases the profit of the company. Globalization reduces affect the financial performance of

the company by reducing their corporate profit. Globalization also increase the competition in

market and due to cut-throat competition organization has to reduces their prices to sustain in the

market and provide their goods and services to the customer at lower profit margin rate. The

relation of globalization and corporate tax influence the companies to provide their best services

to the customer at lower profit margin rate, so the customer can enjoy the best services but it

affects the financial performance of company.

Globalization increases the mobility of the investment that means the due to the

globalization investor easily mobilize their investment. So to retain the investor investment in the

company, government has to provide tax regime which reduces the corporate tax arise from the

personal income tax and consumption tax ultimately it affects the financial performance of the

company. It forces the organization to reduce their price to retain customer and investors.

The effects of relation between globalization and taxation policy on pricing.

Bozyk, (2019), has stated that, Globalization has provided more options and choices for

conducting business at the international level by making compliance of applicable business and

corporate related rules, laws, taxation polices. It has resulted in the increase in the level of

employment by creating more job opportunities by providing required and relevant business

resources, capital, manpower and technological aspects at reasonable and affordable prices. It

has help the British Airways in setting their price for products and services as per the

convenience of both the company and its customers. By using benefits of increasing

interconnectivity of trade, culture and techniques related to business operations it has been able

to increase its business production level and able to satisfy its customer needs. As a result, the

overall business performance and profitability has been increased along with high customer

retention base. Strategies related to pricing can be made in relation with used of better improved

the global requirement. Globalization mobilizes the investment of different investors. The

innovative services attract the investors to invest in the company which perform better in the

market which ultimately affect their financial performance.

But the same time author Jones and Temouri, (2016) criticize that due to globalization the

government force the companies to reduce the corporate tax on their services which ultimately

decreases the profit of the company. Globalization reduces affect the financial performance of

the company by reducing their corporate profit. Globalization also increase the competition in

market and due to cut-throat competition organization has to reduces their prices to sustain in the

market and provide their goods and services to the customer at lower profit margin rate. The

relation of globalization and corporate tax influence the companies to provide their best services

to the customer at lower profit margin rate, so the customer can enjoy the best services but it

affects the financial performance of company.

Globalization increases the mobility of the investment that means the due to the

globalization investor easily mobilize their investment. So to retain the investor investment in the

company, government has to provide tax regime which reduces the corporate tax arise from the

personal income tax and consumption tax ultimately it affects the financial performance of the

company. It forces the organization to reduce their price to retain customer and investors.

The effects of relation between globalization and taxation policy on pricing.

Bozyk, (2019), has stated that, Globalization has provided more options and choices for

conducting business at the international level by making compliance of applicable business and

corporate related rules, laws, taxation polices. It has resulted in the increase in the level of

employment by creating more job opportunities by providing required and relevant business

resources, capital, manpower and technological aspects at reasonable and affordable prices. It

has help the British Airways in setting their price for products and services as per the

convenience of both the company and its customers. By using benefits of increasing

interconnectivity of trade, culture and techniques related to business operations it has been able

to increase its business production level and able to satisfy its customer needs. As a result, the

overall business performance and profitability has been increased along with high customer

retention base. Strategies related to pricing can be made in relation with used of better improved

business processes and globalized features, assisting in charging fair and reasonable prices for its

business products and services.

On this statement Van Hoa and Harvie, (2016), disagree by stating that, by using the

resources, business processes, technologies, capital and other business aspects of other countries

it will result in increase in the cost of business operations including production, manufacturing

etc. Also, it will result in increase in the dependency level of the company on other countries

related to acquisition of business resources, techniques and capital which will hamper the

productivity and performance level of the company at a large extent. It is better to use available

business resources and other requisite essential of its own economy for carrying on business

operations of production and manufacturing. For making profit, it is better to make use of

available business and financial resources in proper and effective manner by framing sound and

accurate business policies and strategies for attaining the set defined business goals as well as the

objectives in cost effective manner.

As per the views of Avdjie and et.al., (2018) the relation between the globalization and

taxation policy affect the pricing policy of company. It encourages company to create innovative

services and product in the market by providing effective tools and techniques to differentiate

their products from the other company. It increases the price of the product and services to get

the benefits of globalization. But the same time Aalbers, (2018) criticize that globalization

increase competition in the market which force the companies to reduce their prices to sustain

the market and retain the customer towards the company.

business products and services.

On this statement Van Hoa and Harvie, (2016), disagree by stating that, by using the

resources, business processes, technologies, capital and other business aspects of other countries

it will result in increase in the cost of business operations including production, manufacturing

etc. Also, it will result in increase in the dependency level of the company on other countries

related to acquisition of business resources, techniques and capital which will hamper the

productivity and performance level of the company at a large extent. It is better to use available

business resources and other requisite essential of its own economy for carrying on business

operations of production and manufacturing. For making profit, it is better to make use of

available business and financial resources in proper and effective manner by framing sound and

accurate business policies and strategies for attaining the set defined business goals as well as the

objectives in cost effective manner.

As per the views of Avdjie and et.al., (2018) the relation between the globalization and

taxation policy affect the pricing policy of company. It encourages company to create innovative

services and product in the market by providing effective tools and techniques to differentiate

their products from the other company. It increases the price of the product and services to get

the benefits of globalization. But the same time Aalbers, (2018) criticize that globalization

increase competition in the market which force the companies to reduce their prices to sustain

the market and retain the customer towards the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

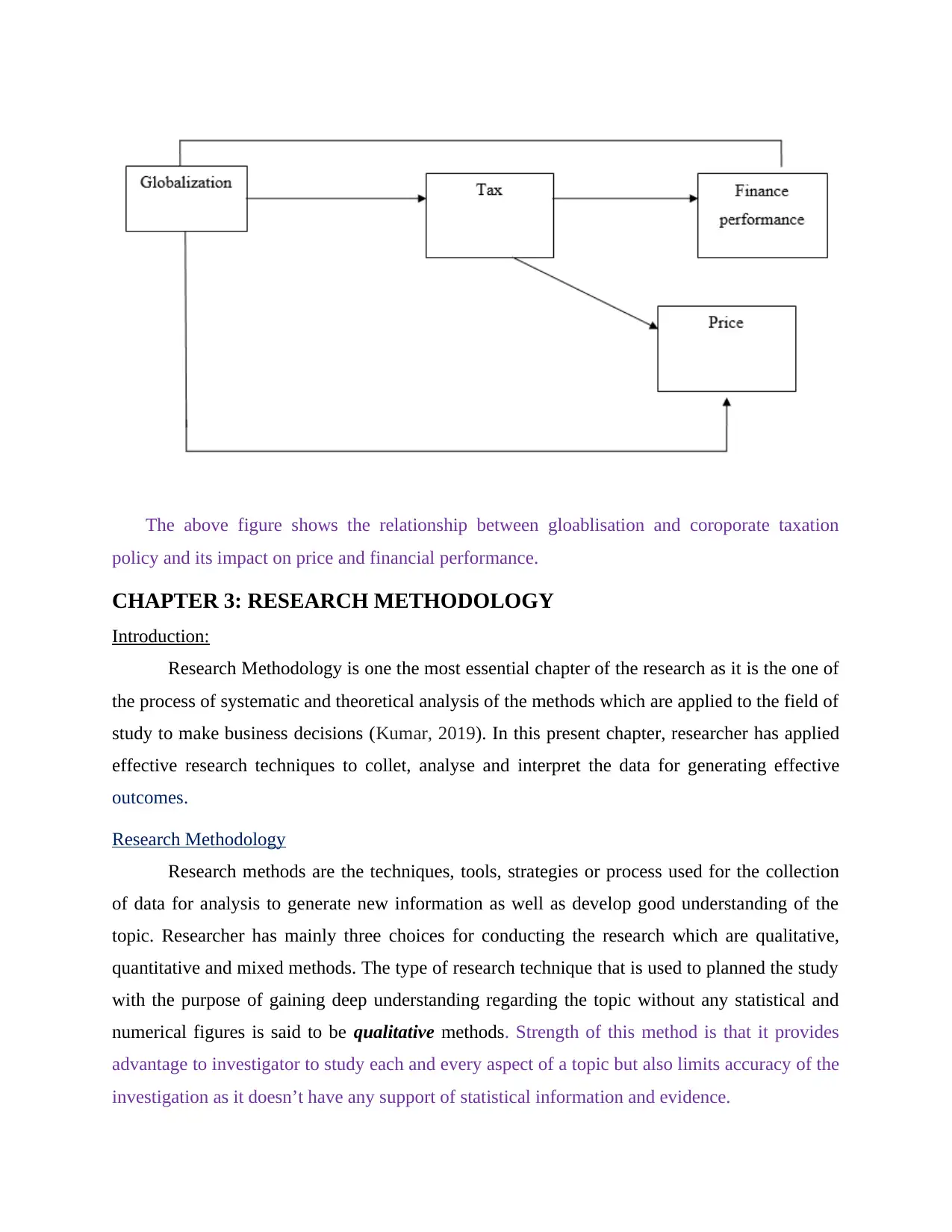

The above figure shows the relationship between gloablisation and coroporate taxation

policy and its impact on price and financial performance.

CHAPTER 3: RESEARCH METHODOLOGY

Introduction:

Research Methodology is one the most essential chapter of the research as it is the one of

the process of systematic and theoretical analysis of the methods which are applied to the field of

study to make business decisions (Kumar, 2019). In this present chapter, researcher has applied

effective research techniques to collet, analyse and interpret the data for generating effective

outcomes.

Research Methodology

Research methods are the techniques, tools, strategies or process used for the collection

of data for analysis to generate new information as well as develop good understanding of the

topic. Researcher has mainly three choices for conducting the research which are qualitative,

quantitative and mixed methods. The type of research technique that is used to planned the study

with the purpose of gaining deep understanding regarding the topic without any statistical and

numerical figures is said to be qualitative methods. Strength of this method is that it provides

advantage to investigator to study each and every aspect of a topic but also limits accuracy of the

investigation as it doesn’t have any support of statistical information and evidence.

policy and its impact on price and financial performance.

CHAPTER 3: RESEARCH METHODOLOGY

Introduction:

Research Methodology is one the most essential chapter of the research as it is the one of

the process of systematic and theoretical analysis of the methods which are applied to the field of

study to make business decisions (Kumar, 2019). In this present chapter, researcher has applied

effective research techniques to collet, analyse and interpret the data for generating effective

outcomes.

Research Methodology

Research methods are the techniques, tools, strategies or process used for the collection

of data for analysis to generate new information as well as develop good understanding of the

topic. Researcher has mainly three choices for conducting the research which are qualitative,

quantitative and mixed methods. The type of research technique that is used to planned the study

with the purpose of gaining deep understanding regarding the topic without any statistical and

numerical figures is said to be qualitative methods. Strength of this method is that it provides

advantage to investigator to study each and every aspect of a topic but also limits accuracy of the

investigation as it doesn’t have any support of statistical information and evidence.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Whereas, the research methods which study the research by considering the statistical and

mathematical techniques is called as quantitative methods (Fletcher, Massis and Nordqvist,

2016). This method has a strength which provides advantage to investigate large number of

numeric data effectively. Besides which, it also has a weakness which is, it limits researcher to

getting deep theoretical insight of the research topic.

When research is planned for collecting, analysing by considering both qualitative and

quantitative methods is said to be mixed methods. This method has strength which enable

investigator to get deep insights of a topic and also to get benefitted to support those insights

with numeric evidence. To gain these benefits researcher has applied mixed method by

considering both qualitative and quantitative as it will minimize the bias nature and aids in

giving positive outcomes. Mixed effect is much better as it will aid in evaluating the concern

issues effectually from both theoretical and numerical perspective. Unfortunately, this method

also has a weakness that it requires high analytical skills and evaluating knowledge.

Research Philosophy

Research Philosophies deals with the nature, knowledge and source and it is belief about

the ways in which data about the phenomenon must be collected, analysed and used. Research

Philosophies are essentially divided into two types which are positivism and Interpretivism

philosophy. The type of philosophy that is highly structured and allows large sample to study the

data is called positivism philosophy (Pankaj, Kumar and Kavitha, 2017). This philosophy is

advantageous as it helps in evaluating big numeric data using an appropriate structure. It also has

a weakness which is its inflexibility as all the aspects in an investigation cannot be calculated.

Whereas, the type of philosophy that allows small samples to study in depth is called as

Interpretivism philosophy. This research is beneficial in the cases of investigation which has

small sample size which even becomes its weakness as it doesn’t facilitate in investigating large

number of respondents.

Researcher has applied positivism philosophy as it is most suitable philosophy when

research is based on quantitative and positivism will also allow studying the large sample and it

is highly structured data. Researcher has been using positivism philosophy as it helps in defining

in depth knowledge about a particular phenomenon.

mathematical techniques is called as quantitative methods (Fletcher, Massis and Nordqvist,

2016). This method has a strength which provides advantage to investigate large number of

numeric data effectively. Besides which, it also has a weakness which is, it limits researcher to

getting deep theoretical insight of the research topic.

When research is planned for collecting, analysing by considering both qualitative and

quantitative methods is said to be mixed methods. This method has strength which enable

investigator to get deep insights of a topic and also to get benefitted to support those insights

with numeric evidence. To gain these benefits researcher has applied mixed method by

considering both qualitative and quantitative as it will minimize the bias nature and aids in

giving positive outcomes. Mixed effect is much better as it will aid in evaluating the concern

issues effectually from both theoretical and numerical perspective. Unfortunately, this method

also has a weakness that it requires high analytical skills and evaluating knowledge.

Research Philosophy

Research Philosophies deals with the nature, knowledge and source and it is belief about

the ways in which data about the phenomenon must be collected, analysed and used. Research

Philosophies are essentially divided into two types which are positivism and Interpretivism

philosophy. The type of philosophy that is highly structured and allows large sample to study the

data is called positivism philosophy (Pankaj, Kumar and Kavitha, 2017). This philosophy is

advantageous as it helps in evaluating big numeric data using an appropriate structure. It also has

a weakness which is its inflexibility as all the aspects in an investigation cannot be calculated.

Whereas, the type of philosophy that allows small samples to study in depth is called as

Interpretivism philosophy. This research is beneficial in the cases of investigation which has

small sample size which even becomes its weakness as it doesn’t facilitate in investigating large

number of respondents.

Researcher has applied positivism philosophy as it is most suitable philosophy when

research is based on quantitative and positivism will also allow studying the large sample and it

is highly structured data. Researcher has been using positivism philosophy as it helps in defining

in depth knowledge about a particular phenomenon.

Research Approach

The procedure and plan that comprises the steps of wide assumption over defining the

detailed methods for data collection, its evaluation and interpretation. It is very important to

select the most appropriate research approach it is because after selecting the research methods

researcher have essentially looked for the research approach. Research approaches are essentially

divided into two methods which are inductive and deductive. Deductive approach is mainly

concern with the development of hypothesis which is based on existing concept and the

designing plan of action to trial the hypotheses (Alase, 2017). This approach has various

strengths which are; it helps in time saving, it can apply to variety of examples and it even can be

used for higher level of investigation. On the contrary, complexity is its disadvantage.

The type of approach that begins with the theories and observation proposed towards the

end of research process is called as inductive approach. This approach is good with theoretical

investigation but lacks where researcher requires experimentation. In this present research,

researcher has applied deductive research approach as this method has high possibility to explain

experimental relationship between concept and variables and possibility to measure the concept

of quantitatively. Researcher has made of deductive research approach as it helps in framing of

hypothesis which forms base for making decisions in respect of rejection or confirmation of the

test within the research process.

Research strategy – It is a step by step plan of conducting research in systematic way. It

includes research design and methods. Also, it gives an insight that how methodology will be

implemented. The use of strategy depends on aims and objective of research. Generally, there are

4 types of research strategies available that are case study, qualitative interview, quantitative

survey and action oriented research.

Case study strategy facilitates in investigating different pre reviewed case studies but lacks

in primary research of first hand data. Qualitative interview allows to conduct interviews with

few respondents about their opinion against asked questions. This strategy helps in getting deep

insights from respondents but it also limits the number of respondents as it is a time taking

activity. Third strategy is quantitative survey, in this multiple questions are asked from ample

number of respondents to get their opinion against research topic but its lacks in getting detailed

information from the respondents.

The procedure and plan that comprises the steps of wide assumption over defining the

detailed methods for data collection, its evaluation and interpretation. It is very important to

select the most appropriate research approach it is because after selecting the research methods

researcher have essentially looked for the research approach. Research approaches are essentially

divided into two methods which are inductive and deductive. Deductive approach is mainly

concern with the development of hypothesis which is based on existing concept and the

designing plan of action to trial the hypotheses (Alase, 2017). This approach has various

strengths which are; it helps in time saving, it can apply to variety of examples and it even can be

used for higher level of investigation. On the contrary, complexity is its disadvantage.

The type of approach that begins with the theories and observation proposed towards the

end of research process is called as inductive approach. This approach is good with theoretical

investigation but lacks where researcher requires experimentation. In this present research,

researcher has applied deductive research approach as this method has high possibility to explain

experimental relationship between concept and variables and possibility to measure the concept

of quantitatively. Researcher has made of deductive research approach as it helps in framing of

hypothesis which forms base for making decisions in respect of rejection or confirmation of the

test within the research process.

Research strategy – It is a step by step plan of conducting research in systematic way. It

includes research design and methods. Also, it gives an insight that how methodology will be

implemented. The use of strategy depends on aims and objective of research. Generally, there are

4 types of research strategies available that are case study, qualitative interview, quantitative

survey and action oriented research.

Case study strategy facilitates in investigating different pre reviewed case studies but lacks

in primary research of first hand data. Qualitative interview allows to conduct interviews with

few respondents about their opinion against asked questions. This strategy helps in getting deep

insights from respondents but it also limits the number of respondents as it is a time taking

activity. Third strategy is quantitative survey, in this multiple questions are asked from ample

number of respondents to get their opinion against research topic but its lacks in getting detailed

information from the respondents.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 28

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.